UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21187

(Exact name of registrant as specified in charter)

| | |

| 30 Penhallow Street, Suite 400, Portsmouth, NH | | 03801 |

| (Address of principal executive offices) | | (Zip code) |

|

Pax World Management LLC 30 Penhallow Street, Suite 400, Portsmouth, NH 03801 Attn.: Joseph Keefe |

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-767-1729

Date of fiscal year end: December 31

Date of reporting period: 12/31/11

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Annual Report to Shareholders |

Table of Contents

For More Information

General Fund Information

888.729.3863

www.esgshares.com

Transfer Agent and

Custodian

State Street Bank and Trust Company

1 Lincoln Street

Boston, MA 02111

Investment Adviser

Pax World Management LLC

30 Penhallow Street, Suite 400

Portsmouth, NH 03801

Letter to Shareholders

by Joseph Keefe, President & CEO

Dear fellow shareholders,

As 2012 begins, there is a palpable sense of relief in markets. 2011 was a very challenging year, to say the least. Pax World shareholders, like investors everywhere, saw their portfolios whipsawed by volatile markets that seemed to be constantly reacting—or overreacting—to world events.

Environmental disasters such as the tsunami and nuclear

meltdown in Japan and mass flooding in Thailand, coupled with man-made disasters such as the debt ceiling debacle in our nation’s capital and the European sovereign debt crisis, roiled markets throughout the year. In addition, the general failure of policy makers—in Washington and abroad—to confront the economic crisis not only exacerbated already volatile markets but contributed to a more general loss of public confidence in societal institutions. From Wall Street to Capitol Hill, from Cairo to Damascus, a rising tide of protest has swept the globe as people demand, in one form or another, that political and economic elites cede power and privilege and be more responsive to the aspirations of the vast majority of citizens. Time Magazine named “The Protestor” its 2011 Person of the Year.

Certainly, there is much to fuel protest. We are now almost four years into an economic downturn the most debilitating aspects of which—high unemployment, depressed housing prices, mortgage foreclosures—stubbornly persist. At the same time, growing inequality has become a defining feature of our age, and whether it is Occupy Wall Street protestors or the Arab Spring, there is a deep sense of injustice unfolding across the globe. There is also growing skepticism about whether market capitalism in its present form, dominated by ever larger financial institutions that are backed (and bailed out) by the state, is delivering the goods to the vast majority of citizens. As the song said, something’s happening here.

Moreover, as the economy struggled, 2011 saw global population grow to seven billion people, a level which leading environmentalists have warned threatens the carrying capacity and sustainable yield thresholds of planet earth. Rising temperatures, emerging food and water shortages, disappearing rainforests and related ecological and global health crises call for a fundamental rethinking of the way economies grow and organize themselves.

New York Times columnist Tom Friedman has cited the Australian ecologist and writer Paul Gilding in referring to this moment as The Great Disruption—“when both Mother Nature and Father Greed have hit the wall at once.” Or, as I put it in remarks to the Boston Economic Club a few years ago: The Financial Crisis and the Sustainability Crisis are “twin crises that…betray deep-seated, systemic problems that neither government nor markets, the public sector or the private sector, as they are presently constituted, seem designed to address. We need a new design.”

2

It seems absolutely clear that the answer cannot be going back to business-as-usual and hoping that the next economic bubble provides temporary relief. We can no longer countenance short-term solutions or temporary fixes. If 2011 underscored anything, it is the need to put short-term thinking aside and embrace a more sustainable, long-term vision of global economic health. That, in a nutshell, is the great challenge before us.

We must all do our part—as citizens, as consumers, as parents. But we can also do our part as investors. This is particularly true at a time when corporations—legal fictions that have now been accorded the status of “persons”—dominate the global economy and exert ever-greater control over policy makers via campaign contributions and lobbying clout. It is incumbent upon us, the shareowners of those corporations, to embrace our responsibilities and attempt to influence them, and ultimately influence markets, in the direction of sustainability. Sustainable investing is not the answer but it is certainly an answer to the challenges ahead, as at its core is the belief that corporate profits and the public interest must be in alignment rather than in conflict.

In 2011, despite enormous headwinds, ESG Shares remained committed to the fundamental rationale underlying the indices: investing in companies that we believe are ahead of their peers in responding to the challenges of sustainability—embracing better environmental practices, aspiring to stronger corporate governance standards, and respecting human dignity in the way they interact with workers, communities and society. We continued to engage companies and policy makers on a range of issues that included hydraulic fracturing, clean fuel standards, corporate disclosure of political contributions, gender diversity on corporate boards and human trafficking. And we continued to focus on the long term.

As 2012 begins, we are confident that this long-term focus will help our ETFs mitigate risk and be better positioned for sustainable growth. Just as importantly, we are hopeful that our efforts, combined with those of many others, can begin to persuade leaders in the business community, in government and across civil society, to heed the call for a more responsible, balanced, and sustainable approach to economic growth and societal and planetary health.

Peace,

Joseph F. Keefe

President and CEO

3

December 31, 2011

Sustainable Investing

Sustainability Update

One of the principal ways that smaller asset managers like Pax become active owners of stocks and bonds is through collaboration with others. While some companies may ignore or give lip service to many investor requests, the more investors that express their concerns, the less acceptable such responses are.

Corporate managers have many things to attend to, and sustainability is not one of the issues that two centuries of corporate tradition tends to regard as significant, or in financial terms, material. It is becoming one, however. The Massachusetts Institute of Technology (MIT) and Boston Consulting Group (BCG) recently published their third annual Sustainability & Innovation Global Executive Study, and concluded that sustainability is nearing a tipping point in terms of managers’ evaluation of issues that warrant attention.1 The MIT/BCG study surveys companies, and in its 2011 survey found that 70% of the respondents to its survey indicated that sustainability is on the agenda of management, and two-thirds of respondents said that sustainability was “critically important” to competitiveness.

We and other investors that have maintained a commitment to sustainable investing for many years can take some credit for this progress. Over the past half-year, we have joined several investor coalitions to advance sustainability on multiple fronts. Examples of some of this work include the following:

| | 1. | Human Rights: Pax was a signatory to a letter expressing support for the Trafficking Victims Protection Reauthorization Act (TVPRA), S.1301, sponsored by ATEST (Alliance To End Slavery and Trafficking). This landmark legislation provides the tools necessary to combat trafficking and modern-day slavery at home and abroad. It was originally signed into law in 2000 and reauthorized in 2003, 2005 and 2008, and must be reauthorized again to remain in effect. Although the bill was passed in the House of Representatives, the House removed key provisions of the bill, and we continue to maintain support for a more robust bill in the Senate. |

| | 2. | Diversity: Pax signed on to an investor letter to the Financial Reporting Council (FRC) of the United Kingdom in response to the FRC’s consultation on potential revisions to the UK Corporate Governance Code with respect to gender diversity. The letter supported the UK moving ahead in incorporating gender disclosure |

1David Kron, Nina Kruschwitz, Knut Haanaes and Ingrid von Streng Velken, “Sustainability Nears a Tipping Point,” Sloan Management Review, December 15, 2011.

4

December 31, 2011

Sustainability Update, continued

| | in the annual reports of boards’ nominating committees. Specifically, the investors expressed support for the idea that nominating committees should describe the board’s policy on gender diversity in the boardroom, including measurable objectives for implementation on that policy and progress toward achieving those objectives. |

| | 3. | Pax participated in several environmental initiatives in 2011: |

| | a. | As we have in the past, Pax continues to be a signatory to the Carbon Disclosure Project (CDP), including the CDP, CDP Water Disclosure, and Carbon Action; the Forest Footprint Disclosure Project; and the Investor Network on Climate Disclosure. Pax participated in a structured engagement through the Principles for Responsible Investment for the CDP Water Disclosure initiative and another engagement for CDP on the CDP Leadership Initiative (CDPLI). Pax was a signatory to a letter prepared by NEI Investments of Canada to the co-chairs of the Alberta Environmental Monitoring Panel commending the panel for designing a good environmental monitoring system for oil company operations in the Alberta Oil Sands, and urging the Panel to follow up with a robust monitoring system for such operations. |

| | b. | Pax continues to be a signatory to the Global Investor Statement on Climate Change, an initiative coordinated by the UN Environment Programme Finance Initiatives, the Investor Network on Climate Risk (INCR), and the Institutional Investor Group on Climate Change. The statement urges national policymakers to establish and enforce policies limiting emissions of greenhouse gases. |

| | c. | Pax was signatory to two letters to state legislators, coordinated by INCR, one supporting a regional Clean Fuel Standard for New England and the Mid-Atlantic States, and a similar letter for California. |

| | d. | Pax signed on to a public statement, coordinated by the Investor Environmental Health Network and Boston Common Asset Management, supporting the establishment of environmental key performance indicators for oil and gas companies using hydraulic fracturing techniques to produce natural gas. The use of this technique has grown dramatically in the United States as a means to produce natural gas from so-called tight shale formations in which conventional gas drilling is impossible, and presents several unique risks, |

5

December 31, 2011

Sustainability Update, continued

| | including drinking water contamination and increased greenhouse gas emissions. |

| | e. | Pax was a signatory to a letter, coordinated by the INCR, sent to members of Congress urging them to support EPA’s efforts to propose and implement new, stronger implementation rules for electric utilities under the Clean Air Act. The letter focused on regulation of mercury and air toxics emissions, and urged Congress to support EPA’s efforts to try to reduce these emissions from utilities. |

| | f. | Pax was also a signatory to a letter, coordinated by Ceres, sent to all the companies in the Russell 1000 Index urging companies to integrate environmental, social and governance (ESG) issues into their business decision-making strategies and investor communications. This was intended as a first step in a longer initiative, which is far from complete. |

6

December 31, 2011

Commentary

The Pax MSCI North America ESG Index ETF (NASI) employs a passive management approach, seeking to track the performance of the MSCI North America ESG Index, a broadly diversified, sector-neutral index of American and Canadian companies with superior ESG performance as rated by MSCI ESG Research.

