UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22264

The Motley Fool Funds Trust

(Exact name of registrant as specified in charter)

Motley Fool Asset Management, LLC

2000 Duke Street, Suite 175

Alexandria, VA 22314

(Address of principal executive offices) (Zip code)

Denise Coursey

Motley Fool Asset Management, LLC

2000 Duke Street, Suite 175

Alexandria, VA 22314

(Name and address of agent for service)

Registrant’s telephone number, including area code: (703) 302-1100

Date of fiscal year end: October 31

Date of reporting period: October 31, 2015

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Look Again

Motley Fool Funds

Annual Report

A series of The Motley Fool Funds Trust

• 10/31/15 •

MOTLEY FOOL INDEPENDENCE FUND

MOTLEY FOOL GREAT AMERICA FUND

MOTLEY FOOL EPIC VOYAGE FUND

MOTLEY FOOL INDEPENDENCE FUND (FOOLX)

| During the year ended October 31, 2015, the Motley Fool Independence Fund returned -1.13% vs. 2.34% for its former benchmark, the MSCI World Index. We are switching our benchmark to the FTSE Global All Cap Index going forward, which returned 0.02% for the year. (Please see page 8 for an explanation of the benchmark change.) |

| Of our Top 11 holdings, ten are the same as in 2014. The eleventh, Korean tech company DuzonBizon, got there entirely through price appreciation. The only thing better than finding a winning investment is not needing to find an additional investment. |

| Alongside DuzonBizon, other notable contributors included Amazon, American Woodmark, Infinera, Natus Medical, Under Armour, and zooplus. |

MOTLEY FOOL GREAT AMERICA FUND (TMFGX)

| During the year ended October 31, 2015, the Motley Fool Great America Fund returned 0.91% vs. 2.77% for its benchmark, the Russell Midcap Index. |

| For the second-straight year, small-cap stocks meaningfully underperformed mid-cap stocks, which also meaningfully underperformed large-cap stocks. |

| Of our Top 11 holdings, six are the same as in 2014, including leading contributors Infinera, Natus Medical, and Tractor Supply. Newer entrants to the list include other long-time favorites like American Woodmark, Drew Industries, and Under Armour. |

MOTLEY FOOL EPIC VOYAGE FUND (TMFEX)

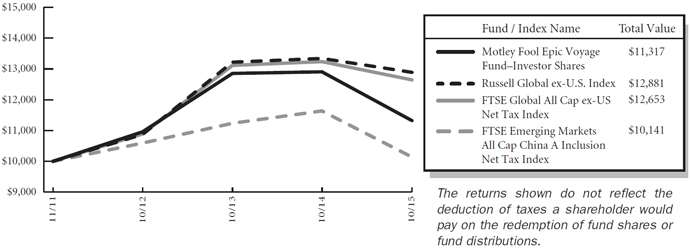

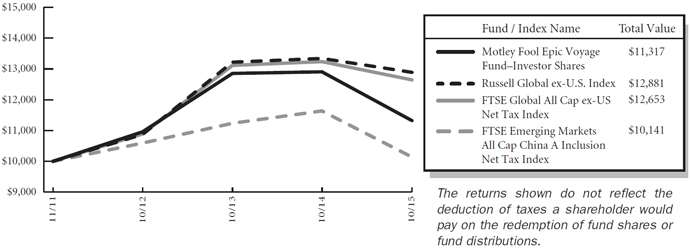

| During the year ended October 31, 2015, the Motley Fool Epic Voyage Fund returned -12.33% vs. -3.47% for its former benchmark, the Russell Global ex-US Index. We are switching our benchmark to the FTSE Global All Cap ex US Index going forward, which returned -4.43% for the year. (Please see page 40 for an explanation of the benchmark change.) |

| Our exposure to emerging markets hurt us this year. For comparison, the FTSE Emerging Markets All Cap China A Inclusion Index returned -12.89% for the same period. Emerging markets last outperformed developed countries in 2010. |

| You remember those international companies that we just mentioned as being notable to the Independence Fund? Well, DuzonBizon and Zooplus also helped Epic. So did HDFC Bank and Shimano. |

This report has been prepared for shareholders of Motley Fool Independence Fund, Motley Fool Great America Fund and Motley Fool Epic Voyage Fund. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current prospectus, which contains more complete information about the Funds. Investors are reminded to read the prospectus carefully before investing. Returns quoted represent past performance, which is no guarantee of future results. Current returns may be lower or higher and can be found at foolfunds.com. Share prices will fluctuate and there may be a gain or loss when shares are redeemed. Fund shares are distributed by Foreside Funds Distributors LLC, Berwyn, Pennsylvania.

