UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

UNITED DEVELOPMENT FUNDING IV

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| | | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: | |

| ¨ | Fee paid previously with preliminary materials: | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

April 27, 2012

Dear Shareholder:

On behalf of our board of trustees, I cordially invite you to attend the 2012 Annual Meeting of Shareholders of United Development Funding IV to be held on Wednesday, June 27, 2012, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051. We look forward to your attendance.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the formal business to be acted upon by our shareholders. A report on the status of our initial public offering and our portfolio of investments will also be presented at the 2012 Annual Meeting of Shareholders, and our shareholders will have an opportunity to ask questions.

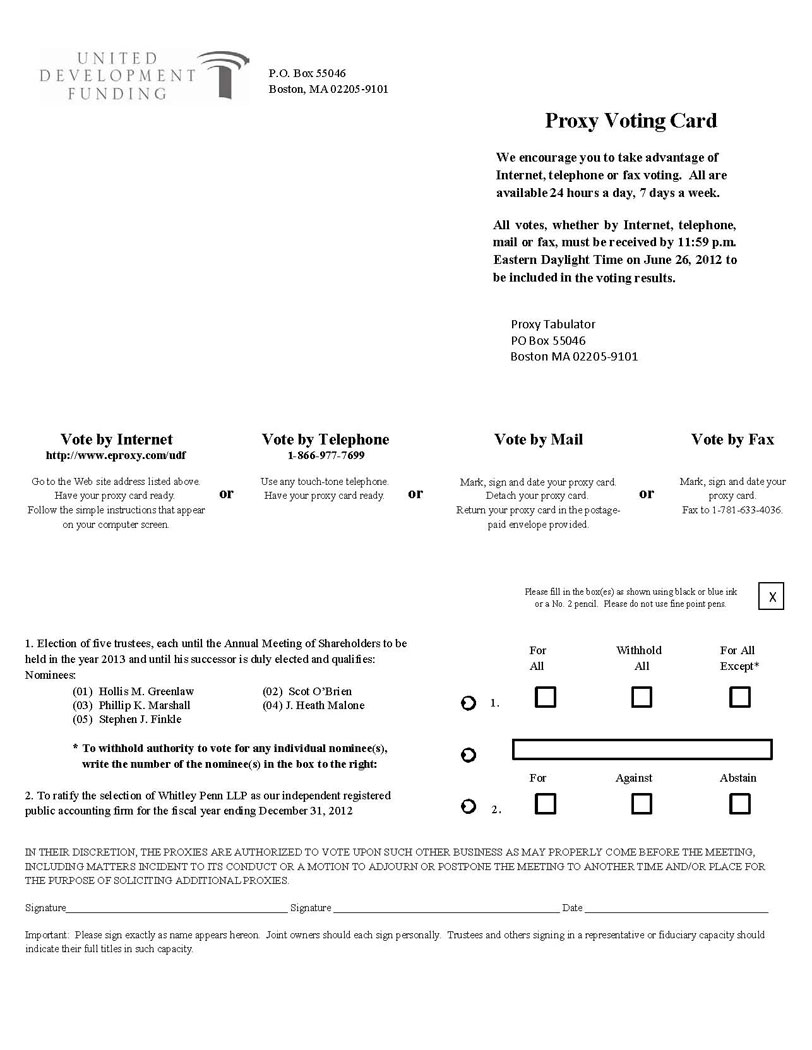

Your vote is very important. Regardless of the number of shares of beneficial interest you own, it is very important that your shares be represented at the 2012 Annual Meeting of Shareholders. ACCORDINGLY, WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE 2012 ANNUAL MEETING OF SHAREHOLDERS IN PERSON, I URGE YOU TO SUBMIT YOUR PROXY AS SOON AS POSSIBLE. You may do this by completing, signing and dating the accompanying proxy card and returning it via fax to 1-781-633-4036 or in the accompanying self-addressed postage-paid return envelope. You also may authorize a proxy via the Internet at http://www.eproxy.com/udf or by telephone by dialing toll-free 1-866-977-7699. Please follow the directions provided in the proxy statement. This will not prevent you from voting in person at the 2012 Annual Meeting of Shareholders, but will assure that your vote will be counted if you are unable to attend the 2012 Annual Meeting of Shareholders.

YOUR VOTE COUNTS. THANK YOU FOR YOUR ATTENTION TO THIS MATTER, AND FOR YOUR CONTINUED SUPPORT OF, AND INTEREST IN, OUR COMPANY.

We appreciate your continued support of United Development Funding IV and encourage you to vote today.

Sincerely,

By Order of the Board of Trustees

Hollis M. Greenlaw

Chief Executive Officer

United Development Funding IV

Notice of Annual meeting of Shareholders

To be held JUNE 27, 2012

To the Shareholders of United Development Funding IV:

You are cordially invited to attend the 2012 Annual Meeting of Shareholders (“Annual Meeting”) of United Development Funding IV, a Maryland real estate investment trust (“Trust”). Notice is hereby given that the Annual Meeting will be held on Wednesday, June 27, 2012, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051, for the following purposes:

| 1. | The election of five trustees to serve until our Annual Meeting of Shareholders to be held in 2013 or until such trustees’ successors are duly elected and qualify; |

| 2. | Ratification of the selection of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2012; and |

| 3. | To transact such other business as may properly come before the Annual Meeting or at any adjournments or postponements thereof. |

A proxy statement describing the matters to be considered at the Annual Meeting is attached to this notice. Only holders of record of our common shares of beneficial interest at the close of business on April 13, 2012 are entitled to notice of and to vote at the meeting or any adjournments or postponements thereof. A list of all shareholders as of April 13, 2012 will be open for inspection at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051 for the ten-day period immediately preceding the Annual Meeting. We reserve the right, in our sole discretion, to adjourn or postpone the Annual Meeting to provide more time to solicit proxies for the meeting.

Your vote is very important even if you own only a small number of shares. You may vote your shares either in person or by proxy. In order to vote in person, you must attend the Annual Meeting. Shareholders may submit their proxy via mail in the pre-addressed envelope provided or via telephone, fax or Internet. For specific instructions on how to vote your shares, please refer to the instructions on the proxy card. Investors with multiple accounts will receive a separate card for each account.

Please feel free to contact our Investor Services team at 1-800-859-9338 if you have any questions or need additional information.

We appreciate your continued support of United Development Funding IV and encourage you to vote today.

By Order of our Board of Trustees

Hollis M. Greenlaw

Chief Executive Officer

Grapevine, Texas

April 27, 2012

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON WEDNESDAY, JUNE 27, 2012.

The proxy statement and annual report to shareholders is available at http://www.eproxy.com/udf.

For directions to the Annual Meeting, please call 1-800-859-9338.

You will need your assigned control number to vote your shares. Your control number can be found on your proxy card.

Please sign and date the accompanying proxy card and return it promptly by fax to 1-781-633-4036 or in the accompanying self-addressed postage-paid return envelope whether or not you plan to attend. You also may authorize a proxy electronically via the Internet at http://www.eproxy.com/udf or by telephone by dialing toll-free 1-866-977-7699. Instructions are included with the proxy card. If you attend the Annual Meeting, you may vote in person if you wish, even if you previously have returned your proxy card or authorized a proxy electronically. You may revoke your proxy at any time prior to its exercise.

UNITED DEVELOPMENT FUNDING IV

1301 Municipal Way, Suite 100

Grapevine, Texas 76051

Proxy Statement

Annual Meeting of shareholders

To Be Held JUNE 27, 2012

We are providing these proxy materials in connection with the solicitation by the board of trustees of United Development Funding IV (“UDF IV,” the “Trust,” “we,” “our,” or “us”), a Maryland real estate investment trust, of proxies for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held Wednesday, June 27, 2012, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051, and at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting. We reserve the right, in our sole discretion, to adjourn the Annual Meeting to provide more time to solicit proxies for the meeting.

This proxy statement, form of proxy and voting instructions are first being mailed or given to shareholders on or about May 9, 2012.

Shareholders Entitled to Vote

Holders of our common shares of beneficial interest at the close of business on April 13, 2012 (the “Record Date”) are entitled to receive this notice and to vote their shares at the Annual Meeting. As of the Record Date, there were 9,271,315 common shares of beneficial interest outstanding. Each share is entitled to one vote on each matter properly brought before the Annual Meeting.

QUESTIONS AND ANSWERS

We are providing you with this proxy statement, which contains information about the items to be voted upon at the Annual Meeting. To make this information easier to understand, we have presented some of the information below in a question and answer format.

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our board of trustees is soliciting your proxy to vote your shares of UDF IV at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission, or the SEC, and is designed to assist you in voting.

