UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

UNITED DEVELOPMENT FUNDING IV

(Name of Registrant as Specified In Its Charter)

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: ____________________________________ |

| (2) | Aggregate number of securities to which transaction applies: ____________________________________ |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: __________________________________________ |

| (5) | Total fee paid: _______________________________________________________________________ |

| ¨ | Fee paid previously with preliminary materials: ________________________________________________ |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: _____________________________________________________________ |

| (2) | Form, Schedule or Registration Statement No.: ______________________________________________ |

| (3) | Filing Party: ________________________________________________________________________ |

| (4) | Date Filed: ___________________________________________________________________________ |

May 29, 2014

Dear Shareholder:

On behalf of our board of trustees, I cordially invite you to attend the 2014 Annual Meeting of Shareholders of United Development Funding IV to be held on Friday, July 25, 2014 at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051. We look forward to your attendance.

The accompanying Notice of Annual Meeting of Shareholders and Proxy Statement describe the formal business to be acted upon by our shareholders. A report on our portfolio of investments will also be presented at the 2014 Annual Meeting of Shareholders, and our shareholders will have an opportunity to ask questions.

Your vote is very important. Regardless of the number of shares of beneficial interest you own, it is very important that your shares be represented at the 2014 Annual Meeting of Shareholders. ACCORDINGLY, WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE 2014Annual Meeting OF SHAREHOLDERS IN PERSON, I URGE YOU TO SUBMIT YOUR PROXY AS SOON AS POSSIBLE. You may do this by completing, signing and dating the accompanying proxy card and returning it via fax to 1-781-633-4036 or in the accompanying self-addressed postage-paid return envelope. You also may authorize a proxy via the Internet at http://www.2voteproxy.com/udf or by telephone by dialing toll-free 1-800-830-3542. Please follow the directions provided in the proxy statement. This will not prevent you from voting in person at the 2014 Annual Meeting of Shareholders, but will assure that your vote will be counted if you are unable to attend the 2014 Annual Meeting of Shareholders.

YOUR VOTE COUNTS. THANK YOU FOR YOUR ATTENTION TO THIS MATTER, AND FOR YOUR CONTINUED SUPPORT OF, AND INTEREST IN, OUR COMPANY.

We appreciate your continued support of United Development Funding IV and encourage you to vote today.

Sincerely,

By Order of the Board of Trustees

Hollis M. Greenlaw

Chief Executive Officer

United Development Funding IV

Notice of Annual meeting of Shareholders

To be held JULY 25, 2014

To the Shareholders of United Development Funding IV:

You are cordially invited to attend the 2014 Annual Meeting of Shareholders (“Annual Meeting”) of United Development Funding IV, a Maryland real estate investment trust (“Trust”). Notice is hereby given that the Annual Meeting will be held on Friday, July 25, 2014, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051, for the following purposes:

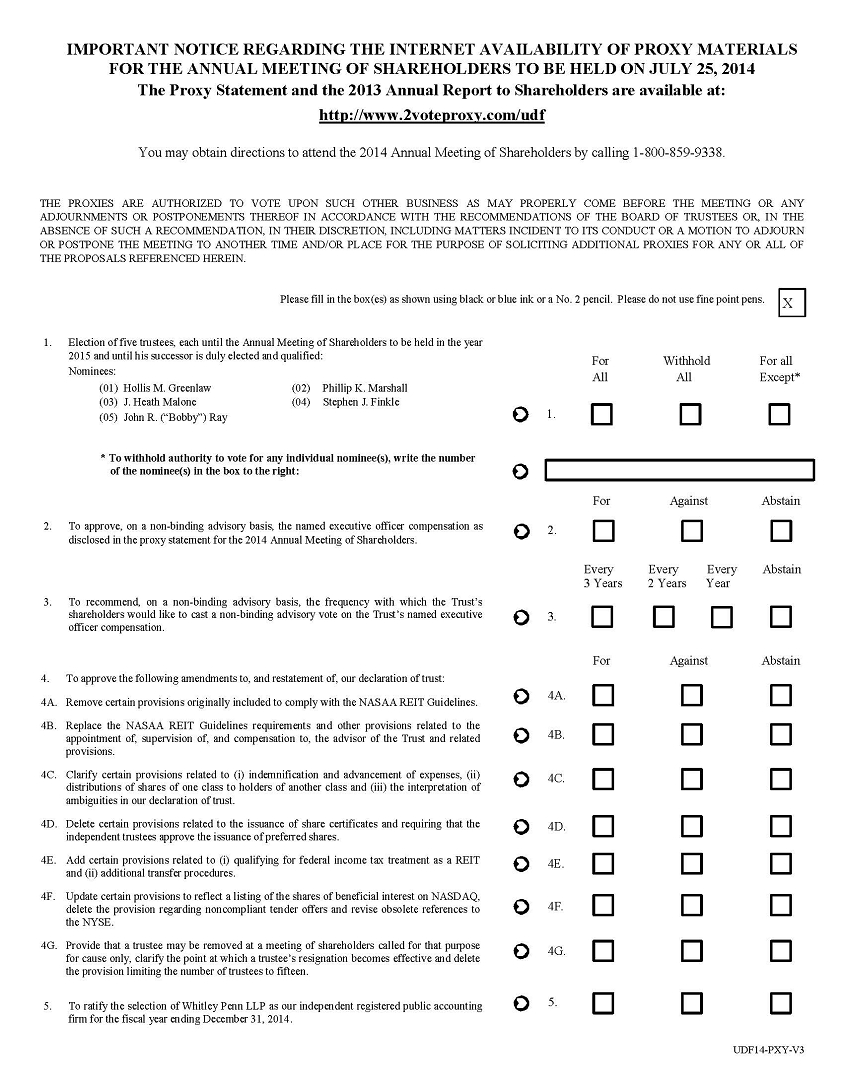

| 1. | The election of five trustees to serve until our Annual Meeting of Shareholders to be held in 2015 or until such trustees’ successors are duly elected and qualify; |

| 2. | Approval, on a non-binding advisory basis, of a resolution approving the compensation of our named executive officer as disclosed pursuant to Item 402 of Regulation S-K; |

| 3. | Approval, on a non-binding advisory basis, of the frequency of a non-binding advisory vote on named executive officer compensation; |

| 4. | Approval of seven proposals to amend and restate our declaration of trust to reflect amendments described in the proxy statement in connection with a listing of our common shares on the NASDAQ Global Select Market (“NASDAQ”), should such a listing occur; |

| 5. | Ratification of the selection of Whitley Penn LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| 6. | To transact such other business as may properly come before the Annual Meeting or at any adjournments or postponements thereof. |

A proxy statement describing the matters to be considered at the Annual Meeting is attached to this notice. Only holders of record of our common shares of beneficial interest at the close of business on May 23, 2014 are entitled to notice of and to vote at the meeting or any adjournments or postponements thereof. A list of all shareholders as of May 23, 2014 will be open for inspection at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051 for the ten-day period immediately preceding the Annual Meeting. We reserve the right, in our sole discretion, to adjourn or postpone the Annual Meeting to provide more time to solicit proxies for the meeting.

Your vote is very important even if you own only a small number of shares. You may vote your shares either in person or by proxy. In order to vote in person, you must attend the Annual Meeting. Shareholders may submit their proxy via mail in the pre-addressed envelope provided or via telephone, fax or Internet. For specific instructions on how to vote your shares, please refer to the instructions on the proxy card. Investors with multiple accounts will receive a separate card for each account.

Please feel free to contact our Investor Services team at 1-800-859-9338 if you have any questions or need additional information.

We appreciate your continued support of United Development Funding IV and encourage you to vote today.

By Order of our Board of Trustees

Hollis M. Greenlaw

Chief Executive Officer

Grapevine, Texas

May 29, 2014

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON FRIDAY, JULY 25, 2014.

The proxy statement and annual report to shareholders is available at http://www.2voteproxy.com/udf.

