UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| þ | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12a |

BDCA Venture, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) Title of each class of securities to which transaction applies: |

| | | |

| | | (2) Aggregate number of securities to which transaction applies: |

| | | |

| | | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | (4) Proposed maximum aggregate value of transaction: |

| | | |

| | | (5) Total fee paid: |

| | | |

| o | | Fee paid previously with preliminary materials. |

| | | |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) Amount Previously Paid: |

| | | |

| | | (2) Form, Schedule or Registration Statement No.: |

| | | |

| | | (3) Filing Party: |

| | | |

| | | (4) Date Filed: |

| | | |

In connection with the solicitation of proxies for the 2015 Annual Meeting of Stockholders of BDCA Venture, Inc. (the “Company”) in person, by mail or electronic delivery, or by telephone or facsimile transmission: (i) by the directors or officers of the Company, (ii) by the officers, employees or agents of the Company’s investment adviser, BDCA Venture Adviser, LLC (the “Adviser”), or (iii) by Georgeson, Inc., the Company’s proxy solicitor, the following additional materials may be used and are hereby being filed with the U.S. Securities and Exchange Commission.

BDCV BDCA Venture, Inc. ISS Presentation June 19, 2015 Nasdaq: BDCV www.BDCV.com

Disclaimer & Disclosure BDCA Venture, Inc. (“BDCV” or the “Company”), a Maryland corporation, is a closed-end fund that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended. BDCA Venture Adviser, LLC is an SEC registered investment adviser and acts as the investment adviser to, and receives base management and/or incentive fees from, BDCV. This presentation is a general communication of BDCV and is not intended to be a solicitation to purchase or sell any security. This presentation may contain certain forward-looking statements, including statements with regard to the future performance of BDCV. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors that could cause actual results to differ materially are included in BDCV’s Form 10-K and Form 10-Q, and other SEC filings, and include uncertainties of economic, competitive, and market conditions, and future business decisions all of which are difficult or impossible to predict accurately, and many of which are beyond the control of BDCV. Although BDCV believes that the assumptions underlying the forward-looking statements included herein are reasonable, any of the assumptions could be inaccurate and therefore there can be no assurance that the forward-looking statements included herein will prove to be accurate. Except as required by the federal securities laws, BDCV undertakes no obligation to revise or update this presentation (including the slides presented) or any forward-looking statements contained herein, whether as a result of new information, future events or otherwise. On May 29, 2015, BDCV filed with the SEC and began mailing to stockholders a notice of annual meeting and a definitive proxy statement, together with a White Proxy Card that can be used to elect the Board’s four current incumbent nominees. BEFORE MAKING ANY VOTING DECISION, STOCKHOLDERS ARE URGED TO READ THE NOTICE OF ANNUAL MEETING AND PROXY STATEMENT, AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT BDCV AND THE UPCOMING JULY 9, 2015 ANNUAL MEETING OF STOCKHOLDERS. Stockholders can obtain additional copies of the notice of annual meeting and proxy statement and other documents filed by BDCV with the SEC when they become available, by contacting BDCV’s proxy solicitor, Georgeson, Inc., at (866) 628-6079. You may also visit BDCV’s website at www.bdcv.com. Additional copies of the proxy materials will be delivered promptly upon request. Free copies of these materials can also be found on the SEC’s website at www.sec.gov.

Executive Summary BDCV’s Board of Directors (the “Board”) is highly experienced and comprised of a majority of independent directors (75%) BDCV’s plan includes a New Investment Strategy and Shareholder First Initiative. In an effort to move the New Investment Strategy forward, BDCV joined in an exemptive application filed with the SEC to allow it to co-invest with other funds managed by BDCA Adviser, LLC (“BDCA Adviser”) The Board and management have been working to close the gap between BDCV’s net asset value per share (“NAV”) and stock price, including the following: Share repurchase programs under which BDCV repurchased shares for a total cost of $3.6 million as of March 31, 2015 Quarterly 2015 distribution declarations of $0.15 per share, totaling $0.60 per share, which may constitute a return of capital BDCV’s investment adviser, BDCA Venture Adviser, LLC (the “Adviser”), through its relationship with BDCA Adviser, has the experience and expertise to implement the New Investment Strategy Bulldog has no plan for operating BDCV, and the returns for shareholders in its campaigns against two other BDCs have been disappointing

BDCV’s History BDCV launched its initial public offering in June 2009 offering shares of its common stock for $10.00 per share (with a sales load of $1.00 per share) BDCV commenced investment activities in January 2010, making investments in equity securities of later stage, pre-IPO companies BDCV listed its shares of common stock on Nasdaq in December 2011 Since inception, BDCV has paid $1.50 per share in total distributions to investors (see slide 21 for distribution history)

