UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22187 |

|

PAX WORLD FUNDS TRUST II |

(Exact name of registrant as specified in charter) |

|

30 Penhallow Street, Suite 400, Portsmouth, NH | | 03801 |

(Address of principal executive offices) | | (Zip code) |

|

Pax World Management LLC

30 Penhallow Street, Suite 400, Portsmouth, NH 03801

Attn.: Joseph Keefe |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 800-767-1729 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | 12/31/13 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. §3507.

Item 1. Annual Report to Shareholders

Pax MSCI EAFE ESG

Index ETF

(EAPS)

Table of Contents

| Commentary and Portfolio Highlights | | | 1 | | |

| Shareholder Expense Examples | | | 5 | | |

| Schedule of Investments | | | 7 | | |

| Statement of Assets and Liabilities | | | 10 | | |

| Statement of Operations | | | 11 | | |

| Statements of Changes in Net Assets | | | 12 | | |

| Financial Highlights | | | 13 | | |

| Notes to Financial Statements | | | 14 | | |

Report of Independent Registered Public

Accounting Firm | | | 24 | | |

General Fund Information

888.729.3863

www.esgshares.com

Transfer Agent and

Custodian

State Street Bank and Trust Company

1 Lincoln Street

Boston, MA 02111

Investment Adviser

Pax World Management LLC

30 Penhallow Street, Suite 400

Portsmouth, NH 03801

Distributor

ALPS Distributors, Inc.

1290 Broadway. #1100

Denver, CO 80203

Pax MSCI EAFE ESG Index ETF

December 31, 2013

The Pax MSCI EAFE ESG Index ETF (the "Fund") employs a passive management approach, seeking to track the performance of the MSCI EAFE ESG Index (the Index), which consists of companies operating in developed countries around the world, excluding the U.S. and Canada, that have superior environmental, social and governance ("ESG") performance as rated by MSCI ESG Research.

For the one-year period ended December 31, 2013, the Fund's NAV return was 24.96%, outperforming the MSCI EAFE ESG (Net) Index return of 24.24% and the MSCI EAFE (Net) Index return of 22.78%.

During the period, seven of the 10 Global Industry Classification Standard (GICS) sectors delivered positive returns for the portfolio relative to the Index with the strongest contributions coming from the financials, consumer discretionary and industrials sectors. The materials, health care and consumer staples sectors detracted from relative performance. From a country perspective, Japan, where the equity market enjoyed strong performance in 2013, largely due to government monetary and economic policy, made the strongest positive contribution to relative performance. Investments in the European and Australasian regions also contributed positively to the portfolio's performance compared to the Index with particularly noteworthy contributions from Germany and Sweden during the period. Investments in the U.K. and Spain detracted from relative performance.

The three largest positive contributions to relative portfolio performance on a company basis were made by investments in Vodafone, PLC, a mobile telecommunication services provider, Fuji Heavy Industries, Ltd., manufactures and sells automobile, aerospace, and industrial products, and the French automobile manufacturer Renault SA. Companies that detracted most from performance included Newcrest Mining, Ltd., as investors turned away from gold and other commodities in 2013, Banco Santander SA, the Spanish banking company, and RSA Insurance Group PLC, a London-based property and casualty insurance business.

The Fund described herein is indexed to an MSCI index. The Fund referred to herein is not sponsored, endorsed or promoted by MSCI or its affiliates, and MSCI and its affiliates bear no liability with respect to any such fund or any index on which such fund is based.

The MSCI EAFE ESG Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities of issuers organized or operating in developed market countries around the world excluding the U.S. and Canada that have high environmental, social and governance (ESG) ratings relative to their sector and industry group peers, as rated by MSCI ESG Research annually. The Index targets sector weights that reflect the relative sector weights of the MSCI Europe & Middle East Index and the MSCI Pacific Index. MSCI ESG Research evaluates companies' ESG characteristics and derives corresponding ESG scores and ratings. Companies are ranked by ESG score against their sector peers to determine their

1

eligibility for the MSCI ESG indices. MSCI ESG Research identifies the highest-rated companies in each peer group to meet the float-adjusted market capitalization sector targets. The rating system is based on general and industry-specific ESG criteria, assigning ratings on a 7-point scale from AAA (highest) to CCC (lowest). Performance for the MSCI EAFE ESG Index is shown "net", which includes dividend reinvestments after deduction of foreign withholding tax. One cannot invest directly in an index.

Constituents of the MSCI EAFE Index having an ESG rating of BB or above are eligible for inclusion in the Index, effective June 2013. The MSCI EAFE ESG Index includes or utilizes data, ratings, analysis, reports, analytics or other information or materials from MSCI's ESG Research Group within Institutional Shareholder Services Inc., an indirect wholly-owned subsidiary of MSCI. The prospectus contains a more detailed description of the limited relationship MSCI has with Pax World Management LLC, ESG Shares and any related funds.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Performance for the MSCI EAFE Index is shown "net", which includes dividend reinvestments after deduction of foreign withholding tax. One cannot invest directly in an index.

The MSCI Europe & Middle East Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe and the Middle East. The MSCI Europe & Middle East Index consisted of the following 16 developed market country indices: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Israel, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

The MSCI Pacific Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in the Pacific region. The MSCI Pacific Index consisted of the following 5 developed market country indices: Australia, Hong Kong, Japan, New Zealand, and Singapore.

Unlike the Fund, the MSCI EAFE ESG Index, the MSCI EAFE Index, the MSCI Europe & Middle East Index and the MSCI Pacific Index are not investments, are not professionally managed and do not reflect deductions for fees, expenses or taxes.

2

Pax MSCI EAFE ESG Index ETF

Portfolio Highlights (Unaudited)

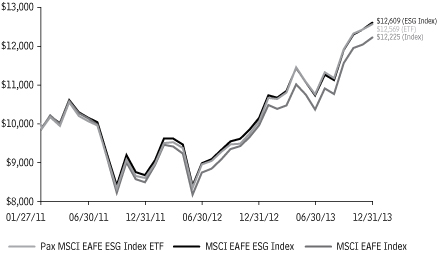

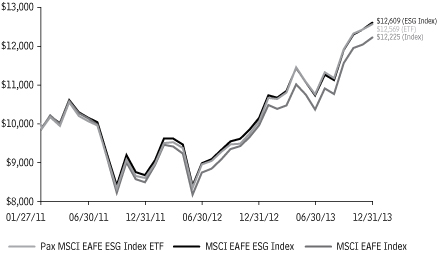

Total Return—Historical Growth of $10,000—Since Inception

Returns—Period ended December 31, 2013

| | | 1 Year | | Since

Inception1 | |

NAV Return2 | | | 24.96 | | | | 8.13 | | |

Market Value Return2 | | | 24.22 | | | | 8.78 | | |

MSCI EAFE ESG Index3 | | | 24.24 | | | | 8.24 | | |

MSCI EAFE Index4 | | | 22.78 | | | | 7.10 | | |

Total annual operating expenses for Pax MSCI EAFE ESG Index ETF are 0.55%.

All total return figures assume reinvestment of dividends and capital gains at net asset value; actual returns may differ. Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Total returns for periods of less than one year have not been annualized. For more recent month-end performance data, please visit www.esgshares.com or call us at 888.729.3863.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund's performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions.

1The Fund's inception date is January 27, 2011.

2The NAV return is based on the closing NAV (net asset value per share) of the Fund and the Market Value return is based on the market price per share of the Fund. The market prices used for Market Value returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times.

3

Pax MSCI EAFE ESG Index ETF

Portfolio Highlights (Unaudited), continued

3MSCI EAFE ESG Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities of issuers organized or operating in Europe and the Asia Pacific region that have high environmental, social and governance (ESG) ratings from MSCI, selected initially and adjusted annually by MSCI. Performance for the MSCI EAFE ESG Index is shown "net", which includes dividend reinvestments after deduction of foreign withholding tax. One cannot invest directly in an index.