Letter from the President

| | |

President Denise H. Coursey | | Dear Fellow Shareholders: I recently had the privilege to travel to Tokyo with a small group of my fellow MFAM Fools. You learn about your co-workers when you travel with them. Bill Mann, for example, has an exceptional talent for looking completely lost even when he knows exactly where he’s going. I’m still amazed that he got us to the tiny, virtually unmarked coffee shop in a residential neighborhood near Harajuku. Best coffee ever. We were there on business, though (not just for the sushi and the coffee), and one of the highlights of the trip was getting to watch Bill and Bryan Hinmon make a presentation about our investing process. During their presentation, I learned a beautiful truth about the asset management business: When your business is studying and finding high-quality businesses, you not only find great investments, but you also learn how to be a great business. |

That realization came to light when Bryan and Bill talked about one of our long-time holdings, Markel. I’ve known about this sleepy little insurer for years. It’s been on the radar within Fooldom for as long as I can remember. I’d really taken it for granted, until Bryan began talking about how much he and the rest of investing team admire Tom Gayner, Markel’s president and chief investment officer. Specifically, Bryan said, “We want to invest like Tom Gayner.”

All of our great investments have something to offer us as a business. From Markel, our team has been able to hone its investing skills. From Under Armour, we learn the value of a strong brand. From Chipotle, we learn the importance of keeping your product simple and delivering it well.

The past few months of 2015 have shown us the value of our investing process – of finding high-quality companies and investing in them for the long term. It’s this investing philosophy that will allow us to survive and thrive in tough markets. The past few months have also re-enforced the value of being a high-quality business – delivering on our promises to you, our shareholders, so you will continue to invest and prosper with us for years to come.

2015 This has been an exciting year for me. When I joined the team at Motley Fool Asset Management in May, I was reunited with some of my favorite Fools

| | | | |

| Motley Fool Funds Trust | | | | 3 |

— Bill Mann and Bill Barker, whom I worked with on Motley Fool Hidden Gems when I began my Foolish career 10 years ago; Bryan Hinmon, Dave Meier, Charly Travers, Nate Weisshaar, and Tony Arsta, whom I worked with to produce great investing ideas and content for our newsletter subscribers. I knew when I came to Motley Fool Asset Management that I was joining a team of Fools who, like me, are driven by quality – finding high-quality companies and delivering great returns and service for you, our shareholders.

This has been our process and focus for the past 6 years – and it will continue to be so. We will continue to work hard to emulate the great businesses we invest in, so we can deliver the great shareholder experience you expect and deserve. Thank you for the trust you’ve placed in us, and we will continue to work hard to earn and deserve your trust.

Sincerely,

Denise H. Coursey

President, Motley Fool Asset Management

| | | | |

| 4 | | | | Motley Fool Funds Trust |

Letter to Shareholders

| | |

Portfolio Manager Bill Mann | | Dear Fellow Fool Funds Shareholder: Sometimes things aren’t as they seem – even when what they seem to be makes perfect sense. My friend Michael Amouri runs a brilliant coffeehouse in my hometown of Vienna, Va., but in a previous life he was a television and radio producer. He once had the opportunity to manage an event on the White House lawn where B.B. King was scheduled to play. A few hours before showtime an event manager called Michael aside and asked if he could spare someone for something really, really important. Michael told him that this was a supremely busy time, but if it was that important, he’d do his best. |

“Well, somehow we managed to leave Lucille at the Hay-Adams Hotel.”

Ah. Now it’s possible that some of you don’t know who Lucille is, but if you happen to like music, you probably know that Lucille was a black Gibson ES-355m guitar, the vessel through which one of the greatest guitarists on Earth plied his craft.

Retrieving Lucille struck Michael as a very important task indeed, so he told the manager that he would take care of it. Michael jumped in his car and raced over to the Hay-Adams, where a concierge was waiting with Lucille, in her case. He strapped her into his front seat, and drove back over very carefully, “at something like 4mph,” and triumphantly delivered the guitar to the manager, who pulled back a curtain to place Lucille in the instrument holding area, which already contained several identical Gibson guitars B.B. King had autographed to be given as gifts to several of the luminaries in attendance, including the president.

