As filed with the Securities and Exchange Commission on april 29, 2013

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2012

Commission file number: 001-34175

ECOPETROL S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

REPUBLIC OF COLOMBIA

(Jurisdiction of incorporation or organization)

Carrera 13 No. 36 – 24

BOGOTA – COLOMBIA

(Address of principal executive offices)

Alejandro Giraldo

Investor Relations Officer

investors@ecopetrol.com.co

Tel. (571) 234 5190

Fax. (571) 234 5628

Carrera 13 N.36-24 Piso 8

Bogota, Colombia

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class | Name of each exchange on which registered: |

| American Depository Shares (as evidenced by American Depository Receipts), each representing 20 common shares par value Ps$250 per share | New York Stock Exchange |

| Ecopetrol common shares par value Ps$250 per share | New York Stock Exchange (for listing purposes only) |

| 7.625% Notes due 2019 | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

41,116,698,456 Ecopetrol common shares, par value Ps$250 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

xYes¨No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

¨YesxNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

xYes¨No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted 28576 submit and post such files).

N/A

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filerx | Accelerated filer¨ | Non-accelerated filer¨ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| ¨ U.S. GAAP | ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board | x Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨ Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

¨YesxNo

TABLE OF CONTENTS

| | | Page |

| | | |

| | Forward-Looking Statements | 1 |

| | Enforcement of Civil Liabilities | 1 |

| | Presentation of Financial Information | 2 |

| | Presentation of Abbreviations | 4 |

| | Presentation of The Nation and Government of Colombia | 4 |

| | Presentation of Information Concerning Reserves | 4 |

| ITEM 1. | Identity of Directors, Senior Management and Advisors | 5 |

| ITEM 2. | Offer Statistics and Expected Timetable | 5 |

| ITEM 3. | Key Information | 5 |

| | Selected Financial Data | 5 |

| | Exchange Rate Information | 7 |

| | Risk Factors | 8 |

| ITEM 4. | Information on the Company | 24 |

| | The Company | 24 |

| | Overview By Business Segment | 29 |

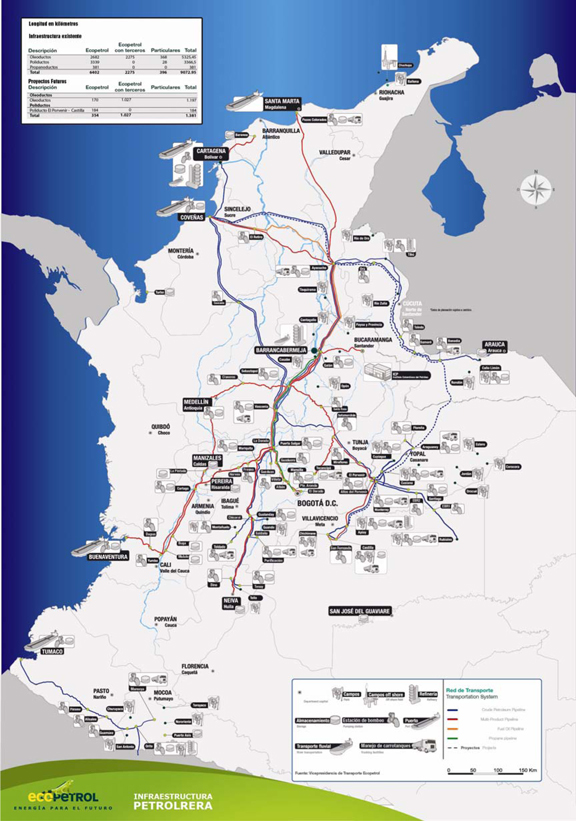

| | Transportation Infrastructure | 53 |

| | Property, Plant and Equipment | 74 |

| ITEM 4A. | Unresolved Staff Comments | 74 |

| ITEM 5. | Operating and Financial Review and Prospects | 75 |

| | Operating Results | 81 |

| | Liquidity and Capital Resources | 93 |

| | Research and Development, Patents and Licenses, etc. | 95 |

| | Off-Balance Sheet Arrangements | 96 |

| | Tabular Disclosure of Contractual Obligations | 97 |

| ITEM 6. | Directors, Senior Management and Employees | 98 |

| | Directors and Senior Management | 98 |

| | Compensation | 102 |

| | Share Ownership | 102 |

| | Board Practices | 102 |

| | Employees | 104 |

| ITEM 7. | Major Shareholders and Related Party Transactions | 107 |

| | Major Shareholders | 107 |

| | Related Party Transactions | 107 |

| ITEM 8. | Financial Information | 113 |

| | Consolidated Statements And Other Financial Information | 113 |

| | Legal Proceedings | 113 |

| | Dividends | 114 |

| | Significant Changes | 114 |

| ITEM 9. | The Offer and Listing | 115 |

| | Trading Markets | 115 |

| | Trading On The Bolsa De Valores De Colombia | 116 |

| ITEM 10. | Additional Information | 118 |

| | Bylaws | 118 |

| | Material Contracts | 121 |

| | Taxation | 122 |

| | Documents On Display | 128 |

| ITEM 11. | Quantitative and Qualitative Disclosures About Market Risk | 128 |

| ITEM 12. | Description of Securities Other than Equity Securities | 131 |

| ITEM 12A. | Debt Securities | 131 |

| ITEM 12B. | Warrants and Rights | 131 |

| ITEM 12C. | Other Securities | 131 |

| ITEM 12D. | American Depositary Shares | 131 |

| ITEM 13. | Defaults, Dividend Arrearages and Delinquencies | 132 |

| ITEM 14. | Material Modifications to the Rights of Security Holders and Use of Proceeds | 133 |

| ITEM 15. | Controls and Procedures | 133 |

| ITEM 16. | [Reserved] | 134 |

| ITEM 16A. | Audit Committee Financial Expert | 134 |

| ITEM 16B. | Code of Ethics | 134 |

| ITEM 16C. | Principal Accountant Fees and Services | 134 |

| | Audit and Non-Audit Fees | 134 |

| ITEM 16D. | Exemptions from the Listing Standards for Audit Committees | 135 |

| ITEM 16E. | Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 135 |

| ITEM 16F. | Change in Registrant’s Certifying Accountant | 135 |

| ITEM 16G. | Corporate Governance | 136 |

| ITEM 16H. | Mine Safety Disclosure | 137 |

| ITEM 17. | Financial Statements | 137 |

| ITEM 18. | Financial Statements | 137 |

| ITEM 19. | Exhibits | 138 |

Forward-Looking Statements

This annual report on Form 20-F contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements are not based on historical facts and reflect our expectations for future events and results. Most facts are uncertain because of their nature. Words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “should,” “plan,” “potential,” “predicts,” “prognosticate,” “project,” “target,” “achieve” and “intend,” among other similar expressions, are understood as forward-looking statements. These factors may include the following:

| · | drilling and exploration activities; |

| · | future production rates; |

| · | import and export activities; |

| · | liquidity, cash flow and uses of cash flow; |

| · | projected capital expenditures; |

| · | dates by which certain areas will be developed or will come on-stream; and |

| · | allocation of capital expenditures to exploration and production activities. |

Actual results are subject to certain factors out of the control of the Company and may differ materially from the anticipated results. These factors may include the following:

| · | changes in international crude oil and natural gas prices; |

| · | limitations on our access to sources of financing; |

| · | significant political, economic and social developments in Colombia and other countries where we do business; |

| · | military operations, terrorist acts, wars or embargoes; |

| · | regulatory developments, including regulations related to climate change; |

| · | technical difficulties; and |

| · | other factors discussed in this document as “Risk Factors.” |

Most of these statements are subject to risks and uncertainties that are difficult to predict. Therefore, our actual results could differ materially from projected results. Accordingly, readers should not place undue reliance on the forward-looking statements contained in this annual report.

