UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| T | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year endedMarch 31, 2013 |

| | |

| £ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:000-53167

American Sands Energy Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 87-0405708 |

| (State or other jurisdiction of incorporation or organization) | (IRS employer identification number) |

| | |

| 4760 S. Highland Dr., Suite 341, Salt Lake City, Utah | 84117 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(801) 699-3966

Securities registered pursuant to Section 12(b) of the Act:None

Securities registered pursuant to Section 12(g) of the Act:Common Stock, Par Value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes £ No T

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes T No £

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes T No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes T No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.£

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | £ | Accelerated filer | £ |

| | Non-accelerated filer | £ | Smaller reporting company | T |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes £ No T

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of the last business day of the registrant’s most recently completed fiscal quarter was $5,985,081.

The number of shares outstanding of the registrant’s common stock on July 9, 2013, was 28,990,715.

DOCUMENTS INCORPORATED BY REFERENCE

| Document Description | | 10-K Part |

| Portions of the Registrant's proxy or information statement related to its 2012 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A or 14C within 120 days after Registrant's fiscal year end of March 31, 2013 are incorporated by reference into Part III of this Report. | | III |

Table of Contents

| | | Page |

| PART I | |

| | | |

| | ITEM 1. BUSINESS | 4 |

| | | |

| | ITEM 1A. RISK FACTORS | 11 |

| | | |

| | ITEM 1B. UNRESOLVED STAFF COMMENTS | 21 |

| | | |

| | ITEM 2. PROPERTIES | 21 |

| | | |

| | ITEM 3. LEGAL PROCEEDINGS | 23 |

| | | |

| | ITEM 4. MINE SAFETY DISCLOSURES | 23 |

| | | |

| PART II | |

| | | |

| | ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 24 |

| | | |

| | ITEM 6. SELECTED FINANCIAL DATA | 24 |

| | | |

| | ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 25 |

| | | |

| | ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 27 |

| | | |

| | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 27 |

| | | |

| | ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 27 |

| | | |

| | ITEM 9A. CONTROLS AND PROCEDURES | 28 |

| | | |

| | ITEM 9B. OTHER INFORMATION | 28 |

| | | |

| PART III | |

| | | |

| | ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 29 |

| | | |

| | ITEM 11. EXECUTIVE COMPENSATION | 29 |

| | | |

| | ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 29 |

| | | |

| | ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 29 |

| | | |

| | ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 29 |

| | | |

| PART IV | |

| | | |

| | ITEM 15. EXHIBITS, FINANCIAL STATEMENTS, SCHEDULES | 30 |

| | | |

| | SIGNATURES | 33 |

Forward-Looking Statements

The statements contained in this annual report on Form 10-K that are not historical facts represent management’s beliefs and assumptions based on currently available information andconstitute “forward-looking statements.” All statements, other than statements of historical or present facts, including the information concerning our future operations, business strategies, need for financing, competitive position, potential growth opportunities, ability to retain and recruit personnel, the effects of competition and the effects of future legislation or regulations are forward-looking statements. Forward-looking statements can be identified by the use of forward-looking terminology such as the words “believes,” “intends,” “may,” “should,” “anticipates,” “expects,” “could,” “plans,” or comparable terminology or by discussions of strategy or trends. Although we believe that the expectations reflected in such forward-looking statements are reasonable, such statements by their nature involve risks and uncertainties that could significantly affect expected results, and actual future results could differ materially from those described in such forward-looking statements.

Among the factors that could cause actual future results to differ materially are the risks and uncertainties discussed in this report. While it is not possible to identify all factors, we continue to face many risks and uncertainties including, but not limited to, changes in the general economic environment; a downturn in the securities markets; and/or uncertainties associated with our ability to obtain operating capital. Should our underlying assumptions prove incorrect or the consequences of the aforementioned risks worsen, actual results could differ materially from those expected. We disclaim any intention or obligation to update publicly or revise such statements whether as a result of new information, future events or otherwise.

Throughout this report, unless otherwise designated, the terms “we,” “us,” “our,” “the Company” and “our company” refer to American Sands Energy Corp., a Delaware corporation, and its wholly owned subsidiary, Green River Resources, Inc., a Utah corporation.

PART I

ITEM 1. Business

Overview

American Sands Energy Corp. (“ASEC”) is a development stage company that proposes to engage in the clean extraction of bitumen from oil sands prevalent in the Mountain West region of North America using proprietary technology. Since the project’s inception, we have been engaged in the business of acquiring and developing oil sand assets and technologies used to separate the oil contained in oil sands. The Company anticipates that its primary operations will include the mining of oil sands, the separation of oil products therefrom and the sale of oil and oil by-products.

We have obtained a license for a hydrocarbon extraction process that separates oil and other hydrocarbons from sand, shale, dirt and other substances, without leaving behind toxins or other contaminants. We are currently developing our first project on certain hydrocarbon and mineral leases which cover approximately 1,760 acres near Sunnyside, Utah (the “Sunnyside Project”). In accordance with the standards contained in Rule 4-10(a) of the SEC’s Regulation S-X, these leases contain no proven reserves of oil or gas. However, we have obtained an independent Resource Audit and Classification report dated May 29, 2009, from a major international geology and mining consulting firm describing the quantity and quality of the bitumen resource estimated to be located on our leases.

To date, we have acquired extensive bitumen resources, have successfully operated a pilot using our process technology on oil sands ore from our bitumen resources and have initiated applications for mining, environmental and other permits required to build a commercial plant (the “Commercial Facility”). Additional work to be completed as part of the project development phase includes:

| | 1. | Final mine planning and civil engineering for the Sunnyside Project. |

| | 2. | Acquisition of additional property in areas of interest in order to block-up properties into logical and economical mining units. |

| | 3. | Determination of technical and economic parameters for the commercial scale use of the process, including engineering. |

| | 4. | Preparation and receipt of federal and state regulatory agency approval for the Commercial Facility. |

| | 5. | Completion of environmental and permitting work for the Commercial Facility. |

| | | |

Contemporaneously with the pursuit of the permitting of the project, we will also finalize engineering and equipment for a 5,000 barrel per day plant. We initially retained a leading engineering firm in the North American oil sands extraction industry, AMEC BDR Limited, to complete an engineering and feasibility study with respect to a commercial plant that would produce up to 3,000 barrels of oil per day. We also engaged a mining engineering firm to prepare a mine plan and feasibility study. We also retained an engineering firm to demonstrate the technology through a new pilot plant. The pilot test runs were successful, removing in excess of 99% of the bitumen from the sand and leaving less than the two parts per million (“ppm”) of solvent in the sand. This means that the sand is suitable to be put back into the environment without tailing ponds or other environmental restrictions. Based on additional findings from the recent pilot tests and recommendations from our mining engineers, we are also proposing to expand the size of the initial Commercial Facility from the 3,000 barrels per day proposed in the AMEC BDR study, to 5,000 barrels per day (“bbl/d”). We have also retained an environmental engineering and consulting firm to assist us in preparing and filing the necessary mine and environmental permits to operate a large mine. Based on the information from our consultants, we believe that additional financing of approximately $70 million will be required to procure and install the necessary equipment to begin operations of a plant that we believe will produce approximately 5,000 barrels per day of bitumen.

