UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| þ | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12a |

Keating Capital, Inc. |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

| | | |

In connection with the solicitation of proxies for the 2014 Annual Meeting of Stockholders of Keating Capital, Inc. (the “Company”) in person, by mail or electronic delivery, or by telephone or facsimile transmission: (i) by the directors, officers or employees of the Company, (ii) by the officers or employees of the Company’s investment adviser, Keating Investments, LLC (the “Adviser”), or (iii) by Boston Financial Data Services, Inc., the Company’s proxy solicitor, the Company intends to deliver pre-recorded voice messages to its stockholders and to hold a number of webinars for stockholders to discuss the proposals to be voted upon at the Annual Meeting. Scripts of the pre-recorded voice message and the webinars (including slides to be presented as part of the webinar) are included below and are being filed with the U.S. Securities and Exchange Commission.

Pre-recorded voice message to stockholders (beginning on or about May 14, 2014)

This is Tim Keating of Keating Capital. By now, you should have received proxy materials related to our 2014 Annual Stockholder Meeting. Our Board recommends that you vote “for” both proposals on the ballot. The vote is important for you to enjoy the benefits of the Transaction described in Proposal 2. So please vote right away. Thank you.

Script for stockholder webinars (beginning on or about May 13, 2014)

Slide 1 [Proxy Solicitation Webinar for 2014 Annual Stockholder Meeting]

Welcome to the Keating Capital webinar. I’m Tim Keating, the CEO of Keating Capital. During this presentation, we will provide information about three matters:

| 1. | Keating Capital’s 2014 Annual Stockholder Meeting, |

| 2. | The recent proxy materials that were sent to all stockholders, and |

| 3. | The importance of your vote, and voting now—immediately after this webinar, if possible. |

Slide 2 [Disclaimer]

Before beginning, I would like to remind you that various statements that I may make during this webinar may include forward-looking statements as defined under applicable securities laws. Management's assumptions, expectations and opinions reflected in those statements are subject to risks and uncertainties that may cause actual results and/or performance to differ materially from any future results, performance or achievements discussed in, or implied by, such forward-looking statements, and Keating Capital can give no assurance that they will prove to be correct. Those risks and uncertainties are described in Keating Capital’s filings with the SEC.

For additional information, please see Keating Capital’s proxy statement and other information relating to the 2014 Annual Meeting of Stockholders available on the SEC’s website (www.sec.gov) or under the Investor Relations section of Keating Capital’s website (www.keatingcapital.com).

