UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by Registrant | ☒ | |

| | | |

| Filed by Party other than Registrant | ☐ | |

| | | |

| Check the appropriate box: | | |

| ☒ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission |

| | | | Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| ☐ | Definitive Proxy Statement | ☐ | Definitive Additional Materials |

| | | |

| ☐ | Soliciting Materials Pursuant to §240.14a-12 | | |

Ecoark Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| | |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | $_____ per share as determined under Rule 0-11 under the Exchange Act. |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

PRELIMINARY PROXY STATEMENT

Ecoark Holdings, Inc.

303 Pearl Parkway Suite 200

San Antonio, TX 78215

(800) 762-7293

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To the stockholders of Ecoark Holdings, Inc.:

We are pleased to invite you to attend a Special Meeting of the Stockholders (the “Special Meeting”) of Ecoark Holdings, Inc., a Nevada corporation (“Ecoark” or the “Company”), which will be held at 1:00 p.m., Eastern Time, on December 16, 2020, virtually via live webcast at www.virtualshareholdermeeting.com/ZEST2020, for the following purposes:

| 1. | Ratify the amendment to the Articles of Incorporation of the Company to increase the number of shares of common stock the Company is authorized to issue from 100,000,000 to 200,000,000 shares (the “Authorized Capital Increase”); |

| 2. | Approve an amendment to the Articles of Incorporation to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is ratified; |

| 3. | Approve an amendment to the Articles of Incorporation to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is not ratified; and |

| 4. | Approve the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve any of the other proposals before the Special Meeting. |

The Company’s Board of Directors (the “Board”) has fixed the close of business on November 16, 2020 as the date (the “Record Date”) for a determination of the stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof.

Important notice regarding the availability of proxy materials for the Special Meeting to be held on

December 16, 2020:

The Notice and Proxy Statement are available at www.proxyvote.com.

This Notice of Special Meeting and the accompanying proxy statement are first being mailed on or about November 30, 2020 to our stockholders of record entitled to vote at the Special Meeting.

The Special Meeting will be accessible through the Internet. You can attend our Special Meeting by visiting www.virtualshareholdermeeting.com/ZEST2020. The Special Meeting will be conducted via live webcast. To be admitted to the Special Meeting, you must enter the control number found on your proxy card or voting instruction form you previously received. We have adopted a virtual format for our Special Meeting to protect the health and well-being of our employees, directors, and stockholders in light of the ongoing COVID-19 pandemic. Additionally, we believe that a virtual meeting allows us to make participation accessible for stockholders from any geographic location with Internet connectivity.

Whether or not you plan to attend the Special Meeting, it is important that you vote your shares. Regardless of the number of shares you own, please promptly vote your shares by telephone (before the Special Meeting) or Internet or, if you have received printed copies of the proxy materials, by marking, signing and dating the proxy card and returning it to the Company in the postage paid envelope provided.

| San Antonio, Texas | BY ORDER OF THE BOARD OF DIRECTORS, |

| November 27, 2020 | |

| | /s/ Randy S. May |

| | Randy S. May |

| | Chairman of the Board and Chief Executive Officer |

Table of Contents

PRELIMINARY PROXY STATEMENT

Ecoark Holdings, Inc.

303 Pearl Parkway Suite 200

San Antonio, TX 78215

(800) 762-7293

SPECIAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This proxy statement (the “Proxy Statement”) is being sent to the holders of shares of voting stock of Ecoark Holdings, Inc., a Nevada corporation (“Ecoark” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at a Special Meeting of Stockholders of the Company which will be held at 1:00 p.m., Eastern Time, on December 16, 2020 (the “Special Meeting”). The Special Meeting will be a virtual only meeting via live webcast over the Internet. You will be able to attend the Special Meeting, vote your shares and submit your questions during the Special Meeting by visiting www.virtualshareholdermeeting.com/ZEST2020. There will not be a physical meeting location. The Notice of the Special Meeting and this Proxy Statement are first being mailed on or about November 30, 2020 to our stockholders of record entitled to vote at the Special Meeting.

What matters will be voted on at the Special Meeting?

The four proposals that are to be considered and voted on at the Special Meeting are as follows:

| 1. | Ratify the amendment to the Articles of Incorporation of the Company to increase the number of shares of common stock the Company is authorized to issue from 100,000,000 to 200,000,000 shares (the “Authorized Capital Increase”); |

| 2. | Approve an amendment to the Articles of Incorporation to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is ratified; |

| 3. | Approve an amendment to the Articles of Incorporation to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is not ratified; and |

| 4. | Approve the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies (the “Adjournment Proposal”). |

PRELIMINARY PROXY STATEMENT

Who is entitled to vote at the Special Meeting?

The Board has fixed the close of business on November 16, 2020 as the record date (the “Record Date”) for a determination of the stockholders entitled to notice of, and to vote at, the Special Meeting.

As of the Record Date, the voting power of the Company consisted of (i) 107,255,723 shares of common stock, par value $0.001 per share (the “Common Stock”), and (ii) under certain circumstances described below, one share of Series A-1 Preferred Stock, par value $0.001 per share (the “Series A-1 Preferred Stock”) of the Company.

Each holder of record of Common Stock as of the Record Date is entitled to one vote for each share held, except that pursuant to Section NRS 78.0296 of the Nevada Revised Statutes, the voting power of any shares issued or purportedly issued pursuant to the corporate act being ratified or validated must be disregarded for all purposes. In other words, for purposes of the ratification of the Authorized Capital Increase (Proposal 1), we must disregard all shares of Common Stock issued in excess of 100,000,000 shares (the “Disregarded Shares”) when determining the total number of our outstanding shares entitled to vote on the ratification of the Authorized Capital Increase and the total number of shares that need to be voted in favor of such ratification to make the same effective. All stockholders are encouraged to vote at the Special Meeting, as further described herein.

The one share of Series A-1 Preferred Stock outstanding represents (i) 104,081,632 votes, the voting power equal to 51% of the number of votes entitled to be cast on the proposal to ratify the Authorized Capital Increase (Proposal 1), or alternatively (ii) 111,633,507 votes, the voting power equal to 51% of the number of votes entitled to be cast on the proposal to approve an amendment to the Articles of Incorporation to increase the authorized Common Stock from 100,000,000 to 150,000,000 shares (Proposal 3). Since the Series A-1 Preferred Stock is owned by the Company’s Chairman and Chief Executive Officer, the Company expects that Proposal 1 and Proposal 3 will be approved.

Series A-1 Preferred Stock is not entitled to vote on any other proposals before the Special Meeting.

The Company expects to file a Certificate of Validation during the Special Meeting if Proposal 1 passes thereby permitting the Disregarded Shares to vote on all other matters.

What are the Board’s voting recommendations?

The Board recommends that you vote “FOR” the ratification of the amendment to effect the Authorized Capital Increase (Proposal 1), “FOR” the amendment to decrease the authorized Common Stock from 200,000,000 to 150,000,000 shares, if the Authorized Capital Increase is ratified (Proposal 2), “FOR” the amendment to increase the authorized Common Stock from 100,000,000 to 150,000,000 shares, if the Authorized Capital Increase is not ratified (Proposal 3) and “FOR” the adjournment of the Special Meeting (Proposal 4).