We have performed lab and pilot plant tests on oil sands from the Utah Green River Formation in which the Sunnyside Project is located to prove the viability of the technology and to understand several key elements in the process. Initial pilot plant test runs were conducted in 2006-2007. We hired AMEC BDR, to witness the initial pilot plant tests and to manage the lab work and review the results. In addition to the initial pilot test, we have run pilot tests on a new system designed by SRS Engineering International during July through September of 2012, and May through June of 2013. In connection with those tests, we ran oil sands from Utah and Africa to acquire additional information on the efficiency of the solvent in removing the bitumen from the sand, the recovery of solvent from the bitumen and sand, and the overall efficiency and energy use of the system. The current test results are summarized as follows:

| · | Virtually all of the bitumen was separated from the sand, leaving the sand “oil” free. |

| · | The compositional characteristics of the bitumen were not altered by the process; therefore, management believes the bitumen will be suitable for upgrading and refining to saleable products by conventional refining technology. |

| · | The sand product contained less than 2 ppm of solvent residue, presents no environmental liability, and can be returned to the mine site or sold. |

| · | Solvent losses to the bitumen product were insignificant. Consequently, because the solvent is recycled with minimal loss in a closed loop system, make-up solvent costs should be minimal. |

| · | The composition and properties of the solvent recovered by the process were not altered by the process; therefore, the solvent should be recycled through the process without further conditioning or processing. |

Based on the pilot test results and recommendations from our mining engineer and SRS Engineering, we have evaluated the feasibility and costs of scaling the process into a plant that will initially process up to 5,000 barrels per day, with possible future expansion of facilities of up to 50,000 barrels per day,subject to market conditions and the availability of financing on terms acceptable to us.

Our pilot test also confirms lab tests that our process works on oil sands from other locations in the world. This may allow us to use our process in other locations around the world where other “oil wet” oil sands are located.

We anticipate initially that our entire estimated output of 5,000 barrels per day will be delivered to refineries located in the Salt Lake City area with one to two refiners as our customer(s). As we develop new facilities with a view to expanding production to 50,000 bbl/d, we will evaluate supplying product to multiple refineries and more distant locations versus Salt Lake City, based on price and transportation costs.

Historical Development of the Company

We were originally incorporated in the State of Utah on April 7, 1983, as Carbon Technologies, Inc. for the purpose of engaging in the carbon fiber technology business. Subsequently, we became inactive and in 2005 we changed our corporate domicile to the State of Nevada and our name to Millstream Ventures, Inc. On October 19, 2011, we again changed the name of the Company to American Sands Energy Corp. and changed the domicile of the Company to the State of Delaware. In 2011, we actively began the search for a new business venture. On June 3, 2011, we completed a reverse acquisition transaction with Green River Resources Corp., a Canadian company formed in 2004 (“GRC”) and its wholly owned subsidiary, Green River Resources, Inc., a Utah corporation formed in 2005 (“GRI”). Pursuant to certain leases, these entities held undivided interests in mining properties for oil sand extraction covering approximately 1,760 acres. GRI had also entered into an operating agreement with an affiliate to provide rights to a proprietary process to extract bitumen from oil sands.

On October 18, 2011, we effected a reverse split of all outstanding shares of common stock at the rate of one share for each two shares outstanding. As a result of the reverse stock split, the number of shares outstanding on the effective date of the reverse split was reduced from 44,104,325 to 22,052,163. Unless otherwise stated herein, the number of shares designated in this annual report gives effect to this reverse split.

Reverse Acquisition

In early April 2011, in contemplation of a reverse acquisition transaction and to provide funding for the search for a new business venture, we sold 6,770,000 restricted shares of our common stock to LIFE Power & Fuels, Inc. (“LIFE”) for gross proceeds of $13,540. These shares represented approximately 39% of our outstanding common stock at the time. We also appointed Edward P. Mooney and Daniel F. Carlson, affiliates of LIFE, as directors. Subsequently in mid April 2011 we completed a second non-public offering of 1,755,062 restricted shares of our common stock for gross proceeds of $100,004 to satisfy our outstanding liabilities at the closing of the reverse acquisition transaction (including $78,053 to repay outstanding promissory notes, $17,500 for legal fees, and $1,414 for transfer agent fees) and to retire certain outstanding shares of common stock at the closing.

In late April 2011, we commenced negotiations with William C. Gibbs as a principal of GRC in order to provide access to funding for the planned operations of GRI. On May 5, 2011, we entered into a Stock Exchange Agreement dated April 29, 2011, as amended on June 3, 2011, with GRC, and the shareholders of such entity (the “Sellers”). Pursuant to the terms of the agreement we agreed to issue shares of our common stock to the Sellers in exchange for all of the outstanding equity securities of GRC. In addition, we agreed to reserve shares of our common stock for issuance upon exercise of outstanding special warrants of GRC assumed by us at closing (the “Special Warrants”), upon exercise of outstanding bridge warrants assumed by us at closing, and for conversion of an outstanding promissory note of GRC also assumed by us at closing. Subsequently on December 6, 2011, we effected a mandatory exercise of the Special Warrants and issued 5,624,752 shares to all of the holders of the GRC Special Warrants.

Closing of the Stock Exchange Agreement was held on June 3, 2011. At the closing we issued 11,334,646 shares of common stock to the Sellers in exchange for all of the outstanding shares of GRC. We also acquired and cancelled 8,804,102 shares of outstanding common stock held by a single shareholder and former principal of our company for $17,436. As a result of the closing, the Sellers obtained approximately 56% of the outstanding stock of the Company. We also assumed a 6% convertible promissory note payable in the amount of $214,281 to Bleeding Rock LLC (“Bleeding Rock”), an entity managed by William C. Gibbs and the majority shareholder of GRC. On July 15, 2013, the promissory note was amended effective retroactive to January 1, 2013, to provide that interest on the note ceased on December 31, 2012, and that the note and accrued interest thereon are convertible at our option into 535,704 shares of our common stock, in which event we have agreed to pay a cash amount equal to the amount of tax liability incurred by the holder. We further assumed outstanding warrants of GRC which grant the right to purchase up to244,420 common shares at $0.40 per share. These warrants expire on March 31, 2013.Management at the time resigned and William C. Gibbs and Mark F. Lindsey were appointed to replace them. We also subsequently appointed Gayle McKeachnie and Barry Larson as directors shortly following the closing. We also granted options to purchase 3,087,500 shares of common stock at $0.40 per share to persons designated by GRC and issued warrants to purchase 231,920 shares of common stock at the price of our next offering to persons designated by GRC. Of these options granted, 1,974,000 were granted to Mr. Gibbs, 875,000 were granted to Mr. Gereluk, who became our Chief Operating Officer at closing, 50,000 were granted to Mr. Larsen, 75,000 were granted to Mr. Lindsey, and 37,500 were granted to Mr. McKeachnie. The options expire seven years from the date of grant and the warrants expire two years from the date of issuance. Based on the reverse merger transaction, the public company is no longer considered to be a shell company.

