For the six months ended June 30, 2007, Seligman Advisors, Inc. (the “Distributor”), agent for the distribution of the Fund’s shares and an affiliate of the Manager, received commissions and concessions of $4,270 from sales of Class A and (prior to June 4, 2007) Class C shares. Commissions of $24,342 and $195 were also paid to dealers for sales of Class A and Class C shares, respectively.

The Fund has an Administration, Shareholder Services and Distribution Plan (the “Plan”) with respect to distribution of its shares. Under the Plan, with respect to Class A shares, service organizations can enter into agreements with the Distributor and receive a continuing fee of up to 0.25% on an annual basis, payable monthly, of the average daily net assets of the Class A shares attributable to the particular service organizations for providing personal services and/or the maintenance of shareholder accounts. The Distributor charges such fees to the Fund pursuant to the Plan. For the six months ended June 30, 2007, fees incurred under the Plan aggregated $267,225, or 0.25% per annum of the average daily net assets of Class A shares.

Under the Plan, with respect to Class B shares, Class C shares, Class D shares, and Class R shares, service organizations can enter into agreements with the Distributor and receive a continuing fee for providing personal services and/or the maintenance of shareholder accounts of up to 0.25% on an annual basis of the average daily net assets of the Class B, Class C, Class D, and Class R shares for which the organizations are responsible; and, for Class C, Class D and Class R shares, fees for providing other distribution assistance of up to 0.75% (0.25%, in the case of Class R shares) on an annual basis of such average daily net assets. Such fees are paid monthly by the Fund to the Distributor pursuant to the Plan.

Notes to Financial Statements (unaudited)

For the six months ended June 30, 2007, fees incurred under the Plan, equivalent to 1% per annum of the average daily net assets of Class B, Class C, and Class D shares, and 0.50% per annum of the average daily net assets of Class R shares, amounted to $27,277, $21,782, $67,304, and $2,241, respectively.

The Distributor and Seligman Services, Inc., also an affiliate of the Manager, are eligible to receive distribution and service (12b-1) fees pursuant to the Plan. For the six months ended June 30, 2007, the Distributor and Seligman Services, Inc. received distribution and service (12b-1) fees of $65,458.

The Distributor is entitled to retain any CDSC imposed on certain redemptions of Class A, Class C, Class D and Class R shares. For the six months ended June 30, 2007, such charges amounted to $2,940. The Distributor has sold to third parties its rights to collect any CDSC imposed on redemptions of Class B shares.

For the six months ended June 30, 2007, Seligman Data Corp., which is owned by the Fund and certain associated investment companies, charged the Fund at cost $347,148 for shareholder account services in accordance with a methodology approved by the Fund’s directors. Class I shares receive more limited shareholder services than the Fund’s other classes of shares (the “Retail Classes”). Seligman Data Corp. does not allocate to Class I the costs of any of its departments that do not provide services to the Class I shareholders.

Costs of Seligman Data Corp. directly attributable to the Retail Classes of the Fund were charged to those classes in proportion to their respective net asset values. Costs directly attributable to Class I shares were charged to Class I. The remaining charges were allocated to the Retail Classes and Class I by Seligman Data Corp. pursuant to a formula based on their net assets, shareholder transaction volumes and number of shareholder accounts.

The Fund and certain other associated investment companies (together, the “Guarantors”) have severally but not jointly guaranteed the performance and observance of all the terms and conditions of two leases entered into by Seligman Data Corp., including the payment of rent by Seligman Data Corp. (the “Guaranties”). The leases and the related Guaranties expire in September 2008 and January 2019, respectively. The obligation of the Fund to pay any amount due under the Guaranties is limited to a specified percentage of the full amount, which generally is based on the Fund’s percentage of the expenses billed by Seligman Data Corp. to all Guarantors in the preceding calendar quarter. As of June 30, 2007, the Fund’s potential obligation under the Guaranties is $343,900. As of June 30, 2007, no event has occurred which would result in the Fund becoming liable to make any payment under the Guaranties. A portion of the rent paid by Seligman Data Corp. is charged to the Fund as part of Seligman Data Corp.’s shareholder account services cost.

As of June 30, 2007, the Fund’s investment in Seligman Data Corp. is recorded at a cost of $22,506.

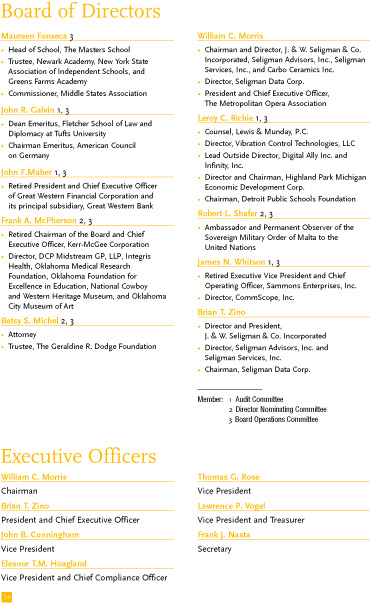

Certain officers and directors of the Fund are officers or directors of the Manager, the Distributor, Seligman Services, Inc., and/or Seligman Data Corp.

