- CSAN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Cosan (CSAN) 6-KCurrent report (foreign)

Filed: 28 May 24, 7:53pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-40155

Cosan S.A.

(Exact name of registrant as specified in its charter)

N/A

(Translation of registrant’s name into English)

Av. Brigadeiro Faria Lima, 4,100 – 16th floor

São Paulo – SP, 04538-132, Brazil

+55 11 3897-9797

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F | ☒ |

| Form 40-F | ☐ |

EXPLANATORY NOTE

Cosan S.A. (the “Company”) is furnishing this current report on Form 6-K to present (i) a discussion of the Company’s business and operations as of December 31, 2023 and 2022 and for each of the three years in the period ended December 31, 2023, and (ii) a convenience translation into English of the Company’s consolidated financial information as of and for the fiscal years ended December 31, 2023 and 2022 filed with the Brazilian Securities Commission (Comissão de Valores Mobiliários).

The financial information for Cosan S.A. as of and for the fiscal years ended December 31, 2023 and 2022 included herein has not been audited in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”). As previously disclosed by the Company on a current report on Form 6-K furnished on March 26, 2024, the Company’s audited consolidated financial statements for the year ended December 31, 2023 will not be completed within the prescribed timeframe strictly due to the date on which the Company’s new independent public accounting firm, BDO RCS Auditores Independentes SS Ltda. (“BDO”), began its audit of the Company, and the number of entities that need to be audited as part of a consolidated audit of the Company. The Company is working with BDO towards completing the necessary work in order to file its annual report on Form 20-F for the year ended December 31, 2023 as soon as possible.

TABLE OF CONTENTS

ITEM

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COSAN S.A. | ||

By: | /s/ Rodrigo Araujo Alves | |

| Name: | Rodrigo Araujo Alves |

| Title: | Chief Financial and Investor Relations Officer |

Date: May 28, 2024.

Item 1

table of contents

We present our individual and consolidated financial information in accordance with International Financial Reporting Standards, or “IFRS,” as issued by the International Accounting Standards Board, or “IASB.”

The individual and consolidated financial information is presented in Brazilian reais, the functional and presentation currency of Cosan S.A., or “Cosan” or “Cosan S.A.” and is the currency of the primary economic environment in which Cosan and its subsidiaries and jointly-controlled entity, located in Brazil, operate and generate and expend cash. The functional currency for the subsidiaries located outside Brazil is the U.S. dollar, British pound or the euro. Cosan S.A. and its subsidiaries are collectively referred to as the “Company,” “we,” “us” and “our.”

Individual and Consolidated Financial Information

We have included in this current report a convenience translation into English of our consolidated financial information as of and for the fiscal years ended December 31, 2023 and 2022 filed with the Brazilian Securities Commission (Comissão de Valores Mobiliários), or the “CVM.”

All references herein to “our financial information,” “our consolidated financial information” and “our individual and consolidated information” are to the convenience translation into English of Cosan S.A.’s consolidated financial information as of and for the fiscal years ended December 31, 2023 and 2022 filed with the CVM and included elsewhere in this current report on Form 6-K.

Restatement of Compass’s and Our 2022 Financial Information

Our subsidiary, Compass Gás e Energia, or “Compass,” restated its consolidated financial statements for the year ended December 31, 2022, as a result of the reclassification by its subsidiary Comgás - Companhia de Gás de São Paulo S.A., or “Comgás,” of the effects of the regulatory current account (conta corrente regulatória), or the “CCR,” on its gross profit. More specifically, the State of São Paulo Public Services Regulation Agency (Agência Reguladora de Serviços Públicos do Estado de São Paulo), or ARSESP, through Deliberation No. 1,205 dated August 18, 2021 (NTF-044-2021), published a new regulatory accounting manual and chart of accounts for the piped gas distribution sector applicable to companies subject to its regulation and effective as of fiscal year 2023. According to this rule, ARSESP set forth that the accounting of variations (positive and negative) between the price included in the tariffs and the price actually paid by a concessionaire to a supplier, which are periodically passed on to users through graphical accounts, must be recorded as net operating revenue. The accounting policy that we usually applied is consistent with our understanding of the essence of this transaction. We classified the effects of the CCR in our gross profit, but with allocations in the cost of products sold and services provided. In addition, the ARSESP rule states that the classification of expenses and costs may vary in relation to commonly adopted practices in which part of the administrative expenses are also admitted as costs of operations related to piped gas distribution services. These reclassifications do not impact the main indicators, such as profit for the year and equity, used by our indirect subsidiary Comgás and other Compass gas distributors.

As a result of the foregoing, we voluntarily reassessed the way in which we present the classification of the effects of CCR and general and administrative expenses, as we understand that such presentation will meet the requirements of ARSESP and Brazilian generally accepted accounting practices and will therefore be more consistent with market practice. Accordingly, we restated our consolidated statement of profit or loss for the fiscal year ended December 31, 2022, in order to reflect Compass’s restated results. For more information, see note 3.4 to our individual and consolidated financial information included elsewhere in this current report.

Certain Corporate Events

Our Corporate Reorganization

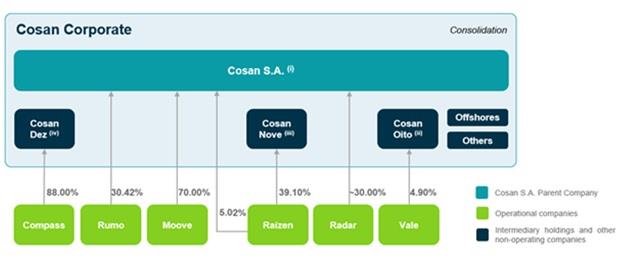

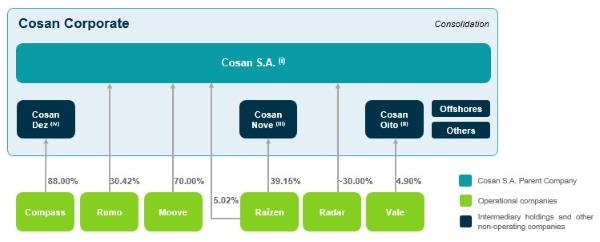

On January 22, 2021, the shareholders of Cosan Limited (the former parent company of Cosan and Cosan Logística S.A., or “Cosan Logística”) and the shareholders of Cosan and Cosan Logística approved an intra-group restructuring, consisting of a merger of companies under common control, pursuant to which Cosan Limited and Cosan Logística were merged into Cosan, or the “Merger,” as part of an effort to streamline our operations and to simplify our corporate structure. Cosan is now the sole holding company of the “Cosan Group,” which consists of Cosan and its consolidated subsidiaries.

Interest in Raízen

On June 1, 2011, we and Shell Brazil Holdings B.V., or “Shell,” formed two joint ventures, or the “Joint Venture,” for a combined 50/50 investment, under the names Raízen Combustíveis S.A., or “Raízen Combustíveis” and Raízen Energia e Participações S.A. (currently Raízen Energia S.A.), or “Raízen Energia.”

On June 1, 2021, Cosan and Shell contributed all their respective common shares, as well as class A and D preferred shares issued by Raízen Energia, in a capital increase of Raízen Combustíveis (with the exception of two common shares, each held by one of Cosan Investimentos e Participações S.A., or “CIP,” and Shell Brasil Holding BV). On this date, Raízen Energia also redeemed all of its own class B preferred shares. As a result, Raízen Combustíveis became the holder of the entire share capital of Raízen Energia, and it subsequently changed its corporate name to Raízen S.A. Following this corporate reorganization, Cosan S.A. and Shell terminated the Raízen Energia shareholders’ agreement and amended the Raízen Combustíveis shareholders’ agreement in order to adapt its terms and conditions to the new corporate organization. After the above-mentioned corporate reorganization, Raízen completed its initial public offering whereby its preferred shares with no voting rights were listed on the Nível 2 segment of the São Paulo Stock, Commodities and Futures Exchange (B3 S.A. – Brasil, Bolsa, Balcão), or “B3.”

