- CSAN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Cosan (CSAN) 6-KCurrent report (foreign)

Filed: 3 Jun 21, 2:01pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Issuer

Pursuant To Rule 13a-16 Or 15d-16 of the

Securities Exchange Act of 1934

For the month of June 2021

Commission File Number: 333-251238

|

COSAN S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

|

Av. Brigadeiro Faria Lima, 4100, – 16th floor

São Paulo, SP 04538-132 Brazil

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

COSAN S.A. |

Corporate Taxpayer ID (CNPJ): 50.746.577/0001-15 |

Company Registry (NIRE): 35.300.177.045 |

Publicly Held Company |

MATERIAL FACT

Investment Agreement at Compass

COSAN S.A. (B3: CSAN3; NYSE: CSAN) (“Cosan” or “Company”), in compliance with Instruction 358/02 issued by the Securities and Exchange Commission of Brazil (CVM), announces to the market in general that it signed, on this date, an Investment Agreement with Atmos Illiquids 1 Equity Investment Fund, Atmos Master Equity Investment Fund, Manzat Inversiones Auu S.A. and Ricardo Ernesto Correa da Silva (together “Investors”), through which the Investors commit to invest R$ 810 million through a capital increase at Compass Gás e Energia S.A. (“Compass”) - subsidiary of the Company, which operates in the Gas&Power segment, through the Issuance of new preferred shares representing 4.68% of Compass's equity (“Transaction”). The Transaction was based on a pre-money Equity Value of R$ 16.5 billion for Compass.

In addition, a Shareholders' Agreement between Compass, the Company and the Investors was signed today, with effectiveness contingent upon the conclusion of the Transaction.

The Transaction is subject to usual conditions precedent, including the listing of Compass as an issuer in B3 S.A. - Brasil, Bolsa, Balcão, and the admission to trading of preferred shares, to be issued exclusively for this Transaction.

São Paulo, May 31, 2021

Marcelo Eduardo Martins

Chief Financial and Investor Relations Officer

COSAN S.A.

Corporate Taxpayer ID (CNPJ): 50.746.577/0001-15

Company Registry (NIRE): 35.300.177.045

Publicly Held Company

MATERIAL FACT

Discontinuance of guidance by Raízen

COSAN S.A. (B3: CSAN3; NYSE: CSAN) (“Cosan” or “Company”), in compliance with Instruction 358/02 issued by the Securities and Exchange Commission of Brazil (CVM), announces to its shareholders and to the market in general that its jointly owned subsidiaries, Raízen Combustíveis S.A. and Raízen Energia S.A. (collectively, “Raízen”), released on this date a Material Fact, as fully presented below:

“Raízen Combustíveis S.A. (“RCSA”) and Raízen Energia S.A. (“RESA”), hereby informs its shareholders and the general public that:

The management of RCSA and RESA has decided to discontinue their disclosure about projections (guidance), in view of the need of aligning their guidance disclosure policies and the procedures adapted by their independent auditors and other advisors in the context of a potential public offering of RCSA’s shares. Any considerations with respect to estimates and statements about plans, expectations on future events, strategies and financial trends that impact the businesses of the RCSA and RESA, including any previously disclosed projections, which are subject to risks and uncertainties (and therefore, shall not represent any assurance in respect of the future), shall not be taken into account by investors for purposes of supporting their investment decisions.

In addition, RCSA has the intention of filling within the next days before the CVM a request for registration of a public offering of preferred shares with the listing in the “Nível 2” segment of B3 S.A. – Brasil, Bolsa, Balcão, to be carried out in Brazil, in unorganized over the counter market, pursuant to Instruction CVM 400 and other applicable regulations, with the underwriting of financial institutions that are part of the securities distribution system, including placement efforts abroad. The Board of Directors of RCSA will at an appropriate time resolve on: (a) the number of shares to be sold under the Offering; e (b) the price per share, as may be determined in the Offering pricing date, following the outcome of bookbuilding procedures in Brazil and abroad as per article 44 of CVM Instruction 400. The potential offering will be subject to registration with the CVM and market conditions. RCSA and RESA will keep the market updated on any developments related to the foregoing matters.