The Fund has a compensation arrangement under which directors who receive fees may elect to defer receiving such fees. Directors may elect to have their deferred fees accrue interest or earn a return based on the performance of the Fund or other funds in the Seligman Group of Investment Companies. The cost of such fees and earnings/loss accrued thereon is included in directors’ fees and expenses and the accumulated balance thereof at June 30, 2007, of $695 is included in accrued expenses and other liabilities. Deferred fees and related accrued earnings are not deductible by the Fund for federal income tax purposes until such amounts are paid.

22

Notes to Financial Statements (unaudited)

| 4. | | Committed Line of Credit — The Fund is a participant in a joint $375 million committed line of credit that is shared by substantially all open-end funds in the Seligman Group of Investment Companies. The directors have currently limited the Fund’s borrowings to 10% of its net assets. Borrowings pursuant to the credit facility are subject to interest at a rate equal to the overnight federal funds rate plus 0.50%. The Fund incurs a commitment fee of 0.10% per annum on its share of the unused portion of the credit facility. The credit facility may be drawn upon only for temporary purposes and is subject to certain other customary restrictions. The credit facility commitment expires in June 2008, but is renewable annually with the consent of the participating banks. For the six months ended June 30, 2007, the Fund did not borrow from the credit facility. |

| 5. | | Purchases and Sales of Securities — Purchases and sales of portfolio securities, excluding short-term investments, for the six months ended June 30, 2007, amounted to $109,129,130 and $128,578,202, respectively. |

| 6. | | Federal Tax Information — Certain components of income, expense and realized capital gain and loss are recognized at different times or have a different character for federal income tax purposes and for financial reporting purposes. Where such differences are permanent in nature, they are reclassified in the components of net assets based on their characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value per share of the Fund. As a result of the differences described above, the treatment for financial reporting purposes of distributions made during the year from net investment income or net realized gains may differ from their treatment for federal income tax purposes. Further, the cost of investments also can differ for federal income tax purposes. |

The tax basis information presented is based on operating results for the six months ended June 30, 2007, and will vary from the final tax information as of the Fund’s year end.

At June 30, 2007, the cost of investments for federal income tax purposes was $232,693,173. The tax basis cost was greater than the cost for financial reporting purposes due to the tax deferral of losses on wash sales of $791,463.

The tax basis components of accumulated earnings at June 30, 2007 are presented below. Undistributed ordinary income primarily consists of net investment income and net short-term capital gains.

| Gross unrealized appreciation of portfolio securities | | | | $ | 25,304,236 | |

| Gross unrealized depreciation of portfolio securities | | | | | (7,458,214 | ) |

| Net unrealized appreciation of portfolio securities | | | | | 17,846,022 | |

| Undistributed ordinary income | | | | | 10,239,379 | |

| Undistributed net realized gains | | | | | 12,060,625 | |

| Total accumulated earnings | | | | $ | 40,146,026 | |

23

Notes to Financial Statements (unaudited)

| 7. | | Options Written — Transactions in options written during the six months ended June 30, 2007, were as follows: |

|

|

|

| Shares Subject

To Call/Put

|

| Premiums

|

|---|

| Options outstanding, December 31, 2006 | | | | | 12,700 | | | $ | 112,773 | |

| Options written | | | | | 367,600 | | | | 575,587 | |

| Options expired | | | | | (125,500 | ) | | | (182,065 | ) |

| Options exercised | | | | | (251,700 | ) | | | (499,962 | ) |

| Options terminated in closing purchase transactions | | | | | (2,100 | ) | | | (5,943 | ) |

| Options outstanding, June 30, 2007 | | | | | 1,000 | | | $ | 390 | |

| 8. | | Capital Share Transactions — The Fund has authorized 500,000,000 shares of $0.50 par value Capital Stock. Transactions in shares of Capital Stock were as follows: |

|

|

|

| Six Months Ended

June 30, 2007

|

| Year Ended

December 31, 2006

|

|

|---|

Class A

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

| Net proceeds from sales of shares | | | | | 93,979 | | | $ | 1,272,518 | | | | 215,617 | | | $ | 2,716,093 | |

| Investment of dividends | | | | | 101,318 | | | | 1,384,091 | | | | 64,733 | | | | 843,455 | |

| Exchanged from associated funds | | | | | 39,186 | | | | 524,030 | | | | 63,963 | | | | 784,998 | |

| Converted from Class B* | | | | | 36,800 | | | | 494,942 | | | | 168,715 | | | | 2,061,910 | |

| Investment of gain distribution | | | | | — | | | | — | | | | 361,369 | | | | 4,636,357 | |

| Total | | | | | 271,283 | | | | 3,675,581 | | | | 874,397 | | | | 11,042,813 | |

| Cost of shares repurchased | | | | | (1,432,563 | ) | | | (19,316,045 | ) | | | (2,960,580 | ) | | | (36,198,317 | ) |