This reorganization and such initial public offering did not by themselves affect the combined businesses of Raízen Combustíveis and Raízen Energia nor did they affect the respective voting rights of Cosan and Shell in Raízen’s share capital. Accordingly, references to “Raízen” refer, (i) prior to the corporate reorganization as a result of which Raízen Energia became the direct wholly-owned subsidiary of Raízen Combustíveis, to Raízen Energia and Raízen Combustíveis collectively, together with their respective consolidated subsidiaries; and (ii) following the corporate reorganization as a result of which Raízen Energia became the direct wholly-owned subsidiary of Raízen Combustíveis, to Raízen S.A. (the current corporate name of Raízen Combustíveis), together with its consolidated direct or indirect subsidiaries.

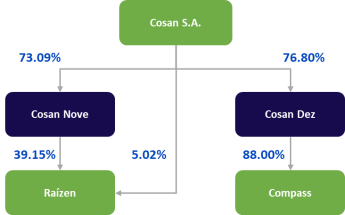

Cosan’s total interest in Raízen is made up of a 5.02% direct interest and a 39.15% indirect interest through Cosan’s interest in its subsidiary Cosan Nove S.A., or “Cosan Nove.” We therefore report an equity interest of 25.90% in Raízen, which is calculated by reference to Cosan’s 66.16% equity interest in its subsidiary Cosan Nove multiplied by Cosan Nove’s 39.15% equity interest in Raízen.

For further information, see note 4, “Segment Information,” to our individual and consolidated financial information as of and for the fiscal years ended December 31, 2023 and 2022, included elsewhere in this current report.

Acquisition of Significant Influence in Vale S.A., or “Vale”

During the fourth quarter of 2022, we completed a financial investment in Vale in a series of transactions that allowed us to finance, and hedge against certain risks relating to, the acquisition of Vale’s shares. The acquisition was financed by a combination of new indebtedness and derivatives. Vale is a Brazilian mining company that operates in 20 countries, has investments in energy infrastructure projects and conducts logistics operations through its railroads, ports and terminals.

On October 14, 2022, our subsidiary Cosan Oito S.A., or “Cosan Oito,” completed the R$16,425.4 million investment in the shares of Vale. The investment was comprised of several transactions starting in September 2022, which included: (i) the acquisition of 1.55% of Vale’s shares in the open market for R$4,918.2 million, which exposed us to the risk of changes in the price of Vale’s shares; (ii) the purchase of 3.31% of Vale’s shares in a private placement transaction for R$11,117.8 million, together with derivative financial instruments (from which we received a R$499.2 million premium) that partially hedge our exposure to changes in Vale’s share price; and (iii) the acquisition of a call spread, which consist of a synthetic economic exposure (“forward”) to an additional 1.6% of Vale’s shares in the open market at a predetermined price per share (for which we paid a R$1,134.9 million premium), together with derivative financial instruments that partially hedge our exposure to changes in Vale’s share price, from which we received a R$246.3 million premium (with the option, subject to satisfaction of certain conditions, to negotiate with the derivative banks in good faith to convert this synthetic exposure into outright ownership subject to the same cap and floor prices). Except as otherwise specified herein, all percentages of Vale’s shares as used in this section are based on 4,535,617,099 Vale shares outstanding as of October 31, 2022.

The net cost of the investment in Vale of R$16,425.4 million in the year ended December 31, 2022, was financed through new indebtedness in the aggregate amount of R$16,569.7 million.

A summary of the loans we entered into for the financing of our investment in Vale is set forth in the table below:

Creditor | Issue Date | Aggregate Amount (in millions of reais) | Maturity Date | Interest Rate | ||||

|---|---|---|---|---|---|---|---|---|

Itaú Unibanco S.A.(1) | September 16, 2022 | R$4,000.0 | September 16, 2023 | CDI + 1.35% | ||||

Bradesco BBI S.A.(1) | September 27, 2022 | R$4,000.0 | September 27, 2023 | CDI + 1.35% | ||||

J.P. Morgan S.A.(2)(3) | October 14, 2022 | R$5,141.8 | October 1, 2027 | 3.28% p.a. | ||||

Citibank S.A.(2)(3) | October 14, 2022 | R$3,427.9 | October 1, 2027 | 0.25% p.a. |

| (1) | Settled prior to maturity in December 2022. |

| (2) | The charges for these operations bear pre-fixed interest, raised in foreign currency for €1.0 billion and ¥95.3 billion with JP Morgan S.A. and Citibank S.A., respectively. Subsequently, derivative financial instruments were structured for these financings, which converted suchoperations into reais at a cost of CDI plus 0.45% p.a. The financings obtained from JP Morgan S.A. and Citibank S.A. are secured by 100% of Vale’s shares in the collar structure, which represent Cosan Oito’s acquired stake of 3.31% of Vale. The collar loans mature in four tranches, namely in October 2024, 2025, 2026 and 2027. “CDI” refers to the Brazilian interbank deposit certificate rate (certificado de depósito interbancário). |

| (3) | During the first months of 2024, the Company settled 100% of the debts linked to the acquisition of our equity interest in Vale, as well as the collar financing derivatives linked to the transaction. |

For protection against the risks involved in the acquisition of a 3.14% stake in Vale by Cosan Oito, cash-settled derivatives were structured with J.P. Morgan S.A. and Citibank S.A. consisting of a combination of call and put positions that mitigate the risk associated with a decrease in the share price of Vale below certain thresholds, while also allowing Cosan Oito to participate in future share value increases up to a certain threshold. These call and put positions are scheduled to expire periodically between October 2024 and November 2027. At the inception of the transaction, a net premium of R$499.2 million was received for the difference between the put and call options.

In order to secure our right to make an additional financial investment of 1.6% stake in Vale at a later date, cash-settled derivatives were structured consisting of an equity forward plus a combination of call and put options that mitigate share value depreciation risk, while also allowing Cosan Oito to participate partially in future share value increases. These call and put positions are scheduled to expire periodically between October 2024 and November 2027. In the equity forward transaction, we paid the amount of R$1,134.9 million to J.P. Morgan S.A. and Citibank S.A., and in the synthetic collar transaction we received from J.P. Morgan S.A. and Citibank S.A. an amount of R$246.3 million upon entering into these structured derivatives, totaling a net payment by us of a premium of R$888.6 million. We have the option, subject to satisfaction of certain conditions, to negotiate with the derivative banks in good faith to convert the synthetic economic exposure under the equity forward into outright ownership subject to the same cap and floor prices.

On December 23, 2022, Banco Bradesco BBI S.A. invested R$4.0 billion in preferred shares representing 23.2% of the share capital of our subsidiary Cosan Dez Participações S.A., or “Cosan Dez.” As part of the transaction, Cosan S.A. contributed to Cosan Dez its investment in Compass and certain commercial notes issued by Banco Bradesco BBI S.A. Cosan Dez redeemed these commercial notes for a total aggregate amount of R$4.0 billion (including principal plus interest until the redemption date) using the proceeds from the issuance of its preferred shares. As a result of the transaction, Cosan Dez now holds 88.0% of Compass’s shares, and, as the holder of preferred shares in Cosan Dez, Banco Bradesco BBI S.A. has a preferential right to the receipt of dividends or other distributions from Cosan Dez. We have also entered into a shareholders’ agreement with Banco Bradesco BBI S.A. with respect to Cosan Dez. In addition, on December 28, 2022, Itaú Unibanco S.A. invested R$4.1 billion in preferred shares representing 26.9% of the share capital of our subsidiary Cosan Nove Participações S.A., or “Cosan Nove.” As part of the transaction, Cosan S.A. contributed to Cosan Nove its investment in Raízen and certain commercial notes issued by Itaú Unibanco S.A. Cosan Nove redeemed these commercial notes for a total aggregate amount of R$4.1 billion (including principal plus interest until the redemption date) using the proceeds from the issuance of its preferred shares. As a result of the transaction, Cosan Nove now holds 39.1% of Raízen’s shares, and, as the holder of preferred shares in Cosan Nove, Itaú Unibanco S.A. has a preferential right to the receipt of dividends or other distributions from Cosan Nove. We have also entered into a shareholders’ agreement with Itaú Unibanco S.A. with respect to Cosan Nove.