Enforcement of Civil Liabilities

We are a Colombian company, all of our Directors and executive officers and some of the experts named in this annual report reside outside the United States. All or a substantial portion of our assets and the assets of these persons are located outside of the United States. As a result, it may not be possible for you to effect service of process within the United States upon us or these persons or to enforce against us or them judgments in U.S. courts obtained in such courts predicated upon the civil liability provisions of the U.S. federal securities laws. Colombian courts will determine whether to enforce a U.S. judgment predicated on the U.S. securities laws through a proceeding known asexequatur. The Colombian Supreme Court will enforce a foreign judgment, without reconsideration of the merits only if the judgment satisfies the following requirements:

| · | a treaty exists between Colombia and the country where the judgment was granted or there is reciprocity in the recognition of foreign judgments between the courts of the relevant jurisdiction and the courts of Colombia; |

| · | the foreign judgment does not relate to“in rem rights” vested in assets that were located in Colombia at the time the suit was filed and does not contravene or conflict with Colombian laws relating to public order other than those governing judicial procedures; |

| · | the foreign judgment, in accordance with the laws of the country where it was rendered, is final and is not subject to appeal and a duly certified and authenticated copy of the judgment has been presented to a competent court in Colombia; |

| · | the foreign judgment does not refer to any matter upon which Colombian courts have exclusive jurisdiction; |

| · | no proceeding is pending in Colombia with respect to the same cause of action, and no final judgment has been awarded in any proceeding in Colombia on the same subject matter and between the same parties; and |

| · | in the proceeding commenced in the foreign court that issued the judgment, the defendant is served in accordance with the laws of such jurisdiction and in a manner reasonably designated to give the defendant an opportunity to defend against the action. |

The United States and Colombia do not have a bilateral treaty providing for automatic reciprocal recognition and enforcement of judgments in civil and commercial matters. The Colombian Supreme Court has in the past accepted that reciprocity exists when it has been proven that either a U.S. court has enforced a Colombian judgment or that a U.S. court would enforce a foreign judgment, including a judgment issued by a Colombian court. However, such enforceability decisions are considered by Colombian courts on a case-by-case basis.

Presentation of Financial Information

Unless the context otherwise requires, the terms “Ecopetrol,” “we,” “us,” “our,” the “Company” or the “Corporate Group” are used in this annual report to refer to Ecopetrol S.A. and its subsidiaries on a consolidated basis.

In this annual report, references to “US$” or “U.S. dollars” are to United States dollars and references to “Ps$,” “Peso” or “Pesos” are to Colombian Pesos, the functional currency under which we prepare our financial statements. Certain figures shown in this annual report have been subject to rounding adjustments and, accordingly, certain totals may therefore not precisely equal the sum of the numbers presented. In this annual report a billion is equal to one with nine zeros.

Our consolidated financial statements are prepared in accordance with accounting principles for Colombian state-owned entities issued by the Colombian National Accounting Office (Contaduría General de la Nación), or CGN, and other applicable legal provisions.

Our consolidated financial statements at and for the years ended December 31, 2012, 2011 and 2010 and the selected financial data at and for the years ended December 31, 2012, 2011, 2010, 2009 and 2008 have been prepared under Public Accounting Regime (Régimen de Contabilidad Pública), or RCP, as adopted by the CGN in September, 2007 and applicable to Ecopetrol beginning with the fiscal year ended December 31, 2008. See Note 1 to our consolidated financial statements. We refer to RCP as Colombian Government Entity GAAP. Colombian Government Entity GAAP differs in certain significant respects from generally accepted accounting principles in the United States, or U.S. GAAP. Note 35 to our consolidated financial statements included in this annual report provides a description of the principal differences between Colombian Government Entity GAAP and U.S. GAAP as they relate to our audited consolidated financial statements and provides a reconciliation of net income and shareholders’ equity for the years and dates indicated therein. As a state-owned company, our consolidated financial statements are periodically reviewed by the CGN. However, the review of our accounts by the CGN does not constitute an audit.

The accompanying audited consolidated financial statements of Ecopetrol and our consolidated subsidiaries for the years ended December 31, 2012, 2011 and 2010 have been prepared from accounting records, which are maintained under the historical cost convention as modified in 1992, to comply with the legal provisions of the CGN.

Certain line items from our consolidated financial statements as of December 31, 2011 and 2010 related to the presentation of the consolidated Balance Sheet and the Consolidated Statement of Financial, Economic, Social and Environmental Activities have been reclassified in order to make the presentation of such financial statements comparable to that of the financial statements as of December 31, 2012. The main reclassifications were under cost of sales, marketing and projects, accounts payable and related parties, Taxes, contributions and duties payable, Deposits held in trust and Other assets. See Note 34 to our consolidated financial statements for a description of the principal differences.

Our consolidated financial statements were consolidated line by line and all transactions and significant balances between affiliates have been eliminated. These financial statements include the financial results of the following companies:

| COMPANY | | OWNERSHIP % | | | Included in

consolidated

Financial Statements

for the year ended | |

| | | | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | |

| Black Gold Re Ltd. | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol Oleo é Gas Do Brasil Ltda. | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol del Perú S.A. | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol America Inc. | | | 100.00 | | | | X | | | | X | | | | X | |

| Andean Chemicals Ltd. | | | 100.00 | | | | X | | | | X | | | | X | |

| Polipropileno del Caribe S.A. (Propilco) | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol Global Energy SLU | | | 100.00 | | | | X | | | | X | | | | X | |

| Refinería de Cartagena S.A. (Reficar) | | | 100.00 | | | | X | | | | X | | | | X | |

| COMAI Compounding and Masterbatching Industry Ltda. | | | 100.00 | | | | X | | | | X | | | | X | |

| Hocol Petroleum Ltd. | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol Capital AG | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol Pipelines International Limited | | | 100.00 | | | | X | | | | X | | | | X | |

| Ecopetrol Global Capital SL | | | 100.00 | | | | X | | | | X | | | | | |

| Cenit Transporte y Logistica de Hidrocarburos S.A.S. | | | 100.00 | | | | X | | | | | | | | | |

| Ecopetrol Transportation Company Ltd. | | | 100.00 | | | | | | | | X | | | | X | |

| Ecopetrol Transportation Investment Ltd | | | 100.00 | | | | | | | | X | | | | X | |

| Bioenergy S.A. | | | 91.43 | | | | X | | | | X | | | | X | |

| ODL Finance S.A. | | | 65.00 | | | | X | | | | X | | | | X | |

| Oleoducto Central S.A. (Ocensa) | | | 72.65 | | | | X | | | | X | | | | X | |

| Oleoducto de Colombia (ODC) | | | 73.00 | | | | X | | | | X | | | | X | |

| Equion Energía Ltd. (Equion) | | | 51.00 | | | | X | | | | X | | | | | |

| Oleoducto Bicentenario de Colombia S.A.S. | | | 55.97 | | | | X | | | | X | | | | X | |

This annual report translates certain Peso amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise indicated, such Peso amounts have been translated at the rate of Ps$1,768.23 per US$1.00, which corresponds to theTasa Representativa del Mercado, or Representative Market Exchange Rate, for December 31, 2012. The Representative Market Exchange Rate is computed and certified by theSuperintendencia Financiera,or Superintendency of Finance, the Colombian banking and securities regulator, on a daily basis and represents the weighted average of the buy and sell foreign exchange rates negotiated on the previous day by financial institutions authorized to engage in foreign exchange transactions. The Superintendency of Finance also calculates the Representative Market Exchange Rate for each month for purposes of preparing financial statements and converting amounts in foreign currency to Pesos. Such conversion should not be construed as a representation that the Peso amounts correspond to, or have been or could be converted into, U.S. dollars at that rate or any other rate. On April 26, 2013, the Representative Market Exchange Rate was Ps$1,830.84 per US$1.00.

