Impel Pharmaceuticals Inc. Corporate Overview September 2023

This presentation and the accompanying oral commentary contains forward-looking statements that are based on Impel Pharmaceutical Inc.’s (the “Company”, “we” or “our”) management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include all statements other than statements of historical fact contained in this presentation, including information concerning our future financial performance, business plans and objectives, timing and success of our planned development activities, our ability to obtain regulatory approval, the potential therapeutic benefits and economic value of our product candidates, potential growth opportunities, competitive position, industry environment and potential market opportunities. Forward-looking statements are subject to known and unknown risks, uncertainties, assumptions and other factors. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. These factors, together with those that may be described in greater detail in our most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q and other reports the Company files from time to time with the Securities and Exchange Commission, may cause our actual results, performance or achievements to differ materially and adversely from those anticipated or implied by our forward-looking statements. In addition, statements that “we believe,” “expect,” “anticipate,” “intends,” “estimate,” “will,” “may,” “continue” and “should” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this presentation, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, these statements shall not be relied upon as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while we believe our own internal research is reliable, such research has not been verified by any independent source.

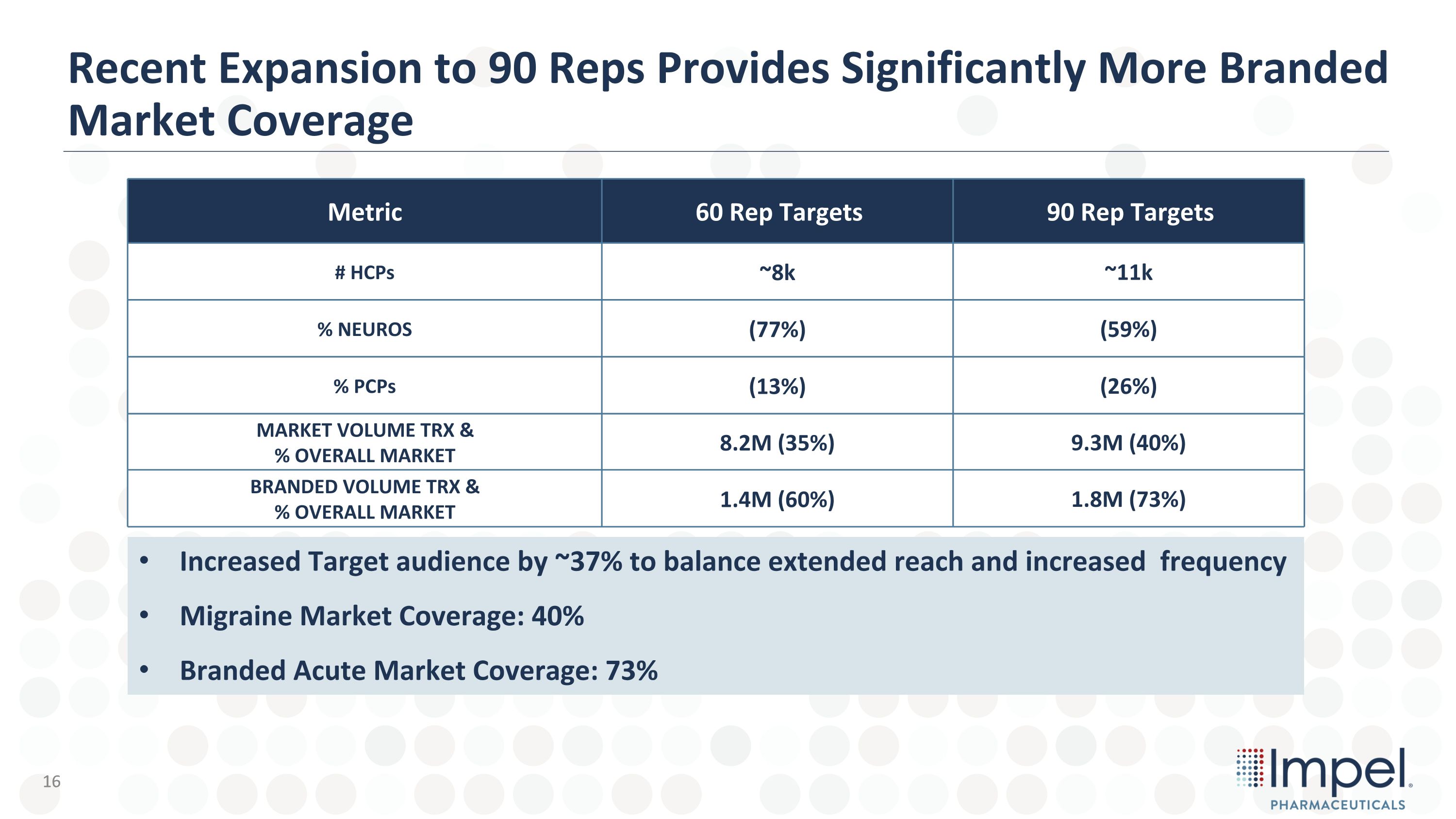

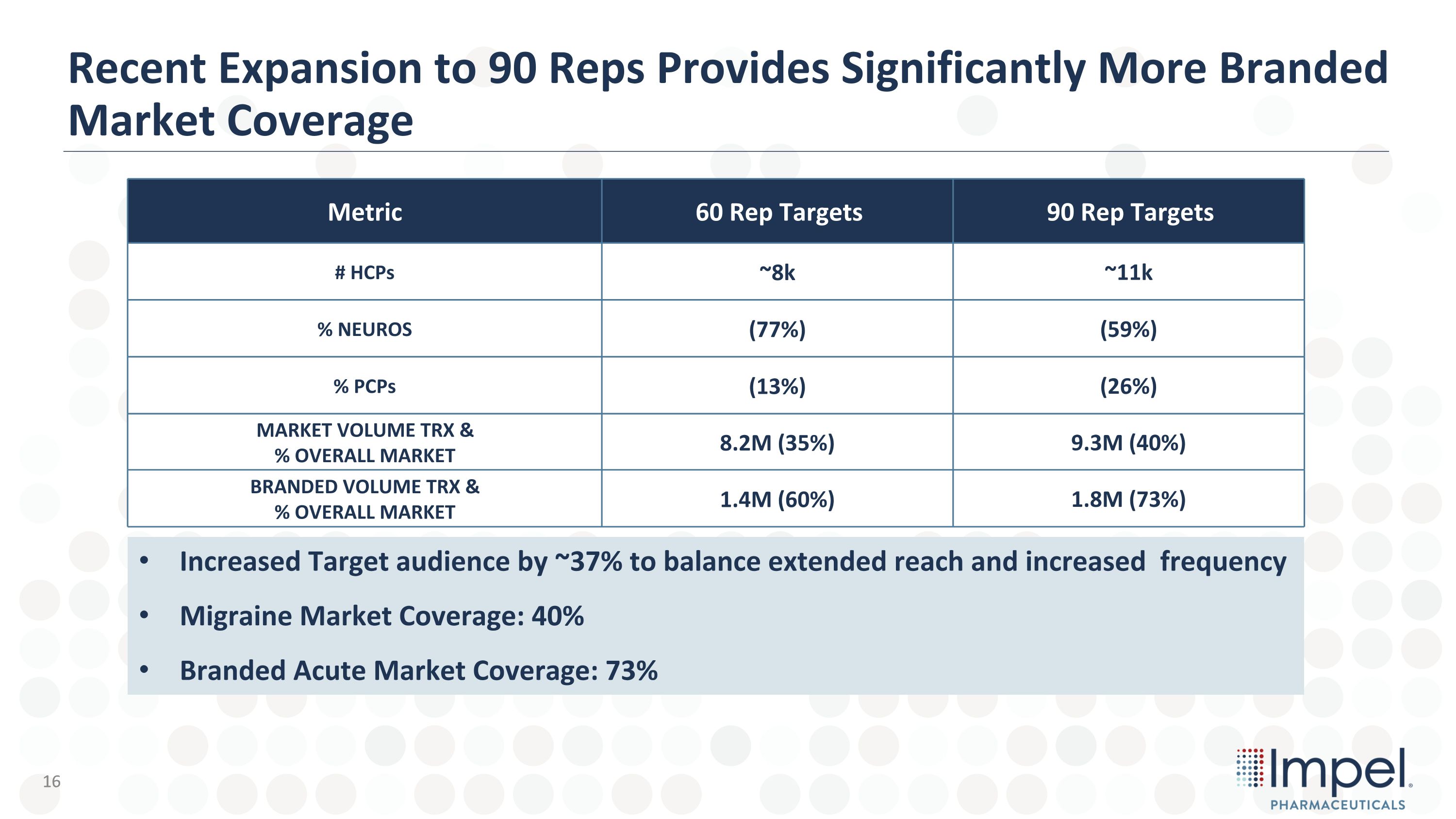

Impel – The Business Opportunity POD® Technology: Clinically Validated and Broad Utility Unique approach targeting upper nasal space; broad disease area applicability First Product – Trudhesa®, first cycle approval in September 2021, launched October 2021 Go To Market Thesis: Our initial focused launch strategy allows for sales promotion to a highly concentrated prescriber base of 8k target HCPs Disciplined Investment: Expanded sales force in late Q3 2022 by 50% from 60 to 90 sales professionals to further capitalize on market opportunity ~11k HCPs prescribe ~75% of gepants; ~80% are Impel target HCPs Efficient Market Coverage: Amplify sales force effectiveness; increased touch points on high value target HCPs Broad IP Portfolio: Provides product / technology protection through 2038