4The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom. Performance for the MSCI EAFE Index is shown "net", which includes dividend reinvestments after deduction of foreign withholding tax. One cannot invest directly in an index.

Asset Allocation | | Percent of Net Assets | |

Common Stocks | | | 98.8 | % | |

Preferred Stocks | | | 0.9 | % | |

Rights | | | 0.0 | %* | |

Money Market Fund | | | 0.7 | % | |

Other Assets & Liabilities | | | (0.4 | )% | |

Total Net Assets | | | 100.0 | % | |

*Less than 0.05%.

Top Ten Holdings

Company | | Percent of Net Assets | |

Vodafone Group PLC | | | 4.0 | % | |

HSBC Holdings PLC | | | 3.5 | % | |

Roche Holding AG | | | 3.3 | % | |

Novartis AG | | | 2.8 | % | |

GlaxoSmithKline PLC | | | 2.6 | % | |

Commonwealth Bank of Australia | | | 2.1 | % | |

BASF SE | | | 1.9 | % | |

Westpac Banking Corp. | | | 1.8 | % | |

Novo Nordisk A/S (Class B) | | | 1.6 | % | |

Allianz SE | | | 1.5 | % | |

Total | | | 25.1 | % | |

Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable. Holdings are subject to change.

4

Shareholder Expense Examples (Unaudited)

Examples As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of your fund shares and (2) ongoing costs, including management fees, and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and compare these costs with the ongoing costs of investing in other funds. For more information, see the prospectus or talk to your financial adviser.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period beginning on July 1, 2013 and ending on December 31, 2013.

Actual Expenses The first line in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes The second line in the table provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not

5

Shareholder Expense Examples (Unaudited), continued

help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account Value

(7/1/13) | | Ending

Account Value

(12/31/13) | | Annualized

Expense

Ratio | | Expenses Paid

During Period1 | |

Based on Actual Fund Return | | $ | 1,000 | | | $ | 1,168.10 | | | | 0.55 | % | | $ | 3.01 | | |

Based on Hypothetical 5% Return | | | 1,000 | | | | 1,022.43 | | | | 0.55 | % | | | 2.80 | | |

1 Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value of the period, multiplied by 184/365 (to reflect the period beginning on July 1, 2013 and ending on December 31, 2013).

6

Pax MSCI EAFE ESG Index ETF

Security Description | | Shares | | Value | |

COMMON STOCKS: 98.8% | |

Australia: 8.2% | |

Australia & New Zealand

Banking Group, Ltd. | | | 29,545 | | | $ | 851,917 | | |

Commonwealth Bank of Australia | | | 17,714 | | | | 1,232,961 | | |

Fortescue Metals Group, Ltd. | | | 21,175 | | | | 110,255 | | |

GPT Group (a) | | | 51,831 | | | | 157,660 | | |

Mirvac Group (a) | | | 124,375 | | | | 186,937 | | |

National Australia Bank, Ltd. | | | 27,933 | | | | 870,410 | | |

Newcrest Mining, Ltd. | | | 18,659 | | | | 130,208 | | |

Orica, Ltd. | | | 288 | | | | 6,148 | | |

Origin Energy, Ltd. | | | 13,100 | | | | 164,899 | | |

Westpac Banking Corp. | | | 37,420 | | | | 1,084,011 | | |

| | | | 4,795,406 | | |

Austria: 0.4% | |

OMV AG | | | 4,810 | | | | 230,586 | | |

Belgium: 2.1% | |

Colruyt SA | | | 15,805 | | | | 883,771 | | |

Delhaize Group | | | 4,122 | | | | 245,372 | | |

KBC Groep NV | | | 1,553 | | | | 88,273 | | |

| | | | 1,217,416 | | |

Denmark: 1.6% | |

Novo Nordisk A/S (Class B) | | | 4,949 | | | | 908,610 | | |

Finland: 0.6% | |

Stora Enso OYJ (R Shares) | | | 12,785 | | | | 128,517 | | |

UPM-Kymmene OYJ | | | 11,509 | | | | 194,746 | | |

| | | | 323,263 | | |

France: 7.3% | |

AXA SA | | | 15,389 | | | | 428,558 | | |

Carrefour SA | | | 8,016 | | | | 318,225 | | |

CGG (b) | | | 5,783 | | | | 100,246 | | |

Compagnie de Saint-Gobain | | | 6,810 | | | | 375,119 | | |

Danone SA | | | 7,274 | | | | 524,414 | | |

L'Oreal SA | | | 3,853 | | | | 677,990 | | |

Lafarge SA | | | 1,872 | | | | 140,506 | | |

Renault SA | | | 5,303 | | | | 427,110 | | |

Schneider Electric SA | | | 6,287 | | | | 549,245 | | |

Societe BIC SA | | | 3,524 | | | | 432,466 | | |

Technip SA | | | 3,343 | | | | 321,809 | | |

| | | | 4,295,688 | | |

Germany: 8.9% | |

Adidas AG | | | 1,910 | | | | 243,818 | | |

Allianz SE | | | 5,002 | | | | 898,438 | | |

BASF SE | | | 10,412 | | | | 1,111,765 | | |

Bayerische Motoren Werke AG | | | 4,318 | | | | 507,058 | | |

Deutsche Boerse AG | | | 1,186 | | | | 98,382 | | |

Deutsche Lufthansa AG (b) | | | 8,046 | | | | 170,961 | | |

Deutsche Post AG | | | 15,241 | | | | 556,535 | | |

HeidelbergCement AG | | | 7,279 | | | | 553,160 | | |

Hochtief AG | | | 1,916 | | | | 163,848 | | |

K+S AG | | | 3,102 | | | | 95,640 | | |

Metro AG | | | 3,024 | | | | 146,675 | | |

ProSieben Sat.1 Media AG | | | 4,210 | | | | 208,842 | | |

SAP AG | | | 4,805 | | | | 412,557 | | |

Suedzucker AG | | | 2,563 | | | | 69,292 | | |

| | | | 5,236,971 | | |

Security Description | | Shares | | Value | |

COMMON STOCKS, continued | |

Hong Kong: 0.4% | |

CLP Holdings, Ltd. | | | 20,000 | | | $ | 158,117 | | |

Li & Fung, Ltd. | | | 80,000 | | | | 103,176 | | |

| | | | 261,293 | | |

Israel: 0.1% | |

Delek Group, Ltd. | | | 196 | | | | 74,876 | | |

Italy: 1.2% | |

Assicurazioni Generali SpA | | | 4,533 | | | | 106,811 | | |

ENI SpA | | | 10,609 | | | | 255,680 | | |

Intesa Sanpaolo SpA | | | 126,176 | | | | 311,912 | | |

Pirelli & C. SpA | | | 199 | | | | 3,450 | | |

| | | | 677,853 | | |

Japan: 21.9% | |

Aisin Seiki Co., Ltd. | | | 3,900 | | | | 158,442 | | |

Canon, Inc. | | | 8,000 | | | | 253,461 | | |

Central Japan Railway Co. | | | 4,000 | | | | 471,148 | | |

Chugai Pharmaceutical Co., Ltd. | | | 12,000 | | | | 265,449 | | |

Denso Corp. | | | 4,000 | | | | 211,217 | | |

East Japan Railway Co. | | | 4,000 | | | | 318,919 | | |

Eisai Co., Ltd. | | | 3,700 | | | | 143,452 | | |

Fast Retailing Co., Ltd. | | | 100 | | | | 41,292 | | |

Fuji Heavy Industries, Ltd. | | | 13,400 | | | | 384,387 | | |

Fujitsu, Ltd. (b) | | | 80,000 | | | | 414,062 | | |

Hitachi Chemical Co., Ltd. | | | 4,000 | | | | 63,822 | | |

Hitachi Construction

Machinery Co., Ltd. | | | 8,000 | | | | 170,877 | | |

Honda Motor Co., Ltd. | | | 16,000 | | | | 659,150 | | |

JFE Holdings, Inc. | | | 6,500 | | | | 154,731 | | |

Kao Corp. | | | 8,000 | | | | 251,939 | | |

KDDI Corp. | | | 8,000 | | | | 492,460 | | |

Komatsu, Ltd. | | | 16,000 | | | | 325,313 | | |

Konica Minolta Holdings, Inc. | | | 34,000 | | | | 339,337 | | |

Kubota Corp. | | | 28,000 | | | | 463,270 | | |

Mazda Motor Corp. (b) | | | 24,000 | | | | 124,219 | | |

McDonald's Holdings Co.

