ENB Financial Corp 2019 Annual Shareholders Meeting

• Welcome • Reading of the Minutes • Certify Voting Activity • Vote on Matters of the Proxy Statement • Discussion of Company Condition – President’s Remarks – Financial Review • Questions & Answers • Voting Results • Adjournment Agenda

Aaron L. Groff, Jr. President, CEO and Board Chairman – ENB Financial Corp and Ephrata National Bank Barry W. Harting Vice President and Corporate Secretary – ENB Financial Corp Senior Vice President and Chief Risk Officer – Ephrata National Bank Presenters

Scott E. Lied Treasurer – ENB Financial Corp Senior Vice President and Chief Financial Officer – Ephrata National Bank Jeffrey S. Stauffer Senior Vice President and Senior Lender – Ephrata National Bank Presenters

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Meeting Certification

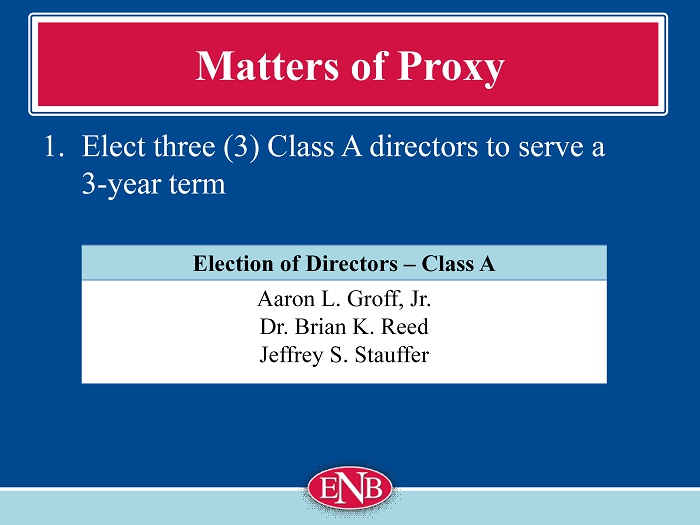

Matters of Proxy Proxy Holders 1. Elect three (3) Class A directors to serve a 3 - year term 2. Conduct a non - binding shareholder vote on executive comp 3. Conduct a non - binding vote on the frequency of the non - binding shareholder vote on executive comp 4. Ratify the selection of S.R. Snodgrass, P.C. 5. Transact other business

1. Elect three (3) Class A directors to serve a 3 - year term Matters of Proxy Election of Directors – Class A Aaron L. Groff, Jr. Dr. Brian K. Reed Jeffrey S. Stauffer

