Annual Shareholder Meeting MAY 7, 2024

Agenda • Welcome • Reading of the Minutes • Meeting Certification • Matters of Proxy • Voting • Discussion of Company Condition • President’s Remarks • Financial Review • Voting Results • Questions & Answers • Adjournment 2

Presenters Jeffrey S. Stauffer President, CEO & Chairman of the Board – ENB Financial Corp and Ephrata National Bank Adrienne L. Miller, Esq. Vice President and Corporate Secretary – ENB Financial Corp Senior Vice President and Legal Counsel – Ephrata National Bank Rachel G. Bitner Treasurer – ENB Financial Corp Executive Vice President and Chief Financial Officer – Ephrata National Bank 3

Meeting Certification 4 Presented by: Adrienne L. Miller, Esq. Corporate Secretary – ENB Financial Corp

Matters of Proxy ONE Elect four (4) Class B directors to serve a 3 - year term TWO To ratify the selection of S.R. Snodgrass, PC as the independent registered public accounting firm for the year ending December 31, 2024 THREE Transact such other business as may be properly presented here today

Matters of Proxy Elect four (4) Class B directors to serve a 3 - year term Election of Directors – Class B • Willis R. Lefever • Jay S. Martin • Judith A. Weaver • Roger L. Zimmerman

Continuing Directors Continuing Directors – Class A • Dr. Brian K. Reed • Jeffrey S. Stauffer • J. Daniel Stoltzfus Continuing Directors – Class C • Joshua E. Hoffman • Susan Young Nicholas • Mark C. Wagner

Voting Process 8 Presented by: Adrienne L. Miller, Esq. Corporate Secretary – ENB Financial Corp

Voting Process Proxy Holders • Aaron L. Groff, Jr. • Mary E. Leaman Judges of Election • Roger S. Kline • John L. Weber • Paul W. Wenger

President’s Remarks 10 Presented by: Jeffrey S. Stauffer President, CEO & Chairman of the Board – ENB Financial Corp

Executive Team Jeff Stauffer President, CEO & Chairman of the Board Chad Neiss SEVP, Chief Strategy Officer & Head of Mortgage Division Bill Kitsch SEVP, Chief Revenue Officer Rachel Bitner Treasurer/EVP, Chief Financial Officer Cindy Cake EVP, Chief Human Resources Officer Adrienne Miller, Esquire VP, Corporate Secretary SVP, Legal Counsel Nick Klein EVP, Chief Risk Officer Joselyn Strohm SEVP, Chief Operating Officer

Mission Statement To remain an independent community bank of undisputed integrity so the communities we serve benefit from our prosperity. To help our employees find career fulfillment through professional growth, personal empowerment and mutual achievement. To help our customers achieve financial health and wellbeing, as defined by them, throughout their lifetime. To provide our shareholders with a consistent return on their investment by being a top performing financial institution.

Executing a Plan for Future Success ENB 2022 – 2024 Strategic Planning Objectives 1. Evolve Purposeful Leadership Capabilities 2. Develop a Robust Sales & Service Culture 3. Achieve Operational Excellence 4. Manage Risk to Achieve Greater Profitability 5. Pursue Emerging Opportunities that Align with our Mission

Building Community J. Harry Hibshman Scholarship By the Numbers Number of scholarships awarded in 2023 66 Value of scholarships awarded in 2023 $ 1.3 m Number of scholarships awarded since inception 4,600 Value of scholarships awarded since inception $ 32.7 m

2023 Financial Results 15 Presented by: Rachel G. Bitner Treasurer – ENB Financial Corp

Disclosures Unaudited Financial Information Some of the following slides present financial information that is unaudited. Therefore, this information is subject to adjustments that could be necessary upon completion of the annual audit. Forward Looking Statements Some of the material and/or language used in this presentation would be considered a forward looking statement. Management is not obligated to update these forward looking statements.

