UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by Registrant | ☒ | |

| | | |

| Filed by Party other than Registrant | ☐ | |

| | | |

| Check the appropriate box: | | |

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission |

| | | | Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

| ☒ | Definitive Proxy Statement | ☐ | Definitive Additional Materials |

| | | |

| ☐ | Soliciting Materials Pursuant to §240.14a-12 | | |

Ecoark Holdings, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): |

| | |

| ☒ | No fee required. |

| | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | $_____ per share as determined under Rule 0-11 under the Exchange Act. |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

Ecoark Holdings, Inc.

303 Pearl Parkway Suite 200

San Antonio, TX 78215

(800) 762-7293

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the stockholders of Ecoark Holdings, Inc.:

We are pleased to invite you to attend the 2020 Annual Meeting of the Stockholders (the “Annual Meeting”) of Ecoark Holdings, Inc., a Nevada corporation (“Ecoark” or the “Company”), which will be held at 1:00 p.m., Eastern Time, on March 17, 2021, virtually via live webcast at www.virtualshareholdermeeting.com/ZEST2021, for the following purposes:

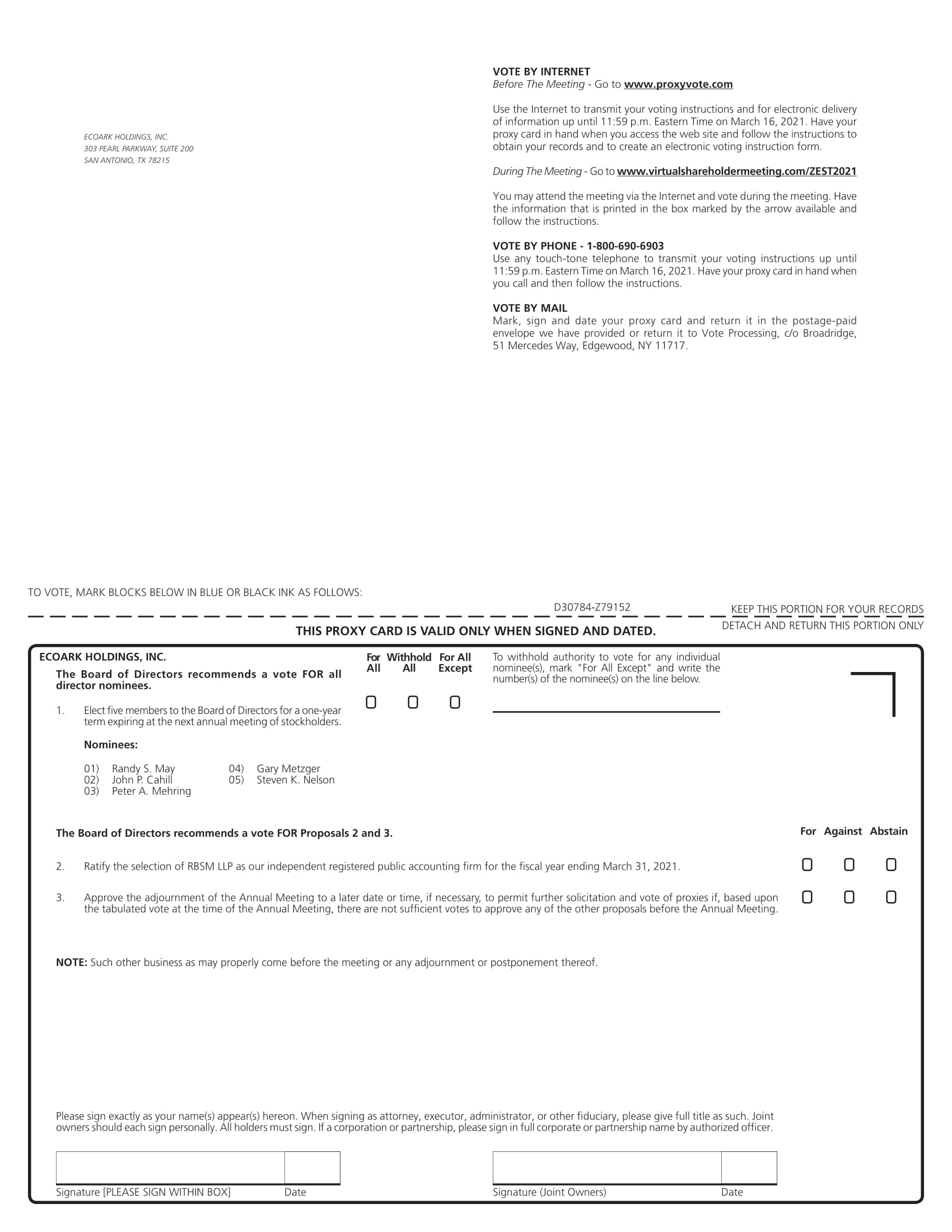

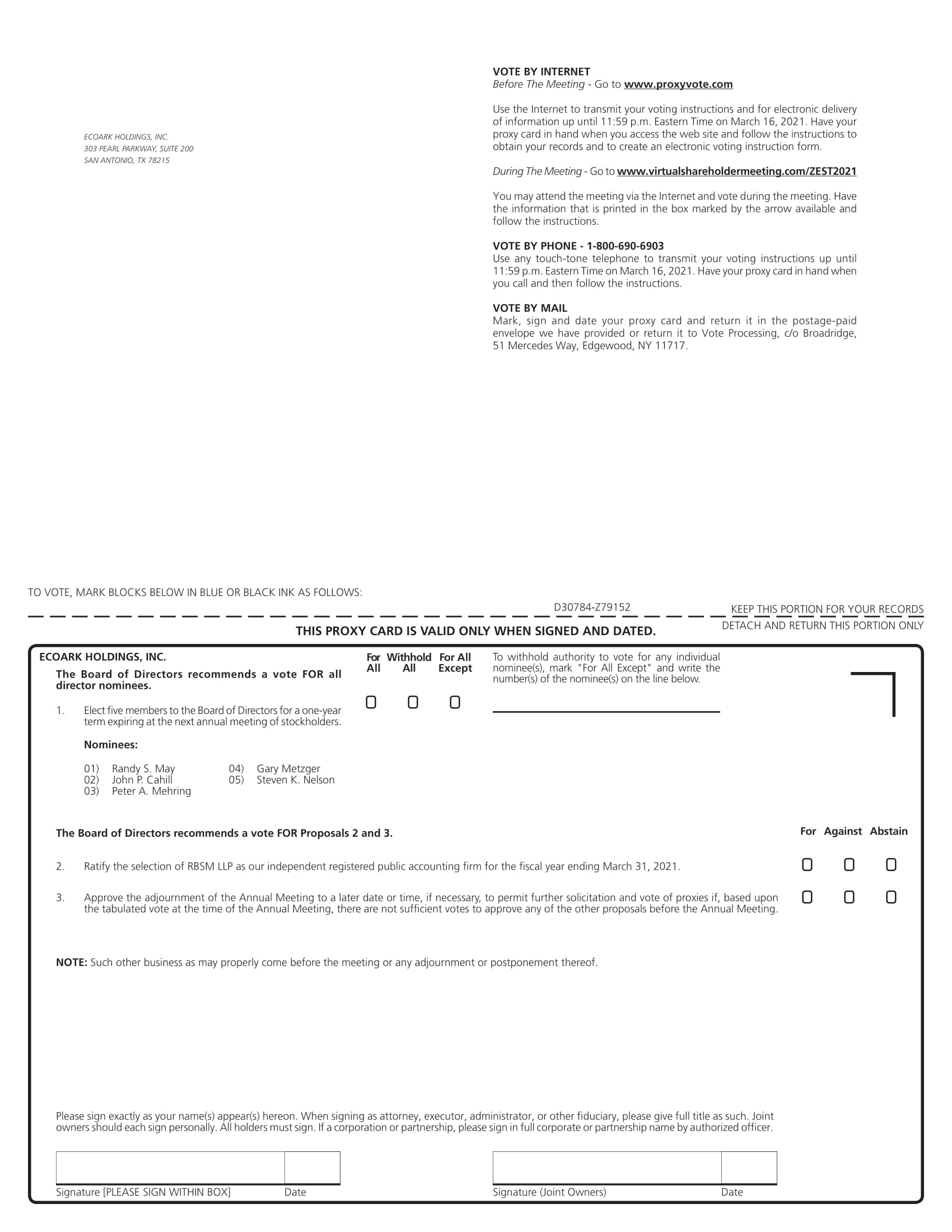

| 1. | Elect five members to the Board of Directors for a one-year term expiring at the next annual meeting of stockholders; |

| 2. | Ratify the selection of RBSM LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2021; |

| 3. | Approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve any of the other proposals before the Annual Meeting; and |

| 4. | Conduct any other business properly brought before the Annual Meeting. |

The Company’s Board of Directors (the “Board”) has fixed the close of business on January 22, 2021 as the date (the “Record Date”) for a determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment or postponement thereof.

Important notice regarding the availability of proxy materials for the Annual Meeting to be held on

March 17, 2021:

The Notice and Proxy Statement are available at www.proxyvote.com.

This Notice of the 2020 Annual Meeting and the accompanying proxy statement are first being mailed on or about February 3, 2021 to our stockholders of record entitled to vote at the Annual Meeting.

The Annual Meeting will be accessible through the Internet. You can attend our Annual Meeting by visiting www.virtualshareholdermeeting.com/ZEST2021. The Annual Meeting will be conducted via live webcast. To be admitted to the Annual Meeting, you must enter the control number found on your proxy card or voting instruction form you previously received. We have adopted a virtual format for our Annual Meeting to protect the health and well-being of our employees, directors, and stockholders in light of the ongoing COVID-19 pandemic. Additionally, we believe that a virtual meeting allows us to make participation accessible for stockholders from any geographic location with Internet connectivity.

Whether or not you plan to attend the Annual Meeting, it is important that you vote your shares. Regardless of the number of shares you own, please promptly vote your shares by telephone (before the Annual Meeting) or Internet or, if you have received printed copies of the proxy materials, by marking, signing and dating the proxy card and returning it to the Company in the postage paid envelope provided.

| San Antonio, Texas | BY ORDER OF THE BOARD OF DIRECTORS, |

| February 3, 2021 | |

| | /s/ Randy S. May |

| | Randy S. May |

| | Chairman of the Board and Chief Executive Officer |

Table of Contents

Ecoark Holdings, Inc.

303 Pearl Parkway Suite 200

San Antonio, TX 78215

(800) 762-7293

2020 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

This proxy statement (the “Proxy Statement”) is being sent to the holders of shares of voting stock of Ecoark Holdings, Inc., a Nevada corporation (“Ecoark” or the “Company”) in connection with the solicitation of proxies by our Board of Directors (the “Board”) for use at the 2020 Annual Meeting of Stockholders of the Company which will be held at 1:00 p.m., Eastern Time, on March 17, 2021 (the “Annual Meeting”). The Annual Meeting will be a virtual only meeting via live webcast over the Internet. You will be able to attend the Annual Meeting, vote your shares and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ZEST2021. There will not be a physical meeting location. The Notice of the Annual Meeting and this Proxy Statement are first being mailed on or about February 3, 2021 to our stockholders of record entitled to vote at the Annual Meeting.

