UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22209

Global X Funds

(Exact name of registrant as specified in charter)

605 Third Avenue, 43rd floor

New York, NY 10158

(Address of principal executive offices) (Zip code)

Thomas Park

Global X Management Company LLC

605 Third Avenue, 43rd floor

New York, NY 10158

(Name and address of agent for service)

With a copy to:

Global X Management Company LLC 605 Third Avenue, 43rd floor New York, NY 10158 | Eric S. Purple, Esq. Stradley Ronon Stevens & Young, LLP 2000 K Street, N.W., Suite 700 Washington, DC 20006-1871 |

Registrant’s telephone number, including area code: (212) 644-6440

Date of fiscal year end: November 30, 2023

Date of reporting period: November 30, 2023

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Act”) (17 CFR § 270.30e-1), is attached hereto.

Global X Millennial Consumer ETF (ticker: MILN)

Global X Aging Population ETF (ticker: AGNG)

Global X Health & Wellness ETF (ticker: BFIT)

Global X Robotics & Artificial Intelligence ETF (ticker: BOTZ)

Global X FinTech ETF (ticker: FINX)

Global X Internet of Things ETF (ticker: SNSR)

Global X U.S. Infrastructure Development ETF (ticker: PAVE)

Global X Autonomous & Electric Vehicles ETF (ticker: DRIV)

Global X Artificial Intelligence & Technology ETF (ticker: AIQ)

Global X Genomics & Biotechnology ETF (ticker: GNOM)

Global X Cloud Computing ETF (ticker: CLOU)

Global X Cannabis ETF (ticker: POTX)

Global X Thematic Growth ETF (ticker: GXTG)

Global X Video Games & Esports ETF (ticker: HERO)

Global X Cybersecurity ETF (ticker: BUG)

Global X Telemedicine & Digital Health ETF (ticker: EDOC)

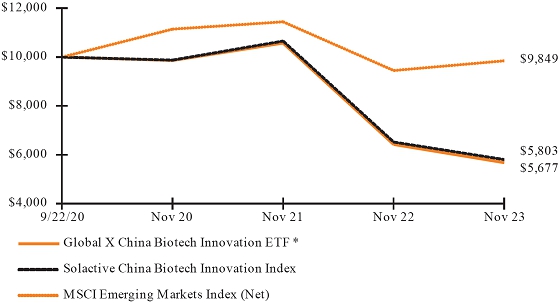

Global X China Biotech Innovation ETF (ticker: CHB)

Global X CleanTech ETF (ticker: CTEC)

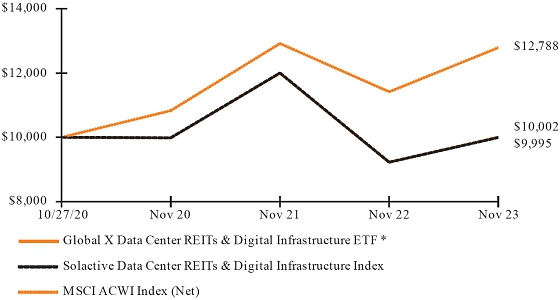

Global X Data Center REITs & Digital Infrastructure ETF (ticker: VPN)

Global X Clean Water ETF (ticker: AQWA)

Global X AgTech & Food Innovation ETF (ticker: KROP)

Global X Blockchain ETF (ticker: BKCH)

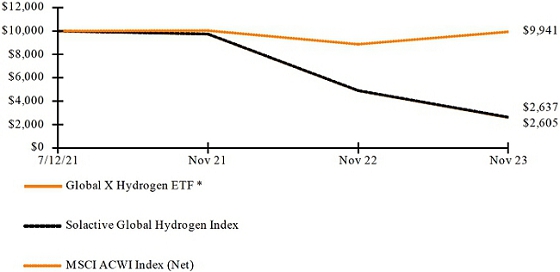

Global X Hydrogen ETF (ticker: HYDR)

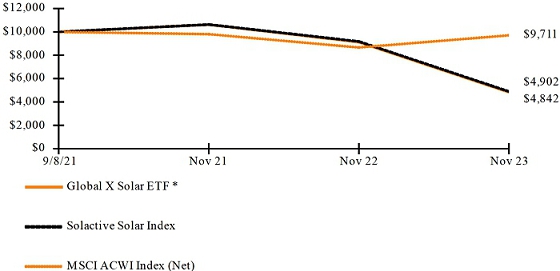

Global X Solar ETF (ticker: RAYS)

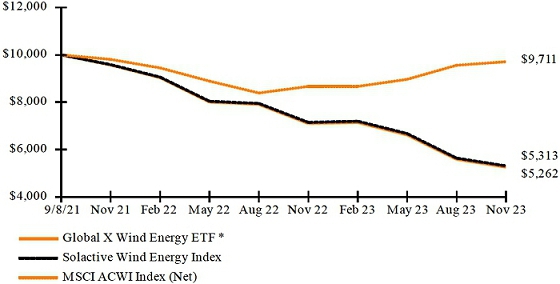

Global X Wind Energy ETF (ticker: WNDY)

Global X Green Building ETF (ticker: GRNR)

Global X Metaverse ETF (ticker: VR)

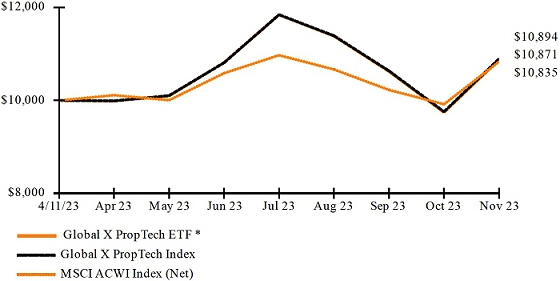

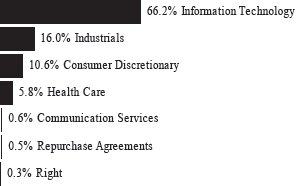

Global X PropTech ETF (ticker: PTEC)

Global X Carbon Credits Strategy ETF (ticker: NTRL)

Global X Defense Tech ETF (ticker: SHLD)

Annual Report

November 30, 2023

As permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ (defined below) shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, shareholder reports will be available on the Funds’ website (www. globalxetfs.com/explore), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary.