We initially recorded our shareholding in Vale as a financial asset accounted for at fair value in accordance with IFRS 9. On April 28, 2023, at Vale’s general shareholder’s meeting, our then-chief executive officer, Luis Henrique Cals de Beauclair Guimarães, was elected as a member of Vale’s board of directors, and, on May 16, 2023, was appointed coordinator of Vale’s capital and projects allocation committee, or the “CACP,” and a member of Vale’s people and compensation committee, or “CPR.” From January 1, 2024, Mr. Guimarães left his position as our chief executive officer, while remaining a member of our board of directors. During the year ended December 31, 2023, we monitored the factors that could indicate our having significant influence in Vale, given Mr. Guimarães’ participation in Vale’s CACP and CPR. On November 30, 2023, we obtained sufficient evidence that demonstrated our ability to exert significant influence on Vale’s policies and operations, given that Mr. Guimarães was able to participate in policy-making processes, including decisions relating to dividends and other distributions. From this date, we began to consider Vale as a related company over which we have significant influence and to account for our investment in Vale using the equity method in accordance with IAS 28. As of December 31, 2023, we had a 4.65% interest in Vale, reflecting the sale of shares equivalent to 0.21% of Vale’s total share capital since we started accounting for Vale using the equity method. For more information, see note 1.1 to our individual and consolidated financial information included elsewhere in this current report.

As shown in the table below, in the fourth quarter of 2023 and the first months of 2024, we accelerated the settlement of the indebtedness tied to the acquisition of Vale shares, as well as the collar financing derivatives tied to this transaction.

Reference Date | Direct Interest | Interest through Collar | Total Interest in Vale’s Share Capital | Aggregate Amount (in millions of reais) – Principal Debt Settlement | ||||

|---|---|---|---|---|---|---|---|---|

Inception date (October 2022) | 1.47% | 3.14% | 4.61% | 8,569.6 | ||||

August 2023 | 1.65% | 3.21% | 4.85% | (275.9) | ||||

October 2023 | 1.75% | 3.11% | 4.85% | (252.5) | ||||

November 2023 | 2.45% | 2.40% | 4.85% | (1,844.0) | ||||

December 2023 | 2.45% | 2.20% | 4.65% | (561.3) | ||||

January 2024 | 2.62% | 2.03% | 4.65% | (1,698.6) | ||||

February 2024 | 3.91% | 0.74% | 4.65% | (2,068.0) | ||||

April 2024 | 3.91% | — | 3.91% | (1,918.8) |

Special Note Regarding Non-GAAP Financial Measures

This current report presents our Net debt, which is a non-GAAP financial measure. A non-GAAP financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measure.

We calculate Net debt as current and non-current loans, borrowings and debentures plus preferred shareholders payable in subsidiaries plus cash and cash equivalents plus marketable securities plus derivatives on debt. Our calculation of Net debt may differ from the calculation of similarly titled measures used by other companies.

Our management believes that disclosure of Net Debt is useful to potential investors as it helps to give them a clearer understanding of our financial liquidity. Net Debt is also used to calculate certain leverage ratios. However, Net Debt is not a measure under IFRS and should not be considered as a substitute for measures of indebtedness determined in accordance with IFRS. For a reconciliation of Net debt to the most directly comparable IFRS measure, see “Selected Financial Data.”

Market Data

We obtained market and competitive position data, including market forecasts, used throughout this current report from market research, publicly available information and industry publications, as well as internal surveys. We include data from reports prepared by LMC International Ltd., the Central Bank of Brazil (Banco Central do Brasil), or the “Brazilian Central Bank,” the Sugarcane Agroindustry Association of the state of São Paulo (União da Agroindústria Canavieira de São Paulo), or “UNICA,” the Brazilian Ministry of Agriculture, Livestock, and Supply (Ministério da Agricultura, Pecuária e Abastecimento), or “MAPA,” the Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística), or “IBGE,” the Brazilian Ministry of Development, Industry and Foreign Trade (Ministério do Desenvolvimento e do Comércio Exterior), or “MDIC,” the Brazilian Ministry of Infrastructure (Ministério da Infraestrutura), or “MI,” the Food and Agriculture Organization of the United Nations, or “FAO,” the National Traffic Agency (Departamento Nacional de Trânsito—DENATRAN), the Brazilian Association of Vehicle Manufactures (Associação Nacional dos Fabricantes de Veículos Automotores—ANFAVEA), Datagro Publicações Ltda., F.O. Licht, Czarnikow, Apoio e Vendas Procana Comunicações Ltda., the B3, the Brazilian Securities Commission (Comissão de Valores Mobiliários), or “CVM,” the International Sugar Organization, the Brazilian National Economic and Social Development Bank (Banco Nacional de Desenvolvimento Econômico e Social), or “BNDES,” the New York Board of Trade, or “NYBOT,” the New York Stock Exchange, or “NYSE,” the Brazilian Agricultural Research Corporation (Empresa Brasileira de Pesquisa Agropecuária), or “Embrapa,” the Brazilian Secretariat for Foreign Trade (Secretaria de Comércio Exterior), or “Secex,” the National Supply Company (Companhia Nacional de Abastecimento), or “Conab,” the United States Department of Agriculture, or “USDA,” the London Stock Exchange, the National Agency of Petroleum, Natural Gas and Biofuels (ANP – Agência Nacional do Petróleo, Gás Natural e Biocombustíveis), or “ANP,” the Brazilian Antitrust Authority (Conselho Administrativo de Defesa Econômica), or the “Brazilian Antitrust Authority,” the National Union of Distributors of Fuels and Lubricants (Sindicato Nacional das Empresas Distribuidoras de Combustíveis e de Lubrificantes), or “Sindicom,” the Sanitation and Energy Regulatory Agency for the state of São Paulo (Agência Reguladora de Energia de São Paulo), or “ARSESP,” the Brazilian Gas Distributors Association (Associação Brasileira das Empresas Distribuidoras de Gás), or “ABEGÁS,” the Agriculture School of the University of São Paulo (Escola Superior de Agricultura Luiz de Queiroz), or “ESALQ,” the National Waterway Transportation Agency (Agência Nacional de Transportes Aquaviários), or “ANTAQ,” the Brazilian Transportation Authority (Agência Nacional de Transporte Terrestre), or “ANTT,” Estação da Luz Participações Ltda., or “EDLP,” the National Electric Energy Agency (Agência Nacional de Energia Elétrica), or “ANEEL,” and the Chamber of Electric Energy Commercialization (Câmara de Comercialização de Energia Elétrica), or “CCEE.” We believe that all market data in this current report is reliable, accurate and complete.

Terms Used in This Current Report

In this current report, we present information in gallons, liters and cubic meters (m³ or cbm). In addition, we also present information in tons. In this current report, references to “ton” or “tonne” refer to the metric tonne, which is equal to 1,000 kilograms.

All references in this current report to “TSR” are to total sugar recovered, which represents the total amount of sugar content in a given quantity of sugarcane.

All references in this current report to “RTK” mean revenue ton kilometer.

All references to the “real,” “reais” or “R$” are to the Brazilian real, the official currency of Brazil. All references in this current report to “U.S. dollars,” “dollars” or “U.S.$” are to U.S. dollars. All references to the “Euro,” “Euros,” “€” or “EUR” are to the official currency of the European Union. All references to the “Yen,” “¥” or “JP¥” are to the Japanese Yen, the official currency of Japan.