B.B. King had a favorite guitar, and he called it Lucille. But Lucille was nothing more than a Gibson ES-355 until it was in the hands of the guitarist himself. There are thousands of similar guitars. You can buy one for about $4,000 right this second. Lucille was special only because of what B.B. King coaxed out of her. It took a master’s touch to transform her from just another Gibson guitar into something as legendary as B.B. King himself. You could play Lucille herself, and the magic would be missing. To that end, Lucille passed away when B.B. King did.

| | | | |

| The Motley Fool Funds Trust | | | | 5 |

Harbinger or trend?

When we’re talking about investing, we make the same mistake — confusing one thing for another. As a basic example, I would suggest that too often we confuse the short-term movements in share prices as signposts for whether our investing theses are correct or not. In other words, we mistake current stock prices and trends as being a gauge of a company’s inherent worth. For example, in 2013, the energy industry was the substantial driver for investing gains in the U.S. stock markets. One who was heavily invested in oil exploration and production stocks in January 2014 would have had to feel pretty danged smart. In 2010 it was emerging-market stocks. In 2006 it was Chinese small caps. In 1999, dot-coms. In 1990, Japan.

In each case, the fullness of time has rendered these short-term impressions largely irrelevant. This fact bears remembering as we come to the end of any short-term period in which one must look back at one’s investing results and determine what’s been working and what hasn’t. We need to look at the bigger picture, ignoring short-term trends and examining whether a company is inherently strong. What will sustain it for the long term? It may be a hot stock now, but does it, for example, have a leadership team that will help ensure its continued success? After all, just like Lucille in anyone else’s hands but B.B. King’s, a business is just a business unless it’s in the hands of capable leadership.

For example, here’s what’s happened over the past six months:

The things that worked: investing in China, Japan, and FANG (Facebook, Apple, Netflix, Google).

The things that didn’t: investing in small caps, energy, emerging markets not named China, and industrials.

Some of the disparities have been amazing. Going back three years, emerging-market stocks have trailed developed-market ones by more than 50% when currencies are taken into account — and that includes China. This trend obviously harms portfolios that include large amounts of emerging-market companies — and neither Epic Voyage nor the Independence Fund has been immune. Companies we consider to be fabulous opportunities have had their share prices hammered.

What do you do about that? First and foremost, you test, and retest, and retest again your reasons for investing. We did not buy Sberbank because we were excited about investing in Russia, or in the Russian banking system. We bought it because our analysis told us this was a great company, completely differentiated in its marketplace, and one that had fallen deeply out of favor. Ask me now if I’m looking to get more deeply invested in Russia, and the answer is no — but I am extremely interested in being invested in great companies. Sberbank is one example of a company that we believe is built for the long term, resting in capable hands and with sustainable qualities.

| | | | |

| 6 | | | | The Motley Fool Funds Trust |

We make that decision with every company we hold and every one that we analyze and choose not to buy: Is it great? How much is it? Does it have inherent and sustainable qualities that set it apart? And, importantly, is it run by good managers, or are they idiots and/or jerks? They can truly be the difference between an ordinary company and a great one.

Investing results are (eventually) about making the right choices

This being the end of the year, you’re likely to hear experts making predictions about where the markets will go in 2016. They will be wrong, perhaps wildly wrong, so perhaps their best bet is to be entertaining. I appreciate their willingness to entertain, but I keep in mind that prognostication on stock prices has absolutely no part in rational business analysis. So to that end, I honor them for their willingness to attempt the impossible.

In this past year, to do well in the stock market, one essentially had to have picked correctly which companies were going to catch consumers’ fancy. Through the middle of November, the largest 200 companies in the Russell 3000 Index had outperformed the Russell Midcap Index by about 450 basis points (+2.4% versus -2%). The Russell 2000 small-cap index has performed even worse by about 1% than the Midcap index.

What does this all mean for us? Well, not that much, actually. We don’t invest in companies based on their size or shape. We neither attempt to predict nor worry about what investors happen to like at the time. If you make the right investing choices and stick with them, focusing on things like sustainable qualities and excellent leadership, time will most likely bear you out. So we focus on that. My colleague Bryan Hinmon has described this approach as “practicing value investing on the way in,” which is precisely correct. Value, as a practice, generally means that we focus on areas of the market where there have been recent doubts. Doubt is something we view as a beneficial commodity. It produces value.

