UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22208

Valued Advisers Trust

(Exact name of registrant as specified in charter)

Unified Fund Services, Inc. 2960 N. Meridian Street, Suite 300 Indianapolis, IN 46208

(Address of principal executive offices) (Zip code)

Capitol Services, Inc.

615 S. Dupont Hwy.

Dover,DE 19901

(Name and address of agent for service)

With a copy to:

John H. Lively, Esq.

The Law Offices of John H. Lively & Associates, Inc.

A member firm of The 1940 Act Law Group

2041 W. 141st Terrace

Suite 119

Leawood, KS 66224

Registrant's telephone number, including area code: 317-917-7000

Date of fiscal year end: 10/31

Date of reporting period: 04/30/2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

TEAM Asset Strategy Fund

Semi-Annual Report

April 30, 2010

Fund Adviser:

TEAM Financial Asset Management, LLC

800 Corporate Circle, Suite 106

Harrisburg, PA 17110

Toll Free (877) 832-6952

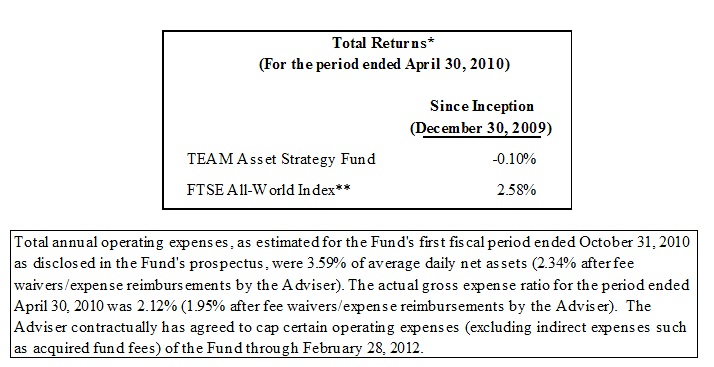

Since the Fund’s inception on December 30th, 2009 and as of April 30th, 2010, TEAM Asset Strategy Fund (the “Fund”) declined -0.10%, which compares to an increase of 2.58% for the FTSE All-World Index, which covers both well established and still developing stock markets around the world.

The Fund is managed with the goal of providing consistent absolute investment returns while experiencing volatility at or below global stock market indexes. The Fund is managed with a broad investment mandate, which can involve participation in global stock, bond, commodity and currency markets. We are also active in utilizing hedging strategies and vehicles.

Our investment process is designed with the goal of participating in a significant portion of upside capture when risk assets like global stock markets are appreciating in value, while preserving capital and experiencing low downside capture during bear markets. The initial period of the Fund’s existence since inception at the end of 2009 has taken place in what we believe to be the maturation phase of a cyclical rebound in risk assets following the November 2008-March 2009 cyclical bottom. We expect our portfolio to correlate significantly with global equity and commodity markets until we reach a point where we believe a cyclical inflection point has been reached, at which point we expect to dramatically reduce portfolio risk exposure to declining prices in risk assets.

Our strategy is a dynamic and flexible one in which we actively seek investment and trading opportunities over multiple time frames. For example, during the first five months of 2010 we were active over short, intermediate and long-term time frames. We were successful in harvesting trading profits by shorting crude oil for a few days in early February, which is obviously a short time frame.

With positions acquired with a shorter time frame, our risk management process is more conservative and ultimately results in some positions being sold at a loss. For example, during the month of February, we sold positions in Exelon (NYSE:EXC) and AOL (NYSE:AOL) at modest losses once the positions violated our risk management parameters.

We remain very bullish on agricultural commodities with a 12-18 month time horizon and continue to allocate a significant percentage of the Fund’s assets to grains and other agricultural commodities via exchange-traded notes (ETN’s). This allocation has been a drag on performance so far in 2010, though we remain confident they will be successful positions over the intended time frame, which is more intermediate in nature.

We entered 2010 expecting a correction in one of our favored long-term stock market segments, precious metals miners, and were able to take advantage of the 30% correction in that segment early in the year to initiate a significant allocation in early February. Our firm has been actively investing in the precious metals space since April 2003, and we continue to expect that market segment to offer significant opportunity over a longer time frame.

Our ability to hedge risk exposure over shorter time frames was a significant contributor to performance during the first four months of 2010. We were able to successfully deploy hedging vehicles for much of the January/February decline in equity and commodity markets and the initial phase of the May correction.

As we look forward, we believe that our investment process, which we have successfully deployed in separate accounts since 2003, is well equipped to navigate what many suspect may be challenging economic and market times.

We sincerely appreciate the investment you’ve made in the TEAM Asset Strategy Fund.

The views in the foregoing discussion were those of the Fund’s investment adviser as of the date set forth above and may not reflect its views on the date this Annual Report is first published or anytime thereafter. These views are intended to assist shareholders in understanding their investment in the Fund and do not constitute investment advice.

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling the Fund at 1-877-832-6952. Fee waivers and expense reimbursements have positively impacted Fund performance. An investor should consider the Fund’s investment objectives, risks, and charges and expenses carefully before investing. The Fund’s Prospectus contains this and other important information. For information on the Fund’s expense ratio, please see the Financial Highlights Table found within the accompanying Semi-Annual Report.

Investment Results – (Unaudited)

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses mu st be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling 1-877-832-6952.

* Return figures reflect any change in price per share and assume the reinvestment of all distributions.