The Trudhesa® Clinical Profile 4

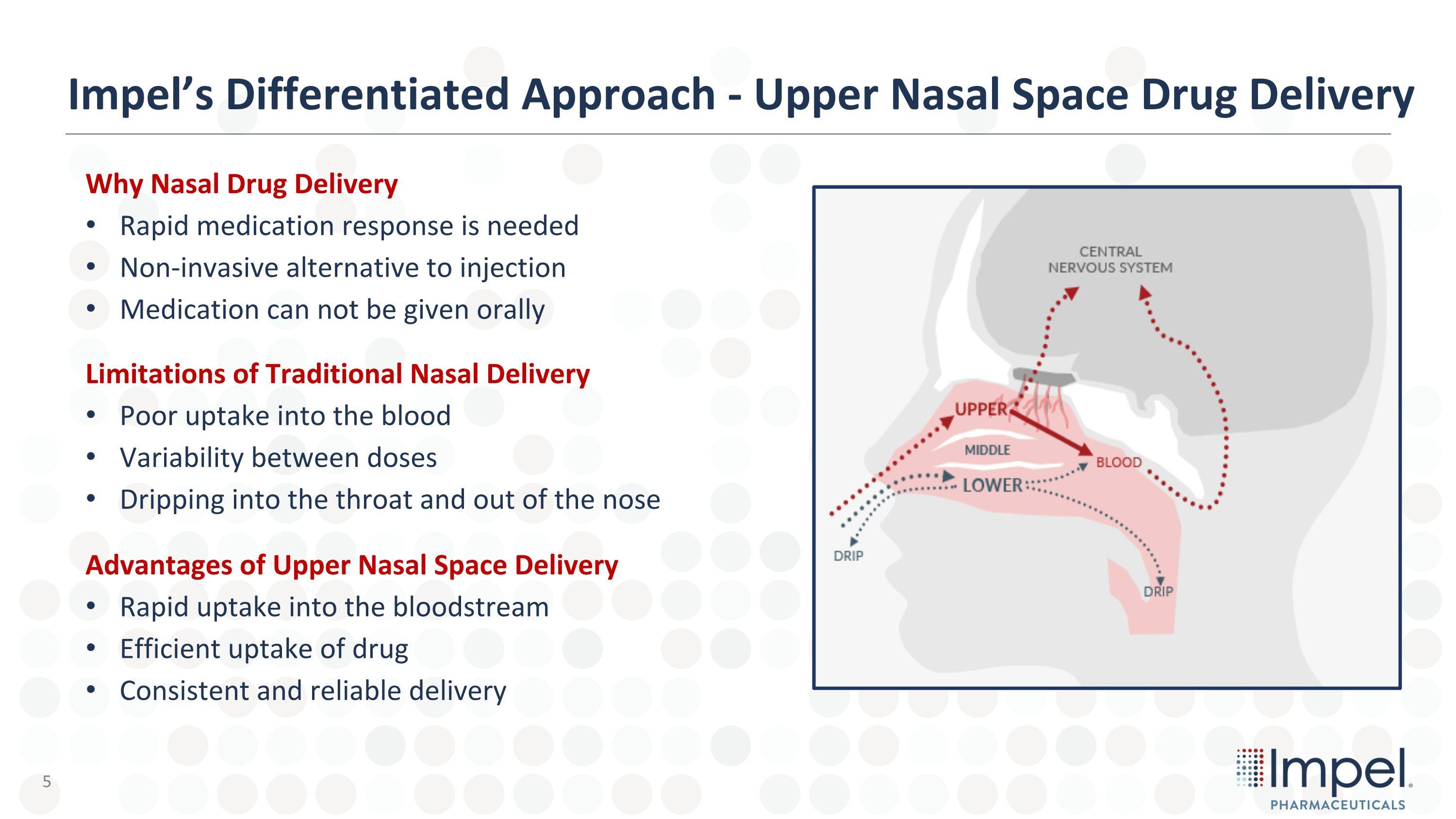

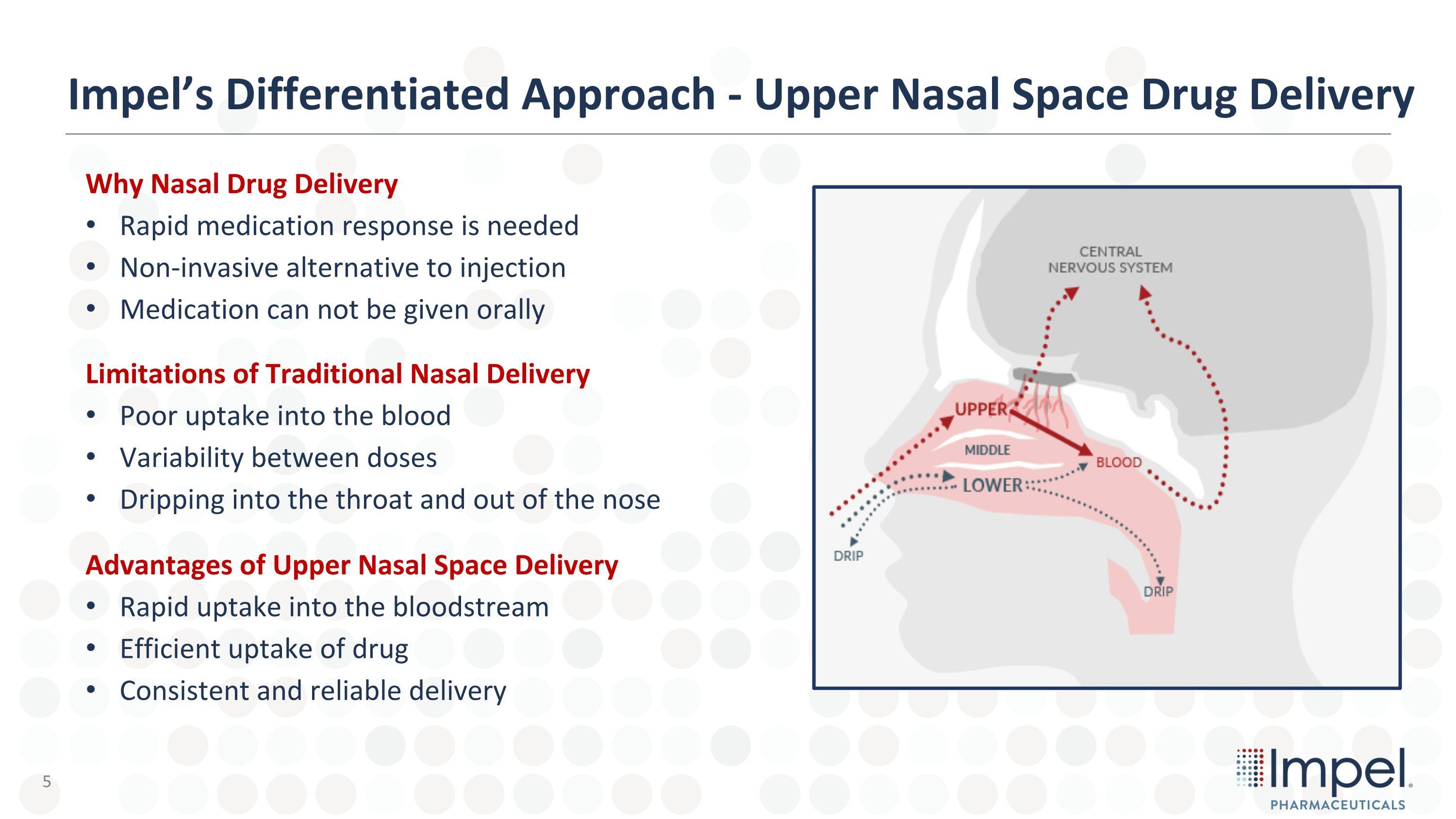

Why Nasal Drug Delivery Rapid medication response is needed Non-invasive alternative to injection Medication can not be given orally Limitations of Traditional Nasal Delivery Poor uptake into the blood Variability between doses Dripping into the throat and out of the nose Advantages of Upper Nasal Space Delivery Rapid uptake into the bloodstream Efficient uptake of drug Consistent and reliable delivery Impel’s Differentiated Approach - Upper Nasal Space Drug Delivery 5

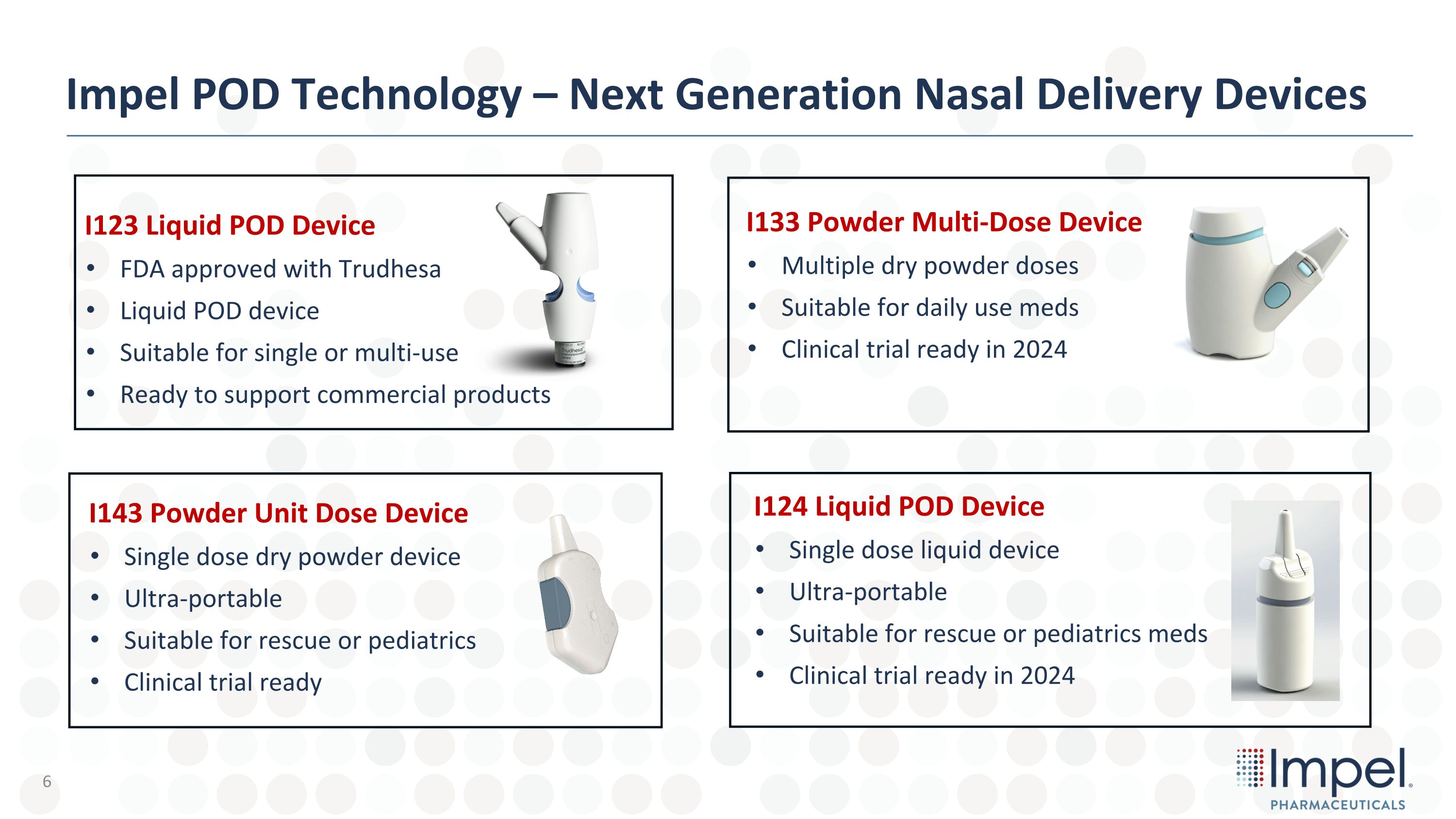

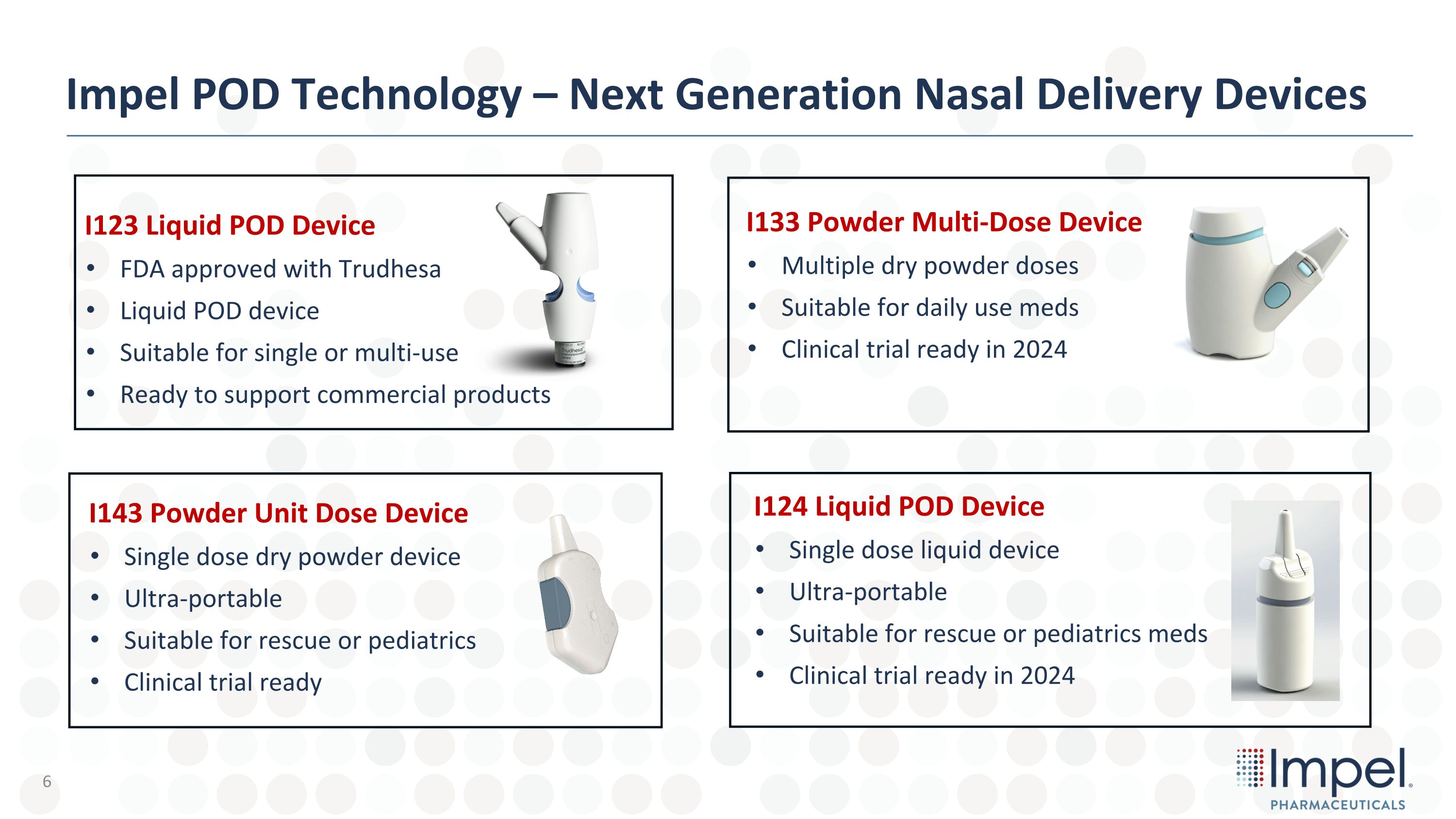

I133 Powder Multi-Dose Device Multiple dry powder doses Suitable for daily use meds Clinical trial ready in 2024 Impel POD Technology – Next Generation Nasal Delivery Devices I124 Liquid POD Device Single dose liquid device Ultra-portable Suitable for rescue or pediatrics meds Clinical trial ready in 2024 I143 Powder Unit Dose Device Single dose dry powder device Ultra-portable Suitable for rescue or pediatrics Clinical trial ready I123 Liquid POD Device FDA approved with Trudhesa Liquid POD device Suitable for single or multi-use Ready to support commercial products

Unsurpassed Outcomes Addressing Unmet Need in Acute Migraine Trudhesa THE ‘IDEAL’ MIGRAINE MEDICINE: 38% First Migraine treated pain free�at 2 hours (354 pts.) 86% Migraine free�at 48 hours ��(for those pain free at 2 hours, weeks 13-24) NO Treatment window limitations 74% Completed 24 week treatment period; 90% continued to 52 weeks 84% Agreed �Trudhesa �“easy to use” FAST �ACTING LONG �LASTING�RELIEF CAN BE TAKEN �AT ANY TIME �during�migraine SUSTAINED RESPONSE�and�FEW OR NO �SIDE EFFECTS EASY �to�incorporate into�everyday life Source: STOP 301 Phase III Clinical Study