Rounding

We have made rounding adjustments to reach some of the figures included in this current report. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

This current report contains estimates and forward-looking statements, mainly under “Risk Factors,” “Information on the Company—B. Business Overview” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the matters discussed concerning our business and financial performance include estimates and forward-looking statements.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates on projections of future events and operating and financial trends, which affect or may affect our industry, market share, reputation, businesses, financial condition, results of operations, margins and/or cash flow. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to several risks and uncertainties, are made in light of information currently available to us and should not be considered a guarantee of the results of operations we may achieve. Many significant factors in addition to those stated in this current report may adversely affect our current estimates and forward-looking statements, and whether these estimates or statements may be realized. Our estimates and forward-looking statements may be influenced by the following factors, among others:

The words “believe,” “should,” “may,” “might,” “could,” “seek,” “aim,” “likely,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and other similar words used in this current report are intended to identify estimates and forward-looking statements. Estimates and forward-looking statements speak only as of the date they were made, and we undertake no obligation to update or to review any estimate and/or forward-looking statement because of new information, future events or other factors. Estimates and forward-looking statements involve risks and uncertainties and are not guarantees of future performance. Our future results may differ materially from those expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described above, the estimates and forward-looking statements discussed in this current report might not occur and our future results and our performance may differ materially from those expressed in these forward-looking statements due to but not limited to, the factors mentioned above. Because of these uncertainties, you should not make any investment decision based on these estimates and forward-looking statements.

The following tables present selected historical financial and operating data for the Company derived from our individual and consolidated financial information. You should read the following information in conjunction with our individual and consolidated financial information and related notes, and the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this current report.

The financial data as of and for the fiscal years ended December 31, 2023 and 2022 have been derived from our individual and consolidated financial information using the predecessor method of accounting prepared in accordance with IFRS as issued by the IASB and included elsewhere in this current report. See “Presentation of Financial and Other Information—Individual and Consolidated Financial Information.”

| As of and for the fiscal year ended December 31, | |||||

|---|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | |||

| (in millions of reais, except where otherwise indicated) | |||||

Consolidated Profit or Loss Data: |

|

|

| |||

Net sales | 39,468.5 | 39,322.8 | 25,865.0 | |||

Cost of sales(1) | (28,549.9 | ) | (30,556.8 | ) | (19,864.2 | ) |

Gross profit(1) | 10,918.6 | 8,766.0 | 6,000.8 | |||

Selling expenses(1) | (1,350.6 | ) | (1,276.3 | ) | (723.4 | ) |

General and administrative expenses(1) | (2,528.0 | ) | (1,758.1 | ) | (1,572.4 | ) |

Other income, net | 3,924.4 | 1,752.2 | 382.6 | |||

Total operations expenses | 45.8 | (1,282.2 | ) | (1,913.2 | ) | |

Profit before equity in earnings of investees, finance results and income taxes | 10,964.4 | 7,483.8 | 4,087.6 | |||

Equity in earnings of investees | 2,046.3 | 326.7 | 4,720.9 | |||

Finance results, net | (7,897.0 | ) | (5,157.9 | ) | (2,557.6 | ) |

Profit before income taxes | 5,113.8 | 2,652.6 | 6,250.9 | |||

Income taxes: |

|

|

| |||

Current | (1,645.1 | ) | (1,247.0 | ) | (787.6 | ) |

Deferred | 1,370.6 | 1,365.4 | 1,233.2 | |||

| (274.4 | ) | 118.4 | 445.6 | ||

Profit for the year | 4,884.7 | 2,820.9 | 6,696.5 | |||

Profit attributable to non-controlling interests | 3,790.4 | 1,644.8 | 384.3 | |||

Profit attributable to owners of the Company) | 1,094.4 | 1,176.0 | 6,312.1 | |||

Consolidated Statement of Financial Position Data: |

|

|

| |||

Cash and cash equivalents | 14,658.5 | 13,301.7 | 16,174.1 | |||

Marketable securities (current and non-current) | 3,504.0 | 22,099.8 | 4,388.0 | |||

Inventories | 1,792.7 | 1,869.1 | 1,149.3 | |||

Right-of-use assets | 9,513.5 | 8,012.9 | 7,947.3 | |||

Property, plant and equipment | 21,240.0 | 18,948.4 | 16,648.6 | |||

Intangible assets and goodwill | 22,650.3 | 22,121.9 | 17,781.5 | |||

Total assets | 139,865.4 | 134,485.0 | 97,842.0 | |||

Current liabilities | 16,158.8 | 15,798.2 | 12,957.0 | |||

| As of and for the fiscal year ended December 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | ||||||

| (in millions of reais, except where otherwise indicated) | ||||||||

Non-current liabilities | 72,725.4 | 70,517.4 | 56,015.0 | ||||||

Loans, borrowings and debentures (current and non-current) | 56,904.7 | 52,987.2 | 45,659.0 | ||||||

Preferred shareholders payable in subsidiaries | — | — | — | ||||||

Provision for legal proceedings | 1,714.4 | 1,801.2 | 1,644.1 | ||||||

Equity attributable to owners of the Company | 20,955.3 | 20,653.2 | 14,740.9 | ||||||

Equity attributable to non-controlling interests | 30,025.9 | 27,516.2 | 14,129.1 | ||||||

Total shareholders’ equity | 50,981.2 | 48,169.4 | 28,870.0 | ||||||

Consolidated Other Financial Data: |

|

|

| ||||||

Depreciation and amortization | 3,364.9 | 3,014.5 | 2,504.4 | ||||||

Net debt(2) | 39,733.0 | 18,814.7 | 21,463.5 | ||||||

Working capital(3) | 11,685.1 | 9,779.7 | 14,336.1 | ||||||

Cash flow provided by (used in): |

|

|

| ||||||

Operating activities | 10,276.4 | 9,972.2 | 5,147.2 | ||||||

Investing activities | (4,303.1 | ) | (20,726.6 | ) | (5,446.8 | ) | |||

Financing activities | (4,516.6 | ) | 8,286.3 | 2,319.4 | |||||

Basic earnings per share from continuing operations(4) | R$ | 0.58 | R$ | 0.62 | R$ | 3.44 | |||

Diluted earnings per share from continuing operations(4) | R$ | 0.58 | R$ | 0.62 | R$ | 3.43 | |||

Number of shares outstanding(4) | 1,867,556,421 | 1,866,638,100 | 1,868,630,160 | ||||||

Declared dividends (millions of reais) | 2,375.6 | 1,237.8 | 2,031.3 | ||||||

Declared dividends (millions of U.S. dollars) | U.S.$ | 475.1 | U.S.$ | 237.2 | U.S.$ | 503.4 | |||

Declared dividends per share (reais)(4) | R$ | 0.5778 | R$ | 0.6173 | R$ | 1.0858 | |||

Declared dividends per share (U.S. dollars)(4) | U.S.$ | 0.1156 | U.S.$ | 0.1194 | U.S.$ | 0.2694 | |||

Other Operating Data: |

|

|

| ||||||

Crushed sugarcane (in million tons) | 83.5 | 73.4 | 54.2 | ||||||

Sugar production (in million tons) | 5.8 | 4.8 | 3.7 | ||||||

Ethanol production (in billion liters) | 3.1 | 3.0 | 2.2 | ||||||

Volume of fuel sold (in million liters) | 35,295 | 34,822 | 33,178 | ||||||

Volume loaded (Rumo) (in million tons) | — | 10.8 | 12.5 | ||||||

Transported volume (Rumo) (in million TKU) | 77,258.4 | 74,944.0 | 64,028.0 | ||||||