When is the Annual Meeting and where will it be held?

The Annual Meeting will be held on Wednesday, June 27, 2012, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051.

Who is entitled to vote, and how many shares can vote?

Only shareholders who owned our shares at the close of business on April 13, 2012, the Record Date, are entitled to receive notice of the Annual Meeting and to vote the shares that they held on that date at the Annual Meeting or any adjournments or postponements thereof. As of the close of business on April 13, 2012, there were 9,271,315 shares outstanding. Each share is entitled to one vote on each matter properly brought before the Annual Meeting.

What constitutes a quorum?

If 50% of the common shares of beneficial interest outstanding on the Record Date are present at the Annual Meeting, either in person or by proxy, we will have a quorum at the meeting, permitting the conduct of business at the meeting. Abstentions and broker non-votes will be counted to determine whether a quorum is present. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that matter and has not received voting instructions from the beneficial owner.

What may I vote on?

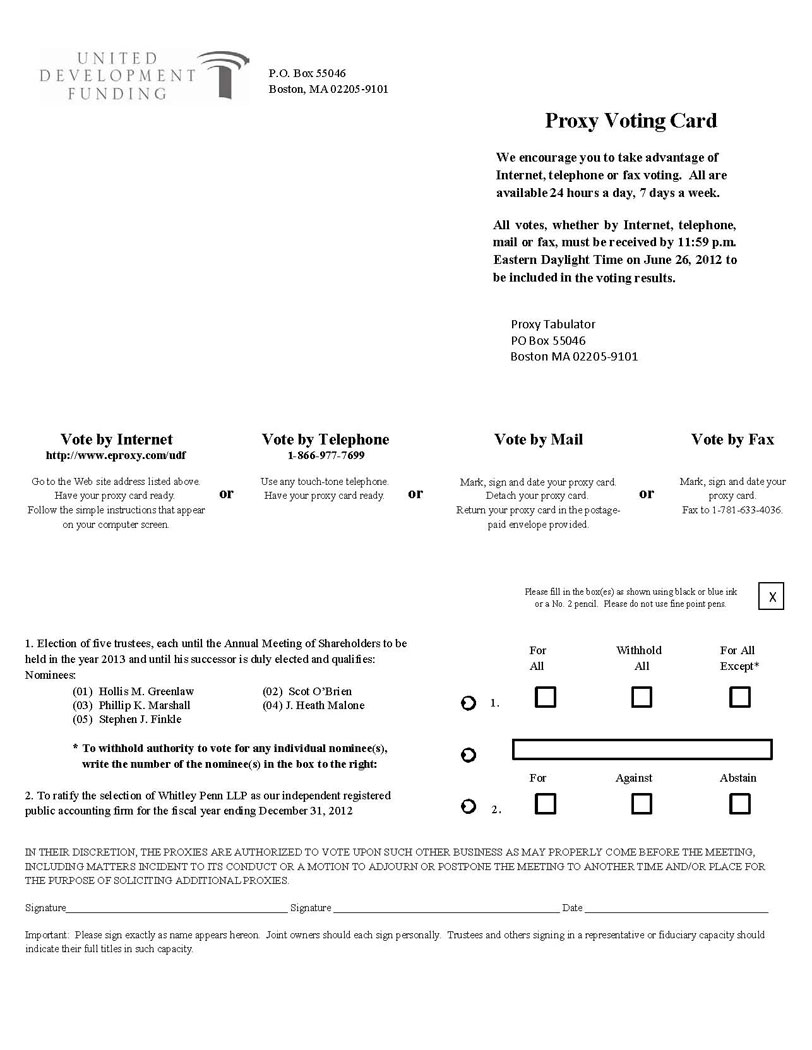

You may vote to: (i) elect five trustees, each to hold office for a one-year term expiring at the 2013 Annual Meeting of Shareholders and until his successor is duly elected and qualifies; (ii) ratify the appointment of Whitley Penn LLP as our independent registered public accounting firm for the year ending December 31, 2012; and (iii) transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

How does the board of trustees recommend I vote on the proposals?

Unless you give other instructions on your proxy card, the individuals named on the card as proxy holders will vote in accordance with the recommendations of our board of trustees. Our board of trustees recommends that you vote your shares “FOR ALL” nominees to our board of trustees and you vote your shares “FOR” the ratification of the appointment of Whitley Penn LLP as our independent registered public accounting firm for the year ending December 31, 2012. No trustee has informed us that he intends to oppose any action intended to be taken by us.

How do I vote?

You may vote your shares either in person or by proxy. In order to vote in person, you must attend the Annual Meeting. Whether or not you plan to attend the meeting and vote in person, we urge you to have your vote recorded by authorizing a proxy and giving the proxy holder permission to vote your shares at the Annual Meeting. The proxy holders who will vote your shares as you instruct are Todd F. Etter and Hollis M. Greenlaw. The proxy holders will vote your shares as you instruct, unless you return your signed proxy card, or authorize a proxy by telephone or over the Internet, but do not indicate how you wish to vote. In this case, the proxy holders will vote in accordance with the recommendation of the board of trustees or, in the absence of such a recommendation, in the discretion of the proxy holders.

Shareholders may submit their proxy via mail or fax, using the enclosed proxy card. In addition, shareholders of record may authorize a proxy by following the “Telephone” instructions on the enclosed proxy card. Shareholders of record with Internet access may authorize a proxy by following the “Internet” instructions on the enclosed proxy card. The telephone and Internet voting procedures are designed to authenticate the shareholder’s identity and to allow shareholders to authorize a proxy and confirm that their instructions have been properly recorded. If the telephone or Internet option is available to you, we strongly encourage you to use it because it is faster and less costly. If you attend the Annual Meeting, you may also submit your vote in person, and any previous votes or proxies that you submitted will be superseded by the vote that you cast at the Annual Meeting. The proxy holders will not vote your shares if you do not return the enclosed proxy card or authorize your proxy by telephone or over the Internet. This is why it is important for you to return the proxy card or authorize your proxy by telephone or over the Internet as soon as possible whether or not you plan on attending the meeting in person.

What vote is required to approve each proposal that comes before the Annual Meeting?

To elect the trustee nominees, the affirmative vote of a majority of our common shares present in person or by proxy at a meeting at which a quorum is present must be cast in favor of the proposal. To ratify the appointment of Whitley Penn LLP, the affirmative vote of a majority of all votes cast at a meeting at which a quorum is present must be cast in favor of the proposal. Abstentions and broker non-votes will count as votes against the proposal to elect the trustee nominees but will have no impact on the proposal to ratify the appointment of Whitley Penn LLP.

Will my vote make a difference?

Yes. Your vote is needed to ensure that the proposals can be acted upon. YOUR VOTE IS VERY IMPORTANT EVEN IF YOU OWN ONLY A SMALL NUMBER OF SHARES! Your immediate response will help avoid potential delays and may save us significant additional expense associated with soliciting shareholder votes. We encourage you to participate in the governance of UDF IV and welcome your attendance at the Annual Meeting.

What if I return my proxy card and then change my mind?

You have the right to revoke your proxy at any time before the vote by:

| · | providing written notice of such revocation to Donna Lawson, at the Trust’s corporate address; |

| · | properly signing and submitting a new proxy card with a later date; |

| · | authorizing a new proxy by telephone or Internet (your latest telephone or Internet proxy is counted); or |

| · | attending and voting your shares in person at the Annual Meeting. Attending the Annual Meeting will not revoke your proxy unless you specifically request it. |

If you hold your shares in “street name,” you will need to contact the institution that holds your shares and follow its instructions for revoking a proxy.

How will voting on any other business be conducted?

Other than the matters described in this proxy statement, we do not expect any additional matters to be presented for a vote at the Annual Meeting. If any other business is properly presented at the Annual Meeting and you are authorizing a proxy, your proxy grants Todd F. Etter and Hollis M. Greenlaw, as proxy holders, the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

Who pays the cost of this proxy solicitation?

The costs of proxy solicitation will be borne by us. We have hired DST Systems to assist us in the distribution of proxy materials and solicitation of votes described above. We will pay DST Systems a fee of $2,500 plus customary costs and expenses for these services. In addition, we expect to pay DST Systems, our transfer agent, approximately $4,500 for communication with our shareholders prior to the Annual Meeting and solicitation of proxies by telephone. In addition to the mailing of these proxy materials, the solicitation of proxies may be made in person, by telephone or by electronic communication by our trustees and officers who will not receive any additional compensation for such solicitation activities. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy solicitation materials to our shareholders.

Who should I call if I have any questions?

