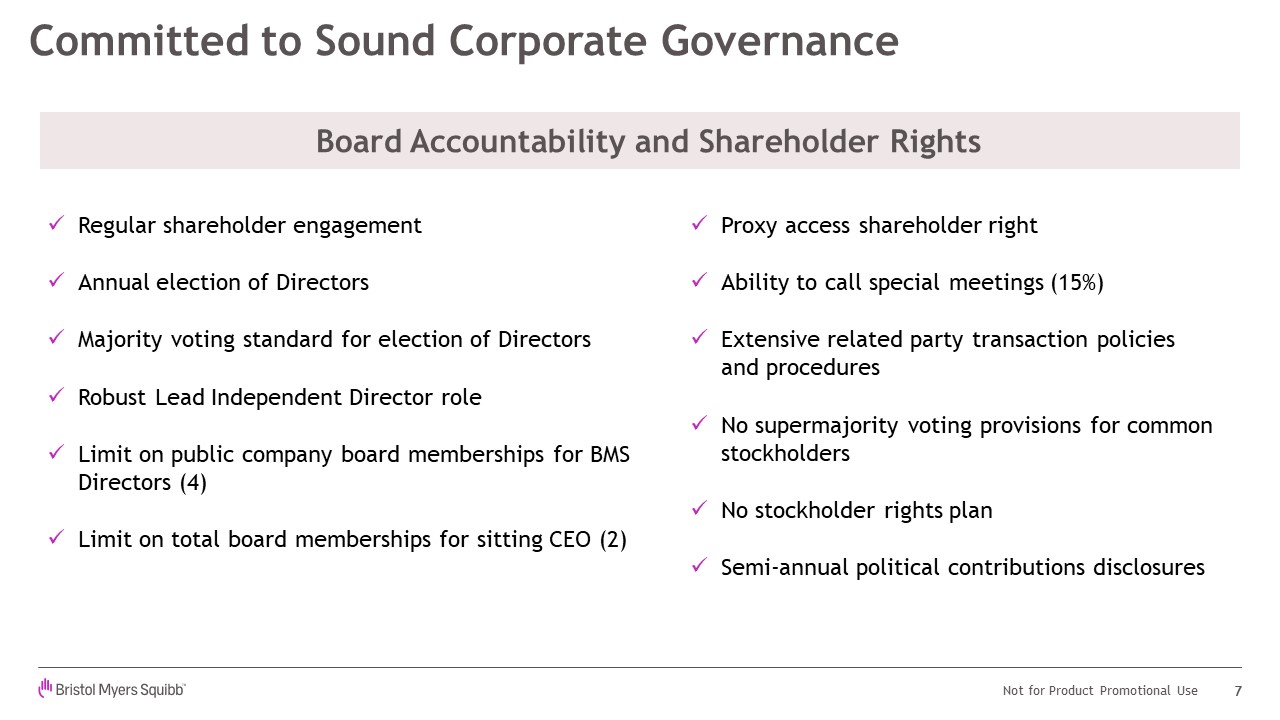

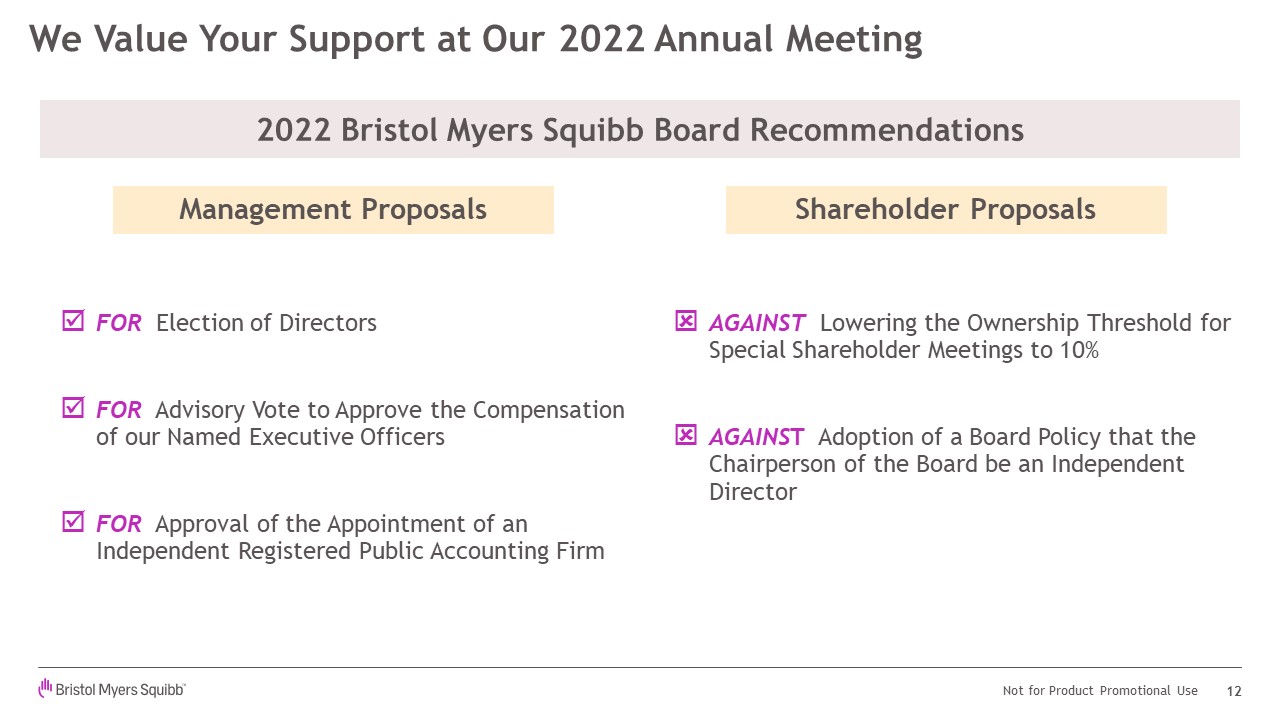

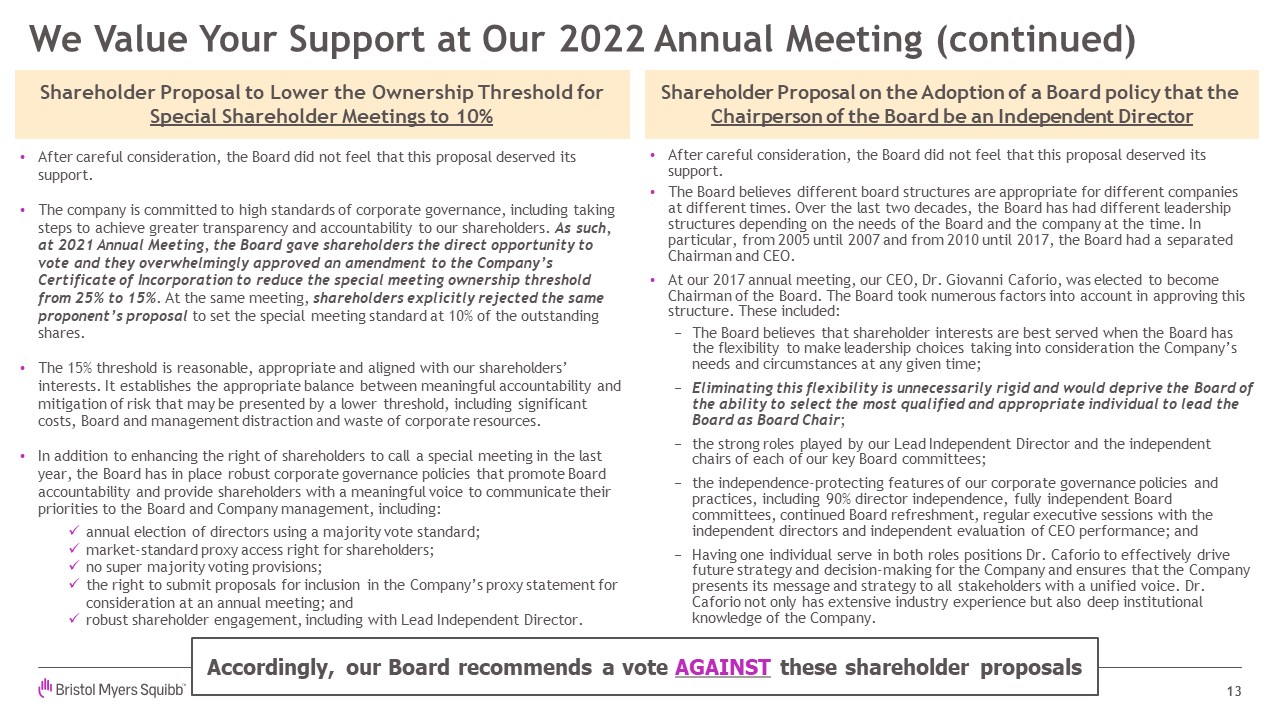

We Value Your Support at Our 2022 Annual Meeting (continued) 13 Shareholder Proposal on the Adoption of a Board policy that the Chairperson of the Board be an Independent Director After careful consideration, the Board did not feel that this proposal deserved its support. The Board believes different board structures are appropriate for different companies at different times. Over the last two decades, the Board has had different leadership structures depending on the needs of the Board and the company at the time. In particular, from 2005 until 2007 and from 2010 until 2017, the Board had a separated Chairman and CEO. At our 2017 annual meeting, our CEO, Dr. Giovanni Caforio, was elected to become Chairman of the Board. The Board took numerous factors into account in approving this structure. These included: The Board believes that shareholder interests are best served when the Board has the flexibility to make leadership choices taking into consideration the Company’s needs and circumstances at any given time; Eliminating this flexibility is unnecessarily rigid and would deprive the Board of the ability to select the most qualified and appropriate individual to lead