As filed with the Securities and Exchange Commission on June 3, 2008

Registration No. ________

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

YOO INC.

(Exact name of Registrant as specified in its charter)

| Delaware | | 2086 | | 36-4620445 |

| (State or other jurisdiction of | | (Primary Standard Industrial | | (I.R.S. Employer |

| incorporation or organization) | | Classification Code) | | Identification No.) |

Zvi Pessahc Frank

45 Or Hachaim St.

Bnei Brak, Israel, 51527

Tel: + (972)-3-977-0201

Fax: + (972) 577-961-456

(Address and telephone number of Registrant’s principal executive offices)

(Address of principal place of business or intended principal place of business)

National Corporate Research Ltd.

615 South Dupont Highway

Dover, Delaware 19901

Phone: (800) 483-1140

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all Correspondence to:

SRK Law Offices

Rabin Science Park

Rehovot, Israel

Telephone No.: (718) 360-5351

Facsimile No.: (011) (972) 8-936-6000

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box:x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

Large accelerated filer [ ] Accelerated Filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

Calculation of Registration Fee

| | | | | | | | Proposed | | Amount of |

| | Title of Class | | Amount to be | | Proposed | | Maximum | | Registration |

| | of Securities to | | Registered(¹) | | Maximum | | Aggregate | | Fee |

| | be Registered | | | | Aggregate | | Offering | | |

| | | | | | Price Per Share | | Price(²) | | |

| | Common | | 2,000,000 | | $0.025 | | $50,000 | | $4.60 |

| | Stock, $0.0001 | | | | | | | | |

| | per share | | | | | | | | |

| | Total | | 2,000,000 | | $0.025 | | $50,000 | | $4.60 |

| (¹) | In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended. |

| |

| (²) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(a) and (o) under the Securities Act of 1933. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

Subject to Completion Dated June 3, 2008

YOO Inc.

2,000,000 Shares of Common Stock, par value $0.0001

This prospectus relates to the resale of 2,000,000 shares of common stock, par value $0.0001, of Yoo Inc., which are issued and outstanding and held by persons who are stockholders of Yoo Inc.

The selling security holders will be offering their shares of common stock at a price of $0.025 per share until a market develops and thereafter at prevailing market prices or privately negotiated prices. There has been no market for our securities and a public market may not develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority (“FINRA”), for our common stock to be eligible for trading on the Over the Counter Bulletin Board. We do not yet have a market maker who has agreed to file such application.

Investing in our securities involves significant risks. See “Risk Factors” beginning on page 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. The selling security holders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is ____, 2008

The following table of contents has been designed to help you find information contained in this prospectus. We encourage you to read the entire prospectus.

Table of Contents

| | | Page |

| |

| Prospectus Summary | | 1 |

| Risk Factors | | 4 |

| Risk Relating to Our Lack of Operating History | | 4 |

| Risk Relating to Our Business | | 5 |

| Risk Relating to Our Strategy and Industry | | 6 |

| Risks Relating to this Offering | | 8 |

| Risks Relating to Operating in Israel | | 10 |

| Cautionary Statement Regarding Forward Looking Statements | | 11 |

| The Offering | | 11 |

| Use of Proceeds | | 11 |

| Determination of Offering Price | | 12 |

| Dividend Policy | | 12 |

| Market for our Common Stock | | 12 |

| Selling Security Holders | | 13 |

| Management’s Discussion and Analysis of Financial Condition and Results of | | 15 |

| Operation | | |

| Description of Business | | 17 |

| Description of Property | | 25 |

| Management | | 26 |

| Executive Compensation | | 27 |

| Certain Relationships and Related Transactions | | 28 |

| Principal Shareholders | | 29 |

| Plan of Distribution | | 30 |

| Description of Securities | | 31 |

| Shares Eligible for Future Sales | | 33 |

| Legal Matters | | 33 |

| Experts | | 34 |

| Where You Can Find More Information | | 34 |

| Disclosure of SEC Position on Indemnification for Securities Act Liabilities | | 34 |

| Financial Statements | | F-1 |

| Information not Required in Prospectus | | I-1 |

PROSPECTUS SUMMARY

This summary highlights certain information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including our financial statements and related notes, and especially the risks described under “Risk Factors” beginning on page 4. All references to “we,” “us,” “our,” “Yoo Inc.,” “Yoo,” “Company” or similar terms used in this prospectus refer to Yoo Inc.

Corporate Background

We were incorporated on October 31, 2007. We have not generated any revenues to date and we are a development stage company. We are focused on offering to distributors of soft drinks in Israel a natural energy drink derived from coconut water to be branded as Yoo Juice. Our goal is to penetrate the Israeli energy drink market. We plan to direct our sales and distribution efforts to distributors and retailers in Israel that target consumers of soft drinks and energy drinks. It is our goal to be a leading supplier in Israel of energy drinks derived from coconut water and to turn Yoo Juice into one of Israel’s leading natural energy drinks.

Our offices are currently located at 45 Or Hachaim St. Bnei-Brak, 51527, Israel. Our telephone number is 972-3-977-0201. We have secured a domain name but do not currently have an operating web site. Our fiscal year end is December 31.

Our auditors have issued an audit opinion which includes a statement describing their doubts about whether we will continue as a going concern. In addition, our financial status creates substantial doubt whether we will continue as a going concern.

| The Offering | | |

| |

| Securities being offered by the | | 2,0000,000 shares of common stock |

| selling stockholders: | | |

| |

| Offering price: | | $0.025 per share until a market develops and thereafter at |

| | | market prices or prices negotiated in private transactions |

| |

| Number of shares outstanding prior | | |

| to the offering: | | 6,000,000 shares of common stock |

| |

| Number of shares outstanding after | | |

| the offering: | | 6,000,000 shares of common stock |

| |

| Market for the common stock: | | There has been no market for our securities. Our common |

| | | stock is not traded on any exchange or on the over-the- |

| | | counter market. After the effective date of the registration |

| | | statement relating to this prospectus, we hope to have a |

| | | market maker file an application with the FINRA for our |

| | | common stock to eligible for trading on the Over The |

| | | Counter Bulletin Board. We do not yet have a market |

| | | maker who has agreed to file such application. |

1

| | There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale. |

| |

Use of proceeds: | We will not receive any proceeds from the sale of shares by the selling stockholders. |

| |

Risk Factors | See “Risk Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock. |

2

Summary Financial Data

The following summary financial information for the period from October 31, 2007 (date of inception) through April 30, 2008, includes statement of operations and balance sheet data from our audited financial statements. The information contained in this table should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and the financial statements and accompanying notes included in this prospectus.