If you have any questions about how to submit your proxy, or if you need additional copies of this proxy statement or the enclosed proxy card or voting instructions, you should contact:

Investor Services

1301 Municipal Way, Suite 100

Grapevine, TX 76051

1-800-859-9338

PROPOSAL 1 – ELECTION OF TRUSTEES

Our declaration of trust and bylaws provide that the number of our trustees may be established by a majority of the entire board of trustees. We currently have five trustees, three of whom are independent trustees under the definition of independence set forth in our declaration of trust and the independence tests provided in the New York Stock Exchange Listed Company Manual. An “independent trustee” is a person who is not one of our officers or employees or an officer or employee of our advisor or its affiliates and has not otherwise been affiliated with such entities for the previous two years.

A total of five trustees are scheduled to be elected at the Annual Meeting to serve for a one-year term ending on the date of the 2013 Annual Meeting of Shareholders and until their successors are duly elected and qualify. The nominees for members of our board of trustees are set forth below. Unless authorization is withheld, the persons named as proxies will voteFOR ALL nominees for trustees listed below unless otherwise specified by the shareholder. Each of the nominees has consented to being named as a nominee in this proxy statement and has agreed that, if elected, he will serve on our board of trustees for a one-year term ending on the date of the 2013 Annual Meeting of Shareholders and until their successors are duly elected and qualify. In the event any nominee is unable or declines to serve as a trustee at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present board of trustees to fill the vacancy. In the event that additional persons are nominated for election as trustees, the proxy holders intend to vote all proxies received by them for the nominees listed below and against any other nominees. As of the date of this proxy statement, our board of trustees is not aware of any nominee who is unable or will decline to serve as trustee. All of the nominees listed below already are serving as our trustees and constitute all of our current trustees. We are not aware of any family relationship among any of the nominees to become trustees or executive officers of the Trust. Each of the nominees for election as trustee has stated that there is no arrangement or understanding of any kind between him and any other person relating to his election as a trustee, except that such nominees agreed to serve as our trustees if elected.

The election to our board of trustees of each of the five nominees identified in this proxy statement will require the affirmative vote of a majority of the common shares of beneficial interest present in person or by proxy at a meeting at which a quorum is present.

OUR BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR ALL” NOMINEES IDENTIFIED BELOW.

Nominees to Board of Trustees

The names and ages (as of December 31, 2011) of the persons nominated for election as our trustees are set forth below:

| Name | | Age | | Offices Held |

| | | | | |

| Hollis M. Greenlaw | | 47 | | Chief Executive Officer and Chairman of the Board of Trustees |

| Scot O’Brien | | 52 | | Trustee |

| Phillip K. Marshall | | 62 | | Independent Trustee |

| J. Heath Malone | | 45 | | Independent Trustee |

| Steven J. Finkle | | 62 | | Independent Trustee |

Director Qualifications

We believe our board of trustees should encompass a diverse range of talent, skill and expertise sufficient to provide sound and prudent guidance with respect to our operations and interests. Each trustee also is expected to: exhibit high standards of integrity, commitment and independence of thought and judgment; use his or her skills and experiences to provide independent oversight to our business; participate in a constructive and collegial manner; be willing to devote sufficient time to carrying out their duties and responsibilities effectively; devote the time and effort necessary to learn our business and our board of trustees; and represent the long-term interests of all shareholders. We have determined that our board of trustees as a whole must have the right mix of characteristics and skills for the optimal functioning of the board in its oversight of the company. We believe our board of trustees should be comprised of persons with skills in areas such as: finance; real estate; strategic planning; leadership of business organizations; and legal matters. In addition to the targeted skill areas, our board of trustees looks for a strong record of achievement in key knowledge areas that it believes are critical for trustees to add value to the board, including:

| · | Strategy — knowledge of our business model, the formulation of business strategies, knowledge of key competitors and markets; |

| · | Leadership — skills in coaching and working with senior executives and the ability to assist the Chief Executive Officer; |

| · | Relationships — understanding how to interact with investors, accountants, attorneys, analysts and markets in which we operate; and |

| · | Functional — understanding of finance matters, financial statements and auditing procedures, technical expertise, legal issues, information technology and marketing. |

Business Experience of Nominees

The following is a summary of the business experience of the nominees for election as our trustees.

Hollis M. Greenlaw.Mr. Greenlaw has served as our Chief Executive Officer and Chairman of our board of trustees since our formation in May 2008. Mr. Greenlaw also has served as Chief Executive Officer of UMTH Land Development, L.P. (“UMTH LD”), our asset manager, since March 2003 and served as its President from March 2003 until July 2011. He also has served as partner, Vice Chairman and Chief Executive Officer of UMT Holdings, L.P. (“UMTH”) and as President, Chief Executive Officer and a director of UMT Services, Inc. (“UMT Services”) since March 2003. Mr. Greenlaw is also the co-founder of United Development Funding, L.P. (“UDF I”) and United Development Funding II, L.P. (“UDF II”), each a Delaware limited partnership, and United Development Funding III, L.P. (“UDF III”), a publicly registered Delaware limited partnership. UDF I, UDF II and UDF III are affiliated real estate finance companies that provide custom financing and make opportunistic purchases of land for residential lot development and home construction. Mr. Greenlaw has directed the funding of more than $1 billion in loans and equity investments through United Development Funding products, receiving more than $600 million in repayments to date, most notably through UDF III. From March 1997 until June 2003, Mr. Greenlaw served as Chairman, President, and Chief Executive Officer of a multi-family real estate development and management company owned primarily by The Hartnett Group, Ltd., a closely-held private investment company managing more than $40 million in assets. There he developed seven multi-family communities in Arizona, Texas, and Louisiana with a portfolio value exceeding $80 million. Prior to joining The Hartnett Group, Mr. Greenlaw was an attorney with the Washington, D.C. law firm, Williams & Connolly, where he practiced business and tax law. Mr. Greenlaw was a member of Phi Beta Kappa at Bowdoin College and received his Juris Doctorate from the Columbia University School of Law in 1990. Mr. Greenlaw is a member of the Maine, District of Columbia, and Texas bars. Our board of trustees selected Mr. Greenlaw to serve as a trustee because he is our Chief Executive Officer and has served in various executive roles with our sponsor or its affiliates since 2003. He has expansive knowledge of the public homebuilding and real estate industries, and has relationships with chief executives and other senior management at a multitude of real estate companies. His demonstrated leadership skills, business expertise and extensive REIT executive experience provide him with the skills and qualifications to serve as a trustee.

Scot W. O’Brien. Mr. O’Brien has served as a member of our board of trustees since August 2008. He is a shareholder in the law firm of Hallett & Perrin, P.C., has over 24 years of experience in real estate transactions, bank and other institutional financings, mergers and acquisitions, private placements, tax planning (including providing tax advice in conjunction with the formation and operation of real estate investment trusts), and general corporate matters and has a peer review rating of AV by Martindale-Hubbell. In his capacity with Hallett & Perrin, Mr. O’Brien provides legal services to UMTH General Services, LP (“UMTH GS” or our “Advisor”), our asset manager and affiliates of our Advisor and our asset manager. He has advised United Mortgage Trust (“UMT”), a real estate investment trust that is affiliated with our Advisor that invests exclusively in: (i) first lien secured mortgage loans for the acquisition and renovation of single-family homes, (ii) lines of credit and secured loans for the acquisition and development of single-family home lots, (iii) lines of credit and loans secured by developed single-family lots, and (iv) lines of credit and loans secured by completed model homes; formerly, UMT invested in: (i) first lien secured construction loans for the acquisition of lots and construction of single-family homes and (ii) first lien, fixed rate mortgages secured by single-family residential property). He has also advised UMTH and UDF I since 2003 and has advised UDF III since its initial public offering, which commenced in May 2006 and terminated in April 2009. Mr. O’Brien oversaw the structure and formation of United Development Funding Land Opportunity Fund, L.P., an affiliated Delaware limited partnership (“UDF LOF”). He is responsible for the direction and structure of the United Development Funding lending transactions. Mr. O’Brien also represents numerous real estate-related funds. As a regular part of his practice, Mr. O’Brien analyzes, structures, negotiates and closes numerous acquisitions and dispositions of real estate and real estate-related investments, including improved and unimproved real estate and loans secured by real estate. Mr. O’Brien has also structured and negotiated the financing, development and construction terms for numerous real estate development projects, including lot developments, hotels, medical office buildings, apartment complexes and shopping centers. He joined Hallett & Perrin in April 1996. Prior to joining Hallett & Perrin, Mr. O’Brien was an associate (1985-1992) and a shareholder (1993-1996) in the law firm of Winstead, P.C. (f/k/a Winstead, Sechrest & Minick). Mr. O’Brien received a Bachelor of Business Administration from the University of Notre Dame in 1982. He received a Juris Doctorate with honors from St. Mary’s University in 1985, and an L.L.M. (Taxation) from Southern Methodist University in 1988. Mr. O’Brien is a member of the State Bar of Texas. Our board of trustees selected Mr. O’Brien to serve as a trustee due to his legal expertise, particularly in the real estate industry. He has provided counsel to our sponsor and its affiliates for the past five years.