| Exchanged into associated funds | | | | | (51,793 | ) | | | (693,454 | ) | | | (259,440 | ) | | | (3,197,818 | ) |

| Total | | | | | (1,484,356 | ) | | | (20,009,499 | ) | | | (3,220,020 | ) | | | (39,396,135 | ) |

| Decrease | | | | | (1,213,073 | ) | | $ | (16,333,918 | ) | | | (2,345,623 | ) | | $ | (28,353,322 | ) |

| | | | | | | | | | | | | | | | | | | |

Class B

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

| Net proceeds from sales of shares | | | | | 6,575 | | | $ | 86,579 | | | | 38,641 | | | $ | 461,979 | |

| Investment of dividends | | | | | 2,023 | | | | 27,206 | | | | — | | | | — | |

| Exchanged from associated funds | | | | | 17,055 | | | | 222,247 | | | | 30,502 | | | | 378,814 | |

| Investment of gain distribution | | | | | — | | | | — | | | | 13,788 | | | | 171,931 | |

| Total | | | | | 25,653 | | | | 336,032 | | | | 82,931 | | | | 1,012,724 | |

| Cost of shares repurchased | | | | | (75,812 | ) | | | (992,657 | ) | | | (206,499 | ) | | | (2,471,910 | ) |

| Exchanged into associated funds | | | | | (6,160 | ) | | | (78,392 | ) | | | (20,834 | ) | | | (249,307 | ) |

| Converted to Class A* | | | | | (37,666 | ) | | | (494,942 | ) | | | (172,745 | ) | | | (2,061,910 | ) |

| Total | | | | | (119,638 | ) | | | (1,565,991 | ) | | | (400,078 | ) | | | (4,783,127 | ) |

| Decrease | | | | | (93,985 | ) | | $ | (1,229,959 | ) | | | (317,147 | ) | | $ | (3,770,403 | ) |

| * | | Automatic conversion of Class B shares to Class A shares approximately eight years after their initial purchase date. |

24

Notes to Financial Statements (unaudited)

|

|

|

| Six Months Ended

June 30, 2007

|

| Year Ended

December 31, 2006

|

|

|---|

Class C

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

| Net proceeds from sales of shares | | | | �� | 4,893 | | | $ | 64,167 | | | | 17,641 | | | $ | 201,800 | |

| Investment of dividends | | | | | 1,785 | | | | 24,107 | | | | — | | | | — | |

| Exchanged from associated funds | | | | | 6,693 | | | | 86,716 | | | | 11,568 | | | | 149,695 | |

| Investment of gain distribution | | | | | — | | | | — | | | | 9,098 | | | | 113,541 | |

| Total | | | | | 13,371 | | | | 174,990 | | | | 38,307 | | | | 465,036 | |

| Cost of shares repurchased | | | | | (40,537 | ) | | | (542,183 | ) | | | (92,527 | ) | | | (1,083,383 | ) |

| Exchanged into associated funds | | | | | (5,209 | ) | | | (67,272 | ) | | | (12,121 | ) | | | (171,833 | ) |

| Total | | | | | (45,746 | ) | | | (609,455 | ) | | | (104,648 | ) | | | (1,255,216 | ) |

| Decrease | | | | | (32,375 | ) | | $ | (434,465 | ) | | | (66,341 | ) | | $ | (790,180 | ) |

| | | | | | | | | | | | | | | | | | | |

Class D

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

| Net proceeds from sales of shares | | | | | 88,515 | | | $ | 1,165,955 | | | | 139,298 | | | $ | 1,668,485 | |

| Investment of dividends | | | | | 5,031 | | | | 67,616 | | | | — | | | | — | |

| Exchanged from associated funds | | | | | 5,930 | | | | 77,213 | | | | 25,724 | | | | 306,120 | |

| Investment of gain distribution | | | | | — | | | | — | | | | 30,912 | | | | 385,478 | |

| Total | | | | | 99,476 | | | | 1,310,784 | | | | 195,934 | | | | 2,360,083 | |

| Cost of shares repurchased | | | | | (161,936 | ) | | | (2,133,384 | ) | | | (283,481 | ) | | | (3,415,311 | ) |

| Exchanged into associated funds | | | | | (3,473 | ) | | | (45,645 | ) | | | (49,636 | ) | | | (594,976 | ) |

| Total | | | | | (165,409 | ) | | | (2,179,029 | ) | | | (333,117 | ) | | | (4,010,287 | ) |

| Decrease | | | | | (65,933 | ) | | $ | (868,245 | ) | | | (137,183 | ) | | $ | (1,650,204 | ) |

| | | | | | | | | | | | | | | | | | | |

Class I

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

| Net proceeds from sales of shares | | | | | 18,657 | | | $ | 249,099 | | | | 113,072 | | | $ | 1,434,150 | |

| Investment of dividends | | | | | 5,705 | | | | 78,315 | | | | 3,783 | | | | 49,549 | |

| Investment of gain distribution | | | | | — | | | | — | | | | 11,266 | | | | 145,560 | |