** The FTSE All-World Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus contains this and other important information about the investment company and may be obtained by calling the same number as above. Please read it carefully before investing. The Fund is distributed by Unified Financial Securities, Inc. Member FINRA.

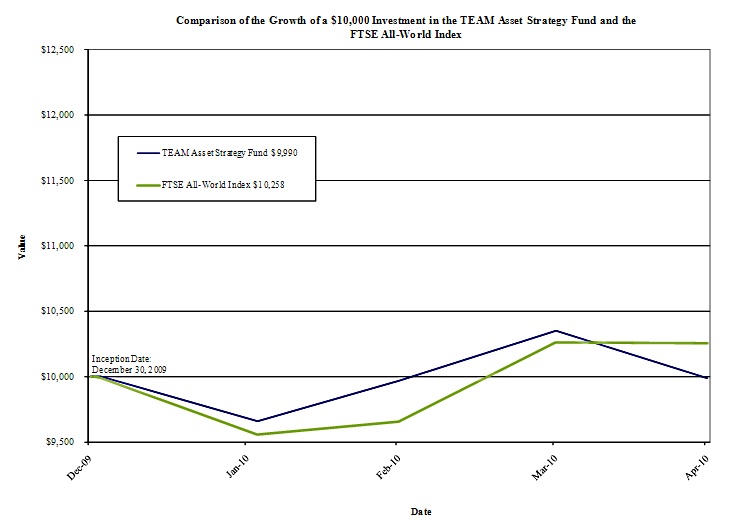

The chart above assumes an initial investment of $10,000 made on December 30, 2009 (commencement of Fund operations) and held through April 30, 2010. The FTSE All-World Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange- traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxe s that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month end or to request a prospectus, please call 1-877-832-6952. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Unified Financial Securities, Inc., member FINRA.

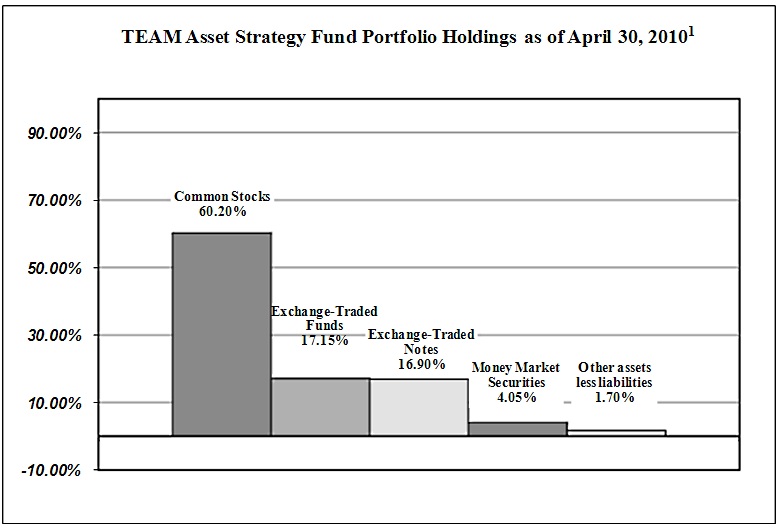

Fund Holdings – (Unaudited)

1As a percentage of net assets.

The Fund invests in a portfolio of equity, debt, currency, commodity, and money market securities.

Availability of Portfolio Schedule

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available at the SEC’s website at www.sec.gov. The Fund’s Forms N-Q may be reviewed and copied at the SEC’s Public Reference Room in Washington DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Summary of Fund’s Expenses

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, such as short-term redemption fees; and (2) ongoing costs, including management fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning and held for the entire period from December 30, 2009 through April 30, 2010.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as the redemption fee imposed on short-term redemptions. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if the short-term redemption fee imposed by the Fund were included, your costs would have been higher.

TEAM Asset Strategy Fund | Beginning Account Value | Ending Account Value April 30, 2010 | Expenses Paid During the Period Ended April 30, 2010 | |||||||||

| Actual* | $ | 1,000.00 | $ | 999.00 | $ | 6.51 | ||||||

| Hypothetical** | $ | 1,000.00 | $ | 1,015.12 | $ | 9.74 | ||||||

*Expenses are equal to the Fund’s annualized expense ratio of 1.95%, multiplied by the average account value over the period, multiplied by 122/365 (to reflect the period since commencement of Fund operations on December 30, 2009).

** Assumes a 5% return before expenses. The hypothetical example is calculated based on a six month period from November 1, 2009 to April 30, 2010. Accordingly, expenses are equal to the Fund’s annualized expense ratio of 1.95% multiplied by the average account value over the six month period, multiplied by 181/365 (to reflect the partial year period).