You may elect to receive all future Fund shareholder reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of Fund shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Table of Contents

Table of Contents

Shares are bought and sold at market price (not NAV) and are not individually redeemed from a Fund. Shares may only be redeemed directly from a Fund by Authorized Participants, in very large creation/redemption units. Brokerage commissions will reduce returns.

The Funds file their complete schedules of Fund holdings with the Securities and Exchange Commission (the “SEC” or “Commission”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT is available on the Commission’s website at https://www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Global X Funds uses to determine how to vote proxies relating to Fund securities, as well as information relating to how the Funds voted proxies relating to Fund securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-888-493-8631; and (ii) on the Commission’s website at https://www.sec.gov

Management Discussion of Fund Performance (unaudited)

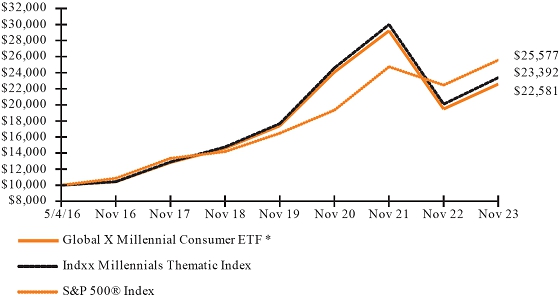

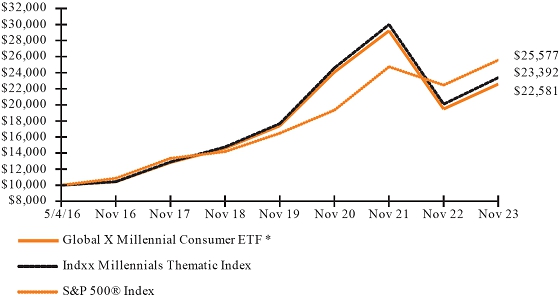

Global X Millennial Consumer ETF

Global X Millennial Consumer ETF

Global X Millennial Consumer ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Millennials Thematic Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index measures the performance of U.S. listed companies that provide exposure to the Millennial generation, (“Millennial Companies”). The Millennial generation refers to the demographic cohort in the US with birth years ranging from 1980 to 2000.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 15.87%, while the Underlying Index increased 16.42%. The Fund had a net asset value of $28.43 per share on November 30, 2022 and ended the reporting period with a net asset value of $32.86 on November 30, 2023.

During the reporting period, the highest returns came from Carvana Co. Class A and Meta Platforms Inc. Class A, which returned 306.23% and 177.01%, respectively. The worst performers were Bed Bath & Beyond Inc and 2U Inc., which returned -91.37% and -87.77%, respectively.

The Fund recorded positive returns during the reporting period, capitalizing on the evolving preferences of Millennial and Gen Z consumers, a significant global demographic. These cohorts increasingly favored cutting-edge technology and convenience, driven by heightened social media consumption that propelled mobile shopping and alternative payment methods during the reporting period. Noteworthy trends included a preference for experiential pursuits (such as travel) over material possessions and a discernible shift toward access over ownership, observed in the popularity of ridesharing and collaborative consumption. These trends not only presented lucrative opportunities for modern companies but also contributed to the enduring success of established legacy businesses, fueled by the growing spending capacity of these consumer groups. During the reporting period, the Fund had the highest sector exposure to Consumer Discretionary at 42.78% and Communication Services at 23.77%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Millennial Consumer ETF | 15.87% | 15.97% | -2.11% | -2.10% | 9.11% | 9.10% | 11.35% | 11.29% |

| Indxx Millennials Thematic Index | 16.42% | 16.42% | -1.66% | -1.66% | 9.65% | 9.65% | 11.87% | 11.87% |

| S&P 500® Index | 13.84% | 13.84% | 9.76% | 9.76% | 12.51% | 12.51% | 13.19% | 13.19% |

1

Management Discussion of Fund Performance (unaudited)

Global X Millennial Consumer ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on May 4, 2016.

The S&P 500® Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

2

Management Discussion of Fund Performance (unaudited)

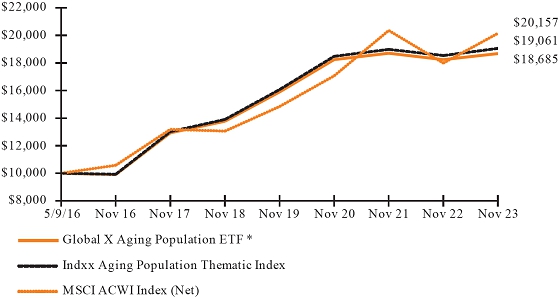

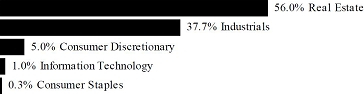

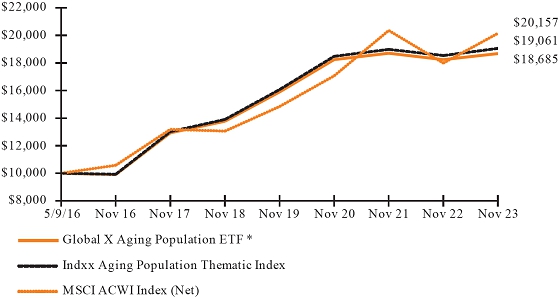

Global X Aging Population ETF

Global X Aging Population ETF

Global X Aging Population ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Aging Population Thematic Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to track the performance of companies listed in developed markets that are expected to directly or indirectly contribute to increasing the life-spans of the senior population of the world. The Underlying Index provides access to companies involved in biotechnology, medical devices, pharmaceuticals, senior living facilities and specialized health care services, which respond to the needs of this demographic.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 2.42%, while the Underlying Index increased 2.80%. The Fund had a net asset value of $26.46 per share on November 30, 2022 and ended the reporting period with a net asset value of $26.93 on November 30, 2023.

