UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | For the fiscal year ended March 31, 2014 |

| | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number:000-53167

American Sands Energy Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 87-0405708 |

| (State or other jurisdiction of incorporation or organization) | (IRS employer identification number) |

| | |

| 201 S. Main St., Suite 1800, Salt Lake City, UT 84111 | 84117 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code:(801) 536-6140

Securities registered pursuant to Section 12(b) of the Act:None

Securities registered pursuant to Section 12(g) of the Act:Common Stock, Par Value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | o | Accelerated filer | o |

| | Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of the last business day of the registrant’s most recently completed fiscal quarter was $16,298,542.

The number of shares outstanding of the registrant’s common stock on June 24, 2014, was 31,048,197.

DOCUMENTS INCORPORATED BY REFERENCE

| Document Description | | 10-K Part |

| Portions of the Registrant's proxy or information statement related to its 2014 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A or 14C within 120 days after Registrant's fiscal year end of March 31, 2014 are incorporated by reference into Part III of this Report. | | III |

Table of Contents

| | | Page |

| PART I | |

| | | |

| | ITEM 1. BUSINESS | 4 |

| | | |

| | ITEM 1A. RISK FACTORS | 10 |

| | | |

| | ITEM 1B. UNRESOLVED STAFF COMMENTS | 21 |

| | | |

| | ITEM 2. PROPERTIES | 21 |

| | | |

| | ITEM 3. LEGAL PROCEEDINGS | 22 |

| | | |

| | ITEM 4. MINE SAFETY DISCLOSURES | 22 |

| | | |

| PART II | |

| | | |

| | ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | 23 |

| | | |

| | ITEM 6. SELECTED FINANCIAL DATA | 24 |

| | | |

| | ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 24 |

| | | |

| | ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 27 |

| | | |

| | ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | 28 |

| | | |

| | ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 28 |

| | | |

| | ITEM 9A. CONTROLS AND PROCEDURES | 28 |

| | | |

| | ITEM 9B. OTHER INFORMATION | 28 |

| | | |

| PART III | |

| | | |

| | ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | 29 |

| | | |

| | ITEM 11. EXECUTIVE COMPENSATION | 29 |

| | | |

| | ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 29 |

| | | |

| | ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE | 29 |

| | | |

| | ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES | 29 |

| | | |

| PART IV | |

| | | |

| | ITEM 15. EXHIBITS, FINANCIAL STATEMENTS, SCHEDULES | 30 |

| | | |

| | SIGNATURES | 34 |

Forward-Looking Statements

The statements contained in this annual report on Form 10-K that are not historical facts represent management’s beliefs and assumptions based on currently available information and constitute “forward-looking statements.” All statements, other than statements of historical or present facts, including the information concerning our future operations, business strategies, need for financing, competitive position, potential growth opportunities, ability to retain and recruit personnel, the effects of competition and the effects of future legislation or regulations are forward-looking statements. Forward-looking statements can be identified by the use of forward-looking terminology such as the words “believes,” “intends,” “may,” “should,” “anticipates,” “expects,” “could,” “plans,” or comparable terminology or by discussions of strategy or trends. Although we believe that the expectations reflected in such forward-looking statements are reasonable, such statements by their nature involve risks and uncertainties that could significantly affect expected results, and actual future results could differ materially from those described in such forward-looking statements.

Among the factors that could cause actual future results to differ materially are the risks and uncertainties discussed in this report. While it is not possible to identify all factors, we continue to face many risks and uncertainties including, but not limited to, changes in the general economic environment; a downturn in the securities markets; and/or uncertainties associated with our ability to obtain operating capital. Should our underlying assumptions prove incorrect or the consequences of the aforementioned risks worsen, actual results could differ materially from those expected. We disclaim any intention or obligation to update publicly or revise such statements whether as a result of new information, future events or otherwise.

Throughout this report, unless otherwise designated, the terms “we,” “us,” “our,” “the Company” and “our company” refer to American Sands Energy Corp., a Delaware corporation, and its wholly owned subsidiary, Green River Resources, Inc., a Utah corporation.

PART I

ITEM 1. Business

Overview

American Sands Energy Corp. (“ASEC” or “the Company”) is a pre-production oil company with oil sand resources located near Sunnyside, Utah. We will mine the oil sands ore using conventional mining techniques and use a licensed proprietary solvent and process to extract oil from the oil sand ore. Our water-free process produces high quality heavy oil or bitumen, recovers nearly 100% of the solvent, requires no tailings ponds, and its only by-product is reclamation ready sand. Since the project’s inception, we have been engaged in the business of acquiring and developing oil sands assets and technologies used to separate the oil contained in oil sands. The Company anticipates that its primary operations will include the mining of oil sands, the separation of oil products therefrom and the sale of oil and oil by-products.

We have obtained a license for a hydrocarbon extraction process that separates oil and other hydrocarbons from sand, shale, dirt and other substances, without leaving behind toxins or other contaminants. We are currently developing our first project on certain hydrocarbon and mineral leases which cover approximately 1,760 acres near Sunnyside, Utah (the “Sunnyside Project”). On March 6, 2014, we filed an application for a Large Mine Plan with the Utah Department of Oil, Gas & Mining, which, if granted, will allow the Company to move forward with development of operations on the Sunnyside Project. The application covers the construction and operation of the mine, extraction facilities and related infrastructure. In accordance with the standards contained in Rule 4-10(a) of the SEC’s Regulation S-X, these leases contain no proven reserves of oil or gas. However, we have obtained an independent Resource Audit and Classification report dated May 29, 2009, from a major international geology and mining consulting firm describing the quantity and quality of the bitumen resource estimated to be located on our leases.

To date, we have acquired extensive bitumen resources, have successfully operated a pilot plant using our process technology on oil sands ore from our bitumen resources and have submitted applications for mining, environmental and other permits required to build a commercial plant (the “Commercial Facility”). Additional work to be completed as part of the project development phase includes:

| | 1. | Final mine planning and civil engineering for the Sunnyside Project. |

| | 2. | Acquisition of additional property in areas of interest in order to block-up properties into logical and economical mining units. |

| | 3. | Determination of technical and economic parameters for the commercial scale use of the process, including engineering. |

| | 4. | Receipt of federal and state regulatory agency approval for the Commercial Facility. |

Contemporaneously with the pursuit of the permitting of the project, we will also finalize engineering and equipment for a 5,000 barrel per day plant. We initially retained a leading engineering firm in the North American oil sands extraction industry, AMEC BDR Limited, to complete an engineering and feasibility study with respect to a commercial plant that would produce up to 3,000 barrels of oil per day. We also retained an engineering firm to demonstrate the technology through a new pilot plant. The pilot test runs were successful, removing in excess of 99% of the bitumen from the sand and leaving less than the two parts per million (“ppm”) of solvent in the sand. This means that the sand is suitable to be put back into the environment without tailing ponds or other environmental restrictions. Based on additional findings from the recent pilot tests and recommendations from our mining engineers, we are also proposing to expand the size of the initial Commercial Facility from the 3,000 barrels per day proposed in the AMEC BDR study, to 5,000 barrels per day (“bbl/d”). We recently engaged a new engineering firm to prepare a new feasibility report for a 5,000 bbl/d facility. We have also engaged a mining engineering firm to prepare a mine plan and feasibility study and we have also retained an environmental engineering and consulting firm to help us obtain the necessary mine and environmental permits to operate a large mine. On March 6, 2014, we filed a Notice of Intent to Commence Large Mine Operations (“Mine Permit”) with the Utah Department of Oil, Gas and Mining (“DOGM”). Based on the information from our consultants, we believe that additional financing of approximately $75 million will be required to procure and install the necessary equipment to begin operations of a plant that we believe will produce approximately 5,000 bbl/d of bitumen.

