UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22211

IVA Fiduciary TRUST

(Exact name of registrant as specified in charter)

717 Fifth Avenue, 10th Floor, New York, NY 10022

(Address of principal executive offices) (zip code)

Michael W. Malafronte

International Value Advisers, LLC

717 Fifth Avenue

10th Floor

New York, NY 10022

(Name and address of agent for service)

Copy to:

Michael S. Caccese, Esq.

K&L Gates LLP

State Street Financial Center

One Lincoln Street

Boston, Massachusetts 02111-2950

Brian F. Link, Esq.

State Street Bank and Trust Company

Mail Code: SUM00805

One Lincoln Street, 8th Floor

Boston, MA 02110

Registrant’s telephone number, including area code: (212) 584-3570

Date of fiscal year end: September 30

Date of reporting period: September 30, 2020

Item 1. Report to Shareholders.

|

| |

IVA Worldwide Fund IVA International Fund

Annual Report September 30, 2020

Beginning in May 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds or your financial intermediary electronically by notifying your financial intermediary directly or, if you are a direct investor, by calling (866) 941-4482 or by visiting www.fundreports.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your reports. If you invest directly with the Funds, you can call (866) 941-4482 or visit www.fundreports.com. Your election to receive reports in paper will apply to all funds held with IVA Funds or your financial intermediary. | ||

| Advised by International Value Advisers, LLC | An investment in the Funds is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. |

| Contents | IVA Funds |

| 2 | An Owner’s Manual |

| 3 | Letter from the President |

| 4 | Letter from the Portfolio Manager |

| 7 | Management’s Discussion of Fund Performance |

| IVA Worldwide Fund | |

| 9 | Performance |

| 10 | Portfolio Composition |

| 11 | Schedule of Investments |

| IVA International Fund | |

| 16 | Performance |

| 17 | Portfolio Composition |

| 18 | Schedule of Investments |

| 24 | Statements of Assets and Liabilities |

| 25 | Statements of Operations |

| 26 | Statements of Changes in Net Assets |

| 27 | Financial Highlights |

| 33 | Notes to Financial Statements |

| 42 | Report of Independent Registered Public Accounting Firm |

| 43 | Trustees and Officers |

| 45 | Additional Information |

| 50 | Important Tax Information |

| 51 | Fund Expenses |

1

| An Owner’s Manual | IVA Funds |

An Atypical Investment Strategy

We manage both the IVA Worldwide and IVA International Funds with a dual attempt that is unusual in the mutual fund world: in the short-term (12-18 months), we attempt to preserve capital, while over the longer-term (5-10 years, i.e., over a full economic cycle), we seek to perform better than the MSCI All Country World Index, in the case of your IVA Worldwide Fund, and the MSCI All Country World (ex-U.S.) Index, in the case of your IVA International Fund.

The Worldwide Fund is typically used by investors who are looking for an “all weather fund” where we are given the latitude to decide how much we should have in the U.S. versus outside the U.S. The International Fund is typically used by investors who practice asset allocation and want to decide for themselves how much should be allocated to a domestic manager and how much should be allocated to a pure “international” (i.e., non-U.S.) manager, yet at the same time are looking for a lower risk – and lower volatility – exposure to international markets than may be obtained from a more traditional international fund.

We believe our investment approach is very different from the traditional approach of most mutual funds. We are trying to deliver returns that are as absolute as possible, i.e., returns that try to be as resilient as possible in down markets, while many of our competitors try to deliver good relative performance, i.e., try to beat an index, and thus would be fine with being down 15% if their benchmark is down 20%.

Why do we have such an unusual strategy (which, incidentally, is not easy to carry out)? Because we believe this strategy makes sense for many investors. We are fond of the quote by Mark Twain: “There are two times in a man’s life when he should not speculate: the first time is when he cannot afford to; the second time is when he can.” We realize that many investors cannot tolerate high volatility and appreciate that “life’s bills do not always come at market tops.” This strategy also appeals to us at International Value Advisers as our partners and many employees “eat our own cooking” by investing in IVA products and have an extreme aversion to losing money.

An Eclectic Investment Approach

Here is how we try to implement our strategy:

| ■ | We don’t hug benchmarks. In practical terms, this means we are willing to make big “negative bets,” i.e., having nothing or little in what has become big in the benchmark. Conversely, we will generally seek to avoid overly large positive bets. |

| ■ | We prefer having diversified portfolios (100 to 150 names). Because we invest on a global basis, we believe that diversification helps protect against weak corporate governance or insufficient disclosure, or simply against “unknown unknowns.” We like the flexibility to invest in small, medium and large companies, depending on where we see value. |

| ■ | We attempt to capture equity-type returns through fixed income securities but predominantly when credit markets (or sub-sets of them) are depressed and offer this potential. |

| ■ | We hold some gold, either in bullion form or via gold mining securities, as we believe gold provides a good hedge in either an inflationary or deflationary period, and it can help mitigate currency debasement over time. |

| ■ | We are willing to hold cash when we cannot find enough cheap securities that we like or when we find some, yet the broader market (Mr. Market) seems fully priced. We will seek to use that cash as ammunition for future bargains. |

| ■ | At the individual security level, we ask a lot of questions about “what can go wrong?” and will establish not only a “base case intrinsic value” but also a “worst case scenario” (What could prove us wrong? If we were wrong, are we likely to lose 25%, 30%, or even more of the money invested?). As a result, we will miss some opportunities, yet hopefully, we will also avoid instances where we experience a permanent impairment of value. |

2

| Letter from the President | IVA Funds |

Michael W.

Malafronte

Dear Shareholder,

This annual report covers the fiscal year ended September 30, 2020. The IVA Worldwide Fund and IVA International Fund (the “Funds”) have now completed their twelfth year of operation. The Funds’ investment adviser, International Value Advisers, LLC (“IVA”) is frustrated with the Funds’ performance during this period.

This period has seen a continuation of the COVID-19 pandemic and the challenges a global pandemic presents. As the period progressed, the duration and full impact are still unknown but we are seeing clearer that virus challenges will last longer and the economic impacts for many will be devastating. These developing facts are not remotely evident in equity prices so our experienced team, led by Charles de Vaulx, will remain vigilant in assessing valuations and investing your capital.

During this period, IVA parted ways with our longtime co-Portfolio Manager and recently appointed co-CIO, Chuck de Lardemelle. The transition has been seamless. Charles de Vaulx has been leading this investment team since May 2008 and having one voice to guide the portfolios and investment team is the best way forward for our clients and IVA.

I want to offer my thanks to all my colleagues and to our shareholders for their continued support during this difficult time.

Sincerely,

Michael W. Malafronte, President

3

| Letter from the Portfolio Manager | IVA Funds |

Charles de Vaulx

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Returns are shown net of fees and expenses and assume reinvestment of dividends and other income. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than the original cost. To obtain performance information current to the most recent month-end, please call 1-866-941-4482.

October 28, 2020

Dear Shareholder,

Over the period under review, October 1, 2019 to September 30, 2020, the IVA Worldwide Class A (no load) was down -4.86% while the IVA International Class A (no load) was down -6.82%. The MSCI All Country World Index (“ACWI”) over the same period was up 10.44%, while the MSCI ACWI (ex-U.S.) was up 3.00%.

What a difference a year can make! Last year at this time, life was seemingly “normal” and then 2020 came along and the year can be best described as volatile and unpredictable. The once-in-a-lifetime global pandemic has changed just about everything from the economy, to the way business is conducted, how our children are educated and life in general. What has happened in the markets over the last twelve months can be summed up in three sub segments. A year ago, the economy was on a strong footing with unemployment at record lows and markets reaching record highs in mid-February. Then COVID-19 suddenly hit the entire world, panic ensued and global markets made a complete about-face falling sharply up until late March. Since then, we have seen a vigorous market recovery like no other, though many questions still loom in the background.

With the speedy recovery over the last six months and indices once again in positive territory, the performance of your Funds may seem disappointing over this past fiscal year. One thing that has remained relatively constant throughout the past several years is the fact that value stocks continue to lag their growth counterparts. Also, smaller stocks have trailed larger stocks significantly. The divergence between value and growth widened even further this year which was attributed to a number of factors and exacerbated by the virus. First and foremost, a very long period of ultra-low interest rates has dramatically favored growth stocks which are long duration assets and benefit much more from lower rates than the more mundane value stocks. Second, technology has disrupted so many industries in a way that may temporarily destroy “moats” that used to exist. The tremendous gains in technology stocks were further fueled by the pandemic and resulting lockdowns throughout the world which favored a select few technology companies that are in a unique position of being able to thrive with everyone stuck at home. Amazon, Apple, Microsoft, Facebook, Zoom, and Netflix are some that come to mind. From the March 23rd low, the NASDAQ Composite rose 75.7% through September 2nd. Finally, the increasing popularity of passive investing is forcing the gradual liquidation of portfolios invested in small and mid-cap value stocks.

In addition to the struggles experienced by value stocks, international stocks have also lagged considerably. International indices took a greater beating earlier this year and have not bounced back with as much enthusiasm as the U.S. market. This is explained to a great extent by the fact that there are far fewer technology stocks outside the U.S. and many more value stocks. Technology companies today account for 27.5% of the S&P 500 compared to just 7.5% of the S&P Europe 350. Conversely, financials have the largest weighting in Europe at 15.1% of the index vs. 10.3% in the U.S. As a matter of fact, it has been observed that half of the underperformance of international markets relative to the U.S. market over the last ten years is due to this underweight in technology. That is truly eye-opening!

