Disclosures Participation in the annual meeting, including voting shares and submitting questions, is limited to shareholders. During the annual meeting, the company will not permit discussions or questions that are not relevant or pertinent to the agenda matter, then being discussed, as determined by the Chair in his reasonable judgement. Following adjournment of the formal business of the annual meeting, the Company will address appropriate general questions from shareholders regarding the Company.

Agenda • Welcome • Reading of the Minutes • Meeting Certification • Matters of Proxy – Voting • Discussion of Company Condition – President’s Remarks – Financial Review • Voting Results • Questions & Answers • Adjournment

Presenters Adrienne L. Miller, Esq. Vice President and Corporate Secretary – ENB Financial Corp Senior Vice President and General Counsel – Ephrata National Bank Rachel G. Bitner Treasurer – ENB Financial Corp Executive Vice President and Chief Financial Officer – Ephrata National Bank Jeffrey S. Stauffer President, CEO & Chairman of the Board – ENB Financial Corp and Ephrata National Bank

Meeting Certification Presented by: Adrienne L. Miller, Esq. Corporate Secretary - ENB Financial Corp • Notice of Mailing to Shareholders of Record • Confirmation of Quorum

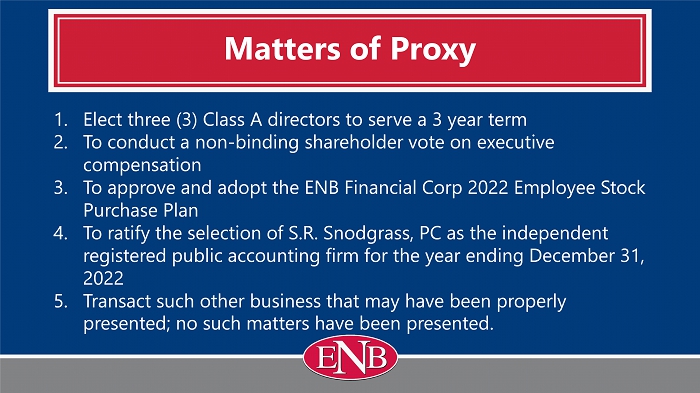

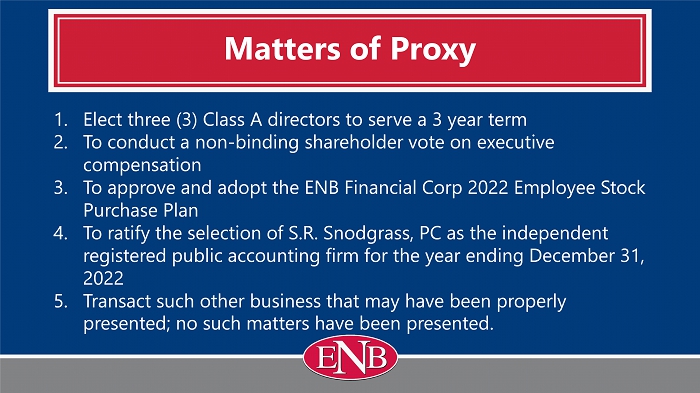

Matters of Proxy 1. Elect three (3) Class A directors to serve a 3 year term 2. To conduct a non - binding shareholder vote on executive compensation 3. To approve and adopt the ENB Financial Corp 2022 Employee Stock Purchase Plan 4. To ratify the selection of S.R. Snodgrass, PC as the independent registered public accounting firm for the year ending December 31, 2022 5. Transact such other business that may have been properly presented; no such matters have been presented.

