Exhibit 22

COUGAR OIL AND GAS CANADA INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 1, 2010

AND

MANAGEMENT INFORMATION CIRCULAR

DATED APRIL 30, 2010

COUGAR OIL AND GAS CANADA INC.

1120, 833 4th Avenue SW

Calgary, Alberta

T2P 3T5

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT an annual meeting (the “Meeting”) of the shareholders of Cougar Oil and Gas Canada Inc. (the “Corporation”) will be held at the offices of Cougar Oil and Gas Canada, Inc., Suite 1120, 833 – 4th Avenue S.W., Calgary, Alberta on June 1st, 2010 at 3:30 p.m. (Calgary time) for the following purposes:

| 1. | to receive and consider the audited financial statements of the Corporation for the last financial year ending July 31, 2009 and the report of the auditors thereon, as filed with the U.S. Securities and Exchange Commission on January 13, 2010. |

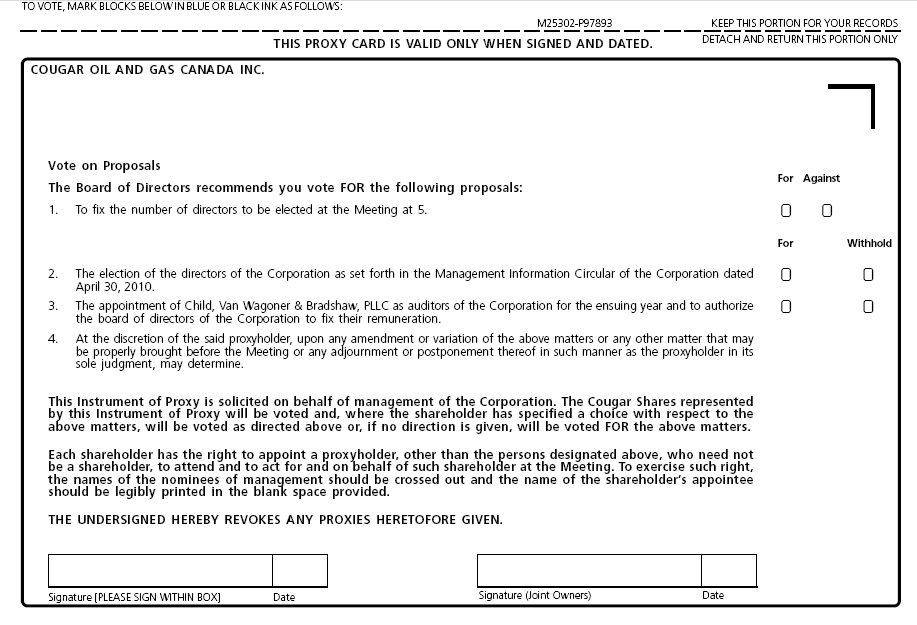

| 2. | to fix the number of directors to be elected at the Meeting at 5; |

| 3. | to elect the directors of the Corporation for the ensuing year; |

| 4. | to appoint Child, Van Wagoner & Bradshaw, PLLC as the auditors of the Corporation for the ensuing year and to authorize the board of directors to fix their remuneration; and |

| 5. | to transact such other business as may properly come before the Meeting or any adjournment or adjournments thereof. |

The details of all matters proposed to be put before shareholders at the Meeting are set forth in the Management Information Circular accompanying this Notice of Meeting. At the Meeting, shareholders will be asked to approve each of the foregoing items.

Only shareholders of record as of the close of business on April 29th, 2010, are entitled to receive notice of the Meeting.

DATED at Calgary, Alberta, this 30th day of April 2010.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| | “Lee Lischka” |

| | President Secretary-Treasurer |

IMPORTANT

It is desirable that as many common shares as possible be represented at the Meeting. If you do not expect to attend and would like your common shares represented, please complete the enclosed form of proxy and return it as soon as possible in the envelope provided for that purpose. In accordance with the by-laws of the Corporation, all proxies, to be valid, must be deposited with one of the offices below, or voted electronically, or by telephone as indicated, no later than 3:30 p.m. (Calgary time) on May 28th, 2010 or on the second last business day preceding any adjournment of the Meeting.