For directions to the Annual Meeting, please call 1-800-859-9338.

You will need your assigned control number to vote your shares. Your control number can be found on your proxy card.

Please sign and date the accompanying proxy card and return it promptly by fax to 1-781-633-4036 or in the accompanying self-addressed postage-paid return envelope whether or not you plan to attend. You also may authorize a proxy electronically via the Internet at http://www.2voteproxy.com/udf or by telephone by dialing toll-free 1-800-830-3542. Instructions are included with the proxy card. If you attend the Annual Meeting, you may vote in person if you wish, even if you previously have returned your proxy card or authorized a proxy electronically. You may revoke your proxy at any time prior to its exercise.

UNITED DEVELOPMENT FUNDING IV

1301 Municipal Way, Suite 100

Grapevine, Texas 76051

____________________

Proxy Statement

_____________________

Annual Meeting Of Shareholders

To Be Held July 25, 2014

_______________________________

We are providing these proxy materials in connection with the solicitation by the board of trustees of United Development Funding IV (“UDF IV,” the “Trust,” “we,” “our,” or “us”), a Maryland real estate investment trust, of proxies for use at the Annual Meeting of Shareholders (the “Annual Meeting”) to be held Friday, July 25, 2014, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051, and at any adjournments or postponements thereof, for the purposes set forth in the accompanying Notice of Annual Meeting. We reserve the right, in our sole discretion, to adjourn the Annual Meeting to provide more time to solicit proxies for the meeting.

This proxy statement, form of proxy and voting instructions are first being mailed or given to shareholders on or about June 4, 2014.

Shareholders Entitled to Vote

Holders of our common shares of beneficial interest at the close of business on May 23, 2014 (the “Record Date”) are entitled to receive this notice and to vote their shares at the Annual Meeting. As of the Record Date, there were 32,310,459 common shares of beneficial interest outstanding. Each share is entitled to one vote on each matter properly brought before the Annual Meeting.

QUESTIONS AND ANSWERS

We are providing you with this proxy statement, which contains information about the items to be voted upon at the Annual Meeting. To make this information easier to understand, we have presented some of the information below in a question and answer format.

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our board of trustees is soliciting your proxy to vote your shares of UDF IV at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission, or the SEC, and is designed to assist you in voting.

When is the Annual Meeting and where will it be held?

The Annual Meeting will be held on Friday, July 25, 2014, at 10:00 a.m. local time, at the Trust’s executive offices at 1301 Municipal Way, Suite 100, Grapevine, Texas 76051.

Who is entitled to vote, and how many shares can vote?

Only shareholders who owned our shares at the close of business on May 23, 2014, the Record Date, are entitled to receive notice of the Annual Meeting and to vote the shares that they held on that date at the Annual Meeting or any adjournments or postponements thereof. As of the close of business on May 23, 2014, there were 32,310,459 shares outstanding. Each share is entitled to one vote on each matter properly brought before the Annual Meeting.

What constitutes a quorum?

If 50% of the common shares of beneficial interest outstanding on the Record Date are present at the Annual Meeting, either in person or by proxy, we will have a quorum at the meeting, permitting the conduct of business at the meeting. Abstentions and broker non-votes will be counted to determine whether a quorum is present. A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that matter and has not received voting instructions from the beneficial owner.

What may I vote on?

You may vote: (i) to elect five trustees, each to hold office for a one-year term expiring at the 2015 Annual Meeting of Shareholders and until his successor is duly elected and qualifies; (ii) to approve, on a non-binding advisory basis, a resolution approving the compensation of our named executive officer as disclosed pursuant to Item 402 of Regulation S-K; (iii) to approve, on a non-binding advisory basis, the frequency of a non-binding advisory vote on named executive officer compensation; (iv)to approve seven proposals to amend and restate our declaration of trust in connection with a listing of our common shares on NASDAQ, should such a listing occur; (v) to ratify the appointment of Whitley Penn LLP as our independent registered public accounting firm for the year ending December 31, 2014; and (iv) on such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

How does the board of trustees recommend I vote on the proposals?

Unless you give other instructions on your proxy card, the individuals named on the card as proxy holders will vote in accordance with the recommendations of our board of trustees. Our board of trustees recommends that: (i) you vote your shares “FOR ALL” nominees to our board of trustees; (ii) you vote your shares “FOR” the advisory vote to approve the named executive officer compensation as disclosed pursuant to Item 402 of Regulation S-K; (iii) you vote your shares to recommend that an advisory vote to approve, on an advisory basis, named executive officer compensation be held “EVERY THREE YEARS”; (iv) you vote your shares “FOR” each of the seven proposals to amend and restate our declaration of trust; and (v) you vote your shares“FOR” the ratification of the appointment of Whitley Penn LLP as our independent registered public accounting firm for the year ending December 31, 2014. No trustee has informed us that he intends to oppose any action intended to be taken by us.

Why is the board of trustees seeking to amend and restate the declaration of trust?

Our offering terminated on May 13, 2013. As our offering stage has closed, our board of trustees has considered various forms of liquidity, including a listing of our commonshareson NASDAQ. On April 28, 2014, we announced that our board of trustees has decided to list our common shares on NASDAQ. While we cannot assure you if or when a listing of our common shares on NASDAQ will be completed, our board of trustees believes that an amendment and restatement of our declaration of trust would be desirable in connection with a potential listing of our commonshares. Our declaration of trust currently includes certain provisions required by the Statement of Policy Regarding Real Estate Investment Trusts published by the North American Securities Administrators Association, or the NASAA REIT Guidelines, which apply to REITs with shares that are publicly registered with the SEC but are not listed on a national securities exchange. If we become a listed company, it will no longer be necessary for our declaration of trust to include these provisions from the NASAA REIT Guidelines, which are not typically included in the charters of exchange-traded REITs and other companies, including our competitors. In addition to removing those NASAA REIT Guidelines provisions from our declaration of trust that will no longer be necessary upon our listing, we are seeking to update our declaration of trust in other respects to reflect recent developments in public company governance and to more closely reflect listed company standards. We believe operating under our existing declaration of trust as a listed company could restrict our ability to achieve our highest possible value per share, compete effectively for investment opportunities, management talent and attracting and retaining independent trustees.

In addition, we are proposing certain other changes to our declaration of trust to take effect in connection with a potential listing, including the removal of certain provisions governing our relationship with an external advisor and sponsor, certain changes for clarification purposes and other changes to make our declaration of trust consistent with Maryland law, under which we are formed.

We only intend to cause the amendment and restatement of our declaration of trust to become effective in connection with a listing of our common shares of beneficial interest on NASDAQ. If approved by our shareholders and, if our common shares of beneficial interest become listed on NASDAQ, upon the later of such approval by our shareholders or our listing, we would file the amendment and restatement of our declaration of trust in Maryland with the State Department of Assessments and Taxation of Maryland (the “SDAT”), which would be effective upon the acceptance for record of the amendment and restatement of our declaration of trust by the SDAT.

Why is the Trust considering a listing of the commonshares?

With a successful listing on NASDAQ, our shareholders would have greater access to liquidity with the flexibility to sell or retain shares based on public market value. Currently, our shareholders’ options for liquidity are very limited. In addition, as a listed company, we would have the opportunity to better access institutional investors and related capital sources to fund the continued growth of the Trust.

There can be no assurance that we will successfully list our commonshareson NASDAQ or that, if we are successful in listing, an active trading market for our commonshareswould develop and be sustained or that the price at which our commonsharesmay trade in the future would increase.

What would be the consequences of a failure to approve the proposed amendment and restatement of our declaration of trust?