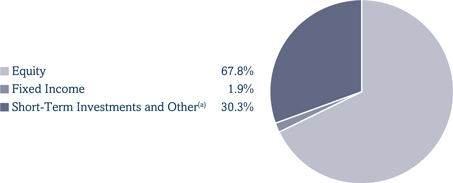

As of September 30, 2020, the IVA Worldwide Fund had 59.2% in equities (compared to 62.7% a year prior) while the IVA International Fund had 67.8% in equities (compared to 76.6%) a year prior. While we did put a good amount

4

| Letter from the Portfolio Manager | IVA Funds |

of cash to work when markets corrected in March, particularly in the Worldwide Fund (about 10%), we have been net sellers recently as markets snapped back and some names approached their intrinsic values. Some notable additions to the portfolios over the last fiscal year are Anheuser Busch InBev SA (Belgium), Heineken NV (Netherlands), Dassault Aviation SA (France), Gruma (Mexico), Wells Fargo & Co. (U.S.), Western Union Co. (U.S.), Aena SA (Spain), Publicis Group SA (France) and Bangkok Bank Public Co. (Thailand). Some names that we exited and took profits are Acuity Brands Inc. (U.S.), Alten SA (France), Antofagasta Plc (U.K.), Arcos Dorados Holdings Inc. (Uruguay), Hyundai Motor Co. (South Korea), Samsung Electronics Co. Ltd. (South Korea), and Oracle Corp. (U.S.). We also benefited from two takeovers (Millennium & Copthorne Hotels and Clear Media) that each took place at a nice premium to their share price at the time of acquisition.

We are now completely out of gold bullion in both Funds and our gold exposure consists of a handful of gold mining stocks. As a mutual fund, we are at the mercy of the IRS and a tax rule limiting the amount of gains that can be derived from owning a physical commodity. Gold has behaved exactly as it should over the last year and was up 28%. Negative real interest rates have increased the investment demand for gold and it is our expectation that real yields may remain negative for the foreseeable future. Also, the U.S. dollar has weakened which further supports the price of gold. Even though gold mining shares are not cheap these days, it is not our intention at this point to buy back bullion.

We believe that now more than ever caution is in order. The pandemic crisis will have lasting and unpredictable consequences on society and the economy, as well as on a vast number of business models in industries such as travel, hospitality, airlines, catering, retail, and commercial real estate to name a few. So many questions surrounding the impact on the global economy and corporate earnings remain impossible to answer with any certainty at this stage: Will an effective vaccine be found soon or is COVID-19 going to be with us for a few more years? Is the virus going to mutate and become more deadly or will it fade into extinction? Will a second wave force countries to impose new restrictions and lockdowns? We are already seeing this happen in Europe – is the U.S. next? How will consumer behavior be affected? Will the pressure of falling incomes and health care costs trigger some social unrest? To make matters worse, we are in the midst of what could end up being a contentious U.S. election that could send markets into a tailspin.

This situation makes the valuation of many businesses today rather difficult and we struggle in this environment to find enough suitable investment opportunities. The valuation of many stocks is still quite elevated, especially amongst what we consider high quality businesses with "safe" balance sheets, good capital allocation, decent corporate governance, and strong franchise value. Even though the valuation spread between value and growth stocks is as high now as it was during the previous tech bubble in the late 90’s, that remains a relative valuation spread. In absolute terms, stocks and in particular value stocks, are not remotely as cheap as they were back then and we would argue that they are probably 30% to 40% on average more expensive, courtesy of low interest rates. Not only are interest rates throughout the world lower today than before the onslaught of the pandemic, but what used to be the “lower for longer” view has morphed into “lower forever.” We know, as the saying goes, that history does not repeat itself but it often rhymes. This lower forever brings to mind a quote I recently came across:

“That the rate of interest will be lower when commerce languishes and when there is little demand for money, than when the energies of commerce are in full play and there is an active demand for money, is indisputable; but it is equally beyond doubt, that every speculative mania which has run its course of folly and disaster in this country has derived its original impulse from cheap money.”

— The Economist, 1858 (h/t Jamie Catherwood)

5

| Letter from the Portfolio Manager | IVA Funds |

There is no doubt that the U.S. stock market today is again in bubbly territory. Market cap to GDP in the U.S. is approaching 200%, an unprecedented level. We have seen this movie play out before. The last two times that this ratio peaked, a market crash soon followed. Today, there are certainly major differences than with the Great Financial Crisis of 2009. The Fed and the European Central Bank are providing ample liquidity. Interest rates are lower today, corporate taxes are lower as well, which pushes valuations up. Also, the most valuable companies today in the U.S. are global technology companies, and comparing those market caps to the U.S. GDP alone (as opposed to global GDP) may skew the ratio slightly higher than it should be. Nevertheless, even accounting for these changes over time, it remains difficult to argue that markets are cheap on an absolute basis.

So how do we deal with this situation? Our analysts are busy valuing companies on the basis of reasonable multiples of our own 2022 earnings estimates; we model such estimates assuming that the world economy in the year 2021 remains in a severe recession versus 2019. We are attempting to understand and avoid risk while finding those companies with the strength to survive a rocky road. We also make sure to take into account any balance sheet deterioration between now and then. We continue to favor well capitalized companies.

These are challenging times indeed and only time will tell how this movie plays itself out in the end. In the meantime, we continue to stay the course and stick to our beliefs. We admit that it has been very difficult to be a value investor and the headwinds are well known: ultra-low interest rates, aggressive share buybacks and capital structures, massive industry disruptions, widespread technological innovation, and extreme aversion to cyclical risk during the pandemic. However, we question the alternatives, especially when one’s objective is to preserve capital. The idea of purposely owning exceedingly expensive, if not overpriced assets, both stocks and bonds, today because value investing has done so poorly for so long, is truly a very misguided idea. We believe that, with a three-year view, many cyclicals we own are substantially undervalued today, and will outperform more fully valued defensive or growth equities as the world economy comes out of the funk sometime in the future. We also think that international stocks may be poised to make a comeback especially if the U.S. dollar continues to weaken.

We appreciate your continued confidence and thank you for your support.

Charles de Vaulx, Chief Investment Officer and Portfolio Manager

6

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

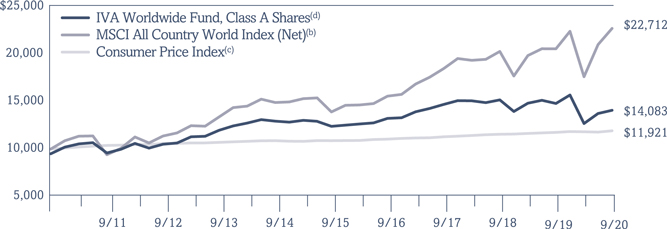

IVA Worldwide Fund

The IVA Worldwide Fund Class A, at net asset value, returned -4.86% over the one-year period ended September 30, 2020 compared to the MSCI All Country World Index (Net) (the “Index”) return of 10.44% over the same period.

The Fund significantly trailed the Index for the period due to the continued worldwide struggle of value stocks, which make up the bulk of our equities. Gold and gold mining’s positive 46.8% return for the period and our allocation to cash helped dampen the impact from these equities, which were down -9.1% over the period, compared to those in the Index* which were up 10.3%. Our names invested in the United States, Ireland, and the Netherlands detracted a total of -5.2% from performance. Japan, Germany, and China contributed a total of 2.3%. Our names in industrials, financials and energy detracted a total of -6.5%. Technology, communication services and health care were the largest positively contributing equity sectors, adding a total of 1.6%.

The top five individual equity contributors to return this period were: Newmont Corp. (United Kingdom, gold and gold mining), Bayerische Motoren Werke AG (Germany, consumer discretionary), LKQ Corp. (U.S., consumer discretionary), Z Holdings Corp. (Japan, communication services), and Samsung Electronics Co., Ltd. (South Korea, technology). The top five individual equity detractors were: AIB Group Plc (Ireland, financials), Airbus SE (Netherlands, industrials), Astronics Corp. (U.S., industrials), Sodexo SA (France, consumer discretionary), and Cimarex Energy Co. (U.S., energy).

Fixed income detracted -1.0%. Gold and gold mining contributed 1.5%.

In an effort to neutralize part of our foreign exchange risk, we were partially hedged against several currencies over the period. This effort had no material effect on performance. At the end of the period, our currency hedges were: 10% British pound; 95% Thai baht; 40% South Korean won.

7

| Management’s Discussion of Fund Performance (unaudited) | IVA Funds |

IVA International Fund

The IVA International Fund Class A, at net asset value, returned -6.82% over the one-year period ended September 30, 2020 compared to the MSCI All Country World Index (ex-U.S.) (Net) (the “Index”) return of 3.00% over the same period.

The Fund significantly trailed the Index for the period due to the continued worldwide struggle of value stocks, which make up the bulk of our equities. Gold and gold mining’s positive 39.4% return for the period and our allocation to cash helped dampen the impact from these equities which were down -8.2% over the period, compared to those in the Index* which were up 2.7%. Equity performance was hurt the most by our names in financials, industrials and consumer discretionary, which together detracted -6.1%. The two sectors with positive results were technology and health care contributing a total of 0.8%. Our names invested in France, Ireland, and the Netherlands detracted -5.6% while Japan, South Korea, and China contributed a total of 3.5%.

The top five individual equity contributors to return this period were: Newmont Corp. (United Kingdom, gold and gold mining), Clear Media Limited (China, communication services), Bayerische Motoren Werke AG (Germany, consumer discretionary), Samsung Electronics Co., Ltd. (South Korea, technology), Z Holdings Corp. (Japan, communication services). The top five individual equity detractors were: AIB Group Plc (Ireland, financials), Airbus SE (Netherlands, industrials), Sodexo SA (France, consumer discretionary), Haw Par Corp. Ltd. (Singapore, health care), Mitie Group Plc (United Kingdom, industrials).

Fixed Income detracted -1.5%. Gold and gold mining contributed 2.2%.

In an effort to neutralize part of our foreign exchange risk, we were partially hedged against several currencies over the period which contributed 0.1%. At the end of the period, our currency hedges were: 10% British pound; 40% South Korean won; and 94% Thai baht.

Investment Risks: There are risks associated with investing in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. Value-based investments are subject to the risk that the broad market may not recognize their intrinsic value.

*The Index equity return excludes gold mining stocks.