We have performed lab and pilot plant tests on oil sands from the Utah Green River Formation in which the Sunnyside Project is located to prove the viability of the technology and to understand several key elements in the process. Initial pilot plant test runs were conducted in 2006-2007. We hired AMEC BDR to witness the initial pilot plant tests and to manage the lab work and review the results. In addition to the initial pilot test, we have run pilot tests on a new system, designed by SRS Engineering International. In connection with those tests, we ran oil sands from Utah and Africa to acquire additional information on the efficiency of the solvent in removing the bitumen from the sand, the recovery of solvent from the bitumen and sand, and the overall efficiency and energy use of the system. The results are summarized as follows:

| | · | Virtually all of the bitumen was separated from the sand, leaving the sand “oil” free. |

| | · | The compositional characteristics of the bitumen were not altered by the process; therefore, management believes the bitumen will be suitable for upgrading and refining to saleable products by conventional refining technology. |

| | · | The sand product contained less than 2 ppm of solvent residue, presents no environmental liability, and can be used for reclamation or sold. |

| | · | Solvent losses to the bitumen product were minimal. Consequently, because the solvent is recycled with minimal loss in a closed loop system, make-up solvent costs should be minimal. |

| | · | The composition and properties of the solvent recovered through the process were not altered by the process; therefore, the solvent can be recycled in the process without further conditioning or processing. |

Based on the pilot test results and recommendations from our engineering consultants, we have evaluated the feasibility and costs of scaling the process into a plant that will initially process up to 5,000 bbl/d, with possible future expansion of facilities,subject to market conditions, accessible resources, and the availability of financing on terms acceptable to us.

Our pilot test also confirms lab tests that our process works on oil sands from other locations in the world. This may allow us to use our process in other locations around the world where other “oil wet” oil sands are located.

We anticipate initially that our entire estimated output of 5,000 bbl/d could be delivered to refineries located in the Salt Lake City area via truck, with one to two refiners as our customer(s). If we develop new facilities with a view to expanding production, we will evaluate supplying product to multiple refineries and more distant locations via rail, based on price and transportation costs.

Historical Development of the Company

We were originally incorporated in the State of Utah on April 7, 1983, as Carbon Technologies, Inc. for the purpose of engaging in the carbon fiber technology business. Subsequently, we became inactive and in 2005 we changed our corporate domicile to the State of Nevada and our name to Millstream Ventures, Inc. On October 19, 2011, we again changed the name of the Company to American Sands Energy Corp. and changed the domicile of the Company to the State of Delaware. In 2011, we actively began the search for a new business venture. On June 3, 2011, we completed a reverse acquisition transaction with Green River Resources Corp., a Canadian company formed in 2004 (“GRC”) and its wholly owned subsidiary, Green River Resources, Inc., a Utah corporation formed in 2005 (“GRI”). Pursuant to certain leases, these entities held undivided interests in mining properties for oil sand extraction covering approximately 1,760 acres. GRI had also entered into an operating agreement with an affiliate to provide rights to a proprietary process to extract bitumen from oil sands.

On October 18, 2011, we effected a reverse split of all outstanding shares of common stock at the rate of one share for each two shares outstanding. As a result of the reverse stock split, the number of shares outstanding on the effective date of the reverse split was reduced from 44,104,325 to 22,052,163. Unless otherwise stated herein, the number of shares designated in this annual report gives effect to this reverse split.

On December 31, 2011, GRC was voluntarily dissolved and the Company assumed all of the outstanding stock of GRI, which was the sole asset of GRC at the time of dissolution. GRI is the principal operating entity for the Company and holds the Company’s mining claims. As a result of the dissolution of GRC, GRI is now the sole subsidiary of, and is wholly owned by ASEC.

Business of GRI

Leases and Resources

Of the 24 states in the United States that contain oil sand deposits, approximately 90% of the USGS mapped mineable resource is located in Utah, where in excess of 25 billion barrels of oil are in place. There are eleven oil sands deposit areas located in Utah. The seven major areas are Sunnyside, P. R. Spring, Asphalt Ridge, White Rocks, Tar Sand Triangle, Circle Cliffs, and Hill Creek. Three of these seven areas, Tar Sand Triangle, Circle Cliffs, and Hill Creek, have substantial constraints to resource development including environmental drawbacks related to their location on Indian Reservations and/or National Parks, significant overburden, lack of rich ore, and high sulfur content. The prime oil sand properties include Sunnyside, P. R. Spring, Asphalt Ridge and White Rocks.

We have obtained leases in the Sunnyside area, on private property. We currently hold an undivided 60% interest pursuant to two freehold hydrocarbon and mineral lease agreements in Section 2, East Half and North West quarters of Section 3 Township 14 South, Range 14 East, SLM containing approximately 1,120 acres; and an undivided 21.67% interest pursuant to two further freehold hydrocarbon and mineral lease agreements in the North West quarter of Section 3, East half and North West quarter of Section 10, Township 14, Range 14 East, SLM containing approximately 640 acres, pursuant to which we have the right to extract bitumen from the land. Three of our four leases are conditioned upon reaching the production stage by December 31, 2016 and the fourth lease requires production by October 2015. If we do not attain average productivity of at least 500 bbl/d by these dates subject to certain acceptable interruptions, our interest in the leases may be terminated. The leases are for a primary term ending December 31, 2016, and are extended thereafter for so long as an average of 500 barrels of oil is produced per day, subject to certain acceptable interruptions.

We have reviewed previous resource estimates prepared for Chevron and Amoco, as well as USGS estimates of mineable oil sands on our leases. In addition, we retained an outside firm to provide us with a Resource Audit and Classification report which was done in accordance with the provisions of the National Instrument 51-101Standards of Disclosure for Oil and Gas Activities (“NI 51-101”). In accordance with the standards contained in Rule 4-10(a) of the SEC’s Regulation S-X, these leases contain no proven reserves of oil or gas. However, we have obtained an independent Resource Audit and Classification report from a major international geology and mining consulting firm describing the quantity and quality of the bitumen resource estimated to be located on our leases as of May 29, 2009. The Resource Audit and Classification was completed in accordance with the provisions of the NI 51-101. Such evaluation of our estimates of resources under NI 51-101 was carried out in accordance with the standards set out in the Canadian Oil and Gas Evaluation (“COGE”) Handbook, prepared jointly by the Society of Petroleum Evaluation Engineers and the Canadian Institute of Mining, Metallurgy & Petroleum. Those standards require that the evaluator plan and perform an evaluation to obtain reasonable assurance as to whether the reserves are free of material misstatement. An evaluation must also include an assessment as to whether the reserves data are in accordance with the principles and definitions presented in the COGE Handbook. The estimate provided in this report is classified as contingent resources according to the guidelines set forth in NI 51-101 and COGE. The project resource calculation is contingent upon completion of additional exploration drilling, processing and extraction analysis, detailed economic analysis, evolution of legal mining rights, and environmental evaluations. There is no certainty that the project will be commercially viable to produce any portion of the resource. As a result of the differences between the U.S. rules and Canadian standards governing disclosure of reserve or resource estimates, differing estimates of reserves or resources available under our leases are reported, and may in the future be reported, between our website and our periodic reports filed with the SEC.