Prior to the closing we commenced a non-public offering of 10% convertible promissory notes (the “Notes”) and warrants exercisable through April 30, 2014 (the “Warrants”) to raise operating funds for GRI. At the closing we received approximately $770,000 in funding from this offering. The offering continued after the closing and was completed on January 31, 2012. The Notes bear interest at the rate of 10% per annum. Principal and interest on the Notes will be due and payable on or before April 30, 2014. The Notes may be prepaid by the Company upon 30 days’ prior notice, are convertible at $0.50 per share, and are subject to mandatory conversion by us upon completion of a debt or equity financing of $10,000,000 or more. The Warrants are exercisable in whole or in part at any time through April 30, 2014, at $0.50 per share. In the aggregate, we issued Notes in the total amount of $1,515,000 which are convertible into 3,030,000 shares of common stock of the Company, and Warrants to purchase a total of 3,038,667 common shares. None of these securities were or will be registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Dissolution of GRC

On December 31, 2011, GRC was voluntarily dissolved and the Company assumed all of the outstanding stock of GRI, which was the sole asset of GRC at the time of dissolution. GRI is the principal operating entity for the Company and holds the Company’s mining claims. As a result of the dissolution of GRC, GRI is now the sole subsidiary of, and is wholly owned by ASEC.

License, Development and Engineering Agreement and Termination of Operating Agreement

Effective January 24, 2012, we entered into a License, Development and Engineering Agreement with Universal Oil Recovery Corp. and SRS International (the “License Agreement”) whereby we were granted an exclusive non-transferable license to use certain technology in our proposed business to extract bitumen from oil sands. The territory covered by the License Agreement includes the State of Utah and any other geographic location in which a future designated project is commenced by or through the Company. In conjunction with the License Agreement, we terminated our operating agreement with Bleeding Rock under which Bleeding Rock had licensed rights to use similar technology to GRI. The License Agreement also designates the Company as an “authorized agent” in representing the owner of the technology in future projects. William C. Gibbs, the Chief Executive Officer, a director, and principal shareholder of the Company, is an owner and manager of Bleeding Rock.

The License Agreement requires the licensing parties to provide demonstration equipment for the process by which their proprietary solvent extracts bitumen from oil sands and to demonstrate the process on up to 150 tons of oil sands. The term of the License Agreement is for 20 years and so long thereafter as production of products using the technology is commercially and economically feasible.

Upon successful completion of the demonstration project, the Company and the owners of the technology have agreed to enter into a project development agreement whereby the Company and such owners will engineer, design and construct a facility capable of processing up to 5,000 barrels per day of bitumen from oil sand ore.

The owners of the technology may terminate the License Agreement if the Company fails to use commercially reasonable efforts to develop its oil sands projects. The Company may terminate the agreement if the technology owners breach any of their obligations under the agreement, including representations that the solvent is suitable for the Company’s Sunnyside Project, or if the demonstration project is unsuccessful.

In conjunction with entering into the License Agreement, we also entered into a Termination Agreement dated January 24, 2012, with Bleeding Rock (the “Termination Agreement”). The purpose of the Termination Agreement was to terminate the Operating Agreement dated May 31, 2005, as amended, between Bleeding Rock and GRI (the “Operating Agreement”). Pursuant to the Operating Agreement GRI had obtained the rights through Bleeding Rock to utilize a process for the development, engineering and extraction of hydrocarbons from oil sands. In light of conversations with potential investors, management determined that having the technology licensed directly to the Company rather than through Bleeding Rock would be beneficial to fund raising prospects. As a result, the Company entered into the License Agreement described above. In partial consideration for Bleeding Rock agreeing to terminate the Operating Agreement, we entered into a royalty agreement with Bleeding Rock. Under the terms of the Gross Royalty Agreement we are obligated to pay a royalty equal to 1.5% of the gross receipts from future projects using the technology, excluding the current project in Sunnyside, Utah. Bleeding Rock subsequently assigned all of its interest in the Gross Royalty Agreement to Hidden Peak Partners LC (“Hidden Peak”), an entity managed and partially owned by Mr. Gibbs. The Termination Agreement also contains mutual releases by the parties relating to the Operating Agreement.

As of the date of the Termination Agreement, GRI owed $1,446,551 to Bleeding Rock payable under the terms of the Operating Agreement. In connection with the termination of the Operating Agreement, GRI issued a 5% convertible promissory note to Bleeding Rock for this amount. The note was due and payable on April 30, 2014, , and is convertible into shares of our common stock any time before maturity at the rate of one share for each $0.50 of principal or interest converted. Under the terms of the promissory note, GRI is solely responsible for the repayment of the note. Bleeding Rock subsequently assigned all of its interest in this promissory note to Hidden Peak. On July 15, 2013, the promissory note was amended to provide that it is due and payable at the earlier of April 30, 2014, or the date on which we raise not less than $10,000,000. In accordance with the terms of the amendment, interest on the note ceased on December 31, 2012. Further to the amendment, we shall have the option to convert the note into shares of our common stock on the maturity date at the rate of one share for each $0.50 of principal and accrued but unpaid interest thereon, in which event we have agreed to pay a cash amount equal to the amount of tax liability incurred by the holder.

Amended Employment Agreements

On July 15, 2013, the Board of Directors approved amendments dated May 15, 2013, to certain employment and management agreements as disclosed below:

| · | Effective December 31, 2013, the annual salary of Mr. Gibbs, our CEO, was reduced to $276,000 until we complete one or more debt or equity financings in an aggregate amount of $10,000,000, at which point it will increase to $400,000 per annum. This salary will accrue until we complete an offering of at least $2,000,000, after which we will pay four months of the accrued salary and will pay the balance of the accrued salary in equal monthly installments. The accrued salary is convertible into debt or equity securities upon the same terms in a financing of $5,000,000 or more. The accrued salary for calendar year 2012 is payable upon close of a financing of at least $2,000,000 and unpaid expenses incurred prior to May 1, 2013, shall be reimbursed to Mr. Gibbs upon a financing of at least $500,000. The outstanding salary payable to Mr. Gibbs at December 31, 2012, will stop accruing interest as of January 1, 2013, and will be automatically convertible into common stock at $0.50 per share upon completion of a financing of at least $10,000,000, in which event we have agreed to pay a cash amount equal to the amount of tax liability incurred by Mr. Gibbs. |

| · | Effective January 1, 2013, any amounts then accrued and payable to LIFE Power & Fuels, LLC were reduced to $200,000. In addition, the monthly fee payable under our agreement with LIFE was reduced to $5,000 until Mr. Carlson, our CFO, is no longer employed by us, at which time the monthly fee will increase to $25,000. The monthly fee will accrue until we complete a financing of at least $10,000,000, at which time the accrued amount will convert into debt or equity instruments under the same terms as the financing. |

Also on July 15, 2013, the Board of Directors approved an amendment and restatement dated May 15, 2013, of our employment agreement with Mr. Carlson, our CFO. The effective date of the amended and restated agreement is January 1, 2013 and it will expire on December 31, 2014. Under the terms of the amended and restated agreement, we have agreed to pay him an annual salary of $175,000 which will accrue until we complete a financing of at least $2,000,000, at which time four months of the accrued salary will be paid in equal monthly payments and the balance will be converted into debt or equity instruments under the same terms as a $5,000,000 financing completed prior to the $2,000,000 financing.

