Q4 2021 Results February 4, 2022

Q4 2021 Results Not for Product Promotional Use Forward Looking Statement and Non-GAAP Financial Information 2 This presentation contains statements about the Company’s future plans and prospects that constitute forward-looking statements for purposes of the safe harbor prov isions under the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated as a result of various important factors, including those discussed in the Company’s most recent annual report on Form 10-K and reports on Form 10-Q and Form 8-K. These documents are available on the SEC’s website, on the Bristol-Myers Squibb website or from Bristol-Myers Squibb Investor Relations. In addition, any forward-looking statements represent our estimates only as of the date hereof and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if our estimates change. This presentation includes certain non-generally accepted accounting principles (GAAP) financial measures that we use to describe our company’s performance. The non-GAAP information presented prov ides investors with additional useful information but should not be considered in isolation or as substitutes for the related GAAP measures. Moreover, other companies may define non-GAAP measures differently, which limits the usefulness of these measures for comparisons with such other companies. We encourage investors to rev iew our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. An explanation of these non-GAAP financial measures and a reconciliation to the most directly comparable GAAP financial measure are available on our website at bms.com/investors. Also note that a reconciliation of certain forward-looking non-GAAP financial measures, however, is not prov ided due to no reasonably accessible or reliable comparable GAAP measures for such statements and the inherent difficulty in forecasting and quantifying such measures that are necessary for such reconciliation. Namely, we are not able to reliably predict the impact of certain specified items or currency exchange rates beyond the next twelve months. As a result, the reconciliation of these non- GAAP measures to the most directly comparable GAAP measures is not available without unreasonable effort. In addition, the company believes such a reconciliation would imply a degree of precision and certainty that could be confusing to investors. The variability of the specified items may have a significant and unpredictable impact on our future GAAP results.

Not for Product Promotional Use Q4 2021 Results Giovanni Caforio Board Chair and Chief Executive Officer 3

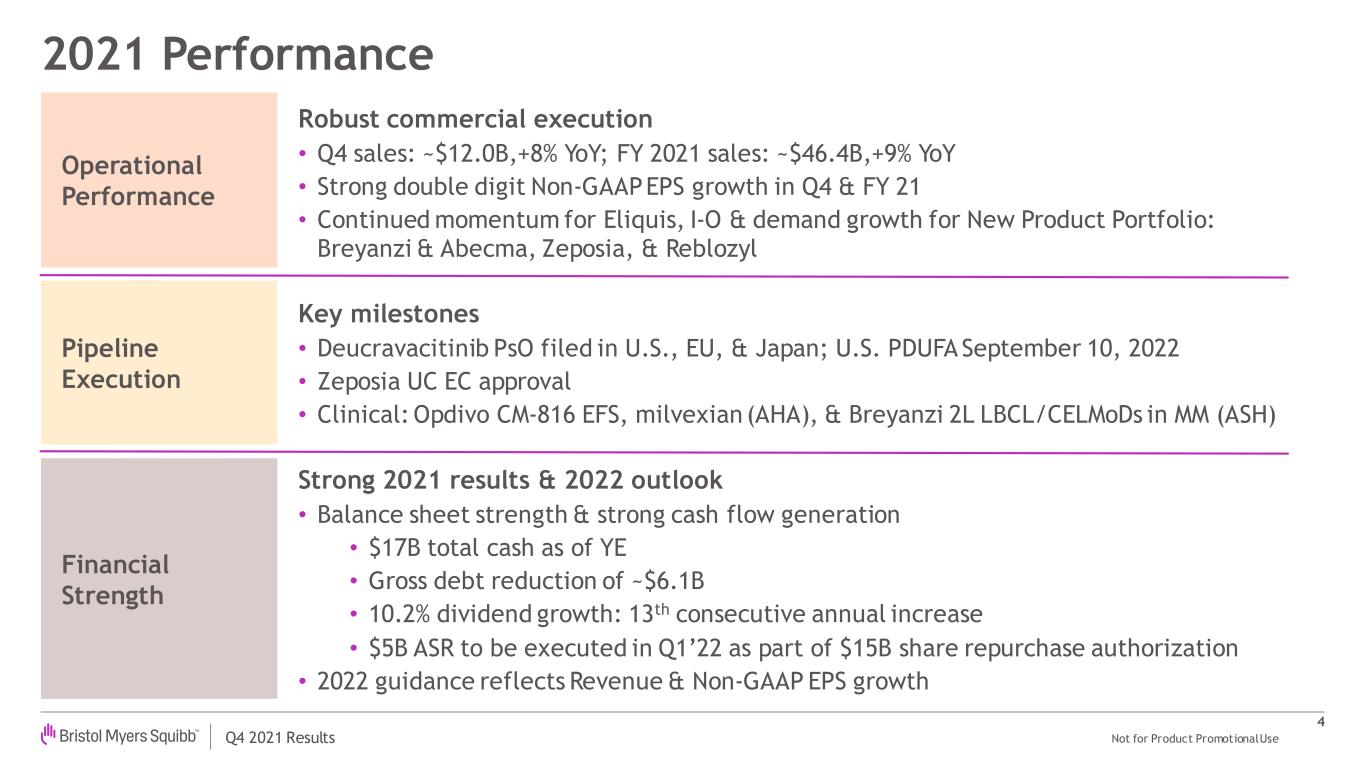

Q4 2021 Results Not for Product Promotional Use Operational Performance Robust commercial execution • Q4 sales: ~$12.0B,+8% YoY; FY 2021 sales: ~$46.4B,+9% YoY • Strong double digit Non-GAAP EPS growth in Q4 & FY 21 • Continued momentum for Eliquis, I-O & demand growth for New Product Portfolio: Breyanzi & Abecma, Zeposia, & Reblozyl Pipeline Execution Key milestones • Deucravacitinib PsO filed in U.S., EU, & Japan; U.S. PDUFA September 10, 2022 • Zeposia UC EC approval • Clinical: Opdivo CM-816 EFS, milvexian (AHA), & Breyanzi 2L LBCL/CELMoDs in MM (ASH) Financial Strength Strong 2021 results & 2022 outlook • Balance sheet strength & strong cash flow generation • $17B total cash as of YE • Gross debt reduction of ~$6.1B • 10.2% dividend growth: 13th consecutive annual increase • $5B ASR to be executed in Q1’22 as part of $15B share repurchase authorization • 2022 guidance reflects Revenue & Non-GAAP EPS growth 2021 Performance 4

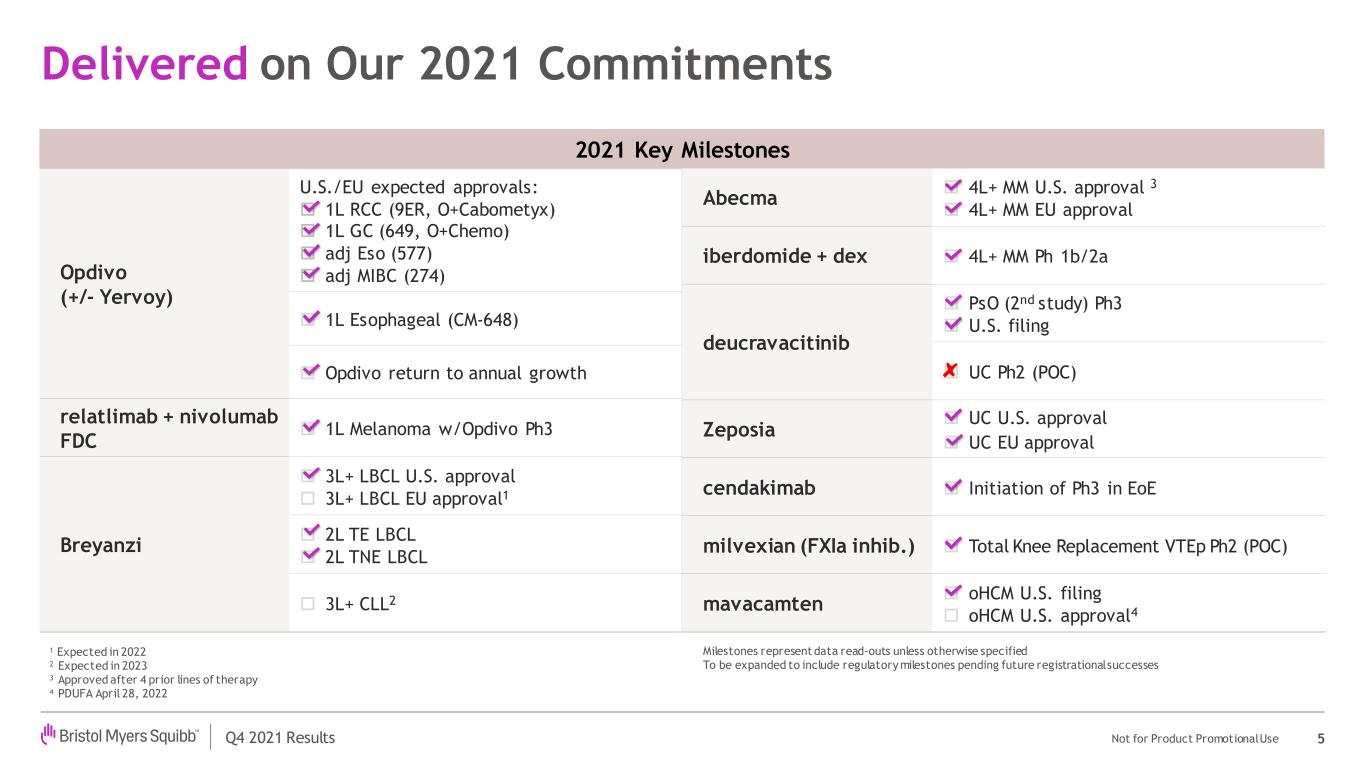

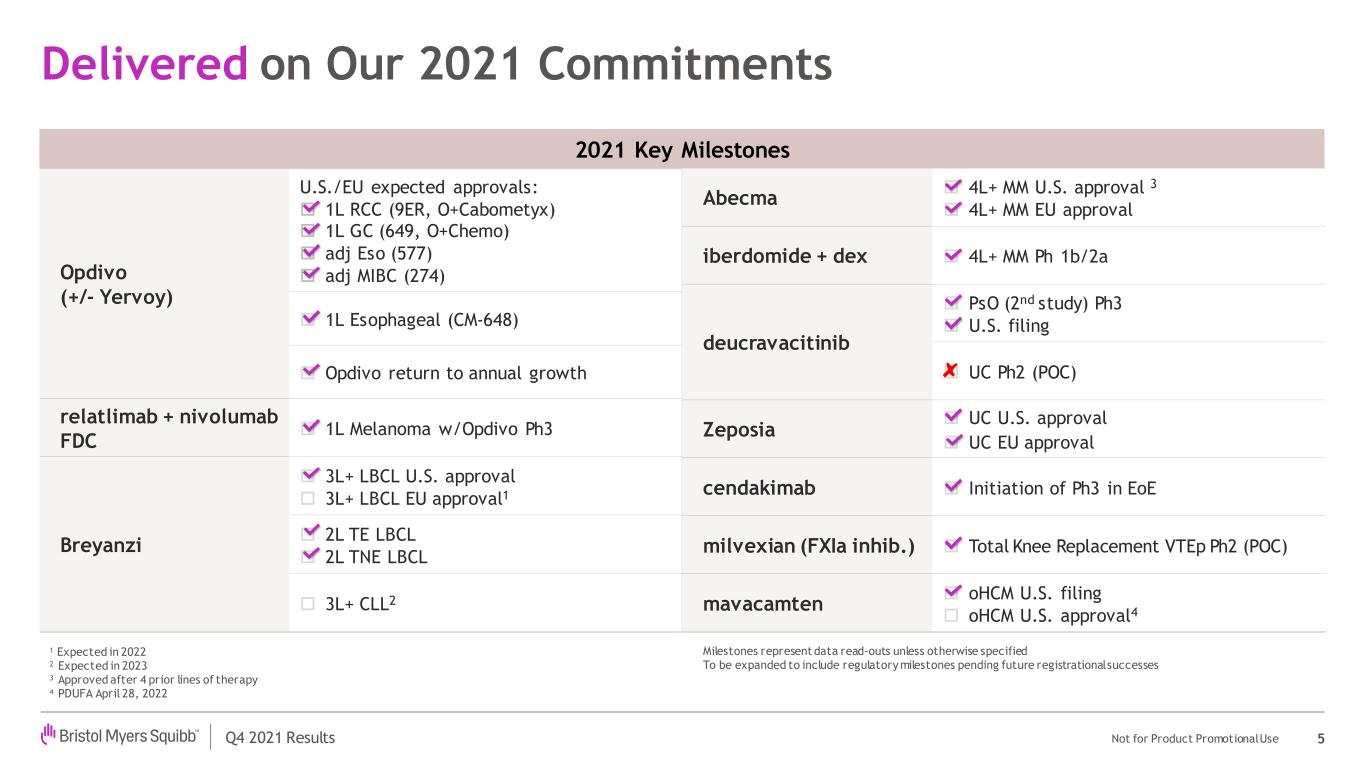

Q4 2021 Results Not for Product Promotional Use 2021 Key Milestones Opdivo (+/- Yervoy) U.S./EU expected approvals: 1L RCC (9ER, O+Cabometyx) 1L GC (649, O+Chemo) adj Eso (577) adj MIBC (274) 1L Esophageal (CM-648) Opdivo return to annual growth relatlimab + nivolumab FDC 1L Melanoma w/Opdivo Ph3 Breyanzi 3L+ LBCL U.S. approval 3L+ LBCL EU approval1 2L TE LBCL 2L TNE LBCL 3L+ CLL2 Delivered on Our 2021 Commitments 5 1 Expected in 2022 2 Expected in 2023 3 Approved after 4 prior lines of therapy 4 PDUFA April 28, 2022 Abecma 4L+ MM U.S. approval 3 4L+ MM EU approval iberdomide + dex 4L+ MM Ph 1b/2a deucravacitinib PsO (2nd study) Ph3 U.S. filing UC Ph2 (POC) Zeposia UC U.S. approval UC EU approval cendakimab Initiation of Ph3 in EoE milvexian (FXIa inhib.) Total Knee Replacement VTEp Ph2 (POC) mavacamten oHCM U.S. filing oHCM U.S. approval4 Milestones represent data read-outs unless otherwise specified To be expanded to include regulatory milestones pending future registrational successes