What is the difference between holding shares as a record holder and as a beneficial owner?

If your shares are registered in your name with the Company’s transfer agent, Philadelphia Stock Transfer, Inc., you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the Special Meeting and how do I attend?

Record holders and beneficial owners may attend the Special Meeting. The Special Meeting will be held entirely online via live webcast.

Set forth below is a summary of the information you need to attend the virtual Special Meeting:

| | ● | Visit www.virtualshareholdermeeting.com/ZEST2020 to access the live webcast; |

| | | |

| | ● | Stockholders can vote electronically and submit questions online while attending the Special Meeting; To be admitted to the Special Meeting, you must enter the control number found on your proxy card or voting instruction form you previously received; |

| | | |

| | ● | Instructions on how to attend and participate in the virtual Special Meeting, including how to demonstrate proof of stock ownership, are also available at www.virtualshareholdermeeting.com/ZEST2020. |

Stockholders may vote electronically and submit questions online while attending the virtual Special Meeting.

How do I vote?

Record Holder

| | 1. | Vote by Internet. The website address for Internet voting is on your proxy card. |

| | 2. | Vote by phone. Call 1-800-690-6903 and follow the instructions on your proxy card. |

| | 3. | Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States). |

| | 4. | Vote in person. Visit www.virtualshareholdermeeting.com/ZEST2020 to vote at the virtual Special Meeting. |

If you vote by Internet or phone, please DO NOT mail your proxy card.

Beneficial Owner (Holding Shares in Street Name)

| | 1. | Vote by Internet. The website address for Internet voting is on your voting instruction form. |

| | 2. | Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States). |

| | 3. | Vote in person. Visit www.virtualshareholdermeeting.com/ZEST2020 to vote at the virtual Special Meeting. |

If you are a beneficial owner, you must follow the voting procedures of your nominee included with your proxy materials. If your shares are held by a nominee and you intend to vote at the Special Meeting, please be ready to demonstrate proof of your beneficial ownership as of the Record Date (such as your most recent account statement as of the Record Date, a copy of the voting instruction form provided by your broker, bank, trustee or nominee, or other similar evidence of ownership) and a legal proxy from your nominee authorizing you to vote your shares.

What constitutes a quorum?

To carry on the business of the Special Meeting, we must have a quorum. A quorum is present when the holders of a majority of the voting power, as of the Record Date, are represented in person or by proxy.

Pursuant to the Certificate of Designation, Series A-1 Preferred Stock only has the right to vote on Proposal 1 and Proposal 3, and not on any other proposals before the Special Meeting. Accordingly, the voting power with respect to Proposal 1 and Proposal 3 includes the voting power of the Series A-1 Preferred Stock. Additionally, as required by Section NRS 78.0296 of the Nevada Revised Statutes, the voting power with respect to Proposal 1 excludes the Disregarded Shares.

In order to ensure that the voting results fairly represent the views of all our stockholders to the fullest extent permitted by applicable law, a quorum will be deemed present at the Special Meeting if the holders of a majority of shares of Common Stock outstanding as of the Record Date are represented in person or by proxy, without including any Disregarded Shares.

Shares owned by the Company are not considered outstanding or considered to be present at the Special Meeting. Broker non-votes and abstentions are counted as present for the purpose of determining the existence of a quorum.

What happens if the Company is unable to obtain a quorum?

If a quorum is not present to transact business at the Special Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Special Meeting, the persons named as proxies may propose one or more adjournments of the Special Meeting to permit solicitation of proxies. Because the Company’s Chairman and Chief Executive Officer owns the share of Series A-1 Preferred Stock, the Company expects it will have a quorum.

What is the effect of the Series A-1 Preferred Stock on the outcome of proposals before the Special Meeting?

On November 12, 2020, the Company, after becoming aware of a lawsuit filed in federal court challenging the validity of the approval by the stockholders of the Authorized Capital Increase, filed a Certificate of Designation of Preferences, Rights and Limitations (the “Certificate of Designation”) of Series A-1 Preferred Stock with the Secretary of State of Nevada. The Certificate of Designation was effective immediately upon filing. On November 16, 2020, the Company issued to its Chairman and Chief Executive Officer one share of Series A-1 Preferred Stock. Because one share of the Series A-1 Preferred Stock represents the voting power equal to 51% of the number of shares of Common Stock eligible to vote on the proposal to ratify the amendment to effect the Authorized Capital Increase (Proposal 1) and the proposal to approve an amendment to the Articles of Incorporation to increase the number of shares the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Reduction is not ratified (Proposal 3), the Company expects that these proposals will be approved at the Special Meeting. The Board, recognizing that the Company will need the extra shares of Common Stock to meet obligations to holders of securities exercisable for Common Stock and to meet its working capital needs in order to remain operational and in reliance upon the advice of counsel, approved the authorization to establish the Series A-1 Preferred Stock and issue one share for a limited and temporary purpose.

The share of Series A-1 Preferred Stock issued and outstanding on the Record Date shall be automatically surrendered to the Company and cancelled upon the approval of Proposal 1 or Proposal 3. Upon such surrender and cancellation, all rights of the Series A-1 Preferred Stock will terminate.

Series A-1 Preferred Stock is not entitled to vote on any other proposals before the Special Meeting.

Which proposals are considered “Routine” or “Non-Routine”?

Proposals 1, 2, 3and 4 are routine proposals.

What is a “broker non-vote”?

If your shares are held in street name, you must instruct the organization which holds your shares how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any non-routine proposal. This vote is called a “broker non-vote.” Broker non-votes do not count as a vote “FOR” or “AGAINST” any of the proposals submitted to a vote at the Special Meeting.

If you are a stockholder of record, and you sign and return a proxy card without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting. If your shares are held in street name and you do not provide specific voting instructions to the organization that holds your shares, the organization may generally vote at its discretion on routine matters, but not on non-routine matters. If you sign your proxy card but do not provide instructions on how your broker should vote, your broker will vote your shares as recommended by the Board on any non-routine matter.

How many votes are needed for each proposal to pass?

| Proposals | | Vote Required | |

| (1) | Ratify the amendment to the Articles of Incorporation of the Company to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 200,000,000 shares; | | Majority of voting power, including Series A-1 Preferred Stock | |

| (2) | Approve an amendment to the Articles of Incorporation to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is ratified; | | Majority of voting power of Common Stock | |

| (3) | Approve an amendment to the Articles of Incorporation to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is not ratified; and | | Majority of voting power, including Series A-1 Preferred Stock | |

| (4) | Approve the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies. | | Majority of the votes cast | |

Under Nevada law, the affirmative vote of the holders of a majority of the voting power is required to ratify the Authorized Capital Increase (Proposal 1). With respect to this proposal, the voting power includes the voting power of the Series A Preferred Stock, but excludes the Disregarded Shares.