(Japan), Ltd. | | | 3,700 | | | | 94,590 | | |

Mitsubishi Corp. | | | 27,500 | | | | 527,734 | | |

Mitsubishi Electric Corp. | | | 40,000 | | | | 502,355 | | |

Mitsubishi UFJ Lease &

Finance Co., Ltd. | | | 39,900 | | | | 244,855 | | |

Mitsui Fudosan Co., Ltd. | | | 13,000 | | | | 468,151 | | |

Mizuho Financial Group, Inc. | | | 218,000 | | | | 472,899 | | |

Murata Manufacturing Co., Ltd. | | | 3,700 | | | | 328,795 | | |

Nikon Corp. | | | 4,000 | | | | 76,457 | | |

Nippon Steel Corp. | | | 40,000 | | | | 133,961 | | |

Nissan Motor Co., Ltd. | | | 36,000 | | | | 302,783 | | |

NTT DoCoMo, Inc. | | | 20,000 | | | | 328,243 | | |

Panasonic Corp. | | | 20,000 | | | | 232,910 | | |

Resona Holdings, Inc. | | | 300 | | | | 1,530 | | |

Santen Pharmaceutical Co., Ltd. | | | 8,000 | | | | 373,341 | | |

Seven & I Holdings Co., Ltd. | | | 7,200 | | | | 286,342 | | |

Shin-Etsu Chemical Co., Ltd. | | | 4,000 | | | | 233,671 | | |

Softbank Corp. | | | 8,000 | | | | 700,252 | | |

Sony Corp. | | | 12,000 | | | | 208,477 | | |

Sumitomo Mitsui

Financial Group, Inc. | | | 12,100 | | | | 623,966 | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

7

Pax MSCI EAFE ESG Index ETF

Schedule of Investments, continued

Security Description | | Shares | | Value | |

COMMON STOCKS, continued | |

Japan, continued | |

Suzuken Co., Ltd. | | | 300 | | | $ | 9,719 | | |

Suzuki Motor Corp. | | | 7,500 | | | | 201,798 | | |

Takashimaya Co., Ltd. | | | 39,000 | | | | 388,497 | | |

Takeda Pharmaceutical Co., Ltd. | | | 8,000 | | | | 367,252 | | |

Toho Gas Co., Ltd. | | | 1,000 | | | | 4,871 | | |

| | | | 12,820,396 | | |

Luxembourg: 0.5% | |

Tenaris SA | | | 12,573 | | | | 275,120 | | |

Netherlands: 3.5% | |

Akzo Nobel NV | | | 4,670 | | | | 362,549 | | |

| ASML Holding NV | | | 4,108 | | | | 385,149 | | |

ING Groep NV (b) | | | 34,478 | | | | 479,840 | | |

Unilever NV | | | 20,575 | | | | 829,985 | | |

| | | | 2,057,523 | | |

New Zealand: 0.8% | |

Auckland International

Airport, Ltd. | | | 156,849 | | | | 455,704 | | |

Norway: 0.4% | |

Norsk Hydro ASA | | | 27,460 | | | | 122,525 | | |

Statoil ASA | | | 4,132 | | | | 100,119 | | |

| | | | 222,644 | | |

Singapore: 0.7% | |

City Developments, Ltd. | | | 30,000 | | | | 228,101 | | |

Keppel Land, Ltd. | | | 63,000 | | | | 166,656 | | |

| | | | 394,757 | | |

Spain: 3.9% | |

Banco Bilbao Vizcaya Argentaria SA | | | 50,966 | | | | 628,408 | | |

Distribuidora Internacional

de Alimentacion SA | | | 3,978 | | | | 35,630 | | |

Ferrovial SA | | | 14,441 | | | | 279,879 | | |

Iberdrola SA | | | 52,969 | | | | 338,302 | | |

Inditex SA | | | 4,148 | | | | 684,745 | | |

Repsol YPF SA | | | 13,397 | | | | 338,194 | | |

| | | | 2,305,158 | | |

Sweden: 5.3% | |

Atlas Copco AB | | | 7,472 | | | | 207,433 | | |

Hennes & Mauritz AB (Class B) | | | 15,392 | | | | 709,854 | | |

Nordea Bank AB | | | 44,007 | | | | 593,717 | | |

Sandvik AB | | | 14,689 | | | | 207,438 | | |

Skandinaviska Enskilda

Banken AB (Class A) | | | 21,423 | | | | 282,856 | | |

Skanska AB (B Shares) | | | 20,485 | | | | 419,103 | | |

Swedbank AB (Class A) | | | 17,021 | | | | 479,681 | | |

Volvo AB (Class B) | | | 17,385 | | | | 228,593 | | |

| | | | 3,128,675 | | |

Switzerland: 7.4% | |

Givaudan SA (b) | | | 68 | | | | 97,410 | | |

Lindt & Spruengli AG | | | 77 | | | | 348,139 | | |

Novartis AG | | | 20,652 | | | | 1,653,368 | | |

Roche Holding AG | | | 6,891 | | | | 1,930,890 | | |

Swiss Re AG (b) | | | 3,347 | | | | 308,789 | | |

| | | | 4,338,596 | | |

Security Description | | Shares | | Value | |

COMMON STOCKS, continued | |

United Kingdom: 23.6% | |

Associated British Foods PLC | | | 10,679 | | | $ | 432,449 | | |

Aviva PLC | | | 18,303 | | | | 136,324 | | |

BG Group PLC | | | 37,563 | | | | 807,222 | | |

BT Group PLC | | | 71,350 | | | | 448,350 | | |

Bunzl PLC | | | 36,994 | | | | 888,433 | | |

Experian PLC | | | 3 | | | | 55 | | |

Fresnillo PLC | | | 5,119 | | | | 63,206 | | |

GlaxoSmithKline PLC | | | 58,039 | | | | 1,549,087 | | |

HSBC Holdings PLC | | | 187,783 | | | | 2,060,166 | | |

InterContinental Hotels Group PLC | | | 394 | | | | 13,136 | | |

Marks & Spencer Group PLC | | | 25,708 | | | | 184,196 | | |

National Grid PLC | | | 11,886 | | | | 155,127 | | |

Pearson PLC | | | 37,851 | | | | 840,682 | | |

Prudential PLC | | | 33,499 | | | | 743,468 | | |

Reckitt Benckiser Group PLC | | | 2,100 | | | | 166,706 | | |

RSA Insurance Group PLC | | | 187,477 | | | | 283,805 | | |

Standard Chartered PLC | | | 26,865 | | | | 605,134 | | |

Tesco PLC | | | 103,350 | | | | 572,318 | | |

Tullow Oil PLC | | | 15,076 | | | | 213,490 | | |

Unilever PLC | | | 18,738 | | | | 770,284 | | |

Vodafone Group PLC | | | 595,122 | | | | 2,336,038 | | |

Wolseley PLC | | | 3,713 | | | | 210,624 | | |

WPP PLC | | | 14,970 | | | | 342,158 | | |

| | | | 13,822,458 | | |

TOTAL COMMON STOCKS | |

(Cost $51,302,702) | | | | | | | 57,842,993 | | |

PREFERRED STOCKS—0.9% | |

Germany: 0.9% | |

Volkswagen AG Preference Shares | | | 1,822 | | | | 512,544 | | |

TOTAL PREFERRED STOCKS | |

(Cost $402,544) | | | | | | | 512,544 | | |

RIGHTS: 0.0%(c) | |

Spain: 0.0%(c) | |

Repsol SA, Expires 01/15/14 (b) | | | 13,060 | | | | 8,926 | | |

TOTAL RIGHTS | |

(Cost $8,516) | | | | | | | 8,926 | | |

SHORT TERM INVESTMENT: 0.7% | |

United States: 0.7% | |

MONEY MARKET FUND: 0.7% | |

SSgA Prime Money Market Fund | |

(Cost $415,835) | | | 415,835 | | | | 415,835 | | |

TOTAL INVESTMENTS: 100.4% | |

(Cost $52,129,597) | | | | | 58,780,298 | | |

OTHER ASSETS &

LIABILITIES: (0.4)% | | | | | (231,368 | ) | |

Net Assets: 100.0% | | | | $ | 58,548,930 | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