Phillip K. Marshall. Mr. Marshall has served as one of our independent trustees since August 2008. Since September 2006, Mr. Marshall has served as an independent trustee of UMT. As a trustee of UMT, Mr. Marshall participates in the monthly review and approval of real estate investments made and managed by such entity, and also participates annually in the review and restatement of UMT’s investment policies. Mr. Marshall also currently chairs the UMT audit committee and serves on the financial reporting and liquidity committees. From May 2007 to the present, Mr. Marshall has served as Chief Financial Officer of Rick’s Cabaret International, Inc., a publicly traded restaurant and entertainment company. From February 2007 to May 2007, he served as Controller of Dorado Exploration, Inc., a privately held oil and gas company. From July 2003 to January 2007, he served as Chief Financial Officer of CDT Systems, Inc., a publicly held company that was located in Addison, Texas and was engaged in water technology. From 2001 to 2003, he was a principal of Whitley Penn LLP, independent certified public accountants. From 1992 to 2001, Mr. Marshall served as Director of Audit Services at Jackson & Rhodes PC, where he consulted in the structure and formation of UMT in 1996, including developing the criteria necessary to determine the type of assets suitable for acquisition by UMT pursuant to its desire to qualify as a real estate investment trust. While at Jackson and Rhodes PC and subsequently with Whitley Penn LLP, Mr. Marshall served as the audit partner for UMT. From 1991 to 1992, Mr. Marshall served as an audit partner at Toombs, Hall and Foster; from 1987 to 1991, he served as an audit partner for KPMG Peat Marwick (“KPMG”); and from 1980 to 1987, he served as audit partner for KMG Main Hurdman (“KMG”). As an audit partner for KPMG and KMG, Mr. Marshall had extensive experience working with a number of mortgage banking clients and savings and loan institutions involved in residential real estate finance. In his capacity as auditor and audit partner for his mortgage banking clients, Mr. Marshall performed reviews and tests of income recognition and reporting, quality of asset testing (including analysis of real estate appraisals), historical loss reserves and comparison to industry loss reserves. Additionally, Mr. Marshall performed single audit procedures to assess the adequacy of loan servicing services including collections, cash management and reporting procedure testing, and escrow analysis. Mr. Marshall is a Certified Public Accountant in the State of Texas. He received a BBA in Accounting, Texas State University in 1972. Our board of trustees selected Mr. Marshall to serve as a trustee in part due to his financial and accounting expertise, as well as his knowledge of the financial markets in which we operate. Our board of trustees believes that his experience as a partner at a public accounting firm, as well as his previous service on the board of trustees of a real estate investment trust, will bring value to us, particularly in his role as the audit committee chairman and audit committee financial expert.

J. Heath Malone. Mr. Malone has served as one of our independent trustees since August 2008. Mr. Malone is a co-founder and partner of Max Industries, LTD., an Inc. 5,000 company, which does business as Max Furniture. Max Furniture is a designer, importer and on-line retailer of furniture with $15 million in annual revenue. Since 2002, Mr. Malone has served as Chief Financial Officer of Max Furniture, managing all aspects of its operations including financing, accounting, administration, transportation management and warehouse management, and serving as one of the two principal buyers for the company. Previously, Mr. Malone was the Chief Financial Officer of Mericom Corporation from 1998 to 2002. Mericom was engaged in the service and installation of wireless networks throughout the United States. During Mr. Malone’s tenure, Mericom grew from a small regional $5 million firm to a $60 million national company. From 1995 to 1998, Mr. Malone served as the Chief Operating Officer of OmniAmerica Development, a Hicks, Muse, Tate & Furst company in the business of designing and building cell tower networks throughout the United States. Working with a sister company, Specialty Teleconstructors, OmniAmerica Development became the third-largest owner of cellular phone towers in the United States prior to an acquisition by American Tower in 1998. Mr. Malone was the Chief Financial Officer of US Alarm Systems from 1992 to 1995, building that company from a startup to a mid-sized regional alarm firm. From 1989 to 1992, he was employed by Arthur Andersen LLP, an international accounting and consulting firm. At Arthur Andersen, Mr. Malone specialized in manufacturing and retail companies and served on a fraud audit team. Mr. Malone is a Certified Public Accountant and received a Bachelor of Arts degree in accounting from Southern Methodist University in Dallas in 1989. Our board of trustees selected Mr. Malone to serve as a trustee in part due to his financial and accounting expertise, as well as his experience in raising capital through public and private markets. Our board of trustees believes he will bring value to us in his role as an audit committee member, as well as providing an entrepreneurial perspective to our board of trustees.

Steven J. Finkle. Mr. Finkle has served as one of our independent trustees since August 2008. In 1995, Mr. Finkle founded National Brokerage Associates (“NBA”) and currently serves as its President. NBA is a full service insurance brokerage house serving agents in the Washington, D.C. metropolitan area and on a national basis. NBA has a niche in the variable life marketplace and has been involved with designing several variable life insurance products. A full service brokerage firm specializing in life, annuities, long term care, and disability, NBA works with several nationwide broker-dealers, a number of banks and the insurance brokerage community. From 1989 to 1995, Mr. Finkle served as a partner and President of CFG Insurance Services. In 1975, Mr. Finkle became part of the first franchised insurance brokerage operation in the United States when he co-founded MTA Brokerage. From 1972 to 1974, Mr. Finkle served as an assistant manager for the insurance brokerage firm of Johnson & Higgins at the Atlanta, Georgia regional office and later with National Life of Vermont. Mr. Finkle holds Series 7, 24, and 63 securities licenses and serves on the advisory committee for multiple insurance carriers. Mr. Finkle currently serves on the Brokerage Task Force of the Association for Advanced Life Underwriting, a membership organization of over 2,200 of the top producing life insurance agents in the country, and is a partner of Brokerage Resources of America, an affiliation of national insurance brokerage firms. Mr. Finkle also previously served on the boards of directors of the District of Columbia Association of Insurance and Financial Advisors and the National Association of Life Brokerage Agencies, the premier association representing the insurance brokerage community. Mr. Finkle received his B.B.A. degree in Insurance from Georgia State University in 1972 where he was a Kemper Scholar. Our board of trustees selected Mr. Finkle to serve as a trustee due to his strong relationships and his understanding of the financial markets through which we offer our shares for sale. Our board of trustees believes that this experience will bring valuable operational expertise and insight to the board of trustees.

Board Meetings and Director Attendance at Annual Meetings of Shareholders

The board of trustees held 3 regular meetings and acted by unanimous consent 37 times during the fiscal year ended December 31, 2011. Each trustee attended all of the board meetings in 2011. The audit committee met 4 times during 2011, with all committee members attending the meetings. Although we do not have a formal policy regarding attendance by members of our board of trustees at our Annual Meeting of Shareholders, we encourage all of our trustees to attend. All of our trustees attended the 2011 Annual Meeting of Shareholders in person or by conference telephone.

Trustee Independence

We have a five-member board of trustees. Our declaration of trust provides that a majority of the trustees must be “independent trustees.” Two of our directors, Hollis M. Greenlaw and Scot W. O’Brien, are affiliated with us and we do not consider them to be independent trustees. Our three remaining trustees qualify as “independent trustees” as defined in our declaration of trust in compliance with the requirements of the North American Securities Administrators Association’s Statement of Policy Regarding Real Estate Investment Trusts. As defined in our declaration of trust, the term “independent trustee” means a trustee who is not on the date of determination, and within the last two years from the date of determination has not been, directly or indirectly associated with our sponsor or our Advisor by virtue of: (i) ownership of an interest in our sponsor, our Advisor or any of their affiliates, other than in us; (ii) employment by our sponsor, our Advisor or any of their affiliates; (iii) service as an officer or director of our sponsor, our Advisor or any of their affiliates, other than as our trustee or a director or trustee of any other real estate investment trust organized by our sponsor or advised by our Advisor; (iv) performance of services, other than as a trustee for us; (v) service as a director or trustee of more than three real estate investment trusts organized by our sponsor or advised by our Advisor; or (vi) maintenance of a material business or professional relationship with our sponsor, our Advisor or any of their affiliates. A business or professional relationship is considered “material” if the aggregate gross income derived by a trustee from our sponsor, our Advisor and their affiliates (excluding fees for serving as our trustee or another real estate investment trust or real estate program that is organized, advised or managed by our Advisor or its affiliates) exceeds 5% of either the trustee’s annual gross income during either of the last two years or the trustee’s net worth on a fair market value basis. An indirect association with our sponsor or our Advisor shall include circumstances in which a trustee’s spouse, parent, child, sibling, mother- or father-in-law, son- or daughter-in-law or brother- or sister-in-law is or has been associated with our sponsor, our Advisor, any of their affiliates or with us.