Under Nevada law, the affirmative vote of the holders of a majority of the voting power is required to approve an amendment to the Articles of Incorporation to decrease the authorized Common Stock (Proposal 2). Because Series A-1 Preferred Stock has no right to vote on this Proposal 2, a vote “FOR” this proposal by the holders of a majority of the shares of Common Stock outstanding as of the Record Date will be sufficient for Proposal 2 to be approved.

Under Nevada law, the affirmative vote of the holders of a majority of the voting power is required to approve an amendment to the Articles of Incorporation to increase the authorized Common Stock (Proposal 3). With respect to this proposal, the voting power includes the voting power of the Series A Preferred Stock.

Under our bylaws, the votes cast “FOR” must exceed the votes cast “AGAINST” the adjournment of the Special Meeting (Proposal 4).

Is broker discretionary voting allowed and what is the effect of broker non-votes?

| Proposals | | Broker Discretionary Vote Allowed | | Effect of Broker Non-Votes on the Proposal |

| (1) | Ratify the amendment to the Articles of Incorporation of the Company to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 200,000,000 shares; | | Yes | | N/A |

| (2) | Approve an amendment to the Articles of Incorporation to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is ratified; | | Yes | | N/A |

| (3) | Approve an amendment to the Articles of Incorporation to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is not ratified; and | | Yes | | N/A |

| (4) | Approve the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies. | | Yes | | N/A |

What is the effect of abstentions?

| Proposals | | Effect of Abstentions on the Proposal |

| (1) | Ratify the amendment to the Articles of Incorporation of the Company to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 200,000,000 shares; | | Against |

| (2) | Approve an amendment to the Articles of Incorporation to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is ratified; | | Against |

| (3) | Approve an amendment to the Articles of Incorporation to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is not ratified; and | | Against |

| (4) | Approve the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies. | | None |

What are the voting procedures?

You may vote in favor of each proposal or against each proposal, or in favor of some proposals and against others, or you may abstain from voting on any of these proposals. You should specify your respective choices on the accompanying proxy card or your voting instruction form.

Is my proxy revocable?

You may revoke your proxy and reclaim your right to vote up to and including the day of the Special Meeting by giving written notice to the Corporate Secretary of the Company, by delivering a proxy card dated after the date of the proxy or by voting in person at the Special Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

Who is paying the expenses involved in preparing and mailing this proxy statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by the Company. In addition to the solicitation by mail, proxies may be solicited by the Company’s officers and regular employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing. We have retained Innisfree M&A Incorporated to assist in proxy solicitation for a fee of $15,000, $5.50 for each telephone contact plus expenses.

Could other matters be decided at the Special Meeting?

Other than the items of business described in this Proxy Statement, no other matters will be presented for action by the stockholders at the Special Meeting.

What is “householding” and how does it affect me?

Record holders who have the same address and last name will receive only one copy of their proxy materials, unless we are notified that one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce the Company’s printing costs and postage fees. Stockholders who participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of these proxy materials, or if you hold the Company’s Common Stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact the Company’s Corporate Secretary at: Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

If you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact the Company’s Corporate Secretary as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Do I have dissenters’ (appraisal) rights?

Appraisal rights are not available to the Company’s stockholders with any of the proposals brought before the Special Meeting.

Interest of Officers and Directors in Matters to Be Acted Upon

None of the officers or directors of the Company have any interest in any of the matters to be acted upon at the Special Meeting, except that officers and directors have in the past received and may in the future receive equity awards as compensation for their services. Additionally, the individual directors are named in the complaint challenging the validity of prior approval by the stockholders of the amendment to the Articles of Incorporation to effect the Authorized Capital Increase, as discussed in more detail in Proposal 1.

The Board Recommends that THE STOCKholders Vote “FOR” Proposals 1, 2, 3 and 4.