| TEAM Asset Strategy Fund | ||||||||

| Schedule of Investments | ||||||||

| April 30, 2010 | ||||||||

| (Unaudited) | ||||||||

| Shares | Value | |||||||

| Common Stocks - 60.20% | ||||||||

| Banks - 5.90% | ||||||||

| Mitsubishi UFJ Financial Group, Inc. (b) | 249,000 | $ | 1,287,330 | |||||

| Mizuho Financial Group, Inc. (b) | 249,000 | 951,180 | ||||||

| 951,180 | ||||||||

| Chemicals - 5.12% | ||||||||

| Intrepid Potash, Inc. (a) | 74,000 | 1,943,240 | ||||||

| Gold & Silver Ores - 19.85% | ||||||||

| Goldcorp., Inc. | 40,000 | 1,729,200 | ||||||

| Minefinders Corp., Ltd. (a) | 78,000 | 784,680 | ||||||

| Newmont Mining Corp. | 30,000 | 1,682,400 | ||||||

| Northgate Minerals Corp. (a) | 512,000 | 1,648,640 | ||||||

| Yamana Gold, Inc. | 155,000 | 1,684,850 | ||||||

| 7,529,770 | ||||||||

| Petroleum & Natural Gas - 12.63% | ||||||||

| Exxon Mobil Corp. | 43,400 | 2,944,690 | ||||||

| Total SA (b) | 34,000 | 1,848,920 | ||||||

| 4,793,610 | ||||||||

| Semiconductors - 2.26% | ||||||||

| MEMC Electronic Materials, Inc. (a) | 66,000 | 856,020 | ||||||

| Services - 3.62% | ||||||||

| Jacobs Engineering Group, Inc. (a) | 28,500 | 1,374,270 | ||||||

| Telecommunications - 6.98% | ||||||||

| AT&T, Inc. | 51,682 | 1,346,833 | ||||||

| Verizon Communications, Inc. | 45,069 | 1,302,043 | ||||||

| 2,648,876 | ||||||||

| Transportation - 3.84% | ||||||||

| Diana Shipping, Inc. (a) | 49,000 | 750,680 | ||||||

| DryShips, Inc. (a) | 122,000 | 707,600 | ||||||

| 1,458,280 | ||||||||

| TOTAL COMMON STOCKS (Cost $22,036,755) | 22,842,576 | |||||||

| Exchange-Traded Funds - 17.15% | ||||||||

| Direxion Daily Energy Bear 3X Shares (a) | 73,000 | 649,116 | ||||||

| Direxion Daily Financial Bear 3X Shares (a) | 228,000 | 2,791,290 | ||||||

| UltraShort Russell 2000 ProShares (a) | 82,000 | 1,494,860 | ||||||

| United States Natural Gas Fund LP (a) | 229,000 | 1,570,940 | ||||||

| TOTAL EXCHANGE-TRADED FUNDS (Cost $6,642,317) | 6,506,206 | |||||||

*See accompanying notes which are an integral part of these financial statements.

| TEAM Asset Strategy Fund | ||||||||

| Schedule of Investments - continued | ||||||||

| April 30, 2010 | ||||||||

| (Unaudited) | Shares | Value | ||||||

| Exchange-Traded Notes - 16.90% | ||||||||

| ELEMENTS Rogers International Commodity Index - Agriculture Total Return (a) | 305,000 | $ | 2,247,850 | |||||

| iPath Dow Jones - UBS Grains Total Return Sub-Index (a) | 115,000 | 4,163,000 | ||||||

| TOTAL EXCHANGE-TRADED NOTES (Cost $6,735,334) | 6,410,850 | |||||||

| Money Market Securities - 4.05% | ||||||||

| Federated Prime Obligations Fund - Institutional Shares, 0.14% (c) | 1,536,590 | 1,536,590 | ||||||

| TOTAL MONEY MARKET SECURITIES (Cost $1,536,590) | 1,536,590 | |||||||

| TOTAL INVESTMENTS (Cost $36,950,996) - 98.30% | $ | 37,296,222 | ||||||

| Other assets less liabilities - 1.70% | 646,065 | |||||||

| TOTAL NET ASSETS - 100.00% | $ | 37,942,287 | ||||||

| (a) Non-income producing. | ||||||||

| (b) American Depositary Receipt. | ||||||||

| (c) Variable rate security; the rate shown represents the yield at April 30, 2010. | ||||||||

*See accompanying notes which are an integral part of these financial statements.

| TEAM Asset Strategy Fund | ||||

| Statement of Assets and Liabilities | ||||

| April 30, 2010 | ||||

| (Unaudited) | ||||

| Assets | ||||

| Investments in securities, at fair value (cost $36,950,996) | $ | 37,296,222 | ||

| Receivable for investments sold | 2,520,393 | |||

| Dividends receivable | 99,351 | |||

| Receivable for Fund shares sold | 43,522 | |||

| Prepaid expenses | 38,169 | |||

| Interest receivable | 175 | |||

| Total assets | 39,997,832 | |||

| Liabilities | ||||

| Payable for investments purchased | 1,984,896 | |||

| Payable to Adviser (a) | 50,216 | |||

| Payable to administrator, fund accountant, and transfer agent | 7,851 | |||

| Payable to custodian | 2,536 | |||

| Payable to trustees and officers | 747 | |||

| Other accrued expenses | 9,299 | |||

| Total liabilities | 2,055,545 | |||

| Net Assets | $ | 37,942,287 | ||

| Net Assets consist of: | ||||

| Paid in capital | $ | 38,177,667 | ||

| Accumulated undistributed net investment income (loss) | 5,559 | |||

| Accumulated net realized gain (loss) from investment transactions | (586,165 | ) | ||

| Net unrealized appreciation (depreciation) on investments | 345,226 | |||

| Net Assets | $ | 37,942,287 | ||

| Shares outstanding (unlimited number of shares authorized) | 3,796,286 | |||

| Net Asset Value and offering price per share | $ | 9.99 | ||

| Redemption price per share (NAV * 99%) (b) | $ | 9.89 | ||

| (a) See Note 4 in the Notes to the Financial Statements. | ||||

| (b) The Fund charges a 1.00% redemption fee on shares redeemed within 30 days of purchase. | ||||