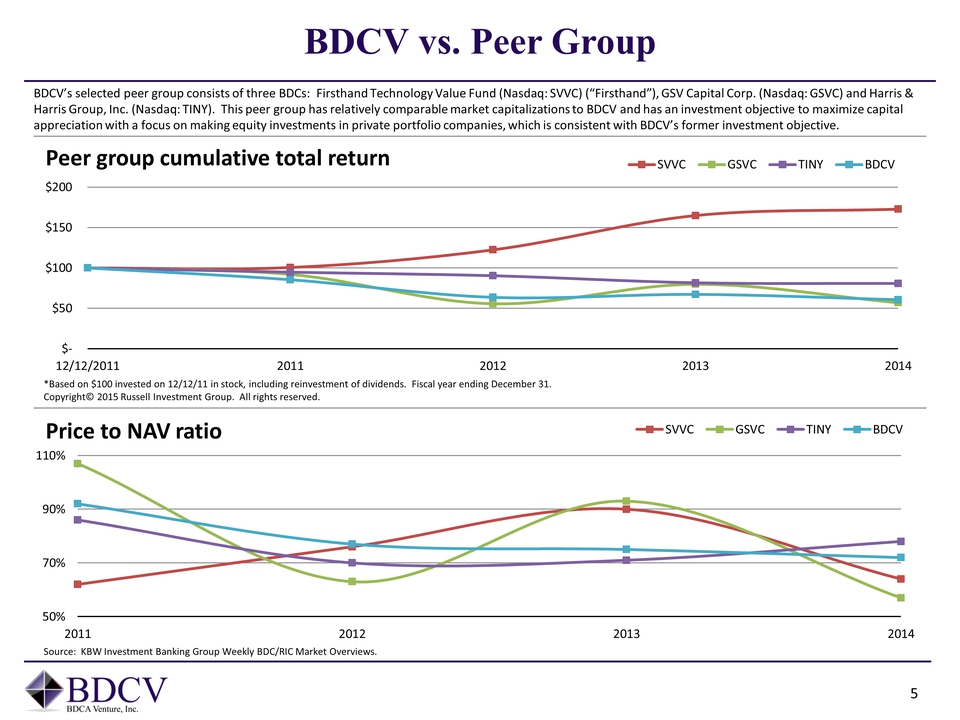

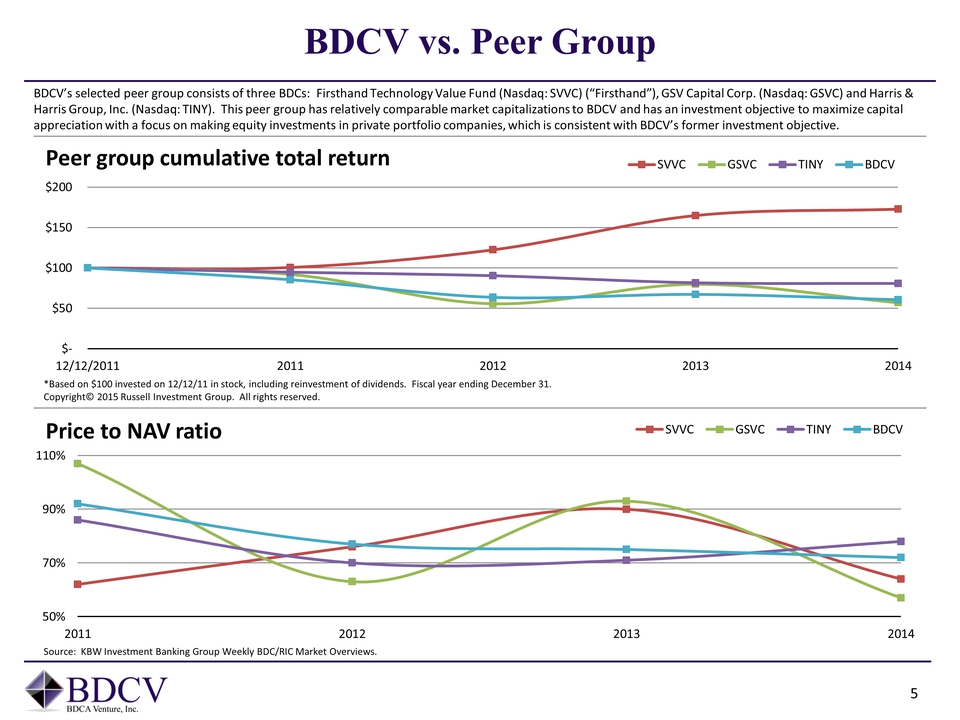

50% 70% 90% 110% 2011 2012 2013 2014 Price to NAV ratio SVVC GSVC TINY BDCV BDCV vs. Peer Group $- $50 $100 $150 $200 12/12/2011 2011 2012 2013 2014 Peer group cumulative total return SVVC GSVC TINY BDCV *Based on $100 invested on 12/12/11 in stock, including reinvestment of dividends. Fiscal year ending December 31. Copyright© 2015 Russell Investment Group. All rights reserved. Source: KBW Investment Banking Group Weekly BDC/RIC Market Overviews. BDCV’s selected peer group consists of three BDCs: Firsthand Technology Value Fund (Nasdaq: SVVC) (“Firsthand”), GSV Capital Corp. (Nasdaq: GSVC) and Harris & Harris Group, Inc. (Nasdaq: TINY). This peer group has relatively comparable market capitalizations to BDCV and has an investment objective to maximize capital appreciation with a focus on making equity investments in private portfolio companies, which is consistent with BDCV’s former investment objective.

BDCV Board Credentials & Actions The Board is comprised of four individuals who have substantial professional accomplishments and experience Three of the four directors (75%), Laurence W. Berger, Leslie D. Michelson and J. Taylor Simonton, are independent under the Investment Company Act of 1940 and Nasdaq rules The actions by the Board and the Adviser demonstrate a commitment to all investors and have benefited all stockholders: In December 2014, BDCV and the Adviser agreed upon an operating expense cap In November 2014, BDCV announced a “Shareholder First” initiative In September 2014, BDCV announced a New Investment Strategy In September 2014, the Board authorized a share repurchase program of up to $5 million (BDCV has repurchased $3.6 million of its shares under this and a prior repurchase program as of March 31, 2015) Based on the closing price on June 18, 2015, BDCV currently trades at a price that is closest to NAV (28% discount) among its specialty group of externally managed, equity-focused BDCs which include GSV Capital Corp. (“GSV”) (32%) and Firsthand (45%) Bulldog has offered up a slate of the same nominees used in other contests, with director candidates who have no real experience or background in operating a BDC

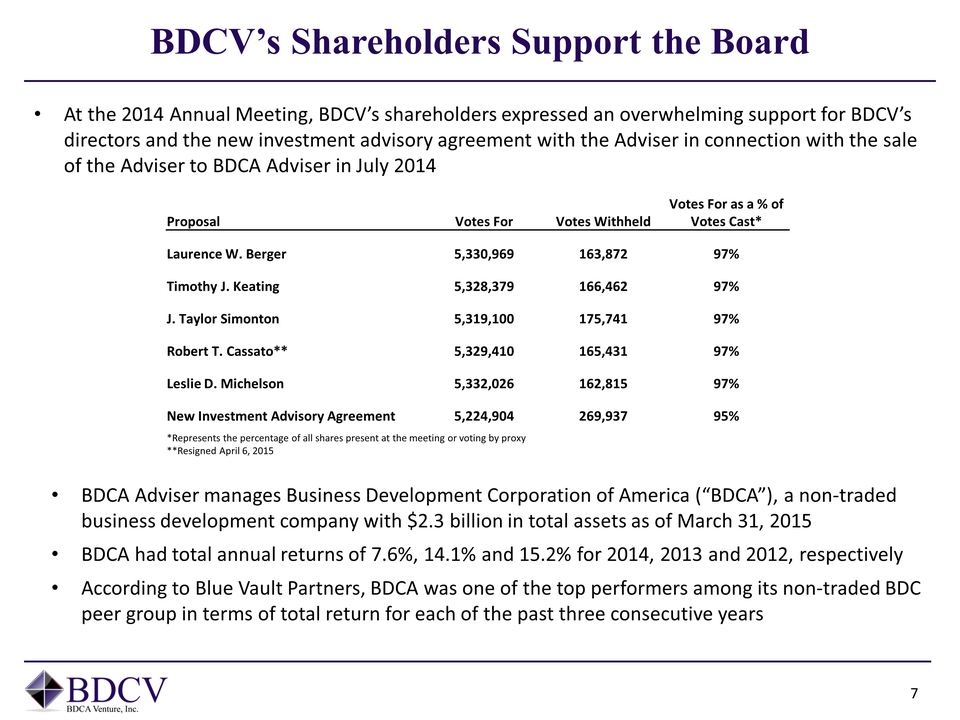

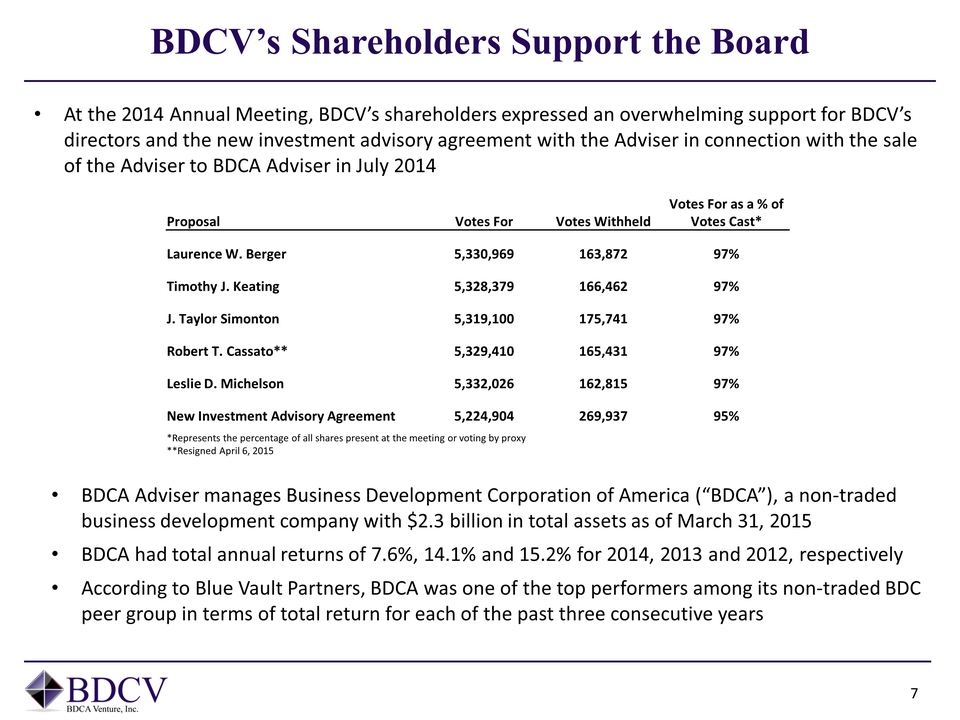

BDCV’s Shareholders Support the Board At the 2014 Annual Meeting, BDCV’s shareholders expressed an overwhelming support for BDCV’s directors and the new investment advisory agreement with the Adviser in connection with the sale of the Adviser to BDCA Adviser in July 2014 Proposal Votes For Votes Withheld Votes For as a % of Votes Cast* Laurence W. Berger 5,330,969 163,872 97% Timothy J. Keating 5,328,379 166,462 97% J. Taylor Simonton 5,319,100 175,741 97% Robert T. Cassato** 5,329,410 165,431 97% Leslie D. Michelson 5,332,026 162,815 97% New Investment Advisory Agreement 5,224,904 269,937 95% *Represents the percentage of all shares present at the meeting or voting by proxy **Resigned April 6, 2015 BDCA Adviser manages Business Development Corporation of America (“BDCA”), a non-traded business development company with $2.3 billion in total assets as of March 31, 2015 BDCA had total annual returns of 7.6%, 14.1% and 15.2% for 2014, 2013 and 2012, respectively According to Blue Vault Partners, BDCA was one of the top performers among its non-traded BDC peer group in terms of total return for each of the past three consecutive years