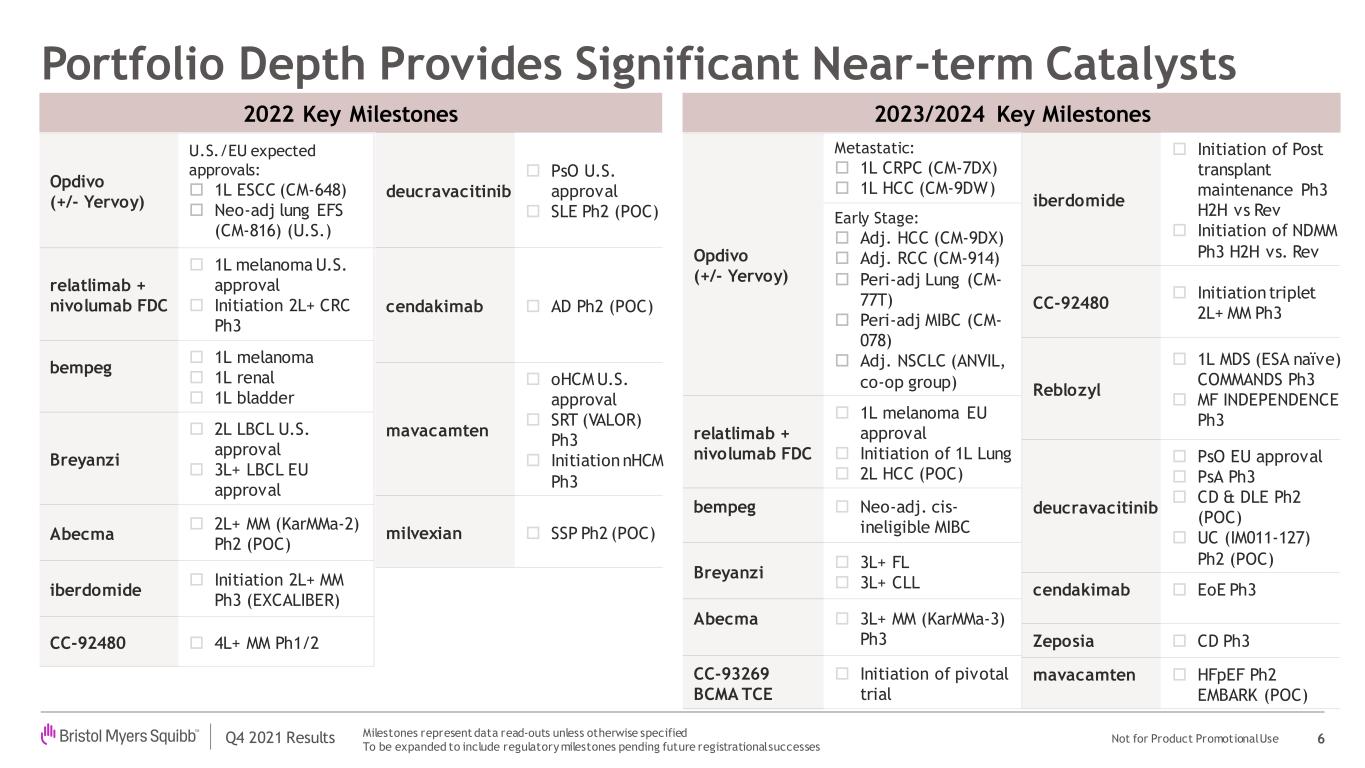

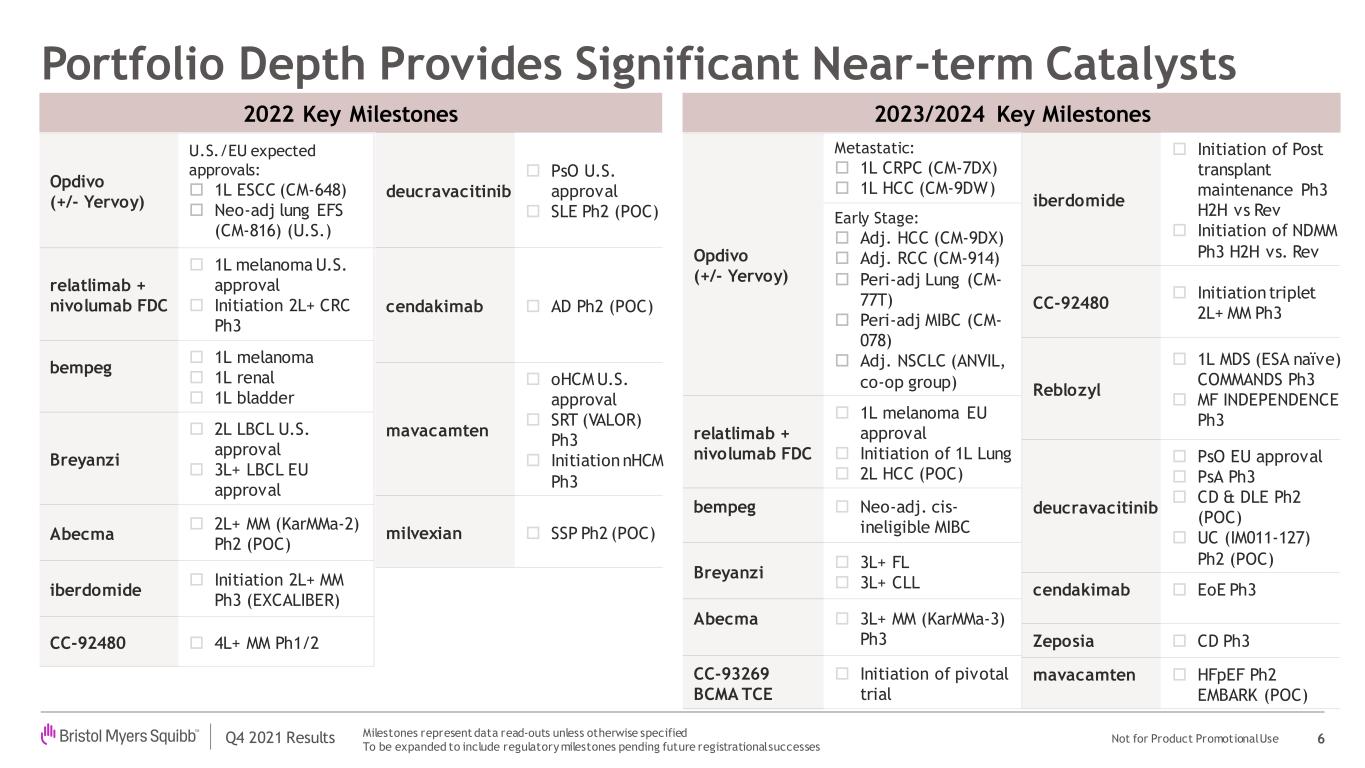

Q4 2021 Results Not for Product Promotional Use 2022 Key Milestones Opdivo (+/- Yervoy) U.S./EU expected approvals: 1L ESCC (CM-648) Neo-adj lung EFS (CM-816) (U.S.) relatlimab + nivolumab FDC 1L melanoma U.S. approval Initiation 2L+ CRC Ph3 bempeg 1L melanoma 1L renal 1L bladder Breyanzi 2L LBCL U.S. approval 3L+ LBCL EU approval Abecma 2L+ MM (KarMMa-2) Ph2 (POC) iberdomide Initiation 2L+ MM Ph3 (EXCALIBER) CC-92480 4L+ MM Ph1/2 Portfolio Depth Provides Significant Near-term Catalysts 6 Milestones represent data read-outs unless otherwise specified To be expanded to include regulatory milestones pending future registrational successes deucravacitinib PsO U.S. approval SLE Ph2 (POC) cendakimab AD Ph2 (POC) mavacamten oHCM U.S. approval SRT (VALOR) Ph3 Initiation nHCM Ph3 milvexian SSP Ph2 (POC) 2023/2024 Key Milestones Opdivo (+/- Yervoy) Metastatic: 1L CRPC (CM-7DX) 1L HCC (CM-9DW) Early Stage: Adj. HCC (CM-9DX) Adj. RCC (CM-914) Peri-adj Lung (CM- 77T) Peri-adj MIBC (CM- 078) Adj. NSCLC (ANVIL, co-op group) relatlimab + nivolumab FDC 1L melanoma EU approval Initiation of 1L Lung 2L HCC (POC) bempeg Neo-adj. cis- ineligible MIBC Breyanzi 3L+ FL 3L+ CLL Abecma 3L+ MM (KarMMa-3) Ph3 CC-93269 BCMA TCE Initiation of pivotal trial iberdomide Initiation of Post transplant maintenance Ph3 H2H vs Rev Initiation of NDMM Ph3 H2H vs. Rev CC-92480 Initiation triplet 2L+ MM Ph3 Reblozyl 1L MDS (ESA naïve) COMMANDS Ph3 MF INDEPENDENCE Ph3 deucravacitinib PsO EU approval PsA Ph3 CD & DLE Ph2 (POC) UC (IM011-127) Ph2 (POC) cendakimab EoE Ph3 Zeposia CD Ph3 mavacamten HFpEF Ph2 EMBARK (POC)