*See accompanying notes which are an integral part of these financial statements.

| TEAM Asset Strategy Fund | ||||

| Statement of Operations | ||||

| For the period ended April 30, 2010 (a) | ||||

| (Unaudited) | ||||

| Investment Income | ||||

| Dividend income (net of foreign withholding tax of $4,895) | $ | 180,869 | ||

| Interest income | 832 | |||

| Total Investment Income | 181,701 | |||

| Expenses | ||||

| Investment Adviser fee (b) | 112,911 | |||

| Transfer agent expenses | 17,499 | |||

| Administration expenses | 13,371 | |||

| Registration expenses | 10,964 | |||

| Fund accounting expenses | 10,337 | |||

| Offering cost expenses | 6,122 | |||

| Auditing expenses | 6,009 | |||

| Custodian expenses | 5,661 | |||

| Legal expenses | 5,600 | |||

| Pricing expenses | 1,091 | |||

| Miscellaneous expenses | 770 | |||

| Trustee expenses | 747 | |||

| Insurance expense | 602 | |||

| Printing expenses | 186 | |||

| Total Expenses | 191,870 | |||

| Less: Fees waived and expenses reimbursed by Adviser (b) | (15,728 | ) | ||

| Net operating expenses | 176,142 | |||

| Net Investment Income (Loss) | 5,559 | |||

| Realized & Unrealized Gain (Loss) on Investments | ||||

| Net realized gain (loss) on investment securities | (586,165 | ) | ||

| Change in unrealized appreciation (depreciation) on investment securities | 345,226 | |||

| Net realized and unrealized gain (loss) on investment securities | (240,939 | ) | ||

| Net increase (decrease) in net assets resulting from operations | $ | (235,380 | ) | |

| (a) For the period December 30, 2009 (Commencement of Operations) to April 30, 2010. | ||||

| (b) See Note 4 in the Notes to the Financial Statements. | ||||

*See accompanying notes which are an integral part of these financial statements.

| TEAM Asset Strategy Fund | |||||

| Statement of Changes In Net Assets | For the | ||||

| Period Ended | |||||

| April 30, 2010 | |||||

| (Unaudited) | (a) | ||||

| Increase (Decrease) in Net Assets due to: | |||||

| Operations | |||||

| Net investment income (loss) | $ | 5,559 | |||

| Net realized gain (loss) on investment securities | (586,165 | ) | |||

| Change in unrealized appreciation (depreciation) on investment securities | 345,226 | ||||

| Net increase (decrease) in net assets resulting from operations | (235,380 | ) | |||

| Capital Share Transactions | |||||

| Proceeds from shares sold | 38,318,536 | ||||

| Amount paid for shares redeemed | (141,166 | ) | |||

| Proceeds from redemption fees collected (b) | 297 | ||||

| Net increase (decrease) in net assets resulting from capital share transactions | 38,177,667 | ||||

| Total Increase (Decrease) in Net Assets | 37,942,287 | ||||

| Net Assets | |||||

| Beginning of period | - | ||||

| End of period | $ | 37,942,287 | |||

| Accumulated net investment income | |||||

| included in net assets at end of period | $ | 5,559 | |||

| Capital Share Transactions | |||||

| Shares sold | 3,810,154 | ||||

| Shares redeemed | (13,868 | ) | |||

| Net increase (decrease) from capital share transactions | 3,796,286 | ||||

| (a) For the period December 30, 2009 (Commencement of Operations) to April 30, 2010. | |||||

| (b) The Fund charges a 1% redemption fee on shares redeemed within 30 calendar days of purchase. | |||||

| Shares are redeemed at the Net Asset Value if held longer than 30 calendar days. | |||||

*See accompanying notes which are an integral part of these financial statements.

| TEAM Asset Strategy Fund | ||||||||

| Financial Highlights | ||||||||

| (For a share outstanding during the period) | ||||||||

| For the | ||||||||

| Period Ended | ||||||||

| April 30, 2010 | ||||||||

| (Unaudited) | (a) | |||||||

| Selected Per Share Data: | ||||||||

| Net asset value, beginning of period | $ | 10.00 | ||||||

| Income from investment operations: | ||||||||

| Net investment income (loss) | - | * | ||||||

| Net realized and unrealized gain (loss) on investments | (0.01 | ) | ||||||

| Total from investment operations | (0.01 | ) | ||||||

| Net asset value, end of period | $ | 9.99 | ||||||

Total Return (b) | -0.10 | % | (c) | |||||

| Ratios and Supplemental Data: | ||||||||

| Net assets, end of period (000) | $ | 37,942 | ||||||

| Ratio of expenses to average net assets | 1.95 | % | (d) | |||||

| Ratio of expenses to average net assets | ||||||||

| before waiver and reimbursement | 2.12 | % | (d) | |||||

| Ratio of net investment income (loss) to | ||||||||

| average net assets | 0.06 | % | (d) | |||||

| Ratio of net investment income (loss) to | ||||||||

| average net assets before waiver and reimbursement | (0.11 | )% | (d) | |||||

| Portfolio turnover rate | 189.57 | % | ||||||

| * Amounts to less than $0.005 per share. | ||||||||

| (a) For the period December 30, 2009 (Commencement of Operations) to April 30, 2010. | ||||||||

| (b) Total return in the above table represents the rate that the investor would have earned or | ||||||||

| lost on an investment in the Fund, assuming reinvestment of dividends. | ||||||||

| (c) Not annualized. | ||||||||

| (d) Annualized. | ||||||||

*See accompanying notes which are an integral part of these financial statements.