BDCV’s Plan: The New Investment Strategy In September 2014, BDCV announced a New Investment Strategy, which is designed primarily to: Generate current income, which will potentially offset operating expenses, and Create the potential to provide a more predictable and consistent source of return to BDCV’s stockholders Under the New Investment Strategy, BDCV will invest in the secured and unsecured debt instruments of growth companies that BDCV and the Adviser believe are poised to grow at above-average rates relative to other sectors of the U.S. economy As BDCV transitions its portfolio to debt investments, BDCV expects to generate current income that will comprise a source of return for its stockholders over time

BDCV’s Plan: “Shareholder First” Initiative BDCV announced in November 2014 the details of a “Shareholder First” initiative, the principal components of which include: The deferral of the payment of base management fees due to the Adviser until a threshold level of net realized capital gains is earned, and An expense reduction initiative that effectively caps certain of BDCV’s operating expenses (excluding any management and incentive fees, litigation costs, extraordinary expenses and certain other expenses) at $1.5 million annually, with the Adviser absorbing any such operating expenses in excess of $1.5 million. Expenses associated with the proxy contest and related litigation are not subject to this arrangement

Bulldog’s Attempt to Impede BDCV’s Progress The Adviser, through its relationship with BDCA Adviser, has the experience and expertise to implement the New Investment Strategy In an effort to move the New Investment Strategy forward, BDCV joined in an exemptive application filed with the SEC to allow it to co-invest with other funds managed by BDCA Adviser However, Bulldog is attempting to thwart this strategy by requesting a last-minute hearing in an effort to delay or prevent the SEC from granting this exemptive relief The outcome of Bulldog’s request is unknown at this time, but, it is clear that Bulldog is trying to impede BDCV’s ability to implement the New Investment Strategy

Bulldog Has No Plan BDCV believes that the proposals submitted by Bulldog have little chance of generating future value for BDCV’s shareholders, ignore the complexity of BDCV’s existing equity investments, are silent on the potential follow-on investments that may be required to preserve future value, and provide no real upside to stockholders Bulldog has provided no detail about its proposal “to direct the Board to consider adopting a plan to maximize shareholder value within a reasonable period of time” Bulldog apparently wants to internally manage BDCV but again has provided no details Several questions remain unanswered by the Bulldog proposal: Who would be the managers or officers? What would be the costs? How do stockholders know what is next? Will Bulldog provide an operating expense cap similar to the Adviser’s? How does Bulldog intend to support existing equity positions if follow-on investments are required to protect a position?