What matters will be voted on at the Annual Meeting?

The proposals that are to be considered and voted on at the Annual Meeting are as follows:

| 1. | Elect five members to the Board of Directors for a one-year term expiring at the next annual meeting of stockholders; |

| 2. | Ratify the selection of RBSM LLP as our independent registered public accounting firm for the fiscal year ending March 31, 2021; |

| 3. | Approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Annual Meeting, there are not sufficient votes to approve any of the other proposals before the Annual Meeting; and |

| 4. | Conduct any other business properly brought before the Annual Meeting. |

Who is entitled to vote at the Annual Meeting?

The Board has fixed the close of business on January 22, 2021 as the record date (the “Record Date”) for a determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting.

As of the Record Date, the voting power of the Company consisted of 22,470,399 shares of common stock, par value $0.001 per share (the “Common Stock”).

Each holder of record of Common Stock as of the Record Date is entitled to one vote for each share held. All stockholders are encouraged to vote at the Annual Meeting, as further described herein.

What is the difference between holding shares as a record holder and as a beneficial owner?

If your shares are registered in your name with the Company’s transfer agent, Philadelphia Stock Transfer, Inc., you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. As the beneficial owner, you have the right to instruct this organization on how to vote your shares.

Who may attend the Annual Meeting and how do I attend?

Record holders and beneficial owners may attend the Annual Meeting. The Annual Meeting will be held entirely online via live webcast.

Set forth below is a summary of the information you need to attend the virtual Annual Meeting:

| | ● | Visit www.virtualshareholdermeeting.com/ZEST2021 to access the live webcast; |

| | | |

| | ● | Stockholders can vote electronically and submit questions online while attending the Annual Meeting; To be admitted to the Annual Meeting, you must enter the control number found on your proxy card or voting instruction form you previously received; |

| | | |

| | ● | Instructions on how to attend and participate in the virtual Annual Meeting, including how to demonstrate proof of stock ownership, are also available at www.virtualshareholdermeeting.com/ZEST2021. |

Stockholders may vote electronically and submit questions online while attending the virtual Annual Meeting.

How do I vote?

Record Holder

| | 1. | Vote by Internet. The website address for Internet voting is on your proxy card. |

| | 2. | Vote by phone. Call 1-800-690-6903 and follow the instructions on your proxy card. |

| | | |

| | 3. | Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States). |

| | | |

| | 4. | Vote in person. Visit www.virtualshareholdermeeting.com/ZEST2021 to vote at the virtual Annual Meeting. |

If you vote by Internet or phone, please DO NOT mail your proxy card.

Beneficial Owner (Holding Shares in Street Name)

| | 1. | Vote by Internet. The website address for Internet voting is on your voting instruction form. |

| | | |

| | 2. | Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States). |

| | | |

| | 3. | Vote in person. Visit www.virtualshareholdermeeting.com/ZEST2021 to vote at the virtual Annual Meeting. |

If you are a beneficial owner, you must follow the voting procedures of your nominee included with your proxy materials. If your shares are held by a nominee and you intend to vote at the Annual Meeting, please be ready to demonstrate proof of your beneficial ownership as of the Record Date (such as your most recent account statement as of the Record Date, a copy of the voting instruction form provided by your broker, bank, trustee or nominee, or other similar evidence of ownership) and a legal proxy from your nominee authorizing you to vote your shares.

What constitutes a quorum?

To carry on the business of the Annual Meeting, we must have a quorum. A quorum is present when the holders of a majority of the voting power, as of the Record Date, are represented in person or by proxy.

In order to ensure that the voting results fairly represent the views of all our stockholders to the fullest extent permitted by applicable law, a quorum will be deemed present at the Annual Meeting if the holders of a majority of shares of Common Stock outstanding as of the Record Date are represented in person or by proxy.