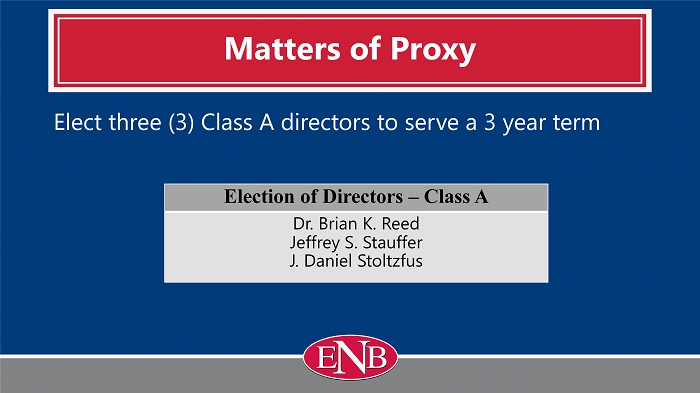

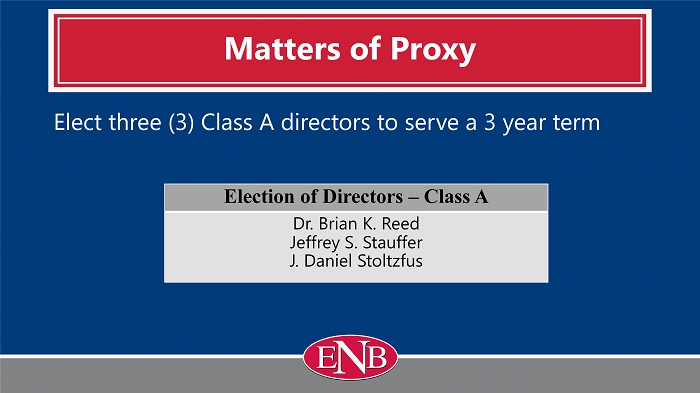

Matters of Proxy Elect three (3) Class A directors to serve a 3 year term Election of Directors – Class A Dr. Brian K. Reed Jeffrey S. Stauffer J. Daniel Stoltzfus

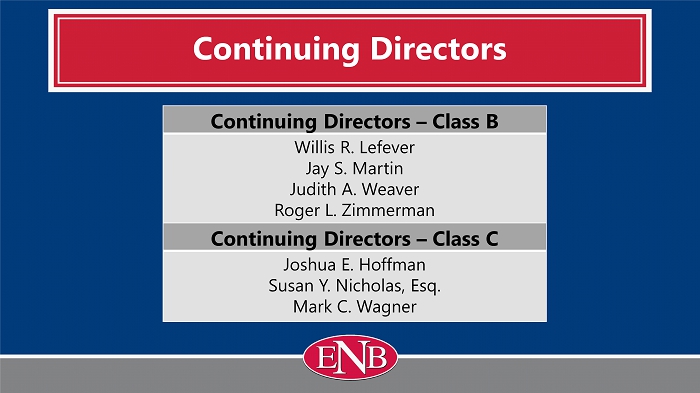

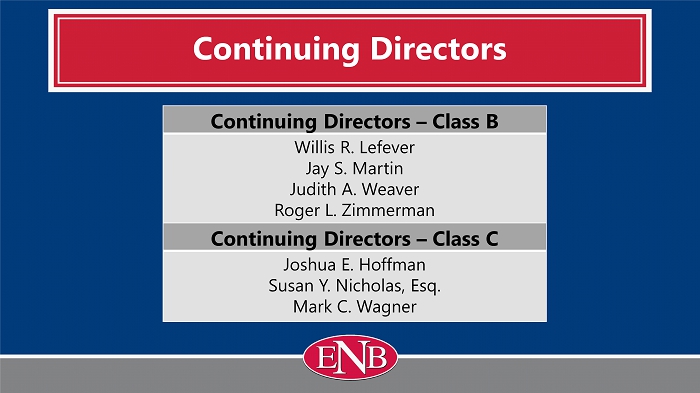

Continuing Directors Continuing Directors – Class B Willis R. Lefever Jay S. Martin Judith A. Weaver Roger L. Zimmerman Continuing Directors – Class C Joshua E. Hoffman Susan Y. Nicholas, Esq. Mark C. Wagner