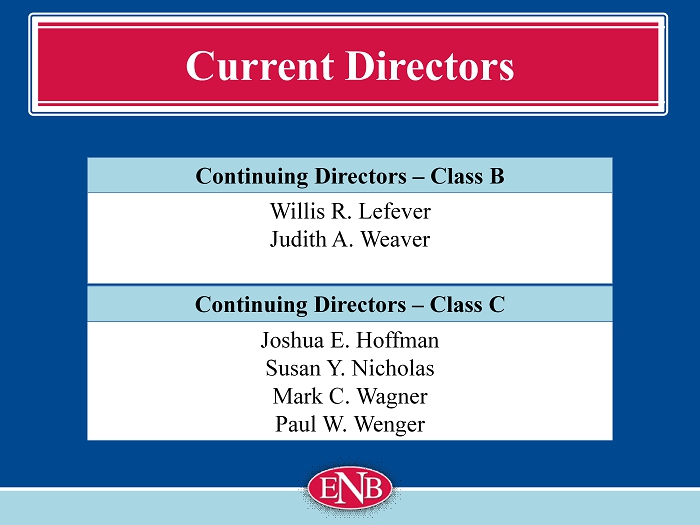

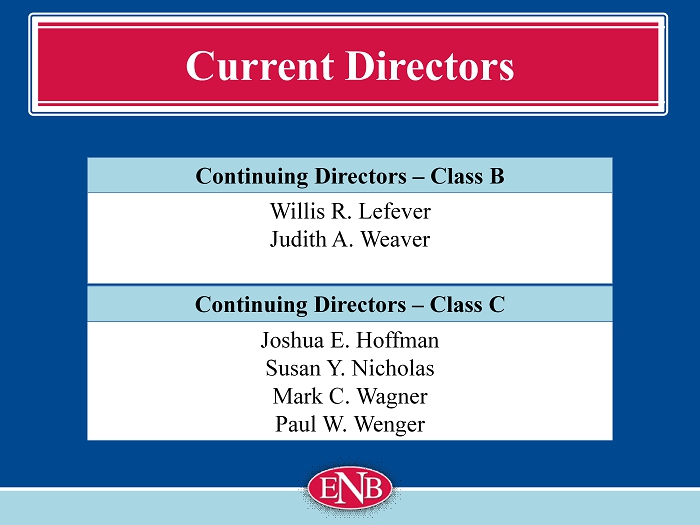

Current Directors Continuing Directors – Class C Joshua E. Hoffman Susan Y. Nicholas Mark C. Wagner Paul W. Wenger Continuing Directors – Class B Willis R. Lefever Judith A. Weaver

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Voting Process

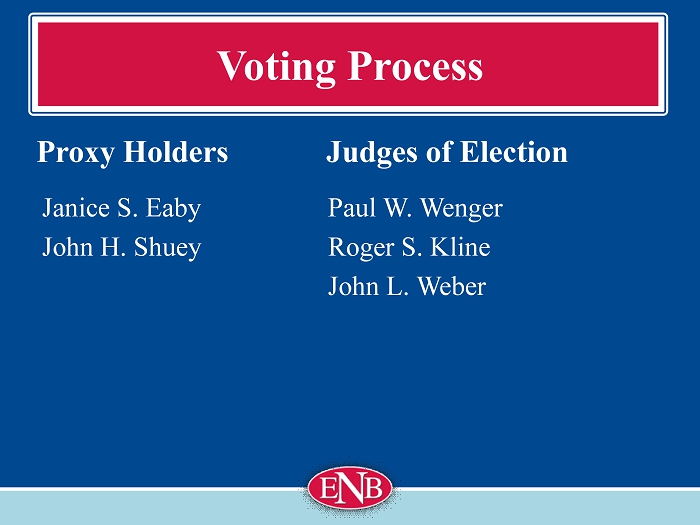

Voting Process Proxy Holders Janice S. Eaby John H. Shuey Judges of Election Paul W. Wenger Roger S. Kline John L. Weber

Presented by: Aaron L. Groff, Jr. President & CEO - ENB Financial Corp President’s Remarks

To remain an independent community bank of undisputed integrity, serving the communities of Lancaster County and beyond. To offer state - of - the - art financial products and services of high quality and value at an affordable price. To provide unsurpassed personal service, delivered by a highly dedicated professional team. Mission Statement

To help clients achieve financial success as defined by them by discovering their goals and dreams in order to provide helpful advice. Vision Statement

2019 – 2021 Strategic Plan 1. Energize employees and manage succession 2. Improve efficiency and financial performance 3. Attract customers at earlier stages of financial life 4. Improve how we deliver the Bank to area businesses 5. Implement a focused shareholder relations program

Employees

Customers

Shareholders • Maximize Efficiency • Dividend Increases • Stock Split • OTCQX Exchange • Stock B uy Back

Keeping our Customers Safe

Community

Presented by: Scott E. Lied Treasurer - ENB Financial Corp Financial Results

Unaudited Financial Information Some of the following slides do present financial information that is unaudited. Therefore, this information is subject to adjustments that could be necessary upon completion of the annual audit. Forward Looking Statements Some of the material and/or language used in this presentation would be considered as a forward looking statement. Management is not obligated to update these forward looking statements. Disclosures