| Total | | | | | 24,362 | | | | 327,414 | | | | 128,121 | | | | 1,629,259 | |

| Cost of shares repurchased | | | | | (18,779 | ) | | | (255,632 | ) | | | (31,030 | ) | | | (381,807 | ) |

| Increase | | | | | 5,583 | | | $ | 71,782 | | | | 97,091 | | | $ | 1,247,452 | |

| | | | | | | | | | | | | | | | | | | |

Class R

|

|

|

| Shares

|

| Amount

|

| Shares

|

| Amount

|

|---|

| Net proceeds from sales of shares | | | | | 37,683 | | | $ | 506,224 | | | | 25,568 | | | $ | 316,651 | |

| Investment of dividends | | | | | 220 | | | | 2,847 | | | | 3 | | | | 39 | |

| Exchanged from associated funds | | | | | 273 | | | | 3,576 | | | | 246 | | | | 2,970 | |

| Investment of gain distribution | | | | | — | | | | — | | | | 1,205 | | | | 15,434 | |

| Total | | | | | 38,176 | | | | 512,647 | | | | 27,022 | | | | 335,094 | |

| Cost of shares repurchased | | | | | (3,026 | ) | | | (40,053 | ) | | | (14,028 | ) | | | (175,061 | ) |

| Exchanged into associated funds | | | | | — | | | | — | | | | (175 | ) | | | (2,182 | ) |

| Total | | | | | (3,026 | ) | | | (40,053 | ) | | | (14,203 | ) | | | (177,243 | ) |

| Increase | | | | | 35,150 | | | $ | 472,594 | | | | 12,819 | | | $ | 157,851 | |

25

Notes to Financial Statements (unaudited)

| 9. | | Other Matters — In late 2003, the Manager conducted an extensive internal review in response to public announcements concerning frequent trading in shares of open-end mutual funds. As of September 2003, the Manager had one arrangement that permitted frequent trading in the Seligman registered investment companies (the “Seligman Funds”). This arrangement was in the process of being closed down by the Manager before the first proceedings relating to trading practices within the mutual fund industry were publicly announced. Based on a review of the Manager’s records for 2001 through 2003, the Manager identified three other arrangements that had permitted frequent trading in the Seligman Funds. All three had already been terminated prior to the end of September 2002. |

The results of the Manager’s internal review were presented to the Independent Directors of all Seligman Funds. In order to resolve matters with the Independent Directors relating to the four arrangements that permitted frequent trading, the Manager, in May 2004, made payments to three mutual funds and agreed to waive a portion of its management fee with respect to another mutual fund (none of which was Seligman Common Stock Fund).

Beginning in February 2004, the Manager was in discussions with the New York staff of the Securities and Exchange Commission (“SEC”) and the Office of the New York Attorney General (“Attorney General”) in connection with their review of frequent trading in certain of the Seligman Funds. No late trading is involved. This review was apparently stimulated by the Manager’s voluntary public disclosure of the foregoing arrangements in January 2004. In March 2005, negotiations to settle the matter were initiated by the New York staff of the SEC. After several months of negotiations, tentative agreement was reached, both with the New York staff of the SEC and the Attorney General, on the financial terms of a settlement. However, settlement discussions with the Attorney General ended when the Attorney General sought to impose operating conditions on the Manager that were unacceptable to the Manager, would have applied in perpetuity and were not requested or required by the SEC. Subsequently, the New York staff of the SEC indicated that, in lieu of moving forward under the terms of the tentative financial settlement, the staff was considering recommending to the Commissioners of the SEC the instituting of a formal action against the Manager, the Distributor, and Seligman Data Corp. (together, “Seligman”).

Seligman believes that any action would be both inappropriate and unnecessary, especially in light of the fact that Seligman previously resolved the underlying issue with the Independent Directors of the Seligman Funds and made recompense to the affected Seligman Funds.

Immediately after settlement discussions with the Attorney General ended, the Attorney General issued subpoenas to certain of the Seligman Funds and their directors. The subpoenas sought various Board materials and information relating to the deliberations of the Independent Directors as to the advisory fees paid by the Seligman Funds to the Manager. The Manager objected to the Attorney General’s seeking of such information and, on September 6, 2005, filed suit in federal district court seeking to enjoin the Attorney General from pursuing a fee inquiry. Seligman believes that the Attorney General’s inquiry is improper because Congress has vested exclusive regulatory oversight of investment company advisory fees in the SEC.

At the end of September 2005, the Attorney General indicated that it intended to file an action at some time in the future alleging, in substance, that the Manager permitted other persons to engage in frequent trading other than the arrangements described above and, as a result, the prospectus disclosure of the Seligman Funds is and has been misleading.