During the reporting period, the highest returns came from Seagen, Inc. and Novo Nordisk A/S Class B, which returned 75.64% and 68.44%, respectively. The worst performers were FibroGen, Inc. and Cano Health, Inc. Class A, which returned -96.16% and -96.12%, respectively.

The Fund recorded modestly positive returns during the reporting period as advances in medical science and technology supported growth of the healthcare industry. Continued growth of the aging population theme resulted in increased demand for medical care and healthcare services, leading to positive investor sentiment. Growing focus on research and development (R&D) in the medical industry towards addressing age-related disorders like cardiovascular illnesses and type 2 diabetes also played a role in growing returns. Furthermore, senior living facilities benefited from increased demand for round-the-clock care and operational improvements to better scale care. Ongoing supply chain and macroeconomic headwinds limited upside in the Fund during the reporting period, with inflationary pressures impacting margins in the medical devices sector. The Fund also benefitted from a slower-than-expected rebound for aging-related surgical procedures following the COVID-19 pandemic.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Aging Population ETF | 2.42% | 1.54% | 0.79% | 0.63% | 6.28% | 6.10% | 8.62% | 8.86% |

| Indxx Aging Population Thematic Index | 2.80% | 2.80% | 1.03% | 1.03% | 6.51% | 6.51% | 8.90% | 8.90% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 9.71% | 9.71% |

3

Management Discussion of Fund Performance (unaudited)

Global X Aging Population ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on May 9, 2016.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

4

Management Discussion of Fund Performance (unaudited)

Global X Health & Wellness ETF

Global X Health & Wellness ETF

Global X Health & Wellness ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Health & Wellness Thematic Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to track the performance of companies listed in developed markets that provide products and services aimed at promoting physical wellness through active and healthy lifestyles, including but not limited to fitness equipment and technology, athletic apparel, nutritional supplements, and organic/ natural food offerings.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 5.64%, while the Underlying Index increased 6.04%. The Fund had a net asset value of $21.37 per share on November 30, 2022 and ended the reporting period with a net asset value of $22.35 on November 30, 2023.

During the reporting period, the highest returns came from BellRing Brands, Inc. and WW International, Inc., which returned 112.36% and 105.08%, respectively. The worst performers were F45 Training Holdings, Inc. and Li Ning Company Limited, which returned -66.17% and -63.76%, respectively.

The Fund recorded positive returns during the reporting period as increased focus on health, prevention, and self-care among consumers supported the global health and wellness market. Higher consumer spending on products and services geared towards maintaining a healthy and active lifestyle further supported investor sentiment. Technological advancements and integration of digital devices in the health and wellness industry increased demand for fitness wearable devices. Furthermore, the wellness economy continued to grow amid increased government expenditure on the development of sophisticated healthcare infrastructure and new medical technologies. Ongoing supply chain and recessionary concerns limited upside in the Fund during the reporting period, with slower-than-expected demand for high end home workout equipment and athletic apparel. During the reporting period, the Fund had an average approximate stock exposure of 39.93% in the United States and 14.72% in Japan. By sector, the Fund had its highest exposures, on average, to Consumer Discretionary at 70.84%, followed by Consumer Staples at 23.61%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Health & Wellness ETF | 5.64% | 5.36% | -1.71% | -1.93% | 4.52% | 4.35% | 6.27% | 6.34% |

| Indxx Global Health & Wellness Thematic Index | 6.04% | 6.04% | -1.38% | -1.38% | 4.90% | 4.90% | 6.70% | 6.70% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 9.71% | 9.71% |

5

Management Discussion of Fund Performance (unaudited)

Global X Health & Wellness ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on May 9, 2016.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

6

Management Discussion of Fund Performance (unaudited)

Global X Robotics & Artificial Intelligence ETF

Global X Robotics & Artificial Intelligence ETF

Global X Robotics & Artificial Intelligence ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Robotics & Artificial Intelligence Thematic Index (“Underlying Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index seeks to invest in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 25.75%, while the Underlying Index increased 26.09%. The Fund had a net asset value of $21.09 per share on November 30, 2022 and ended the reporting period with a net asset value of $26.47 on November 30, 2023.

During the reporting period, the highest returns came from Rainbow Robotics and Symbotic Inc., which returned 448.70% and 199.60%, respectively. The worst performers were Tusimple Holdings Inc. Class A and Faro Technologies Inc., which returned -62.18% and -38.60%, respectively.

The Fund recorded positive returns during the reporting period amid heightened adoption rates of automation to combat labor shortages and supply chain inefficiencies in artificial intelligence, alongside other advancements. Industrial robotics installations experienced momentum worldwide over the course of the reporting period. This trend was fueled by the increasing affordability and sophistication of robots, which led to higher precision and productivity across various industries. Concurrently, the shift towards reshoring and supply chain diversification spurred demand for automated manufacturing. This demand proved crucial in enhancing quality, reducing costs, and maintaining global competitiveness. In the U.S. specifically, substantial investment in chip manufacturing also propelled automation. Similarly, service robots, especially those used in delivery and healthcare, also expanded their presence due to advancements in generative AI technology and the growing use of internet of things devices. During the reporting period, the Fund had an average approximate stock exposure of 46.74% in United States and 32.29% in Japan. By sector, the Fund had its highest average sector exposure to Information Technology at 42.77%, followed by Industrials at 39.46%).