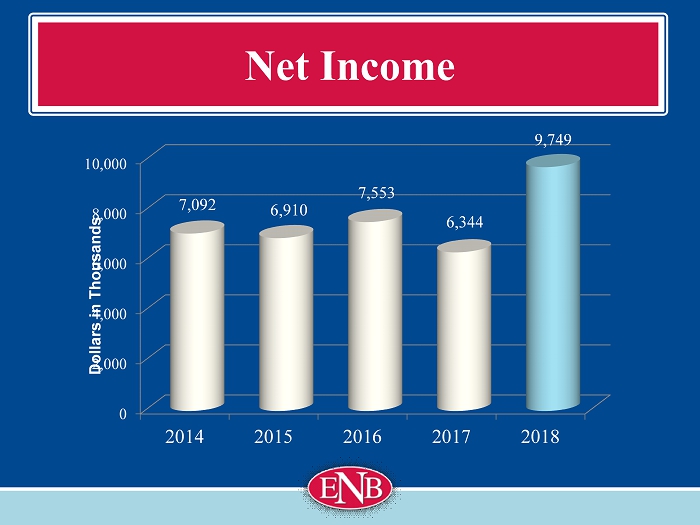

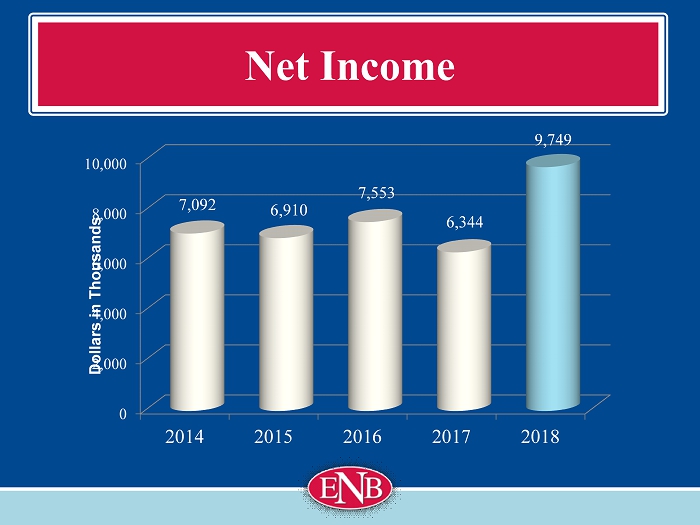

Net Income 0 2,000 4,000 6,000 8,000 10,000 2014 2015 2016 2017 2018 7,092 6,910 7,553 6,344 9,749 Dollars in Thousands