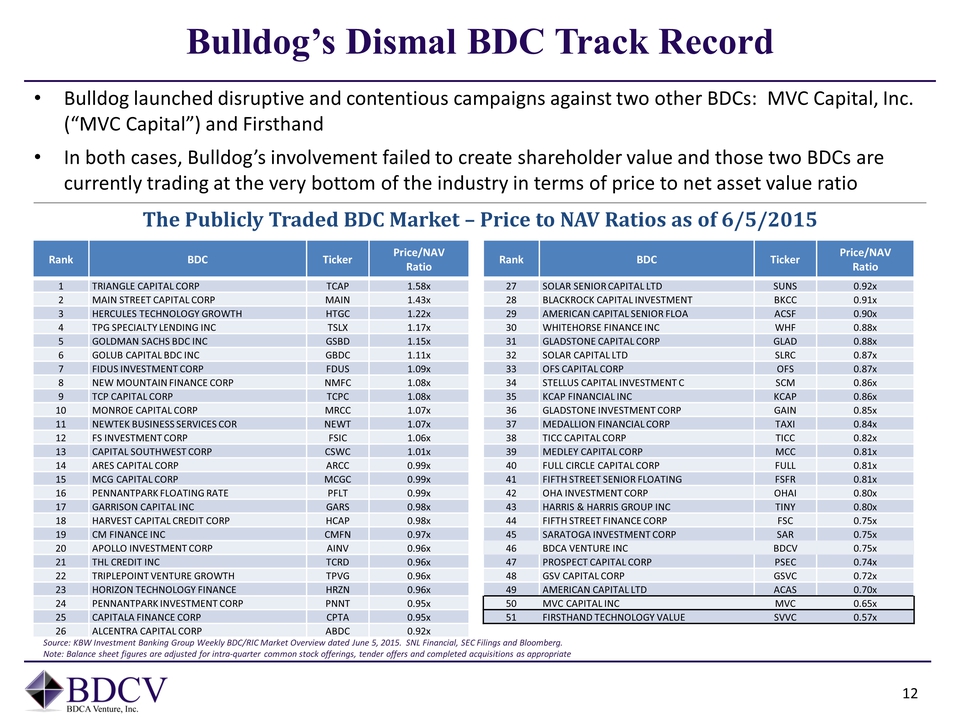

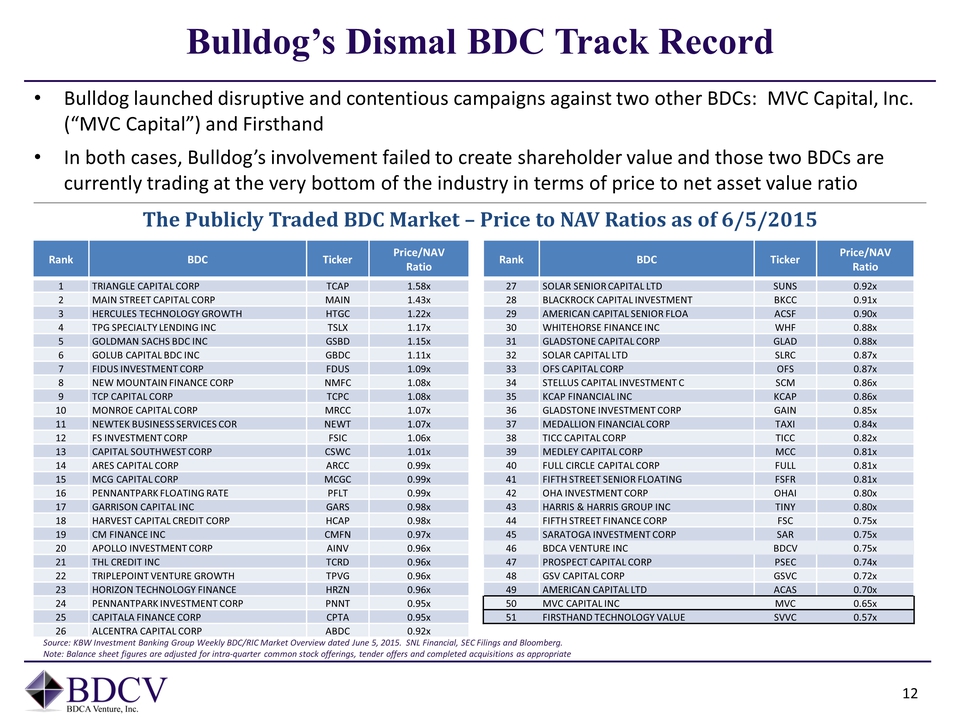

Bulldog’s Dismal BDC Track Record Bulldog launched disruptive and contentious campaigns against two other BDCs: MVC Capital, Inc. (“MVC Capital”) and Firsthand In both cases, Bulldog’s involvement failed to create shareholder value and those two BDCs are currently trading at the very bottom of the industry in terms of price to net asset value ratio The Publicly Traded BDC Market – Price to NAV Ratios as of 6/5/2015 Rank BDC Ticker Price/NAV Ratio 1 TRIANGLE CAPITAL CORP TCAP 1.58x 2 MAIN STREET CAPITAL CORP MAIN 1.43x 3 HERCULES TECHNOLOGY GROWTH HTGC 1.22x 4 TPG SPECIALTY LENDING INC TSLX 1.17x 5 GOLDMAN SACHS BDC INC GSBD 1.15x 6 GOLUB CAPITAL BDC INC GBDC 1.11x 7 FIDUS INVESTMENT CORP FDUS 1.09x 8 NEW MOUNTAIN FINANCE CORP NMFC 1.08x 9 TCP CAPITAL CORP TCPC 1.08x 10 MONROE CAPITAL CORP MRCC 1.07x 11 NEWTEK BUSINESS SERVICES COR NEWT 1.07x 12 FS INVESTMENT CORP FSIC 1.06x 13 CAPITAL SOUTHWEST CORP CSWC 1.01x 14 ARES CAPITAL CORP ARCC 0.99x 15 MCG CAPITAL CORP MCGC 0.99x 16 PENNANTPARK FLOATING RATE PFLT 0.99x 17 GARRISON CAPITAL INC GARS 0.98x 18 HARVEST CAPITAL CREDIT CORP HCAP 0.98x 19 CM FINANCE INC CMFN 0.97x 20 APOLLO INVESTMENT CORP AINV 0.96x 21 THL CREDIT INC TCRD 0.96x 22 TRIPLEPOINT VENTURE GROWTH TPVG 0.96x 23 HORIZON TECHNOLOGY FINANCE HRZN 0.96x 24 PENNANTPARK INVESTMENT CORP PNNT 0.95x 25 CAPITALA FINANCE CORP CPTA 0.95x 26 ALCENTRA CAPITAL CORP ABDC 0.92x Rank BDC Ticker Price/NAV Ratio 27 SOLAR SENIOR CAPITAL LTD SUNS 0.92x 28 BLACKROCK CAPITAL INVESTMENT BKCC 0.91x 29 AMERICAN CAPITAL SENIOR FLOA ACSF 0.90x 30 WHITEHORSE FINANCE INC WHF 0.88x 31 GLADSTONE CAPITAL CORP GLAD 0.88x 32 SOLAR CAPITAL LTD SLRC 0.87x 33 OFS CAPITAL CORP OFS 0.87x 34 STELLUS CAPITAL INVESTMENT C SCM 0.86x 35 KCAP FINANCIAL INC KCAP 0.86x 36 GLADSTONE INVESTMENT CORP GAIN 0.85x 37 MEDALLION FINANCIAL CORP TAXI 0.84x 38 TICC CAPITAL CORP TICC 0.82x 39 MEDLEY CAPITAL CORP MCC 0.81x 40 FULL CIRCLE CAPITAL CORP FULL 0.81x 41 FIFTH STREET SENIOR FLOATING FSFR 0.81x 42 OHA INVESTMENT CORP OHAI 0.80x 43 HARRIS & HARRIS GROUP INC TINY 0.80x 44 FIFTH STREET FINANCE CORP FSC 0.75x 45 SARATOGA INVESTMENT CORP SAR 0.75x 46 BDCA VENTURE INC BDCV 0.75x 47 PROSPECT CAPITAL CORP PSEC 0.74x 48 GSV CAPITAL CORP GSVC 0.72x 49 AMERICAN CAPITAL LTD ACAS 0.70x 50 MVC CAPITAL INC MVC 0.65x 51 FIRSTHAND TECHNOLOGY VALUE SVVC 0.57x Source: KBW Investment Banking Group Weekly BDC/RIC Market Overview dated June 5, 2015. SNL Financial, SEC Filings and Bloomberg. Note: Balance sheet figures are adjusted for intra-quarter common stock offerings, tender offers and completed acquisitions as appropriate

MVC and Firsthand Case Studies MVC Capital. Mr. Goldstein has been a member of the board of directors of MVC Capital since September 2012, and MVC Capital has not filed its financial statements since its July 2014 reporting period. Under Mr. Goldstein’s tenure as a director, MVC Capital’s price to NAV ratio has worsened from 78% at the time of his appointment to 65% (based on the June 5, 2015 closing price and the last disclosed NAV as of July 31, 2014) Firsthand. Firsthand operates in the same specialty, equity-focused BDC space that BDCV does. At the time of Bulldog’s initial investment in Firsthand almost three years ago (July 2012), the price to NAV ratio was approximately 64% and has dropped to its current dismal level of 57%, the worst price to NAV ratio, not only among BDCV’s specialty peer group but also the entire publicly traded BDC industry

Conclusion The Board and management have been working to close the gap between BDCV’s stock price and NAV BDCV has implemented share repurchase programs under which BDCV has repurchased shares for a total cost of $3.6 million as of March 31, 2015 BDCV has also declared quarterly distributions which will pay shareholders a total of $0.60 per share in 2015, although these distributions may represent a return of capital. In addition, BDCV declared capital gains dividends totaling $0.695 per share in 2014 The Board and management remain committed to grow BDCV and enhance stockholder value The Board and the Adviser have developed and begun implementing the New Investment Strategy and Shareholder First Initiative Bulldog has no plan and its director nominees are not the best option for BDCV’s shareholders

Board of Directors Biographies Timothy J. Keating Chairman, President and Chief Executive Officer Board Member since 2008 Mr. Keating has served as the President, Chief Executive Officer and Chairman of the Board of Directors of BDCA Venture since its inception in 2008. Mr. Keating was a member of BDCA Venture Adviser from its founding in 1997 to July 1, 2014, when the members of BDCA Venture Adviser sold 100% of their membership interests to BDCA Adviser, LLC (“BDCA Adviser”). Mr. Keating has also served as a member of the Investment Committee of BDCA Venture Adviser since 2008. Mr. Keating served as the President and Chief Executive Officer of BDCA Venture Adviser from its founding in 1997 to March 2015. Mr. Keating previously served as the President of Keating Securities, LLC, formerly a wholly owned subsidiary of BDCA Venture Adviser and a Financial Industry Regulatory Authority, Inc. (“FINRA”) registered broker-dealer, from August 1999 to August 2008. Prior to founding BDCA Venture Adviser, Mr. Keating was a proprietary arbitrage trader and also head of the European Equity Trading Department at Bear Stearns International Limited (London) from 1994 to 1997. From 1990 to 1994, Mr. Keating founded and ran the European Equity Derivative Products Department for Nomura International Plc in London. Mr. Keating began his career at Kidder, Peabody & Co., Inc. where he was active in the Financial Futures Department in both New York and London. Mr. Keating is a 1985 cum laude graduate of Harvard College with an A.B. in economics. Mr. Keating’s intimate knowledge of the business and operations of BDCA Venture, 30 years’ experience in multiple areas of the financial services industry, extensive knowledge of capital markets, as well as the management of various investment funds in particular, provides valuable insight to the Board of Directors and also positions Mr. Keating to continue to effectively serve as the Chairman of our Board of Directors.