Shares owned by the Company are not considered outstanding or considered to be present at the Annual Meeting. Broker non-votes and abstentions are counted as present for the purpose of determining the existence of a quorum.

What happens if the Company is unable to obtain a quorum?

If a quorum is not present to transact business at the Annual Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Annual Meeting, the persons named as proxies may propose one or more adjournments of the Annual Meeting to permit solicitation of proxies.

Which proposals are considered “Routine” or “Non-Routine”?

Proposal 1 is considered a non-routine proposal. Proposals 2 and 3 are considered routine proposals.

What is a “broker non-vote”?

If your shares are held in street name, you must instruct the organization which holds your shares how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any non-routine proposal. This vote is called a “broker non-vote.” Broker non-votes do not count as a vote “FOR” or “AGAINST” any of the proposals submitted to a vote at the Annual Meeting.

If you are a stockholder of record, and you sign and return a proxy card without giving specific voting instructions, the proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. If your shares are held in street name and you do not provide specific voting instructions to the organization that holds your shares, the organization may generally vote at its discretion on routine matters, but not on non-routine matters. If you sign your proxy card but do not provide instructions on how your broker should vote, your broker will vote your shares as recommended by the Board on any non-routine matter.

How many votes are needed for each proposal to pass?

| Proposals | | Vote Required |

| (1) | Elect the Board of Directors; | | Plurality of shares present and entitled to vote on the matter |

| | | | |

| (2) | Ratify the selection of our independent registered public accounting firm for the fiscal year ending March 31, 2021; | | Majority of the votes cast |

| | | | |

| (3) | Approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies. | | Majority of the votes cast |

Election of Directors. In order to be elected to the Board, each nominee must receive a plurality of the aggregate voting power of the shares present at the Annual Meeting in person or by proxy and entitled to vote on the election of directors. This means that the director nominees who receive the highest number of votes “FOR” their election are elected. You may vote “FOR” all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. Stockholders may only vote “FOR” or withhold their votes with respect to the election of the nominees to the Board.

Ratification of the Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast on the matter is required for the ratification of the selection of RBSM LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2021.

Is broker discretionary voting allowed and what is the effect of broker non-votes?

| Proposals | | Broker Discretionary Vote Allowed | | Effect of Broker Non-Votes on the Proposal |

| (1) | Elect the Board of Directors | | No | | None |

| | | | | | |

| (2) | Ratify the selection of our independent registered public accounting firm for the fiscal year ending March 31, 2021 | | Yes | | None |

| | | | | | |

| (3) | Approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies | | Yes | | None |

What is the effect of abstentions?

| Proposals | | Effect of Abstentions on the Proposal |

| (1) | Elect the Board of Directors; | | None |

| | | | |

| (2) | Ratify the selection of our independent registered public accounting firm for the fiscal year ending March 31, 2021; | | None |

| | | | |

| (3) | Approve the adjournment of the Annual Meeting to a later date or time, if necessary, to permit further solicitation and vote of proxies | | None |

What are the voting procedures?

You may vote in favor of each proposal or against each proposal, or in favor of some proposals and against others, or you may abstain from voting on any of these proposals. You should specify your respective choices on the accompanying proxy card or your voting instruction form.

Is my proxy revocable?

You may revoke your proxy and reclaim your right to vote up to and including the day of the Annual Meeting by giving written notice to the Corporate Secretary of the Company, by delivering a proxy card dated after the date of the proxy or by voting in person at the Annual Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

Who is paying the expenses involved in preparing and mailing this proxy statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by the Company. In addition to the solicitation by mail, proxies may be solicited by the Company’s officers and regular employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing.

Could other matters be decided at the Annual Meeting?

Other than the items of business described in this Proxy Statement, no other matters will be presented for action by the stockholders at the Annual Meeting.

What is “householding” and how does it affect me?

Record holders who have the same address and last name will receive only one copy of their proxy materials, unless we are notified that one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce the Company’s printing costs and postage fees. Stockholders who participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of these proxy materials, or if you hold the Company’s Common Stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact the Company’s Corporate Secretary at: Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

If you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact the Company’s Corporate Secretary as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Do I have dissenters’ (appraisal) rights?

Appraisal rights are not available to the Company’s stockholders with any of the proposals brought before the Annual Meeting.

Can a Stockholder Present a Proposal To Be Considered At the 2021 Annual Meeting?

If you wish to submit a proposal to be considered at the 2021 annual meeting of stockholders, the following is required:

| ● | For a stockholder proposal to be considered for inclusion in the Company’s Proxy Statement and proxy card for the 2021 annual meeting of stockholders (the “2021 Annual Meeting”) in accordance with Rule 14a-8 under the Securities Exchange Act of 1934 (the “Exchange Act”) our Corporate Secretary must receive the written proposal no later than July 15, 2021, which the Company believes is a reasonable time before it will begin to print and send its proxy materials for the 2021 Annual Meeting. Such proposals also must comply with Securities and Exchange Commission (“SEC”) regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company sponsored materials. |

| ● | Our Bylaws include advance notice provisions that require stockholders desiring to recommend or nominate individuals for election to the Board or who wish to present a proposal at the 2021 Annual Meeting to do so in accordance with the terms of the advance notice provisions. For a stockholder proposal or a nomination that is not intended to be included in the Company’s Proxy Statement and proxy card under Rule 14a-8, our Corporate Secretary must receive the written proposal not less than 60 days nor more than 90 days before the first anniversary of this year’s Annual Meeting; Provided, however, that in the event that the 2021 Annual Meeting is called for a date that is not within 30 days before or after the first anniversary date of this Annual Meeting, the proposal must be received not less than five days after the earlier of the date the corporation: (A) mailed notice to its stockholders that the 2021 Annual Meeting will be held, (B) issued a press release or filed a periodic or current report with the SEC announcing the date of the 2021 Annual Meeting or (C) otherwise publicly disseminated notice that the 2021 Annual Meeting will be held. Your notice must contain the specific information set forth in our Bylaws. |

| ● | Additionally, you must be a record holder at the time you deliver your notice to the Corporate Secretary and be entitled to vote at the next annual meeting of stockholders. |

A nomination or other proposal will be disregarded if it does not comply with the above procedures. All proposals and nominations should be sent to our Corporate Secretary at Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

We reserve the right to amend our Bylaws and any change will apply to the 2021 Annual Meeting unless otherwise specified in the amendment.

Interest of Officers and Directors in Matters to Be Acted Upon

Except in the election to our Board of nominees set forth herein, none of the officers or directors have any interest in any of the matters to be acted upon at the Annual Meeting.

The Board Recommends that THE STOCKholders Vote “FOR” Proposals 1, 2, and 3.

PROPOSAL 1.

ELECTION OF DIRECTORS

Pursuant to the authority granted to our Board of Directors (the “Board”) under our Bylaws, the Board has fixed the number of directors constituting the entire Board at five. The Board currently consists of five directors.

Upon the recommendation of the Corporate Governance and Nominating Committee of the Board, our Board has nominated the five current directors named below to be elected as directors at the Annual Meeting, each to hold office until the next annual meeting of stockholders and until his or her successor is duly elected and qualified. Although management does not anticipate that any nominee will be unable or unwilling to serve as a director, in the event of such an occurrence, proxies may be voted in the discretion of the persons named in the proxy for a substitute designated by the Board, unless the Board decides to reduce the number of directors constituting the Board.