8

| IVA Worldwide Fund | IVA Funds |

| Performance (unaudited) | As of September 30, 2020 |

| Average Annual Total Returns as of September 30, 2020 | One Year | Five Year | Ten Year | Since Inception(a) | ||||

| Class A | -4.86% | 2.59% | 4.01% | 6.15% | ||||

| Class A (with a 5% maximum initial sales charge) | -9.63% | 1.54% | 3.48% | 5.70% | ||||

| Class C | -5.58% | 1.82% | 3.24% | 5.36% | ||||

| Class I | -4.58% | 2.86% | 4.28% | 6.42% | ||||

| MSCI All Country World Index (Net)(b) | 10.44% | 10.30% | 8.55% | 7.79% | ||||

| Consumer Price Index(c) | 1.50% | 1.84% | 1.77% | 1.45% |

Growth of a $10,000 Initial Investment

| (a) | The Fund commenced investment operations on October 1, 2008. |

| (b) | The MSCI All Country World Index (Net) is an unmanaged, free float-adjusted market capitalization weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2010, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2020. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. Amounts redeemed within 30 days of purchase are subject to a 2.00% fee. The expense ratios for the Fund are as follows: 1.16% (Class A shares); 1.91% (Class C shares); and 0.91% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2020. More recent expense ratios can be found in the Financial Highlights section of this Annual Report.

Information Classification: Limited Access

9

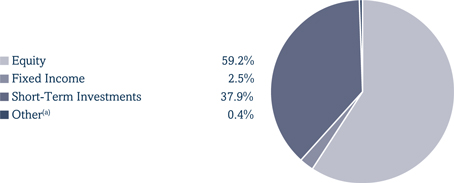

| IVA Worldwide Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of September 30, 2020 |

Asset Allocation (As a Percent of Total Net Assets)

Sector Allocation (As a Percent of Total Net Assets)

Top 10 Positions (As a Percent of Total Net Assets)(b)

| Berkshire Hathaway Inc., Class ‘A’, Class ‘B’ | 5.3 | % | ||

| Bayerische Motoren Werke AG | 3.3 | % | ||

| Astellas Pharma Inc. | 3.2 | % | ||

| Newmont Corp. | 2.9 | % | ||

| Compagnie Financière Richemont SA | 2.5 | % | ||

| H.U. Group Holdings Inc. | 2.4 | % | ||

| LKQ Corp. | 2.2 | % | ||

| Bureau Veritas SA | 2.1 | % | ||

| Western Union Co. | 2.0 | % | ||

| Sodexo SA | 1.9 | % |

Top 10 positions represent 27.8% of total net assets.

| (a) | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

10

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Shares | Description | Fair Value | ||||||||

| COMMON STOCKS – 59.1% | ||||||||||

| Belgium | 0.5% | ||||||||||

| 219,012 | Anheuser-Busch InBev SA/NV | $ | 11,869,682 | |||||||

| Bermuda | 0.5% | ||||||||||

| 627,500 | Jardine Strategic Holdings Ltd. | 12,430,775 | ||||||||

| Canada | 0.8% | ||||||||||

| 715,726 | Barrick Gold Corp. | 20,119,058 | ||||||||

| China | 0.9% | ||||||||||

| 50,277 | Baidu Inc., ADR (a) | 6,364,565 | ||||||||

| 343,214 | SINA Corp. (a) | 14,624,349 | ||||||||

| 20,988,914 | ||||||||||

| France | 8.7% | ||||||||||

| 9,619,296 | Bolloré SA | 35,954,715 | ||||||||

| 2,241,886 | Bureau Veritas SA (a) | 50,624,886 | ||||||||

| 167,001 | Criteo SA, ADR (a) | 2,035,742 | ||||||||

| 16,962 | Dassault Aviation SA (a) | 14,418,142 | ||||||||

| 13,631 | Financière de l’Odet SA | 10,739,677 | ||||||||

| 85,739 | Ipsos SA | 2,146,202 | ||||||||

| 1,072,181 | Publicis Groupe SA | 34,670,222 | ||||||||

| 657,579 | Sodexo SA | 47,045,099 | ||||||||

| 141,564 | Wendel SE | 12,854,894 | ||||||||

| 210,489,579 | ||||||||||

| Germany | 3.3% | ||||||||||

| 1,099,087 | Bayerische Motoren Werke AG | 79,881,821 | ||||||||

| Hong Kong | 0.1% | ||||||||||

| 3,808,658 | Hongkong & Shanghai Hotels Ltd. | 2,958,448 | ||||||||

| Ireland | 1.1% | ||||||||||

| 24,967,035 | AIB Group Plc (a) | 25,642,793 | ||||||||

| Japan | 8.0% | ||||||||||

| 5,154,800 | Astellas Pharma Inc. | 76,590,069 | ||||||||

| 238,000 | Benesse Holdings Inc. | 6,104,300 | ||||||||

| 496,700 | Fan Communications Inc. | 2,270,036 | ||||||||

| 2,158,300 | H.U. Group Holdings Inc. | 57,546,481 | ||||||||

| 101,700 | Medikit Co., Ltd. | 3,230,408 | ||||||||

| 55,500 | Nitto Kohki Co., Ltd. | 1,096,160 | ||||||||

| 1,353,400 | Rohto Pharmaceutical Co., Ltd. | 44,336,955 | ||||||||

| 229,000 | Techno Medica Co., Ltd. | 3,650,017 | ||||||||

| 194,824,426 | ||||||||||

| Mexico | 1.3% | ||||||||||

| 9,454,484 | Grupo México SAB de CV, Series ‘B’ | 24,064,327 | ||||||||

| 1,035,169 | Promotora y Operadora de Infraestructura SAB de CV, Series ‘A’ (a) | 7,280,335 | ||||||||

| 238,353 | Promotora y Operadora de Infraestructura SAB de CV, Series ‘L’ (a) | 1,244,935 | ||||||||

| 32,589,597 |

See Notes to Financial Statements.

11

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Shares | Description | Fair Value | ||||||||

| Netherlands | 2.8% | ||||||||||

| 261,425 | Airbus SE (a) | $ | 19,024,932 | |||||||

| 267,534 | Heineken NV | 23,801,293 | ||||||||

| 1,213,492 | Royal Boskalis Westminster NV (a) | 24,158,438 | ||||||||

| 66,984,663 | ||||||||||

| Singapore | 0.4% | ||||||||||

| 11,331,599 | First Resources Ltd. | 10,044,493 | ||||||||

| South Korea | 3.1% | ||||||||||

| 277,924 | Daou Technology Inc. | 5,149,288 | ||||||||

| 145,281 | Hyundai Mobis Co., Ltd. | 28,537,637 | ||||||||

| 1,338,968 | Kangwon Land Inc. | 24,597,591 | ||||||||

| 251,694 | KT&G Corp. | 17,768,886 | ||||||||

| 76,053,402 | ||||||||||

| Spain | 0.7% | ||||||||||

| 129,590 | Aena SME, SA (a) | 18,126,175 | ||||||||

| Switzerland | 4.0% | ||||||||||

| 897,448 | Compagnie Financière Richemont SA | 60,118,931 | ||||||||

| 153,915 | Nestlé SA | 18,271,610 | ||||||||

| 1,653,409 | UBS Group AG | 18,489,889 | ||||||||

| 96,880,430 | ||||||||||

| Thailand | 0.7% | ||||||||||

| 5,625,900 | Bangkok Bank PCL, NVDR | 17,044,147 | ||||||||

| United Kingdom | 3.3% | ||||||||||

| 851,519 | Inchcape Plc (a) | 4,841,123 | ||||||||

| 1,097,187 | Newmont Corp. | 69,616,515 | ||||||||

| 655,659 | WPP Plc | 5,143,857 | ||||||||

| 79,601,495 | ||||||||||

| United States | 18.9% | ||||||||||

| 1,614,559 | Adtalem Global Education Inc. (a) | 39,621,278 | ||||||||

| 8,970 | Alphabet Inc., Class ‘A’ (a) | 13,146,432 | ||||||||

| 16,499 | Alphabet Inc., Class ‘C’ (a) | 24,246,930 | ||||||||

| 72,965 | American Express Co. | 7,314,741 | ||||||||

| 1,139,885 | Astronics Corp. (a) | 8,799,912 | ||||||||

| 171 | Berkshire Hathaway Inc., Class 'A' (a) | 54,720,171 | ||||||||

| 346,842 | Berkshire Hathaway Inc., Class ‘B’ (a) | 73,856,536 | ||||||||

| 420,864 | CDK Global Inc. | 18,345,462 | ||||||||

| 233,023 | Chevron Corp. | 16,777,656 | ||||||||

| 188,802 | Flowserve Corp. | 5,152,407 | ||||||||

| 1,504,275 | Gruma SAB de CV, Series ‘B’ | 16,647,269 | ||||||||

| 1,967,581 | LKQ Corp. (a) | 54,561,021 | ||||||||

| 47,095 | Mastercard Inc., Class ‘A’ | 15,926,116 | ||||||||

| 381,321 | Qurate Retail, Inc., Series ‘A’ | 2,737,885 | ||||||||

| 129,568 | Schlumberger Ltd. | 2,016,078 | ||||||||

| 305,335 | Skechers USA Inc., Class ‘A’ (a) | 9,227,224 | ||||||||

| 433,827 | Tapestry Inc. | 6,780,716 |

See Notes to Financial Statements.