For the one year period ended December 31, 2011, the Fund’s NAV return was -1.03% tracking the MSCI North America ESG Index return of -0.33%, while underperforming the MSCI North America Index return of 0.55%. During the period the health care, consumer staples and utility sectors made the most positive contributions to performance while the financial, material and energy sectors had the largest negative impact to performance. From a country perspective, Canada (11.30% average weight of total investments for the period) was a notable detractor to performance while the United States made up the largest positive contribution to performance. Companies that contributed positively to performance included IBM, a company that provides computer solutions through technology service, systems and software and McDonalds Corp., one of the largest franchisers and operators of fast-food restaurants. Despite the overall lagging performance of the information technology sector (18.13% average weight of total investments for the period), IBM posted a strong return for the period (3.39% average weight of total investments for the period). McDonalds demonstrated strong same store sales growth which resulted in a solid increase in earnings for the period (1.41% average weight of total investments for the period). Companies that detracted most from performance included Hewlett-Packard Co., a manufacturer of computer and printer systems and Oracle Corp., a manufacturer of enterprise software systems. Hewlett-Packard and Oracle both gave weak outlooks for their businesses during the period (1.24% and 2.03% respectively, average weights of total investments for the period).

The Fund described herein is indexed to an MSCI index. The Fund referred to herein is not sponsored, endorsed or promoted by MSCI or its affiliates, and MSCI and its affiliates bear no liability with respect to any such fund or any index on which such fund is based.

The MSCI North America ESG Index is designed to measure the performance of equity securities of issuers organized or operating in the United States and Canada that have high Environmental, Social and Governance (ESG) ratings relative to their sector and industry group peers, as rated by MSCI ESG Research annually.

MSCI ESG Research evaluates companies’ ESG characteristics and derives corresponding ESG scores and ratings. Companies are ranked by ESG score against their sector peers to determine their eligibility for the MSCI ESG indices. MSCI ESG Research identifies the highest-rated companies in each peer group to meet the float-adjusted market capitalization sector targets. The rating system is based on general and industry-specific ESG criteria, assigning ratings on a 9-point scale from AAA (highest) to C (lowest). Constituents of the MSCI EAFE Index having an ESG rating of B or above are eligible for inclusion in the Index.

7

December 31, 2011

Commentary, continued

The MSCI North America ESG Index includes or utilizes data, ratings, analysis, reports, analytics or other information or materials from MSCI’s ESG Research Group within Institutional Shareholder Services Inc., an indirect wholly-owned subsidiary of MSCI. The prospectus contains a more detailed description of the limited relationship MSCI has with Pax World Management LLC, ESG Shares and any related funds.

The MSCI North America Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of North America.

Unlike the Fund, the MSCI North America ESG Index and the MSCI North America Index are not investments, are not professionally managed and do not reflect deductions for fees, expenses or taxes.

8

Pax MSCI North America ESG Index ETF

December 31, 2011

Portfolio Highlights (Unaudited)

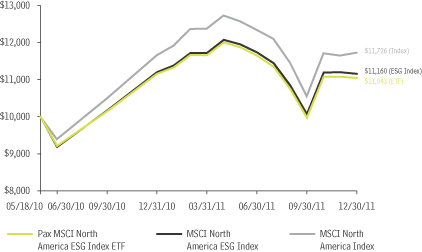

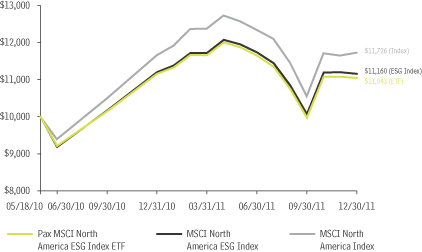

Total Return—Historical Growth of $10,000—Since Inception

Returns—Period ended December 31, 2011

| | | | | | | | |

| | | | | | Total Return | |

| | |

| | | One Year | | | Since Inception1 | |

NAV Return2 | | | -1.03% | | | | 6.29% | |

Market Value Return2 | | | -1.10% | | | | 6.49% | |

MSCI North America ESG Index3 | | | -0.33% | | | | 7.01% | |

MSCI North America Index4 | | | 0.55% | | | | 9.09% | |

All total return figures assume reinvestment of dividends and capital gains at net asset value; actual returns may differ. Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Total returns for periods of less than one year have not been annualized.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions.

1The Fund’s inception date is May 18, 2010.

2The NAV return is based on the closing NAV (net asset value per share) of the Fund and the Market Value return is based on the market price per share of the Fund. The market prices used for Market Value returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times.

3The MSCI North America ESG Index is designed to measure the performance of equity securities of issuers organized or operating in North America that have high environmental, social and governance (ESG) ratings from MSCI, selected initially and adjusted annually by MSCI.

4The MSCI North America Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of North America.

9

Pax MSCI North America ESG Index ETF

December 31, 2011

Portfolio Highlights (Unaudited), continued

| | | | | | |

| Asset Allocation | | Percent of Net Assets | |

Common Stocks | | | 99.7% | |

Money Market Funds | | | 1.0% | |

Other Assets & Liabilities | | | (0.7)% | |

| | | | | | |

Total Net Assets | | | 100.0% | |

Top Ten Holdings

| | | | | | |

| Company | | Percent of Net Assets | |

IBM | | | 3.7% | |

Procter & Gamble Co. | | | 3.1% | |

Johnson & Johnson | | | 3.0% | |

Google, Inc. (Class A) | | | 2.7% | |

Intel Corp. | | | 2.1% | |

Merck & Co., Inc. | | | 1.9% | |

PepsiCo, Inc. | | | 1.8% | |

Oracle Corp. | | | 1.7% | |

McDonald’s Corp. | | | 1.7% | |

Cisco Systems, Inc. | | | 1.7% | |

| | | | |

Total | | | 23.4% | |

Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable.

Sector Diversification

| | | | | | |

| Sector | | Percent of Net Assets | |

Information Technology | | | 18.4% | |

Financials | | | 17.0% | |

Health Care | | | 12.1% | |

Industrials | | | 11.4% | |

Consumer Staples | | | 11.2% | |

Consumer Discretionary | | | 10.8% | |

Energy | | | 8.9% | |

Materials | | | 5.1% | |

Utilities | | | 2.9% | |

Telecommunication Services | | | 1.9% | |

Cash and cash equivalents plus other assets less liabilities | | | 0.3% | |

| | | | |

Total | | | 100.0% | |

Geographical Diversification

| | | | | | |

| Country | | Percent of Net Assets | |

United States | | | 89.8% | |

Canada | | | 10.9% | |

Other Assets & Liabilities | | | (0.7)% | |

| | | | |

Total | | | 100.0% | |

10

December 31, 2011

Commentary

The Pax MSCI EAFE ESG Index ETF (EAPS) employs a passive management approach, seeking to track the performance of the MSCI EAFE ESG Index, which consists of companies operating in developed market countries around the world, excluding the U.S. and Canada, that have superior ESG performance as rated by MSCI ESG Research.

The Fund commenced operations on January 27, 2011. Since inception through December 31, 2011, the Fund’s NAV return was -14.04% tracking the MSCI EAFE ESG Index return of -13.28%, while outperforming the MSCI EAFE Index return of -15.13%. During the period, regional exposure to Europe, which is the largest regional weighting (42.77% average weight of total investments for the period) in the Fund, was the greatest detractor from performance. The European sovereign debt crisis pressured many of the European stock indices during the latter part of the year. Japan was another significant detractor from performance. Japan is one of the largest country weightings (22.85% average weight of total investments for the period) in the Fund and was negatively impacted earlier in the period as a result of a tsunami and the nuclear crisis at the Fukushima Daiichi Nuclear Power Station. On a positive note, despite the European sovereign debt crisis, country exposure to Switzerland and the Netherlands had a moderately positive impact on performance for the period. Companies that contributed positively to performance included GlaxoSmithKline PLC, a large pharmaceutical company based in the United Kingdom and Roche Holding AG, a large pharmaceutical company headquartered in Switzerland (2.44% and 2.29%, respectively, average weights of total investments for the period). Companies that detracted from performance included HSBC Holdings PLC, an international banking and financial service company located in the United Kingdom and Mitsui Fudosan Co., Ltd., a Japanese property development company (3.39% and 1.64%, respectively, average weights of total investments for the period). The European sovereign debt crisis pressured many of the European banks during the period, while the tsunami and resulting nuclear disaster negatively impacted many Japanese companies.

The Fund described herein is indexed to an MSCI index. The Fund referred to herein is not sponsored, endorsed or promoted by MSCI or its affiliates, and MSCI and its affiliates bear no liability with respect to any such fund or any index on which such fund is based.

The MSCI EAFE ESG Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities of issuers organized or operating in developed market countries around the world excluding the U.S. and Canada that have high environmental, social and governance (ESG) ratings relative to their sector and industry group

11

December 31, 2011

Commentary, continued

peers, as rated by MSCI ESG Research annually. The Index targets sector weights that reflect the relative sector weights of the MSCI Europe & Middle East Index1 and the MSCI Pacific Index2.

MSCI ESG Research evaluates companies’ ESG characteristics and derives corresponding ESG scores and ratings. Companies are ranked by ESG score against their sector peers to determine their eligibility for the MSCI ESG indices. MSCI ESG Research identifies the highest-rated companies in each peer group to meet the float-adjusted market capitalization sector targets. The rating system is based on general and industry-specific ESG criteria, assigning ratings on a 9-point scale from AAA (highest) to C (lowest). Constituents of the MSCI EAFE Index having an ESG rating of B or above are eligible for inclusion in the Index.