Voting Process Presented by: Adrienne L. Miller, Esq. Corporate Secretary - ENB Financial Corp • Introduction of Proxy Holders and Judges • Collection of any votes placed at the meeting

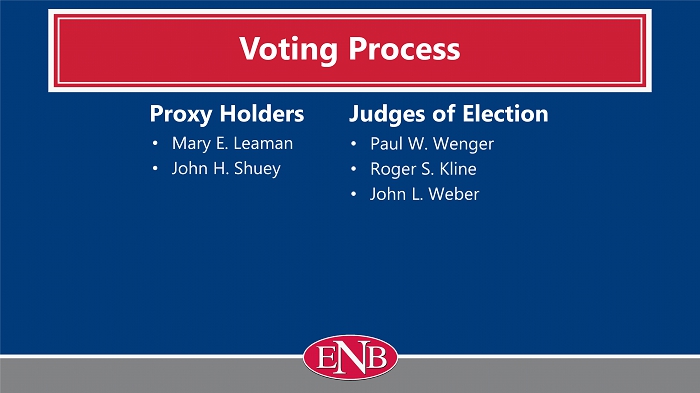

Voting Process Proxy Holders • Mary E. Leaman • John H. Shuey Judges of Election • Paul W. Wenger • Roger S. Kline • John L. Weber

President’s Remarks Presented by: Jeffrey S. Stauffer President , CEO & Chairman of the Board - ENB Financial Corp

Reaching for New Heights ENB 2022 – 2024 Strategic Planning Objectives 1. Evolve Purposeful Leadership Capabilities 2. Achieve Operational Excellence 3. Develop a Robust Sales Culture 4. Manage Risk to Achieve Greater Profitability 5. Pursue Emerging Opportunities that Align with our Mission

Mission Statement To remain an independent community bank of undisputed integrity so the communities we serve benefit from our prosperity. To help our employees find career fulfillment through professional growth, personal empowerment and mutual achievement. To help our customers achieve financial health and wellbeing, as defined by them, throughout their lifetime. To provide our shareholders with a consistent return on their investment by being a top performing financial institution.

Creating a Plan for Future S uccess

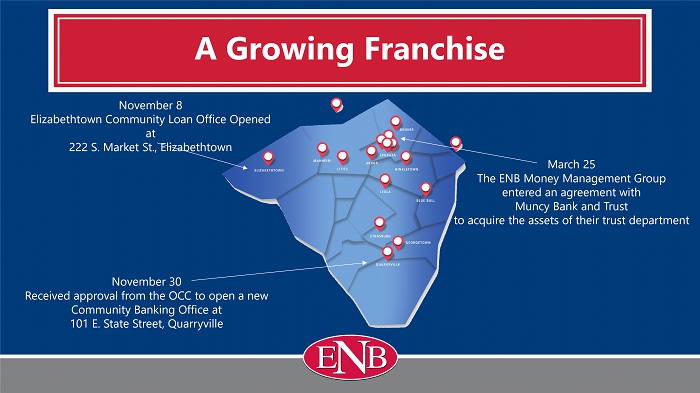

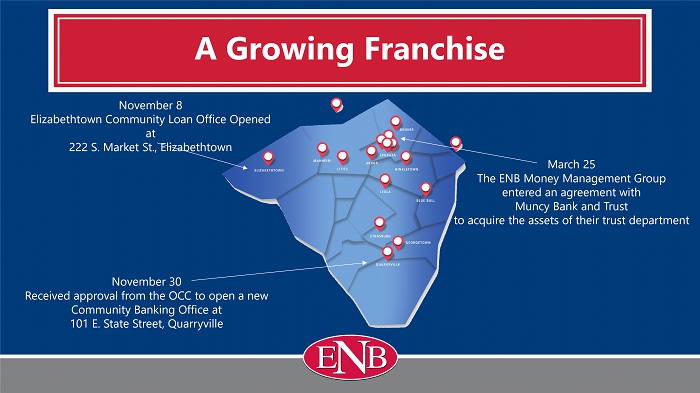

A Growing Franchise November 8 Elizabethtown Community Loan Office Opened at 222 S. Market St., Elizabethtown November 30 Received approval from the OCC to open a new Community Banking Office at 101 E. State Street, Quarryville March 25 The ENB Money Management Group entered an agreement with Muncy Bank and Trust to acquire the assets of their trust department