Board of Directors Biographies Laurence W. Berger Independent Director, Compensation Committee Chair Board Member since 2011 Mr. Berger is a Senior Advisor with McKinsey & Company’s Asian Financial Institutions Group, serving as a business strategy consultant for banks and major financial institutions in East Asia for the past 17 years. Mr. Berger’s consultancy engagements have included the development and implementation of investment strategy, capital markets strategy, organizational and corporate governance initiatives, loan rehabilitation and risk management, front-line sales improvement, growth and merger and acquisition strategy for central and commercial banks, government agencies, monetary authorities, and several other types of institutions across the Asia-Pacific region. Previously, Mr. Berger held senior management positions at Kidder, Peabody & Co. from January 1987 to December 1989 and Bank of America from July 1985 to December 1986, where he built and managed a number of financial services businesses. From June 1970 to July 1985, Mr. Berger served as a Managing Director at J.P. Morgan, with a variety of management responsibilities at the bank’s New York, Tokyo and Seoul offices. Mr. Berger completed his undergraduate studies at Claremont McKenna College, where he earned an honors degree in Political Science and International Relations, and earned a M.B.A. at the University of California Berkeley with a dual major in Corporate Finance and International Finance. Mr. Berger is qualified to serve on our Board of Directors because of his nearly 40 years’ experience working at and advising some of the largest financial institutions in the world. Additionally, Mr. Berger has worked and lived outside of the U.S. for a significant portion of his career and brings an extensive network and understanding of international companies, markets and cultures to our Board of Directors.

Board of Directors Biographies Leslie D. Michelson Independent Director Board Member since 2014 Mr. Leslie D. Michelson, J.D. has served as the Chairman and Chief Executive Officer of Private Health Management, Inc. since April 2007. Mr. Michelson has served as an independent director of Business Development Corporation of America (“BDCA”) since January 2011, an independent director of Business Development Corporation of America II (“BDCA II”) since August 2014, an independent director of Realty Capital Income Trust Funds since April 2013, each of which entities is affiliated with or sponsored by AR Capital, LLC (“AR Capital”). Mr. Michelson has served as a director of ALS Therapy Development Institute since June 2004, where he has also served as the Vice Chairman since 2011, and as a director of Druggability Technologies Holdings Ltd. since April 2013. Mr. Michelson previously served as an independent director of American Realty Capital Properties, Inc. (Nasdaq: ARCP) from October 2012 to April 2015, an independent director of Realty Finance Trust from January 2013 to November 2014, an independent director of American Realty Capital Trust from January 2008 to July 2013, an independent director of New York REIT, Inc. from October 2009 to August 2011, an independent director of American Realty Capital Daily Net Asset Value Trust from August 2011 to February 2012, an independent director of American Realty Capital Healthcare Trust, Inc. from January 2011 to January 2015, and an independent director of American Realty Capital Retail Centers of America from March 2012 to October 2012, each of which entities is or was affiliated with or sponsored by AR Capital. Mr. Michelson also previously served as an independent director of Landmark Imaging Medical Group, Inc. from 2007 to 2010, Highlands Acquisition Corp. from 2007 to 2009, and Nastech Pharmaceutical Company, Inc. from 2004 to 2008. He previously served as the Vice Chairman and Chief Executive Officer of the Prostate Cancer Foundation from 2002 to 2006 and served as a director from 2002 to 2013. Mr. Michelson previously served as an independent director of Catellus Development Corp from 1997 to 2004, where he also held positions as the Chair of the Audit and Compensation Committees. From March 2000 to August 2001, Mr. Michelson served as the Chief Executive Officer and Director of Acurian, Inc. Mr. Michelson served as an adviser at Saybrook Capital, LLC, from 1999 to March 2000. Mr. Michelson served as the Chairman and Co-Chief Executive Officer of Protocare, Inc. from June 1998 to February 1999 and the Chairman and Chief Executive Officer of Value Health Sciences, Inc. from 1988 to 1998. Mr. Michelson served as a director of G&L Realty Corp. from 1995 to 2001. He served as a Special Assistant to the General Counsel of the United States Department of Health and Human Services, from 1979 to 1981. Mr. Michelson received a J.D. from Yale Law School in 1976 and a B.A. degree in Social and Behavioral Sciences from Johns Hopkins University in 1973. Mr. Michelson’s more than 20 years of experience as a founder, chief executive officer, investor, adviser and/or director for a portfolio of entrepreneurial health care, technology and real estate companies, benefits our Board of Directors.

Board of Directors Biographies J. Taylor Simonton Independent Director, Audit and Nominating Committee Chair Board Member since 2008 Mr. Simonton spent 35 years at PricewaterhouseCoopers LLP (“PwC”), including 23 years as a partner in the firm’s Assurance Services, before retiring in 2001. Mr. Simonton was a partner for seven years in PwC’s National Professional Services Group, which handles the firm’s auditing and accounting standards, SEC, corporate governance, risk management and quality matters. In May 2014, he was elected an independent director and chair of the Audit Committee of Advanced Emissions Solutions, Inc. (OTCBB: ADES), an environmental technology and specialty chemicals company. Since October 2013, Mr. Simonton has served as an independent director, chair of the Audit Committee and member of the Nominating and Governance Committee of Escalera Resources, Co. and a member of the Compensation Committee since July 2014 (Nasdaq: ESCR), a natural gas exploration and development company. From October 2008 to January 2014, Mr. Simonton served as an independent director and chair of the Audit Committee of Zynex, Inc. (OTCBB: ZYXI), a company that primarily engineers, manufactures, markets and sells its own design of electrotherapy medical devices used for pain management and rehabilitation. Mr. Simonton served as a director from September 2005 to May 2013 of Red Robin Gourmet Burgers, Inc. (NasdaqGS: RRGB), a casual dining restaurant chain operator serving high quality gourmet burgers where he was a member of the Audit Committee, of which he was chair from October 2005 until June 2009, and a member of the Nominating and Governance Committee. From January 2003 to February 2007, he also served as a director and the chair of the Audit Committee of Fischer Imaging Corporation, a public company that designed, manufactured and marketed medical imaging systems. Mr. Simonton is a Director, Past Chair and Past President of the Colorado Chapter of the National Association of Corporate Directors (NACD) and is a NACD Board Leadership Fellow. Mr. Simonton received a B.S. in Accounting from the University of Tennessee in 1966 and is a Certified Public Accountant. Mr. Simonton’s extensive accounting, SEC reporting and corporate governance experience, as well as his comprehensive experience on the board of directors of other public companies, benefits the Board of Directors.