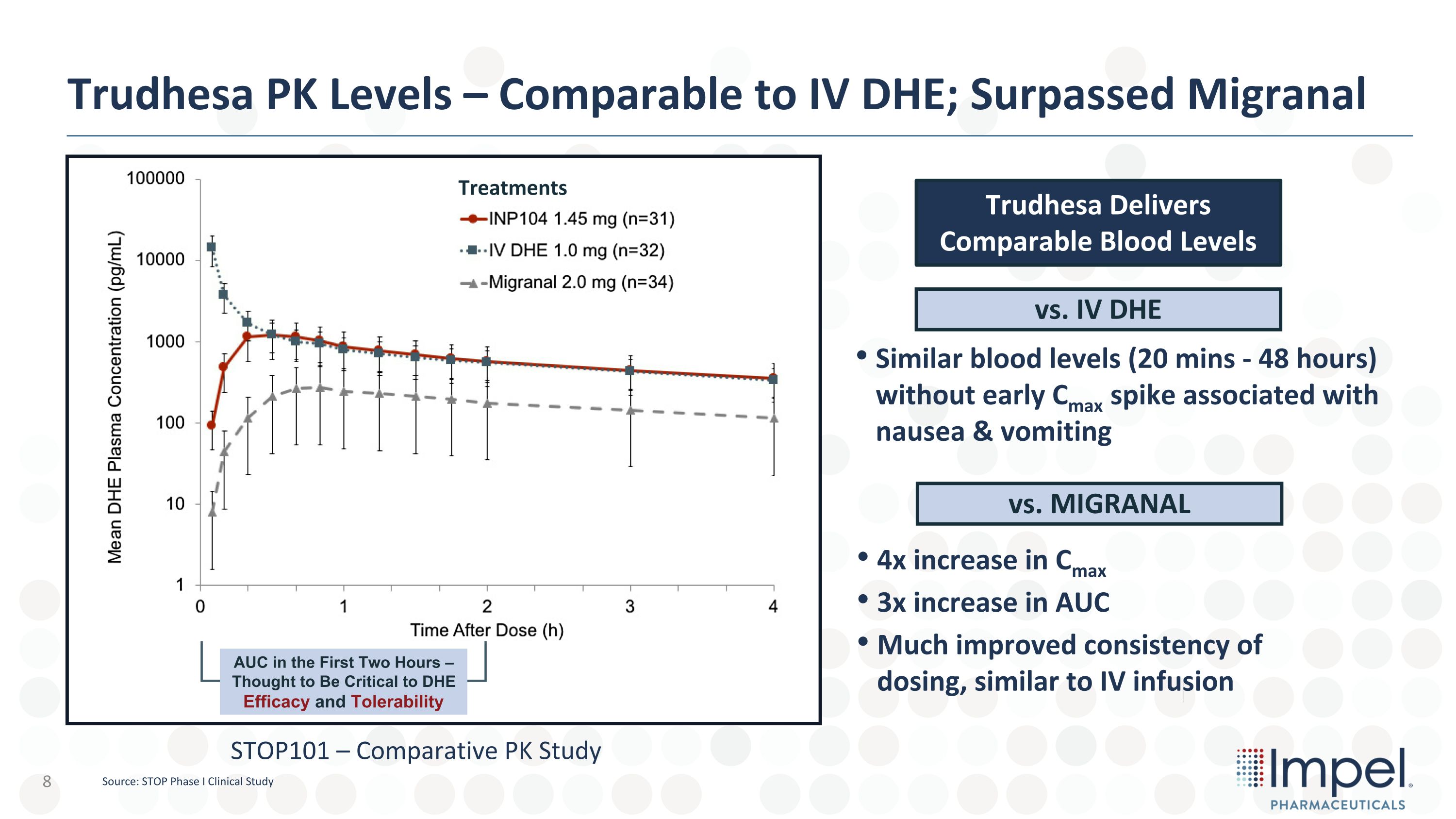

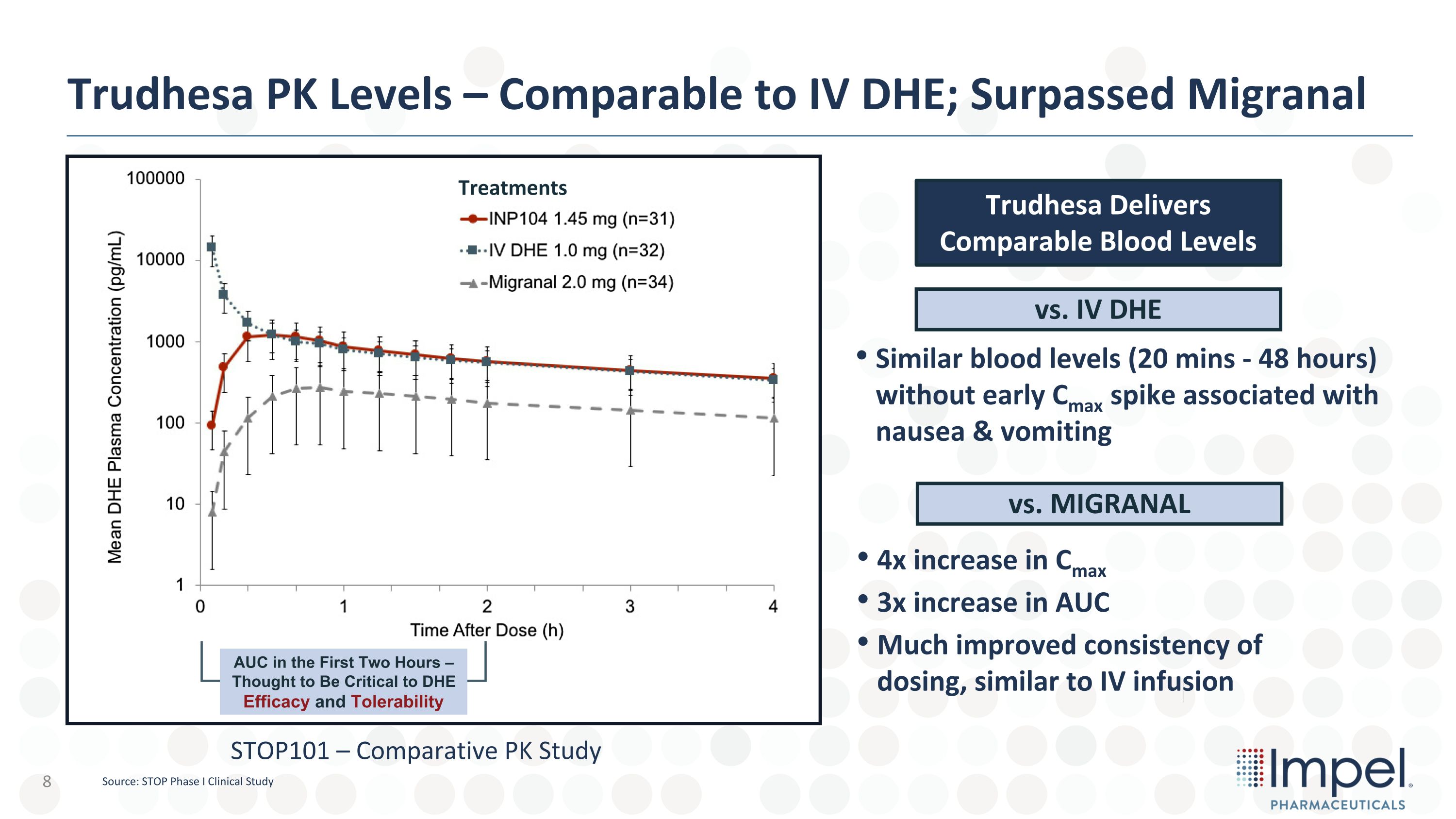

Trudhesa PK Levels – Comparable to IV DHE; Surpassed Migranal AUC in the First Two Hours – Thought to Be Critical to DHE�Efficacy and Tolerability Trudhesa Delivers �Comparable Blood Levels vs. IV DHE vs. MIGRANAL 4x increase in Cmax 3x increase in AUC Much improved consistency of dosing, similar to IV infusion Similar blood levels (20 mins - 48 hours) without early Cmax spike associated with nausea & vomiting Treatments STOP101 – Comparative PK Study Source: STOP Phase I Clinical Study

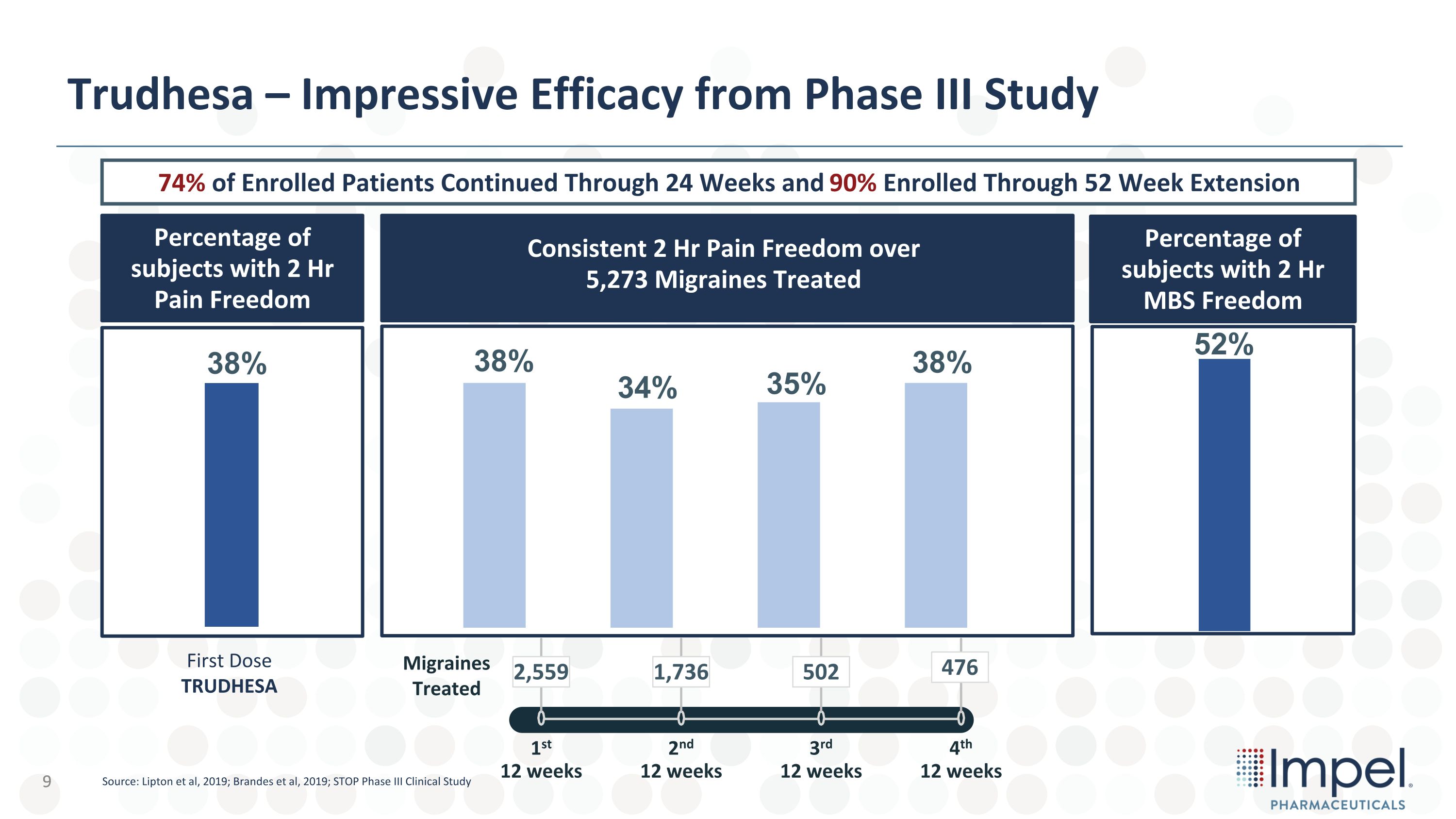

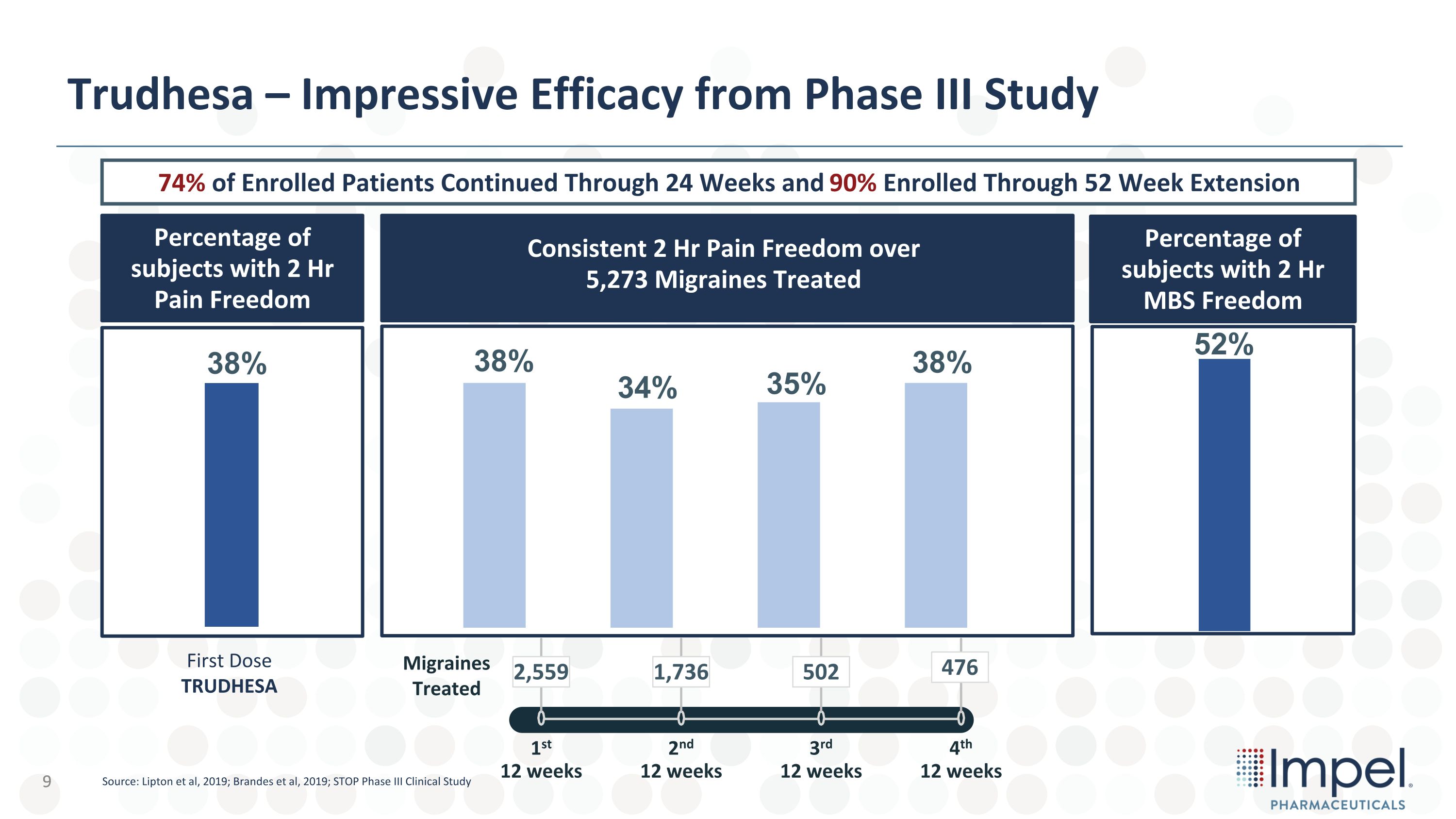

Trudhesa – Impressive Efficacy from Phase III Study Migraines Treated 4th�12 weeks 3rd�12 weeks 2nd�12 weeks 1st�12 weeks 2,559 1,736 502 476 38% 35% 38% 34% 38% Percentage of subjects with 2 Hr Pain Freedom First Dose TRUDHESA 52% Percentage of subjects with 2 Hr MBS Freedom Consistent 2 Hr Pain Freedom over 5,273 Migraines Treated 74% of Enrolled Patients Continued Through 24 Weeks and 90% Enrolled Through 52 Week Extension Source: Lipton et al, 2019; Brandes et al, 2019; STOP Phase III Clinical Study 9