8

Pax MSCI EAFE ESG Index ETF

Schedule of Investments, continued

SECTOR DIVERSIFICATION (d) | |

Sector (unaudited) | | Percent of

Net Assets | |

Financials | | | 25.7 | % | |

Consumer Discretionary | | | 13.5 | % | |

Industrials | | | 13.5 | % | |

Health Care | | | 12.1 | % | |

Consumer Staples | | | 11.2 | % | |

Telecommunication Services | | | 7.4 | % | |

Materials | | | 6.3 | % | |

Energy | | | 5.2 | % | |

Information Technology | | | 3.7 | % | |

Utilities | | | 1.1 | % | |

Cash and cash equivalents plus other assets

less liabilities | | | 0.3 | % | |

Total | | | 100.0 | % | |

(a) REIT = Real Estate Investment Trust

(b) Non-income producing security.

(c) Amount shown represents less than 0.05% of net assets.

(d) Broad industry sectors used for financial reporting purposes. Diversification compliance testing is based on narrower industries within broad sector

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

9

Statement of Assets and Liabilities

| | | Pax MSCI

EAFE ESG

Index ETF | |

ASSETS | |

Investments, at value (Note B) | | $ | 58,780,298 | | |

Foreign currency, at value | | | 11,297 | | |

Receivable for fund shares sold | | | 1,463,723 | | |

Receivable for foreign taxes recoverable | | | 23,717 | | |

Dividends receivable (Note B) | | | 84,397 | | |

Total Assets | | | 60,363,432 | | |

LIABILITIES | |

Payable for investments purchased | | | 1,463,933 | | |

Distributions payable | | | 325,007 | | |

Accrued advisory fee (Note C) | | | 25,562 | | |

Total Liabilities | | | 1,814,502 | | |

NET ASSETS | | $ | 58,548,930 | | |

NET ASSETS CONSIST OF: | |

Paid in capital | | $ | 52,094,975 | | |

Distributions in excess of net investment income | | | (7,811 | ) | |

Accumulated net realized gain (loss) on: | |

Investments and foreign currency transactions | | | (191,651 | ) | |

Net unrealized appreciation (depreciation) of: | |

Investments | | | 6,650,701 | | |

Foreign currency | | | 2,716 | | |

NET ASSETS | | $ | 58,548,930 | | |

NET ASSET VALUE PER SHARE | |

Net asset value per share | | $ | 29.27 | | |

Outstanding beneficial interest shares (unlimited amount authorized,

$0.01 par value) | | | 2,000,000 | | |

COST OF INVESTMENTS: | |

Investments, at cost (Note B) | | $ | 52,129,597 | | |

Foreign currency, at cost | | $ | 11,271 | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

10

For the Year Ended December 31, 2013

| | | Pax MSCI

EAFE ESG

Index ETF | |

INVESTMENT INCOME | |

Dividend income | | $ | 1,023,549 | | |

Foreign taxes withheld | | | (66,978 | ) | |

Total Investment Income | | | 956,571 | | |

EXPENSES | |

Advisory fee (Note C) | | | 181,465 | | |

Total Expenses | | | 181,465 | | |

Net Investment Income | | | 775,106 | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

Net realized gain (loss) on: | |

Investments | | | (102,601 | ) | |

Foreign currency transactions | | | (7,590 | ) | |

Net change in unrealized appreciation (depreciation) on: | |

Investments | | | 6,136,181 | | |

Foreign currency translation | | | 3,287 | | |

Net realized and unrealized gain (loss) on investments and foreign

currency transactions | | | 6,029,277 | | |

Net increase in net assets from operations | | $ | 6,804,383 | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

11

Statements of Changes in Net Assets

| | | Pax MSCI EAFE ESG Index ETF | |

| | | Year Ended

12/31/13 | | Year Ended

12/31/12 | |

INCREASE (DECREASE) IN NET ASSETS FROM

OPERATIONS: | |

Net investment income (loss) | | $ | 775,106 | | | $ | 272,896 | | |

Net realized gain (loss) on investments and foreign currency

transactions | | | (110,191 | ) | | | (58,788 | ) | |

Net change in unrealized appreciation (depreciation) on

investments and foreign currency translation | | | 6,139,468 | | | | 915,623 | | |

Net increase in net assets resulting from operations | | | 6,804,383 | | | | 1,129,731 | | |

Net equalization credits and charges | | | 299,424 | | | | 93,498 | | |

Distributions to shareholders from: | |

Net investment income | | | (761,762 | ) | | | (282,212 | ) | |

Total distributions to shareholders | | | (761,762 | ) | | | (282,212 | ) | |

From capital share transactions: | |

Proceeds from sale of shares sold | | | 39,344,324 | | | | 8,107,461 | | |

Net income equalization (Note B) | | | (299,424 | ) | | | (93,498 | ) | |

Net increase (decrease) in net assets from capital

share transactions | | | 39,044,900 | | | | 8,013,963 | | |

Net increase in net assets during the year | | | 45,386,945 | | | | 8,954,980 | | |

Net assets at beginning of year | | | 13,161,985 | | | | 4,207,005 | | |

Net assets at end of year (1) | | $ | 58,548,930 | | | $ | 13,161,985 | | |

(1) Including Distributions in excess of net

investment income | | $ | (7,811 | ) | | $ | (13,565 | ) | |

Shares of beneficial interest: | |

Shares sold | | | 1,450,000 | | | | 350,000 | | |

Net increase in shares outstanding | | | 1,450,000 | | | | 350,000 | | |

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

12

Selected data for a share outstanding throughout each period

| | | Pax MSCI EAFE ESG Index ETF | |

| | | Year Ended

12/31/13 | | Year Ended

12/31/12 | | For the Period

1/27/11*-12/31/11 | |

Net asset value, beginning of

period | | $ | 23.93 | | | $ | 21.04 | | | $ | 25.06 | | |

Income (loss) from investment

operations: | |

Net investment income1 | | | 0.64 | | | | 0.72 | | | | 0.62 | | |

Net realized and unrealized gain (loss)2 | | | 5.01 | | | | 2.54 | | | | (4.30 | ) | |

Total from investment operations | | | 5.65 | | | | 3.26 | | | | (3.68 | ) | |

Net equalization credits and charges | | | 0.25 | | | | 0.25 | | | | 0.22 | | |

Distributions to shareholders from: | |

Net investment income | | | (0.56 | ) | | | (0.62 | ) | | | (0.56 | ) | |

Total distributions | | | (0.56 | ) | | | (0.62 | ) | | | (0.56 | ) | |

Net asset value, end of period | | $ | 29.27 | | | $ | 23.93 | | | $ | 21.04 | | |

Total return3 | | | 24.96 | % | | | 16.98 | % | | | (14.04 | )% | |

Net assets, end of period (in 000's) | | $ | 58,549 | | | $ | 13,162 | | | $ | 4,207 | | |

Ratio of expenses to average net

assets | | | 0.55 | % | | | 0.55 | % | | | 0.55 | %4 | |

Ratio of net investment income to

average net assets | | | 2.34 | % | | | 3.21 | % | | | 2.91 | %4 | |

Portfolio turnover rate5 | | | 12 | % | | | 8 | % | | | 11 | % | |

1 Based on average shares outstanding during the period.

2 Amounts shown in this caption for a share outstanding may not accord with the change in aggregate gains and losses in securities for the fiscal period because of the timing of sales and repurchases of Fund shares in relation to fluctuating market values for the Fund.