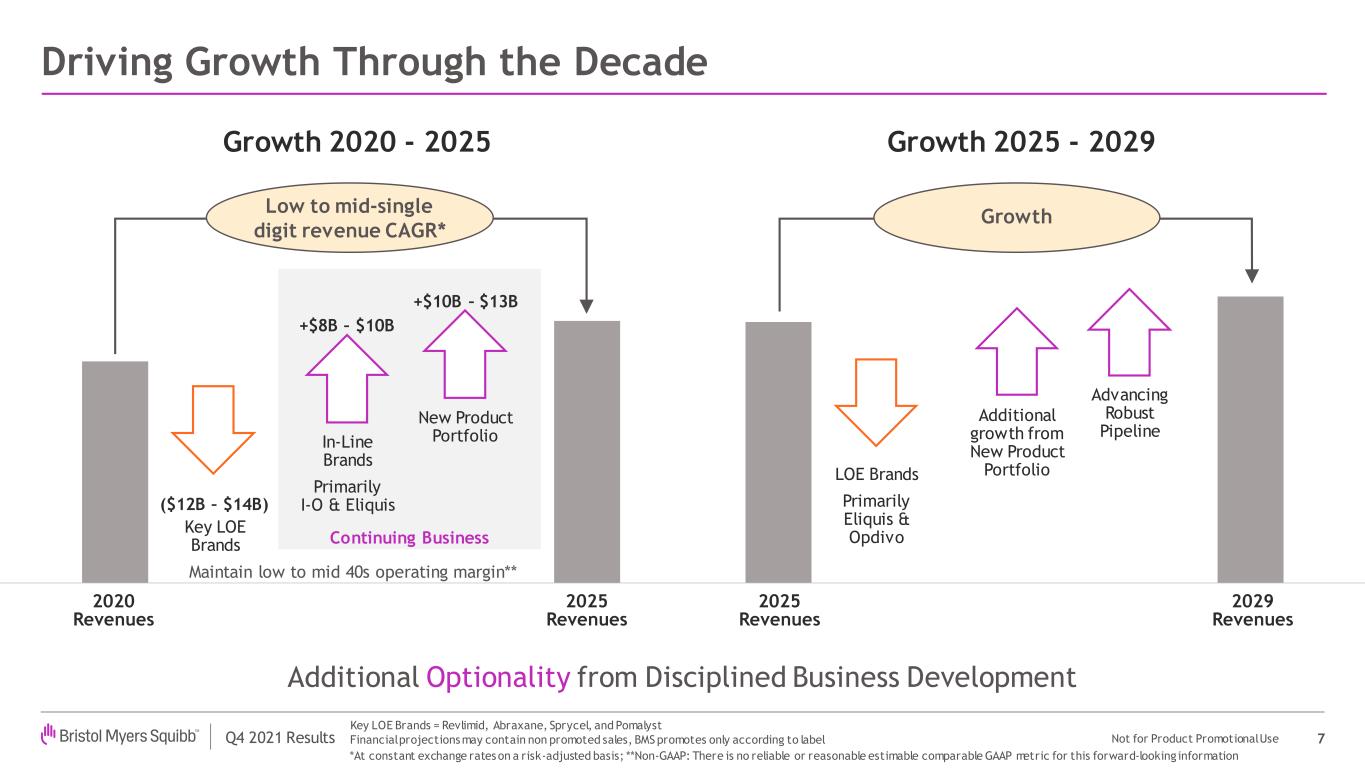

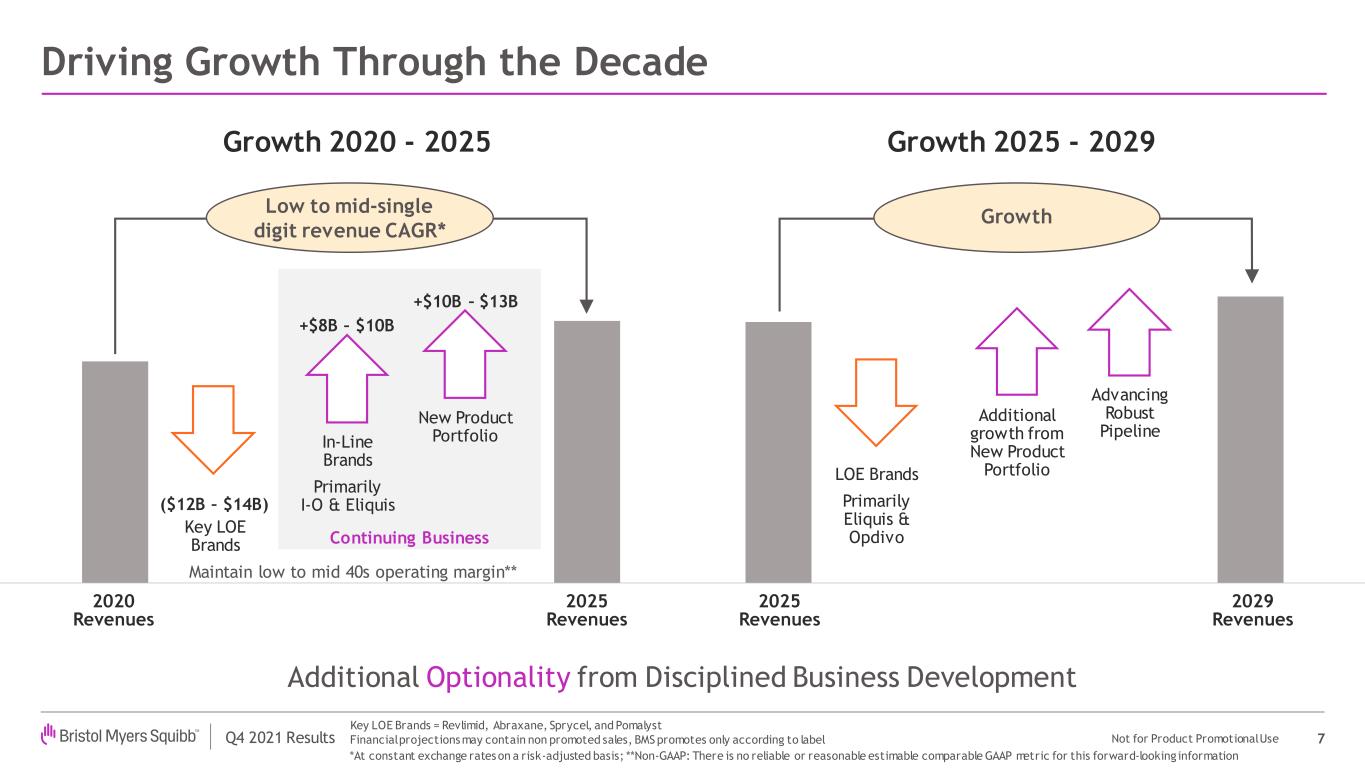

Q4 2021 Results Not for Product Promotional Use Driving Growth Through the Decade 7 ($12B – $14B) +$8B – $10B +$10B – $13B 2020 Revenues Key LOE Brands In-Line Brands Primarily I-O & Eliquis 2025 Revenues New Product Portfolio Growth 2020 - 2025 Growth 2025 - 2029 2025 Revenues 2029 Revenues LOE Brands Primarily Eliquis & Opdivo Additional growth from New Product Portfolio Advancing Robust Pipeline Additional Optionality from Disciplined Business Development Maintain low to mid 40s operating margin** Key LOE Brands = Revlimid, Abraxane, Sprycel, and Pomalyst Financial projections may contain non promoted sales, BMS promotes only according to label *At constant exchange rates on a risk-adjusted basis; **Non-GAAP: There is no reliable or reasonable estimable comparable GAAP metric for this forward-looking information Continuing Business Growth Low to mid-single digit revenue CAGR*

Not for Product Promotional Use David Elkins Chief Financial Officer 8 Q4 2021 Results

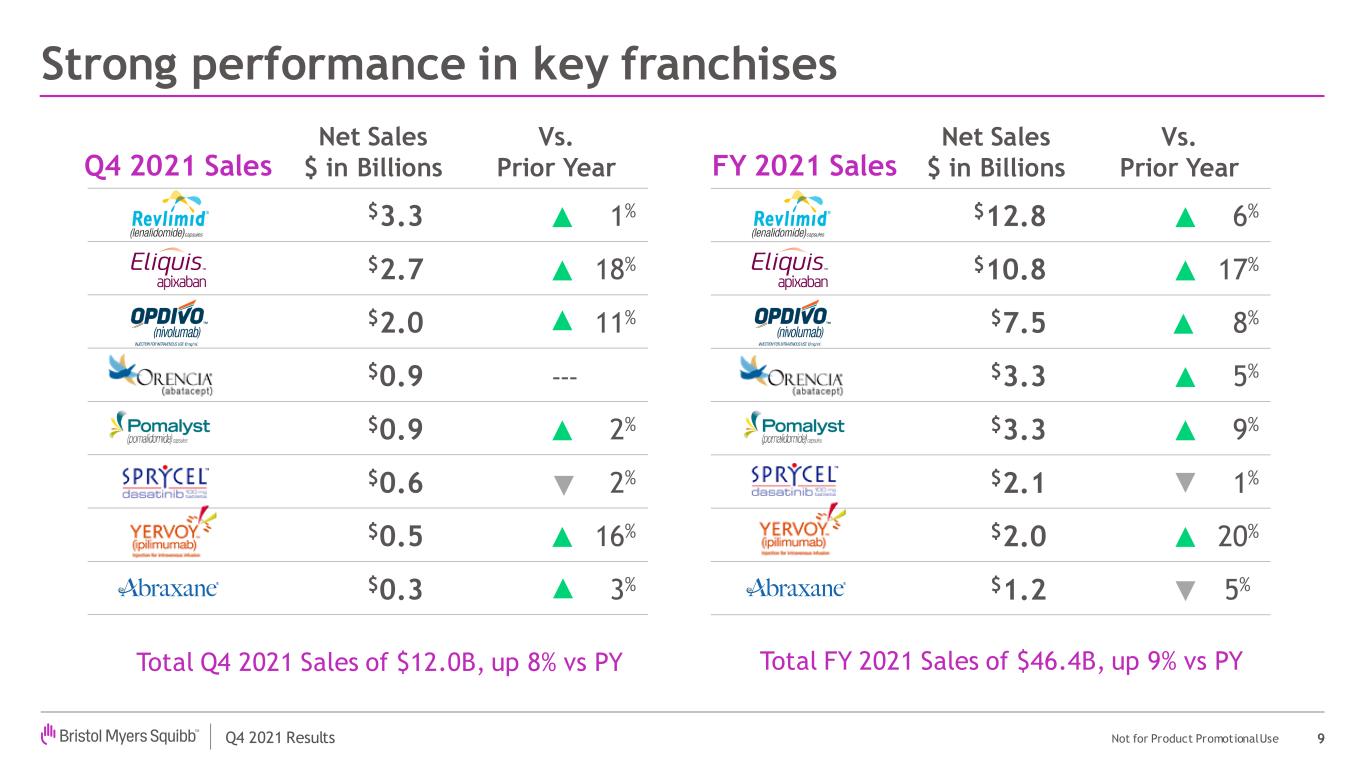

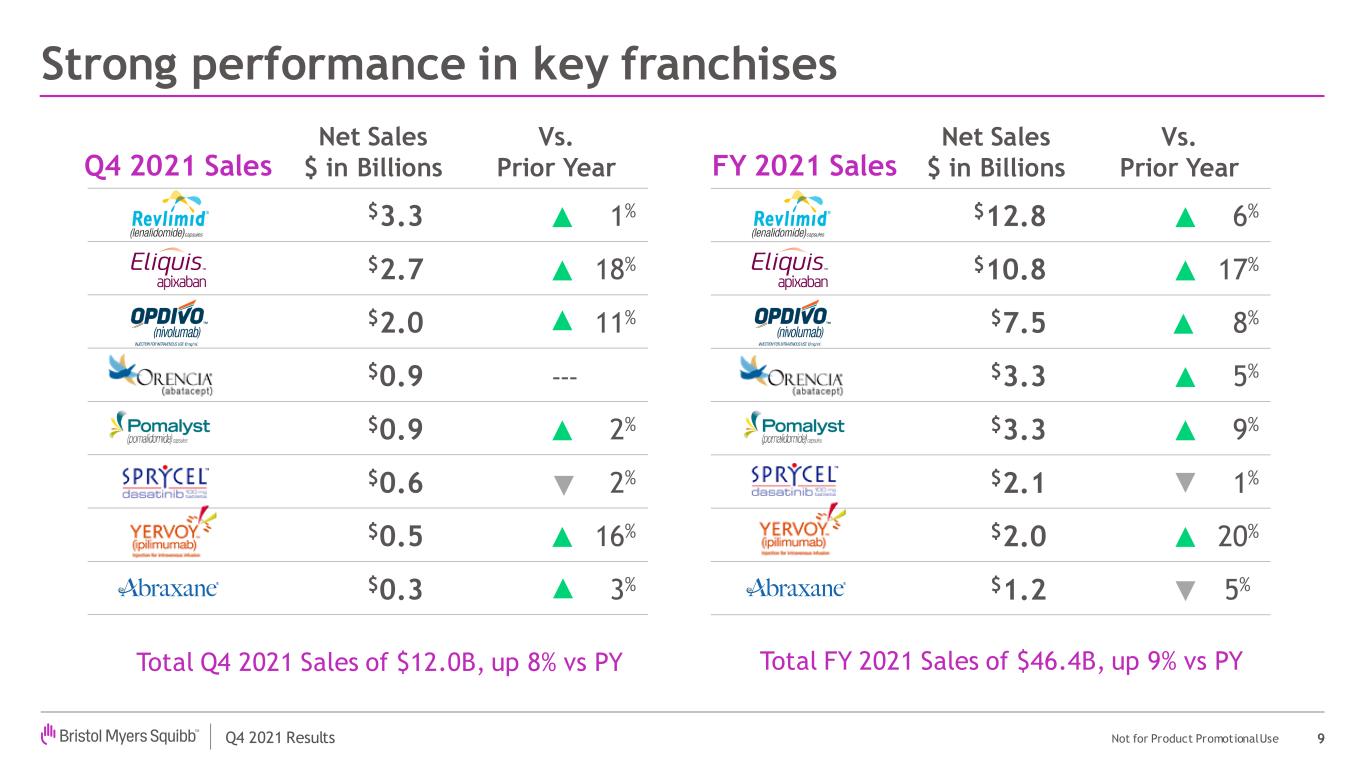

Q4 2021 Results Not for Product Promotional Use Net Sales $ in Billions Vs. Prior Year $3.3 1% $2.7 18% $2.0 11% $0.9 $0.9 2% $0.6 2% $0.5 16% $0.3 3% Strong performance in key franchises 9 Net Sales $ in Billions Vs. Prior Year $12.8 6% $10.8 17% $7.5 8% $3.3 5% $3.3 9% $2.1 1% $2.0 20% $1.2 5% FY 2021 SalesQ4 2021 Sales ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ ▲ Total Q4 2021 Sales of $12.0B, up 8% vs PY Total FY 2021 Sales of $46.4B, up 9% vs PY --- ▲ ▲ ▲ ▲ ▲

Q4 2021 Results Not for Product Promotional Use US: Continued significant demand growth • Continued strong underlying demand & ~$100m inventory build vs. Q3 • ~13% TRx growth Q4 2021 Eliquis performance 10Rx Source: Symphony Health Significant future growth opportunity • Expect to continue to grow share within an expanding class International: Strong demand growth • Continues to be #1 OAC in key markets Global net sales up 18% in Q4, 17% for FY vs. PY 52% 57% 22% 18% 26% 25% Q4 2020 Q4 2021 TRx Share - US Other NOACs Warfarin Eliquis 61% 63% 13% 12% 26% 25% Q4 2020 Q4 2021 NBRx Share – US