| | | | | | | As of | |

| | | | | | | April 30, | |

| | | | | | | 2008 | |

| | | | | | | (Audited) | |

| Balance Sheet Items- | | | | | | | | |

| Cash in bank | | | | | | $ | 49,892 | |

| |

| Total current assets | | | | | | $ | 49,892 | |

| |

| Total assets | | | | | | $ | 49,892 | |

| |

| Accrued liabilities | | | | | | $ | 30,500 | |

| |

| Total current liabilities | | | | | | $ | 30,500 | |

| |

| Stockholders’ equity | | | | | | $ | 19,392 | |

| | | Period | | | | | |

| | | Ended | | | Cumulative | |

| | | April 30, | | | from | |

| | | 2008 | | | Inception | |

| | | (Audited) | | | (Audited) | |

| Statements of Operations items- | | | | | | | | |

| Revenues | | $ | - | | | $ | - | |

| |

| General and administrative expenses | | $ | 30,608 | | | $ | 30,608 | |

| |

| Other income (expense) | | $ | - | | | $ | - | |

| |

| Net (loss) | | $ | (30,608 | ) | | | (30,608 | ) |

| |

| (Loss) per common share - Basic and Diluted | | $ | (0.01 | ) | | | | |

| |

| Weighted Average Number of Common Shares | | | | | | | | |

| Outstanding - Basic and Diluted | | | 5,486,612 | | | | | |

3

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in our Company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

Risks Relating to Our Lack of Operating History

1. We have a going concern opinion from our auditors, indicating the possibility that we may not be able to continue as a going concern.

The Company has incurred net losses of $30,608 for the period from October 31, 2007, (date of inception) through April 30, 2008. We anticipate generating losses for the next 12 months. We do not anticipate generating revenues prior to February 2009. Therefore, we may be unable to continue operations in the future as a going concern. No adjustment has been made in the accompanying financial statements to the amounts and classification of assets and liabilities which could result should we be unable to continue as a going concern. If we cannot continue as a viable entity, our stockholders may lose some or all of their investment in the Company.

In addition, our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. As a result, we may not be able to obtain additional necessary funding. There can be no assurance that we will ever achieve any revenues or profitability. The revenue and income potential of our proposed business and operations are unproven, and the lack of operating history makes it difficult to evaluate the future prospects of our business.

2. We are a development stage company and may never be able to execute our business plan.

We were incorporated on October 31, 2007. We currently have no products, no distributors, nor any revenues. Although we have begun initial planning for the distribution of Yoo Juice in Israel, we may not be able to execute our business plan, including importing and distributing Yoo Juice in Israel, unless and until we are successful in raising funds. We anticipate that we will require a minimum of approximately $50,000 to commence operations, and to remain operational during the next twelve months. Due to our present financial situation, however, such financing may not be forthcoming. Even if financing is available, it may not be available on terms we find favorable. As a result, we may not be able to obtain the necessary funding. Failure to secure the needed financing will have a very serious effect on our Company’s ability to survive. At this time, there are no anticipated additional sources of funds in place.

3. Our business plan may be unsuccessful.

The success of our business plan is dependent on our developing a market in Israel for coconut water as a natural energy drink. Our ability to develop an interest in coconut water is unproven, and the lack of operating history makes it difficult to validate our business plan. Should residents of Israel not be as responsive as we anticipate to natural energy drinks derived from coconut water, we will not have in place alternate products that we can offer to ensure our continuing as a going concern.

4

4. We have no operating history and have maintained losses since inception, which we expect to continue in the future.

We incurred a net loss of $30,608 for the period from October 31, 2007 (date of inception) through April 30, 2008. We also expect to continue to incur operating losses in future periods. These losses will occur because we do not yet have any revenues to offset the expenses associated with the initial distribution and the marketing and sale of Yoo Juice. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations.

There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Risks Relating to Our Business

5. Our executive officers and Directors have significant voting power and may take actions that may be different than actions sought by our other stockholders.

Our officers and Directors own approximately 63.33% of the outstanding shares of our common stock. These stockholders will be able to exercise significant influence over all matters requiring stockholder approval. This influence over our affairs might be adverse to the interest of our other stockholders. In addition, this concentration of ownership could delay or prevent a change in control and might have an adverse effect on the market price of our common stock.

6. Since our officers and Directors may work or consult for other companies, their other activities could slow down our operations.

Our officers and Directors are not required to work exclusively for us and do not devote all of their time to our operations. Presently, our officers and Directors allocate only a portion of their time to the operation of our business. Since our officers and Directors are currently employed full-time elsewhere, they are able to commit to us only up to 2- 3 hours a week. Therefore, it is possible that their pursuit of other activities may slow our operations and reduce our financial results because of the slow-down in operations.

7. Our officers and Directors are located in Israel.

Since all of our officers and Directors are located in Israel, any attempts to enforce liabilities upon such individuals under the U.S. securities and bankruptcy laws may be difficult.

5

Risks Relating to Our Strategy and Industry

8. Our product has a limited shelf life and limited sales could dramatically increase operating costs.

Our business is to distribute a natural energy drink made from coconut water. Shelf life for coconut water is typically 9-12 months depending on the packaging. Should our product not sell in that time period, the product will not be usable. Inventory shrinkage can dramatically increase operating costs.

If we are unable, due to resource constraints or other reasons, to limit the amount of our product that is not sold during its shelf life, our operating results would decline and our business would not grow.

9. We are a small company with limited resources compared to some of our current and potential competitors in the energy drink market in Israel and we may not be able to compete effectively and increase market share. Also, intense competition in the energy drink and bottled water market could prevent us from increasing or sustaining our revenue and prevent us from achieving profitability.

Most of our current and potential competitors in the energy drink and bottled water market in Israel have longer operating histories, significantly greater resources and name recognition, and a larger base of distributors and retailers. As a result, these competitors have greater credibility with our potential distributors and retailers. They also may be able to adopt more aggressive pricing policies and devote greater resources to the development, promotion, and sale of their products. It will be difficult to launch a new, lesser known brand name such as Yoo Juice and to compete for shelf space at supermarkets and smaller grocery stores.

10. We need to retain key personnel to support our services and ongoing operations.

The marketing of our natural energy drink will continue to place a significant strain on our limited personnel, management, and other resources. Our future success depends upon the continued services of our executive officers and distributors who have critical industry experience and relationships that we rely on to implement our business plan. The loss of the services of any of our officers or the lack of availability of other skilled personnel would negatively impact our ability to build relationships with potential manufacturers of coconut water and with distributors of our product, which could adversely affect our financial results and impair our growth.

11. We depend on the availability of coconut water in order to produce our product.

The market for coconut water is projected to increase steadily as product awareness becomes more evident globally. As the global market for coconut water increases and demand increases, because coconuts are grown naturally and not in hydro-growing environments, there is a risk of supply not meeting demand requirements. If we are unable to purchase coconut water in quantities sufficient to meet our requirements at reasonable prices, our business will suffer.