Natural gas (Compass) (in million m³) | 4,926.7 | 5,448.3 | 4,859.1 | ||||||

Volume of finished goods and base oil sold (in million liters) | 665.5 | 524.7 | 388.7 | ||||||

| (1) | Our subsidiary Compass restated its consolidated financial statements for the year ended December 31, 2022, as a result of the reclassification by its subsidiary Comgás of the effects of the CCR on its gross profit. As a result, we voluntarily reassessed the way in which we present the classification of the effects of CCR and general and administrative expenses, as we understand that such presentation will meet the requirements of ARSESP and Brazilian generally accepted accounting practices and will therefore be more consistent with market practice. Accordingly, we restated our consolidated statement of profit or loss for the fiscal year ended December 31, 2022, in order to reflect Compass’s restated results. For more information, see “Presentation of Financial Information— Individual and Consolidated Financial Information—Restatement of Compass’s and Our 2022 Financial Information” and note 3.4 to our Individual and consolidated financial information included elsewhere in this current report. |

| (2) | Net debt consists of current and non-current debt (including preferred shareholders payable in subsidiaries), net of cash and cash equivalents, marketable securities and derivatives on debt recorded in our consolidated financial statements as other non-current assets. Net debt is a non-GAAP measure. |

| (3) | Working capital consists of total current assets less total current liabilities. |

| (4) | Reflects the Merger and the stock split undertaken on April 30, 2021 for all years presented as if it had occurred on January 1, 2020. For more information about the Merger and the stock split, see “Information on the Company—A. History and Development of the Company—History.” |

The information in the table below presents a reconciliation of Net debt, a non-GAAP financial measure, the most directly comparable IFRS financial measure. Our calculation of Net debt may differ from the calculation of similarly titled measures used by other companies. Our management believes that disclosure of Net Debt is useful to potential investors as it helps to give them a clearer understanding of our financial liquidity. Net Debt is also used to calculate certain leverage ratios. However, Net Debt is not a measure under IFRS and should not be considered as a substitute for measures of indebtedness determined in accordance with IFRS.

| As of December 31, | |||||||

|---|---|---|---|---|---|---|---|---|

| 2023 | 2022 | 2021 | |||||

| (in millions of reais, except where otherwise indicated) | |||||||

Current loans, borrowings and debentures | 4,882.4 | 4,542.2 | 4,241.4 | |||||

Non-current loans, borrowings and debentures | 52,022.3 | 48,445.0 | 41,417.7 | |||||

Total | 56,904.7 | 52,987.2 | 45,659.0 | |||||

Cash and cash equivalents | (14,658.5 | ) | (13,301.7 | ) | (16,174.1 | ) | ||

Current marketable securities | (3,407.9 | ) | (2,422.5 | ) | (4,372.7 | ) | ||

Noncurrent marketable securities | (96 | ) | (19,677.3 | ) | (15.3 | ) | ||

Total | (18,162.5 | ) | (35,401.5 | ) | (20,562.1 | ) | ||

Derivatives on debt, net (1) | 990.8 | 1,228.9 | (3,633.4 | ) | ||||

Net debt(1)(2) | 39,733.0 | 18,814.7 | 21,463.5 | |||||

| (1) | As of December 31, 2022, we started calculating Net Debt taking into account only derivatives on debt as opposed to the total amount of derivatives. |

| (2) | Our covenants consider preferred shareholders payable in subsidiaries in the calculation of net debt. |

Summary of Risk Factors

The following summarizes the principal factors that make an investment in our company speculative or risky, all of which are more fully described in the Risk Factors below. This summary should be read in conjunction with the Risk Factors below and should not be relied upon as an exhaustive summary of the material risks facing our business. The following factors could result in harm to our business, reputation, revenue, financial results, and prospects, among other impacts:

Summary of Risks Related to Our Businesses and the Industries in Which We Operate Generally

Summary of Risks Related to Our American Depositary Shares and Our Common Shares

Summary of Risks Related to the Countries in Which We Operate

Risks Related to Our Businesses and the Industries in Which We Operate Generally

The expansion of our business through acquisitions and strategic alliances creates risks that may reduce the benefits we anticipate from these transactions.

We have grown substantially through acquisitions and intend to continue to grow by acquiring, or investing in, directly or indirectly, from time to time, businesses considered suitable by our management that are consistent with our values and which we believe are conducive to generating results. Additionally, we may enter into strategic alliances to increase our competitiveness in the markets in which we operate.

Despite our recent expansion, our management is unable to predict whether and when any new acquisitions or strategic alliances will occur or the likelihood that any particular transaction will be completed on favorable terms and conditions. Our ability to continue to expand our business through acquisitions or alliances depends on many factors, including its ability to identify acquisition opportunities or access capital markets on acceptable terms. Even if we are able to identify opportunities and obtain the resources necessary to do so, financing these acquisitions could result in an over-commitment on our part.

Acquisitions, particularly those involving sizeable enterprises, may bring managerial and operational challenges, including the diversion of management’s attention from existing operations and difficulties in integrating operations and personnel. Any material failure by us in integrating new businesses or in managing any new alliances may adversely affect our business and financial performance. Additionally, some of our major competitors may pursue growth through acquisitions and alliances, which may reduce the likelihood that we will be successful in completing acquisitions and alliances. In addition, any major acquisition we consider may be subject to antitrust and other regulatory approvals. We may not be successful in obtaining required approvals on a timely basis or at all.

Acquisitions also expose us to the risk of successor liability-related actions involving any acquired entity, their respective management or contingent liabilities incurred before the acquisition. The due diligence investigation conducted in connection with an acquisition, and any contractual guarantees or indemnities that we may receive from sellers of acquired companies, may not be sufficient to protect us from, or compensate us for, actual liabilities. Material liabilities associated with an acquisition, such as labor or environmental liabilities, could materially and adversely affect our reputation, business, operating results or financial condition, and reduce the benefits that we expect to result from such acquisition.

On October 14, 2022, our subsidiary Cosan Oito completed the acquisition of a noncontrolling interest in Vale. For more information about the risks related to the acquisition of the interest at Vale, see “—The financial investment by the Company in Vale involved a combination of complex transactions and involves financial risks” and “Risks Related to Vale.”

We may not successfully acquire or develop additional production capacity through greenfield projects or expansion of existing facilities.

We may explore growth opportunities in the future through the acquisition or development of greenfield projects or through the expansion of our existing facilities. We may be unable to complete these projects on a timely basis or at all, and may not realize the related benefits we anticipate. The factors which may prevent us from doing so include, among other things, (i) our failure to obtain environmental and other licenses; (ii) our inability to obtain supplies of appropriate equipment or raw materials; (iii) increases in costs and/or decreases in revenue; (iv) a lack of qualified workforce; (v) lack of service providers; and (vi) our inability to obtain any required financing on satisfactory terms, or at all.

Our greenfield projects and/or expansion of existing facilities require a significant number of service providers. Any inability on our part to enter into contracts with duly qualified service providers who are able to provide the technical services that we require may prevent us from completing our greenfield projects and/or expansions of existing facilities on a timely basis, or at all. In addition, the integration of greenfield projects or expansion of our existing facilities may result in unforeseen operating difficulties and may require significant financial and managerial resources that would otherwise be used for our current operations. Planned or future greenfield projects or expansions of existing facilities may not enhance our financial performance. Any failure in the implementation of growth projects and/or expansion of existing facilities may have a material adverse effect on our business, financial condition and results of operations.

We may be unable to implement our growth strategy successfully.

Our future growth and financial performance depend, in part, on the successful implementation of our business strategy, including (i) our ability to maintain our existing client base, increase volume from existing clients in specific markets and locations and attract new clients, (ii) our capacity to finance investments (through indebtedness or otherwise), or (iii) our ability to increase our operational capacity and expand our current capacity to supply to new markets, among others. We cannot assure you that we will be able to achieve these objectives and/or strategies successfully or at all. Our failure to achieve any of these objectives and/or strategies as a result of competitive difficulties, cost increases or restrictions on our ability to invest, among other factors, may limit our ability to implement our growth strategy successfully. We may need to incur additional indebtedness in order to finance new investments to implement our growth strategy. Unfavorable economic conditions in Brazil and in the global credit markets, such as high interest rates on new loans, reduced liquidity or reduced interest of financial institutions in granting loans may limit our access to new credit. Furthermore, failure to achieve our expected growth may have a material adverse effect on our business, financial condition, results of operations and ability to repay our debt obligations.