The MSCI EAFE ESG Index includes or utilizes data, ratings, analysis, reports, analytics or other information or materials from MSCI’s ESG Research Group within Institutional Shareholder Services Inc., an indirect wholly-owned subsidiary of MSCI. The prospectus contains a more detailed description of the limited relationship MSCI has with Pax World Management LLC, ESG Shares and any related funds.

The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

1The MSCI Europe & Middle East Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe and the Middle East. The MSCI Europe & Middle East Index consisted of the following 17 developed market country indices: Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Israel, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, and the United Kingdom.

2The MSCI Pacific Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in the Pacific region. The MSCI Pacific Index consisted of the following 5 Developed Market countries: Australia, Hong Kong, Japan, New Zealand, and Singapore.

Unlike the Fund, the MSCI EAFE ESG Index, the MSCI EAFE Index, the MSCI Europe & Middle East Index and the MSCI Pacific Index are not investments, are not professionally managed and do not reflect deductions for fees, expenses or taxes.

12

Pax MSCI EAFE ESG Index ETF

December 31, 2011

Portfolio Highlights (Unaudited)

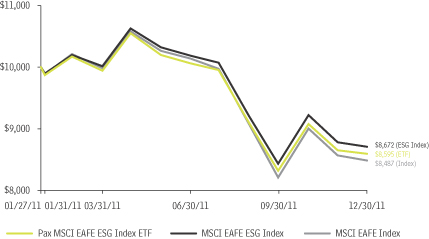

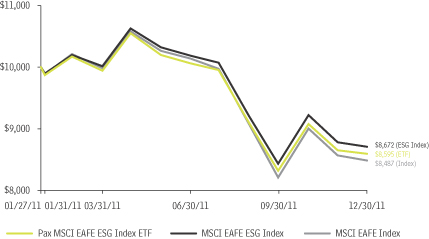

Total Return—Historical Growth of $10,000—Since Inception

Returns—Period ended December 31, 2011

| | | | | | | | |

| | | | | | Total Return | |

| | |

| | | 3 Month | | | Since Inception1 | |

NAV Return2 | | | 3.27% | | | | -14.04% | |

Market Value Return2 | | | 4.24% | | | | -13.96% | |

MSCI EAFE ESG Index3 | | | 3.22% | | | | -13.28% | |

MSCI EAFE Index4 | | | 3.33% | | | | -15.13% | |

All total return figures assume reinvestment of dividends and capital gains at net asset value; actual returns may differ. Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance data may be higher or lower than actual data quoted. Total returns for periods of less than one year have not been annualized.

An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities, incur expenses or pay any transaction costs. Therefore, index returns do not reflect deductions for fees or expenses and are not available for direct investment. In comparison, the Fund’s performance is negatively impacted by these deductions. Fund returns do not reflect brokerage commissions on transactions in Fund shares or taxes that a shareholder would pay on Fund distributions.

1The Fund’s inception date is January 27, 2011.

2The NAV return is based on the closing NAV (net asset value per share) of the Fund and the Market Value return is based on the market price per share of the Fund. The market prices used for Market Value returns are based on the midpoint of the bid/ask spread at 4 p.m. ET and do not represent the returns an investor would receive if shares were traded at other times.

13

Pax MSCI EAFE ESG Index ETF

December 31, 2011

Portfolio Highlights (Unaudited), continued

3MSCI EAFE ESG Index is a free float-adjusted market capitalization weighted index designed to measure the performance of equity securities of issuers organized or operating in Europe and the Asia Pacific region that have high environmental, social and governance (ESG) ratings from MSCI, selected initially and adjusted annually by MSCI.

4The MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. The MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

| | | | | | |

| Asset Allocation | | Percent of Net Assets | |

Common Stocks | | | 99.2% | |

Preferred Stocks | | | 0.8% | |

Money Market Funds | | | 0.5% | |

Other Assets & Liabilities | | | (0.5)% | |

| | | | |

Total Net Assets | | | 100.0% | |

Top Ten Holdings

| | | | | | |

| Company | | Percent of Net Assets | |

Vodafone Group PLC | | | 3.5% | |

HSBC Holdings PLC | | | 3.1% | |

GlaxoSmithKline PLC | | | 3.0% | |

Novartis AG | | | 2.7% | |

Roche Holding AG | | | 2.7% | |

Commonwealth Bank Of Australia | | | 1.9% | |

BG Group PLC | | | 1.8% | |

BASF SE | | | 1.7% | |

Westpac Banking Corp. | | | 1.6% | |

Pearson PLC | | | 1.6% | |

| | | | |

Total | | | 23.6% | |

Ten largest holdings do not include money market securities, certificates of deposit, commercial paper or cash and equivalents, if applicable.

Sector Diversification

| | | | | | |

| Sector | | Percent of Net Assets | |

Financials | | | 23.6% | |

Industrials | | | 12.0% | |

Consumer Discretionary | | | 12.0% | |

Health Care | | | 11.8% | |

Consumer Staples | | | 11.4% | |

Materials | | | 7.8% | |

Energy | | | 7.3% | |

Telecommunication Services | | | 7.2% | |

Information Technology | | | 3.6% | |

Utilities | | | 3.3% | |

Cash and cash equivalents plus other assets less liabilities | | | (0.0)% | * |

| | | | |

Total | | | 100.0% | |

*Less than 0.05%.

14

Pax MSCI EAFE ESG Index ETF

December 31, 2011

Portfolio Highlights (Unaudited), continued

Geographical Diversification

| | | | | | |

| Country | | Percent of Net Assets | |

Japan | | | 24.4% | |

United Kingdom | | | 23.2% | |

Australia | | | 9.2% | |

Switzerland | | | 8.6% | |

France | | | 7.4% | |

Spain | | | 5.4% | |

Germany | | | 4.8% | |

Sweden | | | 4.2% | |

Netherlands | | | 2.6% | |

Belgium | | | 2.0% | |

Denmark | | | 1.7% | |

Norway | | | 1.5% | |

Italy | | | 1.2% | |

Finland | | | 0.9% | |

Hong Kong | | | 0.8% | |

New Zealand | | | 0.7% | |

Luxembourg | | | 0.5% | |

Greece | | | 0.4% | |

Israel | | | 0.4% | |

Ireland | | | 0.1% | |

Cash and cash equivalents | | | 0.5% | |

Other Assets & Liabilities | | | (0.5)% | |

| | | | |

Total | | | 100.0% | |

15

December 31, 2011

Shareholder Expense Examples (Unaudited)

Examples As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of your fund shares and (2) ongoing costs, including management fees, and other Fund expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and compare these costs with the ongoing costs of investing in other funds. For more information, see the prospectus or talk to your financial adviser.

The examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period beginning on July 1, 2011 and ending on December 31, 2011.

Actual Expenses The first line in the table provides information about actual account values and actual expenses. You may use the information in this table, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Examples for Comparison Purposes The second line in the table provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table under each Fund is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | | | | | | | | | | | | |

| | | Beginning Account Value (7/1/11) | | | Ending Account Value (12/31/11) | | | Annualized Expense Ratio | | | Expenses Paid During Period1 | |

Pax MSCI North America ESG Index ETF | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | | $ | 948.20 | | | | 0.50 | % | | $ | 2.46 | |

Based on Hypothetical 5% Return | | | 1,000 | | | | 1,022.68 | | | | 0.50 | % | | | 2.55 | |

Pax MSCI EAFE ESG Index ETF | | | | | | | | | | | | | | | | |

Based on Actual Fund Return | | $ | 1,000 | | | $ | 854.00 | | | | 0.55 | % | | $ | 2.57 | |

Based on Hypothetical 5% Return | | | 1,000 | | | | 1,022.43 | | | | 0.55 | % | | | 2.80 | |

1 Expenses are equal to the Fund’s annualized expense ratio, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the period beginning on July 1, 2011 and ending on December 31, 2011).

16

Pax MSCI North America ESG Index ETF

December 31, 2011

Schedule of Investments, continued

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS: 99.7% | |

|

Consumer Discretionary: 10.8% | |

Advance Auto Parts, Inc. | | | 71 | | | $ | 4,944 | |

Autoliv, Inc. | | | 78 | | | | 4,172 | |

AutoZone, Inc. (a) | | | 23 | | | | 7,474 | |

Bed Bath & Beyond, Inc. (a) | | | 221 | | | | 12,811 | |

Best Buy Co., Inc. | | | 292 | | | | 6,824 | |

BorgWarner, Inc. (a) | | | 97 | | | | 6,183 | |

Cablevision Systems Corp. (Class A) | | | 185 | | | | 2,631 | |

Canadian Tire Corp., Ltd. (Class A) | | | 68 | | | | 4,399 | |

CarMax, Inc. (a) | | | 197 | | | | 6,005 | |

Chipotle Mexican Grill, Inc. (a) | | | 28 | | | | 9,457 | |

Darden Restaurants, Inc. | | | 120 | | | | 5,470 | |

DeVry, Inc. | | | 57 | | | | 2,192 | |

Discovery Communications, Inc.

(Series A) (a) | | | 121 | | | | 4,957 | |

Discovery Communications, Inc.