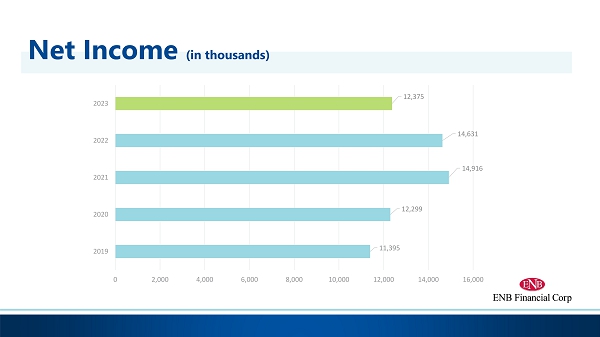

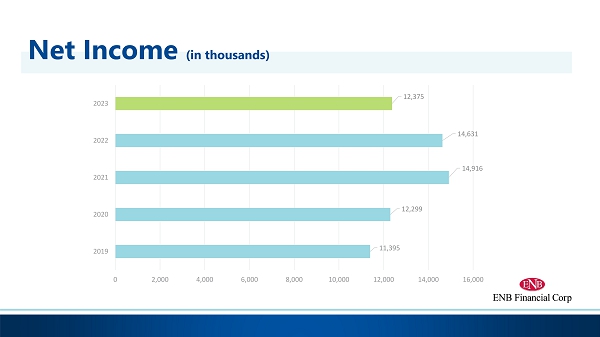

Net Income (in thousands) 11,395 12,299 14,916 14,631 12,375 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 2019 2020 2021 2022 2023

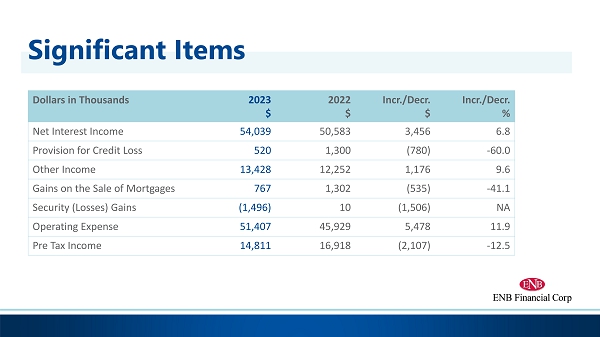

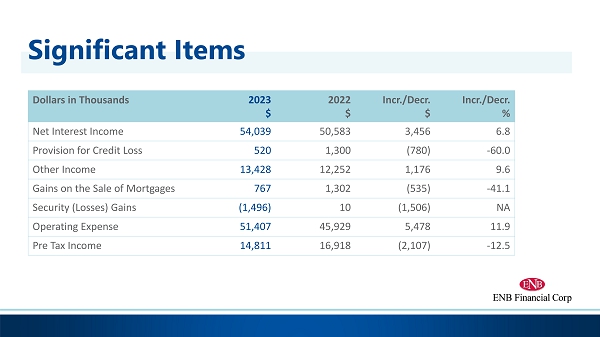

Significant Items Incr./ Decr . % Incr./ Decr . $ 2022 $ 2023 $ Dollars in Thousands 6.8 3,456 50,583 54,039 Net Interest Income - 60.0 (780) 1,300 520 Provision for Credit Loss 9.6 1,176 12,252 13,428 Other Income - 41.1 (535) 1,302 767 Gains on the Sale of Mortgages NA (1,506) 10 (1,496) Security (Losses) Gains 11.9 5,478 45,929 51,407 Operating Expense - 12.5 (2,107) 16,918 14,811 Pre Tax Income

