Exhibit 10.284

AGREEMENT OF PURCHASE AND SALE

[Domain Site, Garland, TX]

ARTICLE 1. PROPERTY/PURCHASE PRICE; PHASES

1.1 Certain Basic Terms.

| (a) | Purchaser and Notice Address: |

| With a copy to: | |

| ArchCo Residential LLC | Sherman & Howard L.L.C. |

| Attn: Mark Denyer | Attn: Mike Shomo |

| 2801 SE Hampden Road | 633 Seventeenth Street, Suite 3000 |

| Bartlesville, OK 74006 | Denver, CO 80202 |

| Telephone: (918) 397-3760 | Telephone: (303) 299-8256 |

| E-mail:realcap@ionet.net | E-mail:mshomo@shermanhoward.com |

| and to: | |

| ArchCo Residential LLC | |

| Attn: Neil T. Brown | |

| 7 Piedmont Center, Suite 300 | |

| Atlanta, GA 30305 | |

| Telephone: (571) 220-4829 | |

| E-mail:neil@ntbrown.com |

| (b) | Seller and Notice Address: |

| With a copy to: | |

| RCM Firewheel, LLC | Realty Capital Management, LLC |

| Attn: Richard Myers | Attn: Tim Coltart |

| 909 Lake Carolyn Parkway, # 150 | 909 Lake Carolyn Parkway, # 150 |

| Irving, TX 75039 | Irving, TX 75039 |

| Telephone: (469) 533-4100 | Telephone: (469) 533-4100 |

| E-mail:myers@rcpinvestments.com | E-mail:tcoltart@realtycapital.com |

| and to: | |

| Kelly Hart & Hallman, LLP | |

| Attn: J. Andrew Rogers | |

| 201 Main Street, Suite 2500 | |

| Fort Worth, Texas 76102 | |

| Telephone: (817) 878-3546 | |

| E-mail: andy.rogers@kellyhart.com |

| (c) | Title Company and Notice Address: |

| Old Republic National Title Insurance Company | |

| Attn: David Lawrence | |

| 8201 Preston Road, Suite 450 | |

| Dallas, TX 75225 | |

| Telephone: (214) 239-6412 | |

| E-mail: dlawrence@oldrepublictitle.com |

| 1 |

| (d) | Escrow Agent: |

| Old Republic National Title Insurance Company | |

| Attn: David Lawrence | |

| 8201 Preston Road, Suite 450 | |

| Dallas, TX 75225 | |

| Telephone: (214) 239-6412 | |

| E-mail: dlawrence@oldrepublictitle.com |

| (e) | Agreement Date: | The latest date of execution by the Seller or the Purchaser, as indicated on the signature page of this Agreement. |

| (f) | Purchase Price: | (i) With respect to the Phase I Property (defined in Section 1.3), $3,975,000 (the “Phase I Purchase Price”). The Phase I Purchase Price may be increased pursuant to Section 2.4(c)(1). |

| (ii) With respect to the Phase II Property (defined in Section 1.3), $5,075,000 (the “Phase II Purchase Price”). The Phase II Purchase Price may be increased pursuant to Section 2.4(c)(2). | ||

| (iii) With respect to the Phase III Property (defined in Section 1.3), $6,000,000 (the “Phase III Purchase Price”). The Phase III Purchase Price may be increased pursuant to Section 2.4(c)(3). | ||

| (g) | Earnest Money: | Defined in Section 1.4. |

| (h) | Due Diligence Period: | The period ending 75 days after the Agreement Date. |

| (i) | Closing Date: | (i) With respect to the Phase I Property, as designated by the Purchaser upon not less than five days’ prior notice, but no later than the Outside Closing Date for the Phase I Property. The “Outside Closing Date” for the Phase I Property means October 30, 2015. |

| (ii) With respect to the Phase II Property, 30 days after Purchaser delivers its Phase II Option Notice (defined in Section 1.2(c)), but no later than the Outside Closing Date for the Phase II Property. The “Outside Closing Date” for the Phase II Property means the earlier of (A) six months after Purchaser receives a final certificate of occupancy for the Phase I Project or (B) December 15th, 2017. The Outside Closing Date for the Phase II Property may be extended by Purchaser pursuant to Section 1.2(d) and in accordance with Sections 2.7(a) and 2.7(d). | ||

| (iii) With respect to the Phase III Property, 30 days after Purchaser delivers its Phase III Option Notice (defined in Section 1.2(e)), but no later than the Outside Closing Date for the Phase III Property. The “Outside Closing Date” for the Phase III Property means the earlier of (A) six months after Purchaser receives a final certificate of occupancy for the Phase II Project, or (B) December 15th, 2019. The “Outside Closing Date” for the Phase III Property may be extended by Purchaser pursuant to Section 1.2(f) and in accordance with Sections 2.7(a) and 2.7(d). |

| 2 |

| (j) | Brokers: | Mark Boone of Realty Capital Management and Andrew Prine of Stratford Land Company. |

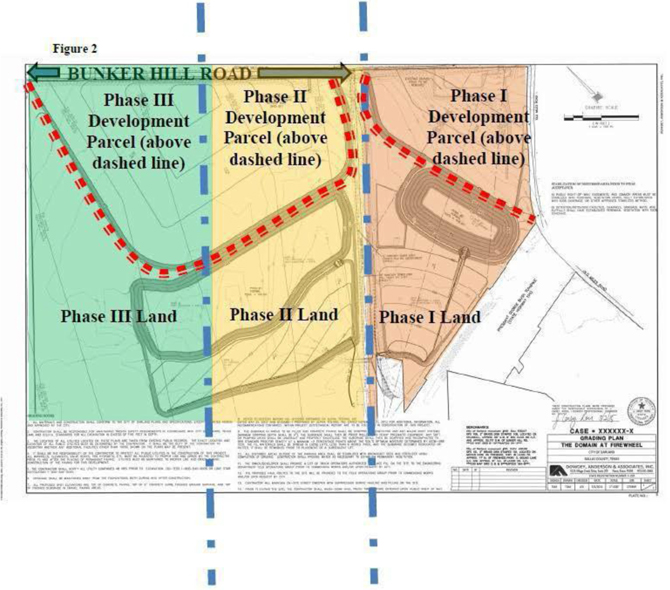

| (k) | Proposed Project: | A Class A, urban-style apartment complex of approximately 1,025 units to be developed in three phases: |

| (i) The “Phase I Project”, comprised of a minimum of 300 units to be constructed on the Phase I Development Parcel (defined in Section 1.6(d)(1); | ||

| (ii) The “Phase II Project”, comprised of approximately 350 units to be constructed on the Phase II Development Parcel (defined in Section 2.3(b); and | ||

| (iii) The “Phase III Project”, comprised of approximately 375 units to be constructed on the Phase III Development Parcel (defined in Section 2.3(b)); in each case pursuant to plans and specifications prepared by and reasonably satisfactory to Purchaser. | ||

| (l) | Business Day: | Any day which is not (i) a Saturday, (ii) a Sunday, or (iii) a holiday on which national banks operating in Garland, Texas, are authorized to be closed. |

1.2 Purchase and Sale and Option.

(a) Agreement and Grant. Subject to the terms and conditions of this Agreement, (i) Seller agrees to sell to Purchaser, and Purchaser agrees to purchase from Seller, the Phase I Property (defined in Section 1.3), and (ii) Seller grants to Purchaser the exclusive option to purchase the Phase II Property (defined in Section 1.3) (the“PhaseII Option”) and the Phase III Property (defined in Section 1.3) (the“Phase III Option”). At the Closing (defined in Section 5.1) for the Phase I Property, Seller and Purchaser shall execute a Memorandum of Option (the“Memorandum”). Purchaser shall deliver a proposed form of Memorandum to Seller for its reasonable review and approval within 45 days after the Agreement Date and the parties shall mutually and in good faith agree upon the form of the Memorandum prior to the end of the Due Diligence Period. Upon the Closing for the Phase I Property, the Escrow Agent shall record the Memorandum in the real property records of Dallas County, Texas.

(b) Intentionally Deleted.