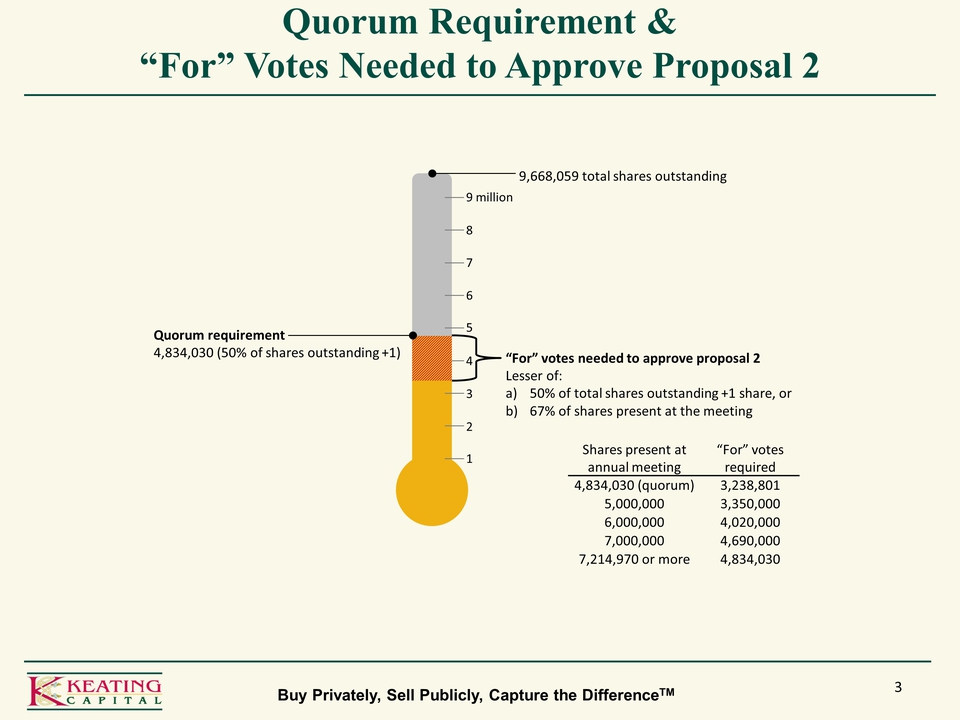

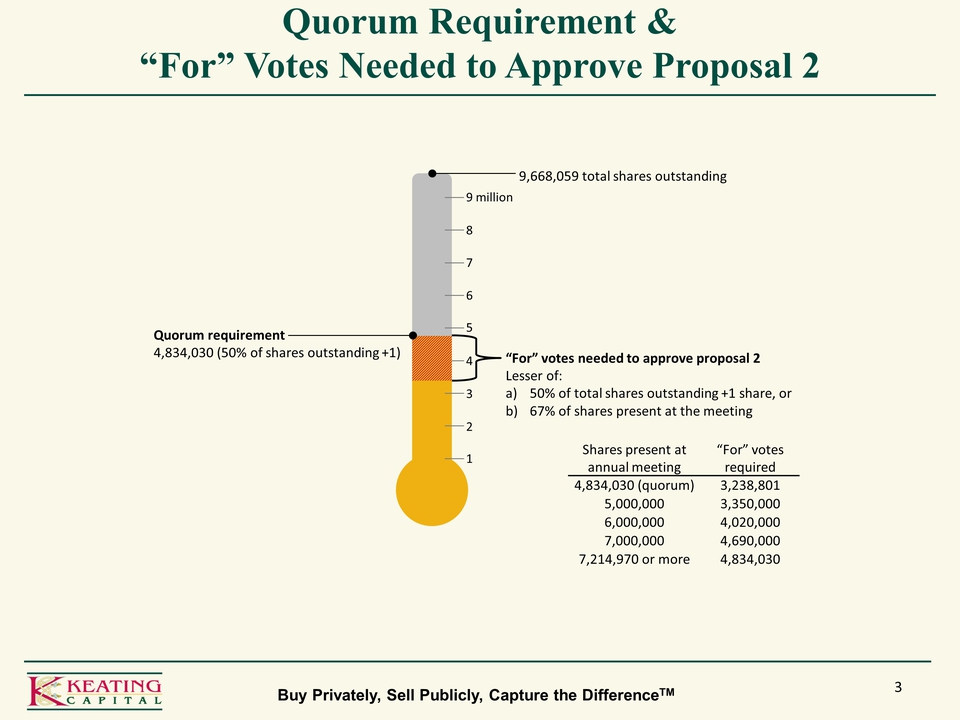

Slide 3 [Quorum Requirement & “For” Votes Needed to Approve Proposal 2]

This webinar will last about 10 minutes. In order for Keating Capital to conduct its 2014 Annual Stockholder Meeting scheduled for June 16th, and to take action on the two proposals included in the proxy materials, we need stockholders representing a majority of our outstanding shares to vote. Many stockholders mistakenly think that their votes do not matter due to their small ownership position. This is not true. Without a majority of stockholder votes, we will not be able to hold our 2014 Annual Meeting. And this, in turn, would deprive stockholders of the opportunity to approve Proposal 2 (related to the approval of a New Investment Advisory Agreement) and enjoy the benefits we believe are associated with the Transaction described in our proxy materials.