The practice of preparing production and reserve quantities data under NI 51-101 differs from the U.S. rules. The primary differences between the two reporting requirements include: (i) NI 51-101 requires disclosure of proved and probable reserves and the U.S. rules require disclosure of only proved reserves; (ii) NI 51-101 requires the use of forecast prices in the estimation of reserves and the U.S. rules require the use of 12-month average prices which are held constant; (iii) NI 51-101 requires disclosure of reserves on a gross (before royalties) and net (after royalties) basis and the U.S. rules require disclosure on a net (after royalties) basis; (iv) the Canadian standards require disclosure of production on a gross (before royalties) basis and the U.S. rules require disclosure on a net (after royalties) basis; and (v) NI 51-101 requires that reserves and other data be reported on a more granular product type basis than required by the U.S. rules.

Our Process

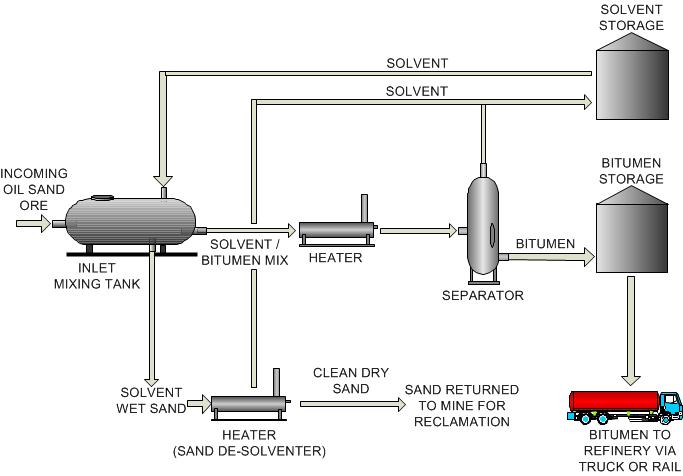

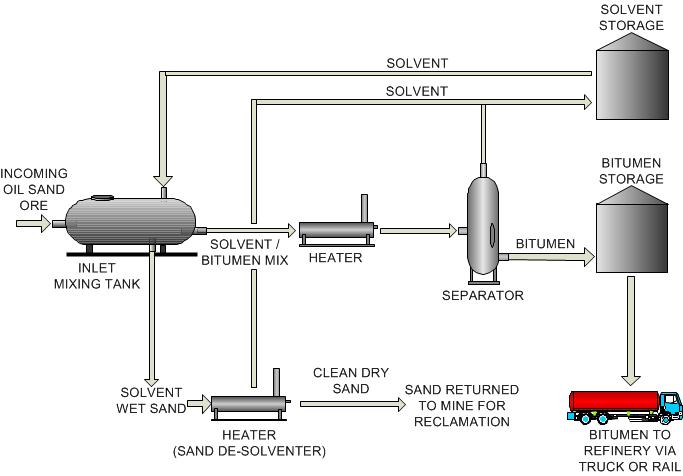

The following diagram demonstrates the stages of the process to remove bitumen from the oil sands using our proprietary bitumen recovery system:

Our process starts with the mixing of oil sand ore with a proprietary solvent. The solvent immediately separates the hydrocarbons contained in the ore from the inorganic insoluble material such as sand, rock and clay. We utilize much less heat than traditional or competing technologies.

The liquid hydrocarbon/solvent mix is then separated from the clean sand by gravity. The sand is heated to evaporate the solvent and the resulting solvent vapors are condensed and reused. The clean sand can be returned to the mine site as reclamation material or sold for industrial purposes.

The liquid hydrocarbon/solvent mix is subject to a simple, refluxed, low pressure, medium temperature distillation process to separate the solvent from the recovered hydrocarbon. The solvent distilled from the recovered hydrocarbon is condensed and reused. The extracted bitumen is transported to a refinery.

As a result, tailing ponds and other environmental hazards are eliminated from the process, with the attendant reduction in costs and effects on the environment.

In connection with the engineering and development of the technology, we incurred costs of approximately $923,774 and $220,406 for the fiscal years ended March 31, 2014 and 2013, respectively.

License, Development and Engineering Agreement and Termination of Operating Agreement

Effective January 24, 2012, the Company entered into a License, Development and Engineering Agreement with Universal Oil Recovery Corp. and SRS International (the “License Agreement”) whereby the Company was granted an exclusive non-transferable license to use certain technology in its proposed business to extract bitumen from oil sands. The territory covered by the agreement includes the State of Utah and any other geographic location in which a future designated project is commenced by or through the Company. In conjunction with the License Agreement, the Company terminated its operating agreement with Bleeding Rock, LLC (“Bleeding Rock”). Our Chief Executive Officer is the manager of Bleeding Rock and has an indirect ownership interest therein. On November 18, 2013, the Company entered into an Amended and Restated License, Development and Engineering Agreement with Universal Oil Recovery LLC and SRS International (“Amendment”). The Amendment amends and restates the License Agreement. Pursuant to the terms of the Amendment, the previous royalties of 75% on projects outside of Utah and the minimum royalty of $1,000,000 per year on such agreements have been eliminated. Pursuant to the Amendment, the Company will now pay royalties on projects outside of Utah of 15% of the net fees (net of all costs other than general and administrative expenses) collected by the Company on any license of the technology. In addition, the $25,000 per month management fee is eliminated until a permanent financing is closed (minimum of $25,000,000), at which time the payment will be reinstated. In consideration of the amendment, the Company issued to Universal Oil Recovery LLC (“UOR”), 575,000 warrants to purchase common stock of the Company for $0.01 per share, exercisable for ten years in November 2013. The term of the License Agreement is for 20 years and thereafter so long as production of products using the technology is commercially and economically feasible.

In conjunction with entering into the License Agreement, we also entered into a Termination Agreement dated January 24, 2012, with Bleeding Rock (the “Termination Agreement”). The purpose of the Termination Agreement was to terminate the Operating Agreement dated May 31, 2005, as amended, between Bleeding Rock and GRI (the “Operating Agreement”). Pursuant to the Operating Agreement GRI had obtained the rights through Bleeding Rock to utilize a process for the development, engineering and extraction of hydrocarbons from oil sands. In light of conversations with potential investors, management determined that having the technology licensed directly to the Company rather than through Bleeding Rock would be beneficial to fund raising prospects. As a result, the Company entered into the License Agreement described above. In partial consideration for Bleeding Rock agreeing to terminate the Operating Agreement, we entered into a royalty agreement with Bleeding Rock. Under the terms of the Gross Royalty Agreement we are obligated to pay a royalty equal to 1.5% of the gross receipts from future projects using the technology, excluding the current project in Sunnyside, Utah. Bleeding Rock subsequently assigned all of its interest in the Gross Royalty Agreement to Hidden Peak Partners LC (“Hidden Peak”), an entity managed and partially owned by Mr. Gibbs. The Termination Agreement also contains mutual releases by the parties relating to the Operating Agreement.