Presentation Of Abbreviations

The following is a list of crude oil and natural gas measurement abbreviations commonly used throughout this annual report.

| bpd | Barrels per day |

| boe | Barrels of oil equivalent |

| boepd | Barrels of oil equivalent per day |

| btu | British thermal units |

| cf | Cubic feet |

| cfpd | Cubic feet per day |

| mcf | Million cubic feet |

| mcfpd | Million cubic feet per day |

| mbtu | Million British thermal units |

| gbtu | Giga British thermal units |

| gbtud | Giga British thermal units per day |

| bcf | Billion Cubic feet |

Presentation Of The Nation And Government Of Colombia

References to the Nation in this annual report relate to the Republic of Colombia, our controlling shareholder. References made to the Government of Colombia or the Government correspond to the executive branch including the President of Colombia, the ministries and other governmental agencies responsible for regulating our business.

Presentation Of Information Concerning Reserves

The estimates of our proved reserves of crude oil and natural gas included in this annual report have been calculated according to the technical definitions required by the U.S. Securities and Exchange Commission, or SEC. Our hydrocarbon net proved reserves have been audited in 2012 by Ryder Scott Company L.P., DeGolyer and MacNaughton and Gaffney, Cline & Associates Inc., which we refer to collectively as the External Engineers, and their reserves reports are included as exhibits herein. All reserve estimates involve some degree of uncertainty. See “Item 4. Information on the Company—Overview by Business Segment—Exploration and Production—Reserves” for additional information on our reserves estimates.

The following table sets forth the percentage of our estimated net proved reserves audited by External Engineers and the percentage calculated internally for the years ended December 31, 2012, 2011 and 2010. Our proved reserves as of December 31, 2012, 2011 and 2010 are based on the SEC average price methodology for purposes of both Colombian Government Entity GAAP and U.S. GAAP. See “Item 3. Key Information—Risk Factors—Risks related to our business” for a description of the risks’ relating to our reserves and our reserve estimates.

| | | Estimated proved reserves for the year ended

December 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

| Net proved reserves audited by External Engineers | | | 99 | % | | | 99 | % | | | 99 | % |

| Net proved reserves estimates on our own calculations | | | 1 | % | | | 1 | % | | | 1 | % |

We are required, as are all oil companies undertaking exploratory and production activities in Colombia, to pay a percentage of our production to the Government as royalties. The oil and gas reserve figures included in this annual report are net of such royalties.

| ITEM 1. | Identity of Directors, Senior Management and Advisors |

Not applicable.

| ITEM 2. | Offer Statistics and Expected Timetable |

Not applicable.

Selected Financial Data

The following table sets forth, for the periods and at the dates indicated, our selected historical financial data, which have been derived from and should be read in conjunction with, and are qualified in their entirety by reference to, our consolidated financial statements and accompanying Notes included in this annual report, presented in Pesos. KPMG Ltda. audited our consolidated financial statements for the years ended December 31, 2012 and 2011. Our consolidated financial statements for the years ended December 31, 2010, 2009 and 2008 were audited by PricewaterhouseCoopers Ltda. The information included below and elsewhere in this annual report is not necessarily indicative of our future performance. See also “Item 5. Operating and Financial Review and Prospects” in this annual report.

Colombian Government Entity GAAP differs in certain significant respects from U.S. GAAP. For a description of the principal differences between Colombian Government Entity GAAP and U.S. GAAP as they relate to us, a reconciliation to U.S. GAAP of net income and shareholders’ equity, and financial statements under U.S. GAAP, see Note 35 to our consolidated financial statements and “Item 5. Operating and Financial Review and Prospects—Principal Differences Between Colombian Government Entity GAAP and U.S. GAAP.”

| | | BALANCE SHEET | |

| | | For the year ended December 31, | |

| | | 2012(1) | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (US$ in thousands

except for common

share and dividends

per share amounts) | | | (Pesos in millions except for common share and dividends per share amounts) | |

| | | | | | | |

| Total assets | | | 64,403,148 | | | | 113,879,578 | | | | 92,277,386 | | | | 68,769,356 | | | | 55,559,517 | | | | 48,702,412 | |

| Shareholders’ Equity | | | 36,613,382 | | | | 64,740,881 | | | | 54,688,855 | | | | 41,328,181 | | | | 32,569,957 | | | | 34,619,717 | |

| Subscribed capital | | | 5,813,257 | | | | 10,279,175 | | | | 10,279,175 | | | | 10,118,128 | | | | 10,118,128 | | | | 10,118,128 | |

| Number of common shares | | | 41,116,698,456 | (2) | | | 41,116,698,456 | (2) | | | 41,116,698,456 | (2) | | | 40,472,512,588 | | | | 40,472,512,588 | | | | 40,472,512,588 | |

| Dividends declared per share(3) | | | 0.17 | | | | 300 | | | | 145 | | | | 91.0 | | | | 220.0 | | | | 115.0 | |

| Amounts in accordance with U.S. GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| Total Assets | | | 46,102,222 | | | | 81,519,332 | | | | 70,909,079 | | | | 52,332,148 | | | | 42,624,352 | | | | 40,244,452 | |

| Shareholders’ Equity | | | 21,291,547 | | | | 37,648,352 | | | | 36,055,173 | | | | 27,175,285 | | | | 22,383,712 | | | | 27,425,735 | |

| Number of common shares | | | 41,116,698,456 | (2) | | | 41,116,698,456 | (2) | | | 41,116,698,456 | (2) | | | 40,472,512,588 | | | | 40,472,512,588 | | | | 40,472,512,588 | |

| Dividends declared per share(3) | | | 0.17 | | | | 300 | | | | 145 | | | | 91.0 | | | | 220.0 | | | | 115.0 | |

| (1) | Amounts stated in U.S. dollars have been translated for the convenience of the reader at the rate of Ps$1,768.23 to US$1.00, which is the Representative Market Exchange Rate at December 31, 2012, as reported and certified by the Superintendency of Finance. |

| (2) | Number of common shares includes 644,185,868 shares issued to the public in connection with our second offering of shares in Colombia in September 2011. |

| (3) | Represents payments made in 2012, 2011, 2010, 2009 and 2008, based on net income and retained earnings for the years ended December 31, 2011, 2010, 2009, 2008 and 2007 respectively. |

| | | INCOME STATEMENT | |

| | | For the year ended December 31, | |

| | | 2012(1) | | | 2012 | | | 2011 | | | 2010 | | | 2009 | | | 2008 | |

| | | (US$ in thousands

except for net

income per share

and average number

of shares amounts) | | | (Pesos in millions except for net income per share and average number of shares amounts) | |

| Total revenue | | | 38,938,375 | | | | 68,852,002 | | | | 65,967,514 | | | | 42,089,745 | | | | 30,404,390 | | | | 33,896,669 | |

| Operating income | | | 13,689,560 | | | | 24,206,290 | | | | 25,872,980 | | | | 12,747,448 | | | | 7,873,339 | | | | 12,657,358 | |

| Net operating income per share | | | 0.33 | | | | 589 | | | | 637 | | | | 315 | | | | 195 | | | | 313 | |

| Income before income tax | | | 12,629,410 | | | | 22,331,701 | | | | 23,641,432 | | | | 11,492,617 | | | | 7,250,844 | | | | 16,011,204 | |

| Net income | | | 8,358,046 | | | | 14,778,947 | | | | 15,452,334 | | | | 8,146,471 | | | | 5,132,054 | | | | 11,629,677 | |

| Weighted average number of shares outstanding | | | 41,116,698,456 | (2) | | | 41,116,698,456 | (2) | | | 40,634,882,725 | (2) | | | 40,472,512,588 | | | | 40,472,512,588 | | | | 40,472,512,588 | |