While our shares are not listed on the New York Stock Exchange, each of our independent trustees would also qualify as independent under the rules of the New York Stock Exchange.

Board Leadership Structure

Mr. Greenlaw serves as both our Chairman of the Board of Trustees and Chief Executive Officer. Our independent trustees have determined that the most effective leadership structure for us at the present time is for our Chief Executive Officer to also serve as our Chairman of the Board of Trustees. Our independent trustees believe that because our Chief Executive Officer is ultimately responsible for our day-to-day operations and for executing our business strategy, and because our performance is an integral part of the deliberations of our board of trustees, our Chief Executive Officer is the trustee best qualified to act as Chairman of the Board of Trustees. Our board of trustees retains the authority to modify this structure to best address our unique circumstances, and so advance the best interests of all shareholders, as and when appropriate. In addition, although we do not have a lead independent trustee, our board of trustees believes that the current structure is appropriate, as we have no employees and are externally managed by our Advisor, whereby all operations are conducted by our Advisor or its affiliates.

Our board of trustees also believes, for the reasons set forth below, that its existing corporate governance practices achieve independent oversight and management accountability, which is the goal that many seek to achieve by separating the roles of Chairman of the Board of Trustees and Chief Executive Officer. Our governance practices provide for strong independent leadership, independent discussion among trustees and independent evaluation of, and communication with, many members of senior management. These governance practices are reflected in our Code of Business Conduct and Ethics, or our Code of Ethics. Some of the relevant processes and other corporate governance practices include:

| · | A majority of our trustees are independent trustees. Each trustee is an equal participant in decisions made by our full board of trustees. In addition, all matters that relate to our sponsor, our Advisor or any of their affiliates must be approved by a majority of our independent trustees. The audit committee is comprised entirely of independent trustees. |

| · | Each of our trustees is elected annually by the shareholders. |

Board Committees

To date, the board has established one permanent committee, the audit committee. From time to time, our board of trustees may establish other committees it deems appropriate to address specific areas in more depth than may be possible at a full board of directors meeting.

Audit Committee

Our audit committee is composed of Messrs. Marshall, Finkle, and Malone, all independent trustees. Each of our audit committee members would qualify as independent under the New York Stock Exchange’s rules applicable to audit committee members. Our board of trustees has determined that Mr. Marshall, the chairman of the audit committee, qualifies as an “audit committee financial expert,” as defined by SEC regulations, based on the experience described in “– Business Experience of Nominees,” above. The audit committee of the board reports regularly to the full board. The audit committee meets periodically throughout the year, usually in conjunction with regular meetings of the board.

The audit committee, by approval of at least a majority of the members, selects the independent registered public accounting firm to audit our annual financial statements, reviews with the independent registered public accounting firm the plans and results for the audit engagement, approves the audit and non-audit services provided by the independent registered public accounting firm, reviews the independence of the independent registered public accounting firm, considers the range of audit and non-audit fees and reviews the adequacy of our internal controls. Our board of trustees has adopted a charter for the audit committee that sets forth its specific functions and responsibilities. A copy of the audit committee charter is available in the “Legal” section of our website,www.udfonline.com. The audit committee met 4 times during 2011.

Compensation Committee

Our board of trustees believes that it is appropriate for our board of trustees not to have a standing compensation committee based upon the fact that our executive officers do not receive compensation directly from us for services rendered to us. Our independent trustees receive compensation pursuant to the terms described in “– Compensation of Trustees” below and will, from time to time, review, evaluate, and make recommendations to the full board of trustees regarding the compensation of the trustees.

Nominating and Corporate Governance Committee

We do not have a separate nominating and corporate governance committee. We believe that our board of trustees is qualified to perform the functions typically delegated to a nominating and corporate governance committee and that the formation of a separate committee is not necessary at this time. Instead, our full board of trustees performs functions similar to those which might otherwise normally be delegated to such a committee, including, among other things, developing a set of corporate governance principles, adopting a code of ethics, adopting objectives with respect to conflicts of interest, monitoring our compliance with corporate governance requirements of state and federal law, establishing criteria for prospective members of our board of trustees, conducting candidate searches and interviews, overseeing and evaluating our board of trustees and our management, evaluating from time to time the appropriate size and composition of our board of trustees and recommending, as appropriate, increases, decreases and changes to the composition of our board of trustees and formally proposing the slate of trustees to be elected at each annual meeting of our shareholders.

Compensation of Trustees

We pay each of our independent trustees, as well as any trustees who are not also our executive officers or executive officers of our Advisor or its affiliates, an annual retainer of $25,000 per year. In addition, we pay each of our independent trustees, as well as any trustees who are not also our executive officers or executive officers of our Advisor or its affiliates, (i) $2,000 for each board or committee meeting attended in person (the chairman of the audit committee shall receive $3,000 for each audit committee meeting attended in person) and (ii) $250 for each board or committee meeting attended by telephone. In the event that there are multiple meetings in one day, the fees will be limited to $2,000 per day ($3,000 per day payable to the chairman of the audit committee if one of the meetings is of the audit committee).

The following table sets forth a summary of the compensation received by our trustees during the fiscal year ended December 31, 2011:

| Name | | Fees

Earned

or Paid

in Cash | | | Stock

Awards | | | Option

Awards

(1) | | | Non-Equity

Incentive Plan

Compensation

(2) | | | Change in

Pension Value

and Non-

Qualified

Deferred

Compensation

Earnings (3) | | | All Other

Compensation | | | Total | |

| Hollis M. Greenlaw (4) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Scot O’Brien | | $ | 23,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 23,000 | |

| Phillip K. Marshall | | $ | 23,750 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 23,750 | |

| J. Heath Malone | | $ | 23,750 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 23,750 | |

| Steven J. Finkle | | $ | 23,750 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 23,750 | |

| (1) | The Trust does not have a share option plan. | |

| (2) | The Trust does not have an incentive plan. | |

| (3) | The Trust does not have a pension plan. | |

| (4) | Denotes a trustee who is not considered an independent trustee or who is also our executive officer or an executive officer of our Advisor or its affiliates. | |

The Board’s Role in Risk Oversight

The board of trustees oversees our shareholders’ and other stakeholders’ interest in the long-term health and the overall success of the Trust and its financial strength.

The full board of trustees is actively involved in overseeing risk management for the Trust. It does so, in part, through its approval of all investments and all assumptions of debt, as well as its oversight of the Trust’s executive officers and the control it has over our Advisor. In particular, the board of trustees must evaluate the performance of the Advisor and may determine at any time to terminate the Advisor; the board of trustees also re-authorizes the advisory agreement on an annual basis.

In addition, the audit committee reviews risks related to financial reporting. The audit committee meets with our President, our Advisor, and representatives of our independent registered public accounting firm on a quarterly basis to discuss and assess the risks related to our internal controls. The board of trustees discusses material violations of the Trust’s policies brought to its attention on an ad hoc basis, and once per year reviews a summary of the finance-related violations. Material violations of the Trust’s Code of Business Conduct and Ethics and related corporate policies are reported to the board of trustees.

Director Nominations; Qualifications and Diversity

Our board of trustees will consider nominees for our board of trustees recommended by shareholders. Notice of proposed shareholder nominations for trustees must be delivered in accordance with the requirements set forth in our bylaws and SEC Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Nominations must include the full name of the proposed nominee, a brief description of the proposed nominee’s business experience for at least the previous five years and a representation that the nominating shareholder is a beneficial or record owner of our common shares. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a trustee if elected. Nominations should be delivered to: United Development Funding IV, 1301 Municipal Way, Suite 100, Grapevine, Texas 76051, Attention: Donna Lawson.