6

12.If we are unable to attract and retain Israeli distributors and retailers interested in selling our energy drink, we will not be successful.

We will rely significantly on our ability to attract and retain Israeli distributors and retailers to sell our energy drink product. We will need to continually evaluate and build our network of distributors to keep pace with the needs of both retailers and potential consumers of coconut water to remain competitive in our business. We may be unable to identify or obtain the participation of a sufficient number of distributors and retailers that are interested in selling our coconut water product, which may decrease the potential for the growth of our business.

13. Our success depends on independent contractors to supply the coconut water and to bottle and label our product.

We intend to rely on third party independent contractors for the supply of coconut water and for the bottling and labeling of our product. These third party contractors may not dedicate sufficient resources or give sufficient priority to developing our required resources. There is no history upon which to base any assumption as to the likelihood that we will prove successful in selecting such third party independent contractors. If we are unsuccessful in addressing these risks, our business will most likely fail.

14. Future regulation of natural energy drinks could restrict our business, prevent us from offering our product, and/or increase our cost of doing business.

The laws, regulations, or rulings that specifically address the sale of natural energy drinks in Israel are subject to change. We are unable to predict the impact, if any, that future legislation, judicial precedents, or regulations relating to energy drinks may have on our business, financial condition, and results of operations. The increasing growth of the energy drink and bottled water market heighten the risk that the Israeli government will seek to regulate such market, which could have a material adverse effect on our business, financial condition, and operating results.

15. We may lose customers if the costs related to the supply and sale of coconut water increases.

As coconut water becomes more sought after, our costs may increase. As of now, a major advantage of coconut water over its energy drink competition is price. If the price goes up, that selling point deteriorates. In addition, we face the risk that our logistical costs may increase. Because the price of oil is volatile and has been on the increase, the costs associated with shipping our product to Israel may increase. In both scenarios, cost increases may be unavoidable since the raw material for coconut water,i.e., green coconuts, are not produced locally in Israel.

16. We may lose customers if the costs related to supplying coconut water increases as a result of tariffs being imposed on coconut water.

As product awareness grows and as the market grows there is always a risk of government intervention in the form of tariffs/taxes. Should the governments of countries where we or our contractors operate increase the taxes to produce or import coconut water, or add tariffs or customs charges, the final cost to deliver our product will increase. This would have a material adverse effect on our business, financial condition, and operating results.

7

17. Our competition includes existing distributors of energy drinks that have established themselves in the Israeli market and have well-developed distribution operations.

Our competition in Israel includes existing distributors of other energy drinks. These distributors already have market share and it may be difficult for us to take market share away from them. In addition, new energy drinks are being created frequently, with a number of different marketing schemes to make them appealing to the everyday consumer looking for a quick energy fix. Also, as product awareness increases, global food and distribution companies looking to import and sell coconut water in Israel could enter this market and directly compete with us. It is extremely difficult to compete with global distribution companies, such as Coca Cola for example, because they have well-developed distribution operations, existing logistical supply chains, and large marketing budgets. If we are not successful in competing with the distributors of competing products, our business will fail.

18. We may incur losses as a result of claims that may be brought against us due to defective products or as a result of product recalls.

We may be liable if the consumption of our product causes injury, illness, or death. We also may be required to withdraw or recall some of our products if they become contaminated or are damaged or mislabeled. A significant product liability judgment against us or a widespread product withdrawal or recall could have a material adverse effect on our business and financial condition.

19. We may be unable to protect our brand name.

Brand recognition is critical in attracting consumers to our product. If we are unable to trademark our brand name or to adequately protect our trade name against infringement or misappropriation, our competitive position in the energy drink market may be undermined, which could lead to a significant decrease in the volume of coconut water that we sell. Such a result would materially and adversely affect our results of operations.

20. Coconut prices may be subject to U.S. dollar/local currency exchange rate risk which could increase our costs of operations.

Numerous raw materials, including coconuts, are used in producing and packaging our coconut water product. We may be purchasing raw materials from both domestic and international suppliers. See “Description of Business.” Because we will be required to purchase raw materials in the international markets, while our product will be sold to consumers in Israel in New Israeli Shekels, we may be subject to local currency risk in our operations. If the U.S. Dollar continues to depreciate significantly against local currencies where we do business, our costs could rise significantly, which could have an adverse effect on our financial condition and results of operation. Alternatively, we cannot assure you that the U.S. Dollar or local currencies in the countries where we might purchase our raw materials (Brazil, Indonesia, or Thailand) will not lose value against the New Israeli Shekel in the future.

Risks Relating to this Offering

21. NASD sales practice requirements may limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described below, the NASD has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for

8

believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may have the effect of reducing the level of trading activity in our common stock. As a result, fewer broker-dealers may be willing to make a market in our common stock, reducing a stockholder’s ability to resell shares of our common stock.

22. There is no public market for the securities and even if a market is created, the market price of our common stock will be subject to volatility.

Prior to this offering, there has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop after this offering, or, if developed, be sustained. We anticipate that, upon completion of this offering, our common stock will be eligible for quotation on the OTC Bulletin Board. If for any reason, however, our securities are not eligible for initial or continued quotation on the OTC Bulletin Board or a public trading market does not develop, purchasers of the common stock may have difficulty selling their securities should they desire to do so and purchasers of our common stock may lose their entire investment if they are unable to sell our securities.

23. The price of our shares in this offering was arbitrarily determined by us and may not reflect he actual market price for the securities.

The initial public offering price of the common stock was determined by us arbitrarily. The price is not based on our financial condition and prospects, market prices of similar securities of comparable publicly traded companies, certain financial and operating information of companies engaged in similar activities to ours, or general conditions of the securities market. The price may not be indicative of the market price, if any, for the common stock in the trading market after this offering. The market price of the securities offered herein, if any, may decline below the initial public offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against various companies following periods of volatility in the market price of their securities. If instituted against us, regardless of the outcome, such litigation would result in substantial costs and a diversion of management’s attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

24. State securities laws may limit secondary trading, which may restrict the states in which you can sell the shares offered by this prospectus.

If you purchase shares of our common stock sold in this offering, you may not be able to resell the shares in any state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse

9

to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder’s ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder’s risk of losing some or all of his investment.

25. Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our stock.

If a trading market does develop for our stock, it is likely we will be subject to the regulations applicable to “Penny Stock,” the regulations of the SEC promulgated under the Exchange Act that require additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The SEC regulations define penny stocks to be any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Unless an exception is available, those regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a standardized risk disclosure schedule prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the purchaser’s account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that becomes subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage market investor interest in and limit the marketability of our common stock.

Risks Relating to Operating in Israel

26. We conduct our operations in Israel and therefore our results may be adversely affected by political, economic and military instability in Israel.