On September 26, 2006, the Attorney General commenced a civil action in New York State Supreme Court against J. & W. Seligman & Co. Incorporated, Seligman Advisors, Inc., Seligman Data Corp. and Brian T. Zino (President of the Manager and the Seligman Funds), reiterating, in substance, the foregoing claims

26

Notes to Financial Statements (unaudited)

and various other related matters. The Attorney General also claims that the fees charged by Seligman are excessive. The Attorney General is seeking damages and restitution, disgorgement, penalties and costs (collectively, “Damages”), including Damages of at least $80 million relating to alleged timing occurring in the Seligman Funds and disgorgement of profits and management fees, and injunctive relief. Seligman and Mr. Zino believe that the claims are without merit and intend to defend themselves vigorously.

Any resolution of these matters with regulatory authorities may include, but not be limited to, sanctions, penalties, injunctions regarding Seligman, restitution to mutual fund shareholders or changes in procedures. Any Damages will be paid by Seligman and not by the Seligman Funds. If Seligman is unsuccessful in its defense of these proceedings, it and its affiliates could be barred from providing services to the Seligman Funds, including serving as an investment adviser for the Seligman Funds and principal underwriter for the open-end Seligman Funds. If these results occur, Seligman will seek exemptive relief from the SEC to permit it and its affiliates to continue to provide services to the Seligman Funds. There is no assurance that such exemptive relief will be granted.

Seligman does not believe that the foregoing legal action or other possible actions should have a material adverse impact on Seligman or the Seligman Funds; however, there can be no assurance of this, or that these matters and any related publicity will not result in reduced demand for shares of the Seligman Funds or other adverse consequences.

10. | | Recently Issued Accounting Pronouncement — In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157 (“SFAS No. 157”), “Fair Value Measurements.” SFAS No. 157 defines fair value, establishes a framework for measuring fair value of assets and liabilities and expands disclosure about fair value measurements. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Fund is currently evaluating the impact of the adoption of SFAS No. 157 but believes the impact will be limited to expanded disclosures in the Fund’s financial statements. |

27

Financial Highlights (unaudited)

The tables below are intended to help you understand each Class’s financial performance for the periods presented. Certain information reflects financial results for a single share of a Class that was held throughout the periods shown. Per share amounts are calculated using average shares outstanding during the period. Total return shows the rate that you would have earned (or lost) on an investment in each Class, assuming you reinvested all your dividend and capital gain distributions, if any. Total returns do not reflect any taxes or sales charges and are not annualized for periods of less than one year.

CLASS A

|

|

|---|

| | | | | | Year Ended December 31,

|

|

|---|

|

|

|

| Six Months

Ended

6/30/07

|

| 2006

|

| 2005

|

| 2004

|

| 2003

|

| 2002

|

|---|

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $13.08 | | | | $11.67 | | | | $11.58 | | | | $10.42 | | | | $8.49 | | | | $11.55 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | 0.15 | | | | 0.09 | | | | 0.06 | | | | 0.07 | | | | 0.03 | | | | 0.05 | |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | | | 0.84 | | | | 1.80 | | | | 0.09 | | | | 1.16 | | | | 1.93 | | | | (3.06 | ) |

Total from Investment Operations | | | | | 0.99 | | | | 1.89 | | | | 0.15 | | | | 1.23 | | | | 1.96 | | | | (3.01 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.14 | ) | | | (0.09 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.03 | ) | | | (0.05 | ) |

| Distributions from net realized capital gain | | | | | — | | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Total Distributions | | | | | (0.14 | ) | | | (0.48 | ) | | | (0.06 | ) | | | (0.07 | ) | | | (0.03 | ) | | | (0.05 | ) |

Net Asset Value, End of Period | | | | | $13.93 | | | | $13.08 | | | | $11.67 | | | | $11.58 | | | | $10.42 | | | | $8.49 | |

| |

Total Return | | | | | 7.61 | % | | | 16.23 | % | | | 1.26 | % | | | 11.82 | %# | | | 23.11 | % | | | (26.10 | )% |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s omitted) | | | | $ | 217,495 | | | $ | 220,152 | | | $ | 223,800 | | | $ | 264,142 | | | $ | 271,692 | | | $ | 255,027 | |

| Ratio of expenses to average net assets | | | | | 1.32 | %† | | | 1.33 | % | | | 1.29 | % | | | 1.28 | % | | | 1.31 | % | | | 1.31 | % |

| Ratio of net investment income to average net assets | | | | | 2.23 | %† | | | 0.71 | % | | | 0.50 | % | | | 0.66 | % | | | 0.38 | % | | | 0.48 | % |

| Portfolio turnover rate | | | | | 50.75 | % | | | 93.45 | % | | | 68.31 | % | | | 43.50 | % | | | 140.33 | % | | | 174.50 | % |

See footnotes on page 33.28

Financial Highlights (unaudited)

CLASS B

|

|

|---|

| | | | | | Year Ended December 31,

|

|

|---|

|

|

|

| Six Months

Ended

6/30/07

|

| 2006

|

| 2005

|

| 2004

|

| 2003

|

| 2002

|

|---|

| |

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $12.79 | | | | $11.43 | | | | $11.37 | | | | $10.25 | | | | $8.39 | | | | $11.44 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | | 0.10 | | | | (0.01 | ) | | | (0.03 | ) | | | (0.01 | ) | | | (0.03 | ) | | | (0.03 | ) |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | | | 0.82 | | | | 1.76 | | | | 0.09 | | | | 1.13 | | | | 1.89 | | | | (3.02 | ) |