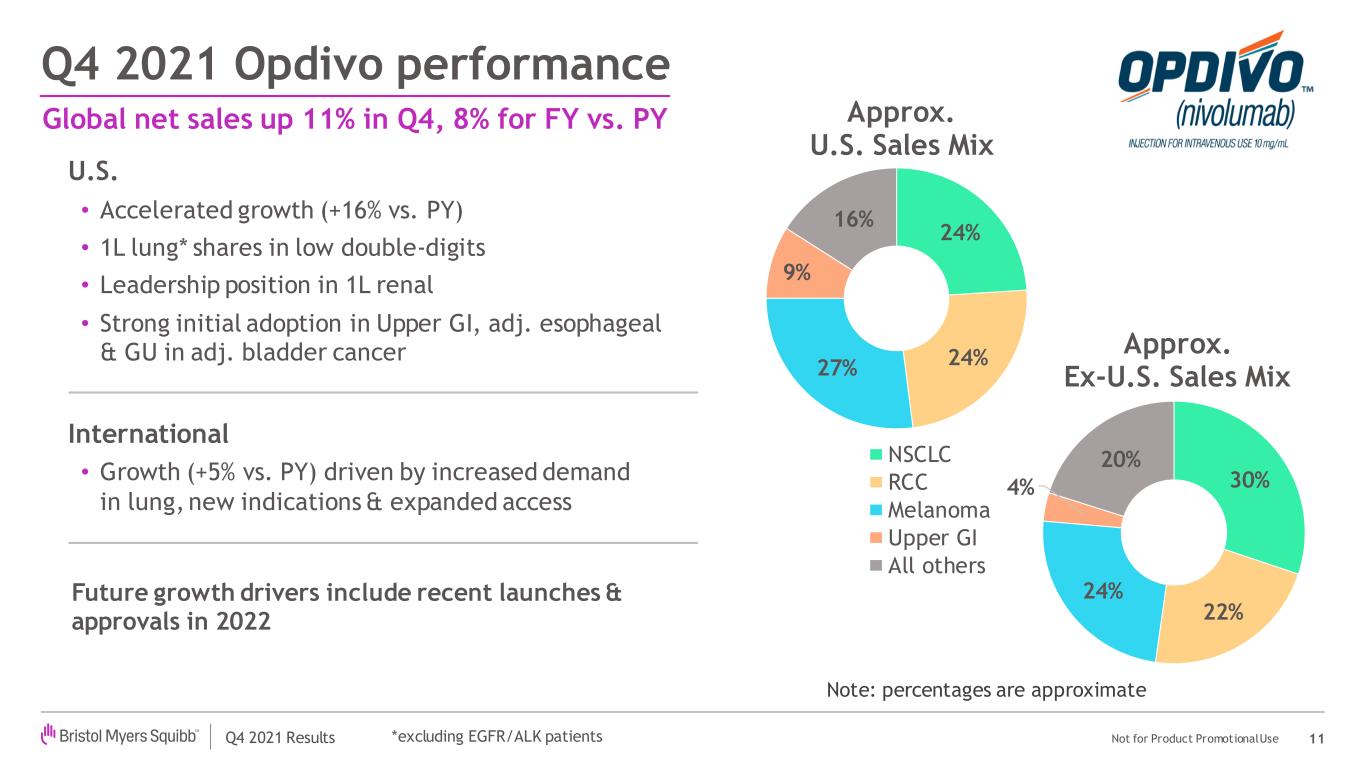

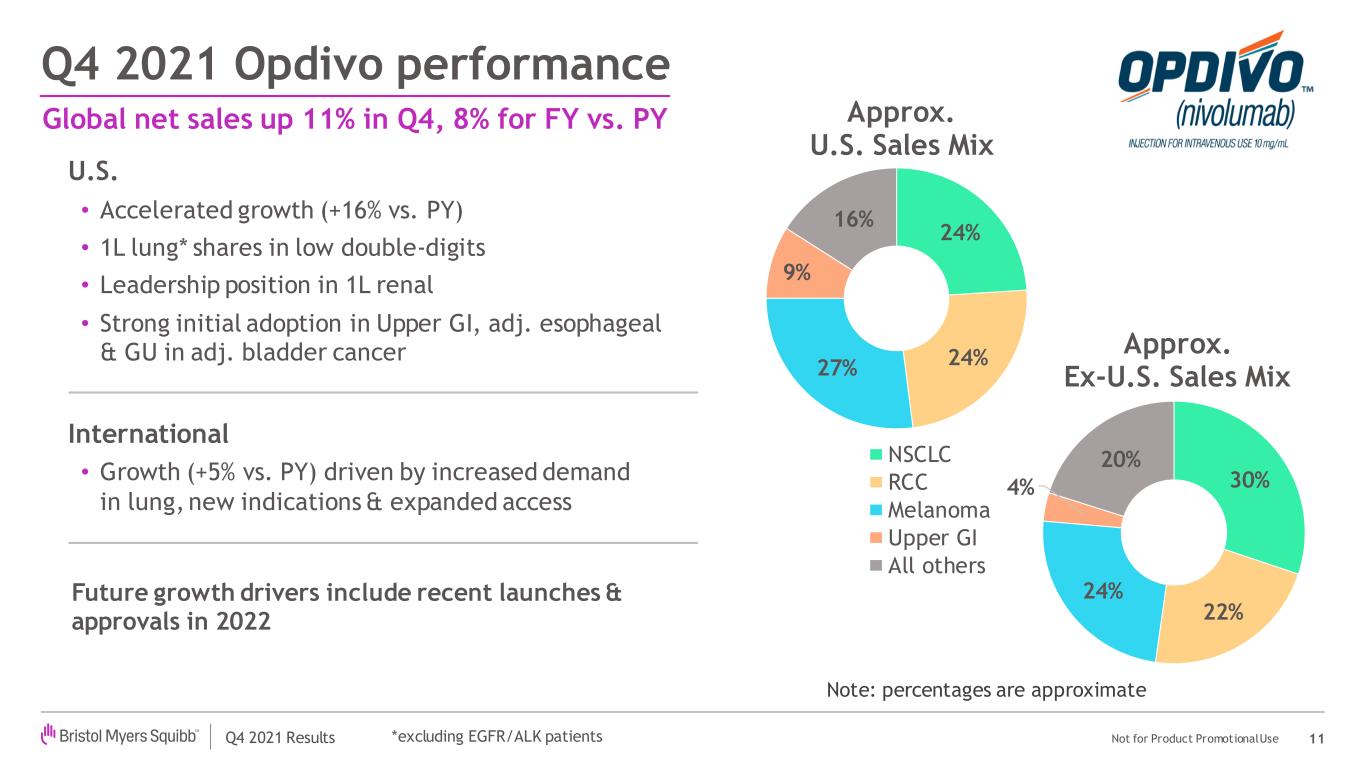

Q4 2021 Results Not for Product Promotional Use Global net sales up 11% in Q4, 8% for FY vs. PY U.S. • Accelerated growth (+16% vs. PY) • 1L lung* shares in low double-digits • Leadership position in 1L renal • Strong initial adoption in Upper GI, adj. esophageal & GU in adj. bladder cancer Q4 2021 Opdivo performance 11 24% 24%27% 9% 16% Approx. U.S. Sales Mix Note: percentages are approximate 30% 22% 24% 4% 20% Approx. Ex-U.S. Sales Mix NSCLC RCC Melanoma Upper GI All others Future growth drivers include recent launches & approvals in 2022 *excluding EGFR/ALK patients International • Growth (+5% vs. PY) driven by increased demand in lung, new indications & expanded access

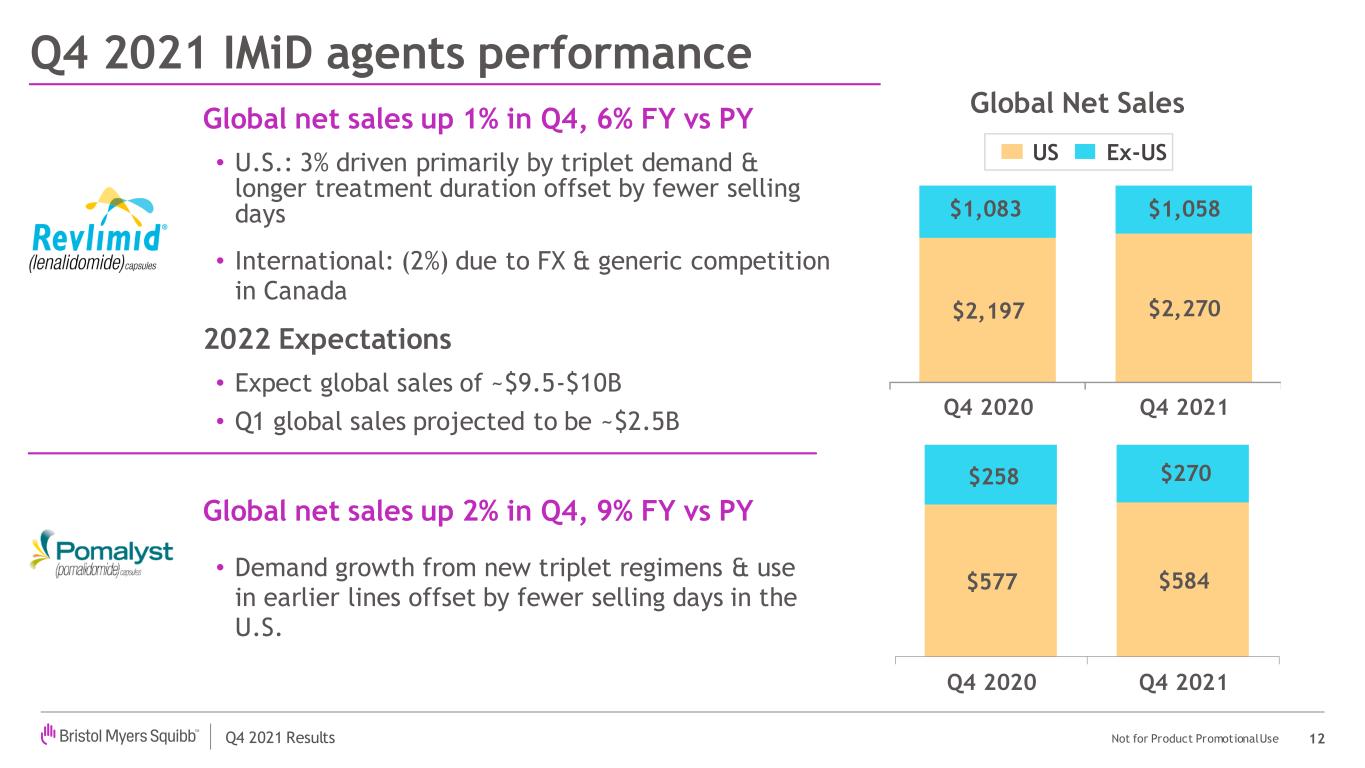

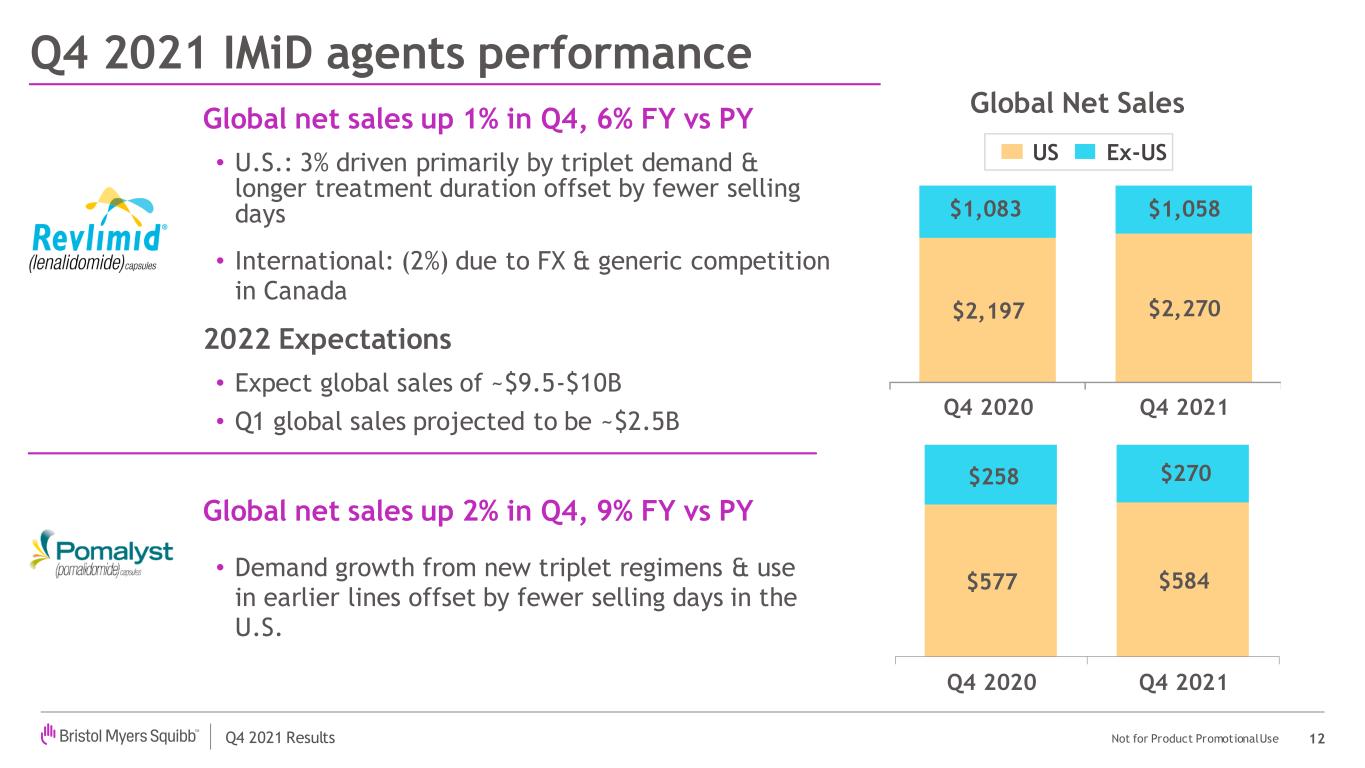

Q4 2021 Results Not for Product Promotional Use Q4 2021 IMiD agents performance 12 $577 $584 $258 $270 Q4 2020 Q4 2021 Global net sales up 1% in Q4, 6% FY vs PY • U.S.: 3% driven primarily by triplet demand & longer treatment duration offset by fewer selling days • International: (2%) due to FX & generic competition in Canada Global net sales up 2% in Q4, 9% FY vs PY • Demand growth from new triplet regimens & use in earlier lines offset by fewer selling days in the U.S. Global Net Sales $2,197 $2,270 $1,083 $1,058 Q4 2020 Q4 2021 US Ex-US 2022 Expectations • Expect global sales of ~$9.5-$10B • Q1 global sales projected to be ~$2.5B