12

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Shares | Description | Fair Value | ||||||||

| United States | 18.9% (continued) | ||||||||||

| 1,681,197 | Wells Fargo & Co. | $ | 39,524,941 | |||||||

| 2,256,095 | Western Union Co. | 48,348,116 | ||||||||

| 457,750,891 | ||||||||||

| TOTAL COMMON STOCKS (Cost — $1,220,721,673) | 1,434,280,789 | |||||||||

| PREFERRED STOCKS – 0.1% | ||||||||||

| United States | 0.1% | ||||||||||

| 11,501 | Qurate Retail Inc., 8% Series ‘A’ | 1,132,848 | ||||||||

| TOTAL PREFERRED STOCKS (Cost — $524,303) | 1,132,848 |

| PRINCIPAL AMOUNT | ||||||||||

| CORPORATE NOTES & BONDS – 2.5% | ||||||||||

| South Africa | 1.4% | ||||||||||

| 35,068,000 | USD | Gold Fields Orogen Holding (BVI) Ltd., 4.875% due 10/7/2020 (b) | 35,038,543 | |||||||

| United States | 1.1% | ||||||||||

| 19,417,000 | USD | Bristow Group Inc., 7.75% due 12/15/2022 | 18,642,262 | |||||||

| 7,079,079 | USD | Tidewater Inc., 8% due 8/1/2022 | 6,962,380 | |||||||

| 25,604,642 | ||||||||||

| TOTAL CORPORATE NOTES & BONDS (Cost — $61,213,340) | 60,643,185 | |||||||||

| SHORT-TERM INVESTMENTS – 37.9% | ||||||||||

| Commercial Paper | 37.8% | ||||||||||

| Barclays Bank Plc: | ||||||||||

| 24,000,000 | USD | 0.13% due 10/5/2020 (b) | 23,999,603 | |||||||

| 40,000,000 | USD | 0.11% due 10/7/2020 (b) | 39,998,989 | |||||||

| 67,900,000 | USD | BNP Paribas SA, 0.07% due 10/1/2020 (b) | 67,899,885 | |||||||

| 50,000,000 | USD | Crédit Agricole Corp., 0.07% due 10/28/2020 (b) | 49,996,850 | |||||||

| DNB Bank ASA: | ||||||||||

| 22,000,000 | USD | 0.02% due 10/7/2020 (b) | 21,999,572 | |||||||

| 34,900,000 | USD | 0.04% due 10/7/2020 (b) | 34,899,322 | |||||||

| 12,000,000 | USD | 0.02% due 10/9/2020 (b) | 11,999,700 | |||||||

| 21,700,000 | USD | Exxon Mobil Corp., 0.09% due 11/3/2020 | 21,698,073 | |||||||

| L’Oréal USA Inc.: | ||||||||||

| 40,000,000 | USD | 0.07% due 10/6/2020 (b) | 39,999,487 | |||||||

| 2,800,000 | USD | 0.09% due 10/14/2020 (b) | 2,799,924 | |||||||

| 50,000,000 | USD | Landesbank Hessen-Thuringen Gi, 0.09% due 10/22/2020 (b) | 49,996,517 |

See Notes to Financial Statements.

13

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2020

PRINCIPAL AMOUNT | DESCRIPTION | FAIR VALUE | ||||||||

| Commercial Paper | 37.8% (continued) | ||||||||||

| 40,000,000 | USD | Lloyds Bank Plc, 0.08% due 10/1/2020 (b) | $ | 39,999,867 | ||||||

| 30,000,000 | USD | LVMH Moët Hennessy Louis Vuitton SE, 0.07% due 10/5/2020 (b) | 29,999,750 | |||||||

| Merck & Co. Inc.: | ||||||||||

| 30,000,000 | USD | 0.06% due 10/8/2020 (b) | 29,999,533 | |||||||

| 15,500,000 | USD | 0.06% due 10/13/2020 (b) | 15,499,608 | |||||||

| 35,400,000 | USD | 0.06% due 10/19/2020 (b) | 35,398,636 | |||||||

| Nestlé Capital Corp.: | ||||||||||

| 25,600,000 | USD | 0.05% due 10/2/2020 (b) | 25,599,910 | |||||||

| 30,000,000 | USD | 0.03% due 10/19/2020 (b) | 29,999,113 | |||||||

| 20,000,000 | USD | Novartis Finance Corp., 0.09% due 10/13/2020 (b) | 19,998,339 | |||||||

| 30,000,000 | USD | Roche Holdings, Inc., 0.07% due 10/26/2020 (b) | 29,998,332 | |||||||

| Société Générale North America Inc.: | ||||||||||

| 19,700,000 | USD | 0.11% due 10/2/2020 (b) | 19,699,890 | |||||||

| 30,000,000 | USD | 0.09% due 10/7/2020 (b) | 29,999,417 | |||||||

| 65,700,000 | USD | Swedbank AB, 0.1% due 10/14/2020 | 65,697,445 | |||||||

| Toronto Dominion Bank: | ||||||||||

| 14,900,000 | USD | 0.13% due 10/29/2020 (b) | 14,898,572 | |||||||

| 40,000,000 | USD | 0.13% due 10/30/2020 (b) | 39,996,000 | |||||||

| 8,600,000 | USD | Total Fina Elf Capital SA, 0.07% due 10/1/2020 (b) | 8,599,982 | |||||||

| 63,000,000 | USD | Unilever Capital Corp., 0.09% due 10/5/2020 (b) | 62,999,029 | |||||||

| United Parcel Service Inc.: | ||||||||||

| 17,000,000 | USD | 0.02% due 10/1/2020 (b) | 16,999,976 | |||||||

| 12,200,000 | USD | 0.03% due 10/1/2020 (b) | 12,199,983 | |||||||

| 25,000,000 | USD | 0.03% due 10/7/2020 (b) | 24,999,757 | |||||||

| 917,871,061 | ||||||||||

| Treasury Bills | 0.1% | ||||||||||

| 2,000,000 | USD | U.S. Treasury Bill, 0.105% due 12/10/2020 (c)(d) | 1,999,650 | |||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost — $919,876,798) | 919,870,711 | |||||||||

| TOTAL INVESTMENTS — 99.6% (Cost — $2,202,336,114) | 2,415,927,533 | |||||||||

| Other Assets In Excess of Liabilities — 0.4% | 9,232,072 | |||||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,425,159,605 |

See Notes to Financial Statements.

14

| IVA Worldwide Fund | IVA Funds |

Schedule of Investments

September 30, 2020

The IVA Worldwide Fund had the following open forward foreign currency contracts at September 30, 2020:

| FOREIGN CURRENCY | COUNTERPARTY | SETTLEMENT DATES THROUGH | LOCAL CURRENCY | USD EQUIVALENT | USD VALUE AT SEPTEMBER 30, 2020 | NET UNREALIZED APPRECIATION | ||||||||||||||

| Contracts to Sell: | ||||||||||||||||||||

| British pound | State Street Bank & Trust Co. | 12/09/2020 | GBP 770,000 | $ | 1,043,337 | $ | 993,950 | $ | 49,387 | |||||||||||

| Thai baht | State Street Bank & Trust Co. | 12/09/2020 | THB 515,222,000 | 16,480,344 | 16,257,885 | 222,459 | ||||||||||||||

| Net Unrealized Appreciation on Open Forward Foreign Currency Contracts | $ | 271,846 | ||||||||||||||||||

| FOREIGN CURRENCY | COUNTERPARTY | SETTLEMENT DATES THROUGH | LOCAL CURRENCY | USD EQUIVALENT | USD VALUE AT SEPTEMBER 30, 2020 | NET UNREALIZED DEPRECIATION | ||||||||||||||

| Contracts to Sell: | ||||||||||||||||||||

| South Korean won | State Street Bank & Trust Co. | 10/08/2020 | KRW35,636,000,000 | $ | 30,021,423 | $ | 30,497,219 | $ | (475,796 | ) | ||||||||||

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (475,796 | ) | |||||||||||||||||

Abbreviations used in this schedule:

| ADR | — | American Depositary Receipt |

| GBP | — | British pound |

| KRW | — | South Korean won |

| NVDR | — | Non-voting Depositary Receipt |

| THB | — | Thai baht |

| USD | — | United States dollar |

| (a) | Non-income producing investment. |

| (b) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. |

| (c) | This security is held at the custodian as collateral for forward foreign currency contracts sold. As of September 30, 2020, portfolio securities valued at $1,999,650 were segregated, of which $475,796 is used to cover collateral requirements. |

| (d) | The rate shown represents an annualized yield at time of purchase. |

| Schedule of Affiliates | ||||||||||||||||||||||||||||||||

| SECURITY | SHARES HELD AT SEPTEMBER 30, 2019 | SHARE ADDITIONS | SHARE REDUCTIONS | SHARES HELD AT SEPTEMBER 30, 2020 | FAIR VALUE AT SEPTEMBER 30, 2020 | REALIZED LOSS | CHANGE IN UNREALIZED DEPRECIATION | DIVIDEND INCOME(a) | ||||||||||||||||||||||||

| Astronics Corp.(b) | 1,297,449 | 885,714 | 1,043,278 | 1,139,885 | $ | 8,799,912 | $ | (20,685,553 | ) | $ | (20,884,774 | ) | — | |||||||||||||||||||

| H.U. Group Holdings Inc.(b)(c) | 3,639,600 | 198,600 | 1,679,900 | 2,158,300 | 57,546,481 | (26,746,656 | ) | 32,764,488 | $ | 2,640,111 | ||||||||||||||||||||||

| Net 1 U.E.P.S. Technologies Inc.(b) | 2,986,316 | 81,081 | 3,067,397 | — | — | (15,468,834 | ) | — | — | |||||||||||||||||||||||

| Total | $ | 66,346,393 | $ | (62,901,043 | ) | $ | 11,879,714 | $ | 2,640,111 | |||||||||||||||||||||||

| (a) | Dividend income is gross of withholding taxes. |

| (b) | Non-affiliated at September 30, 2020. |

| (c) | Effective July 1, 2020 Miraca Holdings Inc. changed its name to H.U. Group Holdings Inc. |

See Notes to Financial Statements.

15

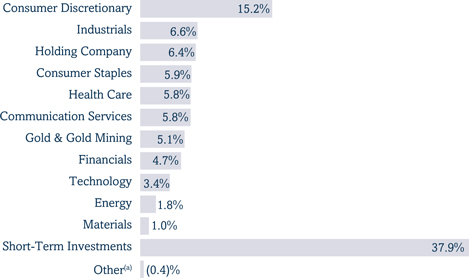

| IVA International Fund | IVA Funds |

| Performance (unaudited) | As of September 30, 2020 |

| Average Annual Total Returns as of September 30, 2020 | One Year | Five Year | Ten Year | Since Inception(a) | ||||

| Class A | -6.82% | 0.89% | 3.42% | 5.39% | ||||

| Class A (with a 5% maximum initial sales charge) | -11.50% | -0.14% | 2.89% | 4.94% | ||||

| Class C | -7.51% | 0.14% | 2.65% | 4.60% | ||||

| Class I | -6.62% | 1.14% | 3.68% | 5.65% | ||||

| MSCI All Country World (ex-U.S.) Index (Net)(b) | 3.00% | 6.23% | 4.00% | 4.45% | ||||

| Consumer Price Index(c) | 1.50% | 1.84% | 1.77% | 1.45% |

Growth of a $10,000 Initial Investment

| (a) | The Fund commenced investment operations on October 1, 2008. |

| (b) | The MSCI All Country World (ex-U.S.) Index (Net) is an unmanaged, free float-adjusted, market capitalization weighted index composed of stocks of companies located in countries throughout the world, excluding the United States. It is designed to measure equity market performance in global developed and emerging markets outside the United States. The index includes reinvestment of dividends, net of foreign withholding taxes. Please note that an investor cannot invest directly in an index. |

| (c) | The Consumer Price Index examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food and medical care. Please note that an investor cannot invest directly in an index. |

| (d) | Hypothetical illustration of $10,000 invested in Class A shares on October 1, 2010, assuming the deduction of the maximum initial sales charge of 5% at the time of investment for Class A shares and the reinvestment of all distributions, including returns of capital, if any, at net asset value through September 30, 2020. The performance of the Fund’s other classes may be greater or less than the Class A shares’ performance indicated on this chart depending on whether greater or lesser sales charges and fees were incurred by shareholders investing in the other classes. |

Past performance is no guarantee of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. To obtain performance information current to the most recent month-end, please call 866-941-4482.