But what it cannot do, and what we don’t try to control for — because we think to attempt to do so is small “f” foolish — is forecast when those doubts will go away. This reality, from time to time, makes it look as if we’re making bad decisions. Our focus on being business analysts rather than stock analysts means that we necessarily must be comfortable with waiting for the market to realize the value that we perceive and, in the meantime, making sure the current narrative isn’t reflexively destroying the company’s intrinsic value.

Doing so is not an easy task, and it is at times an emotionally trying process, but we think attempting to focus on things as they are instead of as they seem creates a repeatable process for us. We are completely convinced that finding and holding a set of companies that are diverse on all vectors except for business excellence gives us and our shareholders the greatest chance of long-term success. Companies are not their current stock prices, and we remain focused in the year ahead

| | | | |

| The Motley Fool Funds Trust | | | | 7 |

on looking past the short term to identify companies whose values, qualities, and leaders make them likely to keep creating beautiful music for investors for years to come.

In 2016, we’ll continue our quest to find and invest in great companies throughout the world. We hope that you’ll continue to join us on that quest in the new year. As always, we are deeply humbled that you have entrusted your wealth with us

Foolishly,

William H. Mann, III

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by the annual report. They do not comprise the entire investment portfolio of the Funds, may be sold at any time, and may no longer be held by the Funds. The opinions of the Adviser with respect to those securities may change at any time.

| | | | |

| 8 | | | | The Motley Fool Funds Trust |

| | | | |

| |  New to investing? Reading your first mutual fund annual report? New to investing? Reading your first mutual fund annual report?

| | |

| | Welcome! Here are some important things you need to know. | | |

| | Mutual fund investing offers many potential benefits. But there also are risks. Financial gain is not guaranteed when it comes to investing in equity securities. It’s possible to lose money, including your principal — especially during the short term. | | |

| | We focus on stocks we have good reason to believe are undervalued by the market. We expect the price of these stocks eventually to rise as the market recognizes the true worth of the companies issuing them. But keep in mind that value stocks can remain undervalued by the market for a long time. And it’s possible that the intrinsic worth of any particular company may not match our valuation. | | |

| | Our funds may invest in foreign companies and in companies with small market capitalization. There are certain risks associated with these types of investments. The risks are described on pages 11, 28 and 44 of this report. Additional risk information is provided in section 3 of the Notes to Financial Statements, pp.64-69. | | |

| | | | |

| The Motley Fool Funds Trust | | | | 9 |

Motley Fool Independence Fund Portfolio Characteristics

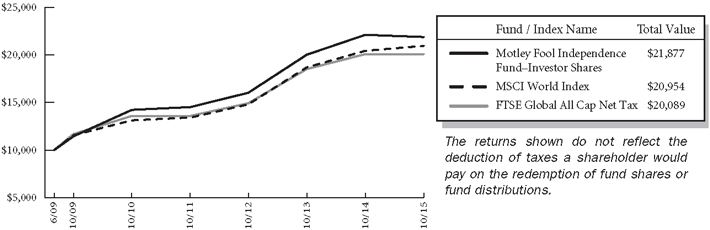

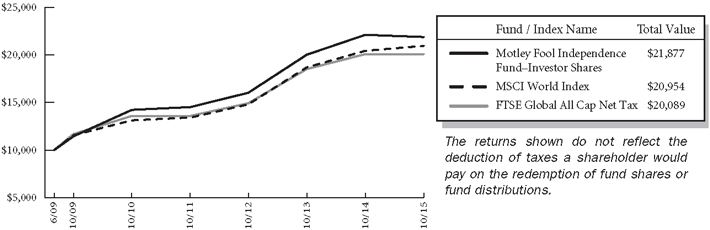

At October 31, 2015, the Motley Fool Independence Fund Investor Shares had an audited net asset value of $20.32 per share attributed to 19,372,457 shares outstanding and the Institutional Shares had an audited net asset value of $20.35 per share attributed to 379,611 shares outstanding. This compares with an unaudited net asset value as of June 16, 2009 for the Investor Shares of $10.00 per share attributed to 100,000 shares outstanding and as of June 17, 2014 for the Institutional Shares of $20.36 per share attributed to 1 share outstanding. From the Investor Shares launch on June 16, 2009 to October 31, 2015, the Shares had an average annual total return of 13.07% versus a return of 11.56% over the same period for its benchmark, FTSE Global All Cap Index, and a return of 12.30% for its previous benchmark the MSCI World Index. From June 17, 2014 to October 31, 2015, the Institutional Shares returned 1.59%, versus a return of -0.54% over the same period for the FTSE Global All Cap Index, and a return of 1.34% for the MSCI World Index.