If any of the proposals to amend and restate our declaration of trust is not approved, our board of trustees may determine not to list our common shares of beneficial interest onNASDAQ. We are not, however, prohibited from doing so; and we may consider listing our common shares of beneficial interest onNASDAQ before our shareholders vote on the proposals to amend and restate our declaration of trust, or we may consider listing our common shares of beneficial interest on NASDAQif our board of trustees determines that a listing without the amendment and restatement of our declaration of trust, or with an amendment and restatement of our declaration of trust that does not include certain proposed amendments that were not approved by our shareholders, would be in the best interests of our shareholders. If we were to decide to list our common shares prior to, or without, the amendment and restatement of our declaration of trust, or with an amendment and restatement of our declaration of trust that does not include certain proposed amendments that were not approved by our shareholders, we believe that operating in such manner as a listed entity could restrict our ability to compete effectively for investment opportunities and management talent and to attract and retain independent trustees.

How do I vote?

You may vote your shares either in person or by proxy. In order to vote in person, you must attend the Annual Meeting. Whether or not you plan to attend the meeting and vote in person, we urge you to have your vote recorded by authorizing a proxy and giving the proxy holder permission to vote your shares at the Annual Meeting. The proxy holders who will vote your shares as you instruct are Todd F. Etter and Hollis M. Greenlaw. The proxy holders will vote your shares as you instruct, unless you return your signed proxy card, or authorize a proxy by telephone or over the Internet, but do not indicate how you wish to vote. In this case, the proxy holders will vote in accordance with the recommendation of the board of trustees or, in the absence of such a recommendation, in the discretion of the proxy holders.

Shareholders may submit their proxy via mail or fax, using the enclosed proxy card. In addition, shareholders of record may authorize a proxy by following the “Telephone” instructions on the enclosed proxy card. Shareholders of record with Internet access may authorize a proxy by following the “Internet” instructions on the enclosed proxy card. The telephone and Internet voting procedures are designed to authenticate the shareholder’s identity and to allow shareholders to authorize a proxy and confirm that their instructions have been properly recorded. If the telephone or Internet option is available to you, we strongly encourage you to use it because it is faster and less costly. If you attend the Annual Meeting, you may also submit your vote in person, and any previous votes or proxies that you submitted will be superseded by the vote that you cast at the Annual Meeting. The proxy holders will not vote your shares if you do not return the enclosed proxy card or authorize your proxy by telephone or over the Internet. This is why it is important for you to return the proxy card or authorize your proxy by telephone or over the Internet as soon as possible whether or not you plan on attending the meeting in person.

What vote is required to approve each proposal that comes before the Annual Meeting?

To elect the trustee nominees, the affirmative vote of a majority of our common shares present in person or by proxy at a meeting at which a quorum is present must be cast in favor of the proposal. Abstentions and broker non-votes will count as votes against the proposal to elect the trustee nominees.

The advisory resolutions are non-binding on us and our board of trustees.

With respect to the advisory resolution regarding the compensation of our named executive officer, although this proposal relates to a non-binding, advisory vote, our board of trustees will carefully consider the outcome of the vote. In counting votes on this advisory resolution, abstentions will be counted as votes against the matter and broker non-votes, if any, will not be counted as votes cast and therefore will have no effect. To the extent there are a significant number of negative votes or abstentions on this resolution, we would expect to initiate procedures to better understand the concerns that influenced the resolution. Our board of trustees will consider constructive feedback obtained through this process in making future decisions about named executive officer compensation programs.

With respect to the advisory resolution regarding the frequency of the shareholder vote to solicit support for our named executive officer compensation, because this proposal relates to a non-binding, advisory vote, there is no “required vote” that would constitute approval. Our board of trustees will carefully consider the outcome of the vote when making its decision regarding the frequency of future advisory votes on named executive officer compensation. In counting votes on this advisory resolution, abstentions and broker non-votes are disregarded. However, because this vote is advisory and not binding, our board of trustees may decide that it is in the best interests of us and our shareholders to hold future advisory votes on named executive officer compensation more or less frequently than the alternative that has been selected by our shareholders.

To approve each proposal to amend and restate our declaration of trust, the affirmative vote of a majority of all votes entitled to be cast on each proposal must be cast in favor of each such proposal.Abstentions and broker non-votes will count as votes againsteach proposal to amend and restate our declaration of trust.

To ratify the appointment of Whitley Penn LLP, the affirmative vote of a majority of all votes cast at a meeting at which a quorum is present must be cast in favor of the proposal. Abstentions and broker non-votes will have no impact on the proposal to ratify the appointment of Whitley Penn LLP.

Will my vote make a difference?

Yes. Your vote is needed to ensure that the proposals can be acted upon. YOUR VOTE IS VERY IMPORTANT EVEN IF YOU OWN ONLY A SMALL NUMBER OF SHARES! Your immediate response will help avoid potential delays and may save us significant additional expense associated with soliciting shareholder votes. We encourage you to participate in the governance of UDF IV and welcome your attendance at the Annual Meeting.

What if I return my proxy card and then change my mind?

You have the right to revoke your proxy at any time before the vote by:

| · | providing written notice of such revocation to Donna Lawson, at the Trust’s corporate address; |

| · | properly signing and submitting a new proxy card with a later date; |

| · | authorizing a new proxy by telephone or Internet (your latest telephone or Internet proxy is counted); or |

| · | attending and voting your shares in person at the Annual Meeting. Attending the Annual Meeting will not revoke your proxy unless you specifically request it. |

If you hold your shares in “street name,” you will need to contact the institution that holds your shares and follow its instructions for revoking a proxy.

How will voting on any other business be conducted?

Other than the matters described in this proxy statement, we do not expect any additional matters to be presented for a vote at the Annual Meeting. If any other business is properly presented at the Annual Meeting and you are authorizing a proxy, your proxy grants Todd F. Etter and Hollis M. Greenlaw, as proxy holders, the discretion to vote your shares on any additional matters properly presented for a vote at the Annual Meeting.

Who pays the cost of this proxy solicitation?

The costs of proxy solicitation will be borne by us. We have hired DST Systems to assist us in the distribution of proxy materials and solicitation of votes described above. We will pay DST Systems a fee of $2,500 plus customary costs and expenses for these services. In addition, we expect to pay DST Systems, our transfer agent, approximately $12,000 for communication with our shareholders prior to the Annual Meeting and solicitation of proxies by telephone. In addition to the mailing of these proxy materials, the solicitation of proxies may be made in person, by telephone or by electronic communication by our trustees and officers who will not receive any additional compensation for such solicitation activities. We will also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy solicitation materials to our shareholders.

Who should I call if I have any questions?

If you have any questions about how to submit your proxy, or if you need additional copies of this proxy statement or the enclosed proxy card or voting instructions, you should contact:

Investor Services

1301 Municipal Way, Suite 100

Grapevine, TX 76051

1-800-859-9338

PROPOSAL 1 – ELECTION OF TRUSTEES

Our declaration of trust and bylaws provide that the number of our trustees may be established by a majority of the entire board of trustees. Scot W. O’Brien, who had served as a member of our board of trustees since August 2008, resigned as a member of our board of trustees in April 2014. In connection therewith, our board of trustees has reduced the size of our board from six trustees to five trustees. We currently have five trustees, three of whom are independent trustees under the definition of independence set forth in our declaration of trust and the independence tests provided under the rules of NASDAQ.

A total of five trustees are scheduled to be elected at the Annual Meeting to serve for a one-year term ending on the date of the 2015 Annual Meeting of Shareholders and until their successors are duly elected and qualify. The nominees for members of our board of trustees are set forth below. Unless authorization is withheld, the persons named as proxies will voteFOR ALL nominees for trustees listed below unless otherwise specified by the shareholder. Each of the nominees has consented to being named as a nominee in this proxy statement and has agreed that, if elected, he will serve on our board of trustees for a one-year term ending on the date of the 2015 Annual Meeting of Shareholders and until their successors are duly elected and qualify. In the event any nominee is unable or declines to serve as a trustee at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present board of trustees to fill the vacancy. In the event that additional persons are nominated for election as trustees, the proxy holders intend to vote all proxies received by them for the nominees listed below and against any other nominees. As of the date of this proxy statement, our board of trustees is not aware of any nominee who is unable or will decline to serve as trustee. All of the nominees listed below already are serving as our trustees and constitute all of our current trustees. We are not aware of any family relationship among any of the nominees to become trustees or executive officers of the Trust. Each of the nominees for election as trustee has stated that there is no arrangement or understanding of any kind between him and any other person relating to his election as a trustee, except that such nominees agreed to serve as our trustees if elected.