the Board as Board Chair; the strong roles played by our Lead Independent Director and the independent chairs of each of our key Board committees; the independence-protecting features of our corporate governance policies and practices, including 90% director independence, fully independent Board committees, continued Board refreshment, regular executive sessions with the independent directors and independent evaluation of CEO performance; and Having one individual serve in both roles positions Dr. Caforio to effectively drive future strategy and decision-making for the Company and ensures that the Company presents its message and strategy to all stakeholders with a unified voice. Dr. Caforio not only has extensive industry experience but also deep institutional knowledge of the Company. After careful consideration, the Board did not feel that this proposal deserved its support. The company is committed to high standards of corporate governance, including taking steps to achieve greater transparency and accountability to our shareholders. As such, at 2021 Annual Meeting, the Board gave shareholders the direct opportunity to vote and they overwhelmingly approved an amendment to the Company’s Certificate of Incorporation to reduce the special meeting ownership threshold from 25% to 15%. At the same meeting, shareholders explicitly rejected the same proponent’s proposal to set the special meeting standard at 10% of the outstanding shares. The 15% threshold is reasonable, appropriate and aligned with our shareholders’ interests. It establishes the appropriate balance between meaningful accountability and mitigation of risk that may be presented by a lower threshold, including significant costs, Board and management distraction and waste of corporate resources. In addition to enhancing the right of shareholders to call a special meeting in the last year, the Board has in place robust corporate governance policies that promote Board accountability and provide shareholders with a meaningful voice to communicate their priorities to the Board and Company management, including: annual election of directors using a majority vote standard; market-standard proxy access right for shareholders; no super majority voting provisions; the right to submit proposals for inclusion in the Company’s proxy statement for consideration at an annual meeting; and robust shareholder engagement, including with Lead Independent Director. Shareholder Proposal to Lower the Ownership Threshold for Special Shareholder Meetings to 10% Accordingly, our Board recommends a vote AGAINST these shareholder proposals