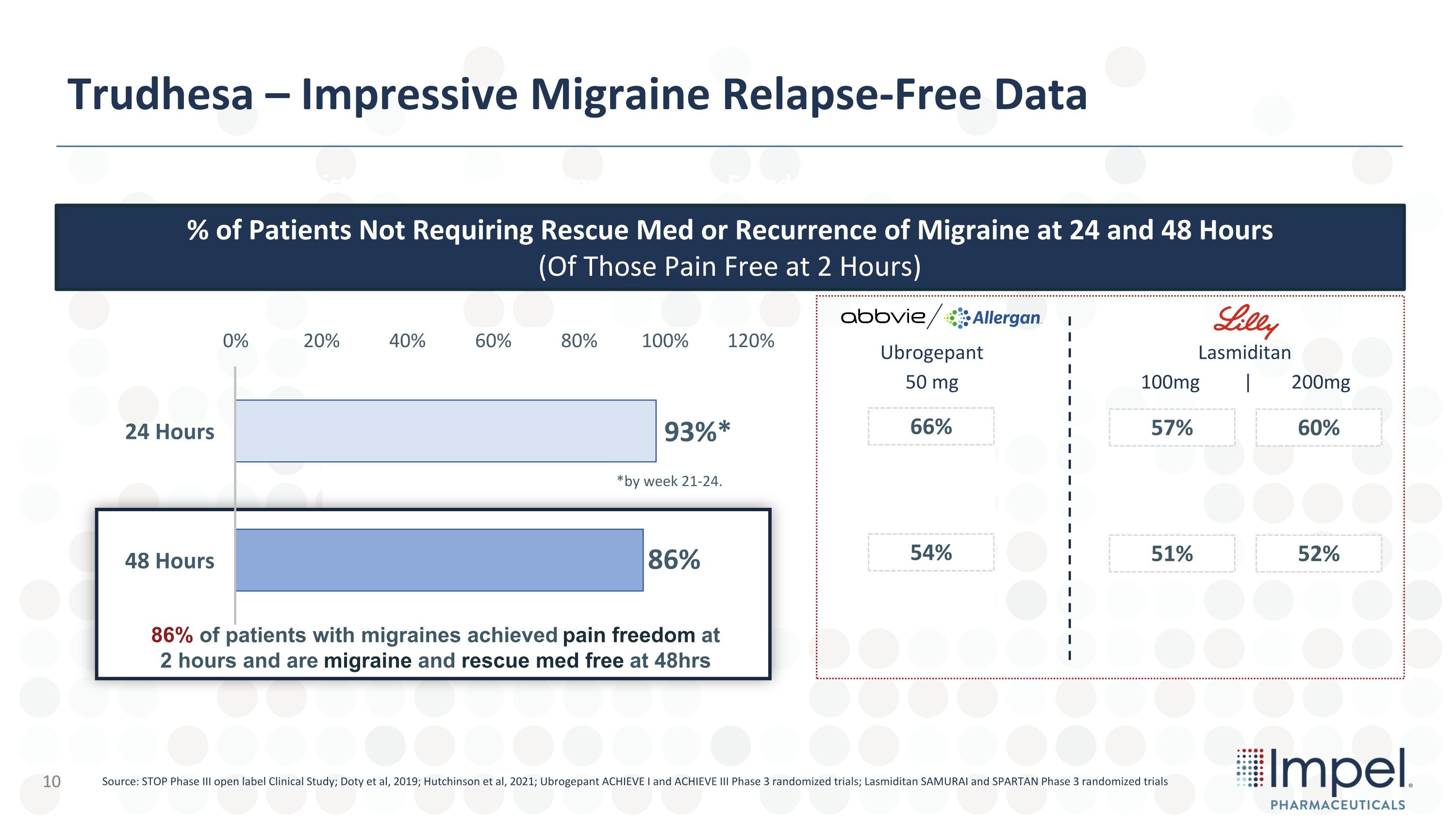

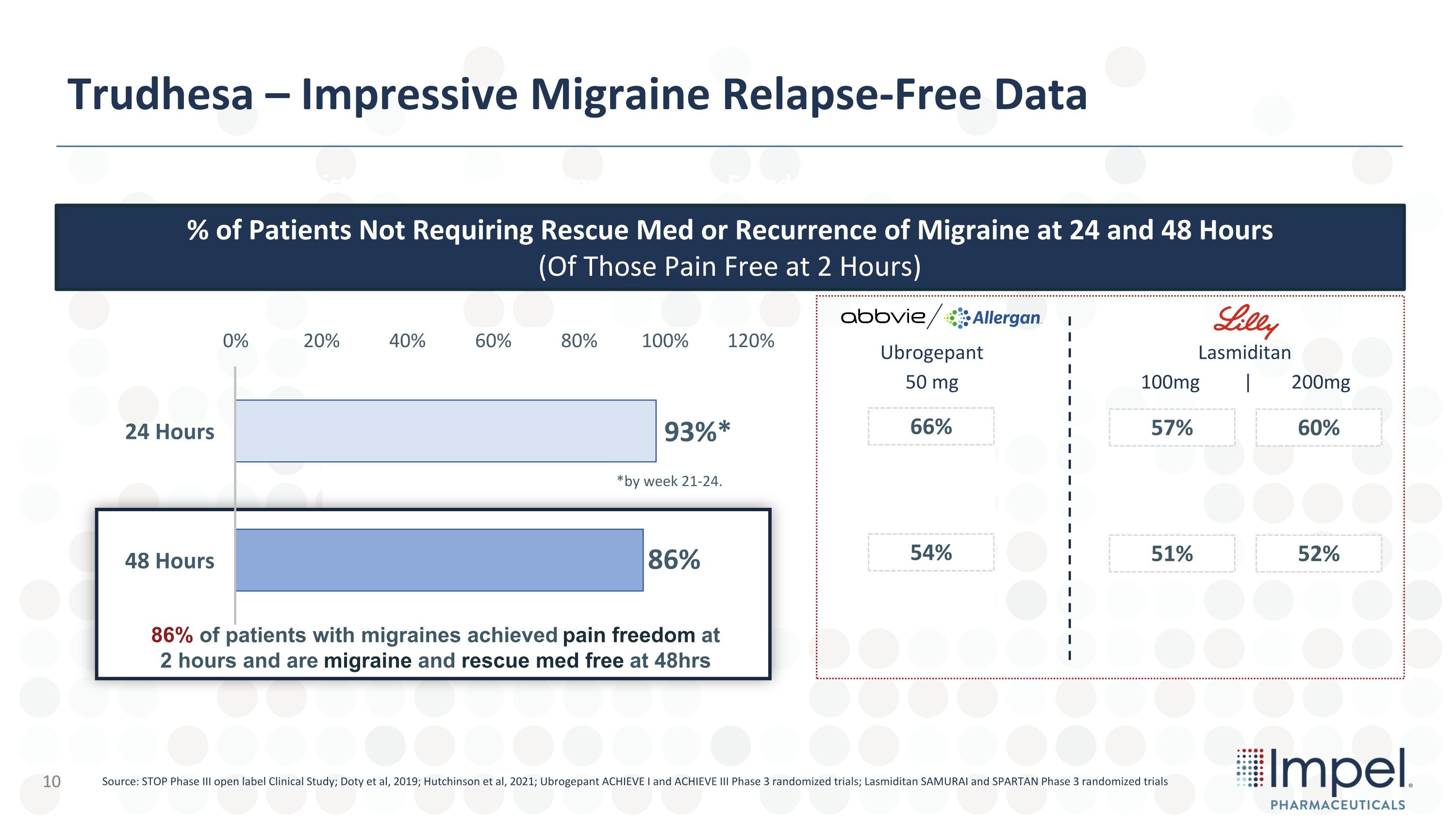

Trudhesa – Impressive Migraine Relapse-Free Data Consistent 2 Hr Pain Freedom over 5,273 Migraines Treated Source: STOP Phase III open label Clinical Study; Doty et al, 2019; Hutchinson et al, 2021; Ubrogepant ACHIEVE I and ACHIEVE III Phase 3 randomized trials; Lasmiditan SAMURAI and SPARTAN Phase 3 randomized trials 10 Consistent 2 Hr Pain Freedom over 5,273 Migraines Treated 86% of patients with migraines achieved pain freedom at 2 hours and are migraine and rescue med free at 48hrs % of Patients Not Requiring Rescue Med or Recurrence of Migraine at 24 and 48 Hours �(Of Those Pain Free at 2 Hours) *by week 21-24. Lasmiditan Ubrogepant 66% 54% 57% 51% 60% 52% 50 mg 100mg | 200mg

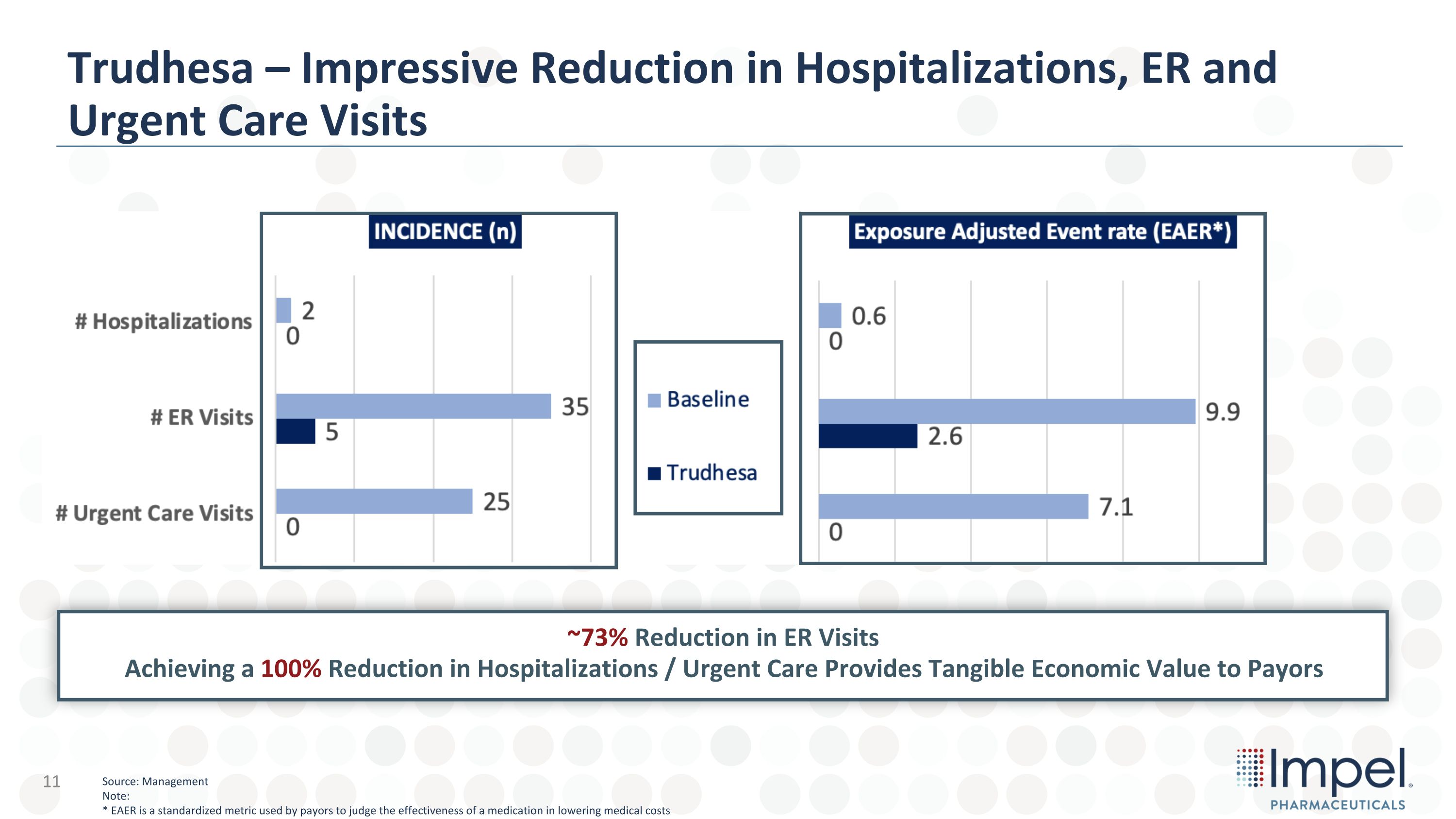

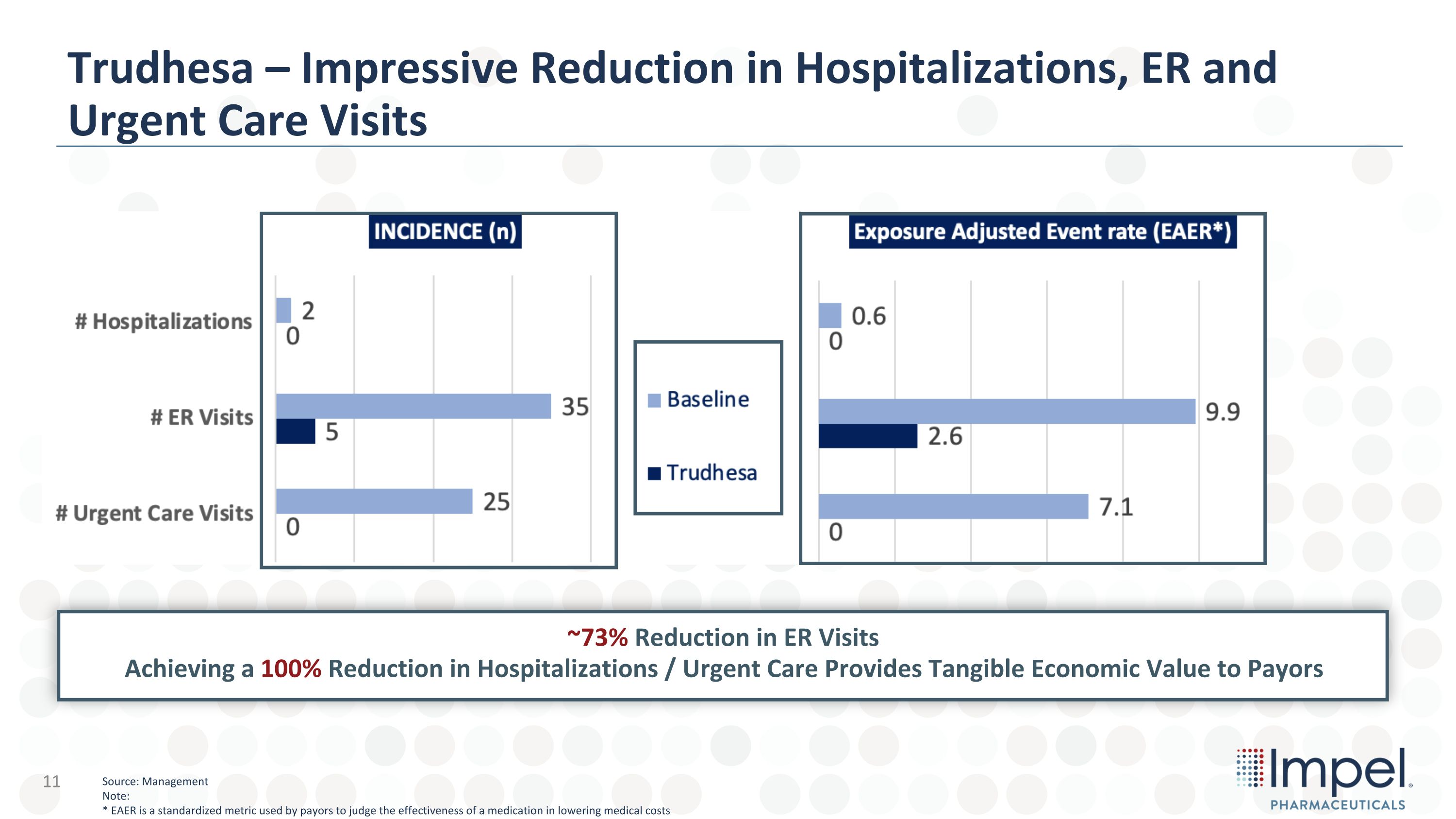

Trudhesa – Impressive Reduction in Hospitalizations, ER and �Urgent Care Visits ~73% Reduction in ER Visits�Achieving a 100% Reduction in Hospitalizations / Urgent Care Provides Tangible Economic Value to Payors Source: Management Note: * EAER is a standardized metric used by payors to judge the effectiveness of a medication in lowering medical costs 11