(Series C) (a) | | | 122 | | | | 4,599 | |

Ford Motor Co. (a) | | | 3,187 | | | | 34,292 | |

GameStop Corp. (Class A) (a) | | | 130 | | | | 3,137 | |

Genuine Parts Co. | | | 138 | | | | 8,446 | |

Gildan Activewear, Inc. | | | 101 | | | | 1,900 | |

Harley-Davidson, Inc. | | | 206 | | | | 8,007 | |

Hasbro, Inc. | | | 108 | | | | 3,444 | |

J.C. Penney Co., Inc. | | | 151 | | | | 5,308 | |

Johnson Controls, Inc. | | | 594 | | | | 18,568 | |

Kohl’s Corp. | | | 242 | | | | 11,943 | |

Liberty Global, Inc. (Series A) (a) | | | 100 | | | | 4,103 | |

Liberty Global, Inc. (Series C) (a) | | | 106 | | | | 4,189 | |

Liberty Media Corp. – Interactive

(Class A) (a) | | | 499 | | | | 8,091 | |

Lowe’s Cos., Inc. | | | 1,174 | | | | 29,796 | |

Macy’s, Inc. | | | 371 | | | | 11,939 | |

Marriott International, Inc. (Class A) | | | 256 | | | | 7,468 | |

Mattel, Inc. | | | 305 | | | | 8,467 | |

McDonald’s Corp. | | | 928 | | | | 93,106 | |

Mohawk Industries, Inc. (a) | | | 51 | | | | 3,052 | |

Newell Rubbermaid, Inc. | | | 254 | | | | 4,102 | |

NIKE, Inc. (Class B) | | | 322 | | | | 31,031 | |

Nordstrom, Inc. | | | 153 | | | | 7,606 | |

O’Reilly Automotive, Inc. (a) | | | 123 | | | | 9,834 | |

PetSmart, Inc. | | | 102 | | | | 5,232 | |

Ross Stores, Inc. | | | 208 | | | | 9,886 | |

Staples, Inc. | | | 631 | | | | 8,765 | |

Starbucks Corp. | | | 674 | | | | 31,011 | |

Starwood Hotels & Resorts

Worldwide, Inc. | | | 169 | | | | 8,107 | |

Target Corp. | | | 583 | | | | 29,861 | |

The Gap, Inc. | | | 372 | | | | 6,901 | |

The TJX Cos., Inc. | | | 344 | | | | 22,205 | |

The Washington Post Co. (Class B) | | | 4 | | | | 1,507 | |

Thomson Reuters Corp. | | | 335 | | | | 8,954 | |

Tiffany & Co. | | | 105 | | | | 6,957 | |

Tim Hortons, Inc. | | | 145 | | | | 7,025 | |

Time Warner Cable, Inc. | | | 299 | | | | 19,007 | |

V.F. Corp. | | | 76 | | | | 9,651 | |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

|

Consumer Discretionary, continued | |

Virgin Media, Inc. | | | 268 | | | $ | 5,730 | |

Whirlpool Corp. | | | 67 | | | | 3,179 | |

| | | | | | | | |

| | | | | | | 583,925 | |

| | | | | | | | |

Consumer Staples: 11.2% | | | | | | | | |

Avon Products, Inc. | | | 377 | | | | 6,586 | |

Campbell Soup Co. | | | 173 | | | | 5,750 | |

Coca-Cola Enterprises, Inc. | | | 288 | | | | 7,425 | |

Colgate-Palmolive Co. | | | 432 | | | | 39,912 | |

ConAgra Foods, Inc. | | | 375 | | | | 9,900 | |

Dr. Pepper Snapple Group, Inc. | | | 196 | | | | 7,738 | |

Empire Co., Inc. (Class A) | | | 24 | | | | 1,393 | |

General Mills, Inc. | | | 587 | | | | 23,721 | |

Green Mountain Coffee Roasters, Inc. (a) | | | 112 | | | | 5,023 | |

H.J. Heinz Co. | | | 281 | | | | 15,185 | |

Hansen Natural Corp. (a) | | | 66 | | | | 6,081 | |

Hormel Foods Corp. | | | 128 | | | | 3,749 | |

Kellogg Co. | | | 224 | | | | 11,328 | |

Kimberly-Clark Corp. | | | 352 | | | | 25,893 | |

Kraft Foods, Inc. (Class A) | | | 1,509 | | | | 56,376 | |

Loblaw Cos., Ltd. | | | 98 | | | | 3,702 | |

McCormick & Co., Inc. | | | 106 | | | | 5,345 | |

Mead Johnson Nutrition Co. | | | 179 | | | | 12,303 | |

Metro, Inc. (Class A) | | | 90 | | | | 4,771 | |

PepsiCo, Inc. | | | 1,424 | | | | 94,482 | |

Procter & Gamble Co. | | | 2,486 | | | | 165,841 | |

Ralcorp Holdings, Inc. (a) | | | 48 | | | | 4,104 | |

Safeway, Inc. | | | 319 | | | | 6,712 | |

Saputo, Inc. | | | 125 | | | | 4,789 | |

Sara Lee Corp. | | | 510 | | | | 9,649 | |

Sysco Corp. | | | 510 | | | | 14,958 | |

The Clorox Co. | | | 119 | | | | 7,921 | |

The Estee Lauder Cos., Inc. (Class A) | | | 106 | | | | 11,906 | |

The J.M. Smucker Co. | | | 104 | | | | 8,130 | |

The Kroger Co. | | | 523 | | | | 12,667 | |

Viterra, Inc. | | | 325 | | | | 3,426 | |

Whole Foods Market, Inc. | | | 129 | | | | 8,976 | |

| | | | | | | | |

| | | | | | | 605,742 | |

| | | | | | | | |

Energy: 8.9% | | | | | | | | |

Apache Corp. | | | 355 | | | | 32,156 | |

ARC Resources, Ltd. | | | 251 | | | | 6,184 | |

Bonavista Energy Corp. | | | 119 | | | | 3,045 | |

Cabot Oil & Gas Corp. | | | 92 | | | | 6,983 | |

Cameron International Corp. (a) | | | 214 | | | | 10,527 | |

Cenovus Energy, Inc. | | | 664 | | | | 22,050 | |

Chesapeake Energy Corp. | | | 572 | | | | 12,750 | |

Cimarex Energy Co. | | | 75 | | | | 4,642 | |

Concho Resources, Inc. (a) | | | 86 | | | | 8,062 | |

Continental Resources, Inc. (a) | | | 40 | | | | 2,668 | |

Crescent Point Energy Corp. | | | 215 | | | | 9,476 | |

Denbury Resources, Inc. (a) | | | 350 | | | | 5,285 | |

Devon Energy Corp. | | | 354 | | | | 21,948 | |

Diamond Offshore Drilling, Inc. | | | 60 | | | | 3,316 | |

El Paso Corp. | | | 679 | | | | 18,041 | |

| | | | |

| | 17 | | SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. |

Pax MSCI North America ESG Index ETF

December 31, 2011

Schedule of Investments, continued

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Energy, continued | | | | | | | | |

Enbridge, Inc. | | | 647 | | | $ | 24,191 | |

Enerplus Corp. | | | 160 | | | | 4,060 | |

EOG Resources, Inc. | | | 237 | | | | 23,347 | |

EQT Corp. | | | 124 | | | | 6,794 | |

FMC Technologies, Inc. (a) | | | 210 | | | | 10,968 | |

Hess Corp. | | | 267 | | | | 15,166 | |

Kinder Morgan Management, LLC (a) | | | 75 | | | | 5,889 | |

Marathon Oil Corp. | | | 622 | | | | 18,206 | |

National-Oilwell Varco, Inc. | | | 384 | | | | 26,108 | |

Newfield Exploration Co. (a) | | | 118 | | | | 4,452 | |

Nexen, Inc. | | | 462 | | | | 7,351 | |

Noble Corp. (a) | | | 221 | | | | 6,679 | |

Noble Energy, Inc. | | | 154 | | | | 14,536 | |

Pacific Rubiales Energy Corp. | | | 222 | | | | 4,081 | |

Penn West Petroleum ,Ltd. | | | 409 | | | | 8,106 | |

Pioneer Natural Resources Co. | | | 92 | | | | 8,232 | |

Plains Exploration & Production Co. (a) | | | 123 | | | | 4,516 | |

QEP Resources, Inc. | | | 154 | | | | 4,512 | |

Range Resources Corp. | | | 140 | | | | 8,672 | |

Southwestern Energy Co. (a) | | | 305 | | | | 9,742 | |

Spectra Energy Corp. | | | 568 | | | | 17,466 | |

Suncor Energy, Inc. | | | 1,421 | | | | 40,981 | |

Sunoco, Inc. | | | 106 | | | | 4,348 | |

Talisman Energy, Inc. | | | 898 | | | | 11,441 | |

Ultra Petroleum Corp. (a) | | | 134 | | | | 3,970 | |

Vermilion Energy, Inc. | | | 74 | | | | 3,296 | |

Weatherford International, Ltd. (a) | | | 651 | | | | 9,531 | |

Whiting Petroleum Corp. (a) | | | 104 | | | | 4,856 | |

| | | | | | | | |

| | | | | | | 478,630 | |

| | | | | | | | |

Financials: 17.0% | | | | | | | | |

ACE, Ltd. | | | 294 | | | | 20,615 | |

AFLAC, Inc. | | | 410 | | | | 17,737 | |

American Express Co. | | | 987 | | | | 46,557 | |

Ameriprise Financial, Inc. | | | 216 | | | | 10,722 | |

Annaly Capital Management, Inc. (b) | | | 840 | | | | 13,406 | |

Arch Capital Group, Ltd. (a) | | | 118 | | | | 4,393 | |

Assurant, Inc. | | | 87 | | | | 3,572 | |

Axis Capital Holdings, Ltd. | | | 100 | | | | 3,196 | |

Bank of Nova Scotia | | | 977 | | | | 48,747 | |

BB&T Corp. | | | 608 | | | | 15,303 | |

Berkshire Hathaway, Inc. (Class B) (a) | | | 819 | | | | 62,490 | |

BlackRock, Inc. | | | 87 | | | | 15,507 | |

Boston Properties, Inc. (b) | | | 125 | | | | 12,450 | |

Capital One Financial Corp. | | | 398 | | | | 16,831 | |

CBRE Group, Inc. (Class A) (a) | | | 255 | | | | 3,881 | |

Chubb Corp. | | | 258 | | | | 17,859 | |

Cincinnati Financial Corp. | | | 136 | | | | 4,143 | |

CME Group, Inc. | | | 56 | | | | 13,646 | |

Comerica, Inc. | | | 159 | | | | 4,102 | |

Discover Financial Services | | | 478 | | | | 11,472 | |

Duke Realty Corp. (b) | | | 221 | | | | 2,663 | |

Eaton Vance Corp. | | | 103 | | | | 2,435 | |

Everest Re Group, Ltd. | | | 48 | | | | 4,036 | |

Federal Realty Investment Trust (b) | | | 54 | | | | 4,900 | |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Financials, continued | | | | | | | | |