In considering possible candidates for election as a trustee, our board of trustees is guided by the principle that our trustees should: (i) be an individual of high character and integrity; (ii) be accomplished in his or her respective field, with superior credentials and recognition; (iii) have relevant expertise and experience upon which to be able to offer advice and guidance to management; (iv) have sufficient time available to devote to our affairs; (v) represent the long-term interests of our shareholders as a whole; and (vi) represent a diversity of background and experience. While we do not have a formal diversity policy, we believe that the backgrounds and qualifications of our trustees, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow our board of trustees to fulfill its responsibilities. Applying these criteria, our board of trustees considers candidates for membership on our board of trustees suggested by its members, as well as by our shareholders. Members of our board of trustees annually review our board of trustees’ composition by evaluating whether our board of trustees has the right mix of skills, experience and backgrounds.

Our board of trustees identifies nominees by first evaluating the current members of our board of trustees willing to continue in service. Current members of our board of trustees with skills and experience relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of our board of trustees does not wish to continue in service or if our board of trustees decides not to nominate a member for re-election, our board of trustees will review the desired skills and experience of a new nominee in light of the criteria set forth above.

Our board of trustees will review the qualifications and backgrounds of trustees and nominees (without regard to whether a nominee has been recommended by shareholders), as well as the overall composition of our board of trustees, and recommend the slate of trustees to be nominated for election at the annual meeting of shareholders. We do not currently employ or pay a fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential director nominees.

Code of Business Conduct and Ethics

Our board of trustees has adopted a Code of Business Conduct and Ethics, which contains general guidelines for conducting our business and is designed to help our trustees, officers and employees resolve ethical issues in an increasingly complex business environment. Our Code of Business Conduct and Ethics is applicable to all trustees, officers and employees of the Trust. Our Code of Business Conduct and Ethics can be found in the “Legal” section of our website, www.udfonline.com. If, in the future, we amend, modify or waive a provision in our Code of Ethics, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website.

Communications with the Board of Trustees

We do not have a formal policy for communications with our board of trustees. However, shareholders may communicate with the board of trustees or an individual trustee or group of trustees in person writing to us at:

United Development Funding IV

Board of Trustees

1301 Municipal Way

Suite 100

Grapevine, Texas 76051

All communication sent to our board of trustees will be distributed to each member of our board of trustees, unless otherwise directed in the communication.

Executive Officers

We have provided below certain information about our executive officers. Each of our executive officers has stated that there is no arrangement or understanding of any kind between him or her and any other person relating to their appointment as an executive officer.

Name | | Age* | | Position(s) |

| Hollis M. Greenlaw | | 47 | | Chief Executive Officer and Chairman of the Board of Trustees |

| David A. Hanson | | 48 | | Chief Operating Officer and Chief Accounting Officer |

| Cara D. Obert | | 42 | | Chief Financial Officer and Treasurer |

* As of December 31, 2011.

For more information regarding the background and experience of Mr. Greenlaw, see “– Business Experience of Nominees,” above.

David A. Hanson. Mr. Hanson has served as our Chief Operating Officer and Chief Accounting Officer since May 2008. He has also served as President of UMTH GS, Chief Financial Officer of UMTH, and Chief Financial Officer of UMT Services since June 2007. Mr. Hanson has over 21 years of experience as a financial executive in both private and public accounting positions. From 2006 to 2007, he was a Director of Land Finance for the Central/Eastern Region at Meritage Homes Corporation (“Meritage”), the twelfth largest publicly traded homebuilder. While at Meritage, Mr. Hanson handled all aspects of establishing, financing, administering and monitoring off-balance sheet entities for the Central/Eastern Region. From 2001 to 2006, he was employed with Lennar Corporation, a national homebuilding company, as the Regional Finance Manager and served as acting homebuilding Division President, Regional Controller, and Controller for both homebuilding and land divisions. From 1999 to 2001, Mr. Hanson was the Director, Finance and Administration for One, Inc., a technology consulting firm. From 1996 to 1999, Mr. Hanson was the Vice President, Finance and Accounting for MedicalControl, Inc., a publicly traded managed healthcare company. Prior to 1996, he was employed with Arthur Andersen LLP, an international accounting and consulting firm, for approximately nine years. He graduated from the University of Northern Iowa in 1984 with a Bachelor of Arts degree in Financial Management/Economics and in 1985 with a Bachelor of Arts degree in Accounting. He is a Certified Public Accountant and Certified Management Accountant.

Cara D. Obert. Ms. Obert has served as our Chief Financial Officer and Treasurer since May 2008 and is a partner of UMTH. Ms. Obert served as the Chief Financial Officer for UMTH from March 2004 until August 2006 and served as Controller for UMTH from October 2003 through March 2004. She has served as the Chief Financial Officer of UMTH LD since August 2006. From 1996 to 2003, she was a self-employed consultant, assisting clients, including Fortune 500 companies, in creating and maintaining financial accounting systems. From May 1995 until June 1996, she served as Controller for Value-Added Communications, Inc., a Nasdaq-listed telecommunications company that provided communications systems for the hotel and prison industries. From 1990 to 1993, she was employed with Arthur Andersen LLP, an international accounting and consulting firm. She graduated from Texas Tech University in 1990 with a Bachelor of Arts degree in accounting. She is a Certified Public Accountant.

Duties of Our Executive Officers

The Chairman of the Board of Trustees presides at all meetings of the shareholders, the board of trustees and any committee on which he serves. The Chief Executive Officer is our highest ranking executive officer and, subject to the supervision of the board of trustees, has all authority and power with respect to, and is responsible for, the general management of our business, financial affairs, and day-to-day operations. The Chief Executive Officer oversees the advisory services performed by our Advisor.

The Chief Operating Officer and Chief Accounting Officer and the Chief Financial Officer report to the Chief Executive Officer, and have the authority and power with respect to, and the responsibility for, our accounting, auditing, reporting and financial record-keeping methods and procedures; controls and procedures with respect to the receipt, tracking and disposition of our revenues and expenses; the establishment and maintenance of our depository, checking, savings, investment and other accounts; relations with accountants, financial institutions, lenders, underwriters and analysts; the development and implementation of funds management and short-term investment strategies; the preparation of our financial statements and all of our tax returns and filings; and the supervision and management of all subordinate officers and personnel associated with the foregoing.

The Treasurer has responsibility for the general care and custody of our funds and securities and the keeping of full and accurate accounts of receipts and disbursements in our books. The Treasurer also shall deposit all moneys and other valuable effects in our name and to our credit in such depositories as may be designated by the board of trustees. The Treasurer shall disburse our funds as may be ordered by the board of trustees, taking proper vouchers for such disbursements, and shall render to the Chief Executive Officer and board of trustees, at the regular meetings of the board of trustees or whenever it may so require, an account of all his or her transactions as Treasurer and of our financial condition.

Executive Compensation

We have no employees. Our executive officers are all employees of our Advisor and/or its affiliates, and are compensated by these entities for their services to us. Our day-to-day management is performed by our Advisor and its affiliates. We pay these entities fees and reimburse expenses pursuant to the advisory agreement. We do not currently intend to pay any compensation directly to our executive officers. As a result, we do not have, and our board of trustees has not considered, a compensation policy or program for our executive officers and has not included a Compensation Discussion and Analysis, a Compensation Committee Report or a resolution subject to a shareholder advisory vote to approve the compensation of our executive officers in this proxy statement.

Compensation Committee Interlocks and Insider Participation

Other than Mr. Greenlaw, no member of our board of trustees during the year ended December 31, 2011 has served as an officer, and no member of our board of trustees served as an employee, of the Trust or any of our subsidiaries. We have no standing compensation committee. During the year ended December 31, 2011, none of our executive officers served on the board or on the compensation committee (or other committee performing equivalent functions) of any other entity which had one or more executive officers who served on our board of trustees.