The Board recommends a vote “For” the election of all of the director nominees.

Nominees for Director

The following table sets forth information provided by the nominees as of the Record Date. All of the nominees are currently serving as directors of the Company. All of the nominees have consented to serve if elected by our stockholders.

| Name | | Age | | Position | | Director

Since |

| | | | | | | |

| Randy S. May | | 56 | | Chairman and Chief Executive Officer | | 2016* |

| John P. Cahill | | 62 | | Director | | 2016 |

| Peter A. Mehring | | 59 | | President, CEO and President of Zest Labs, Inc. and Director | | 2017 |

| Gary M. Metzger | | 69 | | Lead Director | | 2016* |

| Steven K. Nelson | | 62 | | Director | | 2017 |

| * | Messrs. May and Metzger served on the board of directors of Ecoark, Inc. from 2011 and 2013, respectively, until it effected a reverse acquisition of Ecoark Holdings, Inc. (“Ecoark” or “the Company”, formerly known as Magnolia Solar Corporation) on March 24, 2016. Messrs. May and Metzger again joined the Board effective on April 11, 2016. |

There are no family relationships among our directors and executive officers except that Mr. Metzger is Mr. Hoagland’s stepfather-in-law.

Director Nominees Biographies

Randy S. May. Mr. May has served as Chairman of the Board since April 11, 2016 and served as Chief Executive Officer of the Company from April 13, 2016 through March 28, 2017, and then again from September 21, 2017, to the present. He previously served as Chairman of the Board of Directors and as Chief Executive Officer of Ecoark, Inc. from its incorporation until its reverse acquisition with Magnolia Solar Corporation in March 2016. Mr. May is a 25-year retail and supply-chain veteran with experience in marketing, operational and executive roles. Prior to joining the Company, Mr. May held a number of roles with Wal-Mart Stores, Inc. (“Walmart”). From 1998 to 2004, Mr. May served as Divisional Manager for half the United States for one of Walmart’s specialty divisions, where he was responsible for all aspects of strategic planning, finance, and operations for more than 1,800 stores. Mr. May’s qualifications and background that qualify him to serve on the Board include his strong managerial and leadership experience, his extensive knowledge of strategic planning, finance and operations, as well his ability to guide the Company.

John P. Cahill. Mr. Cahill has served on the Board since May 2016. Mr. Cahill is currently Chief of Staff and Special Counsel to the Archbishop of New York, which position he has held since April of 2019. Previously he was Senior Counsel at the law firm of Norton Rose Fulbright (formerly Chadbourne & Parke LLP) and had served in that capacity since 2007. He is also a principal at the Pataki-Cahill Group LLC, a strategic consulting firm focusing on the economic and policy implications of domestic energy needs, which he co-founded in March 2007. He served in various capacities in the administration of the Governor of New York, George E. Pataki from 1997 to 2006, including Secretary and Chief of Staff to the Governor from 2002 to 2006. He also serves on the board of directors of Sterling Bancorp, Inc., a bank holding company listed on the New York Stock Exchange. Mr. Cahill’s extensive experience in government and in business, his legal experience and his extensive knowledge of and high-level experience in energy and economic policy, qualifies him as a member of the Board.

Peter A. Mehring. Mr. Mehring became a member of the Board in January 2017. He has also served as the Chief Executive Officer and President of Ecoark’s subsidiary, Zest Labs, Inc., since 2009, and he was appointed President of the Company on September 25, 2017. Mr. Mehring brings extensive experience in engineering, operations and general management at emerging companies and large enterprises. As Chief Executive Officer of Zest Labs, Inc., he has led the Company’s efforts in pioneering on-demand data visibility and condition monitoring solutions for the fresh produce market. Prior to joining Zest Labs, Inc., from 2004 to 2006, Mr. Mehring was the Vice President of Macintosh hardware group at Apple Computer, Senior Vice President of Engineering at Echelon, and founder, General Manager and Vice President of R&D at UMAX. Mr. Mehring held Engineering Management positions at Radius, Power Computing Corporation, Sun Microsystems and Wang Laboratories. Mr. Mehring’s knowledge and experience in engineering, operations, management, product and service development, and technological innovation are among the many qualifications that have led to the conclusion that Mr. Mehring is qualified to serve on the Board.

Gary M. Metzger. Mr. Metzger has been serving on the Board since March 24, 2016 and served on the Board of Directors of Ecoark, Inc. from 2013 until its reverse merger with Magnolia Solar Corporation in March 2016. Mr. Metzger has 40 years of product development, strategic planning, management, business development and operational expertise. He served as an executive at Amco International, Inc. and Amco Plastics Materials, Inc. (“Amco”), where in 1986 he was named President and served in such role for 24 years until Amco was sold to global resin distribution company, Ravago Americas, in December 2011, where he remains a product developer and product manager. Mr. Metzger was also a co-owner of Amco. In addition to his leadership functions, Mr. Metzger spearheaded research and development for recycled polymers, new alloy and bio-based polymer development, and introduced fragrance into polymer applications. He also developed encrypted item level bar code identification technology, anti-counterfeiting technologies, and antimicrobial technologies. The Company believes that Mr. Metzger’s leadership and knowledge of manufacturing companies, product development, strategic planning, management and business development are an asset to the Board. Taken together, these are among the many qualifications and the significant experience that have led to the conclusion that Mr. Metzger is qualified to serve on the Board.

Steven K. Nelson. Mr. Nelson has been serving on the Board since April 2017. Since 2015, Mr. Nelson has been a lecturer for the Department of Accounting at the University of Central Arkansas. From 1988 to 2015 Mr. Nelson served as Vice-President, Controller of Dillard’s, Inc., where he was responsible for administering financial accounting and reporting. Prior to that, in 1980 Mr. Nelson served as a staff accountant for Ernst & Young and attained the title of audit manager by the time he left the firm in 1984. Mr. Nelson is licensed as a Certified Public Accountant (“CPA”) in the State of Arkansas. Mr. Nelson’s 35-year career as a CPA and his extensive experience as controller of a publicly traded company qualify him to serve on the Board and its Audit Committee. His broad experience as the controller of a public company uniquely qualifies Mr. Nelson to advise Ecoark not only on general accounting and financial matters but also on various technical accounting, corporate governance and risk management matters that the Board may address from time to time. He possesses key insight on financial reporting processes and external reporting issues.

EXECUTIVE OFFICERS

Set forth below is biographical information with respect to each current executive officer of the Company. Mr. May and Mr. Mehring also serve as directors of the Company. Officers are elected by the Board to hold office until their successors are elected and qualified.

| Name | | Age | | Positions Held with the Company |

| Randy S. May | | 56 | | Chairman of the Board and Chief Executive Officer of the Company |

| Peter Mehring | | 59 | | President and Director of the Company; President and CEO of Zest Labs, Inc. |

| Jimmy R. Galla | | 53 | | Chief Accounting Officer of the Company |

| William B. Hoagland | | 38 | | Secretary, Principal Financial Officer of the Company; President of Trend Discovery Holdings Inc. |

| Jay Puchir | | 45 | | Treasurer of the Company; CEO and President of Banner Midstream Corp. |

Randy S. May. See “Nominees for Directors” above for Mr. May’s biographical information.

Peter Mehring. See “Nominees for Directors” above for Mr. Mehring’s biographical information.