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Robotics & Artificial Intelligence ETF | 25.75% | 23.56% | -5.73% | -5.65% | 6.76% | 6.69% | 8.83% | 8.81% |

| Indxx Global Robotics & Artificial Intelligence Thematic Index | 26.09% | 26.09% | -5.24% | -5.24% | 7.22% | 7.22% | 9.22% | 9.22% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 9.32% | 9.32% |

7

Management Discussion of Fund Performance (unaudited)

Global X Robotics & Artificial Intelligence ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on September 12, 2016.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

8

Management Discussion of Fund Performance (unaudited)

Global X FinTech ETF

Global X FinTech ETF

The Global X FinTech ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global FinTech Thematic Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies in developed markets that provide financial technology products and services, including companies involved in mobile payments, peer-to-peer (“P2P”) and marketplace lending, financial analytics software and alternative currencies (collectively, “FinTech Companies”), as defined by Indxx, LLC, the provider of the Underlying Index.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 9.70%, while the Underlying Index increased 10.00%. The Fund had a net asset value of $20.44 per share on November 30, 2022 and ended the reporting period with a net asset value of $22.37 on November 30, 2023.

During the reporting period, the highest returns came from Coinbase Global Inc. Class-A and Riot Platforms Inc., which returned 172.73% and 169.89%, respectively. The worst performers were Sunlight Financial Holdings Inc. Class A and Linklogis Inc. Class-B, which returned -61.33% and -55.42%, respectively.

The Fund recorded positive performance during the reporting period as digital wallet adoption and point-of-sale (POS) systems generated additional revenues for FinTech Companie. In response to the U.S. Federal Reserve’s increase in interest rates and borrowing costs, market players adapted to the economic environment by embracing new features and functionalities to stabilize revenues, with a focus on improving margins. Furthermore, the rise of artificial intelligence and machine learning reduced costs for financial institutions in assessing the credibility of borrowers and their spending behaviors. Lastly, the broader improvement in the crypto industry further helped boost revenues and profits in crypto exposed franchises of FinTech Companies. Companies that supply financial software and technology to traditional banks and legacy financial institutions also saw strong performance, and banks continued to spend incremental dollars on digitizing their information technology. During the reporting period, the Fund had an average approximate stock exposure of 62.90% in United States. By sector, it had the highest exposure to Financials at 66.39% and Information Technology at 27.47%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X FinTech ETF | 9.70% | 8.82% | -17.87% | -17.92% | -0.68% | -0.73% | 6.49% | 6.46% |

| Indxx Global Fintech Thematic Index | 10.00% | 10.00% | -17.58% | -17.58% | -0.22% | -0.22% | 7.04% | 7.04% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 9.32% | 9.32% |

9

Management Discussion of Fund Performance (unaudited)

Global X FinTech ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on September 12, 2016.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

10

Management Discussion of Fund Performance (unaudited)

Global X Internet of Things ETF

Global X Internet of Things ETF

Global X Internet of Things ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Internet of Things Thematic Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index seeks to invest in companies that stand to potentially benefit from the broader adoption of the Internet of Things (“IoT”). This includes the development and manufacturing of semiconductors and sensors, integrated products and solutions, and applications serving smart grids, smart homes, connected cars, and the industrial internet.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 7.26%, while the Underlying Index increased 7.78%. The Fund had a net asset value of $30.54 per share on November 30, 2022 and ended the reporting period with a net asset value of $32.45 on November 30, 2023.

During the reporting period, the highest returns came from Samsara Inc. CL-A and Arlo Technologies Inc., which returned 188.98% and 137.96%, respectively. The worst performers were Butterfly Network Inc. and Spirent Communications Plc, which returned -70.52% and -55.14%, respectively.

The Fund recorded positive returns during the reporting period amid heightened industrial and automotive demand due to increased spending on industrial automation and growing use of semiconductors in autonomous vehicles. Furthermore, businesses benefitted through the synergy between IoT, data analytics, and generative artificial intelligence (AI) to optimize operations and improve customer experiences. Enhanced connectivity through high-speed internet, including 5G networks, provided greater network reliability and opened new possibilities for IoT applications in areas such as smart cities and healthcare. Lastly, increased deployments of IoT solutions amid development of more robust encryption protocols and security measures further supported IoT growth. During the reporting period, by sector, the Fund had the highest average exposure to Information Technology at 65.51% and Industrials at 17.10%.

11

Management Discussion of Fund Performance (unaudited)

Global X Internet of Things ETF

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Internet of Things ETF | 7.26% | 6.64% | 3.33% | 3.34% | 13.42% | 13.45% | 12.12% | 12.12% |

| Indxx Global Internet of Things Thematic Index | 7.78% | 7.78% | 3.72% | 3.72% | 13.80% | 13.80% | 12.50% | 12.50% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 9.32% | 9.32% |

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on September 12, 2016.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

12

Management Discussion of Fund Performance (unaudited)

Global X Internet of Things ETF

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous pages.

13

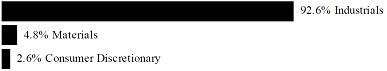

Management Discussion of Fund Performance (unaudited)

Global X U.S. Infrastructure Development ETF

Global X U.S. Infrastructure Development ETF

Global X U.S. Infrastructure Development ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx U.S. Infrastructure Development Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to measure the performance of U.S. listed companies that provide exposure to domestic infrastructure development, including companies involved in construction and engineering; production of infrastructure raw materials, composites and products; industrial transportation; and producers/distributors of heavy construction equipment (collectively, “U.S. Infrastructure Development Companies”), as defined by Indxx, LLC, the provider of the Underlying Index.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 13.63%, while the Underlying Index increased 14.31%. The Fund had a net asset value of $27.94 per share on November 30, 2022 and ended the reporting period with a net asset value of $31.50 on November 30, 2023.