Resource Base and Mine Plan

We have reviewed previous resource estimates prepared for Chevron and Amoco, as well as USGS estimates of mineable oil sands on our leases. In addition, we retained an outside firm to provide us with a Resource Audit and Classification report which was done in accordance with the provisions of the NI 51-101.

We also have access to and have reviewed detailed mining and operational plans prepared for Amoco with respect to our leases prepared in the mid-1990s. The Company intends to utilize these previous studies in finalizing a mine plan and operations.

Initially, we intend to obtain our oil sands through underground mining. We have completed an initial mine plan and cost estimate for the mine. The proposed mine plan layout is for an average daily production of 10,000 tons. Mining would occur year-round, with approximately one month overall allowed for shut-downs due to maintenance and repairs. Anticipated yearly mined tonnages include: 10,000 tons of oil sands mined per day; 2,700,000 tons per year (based on 270 days/year of production). Based upon the amount of estimated oil sands contained in the oil sand zone and expected grade, at this mining rate the life of the mine is expected to be between 20 and 30 years.

We intend to use a contract miner to initially mine the oil sands. Contract mining is an accepted practice in this area and has been used in coal mines as well as to mine tar sands for use in road paving. Because of recent coal mine shut downs, there is both excess capacity and excess mining equipment in the area. Mining equipment will consist of dozers, haul trucks, loaders, water trucks, and service trucks. Mined ore will be hauled by trucks via a haul road to the process area, where it can be either discharged directly to the inlet hopper or placed in a temporary storage pile adjacent to the processing facility for off-shift processing. Generally, a 3-day reserve supply of ore will be maintained in stockpiles at the processing facility.

The clean sand generated from processing the oil sands will be stored on surface (unless sold) under our mine plan. We have designated an area on surface to accommodate approximately 3 years of sand. The first 3 years of processed sand will be stored on surface. After that, we anticipate that the processed sand will be disposed of underground in mined out mining panels. The processed sand area will be designed to store approximately 6,000,000 cubic yard of processed sand. The processed sand will be transported to the storage site in the same trucks used for ore haulage.

Overall Market for Oil and Petroleum Products

According to the International Energy Agency (“IEA”), estimates of world crude oil and liquid fuels consumption grew to 88.9 million bbl/d in 2011. IEA expected that world liquid fuels consumption would grow by 0.9 million bbl/d in 2012, followed by 0.8 million bbl/d growth in 2013, resulting in total world consumption of 90.6 million bbl/d in 2013. Countries outside the Organization for Economic Cooperation and Development (“OECD”) will make up almost all of the growth in consumption over the next two years, with the largest increases coming from China, other Asian countries, Latin America and the Middle East. The IEA believes 2013 will mark the first time that non-OECD demand will exceed OECD demand.

According to the IEA, in addition to the overall increase in demand, fears of a supply disruption are keeping crude prices high in a well-supplied market. Speculators worry that even a small terrorist-caused disruption to oil supplies could cause major repercussions that wreak havoc with the supply chain.

Projected Markets for the Company’s Oil

The primary product we will produce will be a heavy oil called bitumen. There are numerous refineries within our potential marketing area. Located within 150 miles of the Salt Lake City area, there are a number of refineries with cumulative total daily capacity of approximately 175,000 bbl/d, according to the U.S. Energy Administration. These refineries are able to refine bitumen and have sufficient capacity to accept our product. Additionally, refineries in Colorado, Wyoming and New Mexico have daily combined capacity of approximately 417,000 bbl/d. In addition, a rail oil loading facility is available in Price, Utah, which allows us to transport our product to the refineries in Southern California.

Pricing is typically benchmarked to leading crude price indices. Historically, bitumen has traded at a discount to West Texas Intermediate (“WTI”) of between 22-30%. We anticipate initially that our entire estimated output of 5,000 bbl/d will be delivered to the Salt Lake City refining center via truck, with one to two refiners as our customer(s). If we develop new facilities with a view to expanding production, we will evaluate supplying product to multiple refineries and more distant locations via rail versus Salt Lake City, based on price and transportation costs.

Government Regulation

We have commenced the process of obtaining the regulatory approvals required in connection with our project and filed our Mine Permit on March 6, 2014. We are committed to environmental responsibility and to meeting or exceeding best practices for environmental stewardship in our industry. We support the principle of sustainable development through adaptive management and we are working with stakeholders in the community, government and industry to protect and sustain air, land and aquatic resources in the region.

The key environmental issues to be managed in the development of our project encompass surface disturbance on the terrestrial ecosystem, effects on traditional land use and historical resources, and effects on wildlife populations and other natural resources. Because the commercial facility to be constructed will be a closed loop system, the only emissions anticipated will be from power generation. Only clean sand and bitumen will be produced.

We are committed to operating our project to achieve compliance with applicable statutes, regulations, codes, regulatory approvals and, to the extent practicable, government guidelines. Where the applicable laws are not clear or do not address all environmental concerns, management will apply appropriate internal standards and guidelines to address such concerns. In addition to complying with statutes, regulations, codes and regulatory approvals and exercising due diligence, we will strive to continuously improve the overall environmental performance of the operation and products.

There are a number of state and federal permits required in connection with the large permit necessary to commence principal operations. On March 6, 2014, ASEC filed its Mine Permit, which, if granted, will allow the Company to move forward with development of operations on the Sunnyside Project. The Mine Permit includes a number of studies and will require clearances or approvals from other agencies and from Carbon County. The Mine Permit will also require engineering and operation plans and posting of a reclamation bond. We also intend to seek the necessary business license from Carbon County in conjunction with the Mine Permit.

Competition

To our knowledge, the only company currently engaged in oil sands development in Utah is U.S. Oil Sands, a Canadian company that has publicly announced its intent to commence operations on a 62-acre plant in eastern Utah to remove bitumen from oil sands using a citrus-based solvent. Several other companies have acquired sites with oil sand deposits, including U.S. Oil Sands, but they are not in production and require significant capital to commence operations. Additionally, many of these companies are using processes that require substantial water, and are unproven in commercial production.