The election to our board of trustees of each of the five nominees identified in this proxy statement will require the affirmative vote of a majority of the common shares of beneficial interest present in person or by proxy at a meeting at which a quorum is present.

OUR BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “FOR ALL” NOMINEES IDENTIFIED BELOW.

Nominees to Board of Trustees

The names and ages (as of December 31, 2013) of the persons nominated for election as our trustees are set forth below:

| Name | | Age | | Offices Held |

| | | | | |

| Hollis M. Greenlaw | | 49 | | Chief Executive Officer and Chairman of the Board of Trustees |

| Phillip K. Marshall | | 64 | | Independent Trustee |

| J. Heath Malone | | 47 | | Independent Trustee |

| Steven J. Finkle | | 64 | | Independent Trustee |

| John R. (“Bobby”) Ray | | 68 | | Trustee |

Trustee Qualifications

We believe our board of trustees should encompass a diverse range of talent, skill and expertise sufficient to provide sound and prudent guidance with respect to our operations and interests. Each trustee also is expected to: exhibit high standards of integrity, commitment and independence of thought and judgment; use his or her skills and experiences to provide independent oversight to our business; participate in a constructive and collegial manner; be willing to devote sufficient time to carrying out their duties and responsibilities effectively; devote the time and effort necessary to learn our business and our board of trustees; and represent the long-term interests of all shareholders. We have determined that our board of trustees as a whole must have the right mix of characteristics and skills for the optimal functioning of the board in its oversight of the Trust. We believe our board of trustees should be comprised of persons with skills in areas such as: finance; real estate; strategic planning; leadership of business organizations; and legal matters. In addition to the targeted skill areas, our board of trustees looks for a strong record of achievement in key knowledge areas that it believes are critical for trustees to add value to the board, including:

| · | Strategy — knowledge of our business model, the formulation of business strategies, knowledge of key competitors and markets; |

| · | Leadership — skills in coaching and working with senior executives and the ability to assist the Chief Executive Officer; |

| · | Relationships — understanding how to interact with investors, accountants, attorneys, analysts and markets in which we operate; and |

| · | Functional — understanding of finance matters, financial statements and auditing procedures, technical expertise, legal issues, information technology and marketing. |

Business Experience of Nominees

The following is a summary of the business experience of the nominees for election as our trustees.

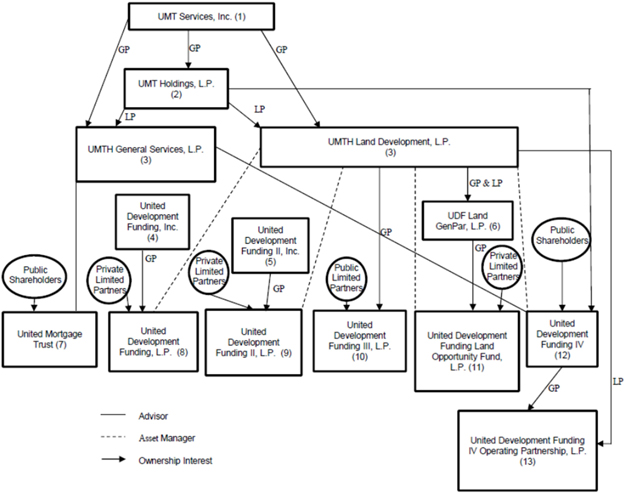

Hollis M. Greenlaw.Mr. Greenlaw has served as our Chief Executive Officer and Chairman of our board of trustees since our formation in May 2008. Mr. Greenlaw also has served as Chief Executive Officer of UMTH Land Development, L.P. (“UMTH LD”), our asset manager, since March 2003 and served as its President from March 2003 until July 2011. He also has served as partner, Vice Chairman and Chief Executive Officer of UMT Holdings, L.P. (“UMTH”) and as President, Chief Executive Officer and a director of UMT Services, Inc. (“UMT Services”) since March 2003. Mr. Greenlaw is also the co-founder of United Development Funding, L.P. (“UDF I”), United Development Funding II, L.P. (“UDF II”), United Development Funding III, L.P. (“UDF III”) and United Development Funding Land Opportunity Fund, L.P. (“UDF LOF”). UDF I, UDF II, UDF III and UDF LOF are affiliated real estate finance companies that provide custom financing, including transactions involving real estate development and construction loans and credit enhancements, and make opportunistic purchases of land for residential lot development and home construction. Mr. Greenlaw has directed the funding of more than $1.5 billion in loans and land banking transactions and over $168 million in equity investments through us and through these other United Development Funding products, receiving more than $686 million in repayments and over $92 million in equity investment distributions to date. From March 1997 until June 2003, Mr. Greenlaw served as Chairman, President and Chief Executive Officer of a multi-family real estate development and management company owned primarily by The Hartnett Group, Ltd., a closely-held private investment company managing more than $40 million in assets. There he developed seven multi-family communities in Arizona, Texas, and Louisiana with a portfolio value exceeding $80 million. Prior to joining The Hartnett Group, Mr. Greenlaw was an attorney with the Washington, D.C. law firm, Williams & Connolly, where he practiced business and tax law. Mr. Greenlaw was a member of Phi Beta Kappa at Bowdoin College and received his Juris Doctorate from the Columbia University School of Law in 1990. Mr. Greenlaw is a member of the Maine, District of Columbia, and Texas bars. Our board of trustees selected Mr. Greenlaw to serve as a trustee because he is our Chief Executive Officer and has served in various executive roles with our sponsor or its affiliates since 2003. He has expansive knowledge of the public homebuilding and real estate industries, and has relationships with chief executives and other senior management at a multitude of real estate companies. His demonstrated leadership skills, business expertise and extensive REIT executive experience provide him with the skills and qualifications to serve as a trustee.

Phillip K. Marshall. Mr. Marshall has served as one of our independent trustees since August 2008 and serves as the chairman of our audit committee. Since September 2006, Mr. Marshall has served as an independent trustee of United Mortgage Trust (“UMT”), a REIT that invests exclusively in: (i) lines of credit and secured loans for the acquisition and development of single-family home lots; (ii) lines of credit and loans secured by developed single-family lots; (iii) lines of credit and loans secured by completed model homes; (iv) loans provided to entities that have recently filed for bankruptcy protection under Chapter 11 of the U.S. bankruptcy code, secured by a priority lien over pre-bankruptcy secured creditors; (v) lines of credit and loans, with terms of 18 months or less, secured by single-family lots and homes constructed thereon; (vi) discounted cash flows secured by assessments levied on real property; and (vii) credit enhancements to real estate developers, homebuilders, land bankers and other real estate investors who acquire real property, subdivide real property into single-family residential lots, acquire finished lots and/or build homes on such lots. As a trustee of UMT, Mr. Marshall participates in the monthly review and approval of real estate investments made and managed by such entities, and also participates annually in the review and restatement of such entities’ investment policies. Mr. Marshall also currently chairs the UMT audit committee and serves on the UMT financial reporting and liquidity committees. From May 2007 to the present, Mr. Marshall has served as Chief Financial Officer of Rick’s Cabaret International, Inc., a publicly traded restaurant and entertainment company. From February 2007 to May 2007, he served as Controller of Dorado Exploration, Inc., a privately held oil and gas company. From July 2003 to January 2007, he served as Chief Financial Officer of CDT Systems, Inc., a publicly held company that was located in Addison, Texas and was engaged in water technology. From 2001 to 2003, he was a principal of Whitley Penn LLP, independent certified public accountants. From 1992 to 2001, Mr. Marshall served as Director of Audit Services at Jackson & Rhodes PC, where he consulted in the structure and formation of UMT in 1996, including developing the criteria necessary to determine the type of assets suitable for acquisition by UMT pursuant to its desire to qualify as a real estate investment trust. While at Jackson & Rhodes PC and subsequently with Whitley Penn LLP, Mr. Marshall served as the audit partner for UMT. From 1991 to 1992, Mr. Marshall served as an audit partner at Toombs, Hall and Foster; from 1987 to 1991, he served as an audit partner for KPMG Peat Marwick (“KPMG”); and from 1980 to 1987, he served as audit partner for KMG Main Hurdman (“KMG”). As an audit partner for KPMG and KMG, Mr. Marshall had extensive experience working with a number of mortgage banking clients and savings and loan institutions involved in residential real estate finance. In his capacity as auditor and audit partner for his mortgage banking clients, Mr. Marshall performed reviews and tests of income recognition and reporting, quality of asset testing (including analysis of real estate appraisals), historical loss reserves and comparison to industry loss reserves. Additionally, Mr. Marshall performed single audit procedures to assess the adequacy of loan servicing services including collections, cash management and reporting procedure testing, and escrow analysis. Mr. Marshall is a Certified Public Accountant in the State of Texas. He received a BBA in Accounting, Texas State University in 1972. Our board of trustees selected Mr. Marshall to serve as a trustee in part due to his financial and accounting expertise, as well as his knowledge of the financial markets in which we operate. Our board of trustees believes that his experience as a partner at a public accounting firm, as well as his previous service on the board of trustees of a real estate investment trust, will bring value to us, particularly in his role as the audit committee chairman and audit committee financial expert.