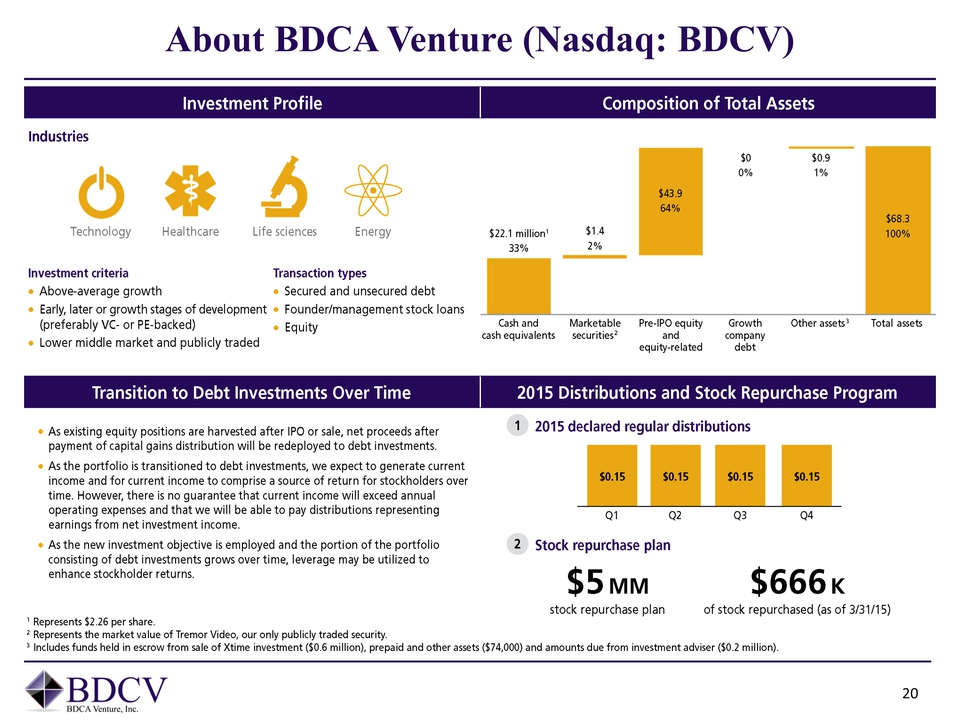

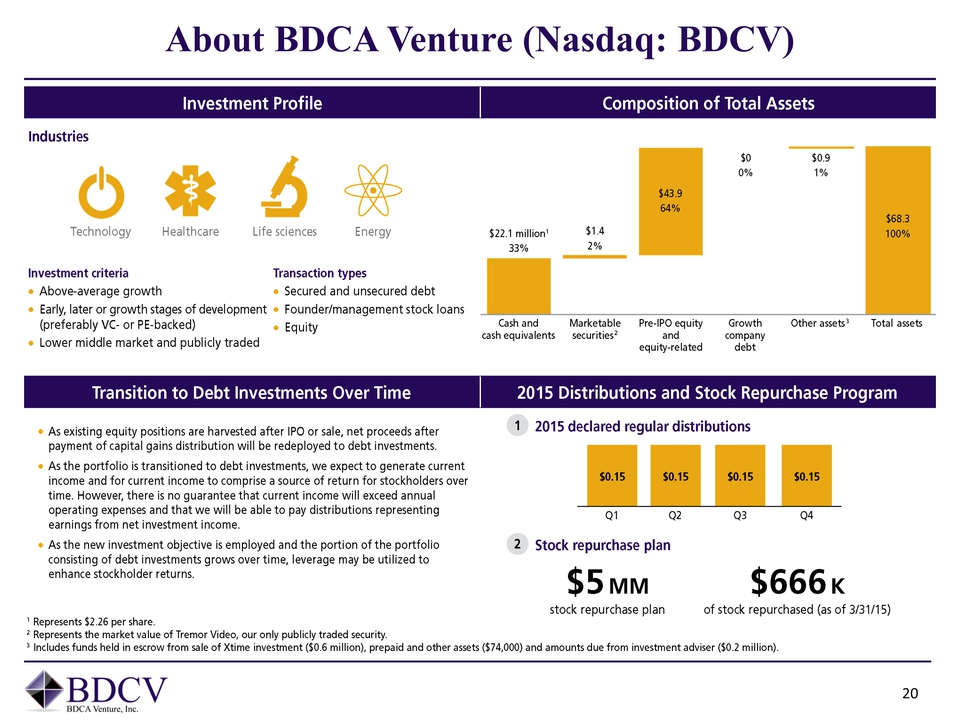

About BDCA Venture (Nasdaq: BDCV) Investment Profile Composition of Total Assets Industries Technology Healthcare Life sciences Energy Investment criteria Transaction types Above-average growth Early, later or growth stages of development (preferable VC- or PE-backed) Lower middle market and publicly traded Secured and unsecured debt Founder/management stock loans Equity $22.1 million1 33% $1.4 2% $43.9 64% $0 0% $0.9 1% $68.3 100% Cash and cash equivalents Marketable securities2 Pre-IPO equity and equity-related Growth company debt Other assets3 Total assets Transition to Debt Investments Over Time 2015 Distributions and Stock Repurchase Program As existing equity positions are harvested after IPO or sale, net proceeds after payment of capital gains distribution will be redeployed to debt investments. As the portfolio is transitioned to debt investments, we expect to generate current income and for current income to comprise a source of return for stockholders over time. However, there is no guarantee that current income will exceed annual operating expenses and that we will be able to pay distributions representing earnings from net investment income. As the new investment objective is employed and the portion of the portfolio consisting of debt investment grows over time, leverage may be utilized to enhance stockholder returns. 1 Represents $2.26 per share. 2 Represents the market value of Tremor Video, our only publicly traded security. 3 Includes funds held in escrow from sale of Xtime investment ($0.6 million), prepaid and other assets ($74,000) and amounts due from investment adviser ($0.2 million). 1 2015 declared regular distributions $0.15 $0.15 $0.15 $0.15 Q1 Q2 Q3 Q4 2 Stock repurchase plan $5MM $666K stock repurchase plan of stock repurchased (as of 3/31/15)