| Net income per share(3) | | | 0.20 | | | | 359 | | | | 380 | | | | 201.28 | | | | 127 | | | | 287 | |

| Amounts in accordance with U.S. GAAP | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total revenue | | | 37,815,859 | | | | 66,867,137 | | | | 62,715,815 | | | | 40,879,324 | | | | 29,551,574 | | | | 33,849,213 | |

| Operating income | | | 13,322,341 | | | | 23,556,963 | | | | 23,673,787 | | | | 13,878,515 | | | | 8,055,213 | | | | 9,840,311 | |

| Net operating income per share | | | 0.32 | | | | 573 | | | | 583 | | | | 343 | | | | 199 | | | | 243 | |

| Income before income tax and non-controlling interest | | | 12,675,660 | | | | 22,413,482 | | | | 23,456,685 | | | | 12,840,721 | | | | 8,768,383 | | | | 13,427,443 | |

| Net income attributable to Ecopetrol | | | 8,310,937 | | | | 14,695,649 | | | | 14,817,207 | | | | 8,211,035 | | | | 5,718,304 | | | | 8,841,883 | |

| Net income per share | | | 0.20 | | | | 357 | | | | 365 | | | | 203 | | | | 141 | | | | 218 | |

| Average number of shares outstanding(4) | | | 41,116,698,456 | | | | 41,116,698,456 | | | | 40,634,882,725 | | | | 40,472,512,588 | | | | 40,472,512,588 | | | | 40,472,512,588 | |

| (1) | Amounts stated in U.S. dollars have been translated for the convenience of the reader at the rate of Ps$1,768.23 to US$1.00, which was the Representative Market Exchange Rate at December 31, 2012, as reported and certified by the Superintendency of Finance. |

| (2) | The weighted average number of common shares outstanding during 2012 and 2011 was 41,116,698,456 and 40,634,882,725, respectively, as a result of 644,185,868 shares issued to the public in connection with our second offering of shares in Colombia in September 2011. |

| (3) | Net income per share is calculated using the weighted-average number of outstanding shares at December 31 of each year. |

| (4) | Calculated in accordance with U.S. GAAP, which differs in certain respects with the calculation of weighted average number of shares pursuant to Colombian Government Entity GAAP. |

Exchange Rate Information

On April 26, 2013, the Representative Market Exchange Rate was Ps$1,830.84 per US$1.00. The Federal Reserve Bank of New York does not report a noon-buying rate for Colombian Pesos. The Superintendency of Finance calculates the Representative Market Exchange Rate based on the weighted averages of the buy and sell foreign exchange rates quoted daily by foreign exchange rate market intermediaries including financial institutions for the purchase and sale of U.S. dollars.

The following table sets forth the high, low, average and period-end exchange rate for Pesos/U.S. dollar Representative Market Exchange Rate for each of the last five years and for the last six months.

| | | Exchange Rates | |

| | | High | | | Low | | | Average | | | Period-End | |

| | | | | | | | | | | | | |

| 2008 | | | 2,392.28 | | | | 1,652.41 | | | | 1,966.26 | | | | 2,243.59 | |

| 2009 | | | 2,596.37 | | | | 1,825.68 | | | | 2,156.29 | | | | 2,044.23 | |

| 2010 | | | 2,044.23 | | | | 1,786.20 | | | | 1,897.89 | | | | 1,913.98 | |

| 2011 | | | 1,972.76 | | | | 1,748.41 | | | | 1,848.17 | | | | 1,942.70 | |

| 2012 | | | 1,942.70 | | | | 1,754.89 | | | | 1,798.23 | | | | 1,768.23 | |

| October | | | 1,831.25 | | | | 1,795.40 | | | | 1,804.97 | | | | 1,829.89 | |

| November | | | 1,831.25 | | | | 1,814.21 | | | | 1,820.29 | | | | 1,817.93 | |

| December | | | 1,813.73 | | | | 1,768.23 | | | | 1,793.94 | | | | 1,768.23 | |

| | | | | | | | | | | | | | | | | |

| 2013: | | | | | | | | | | | | | | | | |

| January | | | 1,779.84 | | | | 1,758.45 | | | | 1,770.01 | | | | 1,773.24 | |

| February | | | 1,818.54 | | | | 1,775.65 | | | | 1,791.48 | | | | 1,816.42 | |

| March | | | 1,828.95 | | | | 1,797.28 | | | | 1,809.89 | | | | 1,832.20 | |

| April (through April 26) | | | 1,847.02 | | | | 1,813.11 | | | | 1,829.83 | | | | 1,830.84 | |

Source: Superintendency of Finance for historical data.Banco de la República, or the Colombian Central Bank for averages.

Risk Factors

Risks related to our business

Our crude oil and natural gas reserve estimates involve some degree of uncertainty and may prove to be incorrect over time, which could adversely affect our ability to generate revenue.

Reserves estimates are prepared using generally accepted geological and engineering evaluation methods and procedures. Estimates are based on geological, topographic and engineering facts. Actual reserves and production may vary materially from estimates shown in this annual report, and downward revisions in our reserve estimates could lead to lower future production which could affect our results of operations and financial condition.

Our business depends substantially on international prices for crude oil and refined products, and prices for these products are volatile. A sharp decrease in such prices could adversely affect our business prospects and results of operations.

Crude oil prices have traditionally fluctuated as a result of a variety of factors including, among others, the following:

| · | competition within the oil and natural gas industry; |

| · | changes in international prices of natural gas and refined products; |

| · | long-term changes in the demand for crude oil, natural gas and refined products; |

| · | increase in the cost of capital; |

| · | adverse economic conditions; |

| · | global or regional financial crises, such as the global financial crisis of 2008; |

| · | development of new technologies; |

| · | global and regional economic and political developments in oil producing regions, particularly in the Middle East; |

| · | the willingness and ability of the Organization of the Petroleum Exporting Countries, or OPEC, and its members to set production levels and prices; |

| · | local and global demand and supply for crude oil, oil products and natural gas; |

| · | trading activity in oil and natural gas and transactions in derivative financial instruments related to oil and gas; |

| · | development oravailability of alternative fuels; |

| · | natural events or disasters; and |

| · | terrorism and armed conflict. |

As of December 2012, nearly 96% of our revenues came from sales of crude oil, natural gas and refined products. Most prices for products developed and sold by us are quoted in U.S. dollars and consequently, fluctuations in the U.S. dollar/Peso exchange rate have a direct effect on our Peso-denominated financial statements.

A significant and sustained decrease in crude oil prices could have a negative impact on our results of operations and financial condition. In addition, a reduction of international crude oil prices could result in a delay or a change in our capital expenditure plan, in particular delaying exploration and development activities, thereby delaying the development of reserves and affecting future cash flows.

Our operations are subject to certain operational risks that, if materialized, may result in the disruption or shutdown of our operation activities, as well as in damages to the environment and to third parties.

Our exploration, production, refining and transportation activities are subject to industry-specific operating risks, some of which, despite our internal procedures, are beyond our control. Our operations may be curtailed, delayed or cancelled due to adverse or abnormal weather conditions, natural disasters, equipment failures or accidents, oil or natural gas spills or leaks, shortages or delays in the availability or in the delivery of equipment, delays or cancellation of environmental licenses or other government authorizations, fires, explosions, blow-outs, surface cratering, pipeline failures, theft and damage to our transportation infrastructure, sabotage, terrorist attacks and criminal activities.

The occurrence of any of these operating risks could result in substantial losses or slowdowns to our operations, including injury to our employees, destruction of property, equipment and infrastructure, clean-up responsibilities, third-party liability claims, government investigations and imposition of fines, withdrawal of environmental licenses and other government permits, suspension or shutdown of our activities and loss of revenue. The occurrence of any of these events may have a material adverse effect on our financial condition and results of operations.

We are exposed to the credit risks of our customers and any material nonpayment or nonperformance by our key customers could adversely affect our cash flow and results of operations.