Please note that we are using a new benchmark for the Fund, the FTSE Global All Cap Index, as a replacement for the MSCI World Index. There are multiple reasons for this. In the past, the Independence Fund used a benchmark provided by MSCI while other funds managed by Motley Fool Asset Management (the “Adviser”) used Russell indexes. During 2015, FTSE Group and Russell Indexes began operating as one business known as FTSE Russell. This change allows the Adviser to utilize one globally recognized index provider across all its funds, by working with a leading provider of benchmarks which covers 98% of the world’s investable securities through a transparent, rules-based construction methodology. Additionally, the FTSE Global All Cap Index represents the performance of large-, mid-, and small-cap companies in Developed and Emerging markets. Meanwhile the MSCI World Index follows the performance of Developed markets only, and does not include small-cap companies. With this broader mandate, the FTSE index is more closely aligned to the Principal Investing Strategies of the adviser as explained in the prospectus. While we believe this index will provide a closer basis of comparison to the Fund, it is also worth noting that the Adviser does not make investment decisions in an attempt to match any benchmark allocations.

The graph below shows the performance of $10,000 invested in the Investor Shares at inception. The results shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | |

Average Annual Total Returns as of 10/31/2015 | | | | | | | | |

| | | One Year | | Five Year | | Since

Inception | | Inception

Date |

| | | | | |

Investor Shares* | | -1.13% | | 8.94% | | 13.07% | | 6/16/2009 |

| | | | |

Institutional Shares* | | -0.97% | | — | | 1.59% | | 6/17/2014 |

| | | | |

MSCI World Index** | | 2.34% | | 9.76% | | — (1) | | — |

| | | | |

FTSE Global All Cap Net Tax Index*** | | 0.02% | | 8.07% | | — (2) | | — |

|

Fund Expense Ratios(3): Investor Shares: Gross 1.17% and Net 1.15%; Institutional Shares: Gross 2.63% and Net 0.95% |

| | | | |

| 10 | | | | Motley Fool Independence Fund |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.FoolFunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

(1) The index returned 12.30% from the inception date of the Investor Shares and 1.34% from the inception date of the Institutional Shares.

(2) The index returned 11.56% from the inception date of the Investor Shares and -0.54% from the inception date of the Institutional Shares.

(3) The expense ratios of the Fund are set forth according to the 2/28/15 Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios.

*These returns reflect expense waivers by the Fund’s investment adviser. Without these waivers, returns would have been lower.

**The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund may invest in countries that are not included within the MSCI World Index (such as emerging market countries) and its investment portfolio is not weighted in terms of countries or issuers the same as the MSCI World Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the MSCI World Index.

***The FTSE Global All Cap Index is a market-capitalization weighted index representing the performance of large, mid and small cap companies in Developed and Emerging markets. The index is comprised of approximately 7,600 securities from 47 countries and captures 98% of the world’s investable market capitalization. Fair value prices and foreign exchange as of 4 pm EST are used in the calculation of this index, and returns are adjusted for withholding taxes applicable to dividends received by a U.S. Regulated Investment Company domiciled in the United States. This Benchmark is new as of this annual report. See description above for an explanation of the change.

The investment objective of the Independence Fund is to achieve long-term capital appreciation. The Fund pursues this objective by investing primarily in common stocks of companies located anywhere in the world. The Fund invests in areas of the market that, in the view of Motley Fool Asset Management, LLC (the “Adviser”), offer the greatest potential for long-term capital appreciation. The Fund may invest in other types of securities and in other asset classes when, in the judgment of the Adviser, such investments offer attractive potential returns. As such, the Fund’s performance will deviate significantly from its benchmark from time to time. It is the view of the Adviser that this deviation is less meaningful over shorter time frames and is more relevant over multi-year periods.

Because the Independence Fund is free to invest in companies of any size around the world, at times, the Fund may be heavily invested in small-cap stocks and foreign securities, each of which presents extra risk. Small-cap stocks tend to be more volatile and less liquid than their large-cap counterparts. Fluctuations in currency exchange rates can cause losses when investing in foreign securities, with emerging markets presenting additional risks of illiquidity, political instability, and lax regulation. You are strongly encouraged to read more about the Fund’s strategies and risks in the prospectus.