TEAM Asset Strategy Fund

Notes to the Financial Statements

April 30, 2010

(Unaudited)

NOTE 1. ORGANIZATION

The TEAM Asset Strategy Fund (the “Fund”) is an open-end, non-diversified series of the Valued Advisers Trust (the “Trust”). The Trust is a management investment company established under the laws of Delaware by an Agreement and Declaration of Trust dated June 13, 2008 (the “Trust Agreement”). The Trust Agreement permits the Trustees to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds authorized by the Board of Trustees (the “Board”). The Fund’s investment adviser is TEAM Financial Asset Management, LLC (the “Adviser”). The investment objective of th e Fund is to provide high total investment return, which will generally be achieved through a combination of appreciation in capital and income.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

Securities Valuation – All investments in securities are recorded at their estimated fair value as described in Note 3.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the period ended April 30, 2010, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the statement of operations. During the period, the Fund did not incur any interest or penalties. The Fund is subject to examination by U.S. federal tax authorities for the tax year 2009.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Trustees).

Security Transactions and Related Income - The Fund follows industry practice and records security transactions on the trade date. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Discounts and premiums on securities purchased are amortized or accreted using the effective interest method. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. T he ability of issuers of debt securities held by the Fund to meet their obligations may be affected by economic and political developments in a specific country or region.

Dividends and Distributions - The Fund intends to distribute substantially all of its net investment income, if any, as dividends to its shareholders on at least an annual basis. The Fund intends to distribute its net realized long-term capital gains and its net realized short-term capital gains, if any, at least once a year. Dividends to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate tre atment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset values per share of the Fund.

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

April 30, 2010

(Unaudited)

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES - continued

Subsequent Events – In accordance with accounting principles generally accepted in the United States of America (“GAAP”), management has evaluated subsequent events through the date these financial statements were issued and determined there were no material subsequent events, except as noted in Note 9.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

Fair value is defined as the price that a Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value such as pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability develop ed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| · | Level 1 – quoted prices in active markets for identical securities |

| · | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| · | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities, including common stocks, exchange-traded funds and exchange-traded notes, are generally valued by using market quotations, but may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices more accurately reflect the fair value of such securities. Securities that are traded on any stock exchange are generally valued by the pricing service at the last quoted sale price. Lacking a last sale price, an exchange traded security is generally valued by the pricing service at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued by the pricing service at the NASDAQ Official Closing Price. When using the market qu otations or close prices provided by the pricing service and when the market is considered active, the security will be classified as a Level 1 security. Sometimes, an equity security owned by the Fund will be valued by the pricing service with factors other than market quotations or when the market is considered inactive. When this happens, the security will be classified as a Level 2 security. When market quotations are not readily available, when the Adviser determines that the market quotation or the price provided by the pricing service does not accurately reflect the current fair value, or when restricted or illiquid securities are being valued, such securities are valued as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review by the Board. These securities will be categorized as Level 3 securities.

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

April 30, 2010

(Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS – continued

Investments in mutual funds, including money market mutual funds, are generally priced at the ending net asset value (NAV) provided by the service agent of the funds. These securities will be categorized as Level 1 securities.

Fixed income securities, when valued using market quotations in an active market, will be categorized as Level 1 securities. However, they may be valued on the basis of prices furnished by a pricing service when the Adviser believes such prices more accurately reflect the fair value of such securities. A pricing service utilizes electronic data processing techniques based on yield spreads relating to securities with similar characteristics to determine prices for normal institutional-size trading units of debt securities without regard to sale or bid prices. These securities will generally be categorized as Level 2 securities. If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securitie s, when prices are not readily available from a pricing service, or when restricted or illiquid securities are being valued, securities are valued at fair value as determined in good faith by the Adviser, in conformity with guidelines adopted by and subject to review of the Board. These securities will be categorized as Level 3 securities.

Short-term investments in fixed income securities, (those with maturities of less than 60 days when acquired, or which subsequently are within 60 days of maturity), are valued by using the amortized cost method of valuation, which the Board has determined will represent fair value. These securities will be classified as Level 2 securities.

In accordance with the Trust’s good faith pricing guidelines, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single standard exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of an issue of securities being valued by the Adviser would appear to be the amount which the owner might reasonably expect to receive for them upon their current sale. Methods which are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market of a similar fr eely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Good faith pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before a Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations. Good faith pricing may also be used in instances when the bonds the Fund invests in may default or otherwise cease to have market quotations readily available.

The following is a summary of the inputs used to value the Fund’s investments as of April 30, 2010:

| Valuation Inputs | ||||||||||||||||

| Assets | Level 1 - Quoted Prices in Active Markets | Level 2 - Other Significant Observable Inputs | Level 3 - Significant Unobservable Inputs | Total | ||||||||||||

| Common Stocks* | $ | 18,755,146 | $ | - | $ | - | $ | 18,755,146 | ||||||||

| American Depositary Receipts* | 4,087,430 | - | - | 4,087,430 | ||||||||||||

| Exchange-Traded Funds | 6,506,206 | - | - | 6,506,206 | ||||||||||||

| Exchange-Traded Notes | 6,410,850 | - | - | 6,410,850 | ||||||||||||

| Money Market Securities | 1,536,590 | - | - | 1,536,590 | ||||||||||||

| Total | $ | 37,296,222 | $ | - | $ | - | $ | 37,296,222 | ||||||||

*Refer to the Schedule of Investments for industry classifications.