Our customers may experience financial problems that could have a significant negative effect on their creditworthiness. Severe financial problems encountered by our customers could limit our ability to collect amounts owed to us, or to enforce the performance of obligations owed to us under contractual arrangements. In addition, many of our customers finance their activities through their cash flows from operations, the incurrence of debt or the issuance of equity.

The combination of declining cash flows as a result of declines in commodity prices, a reduction in borrowing bases under reserve-based credit facilities and the lack of availability of debt or equity financing may result in a significant reduction of our customers’ liquidity and limit their ability to make payments or perform on their obligations to us.

Furthermore, some of our customers may be highly leveraged and subject to their own operating expenses. Therefore, the risk we face in doing business with these customers may increase. Other customers may also be subject to regulatory changes, which could increase the risk of defaulting on their obligations to us. For example, constraints on foreign currency transactions by the Venezuelan government have resulted in delays by PDVSA Gas to make payments to its providers, including us. Financial problems experienced by our customers could result in the impairment of our assets, a decrease in our operating cash flows and may also reduce or curtail our customers’ future use of our products and services, which may have an adverse effect on our revenues.

Achieving our long-term growth prospects depends on our ability to execute our Strategic Plan, in particular discovering additional reserves and successfully developing them.

We describe our Strategic Plan under “Item 4. Information on the Company—The Company—Strategic Plan.” The ability to achieve our long-term growth objectives depends on discovering or acquiring new reserves as well as successfully developing them. Our exploration activities expose us to the inherent risks of drilling, including the risk that we will not discover commercially productive crude oil or natural gas reserves. The costs associated with drilling wells are often uncertain, and numerous factors beyond our control may cause drilling operations to be curtailed, delayed or cancelled.

If we are unable to conduct successful exploration and development of our exploration activities, or if we do not acquire properties having proved reserves, our level of proved reserves will decline. Failure to secure additional reserves may impede us from achieving production targets, and may have a negative effect on our results of operation and financial condition.

Our current and planned investments outside Colombia are exposed to political and economic risks.

As part of our Strategic Plan, we have begun to operate through business partners, subsidiaries or affiliates outside of Colombia. As of the date hereof, we have investments and subsidiaries incorporated in Peru, Brazil, Bermuda, Panama, the Cayman Islands, Switzerland, Spain, the United Kingdom and the United States, and we are analyzing investments in other countries. In connection with making investments, we are and will be subject to risks relating to economic and political conditions, governmental economic actions, such as exchange or price controls or limits on the activities to be performed by us, increases in tax rates, contractual changes, and social and environmental challenges.

In addition, we cannot predict the positions of foreign governments relating to the oil and gas industry, land tenure, protection of private property, environmental regulation or taxation; nor can we assure you that future governments will maintain a generally favorable business climate and economic policies. Any changes in the economic policies or regulations by the governments of the countries where we own investments may adversely affect our business, financial condition and results of operations.

Our participation in deep water drilling in conjunction with our business partners involves certain risks and costs, which may be outside of our control.

In association with our business partners, we have undertaken deep water exploratory drilling in the U.S. Gulf Coast and in Brazil. Additionally, as of December 31, 2012, we were involved in 19 off-shore exploratory and production projects in Colombia that involve deep-water drilling, of which we act as operators in four, while Equion acts as operator in two. Our deep water drilling activities present several risks such as the risk of spills, explosions in platforms and drilling operations, and natural disasters. The occurrence of any of these events or other incidents could result in personal injuries, loss of life, severe environmental damage with the resulting containment, clean-up and repair expenses, equipment damage and liability in civil and administrative proceedings. Heightened risks and costs associated with deep water drilling may have a negative effect on our results of operations, financial condition and reputation.

As a result of the oil spill in the Macondo field in the U.S. Gulf Coast in April 2010, significant concerns regarding the safety of deep water drilling had been raised and regulation in different countries has changed. In association with our business partners, which act as operators, we are currently drilling and have plans to drill exploratory wells in the U.S. Gulf Coast and Brazil. Since we have no control over these types of foreign government regulations, they may negatively impact the timing of our deep water drilling operations and consequently our results of operations and financial condition.

Our drilling activities are capital intensive and may not be productive.

Drilling for crude oil and natural gas involves numerous risks, including the risk that we will not encounter commercially productive crude oil or natural gas reservoirs. The cost of drilling, completing and operating wells is high and uncertain, and drilling operations may be curtailed, delayed or canceled as a result of a variety of factors, including:

| · | unexpected drilling conditions; |

| · | pressure or irregularities in formations; |

| · | equipment failures or accidents; |

| · | fires, explosions, blow-outs and surface cratering; |

| · | delays or cancellation of environmental licenses; |

| · | other adverse weather conditions and natural disasters; and |

| · | shortages or delays in the availability or in the delivery of equipment. |

Certain of our future drilling activities may not be successful and, if unsuccessful, this failure could reduce the ratio at which we replace our reserves, which could have an adverse effect on our results of operations and financial condition. While all drilling, whether developmental or exploratory, involves risks, exploratory drilling involves greater risks of dry holes or failure to find commercial quantities of hydrocarbons. Because of the percentage of our capital budget devoted to higher-risk exploratory projects, it is likely that we may in the future experience significant exploration and dry hole expenses.

Increased competition from local and foreign crude oil companies may have a negative impact on our ability to gain access to additional crude oil and natural gas reserves in Colombia.

The ANH is the governmental entity responsible for promoting oil and gas investments in Colombia, establishing terms of reference for exploration rounds and assigning exploration blocks to oil and gas companies. Prior to the enactment of Decree Law 1760 of 2003, we had an automatic right to explore any territory in Colombia and to enter into joint venture agreements with foreign and local oil companies. Under current regulations, we are entitled to bid for any exploration blocks offered for exploration by the ANH and we compete under the same conditions as other domestic and foreign oil and gas companies, receiving no special treatment. We or other oil companies may request the ANH to directly assign exploration blocks which have not been previously reserved by that Agency, depending on exceptional situations that are defined on Accord 04 of 2012. Our ability to obtain access to potential production fields also depends on our ability to evaluate and select potential hydrocarbon-producing fields and to adequately bid for these exploration fields.

Our strategies include international expansion where we face competition from local market players and international oil companies that have experience exploring in other countries.

If we are unable to adequately compete with local and foreign oil companies, or if we cannot enter into joint ventures with market players with properties where we could potentially find additional reserves, we may be conducting exploration activities in less attractive blocks, and we could reduce our market share participation. If we fail to maintain our current market position in Colombia, our results of operations and financial conditions may be adversely affected.

Our future performance depends on the successful development and deployment of new technologies and the knowledge to apply and improve them.

Technology, knowledge and innovation are essential to our business, especially for improvements in the production of heavy crude oil, the exploitation of mature fields and the development of non-conventional hydrocarbons. If we do not develop the right technology or do not obtain the expertise to operate new technology or to improve our processes, do not have access to, or deploy the knowledge necessary to apply and improve such technology effectively, the execution of our Strategic Plan, our profitability and our earnings may be adversely affected.

Legislation and regulatory initiatives relating to hydraulic fracturing and other drilling activities for non-conventional oil and gas reserves could increase the cost of implementing our Strategic Plan and the future costs of doing business or cause delays and adversely affect our operations.