Cougar Oil and Gas Canada Inc. Mail: Suite 1120, 833 – 4 Avenue S.W. Calgary, AB T2P 3T5 Fax: (403) 513-2670 | OR | Broadridge Mail: Vote Processing, c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 Phone: 1-800-690-6903 Internet: www.proxyvote.com |

Web address for shareholders to access the proxy statement, Form 20F and to vote by internet: www.proxyvote.com |

COUGAR OIL AND GAS CANADA INC.

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 1ST, 2010

MANAGEMENT INFORMATION CIRCULAR

This Management Information Circular is furnished in connection with the solicitation of proxies by the management of Cougar Oil and Gas Canada Inc. (“Cougar” or the “Corporation”) for use at the annual meeting of the holders of common shares (the “Common Shares”) of the Corporation to be held on the 1st day of June 2010 at 3:30 p.m. (Calgary time), or at any adjournment thereof (the “Meeting”), for the purposes set forth in the Notice of Meeting. The information contained herein is given as of the 1st day of June 2010, except where otherwise indicated. There is enclosed herewith a form of proxy for use at the Meeting, together with a copy of the financial statements of the Corporation to be presented at the Meeting. Each shareholder who is entitled to attend at meetings of shareholders is encouraged to participate in the Meeting and shareholders are urged to vote in person or by proxy on matters to be considered.

APPOINTMENT AND REVOCATION OF PROXIES

Those shareholders desiring to be represented by proxy must deposit their respective forms of proxy with one of the offices below, or voted electronically, or by telephone as indicated below:

Cougar Oil and Gas Canada Inc. Mail: Suite 1120, 833 – 4 Avenue S.W. Calgary, AB T2P 3T5 Fax: 403) 513-2670 | OR | Broadridge Mail: Vote Processing, c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 Phone: 1-800-690-6903 Internet: www.proxyvote.com |

by no later than 3:30 p.m. (Calgary time) on May 28th, 2010 or on the second last business day preceding any adjournment of the Meeting. A proxy must be executed by the shareholder or by his or her attorney authorized in writing, or if the shareholder is a corporation, under its seal or by an officer or attorney thereof duly authorized. A proxy is valid only at the Meeting in respect of which it is given or any adjournment of the Meeting.

Each shareholder submitting a proxy has the right to appoint a person to represent him, her or it at the Meeting other than the persons designated in the form of proxy furnished by the Corporation. The shareholder may exercise this right by striking out the names of the persons so designated and inserting the name of the desired representative in the blank space provided, or by completing another form of proxy and in either case depositing the proxy with Cougar Oil and Gas Canada Inc. or Broadridge at the place and within the time specified above for the deposit of proxies.

A proxy may be revoked by the person giving it at any time prior to the exercise thereof. If a person who has given a proxy attends personally at the Meeting at which such proxy is to be voted, such person may revoke the proxy and vote in person. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing executed by the shareholder or his or her attorney authorized in writing, or if the shareholder is a corporation, under its seal or by an officer or attorney thereof duly authorized, and deposited with Cougar Oil and Gas Canada Inc. or Broadridge at the place and within the time specified above for the deposit of proxies. Only shareholders of record as of the close of business on April 29th, 2010 are entitled to notice of, and to attend and vote at, the Meeting.

ADVICE TO BENEFICIAL HOLDERS OF SHARES

Shareholders who do not hold their Common Shares in their own name (referred to herein as “beneficial shareholders”) are advised that only proxies from shareholders of record can be recognized and voted upon at the Meeting. If Common Shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those Common Shares will not be registered in the shareholder’s name on the records of the Corporation. Such Common Shares will more likely be registered under the name of the shareholder’s broker or an agent of that broker. Common Shares held by brokers or their nominees can only be voted (for or against resolutions) upon the instructions of the beneficial shareholder. Without specific instructions, brokers/nominees are prohibited from voting Common Shares for their clients. The directors and officers of the Corporation do not necessarily know for whose benefit the Common Shares registered in the name of any broker or agent are held. Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from beneficial shareholders in advance of shareholders’ meetings. Every intermediary (broker) has its own mailing procedure, and provides its own return instructions, which should be carefully followed.