Continuing Digital Transformation

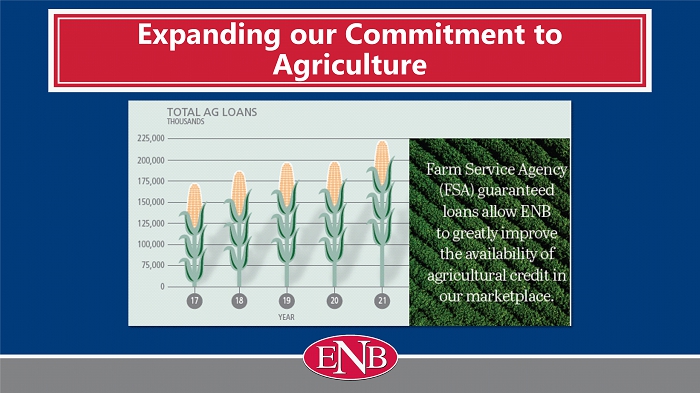

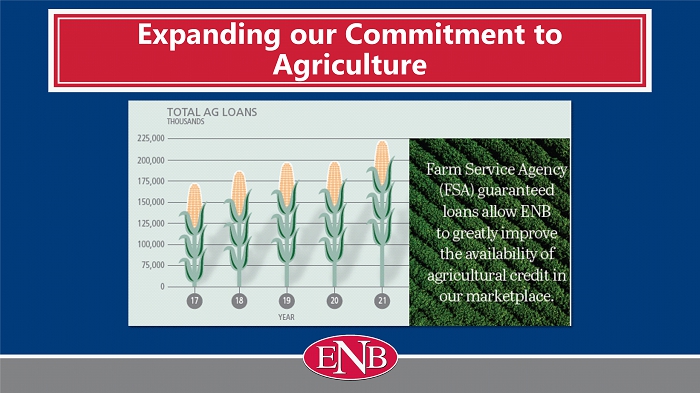

Expanding our Commitment to Agriculture

Sharing our Prosperity

Sharing our Prosperity J. Harry Hibshman Scholarship • 4,473 scholarships totaling $ 30.2M awarded over the past 57 years • 78 scholarships totaling $ 1.55M awarded in 2021

Making the Holidays Brighter

Board Retirement - Aaron L. Groff, Jr .

2021 Financial Results Presented by: Rachel G. Bitner Treasurer - ENB Financial Corp

Disclosures Unaudited Financial Information Some of the following slides present financial information that is unaudited. Therefore, this information is subject to adjustments that could be necessary upon completion of the annual audit. Forward Looking Statements Some of the material and/or language used in this presentation would be considered a forward looking statement. Management is not obligated to update these forward looking statements.