Our operations and our officers and Directors are located in Israel. Accordingly, political, economic and military conditions in Israel may directly affect our business. Since the establishment of the State of Israel in 1948, a number of armed conflicts have taken place between Israel and its Arab neighbors. Any hostilities involving Israel or the interruption or curtailment of trade within Israel or between Israel and its trading partners could adversely affect our operations and could make it more difficult for us to raise capital. Since September 2000, terrorist violence in Israel has increased significantly and negotiations between Israel and Palestinian representatives have not achieved a peaceful resolution of the conflict. The establishment in 2006 of a government in the Palestinian Authority by representatives of the Hamas militant group has created additional unrest and uncertainty in the region.

Further, Israel was engaged in an armed conflict with Hezbollah in the summer of 2006, a Lebanese Islamist Shiite militia group, which involved thousands of missile strikes and disrupted most day-to-day civilian activity in northern Israel. Any armed conflicts, terrorist activities or political instability in the region would likely negatively affect business conditions and could significantly harm our results of operations.

10

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some discussions in this prospectus may contain forward-looking statements that involve risks and uncertainties. These statements relate to future events or future financial performance. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this prospectus. Forward-looking statements are often identified by words like: “believe,” “expect,” “estimate,” “anticipate,” “intend,” “project” and similar expressions or words which, by their nature, refer to future events. In some cases, you can also identify forward-looking statements by terminology such as “may,” “will,” “should,” “plans,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled Risk Factors beginning on page 9, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. In addition, you are directed to factors discussed in the Management’s Discussion and Analysis of Financial Condition and Results of Operation section beginning on page 19 and in the Business section beginning on page 21, and as well as those discussed elsewhere in this prospectus.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with accounting principles generally accepted in the United States.

THE OFFERING

This prospectus relates to the resale by certain selling security holders of the Company of up to 2,000,000 shares of our common stock. Such shares were offered and sold by us at a purchase price of $0.025 per share to the selling security holders in a fully subscribed private placement conducted from December 2007 through February 2008, pursuant to the exemptions from registration under the Securities Act provided by Regulation S of the Securities Act. As of April 30, 2008, the Company had fully subscribed the private placement and raised $50,000 in gross proceeds.

The selling security holders will be offering the shares of common stock being covered by this prospectus at a price of $0.025 per share until a market develops and thereafter at prevailing market prices or privately negotiated prices.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the common shares being offered for sale by the selling security holders.

11

DETERMINATION OF THE OFFERING PRICE

There has been no public market for our common shares. The price of the shares we are offering was arbitrarily determined at $0.025 per share. We believe that this price reflects the appropriate price that a potential investor would be willing to invest in our company at this initial stage of our development.

The price was arbitrarily determined and bears no relationship whatsoever to our business plan, the price paid for our shares by our founders, our assets, earnings, book value or any other criteria of value. The offering price should not be regarded as an indicator of the future market price of the securities, which is likely to fluctuate.

DIVIDEND POLICY

We have not paid any dividends since our incorporation and do not anticipate the payment of dividends in the foreseeable future. At present, our policy is to retain earnings, if any, to develop and market our products. The payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and operating financial conditions.

MARKET FOR OUR COMMON STOCK

Market Information

There is no public market for our common stock.

We have issued 6,000,000 common shares since the Company’s inception on October 31, 2007 all of which are restricted shares. See “Certain Relationships and Related Transactions” section below regarding these shares. There are no outstanding options or warrants or securities that are convertible into shares of common stock.

Holders

We had 44 holders of record for our common shares as of May 30, 2008.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any compensation plan under which equity securities are authorized for issuance.

Dividends

Please see “Dividend Policy” above.

12

SELLING SECURITY HOLDERS

The following table sets forth the shares beneficially owned, as of May 30, 2008, by the selling security holders prior to the offering contemplated by this prospectus, the number of shares each selling security holder is offering by this prospectus and the number of shares which each would own beneficially if all such offered shares are sold.

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the voting of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest. Except as noted below, each person has sole voting and investment power.

None of the selling security holders is a registered broker-dealer or an affiliate of a registered broker-dealer. Each of the selling security holders has acquired his, her or its shares pursuant to a private placement solely for investment and not with a view to or for resale or distribution of such securities. The shares were offered and sold to the selling security holders at a purchase price of $0.025 per share in a fully subscribed private placement made from December 2007 through February 2008, pursuant to the exemption from the registration under the Securities Act provided by Regulation S of the Securities Act. None of the selling security holders are affiliates or controlled by our affiliates and none of the selling security holders are now or were at any time in the past an officer or Director of ours or any of any of our predecessors or affiliates.

The percentages below are calculated based on 6,000,000 shares of our common stock issued and outstanding. We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock.