Fifth Third Bancorp | | | 804 | | | $ | 10,227 | |

Franklin Resources, Inc. | | | 136 | | | | 13,064 | |

General Growth Properties, Inc. (b) | | | 379 | | | | 5,693 | |

Genworth Financial, Inc. (Class A) (a) | | | 429 | | | | 2,810 | |

HCP, Inc. (b) | | | 352 | | | | 14,583 | |

Health Care REIT, Inc. (b) | | | 171 | | | | 9,325 | |

Host Hotels & Resorts, Inc. (b) | | | 597 | | | | 8,818 | |

Hudson City Bancorp, Inc. | | | 415 | | | | 2,594 | |

Intercontinental Exchange, Inc. (a) | | | 64 | | | | 7,715 | |

Invesco, Ltd. | | | 403 | | | | 8,096 | |

KeyCorp | | | 832 | | | | 6,398 | |

Legg Mason, Inc. | | | 125 | | | | 3,006 | |

Liberty Property Trust (b) | | | 100 | | | | 3,088 | |

Lincoln National Corp. | | | 276 | | | | 5,360 | |

M&T Bank Corp. | | | 98 | | | | 7,481 | |

New York Community Bancorp, Inc. | | | 382 | | | | 4,725 | |

Northern Trust Corp. | | | 190 | | | | 7,535 | |

NYSE Euronext | | | 229 | | | | 5,977 | |

PartnerRe, Ltd. | | | 56 | | | | 3,596 | |

People’s United Financial, Inc. | | | 320 | | | | 4,112 | |

PNC Financial Services Group, Inc. | | | 461 | | | | 26,586 | |

Principal Financial Group, Inc. | | | 281 | | | | 6,913 | |

ProLogis, Inc. (b) | | | 413 | | | | 11,808 | |

Prudential Financial, Inc. | | | 423 | | | | 21,201 | |

Regency Centers Corp. (b) | | | 74 | | | | 2,784 | |

Regions Financial Corp. | | | 1,101 | | | | 4,734 | |

RenaissanceRe Holdings, Ltd. | | | 46 | | | | 3,421 | |

Royal Bank of Canada | | | 1,293 | | | | 65,973 | |

SEI Investments Co. | | | 130 | | | | 2,256 | |

Simon Property Group, Inc. (b) | | | 267 | | | | 34,427 | |

State Street Corp. | | | 439 | | | | 17,696 | |

T. Rowe Price Group, Inc. | | | 226 | | | | 12,871 | |

The Bank of New York Mellon Corp. | | | 1,086 | | | | 21,622 | |

The Charles Schwab Corp. | | | 907 | | | | 10,213 | |

The Macerich Co. (b) | | | 114 | | | | 5,768 | |

The NASDAQ OMX Group, Inc. (a) | | | 108 | | | | 2,647 | |

The Progressive Corp. | | | 548 | | | | 10,691 | |

The Toronto-Dominion Bank | | | 810 | | | | 60,658 | |

The Travelers Cos., Inc. | | | 375 | | | | 22,189 | |

U.S. Bancorp | | | 1,728 | | | | 46,742 | |

Ventas, Inc. (b) | | | 236 | | | | 13,011 | |

Vornado Realty Trust (b) | | | 145 | | | | 11,145 | |

W.R. Berkley Corp. | | | 105 | | | | 3,611 | |

XL Group PLC | | | 272 | | | | 5,377 | |

| | | | | | | | |

| | | | | | | 919,210 | |

| | | | | | | | |

Health Care: 12.1% | | | | | | | | |

Abbott Laboratories | | | 1,395 | | | | 78,441 | |

Aetna, Inc. | | | 336 | | | | 14,176 | |

Agilent Technologies, Inc. (a) | | | 304 | | | | 10,619 | |

Baxter International, Inc. | | | 505 | | | | 24,987 | |

Becton, Dickinson & Co. | | | 193 | | | | 14,421 | |

Biogen Idec, Inc. (a) | | | 211 | | | | 23,221 | |

Bristol-Myers Squibb Co. | | | 1,535 | | | | 54,093 | |

CIGNA Corp. | | | 257 | | | | 10,794 | |

| | | | |

| SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. | | 18 | | |

Pax MSCI North America ESG Index ETF

December 31, 2011

Schedule of Investments, continued

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Health Care, continued | | | | | | | | |

Coventry Health Care, Inc. (a) | | | 131 | | | $ | 3,979 | |

Gilead Sciences, Inc. (a) | | | 694 | | | | 28,405 | |

Henry Schein, Inc. (a) | | | 80 | | | | 5,154 | |

Humana, Inc. | | | 148 | | | | 12,966 | |

Johnson & Johnson | | | 2,465 | | | | 161,655 | |

Life Technologies Corp. (a) | | | 157 | | | | 6,109 | |

Medco Health Solutions, Inc. (a) | | | 353 | | | | 19,733 | |

Medtronic, Inc. | | | 939 | | | | 35,917 | |

Merck & Co., Inc. | | | 2,792 | | | | 105,258 | |

Patterson Cos., Inc. | | | 86 | | | | 2,539 | |

Valeant Pharmaceuticals

International, Inc. (a) | | | 252 | | | | 11,789 | |

Waters Corp. (a) | | | 80 | | | | 5,924 | |

WellPoint, Inc. | | | 327 | | | | 21,664 | |

| | | | | | | | |

| | | | | | | 651,844 | |

| | | | | | | | |

Industrials: 11.4% | | | | | | | | |

3M Co. | | | 606 | | | | 49,528 | |

AMETEK, Inc. | | | 141 | | | | 5,936 | |

Avery Dennison Corp. | | | 88 | | | | 2,524 | |

Bombardier, Inc. (Class B) | | | 1,257 | | | | 5,010 | |

C.H. Robinson Worldwide, Inc. | | | 144 | | | | 10,048 | |

CAE, Inc. | | | 225 | | | | 2,184 | |

Canadian National Railway Co. | | | 402 | | | | 31,627 | |

Canadian Pacific Railway, Ltd. | | | 148 | | | | 10,026 | |

Caterpillar, Inc. | | | 584 | | | | 52,910 | |

Cooper Industries PLC | | | 144 | | | | 7,798 | |

CSX Corp. | | | 973 | | | | 20,491 | |

Cummins, Inc. | | | 164 | | | | 14,435 | |

Danaher Corp. | | | 524 | | | | 24,649 | |

Deere & Co. | | | 369 | | | | 28,542 | |

Dover Corp. | | | 163 | | | | 9,462 | |

Eaton Corp. | | | 282 | | | | 12,276 | |

Emerson Electric Co. | | | 670 | | | | 31,215 | |

Equifax, Inc. | | | 108 | | | | 4,184 | |

Expeditors International

Washington, Inc. | | | 186 | | | | 7,619 | |

Fastenal Co. | | | 245 | | | | 10,684 | |

Finning International, Inc. | | | 150 | | | | 3,270 | |

Fluor Corp. | | | 154 | | | | 7,739 | |

IHS, Inc. (Class A) (a) | | | 36 | | | | 3,102 | |

Illinois Tool Works, Inc. | | | 393 | | | | 18,357 | |

Ingersoll-Rand PLC | | | 289 | | | | 8,806 | |

Iron Mountain, Inc. | | | 158 | | | | 4,866 | |

J.B. Hunt Transport Services, Inc. | | | 84 | | | | 3,786 | |

Jacobs Engineering Group, Inc. (a) | | | 111 | | | | 4,504 | |

Joy Global, Inc. | | | 92 | | | | 6,897 | |

Manpower, Inc. | | | 72 | | | | 2,574 | |

Masco Corp. | | | 315 | | | | 3,301 | |

Norfolk Southern Corp. | | | 311 | | | | 22,660 | |

PACCAR, Inc. | | | 289 | | | | 10,829 | |

Pall Corp. | | | 101 | | | | 5,772 | |

Parker Hannifin Corp. | | | 142 | | | | 10,828 | |

Pentair, Inc. | | | 86 | | | | 2,863 | |

Pitney Bowes, Inc. | | | 178 | | | | 3,300 | |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Industrials, continued | | | | | | | | |