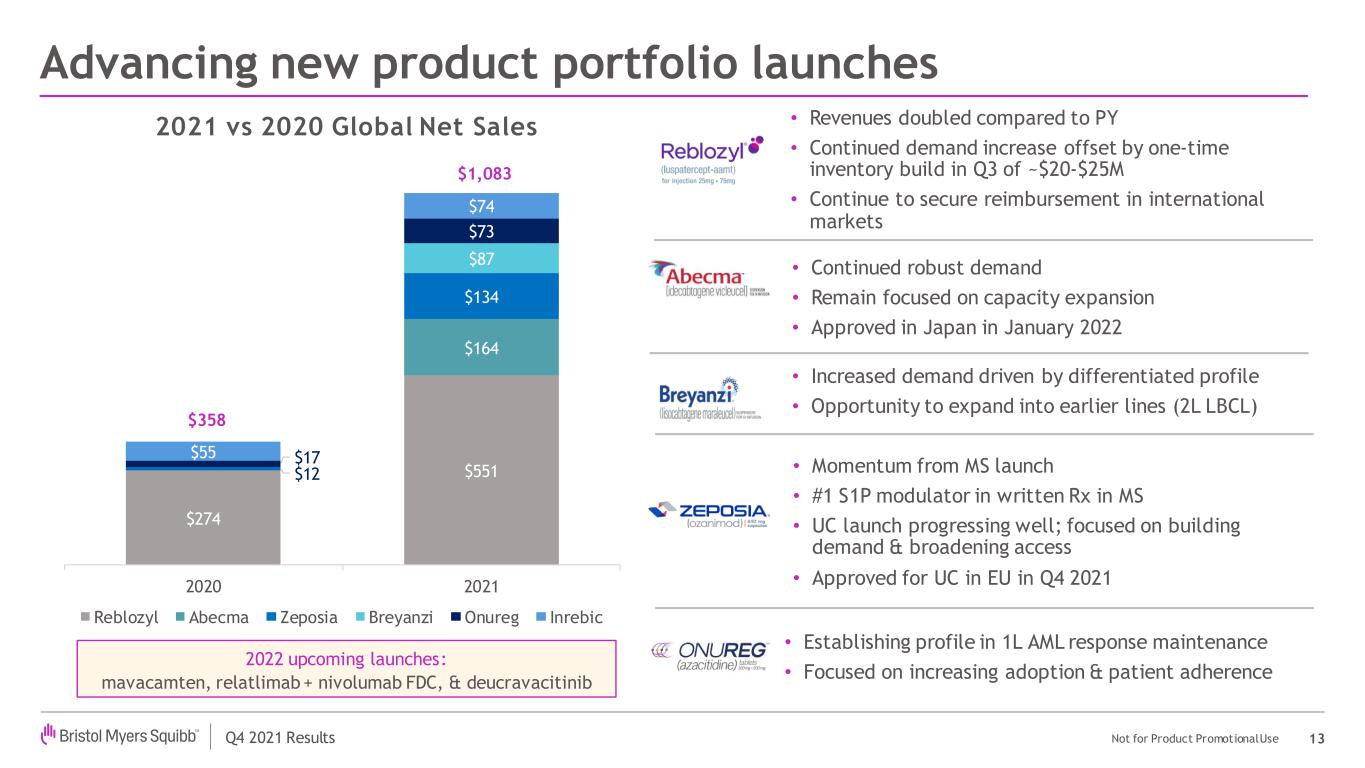

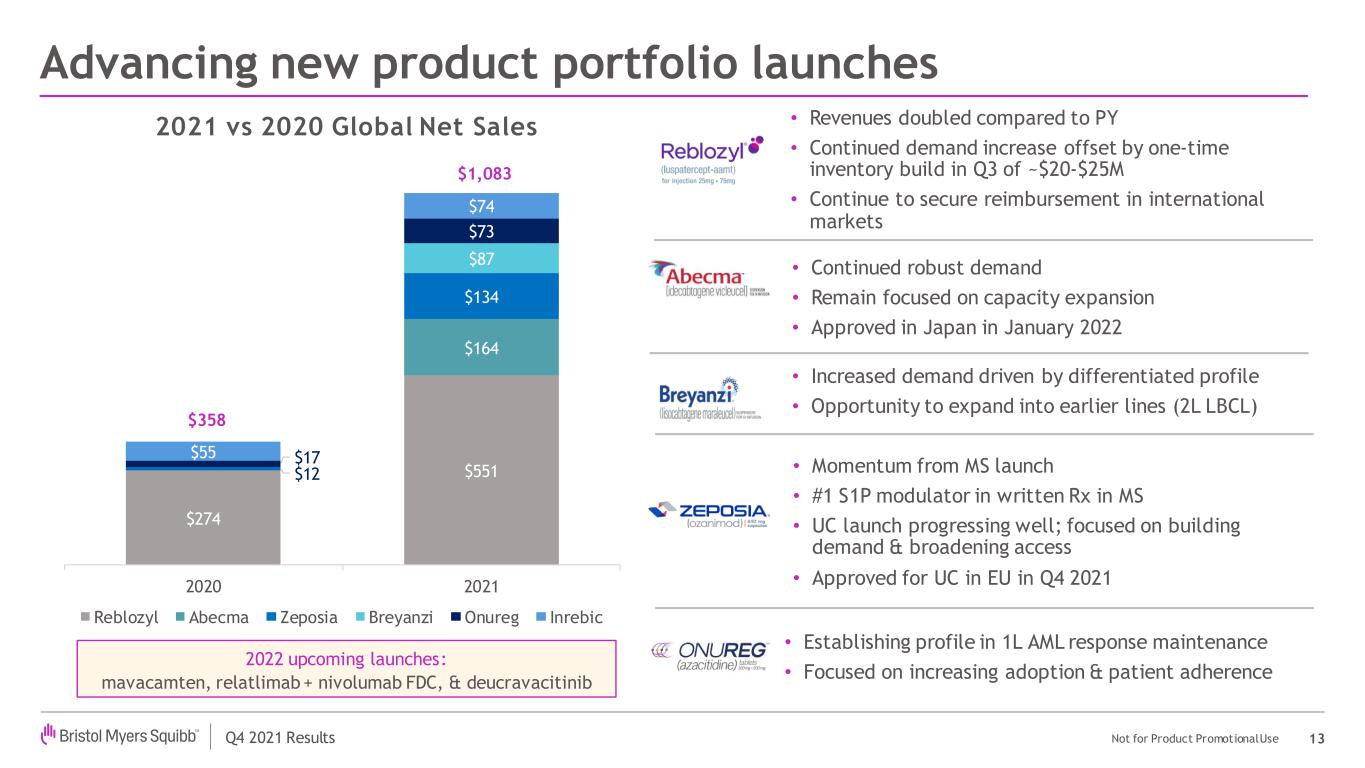

Q4 2021 Results Not for Product Promotional Use Advancing new product portfolio launches 13 $274 $551 $164 $12 $134 $87 $17 $73 $55 $74 $358 $1,083 2020 2021 2021 vs 2020 Global Net Sales Reblozyl Abecma Zeposia Breyanzi Onureg Inrebic • Revenues doubled compared to PY • Continued demand increase offset by one-time inventory build in Q3 of ~$20-$25M • Continue to secure reimbursement in international markets • Continued robust demand • Remain focused on capacity expansion • Approved in Japan in January 2022 • Increased demand driven by differentiated profile • Opportunity to expand into earlier lines (2L LBCL) • Momentum from MS launch • #1 S1P modulator in written Rx in MS • UC launch progressing well; focused on building demand & broadening access • Approved for UC in EU in Q4 2021 • Establishing profile in 1L AML response maintenance • Focused on increasing adoption & patient adherence 2022 upcoming launches: mavacamten, relatlimab + nivolumab FDC, & deucravacitinib

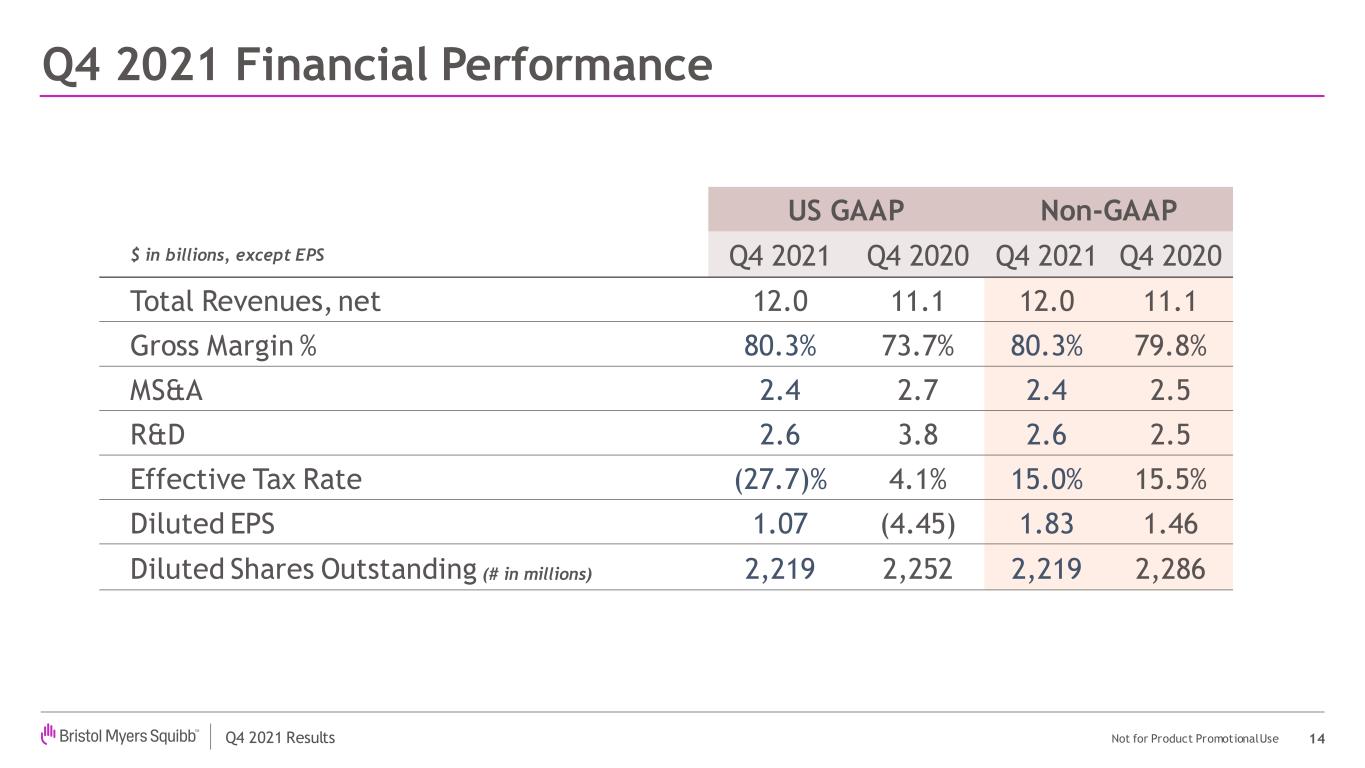

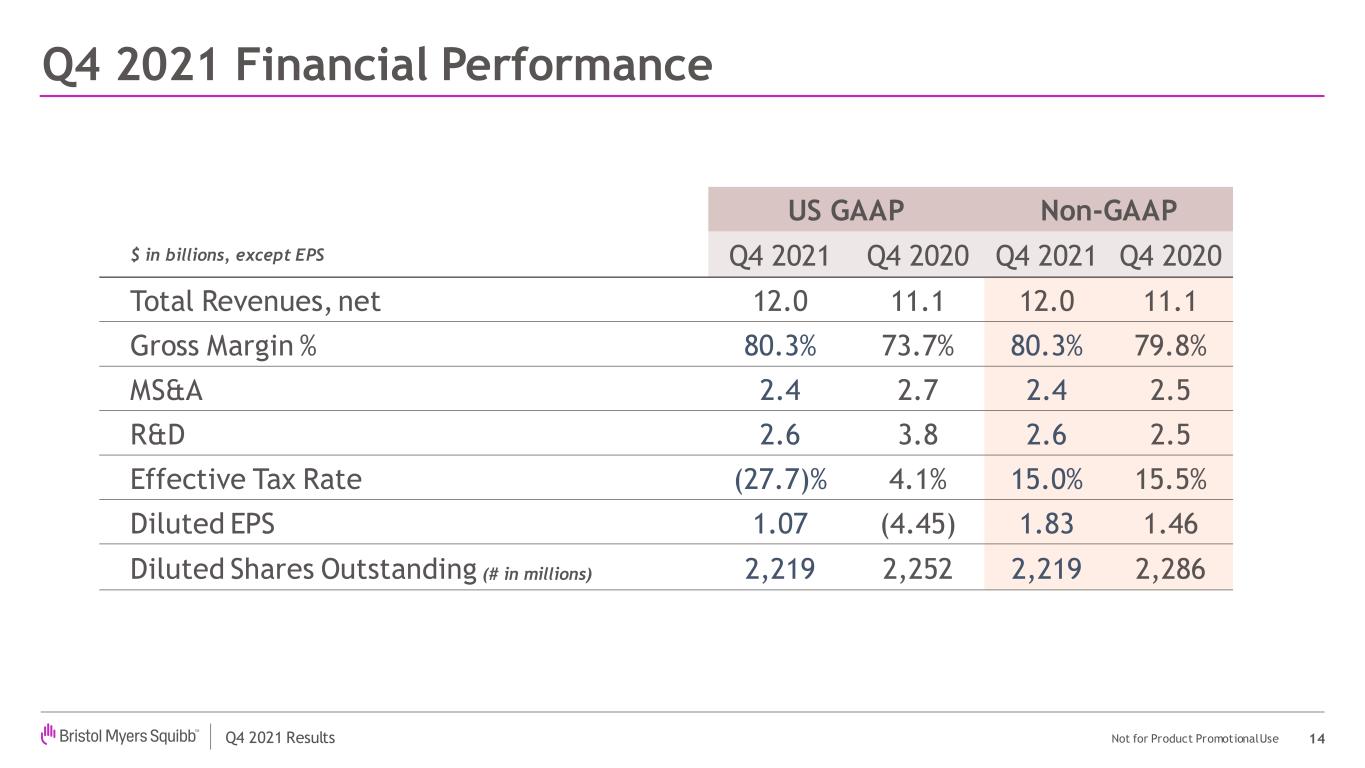

Q4 2021 Results Not for Product Promotional Use US GAAP Non-GAAP $ in billions, except EPS Q4 2021 Q4 2020 Q4 2021 Q4 2020 Total Revenues, net 12.0 11.1 12.0 11.1 Gross Margin % 80.3% 73.7% 80.3% 79.8% MS&A 2.4 2.7 2.4 2.5 R&D 2.6 3.8 2.6 2.5 Effective Tax Rate (27.7)% 4.1% 15.0% 15.5% Diluted EPS 1.07 (4.45) 1.83 1.46 Diluted Shares Outstanding (# in millions) 2,219 2,252 2,219 2,286 Q4 2021 Financial Performance 14