PROPOSAL 1. RATIFICATION OF AUTHORIZED CAPITAL INCREASE

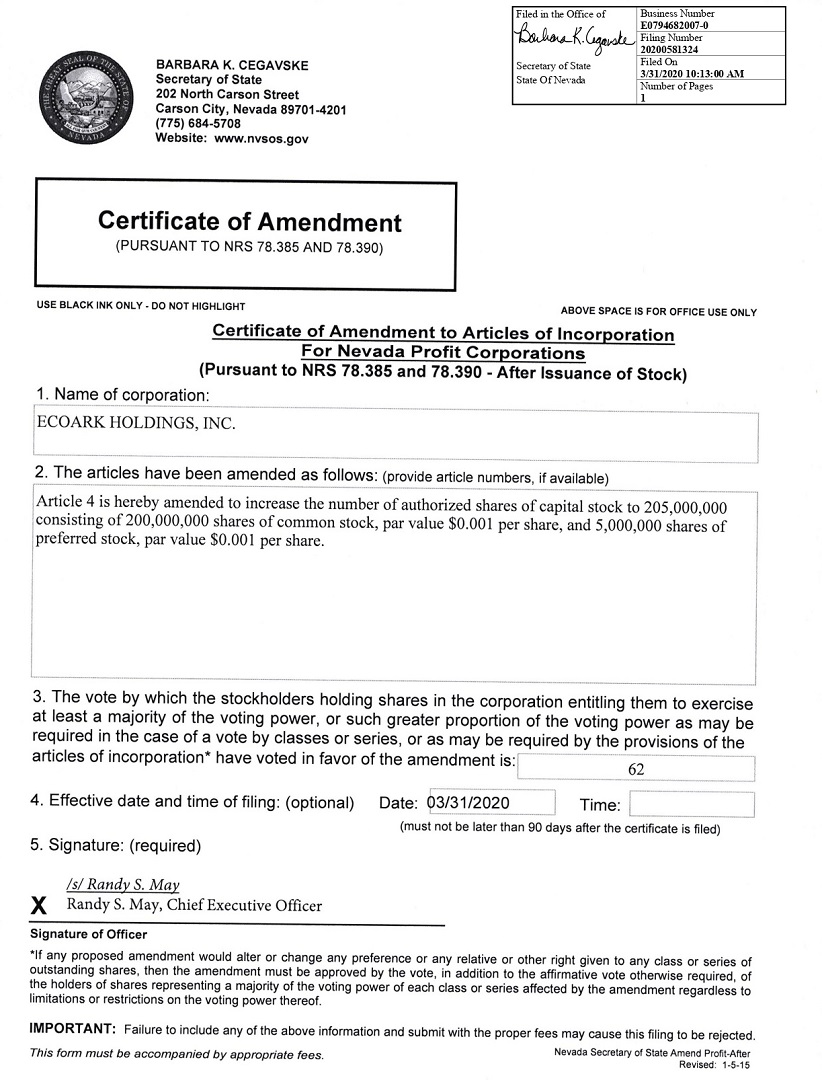

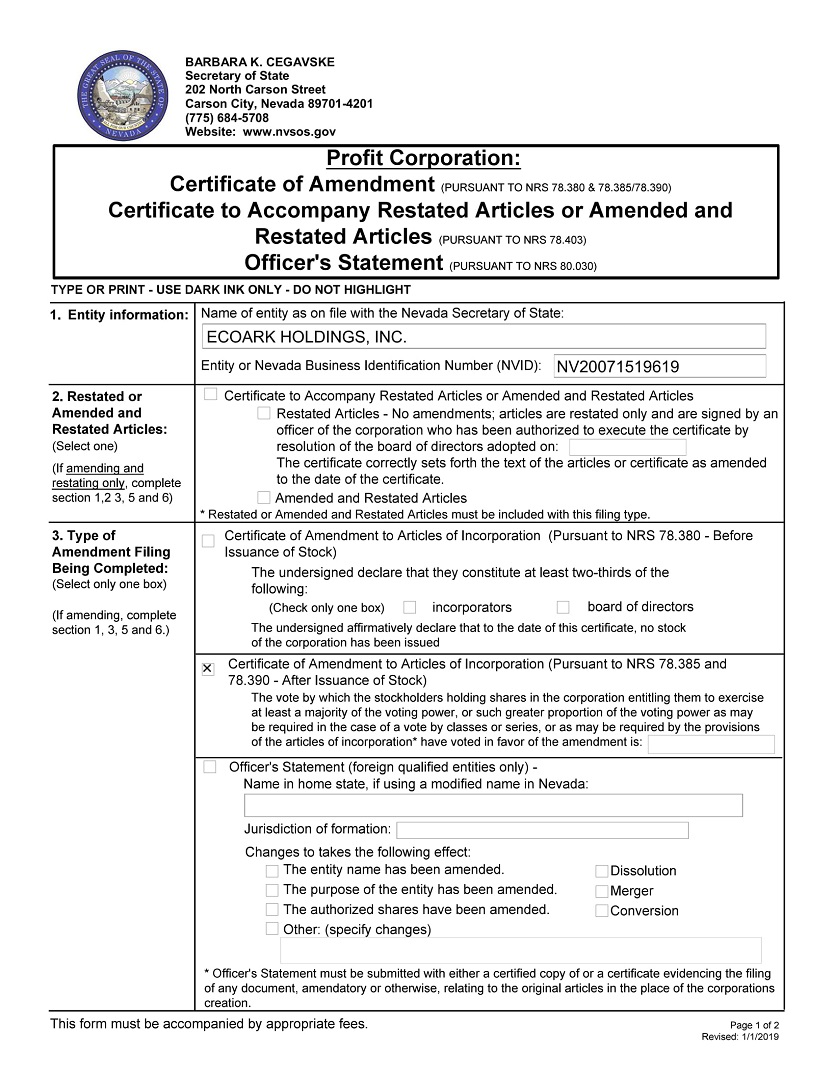

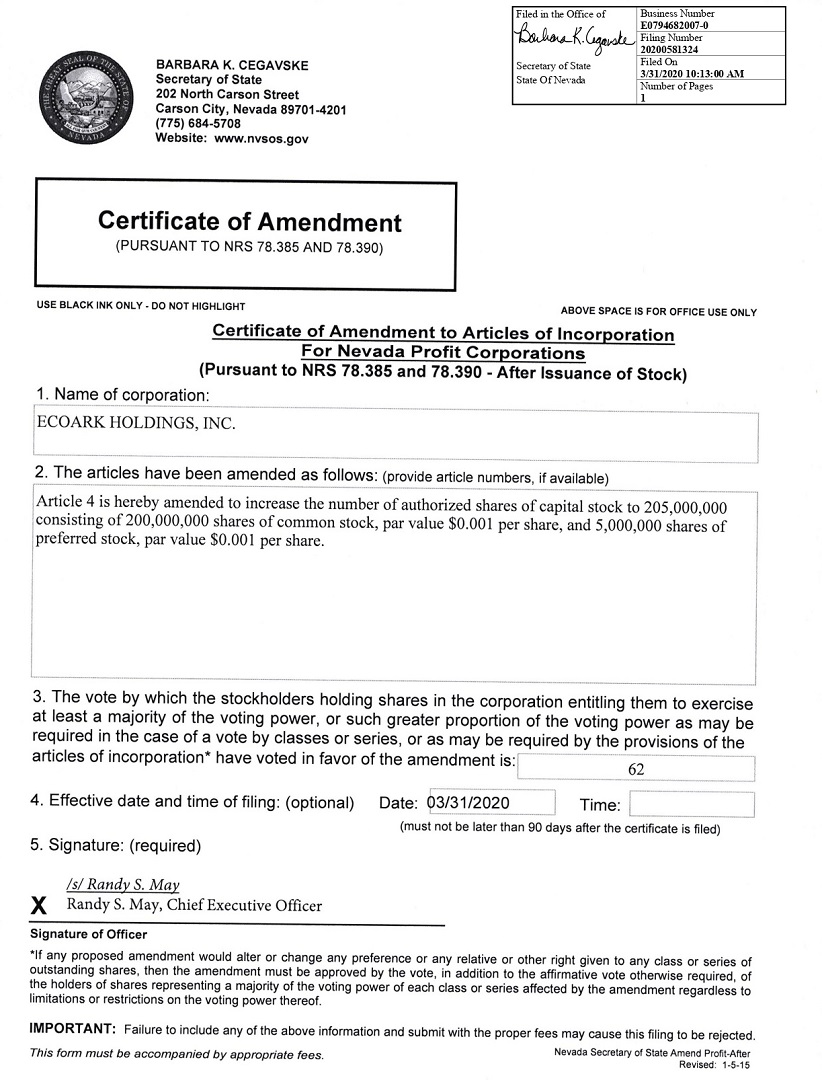

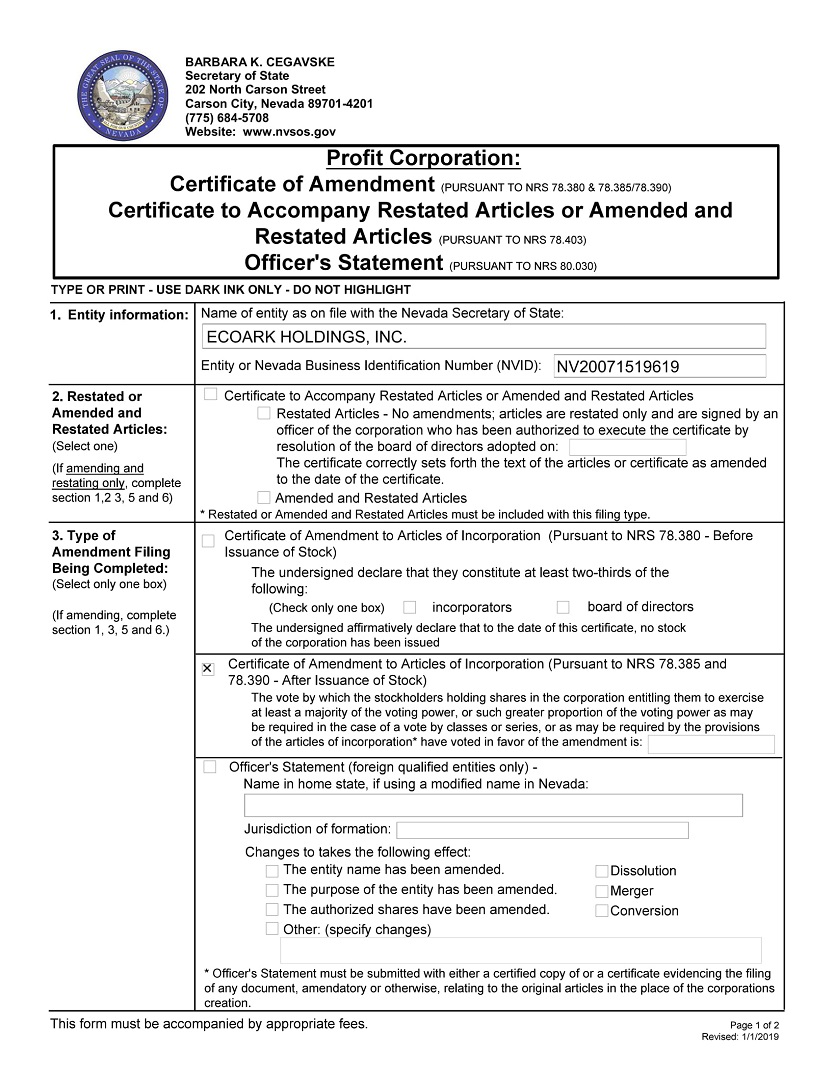

On January 7, 2020, the Board approved, and on February 27, 2020, the stockholders of the Company at the 2019 Annual Meeting of Stockholders of the Company (the “Annual Meeting”), approved an amendment to the Company’s Articles of Incorporation (the “Amendment”) to effect the Authorized Capital Increase from 100,000,000 shares to 200,000,000 shares of Common Stock. The Amendment, which is attached as Annex A to this Proxy Statement, was subsequently filed with the Secretary of State of Nevada, effective March 31, 2020.

Although we believe, that the Amendment to effect the Authorized Capital Increase may have been properly approved by the stockholders at the Annual Meeting, out of an abundance of caution and due to a lawsuit discussed in more detail below in this Proposal 1, we are asking stockholders to ratify the Amendment. This is because the Proxy statement used for the Annual Meeting identified the Authorized Capital Increase as non-routine but ultimately the brokers appeared to have treated it as routine.

Our Board has determined that it is in the best interests of the Company and our stockholders to ratify, pursuant to Section NRS 78.0296 of the Nevada Revised Statutes, the effectiveness of the Amendment. If approved, this ratification will be retroactive to March 31, 2020, the effective date of the Amendment.

Prior Approval of the Amendment at the Annual Meeting

The Amendment was previously submitted to a vote of the stockholders at the Annual Meeting that took place on February 27, 2020. The Amendment received 42,580,362 votes “FOR” out of the 69,146,161 shares of Common Stock outstanding as of January 10, 2020, the record date for the Annual Meeting, or 61.58% of the voting power. Nevada law, where the Company is incorporated, requires approval by a majority of outstanding voting power. Based upon these affirmative votes, the Company considered the Amendment approved, filed a Current Report on Form 8-K disclosing this approval and ultimately filed it with the Secretary of State of Nevada to increase the authorized Common Stock to 200,000,000 shares.

In order to obtain stockholder approval at the Annual Meeting, the Company filed a second amended Proxy Statement on February 18, 2020 (the “February 2020 Proxy Statement”). The February 2020 Proxy Statement described voting procedures for the stockholders who held their shares in “street name” or with brokers, banks or other nominees (the “Nominees”). It stated that only one matter, the ratification of auditors, was routine. By routine, it explained that the Nominees could exercise discretion to vote shares for which they had not received voting instructions. The February 2020 Proxy Statement also stated that Proposal 5 to approve the Authorized Capital Increase was non-routine and that if street name stockholders did not provide voting instructions, the shares could not be voted on that proposal.

The part of the February 2020 Proxy Statement which stated that Proposal 5 was non-routine and could not be voted upon by Nominees was unintentionally incorrect. The February 2020 Proxy Statement was prepared by the Company’s former counsel upon whom the Company, its management and the Board relied for issues of law and legal requirements. At no time until after the Authorized Capital Increase became effective was the Company, its management or the Board aware of this error.