(c) Phase II Option. Purchaser may exercise the Phase II Option by giving written notice to Seller of Purchaser’s exercise of the Phase II Option (the “Phase II Option Notice”), subject to the following conditions: (i) Closing for the Phase I Property has occurred; (ii) at the Closing for the Phase I Property, Purchaser delivered $50,000 to Seller as the option payment for the Phase II Property (the“Phase II Option Payment”); (iii) Purchaser delivers the Phase II Option Notice to Seller not later than 30 days before the Outside Closing Date for the Phase II Property. If Purchaser exercises the Phase II Option in accordance with this Section 1.2(c), then Seller shall sell to Purchaser, and Purchaser shall purchase from Seller, the Phase II Property under the terms and conditions of this Agreement. If Purchaser does not exercise the Phase II Option in accordance with this Section 1.2(c), the Phase II Option, the Phase III Option and this Agreement shall terminate, and all further rights and obligations of the parties under this Agreement shall terminate, except those which by their terms survive any termination of this Agreement. The Phase II Option Payment shall be deemed earned by Seller upon receipt by Seller and shall not be credited against the Phase II Purchase Price at the Closing for the Phase II Property. The Phase II Option Payment shall not be refunded to Purchaser except in the event of Seller’s default under this Agreement.

| 3 |

(d) Phase II Extension. Purchaser may extend the Outside Closing Date for the Phase II Property up to two times, for 30 days for each extension, by (i) giving written notice to Seller (each, a“PhaseII ExtensionNotice”) of the extension at least 30 days before the Outside Closing Date for the Phase II Property, as it may have been previously extended, and (ii) delivering an extension payment in the amount of $20,000 (an“ExtensionPayment”) to Seller within three Business Days after Purchaser delivers the corresponding Phase II Extension Notice. If Purchaser does not pay an Extension Payment in accordance with this Section 1.2(d), Purchaser shall be deemed to have not extended the Outside Closing Date for the Phase II Property under the corresponding Phase II Extension Notice. No Extension Payments shall be credited against the Phase II Purchase Price or refunded to Purchaser except in the event of Seller’s default under this Agreement.

(e) Phase III Option. Purchaser may exercise the Phase III Option by giving written notice to Seller of Purchaser’s exercise of the Phase III Option (the “Phase III Option Notice”), subject to the following conditions: (i) at the Closing for the Phase I Property, Purchaser delivered $50,000 to Seller as the option payment for the Phase III Property (the “Phase III Option Payment”); (ii) Closing for the Phase II Property has occurred; (iii) Purchaser delivers the Phase III Option Notice to Seller not later than 30 days before the Outside Closing Date for the Phase III Property. If Purchaser exercises the Phase III Option in accordance with this Section 1.2(e), then Seller shall sell to Purchaser, and Purchaser shall purchase from Seller, the Phase III Property under the terms and conditions of this Agreement. If Purchaser does not exercise the Phase III Option in accordance with this Section 1.2(e), the Phase III Option and this Agreement shall terminate, and all further rights and obligations of the parties under this Agreement shall terminate, except those which by their terms survive any termination of this Agreement. The Phase III Option Payment shall be deemed earned by Seller upon receipt by Seller and shall not be credited against the Phase III Purchase Price at the Closing for the Phase III Property The Phase III Option Payment shall not be refunded to Purchaser except in the event of Seller’s default under this Agreement.

(f) Phase III Extension. Purchaser may extend the Outside Closing Date for the Phase III Property up to two times, for 30 days for each extension, by (i) giving written notice to Seller (each, a “Phase III ExtensionNotice”) of the extension at least 30 days before the Outside Closing Date for the Phase III Property, as it may have been previously extended, and (ii) delivering an Extension Payment to Seller within three Business Days after Purchaser delivers the corresponding Phase III Extension Notice. If Purchaser does not pay an Extension Payment in accordance with this Section 1.2(f), Purchaser shall be deemed to have not extended the Outside Closing Date for the Phase III Property under the corresponding Phase III Extension Notice. No Extension Payments shall be credited against the Phase III Purchase Price or refunded to Purchaser except in the event of Seller’s default under this Agreement.

1.3 Property. The “Property” means the approximately 135.89 gross acres of land (the“Land”, comprised of, collectively, the Phase I Land, the Phase II Land and the Phase III Land (as those terms are defined in Section 1.6(c))), including at least 36.4 developable acres of land (comprised, collectively, of the Phase I Development Parcel and the Phase II & III Development Parcel (defined in Section 1.6(d))), located in Garland, Texas and as described inExhibit Aattached to this Agreement, together with all and singular the rights, benefits, privileges, easements, tenements, hereditaments, and appurtenances belonging or appertaining to, respectively, each of the Phase I Land, the Phase II Land and the Phase III Land, and Seller’s rights, easements or other interests, if any, in and to adjacent streets, alleys and rights-of-way, or other property abutting, respectively, each of the Phase I Land, the Phase II Land and the Phase III Land, and together with any and all minerals and mineral rights, water and water rights, wells, well rights and well permits, water and sewer taps, sanitary or storm sewer capacity or reservations and rights under utility agreements with any applicable governmental or quasi-governmental entities or agencies with respect to the providing of utility services to, respectively, each of the Phase I Land, the Phase II Land and the Phase III Land (respectively, the “Phase I Property”, the “Phase II Property” and the “Phase III Property”). Each of the Phase I Property, the Phase II Property and the Phase III Property may be referred to individually as a “Phase”.

| 4 |

1.4 Earnest Money. Within five Business Days after receipt of a fully executed copy of this Agreement, Purchaser shall deposit $25,000 with the Escrow Agent as an earnest money deposit (the “First Deposit”). If this Agreement is not terminated under Section 2.2(b), Purchaser shall deposit $50,000 with the Escrow Agent as an additional earnest money deposit (the “Second Deposit”) within five Business Days after the end of the Due Diligence Period. “Earnest Money” means, collectively, the First Deposit, and the Second Deposit (once made by Purchaser), together with interest on such amounts. The Earnest Money shall be applied to the Phase I Purchase Price at Closing for the Phase I Property. If, before Closing for the Phase I Property occurs, this Agreement terminates pursuant to any express right of Purchaser to terminate this Agreement, the Escrow Agent shall disburse the Earnest Money in accordance withArticle 9of this Agreement, and all further rights and obligations of the parties under this Agreement shall terminate, except those which by their terms survive any termination of this Agreement. The Escrow Agent shall hold and disburse the Earnest Money in accordance withArticle 9of this Agreement.

1.5 Independent Contract Consideration. At the same time as the deposit of the Earnest Money to the Escrow Agent, Purchaser shall deliver to Seller the sum of $100.00 in cash or by check (the “Independent ContractConsideration”) which amount has been bargained for and agreed to as consideration for Purchaser’s exclusive option to purchase the Property and the Due Diligence Period as provided in this Agreement, and for Seller’s execution and delivery of this Agreement. The Independent Contract Consideration is in addition to and independent of all other consideration provided in this Agreement, and is nonrefundable in all events.

1.6 Land, Land Areas, Land Phases, Development Parcels and Flood Plain Improvements.

(a) Existing Land. Seller holds title to the Land, consisting of approximately 135.89 acres of land depicted and described on the Land Title Survey – 135.89 Acres, having a revision date of December 20, 2012 and prepared by Dowdey, Anderson & Associates, Inc. as Job No. 07039 (the “Existing Land Survey”). The locations and approximate boundaries of the Phase I Land, the Phase II Land, and the Phase III Land are depicted onExhibit Battached to this Agreement (the “Land Areas Exhibit”).

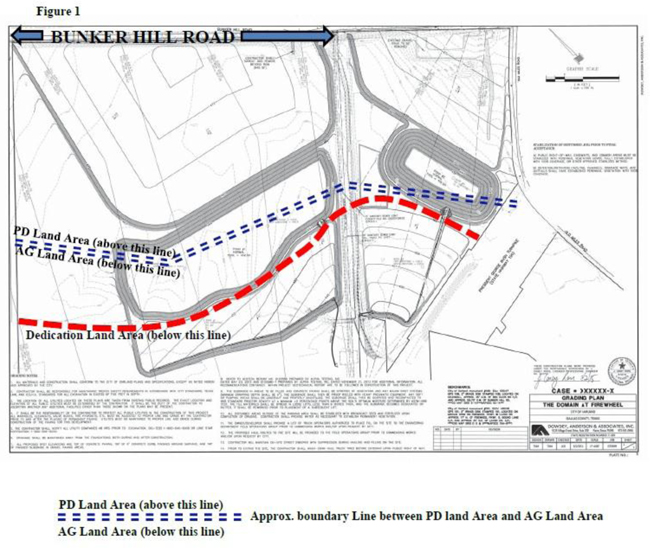

(b) Land Areas. Approximately 50 acres of the Land fronting on Bunker Hill Road (the “PD LandArea”) is zoned as Planned Development District (PD) for Multifamily Uses under Ordinance No. 6539 adopted by the City of Garland, Texas (the “City”) on May 1, 2012. The Land includes the entire PD Land Area. The remainder of the land area of the Land (the “AG Land Area”) is zoned as Agriculture (AG) District. The approximate location of the boundary line between the PD Land Area and the AG Land Area is depicted on the Land Areas Exhibit. A portion of the AG Land Area may be dedicated to the City (collectively, the “DedicationLand Area”) following the Closing for the Phase I Property. The approximate location of the proposed boundary line between the Dedication Land Area and the remainder of the Land (the “Dedication Property Line”) is shown on the Land Areas Exhibit, and the final location of the Dedication Property Line shall be determined pursuant to Section 2.6(a).