During the reporting period, the highest returns came from Powell Industries Inc. and Atlas Technical Consultants, which returned 221.37% and 124.21%, respectively. The worst performers were Titan Machinery Inc. and Calix Inc., which returned -48.08% and -45.88%, respectively.

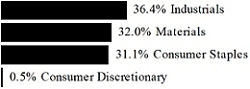

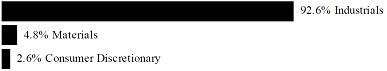

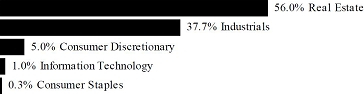

The Fund recorded a positive performance during the reporting period as U.S. Infrastructure Development Companies continued to benefit from high demand for construction work and positive sentiments toward the Infrastructure Investment and Jobs Act (IIJA), Inflation Reduction Act (IRA), and CHIPS Act. The United States also experienced a surge in manufacturing construction spending as companies reoriented their supply chains in the fallout from disruptive events such as the COVID-19 pandemic and conflict in Ukraine. Infrastructure companies with the expertise to build out industrial capacity also benefitted from this onshoring trend. Lastly, after softening around the beginning of the reporting period, construction input prices stabilized, providing support for materials suppliers within the Fund. During the reporting period, by sector, the Fund had the highest exposure to Industrials at 71.80% and Materials at 22.00%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year

Return | Three Year

Return | Five Year

Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X U.S. Infrastructure Development ETF | 13.63% | 13.59% | 16.62% | 16.53% | 15.98% | 15.95% | 12.31% | 12.31% |

| Indxx U.S. Infrastructure Development Index | 14.31% | 14.31% | 17.32% | 17.32% | 16.60% | 16.60% | 12.90% | 12.90% |

| S&P 500® Index | 13.84% | 13.84% | 9.76% | 9.76% | 12.51% | 12.51% | 12.17% | 12.17% |

14

Management Discussion of Fund Performance (unaudited)

Global X U.S. Infrastructure Development ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on March 6, 2017.

The S&P 500® Index is a market capitalization weighted composite index of 500 large capitalization U.S. companies.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

15

Management Discussion of Fund Performance (unaudited)

Global X Autonomous & Electric Vehicles ETF

Global X Autonomous & Electric Vehicles ETF

Global X Autonomous & Electric Vehicles ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Autonomous & Electric Vehicles Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies that are involved in the development of electric vehicles and/or autonomous vehicles, including companies that produce electric/hybrid vehicles, electric/hybrid vehicle components and materials, autonomous driving technology, and network connected services for transportation, as defined by Solactive AG, the provider of the Underlying Index.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 2.71%, while the Underlying Index increased 2.64%. The Fund had a net asset value of $22.89 per share on November 30, 2022 and ended the reporting period with a net asset value of $23.19 on November 30, 2023.

During the reporting period, the highest returns came from NVIDIA Corporation and Hyster-Yale Materials Handling, Inc. Class A, which returned 176.47% and 67.61%, respectively. The worst performers were Plug Power Inc. and Innoviz Technologies Ltd., which returned -74.69% and -68.16%, respectively.

The Fund recorded modestly positive returns during the reporting period due to strong performances from big tech companies that are aligned with autonomous vehicle development as well as continued growth for the electric vehicle (“EV”) industry. A combination of accommodative government policy, technological innovation, deployment of charging infrastructure, and expanded commitments from traditional automakers continued to support progress in EV adoption. Declining battery-related commodity costs and price wars between automakers improved EV affordability, although they continue to sell at an upfront premium to internal combustion engine vehicles. EV sales did not grow as quickly as expected during the reporting period due to economic headwinds in China and elevated borrowing costs for consumers around the world. During the reporting period, the Fund had an average approximate stock exposure of 55.50% in the United States and 10.81% in Japan. By sector, it had the highest average exposure to Consumer Discretionary at 35.39%, followed by Information Technology at 29.80%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Autonomous & Electric Vehicles ETF | 2.71% | 1.65% | 2.94% | 2.75% | 13.34% | 13.32% | 9.33% | 9.27% |

| Solactive Autonomous & Electric Vehicles Index | 2.64% | 2.64% | 3.17% | 3.17% | 13.53% | 13.53% | 9.49% | 9.49% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 7.51% | 7.51% |

16

Management Discussion of Fund Performance (unaudited)

Global X Autonomous & Electric Vehicles ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on April 13, 2018.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

17

Management Discussion of Fund Performance (unaudited)

Global X Artificial Intelligence & Technology ETF

Global X Artificial Intelligence & Technology ETF

Global X Artificial Intelligence & Technology ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Artificial Intelligence & Big Data Index (“Underlying Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies in developed markets that are positioned to benefit from the further development and implementation of artificial intelligence technology, as well as to companies that provide critical technology and services for the analysis of large and complex data sets (collectively, “Artificial Intelligence & Big Data Companies”).

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 38.56%, while the Underlying Index increased 39.45%. The Fund had a net asset value of $21.54 per share on November 30, 2022 and ended the reporting period with a net asset value of $29.73 on November 30, 2023.

During the reporting period, the highest returns came from Alchip Technologies Ltd. and Super Micro Computer Inc., which returned 233.68% and 203.08%, respectively. The worst performers were Meituan-Class B and Envestnet Inc., which returned -44.66% and -41.49%, respectively.