J. Heath Malone. Mr. Malone has served as one of our independent trustees since August 2008 and serves as the chairman of our nominating and governance committee. Mr. Malone is a co-founder and partner of Max Industries, LTD., an Inc. 5,000 company, which does business as Max Furniture. Max Furniture is a designer, importer and on-line retailer of furniture with $15 million in annual revenue. Since 2002, Mr. Malone has served as Chief Financial Officer of Max Furniture, managing all aspects of its operations including financing, accounting, administration, transportation management and warehouse management, and serving as one of the two principal buyers for the company. Previously, Mr. Malone was the Chief Financial Officer of Mericom Corporation from 1998 to 2002. Mericom was engaged in the service and installation of wireless networks throughout the United States. During Mr. Malone’s tenure, Mericom grew from a small regional $5 million firm to a $60 million national company. From 1995 to 1998, Mr. Malone served as the Chief Operating Officer of OmniAmerica Development, a Hicks, Muse, Tate & Furst company in the business of designing and building cell tower networks throughout the United States. Working with a sister company, Specialty Teleconstructors, OmniAmerica Development became the third-largest owner of cellular phone towers in the United States prior to an acquisition by American Tower in 1998. Mr. Malone was the Chief Financial Officer of US Alarm Systems from 1992 to 1995, building that company from a startup to a mid-sized regional alarm firm. From 1989 to 1992, he was employed by Arthur Andersen LLP, an international accounting and consulting firm. At Arthur Andersen, Mr. Malone specialized in manufacturing and retail companies and served on a fraud audit team. Mr. Malone is a Certified Public Accountant and received a Bachelor of Arts degree in accounting from Southern Methodist University in Dallas in 1989. Our board of trustees selected Mr. Malone to serve as a trustee in part due to his financial and accounting expertise, as well as his experience in raising capital through public and private markets. Our board of trustees believes he will bring value to us in his role as an audit committee member, as well as providing an entrepreneurial perspective to our board of trustees.

Steven J. Finkle. Mr. Finkle has served as one of our independent trustees since August 2008 and serves as the chairman of our compensation committee. In 1995, Mr. Finkle founded National Brokerage Associates (“NBA”) and currently serves as its President. NBA is a full service insurance brokerage house serving agents in the Washington, D.C. metropolitan area and on a national basis. NBA has a niche in the variable life marketplace and has been involved with designing several variable life insurance products. A full service brokerage firm specializing in life, annuities, long term care, and disability, NBA works with several nationwide broker-dealers, a number of banks and the insurance brokerage community. From 1989 to 1995, Mr. Finkle served as a partner and President of CFG Insurance Services. In 1975, Mr. Finkle became part of the first franchised insurance brokerage operation in the United States when he co-founded MTA Brokerage. From 1972 to 1974, Mr. Finkle served as an assistant manager for the insurance brokerage firm of Johnson & Higgins at the Atlanta, Georgia regional office and later with National Life of Vermont. Mr. Finkle holds Series 7, 24, and 63 securities licenses and serves on the advisory committee for multiple insurance carriers. Mr. Finkle currently serves as Chairman of the Brokerage Task Force of the Association for Advanced Life Underwriting, a membership organization of over 2,200 of the top producing life insurance agents in the country, and is a partner of Brokerage Resources of America, an affiliation of national insurance brokerage firms. Mr. Finkle also previously served on the boards of directors of the District of Columbia Association of Insurance and Financial Advisors and the National Association of Life Brokerage Agencies, the premier association representing the insurance brokerage community. Mr. Finkle received his B.B.A. degree in Insurance from Georgia State University in 1972 where he was a Kemper Scholar. Our board of trustees selected Mr. Finkle to serve as a trustee due to his strong relationships and his understanding of the financial and brokerage markets. Our board of trustees believes that this experience will bring valuable operational expertise and insight to the board of trustees.

John R. (“Bobby”) Ray.Mr. Ray has served as one of our trustees since September 2013. From January 2012 through January 2013, Mr. Ray served as the Vice Chairman and Partner at Darling Homes, until the company was acquired by Taylor Morrison Homes, a public homebuilder. From 2003 through 2011, Mr. Ray served as Group President of K. Hovnanian Homes (Texas and Florida), focused on building and designing homes in select locations in Texas and Florida, and was responsible for managing due diligence efforts on homebuilder acquisitions, evaluating and approving land acquisitions and dispositions, evaluating personnel and overseeing all operations. At the peak in 2006, while at K. Hovnanian, Mr. Ray managed approximately 6,000 closings and almost $2 billion in revenues. From 1999 to 2003, Mr. Ray was President of K. Hovnanian Homes (Dallas/Fort Worth). From 1994 to 1999, Mr. Ray was President and Partner of Goodman Family of Builders, L.P., a private homebuilder in the Dallas/Fort Worth area which K. Hovnanian Homes acquired in October 1999. Mr. Ray formerly served as Chairman of the Board of Plano Presbyterian Hospital and currently serves on the Texas Health Resources North Zone board. From 2004 to 2012, Mr. Ray served on the board of Northern Trust Banks of Texas. From 1995 to 2007, Mr. Ray served on the Board of Regents at the University of North Texas and, from 1999 through 2007, he served as its Chairman, a position appointed by the Governor of Texas. Mr. Ray previously served on the board of the Home Builders Association of Greater Dallas and the Texas Association of Builders and as the President and Director of the Collin County Homebuilders Association. Mr. Ray holds a Bachelors of Business Administration from the University of North Texas. Our board of trustees believes that Mr. Ray’s experience as an executive officer in both private and public homebuilding companies, including land development, construction, finance and management, brings value to us as an independent trustee.

Board Meetings and Trustee Attendance at Annual Meetings of Shareholders

The board of trustees held 7 regular meetings and acted by unanimous consent 82 times during the fiscal year ended December 31, 2013. Each trustee attended all of the board meetings during their tenure as a trustee in 2013. The audit committee met 4 times during 2013, with all committee members attending the meetings. Although we do not have a formal policy regarding attendance by members of our board of trustees at our Annual Meeting of Shareholders, we encourage all of our trustees to attend.