All references to shareholders in this Management Information Circular and the accompanying form of proxy and Notice of Meeting are to shareholders of record, unless specifically stated otherwise.

EXERCISE OF DISCRETION

The Common Shares represented by the enclosed form of proxy will be voted or withheld from voting in accordance with the instructions of the shareholder where voting is by way of a show of hands or by ballot. The persons appointed under the enclosed form of proxy are conferred with discretionary authority with respect to amendments or variations of those matters specified in the proxy and Notice of Meeting and with respect to any other matters which may properly be brought before the Meeting or any adjournment thereof. If any such matters should come before the Meeting, it is the intention of the persons named in the enclosed form of proxy to vote such proxy in accordance with their best judgment unless the shareholder has specified to the contrary or that Common Shares are to be withheld from voting. At the time of printing this Management Information Circular, the management of the Corporation is not aware of any such amendment, variation, or other matter.

Unless otherwise specified, proxies in the accompanying form will be voted for the resolutions referred to in items 1, 2, 3 and 4 of the proxy.

PERSONS MAKING THE SOLICITATION

This solicitation is made on behalf of the management of the Corporation. The cost incurred in the preparation and mailing of both the proxy and this Management Information Circular will be borne by the Corporation. In addition to the use of mail, proxies may be solicited by personal interviews, personal delivery, telephone or any form of electronic communication or by directors, officers and employees of the Corporation who will not be directly compensated therefor.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

As at April 29th, 2010, Cougar had 61,270,768 issued and outstanding Common Shares. Each Common Share confers upon the holder thereof the right to one vote. Only those shareholders of record as of the close of business on April 29th, 2010 are entitled to receive notice of and vote at the Meeting.

The quorum for the transaction of business at the Meeting consists of at least two persons holding or representing by proxy not less than twenty-five (25%) percent of the Common Shares.

To the knowledge of the directors and executive officers of the Corporation, as of the date hereof no person or company beneficially owns, controls or directs, directly or indirectly, more than 10% of the voting rights attached to all of the issued and outstanding Common Shares of the Corporation other than as set forth below.

| Name and Province and Country of Residence | Type of Ownership | Number of Common Shares | Percentage of Outstanding Common Shares |

Kodiak Energy, Inc. Alberta, Canada | Registered and Beneficial | 38,076,972 | 62.15% |

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

For the year ended July 31, 2009, no compensation was paid to any of the directors and officers of the Corporation. In addition, no compensation has been paid to any directors or officers of the Corporation since the year ended July 31, 2009 to January 24, 2010.

Since January 25, 2010, compensation for the directors and executive officers of the Corporation has been determined as follows. The board of directors of the Corporation (the “Board”) determines the compensation to be provided to the executive officers and directors of the Corporation and, in doing so, receives input from the President and the Chief Executive Officer of the Corporation (the “CEO”) in respect of all executive officers other than the CEO. Compensation of all executive officers, including the CEO, is based on the underlying philosophy that such compensation should be competitive with other corporations of similar size and should be reflective of the experience, performance and contribution of the individuals involved and the overall performance of the Corporation.

The Corporation’s executive compensation program is available to the Named Executive Officers of the Corporation which is defined by the securities legislation to mean each of the following individuals, namely: (i) the Chief Executive Officer of the Corporation; (ii) the Chief Financial Officer of the Corporation; (iii) each of the Corporation’s three most highly compensated executive officers, or the three most highly compensated individuals acting in a similar capacity, other than the Chief Executive Officer and Chief Financial Officer, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for the most recently completed financial year; and (iv) each individual who would be a “Named Executive Officer” under (iii) above but for the fact that the individual was neither an executive officer of the Corporation, nor acting in a similar capacity, at the end of the most recently completed financial year-end (the “Named Executive Officers”). For purposes of this Management Information Circular, the executive officer of the Corporation listed in the table under the heading “Summary Compensation Table” is the Corporation’s only Named Executive Officer.