Trudhesa Commercialization Strategy and Performance Update 12

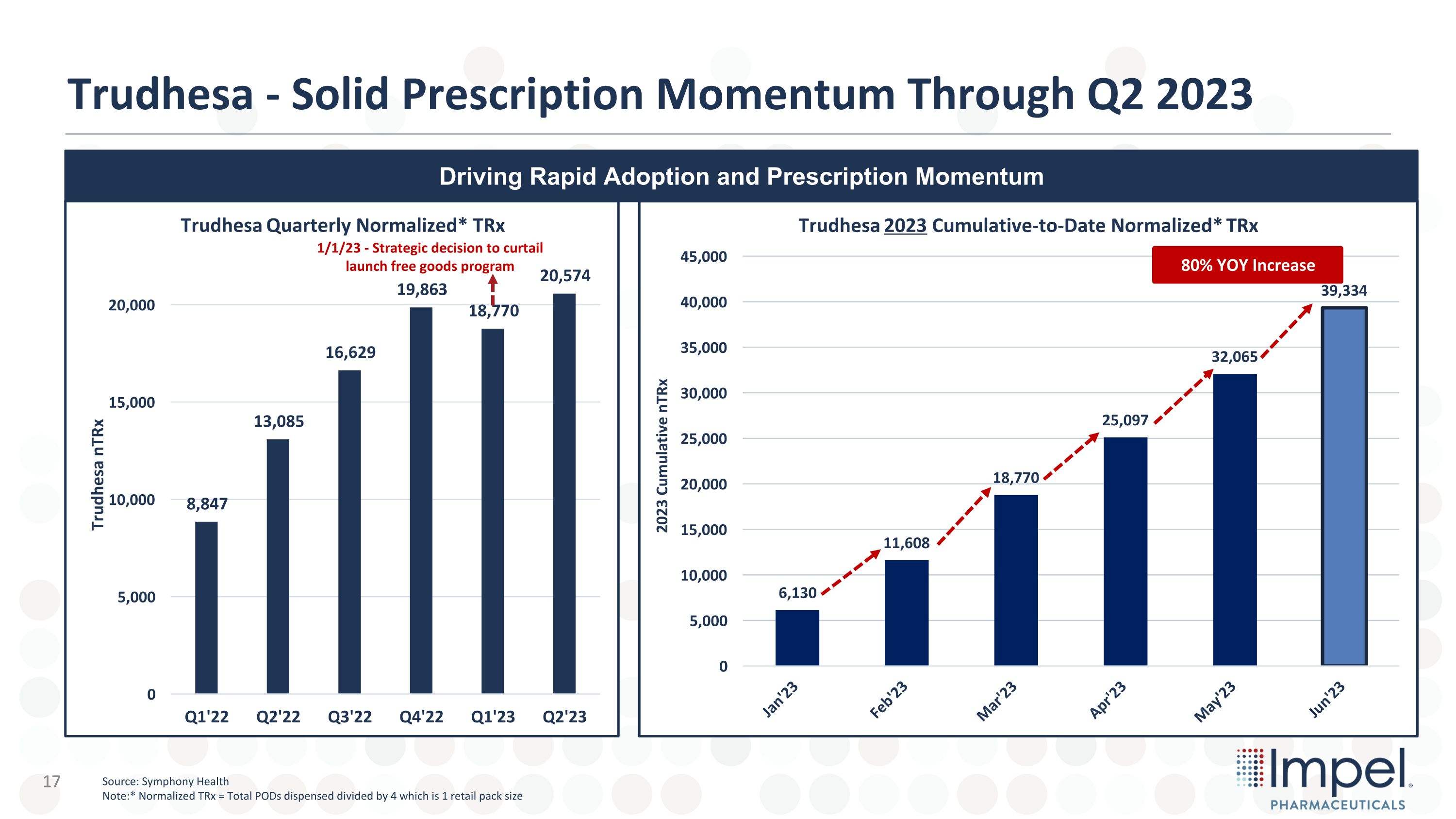

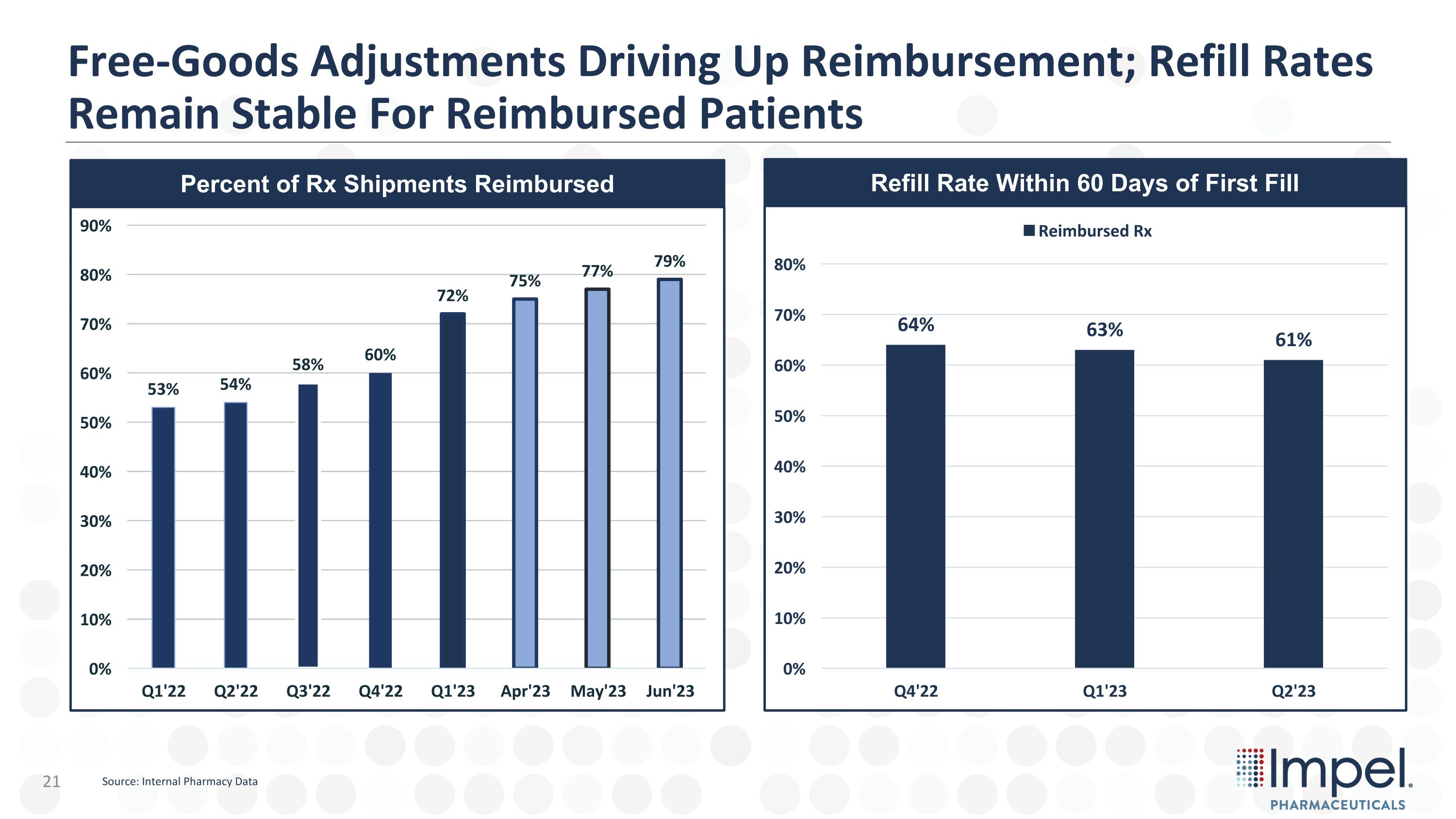

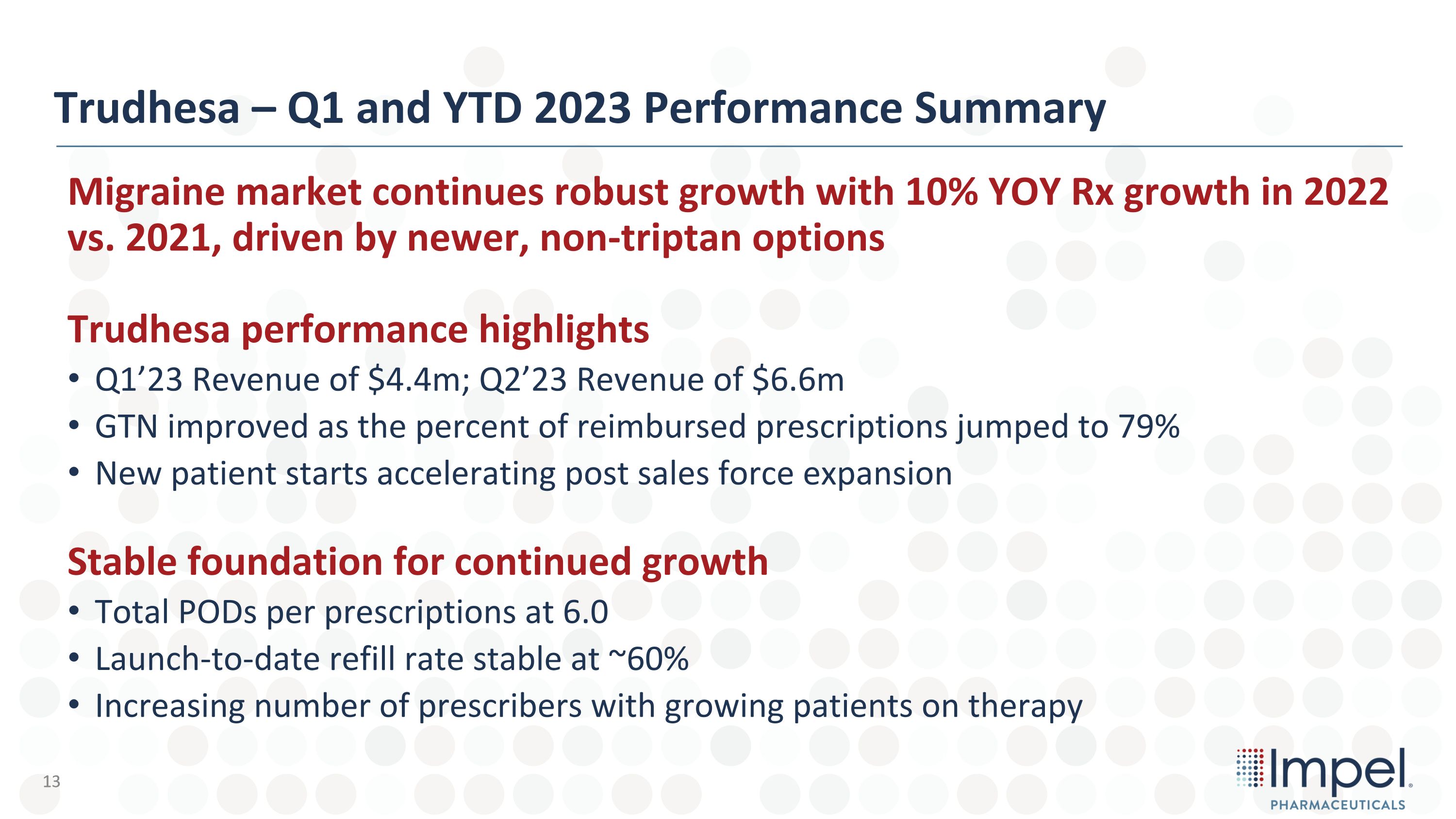

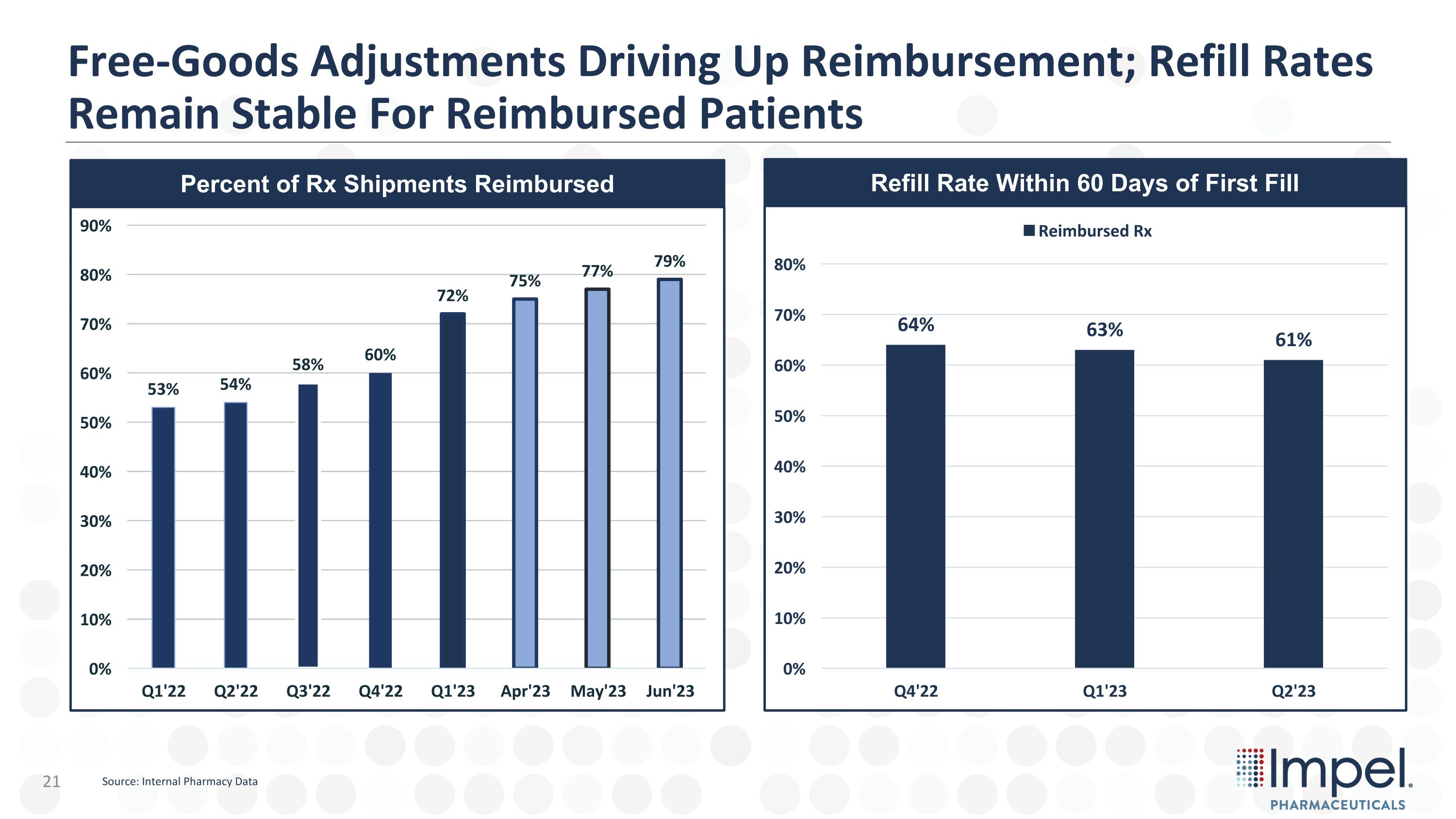

Trudhesa – Q1 and YTD 2023 Performance Summary Migraine market continues robust growth with 10% YOY Rx growth in 2022 vs. 2021, driven by newer, non-triptan options Trudhesa performance highlights Q1’23 Revenue of $4.4m; Q2’23 Revenue of $6.6m GTN improved as the percent of reimbursed prescriptions jumped to 79% New patient starts accelerating post sales force expansion Stable foundation for continued growth Total PODs per prescriptions at 6.0 Launch-to-date refill rate stable at ~60% Increasing number of prescribers with growing patients on therapy 13