(c) Land Phases. The Land will be divided into the Phase I Land, the Phase II Land and the Phase III Land in accordance with the terms and conditions of this Agreement.

(1) “Phase I Land” means the portion of the Land to be determined and described in accordance with Section 2.3(a). Purchaser intends to construct the Phase I Project on the Phase I Land.

(2) “Phase II Land” means the portion of the Land to be determined and described in accordance with Section 2.3(b). Purchaser intends to construct the Phase II Project on the Phase II Land.

(3) “Phase III Land” means the portion of the Land to be determined and described in accordance with Section 2.3(b). Purchaser intends to construct the Phase III Project on the Phase III Land.

(d) Development Parcels. The “Development Parcels” means, collectively, the Phase I Development Parcel and the Phase II & III Development Parcel.

(1) “Phase I Development Parcel” means the portion of the Phase I Land to be determined and described in accordance with Section 2.6(a), subject to the following general criteria: The Phase I Development Parcel shall (A) be comprised of at least 10 acres; (B) be located entirely within the Phase I Land; (C) be located entirely within the PD Land Area; and (D) have boundaries in the approximate locations depicted on the Land Areas Exhibit.

| 5 |

(2) “Phase II & III Development Parcel” means the portion of the Land (excluding the Phase I Land) to be determined and described in accordance with Section 2.6(a), subject to the following general criteria: The Phase II & III Development Parcel shall (A) be comprised of at least 26.4 acres; (B) be located entirely within the PD Land Area; and (C) have boundaries in the approximate locations depicted on the Land Areas Exhibit.

(e) Flood Plain Improvements. As of the Agreement Date, most of Tract 1 and all of Tract 2 and Tract 3 are located within a special flood hazard area (as that phrase is defined in 49 CFR Part 59, an “SFHA”) designated on the Flood Insurance Rate Map (the “FIRM”) promulgated by the Federal Emergency Management Agency (“FEMA”) and applicable to the Property. “Flood Plain Improvements” means all work and materials required to place fill, construct ponds and graded floodplain storage shelves, and perform related grading and other work necessary to cause the Development Parcels to be removed from the SFHA and cause FPI Final Approval to occur. “FPI Final Approval” means, collectively, (i) the approval of the completed Flood Plain Improvements by all applicable federal, state and local governmental agencies, (ii) the issuance by FEMA of a letter of map revision for the FIRM demonstrating that no portion of the Development Parcels is, and no improvements constructed on the Development Parcels will be, within an SFHA (the “LOMR”), (iii) any restrictions, obligations or conditions imposed on the Property or the owner of the Property by any governmental agency, in connection with the approval of the Flood Plain Improvements or the issuance of the LOMR, has been approved in writing by Purchaser, which approval shall not be unreasonably withheld and (provided Purchaser includes with its request for approval a statement inBOLDFACE TYPE AND ALL CAPITAL LETTERSthat Purchaser’s approval shall be deemed given if Purchaser does not deliver written objections to Seller within five (5) business days after Purchaser’s receipt of written request for approval) shall be deemed given if Purchaser does not deliver written objections to any request for approval within five (5) Business Days after Purchaser’s receipt of written request for approval, together with copies of all documents that describe or impose the restrictions, obligations or conditions, and (iv) that all appeal periods with respect to the approvals under clause (i) and the issuance of the LOMR under clause (ii) have expired without any appeal having been filed or, if filed, the appeal has been resolved to the reasonable satisfaction of Purchaser. Seller acknowledges that the completion of the construction of the Flood Plain Improvements and achieving FPI Final Approval by Seller in accordance with this Agreement is a material covenant and a material part of the consideration to Purchaser under this Agreement.

ARTICLE 2. INSPECTION AND DEVELOPMENT APPROVALS

2.1 Seller’s Delivery of Specified Documents. Within five Business Days after the Agreement Date, Seller shall provide to Purchaser the following information with respect to the Property (the “Property Information”) to the extent in Seller’s possession or control: (i) the latest property tax bills and value renditions from all taxing authorities; (ii) any environmental reports and a schedule listing any such reports; (iii) all existing plans, specifications, permits, approvals (and any applications for permits or approvals), maps and surveys (including, without limitation, archaeological, boundary, topographic and tree surveys); (iv) any subdivision reports; (v) any existing title report, commitment or policy, together with copies of any covenants, conditions, restrictions and other exceptions to title; (vi) any soils and engineering reports; (vii) any written notices, reports, citations, orders, decisions, correspondence, or memoranda from any governmental authority (including, but not limited to, copies of any zoning letters); (viii) all agreements with or applications to, and responses and decisions from, any governmental authority with respect to any zoning modification, variance, exception, platting or other matter relating to the zoning, use, development, subdivision or platting of the Property; (ix) copies of all agreements, studies, reports, correspondence and other documents relating to the presence or absence of any endangered species or environmentally sensitive areas on the Property; (x) any pleadings, judgments, court orders and settlement agreements relating to or resulting from legal proceedings affecting the Property; and (xi) any leases, contracts or agreements relating to the Property or services being provided or to be provided to the Property, including, without limitation, any agreements with electric, cable, gas, telephone or other utility providers. Seller shall provide to Purchaser any documents described above and coming into Seller’s possession or control or produced by Seller after the initial delivery above and shall continue to provide same during the pendency of this Agreement.

| 6 |

2.2 Due Diligence.

(a) Purchaser shall have through the last day of the Due Diligence Period in which to examine, inspect, and investigate the Property and, in Purchaser’s sole and absolute judgment and discretion, to determine whether the Property is acceptable to Purchaser, whether Purchaser is prepared to make an investment in the Property, and for Purchaser to obtain all necessary internal approvals.

(b) If Purchaser, in Purchaser’s sole and absolute judgment and discretion, determines that the Property is acceptable to Purchaser, Purchaser may deliver a written notice to Seller and Escrow Agent (a “DueDiligence Approval Notice”) on or before the last day of the Due Diligence Period. If Purchaser so delivers a Due Diligence Approval Notice to Seller and Escrow Agent, Purchaser shall deposit the Second Deposit with the Escrow Agent in accordance with Section 1.4. If Purchaser so delivers a Due Diligence Approval Notice to Seller and Escrow Agent in accordance with this Section 2.2(b) and deposits the Second Deposit with Escrow Agent in accordance with Section 1.4, Purchaser and Seller shall proceed to Closing in accordance with and subject to the terms and conditions of this Agreement. Notwithstanding anything to the contrary in this Agreement, Purchaser may terminate this Agreement by giving notice of termination (a “Due Diligence Termination Notice”) to Seller on or before the last day of the Due Diligence Period. If Purchaser fails to deposit the Second Deposit with Escrow Agent in accordance with Section 1.4 or fails to deliver either a Due Diligence Approval Notice or a Due Diligence Termination Notice to Seller and Escrow Holder, Purchaser shall be deemed to have delivered a Due Diligence Termination Notice on the last day of the Due Diligence Period and Purchaser shall be deemed to have terminated this Agreement effective as of the expiration of the Due Diligence Period.

(c) Purchaser and its agents, employees, and representatives shall have a continuing right of reasonable access to the Property during the pendency of this Agreement for the purpose of conducting surveys, engineering, geotechnical, and environmental inspections and tests (including intrusive inspection and sampling), and any other inspections, studies, or tests reasonably required by Purchaser. In the course of its investigations Purchaser may make inquiries to third parties including, without limitation, lenders, contractors, and municipal, local, and other government officials and representatives, and Seller consents to such inquiries. Purchaser shall keep the Property free and clear of any liens and will indemnify, defend, and hold Seller harmless from all claims and liabilities asserted against Seller as a result of any such entry by Purchaser, its agents, employees, or representatives, excluding any claims or liabilities arising from Purchaser’s discovery of any condition relating to the Property. Further, Purchaser agrees that Purchaser shall carry commercial general liability insurance with limits of liability of not less than $1,000,000.00 per occurrence and $2,000,000.00 general aggregate covering all activities of Purchaser’s agents, contractors and representatives while exercising Purchaser’s right of entry upon the Property. Seller and Seller’s lender shall be named as additional insureds on such commercial general liability policy. Purchaser shall deliver the required certificate of insurance to Seller evidencing such coverage prior to the date that any agent or contractor of Purchaser first goes onto the Property. Purchaser shall deliver copies of all written reports, inspections, tests and studies it obtains regarding the Property to Seller within one Business Day after its receipt of same. Purchaser agrees to keep the contents and results of such reports, inspections, tests and studies confidential except that Purchaser may divulge same to (i) its potential lenders and investors, (ii) its consultants and attorneys, (iii) to the City if necessary in connection with obtaining the Development Approvals (defined below), and (iv) if required by law. If any inspection or test disturbs the Property, Purchaser will restore the Property to the same condition as existed prior to any such inspection or test. Purchaser’s obligations under this Section 2.2(c) shall survive the Closings and any termination of this Agreement.