The objectives of the Corporation’s executive compensation program are twofold, namely: (i) to enable the Corporation to attract and retain highly qualified and experienced individuals to serve as Named Executive Officers; and (ii) to align the compensation levels available to the Named Executive Officers to the successful implementation of the Corporation’s strategic plans. The Corporation’s executive compensation program is designed to reward the Named Executive Officers where they have contributed to the prosperity and growth of the Corporation.

The Corporation’s executive compensation program consists of a combination of the following significant elements, namely: base salary, the payment of bonuses, where appropriate, and participation in the Stock Option Plan (as hereinafter defined). These elements contain both short-term incentives, comprised of cash payments, being those provided by way of base salaries and bonuses, as well as long-term incentives, comprised of equity-based incentives, being those provided under the Stock Option Plan. Extended health care, dental and insurance benefits is provided to all employees, including the Named Executive Officers. The process for determining perquisites and approval of benefits for the Named Executive Officers is, firstly, to implement perquisites and benefits which are comparable to those usually offered by other corporations of a similar size to the Corporation and secondly, to make those perquisites and benefits available to each Named Executive Officer, equally. The Corporation chooses to pay each element of its executive compensation program in order to maintain its competitive position in the marketplace. The amount for each element of the Corporation’s executive compensation program is determined based upon compensation levels provided by the Corporation’s competitors as well as upon the discretion of the Board, where applicable, as described below. Each element of the Corporation’s executive compensation program is intended to contribute to an overall total compensation package which is designed to provide both short-term and long-term financial incentives to the Named Executive Officers and to thereby assist the Corporation to successfully implement its strategic plans. The Board annually assesses how each element fits into the overall total compensation package.

Base Salaries

Base salaries for the Named Executive Officers are reviewed annually and are set to be competitive with industry levels. In addition, in its annual review of base salaries, the Board has regard to the contributions made by the Named Executive Officers, how their compensation levels relate to compensation packages that would be available to such officers from other employment opportunities and commercially available salary survey data and information publicly disclosed by some of the Corporation’s competitors and peers. This enables the Corporation to establish base salaries which attract and retain highly qualified and experienced individuals. Other than as set out immediately above, the base salaries of the Named Executive Officers are not determined based on benchmarks, performance goals or a specific formula.

Bonus

The Corporation has not adopted a formal bonus plan. The Board exercises its discretion regarding the payment of bonuses based upon employee merit and the payment thereof, if any, is determined by the Board. The Board may also consider any extraordinary efforts that were made in enhancing the value of the Corporation’s asset base and any extraordinary success that has been achieved in implementing the Corporation’s business plans, including significant production and reserve additions. Other than the foregoing, recommendations with respect to the payment of bonuses are based on overall contribution and effort and are not based on a formula or previously prescribed guidelines.

Stock Option Plan

The Corporation created a stock option plan (the “Stock Option Plan”) on January 25, 2010 for officers, directors, employees and consultants of the Corporation, which permits the granting of options to purchase up to a maximum of 10% of the outstanding Common Shares. The number of options and the exercise price thereof is set by the Board at the time of grant. The number of Common Shares subject to an option to any one participant shall be determined by the Board. The options granted under the Stock Option Plan shall be exercisable as to 3 year vesting, 33.33% (1/3) on each of the first, second and third anniversary dates of the date of grant unless otherwise determined by the Board. Stock options granted under the Stock Option Plan will be for a term of no longer than 3 years from the date of grant.

As of the date hereof (i) the Corporation has issued under the Stock Option Plan stock options pursuant to which zero Common Shares are issuable which represents 0% of the currently outstanding Common Shares; and (ii) there remains for issuance under the Stock Option Plan stock options pursuant to which 6,127,077 Common Shares may be issued which represent 10% of the currently outstanding Common Shares.