Trustee Independence

We have a five-member board of trustees. Our declaration of trust provides that a majority of the trustees must be “independent trustees.” Two of our trustees, Hollis M. Greenlaw and John R. (“Bobby”) Ray, are affiliated with us and we do not consider them to be independent trustees. Our three remaining trustees qualify as “independent trustees” as defined in our declaration of trust in compliance with the requirements of the NASAA REIT Guidelines. As defined in our declaration of trust, the term “independent trustee” means a trustee who is not on the date of determination, and within the last two years from the date of determination has not been, directly or indirectly associated with our sponsor or our advisor by virtue of: (i) ownership of an interest in our sponsor, our advisor or any of their affiliates, other than in us; (ii) employment by our sponsor, our advisor or any of their affiliates; (iii) service as an officer or director of our sponsor, our advisor or any of their affiliates, other than as our trustee or a director or trustee of any other real estate investment trust organized by our sponsor or advised by our advisor; (iv) performance of services, other than as a trustee for us; (v) service as a director or trustee of more than three real estate investment trusts organized by our sponsor or advised by our advisor; or (vi) maintenance of a material business or professional relationship with our sponsor, our advisor or any of their affiliates. A business or professional relationship is considered “material” if the aggregate gross income derived by a trustee from our sponsor, our advisor and their affiliates (excluding fees for serving as our trustee or another real estate investment trust or real estate program that is organized, advised or managed by our advisor or its affiliates) exceeds 5% of either the trustee’s annual gross income during either of the last two years or the trustee’s net worth on a fair market value basis. An indirect association with our sponsor or our advisor shall include circumstances in which a trustee’s spouse, parent, child, sibling, mother- or father-in-law, son- or daughter-in-law or brother- or sister-in-law is or has been associated with our sponsor, our advisor, any of their affiliates or with us.

While our shares are not currently listed on NASDAQ, each of our independent trustees would also qualify as independent under the rules of NASDAQ.

Board Leadership Structure

Mr. Greenlaw serves as both our Chairman of the Board of Trustees and Chief Executive Officer. Our independent trustees have determined that the most effective leadership structure for us at the present time is for our Chief Executive Officer to also serve as our Chairman of the Board of Trustees. Our independent trustees believe that because our Chief Executive Officer is ultimately responsible for our day-to-day operations and for executing our business strategy, and because our performance is an integral part of the deliberations of our board of trustees, our Chief Executive Officer is the trustee best qualified to act as Chairman of the Board of Trustees. Our board of trustees retains the authority to modify this structure to best address our unique circumstances, and so advance the best interests of all shareholders, as and when appropriate. In addition, although we do not have a lead independent trustee, our board of trustees believes that the current structure is appropriate, as we are externally managed by UMTH General Services, LP (“UMTH GS” or our “Advisor”), whereby all operations are conducted by our Advisor or its affiliates.

Our board of trustees also believes, for the reasons set forth below, that its existing corporate governance practices achieve independent oversight and management accountability, which is the goal that many seek to achieve by separating the roles of Chairman of the Board of Trustees and Chief Executive Officer. Our governance practices provide for strong independent leadership, independent discussion among trustees and independent evaluation of, and communication with, many members of senior management. These governance practices are reflected in our Code of Business Conduct and Ethics, or our Code of Ethics. Some of the relevant processes and other corporate governance practices include:

| · | A majority of our trustees are independent trustees. Each trustee is an equal participant in decisions made by our full board of trustees. In addition, all matters that relate to our sponsor, our Advisor or any of their affiliates must be approved by a majority of our independent trustees. The audit committee is comprised entirely of independent trustees. |

| · | Each of our trustees is elected annually by the shareholders. |

Board Committees

As of December 31, 2013, the board of trustees had established an audit committee and a special committee. In April 2014, the board of trustees established a compensation committee and a nominating and governance committee. From time to time, our board of trustees may establish other committees it deems appropriate to address specific areas in more depth than may be possible at a full board of trustees meeting.

Audit Committee

Our audit committee is composed of Messrs. Marshall, Finkle, and Malone, all independent trustees. Each of our audit committee members would qualify as independent under the NASDAQ’s rules applicable to audit committee members. Our board of trustees has determined that Mr. Marshall, the chairman of the audit committee, qualifies as an “audit committee financial expert,” as defined by SEC regulations, based on the experience described in “– Business Experience of Nominees,” above. The audit committee of the board reports regularly to the full board. The audit committee meets periodically throughout the year, usually in conjunction with regular meetings of the board.

The audit committee, by approval of at least a majority of the members, selects the independent registered public accounting firm to audit our annual financial statements, reviews with the independent registered public accounting firm the plans and results for the audit engagement, approves the audit and non-audit services provided by the independent registered public accounting firm, reviews the independence of the independent registered public accounting firm, considers the range of audit and non-audit fees and reviews the adequacy of our internal controls. Our board of trustees has adopted a charter for the audit committee that sets forth its specific functions and responsibilities. A copy of the audit committee charter is available in the “Legal” section of our website, www.udfonline.com. The audit committee met 4 times during 2013.

Compensation Committee

Prior to April 2014, we did not have a separate compensation committee. Our board of trustees believed that it was appropriate for our board of trustees not to have a standing compensation committee prior to April 2014 based upon the fact that our executive officers did not receive compensation directly from us for services rendered to us.

In February 2014, our board of trustees appointed Stacey H. Dwyer as our Chief Operating Officer, and in connection with this appointment, we entered into an employment agreement with Ms. Dwyer. Ms. Dwyer thereby became our only employee and is directly compensated by us. As a result of the direct compensation by the Trust of one of our executive officers, in April 2014, our board of trustees determined that it is in the Trust’s best interests to establish a compensation committee composed of Messrs. Finkle and Marshall, both independent trustees. Mr. Finkle serves as the chairman of the compensation committee. A copy of the compensation committee charter is available in the “Legal” section of our website, www.udfonline.com. The compensation committee will oversee the Trust’s compensation and any employee benefit plans and practices, including any executive compensation plans, incentive-compensation and equity-based plans. The compensation committee also will oversee and review the advisory agreement with our advisor and will oversee any equity plan that may be established by the Trust. With respect to the Trust’s executive compensation plans, the compensation committee’s duties will include, but will not be limited to, reviewing at least annually the goals and objectives of the executive compensation plans; reviewing at least annually the executive compensation plans in light of the Trust’s goals and objectives with respect to such plans; evaluating at least annually the performance of the Trust’s chief executive officer in light of the goals and objectives of the Trust’s executive compensation plans and determining (either as a committee or together with the other independent trustees, as directed by the board of trustees) the chief executive officer’s compensation based on such evaluation; evaluating at least annually the performance of the other executive officers and making recommendations to the board of trustees regarding their compensation; evaluating annually the appropriate level of compensation for independent trustees for service on the board of trustees or committees; and reviewing and approving any severance or termination arrangements. With respect to the Trust’s general compensation and employee benefit plans, the compensation committee’s duties will include, but will not be limited to, reviewing at least annually the goals and objectives of such general compensation plans and other employee benefit plans; reviewing at least annually such general compensation plans and other employee benefit plans in light of the goals and objectives of such plans; reviewing all equity-compensation plans to be submitted for shareholder approval; and reviewing and approving all equity-compensation plans that are exempt from such shareholder approval requirement. The compensation committee also will annually evaluate the performance of our advisor in light of the goals and objectives of the Trust and the terms of the advisory agreement.

The compensation committee may delegate its duties and responsibilities to one or more subcommittees, consisting of at least two members of the compensation committee, as it determines appropriate. In addition, the compensation committee has the authority to retain or obtain the advice of such consultants, outside counsel and other advisors as it determines appropriate to assist it in the full performance of its functions. The compensation committee will be directly responsible for the appointment, compensation and oversight of the work of any consultants, outside counsel and other advisors retained by the compensation committee, and will receive appropriate funding, as determined by the compensation committee, from the Trust for payment of compensation to any such advisors.