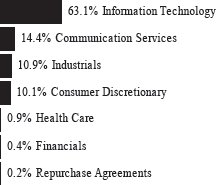

The Fund recorded positive performance during the reporting period as strong growth in the artificial intelligence (“AI”) market and its positive impact on productivity supported economic gains. The growing use of AI-as-a-service gave an opportunity for cloud computing companies to monetize their services by partnering with emerging AI startups and upselling additional cloud infrastructure to their expansive user bases. Additionally, the introduction of new generative AI tools to enhance user experiences contributed to the Fund’s performance. Multi-sectoral applications of AI for automation, productivity enhancement, and quality control gave investors confidence in companies looking to utilize AI for improving profit margins. Investor confidence was also boosted as the technology companies operating in this realm prioritized cost-cutting measures and workforce reductions to enhance margins and improve bottom-line performance. During the reporting period, the Fund had the highest average sector exposure to Information Technology at 61.36%, followed by Communication Services at 14.79%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR ENDED

NOVEMBER 30, 2023 |

| | One Year Return | Three Year Return | Five Year Return | Annualized

Inception to Date* |

| | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price | Net

Asset

Value | Market

Price |

| Global X Artificial Intelligence & Technology ETF | 38.56% | 37.28% | 5.14% | 4.98% | 16.43% | 16.45% | 13.60% | 13.60% |

| Indxx Artificial Intelligence & Big Data Index | 39.45% | 39.45% | 5.67% | 5.67% | 16.94% | 16.94% | 14.09% | 14.09% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 9.07% | 9.07% | 7.23% | 7.23% |

18

Management Discussion of Fund Performance (unaudited)

Global X Artificial Intelligence & Technology ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on May 11, 2018.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

19

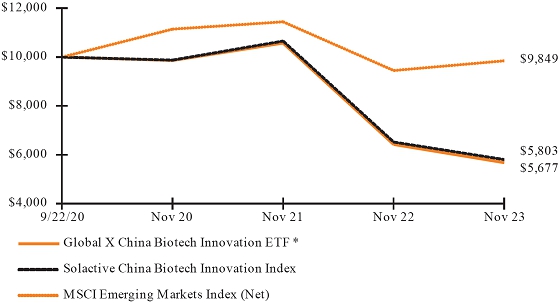

Management Discussion of Fund Performance (unaudited)

Global X Genomics & Biotechnology ETF

Global X Genomics & Biotechnology ETF

Global X Genomics & Biotechnology ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Genomics Index (“Underlying Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies that are positioned to benefit from further advances in the field of genomic science and biotechnology, as well as applications thereof (collectively, “Genomics & Biotechnology Companies”), as defined by Solactive AG, the provider of the Underlying Index (“Index Provider”). In order to be eligible for inclusion in the Underlying Index, a company is considered by the Index Provider to be a Genomics & Biotechnology Company if it derives at least 50% of its revenue, operating income, or assets from genomics and/or biotechnology.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund decreased 22.60%, while the Underlying Index decreased 22.22%. The Fund had a net asset value of $13.45 per share on November 30, 2022 and ended the reporting period with a net asset value of $10.41 on November 30, 2023.

During the reporting period, the highest returns came from Avidity Biosciences Inc. and Natera Inc., which returned 42.52% and 36.07%, respectively. The worst performers were Bionano Genomics Inc. and Sangamo Therapeutics Inc., which returned -93.53% and -91.88%, respectively.

The Fund recorded negative returns during the reporting period on account of challenges faced by biotechnology companies due to growing inflationary pressures and regulatory scrutiny. Rising interest rates affected biotech companies that rely on debt financing to fund their research and development expenses. This forced the industry to prioritize operational efficiencies to expand cash runway and accelerate the path towards profitability, in turn, deprioritizing product innovation. Genomics & Biotechnology Companies were also impacted by a slowdown in mergers and acquisitions (M&A) amid growing scrutiny from regulatory bodies that has put a hold on potential exit opportunities for smaller genomics companies. Continued supply chain constraints also hampered the industry during the reporting period, resulting in shortages of key medications and more costly manufacturing of complex treatment categories.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR

ENDED

NOVEMBER 30, 2023 |

| | One Year

Return | Three Year

Return | Annualized

Inception to Date* |

| | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price |

| Global X Genomics & Biotechnology ETF | -22.60% | -22.81% | -20.83% | -20.83% | -7.88% | -7.49% |

| Solactive Genomics Index | -22.22% | -22.22% | -20.49% | -20.49% | -7.42% | -7.42% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 8.30% | 8.30% |

20

Management Discussion of Fund Performance (unaudited)

Global X Genomics & Biotechnology ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on April 5, 2019.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

21

Management Discussion of Fund Performance (unaudited)

Global X Cloud Computing ETF

Global X Cloud Computing ETF

Global X Cloud Computing ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Cloud Computing Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies in developed and emerging markets that are positioned to benefit from the increased adoption of cloud computing technology, including but not limited to companies whose principal business is in offering computing Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), Infrastructure-as-a-Service (IaaS), managed server storage space and data center REITs, and/or cloud and edge computing infrastructure and hardware (collectively, “Cloud Computing Companies”), as defined by Indxx LLC, the provider of the Indxx Global Cloud Computing Index.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 23.97%, while the Underlying Index increased 24.77%. The Fund had a net asset value of $16.77 per share on November 30, 2022 and ended the reporting period with a net asset value of $20.79 on November 30, 2023.

During the reporting period, the highest returns came from Shopify Inc. Class-A and Fastly Inc. Class-A, which returned 78.13% and 71.95%, respectively. The worst performers were 2U Inc. and Paycom Software Inc., which returned -87.77% and -46.17%, respectively.