Business of GRI

Leases and Resources

Of the 24 states in the United States that contain oil sand deposits, approximately 90% of the USGS mapped mineable resource is located in Utah, where in excess of 25 billion barrels of oil are in place. There are eleven oil sands deposit areas located in Utah. The seven major areas are Sunnyside, P. R. Spring, Asphalt Ridge, White Rocks, Tar Sand Triangle, Circle Cliffs, and Hill Creek. Three of these seven areas, Tar Sand Triangle, Circle Cliffs, and Hill Creek, have substantial constraints to resource development including environmental drawbacks related to their location on Indian Reservations and/or National Parks, significant overburden, lack of rich ore, and high sulfur content. The prime oil sand properties include Sunnyside, P. R. Spring, Asphalt Ridge and White Rocks.

We have obtained leases in the Sunnyside area, on private property. We currently hold an undivided 60% interest pursuant to two freehold hydrocarbon and mineral lease agreements in Section 2, East Half and North West quarters of Section 3 Township 14 South, Range 14 East, SLM containing approximately 1,120 acres; and an undivided 21.67% interest pursuant to two further freehold hydrocarbon and mineral lease agreements in the North West quarter of Section 3, East half and North West quarter of Section 10, Township 14, Range 14 East, SLM containing approximately 640 acres, pursuant to which we have the right to extract bitumen from the land. The leases are for a primary term ending December 31, 2016, and are extended thereafter for so long as an average of 500 barrels of oil is produced per day, subject to certain acceptable interruptions.

We have reviewed previous resource estimates prepared for Chevron and Amoco, as well as USGS estimates of mineable oil sands on our leases. In addition, we retained an outside firm to provide us with a Resource Audit and Classification report which was done in accordance with the provisions of the National Instrument 51-101Standards of Disclosure for Oil and Gas Activities (“NI 51-101”). In accordance with the standards contained in Rule 4-10(a) of the SEC’s Regulation S-X, these leases contain no proven reserves of oil or gas. However, we have obtained an independent Resource Audit and Classification report from a major international geology and mining consulting firm describing the quantity and quality of the bitumen resource estimated to be located on our leases as of May 29, 2009. The Resource Audit and Classification was completed in accordance with the provisions of the NI 51-101. Such evaluation of our estimates of resources under NI 51-101 was carried out in accordance with the standards set out in the Canadian Oil and Gas Evaluation (“COGE”) Handbook, prepared jointly by the Society of Petroleum Evaluation Engineers and the Canadian Institute of Mining, Metallurgy & Petroleum. Those standards require that the evaluator plan and perform an evaluation to obtain reasonable assurance as to whether the reserves are free of material misstatement. An evaluation must also include an assessment as to whether the reserves data are in accordance with the principles and definitions presented in the COGE Handbook. The estimate provided in this report is classified as contingent resources according to the guidelines set forth in NI 51-101 and COGE. The project resource calculation is contingent upon completion of additional exploration drilling, processing and extraction analysis, detailed economic analysis, evolution of legal mining rights, and environmental evaluations. There is no certainty that the project will be commercially viable to produce any portion of the resource. As a result of the differences between the U.S. rules and Canadian standards governing disclosure of reserve or resource estimates, differing estimates of reserves or resources available under our leases are reported, and may in the future be reported, between our website and our periodic reports filed with the SEC.

The practice of preparing production and reserve quantities data under NI 51-101 differs from the U.S. rules. The primary differences between the two reporting requirements include: (i) NI 51-101 requires disclosure of proved and probable reserves and the U.S. rules require disclosure of only proved reserves; (ii) NI 51-101 requires the use of forecast prices in the estimation of reserves and the U.S. rules require the use of 12-month average prices which are held constant; (iii) NI 51-101 requires disclosure of reserves on a gross (before royalties) and net (after royalties) basis and the U.S. rules require disclosure on a net (after royalties) basis; (iv) the Canadian standards require disclosure of production on a gross (before royalties) basis and the U.S. rules require disclosure on a net (after royalties) basis; and (v) NI 51-101 requires that reserves and other data be reported on a more granular product type basis than required by the U.S. rules.

Our Process

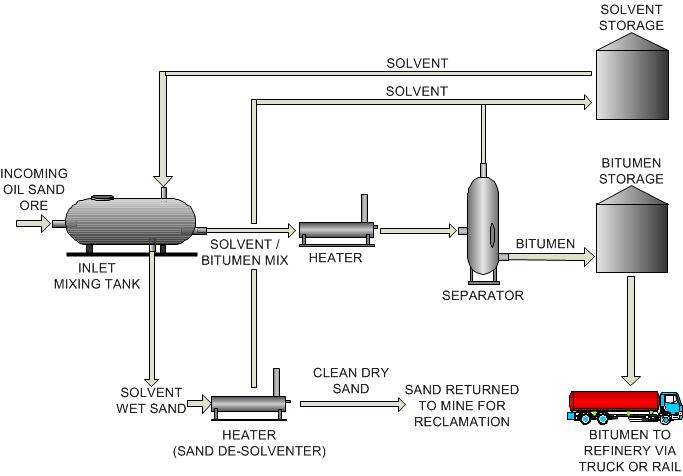

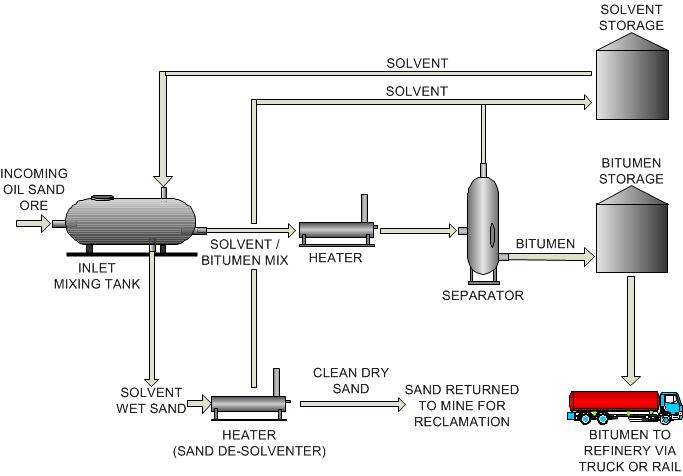

The following diagram demonstrates the stages of the process to remove bitumen from the oil sands using our proprietary bitumen recovery system:

Our process starts with the mixing of oil sand ore with a proprietary solvent. The solvent immediately separates the hydrocarbons contained in the ore from the inorganic insoluble material such as sand, rock and clay. We utilize much less heat than traditional or competing technologies.

The liquid hydrocarbon/solvent mix is then separated from the clean sand by gravity. The sand is heated to evaporate the solvent and the resulting solvent vapors are condensed and reused. The clean sand can be returned to the mine site as reclamation material or sold for industrial purposes.

The liquid hydrocarbon/solvent mix is subject to a simple, refluxed, low pressure, medium temperature distillation process to separate the solvent from the recovered hydrocarbon. The solvent distilled from the recovered hydrocarbon is condensed and reused. The extracted bitumen is transported to a refinery.