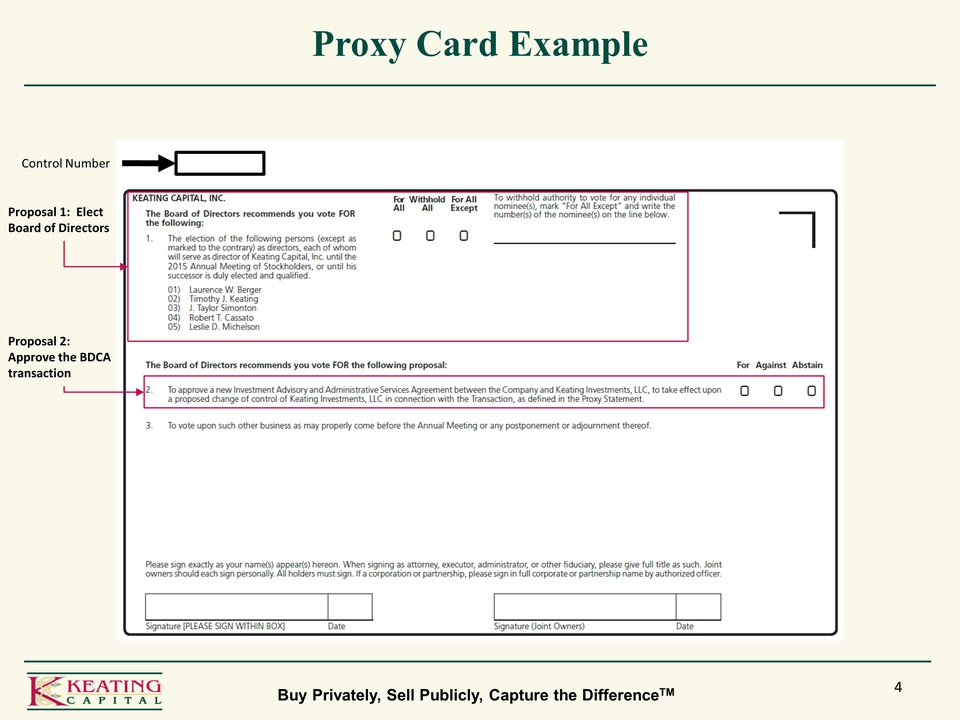

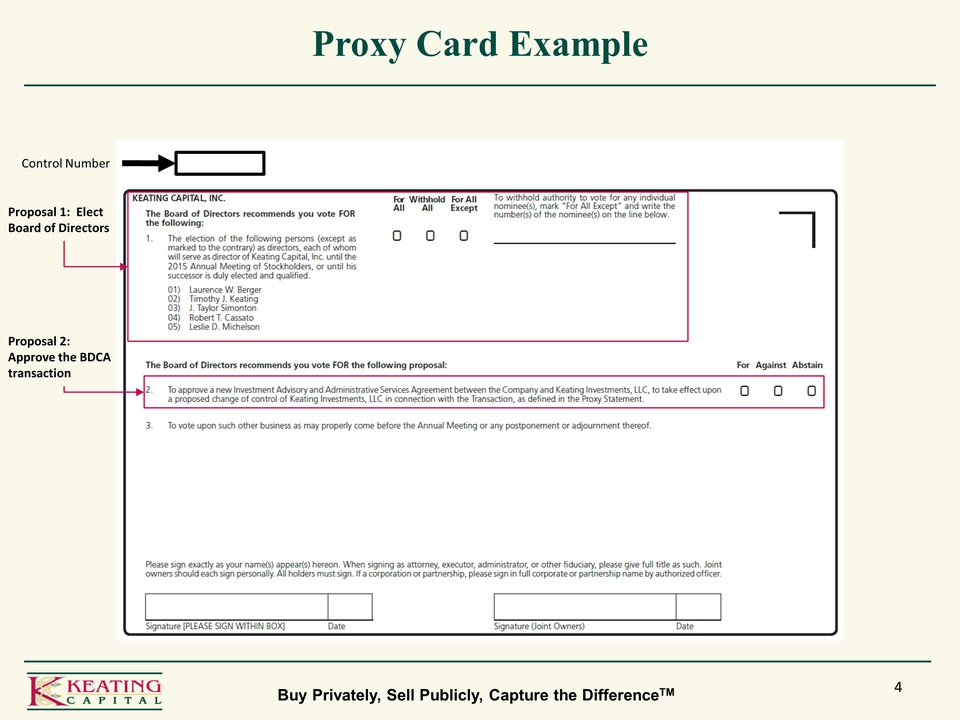

Slide 4 [Proxy Card Example]

So let’s get started.

With respect to the two proposals that Keating Capital stockholders are being asked to vote on, I will begin by explaining the “what,” and then I will discuss the “why” and the “how.”