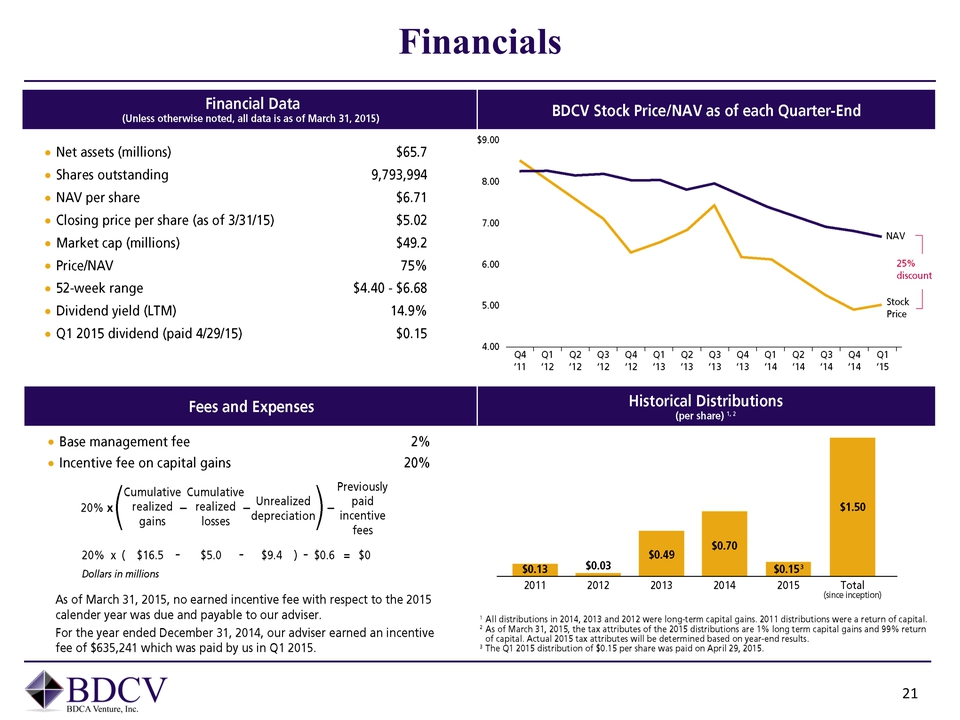

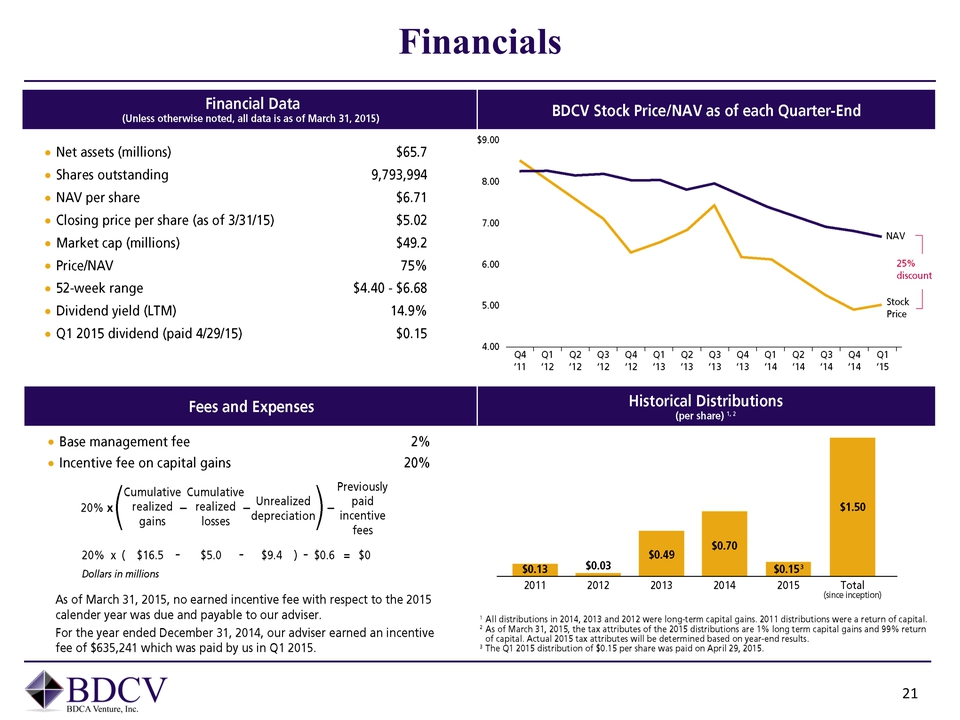

Financials Financial Data (Unless otherwise noted, all data is as of march 31, 2015) Net assets (millions) $65.7 shares outstanding 9,793,994 NAV per share $6.71 Closing price per share (as of 3/31/15) $5.02 Market cap (millions) $49.2 Price/NAV 75% 52-week range $4.40 - $6.68 Dividend yield (LTM) Q1 2015 dividend (paid 4/29/15) $0.15 BDCV Stock Price/NAV as of each Quarter-End NAV 25% discount Stock Price $9.00 8.00 7.00 6.00 5.00 4.00 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Fees and Expenses Base management fee 2% Incentive fee on capital gains 20% 20% x Cumulative realized gains – Cumulative realized losses – Unrealized depreciation – Previously paid incentive fees 20% x ($16.5 - $5.0 - $9.4) - $0.6 = $0 As of March 31, 2015, no earned incentive fee with respect to the 2015 calendar year was due and payable to our adviser. For the year ended December 31, 2014, our adviser earned an incentive fee of $635,241 which was paid by us in Q1 2015. Historical Distributions (per share) 1, 2 1 All distributions in 2014, 2013 and 2012 were long-term capital gains. 20111 distributions were a return of capital. 2 As of March 31, 2015, the tax attributes of the 2015 distributions are 1% long term capital gains and 99% return of capital. Actual 2015 tax attributes will be determined based on year-end results. 3 The Q1 2015 distribution of $0.15 per share was paid on April 29, 2015.

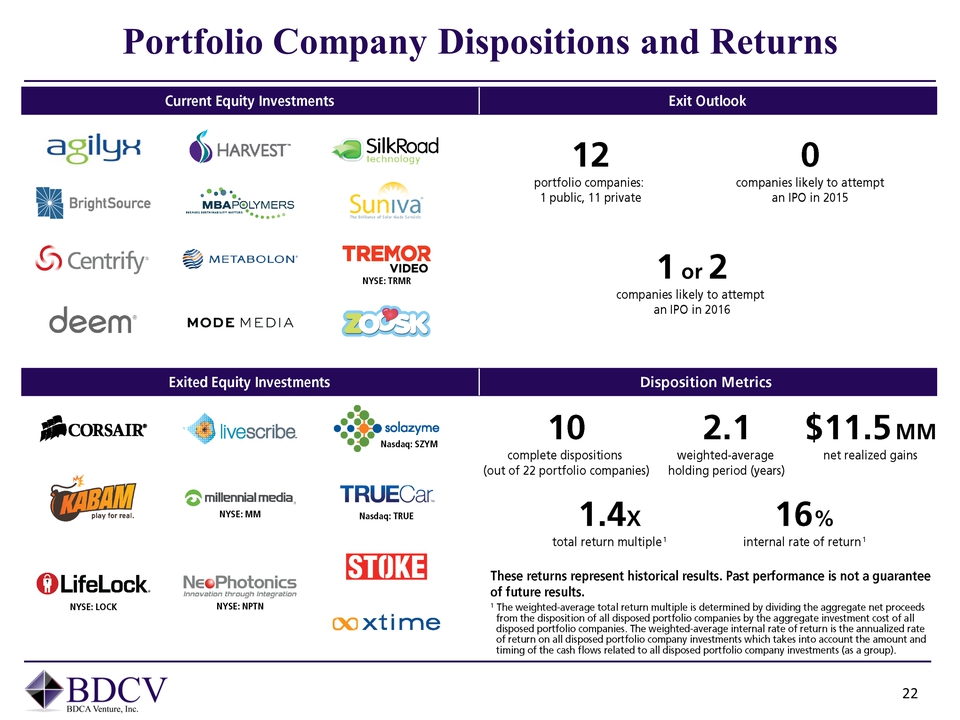

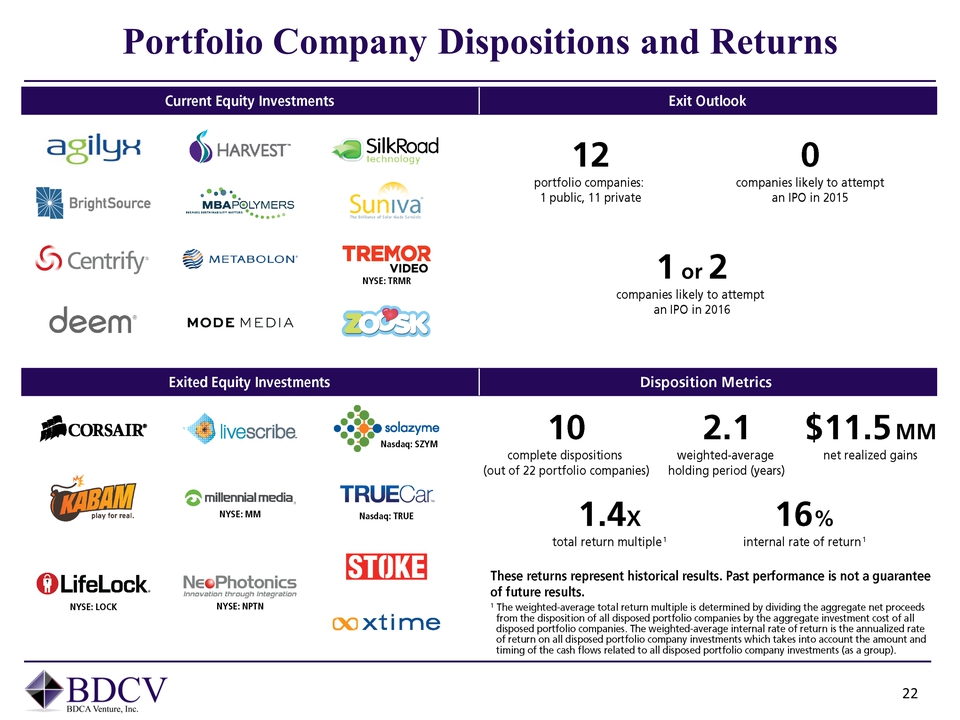

Portfolio Company Dispositions and Returns Current Equity Investments agilyz HARVEST SilkRoad Technology BrightSource MBAPolymers Suniva Centrify Metabolon Tremor Video NYSE:TEMR deem MODE MEDIA ZOOSK Exit Outlook 12 portfolio companies: 1 public, 11 private 0 companies likely to attempt an IPO in 2015 1 or 2 companies likely to attempt an IPO in 2016 Exited Equity Investments CORSAIR livescribe solazyme Nasdaq: SZYM KABAM play for real. Millennial media NYSE: MM TRUECar Nasdaq: TRUE LifeLock NYSE: LOCK NeoPhotonics innovation through integration NYSE: NPTN STOKE xtime Disposition Metrics 10 complete dispositions (out of 22 portfolio companies) 2.1 weighted-average holding period (years) $11.5 MM net realized gains 1.4x total return multiple 1 16% internal rate of return 1 These returns represent historical results. Past performance is not a guarantee of future results. 1 The weighted-average total return multiple is determined by dividing the aggregate net proceeds from the disposition of all disposed portfolio companies by the aggregate investment cost of all disposed portfolio companies. The Weighted-average internal rate of return is the annualized rate of return on all disposed portfolio company investments which take into account the amount and timing of the cash flows related to all disposed portfolio company investments (as a group.)