3 Total return is calculated assuming a purchase of shares at net asset value on the first day of the period, reinvestment of all dividends and distributions at net asset value during the period, and a sale at net asset value on the last day of the period. Total return for periods of less than one year is not annualized. Broker commission charges are not included in this calculation.

4 Annualized.

5 Portfolio turnover rate excludes the value of securities received or delivered from in kind processing of creations or redemptions of the Fund's capital shares.

* Commencement of operations.

SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS.

13

Notes to the Financial Statements

NOTE A—Organization

Pax World Funds Trust II (the "Trust"), which is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), is an open-end management investment company organized under the laws of the Commonwealth of Massachusetts on February 7, 2008.

As of December 31, 2013, the Trust offered the Pax MSCI EAFE ESG Index ETF (the "Fund") which represents beneficial interest in the Trust. The Fund commenced operations on January 27, 2011 and first listed on NYSE Arca, Inc. on January 28, 2011. The Fund operates as a non-diversified investment company. The Fund's investment objective is to seek investment returns that closely correspond to the price and yield performance, before fees and expenses, of the MSCI EAFE ESG Index.

NOTE B—Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements:

Use of Estimates The preparation of financial statements in conformity with U.S. generally accepted accounting principles ("GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Indemnifications and Guarantees Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust enters into contracts with service providers that contain general indemnification clauses. The Trust's maximum exposure under these arrangements is unknown as this could involve future claims that may be made against the Trust that have not yet occurred. However, while the Trust has a relatively short operating history, the Trust nonetheless expects the risk of loss to be remote.

Valuation of Investments For purposes of calculating the net asset value ("NAV"), determined ordinarily as of the close of regular trading (normally 4:00 p.m. Eastern time) (the "NYSE Close") on the New York Stock Exchange ("NYSE") on each day (a "Business Day") that the NYSE is open for trading, the Fund normally uses pricing data for domestic equity securities received

14

shortly after the NYSE Close and do not normally take into account trading, clearances or settlements that take place after the NYSE Close. Domestic fixed income and foreign securities are normally priced using data reflecting the earlier closing of the principal markets for those securities, subject to possible fair value adjustments. Information that becomes known to the Fund or its agents after NAV has been calculated on a particular day will not generally be used to retroactively adjust the price of a security or NAV determined earlier that day.

Fair values for various types of securities and other instruments are determined on the basis of closing prices or last sales prices on an exchange or other market, or based on quotes or other market information obtained from quotation reporting systems, established market makers or pricing services. Short-term investments having a maturity of 60 days or less are generally valued at amortized cost, which approximates fair value.

Investments denominated in currencies other than the U.S. dollar are converted to U.S. dollars using daily exchange rates obtained from pricing services. As a result, NAV of the Fund's shares may be affected by changes in the value of currencies in relation to the U.S. dollar.

If market quotations are not readily available (including in cases when available market quotations are deemed to be unreliable), the Fund's investments will be valued as determined in good faith pursuant to policies and procedures approved by the Board of Trustees (so called "evaluated pricing"). The Board has delegated to the Adviser's Best Execution and Valuation Committee the day-to-day responsibility for making evaluated pricing determinations with respect to Fund holdings. The Best Execution and Valuation Committee is comprised of representatives of the Adviser, including several members of the Portfolio Management team, the Director of Trading, the Chief Compliance Officer and the Chief Financial Officer. One of the functions of the Best Execution and Valuation Committee is to value securities where current and reliable market quotations are not readily available. The Committee meets periodically and reports to the Board at each quarterly meeting regarding any securities for which evaluated pricing was employed during the previous quarter. All actions taken by the Best Execution and Valuation Committee are reviewed and ratified by the Board. Evaluated pricing may require subjective determinations about the value of a security or other asset, and fair values used to determine a Fund's NAV may differ from quoted or published prices, or from prices that are used by others, for the same investments. Also, the use of evaluated pricing may not always result in adjustments to the prices of securities or other assets held by a Fund.

15

Notes to the Financial Statements, continued

The Fund may determine that market quotations are not readily available due to events relating to a single issuer (e.g., corporate actions or announcements) or events relating to multiple issuers (e.g., governmental actions or natural disasters). The Fund may determine the fair value of investments based on information provided by pricing services and other third-party vendors, which may recommend fair value prices or adjustments with reference to other securities, indices or assets. In considering whether fair value pricing is required and in determining fair values, the Fund may, among other things, consider significant events (which may be considered to include changes in the value of U.S. securities or securities indices) that occur after the close of the relevant market and the usual time of valuation. Evaluated pricing could result in a difference between the prices used to calculate the Fund's NAVs and the prices used by the Fund's benchmark indices, which, in turn, could result in a difference between the Fund's performance and the performance of the Fund's benchmark indices.

Non-U.S. markets can be significantly more volatile than U.S. markets, causing the prices of some of the Fund's investments to fluctuate significantly, rapidly and unpredictably. Non-U.S. securities may be less liquid than U.S. securities; consequently, the Fund may at times be unable to sell non-U.S. securities at desirable times or prices. Other risks related to non-U.S. securities include delays in the settlement of transactions; less publicly available information about issuers; different reporting, accounting and auditing standards; the effect of political, social, diplomatic or economic events; seizure, expropriation or nationalization of the issuer or its assets; and the possible imposition of currency exchange controls. If the Fund invests substantially in securities of non-U.S. issuers tied economically to a particular country or geographic region, it will be subject to the risks associated with such country or geographic region to a greater extent than a fund that is more diversified across countries or geographic regions.

The Board of Trustees of the Trust has determined that, because shares of the Fund are purchased or redeemed principally by the delivery of securities in kind, rather than cash, the use of local market closing prices to determine the value of non-U.S. securities, rather than fair values determined as of the NYSE Close to give effect to intervening changes in one or more indices, is unlikely to result in material dilution of the interests of the Fund's shareholders. Therefore, and in order to minimize tracking error relative to the Fund's benchmark index (which is based on local market closing prices), the Fund generally intends to use local market closing prices to value non-U.S. securities using a different methodology.

16

Fair Value Measurements Fair value is defined as the price that the Fund would receive upon selling an investment in orderly transaction between market participants. Various inputs are used in determining value, these are summarized in the three broad Levels listed below.

• Level 1 – quoted prices in active markets for identical investments

• Level 2 – other significant observable inputs (including investments valued at amortized cost, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Following is a general summary of valuation inputs and classifications for different categories of securities.

Equity Securities Equity securities, including common stocks, preferred stocks and exchange-traded funds, for which market quotations are readily available, valued at the last reported sale price or official closing price as reported by an independent pricing service, are generally categorized as Level 1 in the hierarchy. To the extent that significant inputs for equity securities are unobservable, values are categorized as Level 3 in the hierarchy.

Short-term Investments Short-term securities, including repurchase agreements, with remaining maturities of sixty days or less, which are valued at amortized cost, are generally categorized as Level 2 in the hierarchy.

The following is a summary of the inputs used to value the Fund's investments as of December 31, 2013:

| | | Level 1 | | Level 2 | | Level 3 | | Total | |

Common Stocks | | $ | 57,842,993 | | | $ | — | | | $ | — | | | $ | 57,842,993 | | |

Preferred Stocks | | | 512,544 | | | | — | | | | — | | | | 512,544 | | |

Rights | | | 8,926 | | | | — | | | | — | | | | 8,926 | | |

Money Market Fund | | | 415,835 | | | | — | | | | — | | | | 415,835 | | |

Total | | $ | 58,780,298 | | | $ | — | | | $ | — | | | $ | 58,780,298 | | |

17

Notes to the Financial Statements, continued

The Fund did not hold any Level 2 or Level 3 categorized securities during the year ended December 31, 2013.