| | | | | | | | | | Number of Shares and |

| | | | | | | | | | Percent |

| | | | | | Common | | Number of | | of Total Issued and |

| | Name of | | | | Shares owned | | Shares Offered | | Outstanding Shares |

| | Selling | | | | by the Selling | | by Selling | | Held After the |

| | Security | | | | Security Holder | | Security Holder | | Offering(1) |

| | Last name | | First name | | | | | | # of Shares | | % of Class |

| | Andersons | | Matiss | | 40,000 | | 40,000 | | 0 | | * |

| | Bresis | | Vilnis | | 40,000 | | 40,000 | | 0 | | * |

| | Briede | | Ludmila | | 80,000 | | 80,000 | | 0 | | * |

| | Briedis | | Juris | | 80,000 | | 80,000 | | 0 | | * |

| | Brizga | | Martins | | 40,000 | | 40,000 | | 0 | | * |

| | Celmajeva | | Irina | | 80,000 | | 80,000 | | 0 | | * |

| | Dmitrijevs | | Mihails | | 40,000 | | 40,000 | | 0 | | * |

| | Eversa | | Maija | | 40,000 | | 40,000 | | 0 | | * |

| | Rukuts | | Kristians | | 40,000 | | 40,000 | | 0 | | * |

13

| | Fogele | | Dina | | 40,000 | | 40,000 | | 0 | | * |

| | Jansone | | Evita | | 40,000 | | 40,000 | | 0 | | * |

| | Jujukina | | Galina | | 40,000 | | 40,000 | | 0 | | * |

| | Karklina | | Zaiga | | 40,000 | | 40,000 | | 0 | | * |

| | Kasparovica | | Marianna | | 40,000 | | 40,000 | | 0 | | * |

| | Kaugure | | Inita | | 40,000 | | 40,000 | | 0 | | * |

| | Kaupans | | Juris | | 40,000 | | 40,000 | | 0 | | * |

| | Kerstens | | Alberts | | 40,000 | | 40,000 | | 0 | | * |

| | Kuzmins | | Vladislavs | | 40,000 | | 40,000 | | 0 | | * |

| | Lasmanis | | Haralds | | 40,000 | | 40,000 | | 0 | | * |

| | Lipsne | | Elina | | 80,000 | | 80,000 | | 0 | | * |

| | Maklere | | Laura | | 80,000 | | 80,000 | | 0 | | * |

| | Merins | | Dmitrijs | | 40,000 | | 40,000 | | 0 | | * |

| | Nagijevs | | Anatolijs | | 40,000 | | 40,000 | | 0 | | * |

| | Ozols | | Andrejs | | 40,000 | | 40,000 | | 0 | | * |

| | Pankova | | Nadezda | | 80,000 | | 80,000 | | 0 | | * |

| | Petuhova | | Natalija | | 80,000 | | 80,000 | | 0 | | * |

| | Petuskovs | | Romans | | 80,000 | | 80,000 | | 0 | | * |

| |

| | Poppels | | Maris | | 40,000 | | 40,000 | | 0 | | * |

| |

| | Purvens | | Edgars | | 40,000 | | 40,000 | | 0 | | * |

| |

| | Radcenkova | | Rita | | 40,000 | | 40,000 | | 0 | | * |

| |

| | Repolds | | Andris | | 40,000 | | 40,000 | | 0 | | * |

| | Resko | | Karina | | 40,000 | | 40,000 | | 0 | | * |

| | Riekstins | | Rihards | | 80,000 | | 80,000 | | 0 | | * |

| | Rubenis | | Andris | | 40,000 | | 40,000 | | 0 | | * |

| | Straders | | Kristaps | | 40,000 | | 40,000 | | 0 | | * |

| | Straupe | | Janis | | 40,000 | | 40,000 | | 0 | | * |

| | Vicupe | | Lauma | | 40,000 | | 40,000 | | 0 | | * |

| | Virins | | Vladimirs | | 40,000 | | 40,000 | | 0 | | * |

| | Zuntmane | | Kristine | | 40,000 | | 40,000 | | 0 | | * |

| | Zvarte | | Evita | | 80,000 | | 80,000 | | 0 | | * |

| |

| | | | | | 2,000,000 | | 2,000,000 | | 0 | | |

* Represents less than one percent of the total number of shares of common stock outstanding as of the date of this filing.

(1) Assumes all of the shares of common stock offered in this prospectus are sold and no other shares of common stock are sold or issued during this offering period.

We may require the selling security holders to suspend the sales of the securities offered by this prospectus upon the occurrence of any event that makes any statement in this prospectus, or the related registration statement, untrue in any material respect, or that requires the changing of statements in

14

these documents in order to make statements in those documents not misleading. We will file a post-effective amendment to this registration statement to reflect any material changes to this prospectus.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATION

The following discussion of our plan of operation should be read in conjunction with the financial statements and related notes that appear elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those discussed in “Risk Factors” beginning on page 4 of this prospectus.All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made.

Overview

We have not generated any revenue since our inception. We are a development stage company with limited operations. Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months.

Plan of Operation

We are focused on marketing a natural energy coconut water drink in the growing market for energy drinks in Israel. Our goal is to sell to distributors and retailers in Israel a natural energy drink derived from coconut water.

The majority of our current funds will be used for administrative expenses and initial market studies for the launch of the Yoo brand.We intend to execute an agreement with a coconut water producer for the licensing of coconut water for rebranding and repackaging under the Yoo brand. We intend to work with several suppliers based in the United States, Brazil, Indonesia, or Thailand, to achieve favorable terms for the distribution of our branded coconut water in Israel.

We will require additional funding in the future to sustain our operations. At the present time, however, we have not made any firm arrangements to raise additional cash.

If we are unable to raise additional funds or generate revenues after twelve months for any reason, or if we are unable to make a reasonable profit after eighteen months, we may have to suspend or cease operations. There is no assurance that we will have revenue in the future or that we will be able to secure the necessary funding to develop our business. We may seek to obtain additional funds through a second public offering, a private placement of securities, or loans. Other than as described in this paragraph, we have no other financing plans at this time.

15

Activities to Date

We were incorporated under the laws of the State of Delaware on October 31, 2007. We are a development stage company. From our inception to date, we have not generated any revenues, and our operations have been limited to organizational, start-up, and capital formation activities. We currently have no employees.To date we have conducted market research regarding the manufacture and supply of coconut water drinks. We have also conducted preliminary market research of competing energy drink products in our target markets.

Results of Operations

During the period from October 31, 2007 (date of inception) through April 30, 2008, we incurred a net loss of $30,608. This loss consisted primarily of incorporation costs and administrative expenses. Since inception, we have sold 6,000,000 shares of common stock to our stockholders.

Purchase or Sale of Equipment

We do not expect to purchase or sell any plant or significant equipment.

Revenues

We had no revenues for the period from October 31, 2007 (date of inception) through April 30, 2008.

Liquidity and Capital Resources

Our balance sheet as of April 30, 2008 reflects assets of $49,892. Cash and cash equivalents from inception to date have been insufficient to provide the working capital necessary to operate to date.

We anticipate generating losses, and, therefore, may be unable to continue operations in the future. If we require additional capital, we would have to issue debt or equity or enter into a strategic arrangement with a third party. There can be no assurance that additional capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources.

Going Concern Consideration

Our independent auditors included an explanatory paragraph in their report on the accompanying financial statements regarding concerns about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

Recently Issued Accounting Pronouncements

We do not expect the adoption of any recently issued accounting pronouncements to have a significant impact on our net results of operations, financial position, or cash flows.

16

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

DESCRIPTION OF BUSINESS

Overview of the Company

We are a development stage company that was incorporated on October 31, 2007. We have commenced only limited operations, primarily focused on organizational matters in connection with this offering. We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. We have not made any significant purchase or sale of assets, nor has the Company been involved in any mergers, acquisitions or consolidations. We are not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, because we have a specific business plan and purpose. Neither the Company nor its officers, Directors, promoters or affiliates, has had preliminary contact or discussions with, nor do we have any present plans, proposals, arrangements or understandings with any representatives of the owners of any business or company regarding the possibility of an acquisition or merger.

We have not generated any revenue to date and we do not expect to generate revenues during the first 12 months of our operations. Our Directors have reserved a domain name for us. We have not commenced operations other than in connection with this offering and certain preliminary surveys conducted by our officers. We do not currently have sufficient capital to operate our business, and we will require additional funding in the future to sustain our operations. There is no assurance that we will have revenue in the future or that we will be able to secure the necessary funding to develop our business.

Currently, in the State of Israel, a number of energy drinks are available, such as 180, Red Bull and Rockstar – yet no coconut water drinks are sold. We plan to introduce coconut water to the energy drink market in Israel as a healthy alternative to the existing energy drinks being sold. We plan to target the health conscious consumer and promote the many health benefits associated with coconut water.