Our process is efficient, cost effective, and has a small environmental footprint when compared to other technologies currently known or used for the separation of oil sands. By comparison, the processes utilized in Canada for the extraction of bitumen from oil sand consume significant amounts of water and have a significant environmental impact. In comparing our process to known oil sands extraction systems, we believe our licensed proprietary system offers a significantly reduced operating environmental impact. Our process significantly mitigates or eliminates environmental impacts typically associated with oil sand projects including:

| | o | Release of Volatile Organic Hydrocarbons (“VOC’s”): The solvent losses resulting from the operation of our system are minor. The system does not release any solvent to the environment. Solvent consumed by the process is recovered and conserved during the processing of the oil sands. In addition the process does not produce gases to a flare or vent system of any kind. |

| | o | Substantial Water consumption/contamination: Our process neither consumes nor produces any water. It is a dry process and therefore no water is taken from or returned to the environment. |

| | o | Emissions: The process can be powered by natural gas or electricity. If it were powered by electricity, emissions associated with the energy consumption of the process could be controlled through standard power plant emission control systems. The deposit under lease to GRI is currently serviced by electrical power lines. |

| | o | Hydrocarbon and water wet tailings stream: Typical oil sands operations produce a waste stream of spent sand that contains a significant amount of residual hydrocarbons and water. The sand product from our process is dry and essentially free of hydrocarbons, either natural or induced through the solvent wetting process. It is directly suitable for use in reclamation efforts or can be sold as a value added product without further processing. Use of the sand in the reclamation process provides for the return of the mined material to the mine site (less the naturally occurring hydrocarbons) with no loss of material. |

We believe our process is efficient, cost effective, and simple when compared to other technologies currently known or used for the separation of oil sands. By comparison, the processes utilized in Canada for the extraction of bitumen from oil sand consume significant amounts of water and, therefore, have a significant environmental impact.

In Canada, approximately 3/4 of a barrel of tailings is produced for every barrel of bitumen produced by competing technology. Consequently, there are thousands of acres of tailing ponds located at Canadian oil sands operations produced as a direct result of the oil sand extraction process. This is one reason why oil sands are being questioned as a source of energy for the United States. Our process uses little or no water, and recaptures virtually all of the solvent used, resulting in only clean sand as a byproduct.

Production costs using our method to recover bitumen are believed to be significantly lower than those used by established producers of bitumen from oil sands in Canada. In addition, the projected capital cost for our 5,000 bbl/d plant would be significantly lower than the cost of capital for a traditional oil sands project. Thus, our competitive advantages are an environmentally superior process and the ability to be a low-cost producer of high demand energy.

Employees

We currently have three employees; namely, our CEO, William C. Gibbs; our COO, Robin Gereluk; and our CFO, Daniel F. Carlson. Each of these employees works full time for the Company. We also engage consultants and independent contractors as needed.

ITEM 1A. Risk Factors

Our business activities and the oil and gas industry in general, are subject to a variety of risks. If any of the following risk factors should occur, our profitability, financial condition or liquidity could be materially impacted. As a result, holders of our securities could lose part or all of their investment in American Sands Energy Corp.

Risks Related to Our Company and Its Business

Because of our historic losses from operations since inception, there is substantial doubt about our ability to continue as a going concern.

In its report dated June 30, 2014, our independent registered public accounting firm stated that our financial statements for the year ended March 31, 2014, were prepared assuming that we would continue as a going concern. We have incurred recurring loses since the date of inception that have resulted in an accumulated deficit attributable to common stockholders of approximately $14,554,230 as of March 31, 2014. Although we had approximately $2,006,007 of available cash as of March 31, 2014, that amount is not adequate to meet our capital expenditure and operating requirements over the next 12 months. In addition, we estimate that we will require approximately $75,000,000 in capital expenditures and working capital to place our properties into production. These factors raise substantial doubt about our ability to continue as a going concern or to commence principal operations. We are dependent upon obtaining funds from investors to meet our cash flow requirements. If we are unsuccessful in doing so, we will be required to substantially revise our business plan or our proposed business could fail.

The impact of disruptions in the global financial and capital markets may significantly affect our ability to obtain financing.

The market events and conditions that transpired in 2008 and 2009, including disruptions in the international credit markets and other financial systems, and the continued deterioration of global economic conditions, have, among other things, caused significant volatility in commodity prices. These events and conditions caused a loss of confidence in the broader U.S. and global credit and financial markets and resulted in the collapse of, and government intervention in, numerous major banks, financial institutions and insurers, and created a climate of greater volatility, less liquidity, widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by governments, concerns about the general condition of the capital markets, financial instruments, banks, investment banks, insurers and other financial institutions caused the broader credit markets to further deteriorate and stock markets to decline substantially. These factors have negatively impacted enterprise valuations and have impacted the performance of the global economy. Although credit markets, equity markets, commodity markets and the United States and global economies have somewhat stabilized (and in some instances experienced recoveries), some prominent government officials, economists and market commentators have expressed concerns regarding the durability or speed of the recovery over the near and medium term, particularly as the fiscal stimulus that was utilized by the world's governments to combat the global financial crises is withdrawn over time in the coming months and years.

We will continue to need further funding to achieve our business objectives. In the past, the issuance of equity or debt securities has been the major source of capital and liquidity for us. The recent conditions in the global financial and capital markets have limited the availability of this funding. If the disruptions in the global financial and capital markets continue, debt or equity financing may not be available to us on acceptable terms, if at all. If we are unable to fund future operations by way of financing, including public or private offerings of equity or debt securities, our financial condition and results of operations will be adversely impacted. Additionally, these factors, as well as other related factors, may cause decreases in asset values that are deemed to be other than temporary, which may result in impairment losses.

We have not commenced principal operations and have a limited operating history and therefore we cannot ensure the long-term successful operation of our business or the execution of our business plan.

We have not commenced principal mining operations. As a result, we have a limited operating history upon which to evaluate our proposed business and prospects. Our proposed business operations will be subject to numerous risks, uncertainties, expenses and difficulties associated with early stage enterprises. Such risks include but are not limited to the following:

| | · | the absence of a lengthy operating history; |

| | · | insufficient capital to fully realize our operating plan; |

| | · | our ability to purchase or lease necessary equipment when required and at reasonable prices; |

| | · | our ability to obtain regulatory and environmental approvals of our proposed mines and facilities; |

| | · | expected continual losses for the foreseeable future; |

| | · | social and political unrest; |

| | · | disruptions to transportation routes; |

| | · | our ability to anticipate and adapt to developing markets; |

| | · | acceptance of our product by consumers; |

| | · | limited marketing experience; |

| | · | a competitive environment characterized by well-established and well-capitalized competitors; |

| | · | the ability to identify, attract and retain qualified personnel; and |

| | · | reliance on key personnel. |

Because we are subject to these risks, evaluating our business may be difficult. We may be unable to successfully overcome these risks which could harm our business. Our business strategy may be unsuccessful and we may be unable to address the risks we face in a cost-effective manner, if at all. If we are unable to successfully address these risks our business will be harmed.

The early stage of the bitumen extraction technology used by us increases the risk that we may not be able to successfully implement an oil sands recovery program using this technology.