The Fund recorded positive returns during the reporting period resulting from a broad uplift in profitability for companies as well as an increased adoption of cloud technology and generative artificial intelligence (“AI”)-based products and services. Hyperscale cloud platforms capitalized on the generative AI platform shift by quickly enabling access to emerging large-language models through their platforms, and cross selling cloud services to new customers. Similarly, software companies were able to incrementally monetize their offerings by building automated and AI-driven end solutions to clients looking to improve efficiency. Lastly, technology companies operating in the cloud computing market also focused on cost-cutting measures and workforce reductions to enhance margins and improve bottom-line performance, which helped boost broad investor confidence. The continued rise and use of data-heavy assets further helped drive spending on cloud computing services during the period.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR

ENDED

NOVEMBER 30, 2023 |

| | One Year

Return | Three Year

Return | Annualized

Inception to Date* |

| | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price |

| Global X Cloud Computing ETF | 23.97% | 23.78% | -6.45% | -6.53% | 7.61% | 7.68% |

| Indxx Global Cloud Computing Index | 24.77% | 24.77% | -5.85% | -5.85% | 8.28% | 8.28% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 8.23% | 8.23% |

22

Management Discussion of Fund Performance (unaudited)

Global X Cloud Computing ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on April 12, 2019.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

23

Management Discussion of Fund Performance (unaudited)

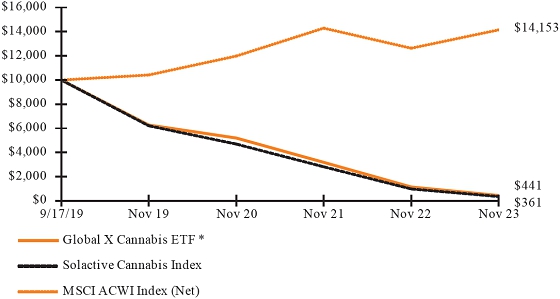

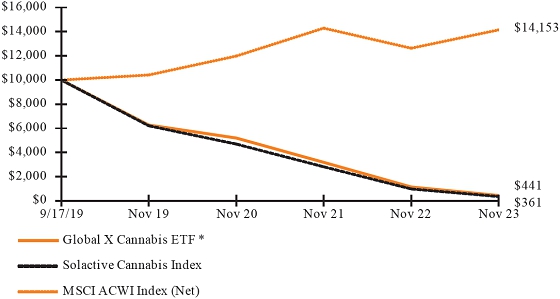

Global X Cannabis ETF

Global X Cannabis ETF

Global X Cannabis ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Cannabis Index (“Underlying Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index, designed to provide exposure to exchange-listed companies that are active in the cannabis industry (collectively, “Cannabis Companies”). In order to be eligible for inclusion in the Cannabis Index, a company is considered by the Index Provider to be a Cannabis Company if it derives at least 50% of its revenue, operating income, or assets from the cannabis industry. These companies include those involved in the following areas of the cannabis industry: (i) the legal production, growth and distribution of marijuana, as well as extracts, derivative products or synthetic versions thereof; (ii) the legal production, growth and distribution of hemp, as well as extracts, derivative products or synthetic versions thereof; (iii) financial services (insurance offerings, property leasing, financing, capital markets activity and investments) provided to companies involved in the production, growth and distribution of cannabis; (iv) pharmaceutical applications of cannabis; (v) cannabidiol (better known as CBD) and cannabis oil products, edibles, topicals, drinks and other products; and (vi) products that may be used to consume cannabis; and (vii) the provision of software and/or online marketplaces or platforms primarily for the cannabis sector.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund decreased 61.63%, while the Underlying Index decreased 63.58%. The Fund had a net asset value of $14.95 per share on November 30, 2022 and ended the reporting period with a net asset value of $5.52 on November 30, 2023.

During the reporting period, the highest returns came from Hexo Corp. and Organigram holdings Inc., which returned 325.84% and 26.60%, respectively. The worst performers were Flora Growth Corp. and MYMD Pharmaceuticals Inc., which returned -87.50% and -86.92%, respectively.

The Fund recorded negative performance during the reporting period amid challenges of a large illicit cannabis market and varied regulatory landscape across key markets. Increased supply in the cannabis market and stringent tax requirements in legal jurisdictions hampered investor sentiment towards Cannabis Companies. Additionally, limited accessibility of capital amid a high interest rate environment and complicated regulatory landscape reduced growth prospects of Cannabis Companies. Slower-than-expected regulatory actions in key markets like the United States and Germany have delayed consolidation efforts from key market players to improve margins and achieve profitability. Lastly, chances of a recession decreased consumer spending on perceived non-essential items, including cannabis products. During the reporting period, the Fund had an average approximate stock exposure of 54.94% in Canada and 34.06% in United States. By sector, it had the highest exposure to Health Care at 65.51% and Real Estate at 18.48%.

24

Management Discussion of Fund Performance (unaudited)

Global X Cannabis ETF

| | | | | | | |

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR

ENDED

NOVEMBER 30, 2023 |

| | One Year

Return | Three Year

Return | Annualized

Inception to Date* |

| | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price |

| Global X Cannabis ETF | -61.63% | -62.50% | -56.06% | -56.37% | -52.38% | -52.86% |

| Solactive Cannabis Index | -63.58% | -63.58% | -57.51% | -57.51% | -54.61% | -54.61% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 8.61% | 8.61% |

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on September 17, 2019.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

25

Management Discussion of Fund Performance (unaudited)

Global X Cannabis ETF

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

26

Management Discussion of Fund Performance (unaudited)

Global X Thematic Growth ETF

Global X Thematic Growth ETF

The Global X Thematic Growth ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Thematic Growth Index (“Underlying Index”). The Fund is passively managed and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index seeks to provide broad exposure to thematic growth strategies using a portfolio of exchange-traded funds (each, an “Underlying ETF”). The Underlying Index allocates index weights among the Underlying ETFs based on a quantitative methodology developed by Solactive AG, the provider of the Underlying Index, which is designed to determine the selection and weighting of the eligible Underlying ETFs.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund decreased 10.30%, while the Underlying Index decreased 10.39%. The Fund had a net asset value of $26.14 per share on November 30, 2022 and ended the reporting period with a net asset value of $23.05 on November 30, 2023.