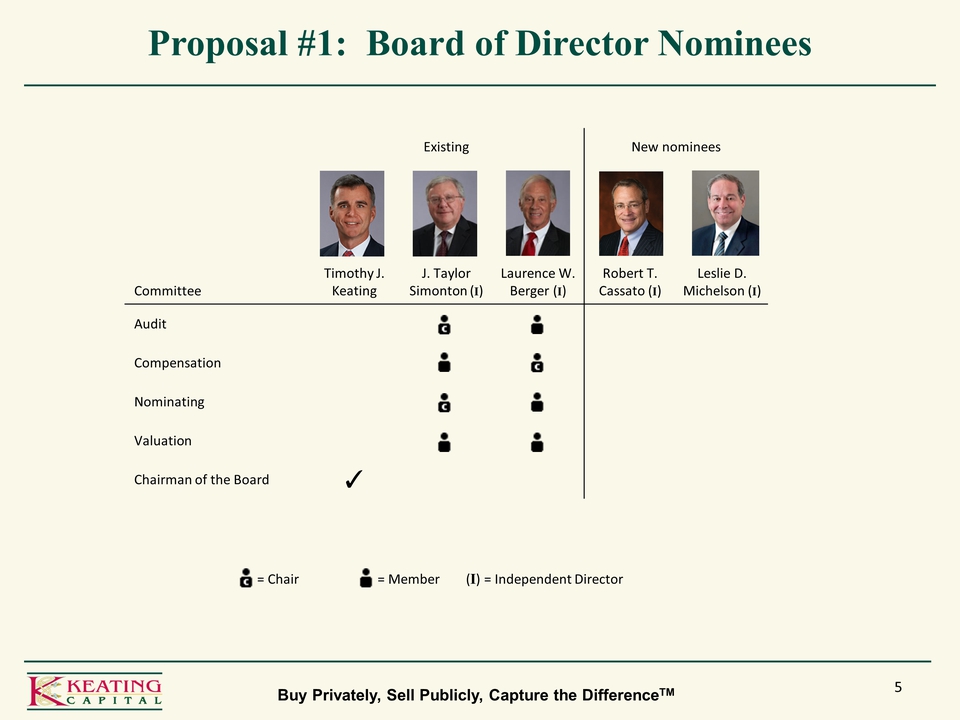

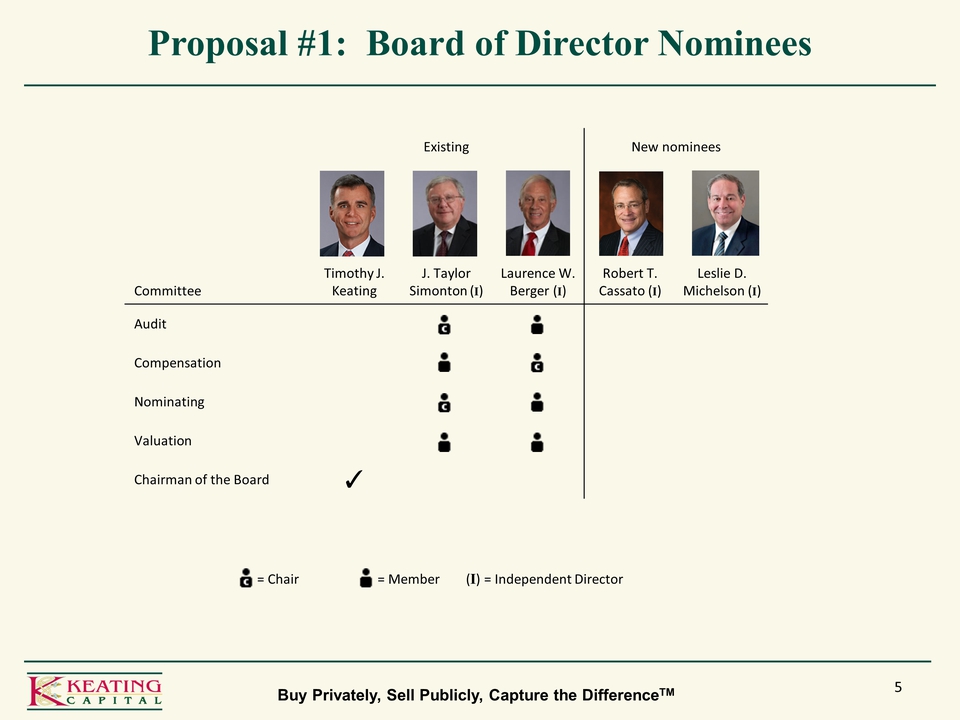

Slide 5 [Proposal 1: Board of Director Nominees]

Proposals 1 and 2

At the Annual Meeting, stockholders are being asked to vote for the following two proposals:

| ● | First, to vote on the election of the five director nominees named in the Proxy Statement; and |

| ● | Second, to approve the New Advisory Agreement between the Company and the Adviser, to take effect upon a proposed change of control of the Adviser in connection with the Transaction. |

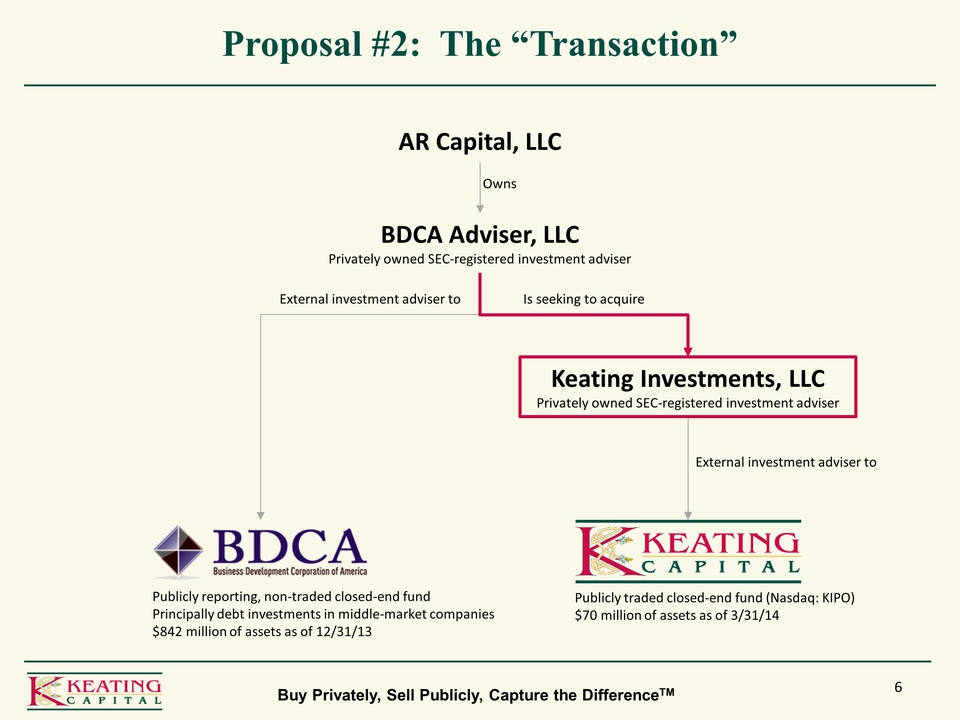

Slide 6 [Proposal 2: The “Transaction”]

The Transaction

The Transaction does not directly involve Keating Capital, which is the closed-end fund publicly traded on Nasdaq under the ticker symbol KIPO. Instead, the Transaction is the sale of Keating Investments, LLC—which is the adviser to Keating Capital—to BDCA Adviser, LLC—which is the investment adviser to Business Development Corporation of America, Inc. Effectively, it is the sale of one investment adviser to another investment adviser.