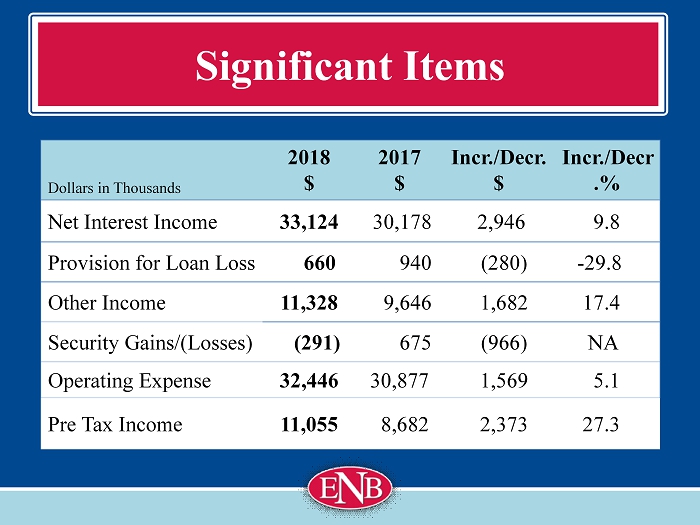

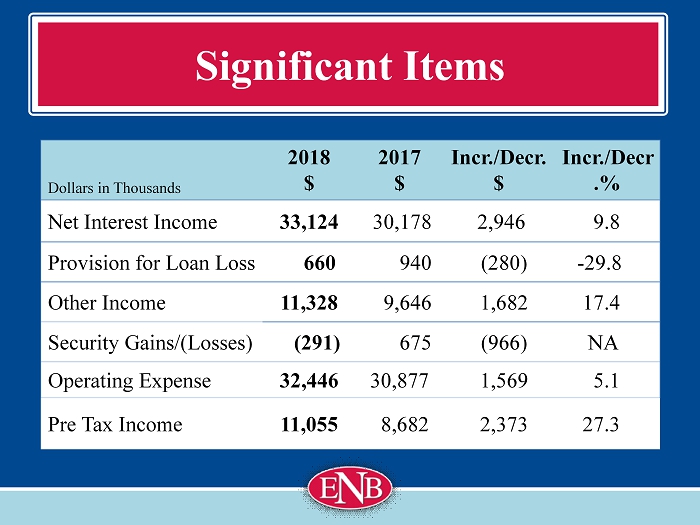

Significant Items Dollars in Thousands 2018 $ 2017 $ Incr./ Decr . $ Incr./ Decr .% Net Interest Income 33,124 30,178 2,946 9.8 Provision for Loan Loss 660 940 (280) - 29.8 Other Income 11,328 9,646 1,682 17.4 Security Gains /(Losses) (291) 675 (966) NA Operating Expense 32,446 30,877 1,569 5.1 Pre Tax Income 11,055 8,682 2,373 27.3

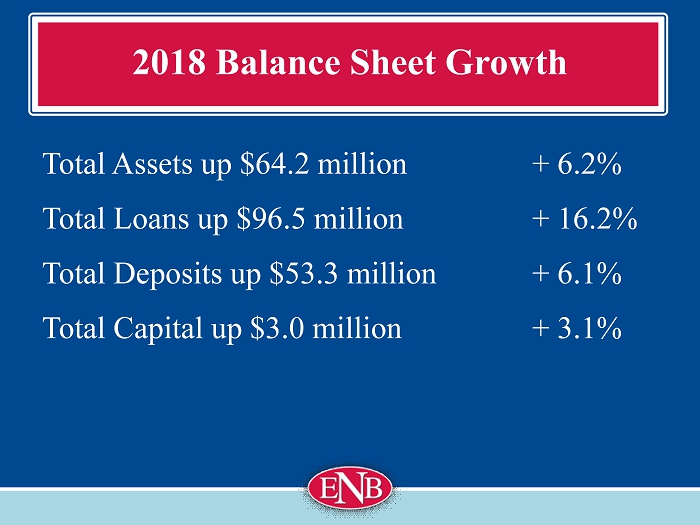

2018 Balance Sheet Growth Total Assets up $64.2 million + 6 .2% Total Loans up $96.5 million + 16.2% Total Deposits up $53.3 million + 6.1% Total Capital up $3.0 million + 3 .1%

Performance Ratios 2018 % 2017 % 2016 % Return on Average Assets (ROA) 0.93 0.63 0.80 Return on Average Equity (ROE) 9.94 6.46 7.74 Net Interest Margin 3.46 3.46 3.12 Efficiency Ratio 71.58 73.23 75.12