Hydraulic fracturing is a commonly used process that involves injecting water, sand, and small volumes of chemicals into the wellbore to fracture the hydrocarbon-bearing rock thousands of feet below the surface to facilitate higher flow of hydrocarbons into the wellbore. Our Strategic Plan contemplates the use of hydraulic fracturing in the production of oil and natural gas from certain reservoirs, especially shale formations. We currently do not have information about any proposals of regulations concerning of hydraulic fracturing beyond the regulation already in place, which has allowed the use of this technique of reservoir stimulation for decades in Colombia. However, various initiatives in regions outside of Colombia with substantial shale gas resources have been or may be proposed or implemented to regulate hydraulic fracturing practices, limit water withdrawals and water use, require disclosure of fracturing fluid constituents, restrict which additives may be used, or implement temporary or permanent bans on hydraulic fracturing. If Colombia adopts similar regulations, which is something we cannot anticipate right now, the imposition of stringent regulatory and permitting requirements related to the practice of hydraulic fracturing in Colombia could significantly increase the cost of or cause delays in the implementation of our Strategic Plan and adversely affect our operations.

We may be subject to substantial risks relating to our development of exploration activities outside Colombia.

We began exploration activities outside Colombia in 2006 through our Brazilian subsidiary, Ecopetrol Oleo é Gas Do Brasil Ltda. Our foreign subsidiaries have subsequently entered into a number of joint venture exploration agreements with regional and international oil companies to explore blocks in Peru, Brazil and the U.S. Gulf Coast. The results of operations and financial condition of our subsidiaries in these countries may be adversely affected not only by risks associated with hydrocarbon exploration and production but also by fluctuations in their local economies, political instability and government actions, including: imposition of price controls; imposition of restrictions on hydrocarbon exports; fluctuation of local currencies against the Peso; nationalization of oil and gas reserves; increases in export tax and income tax rates for crude oil and oil products; and unilateral (governmental) institutional and contractual changes, including controls on investments and limitations on new projects.

We have limited experience exploring outside Colombia, where we are the incumbent operator. We may face new and unexpected risks involving environmental requirements that exceed those currently faced by us. Additionally, we may be exposed to legal disputes with foreign regulators. For example, we were awarded block Tucano-156 in Brazil in the 8th round of 2006. However, in August 2011, the Ministry of Mines and Energy of Brazil (Ministério de Minas e Energía)confirmed that the government would not sign any contract awarded in the 8th round of 2006, after the National Energy Policy Council (Conselho Nacional de Política Energética)decided to annul the bidding process. We may also experience the imposition of restrictions on hydrocarbon exploration and export, or increases in export tax or income tax rates for crude oil and natural gas.

If one or more of these risks described above were to materialize, we might not achieve the strategic objectives in our international operations, which may negatively affect our results of operations and financial condition.

We may incur losses and spend time and money defending pending lawsuits and arbitrations.

We are currently a party to several legal proceedings filed against us. We are also subject to labor-related lawsuits filed by current and former employees in connection with pension plans and retirement benefits. As of December 31, 2012, we were a party to 2,658 legal proceedings relating to civil, administrative, environmental, tax, and labor claims filed against us of which 659 met the accounting threshold for an accrual provision. We allocate substantial amounts of money and time to defend these claims. These claims involve substantial sums of money as well as other remedies. See Notes 19 and 31 to our consolidated financial statements and “Item 8. Financial Information—Legal Proceedings.”

Our natural gas production may not be able to keep up with our natural gas commitments.

We are party to certain natural gas supply contracts that have firm gas commitments. If we are unable to deliver natural gas to supply these contract clients, such as due to cuts in operations, delays in new projects for production facilities or the acceleration of the decline in our gas production, we may be required to compensate such contract customers for our failure to supply natural gas. See “Item 4. Information on the Company—Marketing and Supply—Natural Gas Distribution.” Both situations may negatively impact our financial condition and results of operations.

During 2012, delays in the start of new projects, mainly the Planta de Gas Cupiagua and those for increasing the production capacity at the Guajira fields resulted in fines claimed by our clients. Such delays were mainly caused by the process to obtain environmental licenses for building the pipeline Cupiagua – Cusiana, landslides due to weather conditions and isolated strikes by workers in the project area from other oil and gas companies. During 2010, 2011 and 2012, the fines paid in compensation for non-delivery of natural gas were Ps$85.2 billion (approximately US$44.5 million), Ps$2.5 billion (approximately US$1.3 million) and Ps$9.2 billion (approximately US$5.2 million), respectively.

We are not permitted by law to own more than 25% of a natural gas transportation company, which may not allow us to transport new natural gas reserves to distribution points and to our customers.

We discovered natural gas reserves in the Cusiana and Cupiagua fields for which transportation capacity is limited. New natural gas transportation infrastructure may not be available to transport natural gas from new or existing fields to consumption areas. Furthermore, we are prohibited by law from holding more than 25% of the equity of any natural gas transportation company and consequently there can be no assurance that the transportation capacity necessary to transport natural gas is built by third parties. Due to the limited number of natural gas transportation companies currently operating in Colombia we may be required to enter into agreements on terms that are not as favorable to us as they could be if there were multiple transportation companies.

If we are unable to obtain transportation services to transport natural gas from new discoveries to our customers or to regions where natural gas is demanded, we may not be able to develop these reserves, which may result in impairment of the related assets and would not allow us to recover the capital expenditures invested to make these natural gas discoveries.

In addition, at the end of 2011, we had five medium-term supply contracts with gas-fired power plants that required us to deliver natural gas in Barrancabermeja. In 2012, four of those contracts ended and we currently have only a medium-term supply contract, with one gas-fired power plant that requires us to deliver natural gas in Barrancabermeja. If we were unable to find the necessary transportation, we could be unable to meet our obligation with those power generators, which could result in us having to pay monetary fines.

Our operations could be affected by conflicts with labor unions.

In the past, we have been affected by strikes and work stoppages promoted by our own and our industry’s labor unions. These strikes have been both politically and contract-related, especially during collective bargaining negotiations. In April 2009, we entered into an agreement with theUnión Sindical Obrera de la Industria del Petróleo, or USO, one of our industry labor unions, to restore trust between USO and us with open communication and transparency as the main principles.

Additionally, on August 22, 2009, as a result of consensual negotiations, we entered into a new five-year collective bargaining agreement with three of the most significant industry labor unions: USO,Asociación de Directivos Profesionales,Técnicos y Trabajadores de las Empresas de la Rama de Actividad Económica del Recurso Natural del Petróleo y sus Derivados de Colombia, or ADECO, andSindicato Nacional de Trabajadores de Empresas Operadoras, Contratistas,Subcontratistas de Servicios y Actividades de la Industria del Petróleo y Similares, or SINDISPETROL. The new collective bargaining agreement was effective as of July 1, 2009 and covers salaries, healthcare, education, housing, transportation, meals, cultural activities, union rights and guarantees, among other aspects.Sindicato Nacional de Trabajadores de Empresas Operadoras, or SINCOPETROL, the Company’s labor union, neither presented any list of claims to us nor objected to the bargaining agreement, and as a result, we do not have a labor conflict with SINCOPETROL.

During 2011, there were two work stoppages promoted by USO in Barrancabermeja in support of the protests by employees at Pacific Rubiales, an unaffiliated oil and gas company in Colombia. On June 19, 2012 and December 22, 2012, USO members protested the creation of our subsidiary Cenit Transporte y Logística de Hidrocarburos S.A.S, or Cenit. These protests did not materially affect our operations.See “Item 6. Directors, Senior Management and Employees—Employees.”

We cannot assure you that we will not experience labor unrest in the future. In the event relations with our labor unions deteriorate, which could result in strikes, work stoppages or even sabotage, our results of operations and financial condition could be negatively affected.

We may not be able to achieve our corporate goals if we face difficulty in finding competent successors to our current management and employees.

Our growth strategy and the successful achievement of our corporate goals depend on the competence of our management and employees, and our ability to retain top talent. However, if our managers and employees decide to retire or leave us for other reasons, it may be difficult for us to find adequate successors with the required skills, knowledge, leadership and qualifications for the job. In addition, we may face difficulties in retaining our key managers and employees because of the high level of competition for human resources with experience and knowledge in the oil and gas industries. Furthermore, our compensation structure may not be able to meet industry levels and as a result our key employees may leave for jobs offering higher compensation. We also may face difficulties acquiring or developing the optimal set of professional skills and talent required to reach and sustain our performance under international standards. These difficulties, in turn, may negatively affect our results. See “Item 6. Directors, Senior Management and Employees—Employees.”