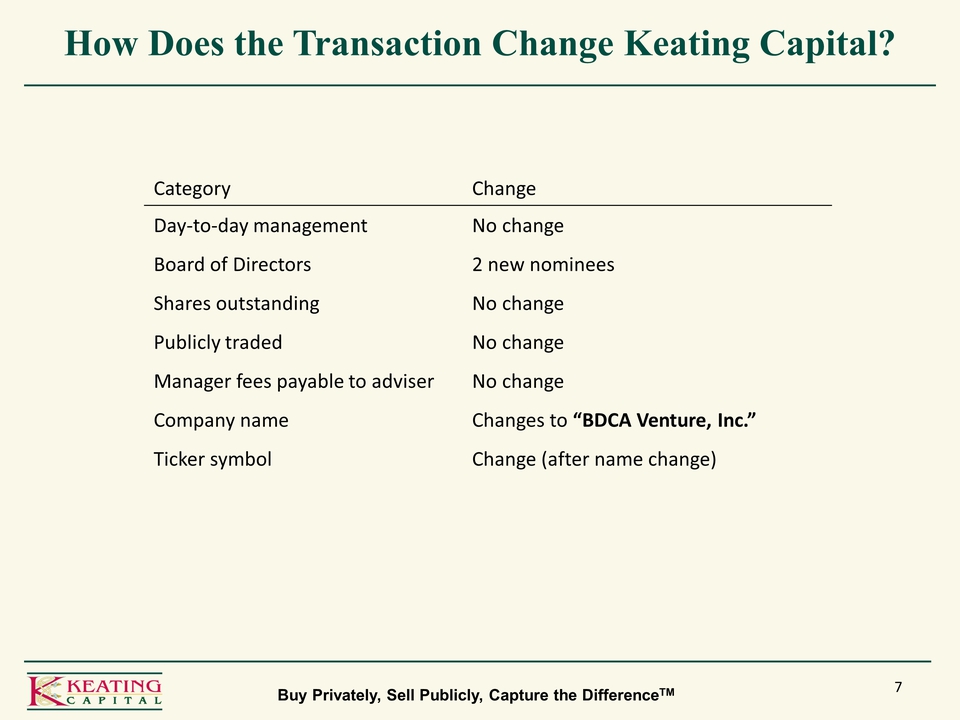

Slide 7 [How Does the Transaction Change Keating Capital?]

The Name Change

After closing of the Transaction, Keating Capital will continue to be a publicly traded closed-end fund and its shares of common stock will continue to be listed on Nasdaq, although its ticker symbol will eventually change upon the change in the name of the Company to “BDCA Venture, Inc.,” as discussed in the proxy statement. Keating Capital’s stockholders will continue to own the same amount and type of shares in the same Company.

Although the Transaction does not directly involve Keating Capital, there are, in fact, significant benefits to Keating Capital stockholders, which I will describe in detail shortly. Suffice it say the overwhelming majority of stockholders with whom I’ve spoken are excited about the Transaction and have indicated they intend to vote for Proposal 2 right away.

Now, let me discuss the “why,” which are really the benefits of the Transaction to Keating Capital and its stockholders.