In fact, Proposal 5, the proposal to approve the Authorized Capital Increase, was treated as routine and is considered routine under Rule 452 of the New York Stock Exchange (the “NYSE”). Accordingly, Nominees, or at least broker-dealers which are members of the NYSE, had discretion to vote for Proposal 5 unless instructed otherwise. Based upon the Company’s access to, and subsequent review of , the votes cast at the Annual Meeting, the votes necessary to pass Proposal 5 came from Nominees. The Company believes all or substantially all of these Nominee votes were from the NYSE member firms. The Company has been advised that these broker-dealers typically vote uninstructed shares proportionately based upon the same ratio as shares voted and held by such broker-dealer actually voted. It is important to note that the Company played no role in the voting process which was conducted by an independent third party. Of course, the Board recommended to the stockholders that they approve Proposal 5 and the Company paid for and solicited the votes.

The Lawsuit

On November 10, 2020, the Company became aware of a federal court lawsuit filed on November 9, 2020 by an alleged stockholder individually and on behalf of a class against the Company and its individual directors. The complaint questions the absence of any broker non-votes on Proposal 5 to approve the Authorized Capital Increase at the Annual Meeting and suggests some kind of improper action. In fact, there were no broker-non-votes on Proposal 5 to approve the Authorized Capital Increase since the brokers obviously elected to use their discretion and vote in favor of Proposal 5.

The essence of the three count lawsuit is that the individually-named Company directors breached their fiduciary duties by either ignoring the outcome of the vote or by using a false and misleading proxy statement. The two breach of fiduciary duty counts seek damages. The third count seeks a declaratory judgment from the court that the Amendment to effect the Authorized Capital Increase was not properly approved and is therefore void. The Company intends to defend the suit on the grounds that the voting by the NYSE members was done independently by these firms in accordance with the NYSE rules.

Proposed Stockholder Action

Out of an abundance of caution, we are re-seeking approval of the Amendment to effect the Authorized Capital Increase by the stockholders of the Company. While we believe that the action of the broker-dealer Nominees in using their discretion and voting for the proposal to approve the Authorized Capital Increase at the Annual Meeting was authorized under the NYSE rules, we are seeking the ratification to resolve any uncertainty.

The Company is vastly different and stronger than what it was in February 2020; it has made significant oil and gas acquisitions and its revenue has ramped up. If the Company is required to reduce or curtail its operations if the proposal to ratify the Authorized Capital Increase is not approved, its stockholders will be harmed.

Certificate of Validation

We expect to file a certificate of validation regarding the Amendment, substantially in the form attached as Annex B (the “Certificate of Validation”) with the Nevada Secretary of State as soon as possible upon the receipt of the required vote of the stockholders at the Special Meeting to ratify the Amendment. If required under the Nevada Revised Statutes, we will also file a Certificate of Correction with the Nevada Secretary of State. The filing date of the Certificate of Validation will be the effective time of the validation of the Authorized Capital Increase within the meaning of Section NRS 78.0296 of the Nevada Revised Statutes. In addition, pursuant to Section NRS 78.0296 of the Nevada Revised Statutes, we will provide notice of the approval of this Proposal 1 (the “Ratification Notice”) to each stockholder of record at the time of such approval not later than 10 days after this Proposal 1 is approved by the stockholders as contemplated in this Proxy Statement.