Transfers in and out of Levels during the period are assumed to be transferred on the last day of the period at their current value. There were no transfers between Level 1 and Level 2 during the period.

Investment Transactions Investment transactions are recorded as of the date of purchase, sale or maturity. Net realized gains and losses from the sale or disposition of securities are determined on the identified cost basis, which is also used for federal income tax purposes. Corporate actions (including cash dividends) are recorded net of foreign tax withholdings.

Investment Income Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion of discount and amortization of premiums, if any. The value of additional securities received as dividend payments is recorded as income and as an increase to the cost basis of such securities.

Distributions to Shareholders Distributions to shareholders are recorded by the Fund on the ex-dividend date. The Fund expects to pay dividends of net investment income and to make distributions of capital gains, if any, at least annually. Income and capital gains distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

Equalization The Fund follows the accounting practice known as "Equalization" by which a portion of the proceeds from sales and costs of reacquiring Fund shares, equivalent on a per share basis to the amount of distributable net investment income on the date of the transaction, is credited or charged to undistributed net investment income. As a result, undistributed net investment income per share is unaffected by sales or reacquisition of Fund shares. Amounts related to Equalization can be found on the Statements of Changes in Net Assets.

Expenses The Fund is charged a unified management fee that includes all the costs and expenses of the Fund (other than taxes, charges of governmental agencies, interest, brokerage commissions incurred in connection with portfolio transactions and extraordinary expenses), including accounting expenses, administrator, transfer agent and custodian fees, Fund legal fees and other expenses (See Note C).

Federal Income Taxes The Fund intends to elect to be treated and qualify each year as a regulated investment company under Subchapter M of the Internal

18

Revenue Code of 1986, as amended (the "Code"). If the Fund so qualifies and satisfies certain distribution requirements, the Fund will ordinarily not be subject to federal income tax on its net investment income (which includes short-term capital gains) and net capital gains that it distributes to shareholders. The Fund expects to distribute all or substantially all of its income and gains to shareholders every year. Therefore, no Federal income or excise tax provision is required. The Fund is treated as a separate entity for U.S. Federal income tax purposes.

Foreign Currency Transactions The accounting records of the Fund are maintained in U.S. dollars. In addition, purchases and sales of investment securities, dividend and interest income and certain expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses occurring during the holding period of investment securities are a component of realized gain (loss) on investment transactions and unrealized appreciation (depreciation) on investments, respectively.

NOTE C—Investment Advisory Fee and Transactions

The Trust has entered into an Investment Advisory Contract (the "Management Contract") with Pax World Management LLC (the "Adviser"). Pursuant to the terms of the Management Contract, the Adviser, subject to the supervision of the Board of Trustees of the Trust, is responsible for managing the assets of the Fund in accordance with the Fund's investment objectives, investment programs and policies.

Pursuant to the Management Contract the Adviser has contracted to furnish the Fund continuously with an investment program, determining what investments to purchase, sell and exchange for the Fund and what assets to hold uninvested. The Adviser also has contracted to provide office space and certain management and administrative facilities for the Fund. The Fund pays a unified management fee to the Adviser at an annual rate of 0.55% (expressed as a percentage of the average daily net assets of the Fund).

Out of the investment advisory fee, the Adviser pays all expenses of managing and operating the Fund, except taxes, charges of governmental agencies, interest, brokerage commissions incurred in connection with portfolio transactions and extraordinary expenses. The aggregate remuneration paid to the Trust's Trustees (and borne by the Adviser) was $15,299.

19

Notes to the Financial Statements, continued

NOTE D—Investment Information

During the year ended December 31, 2013, the Fund had purchases and sales of investment securities as follows:

| Purchases | | Sales | | Purchases In-Kind | | Sales In-Kind | |

$ | 3,884,909 | | | $ | 4,270,252 | | | $ | 39,208,728 | | | $ | — | | |

The identified cost of investments for federal income tax purposes and the gross unrealized appreciation and depreciation at December 31, 2013 were as follows:

Identified Cost | | Gross Unrealized

Appreciation | | Gross Unrealized

Depreciation | | Net Unrealized

Appreciation

(Depreciation) | |

| $ | 52,136,942 | | | $ | 7,579,599 | | | $ | 936,243 | | | $ | 6,643,356 | | |

Tax Information The RIC Modernization Act of 2010, the "Act", was signed into law on December 22, 2010. Under the Act, the Fund will be permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. However, losses incurred post-enactment will be required to be utilized prior to the losses incurred in pre-enactment years. As a result, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment losses that are carried forward will retain their character as either short-term or long-term capital losses, rather than being considered as all short-term as under previous law.

At December 31, 2013, the Fund had short-term capital loss carryforwards of $36,435 and long-term capital loss carryforwards of $154,896, which have no expiration and may be used to offset any future realized gains.

Carryforwards

Utilized in 2013 | | No Expiration

Short-term | | No Expiration

Long-term | |

$ | — | | | $ | 36,435 | | | $ | 154,896 | | |

During the period from November 1, 2013 through December 31, 2013, the Fund incurred a qualified late-year ordinary loss of $786. This loss is treated for federal income tax purposes as if it had occurred on January 1, 2014.

For financial reporting purposes, capital accounts are adjusted to reflect the tax character of permanent book/tax differences. Reclassifications are primarily due

20

to tax treatment of gain (loss) on foreign currency transactions. For the year ended December 31, 2013, the Fund recorded the following reclassifications:

Undistributed Net

Investment Income | | Accumulated Net

Realized Gain (Loss) | | Paid In

Capital | |

| $ | (7,590 | ) | | $ | 7,591 | | | $ | (1 | ) | |

Net assets were not affected by these reclassifications.

The tax character of distributions paid during the years ended December 31, 2013 and December 31, 2012 were as follows:

Distributions Paid in 2013 | | Distributions Paid in 2012 | |

Ordinary

Income | | Long-term

Capital Gains | | Ordinary

Income | | Long-term

Capital Gains | |

$ | 761,762 | | | $ | — | | | $ | 282,212 | | | $ | — | | |

As of December 31, 2013 the components of distributable earnings on a tax basis were as follows:

Undistributed

Net Investment

Income | | Undistributed

Long-term

Capital Gain | | Net Unrealized

Appreciation

(Depreciation) | | Late Year

Loss Deferal | | Capital Loss

Carryforwards | |

$ | — | | | $ | — | | | $ | 6,646,072 | | | $ | (786 | ) | | $ | (191,331 | ) | |

The timing and characterization of certain income and capital gains distributions are determined annually in accordance with federal tax regulations, which may differ from GAAP. These differences primarily relate to investments in foreign denominated securities and passive foreign investment companies (PFICs). Additionally, timing differences may occur due to wash sale loss deferrals. As a result, net investment income (loss) and net realized gain (loss) on investment transactions for a reporting period may differ significantly from distributions during such period, and may result in reclassification among certain capital accounts. For tax purposes, short-term capital gains are considered ordinary income.

Management has analyzed the Fund's tax positions taken for all open years which remain subject to examination by the Fund's major tax jurisdictions (years 2010 through 2012). The Fund recognizes interest and penalties, if any, related to tax liabilities as income tax expense in the Statement of Operations. Management has concluded that, as of and during the year ended December 31, 2013, no provision for federal income tax is necessary and, therefore, the Fund did not have a liability for any unrecognized tax expenses.

21

Notes to the Financial Statements, continued

NOTE E—Shareholder Transactions

The Fund issues and redeems shares only to Authorized Participants (typically broker-dealers) in exchange for delivery of a basket of assets (securities and/or cash), referred to as a Creation Unit, in aggregations of 50,000 shares. The Fund may impose a creation transaction fee and a redemption transaction fee to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units. The standard creation and redemption transaction fee of $1,800 is charged on each transaction of Creation Units purchased or redeemed by an investor on the same day. Purchasers and redeemers of Creation Units for cash (when cash creations and redemptions are permitted) will also be subject to an additional variable charge of up to a maximum of four times the standard creation/ redemption transaction fee to offset the transaction cost to the Fund of buying portfolio securities. In addition, purchasers and redeemers of Creation Units are responsible for payment of the costs of transferring securities to or from a Fund. From time to time, the Adviser may cover the cost of any transaction fees.