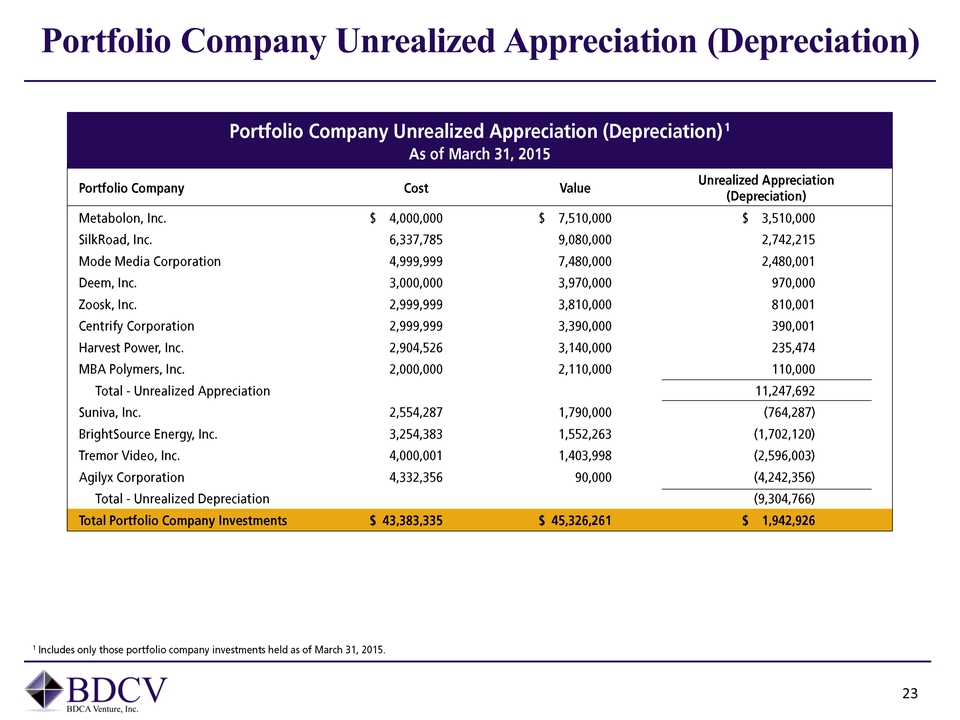

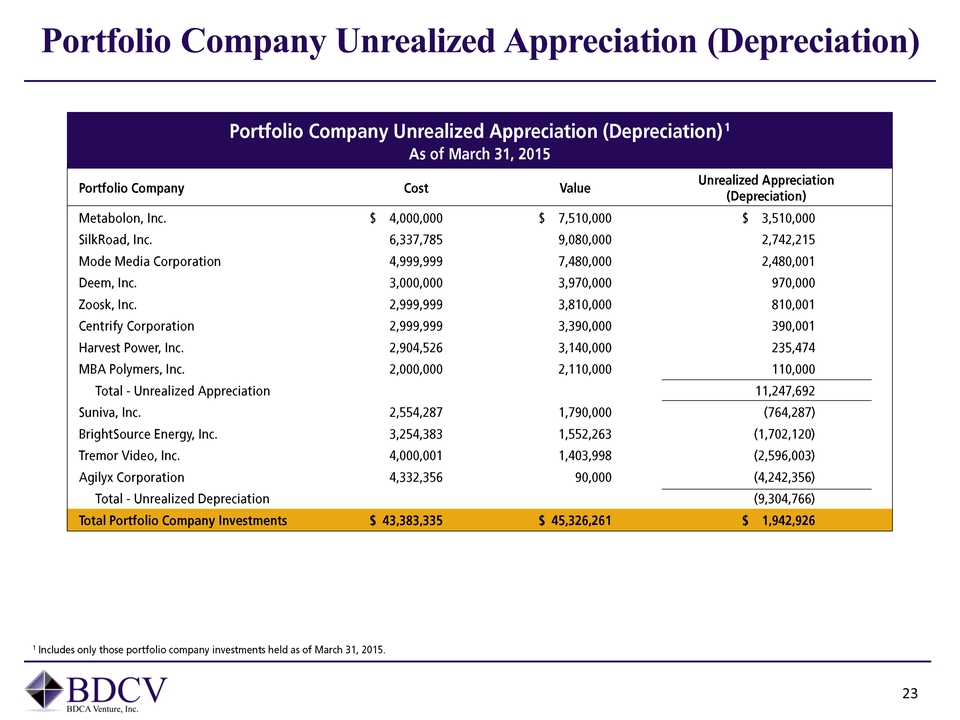

Portfolio Company Unrealized Appreciation (Depreciation) Portfolio company Unrealized Appreciation (Depreciation) 1 As of March 31, 2015 Portfolio Company Cost Value Unrealized Appreciation (Depreciation) Metabolon, Inc. $ 4,000,000 $7,510,000 $3,510,000 SilkRoad, Inc. 6,337,785 9,080,000 2,742,215 Mode Media Corporation 4,999,999 7,480,000 2,480,001 Deem, Inc. 3,000,000 3,970,000 970,000 Zoosk, Inc. 2,999,999 3,810,000 810,001 Centrify Corporation 2,999,999 3,390,000 390,001 Harvest Power, Inc. 2,904,532 3,140,000 235,474 MBA Polymers, Inc. 2,000,000 2,110,000 110,000 Total – Unrealized Appreciation 11,247,692 Suniva, Inc. 2,554,287 1,790,000 (764,287) BrightSource Energy, Inc. 3,254,383 1,552,263 (1,702,120) Temor Video, Inc. 4,000,001 1,403,998 (2,596,003) Agilyx Corporation 4,332,356 90,000 (4,242,356) Total – Unrealized Depreciation (9,304,766) Total Portfolio Company Investments $43,383,335 $45,326,261 $1,942,926 1 Includes only those portfolio company investments held as of March 31, 2015.

Experienced Investment Team Name Prior Experience Years in Industry Timothy J. Keating CEO, Investment Committee Mr. Keating is the Chief Executive Officer of BDCA Venture, Inc. Previously, he held senior management positions in the Equity and Equity Derivatives departments of Bear Stearns, Nomura and Kidder, Peabody in both London and New York. He is a 1985 cum laude graduate of Harvard College with an A.B. in economics. 29 Peter M. Budko Investment Committee Mr. Budko is a founding partner and Chief Investment Officer of AR Capital, LLC. Additionally, her serves as Chief Executive Offier of Business Development Corporation of America (“BDCA”) and Business Development Corporation of America II (“BDCA II”), and their respective investment advisers. Prior to the formation of ARC, Mr. Budko had senior management positions in the Structured Asset Finance Group at Wachovia and in the Corporate Real Estate Finance Group of NationsBank Capital Markets (predecessor to Bank of America Securities). 25 Robert K. Grunewald Investment Committee Mr. Grunewald serves as Chief Executive Officer and President of BDCA Venture Adviser, LLC. Additional he serves as Chief Investment Officer of Business Development Corporation of America and its investment adviser. Within the finance industry, Mr. Grunewald has participated as a lender, investment banker, M&A advisor, portfolio manager and hedge fund manager at institutions including NationsBank/Montgomery Securities and Wells Fargo Securities. He is a 1984 graduate of the University of Notre Dame with a B.B.A in Accounting and Finance and holds an M.B.A from Georgia State University. 22 Kyle L. Rogers, CFA Mr. Rogers is a Managing Director of BDCA Venture Adviser, LLC. Previously, her was a Financial Analyst at Goldman Sachs in both New York and Chicago. He is a CFA Charterholder and 1999 graduate of Dartmouth College with an A.B. in government and a minor in environmental studies. 15 Rexford A. Darko Mr. Darko is a Managing Director of BDCA Venture Adviser, LLC. Previously, he founded Griffen-Rose, a boutique equity research film, was a Senior Analyst at Prospect Street Ventures, and founded Goldline Entertainment Services. He is a 2002 Dean’s List graduate of Columbia Business School with an M.B.A., a 1992 graduate of the University of London with an L.L.M. (Distinction and Merit in Environmental and Media Laws), and a 1988 graduate of King’s college, London with an L.L.B and an A.K.C. 15