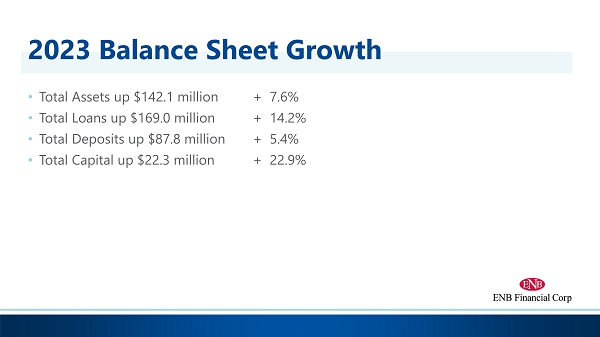

2023 Balance Sheet Growth • Total Assets up $142.1 million + 7.6% • Total Loans up $169.0 million + 14.2% • Total Deposits up $87.8 million + 5.4% • Total Capital up $22.3 million + 22.9%

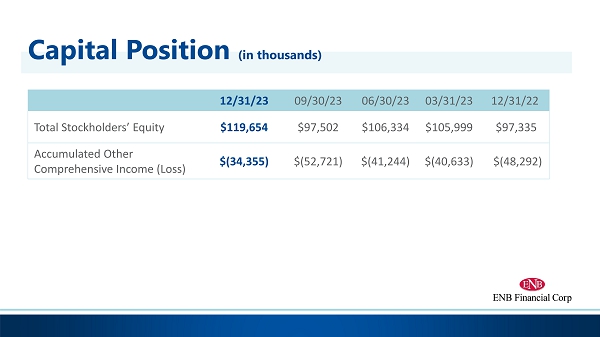

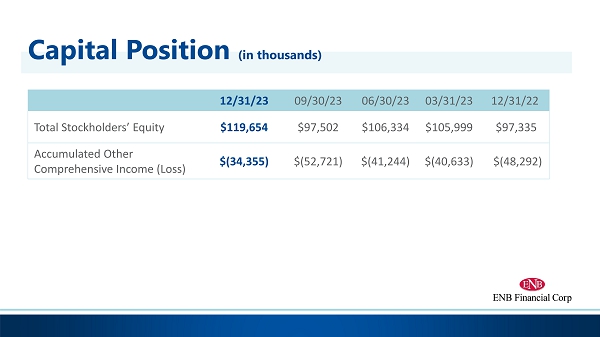

Capital Position (in thousands) 12/31/22 03/31/23 06/30/23 09/30/23 12/31/23 $97,335 $105,999 $106,334 $97,502 $119,654 Total Stockholders’ Equity $(48,292) $(40,633) $(41,244) $(52,721) $(34,355) Accumulated Other Comprehensive Income (Loss)

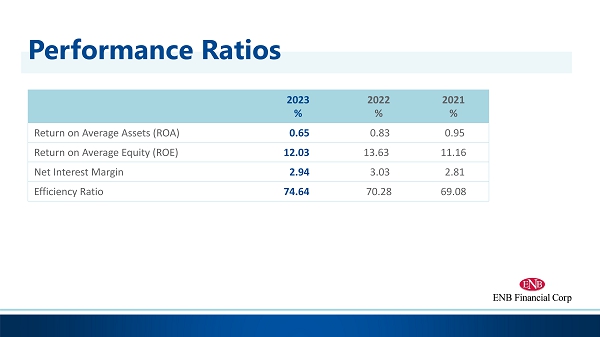

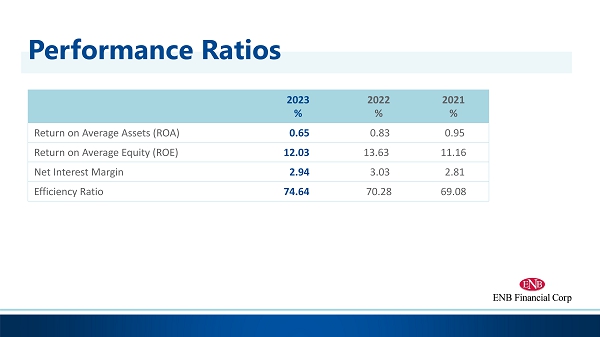

Performance Ratios 2021 % 2022 % 2023 % 0.95 0.83 0.65 Return on Average Assets (ROA) 11.16 13.63 12.03 Return on Average Equity (ROE) 2.81 3.03 2.94 Net Interest Margin 69.08 70.28 74.64 Efficiency Ratio