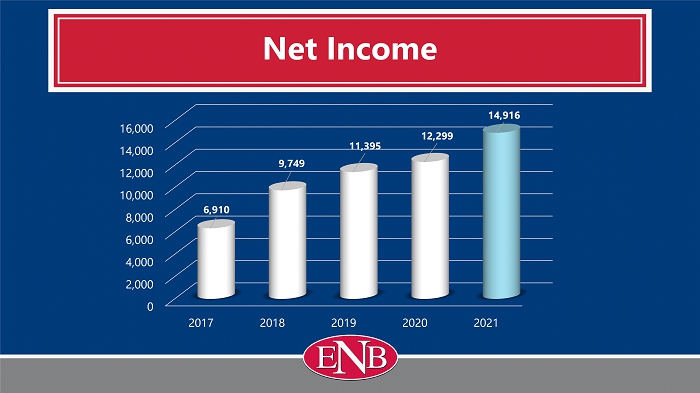

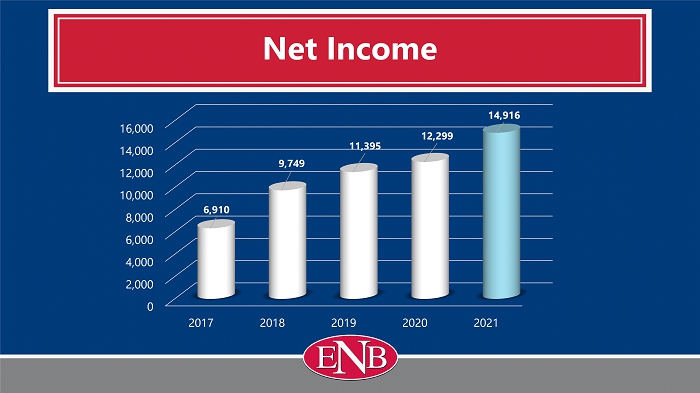

Net Income 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 2017 2018 2019 2020 2021 6,910 9,749 11,395 12,299 14,916

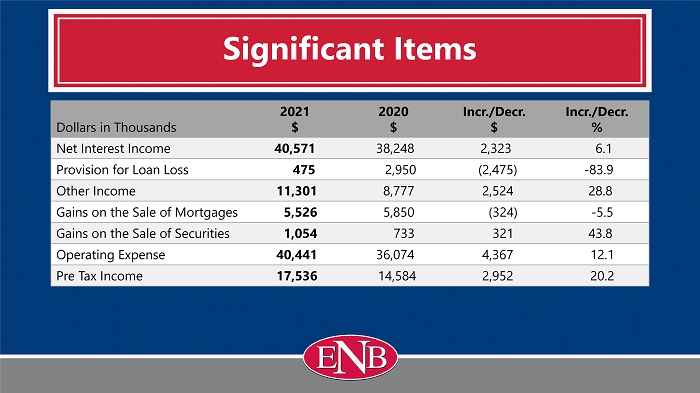

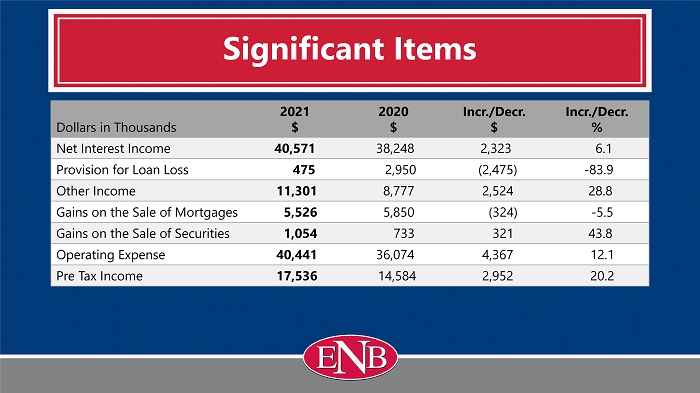

Significant Items Dollars in Thousands 2021 $ 2020 $ Incr./ Decr . $ Incr./ Decr . % Net Interest Income 40,571 38,248 2,323 6.1 Provision for Loan Loss 475 2,950 (2,475) - 83.9 Other Income 11,301 8,777 2,524 28.8 Gains on the Sale of Mortgages 5,526 5,850 (324) - 5.5 Gains on the Sale of Securities 1,054 733 321 43.8 Operating Expense 40,441 36,074 4,367 12.1 Pre Tax Income 17,536 14,584 2,952 20.2