Option-Based Awards

The process that the Corporation uses to grant option-based awards to executive officers, including the Named Executive Officers, and the factors that are taken into account when considering new grants under the Stock Option Plan, are based upon a number of criteria, including the performance of the executive officers, the number of stock options available for grant under the Stock Option Plan, the number of stock options anticipated to be required to meet the future needs of the Corporation, as well as the number of stock options previously granted to each of the Named Executive Officers. The Board determines the need for any amendments to the Stock Option Plan and the number of stock option grants to be made under the Stock Option Plan. The CEO frequently provides input and recommendations to the Board regarding the granting of stock options, from time to time. The CEO, in turn, and where appropriate, also obtains input from other executive officers of the Corporation when providing his input and recommendations. Other than as set out immediately above, the grant of option-based awards is not determined based on benchmarks, performance goals or a specific formula.

Summary Compensation Table

Securities legislation requires the disclosure of the compensation received by each Named Executive Officer of the Corporation for the most recently completed financial year. The following table sets forth, for the Named Executive Officer, for the year ended July 31, 2009, a summary of total compensation:

| Name and principal position | Year | Salary ($) | Share-based awards | Option-based awards ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compens-ation ($) | Total compensation ($) |

| Annual incentive plans | Long-term incentive plans |

| Jonathon Adelman President and Secretary-Treasurer | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil | Nil |

Note:

| (1) | Jonathon Adelman was appointed Director, President and Secretary-Treasurer of the Corporation on April 8, 2008 and resigned on August 25, 2009. No compensation was paid to Mr. Adelman for the year ended July 31, 2009. |

Incentive Plan Awards

Outstanding Share-Based Awards and Option–Based Awards

The Corporation did not have an option plan and no options nor any share-based awards have been granted by the Corporation as at July 31, 2009. No compensation was paid to Mr. Adelman for the year ended July 31, 2009.

Pension Plan Benefits

The Corporation does not have a pension plan or any other plan that provides for payments or benefits at, following or in connection with retirement. The Corporation does not have a deferred compensation plan.

Termination and Change of Control Benefits

The Corporation does not have any contract, agreement, plan or arrangement that provides for payments to the Named Executive Officers at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, a change in control of the Corporation or a change in the Named Executive Officers’ responsibilities.

Director Compensation

Summary Compensation

The following table sets forth information in respect of all amounts of compensation provided to the directors of the Corporation for the last financial period ended July 31, 2009.

| Name | Fees earned ($) | Option- based awards ($) | Total ($) |

Faye Deluna(2) | Nil | Nil | Nil |

Notes:

| (1) | Compensation information for Jonathon Adelman, President and Secretary-Treasurer has been previously provided herein under the section entitled “Summary Compensation Table”. No compensation was paid to any director of the Corporation for the year ended July 31, 2009. |

| (2) | Faye Deluna was appointed as a director on April 8, 2008 and resigned on August 25, 2009. |

Outstanding Share-Based Awards and Option-Based Awards

The Corporation did not have an option plan and no options nor any share-based awards have been granted by the Corporation as at July 31, 2009.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

No director, proposed nominee for election as a director of the Corporation, executive officer, employee or former executive officer, director or employee of the Corporation, or any associate of any such director, officer or employee is, or has been at any time since the last financial period ended July 31, 2009, indebted to the Corporation, nor, at any time since the last financial period ended July 31, 2009, has, any indebtedness of any such person been the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation.

DISCLOSURE OF CORPORATE GOVERNANCE PRACTICES

Notwithstanding that the Corporation is not a reporting issuer, and is therefore not subject to the requirements of National Instrument 58-101 Disclosure of Corporate Governance Practices, or to the requirements of National Policy 58-201 Corporate Governance Guidelines, this Management Information Circular sets out the following disclosure with respect to the Corporation’s corporate governance practices.