Precision Castparts Corp. | | | 126 | | | $ | 20,764 | |

Quanta Services, Inc. (a) | | | 185 | | | | 3,985 | |

R.R. Donnelley & Sons Co. | | | 181 | | | | 2,612 | |

Ritchie Bros Auctioneers, Inc. | | | 84 | | | | 1,847 | |

Robert Half International, Inc. | | | 122 | | | | 3,472 | |

Rockwell Automation, Inc. | | | 125 | | | | 9,171 | |

Rockwell Collins, Inc. | | | 136 | | | | 7,530 | |

Roper Industries, Inc. | | | 84 | | | | 7,297 | |

Southwest Airlines Co. | | | 181 | | | | 1,549 | |

The Dun & Bradstreet Corp. | | | 44 | | | | 3,293 | |

Tyco International, Ltd. | | | 414 | | | | 19,338 | |

United Parcel Service, Inc. (Class B) | | | 663 | | | | 48,525 | |

W.W. Grainger, Inc. | | | 52 | | | | 9,734 | |

Waste Management, Inc. | | | 395 | | | | 12,920 | |

| | | | | | | | |

| | | | | | | 616,639 | |

| | | | | | | | |

Information Technology: 18.4% | |

Accenture PLC (Class A) | | | 593 | | | | 31,565 | |

Adobe Systems, Inc. (a) | | | 442 | | | | 12,495 | |

Advanced Micro Devices, Inc. (a) | | | 510 | | | | 2,754 | |

Analog Devices, Inc. | | | 262 | | | | 9,374 | |

Applied Materials, Inc. | | | 1,154 | | | | 12,359 | |

Autodesk, Inc. (a) | | | 201 | | | | 6,096 | |

CA, Inc. | | | 356 | | | | 7,197 | |

CGI Group, Inc. (Class A) (a) | | | 205 | | | | 3,864 | |

Cisco Systems, Inc. | | | 4,948 | | | | 89,460 | |

Cognizant Technology Solutions Corp. (Class A) (a) | | | 266 | | | | 17,107 | |

Dell, Inc. (a) | | | 1,511 | | | | 22,106 | |

EMC Corp. (a) | | | 1,808 | | | | 38,944 | |

Flextronics International, Ltd. (a) | | | 665 | | | | 3,764 | |

Google, Inc. (Class A) (a) | | | 229 | | | | 147,911 | |

Hewlett-Packard Co. | | | 1,896 | | | | 48,841 | |

IBM | | | 1,078 | | | | 198,223 | |

Intel Corp. | | | 4,741 | | | | 114,969 | �� |

Intuit, Inc. | | | 257 | | | | 13,516 | |

Motorola Mobility Holdings, Inc. (a) | | | 245 | | | | 9,506 | |

Motorola Solutions, Inc. | | | 266 | | | | 12,313 | |

NVIDIA Corp. (a) | | | 514 | | | | 7,124 | |

Open Text Corp. (a) | | | 50 | | | | 2,563 | |

Oracle Corp. | | | 3,672 | | | | 94,187 | |

Research In Motion, Ltd. (a) | | | 413 | | | | 6,000 | |

Salesforce.com, Inc. (a) | | | 109 | | | | 11,059 | |

Symantec Corp. (a) | | | 666 | | | | 10,423 | |

Texas Instruments, Inc. | | | 1,024 | | | | 29,809 | |

Xerox Corp. | | | 1,226 | | | | 9,759 | |

Yahoo!, Inc. (a) | | | 1,087 | | | | 17,533 | |

| | | | | | | | |

| | | | | | | 990,821 | |

| | | | | | | | |

Materials: 5.1% | | | | | | | | |

Agnico-Eagle Mines, Ltd. | | | 148 | | | | 5,383 | |

Agrium, Inc. | | | 138 | | | | 9,263 | |

Air Products & Chemicals, Inc. | | | 188 | | | | 16,016 | |

Airgas, Inc. | | | 68 | | | | 5,309 | |

Alcoa, Inc. | | | 930 | | | | 8,045 | |

| | | | |

| | 19 | | SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. |

Pax MSCI North America ESG Index ETF

December 31, 2011

Schedule of Investments, continued

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Materials, continued | | | | | | | | |

Allegheny Technologies, Inc. | | | 88 | | | $ | 4,206 | |

Ball Corp. | | | 145 | | | | 5,178 | |

Celanese Corp. (Series A) | | | 137 | | | | 6,065 | |

Cliffs Natural Resources, Inc. | | | 123 | | | | 7,669 | |

Eastman Chemical Co. | | | 124 | | | | 4,843 | |

Ecolab, Inc. | | | 270 | | | | 15,609 | |

Franco-Nevada Corp. | | | 110 | | | | 4,187 | |

Inmet Mining Corp. | | | 46 | | | | 2,958 | |

International Flavors & Fragrances, Inc. | | | 70 | | | | 3,669 | |

International Paper Co. | | | 365 | | | | 10,804 | |

Kinross Gold Corp. | | | 993 | | | | 11,336 | |

LyondellBasell Industries NV (Class A) | | | 249 | | | | 8,090 | |

Martin Marietta Materials, Inc. | | | 40 | | | | 3,016 | |

MeadWestvaco Corp. | | | 147 | | | | 4,403 | |

New Gold, Inc. (a) | | | 385 | | | | 3,885 | |

Nucor Corp. | | | 277 | | | | 10,961 | |

Osisko Mining Corp. (a) | | | 301 | | | | 2,907 | |

Owens-Illinois, Inc. (a) | | | 143 | | | | 2,771 | |

Potash Corp. of Saskatchewan, Inc. | | | 779 | | | | 32,200 | |

Praxair, Inc. | | | 275 | | | | 29,398 | |

Rock-Tenn Co. (Class A) | | | 60 | | | | 3,462 | |

Sealed Air Corp. | | | 140 | | | | 2,409 | |

Sigma-Aldrich Corp. | | | 107 | | | | 6,683 | |

Silver Wheaton Corp. | | | 318 | | | | 9,208 | |

Teck Resources, Ltd. (Class B) | | | 509 | | | | 17,942 | |

United States Steel Corp. | | | 126 | | | | 3,334 | |

Vulcan Materials Co. | | | 113 | | | | 4,447 | |

Yamana Gold, Inc. | | | 650 | | | | 9,583 | |

| | | | | | | | |

| | | | | | | 275,239 | |

| | | | | | | | |

Telecommunication Services: 1.9% | |

American Tower Corp. (Class A) | | | 349 | | | | 20,943 | |

BCE, Inc. | | | 223 | | | | 9,296 | |

CenturyLink, Inc. | | | 559 | | | | 20,795 | |

Crown Castle International Corp. (a) | | | 254 | | | | 11,379 | |

Frontier Communications Corp. | | | 870 | | | | 4,481 | |

Level 3 Communications, Inc. (a) | | | 137 | | | | 2,328 | |

MetroPCS Communications, Inc. (a) | | | 218 | | | | 1,892 | |

NII Holdings, Inc. (a) | | | 149 | | | | 3,174 | |

Rogers Communications, Inc. (Class B) | | | 370 | | | | 14,255 | |

SBA Communications Corp. (Class A) (a) | | | 100 | | | | 4,296 | |

Sprint Nextel Corp. (a) | | | 2,617 | | | | 6,124 | |

Windstream Corp. | | | 443 | | | | 5,201 | |

| | | | | | | | |

| | | | | | | 104,164 | |

| | | | | | | | |

Utilities: 2.9% | | | | | | | | |

Alliant Energy Corp. | | | 97 | | | | 4,279 | |

American Water Works Co., Inc. | | | 153 | | | | 4,874 | |

Calpine Corp. (a) | | | 273 | | | | 4,458 | |

Canadian Utilities, Ltd. (Class A) | | | 76 | | | | 4,591 | |

CenterPoint Energy, Inc. | | | 353 | | | | 7,092 | |

Consolidated Edison, Inc. | | | 256 | | | | 15,880 | |

DTE Energy Co. | | | 148 | | | | 8,059 | |

Integrys Energy Group, Inc. | | | 68 | | | | 3,684 | |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Utilities, continued | | | | | | | | |

MDU Resources Group, Inc. | | | 165 | | | $ | 3,541 | |

NextEra Energy, Inc. | | | 351 | | | | 21,369 | |

NiSource, Inc. | | | 245 | | | | 5,833 | |

Northeast Utilities | | | 154 | | | | 5,555 | |

NSTAR | | | 91 | | | | 4,273 | |

Oneok, Inc. | | | 88 | | | | 7,629 | |

Pepco Holdings, Inc. | | | 197 | | | | 3,999 | |

PG&E Corp. | | | 347 | | | | 14,303 | |

Pinnacle West Capital Corp. | | | 95 | | | | 4,577 | |

Sempra Energy | | | 200 | | | | 11,000 | |

TransAlta Corp. | | | 187 | | | | 3,858 | |

Wisconsin Energy Corp. | | | 205 | | | | 7,167 | |

Xcel Energy, Inc. | | | 423 | | | | 11,692 | |

| | | | | | | | |

| | | | | | | 157,713 | |

| | | | | | | | |

TOTAL COMMON STOCKS | |

(Cost $5,107,912) | | | | | | | 5,383,927 | |

| | | | | | | | |

|

SHORT TERM INVESTMENT: 1.0% | |

|

MONEY MARKET FUND: 1.0% | |

|

SSgA Prime Money Market Fund | |

(Cost $54,362) | | | 54,362 | | | | 54,362 | |

| | | | | | | | |

|

TOTAL INVESTMENTS: 100.7% | |

(Cost $5,162,274) | | | | | | | 5,438,289 | |

| | |

OTHER ASSETS &

LIABILITIES: (0.7)% | | | | | | | (37,231 | ) |

| | | | | | | | |

| | |

Net Assets: 100.0% | | | | | | $ | 5,401,058 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | REIT = Real Estate Investment Trust |