Certain Relationships and Related Transactions

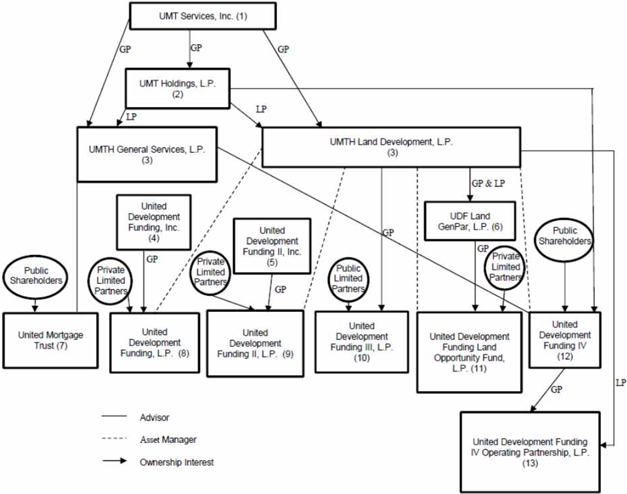

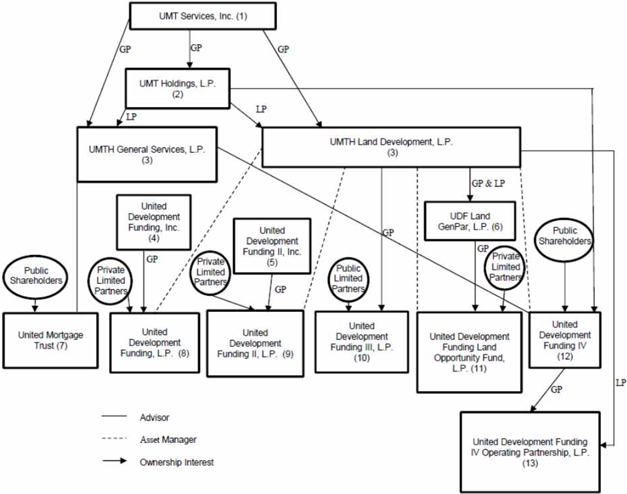

Our executive officers are also executive officers of and hold direct or indirect interests in our Advisor, UMTH GS, or other affiliated entities. In addition, our Advisor and its affiliates act as advisors, asset managers or general partners of other United Development Funding-sponsored programs. The chart below indicates the relationships between our Advisor and its affiliates.

| (1) | Todd F. Etter and Hollis M. Greenlaw each own one-half of the equity interests in UMT Services, Inc. (“UMT Services”). Messrs. Etter and Greenlaw and Michael K. Wilson serve as directors of UMT Services. UMT Services serves as general partner of UMTH GS, our Advisor. |

| (2) | UMT Services serves as the general partner and owns 0.1% of the limited partnership interests in UMTH. The remaining 99.9% of the limited partnership interests in UMTH are held as follows as of December 31, 2011: Mr. Etter (30.00%), Mr. Greenlaw (30.00%), Craig A. Pettit (5.00%), Timothy J. Kopacka (4.84%), Michael K. Wilson (7.41%), Christine A. Griffin (1.95%), Cara D. Obert (4.82%), William E. Lowe (1.06%), Ben L. Wissink (10.09%) and Melissa H. Youngblood (4.83%). |

| (3) | UMT Services serves as the general partner and owns 0.1% of the limited partnership interests in each of UMTH GS and UMTH LD, our asset manager. UMTH owns the remaining 99.9% of the limited partnership interests in each of UMTH GS and UMTH LD. UMTH LD also serves as the asset manager for UDF I and UDF II, each a Delaware limited partnership. In addition, UMTH LD serves as the general partner of UDF III, a publicly registered Delaware limited partnership, and as the general partner and sole limited partner of UDF Land GenPar, LP, a Delaware limited partnership (“UDF LGP”). UDF LGP serves as the general partner of UDF LOF, a Delaware limited partnership. UMTH LD also serves as the asset manager of UDF LOF. |

| (4) | United Development Funding, Inc. is owned 33.75% by each of Messrs. Greenlaw and Etter, 22.5% by Mr. Kopacka, and 10% by Ms. Griffin. |

| (5) | United Development Funding II, Inc. is owned 50% by each of Messrs. Etter and Greenlaw. |

| (6) | UMTH LD owns 100% of the general partnership and limited partnership interests in UDF LGP. |

| (7) | UMTH GS serves as the advisor for UMT, a Maryland real estate investment trust. |

| (8) | United Development Funding, Inc. serves as general partner for UDF I and owns a 0.02% general partnership interest, UMTH LD owns a 49.99% subordinated profits interest, and unaffiliated limited partners own the remaining 49.99% of the interests in UDF I. UDF I is a real estate finance company that engages in the business in which we engage and intend to continue to engage. |

| (9) | United Development Funding II, Inc. serves as general partner for UDF II and owns a 0.1% general partnership interest, UMTH LD owns a 49.95% subordinated profits interest, and unaffiliated limited partners own the remaining 49.95% of the interests in UDF II. UDF II is a real estate finance company that engages in the business in which we engage and intend to continue to engage. |

| (10) | UMTH LD holds a 0.01% general partnership interest in UDF III. Approximately 8,900 limited partners as of December 31, 2011 own 99.99% of the limited partnership units of UDF III. UDF III is a real estate finance company that engages in the business in which we engage and intend to continue to engage. |

| (11) | UDF LGP holds a 0.01% general partnership interest in UDF LOF. UDF LGP also holds a subordinated profit participation interest in UDF LOF. The investors who purchased units in the private offering of UDF LOF own 99.9% of the limited partnership interests. As of December 31, 2011, approximately 590 limited partners held interests in UDF LOF. UDF LOF is a real estate finance company that engages in the business in which we engage and intend to continue to engage. |

| (12) | UMTH owns 10,000 of our shares of beneficial interest as of December 31, 2011. |

| (13) | We own a 99.999% general partnership interest in UDF IV OP. UMTH LD owns a 0.001% limited partnership interest in UDF IV OP. |

Our Advisor and certain of its affiliates receive fees in connection with the acquisition and management of the assets and reimbursement of costs of the Trust.

O&O Reimbursement

Our Advisor or an affiliate of our Advisor funds organization and offering costs on our behalf, and our Advisor is paid by us for such costs in an amount equal to 3% of our gross offering proceeds from the offering of our common shares of beneficial interest (the “O&O Reimbursement”) less any offering costs paid by us directly (except that no organization and offering expenses will be reimbursed with respect to sales under our distribution reinvestment plan). From inception through December 31, 2011, we reimbursed our Advisor approximately $4.3 millionin accordance with the O&O Reimbursement. We have an accrued liability – related parties payable to our Advisor of approximately $7.9million and $7.0 million as of December 31, 2011 and 2010, respectively, for organization and offering costs paid by our Advisor or affiliates related to the offering of our common shares of beneficial interest.

Advisory Fees

Our Advisor receives advisory fees of 2% per annum of the average invested assets (“Advisory Fees”), including secured loan assets; provided, however, that no Advisory Fees will be paid with respect to any asset level indebtedness we incur. The fee will be payable monthly in an amount equal to one-twelfth of 2% of our average invested assets, including secured loan assets, as of the last day of the immediately preceding month. From inception through December 31, 2011, we incurred total Advisory Fees of approximately $2.6 million. We have an accrued liability – related parties payable to our Advisor of approximately $236,000 and $75,000 as of December 31, 2011 and 2010, respectively, for Advisory Fees.

Placement Fees

We incur acquisition and origination fees, payable to UMTH LD, our asset manager, equal to 3% of the net amount available for investment in secured loans and other real estate assets (“Placement Fees”); provided, however, that we will not incur Placement Fees with respect to any asset level indebtedness we incur. The Placement Fees that we incur will be reduced by the amount of any acquisition and origination fees and expenses paid by borrowers or investment entities to our Advisor or affiliates of our Advisor with respect to our investment. We will not incur any Placement Fees with respect to any participation agreement we enter into with our affiliates or any affiliates of our Advisor for which our Advisor or affiliates of our Advisor have previously received acquisition and origination fees and expenses from such affiliate with respect to the same secured loan or other real estate asset. Placement Fees are amortized into expense on a straight line basis over 7 years. The general partner of our Advisor is also the general partner of UMTH LD. From inception through December 31, 2011, we incurred total Placement Fees payable to UMTH LD of approximately $4.6 million. We have an accrued liability – related parties payable to UMTH LD of approximately $834,000 and $773,000 as of December 31, 2011 and 2010, respectively, for Placement Fees.

Debt Financing Fees

Our Advisor receives 1% of the amount made available to us pursuant to the origination of any line of credit or other debt financing, provided that our Advisor has provided a substantial amount of services as determined by our independent trustees and, on each anniversary date of the origination of any such line of credit or other debt financing, an additional fee of 0.25% of the primary loan amount (collectively, “Debt Financing Fees”) will be paid if such line of credit or other debt financing continues to be outstanding on such date, or a prorated portion of such additional fee will be paid for the portion of such year that the financing was outstanding. These Debt Financing Fees are expensed on a straight line basis over the life of the financing arrangement. From inception through December 31, 2011, we incurred total Debt Financing Fees payable to our Advisor of approximately $546,000. As of December 31, 2011, approximately $19,000 is included in accrued liabilities – related parties associated with unpaid Debt Financing Fees. No amount is included in accrued liabilities – related parties associated with unpaid Debt Financing Fees as of December 31, 2010.