William B. Hoagland. Mr. Hoagland is Chief Financial Officer of the Company. Immediately prior to joining Ecoark, Inc. in 2019, Mr. Hoagland spent the previous eight years as Managing Member of Trend Discovery Capital Management (“Trend Discovery”), a hybrid hedge fund with a track record of outperforming the S&P 500. Prior to founding Trend Discovery in 2011, Mr. Hoagland spent six years as a Senior Associate at Prudential Global Investment Management (PGIM), working in both PGIM’s Newark, NJ and London, England offices. Mr. Hoagland holds the Chartered Financial Analyst designation and is a Level III candidate in the Chartered Market Technician Program.

Jimmy R. Galla Mr. Galla has served as our Chief Accounting Officer since October 22, 2020. He had previously served as the Company’s Director of Financial Reporting since July 20, 2020, and prior to that he served as an accounting consultant to the Company from January 2017 to March 2020. From October 2017 to July 2020, Mr. Galla served as VP, Financial Accounting Lead Analyst, Deputy Controller Department of Citibank, Inc. Prior to that he worked at Walmart Stores, Inc., holding the position of Senior Manager, Finance Planning, Real Estate Finance from August 2010 to December 2016.

Jay Puchir. Mr. Puchir has served as Treasurer of the Company since October 22, 2020. Mr. Puchir has also served as the Chief Executive Officer and President of Banner Midstream Corp. since its formation in April 2018. Mr. Puchir served in various roles as an executive at the Company including Director of Finance from December 2016 to March 2017, Chief Executive Officer from March 2017 to October 2017, Chief Financial Officer from October 2017 to May 2018, and Chief Accounting Officer from March 2020 to October 2020. Mr. Puchir started his career as an auditor at PricewaterhouseCoopers and a consultant at Ernst & Young, ultimately achieving the position of Senior Manager at Ernst & Young. Mr. Puchir held the role of Associate Chief Financial Officer with HCA Healthcare, and from February 2013 to February 2016 he served as the Director of Finance at The Citadel. He served as Chief Executive Officer of Banner Energy Services Corp. from November 2019 to August 2020 and as Chairman from February 2020 to August 2020. Mr. Puchir is a licensed Certified Public Accountant.

Family Relationships

There are no family relationships among any of the directors or executive officers, except that Mr. Metzger is Mr. Hoagland’s stepfather-in-law.

CORPORATE GOVERNANCE

Board Committees and Charters

The Board and its committees meet and act by written consent from time to time as appropriate. The Board has formed the following standing committees: (i) the Audit Committee, (ii) the Compensation Committee, and (iii) the Corporate Governance and Nominating Committee (the “Nominating Committee”). These Committees regularly report on their activities and actions to the Board.

Each of our Audit, Compensation, and Corporate Governance and Nominating Committees has a written charter. Each of these committee charters is available through the “Investor Relations” section on our website, which can be found at www.ecoarkusa.com. The information on, or that can be accessed through, our website is not incorporated into this Proxy Statement.

The following table identifies the independent and non-independent Board nominees and Committee members:

| Name | | | Independent | | | Audit | | Compensation | | Nominating and

Corporate Governance |

| | | | | | | | | | | |

| Randy S. May | | | | | | | | | | |

| John P. Cahill | | | × | | | × | | Chair | | Chair |

| Peter A. Mehring | | | | | | | | | | |

| Gary M. Metzger | | | × | | | × | | × | | × |

| Steven K. Nelson | | | × | | | Chair | | × | | × |

All of the directors attended over 75% of the applicable Board and Committee meetings held during the fiscal year ended March 31, 2020 (the “2020 Fiscal Year”).

Board and Committee Meetings

Our Board held four meetings during the 2020 Fiscal Year. We have no formal policy regarding attendance by directors or officers at our stockholder meetings. Mr. May attended our 2019 annual stockholders’ meeting on behalf of the Board and management.

During the 2020 Fiscal Year, our Audit Committee held seven meetings, the Compensation Committee held four meetings, and the Corporate Governance and Nominating Committee three meetings.

Director Independence

Our Board, in the exercise of its reasonable business judgment, has determined that each of the Company’s three non-employee directors qualifies as an independent director pursuant to Rule 5605(a)(2) of Nasdaq Listing Rules and applicable SEC rules and regulations.

Our Board has also determined that Messrs. John P. Cahill, Gary M. Metzger and Steven K. Nelson meet the independence requirements under Rule 5605(c)(2) of the Nasdaq Listing Rules and the heightened independence requirements for Audit Committee members under Rule 10A-3 of the Securities Exchange Act of 1934. Also, our Board has determined that Messrs. John P. Cahill, Gary M. Metzger and Steven K. Nelson are independent under Rule 5605(a) of the Nasdaq Listing Rules independence standards for Compensation Committee members.

Committees of the Board of Directors

Audit Committee

Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls. The Audit Committee reviews the Company’s financial reporting process on behalf of the Board and administers our engagement of the independent registered public accounting firm. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its examinations, the evaluations of our internal controls, and the overall quality of our financial reporting.

The Audit Committee operates under a written charter, a copy of the audit committee charter is available on our website at https://www.ecoarkusa.com/downloads/Audit-Commitee.pdf.

Audit Committee Financial Expert

Our Board has determined that Mr. Steven K. Nelson is qualified as an Audit Committee Financial Expert, as that term is defined under the rules of the SEC and in compliance with the Sarbanes-Oxley Act of 2002.

Corporate Governance and Nominating Committee (“Nominating Committee”)

The responsibilities of the Nominating Committee include the identification of individuals qualified to become Board members, the selection of nominees to stand for election as directors, the oversight of the selection and composition of committees of the Board, establishing procedures for the nomination process including procedures, oversight of possible conflicts of interests involving the Board and its members, developing corporate governance principles, and the oversight of the evaluations of the Board and management. The Nominating Committee has not established a policy with regard to the consideration of any candidates recommended by stockholders. If we receive any stockholder recommended nominations, the Nominating Committee will carefully review the recommendation(s) and consider such recommendation(s) in good faith.

Compensation Committee

The function of the Compensation Committee is to determine the compensation of our executive officers and other compensation matters, including the periodic review of the compensation strategy of the Company in consultation with the chief executive officer and its effect on the achievement of Company goals. Additionally, the Compensation Committee is responsible for administering the Company’s executive and equity compensation plans, including the 2013 Incentive Stock Option Plan and the 2017 Omnibus Stock Plan, and such other compensation and benefit plans as it deems appropriate, subject to the Board’s authority to also appoint other committees to administer awards made to non-executive officers.

Board Diversity

While we do not have a formal policy on diversity, our Board and Nominating Committee consider diversity to include the skill set, background, reputation, type and length of business experience of our board members as well as a particular nominee’s contribution to that mix. Although there are many other factors, our Board seeks individuals with experience in the oil and gas industry, legal and accounting skills and board experience.

Board Leadership Structure

Our Board has determined that its current structure, with a combined Chairman and Chief Executive Officer roles, is in the best interests of the Company and its stockholders at this time. A number of factors support the leadership structure chosen by the Board, including, among others:

| ● | The Chief Executive Officer is intimately involved in the day-to-day operations of the Company and is best positioned to elevate the most critical business issues for consideration by the Board. |

| ● | The Board believes that having the Chief Executive Officer serve in both capacities allows him to more effectively execute the Company’s strategic initiatives and business plans and confront its challenges. A combined Chairman and Chief Executive Officer structure provides us with decisive and effective leadership with clearer accountability to our stockholders. The combined role is both counterbalanced and enhanced by the effective oversight and independence of our Board. The Board believes that the use of regular executive sessions of the non-management directors allows it to maintain effective oversight of management. |

Our Bylaws provide that the Chairman of the Board may be elected by a majority vote of the Board of Directors and shall serve until the meeting of the Board following the next annual meeting of stockholders at which such Chairman is re-elected. The Chairman of the Board shall preside at all meetings.