Retroactive Ratification of the Amendment

Subject to the 180-day period for bringing legal challenges discussed below, when the Certificate of Validation, or, if necessary, a Certificate of Correction, becomes effective in accordance with the Nevada Revised Statutes, it should eliminate any potential uncertainty as to whether the Amendment and the Authorized Capital Increase are void or voidable as a result of the potential failure of authorization described above, and the effect of the ratification will be retroactive to the filing of the Amendment with the Secretary of State on March 31, 2020.

Time Limitations on Legal Challenges

Under the Nevada Revised Statutes, any claim that the Amendment ratified pursuant to this Proposal 1 is void or voidable due to a failure of authorization, must be brought within 180 days from the date of the Ratification Notice.

Effect of Failure to Obtain Stockholder Approval

If the proposal to ratify the Authorized Capital Increase is not approved by our stockholders, the Company may face very serious consequences. The Company will not be able to file the Certificate of Validation with the Nevada Secretary of State and the Amendment may not be deemed effective in accordance with Section NRS 78.0296 of the Nevada Revised Statutes. This may subject us to potential claims that (i) the vote on the Authorized Capital Increase did not receive requisite stockholder approval, (ii) the Amendment therefore was not validly adopted, and (iii) as a result, (a) the Company would not have sufficient authorized but unissued shares of Common Stock to permit future sales and issuances of Common Stock, including pursuant to outstanding warrants and stock options, (b) past issuances of Common Stock may not be valid, and (c) the Company would not be able to make requisite representations regarding its outstanding shares of Common Stock in connection with any strategic transaction that the Board may deem advisable. Any inability to issue Common Stock in the future and any invalidity of past issuances of Common Stock could expose us to significant claims and have a material adverse effect on our liquidity.

Vote Required

The affirmative vote of the holders of a majority of the voting power, including the voting power of the Series A Preferred Stock, but excluding the Disregarded Shares, is required to ratify the Amendment. An abstention with respect to this Proposal 1 will have the same effect as a vote “Against” the proposal. Because the Company’s Chairman and Chief Executive Officer owns the share of Series A-1 Preferred Stock, the Company expects he will vote in favor of Proposal 1 and Proposal 1 will be approved.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THIS PROPOSAL 1.

PROPOSAL 2. APPROVAL OF AN AMENDMENT TO DECREASE THE AUTHORIZED COMMON STOCK

The Board has approved, and is asking stockholders to approve a proposed amendment to the Articles of Incorporation of the Company (the “Proposed Capital Reduction Amendment”) to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 to 150,000,000 shares.

The stockholders will only need to vote on this Proposal 2 if the Authorized Capital Reduction is ratified pursuant to Proposal 1.

Purpose of the Proposed Amendment

The Board believes that the reduced number of authorized shares of Common Stock of 150,000,000 shares will be sufficient to suit the Company’s projected capital stock needs for the foreseeable future, such as capital-raising transactions, the issuance of equity-based compensation and, to the extent opportunities may arise in the future, mergers or acquisitions that may involve issuance of our Common Stock or other equity or equity-linked securities, and is more aligned with the expectations of our stockholders. As of the date of this Proxy Statement, Ecoark has not entered into any agreements requiring it to issue equity in connection with a merger or acquisition. Based on the changes in Ecoark’s business and financial condition since February 27, 2020, the Board does not believe the extra 50,000,000shares are needed to meet working capital and other business needs.

Effects of the Proposed Amendment

If the Proposed Capital Reduction Amendment is approved, the number of authorized shares of Common Stock will be 150,000,000. The total number of authorized shares of the Company will be 155,000,000, consisting of 150,000,000 authorized shares of Common Stock and 5,000,000 authorized shares of Preferred Stock (of which one share is currently outstanding). The Proposed Capital Reduction Amendment will not change the par value of the shares of the Common Stock, affect the number of shares of Common Stock outstanding or the rights or privileges of holders of shares of the Common Stock or have any effect on any outstanding securities, including outstanding equity awards, that are exercisable, convertible or exchangeable for shares of Common Stock.

Setting the authorized Common Stock at 150,000,000 shares could potentially adversely affect the Company. It could result in less latitude for the Board to issue shares of Common Stock in the future, including when we determine doing so would be in the best interests of the Company and its stockholders, such as in connection with possible future financings, acquisitions, stock dividends and other corporate purposes. In the event the Board determines that it would be in the Company’s best interests to issue a number of shares of Common Stock in excess of the number of shares then authorized but unissued and unreserved, the Company may be required to seek stockholder approval to increase the number of authorized shares of Common Stock. If the stockholders do not approve such increase in a timely manner, or at all, the Company may be unable to take advantage of one or more opportunities that might otherwise be advantageous to the Company and its stockholders. However, the Board believes that these risks are outweighed by the anticipated benefits, including addressing stockholder concerns over future dilution.

A form of the certificate of amendment to the Articles of Incorporation that would be filed with the Nevada Secretary of State to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 to 150,000,000 shares is set forth in Annex C (the “Certificate of Amendment”). If the stockholders approve the Proposed Capital Reduction Amendment, the Company intends to file the Certificate of Amendment with the Nevada Secretary of State as soon as practicable following the Special Meeting, and the Certificate of Amendment will be effective upon such filing.

Vote Required

Under Nevada law, the affirmative vote of the holders of a majority of the voting power is required to approve the Proposed Capital Reduction Amendment. Because pursuant to the Certificate of Designation, Series A-1 Preferred Stock has no right to vote on this Proposal 2, the affirmative vote of the holders of a majority of the Common Stock outstanding as of the Record Date will be required to approve this Proposal 2. An abstention with respect to this Proposal 2 will have the same effect as a vote “Against” the proposal.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THIS PROPOSAL 2.

PROPOSAL 3. APPROVAL OF AN AMENDMENT TO INCREASE THE AUTHORIZED COMMON STOCK

The Board has approved, and is asking stockholders to approve a proposed amendment to the Articles of Incorporation of the Company (the “Proposed Capital Increase Amendment”) to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 150,000,000 shares.

The stockholders will only need to vote on this Proposal 3 if the Authorized Capital Reduction is not ratified pursuant to Proposal 1.

Purpose of the Proposed Amendment

If the Authorized Capital Increase is not ratified pursuant to Proposal 1, we will not be able to file the Certificate of Validation with the Nevada Secretary of State and the Authorized Capital Increase may not be deemed effective in accordance with Section NRS 78.0296 of the Nevada Revised Statutes, leaving us with 100,000,000 shares of authorized Common Stock. 100,000,000 shares of authorized Common Stock are not sufficient to suit the Company’s projected capital stock needs. See “Proposal 1. Ratification of Authorized Capital Increase – Effect of Failure to Obtain Stockholder Approval” for more details. The purpose of the Proposed Capital Increase Amendment is to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 150,000,000 shares.