The Independence Fund invests in securities of companies the Adviser believes are undervalued. Unlike mutual funds that are constrained by a style-box, the Fund may invest in any company, country, market, industry or sector where the Adviser’s analysis suggests that there is opportunity for gains that outweigh risks. In identifying investments for the Fund, the Adviser looks for companies it believes the market has irrationally undervalued and looks for companies that have high-quality businesses with strong market positions, manageable leverage, and robust streams of free cash flow. The following tables show the top eleven holdings, sector allocation and top eleven countries in which the Fund was invested as of October 31, 2015. Portfolio holdings are subject to change without notice.

| | | | |

| Motley Fool Independence Fund | | | | 11 |

| | | | | | | | |

| | | |  Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box. Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

| | | | |

| | | | | | | | | | |

Top Eleven Holdings* | | % of Net Assets | | |

| | |

| | | | | | | | | |

| | |

Under Armour, Inc. | | | | 3.62 | % | | |

Markel Corp. | | | | 3.50 | | | |

Infinera Corp. | | | | 3.25 | | | |

Berkshire Hathaway, Inc. | | | | 3.21 | | | |

HDFC Bank Ltd. | | | | 3.20 | | | |

Natus Medical, Inc. | | | | 3.06 | | | |

Banco Latinoamericano de Comercio Exterior SA | | | | 2.78 | | | |

Anthem. Inc. | | | | 2.73 | | | |

Baidu, Inc. | | | | 2.41 | | | |

DuzonBizon Co., Ltd. | | | | 2.40 | | | |

American Woodmark Corp. | | | | 2.22 | | | |

| | | | | | | | |

| | | | 32.38 | % | | |

| | | | | | | | |

| | | | | | | | |

* As of the date of the report, the fund had a holding of 3.88% in the BNY Mellon Cash Reserve.

The Motley Fool Independence Fund uses the Global Industry Classification StandardSM (“GICS SM”) as the basis for the classification of securities on the Schedule of Investments (“SOI”). We believe that this makes the SOI classifications more standard with the rest of the industry.

| | | | | | | | | | |

Sector Allocation | | % of Net

Assets | | |

| | |

| | | | | | | | | |

| | |

Financials | | | | 24.29 | % | | |

Consumer Discretionary | | | | 18.52 | | | |

Information Technology | | | | 18.22 | | | |

Health Care | | | | 12.19 | | | |

Consumer Staples | | | | 8.33 | | | |

Industrials | | | | 7.05 | | | |

Telecommunication Services | | | | 3.27 | | | |

Materials | | | | 2.07 | | | |

Energy | | | | 1.17 | | | |

Utilities | | | | 0.96 | | | |

| | | | | | | | |

| | | | 96.07 | % | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | |

| 12 | | | | Motley Fool Independence Fund |

| | | | | | | | | | |

Top Eleven Countries | | % of Net

Assets | | |

| | |

| | | | | | | | | |

| | |

United States* | | | | 53.44 | % | | |

India | | | | 4.98 | | | |

Switzerland | | | | 3.72 | | | |

South Korea | | | | 3.13 | | | |

Saudi Arabia | | | | 3.01 | | | |

Panama | | | | 2.78 | | | |

United Arab Emirates | | | | 2.67 | | | |

China | | | | 2.41 | | | |

Georgia | | | | 1.84 | | | |

Mexico | | | | 1.76 | | | |

Indonesia | | | | 1.75 | | | |

| | | | | | | | |

| | | | 81.49 | % | | |

| | | | | | | | |

| | | | | | | | |

* As of the date of the report, the fund had a holding of 3.88% in the BNY Mellon Cash Reserve.

| | | | |

| Motley Fool Independence Fund | | | | 13 |

About Your Expenses

As a shareholder of the Independence Fund, you incur ongoing costs, including advisory fees and other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2015 to October 31, 2015.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Independence Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund as compared to the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | | | | | | | |

| | | |  Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average. Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

05/01/15 | | Ending

Account

Value

10/31/15 | | Annualized

Expense

Ratio(1) | | Expenses

Paid

During

Period(2) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | |

Investor Shares | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000 | | | | $ | 964.85 | | | | | 1.15 | % | | | $ | 5.70 | |

Hypothetical | | | $ | 1,000 | | | | $ | 1,019.41 | | | | | 1.15 | % | | | $ | 5.85 | |

Institutional Shares | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000 | | | | $ | 965.36 | | | | | 0.95 | % | | | $ | 4.71 | |