Retail investors may only buy and sell shares of the Fund on a national securities exchange (NYSE Arca) through a broker-dealer. Such transactions may be subject to customary brokerage commission charges. Shares can be bought and sold throughout trading day like other publicly-traded securities, trading at current market prices, which may be different from the Fund's net asset value.

Note F—Subsequent Events

On December 11, 2013, Pax World Funds Series Trust I announced that the Trustees of each of Pax World Funds Series Trust I and Pax World Funds Trust II approved the merger of each of the Pax World International Fund and the Fund into Pax MSCI International ESG Index Fund (the "New International Fund"), a newly-formed series of Pax World Funds Series Trust I that will seek investment returns, before fees and expenses, that closely correspond to the price and yield performance of the MSCI EAFE ESG Index, and will otherwise have the same investment objective, policies and restrictions as the Fund, but will be a "traditional" open-end mutual fund, rather than an exchange-traded fund. The Fund will be the accounting survivor of the merger. In connection with these approvals, the Trustees also approved an amendment to the contractual agreement of Pax World Management LLC to reimburse certain operating expenses of the International Fund to exclude therefrom expenses associated with the proposed mergers. The merger is expected to take place in the first half of the 2014, providing that the shareholders of the Pax

22

World International Fund approve the merger. The shareholders of the International Fund received a Proxy/Information Statement/Prospectus and commenced voting during the first quarter of 2014. Due to the fact that the fund surviving the reorganization will have investment objectives, policies and restrictions identical to those of the Fund, shareholders of the Fund were not asked to vote on the reorganization.

23

Report of Independent Registered Public Accounting Firm

The Board of Trustees and Shareholders of Pax World Funds Trust II:

We have audited the accompanying statement of assets and liabilities of Pax MSCI EAFE ESG Index ETF (the "Fund"), including the schedule of investments, as of December 31, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund's internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and brokers or by other appropriate auditing procedures where replies from brokers were not received. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Pax MSCI EAFE ESG Index ETF at December 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

February 24, 2014

24

December 31, 2013 (Unaudited)

Frequency Distribution of Discounts and Premiums Bid/Offer Midpoint vs. NAV as of December 31, 2013 (Unaudited)

| | Bid/Offer Midpoint Above NAV | | Bid/Offer Midpoint Below NAV | |

Commencement of Trading | | 50-99

Basis Points | | 100-199

Basis Points | | >200

Basis Points | | 50-99

Basis Points | | 100-199

Basis Points | | >200

Basis Points | |

PAX MSCI EAFE ESG Index ETF

01/27/11 through 12/31/13 | | | 222 | | | | 165 | | | | 25 | | | | 44 | | | | 26 | | | | 22 | | |

Tax Information (Unaudited)

For the fiscal year ended December 31, 2013 certain dividends paid by the Trust may be designated as qualified dividend income and subject to a maximum tax rate of 15%, as provided for the Jobs and Growth Tax Relief Reconciliation Act of 2003. Complete information will be reported in conjunction with your 2013 Form 1099-DIV.

For the fiscal year ended December 31, 2013, the Pax MSCI EAFE ESG Index ETF earned foreign source income totaling $1,023,682 and paid $64,588 in foreign taxes which it intends to pass through to its shareholders.

Proxy Voting (Unaudited)

You may obtain a description of the policies and procedures that the Fund uses to determine how to vote proxies relating to their portfolio securities, without charge, upon request by contacting the Fund at 888.729.3863 or on the SEC's website at www.sec.gov. The information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30 is available without charge, upon request, by telephoning ESG Shares (toll-free) at 888.729.3863 or visiting ESG Shares website at www.esgshares.com and will be available without charge by visiting the SEC's website at www.sec.gov.

Quarterly Portfolio Holdings Disclosure (Unaudited)

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund's Form N-Q is available on the SEC website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800.SEC.0330. Information contained in the Fund's Form N-Q may also be obtained by visiting ESG Shares website at www.esgshares.com or telephoning ESG Shares (toll-free) at 888.729.3863.

25

December 31, 2013 (Unaudited)

Management of the Fund (Unaudited)

Officers/Trustees

The following table reflects the name and age, position(s) held with the Trust, the term of office and length of time served, the principal occupation(s) during the past five (5) years, other directorships held, and the number of portfolios overseen in the Pax World Fund Family of those persons who were the trustees and/or officers of the Funds on December 31, 2013. The trustees and officers set forth in the first table below (Interested Trustees and Officers) are considered interested persons under the 1940 Act by virtue of their position or affiliation with the Adviser. The trustees in the second table (Disinterested Trustees) are not considered interested persons and have no affiliation with the Adviser. The business address of each trustee and officer is 30 Penhallow Street, Suite 400, Portsmouth, NH 03801.

None of the officers or trustees of the Fund are related to one another by blood, marriage or adoption. The aggregate remuneration paid on behalf of the Fund during the period covered by the report to (i) all Trustees and all members of any advisory board for regular compensation; (ii) each Trustee and each member of an advisory board for special compensation; (iii) all officers; and (iv) each person of whom any officer or Trustee of the Fund is an affiliated person is $15,299.

Interested Trustees and Officers

Name and Age | | Position(s) Held With the

Trust; Term of Office1; and

Length of Time Served | | Principal Occupation(s) During Past

Five Years and Other Directorships Held

by Trustee or Officer | | Number of

Portfolios in the

Pax World Fund

Family Overseen

by Trustee | |

Laurence A. Shadek

(64) | | Trustee (since 2008) | | Chairman of the Board of the Adviser (1996–present); Executive Vice-President of Wellington Shields & Co. LLC or its predecessor (1986–present); Trustee of Pax World Funds Series Trust I (2006–present); Executive Vice President of Pax World Money Market Fund (1998–2008); Chairman of the Board of Directors of the Pax World Balanced Fund (1996–2006), Pax World Growth Fund (1997–2006), and Pax World High Yield Bond Fund (1999–2006); member of the Board of Trustees of Franklin & Marshall College (1998–present). | | | 12 | | |

26

December 31, 2013 (Unaudited)

Name and Age | | Position(s) Held With the

Trust; Term of Office1; and

Length of Time Served | | Principal Occupation(s) During Past

Five Years and Other Directorships Held

by Trustee or Officer | | Number of

Portfolios in the

Pax World Fund

Family Overseen

by Trustee | |

Joseph Keefe

(60) | | Trustee, Chief Executive Officer (since 2008) | | Chief Executive Officer (2005–present) and President (2006–present) of the Adviser; Trustee of Pax World Funds Series Trust I (2006–present); Chair of the Board, Women Thrive Worldwide (2009–present); member of the Boards of Directors of Americans for Campaign Reform (2003–2013), On Belay (2006–2011) and the Social Investment Forum (2000–2006). | | | 12 | | |

John Boese

(50) | | Chief Compliance Officer (since 2008) | | Chief Compliance Officer of the Adviser (2006–present); Chief Compliance Officer of Pax World Funds Series Trust I (2006–present); Vice President and Chief Regulatory Officer of the Boston Stock Exchange, Boston, MA (2000–2006). | | | N/A | | |

Maureen Conley

(51) | | Secretary (since 2008) | | Senior Vice President of Shareholder Services/Operations (2005–present) and Manager of Shareholder Services (2000–2005) for the Adviser; Secretary of Pax World Funds Series Trust I (2006–present). | | | N/A | | |

Alicia K. DuBois

(54) | | Treasurer (since 2008) | | Chief Financial Officer for the Adviser (2006–present); Treasurer of Pax World Funds Series Trust I (2006–present); Assistant Treasurer for both Jefferson Pilot Investment Advisory Corp. and Jefferson Pilot Variable Fund, Inc. (2001–2006); and Assistant Vice President at Lincoln Financial Group (formerly Jefferson-Pilot Corp.) (2005–2006) | | | N/A | | |

