March 25, 2014

VIA EDGAR AND ELECTRONIC MAIL

Daniel F. Duchovny, Esq.

Special Counsel

Office of Mergers and Acquisitions

United States Securities and Exchange Commission

Division of Corporation Finance

Mail Stop 3628

100 F Street, N.E.

Washington, D.C. 20549

| | Re: | Sensient Technologies Corporation |

| | Definitive Additional Soliciting Materials |

| | Filed By FrontFour Capital Group LLC et. al |

Dear Mr. Duchovny:

We acknowledge receipt of the comment letter of the Staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) dated March 21, 2014 (the “Staff Letter”) with regard to the above-referenced matter filed on March 19, 2014 (the “FrontFour Letter”). We have reviewed the Staff Letter with our client, FrontFour Capital Group LLC (together with its affiliates, “FrontFour”), and we provide the following responses on FrontFour’s behalf. For ease of reference, the comments in the Staff Letter are reproduced in italicized form below. Terms that are not otherwise defined have the meanings ascribed to them in the FrontFour Letter.

| 1. | Each statement or assertion of opinion or belief must be clearly characterized as such, and a reasonable factual basis must exist for each such opinion or belief. Support for opinions or beliefs should be self-evident, disclosed in the proxy statement or provided to the staff on a supplemental basis. We note the following examples that must be supported: |

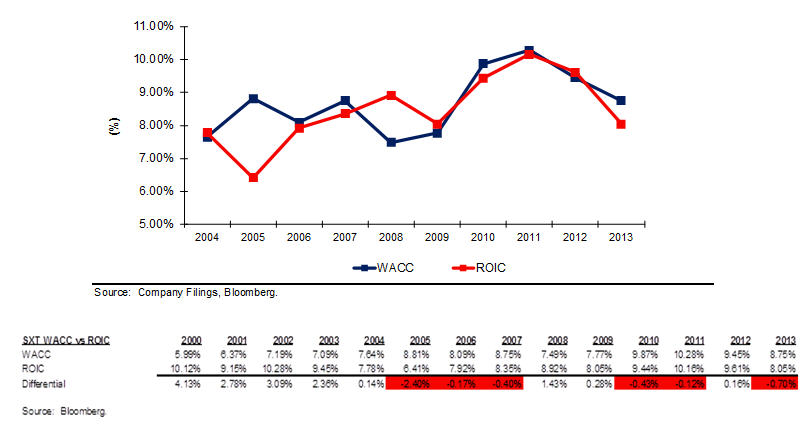

| | · | that the company has failed to earn its cost of capital in 6 out of the last 10 years. |

FrontFour acknowledges the Staff’s comment and provides the following charts below demonstrating that the Company has failed to earn its cost of capital in 6 out of the last 10 years, specifically in 2005, 2006, 2007, 2010, 2011 and 2013. As shown below, the Company’s return on invested capital (ROIC) in each of these years was below its weighted average cost of capital (WACC).