We have entered into a license agreement under which the licensing entities have agreed to provide technical and engineering assistance in building an oil sands recovery plant based upon their proprietary solvent and processes. We are therefore dependent on the ability of such licensors to continue to perform under the licensing agreement and such licenses remaining effective. This solvent process has not been installed on a project which meets the projected recovery amounts in our business plan. In addition the licensors have only recently created a prototype which demonstrates the use of the process. There is a risk that the recovery process and plant will not be completed on time or on budget or at all. Additionally, there is a risk that the program may have delays, interruption of operations or increased costs due to many factors, including, without limitation: breakdown or failure of equipment or processes; construction performance falling below expected levels of output or efficiency; design errors; contractor or operator errors; non-performance by third-party contractors; labor disputes, disruptions or declines in productivity; increases in materials or labor costs; inability to attract sufficient numbers of workers; delays in obtaining, or conditions imposed by, regulatory approvals; changes in program scope; violation of permit requirements; disruption in the supply of energy; transportation accidents, disruption or delays in availability of transportation services or adverse weather conditions affecting transportation; unforeseen site surface or subsurface conditions; and catastrophic events such as fires, earthquakes, storms or explosions. There is also a risk that the manufacturer of the recovery plant used to implement our bitumen extraction process could fail in production due to labor shortages, price increases, and better opportunities with other customers.

Compliance with government regulations and delays in obtaining necessary mining permits and licenses could delay or otherwise adversely affect our proposed business operations.

Our proposed plan to mine and process oil sands is subject to substantial regulation under federal, state and local laws relating to the exploration for, and the development, upgrading, marketing, pricing, taxation, and transportation of oil sands bitumen and related products and other matters. Amendments to current laws and regulations governing operations and activities of oil sands exploration and development operations could have a material adverse impact on our business. In addition, there can be no assurance that income tax laws, royalty regulations, environmental regulations and government incentive programs related to our permits and oil sands exploration licenses, and the oil sands industry generally, will not be changed in a manner which may adversely affect our progress and cause delays, or cause the inability to explore and develop, resulting in the abandonment of these interests.

Permits, licenses and approvals are required from a variety of regulatory authorities at various stages of exploration and development. There can be no assurance that the various government permits, leases, licenses and approvals sought will be granted, that they will be granted in a timely manner, or, if granted, that they will not be cancelled or will be renewed upon expiration. There is no assurance that such permits, leases, licenses and approvals will not contain terms and provisions which may adversely affect our exploration and development activities.

The exploration for and development of oil sands properties are highly competitive.

Oil sands exploration and development involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. We have no proven or probable reserves of oil sands on our properties. As with any petroleum property, there can be no assurance that commercial deposits of bitumen will be produced from our leased lands in Utah.

Furthermore, the marketability of any resource will be affected by numerous factors beyond our control. These factors include, but are not limited to, market fluctuations of prices, proximity and capacity of processing equipment, equipment and labor availability and government regulations (including, without limitation, regulations relating to prices, taxes, royalties, land tenure, allowable production, importing and exporting of oil and gas, land use and environmental protection). The extent of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

If we are unable to hire and retain key personnel, we may not be able to implement our plan of operation and our business may fail.

Our success is largely dependent on our ability to continue to hire and retain highly qualified personnel in both management and operations. These individuals may be in high demand and we may not be able to attract the management staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, including fees associated with persons employed by us, or we may fail to retain such employees after they are hired. Our failure to hire and retain key personnel as needed will have a significant negative effect on our business.

We are dependent upon a few key people and the loss of current management would make it difficult for us to implement our current business plan.

Investors must rely upon the ability, expertise, judgment, discretion, integrity and good faith of our management and directors. Our success is dependent upon our management and key personnel. We do not maintain key-man insurance for any of our employees. The unexpected loss or departure of any of our key officers and employees could be detrimental to our future success.

Environmental and regulatory compliance may impose substantial costs on us.

Our proposed operations will be subject to stringent federal, state, and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested many years ago.

Our exploration activities are or will be subject to extensive laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, land use, protection and remediation of the environment, protection of endangered and protected species, operational safety, toxic substances and other matters. Exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products. Compliance with these laws and regulations will impose substantial costs on us and will subject us to significant potential liabilities. In addition, should there be changes to existing laws or regulations, our competitive position within the oil sands industry may be adversely affected, as many industry players have greater resources than we do.

We are required to obtain and are in various stages of obtaining necessary regulatory permits and approvals in order to explore and develop our properties. The absence of a distinct overlying shale formation on portions of our leases may make it more difficult or costly to obtain regulatory approvals. There is no assurance that regulatory approvals for exploration and development of our properties will be obtained at all or with terms and conditions acceptable to us.

We could encounter third-party liability or environmental liability in connection with our proposed operations.

Our proposed operations could result in liability for personal injuries, property damage, oil spills, discharge of hazardous materials, remediation and clean-up costs and other environmental damages. We could be liable for environmental damages caused by previous owners. As a result, substantial liabilities to third parties or governmental entities may be incurred, and the payment of such liabilities could have a material adverse effect on our financial condition and results of operations. The release of harmful substances in the environment or other environmental damages caused by our activities could result in us losing our operating and environmental permits or inhibit us from obtaining new permits or renewing existing permits. We currently have a limited amount of insurance and, at such time as we commence additional operations, we expect to be able to obtain and maintain additional insurance coverage for our operations, including limited coverage for sudden environmental damages, but we do not believe that insurance coverage for environmental damage that occurs over time is available at a reasonable cost. Moreover, we do not believe that insurance coverage for the full potential liability that could be caused by environmental damage is available at a reasonable cost. Accordingly, we may be subject to liability or may lose substantial portions of our properties in the event of certain environmental damage. We could incur substantial costs to comply with environmental laws and regulations which could affect our ability to operate as planned.

We have significant financial obligations under our mining leases, and if we fail to meet those obligations we would lose the mineral resource on which our business plan depends.

Our interest in certain mining leases is conditioned upon the payments of annual rentals, of royalties, minimum yearly investment in development, tax payments, and other obligations to the owners of the leases. If we are unable to make the required payments or meet the necessary obligations, we could default on our lease agreements which could be terminated and which would void our interest in the leases. There is no certainty we will be able to make every payment and meet all obligations required under the respective lease agreements.

If we do not reach production levels by certain dates, our leases may be terminated.

Three of our four leases are conditioned upon reaching the production stage by December 31, 2016 and the fourth lease requires production by October 2015. If we do not attain average productivity of at least 500 bbl/d by these dates, our interest in the leases may be terminated. The ability to attain productivity is conditioned upon factors of which we are not within complete control such as those listed in this Annual Report. There is no certainty we will ever reach the level of production required to keep our interest in these mining leases from becoming void.

We have no proven or probable reserves or resources.

We have not yet established any reserves. There are numerous uncertainties inherent in estimating quantities of bitumen resources and reserves, including many factors beyond our control, and no assurance can be given that the recovery of bitumen will be realized. In general, estimates of resources and reserves are based upon a number of factors and assumptions made as of the date on which the resources and reserves estimates were determined, such as geological and engineering estimates which have inherent uncertainties, the assumed effects of regulation by governmental agencies and estimates of future commodity prices and operating costs, all of which may vary considerably from estimated results. All such estimates are, to some degree, uncertain and classifications of resources and reserves are only attempts to define the degree of uncertainty involved. For these reasons, estimates of reserves and resources, the classification of such resources and reserves based on risk of recovery, prepared by different engineers or by the same engineers at different times, may vary substantially.