The Board of Directors of the Corporation, which has the statutory responsibility to oversee the conduct of the business of the Corporation and to supervise management, who are responsible for the daily conduct of the business of the Corporation, is comprised of five directors, of which three are independent and accordingly a majority of the directors are independent. A director is independent if he or she would be independent within the meaning of section 1.4 of National Instrument 52-110 Audit Committees. The independent directors are William Brimacombe and Bruce Dowell. Neither the Chief Executive Officer of the Corporation, William (Bill) Tighe, nor the President and Secretary-Treasurer, Lee Lischka, nor the Chief Operating Officer, Glenn Watt, is independent by virtue of being executive officers of the Corporation. Since the last financial period ended July 31, 2009 the independent directors of the Corporation did not hold any regularly scheduled meetings at which non-independent directors and members of management were not in attendance In order to provide leadership for the independent directors, the Board encourages communication among the independent directors. All directors attended the last meeting held by the Board on March 15, 2010. Lee Lischka and Bruce Dowell as directors attended all meetings held by the Board since the last financial year ended July 31, 2009. As William Tighe was not appointed until January 25, 2010, he attended one board meeting since the beginning of the Corporation’s most recently completed financial year. As William Brimacombe and Glenn Watt were not appointed until March 15, 2010, they have not attended any board meetings held since the beginning of the Corporation’s most recently completed financial year.

The following directors are presently directors of other issuers that are reporting issuers (or the equivalent):

| Name of Director | | Names of Other Issuers |

| | | |

| William (Bill) Tighe | | Kodiak Energy, Inc. TAMM Oil and Gas Corp. |

| | | |

| Glenn Watt | | Kodiak Energy, Inc. |

| | | |

| William Brimacombe | | Kodiak Energy, Inc. |

| 2. | Orientation and Continuing Education |

The Corporation has not developed an orientation program for new directors. In order to provide continuing education to directors, the Board has instructed the CEO of the Corporation to supply the directors with updates from time to time, with respect to new legal and regulatory developments which may be of interest to the Board.

| 3. | Ethical Business Conduct |

The Board has not adopted a written code for the directors, officers and employees of the Corporation. The Board relies on the requirements of the Business Corporations Act (Alberta) to ensure that the Board exercises independent judgment in considering transactions and agreements in respect of which a director has a material interest, and therefore expects that a director in those circumstances will comply with applicable law and disclose his interest and refrain from participating in discussions or voting on the matter.

| 4. | Nomination of Directors |

Responsibility for indentifying new candidates to join the Board belongs to the Board as a whole. The Board encourages all directors to participate in considering the need for and identifying and recruiting new candidates for the Board.

The Board as a whole determines the compensation for the director and executive officers of the Corporation. The CEO provides recommendations for the compensation in respect of all executive officers of the Corporation other than the CEO.

The Corporation does not have any other Board committees.

The Board has not taken any formal steps to satisfy itself that the Board and its individual directors are performing effectively. The foregoing matters are considered, from time to time, as required, by the Chairman of the Board and by the directors.

AUDIT COMMITTEE

The Corporation is not a Canadian reporting issuer and does not have an Audit Committee.

External Auditor Service Fees (By Category)

The aggregate fees billed by the Corporation’s external auditors in each of the last two fiscal years are as follows:

Financial Period Ended July 31(1) | Audit Fees(1) | Audit Related Fees | Tax Fees(2) | All Other Fees |

| 2009 | $6,000 USD | $Nil | $Nil | $Nil |

| 2008 | $6,000 USD | $Nil | $Nil | $Nil |

Notes:

| (1) | The aggregate audit fees billed. |

| (2) | The aggregate fees billed for professional services rendered for tax compliance, tax advice and tax planning. |

INTEREST OF CERTAIN PERSONS IN

MATTERS TO BE ACTED UPON

No director or executive officer of the Corporation, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any one of them, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted on at the Meeting except as described in this Management Information Circular under the heading “Election of Directors”.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other than set forth in this Management Information Circular, the management of the Corporation is not aware of any material interest, direct or indirect, of any informed person of the Corporation, any proposed director of the Corporation, or any associate or affiliate of any informed person or proposed director, in any transaction since the last financial period ended July 31, 2009, or in any proposed transaction which has materially affected or would materially affect the Corporation.