Our offices are currently located at 45 Or Hachaim St. Bnei Brak, Israel, 51527. Our telephone number is 972-3-977-0201. We do not currently have a website; however, we have reserved a domain name at yooinc.net.

The Market Opportunity

In recent years, the energy drink industry has seen expanded growth around the world, including Israel. As a result of various cultural factors, including on-the-go lifestyles, the everyday consumer has become reliant upon quick solutions to many of life’s issues. Advertisements for fast food, weight loss pills, nicotine patches, energy bars, and energy drinks are omnipresent on every medium available. However, consumers have also recognized that the excess fat and calories of fast food and snack foods are causes of many health-related problems. Even the diet pills that are available to counteract the health implications of fast food may be a cause of heart attacks and high blood pressure. Consumers are thus looking to stay healthy while continuing to be reliant on quick and easy solutions to their fast-

17

paced lifestyles. They are looking for an energy “kick” without excess calories. The energy drink has capitalized on this demand with impressive results. For example, “Energy drink consumption and sales (in the United States) have exploded since 2001 with more than $3.2 billion in sales in 2006, a 516% increase since 2001. In Israel, a 2007 market survey found that the energy drink market was estimated to be approximately NIS 248 million. The survey further stated that 48% of young Israelis between the ages of 18-30 consume an energy drink at least once a week. This survey reflected an increase in sales up from NIS 230 million in 2006. (http://www.haaretz.com/hasen/spages/949744.html)(www.tgisurveys.com). This explosion has encouraged a proliferation of new brands of energy drinks: as many as 500 new energy drink products were introduced worldwide in 2006.”(Source : Title: Alcohol, Energy Drinks, and Youth: A Dangerous Mix. Author: Michele Simon. 2007)

Most energy drinks, however, contain artificial stimulants, such as caffeine, to provide the energy boost that consumers are looking for. For example, a company called Redux Beverages, LLC makes Cocaine, an energy drink that contains 280 milligrams of caffeine, about three times the amount of caffeine in a cup of coffee.

Energy drinks draw their power from a long list of ingredients, which range from stimulants like caffeine and brain-enhancing drugs called nootropics to more than 4,000 percent of the daily requirement of vitamin B-12.

(http://www.nytimes.com/2006/06/19/health/healthspecial/19drinks.html?n=Top/Reference/Times%20 Topics/People/S/Severson,%20Kim)

What is in an energy drink?

Energy drinks are comprised of many different chemicals and each energy drink is different. Chemicals in energy drinks include:

- Acesulfame Potassium (Sunett)

- Aspartame

- Caffeine

- Citric Acid

- Cyanocobalamin

- Folic Acid

- Fructose

- Glucose

- Glucuronolactone

- 1-Glutamine

- Inositol

- Niacin (nicotinic acid)

- Niacinamide

- Pantothenic Acid (also known as D-pantothenol)

- Potassium sorbate

- Pyridoxine HCL

- Sucralose (splenda)

- Sucrose

- 1-Taurine

(http://www.sciencecases.org/energy_drinks/energy_drinks.pdf)

18

Natural Energy Drinks/Sports Drinks

Despite exotic formulations, the energy boost from energy drinks is delivered generally via a large dose of caffeine. However, not all energy drinks are concocted in a laboratory or contain ingredients that chemically alter the human body’s chemical composition. The energy drink sold under the brand-name Euphoria, for example, boasts that it contains the appropriate blends of natural resources, such as borojo, passion fruit, and guarana to advance the human body’s ability to release its own natural energy (http://www.euphorianatural.com/). Sports drinks such as Gatorade and Powerade are geared towards re-hydrating the body and replenishing the electrolytes the body loses during high levels of activity. They contain electrolytes, sugar, water and other nutrients, and are usually isotonic, containing the same proportions as found in the human body. (http://www.energysip.com/index.html).

Coconut Water

For thousands of years, coconut water has provided people with a nutritious beverage that has been cited for its many health benefits. (http://www.e-f-t.co.uk/younggreencoconutwater.html) Coconut water is a natural energy drink with zero additives, zero chemicals, and zero artificial laboratory sweeteners. Coconut water naturally contains replenishing electrolytes, as well as 530 mg of potassium per 330 ml, while most sports drinks contain 40mg of potassium. (http://www.living-foods.com/articles/coconutwater.html) Coconut water contains less sugar than most sport drinks, and due to its natural sugar content, there is no need to add any artificial sweeteners, such as are added to diet energy drinks.

Coconut Water as an Energy Drink

Coconut water has been used for hundreds years by village people in tropical climates for all sorts of remedies. Until recently, it has not been mass-produced in any way. Within the last 10 years, however, the production and sale of coconut water beverages has become a multi-national industry.

In 2002, All Market LLC foresaw the growth potential in coconut water beverages and took an unknown product and retailed it, netting $50 million in its first year. (http://www.bevnet.com/news/2005/02-25-2005-vita_Coco_whole_foods.asp). While a coconut water energy drink has not yet been introduced in Israel, Vita Coco was born in the United States in 2004 when All Market LLC decided it would import coconut water to the United States and market it as a healthy energy drink. The concept hit the ground running and has become one of the fastest growing lifestyle drinks in the United States. “By 2006, the brand broke through into mainstream groceries and was selling in over 3,000 retail doors nationwide. In 2007, Vita Coco is now sold in close to 5,000 retail doors nationwide, including relationships with Target stores, Whole Foods, Wild Oats, Ralphs, Shaws, HEB, Albertsons, etc.” (http://www.bevnet.com/news/2007/05-17-2007-Vita-Coco-Target-deal.asp). In 2007, Vita Coco was acquired by the Coca Cola Company.

The global coconut water industry is still considered untapped. One reason is that coconut water has a short shelf life when compared to other energy drinks. The company FAO, by utilizing a non-patented cold preservation process, has been investigating mass production capabilities with long term shelf-life inventories meaning large volumes can be moved and stored. “The simple cold preservation process will provide the consumer the convenience of purchasing a bottle of coconut water and opens new opportunities for small farmers and entrepreneurs in coconut producing countries. To date, most coconut water is mostly consumed fresh in tropical countries, such as Brazil. Because once exposed to

19

air and warm temperatures it rapidly deteriorates.” (www.nutraingredients.com/news/nq.aspn?n=74375-fao-coconut-energy-drinkks,

The Market

The energy drink market in Israel is highly competitive, notwithstanding that there are fewer brands available than in the United States. The price range varies depending on the outlets selling. In small shop establishments, energy drinks are more likely to be sold in single units versus 6, 12 or 24-packs. Average retail price per can of the typical energy drink is typically around $2 (http://energy-drink-ratings.blogspot.com/2007/07/unbound-lo-carb-energy-drink-review.html).