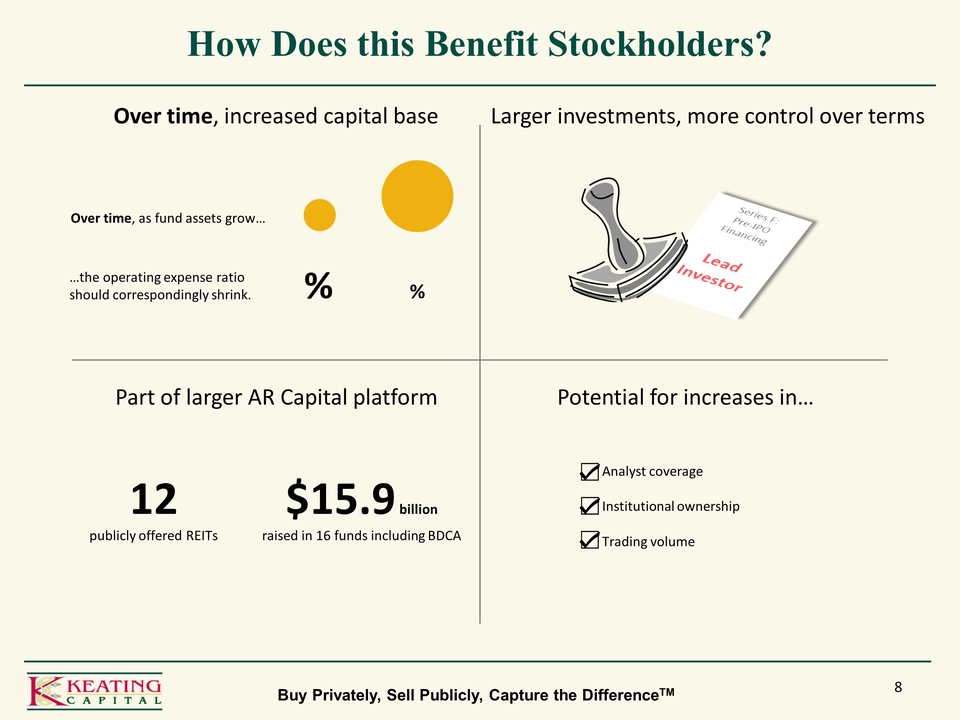

Slide 8 [How Does this Benefit Stockholders?]

As part of the Transaction, stockholders are being asked to approve a New Advisory Agreement between Keating Capital and its adviser, Keating Investments. The New Advisory Agreement is identical in all material respects to the Existing Advisory Agreement, and the investment advisory fee is not being changed.

In evaluating the New Advisory Agreement, the Board reviewed materials provided separately by Keating Investments and BDCA Adviser and discussed the philosophy of management, performance and expectations, and methods of operations. The Board recommends voting in favor of Proposal 2. Why? Three primary reasons:

First, the Board believes that Keating Capital may benefit from the Adviser being part of a larger platform and the opportunities available from being a part of a larger platform. The Board also believes that Keating Capital may benefit from the reputation and experience of BDCA Adviser and AR Capital,. which owns BDCA Adviser. Since 2008, AR Capital has sponsored approximately $15.9 billion of equity raised through 16 direct participation programs.

Second, BDCA Adviser has significantly larger investment management and portfolio origination teams. Although the Adviser will be operated separately, it will also have access to administrative and back office support from BDCA Adviser, as needed.

And third, and most importantly, over the long term, Keating Capital has the potential to benefit from access to capital by being part of the AR Capital platform, which is orders of magnitude larger than Keating Capital’s $70 million in net assets. These benefits may potentially result in the following:

| 1. | An increased capital base, which in turn may lead to a possibly lower operating expense ratio; |

| 2. | Increased investment size, and the corresponding opportunity to act as a lead investor in more transactions; |

| 3. | Increased deal flow as a result of leveraging relationships within the group; and |

| 4. | Increased visibility and brand recognition, potentially resulting in increased trading volume, and increased analyst coverage for Keating Capital’s stock. |

But let me anticipate a frequently asked question: If Keating Capital does not intend to raise additional equity capital immediately since its shares are currently trading at a discount to NAV, how does Keating Capital actually benefit by being part of a “larger” platform and the “opportunities available from being part of a larger platform?”

It’s a matter of both time and timing. Let me explain.

Since Keating Capital expects a majority of its private portfolio companies to go public (or complete a sale or merger) in the next four to eight quarters, raising additional equity capital in the short term would dilute the benefit of these liquidity events to our existing stockholders and simply wouldn’t be fair to them. And, as a reminder, we have generated a 24% weighted-average internal rate of return, based on our net realized gains from portfolio company sales thus far.

The new distribution policy that was adopted in February of this year was designed in part to pay a regular and predictable dividend based on our estimated net gains for the year. This new distribution policy will ensure that existing stockholders receive the ongoing benefit of these IPOs and other liquidity events as they occur.

In addition, while the new 25% cash and 75% stock distribution policy will provide capital for additional portfolio company investments as existing investments are sold, an increase in Keating Capital’s assets solely from its reinvestment of net realized gains will not significantly reduce the operating expense ratio, which continues to impact returns to stockholders. Keating Capital continues to operate sub-scale based on its capital base, and believes there are limited opportunities for further operating cost reductions. Accordingly, after the Transaction, the Board will continuously be weighing the balance of rewarding existing stockholders by not raising additional equity in the short term versus the benefits of an enlarged capital base over the longer term.

The Board has several strategic capital markets levers that it can pull to grow Keating Capital’s assets, and that it may consider at the appropriate time, including:

| 1. | Raising additional equity capital if, as and when Keating Capital’s stock price trades at or above NAV; |

| 2. | Raising debt capital, which would likely be considered only to support the origination of loans with current yield to venture capital-backed companies; or |

| 3. | A possible strategic transaction directly involving Keating Capital, such as a merger or combination with another fund, which typically would be subject to the approval of the Company’s stockholders. |

To summarize: Although the Transaction does not directly involve Keating Capital, there are in fact significant benefits to Keating Capital stockholders.