The maximum sales charge for Class A shares is 5.00%. Class C shares may include a 1.00% contingent deferred sales charge for the first year only. Amounts redeemed within 30 days of purchase are subject to a 2.00% fee. The expense ratios for the Fund are as follows: 1.17% (Class A shares); 1.92% (Class C shares); and 0.92% (Class I shares). These expense ratios are as stated in the most recent Prospectus dated January 31, 2020. More recent expense ratios can be found in the Financial Highlights section of this Annual Report.

Information Classification: Limited Access

16

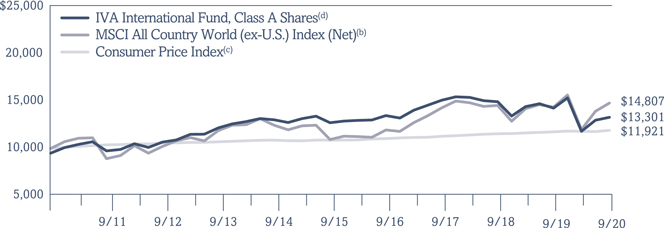

| IVA International Fund | IVA Funds |

| Portfolio Composition (unaudited) | As of September 30, 2020 |

Asset Allocation (As a Percent of Total Net Assets)

Sector Allocation (As a Percent of Total Net Assets)

Top 10 Positions (As a Percent of Total Net Assets)(b)

| Newmont Corp. | 4.0 | % | ||

| Astellas Pharma Inc. | 3.8 | % | ||

| Bayerische Motoren Werke AG | 3.8 | % | ||

| H.U. Group Holdings Inc. | 3.1 | % | ||

| Bureau Veritas SA | 2.6 | % | ||

| Compagnie Financière Richemont SA | 2.6 | % | ||

| Rohto Pharmaceutical Co., Ltd. | 2.3 | % | ||

| Sodexo SA | 2.2 | % | ||

| Bolloré SA | 1.8 | % | ||

| Gold Fields Orogen Holding (BVI) Ltd., 4.875% due 10/7/2020 | 1.7 | % |

Top 10 positions represent 27.9% of total net assets.

| (a) | Other represents unrealized gains and losses on forward foreign currency contracts and other assets and liabilities. |

| (b) | Short-Term Investments are not included. |

17

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Shares | Description | Fair Value | ||||||||

| COMMON STOCKS – 66.8% | ||||||||||

| Argentina | 0.3% | ||||||||||

| 787,908 | Loma Negra Companía Industrial Argentina SA, ADR (a) | $ | 3,395,884 | |||||||

| Australia | 0.5% | ||||||||||

| 115,873 | Newcrest Mining Ltd. | 2,592,733 | ||||||||

| 9,670,756 | WPP AUNZ Ltd. | 2,424,337 | ||||||||

| 5,017,070 | ||||||||||

| Belgium | 0.9% | ||||||||||

| 162,296 | Anheuser-Busch InBev SA/NV | 8,795,874 | ||||||||

| Bermuda | 0.6% | ||||||||||

| 301,326 | Jardine Strategic Holdings Ltd. | 5,969,268 | ||||||||

| Canada | 0.8% | ||||||||||

| 298,474 | Barrick Gold Corp. | 8,390,104 | ||||||||

| China | 1.7% | ||||||||||

| 45,302 | Baidu Inc., ADR (a) | 5,734,780 | ||||||||

| 16,760,000 | Phoenix Media Investment (Holdings) Ltd. (a) | 692,021 | ||||||||

| 1,492,694 | Phoenix New Media Ltd., ADR | 1,836,014 | ||||||||

| 194,591 | SINA Corp. (a) | 8,291,523 | ||||||||

| 16,554,338 | ||||||||||

| France | 11.8% | ||||||||||

| 4,688,376 | Bolloré SA | 17,524,071 | ||||||||

| 1,153,741 | Bureau Veritas SA (a) | 26,053,067 | ||||||||

| 143,984 | Criteo SA, ADR (a) | 1,755,165 | ||||||||

| 9,374 | Dassault Aviation SA (a) | 7,968,144 | ||||||||

| 8,434 | Financière de l’Odet SA | 6,645,033 | ||||||||

| 53,448 | Groupe SFPI SA (a) | 77,391 | ||||||||

| 187,925 | Ipsos SA | 4,704,101 | ||||||||

| 509,916 | Publicis Groupe SA | 16,488,728 | ||||||||

| 306,890 | Sodexo SA | 21,955,796 | ||||||||

| 224,363 | Vicat SA | 7,510,202 | ||||||||

| 71,601 | Wendel SE | 6,501,817 | ||||||||

| 117,183,515 | ||||||||||

| Germany | 3.8% | ||||||||||

| 521,607 | Bayerische Motoren Werke AG | 37,910,481 | ||||||||

| Hong Kong | 1.0% | ||||||||||

| 27,617,000 | APT Satellite Holdings Ltd. | 7,233,826 | ||||||||

| 3,449,416 | Hongkong & Shanghai Hotels Ltd. | 2,679,400 | ||||||||

| 9,913,226 |

See Notes to Financial Statements.

18

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Shares | Description | Fair Value | ||||||||

| India | 0.5% | ||||||||||

| 152,151 | Bajaj Holdings and Investment Ltd. | $ | 4,990,586 | |||||||

| Ireland | 1.1% | ||||||||||

| 10,871,525 | AIB Group Plc (a) | 11,165,774 | ||||||||

| Japan | 12.5% | ||||||||||

| 2,550,500 | Astellas Pharma Inc. | 37,895,354 | ||||||||

| 150,400 | Benesse Holdings Inc. | 3,857,507 | ||||||||

| 913,400 | Fan Communications Inc. | 4,174,454 | ||||||||

| 1,138,900 | H.U. Group Holdings Inc. | 30,366,347 | ||||||||

| 364,000 | Hi-Lex Corp. | 4,114,047 | ||||||||

| 61,000 | Medikit Co., Ltd. | 1,937,610 | ||||||||

| 72,600 | Nitto Kohki Co., Ltd. | 1,433,896 | ||||||||

| 27,400 | Okinawa Cellular Telephone Co. | 1,039,207 | ||||||||

| 713,800 | Rohto Pharmaceutical Co., Ltd. | 23,383,862 | ||||||||

| 181,900 | San-A Co., Ltd. | 7,994,183 | ||||||||

| 248,275 | Shingakukai Holdings Co., Ltd. | 1,092,302 | ||||||||

| 89,150 | Shofu Inc. | 1,207,094 | ||||||||

| 800 | SK Kaken Co., Ltd. | 296,212 | ||||||||

| 373,300 | Techno Medica Co., Ltd. | 5,950,005 | ||||||||

| 124,742,080 | ||||||||||

| Mexico | 4.3% | ||||||||||

| 1,187,288 | Corporativo Fragua, SAB de CV | 11,813,009 | ||||||||

| 7,263,265 | Grupo Comercial Chedraui SAB de CV | 7,906,600 | ||||||||

| 4,109,815 | Grupo México SAB de CV, Series ‘B’ | 10,460,638 | ||||||||

| 874,598 | Promotora y Operadora de Infraestructura SAB de CV, Series ‘A’ (a) | 6,151,041 | ||||||||

| 254,148 | Promotora y Operadora de Infraestructura SAB de CV, Series ‘L’ (a) | 1,327,434 | ||||||||

| 1,105,300 | Quálitas Controladora, SAB de CV | 4,174,461 | ||||||||

| 237,200 | Regional SAB de CV (a) | 559,007 | ||||||||

| 42,392,190 | ||||||||||

| Netherlands | 4.0% | ||||||||||

| 122,925 | Airbus SE (a) | 8,945,739 | ||||||||

| 172,476 | Heineken NV | 15,344,412 | ||||||||

| 760,571 | Royal Boskalis Westminster NV (a) | 15,141,597 | ||||||||

| 39,431,748 | ||||||||||

| Singapore | 2.5% | ||||||||||

| 8,592,300 | First Resources Ltd. | 7,616,338 | ||||||||

| 2,481,720 | Haw Par Corp. Ltd. | 16,907,803 | ||||||||

| 24,524,141 |

See Notes to Financial Statements.