As a result, tailing ponds and other environmental hazards are eliminated from the process, with the attendant reduction in costs and effects on the environment.

In connection with the engineering and development of the technology, we incurred costs of approximately $220,406 and $436,408 for the fiscal years ended March 31, 2013 and 2012, respectively.

Resource Base and Mine Plan

We have reviewed previous resource estimates prepared for Chevron and Amoco, as well as USGS estimates of mineable oil sands on our leases. In addition, we retained an outside firm to provide us with a Resource Audit and Classification report which was done in accordance with the provisions of the NI 51-101.

We also have access to and have reviewed detailed mining and operational plans prepared for Amoco with respect to our leases prepared in the mid-1990s. The Company intends to utilize these previous studies in finalizing a mine plan and operations.

Initially, we intend to obtain our oil sands through underground mining. We have completed an initial mine plan and cost estimate for the mine. The proposed mine plan layout is for an average daily production of 10,000 tons. Mining would occur year-round, with approximately one month overall allowed for shut-downs due to maintenance and repairs. Anticipated yearly mined tonnages include: 10,000 tons of oil sands mined per day; 2,700,000 tons per year (based on 270 days/year of production). Based upon the amount of estimated oil sands contained in the oil sand zone and expected grade, at this mining rate the life of the mine is expected to be between 20 and 30 years.

We intend to use a contract miner to initially mine the oil sands. Contract mining is an accepted practice in this area and has been used in coal mines as well as to mine tar sands for use in road paving. Because of recent coal mine shut downs, there is both excess capacity and excess mining equipment in the area. Mining equipment will consist of dozers, haul trucks, loaders, water trucks, and service trucks. Mined ore will be hauled by trucks via a haul road to the process area, where it can be either discharged directly to the inlet hopper or placed in a temporary storage pile adjacent to the processing facility for off-shift processing. Generally, a 3-day reserve supply of ore will be maintained in stockpiles at the processing facility.

The clean sand generated from processing the oil sands will be stored on surface (unless sold) under our mine plan. We have designated an area on surface to accommodate approximately 3 years of sand. The first 3 years of processed sand will be stored on surface. After that, we anticipate that the processed sand will be disposed of underground in mined out mining panels. The processed sand area will be designed to store approximately 6,000,000 cubic yard of processed sand. The processed sand will be transported to the storage site in the same trucks used for ore haulage.

Overall Market for Oil and Petroleum Products

According to the International Energy Agency (“IEA”), estimates of world crude oil and liquid fuels consumption grew to 88.9 million bbl/d in 2011. IEA expected that world liquid fuels consumption would grow by 0.9 million bbl/d in 2012, followed by 0.8 million bbl/d growth in 2013, resulting in total world consumption of 90.6 million bbl/d in 2013. Countries outside the Organization for Economic Cooperation and Development (“OECD”) will make up almost all of the growth in consumption over the next two years, with the largest increases coming from China, other Asian countries, Latin America and the Middle East. The IEA believes 2013 will mark the first time that non-OECD demand will exceed OECD demand.

According to the IEA, in addition to the overall increase in demand, fears of a supply disruption are keeping crude prices high in a well-supplied market. Speculators worry that even a small terrorist-caused disruption to oil supplies could cause major repercussions that wreak havoc with the supply chain.

Projected Markets for the Company’s Oil

The primary product we will produce will be a heavy oil called bitumen. There are numerous refineries within our potential marketing area. Located within 150 miles of the Salt Lake City area, there are a number of refineries with cumulative total daily capacity of approximately 175,000 barrels per day, according to the U.S. Energy Administration. These refineries are able to refine bitumen and have sufficient capacity to accept our product. Additionally, refineries in Colorado, Wyoming and New Mexico have daily combined capacity of approximately 417,000 barrels per day.

Pricing is typically benchmarked to leading crude price indices. Historically, bitumen has traded at a discount to West Texas Intermediate (“WTI”) of between 22-30%. We anticipate initially that our entire estimated output of 5,000 bbl/d will be delivered to the Salt Lake City refining center with one to two refiners as our customer(s). As we develop new facilities with a view to expanding production to 50,000 bbl/d, we will evaluate supplying product to multiple refineries and more distant locations versus Salt Lake City, based on price and transportation costs.

Government Regulation

We have commenced the process of obtaining the regulatory approvals required in connection with our project. We are committed to environmental responsibility and to meeting or exceeding best practices for environmental stewardship in our industry. We support the principle of sustainable development through adaptive management and we are working with stakeholders in the community, government and industry to protect and sustain air, land and aquatic resources in the region.

The key environmental issues to be managed in the development of our project encompass surface disturbance on the terrestrial ecosystem, effects on traditional land use and historical resources, and effects on wildlife populations and other natural resources. Because the commercial facility to be constructed will be a closed loop system, the only emissions anticipated will be from power generation. Only clean sand and bitumen will be produced.

We are committed to operating our project to achieve compliance with applicable statutes, regulations, codes, regulatory approvals and, to the extent practicable, government guidelines. Where the applicable laws are not clear or do not address all environmental concerns, management will apply appropriate internal standards and guidelines to address such concerns. In addition to complying with statutes, regulations, codes and regulatory approvals and exercising due diligence, we will strive to continuously improve the overall environmental performance of the operation and products.

There are a number of state and federal permits required in connection with the large permit necessary to commence principal operations. The Large Mine Plan permit will require a number of studies and/or clearances, and, other than the approvals from Carbon County, will include processing of the permits and clearances described above. The Large Mine Plan will also require engineering and operation plans and posting of a reclamation bond. We intend to seek the necessary business license from Carbon County and approval of the county planning and zoning concurrent with the preparation of the large mining plan and anticipate being able to obtain the necessary license and approval from Carbon County prior to receiving the large mining permit.

We have contracted with an environmental consulting firm to obtain the required studies and prepare and file a Notice of Intent to Commence Large Mining Operations (“Large Mine Permit”). In addition, we have contracted with a mining consultant to prepare the Large Mine Plan. Management estimates that it will receive its large mining permit from the Utah Division of Oil, Gas and Mining during the second quarter of calendar 2014.

Competition

To our knowledge, there are currently no companies operating in oil sands mining and extraction in the State of Utah, although U.S. Oil Sands, a Canadian company, has publicly announced that it intends to commence operations on a 62-acre plant in eastern Utah to remove bitumen from oil sands using a citrus-based solvent. Several companies have acquired sites with oil sand deposits, including U.S. Oil Sands, but they are not in production and require significant capital to commence operations. Additionally, many of these companies are using processes that require substantial water, and are unproven in commercial production.