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

April 30, 2010

(Unaudited)

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS - continued

The Fund did not hold any assets at any time during the reporting period in which significant unobservable inputs were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

Under the terms of the management agreement (the “Agreement”), the Adviser manages the Fund’s investments subject to approval of the Board. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.25% of the average daily net assets of the Fund. For the period December 30, 2009 (commencement of Fund operations) to April 30, 2010, the Adviser earned a fee of $112,911 from the Fund before the reimbursement described below. At April 30, 2010, the Fund owed the Adviser $50,216 for advisory fees.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, excluding brokerage fees and commissions, borrowing costs (such as interest and dividend expenses on securities sold short), taxes, extraordinary expenses and fees and expenses of acquired funds, do not exceed 1.95% of the Fund’s average daily net assets through February 28, 2012. For the period December 30, 2009 (commencement of Fund operations) to April 30, 2010, the Adviser waived fees of $15,728 to the Fund.

The waiver and/or reimbursement by the Adviser with respect to the Fund is subject to repayment by the Fund within the three fiscal years following the fiscal year in which that particular waiver and/or reimbursement occurred, provided that the Fund is able to make the repayment without exceeding the expense limitations described above. For the period December 30, 2009 (commencement of Fund operations) to April 30, 2010, $15,728 may be subject to potential repayment to the Adviser by the Fund through October 31, 2013.

The Trust retains Unified Fund Services, Inc. (“Unified”) to manage the Fund’s business affairs and provide the Fund with administrative services, including all regulatory reporting and necessary office equipment and personnel. For the period December 30, 2009 (commencement of Fund operations) to April 30, 2010, Unified earned fees of $13,371 for administrative services provided to the Fund. At April 30, 2010, Unified was owed $2,774 from the Fund for administrative services. Certain officers of the Trust are members of management and/or employees of Unified. Unified operates as a wholly-owned subsidiary of Huntington Bancshares, Inc., the parent company of Unified Financial Securities, Inc. (the ̶ 0;Distributor”) and Huntington National Bank, the custodian of the Fund’s investments (the “Custodian”). For the period from December 30, 2009 (commencement of Fund operations) to April 30, 2010, the Custodian earned fees of $5,661 for custody services provided to the Fund. At April 30, 2010, the Custodian was owed $2,536 from the Fund for custody services.

The Trust also retains Unified to act as the Fund’s transfer agent and to provide fund accounting services. For the period December 30, 2009 (commencement of Fund operations) to April 30, 2010, Unified earned fees of $10,570 for transfer agent services and $6,929 in reimbursement of out-of-pocket expenses incurred in providing transfer agent services to the Fund. At April 30, 2010, the Fund owed Unified $3,095 for transfer agent services and out-of-pocket expenses. For the period December 30, 2009 (commencement of Fund operations) to April 30, 2010, Unified earned fees of $10,337 from the Fund for fund accounting services. At April 30, 2010, Unified was owed $1,982 from the Fund for fund accounting serv ices.

The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan provides that the Fund will pay the Distributor and/or any registered securities dealer, financial institution or any other person (the “Recipient”) a shareholder servicing fee of 0.25% of the average daily net assets of the Fund in connection with the promotion and distribution of the Fund’s shares or the provision of personal services to shareholders, including, but not necessarily limited to, advertising, compensation to underwriters, dealers and selling personnel, the printing and mailing

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

April 30, 2010

(Unaudited)

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES - continued

of prospectuses to other than current Fund shareholders, the printing and mailing of sales literature and servicing shareholder accounts (“12b-1 Expenses”). The Fund or Distributor may pay all or a portion of these fees to any Recipient who renders assistance in distributing or promoting the sale of shares, or who provides certain shareholder services, pursuant to a written agreement. The Plan is a compensation plan, which means that the Plan will benefit shareholders because an effective sales program typically is necessary in order for the Fund to reach and maintain a sufficient size to achieve efficiently its investment objectives and to realize economies of scale. The Plan will not be activated through F ebruary 28, 2011.

The Distributor acts as the principal underwriter of the Fund’s shares. There were no payments made by the Fund to the Distributor during the period December 30, 2009 (commencement of Fund operations) to April 30, 2010. An officer of the Trust is an officer of the Distributor and such person may be deemed to be an affiliate of the Distributor.

NOTE 5. INVESTMENTS

For the period ended April 30, 2010, purchases and sales of investment securities, other than short-term investments and short-term U.S. government obligations, were as follows:

| Purchases | ||||

| U.S. Government Obligations | $ | - | ||

| Other | 68,546,315 | |||

| Sales | ||||

| U.S. Government Obligations | $ | - | ||

| Other | 31,797,916 | |||

At April 30, 2010, the net unrealized appreciation (depreciation) of investments for tax purposes was as follows:

| Gross Appreciation | $ | 1,391,268 | ||

| Gross (Depreciation) | (1,046,042 | ) | ||

| Net Appreciation (Depreciation) on Investments | $ | 345,226 |

At April 30, 2010, the aggregate cost of securities for federal income tax purposes was $36,950,996.

NOTE 6. ESTIMATES

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

TEAM Asset Strategy Fund

Notes to the Financial Statements - continued

April 30, 2010

(Unaudited)

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a) (9) of the Investment Company Act of 1940. At April 30, 2010, Charles Schwab, for the benefit of its customers, held 66.61% of the voting securities. As a result, Charles Schwab may be deemed to control the Fund.