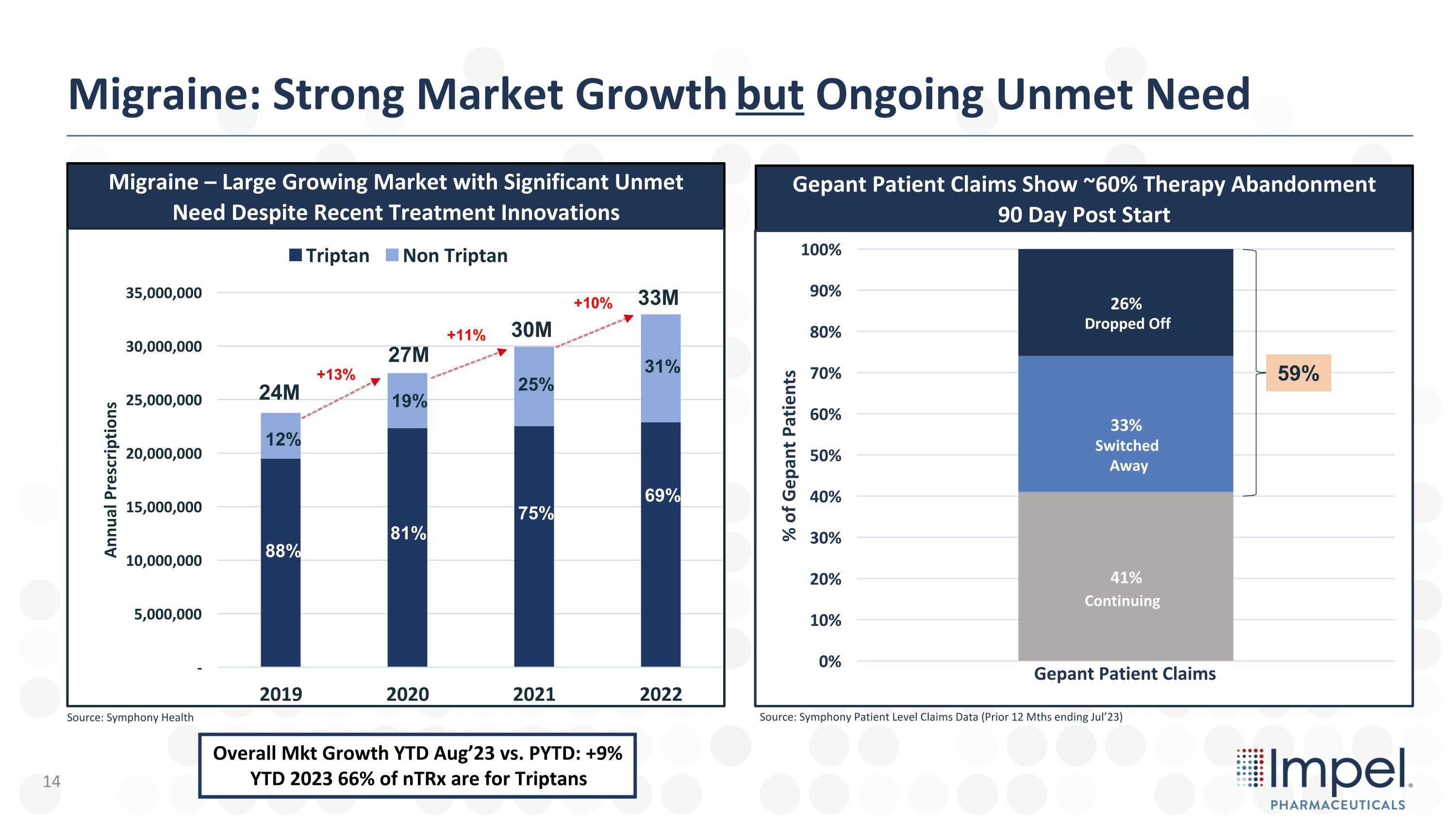

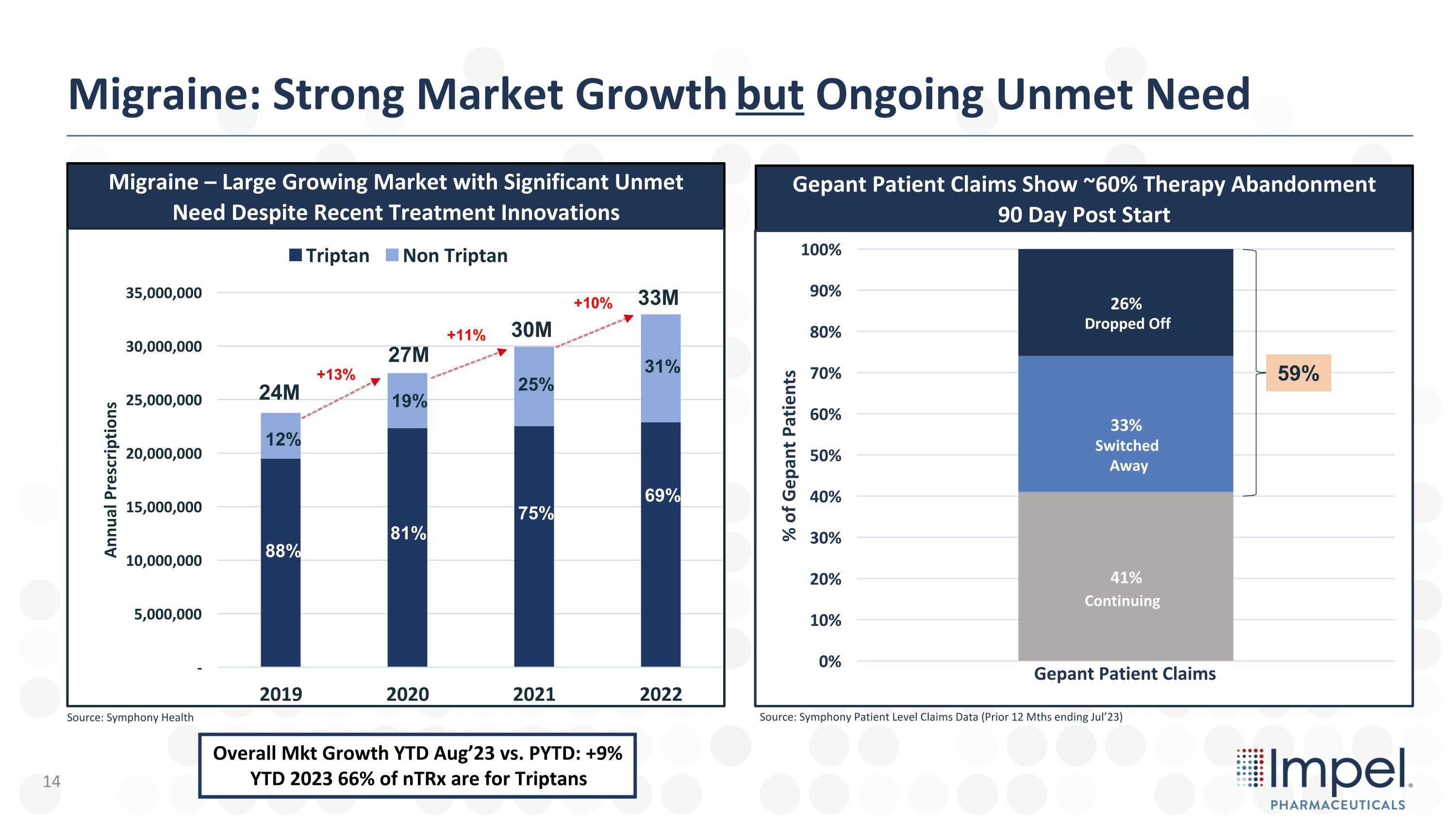

Migraine: Strong Market Growth but Ongoing Unmet Need Migraine – Large Growing Market with Significant Unmet Need Despite Recent Treatment Innovations Gepant Patient Claims Show ~60% Therapy Abandonment 90 Day Post Start 27M 24M +13% 30M +11% 33M +10% 88% 12% 81% 19% 75% 25% Source: Symphony Health 69% 31% Source: Symphony Patient Level Claims Data (Prior 12 Mths ending Jul’23) 59% Dropped Off Switched Away Continuing Overall Mkt Growth YTD Aug’23 vs. PYTD: +9% YTD 2023 66% of nTRx are for Triptans

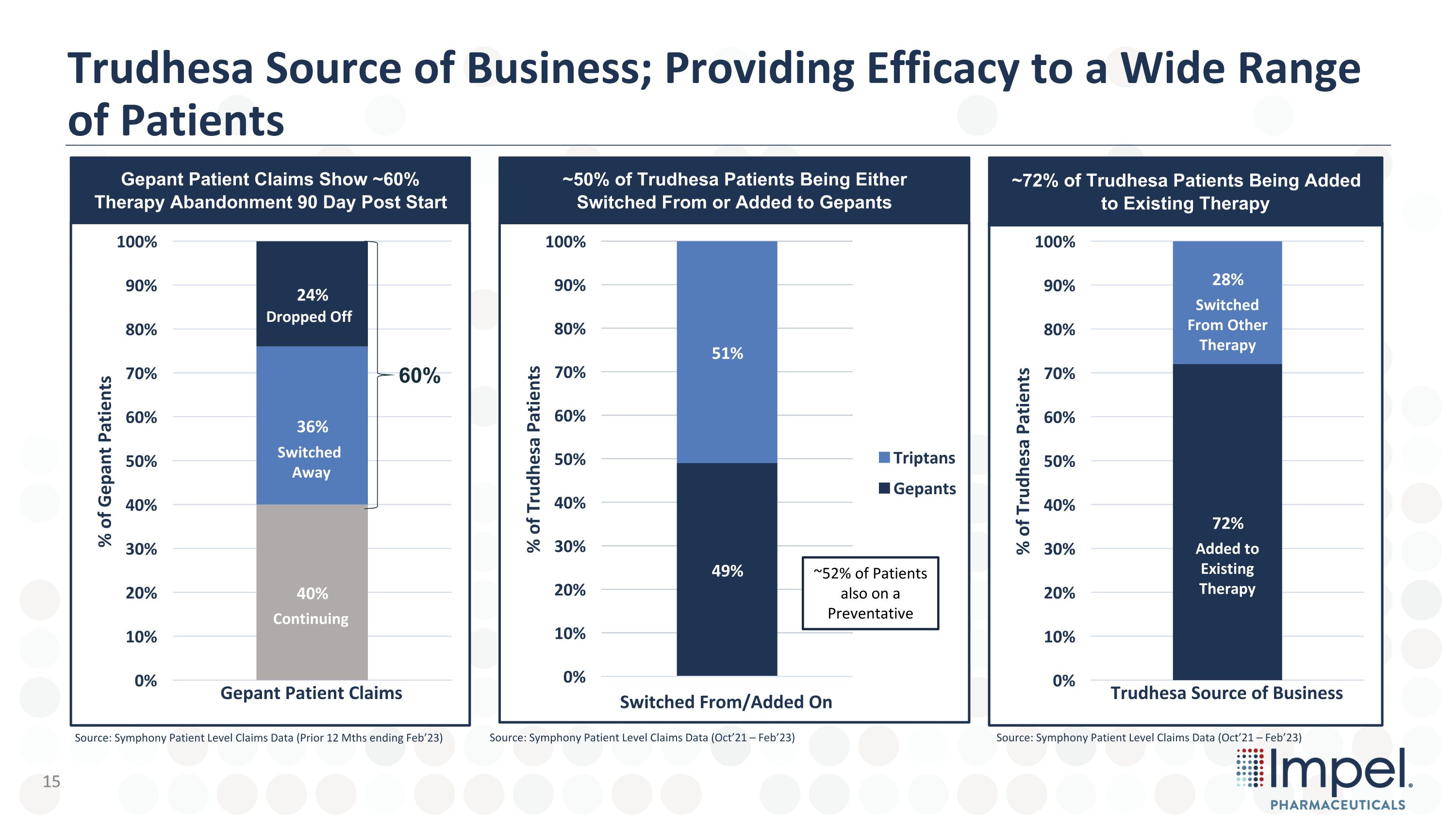

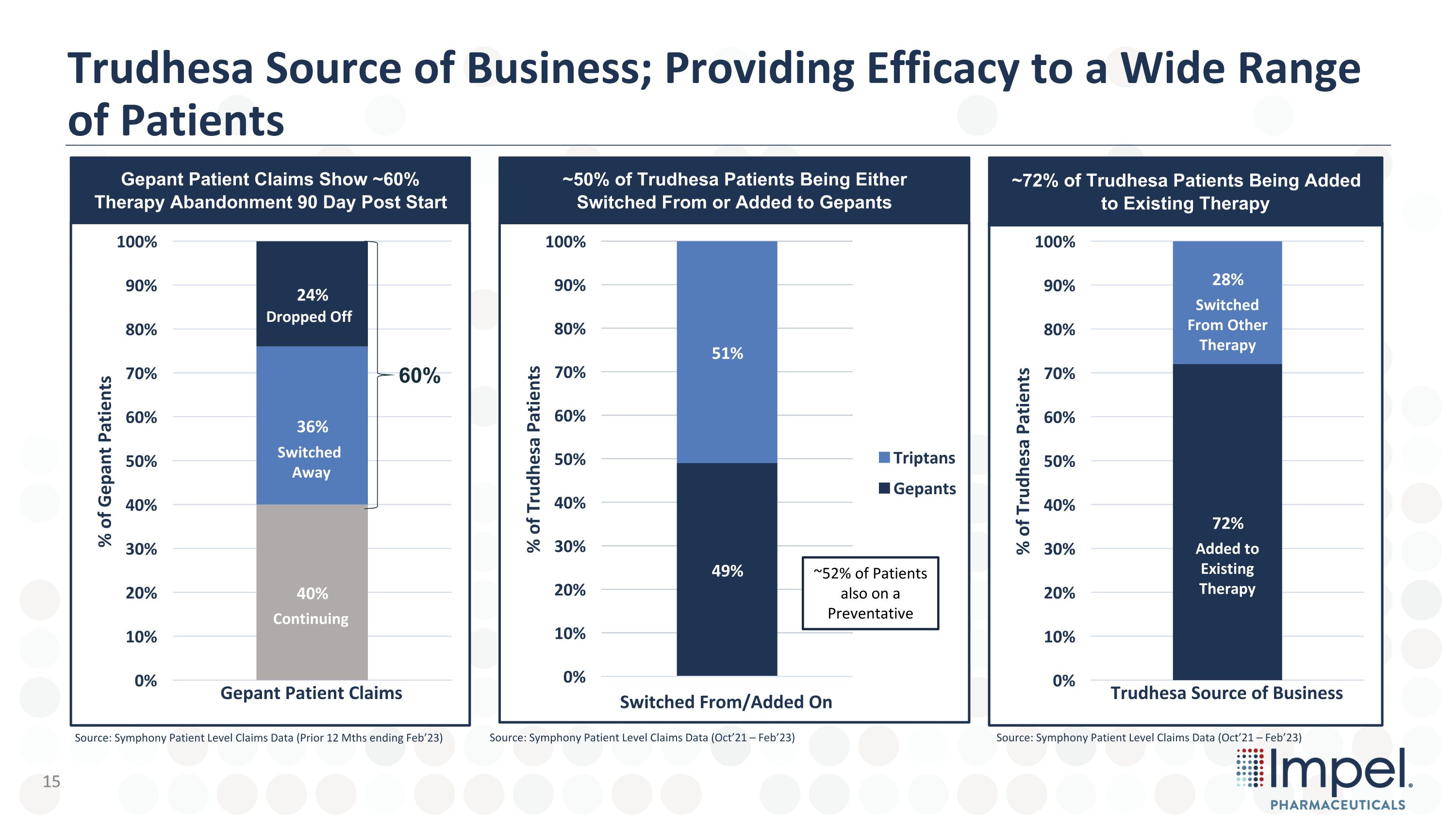

Trudhesa Source of Business; Providing Efficacy to a Wide Range of Patients 60% Dropped Off Switched Away Continuing Added to Existing Therapy Switched From Other Therapy Switch From Other Therapy Added On to Existing Therapy ~52% of Patients also on a Preventative Gepant Patient Claims Show ~60% Therapy Abandonment 90 Day Post Start ~72% of Trudhesa Patients Being Added to Existing Therapy ~50% of Trudhesa Patients Being Either Switched From or Added to Gepants Source: Symphony Patient Level Claims Data (Prior 12 Mths ending Feb’23) Source: Symphony Patient Level Claims Data (Oct’21 – Feb’23) Source: Symphony Patient Level Claims Data (Oct’21 – Feb’23) 15