2.3 Land Phases.

(a) Phase I Land. No later than 10 Business Days before the end of the Due Diligence Period, Purchaser shall deliver to Seller the proposed legal description for the Phase I Land. Within five Business Days after Purchaser delivers the proposed legal description for the Phase I Land, Seller shall review it and give written notice to Purchaser whether Seller approves it. Seller shall not unreasonably withhold its approval of the proposed legal description for the Phase I Land so long as it is substantially consistent with the Land Areas Exhibit.

| 7 |

(b) Phase II Land and Phase III Land. Not later than 90 days before the Outside Closing Date for the Phase II Property, as it may have been extended under Section 1.2(d), Purchaser shall deliver to Seller the proposed legal description for each of (i) the Phase II Land, (ii) the corresponding portion of the Phase II & III Development Parcel located within the Phase II Land (the “Phase II Development Parcel”), (iii) the Phase III Land, and (iv) the corresponding portion of the Phase II & III Development Parcel located within the Phase III Land (the “Phase IIIDevelopment Parcel”). Within five Business Days after Purchaser delivers the proposed legal descriptions, Seller shall review them and give written notice to Purchaser whether Seller approves them. Seller shall not unreasonably withhold its approval of the proposed legal descriptions so long as they are substantially consistent with the Land Areas Exhibit.

2.4 Development Approvals.

(a) Purchaser’s Right to Obtain. Purchaser shall have the right to apply for and obtain from all applicable private and governmental authorities final zoning, site plan and all other applicable development approvals, permits and licenses (excluding only platting and a building permit) (collectively, the “DevelopmentApprovals”) required in connection with the development and construction of the Proposed Project. Purchaser’s efforts to obtain the Development Approvals shall be at its sole cost and expense (including the posting of any fiscal requirements). Development Approvals shall include, without limitation, a Concept Plan (as defined in the City Code of Ordinances) for the entire Proposed Project, a Detail Plan (as defined in the City Code of Ordinances) for the Proposed Project for each Phase, and any approvals required under any declaration of covenants, conditions and restrictions or any other private agreement affecting the Proposed Project for each Phase. Purchaser shall submit to the City its proposed Concept Plan for the entire Proposed Project and the Property within 30 days after the end of the Due Diligence Period. Purchaser shall not be obligated to close the transaction for each Phase unless Final Approval of the Development Approvals (defined below) has occurred with respect to all Development Approvals required for the Proposed Project for the respective Phase. By way of example, Development Approvals required for the Phase I Project includes, among other things, a Concept Plan for the entire Proposed Project and a Detail Plan for the Phase I Project. “Final Approval of the Development Approvals” means that the Development Approvals must be without conditions or restrictions (including the payment of assessments or the posting of security) that are unacceptable to Purchaser, as determined by Purchaser in its reasonable discretion, and that all appeal periods with respect to the Development Approvals shall have expired without any appeal having been filed or, if filed, such appeal shall have been resolved to the reasonable satisfaction of Purchaser.

(b) Seller’s Cooperation. Seller agrees to cooperate fully with Purchaser, without expense to Seller, to enable Purchaser to apply for and obtain all Development Approvals. Seller shall execute all documents required for the development approval process including the appointment of Purchaser as its agent or nominee to obtain any Development Approvals. Seller shall appear at public hearings, city staff meetings, or other meetings related to the approval of Purchaser’s application(s) as may be reasonably requested by Purchaser. Seller agrees to execute such plats, including any necessary lot splits, as may be required whereby each Phase shall be a “legal lot” under all applicable ordinances, laws, and regulations, and Seller shall provide easements over adjacent tracts of land owned by Seller (to be recorded at the appropriate Closing), in form and substance reasonably satisfactory to Purchaser, for access and utilities as may be required in connection with the Development Approvals and as required by utility companies or any governmental authorities with respect to the Proposed Project. Such plats and dedications shall be made and granted by Seller at such time as is required by the applicable governmental authority. The Property description and Survey shall be revised to take into account de minimis changes to the Property boundaries requested by Purchaser that are necessary to permit the development of the Proposed Project.

(c) Purchase Price Adjustment.

(1) Phase I Purchase Price. If, pursuant to Final Approval of the Development Approvals for the Phase I Project, the Phase I Project may be comprised of more than 300 apartment units, the Phase I Purchase Price shall be increased by an amount equal to the product of (A) the number of apartment units so approved for the Phase I Project minus 300, times (B) $13,250.

(2) Phase II Purchase Price. If, pursuant to Final Approval of the Development Approvals for the Phase II Project, the Phase II Project may be comprised of more than 350 apartment units, the Phase II Purchase Price shall be increased by an amount equal to the product of (A) the number of apartment units so approved for the Phase II Project minus 350, times (B) $14,500.

| 8 |

(3) Phase III Purchase Price. If, pursuant to Final Approval of the Development Approvals for the Phase III Project, the Phase III Project may be comprised of more than 375 apartment units, the Phase III Purchase Price shall be increased by an amount equal to the product of (A) the number of apartment units so approved for the Phase III Project minus 375, times (B) $16,000.

(d) Termination Right. Purchaser shall use its commercially reasonable and diligent efforts to obtain the Development Approvals for the Phase I Project. If Purchaser determines at any time that, in spite of the use of its commercially reasonable and diligent efforts, it has been or will be unable to obtain Final Approval of the Development Approvals for a Phase by the Outside Closing Date for the respective Phase, then Purchaser may, by delivering written notice to Seller at least 30 days before the applicable Outside Closing Date, (i) terminate this Agreement (such notice is a “Development Approvals Termination Notice”); or (ii) waive the condition for Final Approval of the Development Approvals for the respective Phase and proceed with the Closing for the respective Phase on such date to which the parties may mutually agree, but in any event, no later than the Outside Closing Date for the respective Phase, as it may have been extended under Section 1.2. In the event Purchaser delivers the Development Approvals Termination Notice in compliance with thisSection 2.4(d), Seller shall retain the Phase II Option Payment and Phase III Option Payment if such payments were made by Purchaser.

2.5 Seller Subdivision and Dedication Responsibilities.

(a) Seller Subdivision for the Phase I Property. Before the Closing for the Phase I Property, Seller shall, at its cost and expense, use its commercially reasonable and diligent efforts to obtain approval for any subdivision of the Property required (A) in order for Seller to legally convey to Purchaser, in accordance with state and local subdivision laws and regulations, the Phase I Property at the Closing for the Phase I Property, and (B) to satisfy the requirements of the City or other governmental agencies in connection with the dedication of the Dedication Land Area.

(b) Seller Subdivision for Subsequent Phases. Before the Closing for, respectively, the Phase II Property and the Phase III Property, Seller shall, at its cost and expense, use its commercially reasonable and diligent efforts to obtain approval for any subdivision required in order for (A) Seller to legally convey to Purchaser, in accordance with state and local subdivision laws and regulations, the Phase II Property at the Closing for the Phase II Property, and (B) Seller to legally convey to Purchaser, in accordance with state and local subdivision laws and regulations, the Phase III Property at the Closing for the Phase III Property.

(c) Seller Subdivision Defined. “Seller Subdivision” means any subdivision of the Property required under Section 2.5(a) or 2.5(b). Seller shall be responsible for all obligations (including, without limitation, the posting of any fiscal requirements, the construction of any improvements and the dedication of any real property or improvements or the payment of any fees in lieu of dedication) imposed as a condition of approval of any Seller Subdivision by any governmental agency. Any Seller Subdivision, and any restrictions, obligations or conditions imposed by any Seller Subdivision on the Property or the owner of the Property, shall be subject to Purchaser’s prior written approval, which approval shall not be unreasonably withheld and (provided Purchaser includes with its request for approval a statementIN BOLDFACE TYPE AND ALL CAPITAL LETTERSthat Purchaser’s approval shall be deemed given if Purchaser does not deliver written objections to Seller within five (5) business days after Purchaser’s receipt of written request for approval) shall be deemed given if Purchaser does not deliver written objections to any request for approval within five (5) Business Days after Purchaser’s receipt of written request for approval, together with copies of all documents that describe or impose the restrictions, obligations or conditions.