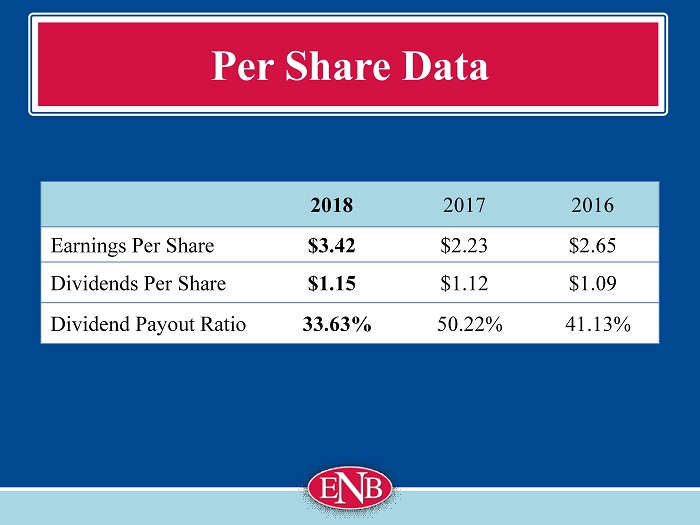

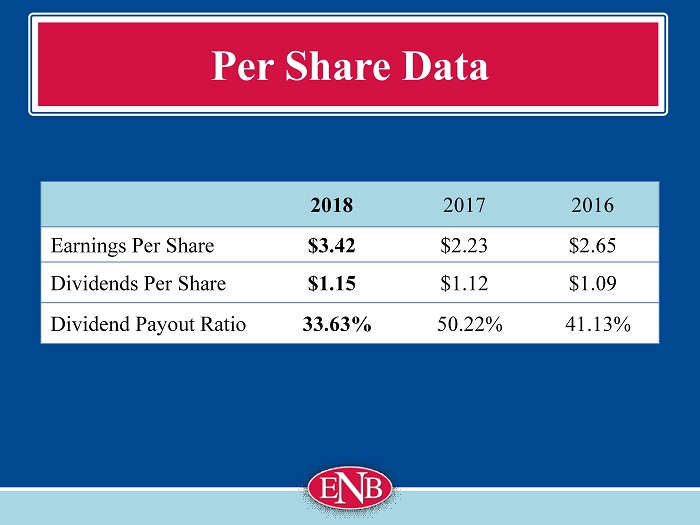

Per Share Data 2018 2017 2016 Earnings Per Share $3.42 $2.23 $2.65 Dividends Per Share $1.15 $1.12 $1.09 Dividend Payout Ratio 33.63% 50.22% 41.13%