Metric 60 Rep Targets 90 Rep Targets # HCPs ~8k ~11k % NEUROS (77%) (59%) % PCPs (13%) (26%) MARKET VOLUME TRX & % OVERALL MARKET 8.2M (35%) 9.3M (40%) BRANDED VOLUME TRX & % OVERALL MARKET 1.4M (60%) 1.8M (73%) Recent Expansion to 90 Reps Provides Significantly More Branded Market Coverage Increased Target audience by ~37% to balance extended reach and increased frequency Migraine Market Coverage: 40% Branded Acute Market Coverage: 73% 16

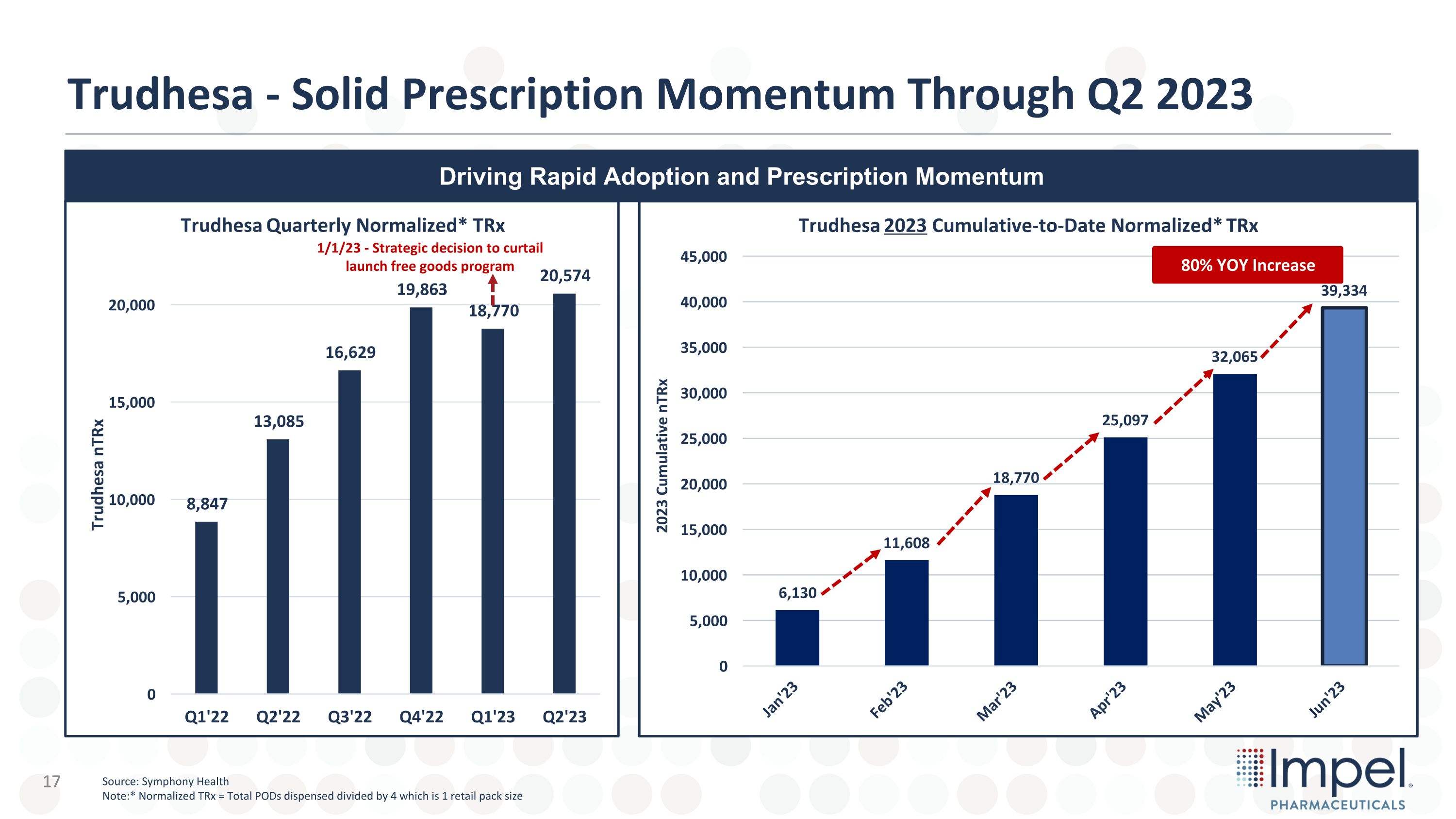

Trudhesa - Solid Prescription Momentum Through Q2 2023 Driving Rapid Adoption and Prescription Momentum +48% Add Q3 to date? 1/1/23 - Strategic decision to curtail launch free goods program 80% YOY Increase Source: Symphony Health Note:* Normalized TRx = Total PODs dispensed divided by 4 which is 1 retail pack size 17

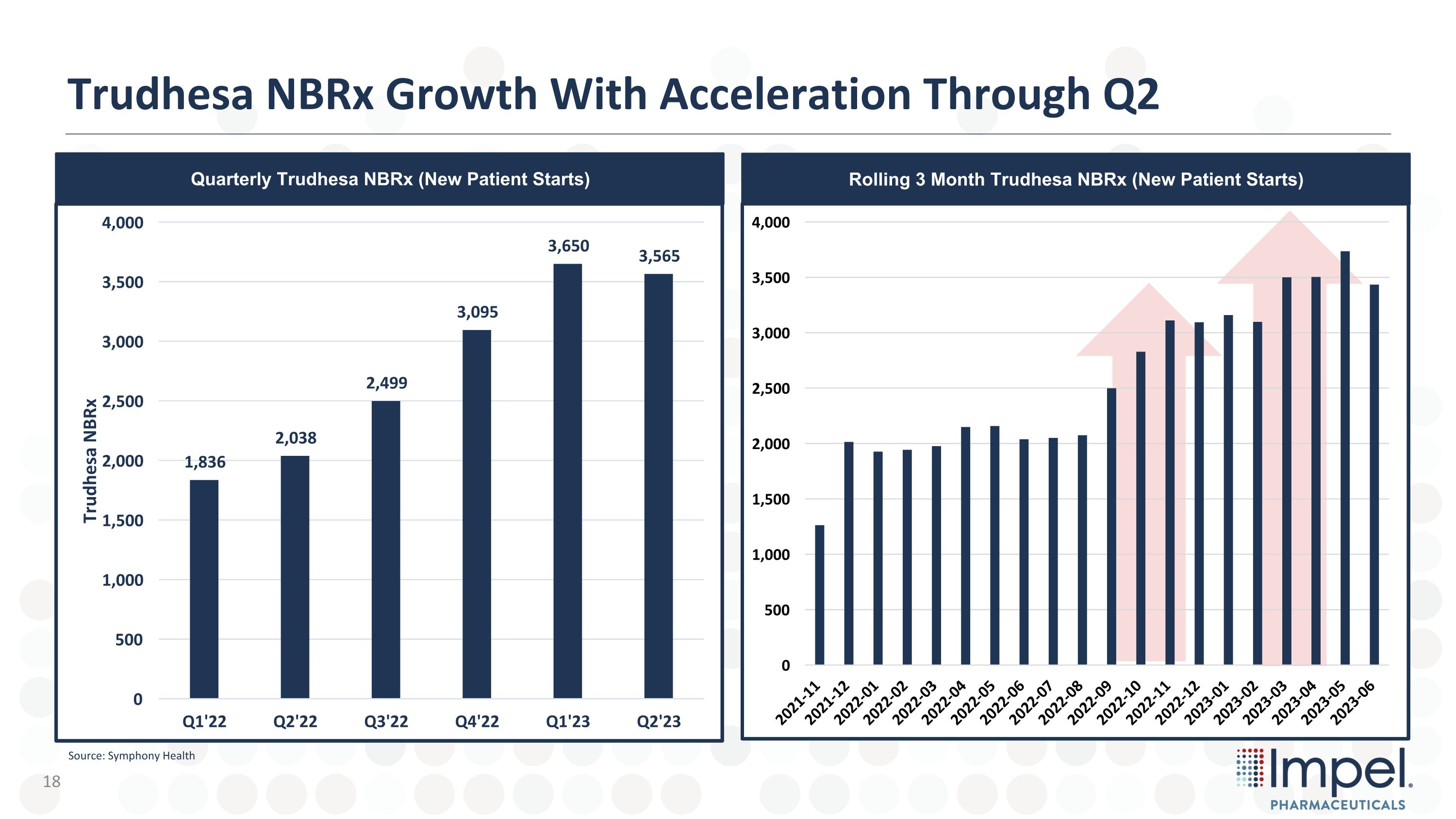

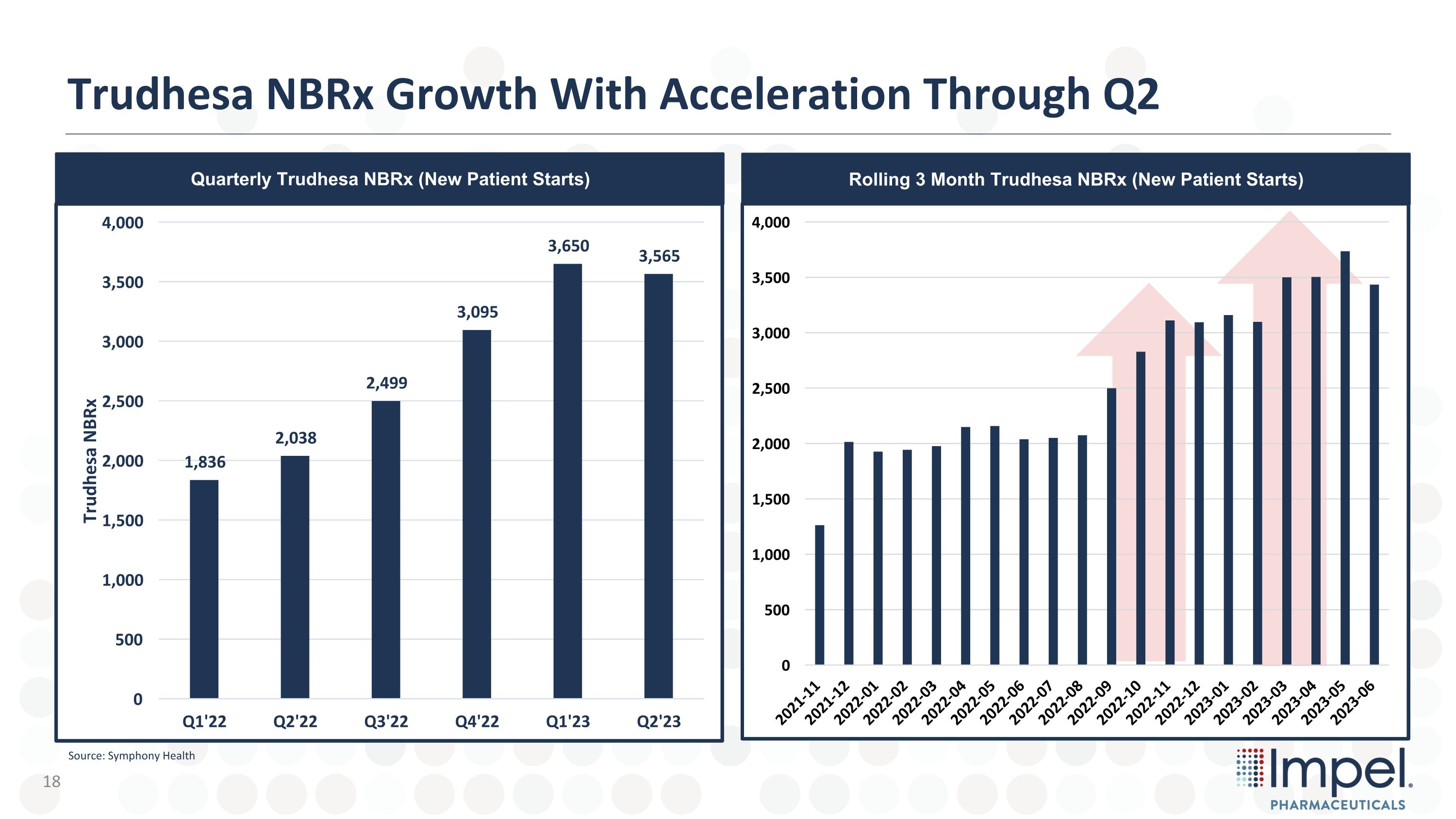

Trudhesa NBRx Growth With Acceleration Through Q2 Quarterly Trudhesa NBRx (New Patient Starts) Rolling 3 Month Trudhesa NBRx (New Patient Starts) Source: Symphony Health