(d) Dedication Land Area. During the pendency of this Agreement, Seller and Purchaser shall agree in writing regarding the timing of the dedication of the Dedication Land Area and the terms upon which either Seller and/or Purchaser, as applicable, may dedicate the Dedication Land Area to the City or other governmental agencies. The parties contemplate that no earlier than the Closing for the Phase I Property and no later than the Closing for the Phase II Property, Seller and/or Purchaser may dedicate the Dedication Land Area to the City or such other governmental agencies as Seller and Purchaser have agreed upon. In the event of a dedication, the party dedicating the Dedication Land Area shall be responsible for all obligations (including, without limitation, the posting of any fiscal requirements, the construction of any improvements and the dedication of any other property or improvements or the payment of any fees) imposed as a condition of approval of the City’s acceptance of that portion of the Dedication Land Area owned by such party. Any restrictions, obligations or conditions imposed in connection with the dedication of the Dedication Land Area on the Property (other than the Dedication Land Area) or on the owner of the Property (other than the Dedication Land Area), shall be subject to Purchaser’s prior written approval, which approval shall not be unreasonably withheld and (provided Purchaser includes with its request for approval a statementIN BOLDFACE TYPE AND ALL CAPITAL LETTERSthat Purchaser’s approval shall be deemed given if Purchaser does not deliver written objections to Seller within five (5) business days after Purchaser’s receipt of written request for approval) shall be deemed given if Purchaser does not deliver written objections to any request for approval within five (5) Business Days after Purchaser’s receipt of written request for approval.

| 9 |

(e) Survival. The parties’ obligations under this Section 2.5 shall survive the Closings.

2.6 FPI Pre-Construction Matters.

(a) FPI Pre-Construction Package. Within 30 days after the Agreement Date, Seller shall deliver to Purchaser the following items (collectively, the “FPI Pre-Construction Package”) for Purchaser’s review and approval: (i) the proposed final engineering drawings and specifications for all Flood Plain Improvements (once approved by Purchaser under this Section 2.6(a), the “Plans and Specifications”); (ii) an estimate of the costs to construct all Flood Plain Improvements (once approved by Purchaser under this Section 2.6(a), the “FPIConstruction Estimate”); (iii) the preliminary construction schedule for construction of the Flood Plain Improvements; (iv) the name of the contractor that Seller proposes to engage to construct the Flood Plain Improvements (once approved by Purchaser under this Section 2.6(a), the “FPI Contractor”); (v) a copy of the proposed construction contract between Seller and the FPI Contractor for the construction of all FPI Improvements (once approved by Purchaser under this Section 2.6(a), the “FPI Construction Contract”) conforming to the requirements of Section 2.6(b); (vi) the names of the surveyor, engineer and other consultants (each, once approved by Purchaser under this Section 2.6(a), an “FPI Consultant”) that Seller proposes to engage to administer and monitor the construction of the Flood Plain Improvements, prepare and process the LOMR Request and obtain the FPI Final Approval; (vii) a copy of the proposed contract between Seller and each FPI Consultant (each, once approved by Purchaser under this Section 2.6(a), an “FPI Consultant Contract”) conforming to the requirements of Section 2.6(c); (viii) an estimate of total costs to administer and monitor the construction of the Flood Plain Improvements, prepare and process the LOMR Request and obtain FPI Final Approval (once approved by Purchaser under this Section 2.6(a), the “FPI Administration Estimate”); and (ix) a list of all permits from applicable federal, state and local governmental agencies necessary to construct the Flood Plain Improvements (the “FPI Permits”). Within 21 days after Seller delivers the complete FPI Pre-Construction Package to Purchaser, Purchaser shall review, and give written notice to Seller whether Purchaser approves, each item of the FPI Pre-Construction Package. Purchaser shall not unreasonably withhold its approval of each item of the FPI Pre-Construction Package, and Purchaser’s approval shall be deemed given unless Purchaser delivers its written objections within such 21-day period. Purchaser’s approval of any item of the FPI Pre-Construction Package shall not constitute Purchaser’s endorsement of the completeness or adequacy of the item and, notwithstanding Purchaser’s approval of any item of the FPI Pre-Construction Package, Seller shall remain responsible for constructing the Flood Plain Improvements and obtaining FPI Final Approval in accordance with this Agreement.

(b) FPI Construction Contract. The FPI Construction Contract shall provide that:

(1) The FPI Contractor shall (A) construct all Flood Plain Improvements for a fixed lump sum or guaranteed maximum price; (B) construct the Flood Plain Improvements in accordance with the Plans and Specifications and all applicable laws and regulations; (C) engage one or more independent third- party testing agencies to perform soils compaction sampling and testing at intervals in the work specified in the FPI Construction Contract and such other sampling and testing consistent with the materials and work comprising the Flood Plain Improvements; (D) maintain, and cause its subcontractors to maintain, commercial liability insurance, workers compensation insurance, builder’s risk insurance and other insurance, all with such coverages, minimum limits and maximum deductibles that Seller and Purchaser shall reasonably require and naming Seller and Purchaser as additional insureds; (E) give written notice to Purchaser of any default by Seller the FPI Construction Contract at the same time that notice of the default is given to Seller; (F) indemnify and hold harmless Purchaser for all claims and liabilities arising in connection with the construction of the Flood Plain Improvements; (G) provide, and cause its subcontractors to provide, for the benefit of, and in form and substance acceptable to, Seller and Purchaser lien waivers in connection with each progress payment and final, unconditional lien waivers upon final payment; (H) remove any lien for labor and materials filed against any portion of the Property so long as the FPI Contractor has been paid (less any applicable retainage) for such labor and materials; (I) provide, and cause its subcontractors to provide, for the benefit of, and in form and substance reasonably acceptable to, Seller and Purchaser warranties for a period of one year after FPI Final Approval that the Flood Plain Improvements and all labor and materials incorporated into the Flood Plain Improvements will be free from defects and that the Flood Plain Improvements will conform with the requirements of the Plans and Specifications and all applicable federal, state and local laws and regulations; and (J) if, within the period ending one year after FPI Final Approval, any of the Flood Plain Improvements are found to be not in accordance with the requirements of the Plans and Specifications and all applicable federal, state and local laws and regulations, correct them promptly after receipt of written notice from Seller or Purchaser to do so.

| 10 |

(2) Seller may assign the FPI Construction Contract to Purchaser; and

(c) FPI Consultant Contract. Each FPI Consultant Contract shall provide that:

(1) Purchaser shall be named as (A) a third-party beneficiary of the FPI Consultant Contract; (B) a reliance party under any report prepared by the FPI Consultant with respect to the Flood Plain Improvements; (C) a beneficiary of any certification given by the FPI Consultant under the FPI Consultant Contract or otherwise with respect to the Flood Plain Improvements;

(2) Purchaser shall have the right to use and rely on any surveys, drawings, specifications, or other instruments of service prepared by any FPI Consultant; and

(3) Seller may assign the FPI Consultant Contract to Purchaser.

(d) FPI Costs Estimate. No later than 10 days before the Closing for the Phase I Property, Seller shall deliver to Purchaser an updated FPI Construction Estimate and an updated FPI Administration Estimate. The sum of the updated FPI Construction Estimate plus the updated FPI Administration Estimate (the “FPI Costs Estimate”) shall not be less than the sum of the fixed lump sum or guaranteed maximum price payable to the FPI Contractor under the FPI Construction Contract, as executed by Seller and the FPI Contractor, plus all amounts reasonably estimated to be paid to the FPI Consultants under the FPI Consultant Agreements. The “FPI Escrow Amount” shall equal 115% of the FPI Costs Estimate. At the Closing for the Phase I Property, Purchaser shall deposit a portion of the Phase I Purchase Price equal to the FPI Escrow Amount with the Escrow Agent to be held in the FPI Escrow Account and, upon deposit of the FPI Escrow Amount together with the delivery of the balance of the Phase I Purchase Price in accordance with this Agreement, Purchaser shall be deemed to have satisfied its obligation to deliver Phase I Purchase Price in accordance with this Agreement. Escrow Agent shall deposit the FPI Escrow Amount into an escrow account to be held by Escrow Agent in accordance with the FPI Escrow Agreement (the “FPI Escrow Account”). No later than 45 days after the Agreement Date, Seller shall deliver to Purchaser for its approval a draft of the proposed form of the FPI Escrow Agreement. The parties shall mutually and in good faith agree on the form of the FPI Escrow Agreement prior to the end of the Due Diligence Period.