Now, let’s wrap it up with the “how.”

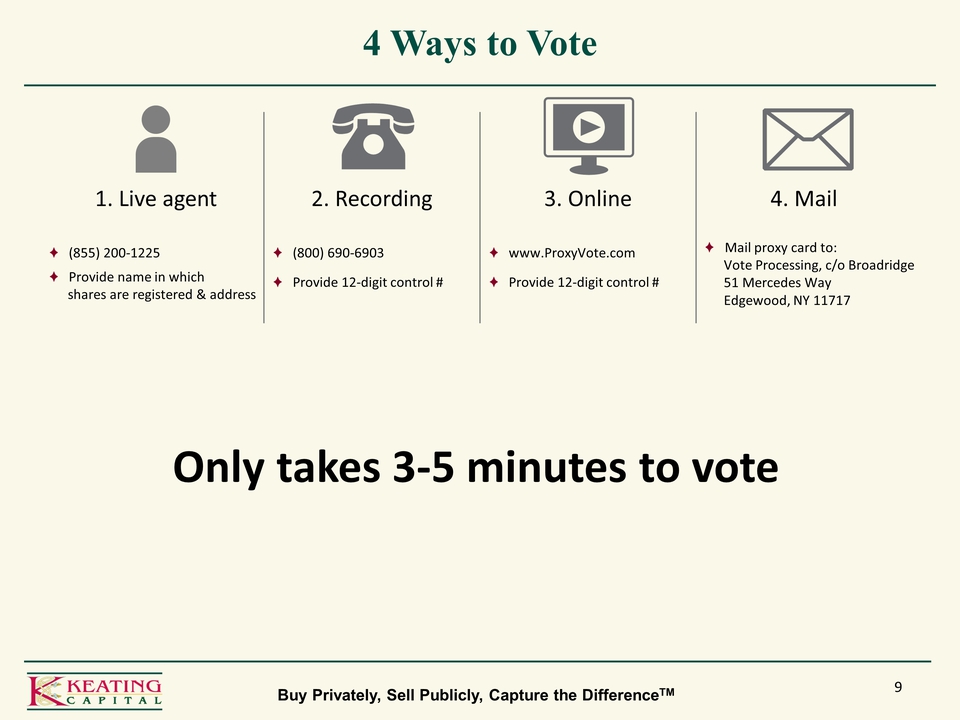

Slide 9 [4 Ways to Vote]

How to Vote

There are four ways to vote your proxy:

| 1. | By speaking to a live agent. The simplest way for a stockholder to vote is to call toll-free (855) 200-1225 and speak to a live agent. The agent will begin by asking the stockholder to provide his or her name and address. The whole process takes only 3-5 minutes to complete; or |

| 2. | By return mail. To do so, please return your proxy card by mail in the self-addressed envelope which was included with your proxy materials; or |

| 3. | By telephone recording. You may vote your shares by calling (800) 690-6903. You will need your 12-digit control number (which is a unique identifier for each stockholder’s vote) and which is located on your proxy card. Or, finally, |

| 4. | Online. You may vote your shares online at www.ProxyVote.com. Again, for this method of voting, you will need your 12-digit control number. |

Slide 10 [We Need Your Vote]

In summary:

| ● | The 2014 Annual Meeting of Keating Capital stockholders will be held on Monday, June 16th, and, most importantly, |

| ● | We need your vote now. The vast majority of stockholders vote within a few days of receiving information about the Annual Meeting. In an effort to minimize Company resources dedicated to soliciting proxies, and to make sure we have a quorum to hold the Annual Meeting, we are asking you to vote now—immediately after this webinar, if possible. This will ensure that Keating Capital stockholders have the opportunity to approve the New Advisory Agreement and enjoy the benefits we believe are associated with the Transaction. |

That concludes the presentation, and we will now open up the discussion for questions.

Buy Privately, Sell Publicly, Capture the Difference™ Proxy Solicitation Webinar for 2014 Annual Stockholder Meeting Nasdaq: KIPO www.KeatingCapital.com KEATING CAPITAL

Disclaimer Buy Privately, Sell Publicly, Capture the DifferenceTM 2 Keating Capital, Inc. (“Keating Capital”), a Maryland corporation, is a closed-end fund that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. Keating Investments, LLC (“Keating Investments”) is an SEC registered investment adviser and acts as the investment adviser to, and receives base management and/or incentive fees from, Keating Capital. Keating Investments and Keating Capital operate under the generic name of Keating. This presentation is a general communication of Keating and is not intended to be a solicitation to purchase or sell any security. This presentation may contain certain forward-looking statements, including statements with regard to the future performance of Keating Capital. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors that could cause actual results to differ materially are included in Keating Capital’s Form 10-K and Form 10-Q, and other SEC filings, and include uncertainties of economic, competitive, and market conditions, and future business decisions all of which are difficult or impossible to predict accurately, and many of which are beyond the control of Keating Capital. Although Keating Capital believes that the assumptions underlying the forward-looking statements included herein are reasonable, any of the assumptions could be inaccurate and therefore there can be no assurance that the forward-looking statements included herein will prove to be accurate. Except as required by the federal securities laws, Keating Capital undertakes no obligation to revise or update this presentation (including the slides presented) or any forward-looking statements contained herein, whether as a result of new information, future events or otherwise. Proxy Statement and Additional Information: For additional information, please see Keating Capital’s proxy statement and other information relating to the 2014 Annual Meeting of Stockholders available on the SEC’s website (www.sec.gov) or under the Investor Relations section of Keating Capital’s website (www.keatingcapital.com).