Our Corporate Governance Guidelines (the “Guidelines”) provide that a lead director selected by the non-management directors (the “Lead Director”) shall preside at meetings of the Board at which the Chairman of the Board is not present. The Guidelines require that the Lead Director shall preside at executive sessions of the non-management directors. The non-management directors will meet in executive session, no less frequently than quarterly, as determined by the Lead Director, or when a director makes a request of the Lead Director. Steven K. Nelson currently serves as the Lead Director. The Lead Director serves as the Company’s lead independent director.

Board Risk Oversight

Our risk management function is overseen by our Board. Our management keeps its Board apprised of material risks and provides its directors access to all information necessary for them to understand and evaluate how these risks interrelate, how they affect us, and how management addresses those risks. Mr. Randy S. May, as our Chief Executive Officer and Chairman of the Board, works closely with the Board once material risks are identified on how to best address such risks. If the identified risk poses an actual or potential conflict with management, our independent directors may conduct the assessment.

The Board actively interfaces with management on seeking solutions to any perceived risk.

Stockholder Communications

Although we do not have a formal policy regarding communications with our Board, stockholders may communicate with the Board by writing to the Corporate Secretary of Ecoark Holdings, Inc. at 303 Pearl Parkway Suite 200, San Antonio, TX 78215. Stockholders who would like their submission directed to a particular member of the Board may so specify, and the communication will be forwarded, as appropriate.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who beneficially own more than 10% of our Common Stock to file initial reports of ownership and changes in ownership of our Common Stock and other equity securities with the SEC. These individuals are required by the regulations of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on a review of the copies of the forms furnished to us, and written representations from reporting persons, we believe that all filing requirements applicable to our officers, directors and 10% beneficial owners were complied with during our fiscal year ended March 31, 2020, except one Form 3 for Jay Puchir, our Treasurer, in March 2020, and one Form 4 for Randy May, our Chief Executive Officer and Chairman, in December 2019, were not filed; and one Form 3 for William B. Hoagland, our Chief Financial Officer, in May 2019, one Form 4 for Peter Mehring, President and director, in September 2019, and three Form 4s for each of John P. Cahill, Gary M. Metzger and Steven K. Nelson, directors, in June, September and December 2019, were not timely filed.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Set forth below is the description of transactions since April 1, 2018, to which the Company has been a party, in which the amount involved exceeded $120,000, and in which any of our directors, executive officers, beneficial owners of 5% or more of our Common Stock and certain other related persons had a direct or indirect material interest, other than compensation arrangements described in this Proxy Statement under “Executive Compensation” Or “Director Compensation.” Unless otherwise indicated, share amounts and stock prices have been adjusted to give effect to the 1-for-5 reverse stock split effective December 17, 2020.

On December 28, 2018, the Company entered into a loan and security agreement (the “Trend Loan Facility”) with Trend Discovery SPV I, LLC, a Delaware limited liability company (“Trend”), wherein Trend agreed to make one or more loans to the Company, and the Company was required to pay interest biannually on the outstanding principal amount of each such loan, calculated at an annual rate of 12%. On March 31, 2020, the Company converted all $2,525,000 of principal and $290,000 of accrued interest under the Trend Loan Facility and issued approximately 3,855,000 shares of its Common Stock. As a result of the conversion, there are no amounts outstanding as of March 31, 2020. William B. Hoagland, the Company’s Chief Financial Officer, managed and was an indirect equity owner of Trend through Trend Holdings (described below).

On May 31, 2019 the Company entered into an Agreement and Plan of Merger with Trend Discovery Holdings Inc., a Delaware corporation (“Trend Holdings”) pursuant to which the Company acquired 100% of Trend Holdings in a merger with the Company as the surviving entity. Pursuant to the merger, the 1,000 issued and outstanding shares of common stock of Trend Holdings were converted into 5,500,000 shares of the Company’s Common Stock (on a pre-reverse stock split basis) with an approximate dollar value of $16,775,000 based on the closing price per share of Common Stock of $3.05 on the closing date of the merger. William B. Hoagland, the Company’s Chief Financial Officer, was President and a principal stockholder of Trend Holdings and received 2,750,000 shares of Common Stock (on a pre-reverse stock split basis), having a total value of $8,387,500, pursuant to the merger.

On October 3, 2019, the Company granted 200,000 stock options having an exercise price of $2.50 per share to Peter Mehring, President and a director of the Company and President and Chief Executive Officer of Zest Labs, Inc.

On December 31, 2019, the Company granted Randy S. May, its Chief Executive Officer and Chairman, 50,000 stock options having an exercise price of $4.55 per share.

Gary Metzger advanced approximately $328,000 to the Company through March 31, 2020, under the terms of a note payable that bears 10% simple interest per annum, and the principal balance along with accrued interest was payable July 30, 2020 or upon demand. Interest expense on the note for the year ended March 31, 2020 was approximately $27,000. In addition, the Company assumed approximately $250,000 in notes entered into in March 2020 via the acquisition of Banner Midstream Corp. (“Banner Midstream”) from Mr. Metzger at 15% interest. Mr. Metzger has waived any default provisions in the note and will accept a repayment of all outstanding principal and interest when the Company elects to make payment.

On March 27, 2020, the Company issued 1,789,041 shares of Common Stock to Banner Energy Services, Inc. (“Banner Energy”) and assumed approximately $11,774,000 in debt and lease liabilities of Banner Midstream. The Company’s Chief Executive Officer and another director, John Cahill, recused themselves from all board discussions on the acquisition of Banner Midstream as they were stockholders and/or noteholders of Banner Midstream. The transaction was approved by all of the disinterested members of the Board of Directors of the Company. The Chairman and CEO of Banner Energy is the Treasurer of the Company and Chief Executive Officer and President of Banner Midstream. Included in the shares issued in this transaction, John Cahill received 164,384 shares of Common Stock and Jay Puchir received 547,945 shares of Common Stock. At the time of this transaction, Mr. Cahill and his brother were also members of Shamrock Upstream Energy LLC, a subsidiary of Banner Midstream.

In the Banner Midstream acquisition, Randy S. May, Chief Executive Officer and Chairman, was the holder of approximately $1,242,000 in notes payable by Banner Midstream and its subsidiaries, which were assumed by the Company in the transaction. Additionally, Mr. May held a note payable by Banner Energy in the amount of $2,000,000 in principal and accrued interest, which was converted into 2,739,726 shares of Common Stock (on a pre-reverse stock split basis) as a result of the transaction. Neither of these amounts remain outstanding.

Prior to serving as Chief Financial Officer, Jim Galla served as a consultant to the Company from January 2017 to July 2020. He was paid a total of $145,334 in cash compensation during this time period.