The ongoing war between Russia and Ukraine and conflicts in the Middle East may have a material adverse effect on the global and Brazilian economies as well as on us.

Russia’s invasion of Ukraine on February 24, 2022 marked the beginning of an ongoing war between the two countries which has materially affected the global economy and international relations. The conflict has already caused strong reactions from the United States, the United Kingdom, the European Union (“EU”), and other countries around the world, notably the members of the North Atlantic Treaty Organization (“NATO”), which have applied broad economic sanctions against Russia, including financial and trade measures. The United States, the EU, and the United Kingdom have taken measures against Russian businesses and governmental entities, the Russian central bank and others, such as sanctioning individuals with close ties to the Russian president, imposing visa restrictions on several oligarchs, as well as their family members and close associates, and blocking or freezing assets. In addition, several countries have already provided support to Ukraine, with the supply of financial resources, weapons and equipment, as well as other humanitarian aid, which may lead to the internationalization of the conflict.

The war has already resulted in significant volatility in the financial markets, depreciation of the Russian ruble and the Ukrainian hryvnia against the U.S. dollar and other currencies, and rising energy and commodity prices around the world. If the conflict continues or escalates, markets may face continued volatility as well as economic and security consequences, including but not limited to supply shortages of different products, further increases in commodity prices, including piped natural gas, higher energy prices, higher prices of foodstuffs, and market volatility, among others.

The potential consequences of the war for us include, without limitation:

Other potential consequences include, but are not limited to, growth in the number of popular uprisings in the region, increased political discontent, especially in the regions most affected by the conflict or economic sanctions, increased cyberterrorism activities and attacks, an exodus from regions close to the areas of conflict and an increase in the number of refugees fleeing across Europe, among other unforeseen social and humanitarian effects.

In addition, on October 7, 2023, Hamas launched an attack on Israel killing hundreds of Israeli civilians. In response, Israel declared war against Hamas, targeting the Gaza Strip. The war is causing a humanitarian crisis and could lead to an escalation of the conflict in the region, rise in oil and gas prices, more inflationary pressures and market volatility, among others. In the aftermath of the conflict, there have been a number of attacks elsewhere in the Middle East, prompting fears that the conflict may spread. It is unclear whether these challenges and uncertainties will be contained or resolved, and what effects they may have on global political and economic conditions in the long term.

The effects of the war between Russia and Ukraine and the conflicts in the Middle East are ongoing, and its continuation or escalation could precipitate or aggravate the other risk factors identified in this current report, which in turn could further materially and adversely affect our business, financial condition, liquidity, results of operations and profitability, including in ways not currently known or considered by us to present material risks.

We may engage in hedging transactions which could have material adverse effect on our results.

We are exposed to market risks arising from the conduct of our business activities—in particular, market risks arising from changes in commodity prices, exchange rates or interest rates. In an attempt to minimize the effects of the volatility of prices and exchange rates on our cash flows and results of operations, for example, we engage in hedging transactions involving commodities and exchange rate futures, options, forwards and swaps. We also engage in interest rate-related hedging transactions from time to time. These transactions expose us to the risk of financial loss. In particular, Raízen enters into hedging transactions against market price fluctuations by fixing the prices of our sugar export volumes and exchange rates. Any fluctuations in market prices could therefore have a material adverse effect on our business, financial condition and results of operations. Alternatively, we may choose not to engage in hedging transactions in the future, which could have a material adverse effect on our financial performance during periods in which commodities prices decrease.

Climate change can create transition risks, physical risks and other risks that could adversely affect us.

Climate risk is a transversal risk that can be an aggravating factor for the types of traditional risks that we manage in the ordinary course of business, including without limitation the risks described in this “Risk Factors” section. Based on the classifications used by Task-Force on Climate-Related Financial Disclosures, we consider that there are two primary sources of climate change-related financial risks: physical and transition.

Physical risks resulting from climate change can be event-driven (acute) or long-term shifts (chronic) in climate patterns. Acute physical risks include increased severity of extreme weather events, such as drought, hurricanes or floods. Chronic physical risks include changes in precipitation patterns and extreme variability in weather patterns, rising mean temperatures, chronic heat waves or rising sea levels.

Especially in Brazil, rainfall patterns have been constantly changing, causing certain regions to experience rainfall volumes far above historical averages, resulting in floods and inundations and landslides in hillside and mountain regions. Such changes in rainfall patterns could have an adverse effect on our production and distribution capacity, affecting crop harvests as well as our ability to produce sugar and ethanol, generate energy, distribute our products and provide services to our customers. The occurrence of storms and floods may also influence the cost to insure our assets, especially those in high-risk regions, where storms, tornadoes and other extreme events are more pronounced. In periods of scarcity of rain, water deficiency occurs because of the decrease in the levels of water reservoirs, with an influence on the availability and costs of electric energy, considering the dependence on energy generated through hydroelectric plants, as well as on crop harvests. The scarcity of rains combined with low levels of reservoirs can lead governments and authorities to restrict industrial activities and direct water for human consumption. The increase in average temperatures may have an impact on our operating costs due to the greater demand for cooling and air conditioning to produce, store and transport some of our products. Historically, in periods of water scarcity, the Brazilian government authorizes an increase in the energy prices as a measure to stimulate the reduction of consumption, which can create inflationary pressure, with impacts on the income levels of the population in general, on production costs and on the final price of products, which consequently affects our revenues and results. Extreme and prolonged changes in rainfall patterns and an increase in temperatures can influence production cycles in certain regions, and droughts can influence the increase in fires and devastation, which may adversely affect our facilities. Additionally, they can also cause a reduction in revenue and an increase in costs due to negative impacts on our employees and suppliers, such as increased absenteeism and issues involving health and safety.

The impact of climate change poses tangible physical risks to the operations of certain of our subsidiaries, as follows:

These requirements may increase going forward as a result of the increasing importance of environmental matters, which could expose us to increased compliance costs and limit our ability to pursue certain business opportunities and provide certain products and services, each of which could adversely affect our business, financial condition and results of operations.

The impact of climate change poses tangible transition risks to the operations of certain of our subsidiaries, as follows:

We may face conflicts of interest in transactions with related parties.

We engage in business and financial transactions with our controlling shareholder and other shareholders that may create conflicts of interest between our Company and these shareholders. Commercial and financial transactions between our affiliates and us, even if entered into on an arm’s-length basis, create the potential for, or could result in, conflicts of interest. See “Major Shareholders and Related Party Transactions—B. Related Party Transactions.”

Technological advances could affect demand for our products and services or require substantial capital expenditures for us to remain competitive.

The development and implementation of new technologies may result in a significant reduction in the costs of the products and services we provide. We cannot predict when new technologies may become available, the rate of acceptance of new technologies by our competitors or the costs associated with such new technologies. Advances in the development of alternatives to the products and services which we currently sell could significantly reduce demand or eliminate the need for them.

For example, the development of alternative products to sugar, ethanol and natural gas may reduce the demand for our products or materially reduce the demand for ethanol or natural gas to be used as a source of energy, and the use of alternative sweeteners may adversely affect the overall demand for sugar in Brazil and abroad, which could have a material adverse effect on our business, financial condition and results of operations.

Any advances in technology which require significant capital expenditures to remain competitive or which otherwise reduce demand for our products and services will have a material adverse effect on our business and financial performance. Any other alternative products or technological advances which reduce demand for the products of our subsidiaries and joint ventures may have a material adverse effect on our results of operations and financial condition.

Any failure of our information technology systems could adversely affect our operating results and make us more susceptible to cyber threats, adversely affecting our business.

We depend on information technology systems for significant elements of our operations, including the storage of data and retrieval of critical business information. Our information technology systems are vulnerable to damage from a variety of sources, including network failures, malicious human acts, and natural disasters. Moreover, despite network security and back-up measures, some of our servers are potentially vulnerable to physical or electronic break-ins, computer viruses, and similar disruptive problems. Failures or significant disruptions to our information technology systems or those used by our third-party service providers could prevent us from conducting our general business operations. Any disruption or loss of information technology systems on which critical aspects of our operations depend could have an adverse effect on our business, results of operations, and financial condition.