| | | | |

| SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. | | 20 | | |

Pax MSCI EAFE ESG Index ETF

December 31, 2011

Schedule of Investments, continued

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS: 99.2% | |

| | |

Australia: 9.2% | | | | | | | | |

Australia & New Zealand Banking Group, Ltd. | | | 2,680 | | | $ | 56,275 | |

Commonwealth Bank of Australia | | | 1,615 | | | | 81,303 | |

Fortescue Metals Group, Ltd. | | | 1,230 | | | | 5,372 | |

GPT Group (b) | | | 5,014 | | | | 15,744 | |

Mirvac Group (b) | | | 12,030 | | | | 14,519 | |

National Australia Bank, Ltd. | | | 2,594 | | | | 61,977 | |

Newcrest Mining, Ltd. | | | 883 | | | | 26,733 | |

Origin Energy, Ltd. | | | 1,194 | | | | 16,291 | |

OZ Minerals, Ltd. | | | 610 | | | | 6,245 | |

Westpac Banking Corp. | | | 3,259 | | | | 66,666 | |

Woolworths, Ltd. | | | 1,418 | | | | 36,403 | |

| | | | | | | | |

| | | | | | | 387,528 | |

| | | | | | | | |

Belgium: 2.0% | | | | | | | | |

Colruyt SA | | | 1,534 | | | | 58,072 | |

Delhaize Group | | | 398 | | | | 22,359 | |

Dexia SA (a) | | | 3,046 | | | | 1,171 | |

KBC Groep NV | | | 204 | | | | 2,569 | |

| | | | | | | | |

| | | | | | | 84,171 | |

| | | | | | | | |

Denmark: 1.7% | | | | | | | | |

Danske Bank A/S (a) | | | 1,006 | | | | 12,778 | |

Novo Nordisk A/S (Class B) | | | 480 | | | | 55,160 | |

Vestas Wind Systems A/S (a) | | | 342 | | | | 3,692 | |

| | | | | | | | |

| | | | | | | 71,630 | |

| | | | | | | | |

Finland: 0.9% | | | | | | | | |

Nokia OYJ | | | 3,824 | | | | 18,668 | |

Stora Enso OYJ (R Shares) | | | 1,230 | | | | 7,367 | |

UPM-Kymmene OYJ | | | 1,112 | | | | 12,248 | |

| | | | | | | | |

| | | | | | | 38,283 | |

| | | | | | | | |

France: 7.4% | | | | | | | | |

Carrefour SA | | | 752 | | | | 17,144 | |

CGG – Veritas (a) | | | 492 | | | | 11,545 | |

Compagnie de Saint-Gobain | | | 646 | | | | 24,803 | |

Danone SA | | | 706 | | | | 44,380 | |

France Telecom SA | | | 1,966 | | | | 30,877 | |

L’Oreal SA | | | 374 | | | | 39,063 | |

Renault SA | | | 1,258 | | | | 43,635 | |

Schneider Electric SA | | | 610 | | | | 32,117 | |

Societe BIC SA | | | 342 | | | | 30,320 | |

Technip SA | | | 324 | | | | 30,452 | |

Veolia Environnement SA | | | 595 | | | | 6,522 | |

| | | | | | | | |

| | | | | | | 310,858 | |

| | | | | | | | |

Germany: 4.0% | | | | | | | | |

BASF SE | | | 1,010 | | | | 70,445 | |

Bayerische Motoren Werke AG | | | 418 | | | | 28,002 | |

Deutsche Boerse AG (a) | | | 114 | | | | 5,977 | |

Deutsche Post AG | | | 1,478 | | | | 22,725 | |

HeidelbergCement AG | | | 39 | | | | 1,655 | |

Hochtief AG | | | 186 | | | | 10,760 | |

K+S AG | | | 324 | | | | 14,643 | |

Metro AG | | | 292 | | | | 10,657 | |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Germany, continued | | | | | | | | |

Wacker Chemie AG | | | 70 | | | $ | 5,631 | |

| | | | | | | | |

| | | | | | | 170,495 | |

| | | | | | | | |

Greece: 0.4% | | | | | | | | |

Coca Cola Hellenic Bottling Co. SA (a) | | | 882 | | | | 15,125 | |

| | | | | | | | |

Hong Kong: 0.8% | | | | | | | | |

CLP Holdings, Ltd. | | | 2,000 | | | | 17,009 | |

Li & Fung, Ltd. | | | 8,000 | | | | 14,812 | |

| | | | | | | | |

| | | | | | | 31,821 | |

| | | | | | | | |

Ireland: 0.1% | | | | | | | | |

Experian PLC | | | 51 | | | | 693 | |

Kerry Group PLC (Class A) | | | 115 | | | | 4,220 | |

| | | | | | | | |

| | | | | | | 4,913 | |

| | | | | | | | |

Israel: 0.4% | | | | | | | | |

Delek Group, Ltd. | | | 20 | | | | 3,764 | |

Israel Chemicals, Ltd. | | | 1,096 | | | | 11,360 | |

| | | | | | | | |

| | | | | | | 15,124 | |

| | | | | | | | |

Italy: 1.2% | | | | | | | | |

ENI SpA | | | 812 | | | | 16,825 | |

Intesa Sanpaolo SpA | | | 12,208 | | | | 20,446 | |

Pirelli & C. SpA | | | 13 | | | | 109 | |

UniCredit SpA | | | 1,650 | | | | 13,710 | |

| | | | | | | | |

| | | | | | | 51,090 | |

| | | | | | | | |

Japan: 24.4% | | | | | | | | |

Canon, Inc. | | | 800 | | | | 35,442 | |

Central Japan Railway Co. | | | 4 | | | | 33,779 | |

Chugai Pharmaceutical Co., Ltd. | | | 1,200 | | | | 19,784 | |

Denso Corp. | | | 400 | | | | 11,048 | |

East Japan Railway Co. | | | 400 | | | | 25,464 | |

FANUC Corp. | | | 300 | | | | 45,914 | |

Fuji Heavy Industries, Ltd. | | | 4,000 | | | | 24,165 | |

Fujitsu, Ltd. | | | 8,000 | | | | 41,575 | |

Hitachi Construction Machinery Co., Ltd. | | | 800 | | | | 13,470 | |

Honda Motor Co., Ltd. | | | 1,600 | | | | 48,809 | |

Isetan Mitsukoshi Holdings, Ltd. | | | 800 | | | | 8,388 | |

Kao Corp. | | | 800 | | | | 21,858 | |

KDDI Corp. | | | 4 | | | | 25,724 | |

Komatsu, Ltd. | | | 1,600 | | | | 37,396 | |

Konica Minolta Holdings, Inc. | | | 4,000 | | | | 29,830 | |

Kubota Corp. | | | 4,000 | | | | 33,520 | |

Mitsubishi Electric Corp. | | | 4,000 | | | | 38,353 | |

Mitsubishi UFJ Financial Group, Inc. | | | 12,600 | | | | 53,530 | |

Mitsubishi UFJ Lease & Finance Co., Ltd. | | | 390 | | | | 15,454 | |

Mitsui Fudosan Co., Ltd. | | | 3,000 | | | | 43,731 | |

Mizuho Financial Group, Inc. | | | 21,200 | | | | 28,645 | |

Nippon Steel Corp. | | | 4,000 | | | | 9,978 | |

Nissan Motor Co., Ltd. | | | 3,600 | | | | 32,366 | |

Nomura Holdings, Inc. | | | 4,400 | | | | 13,319 | |

NTT DoCoMo, Inc. | | | 20 | | | | 36,768 | |

Panasonic Corp. | | | 2,000 | | | | 16,994 | |

Santen Pharmaceutical Co., Ltd. | | | 800 | | | | 32,948 | |

Shikoku Electric Power Co., Inc. | | | 1,200 | | | | 34,393 | |

| | | | |

| | 21 | | SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. |

Pax MSCI EAFE ESG Index ETF

December 31, 2011

Schedule of Investments, continued

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Japan, continued | | | | | | | | |

Shin-Etsu Chemical Co., Ltd. | | | 400 | | | $ | 19,696 | |

Softbank Corp. | | | 800 | | | | 23,562 | |

Sony Corp. | | | 1,200 | | | | 21,546 | |

Takashimaya Co., Ltd. | | | 3,000 | | | | 21,710 | |

Takeda Pharmaceutical Co., Ltd. | | | 800 | | | | 35,131 | |

The Chugoku Electric Power Co., Inc. | | | 2,800 | | | | 49,074 | |

TonenGeneral Sekiyu K.K. | | | 3,000 | | | | 32,779 | |

Ube Industries, Ltd. | | | 4,000 | | | | 10,965 | |

| | | | | | | | |

| | | | | | | 1,027,108 | |

| | | | | | | | |

Luxembourg: 0.5% | | | | | | | | |

Tenaris SA | | | 1,218 | | | | 22,511 | |

| | | | | | | | |

Netherlands: 2.6% | | | | | | | | |

Akzo Nobel NV | | | 427 | | | | 20,647 | |

ASML Holding NV | | | 516 | | | | 21,688 | |

Unilever NV | | | 1,911 | | | | 65,716 | |

| | | | | | | | |

| | | | | | | 108,051 | |

| | | | | | | | |

New Zealand: 0.7% | | | | | | | | |

Auckland International Airport, Ltd. | | | 15,206 | | | | 29,828 | |

| | | | | | | | |

Norway: 1.5% | | | | | | | | |

Aker Solutions ASA | | | 954 | | | | 10,041 | |

Kvaerner ASA (a) | | | 120 | | | | 196 | |

Norsk Hydro ASA | | | 2,652 | | | | 12,300 | |

Seadrill, Ltd. | | | 264 | | | | 8,828 | |

Telenor ASA | | | 1,198 | | | | 19,650 | |

Yara International ASA | | | 256 | | | | 10,273 | |

| | | | | | | | |

| | | | | | | 61,288 | |

| | | | | | | | |

Spain: 5.4% | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA | | | 4,892 | | | | 42,294 | |