Credit Enhancement Fees

We and our wholly-owned subsidiaries will occasionally enter into financing arrangements that require guarantees from entities affiliated with us. These guarantees may require us to pay fees (“Credit Enhancement Fees”) to our affiliated entities as consideration for their guarantees. These Credit Enhancement Fees are either expensed as incurred or prepaid and amortized, based on the terms of the guarantee agreements. From inception through December 31, 2011, we incurred total Credit Enhancement Fees payable to our affiliates of approximately $234,000. We have an accrued liability – related parties payable to our affiliates of approximately $9,000and $16,000 as of December 31, 2011 and 2010, respectively, for Credit Enhancement Fees.

On May 19, 2010, UDF IV Home Finance, LP, our wholly-owned subsidiary (“UDF IV HF”), entered into a $6 million revolving line of credit (the “UDF IV HF CTB LOC”) with Community Trust Bank (“CTB”). In consideration of UDF III guaranteeing the UDF IV HF CTB LOC, UDF IV HF agreed to pay UDF III an annual credit enhancement fee equal to 1% of the line of credit amount. The general partner of our Advisor is also the general partner of UMTH LD, our asset manager. UMTH LD also serves as the asset manager and general partner of UDF III. UDF III has received an opinion from Jackson Claborn, Inc., an independent advisor, that this credit enhancement is fair and at least as reasonable as a credit enhancement with an unaffiliated entity in similar circumstances. As of December 31, 2011, UDF IV HF has agreed to pay total Credit Enhancement Fees of $120,000 to UDF III in consideration for this guarantee.

Effective August 19, 2010, UDF IV Acquisitions, LP, our wholly-owned subsidiary (“UDF IV AC”), obtained a three-year revolving credit facility in the maximum principal amount of $8 million (the “CTB Revolver”) from CTB. In consideration of UDF III guaranteeing the CTB Revolver, UDF IV AC agreed to pay UDF III a monthly credit enhancement fee equal to 1/12th of 1% of the outstanding principal balance of the CTB Revolver at the end of each month. The general partner of our Advisor is also the general partner of UMTH LD, our asset manager. UMTH LD also serves as the asset manager and general partner of UDF III. UDF III has received an opinion from Jackson Claborn, Inc., an independent advisor, that this credit enhancement is fair and at least as reasonable as a credit enhancement with an unaffiliated entity in similar circumstances. As of December 31, 2011, UDF IV AC has agreed to pay total Credit Enhancement Fees of approximately $62,000 to UDF III in consideration for this guarantee.

On December 14, 2010, UDF IV Finance II, LP , our wholly-owned subsidiary (“UDF IV FII”), obtained a revolving credit facility from F&M Bank and Trust Company (“F&M”) in the maximum principal amount of $5 million (the “F&M Note”). In consideration of UDF III guaranteeing the F&M Note, UDF IV FII agreed to pay UDF III a monthly credit enhancement fee equal to 1/12th of 1% of the outstanding principal balance of the F&M Note at the end of each month. The general partner of our Advisor is also the general partner of UMTH LD, our asset manager. UMTH LD also serves as the asset manager and general partner of UDF III. UDF III has received an opinion from Jackson Claborn, Inc., an independent advisor, that this credit enhancement is fair and at least as reasonable as a credit enhancement with an unaffiliated entity in similar circumstances. As of December 31, 2011, UDF IV FII has agreed to pay total Credit Enhancement Fees of approximately $52,000 to UDF III in consideration for this guarantee.

The chart below summarizes the approximate payments to related parties for the years ended December 31, 2011 and 2010:

| | | | For the Year Ended December 31, | |

| Payee | | Purpose | | 2011 | | | 2010 | |

| UMTH GS | | | | | | | | | | | | | | | | | | |

| | O&O Reimbursement | | $ | 2,731,000 | | | | 38 | % | | $ | 1,502,000 | | | | 40 | % |

| | Advisory Fees | | | 1,776,000 | | | | 25 | % | | | 557,000 | | | | 15 | % |

| | Debt Financing Fees | | | 158,000 | | | | 2 | % | | | 318,000 | | | | 8 | % |

| | | | | | | | | | | | | | | | | | | |

| UMTH LD | | | | | | | | | | | | | | | | | | |

| | Placement Fees | | | 2,387,000 | | | | 33 | % | | | 1,319,000 | | | | 35 | % |

| | | | | | | | | | | | | | | | | | | |

| UDF III | | | | | | | | | | | | | | | | | | |

| | Credit Enhancement Fees | | | 161,000 | | | | 2 | % | | | 64,000 | | | | 2 | % |

| Total Payments | | | | $ | 7,213,000 | | | | 100 | % | | $ | 3,760,000 | | | | 100 | % |

The chart below summarizes the approximate expenses associated with related parties for the years ended December 31, 2011 and 2010:

| | | For the Year Ended December 31, | |

| Purpose | | 2011 | | | 2010 | |

| | | | | | | | | | | | | |

| Advisory Fees | | $ | 1,937,000 | | | | 100 | % | | $ | 629,000 | | | | 100 | % |

| | | | | | | | | | | | | | | | | |

| Total Advisory fee – Related Party | | $ | 1,937,000 | | | | 100 | % | | $ | 629,000 | | | | 100 | % |

| | | | | | | | | | | | | | | | | |

| Amortization of Debt Financing Fees | | $ | 171,000 | | | | 23 | % | | $ | 156,000 | | | | 45 | % |

| | | | | | | | | | | | | | | | | |

| Amortization of Placement Fees | | | 412,000 | | | | 56 | % | | | 124,000 | | | | 36 | % |

| | | | | | | | | | | | | | | | | |

| Credit Enhancement Fees | | | 154,000 | | | | 21 | % | | | 65,000 | | | | 19 | % |

| | | | | | | | | | | | | | | | | |

| Total General and Administrative – Related Parties | | $ | 737,000 | | | | 100 | % | | $ | 345,000 | | | | 100 | % |

Loan Participation Interest – Related Parties

Buffington Participation Agreements

On December 18, 2009, we entered into two participation agreements (collectively, the “Buffington Participation Agreements”) with UMT Home Finance, LP, an affiliated Delaware limited partnership (“UMTHF”), pursuant to which we purchased a participation interest in UMTHF’s construction loans (the “Construction Loans”) to Buffington Texas Classic Homes, LLC, an affiliated Texas limited liability company (“Buffington Classic”), and Buffington Signature Homes, LLC, an affiliated Texas limited liability company (“Buffington Signature,” and collectively with Buffington Classic, “Buff Homes”). Our Advisor also serves as the advisor for UMT, which owns 100% of the interests in UMTHF.

The Construction Loans provide Buff Homes, which is a homebuilding group, with residential interim construction financing for the construction of new homes in the greater Austin, Texas area. The Construction Loans are evidenced by promissory notes, are secured by first lien deeds of trust on the homes financed under the Construction Loans, and are guaranteed by the parent company and the principals of Buff Homes.

On April 9, 2010, we entered into an Agent – Participant Agreement with UMTHF (the “UMTHF Agent Agreement”). In accordance with the UMTHF Agent Agreement, UMTHF will continue to manage and control the Construction Loans and each participant party has appointed UMTHF as its agent to act on its behalf with respect to all aspects of the Construction Loans, provided that, pursuant to the UMTHF Agent Agreement, we retain approval rights in connection with any material decisions pertaining to the administration and services of the loans and, with respect to any material modification to the loans and in the event that the loans become non-performing, we shall have effective control over the remedies relating to the enforcement of the loans, including ultimate control of the foreclosure process.

Pursuant to the Buffington Participation Agreements, we will participate in the Construction Loans by funding the lending obligations of UMTHF under the Construction Loans up to a maximum amount of $3.5 million. The Buffington Participation Agreements give us the right to receive payment from UMTHF of principal and accrued interest relating to amounts funded by us under the Buffington Participation Agreements. The interest rate under the Construction Loans is the lower of 13% or the highest rate allowed by law. Our participation interest is repaid as Buff Homes repays the Construction Loans. For each loan originated to it, Buff Homes is required to pay interest monthly and to repay the principal advanced to it upon the sale of the home or in any event no later than 12 months following the origination of the loan. The Buffington Participation Agreements mature on October 28, 2012.

A majority of our trustees, including a majority of our independent trustees, who are not otherwise interested in this transaction, approved the Buffington Participation Agreements as being fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties.

As of December 31, 2011 and 2010, approximately $7.2 millionand $1.4 million, respectively, is included in loan participation interest – related parties related to the Buffington Participation Agreements. For the years ended December 31, 2011 and 2010, we recognized approximately $415,000 and $427,000, respectively, of interest income related to this participation interest. Approximately $33,000 and $9,000 is included in accrued receivable – related parties as of December 31, 2011 and 2010, respectively, for interest associated with the Buffington Participation Agreements.

UDF III Participation Agreement