Nominating and Governance Committee

Prior to April 2014, we did not have a separate nominating and governance committee. We believed that our board of trustees was qualified to perform the functions typically delegated to a nominating and governance committee and that the formation of a separate committee was not necessary prior to April 2014. Instead, our full board of trustees performed functions similar to those which might otherwise normally be delegated to such a committee, including, among other things, developing a set of corporate governance principles, adopting a code of ethics, adopting objectives with respect to conflicts of interest, monitoring our compliance with corporate governance requirements of state and federal law, establishing criteria for prospective members of our board of trustees, conducting candidate searches and interviews, overseeing and evaluating our board of trustees and our management, evaluating from time to time the appropriate size and composition of our board of trustees and recommending, as appropriate, increases, decreases and changes to the composition of our board of trustees and formally proposing the slate of trustees to be elected at each annual meeting of our shareholders.

In April 2014, our board of trustees established a nominating and governance committee composed of Messrs. Malone, Finkle and Marshall, all independent trustees. Mr. Malone serves as the chairman of the nominating and governance committee. A copy of the nominating and governance committee charter is available in the “Legal” section of our website, www.udfonline.com. The nominating and governance committee will identify and recommend to our board of trustees individuals qualified to serve as trustees of the Trust and on committees of the board of trustees; will advise the board of trustees with respect to the board’s composition, procedures and committees; will develop and recommend to the board of trustees a set of governance principles applicable to the Trust; and will oversee the evaluation of the board of trustees and the Trust’s management. With respect to candidates for our board of trustees, the nominating and governance committee’s duties and responsibilities will include identifying, recruiting and, if appropriate, interviewing candidates to fill positions on the board of trustees, including persons suggested by shareholders or others; establishing procedures to be followed by shareholders in submitting recommendations for board candidates; reviewing the background and qualifications of individuals considered as trustee candidates (including experience, skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors that the nominating and governance committee considers appropriate in the context of the needs of the board of trustees; recommending trustee nominees for election by the shareholders or appointment by the board of trustees; and reviewing the suitability for continued service as a trustee of each member of the board of trustees. The nominating and governance committee may delegate its duties and responsibilities to one or more subcommittees as it determines appropriate. The nominating and governance committee will have the authority to retain such outside counsel, experts, and other advisors as it determines appropriate to assist it in the full performance of its functions, including any search firm used to identify trustee candidates, and to approve the fees and other retention terms of any advisors retained by the nominating and governance committee.

Special Committee

During the fiscal year ended December 31, 2013, our board of trustees established a special committee for the purpose of (a) reviewing, considering, investigating, evaluating and negotiating certain proposed transactions involving the Trust, and (b) determining whether any such proposed transaction is fair to and in the best interests of the Trust and its shareholders (other than any affiliated shareholders). Currently, the special committee is composed of Messrs. Marshall, Finkle, and Malone, all independent trustees.

Compensation of Trustees

We currently pay each of our independent trustees, as well as any trustees who are not also our executive officers or executive officers of our Advisor or its affiliates, an annual retainer of $25,000 per year. In addition, we currently pay each of our independent trustees, as well as any trustees who are not also our executive officers or executive officers of our Advisor or its affiliates, (i) $2,000 for each board or committee meeting attended in person (the chairman of the audit committee shall receive $3,000 for each audit committee meeting attended in person) and (ii) $250 for each board or committee meeting attended by telephone. In the event that there are multiple meetings in one day, the fees will be limited to $2,000 per day ($3,000 per day payable to the chairman of the audit committee if one of the meetings is of the audit committee).

The following table sets forth a summary of the compensation received by our trustees during the fiscal year ended December 31, 2013:

| Name | | Fees

Earned

or Paid

in Cash | | | Stock

Awards | | | Option

Awards

(1) | | | Non-Equity

Incentive Plan

Compensation

(2) | | | Change in

Pension Value

and Non-

Qualified

Deferred

Compensation

Earnings (3) | | | All Other

Compensation | | | Total | |

| Hollis M. Greenlaw (4) | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| Scot W. O’Brien (5) | | $ | 31,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 31,000 | |

| Phillip K. Marshall | | $ | 32,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 32,000 | |

| J. Heath Malone | | $ | 32,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 32,000 | |

| Steven J. Finkle | | $ | 32,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 32,000 | |

| John R. (“Bobby”) Ray (4) | | $ | 8,000 | | | | - | | | | - | | | | - | | | | - | | | | - | | | $ | 8,000 | |

| (1) | The Trust does not have a share option plan. |

| (2) | The Trust does not have an incentive plan. |

| (3) | The Trust does not have a pension plan. |

| (4) | Denotes a trustee who is not considered an independent trustee or who is also our executive officer or an executive officer of our Advisor or its affiliates. |

| (5) | Mr. O’Brien resigned as a member of our board of trustees in April 2014. |

In April 2014, our board of trustees approved revised forms of compensation to be paid to our trustees after a listing of our common shares of beneficial interest onNASDAQ. After such a listing, we will pay each of our trustees an annual retainer of $45,000 per year. In addition, after a listing, we will pay annual retainers of (i) $7,000 to the chairman of the audit committee; (ii) $1,000 to each other member of the audit committee; (iii) $4,000 to the chairman of the compensation committee; (iv) $1,000 to each other member of the compensation committee; (v) $4,000 to the chairman of the nominating and governance committee; and (vi) $1,000 to each other member of the nominating and governance committee. We will also reimburse the trustees for all expenses related to (I) attending meetings of the Board or any committee thereof; (II) property visits; and (III) any other service or activity performed or engaged in as trustees of the Trust.

The Board’s Role in Risk Oversight

The board of trustees oversees our shareholders’ and other stakeholders’ interest in the long-term health and the overall success of the Trust and its financial strength.

The full board of trustees is actively involved in overseeing risk management for the Trust. It does so, in part, through its approval of all investments and all assumptions of debt, as well as its oversight of the Trust’s executive officers and the control it has over our Advisor. In particular, the board of trustees must evaluate the performance of the Advisor and may determine at any time to terminate the Advisor; the board of trustees also re-authorizes the advisory agreement on an annual basis.

In addition, the audit committee reviews risks related to financial reporting. The audit committee meets with our President, our Advisor, and representatives of our independent registered public accounting firm on a quarterly basis to discuss and assess the risks related to our internal controls. The board of trustees discusses material violations of the Trust’s policies brought to its attention on an ad hoc basis, and once per year reviews a summary of the finance-related violations. Material violations of the Trust’s Code of Business Conduct and Ethics and related corporate policies are reported to the board of trustees.

Trustee Nominations; Qualifications and Diversity

Our nominating and governance committee and our board of trustees will consider nominees for our board of trustees recommended by shareholders. Notice of proposed shareholder nominations for trustees must be delivered in accordance with the requirements set forth in our bylaws and SEC Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, or the Exchange Act. Nominations must include the full name of the proposed nominee, a brief description of the proposed nominee’s business experience for at least the previous five years and a representation that the nominating shareholder is a beneficial or record owner of our common shares. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a trustee if elected. Nominations should be delivered to: United Development Funding IV, 1301 Municipal Way, Suite 100, Grapevine, Texas 76051, Attention: Donna Lawson.

In considering possible candidates for election as a trustee, our nominating and governance committee and our board of trustees are guided by the principle that our trustees should: (i) be an individual of high character and integrity; (ii) be accomplished in his or her respective field, with superior credentials and recognition; (iii) have relevant expertise and experience upon which to be able to offer advice and guidance to management; (iv) have sufficient time available to devote to our affairs; (v) represent the long-term interests of our shareholders as a whole; and (vi) represent a diversity of background and experience. While we do not have a formal diversity policy, we believe that the backgrounds and qualifications of our trustees, considered as a group, should provide a significant composite mix of experience, knowledge and abilities that will allow our board of trustees to fulfill its responsibilities. Applying these criteria, our nominating and governance committee and our board of trustees consider candidates for membership on our board of trustees suggested by its members, as well as by our shareholders. Members of our nominating and governance committee and our board of trustees annually review our board of trustees’ composition by evaluating whether our board of trustees has the right mix of skills, experience and backgrounds.