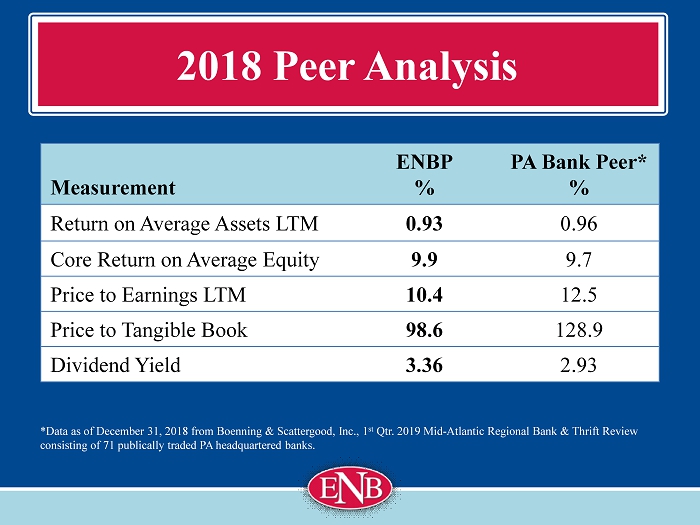

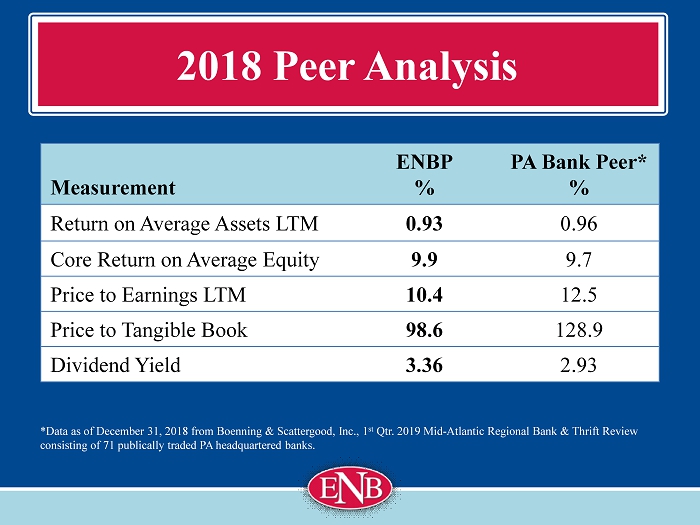

2018 Peer Analysis Measurement ENBP % PA Bank Peer* % Return on Average Assets LTM 0.93 0.96 Core Return on Average Equity 9.9 9.7 Price to Earnings LTM 10.4 12.5 Price to Tangible Book 98.6 128.9 Dividend Yield 3.36 2.93 *Data as of December 31, 2018 from Boenning & Scattergood, Inc., 1 st Qtr. 2019 Mid - Atlantic Regional Bank & Thrift Review consisting of 71 publically traded PA headquartered banks.

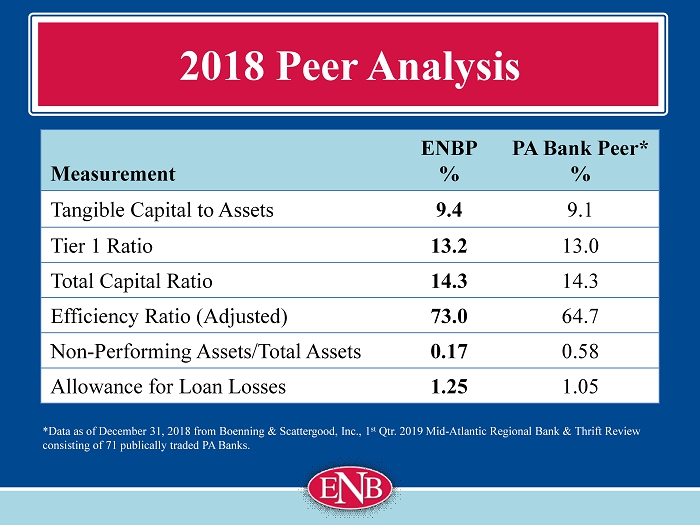

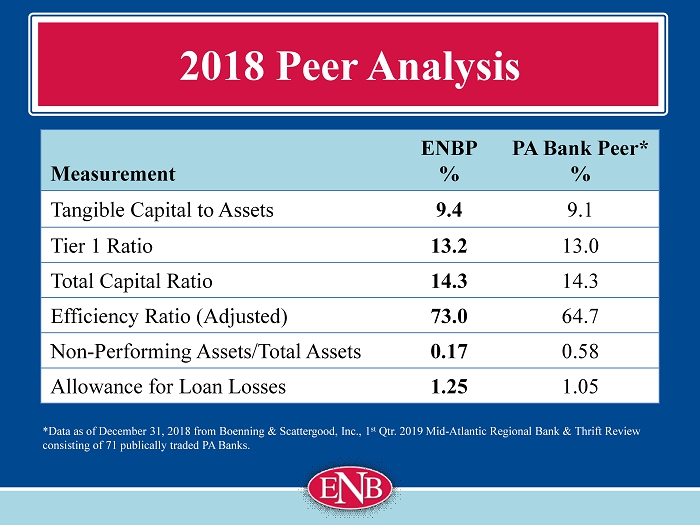

2018 Peer Analysis Measurement ENBP % PA Bank Peer* % Tangible Capital to Assets 9.4 9.1 Tier 1 Ratio 13.2 13.0 Total Capital Ratio 14.3 14.3 Efficiency Ratio (Adjusted) 73.0 64.7 Non - Performing Assets/Total Assets 0.17 0.58 Allowance for Loan Losses 1.25 1.05 *Data as of December 31, 2018 from Boenning & Scattergood, Inc., 1 st Qtr. 2019 Mid - Atlantic Regional Bank & Thrift Review consisting of 71 publically traded PA Banks.