Our process is efficient, cost effective, and has a small environmental footprint when compared to other technologies currently known or used for the separation of oil sands. By comparison, the processes utilized in Canada for the extraction of bitumen from oil sand consume significant amounts of water and have a significant environmental impact. In comparing our process to known oil sands extraction systems, we believe our licensed proprietary system offers a significantly reduced operating environmental impact. Our process significantly mitigates or eliminates environmental impacts typically associated with oil sand projects including:

| | o | Release of Volatile Organic Hydrocarbons (“VOC’s”): The solvent losses resulting from the operation of our system are minor. The system does not release any solvent to the environment. Solvent consumed by the process is recovered and conserved during the processing of the oil sands. In addition the process does not produce gases to a flare or vent system of any kind. |

| | o | Substantial Water consumption/contamination: Our process neither consumes nor produces any water. It is a dry process and therefore no water is taken from or returned to the environment. |

| | o | Emissions: The process can be powered by natural gas or electricity. If it were powered by electricity, emissions associated with the energy consumption of the process could be controlled through standard power plant emission control systems. As noted above, the deposit under lease to GRI is currently serviced by electrical power lines. |

| | o | Hydrocarbon and water wet tailings stream: Typical oil sands operations produce a waste stream of spent sand that contains a significant amount of residual hydrocarbons and water. The sand product from our process is dry and essentially free of hydrocarbons, either natural or induced through the solvent wetting process. It is directly suitable for use in reclamation efforts or can be sold as a value added product without further processing. Use of the sand in the reclamation process provides for the return of the mined material to the mine site (less the naturally occurring hydrocarbons) with no loss of material. |

We believe our process is efficient, cost effective, and simple when compared to other technologies currently known or used for the separation of oil sands. By comparison, the processes utilized in Canada for the extraction of bitumen from oil sand consume significant amounts of water and, therefore, have a significant environmental impact.

Approximately 3/4 of a barrel of tailings is produced for every barrel of bitumen produced by competing technology. Consequently, there are thousands of acres of tailing ponds located at Canadian oil sands operations produced as a direct result of the oil sand extraction process. This is one reason why oil sands are being questioned as a source of energy for the United States. Our process uses little or no water, and recaptures virtually all of the solvent used, resulting in only clean sand as a byproduct.

Production costs using our method to recover bitumen are believed to be significantly lower than those used by established producers of bitumen from oil sands in Canada. In addition, the projected capital cost for our 5,000bbl/dplant would be significantly lower than the cost of capital for a traditional oil sands project. Thus, our competitive advantages are an environmentally superior process and the ability to be a low-cost producer of high demand energy.

Employees

We currently have four employees; namely, our CEO, William C. Gibbs; our COO, Robin Gereluk; our President, Andrew Rosenfeld; and our CFO, Daniel F. Carlson. Each of these employees works part-time, except for Mr. Gibbs, who devotes essentially all of his business time to this project. We also engage consultants and independent contractors as needed.

ITEM 1A. Risk Factors

Our business activities and the oil and gas industry in general, are subject to a variety of risks. If any of the following risk factors should occur, our profitability, financial condition or liquidity could be materially impacted. As a result, holders of our securities could lose part or all of their investment in American Sands Energy Corp.

Risks Related to Our Company and Its Business

Because of our historic losses from operations since inception, there is substantial doubt about our ability to continue as a going concern.

In its report dated July 15, 2013, our independent registered public accounting firm stated that our financial statements for the year ended March 31, 2013, were prepared assuming that we would continue as a going concern. We have incurred recurring loses since the date of inception that have resulted in an accumulated deficit attributable to common stockholders of approximately $11,198,852 as of March 31, 2013. Although we had approximately $59,981 of available cash as of March 31, 2013, that amount is not adequate to meet our capital expenditure and operating requirements over the next 12 months. In addition, we estimate that we will require approximately $70,000,000 in capital expenditures and working capital to place our properties into production. These factors raise substantial doubt about our ability to continue as a going concern or to commence principal operations. We are dependent upon obtaining funds from investors to meet our cash flow requirements. If we are unsuccessful in doing so, we will be required to substantially revise our business plan or our proposed business could fail.

The impact of disruptions in the global financial and capital markets may significantly affect our ability to obtain financing.

The market events and conditions that transpired in 2008 and 2009, including disruptions in the international credit markets and other financial systems, and the continued deterioration of global economic conditions, have, among other things, caused significant volatility in commodity prices. These events and conditions caused a loss of confidence in the broader U.S. and global credit and financial markets and resulted in the collapse of, and government intervention in, numerous major banks, financial institutions and insurers, and created a climate of greater volatility, less liquidity, widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by governments, concerns about the general condition of the capital markets, financial instruments, banks, investment banks, insurers and other financial institutions caused the broader credit markets to further deteriorate and stock markets to decline substantially. These factors have negatively impacted enterprise valuations and have impacted the performance of the global economy. Although credit markets, equity markets, commodity markets and the United States and global economies have somewhat stabilized (and in some instances experienced recoveries), some prominent government officials, economists and market commentators have expressed concerns regarding the durability or speed of the recovery over the near and medium term, particularly as the fiscal stimulus that was utilized by the world's governments to combat the global financial crises is withdrawn over time in the coming months and years.

We will continue to need further funding to achieve our business objectives. In the past, the issuance of equity or debt securities has been the major source of capital and liquidity for us. The recent conditions in the global financial and capital markets have limited the availability of this funding. If the disruptions in the global financial and capital markets continue, debt or equity financing may not be available to us on acceptable terms, if at all. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our financial condition and results of operations will be adversely impacted. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses.

We have not commenced principal operations and have a limited operating history and therefore we cannot ensure the long-term successful operation of our business or the execution of our business plan.

We have not commenced principal mining operations. As a result, we have a limited operating history upon which to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses and difficulties associated with early stage enterprises. Such risks include but are not limited to the following:

| · | the absence of a lengthy operating history; |

| · | insufficient capital to fully realize our operating plan; |

| · | our ability to purchase or lease necessary equipment when required and at reasonable prices; |

| · | our ability to obtain regulatory and environmental approvals of our proposed mines and facilities; |

| · | expected continual losses for the foreseeable future; |

| · | social and political unrest; |

| · | disruptions to transportation routes; |

| · | our ability to anticipate and adapt to developing markets; |

| · | acceptance of our product by consumers; |

| · | limited marketing experience; |

| · | a competitive environment characterized by well-established and well-capitalized competitors; |

| · | the ability to identify, attract and retain qualified personnel; and |

| · | reliance on key personnel. |

Because we are subject to these risks, evaluating our business may be difficult. We may be unable to successfully overcome these risks which could harm our business. Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully address these risks our business will be harmed.

Compliance with government regulations and delays in obtaining necessary mining permits and licenses could delay or otherwise adversely affect our proposed business operations.

Our proposed plan to mine and process oil sands is subject to substantial regulation under federal, state and local laws relating to the exploration for, and the development, upgrading, marketing, pricing, taxation, and transportation of oil sands bitumen and related products and other matters. Amendments to current laws and regulations governing operations and activities of oil sands exploration and development operations could have a material adverse impact on our business. In addition, there can be no assurance that income tax laws, royalty regulations, environmental regulations and government incentive programs related to our permits and oil sands exploration licenses, and the oil sands industry generally, will not be changed in a manner which may adversely affect our progress and cause delays, or cause the inability to explore and develop, resulting in the abandonment of these interests.

Permits, licenses and approvals are required from a variety of regulatory authorities at various stages of exploration and development. There can be no assurance that the various government permits, leases, licenses and approvals sought will be granted, that they will be granted in a timely manner, or, if granted, that they will not be cancelled or will be renewed upon expiration. There is no assurance that such permits, leases, licenses and approvals will not contain terms and provisions which may adversely affect our exploration and development activities.