Jay Puchir, the Company’s Treasurer, served as a consultant from May 2018 to December 2018 and was paid a total of $30,000 in cash compensation. Mr. Puchir also served as a consultant from May 2019 to March 2020 and was paid solely in stock options totaling 200,000 stock options at an exercise price of $0.63 per share.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides information regarding the compensation of our named executive officers during the fiscal years ended March 31, 2020 and 2019.

| Name and Principal Position | | Fiscal

Year | | Salary

(1)($) | | | Option

Awards

($)(2) | | | Total

($) | |

| Randy S. May(3) | | 2020 | | $ | 200,000 | | | $ | 165,137 | (6) | | $ | 365,137 | |

| Chief Executive Officer and Chairman of the Board | | 2019 | | $ | 200,000 | | | $ | --- | | | $ | 200,000 | |

| | | | | | | | | | | | | | | |

| Peter Mehring | | 2020 | | $ | 200,000 | | | $ | 1,229,690 | (7) | | $ | 1,449,690 | |

| President, Chief Executive Officer and President of Zest Labs, Inc. | | 2019 | | $ | 200,000 | | | $ | --- | | | $ | 200,000 | |

| | | | | | | | | | | | | | | |

| William B. Hoagland (4) | | 2020 | | $ | 115,156 | | | $ | --- | | | $ | 115,156 | |

| Secretary, Principal Financial Officer | | 2019 | | | N/A | | | | --- | | | | N/A | |

| | | | | | | | | | | | | | | |

| Jay Oliphant (5) | | 2020 | | $ | 36,098 | | | $ | 84,923 | | | $ | 121,021 | |

| Former Principal Financial Officer | | 2019 | | $ | 170,000 | | | $ | --- | | | $ | 170,000 | |

| (1) | We periodically review, and may increase, base salaries in accordance with the Company’s normal annual compensation review for each of our Named Executive Officers. |

| (2) | Amounts reported represent the aggregate grant date fair value of awards granted without regards to forfeitures during the 2020 Fiscal Year, computed in accordance with ASC 718. This amount does not reflect the actual economic value realized by the recipient. |

| (3) | Mr. May served as Chief Executive Officer of Ecoark from April 13, 2016 through March 28, 2017 and then from September 21, 2017 to the present. |

| (4) | Mr. Hoagland replaced Mr. Oliphant on June 1, 2019. |

| (5) | Jay Oliphant resigned as Principal Financial Officer and Principal Accounting Officer on May 15, 2019. Pursuant to a Separation Agreement with the Company (the “Separation Agreement”), Mr. Oliphant received his normal monthly salary through May 15, 2019. In connection with his resignation, Mr. Oliphant entered into a consulting agreement with the Company for a term of six months beginning May 16, 2019. Under the consulting agreement, Mr. Oliphant has agreed to assist the Company with financial reporting and related matters. William B. Hoagland was appointed as the Principal Financial Officer to succeed Mr. Oliphant. Mr. Hoagland has served as the Managing Member of Trend Discovery Capital Management, an investment fund, since 2011. |

| (6) | Represents 50,000 stock options granted to Mr. May for services as an employee. |

| (7) | Represents 200,000 stock options granted to Mr. Mehring for services as an employee. |

Named Executive Officer Employment Agreements

Peter Mehring

The Employment Agreement with Mr. Mehring effective August 15, 2013, as amended, provides that he will receive an annual base salary of $200,000 and is eligible to participate in regular health insurance, bonus, and other employee benefit plans established by Ecoark.

Randy S. May

The Employment Agreement with Mr. May effective October 1, 2017 provides that he will serve as Chief Executive Officer of the Company for an undefined term and will receive an annual salary of $200,000. Effective June 29, 2020, Mr. May’s salary was increased to $400,000.

William B. Hoagland

The Employment Agreement with Mr. Hoagland effective May 15, 2019 provides that he will serve as Chief Financial Officer of the Company and will receive an annual salary of $180,000. Effective September 18, 2020, Mr. Hoagland’s annual salary was increased to $270,000.

Outstanding Equity Awards at March 31, 2020

The following table presents information concerning equity awards held by our Named Executive Officers as of March 31, 2020:

| | | Number of

Securities

Underlying | | | Number of

Securities

Underlying | | | Option Awards |

| Name | | Unexercised

Options (#)

Exercisable | | | Unexercised

Options (#)

Unexercisable | | | Option

Exercise

Price ($) | | | Option

Expiration

Date |

| Peter Mehring | | | 470,750 | | | | 201,750 | (1) | | | 13.00 | | | 10/23/2027 |

| | | | 50,000 | | | | 150,000 | (2) | | | 2.50 | | | 10/3/2029 |

| | | | | | | | | | | | | | | |

| Randy S. May | | | 50,000 | | | | --- | | | | 4.55 | | | 12/31/2029 |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Jay Oliphant | | | 20,000 | | | | --- | | | | 2.50 | | | 10/3/2029 |

| | | | 39,792 | | | | --- | | | | 13.00 | | | 5/15/2029 |

| (1) | Remainder vests in two equal annual installments on October 13, 2020 and October 13, 2021. |

| (2) | Remainder vests in three equal annual installments on October 3, 2020 through October 3, 2022. |

DIRECTOR COMPENSATION

2020 Director Compensation Table

Directors may receive compensation for their services and reimbursement for their expenses as shall be determined from time to time by resolution of the Board. Beginning with the quarter ended June 30, 2018, directors will receive each quarter a stock option with a Black-Scholes value of $25,000. Additional options are granted for placement and attendance at committee meetings. Options will be granted with an exercise price equal to the fair market value of Ecoark’s Common Stock.

The following table sets forth the compensation earned to our non-employee directors for service during the fiscal year ended March 31, 2020.

| Name | | Fees

Earned

($)(1)(2) | | | Option

Awards

($)(1)(3) | | | Total

($) | |

| John P. Cahill | | | 9,000 | | | | 130,000 | | | | 139,000 | |

| Gary Metzger | | | 9,000 | | | | 160,000 | | | | 169,000 | |

| Steven K. Nelson | | | 9,000 | | | | 137,134 | | | | 169,000 | |

| Michael Green(4) | | | 4,500 | | | | 100,505 | | | | 125,500 | |

| (1) | Amounts reported represent the aggregate grant date fair value of awards granted without regards to forfeitures granted to the independent members of our Board during the 2020 Fiscal Year, computed in accordance with ASC 718. This amount does not reflect the actual economic value realized by each director. |

| (2) | Represents fees which the directors elected to receive in stock options in lieu of cash. |

| (3) | The table below sets forth the shares of unexercised options held by each of our non-employee directors outstanding as of March 31, 2020, adjusted to give effect to the 1-for-5 reverse stock split effective December 17, 2020. |

| Name | | Aggregate Number of Option Awards Outstanding at

March 31,

2020 | |

| John P. Cahill | | | 81,964 | |

| Gary Metzger | | | 91,015 | |

| Steven K. Nelson | | | 91,015 | |

| (4) | Mr. Green is a former director. |

PROPOSAL 2.

RATIFICATION OF THE SELECTION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR ENDING MARCH 31, 2021

Our Audit Committee has selected RBSM LLP (“RBSM”) as our independent registered public accounting firm for the fiscal year ending March 31, 2021 and our Board recommends that stockholders vote for the ratification of such selection. RBSM has been engaged as our independent registered public accounting firm since 2019.

Selection of the Company’s independent registered public accounting firm is not required to be submitted to a vote of the stockholders of the Company for ratification. However, the Company is submitting this matter to the stockholders as a matter of good corporate governance. Even if the selection is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm at any time if they determine that such a change would be in the best interests of the Company and its stockholders. If the selection is not ratified, the Audit Committee will consider its options.

A representative of the RBSM is not expected to be present at the Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THIS PROPOSAL 2.