Furthermore, we store highly confidential information on our information technology systems, including information related to our products. If our servers or the servers of the third party on which our data is stored are attacked by a physical or electronic break-in, computer virus or other malicious human action, our confidential information could be stolen or destroyed. Any security breach involving the misappropriation, loss or other unauthorized disclosure or use of confidential information of our suppliers, customers, or others, whether by us or a third party, may (i) subject us to civil and criminal penalties; (ii) adversely impact our reputation; and (iii) expose us to liability to our suppliers, customers, other third parties or governmental authorities, among others. Any such developments may adversely affect our business, financial condition and results of operations.

In addition, any failure of our information technology systems to operate effectively or integrate with other systems, or inadequate performance of, or breaches of security regarding, such systems could result in interruptions in the availability of our online resources, delays in delivering products or services and reduced efficiency in our operations. Each of these factors may adversely affect our businesses as well as their financial condition, results of operations and reputation. We also hold certain highly confidential personal and financial data relating to our customers in our information technology systems. Any failures in the information technology systems on which we depend or any breaches resulting in the unauthorized disclosure of the personal or financial data of our customers may adversely affect our business, financial condition, results of operations and reputation.

We were the target of a cybersecurity incident which disrupted our systems, and we could be the target of attempted cyber threats in the future, which could adversely affect our business.

We face various cybersecurity risks, including but not limited to penetration of our information technology systems and platforms by ill-intentioned third parties, infiltration of malware (such as computer viruses) into our systems, contamination (whether intentional or accidental) of our networks and systems by third parties with whom we exchange data, unauthorized access to confidential customer and/or proprietary data by persons inside or outside our organization and cyberattacks causing systems degradation or service unavailability that may result in business losses.

In addition, we may be subject to potential fraud and theft by cybercriminals, who are becoming increasingly sophisticated, seeking to gain unauthorized access to or exploit weaknesses that may exist in our systems. We continuously monitor and develop our networks and information technology infrastructure. We also conduct annual tests to prevent, detect, address and mitigate the risk of unauthorized access, misuse, computer viruses and other events that could have an impact on our security. However, we cannot guarantee that these measures will be effective in protecting us against cyberattacks and other breaches related to our information technology systems. Techniques used to gain unauthorized, improper or illegal access to our systems, our data or our customers’ data, to disable or degrade service, or to sabotage systems, due to constant evolution, can be difficult to detect quickly and are often not known until used on a target. Unauthorized parties may attempt to gain access to our systems or facilities through various means, including, among others, hacking into our systems or those of our customers, partners or vendors, or attempting to fraudulently induce our employees, customers, partners, vendors or other users of our systems to disclose usernames, passwords, financial information or other sensitive information, which may in turn be used to access our information technology systems. Certain efforts by third parties to access our information technology systems may be supported by significant financial and technological resources, making them even more sophisticated and difficult to detect. We have seen in recent years computer systems of businesses and organizations being targeted not only by cyber criminals, but also by rogue activists and states. Cyberattacks can cause the loss of significant amounts of customer data and other confidential information, as well as significant levels of liquid assets (including cash). In addition, cyberattacks could cause the shutdown of our information technology systems, including systems used to service our customers. We may also be subject to the effects of cyberattacks against critical infrastructure in Brazil and other countries in which we operate, and we have limited ability to protect our technology systems against such attacks.

If we fail to effectively manage our cybersecurity risk, for example, by failing to update our systems and processes in response to new threats, this could harm our reputation and adversely affect our operating results, financial condition and prospects through the payment of customer compensation, regulatory penalties and fines and/or the loss of assets. Furthermore, upon a failure to comply with applicable laws and regulations, we may be ordered to change our business practices, policies or systems in a manner that adversely impacts our operating results.

Moreover, critical infrastructures that our information technology systems rely on in Brazil and other countries in which we operate may be the target of cyberattacks, which could negatively affect our ability to service our customers.

Further, we store highly confidential information on our information technology systems, including personal data, financial information, and other types of information related to our products and customers. If our servers or the servers of the third parties on which our data is stored are the subject of a physical or electronic break-in, computer virus or other cyber risks, our confidential information could be stolen, rendered unavailable, devalued or destroyed. Any security breach involving the misappropriation, loss or other unauthorized disclosure or use of confidential information of our suppliers, customers, or others, whether by us or a third party, could (i) subject us to civil and criminal penalties, (ii) have a negative impact on our reputation or (iii) expose us to liability to our suppliers, customers, other third parties or government authorities.

We cannot assure you that our information technology systems will not be attacked in the future, that we will be able to adequately protect the confidential information we maintain. If we are the victim of successful cyberattacks or experience cybersecurity incidents in the future, we could incur substantial costs and suffer other negative consequences, such as remediation costs (liabilities for stolen assets or information or repairs of system damage, among others), increased cybersecurity protection costs, lost revenue from unauthorized use of proprietary information or the failure to retain or attract customers after an attack, as mentioned above, litigation and legal risks, increased insurance, reputational damage affecting the trust of our customers and investors, as well as damage to our competitiveness, stock price, and long-term shareholder value. Any failure by us to adequately protect our information technology systems and the confidential data which we hold could have a material adverse effect on our business, financial condition and results of operations. Importantly, even when a failure or disruption to our systems or facilities is resolved in a timely manner or an attempted cyber incident or other security breach is successfully prevented or thwarted, substantial resources are typically expended to do so, and we may be required to take actions that could negatively affect customer satisfaction or behavior and could pose a threat to our reputation.

On March 11, 2020, our subsidiaries and jointly controlled companies suffered a cyberattack by ransomware that caused a partial and temporary interruption of our operations, as widely disclosed by the Company at that time. Following the incident, we have taken certain additional precautionary measures to reduce cyber risks. We cannot assure you that our security frameworks and measures will be successful in preventing future cyberattacks. In addition, we expect that the cost to obtain cyber liability insurance in the future should we wish to do so (we do not currently have cyber liability insurance) will be higher than they would otherwise have been as a result of this incident.

Any of the above developments could adversely affect our business, as well as its financial condition, results of operations and reputation.

Failure to comply with the Brazilian General Data Protection Law may adversely affect our business.

Until the entry into force of Law No. 13,709/2018, or the Brazilian General Data Protection Law (Lei Geral de Proteção de Dados Pessoais), or the “LGPD,” the processing of personal data in Brazil was regulated by a series of rules scattered throughout legislation such as the Brazilian Federal Constitution, Law No. 8,078/1990, or the Consumer Protection Code, and the Brazilian Civil Framework for the Internet. The LGPD, which came into force on September 18, 2020, regulates practices related to the processing of personal data in Brazil, through a system of rules that impacts all sectors of the economy and establishes, among other measures, protection rights for the holders of personal data. In cases where the processing of personal data is permitted through legal bases, there are obligations and requirements related to information security incidents, such as leakage of personal data and transfer of personal data, as well as sanctions for non-compliance. In addition, the LGPD authorized the creation of the National Data Protection Authority (Autoridade Nacional de Proteção de Dados), or ANPD, which is responsible for developing guidelines and applying administrative sanctions in case of non-compliance with the LGPD. The administrative sanctions provided for in the LGPD (art. 52, 53 and 54), came into effect on August 1, 2021, under Law no. 010/2020; if we are not in compliance with the LGPD, we will be subject to the following sanctions, in isolation or cumulatively: (i) warning, with an indication of the deadline for adopting measures; (ii) fines of up to 2% of the revenue of the group’s last fiscal year, excluding taxes, up to an overall amount of R$50 million per violation; (iii) daily fines up to the limit referred to in item B; (iv) an incident disclosure obligation; (v) temporary blocking and/or deletion of personal data; (vi) partial suspension of the database to which the infraction relates for a period of up to six months, extendable for the same period, until the personal data processing is regularized; (vii) suspension of the exercise of the personal data processing activity to which the infraction relates for a period of up to six months, extendable for the same period; and (viii) partial or total prohibition from exercising activities related to data processing.