During the reporting period, the highest returns came from Global X Blockchain ETF and Global X Social Media ETF, which returned 68.55% and 25.11%, respectively. The worst performers were Global X Cannabis ETF and Global X Lithium & Battery ETF, which returned -62.50% and -30.53%, respectively.

The Fund performed negatively during the reporting period on account of the performance of its underlying themes. A portion of the Fund’s negative returns were due to higher interest rates, elevated material costs and permit delays associated with renewable energy companies. Additionally, inflationary pressures, regulatory scrutiny and competition from generic manufacturers adversely impacted the performance of the biotechnology stocks. Within the disruptive materials space, dampened demand leading to higher supply levels amid an uncertain macroeconomic environment negatively contributed to the Fund’s performance. Meanwhile, lithium prices were weighed down by performance in the Chinese spot market, amid weakened demand and bearish sentiment.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR

ENDED

NOVEMBER 30, 2023 |

| | One Year

Return | Three Year

Return | Annualized

Inception to Date* |

| | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price |

| Global X Thematic Growth ETF | -10.30% | -10.78% | -17.39% | -17.45% | -1.18% | -0.99% |

| Solactive Thematic Growth Index | -10.39% | -10.39% | -17.63% | -17.63% | -1.41% | -1.41% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 8.52% | 8.52% |

27

Management Discussion of Fund Performance (unaudited)

Global X Thematic Growth ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on October 25, 2019.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous pages.

28

Management Discussion of Fund Performance (unaudited)

Global X Video Games & Esports ETF

Global X Video Games & Esports ETF

Global X Video Games & Esports ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Video Games & Esports Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies that are positioned to benefit from increased consumption related to video games and esports, including companies whose principal business is in video game development/publishing, video game and esports content distribution and streaming, operating/owning esports leagues/teams, and producing video game/ esports hardware, as defined by Solactive AG, the provider of the Underlying Index.

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 5.29%, while the Underlying Index increased 5.71%. The Fund had a net asset value of $18.96 per share on November 30, 2022 and ended the reporting period with a net asset value of $19.93 on November 30, 2023.

During the reporting period, the highest returns came from Applovin Corp. Class-A and International Games System Co Ltd., which returned 160.10% and 79.18%, respectively. The worst performers were Skillz Inc. Class A and Gumi Inc., which returned -69.56% and -55.60%, respectively.

The Fund recorded positive returns during the reporting period due to the launch of new generations of hardware, improvements in supply chains and back-log orders, continued adoption and innovation in mobile gaming, and the increased use of virtual and augmented reality technologies. Casual mobile gaming continues to remain popular, attracting a significant number of players worldwide. Key mobile platforms brought increasingly media-rich and high-fidelity gaming experiences on smaller devices, driving a resurgence of in-app purchases and rise in the popularity of online multiplayer games. Higher investments and increased merger and acquisition (M&A) activity helped drive growth both for the acquiring companies and broader industry. Lastly, consumer access to games on the go without having to carry around a console or gaming personal computer (PC) weighed positively for mobile cloud gaming industry. During the reporting period, the Fund had an average approximate stock exposure of 33.21% in United States and 27.40% in Japan. By sector, it had the highest exposure to Communication Services at 88.90%.

| | AVERAGE ANNUAL TOTAL RETURN FOR THE YEAR

ENDED

NOVEMBER 30, 2023 |

| | One Year

Return | Three Year

Return | Annualized

Inception

to Date* |

| | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price | Net Asset

Value | Market

Price |

| Global X Video Games & Esports ETF | 5.29% | 3.13% | -10.78% | -11.04% | 7.72% | 7.53% |

| Solactive Video Games & Esports Index | 5.71% | 5.71% | -10.38% | -10.38% | 8.21% | 8.21% |

| MSCI ACWI Index (Net) | 12.01% | 12.01% | 5.69% | 5.69% | 8.52% | 8.52% |

29

Management Discussion of Fund Performance (unaudited)

Global X Video Games & Esports ETF

Growth of a 10,000 Investment

(at Net Asset Value)

* The Fund commenced operations on October 25, 2019.

The MSCI ACWI (Net) (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that, when sold, it may be worth less than its original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike the Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

Performance figures for the periods shown may reflect contractual fee waivers and/or expense reimbursements. In the absence of fee waivers and/or expense reimbursements (if applicable), returns would have been lower.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption or sale of Fund shares.

See definition of comparative indices on the previous page and above.

30

Management Discussion of Fund Performance (unaudited)

Global X Cybersecurity ETF

Global X Cybersecurity ETF

Global X Cybersecurity ETF (the “Fund”) seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Cybersecurity Index (“Underlying Index”). The Fund is passively managed, and the investment adviser does not attempt to take defensive positions in declining markets. The Fund generally seeks to fully replicate the Underlying Index.

The Underlying Index is designed to provide exposure to exchange-listed companies that are positioned to benefit from increased adoption of cybersecurity technology, including but not limited to companies whose principal business is in the development and management of security protocols preventing intrusion and attacks to systems, networks, applications, computers, and mobile devices, as determined by Indxx LLC, the provider of the Underlying Index.

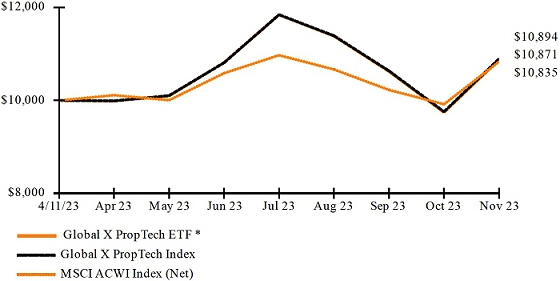

For the 12-month period ended November 30, 2023 (the “reporting period”), the Fund increased 19.29%, while the Underlying Index increased 19.89%. The Fund had a net asset value of $22.85 per share on November 30, 2022 and ended the reporting period with a net asset value of $26.84 on November 30, 2023.