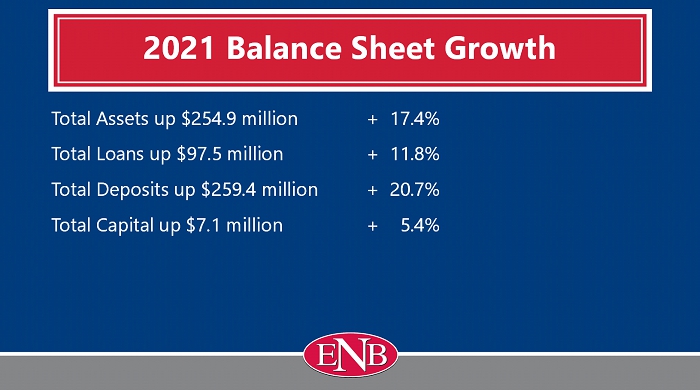

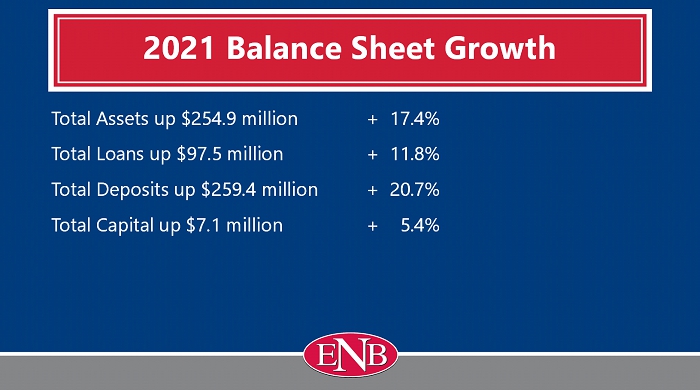

2021 Balance Sheet Growth Total Assets up $254.9 million + 17.4% Total Loans up $97.5 million + 11.8% Total Deposits up $259.4 million + 20.7% Total Capital up $7.1 million + 5.4%

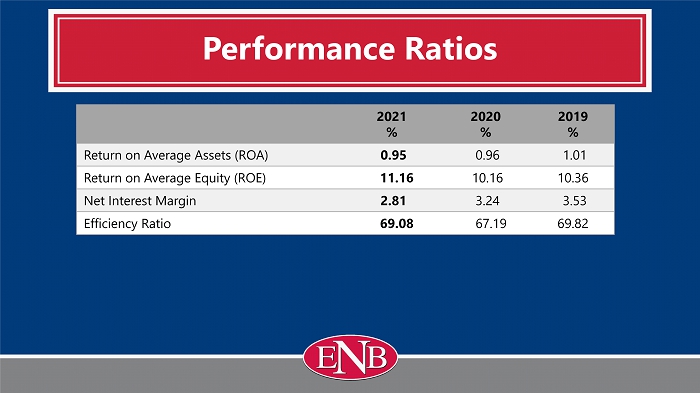

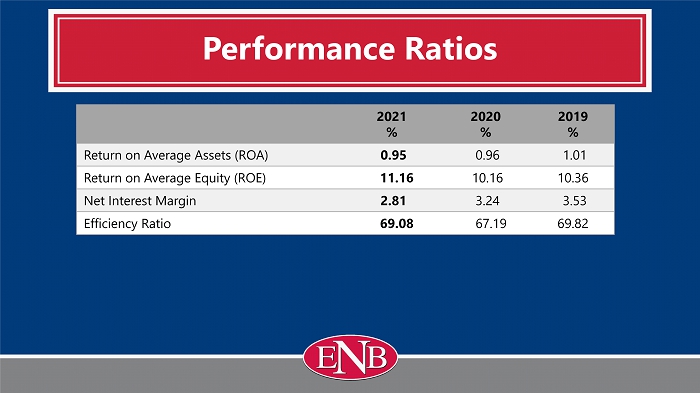

Performance Ratios 2021 % 2020 % 2019 % Return on Average Assets (ROA) 0.95 0.96 1.01 Return on Average Equity (ROE) 11.16 10.16 10.36 Net Interest Margin 2.81 3.24 3.53 Efficiency Ratio 69.08 67.19 69.82