Scott LaBreche

(41) | | Assistant Treasurer (since 2010) | | Director, Portfolio Analysis & Reporting for the Adviser (2009–present); Assistant Treasurer of Pax World Funds Series Trust I (2010–present); Fund Administration Manager & Portfolio Analyst for the Adviser (2007–2009); Securities Fund Analyst, Lincoln Financial Group (formerly Jefferson Pilot Financial) (2000–2007). | | | N/A | | |

27

December 31, 2013 (Unaudited)

Disinterested Trustees

Name and Age | | Position(s) Held With the

Trust; Term of Office1; and

Length of Time Served | | Principal Occupation(s) During Past

Five Years and Other Directorships Held by

Trustee or Officer | | Number of

Portfolios in the

Pax World Fund

Family Overseen

by Trustee | |

Adrian P. Anderson

(59)2 | | Trustee (since 2008) | | Trustee of Pax World Funds Series Trust I (2007–present; Chief Executive Officer of North Point Advisors, LLC (2004–present); Senior Consultant of Gray and Co. (1999–2004). | | | 12 | | |

Carl H. Doerge, Jr.

(75)2 | | Chairman of the

Board of Trustees;

Trustee (since 2008) | | Trustee of Pax World Funds Series Trust I (2006–present); Private investor (1995–present); member of the Board of Trustees and Finance Committee for Hobe Sound Nature (1998–present); member of the Board of Directors (1998–present) and Chairman of the Investment Committee (1999–present) of St. Johnland Nursing Home in Kings Park, NY. | | | 12 | | |

Cynthia Hargadon

(58)3 | | Trustee (since 2008) | | Trustee of Pax World Funds Series Trust I (2006–present); Senior Consultant and Partner of North Point Advisors, LLC (2003–2006, 2010–present); Managing Director of CRA Rogers Casey (2006–2010). | | | 12 | | |

Louis F. Laucirica

(72)2 | | Trustee (since 2008) | | Trustee of Pax World Funds Series Trust I (2006–present); Associate Dean and Director of Undergraduate Studies of Stevens Institute of Technology, Howe School (1999–2010). | | | 12 | | |

John L. Liechty

(59)3 | | Trustee (since 2010) | | Trustee of Pax World Funds Series Trust I (2010–present); Principal, Integrated Investment Solutions (2009–present); Principal, Integrated Financial Planning (2010–present); President and CEO, MMA Praxis Mutual Funds (1997–2008). | | | 12 | | |

Nancy S. Taylor

(58)3 | | Trustee (since 2008) | | Trustee of Pax World Funds Series Trust I (2006–present); Senior Minister, Old South Church in Boston, MA (2005–present); Trustee, Andover Newton Theological School (2002–present); Board of Managers, Old South Meeting House (2005–present); Director, Ecclesia Ministries, a ministry to Boston's homeless population (2003–present). | | | 12 | | |

1 Trustees of the Funds hold office until a successor is chosen and qualifies. Officers of the Funds are appointed by the Board of Trustees and hold office until a successor is chosen and qualifies.

2 Designates a member of the Audit Committee. The Audit Committee has the responsibility of overseeing the establishment and maintenance of an effective financial control environment, for overseeing the procedures for evaluating the system of internal accounting control and for evaluating audit performance. The Audit Committee meets on at least a quarterly basis.

3 Designates a member of the Nomination, Compensation & Compliance Committee. The Nomination, Compensation & Compliance Committee is responsible for considering and recommending Board candidates, reviewing and recommending Board compensation, and overseeing regulatory and fiduciary compliance matters. The Nomination, Compensation & Compliance Committee meets on at least a quarterly basis.

28

December 31, 2013 (Unaudited)

The Statement of Additional Information includes additional information about the trustees and is available upon request without charge by calling 888.729.3863 between the hours of 9:00 a.m. and 6:00 p.m. Eastern time or by visiting our website at www.esgshares.com.

This annual report is intended for shareholders of the Pax MSCI EAFE ESG Index ETF only, and is not authorized for distribution to other persons unless accompanied or preceded by a prospectus. Please consider the Fund's investment objectives, risks and charges and expenses carefully before investing. The Fund's prospectus contains this and other information about the Fund and may be obtained by calling 888.729.3863, e-mailing info@esgshares.com or visiting www.esgshares.com. The performance data quoted herein represents past performance, which does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. In addition, current performance may be lower or higher than the performance data quoted herein. For more recent month-end performance information, please call 888.729.3863 or visit www.esgshares.com.

29

30 Penhallow Street, Suite 400

Portsmouth NH 03801

888.729.3863

www.esgshares.com

Item 2. Code of Ethics.

As of December 31, 2013, the Registrant has adopted a “code of ethics,” as such term is defined in paragraph (b) of this Item 2, that applies to all officers of the Registrant, including Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the Registrant or by a third party. A copy of the code of ethics is filed as an exhibit to this Form N-CSR.

Item 3. Audit Committee Financial Expert.

The Registrant’s Board of Trustees has determined that Carl H. Doerge, Jr. and Adrian Anderson, who each serve on the Board’s Audit Committee, qualify as “audit committee financial experts,” as such term is defined in paragraph (b) of this Item 3. The Board also has determined that Messrs. Doerge and Anderson are “independent,” as such term is interpreted by subparagraph (a)(2) of this Item 3. The Securities and Exchange Commission has stated that the designation of a person as an audit committee financial expert pursuant to this Item 3 of the Form N-CSR does not impose on such a person any duties, obligations or liability that are greater than the duties, obligations or liability imposed on such person as a member of the Audit Committee and the Board of Trustees in the absence of such designation or identification.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the Registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements were $9,000 and $18,000 for the fiscal years ended December 31, 2013 and 2012, respectively.

(b) Audit-Related Fees. The aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the Registrant’s financial statements and are not reported under paragraph (a) of this Item were $0 and $0 for the fiscal years ended December 31, 2013 and 2012, respectively.

(c) Tax Fees. The aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice and tax planning were $11,250 and $15,000 for the fiscal years ended December 31, 2013 and 2012, respectively. Fees disclosed under this category are for professional services related to review and execution of federal, state and excise tax returns and advice concerning tax compliance and planning.

(d) All Other Fees. The aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item, are $0 and $0 for the fiscal years ended December 31, 2013 and 2012, respectively.

(e) (1) To the extent required by applicable regulations, the Audit Committee approves in advance all audit and non-audit services rendered to the Registrant by the independent registered public accounting firm and all non-audit services to the Registrant’s investment adviser and any entity controlling, controlled by or under common control with the Registrant’s investment adviser that provide ongoing services to the Registrant, if the engagement relates directly to the operations and financial reporting of the Registrant.

(2) With respect to the services described in paragraphs (b) through (d) of this Item, no amount was approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X and no amount was required to be approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X.

(f) Not applicable.

(g) The aggregate non-audit fees billed by the Registrant’s accountant for services rendered to the Registrant, or to the Registrant’s investment adviser, or to any entity controlling, controlled by or under common control with the adviser that provides ongoing services to the Registrant totaled $0 and $0, for the fiscal years ended December 31, 2013 and 2012, respectively.

(h) Not applicable.

Item 5. Audit Committee of Listed Registrants.

The registrant has an audit committee which was established by the Board of Trustees of the Trust in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. The members of the registrant’s audit committee are Adrian P. Anderson, Carl H. Doerge, Jr. and Louis F. Laucirica.

Item 6. Schedule of Investments.

A complete series of schedules of investments are included as part of the Report to Shareholders filed under Item 1

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

This disclosure is not applicable to the Registrant, as it is an open-end investment company.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

This disclosure is not applicable to the Registrant, as it is an open-end investment company.

Item 9. Purchase of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

This disclosure is not applicable to the Registrant, as it is an open-end investment company.

Item 10. Submission of Matters to a Vote of Security Holders.