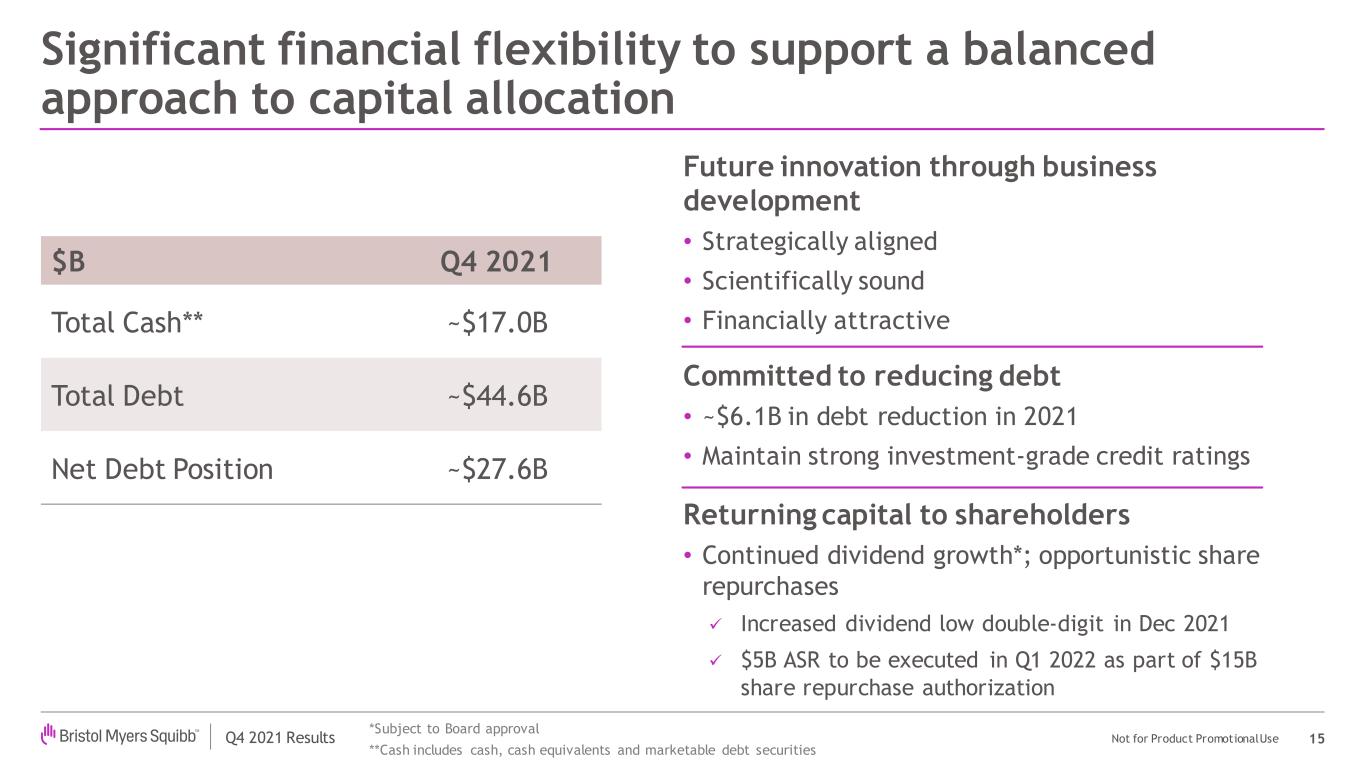

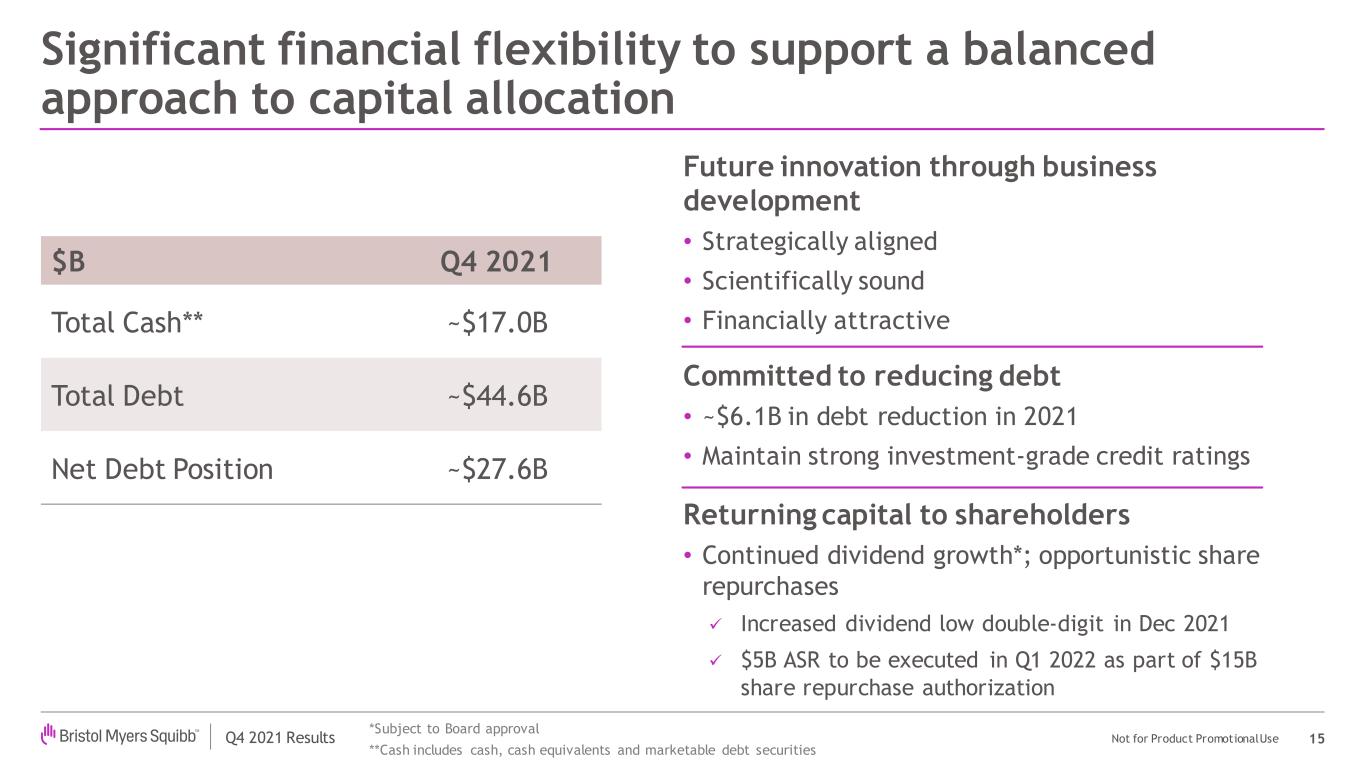

Q4 2021 Results Not for Product Promotional Use Significant financial flexibility to support a balanced approach to capital allocation 15 $B Q4 2021 Total Cash** ~$17.0B Total Debt ~$44.6B Net Debt Position ~$27.6B *Subject to Board approval **Cash includes cash, cash equivalents and marketable debt securities Committed to reducing debt • ~$6.1B in debt reduction in 2021 • Maintain strong investment-grade credit ratings Returning capital to shareholders • Continued dividend growth*; opportunistic share repurchases ✓ Increased dividend low double-digit in Dec 2021 ✓ $5B ASR to be executed in Q1 2022 as part of $15B share repurchase authorization Future innovation through business development • Strategically aligned • Scientifically sound • Financially attractive