Our activities may be interrupted or affected by external factors, such as abnormal weather conditions, natural disasters and third-party acts.

We are exposed to several risks that may partially interrupt our activities. These risks include, among others, fire disasters, explosions, natural disasters such as earthquakes, landslides, volcanic eruptions, tropical storms, hurricanes and floods, criminal acts and acts of terror, malfunction of pipelines and emission of toxic substances.

For instance, in 2011 we were affected by weather conditions that intensified the strength of the average rain season in Colombia, causing landslides due to the abnormal concentration of water in the soil. These abnormal landslides affected transportation of crude oil by trucks, transportation of crude oil, natural gas and products by pipelines and the normal operation of our production fields and Reficar, which experienced floods at its facilities also as a result of torrential rains.

As a result of the occurrence of any of the above, our activities could be significantly affected or paralyzed. These risks could result in property damage, loss of revenue, loss of life, pollution and harm to the environment, among others. If any of these occur, we may be exposed to economic sanctions, fines or penalties, which may adversely affect our financial condition and results of operations. On December 23, 2011, our Salgar-Cartago pipeline ruptured. We believe that this incident occurred as a result of a creep movement as a consequence of severe weather conditions in the area, causing the surrounding soil to exercise strong pressure on the pipeline, causing it to rupture. The spilled gasoline from the pipeline subsequently came into contact with a heat source which ignited it causing several explosions, resulted in 33 fatalities, 77 injuries, and damaged and destroyed property. On December 11, 2011, our Caño Limón – Coveñas oil pipeline ruptured as a result of a soil motion caused by the heavy rainy season. While the accident did not result in any fatalities, it resulted in crude oil spilling into the Iscala creek. See “Item 4. Information on the Company—Transportation Infrastructure—Incidents at Transportation Facilities.”

We conduct exploration and production activities in areas classified as indigenous reserves and Afro-Colombian lands.

We carry out and plan to carry out exploration and production activities in areas classified by the Government as indigenous reserves (resguardos) and Afro-Colombian lands (territorios colectivos). We may not begin to explore for or produce hydrocarbons in these regions until we reach an agreement with the indigenous or Afro-Colombian communities living on these lands. Generally these consultations last between four and six months, but may be significantly delayed if we cannot reach an agreement. For example, we conduct operations in areas of the Northeastern region, which are inhabited by the U’wa community. Commencement of operations on two blocks in this region have been delayed for 20 years and ten years, respectively as of December 2012 because the community has refused to participate in the consultation process and the applicable legislation does not contemplate any alternatives in such a case. Similarly, some of our exploration operations in the Southern region have been delayed for seven years as a result of the presence of the Kofan community who oppose our presence and activities in the reservation. We may be exposed to similar delays due to opposition from local communities in other countries where we carry out exploration activities in indigenous reserves, such as Peru. If our activities endanger the conservation and preservation of these cultural minorities or their identities or beliefs, we may not be able to explore regions with good prospects. We may face similar risks in other jurisdictions where we have initiated exploration activities, which could have a negative effect on our operations.

Our operations are subject to social risks.

Our activities are subject to social risks, including protests by communities surrounding our operations. For example, during the construction of the Bicentenario oil pipeline, construction was suspended as a result of lockouts used by communities in the area of influence of the oil pipeline to demand greater participation of the Government and social investment, as well as greater participation of private companies in the development plans of towns in the departments of Arauca and Casanare. While we are committed to operating in a socially responsible manner, we may face opposition from local communities with respect to our current and future projects and such opposition could adversely affect our business, results of operations and financial condition.

Currency fluctuations and an appreciation of the Peso against the U.S. dollar could have an adverse effect on our financial condition and results of operations given that approximately 65% of our revenues are derived from foreign sales.

Approximately 65% of our sales are made in the international markets. The impact of fluctuations in exchange rates, especially the Peso/U.S. dollar rate on our operations has been and may continue to be material. In addition, a substantial share of our liquid assets are held in U.S. dollars or indexed to foreign currencies and gain value when the Peso depreciates against the U.S. dollar and lose value when the Peso appreciates against the U.S. dollar. We control our currency risk using natural hedging when possible, by maintaining funds in U.S. dollars and Pesos to meet our expenses in its respective currency. In addition, the obligations derived from our U.S. dollar-denominated debt are naturally hedged by our funds in the same currency. This situation partially mitigates any adverse effect that currency risk may have over the financial statements of the Company.

The U.S. dollar/Peso exchange rate has shown some instability in the last several years, particularly with the Peso experiencing significant fluctuations during the last twelve months. The Peso appreciated 2.7% on average against the U.S. dollar in 2012, and depreciated 0.6%, on average, during the first three months of 2013. When the Peso appreciates against the U.S. dollar, our revenues from exports, when translated into Pesos, decrease. However, imported goods, oil services and interest on external debt denominated in U.S. dollars become less expensive for us. Conversely, when the Peso depreciates against the U.S. dollar, our revenues from exports, when translated into Pesos, increase, and our imports and external debt service become more expensive. We cannot assure you that measures adopted by the government of Colombia and the Colombian Central Bank (Banco de la República de Colombia) such as the purchase of U.S. dollars in the foreign exchange market in response to the appreciation of the Peso, and the government’s intervention through the purchase of significant amounts of U.S. dollars in the spot market to pay interest and principal on foreign bonds coming due or to increase the size of the oil-stability fund will be sufficient to control this instability. Future volatility in the exchange rate of the Peso to the U.S. dollar may adversely affect our financial condition and results of operations and our ability to comply with our obligations under our indebtedness, pay dividends or make other distributions to our shareholders.

Our ability to access the credit and capital markets on favorable terms to obtain funding for our capital projects may be limited due to the deterioration of these markets and the authorizations we need before incurring any financial indebtedness.

We expect to make significant expenditures in capital and operations to reach the corporate goals established by our Strategic Plan. See “Item 4. Information on the Company—The Company—Strategic Plan.” Our ability to fund these expenditures is dependent on our ability to access the capital necessary to finance the construction of these facilities on terms acceptable to us. In recent years, domestic and global financial markets and economic conditions have been weak and volatile and have contributed significantly to a substantial deterioration in the credit and capital markets. A new financial crisis or an expansion of the current European sovereign debt crisis could also make it more difficult for us and our subsidiaries to access international capital markets and finance our operations and capital expenditures in the future on terms acceptable to us. These conditions, along with significant write-offs in the financial services sector and the re-pricing of credit risk, can make it difficult for us to obtain funding for our capital needs on favorable terms. As a result, we may be forced to revise the timing and scope of these projects as necessary to adapt to existing market and economic conditions, or access the financial markets on terms less favorable, therefore negatively affecting our results of operation and financial condition.

In addition, under applicable regulation, the Government, through the Ministry of Finance and Public Credit, must authorize all indebtedness of governmental entities and Nation-controlled companies through a majority equity stake. Consequently, all of our own indebtedness and our subsidiaries’ indebtedness, except for our foreign subsidiaries or those subsidiaries in which we hold minority interest, must be previously authorized by the Colombian Ministry of Finance and Public Credit. As such, our indebtedness is subject to the Government’s time frames and policies, and we cannot assure you that such authorizations would be granted in a timely fashion or at all.

We may be exposed to increases in interest rates, thereby increasing our financial costs.

We may incur debt locally and in the international capital markets and, consequently, may be affected by changes in prevailing interest rates. If market interest rates increase, our financing expenses may increase, which could have an adverse effect on our results of operations and financial condition.