However, we have obtained an independent Resource Audit and Classification report from a major international geology and mining consulting firm describing the quantity and quality of the bitumen resource estimated to be located on our leases as of May 29, 2009. The Resource Audit and Classification was completed in accordance with the provisions of the NI 51-101. Such evaluation of our estimates of resources under NI 51-101 was carried out in accordance with the standards set out in the Canadian Oil and Gas Evaluation (“COGE”) Handbook, prepared jointly by the Society of Petroleum Evaluation Engineers and the Canadian Institute of Mining, Metallurgy & Petroleum. Those standards require that the evaluator plan and perform an evaluation to obtain reasonable assurance as to whether the reserves are free of material misstatement. An evaluation must also include an assessment as to whether the reserves data are in accordance with the principles and definitions presented in the COGE Handbook. The estimate provided in this report is classified as contingent resources according to the guidelines set forth in NI 51-101 and COGE. The project resource calculation is contingent upon completion of additional exploration drilling, processing and extraction analysis, detailed economic analysis, evolution of legal mining rights, and environmental evaluations. There is no certainty that the project will be commercially viable to produce any portion of the resource. As a result of the differences between the U.S. rules and Canadian standards governing disclosure of reserve or resource estimates, differing estimates of reserves or resources available under our leases are reported, and may in the future be reported, between our website and our periodic reports filed with the SEC.

Investors are cautioned not to assume that all or any part of a resource is economically or legally extractable.

We may participate in joint ventures and/or strategic alliances to develop and operate our planned business. These partnerships or the failure to establish them could have a material adverse effect on our ability to develop and manage our business. In addition, such undertakings may not be successful.

Our strategy may include plans to participate in joint ventures and other strategic alliances to develop and operate our business and sell our products. We may develop mining operations in part through joint ventures and strategic alliances with other parties as well as with additional outside funding. Joint ventures and strategic alliances may expose us to new operational, regulatory and market risks, as well as risks associated with additional capital requirements. Additionally, we may not be able to identify and secure suitable alliance partners. Even if we identify suitable partners, we may be unable to consummate alliances on terms commercially acceptable to us. If we fail to identify appropriate partners, we may not be able to implement our strategies effectively or efficiently.

In addition to joint venture and strategic alliances, we may raise additional debt and/or equity financing to build and operate our proposed operations. Such capital raises could result in significant dilution to the percentage ownership held by existing stockholders or the failure to secure such capital could impair our ability to execute our business plan.

We anticipate that the cost to build operations on our existing or future properties will be at least $75,000,000 and we have no current sources for this funding. We have received indications of interest in future financings but have no firm commitments for any funds. The net proceeds of future offerings are expected to be used to begin and continue initial operations, including the construction of the processing facility, and fund operations for the next 24 months. Offerings using our equity securities or debt instruments convertible into our common stock could require the issuance of a substantial number of additional shares of common stock. These potential offerings and the issuance of additional shares of common stock would have the effect of diluting the percentage ownership of existing stockholders. Moreover, there can be no assurance that such financing will be available, or, if available, that such financing will be at a price that will be acceptable or favorable to us. Failure to generate sufficient revenue or raise additional capital would have an adverse impact on our ability to achieve our longer-term business objectives, and would adversely affect our ability to continue operating as a going concern.

We do not insure against all potential operating risks. We may incur losses and be subject to liability claims as a result of our operations.

We maintain insurance for some, but not all, of the potential risks and liabilities associated with our business. For some risks, we may not obtain insurance if we believe the cost of available insurance is excessive relative to the risks presented. As a result of market conditions, premiums and deductibles for certain insurance policies can increase substantially, and in some instances, certain insurance may become unavailable or available only for reduced amounts of coverage. As a result, we may not be able to renew our existing insurance policies or procure other desirable insurance on commercially reasonable terms, if at all. Although we maintain insurance at levels we believe are appropriate and consistent with industry practice, we are not fully insured against all risks. In addition, pollution and environmental risks generally are not fully insurable. Losses and liabilities from uninsured and underinsured events and delay in the payment of insurance proceeds could have a material adverse effect on our financial condition, results of operations and cash flows.

American climate change legislation could negatively affect markets for crude and synthetic crude oil.

Environmental legislation regulating carbon fuel standards in the United States could result in increased costs and/or reduced revenue. For example, both California and the federal governments have passed legislation which, in some circumstances, considers the lifecycle greenhouse gas emissions of purchased fuel and which may negatively affect our business, or require the purchase of emissions credits, which may not be economically feasible.

Oil and gas mining operations are subject to applicable law and government regulation. Even if we discover oil and gas deposits in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of those deposits. If we cannot exploit any deposits that we might discover on our properties, our business may fail.

Both oil and gas exploration and extraction in the United States requires permits from various federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, oil and gas production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of oil and gas mining properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

We are currently in compliance with all material laws and regulations that currently apply to our proposed business activities, but have not yet obtained the necessary permits and licenses to commence principal operations. If we are unable to continue to remain in compliance, or obtain these necessary permits and licenses, our business could fail. Current laws and regulations are being amended and we might not be able to comply with them. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mining properties.

Our mining production and delivery operations are subject to conditions and events that are beyond our control, which could result in higher operating costs and decreased production levels.

Our mining operations are planned to be conducted primarily in underground mines and possibly in surface mines. The level of our production is subject to operating conditions or events beyond our control that could disrupt operations, decrease production and affect the cost of mining at particular mines for varying lengths of time. Adverse operating conditions and events that oil and gas producers have experienced in the past include:

| | · | unfavorable geologic conditions, such as the thickness of the oil and gas deposits and the amount of rock embedded in or overlying the oil and gas deposit; |

| | · | poor mining conditions resulting from geological conditions or the effects of prior mining; |

| | · | inability to acquire or maintain, or unexpected delays or difficulties in obtaining, necessary permits or mining or surface rights; |

| | · | changes in governmental regulation of the mining industry or the utility industry; |

| | · | market conditions could change and mean the sale of the type of oil and gas being produced from our concessions is no longer saleable at an economic price; |

| | · | adverse weather conditions and natural disasters; |

| | · | accidental mine water flooding; |

| | · | labor-related interruptions; |

| | · | interruptions due to transportation delays; |

| | · | mining and processing equipment unavailability and failures and unexpected maintenance problems; |

| | · | accidents, including fire and explosions from methane and other sources; |

| | · | surface subsidence from underground mining, which could result in collapsed roofs at our underground mines, among other difficulties; |

| | · | unavailability of mining equipment and supplies and increases in the price of mining equipment and supplies; |

| | · | unexpected maintenance problems or key equipment failures; and |

| | · | increased or unexpected reclamation costs. |

If any of these or similar conditions or events occur in the future at any of the mines we plan to develop or affect deliveries of our product to customers, they may increase our costs of mining and delay or halt production at particular mines or sales to our customers, either permanently or for varying lengths of time, which could adversely affect our results of operations, cash flows and financial condition. Our current insurance coverage would cover some but not all of these risks.

A substantial or extended decline in oil and gas prices could reduce our revenues and the value of our oil and gas resources.