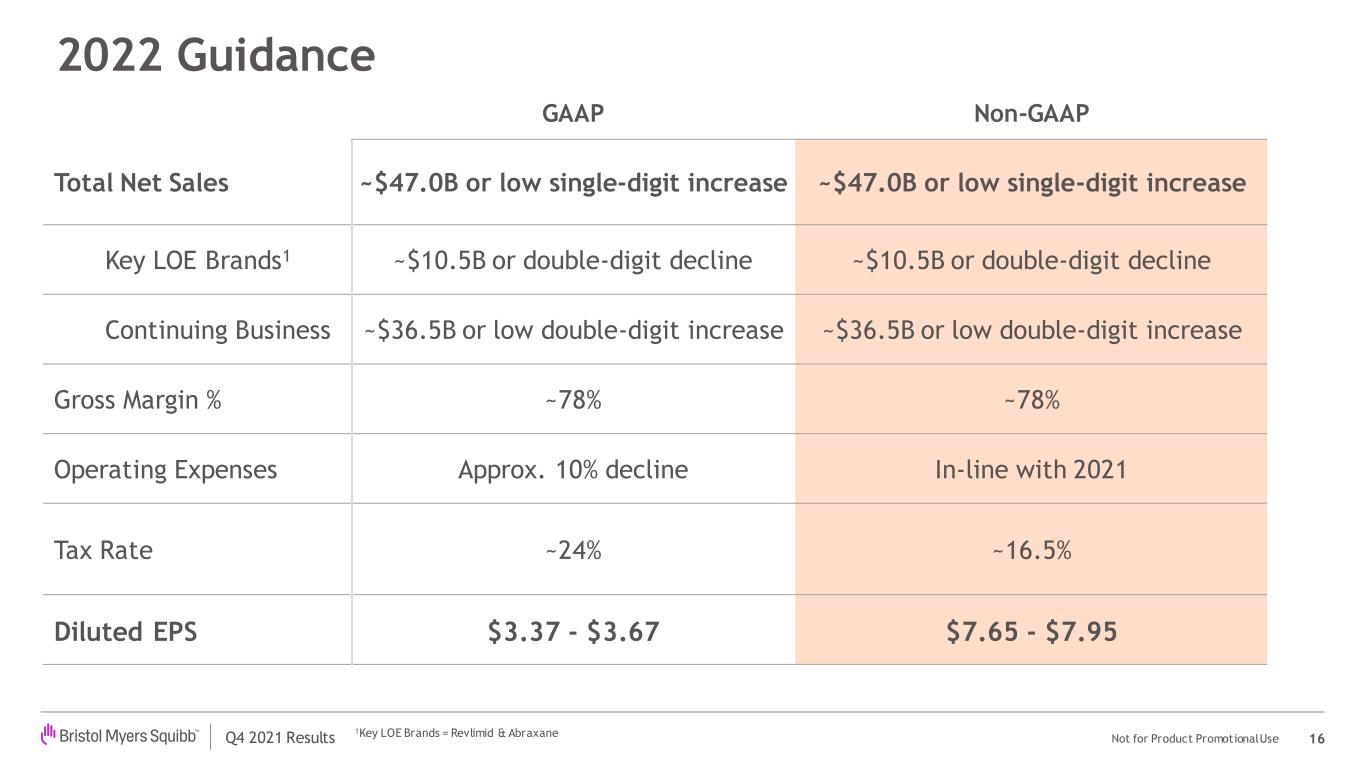

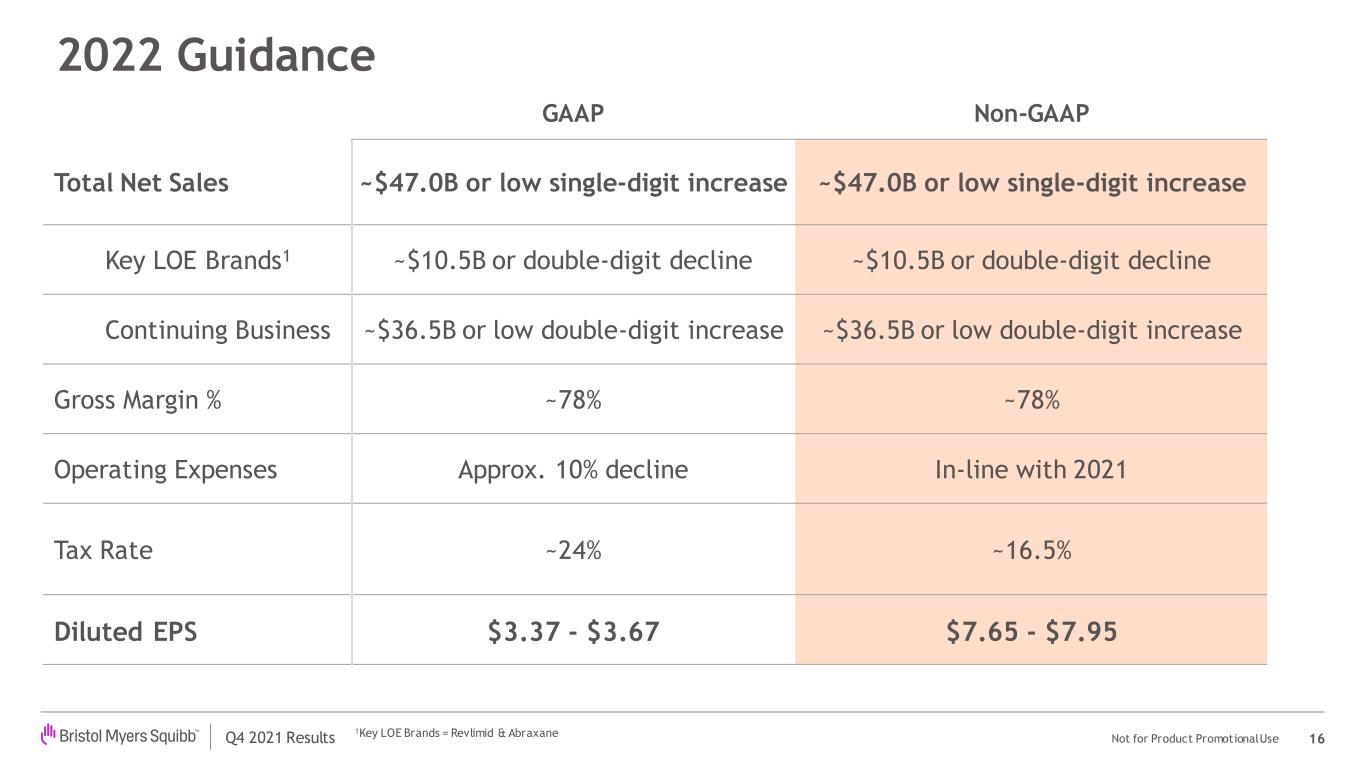

Q4 2021 Results Not for Product Promotional Use 2022 Guidance 16 GAAP Non-GAAP Total Net Sales ~$47.0B or low single-digit increase ~$47.0B or low single-digit increase Key LOE Brands1 ~$10.5B or double-digit decline ~$10.5B or double-digit decline Continuing Business ~$36.5B or low double-digit increase ~$36.5B or low double-digit increase Gross Margin % ~78% ~78% Operating Expenses Approx. 10% decline In-line with 2021 Tax Rate ~24% ~16.5% Diluted EPS $3.37 - $3.67 $7.65 - $7.95 1Key LOE Brands = Revlimid & Abraxane

Q4 2021 Results Not for Product Promotional Use Q&A Giovanni Caforio, M.D. Board Chair, Chief Executive Officer David Elkins Executive VP, Chief Financial Officer 17 Chris Boerner, Ph.D. Executive VP, Chief Commercialization Officer Samit Hirawat, M.D. Executive VP, Chief Medical Officer, Global Drug Development

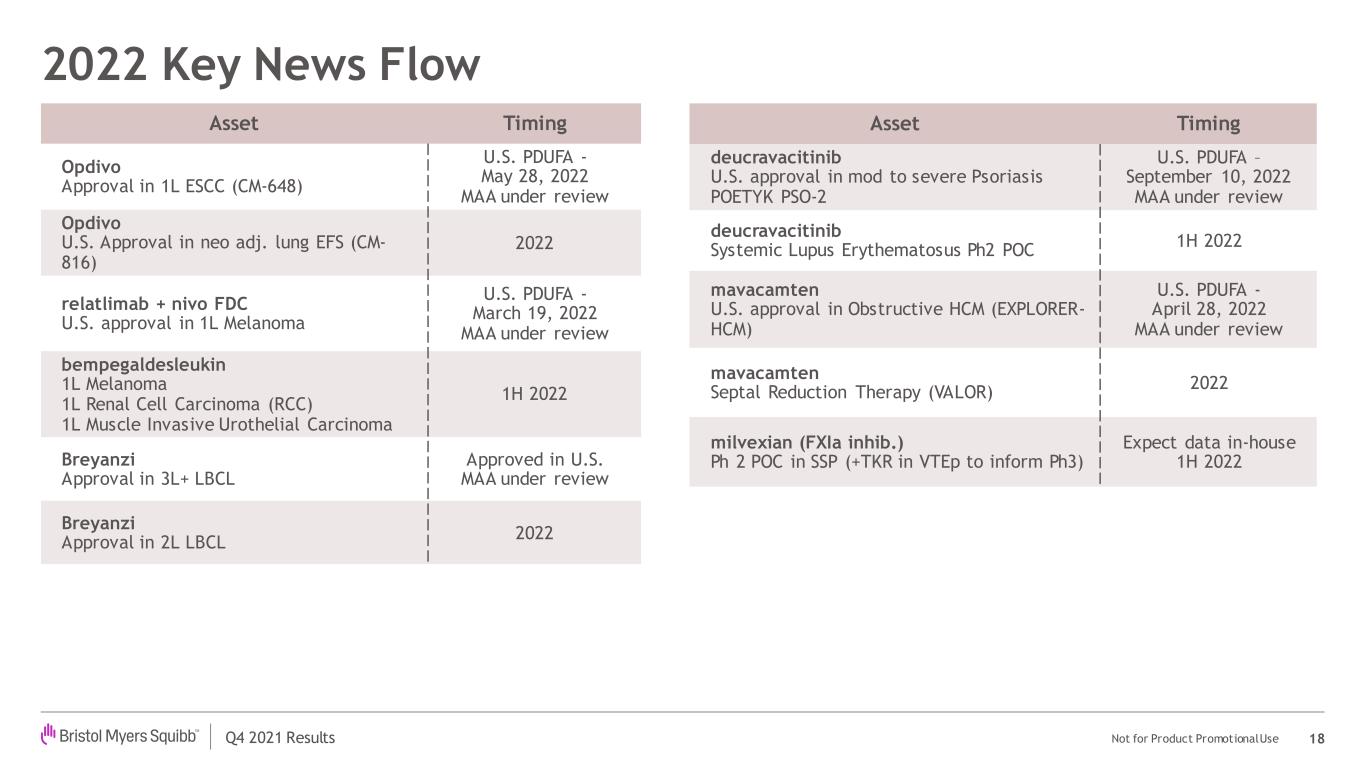

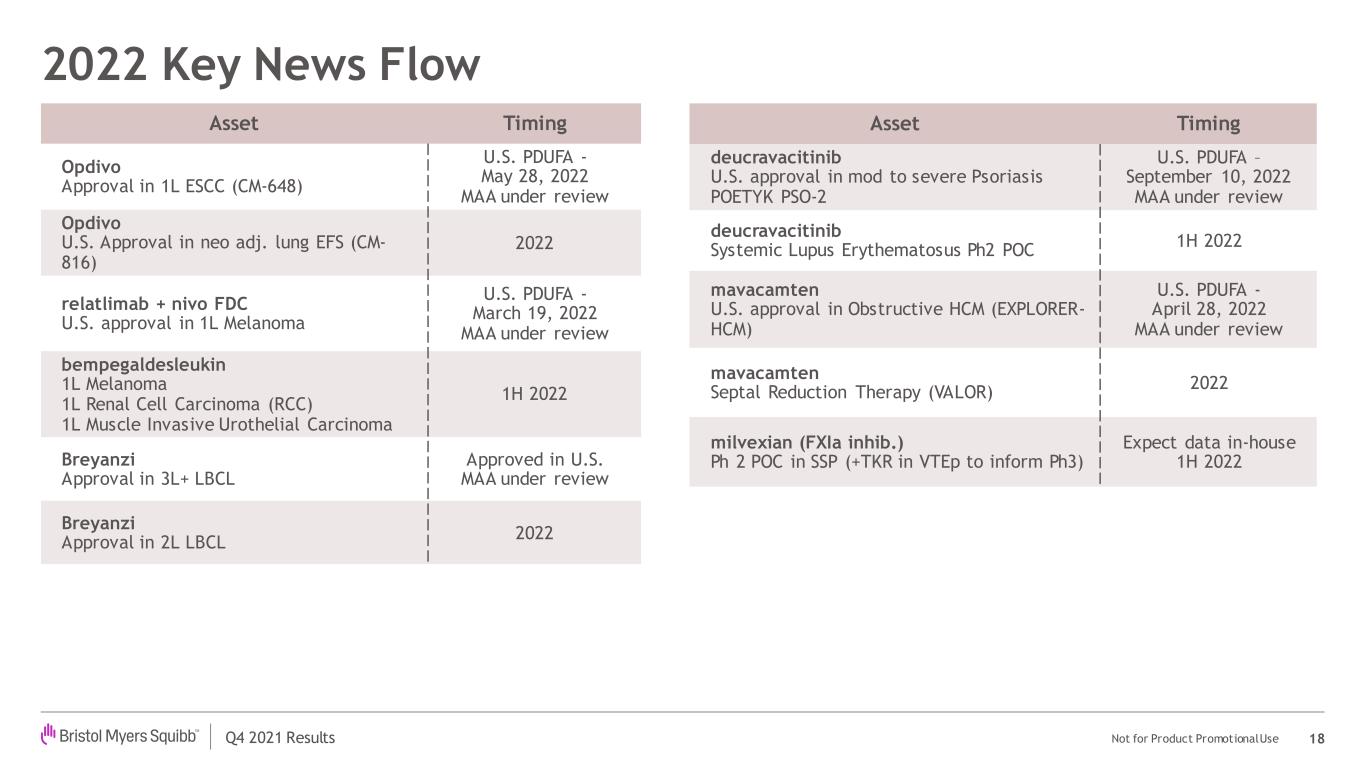

Q4 2021 Results Not for Product Promotional Use 2022 Key News Flow 18 Asset Timing Opdivo Approval in 1L ESCC (CM-648) U.S. PDUFA - May 28, 2022 MAA under review Opdivo U.S. Approval in neo adj. lung EFS (CM- 816) 2022 relatlimab + nivo FDC U.S. approval in 1L Melanoma U.S. PDUFA - March 19, 2022 MAA under review bempegaldesleukin 1L Melanoma 1L Renal Cell Carcinoma (RCC) 1L Muscle Invasive Urothelial Carcinoma 1H 2022 Breyanzi Approval in 3L+ LBCL Approved in U.S. MAA under review Breyanzi Approval in 2L LBCL 2022 Asset Timing deucravacitinib U.S. approval in mod to severe Psoriasis POETYK PSO-2 U.S. PDUFA – September 10, 2022 MAA under review deucravacitinib Systemic Lupus Erythematosus Ph2 POC 1H 2022 mavacamten U.S. approval in Obstructive HCM (EXPLORER- HCM) U.S. PDUFA - April 28, 2022 MAA under review mavacamten Septal Reduction Therapy (VALOR) 2022 milvexian (FXIa inhib.) Ph 2 POC in SSP (+TKR in VTEp to inform Ph3) Expect data in-house 1H 2022