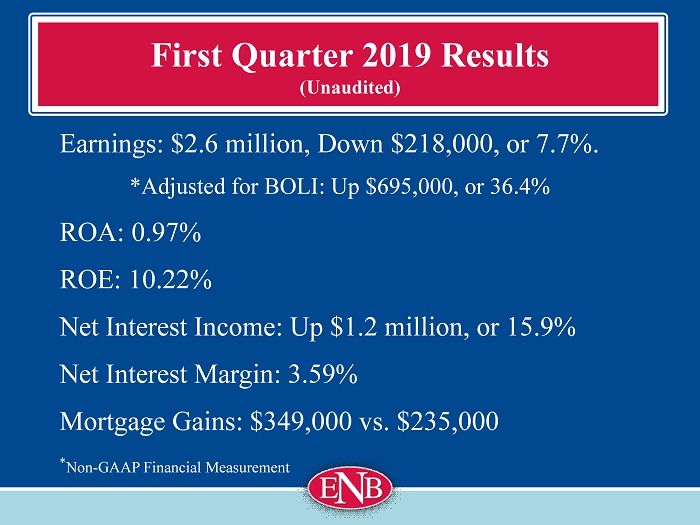

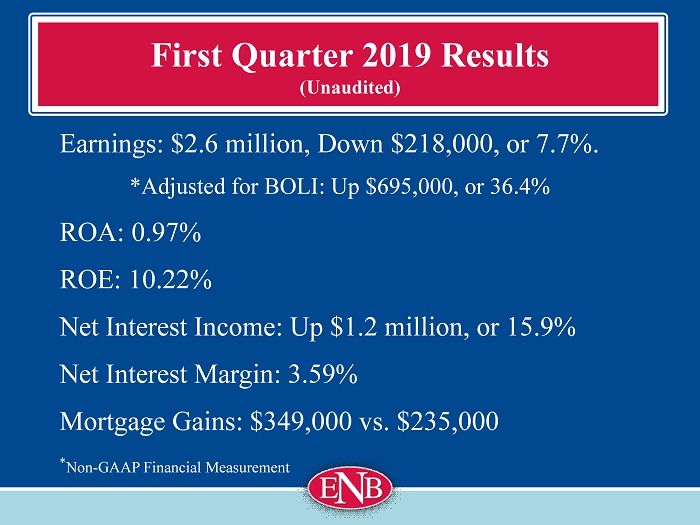

First Quarter 2019 Results (Unaudited) Earnings: $2.6 million, Down $218,000, or 7.7%. *Adjusted for BOLI: Up $695,000, or 36.4% ROA: 0.97% ROE: 10.22% Net Interest Income: Up $1.2 million, or 15.9% Net Interest Margin: 3.59% Mortgage Gains: $349,000 vs. $235,000 * Non - GAAP Financial Measurement

Presented by: Jeffrey S. Stauffer SVP Senior Lender – Ephrata National Bank Loan Growth

Area of Focus 2018 Loan Growth Dollars in Millions 2018 $ 2017 $ Increase $ Increase % Commercial R/E 285.4 260.8 24.6 9.4 Consumer R/E 293.7 249.3 44.4 17.8 Comm & Industrial 104.1 80.9 23.2 28.7 Consumer Loans 9.2 5.3 3.9 73.6 Total Loans * 692.5 596.3 96.2 16.1 * Net of Deferred Fees

Commercial Loan Growth Commercial Mortgages - Grew $11.3 million or 12.6% - Portfolio grew to $101.4 million Commercial & Industrial (C&I) - Grew $19.6 million or 47.4% - Portfolio grew to $61.0 million

Agricultural Loan Growth Agricultural Mortgages - Grew $13.9 million or 9.1% - Portfolio grew to $165.9 million Agricultural C & I Loans - Grew $1.7 million or 9.1% - Portfolio grew to $20.5 million Ag Loans account for 26.9% of Total Loans

Residential Loan Growth 1 – 4 Family Residential Mortgages - Grew $42.1 million or 23.8% - Portfolio grew to $219 million Home Equity Lines of Credit - Grew $3.3 million or 5.4% - Portfolio grew to $64.4 million

Presented by: Barry W. Harting Corporate Secretary - ENB Financial Corp Voting Results

Communication

ENB Financial Corp 2019 Annual Shareholders Meeting