Effects of the Proposed Amendment

If the Proposed Capital Increase Amendment is approved, the number of authorized shares of Common Stock will be 150,000,000. The total number of authorized shares of the Company will be 155,000,000, consisting of 150,000,000 authorized shares of Common Stock and 5,000,000 authorized shares of Preferred Stock (of which one share is currently outstanding). The Proposed Capital Increase Amendment will not change the par value of the shares of the Common Stock, affect the number of shares of Common Stock outstanding or the rights or privileges of holders of shares of the Common Stock or have any effect on any outstanding securities, including outstanding equity awards, that are exercisable, convertible or exchangeable for shares of Common Stock.

A form of the certificate of amendment to the Articles of Incorporation that would be filed with the Nevada Secretary of State to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 to 150,000,000 shares is set forth in Annex C (the “Certificate of Amendment”). If required under the Nevada Revised Statutes, we will also file a Certificate of Correction with the Nevada Secretary of State. If the stockholders approve the Proposed Capital Increase Amendment, the Company intends to file the Certificate of Amendment with the Nevada Secretary of State as soon as practicable following the Special Meeting, and the Certificate of Amendment will be effective upon such filing.

Effect of Failure to Obtain Stockholder Approval

If we do not obtain stockholder approval for this Proposal 3 we may not have the ability to raise sufficient capital to continue to operate our business or have sufficient shares authorized to effect strategic transactions in the future where the consideration would otherwise be capital stock.

As disclosed in its Quarterly Report on Form 10-Q for the three months ended September 30, 2020, the Company needs to raise capital to meet its working capital needs. In addition, as the Form 10-Q disclosed, the Company needs $4.7 million to cover the cost of drilling an oil well scheduled for January 2021. The Company filed a Form S-3 Registration Statement on October 16, 2020. Upon effectiveness, the Company planned to use the Form S-3 to access the capital markets, subject to market conditions, to meet its capital needs. Alternatively, the Company can seek debt financing. While such financing may be available for drilling oil wells, it is not likely to be available for day-to-day working capital. Even if debt financing were available, the terms may be onerous particularly if the Company cannot offer any equity components. Further, the Company has been seeking to consummate a debt facility, but has not executed a definitive agreement to date.

In addition to working capital constraints without the ability to access the capital markets and the ability to remain operational, any ongoing litigation will be expensive and divert management’s time.

Vote Required

The affirmative vote of the holders of a majority of the voting power, including the voting power of the Series A Preferred Stock, is required to approve the Proposed Capital Increase Amendment. An abstention with respect to this Proposal 3 will have the same effect as a vote “Against” the proposal. Because the Company’s Chairman and Chief Executive Officer owns the share of Series A-1 Preferred Stock, the Company expects he will vote in favor of this Proposal 3 and it will be approved.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THIS PROPOSAL 3.

PROPOSAL 4. ADJOURNMENT

General

The Company is asking stockholders to approve, if necessary, an adjournment of the Special Meeting to solicit additional proxies in favor of Proposals 1, 2 and 3 (the “Adjournment”). Any Adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow the stockholders who have already sent in their proxies to revoke them at any time prior to the time that the proxies are used. While the Company expects that all other proposals before the Special Meeting will be approved, it is including this Proposal 4 in order to give street name holders sufficient time to vote.

Vote Required

The affirmative vote of a majority of the votes cast for or against this Proposal 4 is required to approve the Adjournment. Abstentions will not be considered as votes cast under the Company’s bylaws, and accordingly will have no effect on the outcome of this Proposal 4.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THIS PROPOSAL 4.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the number of shares of the Company’s Common Stock and Series A-1 Preferred Stock beneficially owned as of the Record Date by (i) those persons known by the Company to be owners of more than 5% of each class of its voting stock, (ii) each director, (iii) the Named Executive Officers (as such term is defined in Item 402(m)(2) of Regulation S-K under the Securities Exchange Act of 1934, as amended), and (iv) the Company’s executive officers and directors as a group. Unless otherwise specified in the notes to this table, the address for each person is: c/o Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

| Title of Class | | Beneficial

Owner | | Amount of

Beneficial

Ownership

(1) | | | Percent

Beneficially

Owned (1) | |

| Named Executive Officers and Directors: | | | | | Common

Stock | | | Total

Voting

Power | |

| Common Stock, Series | | Randy S. May (2) | | | 2,980,000 | | | | 3.0 | % | | | 1.5 | % |

| A-1 Preferred Stock | | | | | 104,081,632 | | | | 1 | | | | 51.0 | % |

| Common Stock | | John P. Cahill (3) | | | 1,357,689 | | | | 1.4 | % | | | * | |

| Common Stock | | Peter Mehring (4) | | | 3,458,754 | | | | 3.3 | % | | | 1.7 | % |

| Common Stock | | Gary Metzger (5) | | | 4,320,770 | | | | 4.3 | % | | | 2.1 | % |

| Common Stock | | Steven K. Nelson (6) | | | 517,799 | | | | * | | | | * | |

| Common Stock | | William B. Hoagland (7) | | | 2,750,000 | | | | 2.8 | % | | | 1.3 | % |

| Common Stock | | Jay Puchir (8) | | | 3,214,057 | | | | 3.2 | % | | | 1.6 | % |

| Common Stock | | All directors and all executive officers as a group (8 persons) (9) | | | 18,629,069 | | | | 18.6 | % | | | 8.9 | % |

| Common Stock and Preferred Stock | | All directors and all executive officers as a group (8 persons) (9) | | | 122,710,701 | | | | | | | | 58.7 | % |

| 5% Stockholders: | | | | | | | | | | | | | | |

| Common Stock | | Nepsis Capital Management, Inc. (10) | | | 12,596,486 | | | | | | | | 6.2 | % |

* Less than 1%.

| (1) | Applicable percentages are based on 100,000,000 shares of Common Stock outstanding as of the Record Date, excluding the Disregarded Shares, and the outstanding voting power which consisted as of the Record Date of (i) 100,000,000 shares of Common Stock, excluding the Disregarded Shares, and (ii) one share of Series A-1 Preferred Stock outstanding, which represents 104,081,632 votes, the voting power equal to 51% of the number of votes entitled to be cast on the proposal to ratify the Amendment to effect the Authorized Capital Increase (Proposal 1). Beneficial ownership is determined under the rules of the Securities and Exchange Commission (the “SEC”) and generally includes voting or investment power with respect to securities. A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days whether upon the exercise of options, warrants or conversion of notes. Unless otherwise indicated in the footnotes to this table, the Company believes that each of the stockholders named in the table has sole voting and investment power with respect to the shares of Common Stock indicated as beneficially owned by them. This table does not include any unvested stock options except for those vesting within 60 days. |

| (2) | Mr. May is our Chairman of the Board and Chief Executive Officer. |

| (3) | Mr. Cahill is a director. Includes 4,591 shares held by the Pataki-Cahill Group, LLC and 436,792 vested stock options. |

| (4) | Mr. Mehring is our President and Chief Executive Officer and President of Zest Labs, Inc. Includes 3,362,500 vested stock options. |

| (5) | Mr. Metzger is a director. Includes 482,049 vested stock options. |

| (6) | Mr. Nelson is a director. Includes 482,049 vested stock options. |

| (7) | Mr. Hoagland is our Chief Financial Officer. |

| (8) | Mr. Puchir is our Treasurer and the Chief Executive Officer and President of Banner Midstream. Includes 2,739,726 shares of Common Stock held by Atikin Investments LLC, 24,331 shares of Common Stock held by Roth IRA and 450,000 stock options. |

| (9) | This amount represents beneficial ownership by all directors and all current executive officers of the Company including those who are not Named Executive Officers under the SEC’s disclosure rules. Includes 4,778,390 vested stock options and 15,000 stock options vesting within 60 days from the Record Date. |

(10) | The address is 8692 Eagle Creek Circle, Minneapolis, MN 55378. Based solely upon the information contained in a Schedule 13G/A filed on February 10, 2020. According to that Schedule 13G/A, Nepsis Capital Management, Inc. has the sole dispositive power over all reported shares. |

OTHER MATTERS

The Company has no knowledge of any other matters that may come before the Special Meeting and does not intend to present any other matters.