Hypothetical | | | $ | 1,000 | | | | $ | 1,020.42 | | | | | 0.95 | % | | | $ | 4.84 | |

| (1) | These ratios reflect expenses waived by the Fund’s investment adviser. Without these Waivers, the Fund’s expenses would have been higher and the ending account values would have been lower. |

| (2) | Expenses are equal to the Fund’s annualized expense ratio for the period May 1, 2015 to October 31,2015,multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent fiscal half-year, then divided by 365. |

| | | | |

| 14 | | | | Motley Fool Independence Fund (Unaudited) |

The Motley Fool Funds Trust

Motley Fool Independence Fund

Schedule of Investments

October 31, 2015

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | | | | | | | | |

| | |

Equity Securities — 92.79% | | | | | | | | |

Auto Components — 0.67% | | | | | | | | |

Horizon Global Corp. (United States)* | | | 304,933 | | | $ | 2,680,363 | |

| | | | | | | | |

Banks — 9.60% | | | | | | | | |

Banco Latinoamericano de Comercio Exterior SA (Panama) | | | 412,235 | | | | 11,142,712 | |

Bank of Georgia Holdings PLC (Georgia) | | | 239,638 | | | | 7,378,130 | |

HDFC Bank Ltd. (India)(a) | | | 210,000 | | | | 12,839,400 | |

Monarch Financial Holdings, Inc. (United States) | | | 170,000 | | | | 2,218,500 | |

Sberbank of Russia (Russia)* | | | 3,500,000 | | | | 4,962,452 | |

| | | | | | | | |

| | |

| | | | | | | 38,541,194 | |

| | | | | | | | |

Building Products — 2.22% | | | | | | | | |

American Woodmark Corp. (United States)* | | | 122,771 | | | | 8,925,452 | |

| | | | | | | | |

Chemicals — 1.51% | | | | | | | | |

Innophos Holdings, Inc. (United States) | | | 81,164 | | | | 3,448,659 | |

Syngenta AG (Switzerland)(a) | | | 38,601 | | | | 2,597,461 | |

| | | | | | | | |

| | |

| | | | | | | 6,046,120 | |

| | | | | | | | |

Commercial Services & Supplies — 1.79% | | | | | | | | |

Depa Ltd. (United Arab Emirates)* | | | 5,815,390 | | | | 2,675,080 | |

KAR Auction Services, Inc. (United States) | | | 117,708 | | | | 4,519,987 | |

| | | | | | | | |

| | |

| | | | | | | 7,195,067 | |

| | | | | | | | |

Communications Equipment — 3.26% | | | | | | | | |

Infinera Corp. (United States)* | | | 661,100 | | | | 13,063,336 | |

| | | | | | | | |

Construction & Engineering — 0.60% | | | | | | | | |

Chicago Bridge & Iron Co. NV (Netherlands) | | | 54,000 | | | | 2,422,980 | |

| | | | | | | | |

Consumer Finance — 1.76% | | | | | | | | |

Gentera SAB de CV (Mexico) | | | 3,850,000 | | | | 7,071,704 | |

| | | | | | | | |

Diversified Financial Services — 3.21% | | | | | | | | |

Berkshire Hathaway, Inc. Class A (United States)* | | | 63 | | | | 12,889,548 | |

| | | | | | | | |

Diversified Telecommunication Services — 1.49% | | | | | | | | |

Level 3 Communications, Inc. (United States)* | | | 117,500 | | | | 5,986,625 | |

| | | | | | | | |

Electric Utilities — 0.97% | | | | | | | | |

Brookfield Infrastructure Partners LP (Bermuda) | | | 92,127 | | | | 3,874,862 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Motley Fool Independence Fund | | | | 15 |

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | | | | | | | | |

| | |

Equity Securities (continued) | | | | | | | | |

Energy Equipment & Services — 0.94% | | | | | | | | |

National Oilwell Varco, Inc. (United States) | | | 100,000 | | | $ | 3,764,000 | |

| | | | | | | | |

Food & Staples Retailing — 3.18% | | | | | | | | |

Costco Wholesale Corp. (United States) | | | 40,000 | | | | 6,324,800 | |

Whole Foods Market, Inc. (United States) | | | 214,922 | | | | 6,439,063 | |

| | | | | | | | |

| | |

| | | | | | | 12,763,863 | |

| | | | | | | | |

Food Products — 3.14% | | | | | | | | |

BRF - Brasil Foods SA (Brazil)(a) | | | 223,704 | | | | 3,429,382 | |

Nestle SA (Switzerland) | | | 68,694 | | | | 5,246,435 | |

PT Nippon Indosari Corpindo Tbk (Indonesia) | | | 44,934,800 | | | | 3,916,456 | |