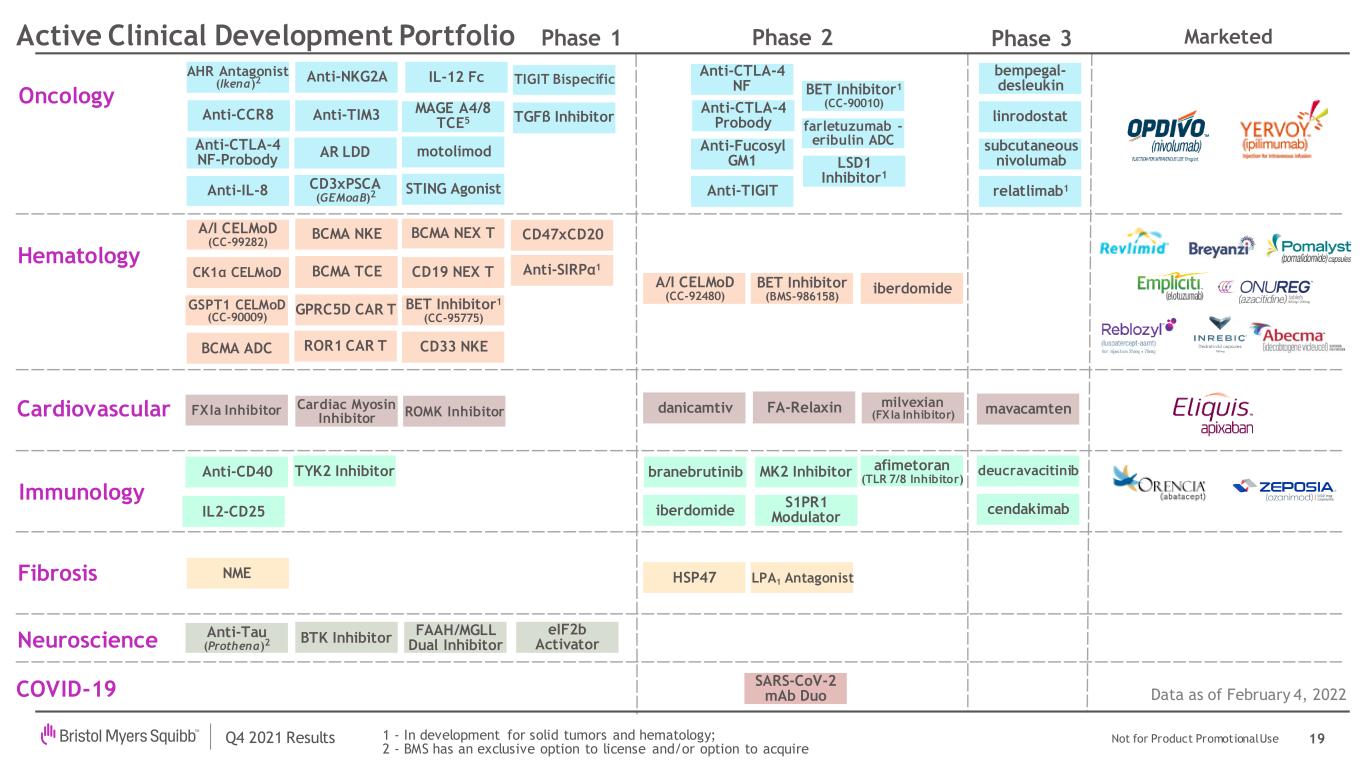

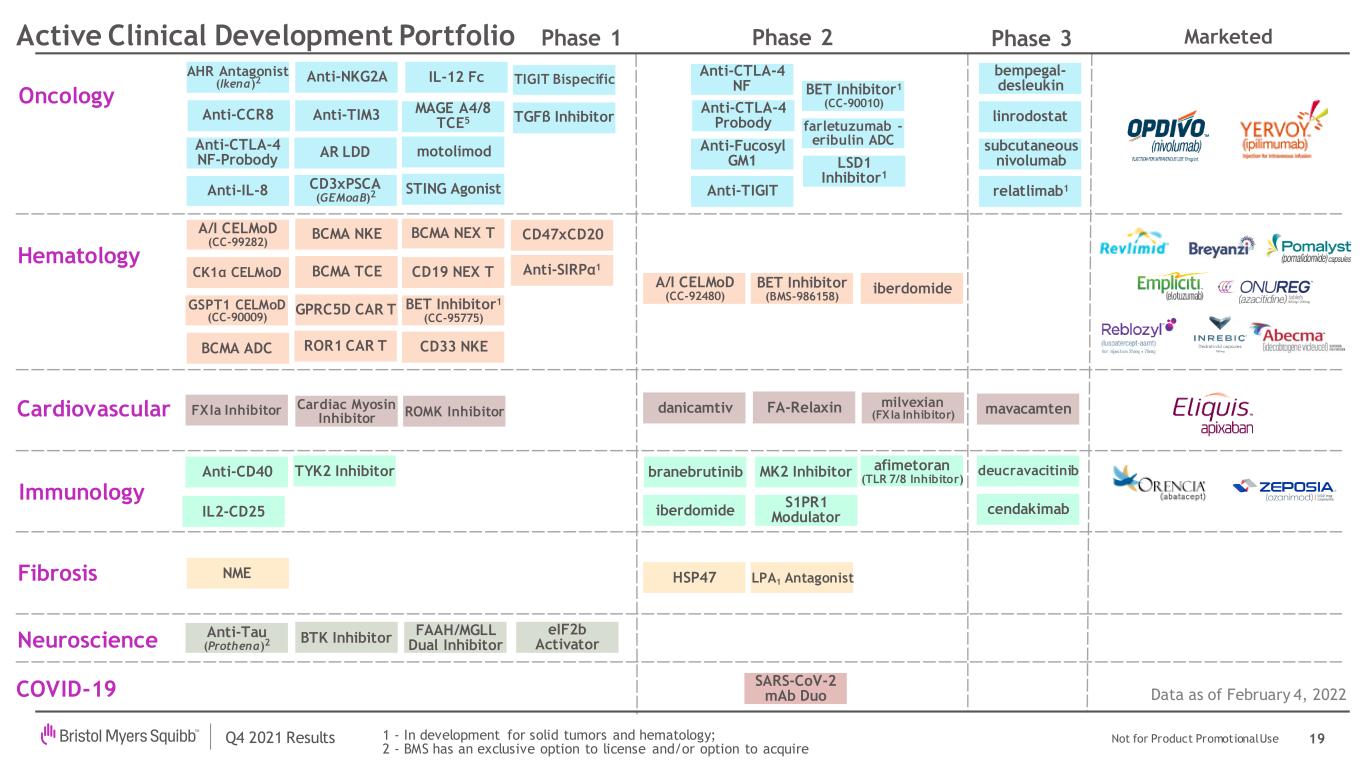

Q4 2021 Results Not for Product Promotional Use Hematology Fibrosis HSP47 LPA1 Antagonist Immunology Oncology Data as of February 4, 2022 Anti-Fucosyl GM1 TIGIT BispecificAnti-NKG2A Anti-SIRPα1 AR LDD Anti-CTLA-4 NF Anti-CCR8 Anti-CTLA-4 Probody BCMA TCE CD3xPSCA (GEMoaB)2 IL-12 Fc Anti-IL-8 Anti-TIGIT BET Inhibitor (BMS-986158) CD19 NEX T BCMA ADC TGFβ Inhibitor LSD1 Inhibitor1 iberdomide iberdomide MK2 InhibitorAnti-CD40 IL2-CD25 cendakimab branebrutinib deucravacitinib Cardiovascular FA-RelaxinFXIa Inhibitor 19 Phase 1 Phase 2 Phase 3 Marketed A/I CELMoD (CC-92480) A/I CELMoD (CC-99282) GSPT1 CELMoD (CC-90009) BET Inhibitor1 (CC-90010) CD33 NKE CD47xCD20 Neuroscience Anti-Tau (Prothena)2 AHR Antagonist (Ikena)2 S1PR1 Modulator afimetoran (TLR 7/8 Inhibitor) BET Inhibitor1 (CC-95775) NME Active Clinical Development Portfolio STING Agonist danicamtiv BCMA NEX T motolimod Cardiac Myosin Inhibitor milvexian (FX Ia Inhibitor) mavacamten TYK2 Inhibitor GPRC5D CAR T COVID-19 SARS-CoV-2 mAb Duo Anti-CTLA-4 NF-Probody CK1α CELMoD ROMK Inhibitor BTK Inhibitor BCMA NKE ROR1 CAR T Anti-TIM3 farletuzumab - eribulin ADC FAAH/MGLL Dual Inhibitor relatlimab1 bempegal- desleukin linrodostat subcutaneous nivolumab eIF2b Activator MAGE A4/8 TCE5 1 - In development for solid tumors and hematology; 2 - BMS has an exclusive option to license and/or option to acquire

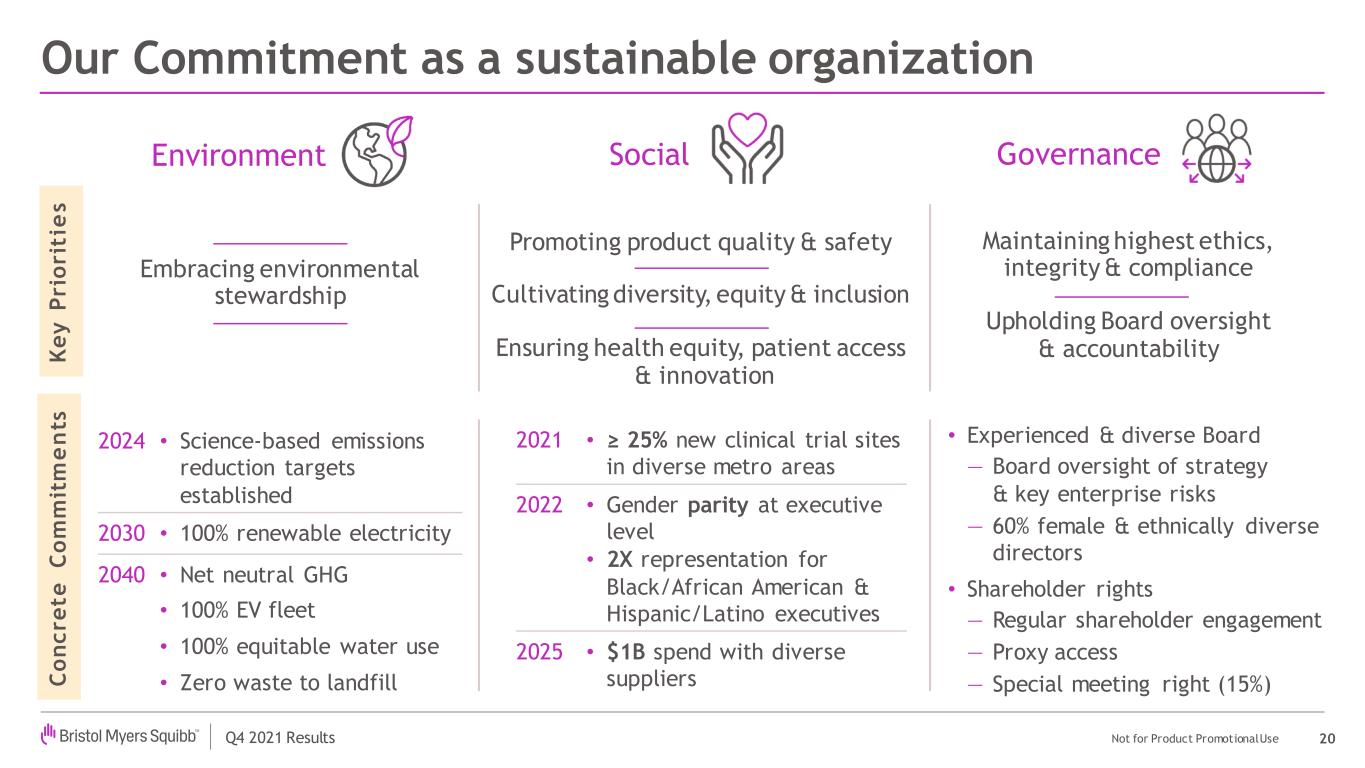

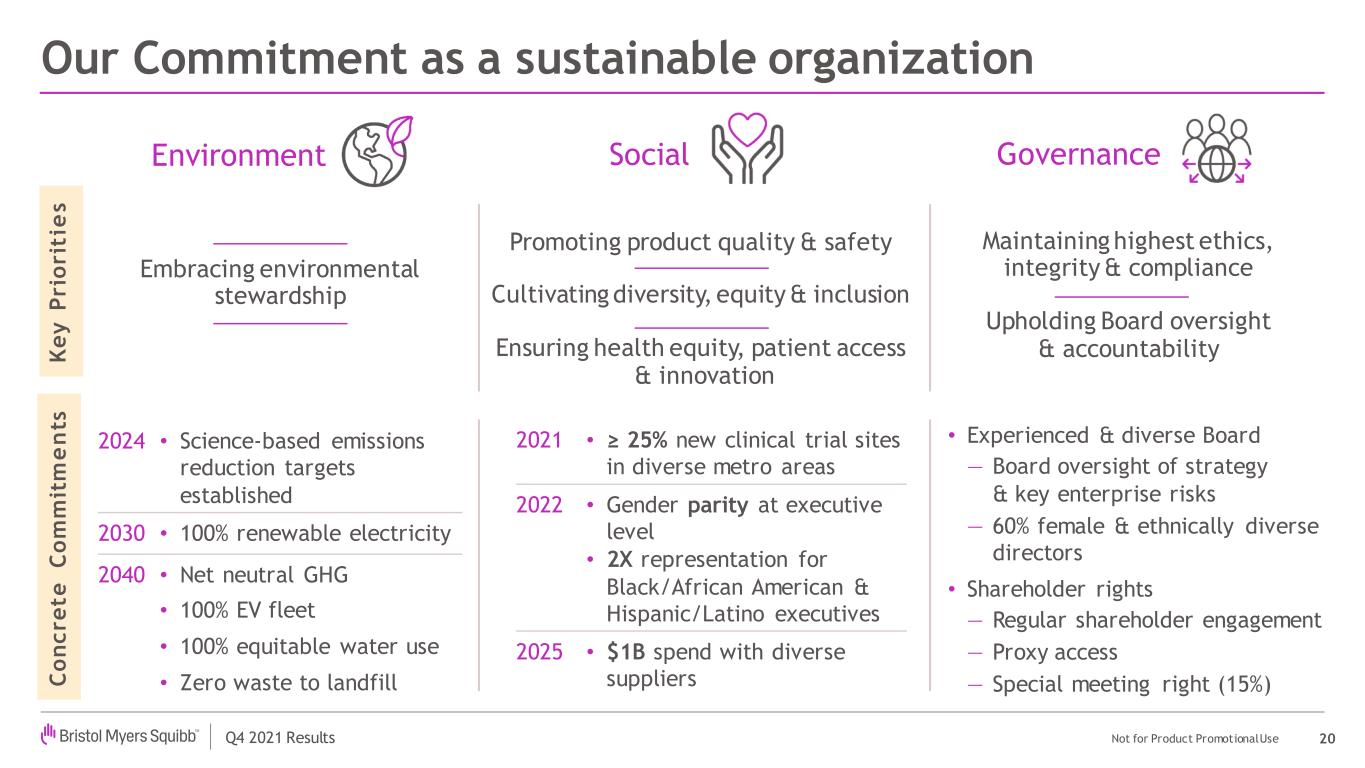

Q4 2021 Results Not for Product Promotional Use Our Commitment as a sustainable organization Embracing environmental stewardship 20 • Experienced & diverse Board ― Board oversight of strategy & key enterprise risks ― 60% female & ethnically diverse directors • Shareholder rights ― Regular shareholder engagement ― Proxy access ― Special meeting right (15%) Environment GovernanceSocial K e y P r io r it ie s C o n c r e t e C o m m it m e n ts 2021 • ≥ 25% new clinical trial sites in diverse metro areas 2022 • Gender parity at executive level • 2X representation for Black/African American & Hispanic/Latino executives 2025 • $1B spend with diverse suppliers 2024 • Science-based emissions reduction targets established 2030 • 100% renewable electricity 2040 • Net neutral GHG • 100% EV fleet • 100% equitable water use • Zero waste to landfill Maintaining highest ethics, integrity & compliance Upholding Board oversight & accountability Promoting product quality & safety Cultivating diversity, equity & inclusion Ensuring health equity, patient access & innovation