A survey by TGI (Target Group Index) in 2007, found that 48% of Israelis between the ages of 18-30 consume an energy drink at least once a week. In 2007, the energy drink market was estimated to be approximatly NIS 248 million, up from NIS 230 million in 2006. (http://www.haaretz.com/hasen/spages/949744.html)(www.tgisurveys.com)

The largest market share is held by Red Bull, which, according to a YNET news story, held approximately 85% of the energy drink market in Israel in 2007. (www.ynetnews.com/articles/0,7340,L-3399039,00.html) XL Energy Drink claims a market share in Israel of over 35% on its website, and is the number two energy drink product in Israel. (www.xl-energy.com/?c=5&l_id=2)

New niche energy drinks are being introduced to the Israeli market. For example, Exit is a Kosher energy drink that is targeted towards the Ultra-religious community in Israel. (www.timesonline.co.uk/tol/news/world/middle_east/article2773915.ece)

Business Model

The goal of Yoo Juice is to penetrate the energy drink market in Israel by launching a coconut water product, targeting the 18-30 age demographic. Grocery stores, bars/nightclubs, fitness centers and local markets will be our primary sales outlets.

We plan to negotiate with suppliers based in South America and the East Indies in order to import coconut water in bulk to distributors in Israel for distribution to local wholesalers and retailers. We have identified several possible suppliers:

Tulus Group Industries – Indonesia

Brazil Worldwide Trading – Brazil

Merit Food Products Co LTC – Thailand

Arrowood Industries Inc - Indonesia

We plan to distribute the product to wholesalers and retailers in Israel. Local distributors include, but are not limited to:

20

Retailers include, but are not limited to:

| | | Shufersal |

| |

| | | Tivtaam |

| |

| | | AMPM |

| |

| | | Paz |

| |

| | | Bodega and market shop owners (sole proprietors) |

| |

| | | Fitness centers such as: |

| |

| | | | Holmes Place |

| |

| | | | Shape |

| |

| | | | Curves |

Pricing

We plan to purchase coconut water from suppliers and import coconut water into Israel at the following projected prices.

Cost per unit/12pk – FOB origin

$.055/$5.40

Cost per 40 ft container

$38,940 – averaging 5,900 cases of 12 per container

Final cost to distributor

$56,463

Distributor final cost to retailer

$76,225

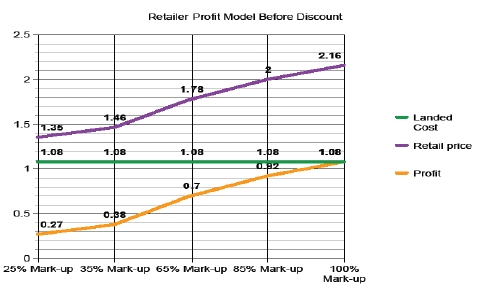

This comes out to a landed retailer cost of $1.08 per unit. Retailers will have leeway of $.92 to work with in terms of mark-up to stay level with the competition. We plan to recommend to retailers to stay under the average cost of an energy drink ($2/unit) in an effort to push value at the price point, which will allow an 85% mark-up. The following is a retailer profit model based on the mark-up or margin the retailer will be able to see.

21

22

As the demand for coconut water increases, we expect to see an increased number of supplier options, particularly from tropical climate countries and the East Indies. Based on price point and product quality, we plan to use one or two main suppliers, with alternate suppliers for back-up purposes in case of stock shortages.

We intend to package our coconut water under the Yoo brand. We plan to work with several suppliers based in the United States, Brazil, Indonesia, or Thailand, in order to acquire the best possible final cost, including logistical fees for shipping to Israel. Product branding will be completed by the supplier so that only finished products will be shipped. We intend to purchase products from manufactures who comply with our requirements. Inventory will be shipped directly to selected distributors or retailers depending on minimum quantities ordered, who will then fulfill orders to our customer base. If the demand for products increases beyond our initial supply capacity, we plan to enter into agreements for the purchase of coconut water from additional suppliers. Should products not be branded for any reason and if only generic packaged products are shipped, we plan to then enter into agreements with our distributors for repackaging services.

Plan of Operation

Over the course of the next twelve-month period we plan to work to develop a customer base for our coconut water product, branded as Yoo Juice, by marketing and selling the Yoo Juice to bodega-type stores, food markets, grocery stores, bars and nightclubs, and fitness centers in Israel.

We intend package the product under the Yoo brand and/or under private labels belonging to retailers in Israel, such as Holmes Place, Ribua Kachol, Shufersal, AM/PM, Yellow, and Tivtaam.

We intend to work with several suppliers based in the United States, Brazil, Indonesia, or Thailand in order to acquire the best possible final cost for our coconut water product, taking into consideration the logistical fees associated with importing coconut water to Israel. We plan for product branding to be completed by our suppliers, so that only finished products will be shipped. We intend to purchase coconut water only from producers who comply with our requirements. Our plan is for inventory to be shipped directly to our customer base. If the demand for our product surpasses our supply arrangements, we will consider seeking additional producers of coconut water from which to purchase our requirements. As order quantities increase, we expect to have stronger bargaining leverage and better pricing.

We plan to develop our business as described above, and to market our natural coconut water energy drink under the brand name Yoo Juice.

Twelve-Month Marketing Plan

Israel is a country that focuses on fresh and healthy foods for consumption. Local markets sell fresh, inexpensive produce grown locally every day. It is not uncommon to see juice vendors selling fresh squeezed carrot, orange, pomegranate and grapefruit juices sold at prices paid for carbonated drinks. Our marketing strategy will focus on creating awareness of our Yoo Juice brand name while incurring minimal costs. We will use print media as the main forum to deliver product advertising to our customer base. We will also use niche based slogans to aid in product knowledge retention and customer awareness.

We intend to market our product through direct and indirect distribution to:

23

Convenience and Grocery stores –We expect to see our largest take rate in these sales arenas.By using independent contractors as our sales force starting by the end of 2008, we willendeavor to penetrate this market by offering bulk quantity discounts. Coconut water is farless expensive then other energy drinks. As a marketing campaign, we will design windowposters that show the Yoo Juice product and tout its natural energy resources, its many healthbenefits, and that fact that it contains zero additives/chemicals. The slogan we intend to usefor these window posters will be Yoo Juice “Natural, delicious, and good for yoo.”

Food Markets –We expect our second largest target to be the local food markets. We plan tohire an independent contractor to sell coconut water to local markets. This company will bepaid a commission percentage for each unit of juice sold. The purpose is to bring awarenessnot only to the individual consumer but to the shop owners as well. Using independentcontractors, we will demonstrate to shop owners that there is a consumer demand for ourproduct. Once product awareness has been achieved, we plan to sell directly to market shopowners in bulk. As a marketing promotion we intend to make Yoo Juice keychains with theslogan “good for yoo” as giveaways to the market shop owners, who may give them away withthe purchase of a case or more of our product.