19

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Shares | Description | Fair Value | ||||||||

| South Korea | 6.3% | ||||||||||

| 412,653 | Daou Technology Inc. | $ | 7,645,504 | |||||||

| 104,511 | DONGKOOK Pharmaceutical Co., Ltd. | 2,442,651 | ||||||||

| 78,636 | Hyundai Mobis Co., Ltd. | 15,446,518 | ||||||||

| 905,190 | Kangwon Land Inc. | 16,628,847 | ||||||||

| 176,250 | KT&G Corp. | 12,442,753 | ||||||||

| 653,824 | WHANIN Pharmaceutical Co., Ltd. | 8,470,366 | ||||||||

| 63,076,639 | ||||||||||

| Spain | 1.1% | ||||||||||

| 81,110 | Aena SME, SA (a) | 11,345,120 | ||||||||

| Switzerland | 4.9% | ||||||||||

| 379,777 | Compagnie Financière Richemont SA | 25,440,791 | ||||||||

| 113,968 | Nestlé SA | 13,529,408 | ||||||||

| 890,666 | UBS Group AG | 9,960,219 | ||||||||

| 48,930,418 | ||||||||||

| Thailand | 1.2% | ||||||||||

| 3,839,000 | Bangkok Bank PCL, NVDR | 11,630,580 | ||||||||

| United Arab Emirates | 0.4% | ||||||||||

| 9,881,361 | Emaar Malls PJSC (a) | 4,008,338 | ||||||||

| United Kingdom | 5.5% | ||||||||||

| 32,962,172 | Avanti Communications Group Plc (a) | — | ||||||||

| 914,889 | Inchcape Plc (a) | 5,201,399 | ||||||||

| 13,857,632 | Mitie Group Plc | 5,865,028 | ||||||||

| 634,726 | Newmont Corp. | 40,273,365 | ||||||||

| 383,227 | WPP Plc | 3,006,540 | ||||||||

| 54,346,332 | ||||||||||

| United States | 1.1% | ||||||||||

| 860,285 | Gruma SAB de CV, Series ‘B’ | 9,520,464 | ||||||||

| 111,399 | Schlumberger Ltd. | 1,733,368 | ||||||||

| 11,253,832 | ||||||||||

| TOTAL COMMON STOCKS (Cost — $627,260,546) | 664,967,538 | |||||||||

| PREFERRED STOCKS — 1.0% | ||||||||||

| Chile | 0.3% | ||||||||||

| 1,168,712 | Embotelladora Andina SA, Series ‘B’ | 2,582,863 | ||||||||

| Germany | 0.7% | ||||||||||

| 29,188 | KSB SE & Co. KgaA Vorzug | 7,186,507 | ||||||||

| TOTAL PREFERRED STOCKS (Cost — $12,937,696) | 9,769,370 |

See Notes to Financial Statements.

20

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2020

Principal Amount | DESCRIPTION | FAIR VALUE | ||||||||

| CORPORATE NOTES & BONDS — 1.9% | ||||||||||

| South Africa | 1.7% | ||||||||||

| 17,291,000 | USD | Gold Fields Orogen Holding (BVI) Ltd., 4.875% due 10/7/2020 (b) | $ | 17,276,475 | ||||||

| United Kingdom | 0.2% | ||||||||||

| 7,019,185 | USD | Avanti Communications Group Plc, 9% due 10/1/2022 (9% PIK) (b)(c) | 1,544,221 | |||||||

| TOTAL CORPORATE NOTES & BONDS (Cost — $24,289,870) | 18,820,696 | |||||||||

| SHORT-TERM INVESTMENTS — 31.2% | ||||||||||

| Commercial Paper | 31.0% | ||||||||||

| 20,000,000 | USD | Barclays Bank Plc, 0.11% due 10/7/2020 (b) | 19,999,494 | |||||||

| 28,000,000 | USD | BNP Paribas SA, 0.07% due 10/1/2020 (b) | 27,999,953 | |||||||

| 20,000,000 | USD | Crédit Agricole Corp., 0.07% due 10/28/2020 (b) | 19,998,740 | |||||||

| 28,000,000 | USD | DNP Bank ASA, 0.02% due 10/7/2020 (b) | 27,999,456 | |||||||

| Exxon Mobil Corp.: | ||||||||||

| 15,400,000 | USD | 0.07% due 10/5/2020 | 15,399,820 | |||||||

| 10,000,000 | USD | 0.09% due 11/3/2020 (b) | 9,999,112 | |||||||

| 10,000,000 | USD | Landesbank Hessen-Thuringen Gi, 0.09% due 10/22/2020 (b) | 9,999,303 | |||||||

| 10,000,000 | USD | Lloyds Bank Plc, 0.08% due 10/1/2020 (b) | 9,999,967 | |||||||

| 19,400,000 | USD | L’Oréal USA Inc., 0.07% due 10/5/2020 (b) | 19,399,774 | |||||||

| Merck & Co. Inc.: | ||||||||||

| 12,500,000 | USD | 0.06% due 10/13/2020 (b) | 12,499,684 | |||||||

| 14,600,000 | USD | 0.06% due 10/19/2020 (b) | 14,599,438 | |||||||

| 15,000,000 | USD | Nestlé Capital Corp., 0.01% due 10/19/2020 (b) | 14,999,557 | |||||||

| 19,000,000 | USD | Roche Holding Inc., 0.05% due 10/1/2020 (b) | 18,999,963 | |||||||

| 4,000,000 | USD | Swedbank AB, 0.1% due 10/14/2020 (b) | 3,999,844 | |||||||

| 21,500,000 | USD | Toronto Dominion Bank, 0.13% due 10/30/2020 (b) | 21,497,850 | |||||||

| 14,400,000 | USD | Total Fina Elf Capital SA, 0.07% due 10/1/2020 (b) | 14,399,970 | |||||||

| 19,000,000 | USD | Unilever Capital Corp., 0.04% due 10/5/2020 (b) | 18,999,707 |

See Notes to Financial Statements.

21

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| Principal Amount | Description | Fair Value | ||||||||

| Commercial Paper | 31.0% (continued) | ||||||||||

| 8,000,000 | USD | United Parcel Service Inc.: 0.02% due 10/1/2020 (b) | $ | 7,999,989 | ||||||

| 20,000,000 | USD | 0.03% due 10/1/2020 (b) | 19,999,972 | |||||||

| 308,791,593 | ||||||||||

| Treasury Bills | 0.2% | ||||||||||

| 2,000,000 | USD | U.S. Treasury Bill, 0.105% due 12/10/2020 (d)(e) | 1,999,650 | |||||||

| TOTAL SHORT-TERM INVESTMENTS (Cost — $310,793,110) | 310,791,243 | |||||||||

| TOTAL INVESTMENTS — 100.9% (Cost — $975,281,222) | 1,004,348,847 | |||||||||

| Liabilities In Excess of Other Assets — (0.9)% | (8,782,776 | ) | ||||||||

| TOTAL NET ASSETS — 100.0% | $ | 995,566,071 |

The IVA International Fund had the following open forward foreign currency contracts at September 30, 2020:

| FOREIGN CURRENCY | COUNTERPARTY | SETTLEMENT DATES THROUGH | LOCAL CURRENCY | USD EQUIVALENT | USD VALUE AT SEPTEMBER 30, 2020 | NET UNREALIZED APPRECIATION | ||||||||||||||

| Contracts to Sell: | ||||||||||||||||||||

| British pound | State Street Bank & Trust Co. | 12/09/2020 | GBP 1,084,000 | $ | 1,463,185 | $ | 1,399,275 | $ | 63,910 | |||||||||||

| Thai baht | State Street Bank & Trust Co. | 12/09/2020 | THB 347,238,000 | 11,106,360 | 10,957,132 | 149,228 | ||||||||||||||

| Net Unrealized Appreciation on Open Forward Foreign Currency Contracts | $ | 213,138 | ||||||||||||||||||

| FOREIGN CURRENCY | COUNTERPARTY | SETTLEMENT DATES THROUGH | LOCAL CURRENCY | USD EQUIVALENT | USD VALUE AT SEPTEMBER 30, 2020 | NET UNREALIZED DEPRECIATION | ||||||||||||||

| Contracts to Sell: | ||||||||||||||||||||

| South Korean won | State Street Bank & Trust Co. | 10/08/2020 | KRW 29,202,000,000 | $ | 24,602,074 | $ | 24,991,014 | $ | (388,940 | ) | ||||||||||

| Net Unrealized Depreciation on Open Forward Foreign Currency Contracts | $ | (388,940 | ) | |||||||||||||||||

Abbreviations used in this schedule:

| ADR | — | American Depositary Receipt |

| GBP | — | British pound |

| KRW | — | South Korean won |

| NVDR | — | Non-voting Depositary Receipt |

| PIK | — | Payment-in-kind |

| THB | — | Thai baht |

| USD | — | United States dollar |

| (a) | Non-income producing investment. |

| (b) | Security is exempt from registration under Rule 144A or Section 4(2) of the Securities Act of 1933 (the “1933 Act”). Any resale of these securities must generally be effected through a sale that is registered under the 1933 Act or otherwise exempted from such registration requirements. |

| (c) | Payment-in-kind security for which the issuer may pay interest with additional debt securities or cash. |

See Notes to Financial Statements.

22

| IVA International Fund | IVA Funds |

Schedule of Investments

September 30, 2020

| (d) | This security is held at the custodian as collateral for forward foreign currency contracts sold. As of September 30, 2020, portfolio securities valued at $1,999,650 were segregated, of which $388,940 is used to cover collateral requirements. |

| (e) | The rate shown represents an annualized yield at time of purchase. |

| Schedule of Affiliates | ||||||||||||||||||||||||||||||||

| SECURITY | SHARES HELD AT SEPTEMBER 30, 2019 | SHARE ADDITIONS | SHARE REDUCTIONS | SHARES HELD AT SEPTEMBER 30, 2020 | FAIR VALUE AT SEPTEMBER 30, 2020 | REALIZED GAIN/(LOSS) | CHANGE IN UNREALIZED APPRECIATION | DIVIDEND INCOME(a) | ||||||||||||||||||||||||

| APT Satellite Holdings Ltd.(b) | 54,595,000 | — | 26,978,000 | 27,617,000 | $ | 7,233,826 | $ | (13,591,808 | ) | $ | 6,844,154 | $ | 1,037,529 | |||||||||||||||||||

| Clear Media Ltd.(b) | 31,530,030 | — | 31,530,030 | — | — | 10,222,817 | — | — | ||||||||||||||||||||||||

| Fan Communications Inc.(b)(c) | 3,887,400 | — | 2,974,000 | 913,400 | 4,174,454 | (6,074,686 | ) | 3,622,644 | 476,209 | |||||||||||||||||||||||

| Kyung Dong Pharmaceutical Co., Ltd.(b) | 1,429,632 | — | 1,429,632 | — | — | (2,878,987 | ) | — | 494,097 | |||||||||||||||||||||||

| Phoenix New Media Ltd., ADR(b) | 3,713,463 | 102,564 | 2,323,333 | 1,492,694 | 692,021 | (10,947,044 | ) | 9,897,844 | 5,017,631 | |||||||||||||||||||||||

| Techno Medica Co., Ltd.(b) | 513,800 | — | 140,500 | 373,300 | 5,950,005 | 303,346 | (2,974,071 | ) | 211,140 | |||||||||||||||||||||||

| WHANIN Pharmaceutical Co., Ltd.(b) | 1,625,926 | — | 972,102 | 653,824 | 8,470,366 | (7,352,516 | ) | 5,854,316 | 393,695 | |||||||||||||||||||||||

| Total | $ | 26,520,672 | $ | (30,318,878 | ) | $ | 23,244,887 | $ | 7,630,301 | |||||||||||||||||||||||

| (a) | Dividend income is gross of withholding taxes. |

| (b) | Non-affiliated at September 30, 2020. |

| (c) | Name changed from F@N Communications Inc. to Fan Communications Inc. effective March 26, 2020. |

See Notes to Financial Statements.