Total from Investment Operations | | | | | 0.92 | | | | 1.75 | | | | 0.06 | | | | 1.12 | | | | 1.86 | | | | (3.05 | ) |

Less Distributions: | | | | |

| Dividends from net investment income | | | | | (0.09 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized capital gain | | | | | — | | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Total Distributions | | | | | (0.09 | ) | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Net Asset Value, End of Period | | | | | $13.62 | | | | $12.79 | | | | $11.43 | | | | $11.37 | | | | $10.25 | | | | $8.39 | |

| |

Total Return | | | | | 7.17 | % | | | 15.38 | % | | | 0.53 | % | | | 10.93 | %# | | | 22.17 | % | | | (26.66 | )% |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s omitted) | | | | | $5,183 | | | | $6,068 | | | | $9,049 | | | | $13,581 | | | | $16,312 | | | | $15,456 | |

| Ratio of expenses to average net assets | | | | | 2.07 | %† | | | 2.08 | % | | | 2.05 | % | | | 2.04 | % | | | 2.07 | % | | | 2.06 | % |

| Ratio of net investment income (loss) to average net assets | | | | | 1.48 | %† | | | (0.04 | )% | | | (0.26 | )% | | | (0.10 | )% | | | (0.38 | )% | | | (0.27 | )% |

| Portfolio turnover rate | | | | | 50.75 | % | | | 93.45 | % | | | 68.31 | % | | | 43.50 | % | | | 140.33 | % | | | 174.50 | % |

See footnotes on page 33.

29

Financial Highlights (unaudited)

CLASS C

|

|

|---|

| | | | | | Year Ended December 31,

|

|

|---|

|

|

|

| Six Months

Ended

6/30/07

|

| 2006

|

| 2005

|

| 2004

|

| 2003

|

| 2002

|

|---|

| |

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $12.80 | | | | $11.44 | | | | $11.38 | | | | $10.26 | | | | $8.39 | | | | $11.45 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | | 0.10 | | | | (0.01 | ) | | | (0.03 | ) | | | (0.01 | ) | | | (0.03 | ) | | | (0.03 | ) |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | | | 0.82 | | | | 1.76 | | | | 0.09 | | | | 1.13 | | | | 1.90 | | | | (3.03 | ) |

Total from Investment Operations | | | | | 0.92 | | | | 1.75 | | | | 0.06 | | | | 1.12 | | | | 1.87 | | | | (3.06 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.09 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized capital gain | | | | | — | | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Total Distributions | | | | | (0.09 | ) | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Net Asset Value, End of Period | | | | | $13.63 | | | | $12.80 | | | | $11.44 | | | | $11.38 | | | | $10.26 | | | | $8.39 | |

| |

Total Return | | | | | 7.16 | % | | | 15.37 | % | | | 0.53 | % | | | 10.92 | %# | | | 22.29 | % | | | (26.73 | )% |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s omitted) | | | | | $4,224 | | | | $4,381 | | | | $4,674 | | | | $5,227 | | | | $6,671 | | | | $6,179 | |

| Ratio of expenses to average net assets | | | | | 2.07 | %† | | | 2.08 | % | | | 2.05 | % | | | 2.04 | % | | | 2.07 | % | | | 2.06 | % |

| Ratio of net investment income (loss) to average net assets | | | | | 1.48 | %† | | | (0.04 | )% | | | (0.26 | )% | | | (0.10 | )% | | | (0.38 | )% | | | (0.27 | )% |

| Portfolio turnover rate | | | | | 50.75 | % | | | 93.45 | % | | | 68.31 | % | | | 43.50 | % | | | 140.33 | % | | | 174.50 | % |

See footnotes on page 33.30

Financial Highlights (unaudited)

CLASS D

|

|

|---|

| | | | | | Year Ended December 31,

|

|

|---|

|

|

|

| Six Months

Ended

6/30/07

|

| 2006

|

| 2005

|

| 2004

|

| 2003

|

| 2002

|

|---|

| |

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $12.79 | | | | $11.43 | | | | $11.37 | | | | $10.25 | | | | $8.39 | | | | $11.45 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | | | 0.10 | | | | (0.01 | ) | | | (0.03 | ) | | | (0.01 | ) | | | (0.03 | ) | | | (0.03 | ) |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | | | 0.83 | | | | 1.76 | | | | 0.09 | | | | 1.13 | | | | 1.89 | | | | (3.03 | ) |

Total from Investment Operations | | | | | 0.93 | | | | 1.75 | | | | 0.06 | | | | 1.12 | | | | 1.86 | | | | (3.06 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.09 | ) | | | — | | | | — | | | | — | | | | — | | | | — | |

| Distributions from net realized capital gain | | | | | — | | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Total Distributions | | | | | (0.09 | ) | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Net Asset Value, End of Period | | | | | $13.63 | | | | $12.79 | | | | $11.43 | | | | $11.37 | | | | $10.25 | | | | $8.39 | |

| |

Total Return | | | | | 7.25 | % | | | 15.38 | % | | | 0.53 | % | | | 10.93 | %# | | | 22.17 | % | | | (26.73 | )% |

Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000s omitted) | | | | | $13,563 | | | | $13,578 | | | | $13,704 | | | | $16,370 | | | | $17,800 | | | | $18,302 | |

| Ratio of expenses to average net assets | | | | | 2.07 | %† | | | 2.08 | % | | | 2.05 | % | | | 2.04 | % | | | 2.07 | % | | | 2.06 | % |

| Ratio of net investment income (loss) to average net assets | | | | | 1.48 | %† | | | (0.04 | )% | | | (0.26 | )% | | | (0.10 | )% | | | (0.38 | )% | | | (0.27 | )% |

| Portfolio turnover rate | | | | | 50.75 | % | | | 93.45 | % | | | 68.31 | % | | | 43.50 | % | | | 140.33 | % | | | 174.50 | % |

See footnotes on page 33.31

Financial Highlights (unaudited)

CLASS I

|

|

|---|

| | | | | | Year Ended December 31,

|

|

|---|

|

|

|

| Six Months

Ended

6/30/07

|

| 2006

|

| 2005

|

| 2004

|

| 2003

|

| 2002

|

|---|

| |

Per Share Data: | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $13.16 | | | | $11.71 | | | | $11.61 | | | | $10.44 | | | | $8.49 | | | | $11.55 | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | | | 0.18 | | | | 0.14 | | | | 0.10 | | | | 0.11 | | | | 0.07 | | | | 0.10 | |

| Net realized and unrealized gain (loss) on investments and foreign currency transactions | | | | | 0.84 | | | | 1.81 | | | | 0.10 | | | | 1.17 | | | | 1.94 | | | | (3.07 | ) |

Total from Investment Operations | | | | | 1.02 | | | | 1.95 | | | | 0.20 | | | | 1.28 | | | | 2.01 | | | | (2.97 | ) |

Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.17 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.11 | ) | | | (0.06 | ) | | | (0.09 | ) |

| Distributions from net realized capital gain | | | | | — | | | | (0.39 | ) | | | — | | | | — | | | | — | | | | — | |

Total Distributions | | | | | (0.17 | ) | | | (0.50 | ) | | | (0.10 | ) | | | (0.11 | ) | | | (0.06 | ) | | | (0.09 | ) |

Net Asset Value, End of Period | | | | | $14.01 | | | | $13.16 | | | | $11.71 | | | | $11.61 | | | | $10.44 | | | | $8.49 | |

| |

Total Return | | | | | 7.80 | % | | | 16.74 | % | | | 1.69 | % | | | 12.23 | %# | | | 23.72 | % | | | (25.82 | )% |

Ratios/Supplemental Data:

|

| Net assets, end of period (000s omitted) | | | | | $6,384 | | | | $5,923 | | | | $4,134 | | | | $4,005 | | | | $3,265 | | | | $2,539 | |

| Ratio of expenses to average net assets | | | | | 0.88 | %† | | | 0.91 | % | | | 0.93 | % | | | 0.90 | % | | | 0.98 | % | | | 0.92 | % |

| Ratio of net investment income to average net assets | | | | | 2.67 | %† | | | 1.13 | % | | | 0.86 | % | | | 1.04 | % | | | 0.71 | % | | | 0.87 | % |

| Portfolio turnover rate | | | | | 50.75 | % | | | 93.45 | % | | | 68.31 | % | | | 43.50 | % | | | 140.33 | % | | | 174.50 | % |

Without expense reimbursement:øø | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | 0.96 | % |

| Ratio of net investment income to average net assets | | | | | | | | | | | | | | | | | | | | | | | | | 0.83 | % |

See footnotes on page 33.32

Financial Highlights (unaudited)

CLASS R

|

|

|---|

| | | | | | Year Ended

December 31,

| |

|---|

|

|

|

| Six Months

Ended

6/30/07

|

| 2006

|

| 2005

|

| 2004

| 4/30/03*

to

12/31/03

|

|

|---|

| |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Period | | | | | $13.09 | | | $ | 11.67 | | | $ | 11.58 | | | $ | 10.42 | | $8.66 | |

Income from Investment Operations: | | | | | | | | | | | | | | | |

| Net investment income | | | | | 0.13 | | | | 0.06 | | | | 0.03 | | | | 0.04 | | 0.01 | |

| Net realized and unrealized gain on investments and foreign currency transactions | | | | | 0.84 | | | | 1.80 | | | | 0.09 | | | | 1.17 | | 1.77 | |

Total from Investment Operations | | | | | 0.97 | | | | 1.86 | | | | 0.12 | | | | 1.21 | | 1.78 | |

Less Distributions: | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | | | (0.12 | ) | | | (0.05 | ) | | | (0.03 | ) | | | (0.05 | ) | (0.02 | ) |

| Distributions from net realized capital gain | | | | | — | | | | (0.39 | ) | | | — | | | | — | | — | |