Per Share Data 2021 2020 2019 Earnings Per Share $2.68 $2.20 $2.01 Dividends Per Share $0.67 $0.64 $0.62 Dividend Payout Ratio 25.00% 29.09% 30.85 % Stock Price at Year - End $21.70 $18.60 $20.75

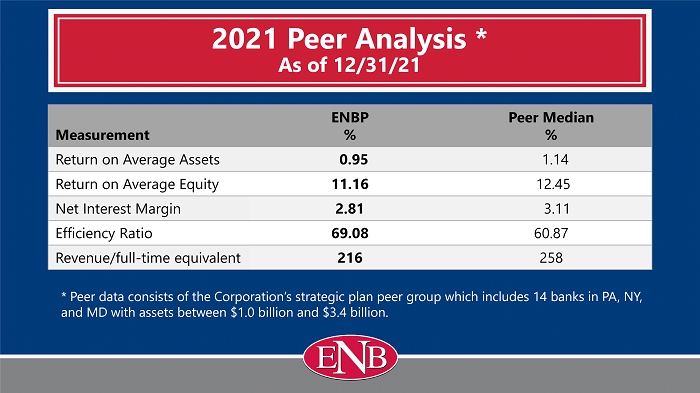

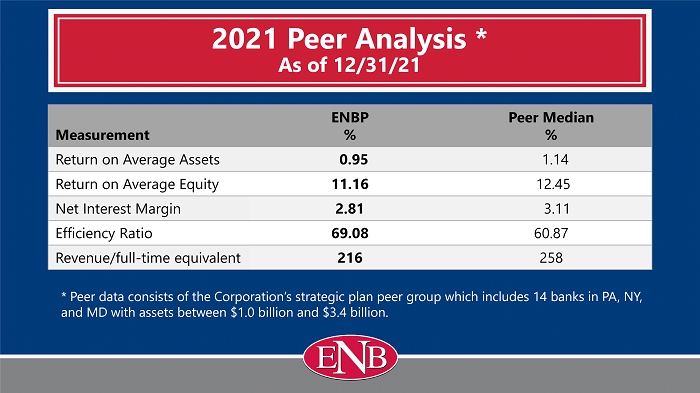

2021 Peer Analysis * As of 12/31/21 Measurement ENBP % Peer Median % Return on Average Assets 0.95 1.14 Return on Average Equity 11.16 12.45 Net Interest Margin 2.81 3.11 Efficiency Ratio 69.08 60.87 Revenue/full - time equivalent 216 258 * Peer data consists of the Corporation’s strategic plan peer group which includes 14 banks in PA, NY, and MD with assets between $1.0 billion and $3.4 billion.