23

| Statements of Assets and Liabilities | IVA Funds |

September 30, 2020

| IVA Worldwide Fund | IVA International Fund | |||||||

| Assets: | ||||||||

| Long-term investments, at cost: | ||||||||

| Non-affiliated securities | $ | 1,282,459,316 | $ | 664,488,112 | ||||

| Short-term investments, at cost | 917,877,208 | 308,793,520 | ||||||

| Collateral for open foreign forward currency contracts, at cost | 1,999,590 | 1,999,590 | ||||||

| Foreign currency, at cost | 29,670 | 25,101 | ||||||

| Long-term investments, at fair value: | ||||||||

| Non-affiliated securities | $ | 1,496,056,822 | $ | 693,557,604 | ||||

| Short-term investments, at fair value | 917,871,061 | 308,791,593 | ||||||

| Collateral for open foreign forward currency contracts, at fair value | 1,999,650 | 1,999,650 | ||||||

| Foreign currency, at fair value | 29,813 | 25,222 | ||||||

| Cash | 219,416 | 406,375 | ||||||

| Receivable for investments sold | 15,709,542 | 208,078 | ||||||

| Dividends and interest receivable | 5,294,392 | 3,021,082 | ||||||

| Unrealized appreciation on open forward foreign currency contracts | 271,846 | 213,138 | ||||||

| Receivable for fund shares sold | 597,986 | 949,922 | ||||||

| Prepaid expenses and other assets | 4,325 | 1,773 | ||||||

| Total assets | $ | 2,438,054,853 | $ | 1,009,174,437 | ||||

| Liabilities: | ||||||||

| Payable for fund shares repurchased | $ | 9,532,714 | $ | 12,006,922 | ||||

| Unrealized depreciation on open forward foreign currency contracts | 475,796 | 388,940 | ||||||

| Accrued investment advisory fees | 1,737,410 | 700,720 | ||||||

| Accrued distribution and service fees | 241,647 | 18,571 | ||||||

| Accrued expenses and other liabilities | 907,681 | 493,213 | ||||||

| Total liabilities | 12,895,248 | 13,608,366 | ||||||

| Net Assets | $ | 2,425,159,605 | $ | 995,566,071 | ||||

| Net Assets Consist of: | ||||||||

| Par value ($0.001 per share) | $ | 161,880 | $ | 72,222 | ||||

| Additional paid-in-capital | 2,306,713,038 | 1,272,860,871 | ||||||

| Total distributable earnings | 118,284,687 | (277,367,022 | ) | |||||

| Net Assets | $ | 2,425,159,605 | $ | 995,566,071 | ||||

| Net Asset Value Per Share: | ||||||||

| Class A | ||||||||

| Net assets | $ | 587,392,415 | $ | 52,670,608 | ||||

| Shares outstanding | 39,279,873 | 3,830,586 | ||||||

| Net asset value per share | $ | 14.95 | $ | 13.75 | ||||

| Maximum offering price per share (with a maximum initial sales charge of 5.00%) | $ | 15.74 | $ | 14.47 | ||||

| Class C | ||||||||

| Net assets | $ | 133,518,924 | $ | 8,453,033 | ||||

| Shares outstanding | 9,192,386 | 629,589 | ||||||

| Net asset value per share | $ | 14.52 | $ | 13.43 | ||||

| Class I | ||||||||

| Net assets | $ | 1,704,248,266 | $ | 934,442,430 | ||||

| Shares outstanding | 113,408,147 | 67,761,397 | ||||||

| Net asset value per share | $ | 15.03 | $ | 13.79 | ||||

See Notes to Financial Statements.

24

| Statements of Operations | IVA Funds |

For the Year Ended September 30, 2020

| IVA Worldwide Fund | IVA International Fund | |||||||

| Investment Income: | ||||||||

| Interest | $ | 25,115,749 | $ | 10,129,399 | ||||

| Dividends: | ||||||||

| Non-affiliated securities | 42,561,158 | 28,231,423 | ||||||

| Affiliated securities | 2,640,111 | 7,630,301 | ||||||

| Other income | 33,752 | — | ||||||

| Less: Foreign taxes withheld | (4,305,591 | ) | (3,306,517 | ) | ||||

| Total income | 66,045,179 | 42,684,606 | ||||||

| Expenses: | ||||||||

| Investment advisory fees | 34,015,340 | 16,278,167 | ||||||

| Distribution and service fees: | ||||||||

| Class A | 1,957,354 | 241,999 | ||||||

| Class C | 2,561,796 | 165,020 | ||||||

| Transfer agent and shareholder service fees | 3,006,998 | 1,147,316 | ||||||

| Trustee fees | 285,628 | 136,848 | ||||||

| Other expenses | 2,643,367 | 1,781,994 | ||||||

| Total expenses | 44,470,483 | 19,751,344 | ||||||

| Net investment income | 21,574,696 | 22,933,262 | ||||||

| Net Realized and Change in Unrealized Gain (Loss) on Investments and Foreign Currency including Forward Foreign Currency Contracts: | ||||||||

| Net realized gain (loss) on: | ||||||||

| Investments: | ||||||||

| Non-affiliated securities | (5,622,553 | ) | (259,199,847 | ) | ||||

| Affiliated securities | (62,901,043 | ) | (30,318,878 | ) | ||||

| Commodities | 1,546,134 | 7,697,321 | ||||||

| Forward foreign currency contracts and other foreign currency transactions | 921,547 | 3,084,253 | ||||||

| Net realized loss | (66,055,915 | ) | (278,737,151 | ) | ||||

| Net change in unrealized appreciation (depreciation) from: | ||||||||

| Investments from: | ||||||||

| Non-affiliated investments | (217,721,229 | ) | 76,856,396 | |||||

| Forward foreign currency contracts and other foreign currency translation | (1,769,666 | ) | (2,256,102 | ) | ||||

| Net change in unrealized appreciation (depreciation) | (219,490,895 | ) | 74,600,294 | |||||

| Net realized and change in unrealized gain (loss) on investments and foreign currency including forward foreign currency contracts | (285,546,810 | ) | (204,136,857 | ) | ||||

| Decrease in net assets resulting from operations | $ | (263,972,114 | ) | $ | (181,203,595 | ) | ||

See Notes to Financial Statements.

25

| Statements of Changes in Net Assets | IVA Funds |

| IVA Worldwide Fund | IVA International Fund | |||||||||||||||

| Year Ended September 30, 2020 | Year Ended September 30, 2019 | Year Ended September 30, 2020 | Year Ended September 30, 2019 | |||||||||||||

| Operations: | ||||||||||||||||

| Net investment income | $ | 21,574,696 | $ | 80,890,827 | $ | 22,933,262 | $ | 51,254,307 | ||||||||

| Net realized gain (loss) | (66,055,915 | ) | 559,550,303 | (278,737,151 | ) | 113,396,371 | ||||||||||

| Net change in unrealized appreciation (depreciation) | (219,490,895 | ) | (867,538,077 | ) | 74,600,294 | (346,311,638 | ) | |||||||||

| Decrease in net assets resulting from operations | (263,972,114 | ) | (227,096,947 | ) | (181,203,595 | ) | (181,660,960 | ) | ||||||||

| Decrease in net assets resulting from distributions | (384,114,149 | ) | (639,448,284 | ) | (106,038,250 | ) | (234,693,218 | ) | ||||||||

| Capital Share Transactions: | ||||||||||||||||

| Proceeds from shares sold | 627,059,111 | 1,214,622,428 | 353,917,376 | 611,893,146 | ||||||||||||

| Reinvestment of distributions | 324,649,462 | 530,777,658 | 89,674,675 | 203,877,710 | ||||||||||||

| Cost of shares repurchased | (3,707,920,726 | ) | (3,066,709,013 | ) | (1,963,577,749 | ) | (1,445,674,304 | ) | ||||||||

| Decrease in net assets from capital share transactions | (2,756,212,153 | ) | (1,321,308,927 | ) | (1,519,985,698 | ) | (629,903,448 | ) | ||||||||

| Decrease in net assets | (3,404,298,416 | ) | (2,187,854,158 | ) | (1,807,227,543 | ) | (1,046,257,626 | ) | ||||||||

| Net Assets: | ||||||||||||||||

| Beginning of year | $ | 5,829,458,021 | $ | 8,017,312,179 | $ | 2,802,793,614 | $ | 3,849,051,240 | ||||||||

| End of year | $ | 2,425,159,605 | $ | 5,829,458,021 | $ | 995,566,071 | $ | 2,802,793,614 | ||||||||

See Notes to Financial Statements.