Our nominating and governance committee and our board of trustees identify nominees by first evaluating the current members of our board of trustees willing to continue in service. Current members of our board of trustees with skills and experience relevant to our business and who are willing to continue in service are considered for re-nomination. If any member of our board of trustees does not wish to continue in service or if our nominating and governance committee or our board of trustees decide not to nominate a member for re-election, our nominating and governance committee and our board of trustees will review the desired skills and experience of a new nominee in light of the criteria set forth above.

Our nominating and governance committee and our board of trustees will review the qualifications and backgrounds of trustees and nominees (without regard to whether a nominee has been recommended by shareholders), as well as the overall composition of our board of trustees, and our board of trustees will recommend the slate of trustees to be nominated for election at the annual meeting of shareholders. We do not currently employ or pay a fee to any third party to identify or evaluate, or assist in identifying or evaluating, potential trustee nominees.

Code of Business Conduct and Ethics

Our board of trustees has adopted a Code of Business Conduct and Ethics, which contains general guidelines for conducting our business and is designed to help our trustees, officers and employees resolve ethical issues in an increasingly complex business environment. Our Code of Business Conduct and Ethics is applicable to all trustees, officers and employees of the Trust. Our Code of Business Conduct and Ethics can be found in the “Legal” section of our website, www.udfonline.com. If, in the future, we amend, modify or waive a provision in our Code of Ethics, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website.

Communications with the Board of Trustees

We do not have a formal policy for communications with our board of trustees. However, shareholders may communicate with the board of trustees or an individual trustee or group of trustees by writing to us at:

United Development Funding IV

Board of Trustees

1301 Municipal Way

Suite 100

Grapevine, Texas 76051

All communication sent to our board of trustees will be distributed to each member of our board of trustees, unless otherwise directed in the communication.

Executive Officers

We have provided below certain information about our executive officers. Each of our executive officers has stated that there is no arrangement or understanding of any kind between him or her and any other person relating to their appointment as an executive officer.

| Name | | Age* | | Position(s) |

| Hollis M. Greenlaw | | 49 | | Chief Executive Officer and Chairman of the Board of Trustees |

| Stacey H. Dwyer | | 47 | | Chief Operating Officer |

| David A. Hanson | | 50 | | Chief Accounting Officer |

| Cara D. Obert | | 44 | | Chief Financial Officer and Treasurer |

* As of December 31, 2013.

For more information regarding the background and experience of Mr. Greenlaw, see “– Business Experience of Nominees,” above.

Stacey H. Dwyer. Ms. Dwyer has served as our Chief Operating Officer since February 2014. Ms. Dwyer joined us from D.R. Horton, Inc., the nation’s largest homebuilding company (“D.R. Horton”), where she had served as an Executive Vice President since 2000 and as Treasurer since 2003. In those roles, Ms. Dwyer was primarily responsible for financial community relations, including banks, investors, rating agencies and analysts. Prior to 2000, Ms. Dwyer held various positions at D.R. Horton in accounting, treasury and mergers and acquisitions. From 1989 to 1991, Ms. Dwyer was an auditor with Ernst and Young, LLP. Ms. Dwyer is a Certified Public Accountant and received a B.S. in Accounting from Southeastern Oklahoma State University and an M.S. in Accounting from the University of Texas at Arlington.

David A. Hanson. Mr. Hanson has served as our Chief Accounting Officer since May 2008 and served as our Chief Operating Officer from May 2008 until February 2014. He has also served as President of UMTH GS, Chief Financial Officer of UMTH, and Chief Financial Officer of UMT Services since June 2007. Mr. Hanson has over 23 years of experience as a financial executive in the residential housing industry and as an accountant with an international public accounting firm. From 2006 to 2007, he was a Director of Land Finance for the Central/Eastern Region at Meritage Homes Corporation (“Meritage”), the twelfth largest publicly traded homebuilder. While at Meritage, Mr. Hanson handled all aspects of establishing, financing, administering and monitoring off-balance sheet FIN 46-compliant entities for the Central/Eastern Region. From 2001 to 2006, he was employed with Lennar Corporation, a national homebuilding company, as the Regional Finance Manager and served as acting homebuilding Division President, Regional Controller, and Controller for both homebuilding and land divisions. From 1999 to 2001, Mr. Hanson was the Director, Finance and Administration for One, Inc., a technology consulting firm. From 1996 to 1999, Mr. Hanson was the Vice President, Finance and Accounting for MedicalControl, Inc., a publicly traded managed healthcare company. Prior to 1996, he was employed with Arthur Andersen LLP, an international accounting and consulting firm, for approximately nine years. He graduated from the University of Northern Iowa in 1984 with a Bachelor of Arts degree in Financial Management/Economics and in 1985 with a Bachelor of Arts degree in Accounting. He is a Certified Public Accountant and Certified Management Accountant.

Cara D. Obert. Ms. Obert has served as our Chief Financial Officer and Treasurer since May 2008 and is a partner of UMTH. Ms. Obert served as the Chief Financial Officer for UMTH from March 2004 until August 2006 and served as Controller for UMTH from October 2003 through March 2004. She has served as the Chief Financial Officer of UMTH LD since August 2006. From 1996 to 2003, she was a self-employed consultant, assisting clients, including Fortune 500 companies, in creating and maintaining financial accounting systems. From May 1995 until June 1996, she served as Controller for Value-Added Communications, Inc., a Nasdaq-listed telecommunications company that provided communications systems for the hotel and prison industries. From 1990 to 1993, she was employed with Arthur Andersen LLP, an international accounting and consulting firm. She graduated from Texas Tech University in 1990 with a Bachelor of Arts degree in accounting. She is a Certified Public Accountant.

Duties of Our Executive Officers

The Chairman of the Board of Trustees presides at all meetings of the shareholders, the board of trustees and any committee on which he serves. The Chief Executive Officer is our highest ranking executive officer and, subject to the supervision of the board of trustees, has all authority and power with respect to, and is responsible for, the general management of our business, financial affairs, and day-to-day operations. The Chief Executive Officer oversees the advisory services performed by our Advisor.

The Chief Operating Officer, Chief Accounting Officer and the Chief Financial Officer report to the Chief Executive Officer, and have the authority and power with respect to, and the responsibility for, our accounting, auditing, reporting and financial record-keeping methods and procedures; controls and procedures with respect to the receipt, tracking and disposition of our revenues and expenses; the establishment and maintenance of our depository, checking, savings, investment and other accounts; relations with accountants, financial institutions, lenders, underwriters and analysts; the development and implementation of funds management and short-term investment strategies; the preparation of our financial statements and all of our tax returns and filings; and the supervision and management of all subordinate officers and personnel associated with the foregoing.

The Treasurer has responsibility for the general care and custody of our funds and securities and the keeping of full and accurate accounts of receipts and disbursements in our books. The Treasurer also shall deposit all moneys and other valuable effects in our name and to our credit in such depositories as may be designated by the board of trustees. The Treasurer shall disburse our funds as may be ordered by the board of trustees, taking proper vouchers for such disbursements, and shall render to the Chief Executive Officer and board of trustees, at the regular meetings of the board of trustees or whenever it may so require, an account of all his or her transactions as Treasurer and of our financial condition.

Executive Compensation

As of December 31, 2013, we had no employees. As of December 31, 2013, our executive officers were all employees of our Advisor and/or its affiliates, and were compensated by these entities for their services to us. Our day-to-day management is performed by our Advisor and its affiliates. We pay these entities fees and reimburse expenses pursuant to the advisory agreement. As a result, as of December 31, 2013, we did not have, and our board of trustees had not considered, a compensation policy or program for our executive officers.

On February 3, 2014, our board of trustees appointed Stacey H. Dwyer as our Chief Operating Officer, effective February 17, 2014, and in connection with this appointment, we entered into an employment agreement with Ms. Dwyer effective as of February 17, 2014. Ms. Dwyer thereby became our only employee and is directly compensated by us.

Compensation Discussion and Analysis