Our results of future operations will be dependent upon the prices we receive for our oil and gas and other products as well as our ability to improve productivity and control costs. Declines in prices could adversely affect our results of operations. The prices charged for oil and gas depend upon factors beyond our control, including:

| | · | the supply of, and demand for, domestic and foreign oil and gas; |

| | · | the price elasticity of supply; |

| | · | the demand for oil and gas; |

| | · | the proximity to and the capacity and cost of transportation facilities; |

| | · | governmental regulations and taxes; |

| | · | air emission standards for oil refineries; |

| | · | regulatory, legislative, administrative and judicial decisions; |

| | · | the price and availability of alternative fuels, including the effects of technological developments; and |

| | · | the effect of worldwide energy conservation measures. |

Decreased demand for oil and gas could result in declines in oil and gas prices and require us to increase productivity and lower costs in order to maintain our margins. If we are not able to maintain our margins, our operating results could be adversely affected. Therefore, price declines may adversely affect our operating results for future periods and our ability to generate cash flows necessary to improve productivity and invest in operations.

A decrease in the availability or increase in costs of labor, key supplies, capital equipment or commodities could reduce any profitability we may achieve.

We will require access to contract miners at commercially acceptable rates. We currently have no contracts or arrangements for necessary mining personnel. Our proposed mining operations will also require a reliable supply of steel-related products (including roof control for our underground mines), replacement parts, belting products and lubricants, none of which have been secured by definitive agreements or contracts. If the cost of any of these or other supplies increases significantly, or if a source for such mining equipment or supplies are unavailable to meet our replacement demands, our profitability could be adversely affected. In addition, industry-wide demand growth has recently exceeded supply growth for certain underground, surface, and other capital equipment. As a result, lead times for some items have increased significantly. Significant delays in obtaining required parts and equipment could cause our profitability to be reduced from our current expectations.

Our inability to obtain or retain qualified operating personnel could negatively affect our proposed operations.

The design, development and construction of our bitumen extraction technology program and any subsequent pilot and commercial projects will require experienced executive and management personnel and operational employees and contractors with expertise in a wide range of areas. No assurance can be given that all of the required personnel and contractors with the necessary expertise will be available. Should other oil sands projects or expansions proceed in the same time frame as our programs and projects, we will have to compete with these other projects and expansions for qualified personnel and such competition may result in increases to compensation paid to such personnel or in a lack of qualified personnel. Any inability of our Company to attract and retain qualified personnel may delay or interrupt the design, development and construction of, and commencement of operations and any subsequent pilot and commercial projects. Sustained delays or interruptions could have a material adverse effect on the financial condition of our Company.

Inaccuracies in our estimates of oil sands deposits could result in lower than expected revenues and higher than expected costs.

We will base our oil sands deposit information on engineering, economic and geological data assembled and analyzed by our in house and contract workers, which will include various engineers and geologists. The estimates of oil sands deposits as to both quantity and quality will be continually updated to reflect the production of bitumen from the deposits and new drilling or other data received. There are numerous uncertainties inherent in estimating quantities and qualities of oil sands deposits and costs to process these deposits, including many factors beyond our control. Estimates of economically recoverable bitumen and net cash flows necessarily depend upon a number of variable factors and assumptions, all of which may vary considerably from actual results, such as:

| | · | geological and mining conditions and/or effects from prior mining activities that may not be fully identified by available exploration data or that may differ from experience, in current operations; |

| | · | the assumed effects of regulation, including the issuance of required permits, and taxes by governmental agencies and assumptions concerning oil and gas prices, operating costs, mining technology improvements, severance and excise tax, development costs and reclamation costs; |

| | · | historical production from the area compared with production from other similar producing areas; and |

| | · | assumptions concerning future oil and gas prices, operating costs, capital expenditures, severance taxes and development and reclamation costs. |

For these reasons, estimates of the economically recoverable quantities and qualities attributable to any particular group of properties, classifications of reserves and non-reserve deposits based on risk of recovery and estimates of net cash flows expected from particular reserves prepared by different engineers or by the same engineers at different times may vary substantially and vary materially from estimates. As a result, these estimates may not accurately reflect actual reserves or non-reserve deposits. Any inaccuracy in our estimates related to our deposits could result in lower than expected revenues, higher than expected costs and decreased profitability.

We compete with numerous alternative and “green” energy industries.

The U.S. and international petroleum industry is highly competitive in all aspects, including the exploration for, and the development of, new sources of supply, the acquisition of oil interests and the distribution and marketing of petroleum products.

The petroleum industry also competes with other industries in supplying energy, fuel and related products to consumers. Some of these industries benefit from lighter regulation, lower taxes and subsidies. In addition, certain of these industries are less capital intensive.

A number of competing companies are engaged in the oil sands business and are actively exploring for and delineating their resource bases. Some of our competitors have announced plans to begin production of synthetic crude oil, or to expand existing operations. If these plans are affected, they could materially increase the supply of synthetic crude oil and other competing crude oil products in the marketplace and adversely affect plans for development of our lands.

We may be subject to unexpected operational hazards based upon the remote location of our properties.

Our exploration and development activities are subject to the customary hazards of operation in remote areas, such as fires, explosions, migration of harmful substances, and spills. A casualty occurrence might result in the loss of equipment or life, as well as injury, property damage or other liability. While we maintain limited insurance to cover current operations, our property and liability insurance may not be sufficient to cover any such casualty occurrences or disruptions. Equipment failures could result in damage to our facilities and liability to third parties against which we may not be able to fully insure or may elect not to insure because of high premium costs or for other reasons. Our operations could be interrupted by natural disasters such as forest fires or other events beyond our control. Losses and liabilities arising from uninsured or under-insured events could have a material adverse effect on our business, our financial condition and results of our operations.

Risks Related to Our Common Stock

Because our shares are designated as “penny stock,” broker-dealers will be less likely to trade in our stock due to, among other items, the requirements for broker-dealers to disclose to investors the risks inherent in penny stocks and to make a determination that the investment is suitable for the purchaser.

Our shares are designated as “penny stock” as defined in Rule 3a51-1 promulgated under the Exchange Act and thus may be more illiquid than shares not designated as penny stock. The SEC has adopted rules which regulate broker-dealer practices in connection with transactions in “penny stocks.” Penny stocks are defined generally as: non-Nasdaq equity securities with a price of less than $5.00 per share; not traded on a “recognized” national exchange; or in issuers with net tangible assets less than $2,000,000, if the issuer has been in continuous operation for at least three years, or $10,000,000, if in continuous operation for less than three years, or with average revenues of less than $6,000,000 for the last three years. The penny stock rules require a broker-dealer to deliver a standardized risk disclosure document prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customer’s account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that is subject to the penny stock rules. Since our securities are subject to the penny stock rules, investors in the shares may find it more difficult to sell their shares. Many brokers have decided not to trade in penny stocks because of the requirements of the penny stock rules and, as a result, the number of broker-dealers willing to act as market makers in such securities is limited. The reduction in the number of available market makers and other broker-dealers willing to trade in penny stocks may limit the ability of purchasers in this offering to sell their stock in any secondary market. These penny stock regulations, and the restrictions imposed on the resale of penny stocks by these regulations, could adversely affect our stock price.