AUDIT COMMITTEE REPORT

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board and administers our engagement of the independent registered public accounting firm. The Audit Committee operates in accordance with a written charter, which was adopted by the Board, a copy of which is available on our corporate website at www.ecoarkusa.com/downloads/Audit-Commitee.pdf. The Audit Committee’s function is more fully described in its charter. The Audit Committee consists of Steven K. Nelson, Chairman, John P. Cahill and Gary Metzger.

Our management is responsible for preparing our financial statements and ensuring they are complete and accurate and prepared in accordance with generally accepted accounting principles (“GAAP”). The independent registered public accounting firm is responsible for performing an independent audit of our consolidated financial statements and expressing an opinion on the conformity of those financial statements with GAAP.

The Audit Committee has:

| ● | reviewed and discussed the audited financial statements with management; |

| ● | met privately with the independent registered public accounting firm and discussed matters required by Statement on Auditing Standard No. 1301, Communications with Audit Committees, as adopted by the Public Company Accounting Oversight Board (“PCAOB”); |

| ● | received the written disclosures and the letter from the independent registered public accounting firm, as required by the applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed its independence with the Company; and |

| ● | in reliance on the review and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended March 31, 2020. |

This report is submitted by the Audit Committee:

Steven K. Nelson, Chairman

John P. Cahill

Gary Metzger

The above Audit Committee Report is not deemed to be “soliciting material,” is not “filed” with the SEC and is not to be incorporated by reference in any filings that the Company files with the SEC.

It is not the duty of the Audit Committee to determine that the Company’s financial statements and disclosures are complete and accurate and in accordance with generally accepted accounting principles or to plan or conduct audits. Those are the responsibilities of management and the Company’s independent registered public accounting firm. In giving its recommendation to the Board, the Audit Committee has relied on: (1) management’s representations that such financial statements have been prepared with integrity and objectivity and in conformity with GAAP; and (2) the report of the Company’s independent registered public accounting firm with respect to such financial statements.

Audit Committee’s Pre-Approval Policy

The Audit Committee pre-approves all audit and permissible non-audit services on a case-by-case basis. In its review of non-audit services, the Audit Committee considers whether the engagement could compromise the independence of our independent registered public accounting firm, and whether for the reasons of efficiency or convenience it is in the Company’s best interest to engage our independent registered public accounting firm to perform the services. During the fiscal year ended March 31, 2020, all of the services provided and fees charged by our independent registered public accounting firm were approved by our Audit Committee in accordance with its pre-approval policy.

Principal Accountant Fees and Services

The following table shows the fees paid to RBSM for the fiscal years ended March 31, 2020 and 2019.

| | | Year Ended

March 31,

2020

($) | | | Year Ended

March 30,

2019

($) | |

| Audit Fees (1) | | $ | 120,000 | | | $ | 55,000 | |

| Audit Related Fees (2) | | | — | | | | — | |

| Tax Fees | | | — | | | | — | |

| All Other Fees | | | — | | | | — | |

| Total | | $ | 120,000 | | | $ | 55,000 | |

| (1) | Audit fees consist of fees incurred in connection with the audit of our annual financial statements and the review of the interim financial statements included in our quarterly reports filed with the SEC. |

| (2) | Audit related fees consist of fees related to issuance of comfort letters to investment bankers in relation to issuance of capital stock and consent for report on fiscal year 2020 and 2019 financial statements included in our annual report on Form 10-K for the fiscal year ended March 31, 2020. |

PROPOSAL 3.

ADJOURNMENT

General

The Company is asking stockholders to approve, if necessary, an adjournment of the Annual Meeting to solicit additional proxies in favor of Proposals 1 and 2 (the “Adjournment”). Any Adjournment of the Annual Meeting for the purpose of soliciting additional proxies will allow the stockholders who have already sent in their proxies to revoke them at any time prior to the time that the proxies are used. While the Company expects that all other proposals before the Annual Meeting will be approved, it is including this Proposal 3 in order to give street name holders sufficient time to vote.

Vote Required

The affirmative vote of a majority of the votes cast for or against this Proposal 3 is required to approve the Adjournment. Abstentions will not be considered as votes cast under the Company’s Bylaws, and accordingly will have no effect on the outcome of this Proposal 3.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THIS PROPOSAL 3.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the number of shares of the Company’s Common Stock beneficially owned as of the Record Date by (i) those persons known by the Company to be owners of more than 5% of our outstanding Common Stock, (ii) each director, (iii) the Named Executive Officers (as such term is defined in Item 402(m)(2) of Regulation S-K under the Exchange Act, as amended), and (iv) the Company’s executive officers and directors as a group. Unless otherwise specified in the notes to this table, the address for each person is: c/o Ecoark Holdings, Inc., 303 Pearl Parkway Suite 200, San Antonio, TX 78215, Attention: Corporate Secretary.

| Title of Class | | Beneficial Owner | | Amount of

Beneficial

Ownership (1) | | | Percent

Beneficially

Owned (1) | |

| Named Executive Officers and Directors: | | | | | | |

| Common Stock, | | Randy S. May (2) | | | 596,000 | | | | 2.7 | % |

| Common Stock | | John P. Cahill (3) | | | 276,345 | | | | 1.2 | % |

| Common Stock | | Peter Mehring (4) | | | 691,751 | | | | 3.1 | % |

| Common Stock | | Gary Metzger (5) | | | 868,961 | | | | 3.9 | % |

| Common Stock | | Steven K. Nelson (6) | | | 108,367 | | | | * | |

| Common Stock | | William B. Hoagland (7) | | | 550,000 | | | | 2.4 | % |

| Common Stock | | All directors and all executive officers as a group (8 persons) (8) | | | 3,740,236 | | | | 16.6 | % |

| 5% Stockholders: | | | | | | | | | | |

| Common Stock | | Nepsis, Inc. (9) | | | 2,647,871 | | | | 11.8 | % |

| (1) | Applicable percentages are based on 22,470,399 shares of Common Stock outstanding as of the Record Date. Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. A person is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days whether upon the exercise of options, warrants or conversion of notes. Unless otherwise indicated in the footnotes to this table, the Company believes that each of the stockholders named in the table has sole voting and investment power with respect to the shares of Common Stock indicated as beneficially owned by them. This table does not include any unvested stock options except for those vesting within 60 days. |

| (2) | Mr. May is our Chairman of the Board and Chief Executive Officer. |

| (3) | Mr. Cahill is a director. Includes 919 shares held by the Pataki-Cahill Group, LLC and 92,166 vested stock options. |

| (4) | Mr. Mehring is our President and Chief Executive Officer and President of Zest Labs, Inc. Includes 672,500 vested stock options. |

| (5) | Mr. Metzger is a director. Includes 101,217 vested stock options and 200,000 shares held by Gary Metzger Irrevocable Trust. |

| (6) | Mr. Nelson is a director. Includes 101,217 vested stock options. |

| (7) | Mr. Hoagland is our Chief Financial Officer. |

| (8) | This amount represents beneficial ownership by all directors and all current executive officers of the Company including those who are not Named Executive Officers under the SEC’s disclosure rules. Includes 1,063,100 vested stock options. |

| (9) | The address is 8674 Eagle Creek Circle, Minneapolis, MN 55378. Based solely upon the information contained in a Schedule 13D/A filed on January 20, 2021. According to that Schedule 13D/A, Nepsis, Inc. has the sole dispositive power over all reported shares. |

OTHER MATTERS

The Company has no knowledge of any other matters that may come before the Annual Meeting and does not intend to present any other matters.

If you do not plan to attend the Annual Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign, date and return your proxy promptly. In the event you are able to attend the Annual Meeting, at your request, the Company will cancel your previously submitted proxy.