Quorum Requirement & “For” Votes Needed to Approve Proposal 2 Buy Privately, Sell Publicly, Capture the DifferenceTM 3 9,668,059 total shares outstanding 1 2 3 4 5 6 7 8 9 million Quorum requirement 4,834,030 (50% of shares outstanding +1) “For” votes needed to approve proposal 2 Lesser of: a) 50% of total shares outstanding +1 share, or b) 67% of shares present at the meeting Shares present at annual meeting “For” votes required 4,834,030 (quorum) 3,238,801 5,000,000 3,350,000 6,000,000 4,020,000 7,000,000 4,690,000 7,214,970 or more 4,834,030

Proxy Card Example Buy Privately, Sell Publicly, Capture the DifferenceTM 4 Proposal 1: Elect Board of Directors Proposal 2: Approve the BDCA transaction Control Number KEATING CAPITAL, INC. The Board of Directors recommends you vote FOR the following: 1. The election of the following persons (except as marked to the contrary) as directors, each of whom will serve as director of Keating Capital, Inc. until the 2015 Annual Meeting of Stockholders, or until his successor is duly elected and qualified. 01) Laurence W. Berger 02) Timothy J. Keating 03) J. Taylor Simonton 04) Robert T. Cassato 05) Leslie D. Michelson For All Withhold All For All Except To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the number(s) of the nominee(s) on the line below For Against Abstain The Board of Directors recommends you vote FOR the following proposal: To approve a new investment Advisory and Administrative Services Agreement between the Company and Keating Investments, LLC, to take effect upon a proposed change of control of Keating Investments, LLC in connection with the Transaction, as defined in the Proxy Statement. To vote upon such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

Existing New nominees Committee Timothy J. Keating J. Taylor Simonton (I) Laurence W. Berger (I) Robert T. Cassato (I) Leslie D. Michelson (I) Audit Compensation Nominating Valuation Chairman of the Board ✓ = Chair = Member (I) = Independent Director Proposal #1: Board of Director Nominees Buy Privately, Sell Publicly, Capture the DifferenceTM 5

Buy Privately, Sell Publicly, Capture the DifferenceTM 6 Proposal #2: The “Transaction” BDCA Adviser, LLC Privately owned SEC‐registered investment adviser Publicly reporting, non‐traded closed‐end fund Principally debt investments in middle‐market companies $842 million of assets as of 12/31/13 Publicly traded closed‐end fund (Nasdaq: KIPO) $70 million of assets as of 3/31/14 External investment adviser to Is seeking to acquire AR Capital, LLC Owns Keating Investments, LLC Privately owned SEC‐registered investment adviser External investment adviser to BDCA Business Development Corporation of America

How Does the Transaction Change Keating Capital? Buy Privately, Sell Publicly, Capture the DifferenceTM 7 Category Change Day‐to‐day management No change Board of Directors 2 new nominees Shares outstanding No change Publicly traded No change Manager fees payable to adviser No change Company name Changes to “BDCA Venture, Inc.” Ticker symbol Change (after name change)

How Does this Benefit Stockholders? Buy Privately, Sell Publicly, Capture the DifferenceTM 8 Over time, increased capital base Larger investments, more control over terms Part of larger AR Capital platform Potential for increases in… 12 publicly offered REITs $15.9billion raised in 16 funds including BDCA Over time, as fund assets grow… …the operating expense ratio should correspondingly shrink. % % Analyst coverage Institutional ownership Trading volume ☑ ☑ ☑

4 Ways to Vote Buy Privately, Sell Publicly, Capture the DifferenceTM 9 1. Live agent 2. Recording 3. Online 4. Mail (855) 200‐1225 Provide name in which shares are registered & address (800) 690‐6903 Provide 12‐digit control # www.ProxyVote.com Provide 12‐digit control # Mail proxy card to: Vote Processing, c/o Broadridge 51 Mercedes Way Edgewood, NY 11717 Only takes 3‐5 minutes to vote

We Need Your Vote Buy Privately, Sell Publicly, Capture the DifferenceTM 10 Vote now! The vast majority of stockholders vote shortly after receiving Annual Meeting proxy materials. Quorum needed to ensure that we can conduct the meeting and so that you and your fellow stockholders have the opportunity to enjoy the benefits of this transaction.