The exploration for and development of oil sands properties is highly competitive.

Oil sands exploration and development involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. We have no proven or probable reserves of oil sands on our properties. As with any petroleum property, there can be no assurance that commercial deposits of bitumen will be produced from our leased lands in Utah.

Furthermore, the marketability of any resource will be affected by numerous factors beyond our control. These factors include, but are not limited to, market fluctuations of prices, proximity and capacity of processing equipment, equipment and labor availability and government regulations (including, without limitation, regulations relating to prices, taxes, royalties, land tenure, allowable production, importing and exporting of oil and gas, land use and environmental protection). The extent of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

If we are unable to hire and retain key personnel, we may not be able to implement our plan of operation and our business may fail.

Our success is largely dependent on our ability to continue to hire and retain highly qualified personnel in both management and operations. These individuals may be in high demand and we may not be able to attract the management staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, including fees associated with persons employed by us, or we may fail to retain such employees after they are hired. Our failure to hire and retain key personnel as needed will have a significant negative effect on our business.

We are dependent upon a few key people and the loss of current management would make it difficult for us to implement our current business plan.

Investors must rely upon the ability, expertise, judgment, discretion, integrity and good faith of our management and directors. Our success is dependent upon our management and key personnel. We do not maintain key-man insurance for any of our employees. The unexpected loss or departure of any of our key officers and employees could be detrimental to our future success.

Environmental and regulatory compliance may impose substantial costs on us.

Our proposed operations will be subject to stringent federal, state, and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested many years ago.

Our exploration activities are or will be subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, land use, protection and remediation of the environment, protection of endangered and protected species, operational safety, toxic substances and other matters. Exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities. In addition, should there be changes to existing laws or regulations, our competitive position within the oil sands industry may be adversely affected, as many industry players have greater resources than we do.

We are required to obtain and are in various stages of obtaining necessary regulatory permits and approvals in order to explore and develop our properties. The absence of a distinct overlying shale formation on portions of our leases may make it more difficult or costly to obtain regulatory approvals. There is no assurance that regulatory approvals for exploration and development of our properties will be obtained at all or with terms and conditions acceptable to us.

We could encounter third-party liability or environmental liability in connection with our proposed operations.

Our proposed operations could result in liability for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. We could be liable for environmental damages caused by previous owners. As a result, substantial liabilities to third parties or governmental entities may be incurred, and the payment of such liabilities could have a material adverse effect on our financial condition and results of operations. The release of harmful substances in the environment or other environmental damages caused by our activities could result in us losing our operating and environmental permits or inhibit us from obtaining new permits or renewing existing permits. We currently have a limited amount of insurance and, at such time as we commence additional operations, we expect to be able to obtain and maintain additional insurance coverage for our operations, including limited coverage for sudden environmental damages, but we do not believe that insurance coverage for environmental damage that occurs over time is available at a reasonable cost. Moreover, we do not believe that insurance coverage for the full potential liability that could be caused by environmental damage is available at a reasonable cost. Accordingly, we may be subject to liability or may lose substantial portions of our properties in the event of certain environmental damage. We could incur substantial costs to comply with environmental laws and regulations which could affect our ability to operate as planned.

The early stage of our bitumen extraction technology increases the risk that we may not be able to successfully implement an oil sands recovery program using this technology.

We have entered into a license agreement under which the licensing entities have agreed to provide technical and engineering assistance in building an oil sands recovery plant based upon their proprietary solvent. This solvent process has not been installed on a project which meets the projected recovery amounts in our business plan. In addition the licensors have only recently created a prototype which demonstrates the use of the process. There is a risk that the recovery process and plant will not be completed on time or on budget or at all. Additionally, there is a risk that the program may have delays, interruption of operations or increased costs due to many factors, including, without limitation: breakdown or failure of equipment or processes; construction performance falling below expected levels of output or efficiency; design errors; challenges to, or inability to access in a timely or economic fashion; contractor or operator errors; non-performance by third-party contractors; labor disputes, disruptions or declines in productivity; increases in materials or labor costs; inability to attract sufficient numbers of workers; delays in obtaining, or conditions imposed by, regulatory approvals; changes in program scope; violation of permit requirements; disruption in the supply of energy; transportation accidents, disruption or delays in availability of transportation services or adverse weather conditions affecting transportation; unforeseen site surface or subsurface conditions; and catastrophic events such as fires, earthquakes, storms or explosions. There is also a risk that the manufacturer of the recovery plant used to implement our bitumen extraction process could fail in production due to labor shortages, price increases, and better opportunities with other customers.

We have significant financial obligations under our mining leases, and if we fail to meet those obligations we would lose the mineral resource on which our business plan depends.

Our interest in certain mining leases is conditioned upon the payments of annual rentals, of royalties, minimum yearly investment in development, tax payments, and other obligations to the owners of the leases. If we are unable to make the required payments or meet the necessary obligations, we could default on our lease agreements which could be terminated and which would void our interest in the leases. There is no certainty we will be able to make every payment and meet all obligations required under the respective lease agreements.

If we do not reach production levels by December 31, 2016, our leases may be terminated.

Three of our four leases are conditioned upon reaching the production stage by December 31, 2016 and the fourth lease requires production by October 2015. If we do not attain average productivity of at least 500 bbl/d by these dates, our interest in the leases may be terminated. The ability to attain productivity is conditioned upon factors of which we are not within complete control such as those listed in this Annual Report. There is no certainty we will ever reach the level of production required to keep our interest in these mining leases from becoming void.

We have no proven or probable reserves or resources.

We have not yet established any reserves. There are numerous uncertainties inherent in estimating quantities of bitumen resources and reserves, including many factors beyond our control, and no assurance can be given that the recovery of bitumen will be realized. In general, estimates of resources and reserves are based upon a number of factors and assumptions made as of the date on which the resources and reserves estimates were determined, such as geological and engineering estimates which have inherent uncertainties, the assumed effects of regulation by governmental agencies and estimates of future commodity prices and operating costs, all of which may vary considerably from estimated results. All such estimates are, to some degree, uncertain and classifications of resources and reserves are only attempts to define the degree of uncertainty involved. For these reasons, estimates of reserves and resources, the classification of such resources and reserves based on risk of recovery, prepared by different engineers or by the same engineers at different times, may vary substantially.

However, we have obtained an independent Resource Audit and Classification report from a major international geology and mining consulting firm describing the quantity and quality of the bitumen resource estimated to be located on our leases as of May 29, 2009. The Resource Audit and Classification was completed in accordance with the provisions of the NI 51-101. Such evaluation of our estimates of resources under NI 51-101 was carried out in accordance with the standards set out in the Canadian Oil and Gas Evaluation (“COGE”) Handbook, prepared jointly by the Society of Petroleum Evaluation Engineers and the Canadian Institute of Mining, Metallurgy & Petroleum. Those standards require that the evaluator plan and perform an evaluation to obtain reasonable assurance as to whether the reserves are free of material misstatement. An evaluation must also include an assessment as to whether the reserves data are in accordance with the principles and definitions presented in the COGE Handbook. The estimate provided in this report is classified as contingent resources according to the guidelines set forth in NI 51-101 and COGE. The project resource calculation is contingent upon completion of additional exploration drilling, processing and extraction analysis, detailed economic analysis, evolution of legal mining rights, and environmental evaluations. There is no certainty that the project will be commercially viable to produce any portion of the resource. As a result of the differences between the U.S. rules and Canadian standards governing disclosure of reserve or resource estimates, differing estimates of reserves or resources available under our leases are reported, and may in the future be reported, between our website and our periodic reports filed with the SEC.