If you do not plan to attend the Special Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign, date and return your proxy promptly. In the event you are able to attend the Special Meeting, at your request, the Company will cancel your previously submitted proxy.

Annex A

Annex B

ECOARK HOLDINGS, INC.

CERTIFICATE OF VALIDATION

(PURSUANT TO NRS 78.0296)

December __, 2020

This Certificate of Validation (this “Certificate”) is filed on behalf of Ecoark Holdings, Inc., a Nevada corporation (the “Corporation”), pursuant to Section 78.0296 of the Nevada Revised Statutes (“NRS”), which provides that, if a corporate act ratified or validated pursuant to NRS Section 78.0296 would have required any filing with the Nevada Secretary of State pursuant to NRS Chapter 78, or if such ratification or validation would cause any such filing to be inaccurate or incomplete in any material respect, then the corporation shall make, amend or correct each such filing in accordance with NRS Chapter 78, and that any such filing, amendment or correction must be accompanied by a certificate of validation indicating that the filing, amendment or correction is being made in connection with a ratification or validation of a corporate act in accordance with NRS 78.0296 and specifying the effective date and time of the filing, amendment or correction, which may be before the date and time of filing.

I, Randy S. May, Chief Executive Officer, hereby certify on behalf of the Corporation as follows:

1. This Certificate accompanies, and has been appended to, that certain Certificate of Amendment filed on March 31, 2020 (the “Articles Amendment”), and is being filed on the date hereof with the Nevada Secretary of State in accordance with NRS Chapter 78 to ratify and validate the Articles Amendment.

2. This Certificate or, if necessary, any required Certificate of Correction, is a filing, amendment or correction being made in connection with a ratification or validation of a corporate act in accordance with NRS Section 78.0296. Such ratification or validation was adopted and approved by unanimous written consent of the Corporation’s board of directors on November __, 2020, and by the affirmative vote of the requisite majority of the Corporation’s stockholders entitled to vote thereon (including after giving effect to the provisions of NRS Section 78.0296(2)) at a special meeting of Corporation’s stockholders held on December 16, 2020.

3. The effective date and time of the Articles Amendment and/or Certificate of Correction is March 31, 2020, at 12:01 a.m., local time.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the undersigned has executed this Certificate on behalf of the Corporation as of the date set forth above.

| ECOARK HOLDINGS, INC., | |

| a Nevada corporation | |

| | | |

| By: | | |

| Randy S. May | |

| Chief Executive Officer | |

The undersigned hereby certifies that the person named above is the duly elected, qualified and acting Chief Executive Officer, and that the signature appearing above is his true and genuine signature.

| | |

| William B. Hoagland | |

| Chief Financial Officer | |

Annex C

PRELIMINARY PROXY STATEMENT

ECOARK HOLDINGS, INC.

303 PEARL PARKWAY SUITE 200

SAN ANTONIO, TX 78215 | VOTE BY INTERNET - www.proxyvote.com |

| Before The Meeting – Go to www.proxyvote.com |

| |

| During The Meeting – Go to www.virtualshareholdermeeting.com/ZEST2020 |

| You may attend the meeting via the Internet and vote during the meeting. Have the information that is printed in the box marked by the arrow available and follow instructions. |

| | |

| | VOTE BY PHONE - 1-800-690-6903 |

| | Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. Eastern Time on 12/15/2020. Have your proxy card in hand when you call and then follow the instructions. |

| | |

| | VOTE BY MAIL |

| | Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | KEEP THIS PORTION FOR YOUR RECORDS |

| — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — |

| | DETACH AND RETURN THIS PORTION ONLY |

| | THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. | |

| ECOARK HOLDINGS, INC. | | | | |

| | | | | | | | | |

| | The Board of Directors recommends you vote FOR proposals 1, 2, 3 and 4. | | For | Against | Abstain |

| | | | | | | |

| | 1. | Ratify the amendment to the Articles of Incorporation of the Company to increase the number of shares of common stock the Company is authorized to issue from 100,000,000 to 200,000,000 shares (the “Authorized Capital Increase”); | | ¨ | ¨ | ¨ |

| | | | | | | |

| | 2. | Approve an amendment to the Articles of Incorporation to decrease the number of shares of Common Stock the Company is authorized to issue from 200,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is ratified; | | ¨ | ¨ | ¨ |

| | | | | | | |

| | 3. | Approve an amendment to the Articles of Incorporation to increase the number of shares of Common Stock the Company is authorized to issue from 100,000,000 shares to 150,000,000 shares, if the Authorized Capital Increase is not ratified; and | | ¨ | ¨ | ¨ |

| | | | | | | |

| | 4. | Approve the adjournment of the Special Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies. | | ¨ | ¨ | ¨ |

| | | | | | | |

| | Please indicate if you plan to attend this meeting | ¨ | ¨ | | | | | | | |

| | | Yes | No | | | | | | | |

| | | | | | | |

| | Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor,

administrator, or other fiduciary, please give full title as such. Joint owners should each sign

personally. All holders must sign. If a corporation or partnership, please sign in full corporate

or partnership name by authorized officer. | | | | |

| | | | | | | |

| | | | | | | |

| | Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owners) | Date | |

| | | | | | | | | | | | | | | | | | | | | |

PRELIMINARY PROXY STATEMENT

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting:

The Notice and Proxy Statement are available at www.proxyvote.com.

| — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — |

| |

| ECOARK HOLDINGS, INC. |

| Special Meeting of Stockholders |

| December 16, 2020, 1:00 p.m., Eastern Time |

| This proxy is solicited on behalf of the Board of Directors |

| |

| The stockholder(s) hereby appoint(s) Jay Puchir and William B. Hoagland, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorize(s) them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of ECOARK HOLDINGS, INC. that the stockholder(s) is/are entitled to vote at the Special Meeting of Stockholders to be held at 1:00 p.m., Eastern Time, on December 16, 2020, virtually via live webcast at www.virtualshareholdermeeting.com/ZEST2020, and any adjournment or postponement thereof. |

| |

| This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted in accordance with the Board of Directors’ recommendations. |

| |

| |

| Continued and to be signed on reverse side |