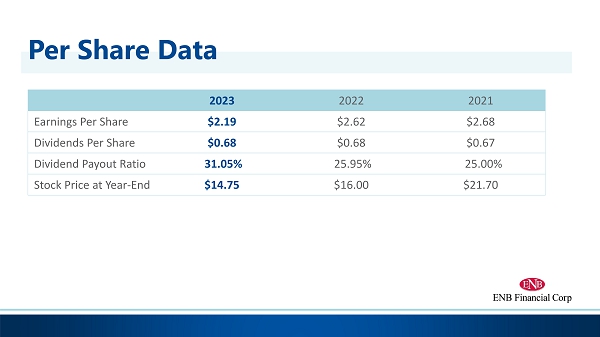

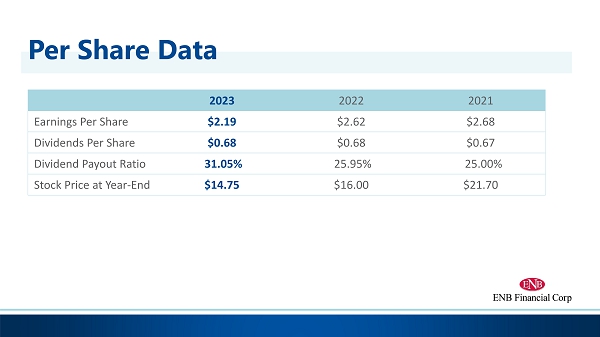

Per Share Data 2021 2022 2023 $2.68 $2.62 $2.19 Earnings Per Share $0.67 $0.68 $0.68 Dividends Per Share 25.00 % 25.95% 31.05% Dividend Payout Ratio $21.70 $16.00 $14.75 Stock Price at Year - End

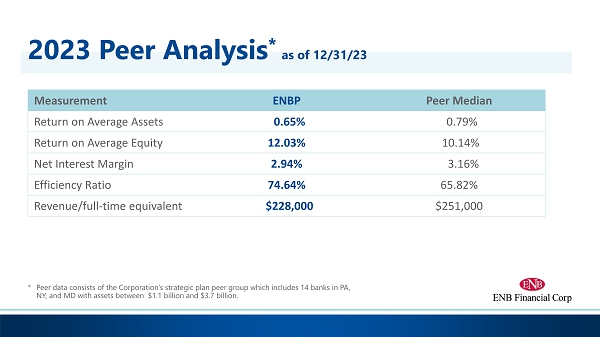

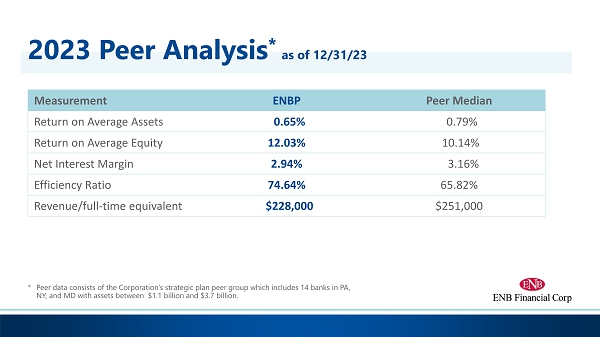

2023 Peer Analysis * as of 12/31/23 Peer Median ENBP Measurement 0.79% 0.65% Return on Average Assets 10.14% 12.03% Return on Average Equity 3.16% 2.94% Net Interest Margin 65.82% 74.64% Efficiency Ratio $251,000 $228,000 Revenue/full - time equivalent * Peer data consists of the Corporation’s strategic plan peer group which includes 14 banks in PA, NY, and MD with assets between $1.1 billion and $ 3.7 billion.