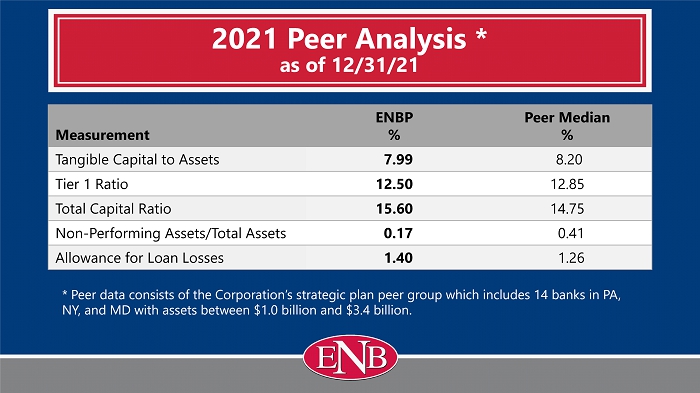

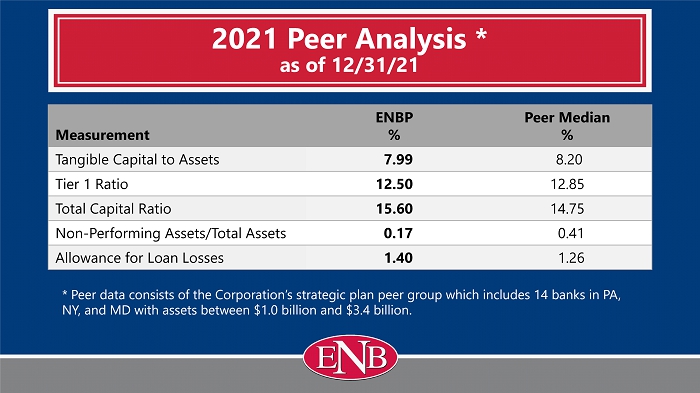

2021 Peer Analysis * as of 12/31/21 Measurement ENBP % Peer Median % Tangible Capital to Assets 7.99 8.20 Tier 1 Ratio 12.50 12.85 Total Capital Ratio 15.60 14.75 Non - Performing Assets/Total Assets 0.17 0.41 Allowance for Loan Losses 1.40 1.26 * Peer data consists of the Corporation’s strategic plan peer group which includes 14 banks in PA, NY, and MD with assets between $1.0 billion and $3.4 billion .

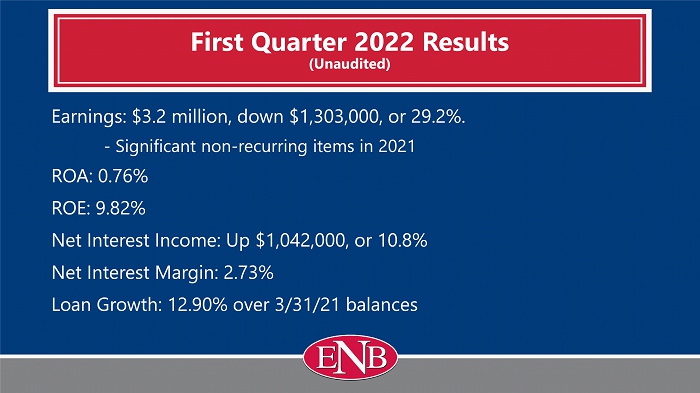

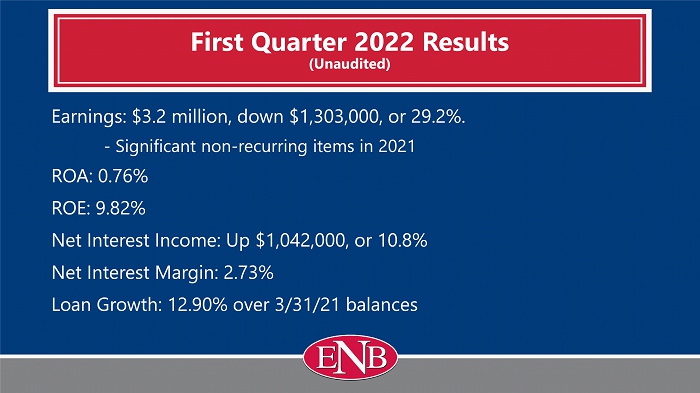

First Quarter 2022 Results (Unaudited) Earnings: $3.2 million, down $1,303,000, or 29.2%. - Significant non - recurring items in 2021 ROA: 0.76% ROE: 9.82% Net Interest Income: Up $1,042,000, or 10.8% Net Interest Margin: 2.73% Loan Growth: 12.90% over 3/31/21 balances

Voting Results Presented by: Adrienne L. Miller, Esq. Corporate Secretary - ENB Financial Corp • Reading of the Election Report concerning the four proposals

Questions & Answers