Investors are cautioned not to assume that all or any part of a resource is economically or legally extractable.

We may participate in joint ventures and/or strategic alliances to develop and operate our planned business. These partnerships or the failure to establish them could have a material adverse effect on our ability to develop and manage our business. In addition, such undertakings may not be successful.

Our strategy may include plans to participate in joint ventures and other strategic alliances to develop and operate our business and sell our products. We may develop mining operations in part through joint ventures and strategic alliances with other parties as well as with additional outside funding. Joint ventures and strategic alliances may expose us to new operational, regulatory and market risks, as well as risks associated with additional capital requirements. Additionally, we may not be able to identify and secure suitable alliance partners. Even if we identify suitable partners, we may be unable to consummate alliances on terms commercially acceptable to us. If we fail to identify appropriate partners, we may not be able to implement our strategies effectively or efficiently.

In addition to joint venture and strategic alliances, we may raise additional debt and/or equity financing to build and operate our proposed operations. Such capital raises could result in significant dilution to the percentage ownership held by existing stockholders or the failure to secure such capital could impair our ability to execute our business plan.

We anticipate that the cost to build operations on our existing or future properties will be at least $70,000,000 and we have no current sources for this funding. We have received indications of interest in future financings but have no firm commitments for any funds. The net proceeds of future offerings are expected to be used to begin and continue initial operations, including the construction of the processing facility, and fund operations for the next 24 months. Offerings using our equity securities or debt instruments convertible into our common stock could require the issuance of a substantial number of additional shares of common stock. These potential offerings and the issuance of additional shares of common stock would have the effect of diluting the percentage ownership of existing stockholders. Moreover, there can be no assurance that such financing will be available, or, if available, that such financing will be at a price that will be acceptable or favorable to us. Failure to generate sufficient revenue or raise additional capital would have an adverse impact on our ability to achieve our longer-term business objectives, and would adversely affect our ability to continue operating as a going concern.

We do not insure against all potential operating risks. We may incur losses and be subject to liability claims as a result of our operations.

We maintain insurance for some, but not all, of the potential risks and liabilities associated with our business. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially, and in some instances, certain insurance may become unavailable or available only for reduced amounts of coverage. As a result, we may not be able to renew our existing insurance policies or procure other desirable insurance on commercially reasonable terms, if at all. Although we maintain insurance at levels we believe are appropriate and consistent with industry practice, we are not fully insured against all risks. In addition, pollution and environmental risks generally are not fully insurable. Losses and liabilities from uninsured and underinsured events and delay in the payment of insurance proceeds could have a material adverse effect on our financial condition, results of operations and cash flows.

American climate change legislation could negatively affect markets for crude and synthetic crude oil.

Environmental legislation regulating carbon fuel standards in the United States could result in increased costs and/or reduced revenue. For example, both California and the federal governments have passed legislation which, in some circumstances, considers the lifecycle greenhouse gas emissions of purchased fuel and which may negatively affect our business, or require the purchase of emissions credits, which may not be economically feasible.

Oil and gas mining operations are subject to applicable law and government regulation. Even if we discover oil and gas deposits in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of those deposits. If we cannot exploit any deposits that we might discover on our properties, our business may fail.

Both oil and gas exploration and extraction in the United States requires permits from various federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, oil and gas production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of oil and gas mining properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We are currently in compliance with all material laws and regulations that currently apply to our proposed business activities, but have not yet obtained the necessary permits and licenses to commence principal operations. If we are unable to continue to remain in compliance, or obtain these necessary permits and licenses, our business could fail. Current laws and regulations are being amended and we might not be able to comply with them. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mining properties.

Our mining production and delivery operations are subject to conditions and events that are beyond our control, which could result in higher operating costs and decreased production levels.

Our mining operations are planned to be conducted primarily in underground mines and possibly in surface mines. The level of our production is subject to operating conditions or events beyond our control that could disrupt operations, decrease production and affect the cost of mining at particular mines for varying lengths of time. Adverse operating conditions and events that oil and gas producers have experienced in the past include:

| · | unfavorable geologic conditions, such as the thickness of the oil and gas deposits and the amount of rock embedded in or overlying the oil and gas deposit; |

| · | poor mining conditions resulting from geological conditions or the effects of prior mining; |

| · | inability to acquire or maintain, or unexpected delays or difficulties in obtaining, necessary permits or mining or surface rights; |

| · | changes in governmental regulation of the mining industry or the utility industry; |

| · | market conditions could change and mean the sale of the type of oil and gas being produced from our concessions is no longer saleable at an economic price; |

| · | adverse weather conditions and natural disasters; |

| · | accidental mine water flooding; |

| · | labor-related interruptions; |

| · | interruptions due to transportation delays; |

| · | mining and processing equipment unavailability and failures and unexpected maintenance problems; |

| · | accidents, including fire and explosions from methane and other sources; |

| · | surface subsidence from underground mining, which could result in collapsed roofs at our underground mines, among other difficulties; |

| · | unavailability of mining equipment and supplies and increases in the price of mining equipment and supplies; |

| · | unexpected maintenance problems or key equipment failures; and |

| · | increased or unexpected reclamation costs. |

If any of these or similar conditions or events occur in the future at any of the mines we plan to develop or affect deliveries of our product to customers, they may increase our costs of mining and delay or halt production at particular mines or sales to our customers, either permanently or for varying lengths of time, which could adversely affect our results of operations, cash flows and financial condition. Our current insurance coverage would cover some but not all of these risks.

A substantial or extended decline in oil and gas prices could reduce our revenues and the value of our oil and gas resources.

Our results of future operations will be dependent upon the prices we receive for our oil and gas and other products as well as our ability to improve productivity and control costs. Declines in prices could adversely affect our results of operations. The prices charged for oil and gas depend upon factors beyond our control, including:

| · | the supply of, and demand for, domestic and foreign oil and gas; |

| · | the price elasticity of supply; |

| · | the demand for oil and gas; |

| · | the proximity to and the capacity and cost of transportation facilities; |

| · | governmental regulations and taxes; |

| · | air emission standards for oil refineries; |

| · | regulatory, legislative, administrative and judicial decisions; |

| · | the price and availability of alternative fuels, including the effects of technological developments; and |

| · | the effect of worldwide energy conservation measures. |

Decreased demand for oil and gas could result in declines in oil and gas prices and require us to increase productivity and lower costs in order to maintain our margins. If we are not able to maintain our margins, our operating results could be adversely affected. Therefore, price declines may adversely affect our operating results for future periods and our ability to generate cash flows necessary to improve productivity and invest in operations.

A decrease in the availability or increase in costs of labor, key supplies, capital equipment or commodities could reduce any profitability we may achieve.