Financial markets have not recovered from the recent global economic crisis and remain vulnerable to the European sovereign debt crisis that affects the liquidity of commercial banks and investment funds. If recovery falters or takes a few years longer than expected, the costs of raising funds in debt and equity capital markets may increase and impair our ability to obtain capital on terms acceptable to us.

We are subject to extensive environmental regulations in Colombia and in the other countries in which we operate and under certain of our credit agreements, we are under an obligation to comply with international environmental standards.

Our operations are subject to extensive national, state and local environmental regulations in Colombia. Environmental rules and regulations are applicable to our exploration, production, refining, transportation, supply and marketing activities, as well as the biofuels we produce. These regulations establish, among other things, quality standards for hydrocarbon products, air emissions and greenhouse gases, water discharges and waste disposal, environmental standards for abandoned crude oil wells, remedies for soil, water pollution and the general storage, handling, transportation and treatment of hydrocarbons in Colombia. Currently, all exploratory projects drilling in areas that do not yet have a license must undergo an environmental impact assessment and must receive an environmental license from the Ministry of the Environment. The Ministry of the Environment routinely inspects our crude oil fields, refineries and other production sites and may decide to open investigations which may result in fines, restrictions on operations or other sanctions in connection with potential non-compliance with environmental laws.

We are also subject to regional environmental regulations issued by thecorporaciones autónomas regionales,or regional environmental authorities, which oversee compliance with each region’s environmental regulations. If we fail to comply with any of these national or regional environmental regulations, we could be subject to administrative and criminal penalties, including warnings, fines and closure orders of our facilities. See “Item 4. Information on the Company—Overview by Business Segment—Environmental Matters.”

Environmental compliance has become more stringent in Colombia in recent years and as a result we have allocated a greater percentage of our expenditures for compliance with these laws and regulations. If environmental laws continue to impose additional costs and expenses on us, and as new laws and regulations relating to climate change become applicable to us, we may need to reduce our investments on strategic projects in order to allocate funds to environmental compliance. We are exposed to delays in obtaining environmental licenses from ANLA (Asociación Nacional de Licencias Ambientales, the government agency which is in charge of environmental licenses), which can lead to cost overruns or to changes in the investment plans of the company. These additional costs may have a negative impact on the profitability of the projects we intend to undertake or may make them economically unattractive, in turn having a negative impact on our results of operations and financial condition.

We are subject to foreign environmental regulations for the exploratory activities conducted by us outside Colombia. Failure to comply with foreign environmental regulations may result in investigations by foreign regulators, which could lead to fines, warnings or temporary suspensions of our operations, which could have a negative impact on our financial condition and results of operations.

Under certain of our credit agreements, we are under an obligation to comply with international environmental standards established by our lenders or by multilateral institutions. Failure to comply with such environmental standards could result in an event of default under the relevant credit agreements that we, or our subsidiaries, have entered into, which would affect our financial condition. For instance, the credit agreements executed by Ecopetrol in order to finance purchases of U.S. goods and services and the credit facilities executed by Reficar for the financing of its expansion and modernization project, include an obligation to comply with the U.S.-Exim Environmental Procedures and Guidelines, and the Organization for Economic Co-operation and Development (OECD) Common Approaches on Environment and Officially Supported Export Credits.

Our activities face operational risks that may affect the health and safety of our workforce and of the local communities.

Some of our operations are developed in remote and dangerous locations which involve health and safety risks that could affect our workforce. Under Colombian law and industrial safety regulations we are required to have health and safety practices that minimize risks and health issues faced by our workforce. Failure to comply with health and safety regulations may lead to investigations by health officials that could result in lawsuits or fines.

We may be required to incur additional costs and expenses to allocate funds to industrial safety and health compliance under Colombian law and industrial safety regulations. Additionally, if any operational incident occurs that affects local communities in nearby areas, we will need to incur additional costs and expenses in order to return affected areas to normality. These additional costs may have a negative impact on the profitability of the projects we may decide to undertake.

In addition, we may be subject to foreign health and safety regulations for our exploratory activities conducted outside Colombia. Foreign health and safety regulations may be more severe than those established under Colombian law and, therefore, we may be required to make additional investments to comply with those regulations.

We have made significant investments in acquisitions and we may not realize the expected value.

We have acquired interests in several companies in Colombia and abroad. See “Item 4. Information on the Company.” Obtaining the expected benefits of the acquisitions will depend, in part, on our ability to (1) obtain the expected operational and financial results from these acquisitions, (2) manage disparate operations and integrate distinct corporate cultures and (3) manage our objectives as a corporate group. These efforts may not succeed. Our failure to successfully obtain the expected results from our acquisitions could adversely affect our financial condition and results of operations.

Our subsidiaries Reficar and Oleoducto Bicentenario are currently engaged in their own construction projects. If they or any other material project is delayed or if its costs exceed our initial estimate, it could affect our operating results and financial condition.

Reficar has raised US$3.5 billion through a limited-recourse project financing in which we have acted as sponsor and have provided both a construction guarantee and a debt service guarantee to the project lenders. If the construction project of the upgraded refinery is delayed because of operational problems, due to, but not limited to, labor productivity or unavailability of construction material in the development of the project, or if the upgraded refinery does not reach the expected performance level in terms of the quality of products and/or volumes produced, the project lenders could request that we act on the guarantees and assume the payment obligations of Reficar, which would require us to make additional capital contributions thereby affecting our operating results and financial condition. Additionally, delays in the implementation of the project may result in larger capital expenditures, which could increase the overall cost of the project and impact our financial position.

In February 2013, Reficar requested contributions from Ecopetrol under the Construction Support Agreement in an amount of US$500 million, of which US$250 million has already been provided, with the remaining amount to be supplied throughout the rest of the year. As the project’s budget and schedule are being revised, we may be required to provide additional funding in excess of this amount. Any increase in the project’s capital expenditures is expected to be funded under the Construction Support Agreement between Reficar and Ecopetrol.

Oleoducto Bicentenario is in the first phase of construction of the Araguaney-Coveñas pipeline, which connects the Araguaney and Banadía loading facilities, and which is expected to be the largest of its kind in Colombia. Its estimated investment of US$2,035 million is expected to be financed by the project partners’ equity participation amounting to a 30% interest and the remaining 70% through loans from local banks, which have approved Ps$2.1 trillion and of which Ps$1,295 billion (approximately US$732 million) has been drawn. The first phase of the construction is expected to permit the evacuation of at least 110 thousand bpd, with a pipeline of 230 kilometers in length and a diameter of 42 inches. Delays in the completion of the first phase of this project due in part to events such as lockouts from communities in the areas of project construction demanding more social investment from the government, security issues, attacks by guerrilla groups, and unfavorable weather conditions could affect our production in certain fields and would prevent us from having the necessary infrastructure for crude oil transportation, negatively impacting our financial position.

Other investment projects that are part of our Strategic Plan could face similar planning and implementation problems, which could impact the competitiveness of our programs and projects, affecting our results and expected financial condition.

Our results may be affected by the performance of our business partners, as many of our operations are executed under association and joint venture agreements with business partners.

Many of our operations are executed through associations, joint ventures and other agreements with our business partners. Consequently, we depend on the performance of our business partners. The poor performance of any of our business partners, especially in those projects in which we do not act as operators, could negatively impact our results of operations and financial condition. In addition, we are exposed to the risk of not finding business partners with the appropriate skills and performance that we require for our projects.

Our insurance policies do not cover all liabilities and may not be available for all risks.

Our insurance policies do not cover all liabilities, and insurance may not be available for all risks. There can be no assurance that incidents will not occur in the future, that insurance will adequately cover the entire scope or extent of our losses or that we will not be found liable in connection with claims arising from these and other events, which could adversely affect our financial condition and results of operations.

A failure in our information technology systems or cyber security attacks may adversely affect our financial results.