This material fact statement has an exclusively informational purpose, pursuant to Instruction No. 358 issued by the Securities and Exchange Commission (Comissão de Valores Mobiliários or “CVM”) of January 3, 2002, as amended, to Instruction CVM No. 400, of December 29, 2003, as amended (“CVM Instruction 400”), and, further, for the purposes of paragraph 4th of article 157 of Law No. 6,404, of December 15, 1976, as amended, and shall not be deemed as an announcement for any offering of shares. There shall be no registration of the offer or the shares with any other agency or capital markets regulator of any other jurisdiction other than CVM in Brazil.”

It is worth mentioning that there were no changes in the other estimates disclosed by Cosan through the Material Fact released on May 14, 2021. Thus, the financial and operating projections disclosed for its subsidiaries for the year 2021 remain valid, which are detailed below:

|

| Guidance 2021 |

|

| (Jan-Dec) |

Compass | EBITDA (BRL Mln) | 2,500 ≤ ∆ ≤ 2,800 |

| Investments (BRL Mln) | 1,500 ≤ ∆ ≤ 1,700 |

| EBITDA (BRL Mln) | 400 ≤ ∆ ≤ 480 |

| EBITDA (BRL Mln) | 4,000 ≤ ∆ ≤ 4,400 |

Investments (BRL Mln) | 3,300 ≤ ∆ ≤ 3,900 |

Main Assumptions:

| (i) | EBITDA considers the adjustments highlighted in the Company’s earnings releases each quarter, that is, reflecting the recurring results of operations, excluding any one-off effects. |

| (ii) | Investments from subsidiaries and co-controlled companies includes assets arising from contracts with clients and excludes acquisitions. |

| (iii) | The macroeconomic assumptions are based on data from specialized outsourced consultants. |

The information provided in this document is only an estimate about the businesses and projections of operating and financial results and, as such, is based primarily on management’s beliefs and assumptions. Such estimates are subject to diverse risk factors and uncertainties, and are based on information currently available, substantially depending on market conditions, performance of the Brazilian economy, the industries operated by the Company and its subsidiaries and international markets and, hence, are subject to change. In view of these uncertainties, investors should not take any investment decision based on these estimates and forward-looking statements, as they are not guarantee of performance. Any change in the perception or in the aforementioned factors can cause actual results to differ from the projections made and disclosed.

São Paulo, May 31, 2021

Marcelo Eduardo Martins

Chief Financial and Investor Relations Office

COSAN S.A.

Corporate Taxpayer ID (CNPJ): 50.746.577/0001-15

Company Registry (NIRE): 35.300.177.045

Publicly Held Company

MATERIAL FACT

Corporate restructuring of Raízen

COSAN S.A. (B3: CSAN3; NYSE: CSAN) (“Cosan” or “Company”), in compliance with Instruction 358/02 issued by the Securities and Exchange Commission of Brazil (CVM), announces to its shareholders and to the market in general that its jointly owned subsidiaries, Raízen Combustíveis S.A. and Raízen Energia S.A., released on this date a Material Fact, as fully presented below:

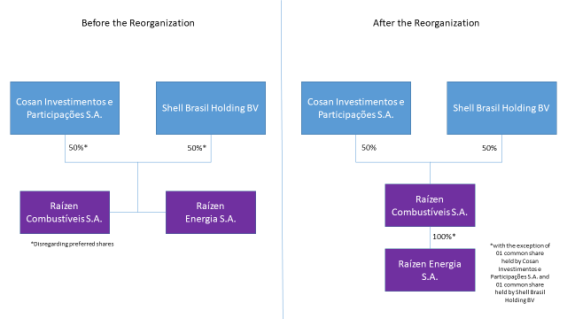

“Raízen Combustíveis S.A. (“RCSA”) and Raízen Energia S.A. (“RESA”) hereby inform that, on the date hereof, the RCSA shareholders, Cosan Investimentos e Participações S.A. (“Cosan”) and Shell Brasil Holding BV (“Shell”), contributed all the common shares, as well as their class A and D preferred shares, all issued by RESA, in a capital increase of RCSA (with the exception of two common shares, each of which remained owned by each such shareholder), for their respective book value, as well as the redemption by RESA of all class B preferred shares of its own issuance. As a result, RCSA became the holder of shares representing 100% (one hundred percent) of RESA's capital stock (subject to the exception mentioned above) (“Reorganization”).

As a result of the Reorganization, Cosan and Shell terminated RESA’s shareholders' agreement and amended RCSA's shareholders' agreement so as to adapt its terms and conditions to the new corporate structure of RCSA.

Illustrational chart of the Reorganization:

On this date, RCSA's shareholders also approved, at an Extraordinary General Shareholders Meeting, the filling of an initial public offering of RCSA's shares, which is the subject matter of the material fact disclosed on May 31, 2021, as per the terms described therein.

This material fact is for information purposes only, in compliance with the provisions of the Brazilian Securities and Exchange Commission (“CVM”) Instruction No. 358, of January 3, 2002, as amended, of CVM Instruction No. 400, of December 29, 2003 , as amended (“CVM Instruction 400”), and also, for the purposes of the provisions of paragraph 4 of article 157 of Law No. 6,404, of December 15, 1976, as amended, under the terms of the legislation in force, and must not be regarded as an announcement of the offering of the shares.”

The long-term agreements signed by Raízen's shareholders, as well as other parties, will be amended to reflect the aforementioned reorganization, preserving what was originally agreed. The new Shareholders' Agreement will be available on the Company's Investor Relations website (www.cosan.com) and on the CVM page (www.gov.br/cvm).

São Paulo, June 1st, 2021

Marcelo Eduardo Martins

Chief Financial and Investor Relations Officer

COSAN S.A.

Corporate Taxpayer ID (CNPJ): 50.746.577/0001-15

Company Registry (NIRE): 35.300.177.045

Publicly Held Company

MATERIAL FACT

Request for registration before the Brazilian Securities and Exchange Commission (“CVM”)

COSAN S.A. (B3: CSAN3; NYSE: CSAN) (“Cosan” or “Company”), in compliance with Instruction 358/02 issued by the Securities and Exchange Commission of Brazil (CVM), announces to its shareholders and to the market in general that its jointly owned subsidiary Raízen S.A. (“Raízen”) and Raízen Energia S.A., subsidiary of Raízen, released on this date a Material Fact, as fully presented below:

“Raízen S.A. (formerly named Raízen Combustíveis S.A.) (“Raízen”) and its subsidiary Raízen Energia S.A. hereby inform that, on the date hereof, Raízen has filed a request for registration before the Brazilian Securities and Exchange Commission (“CVM”) under CVM Instruction No. 400, of December 29, 2003, as amended (“Instruction 400”) of the initial public offering of shares of Raízen described in the material fact disclosed on May 31, 2021, as per the terms described therein.

This material fact is for information purposes only, in compliance with the provisions of the Instruction No. 358, of January 3, 2002, as amended, of Instruction 400, and also, for the purposes of the provisions of paragraph 4 of article 157 of Law No. 6,404, of December 15, 1976, as amended, under the terms of the legislation in force, and must not be regarded as an announcement of the offering of the shares.”

São Paulo, June 3rd, 2021

Marcelo Eduardo Martins

Chief Financial and Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 03, 2021

COSAN S.A. | |

By: | /s/ Marcelo Eduardo Martins |

| Name: Marcelo Eduardo Martins |

| Title: Chief Financial Officer |