Total Distributions | | | | | (0.12 | ) | | | (0.44 | ) | | | (0.03 | ) | | | (0.05 | ) | (0.02 | ) |

Net Asset Value, End of Period | | | | | $13.94 | | | $ | 13.09 | | | $ | 11.67 | | | $ | 11.58 | | $10.42 | |

| |

Total Return | | | | | 7.45 | % | | | 15.99 | % | | | 1.01 | % | | | 11.57 | %# | 20.50 | % |

Ratios/Supplemental Data: | | | | |

| Net assets, end of period (000s omitted) | | | | | $1,129 | | | | $600 | | | | $385 | | | | $321 | | | | $2 | |

| Ratio of expenses to average net assets | | | | | 1.57 | %† | | | 1.58 | % | | | 1.55 | % | | | 1.54 | % | | | 1.58 | %† |

| Ratio of net investment income to average net assets | | | | | 1.98 | %† | | | 0.46 | % | | | 0.24 | % | | | 0.40 | % | | | 0.09 | %† |

| Portfolio turnover rate | | | | | 50.75 | % | | | 93.45 | % | | | 68.31 | % | | | 43.50 | % | | | 140.33 | %ø |

| * | | Commencement of offering of shares. |

| † | | Annualized. |

| ø | | Computed at the Fund level for the year ended December 31, 2003. |

| øø | | The Manager, at its discretion, reimbursed certain expenses of Class I shares. |

| # | | Excluding the effect of certain payments received from the Manager in 2004, total return would have been as follows: Class A 11.79%; Class B 10.90%; Class C 10.89%; Class D 10.90%; Class I 12.20%; and Class R 11.54%. |

See Notes to Financial Statements.

33

Additional Fund Information

Quarterly Schedule of Investments

A complete schedule of portfolio holdings owned by the Fund will be filed with the SEC for the first and third quarters of each fiscal year on Form N-Q, and will be available to shareholders (i) without charge, upon request, by calling toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US or (ii) on the SEC’s website at www.sec.gov. 1 In addition, the Form N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. Certain of the information contained on the Fund’s Form N-Q is also made available to shareholders on Seligman’s website at www.seligman.com. 1

Proxy Voting

A description of the policies and procedures used by the Fund to determine how to vote proxies relating to portfolio securities as well as information regarding how the Fund voted proxies relating to portfolio securities during the 12-month period ended June 30 of each year will be available (i) without charge, upon request, by calling toll-free (800) 221-2450 in the US or collect (212) 682-7600 outside the US and (ii) on the SEC’s website at www.sec.gov. 1 Information for each new 12-month period ending June 30 will be available no later than August 31 of that year.

1 | | These website references are inactive textual references and information contained in or otherwise accessible through these websites does not form a part of this report or the Fund’s prospectuses or statement of additional information. |

35

[This Page Intentionally Left Blank]

[This Page Intentionally Left Blank]

| ITEM 2. | | CODE OF ETHICS.

Not applicable. |

| ITEM 3. | | AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable. |

| ITEM 4. | | PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable. |

| ITEM 5. | | AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable. |

| ITEM 6. | | SCHEDULE OF INVESTMENTS.

Included in Item 1 above. |

| ITEM 7. | | DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable. |

| ITEM 8. | | PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Not applicable. |

| ITEM 9. | | PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable. |

| ITEM 10. | | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

Not applicable. |

| ITEM 11. | | CONTROLS AND PROCEDURES.

(a) The registrant’s principal executive officer and principal financial officer have concluded, based upon their evaluation of the registrant’s disclosure controls and procedures as conducted within 90 days of the filing date of this report, that these disclosure controls and procedures provide reasonable assurance that material information required to be disclosed by the registrant in the report it files or submits on Form N-CSR is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms and that such material information is accumulated and communicated to the registrant’s management, including its principal executive officer and principal financial officer, as appropriate, in order to allow timely decisions regarding required disclosure. |

| | | (b) The registrant’s principal executive officer and principal financial officer are aware of no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

| (a)(2) | | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. |

| (b) | | Certifications of chief executive officer and chief financial officer as required by Rule 30a-2(b) under the Investment Company Act of 1940. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

SELIGMAN COMMON STOCK FUND, INC.

| By: | |

/S/ BRIAN T. ZINO

Brian T. Zino

President and Chief Executive Officer |

Date: August 29, 2007

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | |

/S/ BRIAN T. ZINO

Brian T. Zino

President and Chief Executive Officer |

Date: August 29, 2007

| By: | |

/S/ LAWRENCE P.VOGEL

Lawrence P. Vogel

Vice President, Treasurer and Chief Financial Officer |

Date: August 29, 2007

SELIGMAN COMMON STOCK FUND, INC.

EXHIBIT INDEX

| (a)(2) | | Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940. |

| (b) | | Certification of chief executive officer and chief financial officer as required by Rule 30a-2(b) of the Investment Company Act of 1940. |