NOTE 8. DISTRIBUTIONS TO SHAREHOLDERS

There were no distributions made by the Fund during the period December 30, 2009 (commencement of Fund operations) to April 30, 2010.

NOTE 9. SUBSEQUENT EVENTS

On June 16, 2010, a special meeting of all shareholders of funds in the Trust was held for the purpose of electing two new trustees. Ira Cohen was elected as an independent trustee and R. Jeffrey Young was elected as an interested trustee. The results of the vote were as follows:

| For | Against | Abstain | ||||||||||

| Ira Cohen | 4,137,387 | 3,252 | 7,012 | |||||||||

| R. Jeffrey Young | 4,137,229 | - | 10,423 | |||||||||

Approval of Investment Advisory Agreement

At a meeting held on September 11, 2009, the Board of Trustees (the “Board”) considered the initial approval of the Investment Advisory Agreement between the Trust and TEAM Financial Asset Management, LLC (the “Adviser”). The Board reflected on its discussions with the portfolio manager regarding the proposed Investment Advisory Agreement (the “Advisory Agreement”), the Expense Limitation Agreement and the manner in which the portfolio manager intended to manage the Fund. Legal counsel referred the Board to the Meeting materials, which included, among other things, a memorandum dated August 21, 2009 from Counsel addressing the duties of Trustees regarding the approval of the proposed Advisory Agreement, a letter dated August 18, 2009 from Counsel to the Adviser and the Adviser’s responses to t hat letter, a copy of the Adviser’s Form ADV, a net expense ratio comparison for the Fund, a management fee comparison for the Fund, the Advisory Agreement and Expense Limitation Agreement. Legal counsel reviewed with the Board the memorandum from Counsel and the proposed Advisory Agreement and Expense Limitation Agreement. Counsel outlined the various factors the Board should consider in deciding whether to approve the Advisory Agreement.

In deciding whether to approve the agreements, the Trustees considered numerous factors, including:

| i. | The nature, extent, and quality of the services to be provided by the Adviser. In this regard, the Board considered the responsibilities the Adviser would have under the Advisory Agreement. The Board reviewed the services to be provided by the Adviser to the Fund including, without limitation: the Adviser’s procedures for formulating investment recommendations and assuring compliance with the Fund’s investment objectives and limitations; the efforts of the Adviser during the Fund’s start-up phase, its coordination of services for the Fund among the Fund’s service providers, and the anticipated efforts to promote the Fund, grow its assets, and assist in the distribution of Fund shares. The Board considered: the Adviser’s staffing, personnel, and methods of op erating; the education and experience of the Adviser’s personnel; and the Adviser’s compliance program, policies, and procedures. After reviewing the foregoing and further information from the Adviser (e.g., descriptions of the Adviser’s business, the Adviser’s compliance programs, and the Adviser’s Form ADV), the Board concluded that the quality, extent, and nature of the services to be provided by the Adviser were satisfactory and adequate for the Fund. |

| iii. | The costs of the services to be provided and profits to be realized by the Adviser from the relationship with the Fund. In this regard, the Board considered: the financial condition of the Adviser and the level of commitment to the Fund and the Adviser by the principals of the Adviser; the projected asset levels of the Fund; the Adviser’s payment of startup costs for the Fund; and the overall anticipated expenses of the Fund, including the expected nature and frequency of advisory fee payments. The Board also considered potential benefits for the Adviser in managing the Fund, including promotion of the Adviser’s name and the ability for the Adviser to place small accounts into the Fund. The Board compared the expected fees and expenses of the Fund (including the management fee) to other funds comparable to the Fund in terms of the type of fund, the style of investment management, the anticipated size of fund and the nature of the investment strategy and markets invested in, among other factors. The Board determined that the Fund’s anticipated expense ratio, in light of the contractual Expense Limitation Agreement, and the management fees were generally comparable to those of similar funds. Following this comparison and upon further consideration and discussion of the foregoing, the Board concluded that the fees to be paid to the Adviser by the Fund were fair and reasonable. |

| iv. | The extent to which economies of scale would be realized as the Fund grows and whether advisory fee levels reflect these economies of scale for the benefit of the Fund’s investors. In this regard, the Board considered the Fund’s fee arrangements with the Adviser. The Board noted that the management fee would stay the same as asset levels increased, although it also noted that the shareholders of the Fund would benefit from the Expense Limitation Agreement until the Fund’s expenses fell below the expense cap. The Board also noted that the Fund would benefit from economies of scale under its agreements with service providers other than the Adviser. Following further discussion of the Fund’s projected asset levels, expectations for growth, and levels of fe es, the Board determined that the Fund’s fee arrangements with the Adviser were fair and reasonable and reasonable in relation to the nature and quality of the services to be provided by the Adviser. |

| v. | Brokerage and portfolio transactions. In regard to brokerage and portfolio transactions, the Board considered the Adviser’s standards for seeking best execution and the relevancy of those standards to the strategies that would be employed in managing the Fund. After further review, the Board determined that the Adviser’s practices regarding brokerage and portfolio transactions were satisfactory. |

| vi. | Possible conflicts of interest. In evaluating the possibility for conflicts of interest, the Board considered such matters as: the experience and ability of the advisory person assigned to the Fund; the basis of decisions to buy or sell securities for the Fund and/or the Adviser’s other accounts; the method for bunching of portfolio securities transactions; the substance and administration of the Adviser’s code of ethics and other relevant policies described in the Adviser’s Form ADV. Following further consideration and discussion, the Board indicated that the Adviser’s standards and practices relating to the identification and mitigation of potential conflicts of interests were satisfactory. |

