FrontFour refers the Staff to its public letter to the Chairman and CEO of OM Group, dated January 9, 2015 and filed with the Commission on the same date (the “January 9 Letter”). The January 9 Letter provides detailed support for FrontFour’s opinion that OM Group could capitalize on the following strategic opportunities available to it: (i) realization of a cost-cutting opportunity of at least $50 million, (ii) the release of $30 million in working capital and (iii) a $250 million stock buyback.

FrontFour believes that OM Group’s margins are uncompetitive versus its peers as a result of excessive corporate overhead, inefficient operations, stranded costs from divestitures, acquisitions which were not properly integrated and excessive management compensation. FrontFour therefore estimates that $50 million in cost reduction can be achieved as a result of SG&A reduction, improved operations, and direct and indirect cost rationalization.

Furthermore, OM Group’s working capital as a percentage of sales in 3Q2014 was 32.7%, which is higher than management’s internal target of the high 20s%. It is also significantly higher than its peer group, whose working capital to sales average over the past 5 years is better by a staggering ~900 basis points. FrontFour’s due diligence leads to the conclusion that a minimum of $30 million of excess cash via working capital can potentially be released through improved working capital management.

Lastly, with OM Group’s low capex requirements and attractive free cash flow characteristics, FrontFour believes OM Group can comfortably return capital to shareholders while preserving strategic flexibility and ample liquidity. A properly implemented share repurchase program of $250 million would reduce OM Group’s current shares outstanding by approximately 25%, be significantly accretive to earnings and would allow OM Group to maintain a leverage profile below 1.3x. It is important to note that given OM Group’s cash flow generation, OM Group would quickly reduce leverage from this level.

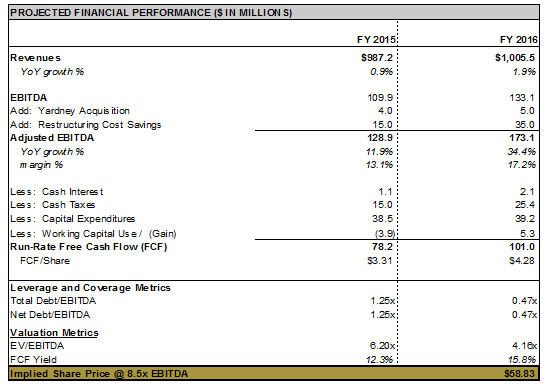

The January 9 Letter elaborates further on each of the points summarized above and provides the following quantitive analysis which demonstrates that if the above-outlined strategic initiatives are successfully implemented, then by FrontFour’s calculations, OM Group’s share price should increase to $58.83 per share through the end of FY2016.

Key Modeling Assumptions:

| | · | $250 million share repurchase program @ $33.00 to be completed in 2015 |

| | · | $50 million of run-rate cost savings realized by 2016; $15 million recognized in 2015 with remainder in 2016 |

| | · | $30 million of cash costs incurred to implement restructuring |

| | · | Working capital reduction of $30 million realized through 2016 |

| | · | Valuation multiple of 8.5x EBITDA which represents midpoint of estimated target range |

| | · | Corporate tax rate of 25% |

| | · | Capital expenditures at 4% of sales |

* * * * *

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments. Thank you for your assistance.

| Sincerely, |

| |

/s/ Steve Wolosky |

| |

|

| cc: | David A Lorber, FrontFour Capital Group LLC |

| | Aneliya S. Crawford, Olshan Frome Wolosky LLP |

ACKNOWLEDGMENT

In connection with responding to the comments of the Staff of the Securities and Exchange Commission (the “Commission”) relating to the soliciting materials on Schedule 14A filed by the undersigned on January 28, 2015 (the “Filing”), each of the undersigned acknowledges the following:

| | · | Each of the undersigned is responsible for the adequacy and accuracy of the disclosure in the Filing. |

| | · | The Staff’s comments or changes to disclosure in response to Staff comments in the Filing do not foreclose the Commission from taking any action with respect to the Filing. |

| | · | The undersigned may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

| | FrontFour Master Fund, Ltd. |

| | |

| | By: | FrontFour Capital Group LLC as Investment Manager |

| | |

| | By: | /s/ David A. Lorber |

| | | Name: | David A. Lorber |

| | | Title: | Managing Member |

| | FrontFour Capital Group LLC |

| | |

| | By: | /s/ David A. Lorber |

| | | Name: | David A. Lorber |

| | | Title: | Managing Member |

| | FrontFour Opportunity Fund |

| | | |

| | By: | FrontFour Capital Corp. as Investment Manager |

| | |

| | By: | /s/ David A. Lorber |

| | | Name: | David A. Lorber |

| | | Title: | Authorized Signatory |

| | FrontFour Capital Corp. |

| | |

| | By: | /s/ David A. Lorber |

| | | Name: | David A. Lorber |

| | | Title: | Authorized Signatory |

| | /s/ David A. Lorber |

| | DAVID A. LORBER Individually and as attorney-in-fact for Thomas R. Miklich and Allen A. Spizzo |

| | /s/ Stephen E. Loukas |

| | STEPHEN E. LOUKAS |

| | /s/ Zachary R. George |

| | ZACHARY R. GEORGE |