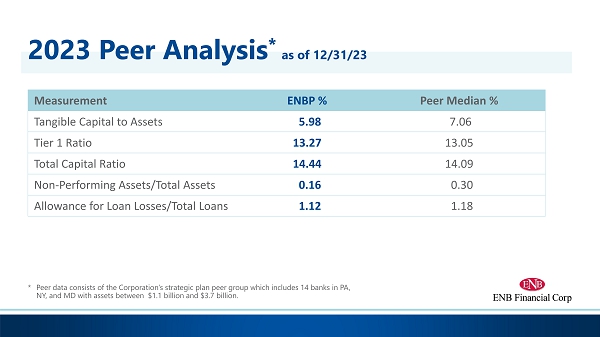

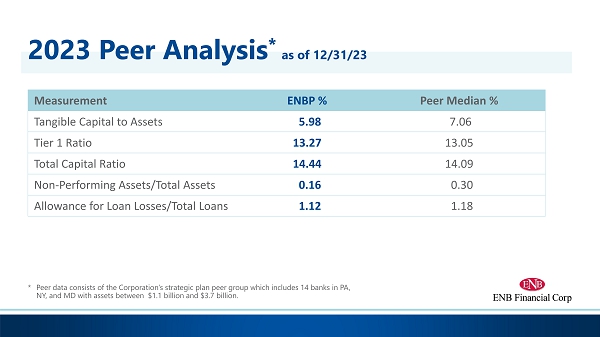

2023 Peer Analysis * as of 12/31/23 * Peer data consists of the Corporation’s strategic plan peer group which includes 14 banks in PA, NY, and MD with assets between $1.1 billion and $ 3.7 billion. Peer Median % ENBP % Measurement 7.06 5.98 Tangible Capital to Assets 13.05 13.27 Tier 1 Ratio 14.09 14.44 Total Capital Ratio 0.30 0.16 Non - Performing Assets/Total Assets 1.18 1.12 Allowance for Loan Losses/Total Loans

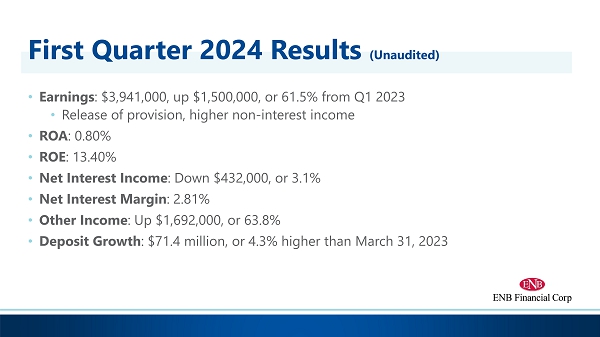

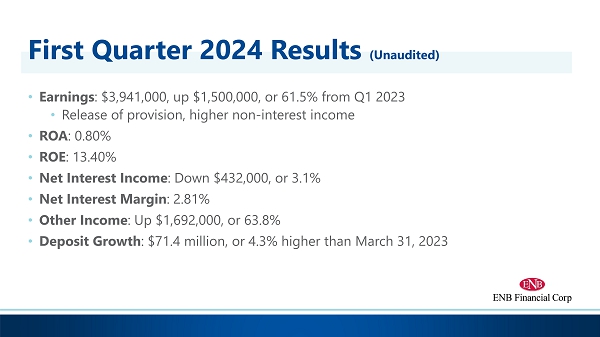

First Quarter 2024 Results (Unaudited) • Earnings : $3,941,000, up $1,500,000, or 61.5% from Q1 2023 • Release of provision, higher non - interest income • ROA : 0.80% • ROE : 13.40% • Net Interest Income : Down $432,000, or 3.1% • Net Interest Margin : 2.81% • Other Income : Up $1,692,000, or 63.8% • Deposit Growth : $71.4 million, or 4.3% higher than March 31, 2023

Voting Results 26 Presented by: Adrienne L. Miller, Esq. Corporate Secretary – ENB Financial Corp

Questions & Answers

Annual Shareholder Meeting MAY 7, 2024