MATTERS TO BE ACTED UPON AT MEETING

| 1. | Financial Statements and Auditors’ Report |

At the Meeting, shareholders will receive and consider the financial statements of the Corporation for the last financial period ended July 31st, 2009 and the auditors’ report thereon, as filed with the U.S. Securities and Exchange Commission on January 13, 2010, but no vote by the shareholders with respect thereto is required or proposed to be taken.

| 2. | Fixing Number of Directors and Election of Directors |

The Corporation is required to have a minimum of one and a maximum of seven directors. The Board presently consists of five directors, each of whose term expires at the Meeting. At the Meeting, shareholders will be asked to fix the number of directors to be elected at the Meeting at five and to elect the nominees named below to serve as directors until the next annual meeting or until their successors are duly elected or appointed. All proposed nominees have consented to be named in this Information Circular and to serve as directors, if elected.

The following table sets forth the name of each of the persons proposed to be nominated for election as a director, their province and country of residence, their principal occupation, the period served as a director and the number of voting Common Shares that each proposed nominee beneficially owns, or exercises control or direction over, directly or indirectly, as of the close of business on April 29th, 2010. The information as to Common Shares owned beneficially, not being within the knowledge of the Corporation, has been provided by each nominee.

Name and Province and Country of Residence | Number of Common Shares Beneficially Owned, Controlled or Directed, Directly or Indirectly | Director Since | Principal Occupation and Positions Held During the Last Five Years |

Lee Lischka Alberta, Canada | Nil | August 2009 | President and Secretary-Treasurer of the Corporation. Currently, he is Sales Manager and Managing Partner of XL Fluid Systems and, prior thereto, Drilling Fluids Technician, Programmer and Technical Sales of Newpark Drilling Fluids from 2000 to 2008. |

William (Bill) S. Tighe Alberta, Canada | 81,207 | January 2010 | Chief Executive Officer of the Corporation since March 2010. Chief Operating Officer and President of Kodiak Energy, Inc. since September 2004, and Chief Executive Officer of Kodiak Energy Inc. since December 2007. Chief Executive Officer of Cougar Energy, Inc. since November 2008. |

Glenn Watt Alberta, Canada | 360,000 | March 2010 | Chief Operating Officer of the Corporation since March 2010. President of Cougar Energy, Inc. since November 2008. Vice President, Operations of Kodiak Energy Inc. since April 2007. Drilling and completions superintendent for large Canadian oil and gas royalty trust from May 2003 to March 2007. |

Bruce Dowell Alberta, Canada | 4,500 | August 2009 | Power field engineer with TAQA North (formerly Amoco Canada) since 1978. |

William Brimacombe Alberta, Canada | 36,000 | March 2010 | Retired and currently a director of the Corporation since March 2010 and Kodiak Energy, Inc. since January 2010. From January 2007 to December 2009, Chief Financial Officer of Kodiak Energy, Inc. From November 2008 to December 2009, Chief Financial Officer of Cougar Energy, Inc. Prior thereto, Vice President Finance from 2000 to 2006 for AltaCanada Energy Corp.. |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

None of those persons who are proposed directors of the Corporation is, or has been within the past 10 years, a director, chief executive officer or chief financial officer of any company, including the Corporation, that while such person was acting in that capacity, was the subject of a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, or after such persons ceased to be a director, chief executive officer or chief financial officer of the company, was the subject of a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, which resulted from an event that occurred while acting in such capacity. In addition, none of those persons who are proposed directors of the Corporation is, or has been within the past 10 years, a director or executive officer of any company, including the Corporation, that, while such person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. None of the persons who are proposed directors of the Corporation have, within the past 10 years, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold his assets. None of those persons who are proposed directors of the Corporation have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director.

| 3. | Appointment of Auditors |

The persons named in the enclosed form of proxy intend to have nominated and to vote for the reappointment of Child, Van Wagoner & Bradshaw, PLLC of Salt Lake City, Utah USA as auditors of the Corporation to hold such office until the next annual meeting of the Corporation and to authorize the Board to fix the remuneration to be paid to the auditors.

ADDITIONAL INFORMATION

Financial information relating to the Corporation is provided in the Corporation’s financial statements for the last financial period ended July 31, 2009. Shareholders may contact the Corporation to request copies of the financial statements by mail to Suite 1120, 833 – 4th Avenue S.W., Calgary, Alberta, Canada T2P 3T5.