(e) Requirements for Closing for Phase I Property. Before the Closing for the Phase I Property, Seller shall (i) obtain all FPI Permits; (ii) enter into the FPI Construction Contract with the FPI Contractor and deliver to Purchaser a copy of the fully-executed FPI Construction Contract; and (iii) enter into an FPI Consultant Contract with each FPI Consultant and deliver to Purchaser a copy of each fully-executed FPI Consultant Contract.

| 11 |

2.7 Construction of Flood Plain Improvements and FPI Final Approval.

(a) General Requirements. Seller, at its cost and expense, shall cause the construction of the Flood Plain Improvements to begin within seven days after the Closing for the Phase I Property and to be completed within 90 days after the Closing for the Phase I Property (the “FPI Completion Date”). Seller shall cause the construction of the Flood Plain Improvements to be performed in accordance with the Plans and Specifications, the FPI Construction Contract, the terms and conditions of the FPI Permits and all applicable federal, state and local laws and regulations. Seller shall not amend, revise, issue any modifications or change orders to or waive any conditions or requirements under any of the Plans and Specifications, the FPI Permits, the FPI Construction Contract or any FPI Consultant Contract without Purchaser’s prior written consent, which consent shall not be unreasonably withheld and (provided Purchaser includes with its request for consent a statementIN BOLDFACE TYPE AND ALL CAPITAL LETTERSthat Purchaser’s consent shall be deemed given if Purchaser does not deliver written objections to Seller within five (5) business days after Purchaser’s receipt of written request for consent) which shall be deemed given if Purchaser fails to deliver its written objections to same within five Business Days after receipt of a written request for consent, together with copies of all documents that describe the modification or change order or the condition or requirement to be waived. If the Flood Plain Improvements are not completed in accordance with this Section 2.7(a) by the FPI Completion Date, then, in addition to any other remedy Purchaser has under this Agreement, the Outside Closing Date for the Phase II Property and the Outside Closing Date for the Phase III Property shall be extended automatically by one day for each day after the FPI Completion Date until the Flood Plain Improvements are completed in accordance with this Section 2.7(a).

(b) FPI Escrow Account. In accordance with the terms and conditions of the FPI Escrow Agreement, Seller may withdraw funds from the FPI Escrow Account for costs relating to the construction of the Flood Plain Improvements and obtaining FPI Final Approval that are payable to the FPI Contractor in accordance with the FPI Construction Contract or to each FPI Consultant in accordance with its FPI Consultant Contract. Provided Seller complies with the previous sentence, Escrow Agent shall disburse funds from the FPI Escrow Agreement directly to Seller within two Business Days after Seller delivers written request for such funds to Escrow Agent and Purchaser, with no confirmation required from Purchaser. So long as the FPI Escrow Amount is funded at the Closing for the Phase I Property, Seller’s obligation to construct the Flood Plain Improvements and obtain FPI Final Approval at its cost and expense shall not be conditioned on the amount or adequacy of funds available in the FPI Escrow Account.

(c) LOMR Request. Within 100 days after the Closing for the Phase I Property, Seller shall prepare a formal request for the LOMR that complies with all applicable FEMA requirements, includes all documents and approvals required under applicable FEMA requirements and demonstrates satisfaction of all known conditions, required to be satisfied by the requestor, for the issuance of the LOMR (collectively, the“LOMRRequest”).

(d) FPI Final Approval. Seller shall have achieved FPI Final Approval within 180 days after the Closing for the Phase I Property (the “FPI Final Approval Date”). If FPI Final Approval does not occur by the FPI Final Approval Date, then, in addition to any other remedy Purchaser has under this Agreement, the Outside Closing Date for the Phase II Property and the Outside Closing Date for the Phase III Property shall be extended automatically by one day for each day after the FPI Final Approval Date until FPI Final Approval occurs.

(e) Seller’s Obligations under Contracts. Seller shall perform all of its obligations under the FPI Permits, the FPI Construction Contract, and each FPI Consultant Agreement.

(f) Seller’s Delivery of Documents. Within one Business Day after Seller produces or receives each of the following items, Seller shall deliver, or shall cause to be delivered, to Purchaser a copy of: (i) each sampling or testing report prepared in connection with sampling and testing required under the FPI Construction Contract; (ii) each inspection report created by the FPI Consultants or received from any governmental agency with respect to the Flood Plain Improvements; (iii) each payment request made by the FPI Contractor under the FPI Construction Contract; (iv) evidence of each payment made and the amount of each payment made to the FPI Contractor under the FPI Construction Contract; (v) each lien waiver provided under the FPI Construction Contract; (vi) any proposed change order to the FPI Construction Contract; (vii) each notice, order, demand or written communication received from any governmental agency with respect to the Flood Plain Improvements; and (viii) each certification given by any FPI Consultant with respect to the Flood Plain Improvements or the LOMR Request.

(g) Liens. Within one Business Day after Seller receives any notice of lien or lien against the Property in connection with the Flood Plain Improvements, Seller shall give written notice, together with a copy, of the notice or lien to Purchaser. Seller shall bond off or otherwise discharge any lien filed against the Property within 45 days after receiving notice of the lien.

| 12 |

(h) Seller’s Indemnification. To the fullest extent permitted by law, Seller shall indemnify, reimburse, hold harmless, and defend Purchaser and its lender, Purchaser’s members, partners, managers, project and/or development manager, the Architect, Architect's consultants, and all of their agents, employees, consultants, parent subsidiaries or affiliated companies, successors and assigns from and against claims, damages, losses and expenses, including, but not limited to, reasonable attorneys' fees, arising out of or resulting from any personal injury or death related to the construction of the Flood Plain Improvements, but only to the extent caused in whole or in part by negligent acts or omissions of Seller, the FPI Contractor, any FPI Consultant, or any subcontractor, material or equipment supplier, or anyone directly or indirectly employed by any of them or anyone for whose acts they may be liable, regardless of whether such claim, damage, loss or expense is caused in part by a party indemnified hereunder. Such obligation shall not be construed to negate, abridge, or reduce other rights or obligations of indemnity which would otherwise exist as to a party or person described in this Section 2.7(h). Seller shall indemnify, hold harmless (including reasonable attorneys’ fees and legal expenses) and defend Purchaser and Purchaser's lenders, if any, from and against any assertion of lien claims by the FPI Contractor, any FPI Consultant, or any subcontractor, material or equipment supplier and against any assertion of security interests by suppliers of goods or materials in connection with the Flood Plain Improvements.

(i) Intentionally Deleted.

(j) FPI Collateral Assignment. Except as provided in this Section 2.7(j), Seller shall not assign or otherwise transfer or grant any security interest in any of the FPI Permits, the FPI Construction Contract, each FPI Consultant Agreement, or Seller’s interest in the FPI Escrow Agreement, the FPI Escrow Account or the FPI Escrow Amount. At the Closing for the Phase I Property, Seller shall execute and deliver to Escrow Agent an assignment (the “FPI Collateral Assignment”), conditionally assigning to Purchaser the FPI Permits, the FPI Construction Contract, each FPI Consultant Agreement, and Seller’s interest in the FPI Escrow Agreement and the FPI Escrow Amount. Purchaser shall deliver a proposed form of FPI Collateral Assignment to Seller for its reasonable review and approval within 45 days after the Agreement Date and the parties shall mutually and in good faith agree upon the form of the FPI Collateral Assignment prior to the end of the Due Diligence Period. Escrow Agent shall hold the FPI Collateral Assignment under the terms and conditions of the FPI Escrow Agreement. If, after the Closing for the Phase I Property, Seller is in default under any of its obligations regarding the construction and completion of the Flood Plain Improvements, the LOMR Request or FPI Final Approval, and Seller fails to cure the default within 30 days after Purchaser gives Seller written notice of the default, Purchaser, in addition to any other remedy Purchaser may have for the default, may give written notice to Seller and Escrow Agent that Purchaser elects to accept the FPI Collateral Assignment. Upon Purchaser’s delivery of such notice, Escrow Agent shall promptly deliver the FPI Collateral Assignment to Purchaser and the FPI Collateral Assignment shall be deemed effective.

(k) Survival. The parties’ obligations under this Section 2.7 shall survive the Closings.

2.8 Adverse Conditions. As a condition to Purchaser’s obligation to close with respect to each Phase, there shall be no material change in any condition of or affecting the respective Phase not caused by Purchaser or its contractors, employees, affiliates or other related or similar parties, that has occurred after the Due Diligence Period including without limitation (i) any environmental contamination; (ii) access; (iii) the availability, adequacy or cost of or for all utilities (including without limitation, water, sanitary sewer, storm sewer, gas, electric, cable and any other utilities required to serve or service the Property) that will be necessary to serve the Proposed Project; or (iv) the imposition of any moratorium which would prohibit or delay the commencement of construction. It shall also be a condition to Purchaser’s obligation to close with respect to each Phase that there shall be no offsite obligations required in connection with the development of the Proposed Project and applicable water, sewer and impact fees charged by the applicable governmental authorities shall not have increased over the levels assessed as of the end of the Due Diligence Period.