Banco Santander SA | | | 8,600 | | | | 65,336 | |

Distribuidora Internacional de Alimentacion SA (a) | | | 370 | | | | 1,674 | |

Ferrovial SA | | | 1,396 | | | | 16,848 | |

Iberdrola SA | | | 4,924 | | | | 30,838 | |

Industria de Diseno Textil SA | | | 402 | | | | 32,924 | |

Repsol YPF SA | | | 1,258 | | | | 38,645 | |

| | | | | | | | |

| | | | | | | 228,559 | |

| | | | | | | | |

Sweden: 4.2% | | | | | | | | |

Boliden AB | | | 406 | | | | 5,929 | |

Hennes & Mauritz AB (Class B) | | | 1,494 | | | | 48,041 | |

Hexagon AB (Class B) | | | 304 | | | | 4,545 | |

Modern Times Group AB (Class B) | | | 212 | | | | 10,129 | |

Nordea Bank AB | | | 4,268 | | | | 33,024 | |

Sandvik AB | | | 1,422 | | | | 17,449 | |

Skandinaviska Enskilda Banken AB (Class A) | | | 2,070 | | | | 12,058 | |

Swedbank AB (Class A) | | | 2,201 | | | | 28,512 | |

Volvo AB (Class B) | | | 1,684 | | | | 18,426 | |

| | | | | | | | |

| | | | | | | 178,113 | |

| | | | | | | | |

Switzerland: 8.6% | | | | | | | | |

Compagnie Financiere Richemont SA | | | 634 | | | | 32,068 | |

Novartis AG | | | 2,006 | | | | 114,683 | |

| | | | | | | | |

| Security Description | | Shares | | | Value | |

| | | | | | | | |

|

COMMON STOCKS, continued | |

| | |

Switzerland, continued | | | | | | | | |

Roche Holding AG | | | 670 | | | $ | 113,557 | |

Swisscom AG | | | 40 | | | | 15,156 | |

Syngenta AG (a) | | | 118 | | | | 34,547 | |

Wolseley PLC | | | 592 | | | | 19,601 | |

Xstrata PLC | | | 2,132 | | | | 32,382 | |

| | | | | | | | |

| | | | | | | 361,994 | |

| | | | | | | | |

United Kingdom: 23.2% | | | | | | | | |

Associated British Foods PLC | | | 1,396 | | | | 24,000 | |

Barclays PLC | | | 17,077 | | | | 46,689 | |

BG Group PLC | | | 3,646 | | | | 77,941 | |

Bunzl PLC | | | 3,480 | | | | 47,775 | |

Burberry Group PLC | | | 331 | | | | 6,091 | |

Cairn Energy PLC (a) | | | 2,602 | | | | 10,721 | |

Compass Group PLC | | | 466 | | | | 4,422 | |

GlaxoSmithKline PLC | | | 5,513 | | | | 125,985 | |

HSBC Holdings PLC | | | 17,171 | | | | 130,946 | |

Lonmin PLC | | | 446 | | | | 6,788 | |

Pearson PLC | | | 3,534 | | | | 66,408 | |

Prudential PLC | | | 3,501 | | | | 34,716 | |

Randgold Resources, Ltd. | | | 39 | | | | 3,988 | |

Royal Bank of Scotland Group PLC (a) | | | 19,768 | | | | 6,195 | |

RSA Insurance Group PLC | | | 17,013 | | | | 27,795 | |

Standard Chartered PLC | | | 2,547 | | | | 55,733 | |

Tesco PLC | | | 9,776 | | | | 61,252 | |

Tullow Oil PLC | | | 1,462 | | | | 31,832 | |

Unilever PLC | | | 1,729 | | | | 58,080 | |

Vodafone Group PLC | | | 53,690 | | | | 149,168 | |

| | | | | | | | |

| | | | | | | 976,525 | |

| | | | | | | | |

TOTAL COMMON STOCKS | | | | | | | | |

(Cost $4,572,359) | | | | | | | 4,175,015 | |

| | | | | | | | |

| | |

PREFERRED STOCKS: 0.8% | | | | | | | | |

Germany: 0.8% | |

Volkswagen AG Preference Shares | | | 174 | | | | 26,067 | |

ProSiebenSat.1 Media AG Preference Shares | | | 406 | | | | 7,417 | |

| | | | | | | | |

TOTAL PREFERRED STOCKS | |

(Cost $37,238) | | | | | | | 33,484 | |

| | | | | | | | |

|

SHORT TERM INVESTMENT: 0.5% | |

United States: 0.5% | |

|

MONEY MARKET FUND: 0.5% | |

| | |

SSgA Prime Money Market Fund | | | | | | | | |

(Cost $20,907) | | | 20,907 | | | | 20,907 | |

| | | | | | | | |

|

TOTAL INVESTMENTS: 100.5% | |

(Cost $4,630,504) | | | | | | | 4,229,406 | |

| | |

OTHER ASSETS &

LIABILITIES: (0.5)% | | | | | | | (22,401 | ) |

| | | | | | | | |

| | |

Net Assets: 100.0% | | | | | | $ | 4,207,005 | |

| | | | | | | | |

| (a) | Non-income producing security. |

| (b) | REIT = Real Estate Investment Trust |

| | | | |

| SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. | | 22 | | |

December 31, 2011

Statements of Assets and Liabilities

| | | | | | | | |

| | | Pax MSCI

North America

ESG Index ETF | | | Pax MSCI

EAFE ESG

Index ETF | |

ASSETS | | | | | | | | |

Investments, at value (Note B) | | $ | 5,438,289 | | | $ | 4,229,406 | |

Foreign currency, at value | | | 478 | | | | 5,276 | |

Receivable for foreign taxes recoverable | | | — | | | | 2,385 | |

Dividends receivable (Note B) | | | 8,931 | | | | 7,199 | |

| | | | | | | | |

Total Assets | | | 5,447,698 | | | | 4,244,266 | |

| | | | | | | | |

| | |

LIABILITIES | | | | | | | | |

Payable for investments purchased | | | — | | | | 6,777 | |

Distributions payable | | | 42,152 | | | | 27,694 | |

Accrued advisory fee (Note C) | | | 4,488 | | | | 2,790 | |

| | | | | | | | |

Total Liabilities | | | 46,640 | | | | 37,261 | |

| | | | | | | | |

NET ASSETS | | $ | 5,401,058 | | | $ | 4,207,005 | |

| | | | | | | | |

NET ASSETS CONSIST OF: | | | | | | | | |

Paid in capital | | $ | 5,133,247 | | | $ | 4,643,191 | |

Undistributed (distribution in excess of) net investment income | | | (688 | ) | | | (1,008 | ) |

Accumulated net realized gain (loss) on: | | | | | | | | |

Investments and foreign currency transactions | | | (7,524 | ) | | | (33,504 | ) |

Net unrealized appreciation (depreciation) of:

Investments | | | 276,015 | | | | (401,098 | ) |

Foreign currency | | | 8 | | | | (576 | ) |

| | | | | | | | |

NET ASSETS | | $ | 5,401,058 | | | $ | 4,207,005 | |

| | | | | | | | |

NET ASSET VALUE PER SHARE | | | | | | | | |

Net asset value per share | | $ | 27.01 | | | $ | 21.04 | |

| | | | | | | | |

Outstanding beneficial interest shares (unlimited amount authorized, $0.01 par value) | | | 200,000 | | | | 200,000 | |

| | | | | | | | |

COST OF INVESTMENTS: | | | | | | | | |

Investments, at cost (Note B) | | $ | 5,162,274 | | | $ | 4,630,504 | |

| | | | | | | | |

Foreign currency, at cost | | $ | 476 | | | $ | 5,880 | |

| | | | | | | | |

| | | | | | | | | |

| | | | |

| | 23 | | SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS. |

Statements of Operations

| | | | | | | | |

| | | Pax MSCI

North America

ESG Index ETF | | | Pax MSCI

EAFE ESG

Index ETF | |

| | | For the

Period Ended

December 31, 2011 | | | For the

Period Ended

December 31, 2011* | |

INVESTMENT INCOME | | | | | | | | |

Dividend income | | $ | 82,125 | | | $ | 87,329 | |

Foreign taxes withheld | | | (1,727 | ) | | | (6,675 | ) |

| | | | | | | | |

Total Investment Income | | | 80,398 | | | | 80,654 | |

| | | | | | | | |

EXPENSES | | | | | | | | |

Advisory fee (Note C) | | | 19,159 | | | | 12,753 | |

| | | | | | | | |

Total Expenses | | | 19,159 | | | | 12,753 | |

| | | | | | | | |

Net Investment Income | | | 61,239 | | | | 67,901 | |

| | | | | | | | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investments | | | 29,233 | | | | (33,504 | ) |

Foreign currency transactions | | | (55 | ) | | | 773 | |

Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (23,265 | ) | | | (401,098 | ) |

Foreign currency translation | | | 2 | | | | (576 | ) |

| | | | | | | | |

Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | 5,915 | | | | (434,405 | ) |

| | | | | | | | |

Net increase (decrease) in net assets from operations | | $ | 67,154 | | | $ | (366,504 | ) |

| | | | | | | | |

| | | | | | | | | |

* Commencement of operations—January 27, 2011.

| | | | |

| SEE ACCOMPANYING NOTES TO FINANCIAL STATEMENTS | | 24 | | |

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | |

| | | Pax MSCI North America ESG Index ETF | | Pax MSCI EAFE ESG

Index ETF |

| | | Year Ended

12/31/11 | | For the Period 5/18/10*-12/31/10 | | For the Period 1/27/11*-12/31/11 |

INCREASE IN NET ASSETS FROM OPERATIONS: | | | | | | | | | | | | | | | |

Net investment income (loss) | | | $ | 61,239 | | | | $ | 26,729 | | | | $ | 67,901 | |

Net realized gain (loss) on investments and foreign currency transactions | | | | 29,178 | | | | | (37,807 | ) | | | | (32,731 | ) |

Net change in unrealized appreciation (depreciation) on investments and foreign currency translation | | | | (23,263 | ) | | | | 299,286 | | | | | (401,674 | ) |

| | | | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | | 67,154 | | | | | 288,208 | | | | | (366,504 | ) |

| | | | | | | | | | | | | | | |

Net equalization credits and charges | | | | 5,761 | | | | | — | | | | | 24,122 | |

Distributions to shareholders from: | | | | | | | | | | | | | | | |

Net investment income | | | | (61,217 | ) | | | | (26,492 | ) | | | | (69,682 | ) |

| | | | | | | | | | | | | | | |