26

| Financial Highlights | IVA Funds |

IVA Worldwide Fund — Class A

For a share of each class of beneficial interest outstanding:

| Year Ended September 30, | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Net asset value, beginning of year | $ | 16.84 | $ | 18.97 | $ | 18.96 | $ | 17.26 | $ | 16.87 | ||||||||||

| Increase (decrease) from investment operations:(a) | ||||||||||||||||||||

| Net investment income(b) | 0.05 | 0.19 | 0.08 | 0.04 | 0.09 | |||||||||||||||

| Net realized and unrealized gain (loss) | (0.75 | ) | (0.72 | ) | 0.53 | 1.86 | 1.01 | |||||||||||||

| Increase (decrease) from investment operations | (0.70 | ) | (0.53 | ) | 0.61 | 1.90 | 1.10 | |||||||||||||

| Decrease from distributions: | ||||||||||||||||||||

| Net investment income | (0.21 | ) | (0.15 | ) | (0.03 | ) | — | (0.23 | ) | |||||||||||

| Net realized gain on investments | (0.98 | ) | (1.45 | ) | (0.57 | ) | (0.20 | ) | (0.48 | ) | ||||||||||

| Decrease from distributions | (1.19 | ) | (1.60 | ) | (0.60 | ) | (0.20 | ) | (0.71 | ) | ||||||||||

| Net asset value, end of year | $ | 14.95 | $ | 16.84 | $ | 18.97 | $ | 18.96 | $ | 17.26 | ||||||||||

| Total return(c) | (4.86 | )% | (2.48 | )% | 3.25 | % | 11.12 | % | 6.75 | % | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Operating expenses | 1.19 | % | 1.23 | % | 1.25 | % | 1.25 | % | 1.25 | % | ||||||||||

| Net investment income | 0.35 | % | 1.09 | % | 0.41 | % | 0.21 | % | 0.52 | % | ||||||||||

| Supplemental data: | ||||||||||||||||||||

| Portfolio turnover rate | 48.8 | % | 39.9 | % | 25.0 | % | 13.9 | % | 29.7 | % | ||||||||||

| Net assets, end of year (000’s) | $ | 587,392 | $ | 950,298 | $ | 1,159,022 | $ | 1,512,543 | $ | 1,587,209 | ||||||||||

| (a) | The amounts shown for a share outstanding may not correlate with the Statements of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. |

| (b) | Calculated using average daily shares outstanding. |

| (c) | Total return assumes reinvestment of all distributions and does not reflect an initial sales charge. |

See Notes to Financial Statements.

27

| Financial Highlights | IVA Funds |

IVA Worldwide Fund — Class C

For a share of each class of beneficial interest outstanding:

| Year Ended September 30, | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Net asset value, beginning of year | $ | 16.38 | $ | 18.48 | $ | 18.59 | $ | 17.05 | $ | 16.67 | ||||||||||

| Increase (decrease) from investment operations:(a) | ||||||||||||||||||||

| Net investment income (loss)(b) | (0.06 | ) | 0.05 | (0.06 | ) | (0.10 | ) | (0.04 | ) | |||||||||||

| Net realized and unrealized gain (loss) | (0.75 | ) | (0.68 | ) | 0.52 | 1.84 | 1.00 | |||||||||||||

| Increase (decrease) from investment operations | (0.81 | ) | (0.63 | ) | 0.46 | 1.74 | 0.96 | |||||||||||||

| Decrease from distributions: | ||||||||||||||||||||

| Net investment income | (0.07 | ) | (0.02 | ) | — | — | (0.10 | ) | ||||||||||||

| Net realized gain on investments | (0.98 | ) | (1.45 | ) | (0.57 | ) | (0.20 | ) | (0.48 | ) | ||||||||||

| Decrease from distributions | (1.05 | ) | (1.47 | ) | (0.57 | ) | (0.20 | ) | (0.58 | ) | ||||||||||

| Net asset value, end of year | $ | 14.52 | $ | 16.38 | $ | 18.48 | $ | 18.59 | $ | 17.05 | ||||||||||

| Total return(c) | (5.58 | )% | (3.18 | )% | 2.47 | % | 10.31 | % | 5.93 | % | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Operating expenses | 1.93 | % | 1.98 | % | 2.00 | % | 2.00 | % | 2.00 | % | ||||||||||

| Net investment income (loss) | (0.38 | )% | 0.29 | % | (0.32 | )% | (0.55 | )% | (0.23 | )% | ||||||||||

| Supplemental data: | ||||||||||||||||||||

| Portfolio turnover rate | 48.8 | % | 39.9 | % | 25.0 | % | 13.9 | % | 29.7 | % | ||||||||||

| Net assets, end of year (000’s) | $ | 133,519 | $ | 379,243 | $ | 691,501 | $ | 856,801 | $ | 1,037,758 | ||||||||||

| (a) | The amounts shown for a share outstanding may not correlate with the Statements of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. |

| (b) | Calculated using average daily shares outstanding. |

| (c) | Total return assumes reinvestment of all distributions and does not reflect a contingent deferred sales charge. |

See Notes to Financial Statements.

28

| Financial Highlights | IVA Funds |

IVA Worldwide Fund — Class I

For a share of each class of beneficial interest outstanding:

| Year Ended September 30, | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Net asset value, beginning of year | $ | 16.92 | $ | 19.05 | $ | 19.04 | $ | 17.28 | $ | 16.90 | ||||||||||

| Increase (decrease) from investment operations:(a) | ||||||||||||||||||||

| Net investment income(b) | 0.10 | 0.23 | 0.13 | 0.08 | 0.13 | |||||||||||||||

| Net realized and unrealized gain (loss) | (0.76 | ) | (0.71 | ) | 0.53 | 1.88 | 1.00 | |||||||||||||

| Increase (decrease) from investment operations | (0.66 | ) | (0.48 | ) | 0.66 | 1.96 | 1.13 | |||||||||||||

| Decrease from distributions: | ||||||||||||||||||||

| Net investment income | (0.25 | ) | (0.20 | ) | (0.08 | ) | — | (0.27 | ) | |||||||||||

| Net realized gain on investments | (0.98 | ) | (1.45 | ) | (0.57 | ) | (0.20 | ) | (0.48 | ) | ||||||||||

| Decrease from distributions | (1.23 | ) | (1.65 | ) | (0.65 | ) | (0.20 | ) | (0.75 | ) | ||||||||||

| Net asset value, end of year | $ | 15.03 | $ | 16.92 | $ | 19.05 | $ | 19.04 | $ | 17.28 | ||||||||||

| Total return(c) | (4.58 | )% | (2.21 | )% | 3.48 | % | 11.46 | % | 6.96 | % | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Operating expenses | 0.93 | % | 0.98 | % | 1.00 | % | 1.00 | % | 1.00 | % | ||||||||||

| Net investment income | 0.61 | % | 1.32 | % | 0.70 | % | 0.47 | % | 0.77 | % | ||||||||||

| Supplemental data: | ||||||||||||||||||||

| Portfolio turnover rate | 48.8 | % | 39.9 | % | 25.0 | % | 13.9 | % | 29.7 | % | ||||||||||

| Net assets, end of year (000’s) | $ | 1,704,248 | $ | 4,499,917 | $ | 6,166,789 | $ | 5,861,001 | $ | 5,651,971 | ||||||||||

| (a) | The amounts shown for a share outstanding may not correlate with the Statements of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. |

| (b) | Calculated using average daily shares outstanding. |

| (c) | Total return assumes reinvestment of all distributions. |

See Notes to Financial Statements.

29

| Financial Highlights | IVA Funds |

IVA International Fund — Class A

For a share of each class of beneficial interest outstanding:

| Year Ended September 30, | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Net asset value, beginning of year | $ | 15.32 | $ | 17.23 | $ | 18.02 | $ | 16.28 | $ | 16.39 | ||||||||||

| Increase (decrease) from investment operations:(a) | ||||||||||||||||||||

| Net investment income(b) | 0.13 | 0.23 | 0.12 | 0.08 | 0.07 | |||||||||||||||

| Net realized and unrealized gain (loss) | (1.10 | ) | (1.05 | ) | (0.30 | ) | 1.86 | 0.86 | ||||||||||||

| Increase (decrease) from investment operations | (0.97 | ) | (0.82 | ) | (0.18 | ) | 1.94 | 0.93 | ||||||||||||

| Decrease from distributions: | ||||||||||||||||||||

| Net investment income | (0.29 | ) | (0.21 | ) | (0.24 | ) | (0.03 | ) | (0.41 | ) | ||||||||||

| Net realized gain on investments | (0.31 | ) | (0.88 | ) | (0.37 | ) | (0.17 | ) | (0.63 | ) | ||||||||||

| Decrease from distributions | (0.60 | ) | (1.09 | ) | (0.61 | ) | (0.20 | ) | (1.04 | ) | ||||||||||

| Net asset value, end of year | $ | 13.75 | $ | 15.32 | $ | 17.23 | $ | 18.02 | $ | 16.28 | ||||||||||

| Total return(c) | (6.82 | )% | (4.51 | )% | (1.07 | )% | 12.09 | % | 5.93 | % | ||||||||||

| Ratios to average net assets: | ||||||||||||||||||||

| Operating expenses | 1.19 | % | 1.23 | % | 1.25 | % | 1.25 | % | 1.24 | % | ||||||||||

| Net investment income | 0.90 | % | 1.45 | % | 0.67 | % | 0.48 | % | 0.41 | % | ||||||||||

| Supplemental data: | ||||||||||||||||||||

| Portfolio turnover rate | 27.7 | % | 25.3 | % | 19.4 | % | 22.7 | % | 34.9 | % | ||||||||||

| Net assets, end of year (000’s) | $ | 52,671 | $ | 133,269 | $ | 181,209 | $ | 269,160 | $ | 282,567 | ||||||||||

| (a) | The amounts shown for a share outstanding may not correlate with the Statements of Operations for the period due to the timing of sales and repurchases of fund shares in relation to income earned and/or gains (losses) both realized and unrealized during the period. |

| (b) | Calculated using average daily shares outstanding. |

| (c) | Total return assumes reinvestment of all distributions and does not reflect an initial sales charge. |

See Notes to Financial Statements.

30

| Financial Highlights | IVA Funds |

IVA International Fund — Class C

For a share of each class of beneficial interest outstanding:

| Year Ended September 30, | ||||||||||||||||||||

| 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||

| Net asset value, beginning of year | $ | 14.97 | $ | 16.85 | $ | 17.64 | $ | 16.03 | $ | 16.14 | ||||||||||

| Increase (decrease) from investment operations:(a) | ||||||||||||||||||||

| Net investment income (loss)(b) | 0.02 | 0.09 | (0.01 | ) | (0.05 | ) | (0.03 | ) | ||||||||||||

| Net realized and unrealized gain (loss) | (1.08 | ) | (1.00 | ) | (0.30 | ) | 1.83 | 0.83 | ||||||||||||

| Increase (decrease) from investment operations | (1.06 | ) | (0.91 | ) | (0.31 | ) | 1.78 | 0.80 | ||||||||||||