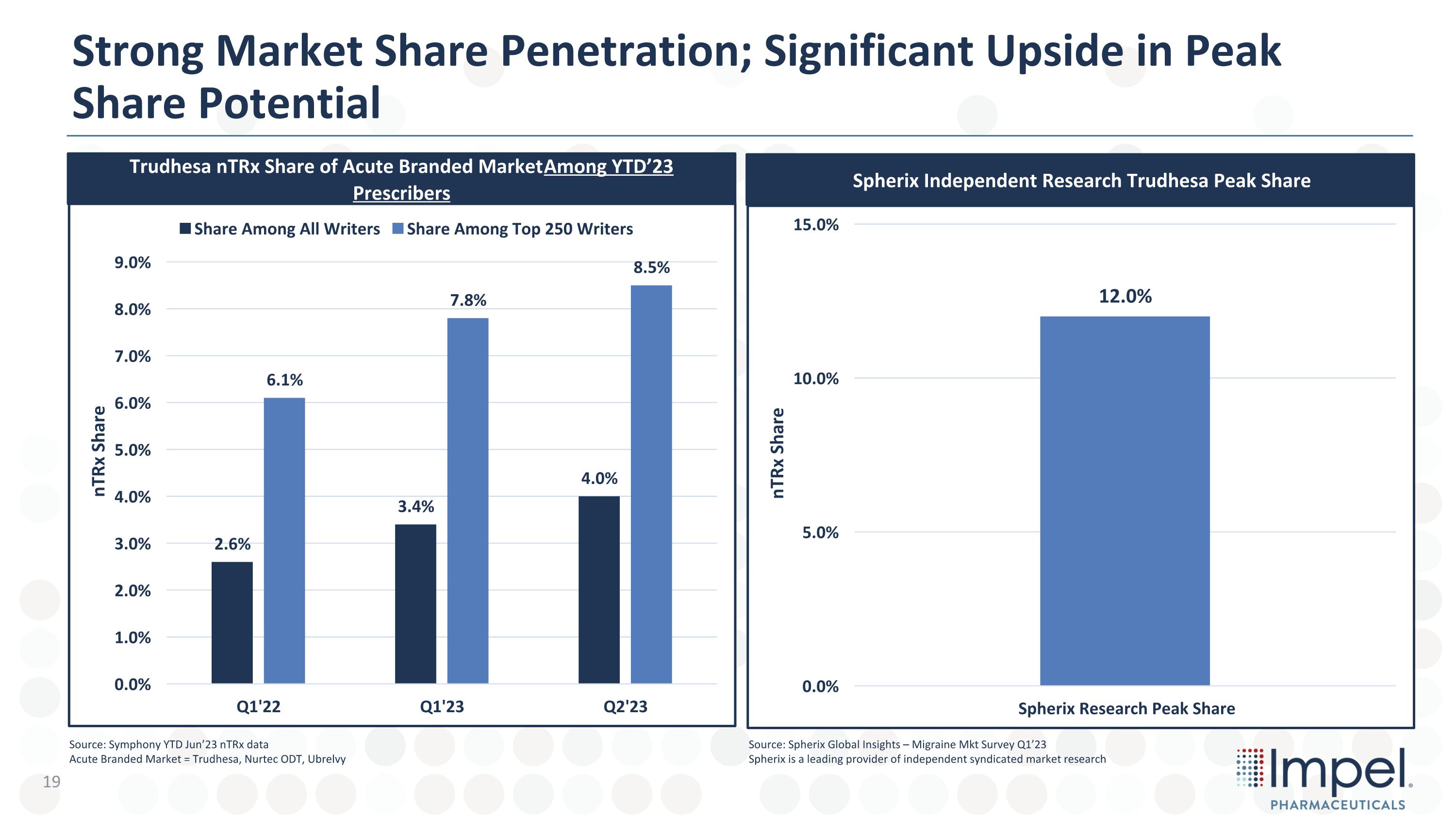

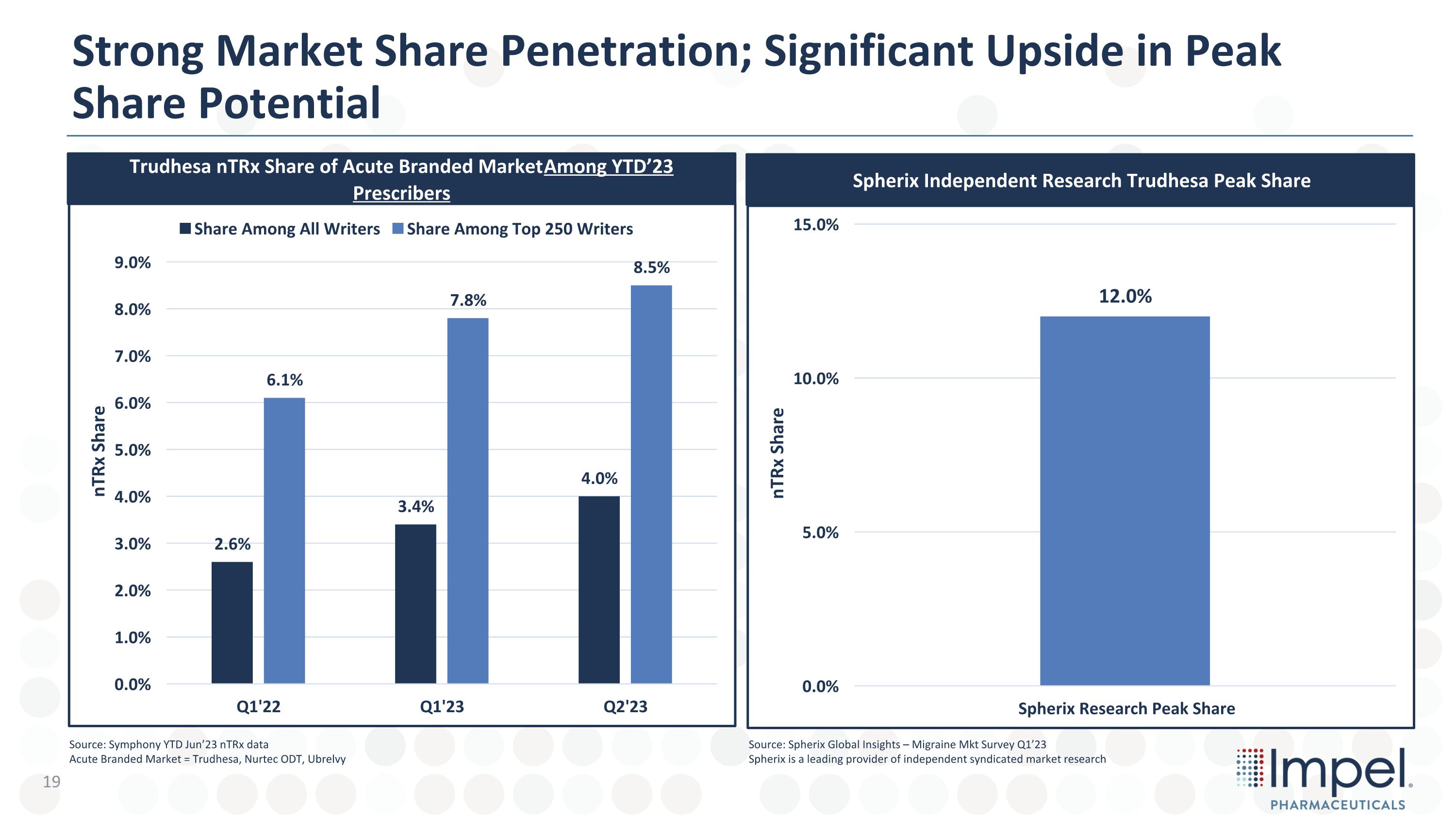

Trudhesa nTRx Share of Acute Branded Market Among YTD’23 Prescribers Spherix Independent Research Trudhesa Peak Share Source: Symphony YTD Jun’23 nTRx data Acute Branded Market = Trudhesa, Nurtec ODT, Ubrelvy Strong Market Share Penetration; Significant Upside in Peak Share Potential Source: Spherix Global Insights – Migraine Mkt Survey Q1’23 Spherix is a leading provider of independent syndicated market research

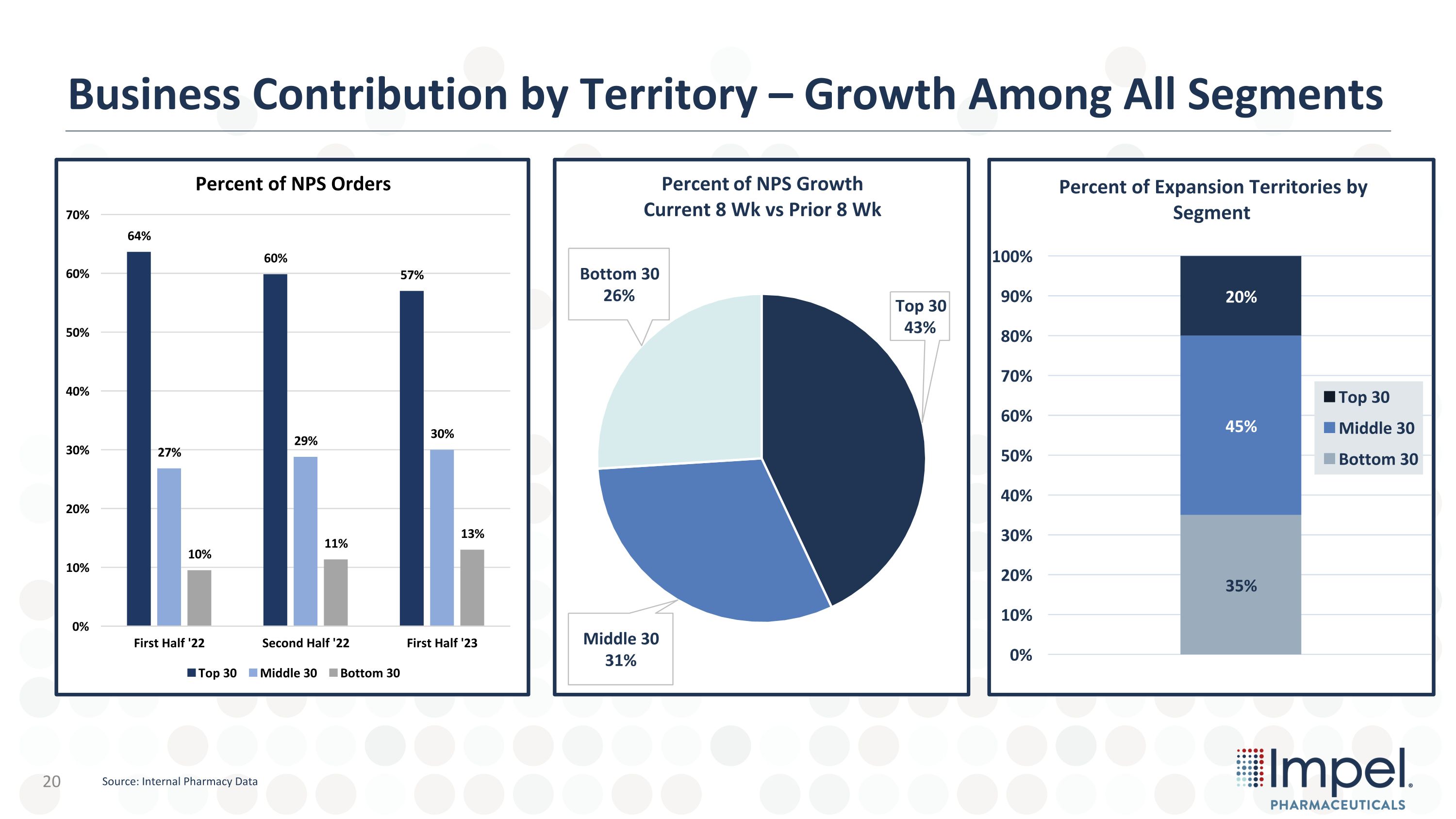

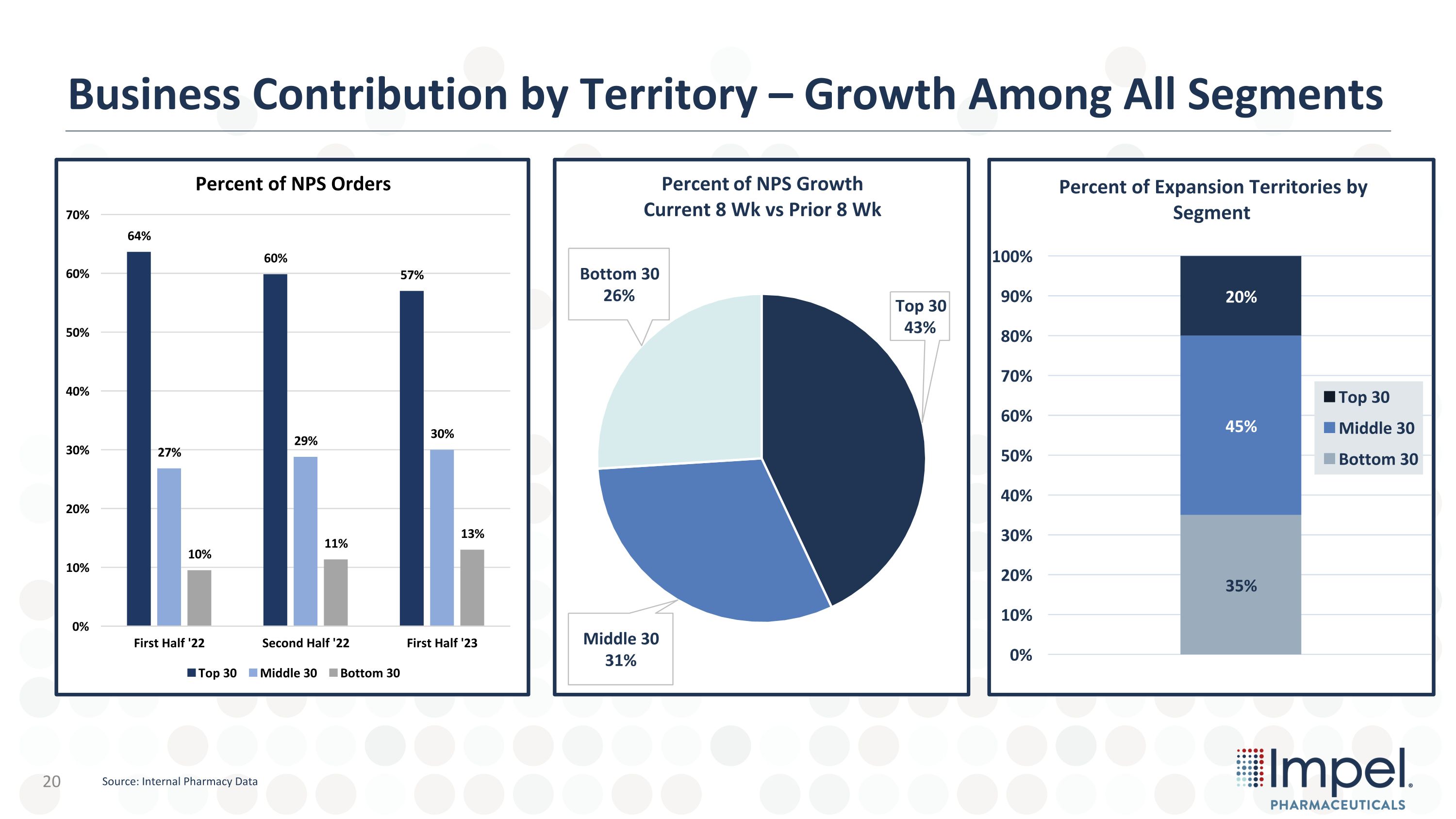

Business Contribution by Territory – Growth Among All Segments Source: Internal Pharmacy Data

Free-Goods Adjustments Driving Up Reimbursement; Refill Rates Remain Stable For Reimbursed Patients Percent of Rx Shipments Reimbursed Refill Rate Within 60 Days of First Fill Source: Internal Pharmacy Data

Trudhesa – Poised For Continued Growth Clear Opportunity to Capitalize on Promotional Sensitivity – With Existing Infrastructure or Modest Investment Drive Further Gains in Net Price – Optimize Payer Policies and Reimbursement Support Accelerate Patient Demand – Target DTC and Digital Activity to Eligible Patients

Thank You September 2023