ARTICLE 3. TITLE AND SURVEY REVIEW

3.1 Delivery of Title Commitment and Survey. Seller shall cause to be prepared within seven Business Days after the Agreement Date a current, effective commitment for title insurance for the Property (the “TitleCommitment”) issued by the Title Company, in the amount of the Purchase Price with Purchaser as the proposed insured, and accompanied by true, complete, and legible copies of all documents referred to in the Title Commitment. Purchaser shall cause to be prepared and delivered to Seller and Title Company within 30 days after the Effective Date a current ALTA/ACSM survey of the Property (the “Survey”) including a certification addressed to Purchaser, Seller and Title Company.

| 13 |

3.2 Title Review and Cure. During the Due Diligence Period, Purchaser shall review title to the Property as disclosed by the Title Commitment and the Survey. Seller shall cooperate with Purchaser in curing any objections Purchaser may have to title to the Property. Seller shall have no obligation to cure title objections except (a) liens or exceptions for delinquent property taxes and assessments and related penalties, (b) deeds of trust and mortgages, (c) mechanics’ liens, (d) other monetary liens, and (e) any exceptions or encumbrances to title which are created by, through or under Seller after the Agreement Date without the written consent of Purchaser, all of which shall be removed from title to the applicable Phase at or prior to the Closing Date for such Phase. Without limiting Seller’s obligations in the prior sentence or elsewhere in this Agreement or Purchaser’s remedies underSection 8.1, Purchaser may terminate this Agreement and receive a refund of the Earnest Money if the Title Company revises the Title Commitment after the expiration of the Due Diligence Period to add or modify exceptions or to delete or modify the conditions to obtaining any endorsement requested by Purchaser during the Due Diligence Period if such additions, modifications or deletions are not acceptable to Purchaser in its reasonable discretion and are not removed by the Closing Date for the applicable Phase. “Permitted Exceptions” means (i) the specific exceptions (exceptions that are not part of the promulgated title insurance form) in the Title Commitment that Purchaser has failed to object to in writing as of the expiration of the Due Diligence Period and that Seller is not required to remove as provided above, and (ii) real estate taxes not yet due and payable. Subject to the preceding sentences of this Section 3.2, the failure of Purchaser to deliver a Due Diligence Termination Notice to Seller prior to the end of the Due Diligence Period shall be deemed Purchaser’s acceptance of all specific exceptions in the most recent version of the Title Commitment.

3.3 Delivery of Title Policy at Closing. At the Closing for each Phase, as a condition to Purchaser’s obligation to close, the Title Company shall deliver to Purchaser an ALTA (or other form required by state law) Owner’s Policy of Title Insurance (“Title Policy”) for the respective Phase issued by the Title Company with ALTA General Exceptions 1 through 5 deleted (or corresponding deletions or endorsements if the Property is located in a non- ALTA state), containing the Purchaser’s Endorsements, dated the date and time of the recording of the Deed for the respective Phase in the amount of the Purchase Price for the respective Phase, insuring Purchaser as owner of good and indefeasible fee simple title to the respective Phase, subject only to the Permitted Exceptions applicable to the respective Phase. “Purchaser’s Endorsements” means, to the extent such endorsements are available under the laws of the state in which the Property is located: (a) owner’s comprehensive; (b) access; (c) survey (accuracy of survey); (d) location (survey legal matches title legal); (e) separate tax lot; (f) legal lot; (g) zoning 3.0; and (h) such other endorsements as Purchaser may require based on its review of the Title Commitment and Survey. Seller shall execute at Closing for each Phase an affidavit on the Title Company’s standard form so that the Title Company can delete or modify the standard printed exceptions as to parties in possession, unrecorded liens, and similar matters and, if required to issue the Title Policy at Closing for the respective Phase, the customary gap indemnity. The Title Policy may be delivered after the Closing for the respective Phase if at the Closing the Title Company issues a currently effective, duly-executed “marked-up” Title Commitment and irrevocably commits in writing to issue the Title Policy in the form of the “marked-up” Title Commitment promptly after the Closing Date for the respective Phase.

3.4 Title and Survey Costs. The standard premium for the Title Policy, including any search and examination fees, shall be paid by Seller. Purchaser shall pay for any additional premium for any Purchaser’s Endorsements it requires.

ARTICLE 4. OPERATIONS AND RISK OF LOSS

4.1 Performance under Contracts. During the pendency of this Agreement, Seller shall perform its material obligations under agreements that affect the Property.

4.2 New Contracts. During the pendency of this Agreement, Seller shall not enter into any lease or contract that will be an obligation affecting the Property after the Closing without Purchaser’s prior written consent.

4.3 Intentionally Deleted.

4.4 Seller’s Obligations. Other than the obligations of Seller expressly assumed by Purchaser, Seller, subject to the terms and conditions of this Agreement, covenants that it shall pay and discharge any and all liabilities of each and every kind arising out of or by virtue of the conduct of its business before and as of the Closing Date for each Phase on or related to the respective Phase. The provisions of thisSection 4.4shall survive the Closings.

| 14 |

4.5 Condemnation. By notice to Seller given within 10 days after Purchaser receives notice of proceedings in eminent domain that are contemplated, threatened or instituted by any applicable governmental or other authority having the power of eminent domain, and if necessary the next Closing Date for a Phase shall be extended to give Purchaser the full 10-day period to make such election, Purchaser may: (i) terminate this Agreement with respect to any Phase for which Closing has not occurred and the Earnest Money (if the Closing for the Phase I Property has not occurred), the Phase II Option Payment (if the Closing for the Phase II Property has not occurred), and the Phase III Option Payment (if the Closing for the Phase III Property has not occurred) shall be immediately returned to Purchaser; or (ii) proceed under this Agreement, in which event Seller shall, at the next Closing for a Phase, assign to Purchaser its entire right, title and interest in and to any condemnation award, and Purchaser shall have the sole right during the pendency of this Agreement to negotiate and otherwise deal with the condemning authority with respect to such eminent domain proceedings.

ARTICLE 5. CLOSING

5.1 Closing. The consummation of the transaction contemplated in this Agreement for each Phase (each, a “Closing”) shall occur on the Closing Date for the respective Phase at the offices of the Escrow Agent. Closing shall occur through an escrow with the Escrow Agent. The balance of the Purchase Price for the respective Phase, plus or minus prorations, shall be deposited into and held by Escrow Agent in a closing escrow account with a bank satisfactory to Purchaser and Seller. Upon satisfaction or completion of all Closing conditions and deliveries for the respective Phase, the parties shall direct the Escrow Agent to immediately record and deliver the Closing documents for the respective Phase to the appropriate parties and make disbursements according to the closing statements executed by Seller and Purchaser. With respect to each Phase, the Escrow Agent and the Title Company shall agree in writing with Purchaser that (a) recordation of the Deed for the respective Phase constitutes the Escrow Agent’s representation that it is holding the Closing documents, Closing funds and Closing statement for the respective Phase and is prepared and irrevocably committed to disburse the Closing funds in accordance with the Closing statement for the respective Phase and (b) upon the Escrow Agent’s release of funds to Seller for the respective Phase, the Title Company shall be irrevocably committed to issue the Title Policy for the respective Phase in accordance with this Agreement.

5.2 Conditions to the Parties’ Obligations to Close.

(a) In addition to all other conditions set forth in this Agreement, the obligation of Seller, on the one hand, and Purchaser, on the other hand, to consummate the transactions contemplated under this Agreement for each Phase shall be conditioned on the following:

(1) The other party’s representations and warranties contained in this Agreement shall be true and correct as of the Agreement Date and the Closing Date. For purposes of this Section 5.2(a)(1), if a representation is made to knowledge, but the factual matter that is the subject of the representation is false notwithstanding any lack of knowledge or notice to the party making the representation, such event shall constitute a failure of this condition only, and not a default by the party making such representation;

(2) As of the Closing Date for the respective Phase, the other party shall have performed its obligations under this Agreement and all deliveries to be made at Closing have been tendered;

(3) There shall exist no pending or threatened actions, suits, arbitrations, claims, attachments, proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings, pending or threatened against the other party or the Property that would materially and adversely affect the other party’s ability to perform its obligations under this Agreement; and

(4) There shall exist no pending or threatened action, suit or proceeding with respect to the other party before or by any court or administrative agency which seeks to restrain or prohibit, or to obtain damages or a discovery order with respect to, this Agreement or the consummation of the transactions contemplated under this Agreement.

| 15 |

(b) In addition to all other conditions set forth in this Agreement, the obligation of Purchaser to consummate the transactions contemplated under this Agreement for each Phase shall also be conditioned on the following:

(1) There shall exist no actions, suits, arbitrations, claims, attachments, proceedings, assignments for the benefit of creditors, insolvency, bankruptcy, reorganization or other proceedings, pending or threatened against the Property that would materially and adversely affect the Property, the operation of the Property or Purchaser’s Proposed Project;

(2) There shall exist no pending or threatened review or appeal of, and there shall exist no right to review or appeal, the Development Approvals by any governmental authority or person other than Purchaser;

(3) There shall exist no pending or threatened moratorium on development or other governmental or quasi-governmental action which could prohibit or delay Purchaser’s development of the Proposed Project;

(4) The availability of all utilities (including without limitation, water, sanitary sewer, storm sewer, gas, electric, cable and any other utilities) to serve or service the Proposed Project shall not have materially changed since the expiration of the Due Diligence Period;

(5) There shall exist no new special assessments, or any additional amounts for special assessments currently assessed, that are payable with respect to the Property other than any special assessments that existed as of the expiration of the Due Diligence Period; and

(6) Final Approval of the Development Approvals has occurred with respect to all Development Approvals required for the respective Phase.