In addition to administrative sanctions, failure to comply with any provisions set forth in the LGPD has the following risks: (i) the filing of legal, individual or collective actions seeking compensation for damages arising from violations, based not only on the LGPD, but on sparse and sectorial legislation on current data protection; and (ii) the application of the penalties provided for in the Consumer Protection Code and the Brazilian Civil Framework for the internet by some consumer protection agencies, since they have already acted in this regard, even before the validity of the LGPD and the effective structuring of the ANPD, especially in cases of security incidents that result in breaches of personal data. Therefore, failures in the protection of personal data processed by us as well as failure to comply with the applicable legislation, including those related to cybersecurity incidents and other events of failures in our information technology systems, may result in high fines, disclosure of the incident to the market, elimination of personal data from the base and even suspension of activities, resulting in costs that may have an adverse and negative effect on our reputation, results, the value of our ADSs and our common shares.

Our performance depends on maintaining functioning labor relations with our employees and our compliance with labor laws. Any deterioration of those relations or increase in labor costs could adversely affect our business.

All of our employees are represented by labor unions. Our relationships with these organizations are governed by labor agreements or collective bargaining agreements which we negotiate with labor unions. Upon the expiry of such agreements, we are required to renegotiate new agreements with the applicable labor union. As part of these renegotiations, new terms and conditions may be established. In certain cases, these agreements may not be renewed, which could lead to strikes and/or stoppages in our activities and have an adverse impact on our business, financial condition and results of operations. Furthermore, since the enactment of Law No. 13,467/2017, labor agreements and collective bargaining agreements prevail over certain provisions of labor legislation, as stated in items I to XV, of Article 611-A, of the Consolidation of Brazilian Labor Laws (Consolidação das Leis do Trabalho), such as working time arrangements and the manner in which these are recorded, work breaks, and certain employer-specific internal rules, among others. As a result, employers may expand or reduce certain labor rights, provided this is done pursuant to the terms of labor agreements negotiated with unions and/or individual agreements negotiated with the respective employees.

Failure to comply with, obtain or renew the licenses and permits required for each of the sectors in which we operate may have a material adverse effect on us.

We are required to obtain specific licenses with respect to our terminals from the applicable environmental authorities, which are required in connection with the emission, ejection and emanation of products and by-products resulting from distribution activities. We are also required to obtain specific licenses and permits from governmental authorities for rural producers in order to carry out certain of our operations. Similarly, we are also required to obtain applicable licenses and comply with regulatory obligations for operations involving fuel and energy sectors. The laws and regulations which govern these licenses may occasionally require us to purchase and install costly pollution control equipment or to make operational changes to limit our impact on the environment and/or the health of our employees.

Any failure to comply with the terms of such laws, regulations and licenses and permits may result in significant financial penalties, criminal sanctions, revocation of operating licenses and permits, and/or the prohibition of certain of our activities. In addition, we may not be able to renew licenses that are currently in effect or obtain new licenses necessary to operate new ventures, which could affect our results or impact the development of our business plans, growth and expansion.

Contamination of our products and other related risks could adversely affect our reputation, leading to judicial and administrative proceedings and/or resulting in the closure of our production facilities.

Certain of our products may have adverse effects on consumers (including certain components, raw materials and supplies used to produce these products), including as a result of product contamination or subsequent errors in the production or distribution chain. Contamination of any of our products may result in a need for recalls or the beginning of legal and administrative proceedings against us, which may adversely affect our reputation, our business, the operation of our production facilities, our financial condition and our operating results. Any damage to our reputation could have a material adverse effect on us.

We are exposed to the possibility of losses related to natural disasters, catastrophes, accidents, fire, political, social and economic events and other events not in our control, which may have a material adverse effect on our business, financial conditions and results of operations.

Our operations are subject to certain risks that affect our properties, facilities, permanent passageways, rail banks and inventory, including, among others, fire, which may destroy machinery, equipment and facilities as well as client cargo being transported, explosions, fuel leaks and other flammable products as well as other environmental events, cargo loss or damage to railroads or cargo loading and unloading terminals, accidents, business interruptions due to political, social or economic events (whether local or international), civil unrest or other conflicts, labor claims, demonstrations by social and/or environmental groups or associations, strikes or work stoppages (of our own employees or of those linked to entities with which we have a relationship, such as port operators) disease outbreaks, pests, adverse weather conditions, and natural disasters, such as floods, may result in the loss of revenues, assumption of liabilities or cost increases. We are also subject to stoppages and blockades of highways and other public roads. Stoppages and blockages of highways and other public roads may adversely affect our business and results. Moreover, our operations may be periodically affected by crop shortfalls, landslides and other natural disasters.

Our transportation and handling of cargo exposes us to risks relating to catastrophes, mechanical and electrical failures, collisions and loss of assets. A portion of our freight activities involves petroleum products and other flammable materials, and the presence of such products may aggravate the effects of any catastrophe.

As our insurance does not cover all potential risks and losses we may incur, the occurrence of a natural disaster of large proportions, catastrophes, cyberattacks, pandemics, mechanical failures, loss of assets or any other of the events referred to above, and any resulting damage to our business, may have a material adverse effect on our business, operating results and financial condition, including as a result of civil, administrative and/or criminal sanctions relating to environmental liability.

We are exposed to credit and other counterparty risks of our customers in the ordinary course of our business.

We have various credit terms with various types of customers, including fuel distributors, wholesalers, retailers, trading companies and consumers of the energy which we generate or trade. Our customers have varying degrees of creditworthiness and are subject to different rules and regulations, which exposes us to the risk of nonpayment or other default under our contracts and other arrangements with them. In the event that a significant number of material customers default on their payment obligations, our cash flows, could be materially and adversely affected.

We are subject to restrictive covenants under our financing agreements.

We are subject to certain restrictive covenants based on certain financial and non-financial indicators which are set forth in the majority of the indebtedness and finance agreements to which we are a party. The majority of such covenants relate to requirements to comply with certain predetermined levels of leverage. A failure by us to comply with the restrictive covenants in our credit agreements as a result of adverse conditions in our business environment may trigger the acceleration of part of our indebtedness, limit our access to new credit facilities and adversely affect our business.

Failure to work within our financial framework could impact our ability to operate and result in financial loss.

Failure to accurately forecast or work within our financial framework could impact our ability to operate and result in financial loss. Trade and other receivables, including overdue receivables, may not be recovered, divestments may not be successfully completed and a substantial and unexpected cash call or funding request could disrupt our financial framework or overwhelm our ability to meet our obligations. An event such as a significant operational incident, legal proceedings or a geopolitical event in an area where we have significant activities, could reduce our financial liquidity and our credit ratings. Credit rating downgrades could potentially increase financing costs and limit access to financing or engagement in our trading activities on acceptable terms, which could put pressure on the group’s liquidity. In the event of extended constraints on our ability to obtain financing, we could be required to reduce capital expenditure or increase asset disposals in order to provide additional liquidity.

We may raise additional capital in the future, including by issuing securities, which may result in a potential dilution of equity investors’ stake in our shares, or by taking on additional indebtedness.

We may need additional funds in the future to implement our business strategy and may choose to raise them through the public or private placement of shares and/or other securities convertible or exchangeable into shares. Any such issuance of our securities may result in a decrease in the price of our common shares and/or ADSs and dilute our existing shareholders’ interests in our share capital. The raising of additional funds by means of the issuance of shares or securities convertible into shares may, under the terms of the Brazilian Corporation Law, be made to the exclusion of the preemptive rights of its shareholders, including investors in our shares, and may therefore dilute the financial investment of investors. We may also opt to raise additional capital by taking on additional indebtedness, which may require us to expend a significant additional portion of our cash flow on servicing indebtedness.