Bars and Nightclubs –We plan to target bars and nightclubs as the mixed drink segments ofthe market. We plan to make drink coasters with the Yoo juice brand and the slogan “get areal drink” on one side. On the other side will be the recipe for three drinks, including acoconut water-based drink such as the Yoo Juice Bay Breeze (coconut water, rum, cranberryand orange juice). We intend to provide these coasters to bar and nightclub owners with bulkpurchases of Yoo juice.

Fitness Centers –In the fitness center segment we plan to capitalize on coconut water’srehydrating and electrolyte qualities. We intend to make fitness headbands and wrist bandswith the Yoo branding that also includes the slogan “fitness + coconut water = YOO.” Weplan to also use window posters for fitness centers to advertise in this health conscious marketsegment the advantages gained by hydrating with an all natural coconut water product.

We plan to assess the success of our marketing and sales strategy on a monthly basis by reviewing sales tracking. Sales tracking will be a simple system of inserting into a database order quantities by each segment on a daily, weekly, and monthly basis. Current reporting will allow us to review which market segments are responding and which market segments are not. We intend to meet quarterly for marketing strategy changes, such as merchandise options, promotional tools and sales focusing. For example, should we not see a response from the fitness center segment, we will then consider modifying our marketing campaign for that segment and applying our resources elsewhere.

24

Expenditures

The following chart provides an overview of our budgeted expenditures by significant area of activity, over the next 12 months:

| | Corporate/ travel | $ | 20,000 |

| | Marketing | $ | 20,000 |

| | Office Rent | $ | 10,000 |

| | Office Equipment | $ | 5,000 |

| | Purchase Product | $ | 8,000 |

| | Miscellaneous | $ | 20,000 |

| | Legal and Accounting | $ | 20,000 |

| | Transfer Agent | $ | 15,000 |

| | Expenses | $ | 118,000 |

Dependence on One or a Few Major Suppliers

We plan to purchase our coconut water products from one or two main suppliers, with alternate suppliers for back-up purposes in case of stock shortages. However, if we end up entering into supply contracts with only one or two suppliers, then we may end up being dependent such supplier(s) for the supply of all of our coconut water products.

Patent, Trademark, License & Franchise Restrictions and Contractual Obligations & Concessions

We have not entered into any franchise agreements or other contracts that have given, or could give rise to, obligations or concessions. Beyond our trade name, we do not hold any other intellectual property.

Governmental Regulations

We may be subject to a variety of laws and regulations relating to, among other things, food safety and health regulations. We believe that we are in compliance with all such laws.

Employees

We currently have no employees. All functions including development, strategy, negotiations and administration are currently being provided by our officers and Directors on an as-needed basis.

DESCRIPTION OF PROPERTY

We do not own any real property. We currently maintain our corporate office at 45 Or Hachaim St. Bnei Brak, Israel, 51527. We do not pay monthly rent for use of this space. This space is sufficient until we commence full operations.

25

Reports to Security Holders

We will voluntarily make available to securities holders an annual report, including audited financials, on Form 10-KSB. We are not currently a fully reporting company, but upon effectiveness of this registration statement, we will be required to file reports with the SEC pursuant to the Securities Exchange Act of 1934; such as quarterly reports on Form 10-QSB and current reports on Form 8-K.

MANAGEMENT

The name, age and position of each of our directors and executive officers are as follows:

| Name | | Age | | Position |

| | | | | |

| Zvi Pessahc Frank | | 29 | | President and Director |

| | | | | |

| Moshe Nachum Bergshtein | | 30 | | Secretary, Treasurer and Director |

Zvi Pessahc Frank:

On November 14, 2007, Zvi Pessahc Frank was appointed our President and a member of our Board of Directors. Since 2005, Mr. Frank has been employed as a sales executive at the Nekudot advertising agency in Bnei Brak, Israel. Between the years 2003-2005, Mr. Frank taught history at Daat Zkenim in Jerusalem, Israel.

Moshe Bergshtein:

On November 19 2007, Mr. Moshe Nachum Bergshtein was appointed our Secretary and Treasurer and a member of our Board of Directors. From 2003 until 2007, Mr. Bergshtein was employed as a travel agent at Derech Hamelech in Jerusalem, Israel. Since 2007, Mr. Bergshtein has been self-employed and provides travel arrangements for groups.

Board Composition

Our bylaws provide that the Board of Directors shall consist of between one to nine members. Each director serves for a term that expires at the next regular meeting of the shareholders and until his successor is elected and qualified.

Committees of the Board of Directors

We do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee or any other committees of our Board of Directors. As such, our entire Board of Directors acts as our audit committee.

Audit Committee Financial Expert

Our Board of Directors does not currently have any member who qualifies as an audit committee financial expert. We believe that the cost related to retaining such a financial expert at this time is

26

prohibitive. Further, because we are in the start-up stage of our business operations, we believe the services of an audit committee financial expert are not warranted at this time.

Involvement in Legal Proceedings

No Director, nominee for Director or officer of the Company has appeared as a party during the past five years in any legal proceedings that may bear on his ability or integrity to serve as a Director or officer of the Company.

Auditors; Code of Ethics; Financial Expert

Our principal registered independent auditor is Alan Weinberg CPA. We do not currently have a Code of Ethics applicable to our principal executive, financial, and accounting officers. We do not have a “financial expert” on the board.

EXECUTIVE COMPENSATION

We have not paid, nor do we owe, any compensation to our executive officers. We have not paid any compensation to our officers since inception.

We have no employment agreements with any of our executive officers or employees.

Option/SAR Grants

We do not currently have a stock option plan. No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to any executive officer or any Director since our inception; accordingly, no stock options have been granted or exercised by any of the officers or Directors since we were founded.

Long-Term Incentive Plans and Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance. No individual grants or agreements regarding future payouts under non-stock price-based plans have been made to any executive officer or any Director or any employee or consultant since our inception; accordingly, no future payouts under non-stock price-based plans or agreements have been granted or entered into or exercised by any of the officers or Directors or employees or consultants since we were founded.

Compensation of Directors

There are no arrangements pursuant to which Directors are or will be compensated in the future for any services provided as a Director.

Employment Contracts, Termination of Employment, Change-in-Control Arrangements

There are currently no employment or other contracts or arrangements with officers or Directors. There are no compensation plans or arrangements, including payments to be made by us, with respect to our

27

officers, Directors or consultants that would result from the resignation, retirement or any other termination of such Directors, officers or consultants from us. There are no arrangements for Directors, officers, employees or consultants that would result from a change-in-control.