(c) In addition to all other conditions set forth in this Agreement, the obligation of Purchaser to consummate the transactions contemplated under this Agreement for the Phase I Property shall also be conditioned on the following:

(1) Seller and the FPI Contractor shall have entered into the FPI Construction Contract.

(2) Seller and each FPI Consultant shall have entered into an FPI Consultant Contract.

(3) Purchaser shall have approved, and Seller shall have obtained approval for, any Seller Subdivision required under Section 2.5(a), and there shall exist no pending review or appeal of, and there shall exist no right to review or appeal, any such Seller Subdivision by any governmental authority or person.

(4) Seller shall have obtained all FPI Permits.

(d) In addition to all other conditions set forth in this Agreement, the obligation of Purchaser to consummate the transactions contemplated under this Agreement for each of the Phase II Property and the Phase III Property shall also be conditioned on the following:

(1) Purchaser shall have given the Phase II Closing Notice (in the case of the Closing for the Phase II Property) or the Phase III Closing Notice (in the case of the Closing for the Phase III Property).

(2) Seller shall have completed the construction of, and there shall be no uncured defects in, the Flood Plain Improvements.

| 16 |

(3) Seller shall have obtained FPI Final Approval.

(4) Purchaser shall have approved, and Seller shall have obtained approval for, any Seller Subdivision required under Section 2.5(b), and there shall exist no right to review or appeal, any such Seller Subdivision by any governmental authority or person.

(e) So long as a party is not in default under this Agreement, if any condition to that party’s obligation to proceed with the Closing for the respective Phase under this Agreement has not been satisfied as of the Closing Date for the respective Phase, the party may, in its sole discretion, elect to (i) terminate this Agreement by delivering written notice to the other party on or before the Closing Date for the respective Phase, (ii) extend the Closing for the respective Phase for a maximum of 30 days to allow for satisfaction of such condition, or (iii) consummate this transaction notwithstanding the non-satisfaction of such condition, in which event the party shall be deemed to have waived any such condition. If a party elects to close, notwithstanding that a condition to that party’s obligation to proceed with the Closing for the respective Phase has not been satisfied, the other party shall have no liability for breaches of representations and warranties of which the party electing to close had actual knowledge at the Closing for the respective Phase. Notwithstanding the foregoing, the failure of a condition due to the breach of a party shall not relieve the breaching party from any liability it would otherwise have under this Agreement.

5.3 Seller’s Deliveries in Escrow. On or prior to the Closing Date for each Phase, Seller shall deliver in escrow to the Escrow Agent the following:

(a) Deed. A special warranty deed in form provided for under the law of Texas or otherwise in conformity with the custom in such jurisdiction and mutually satisfactory to the parties, executed by Seller, and acknowledged, conveying to Purchaser good and indefeasible fee simple title to the respective Phase, subject only to the Permitted Exceptions (the“Deed”).

(b) Assignment of Intangible Property. Such assignments and other documents and certificates as Purchaser may reasonably require in order to fully and completely transfer and assign to Purchaser all of Seller’s right, title, and interest, in and to the Development Approvals, all documents and contracts related to the Development Approvals, and any other permits, rights under utility agreements and similar rights applicable to the Property.

(c) Memorandum of Option. With respect to the Closing for the Phase I Property only, a counterpart of the Memorandum, executed by Seller and acknowledged.

(d) FPI Escrow Agreement. With respect to the Closing for the Phase I Property only, a counterpart of the FPI Escrow Agreement, executed by Seller.

(e) FPI Collateral Assignment. With respect to the Closing for the Phase I Property only, the FPI Collateral Assignment, executed by Seller.

(f) Plat. If any plats or approvals required in connection with any Seller Subdivision or the Development Approvals are to be recorded at or immediately after the Closing, the final executed plat or approvals in form for recording according to applicable law.

(g) State Law Disclosures. Such disclosures and reports, required by applicable state and local law in connection with the conveyance of real property.

(h) FIRPTA. A Foreign Investment in Real Property Tax Act (“FIRPTA”) certificate of non-foreign status in the form attached to this Agreement asExhibit Cand executed by Seller. If Seller fails to provide the FIRPTA certification on the Closing Date, Purchaser may proceed with withholding provisions as provided by law.

(i) Certificate of Representations and Warranties. A certificate executed by Seller, reaffirming and updating to the Closing Date the representations and warranties given by Seller underSection 7.1.

| 17 |

(j) CCRs. If the Phase is subject to a declaration of covenants, conditions and restrictions or similar instrument (“CCRs”) governing or affecting the use, operation, maintenance, management or improvement of such Phase, estoppel certificates, in form and substance reasonably satisfactory to Purchaser, from the declarant, association, committee, agent and/or other person or entity having governing or approval rights under the CCRs.

(k) Authority. Evidence of the existence, organization, and authority of Seller and the authority of the person executing documents on behalf of Seller reasonably satisfactory to Purchaser, the Escrow Agent, and the Title Company.

(l) Additional Documents. Any additional documents that Purchaser, the Escrow Agent or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement for the respective Phase.

5.4 Purchaser’s Deliveries in Escrow. On or prior to the Closing Date for each Phase, Purchaser shall deliver in escrow to the Escrow Agent the following:

(a) Purchase Price. The Purchase Price for the respective Phase (with respect to the Closing for the Phase I Property, the Phase I Purchase Price, less the sum of the Earnest Money plus the FPI Escrow Amount), plus or minus applicable prorations, deposited by Purchaser with the Escrow Agent in immediate, same day federal funds wired for credit into the Escrow Agent’s escrow account.

(b) Memorandum of Option. With respect to the Closing for the Phase I Property only, a counterpart of the Memorandum, executed by Purchaser and acknowledged.

(c) FPI Escrow Agreement. With respect to the Closing for the Phase I Property only, a counterpart of the FPI Escrow Agreement, executed by Purchaser.

(d) FPI Deposit. With respect to the Closing for the Phase I Property only, the FPI Escrow Amount, as partial payment of the Phase I Purchase Price, for deposit into the FPI Escrow Account.

(e) Option Payments. Phase II Option Payment and Phase III Option Payment.

(f) State Law Disclosures. Such disclosures and reports required by applicable state and local law in connection with the conveyance of real property.

(g) Additional Documents. Any additional documents that Seller, the Escrow Agent or the Title Company may reasonably require for the proper consummation of the transaction contemplated by this Agreement for the respective Phase.

5.5 Closing Statements. At Closing for each Phase, Seller and Purchaser shall deposit with the Escrow Agent executed closing statements for the respective Phase consistent with this Agreement in form required by the Escrow Agent. If Seller and Purchaser cannot agree on the closing statements to be deposited as aforesaid because of a dispute over the prorations and adjustments set forth in the closing statements, the Closing nevertheless shall occur, and the amount in dispute shall be withheld from the Purchase Price and placed in an escrow with the Escrow Agent, to be paid out upon the joint direction of the parties or pursuant to court order upon resolution or other final determination of the dispute.

5.6 Title Policy. The Title Company shall deliver to Purchaser the Title Policy for the respective Phase pursuant to Section 3.3.

5.7 Possession. Seller shall deliver possession of each Phase to Purchaser at the Closing for the respective Phase subject only to the Permitted Exceptions applicable to the respective Phase.

5.8 Costs. Seller shall pay the cost of recording the Deed for the respective Phase and any other documents to be recorded in connection with the Closing for the respective Phase and all documentary, transfer, excise and similar taxes and fees for the respective Phase. The Escrow Agent’s fee shall be evenly divided between Purchaser and Seller.

| 18 |

ARTICLE 6. PRORATIONS