Having considered these factors and additional information provided to the Board in advance of the meeting, the Board of Trustees determined that the Advisory Agreement is fair and in the best interests of the Fund and its shareholders and unanimously approved the appointment of the Adviser to serve as the investment adviser to the Fund under the terms and conditions set forth in the Advisory Agreement.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities is available without charge upon request by calling the Fund at (877) 832-6952 and from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

TRUSTEES

Dr. Merwyn R. Vanderlind

Ira Cohen

R. Jeffrey Young

OFFICERS

R. Jeffrey Young, Principal Executive Officer and President

John C. Swhear, Chief Compliance Officer, AML Officer and Vice-President

Carol J. Highsmith, Vice President

William J. Murphy, Principal Financial Officer and Treasurer

Heather A. Bonds, Secretary

INVESTMENT ADVISER

TEAM Financial Asset Management, LLC

800 Corporate Circle, Suite 106

Harrisburg, PA 17110

DISTRIBUTOR

Unified Financial Securities, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

BBD, LLP

1835 Market Street, 26th Floor

Philadelphia, PA 19103

LEGAL COUNSEL

The Law Offices of John H. Lively & Associates, Inc.,

A member firm of The 1940 Act Law Group

2041 West 141st Terrace, Suite 119

Leawood, KS 66224

CUSTODIAN

Huntington National Bank

41 South Street

Columbus, OH 43125

ADMINISTRATOR, TRANSFER AGENT AND FUND ACCOUNTANT

Unified Fund Services, Inc.

2960 North Meridian Street, Suite 300

Indianapolis, IN 46208

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Unified Financial Securities, Inc.

Member FINRA/SIPC

Item 2. Code of Ethics. NOT APPLICABLE – disclosed with annual report

Item 3. Audit Committee Financial Expert. NOT APPLICABLE- disclosed with annual report

Item 4. Principal Accountant Fees and Services. NOT APPLICABLE – disclosed with annual report

Item 5. Audit Committee of Listed Companies. NOT APPLICABLE – applies to listed companies only

Item 6. Schedule of Investments.

(a) Schedule filed with Item 1

(b) NOT APPLICABLE

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. NOT APPLICABLE – applies to closed-end funds only

Item 8. Portfolio Managers of Closed-End Investment Companies. NOT APPLICABLE – applies to closed-end funds only

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. NOT APPLICABLE – applies to closed-end funds only

Item 10. Submission of Matters to a Vote of Security Holders.

At a meeting of the Board of Trustees (the “Board”) of the registrant held on April 23, 2010, the Board established a Governance and Nominating Committee (the “GNC”), and it adopted a charter for that committee (the “GNC Charter”). The GNC Charter contains, among other things, procedures with respect to nominees to the Board, which include procedures related to the process by which shareholders may submit nominations for independent trustees. These procedures indicate that the GNC will, when identifying candidates for the position of independent trustee, consider any such candidate recommended by a shareholder if such recommendation c ontains: (i) sufficient background information concerning the candidate, including evidence the candidate is willing to serve as an independent trustee if selected for the position; and (ii) is received in a sufficiently timely manner as determined by the GNC in its discretion. Shareholders shall be directed to address any such recommendations in writing to the attention of the GNC, c/o the Secretary of the registrant. The Secretary of the registrant shall retain copies of any shareholder recommendations which meet the foregoing requirements for a period of not more than 12 months following receipt. The Secretary shall have no obligation to acknowledge receipt of any shareholder recommendations. In evaluating a candidate for a position on the Board, including any candidate recommended by shareholders, the GNC shall consider the following: (i) the candidate’s knowledge in matters relating to the mutual fund industry; (ii) any experience possessed by the candidate as a director or senior offic er of public companies; (iii) the candidate’s educational background; (iv) the candidate’s reputation for high ethical standards and professional integrity; (v) any specific financial, technical or other expertise possessed by the candidate, and the extent to which such expertise would complement the Board’s existing mix of skills, core competencies and qualifications; (vi) the candidate’s perceived ability to contribute to the ongoing functions of the Board, including the candidate’s ability and commitment to attend meetings regularly and work collaboratively with other members of the Board; (vii) the candidate’s ability to qualify as an independent trustee and any other actual or potential conflicts of interest involving the candidate and the Trust; and (viii) such other factors as the GNC determines to be relevant in light of the existing composition of the Board and any anticipated vacancies. Prior to making a final recommendation to the Board, the GNC shall conduct pe rsonal interviews with those candidates it concludes are the most qualified candidates.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant is made known to them by others within those entities and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a time ly basis.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not Applicable – filed with annual report

| (a)(2) | Certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes- Oxley Act of 2002 and required by Rule 30a-2under theInvestment Company Act of 1940 are filed herewith. |

(a)(3) Not Applicable – there were no written solicitations to purchase securities under Rule 23c-1 during the period

| (b) | Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Valued Advisers Trust

By

* /s/ R. Jeffrey Young

R. Jeffrey Young, President

Date 7/6/10

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By

* /s/ R. Jeffrey Young

R. Jeffrey Young, President

Date 7/6/10

By

* /s/ William J. Murphy

William J. Murphy, Treasurer

Date 7/6/10