| | | | | | | | |

| | |

| | | | | | | 12,592,273 | |

| | | | | | | | |

Health Care Equipment & Supplies — 5.18% | | | | | | | | |

Medtronic PLC (Ireland) | | | 59,272 | | | | 4,381,386 | |

Natus Medical, Inc. (United States)* | | | 268,900 | | | | 12,243,017 | |

Zimmer Biomet Holdings, Inc. (United States) | | | 40,000 | | | | 4,182,800 | |

| | | | | | | | |

| | |

| | | | | | | 20,807,203 | |

| | | | | | | | |

Health Care Providers & Services — 4.00% | | | | | | | | |

Anthem, Inc. (United States) | | | 78,697 | | | | 10,950,688 | |

NMC Health PLC (United Arab Emirates) | | | 435,482 | | | | 5,115,577 | |

| | | | | | | | |

| | |

| | | | | | | 16,066,265 | |

| | | | | | | | |

Hotels, Restaurants & Leisure — 1.66% | | | | | | | | |

Chipotle Mexican Grill, Inc. (United States)* | | | 10,400 | | | | 6,658,392 | |

| | | | | | | | |

Insurance — 5.15% | | | | | | | | |

Loews Corp. (United States) | | | 181,690 | | | | 6,624,417 | |

Markel Corp. (United States)* | | | 16,200 | | | | 14,061,600 | |

| | | | | | | | |

| | |

| | | | | | | 20,686,017 | |

| | | | | | | | |

Internet & Catalog Retail — 5.27% | | | | | | | | |

Amazon.com, Inc. (United States)* | | | 12,500 | | | | 7,823,750 | |

CJ O Shopping Co., Ltd. (South Korea) | | | 18,949 | | | | 2,923,365 | |

TripAdvisor, Inc. (United States)* | | | 50,000 | | | | 4,189,000 | |

zooplus AG (Germany)* | | | 42,499 | | | | 6,211,010 | |

| | | | | | | | |

| | |

| | | | | | | 21,147,125 | |

| | | | | | | | |

Internet Software & Services — 7.43% | | | | | | | | |

Alphabet, Inc. Class A (United States)* | | | 9,000 | | | | 6,636,510 | |

See Notes to Financial Statements.

| | | | |

| 16 | | | | Motley Fool Independence Fund |

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | | | | | | | �� | |

| | |

Equity Securities (continued) | | | | | | | | |

Internet Software & Services (continued) | | | | | | | | |

Alphabet, Inc. Class C (United States)* | | | 9,024 | | | $ | 6,414,350 | |

Baidu, Inc. (China)*(a) | | | 51,500 | | | | 9,654,705 | |

Xoom Corp. (United States)* | | | 284,862 | | | | 7,104,458 | |

| | | | | | | | |

| | |

| | | | | | | 29,810,023 | |

| | | | | | | | |

Leisure Products — 0.71% | | | | | | | | |

Shimano, Inc. (Japan) | | | 18,000 | | | | 2,836,235 | |

| | | | | | | | |

Life Sciences Tools & Services — 1.23% | | | | | | | | |

Horizon Discovery Group PLC (United Kingdom)* | | | 1,450,000 | | | | 2,917,078 | |

Siegfried Holding Ltd. (Switzerland)* | | | 10,000 | | | | 2,003,136 | |

| | | | | | | | |

| | |

| | | | | | | 4,920,214 | |

| | | | | | | | |

Machinery — 1.38% | | | | | | | | |

FANUC Corp. (Japan) | | | 14,000 | | | | 2,470,181 | |

TriMas Corp. (United States)* | | | 152,333 | | | | 3,048,183 | |

| | | | | | | | |

| | |

| | | | | | | 5,518,364 | |

| | | | | | | | |

Media — 1.58% | | | | | | | | |

BrainJuicer Group PLC (United Kingdom) | | | 700,000 | | | | 3,841,647 | |

Multiplus SA (Brazil) | | | 278,600 | | | | 2,480,747 | |

| | | | | | | | |

| | |

| | | | | | | 6,322,394 | |

| | | | | | | | |

Metals & Mining — 0.56% | | | | | | | | |

Constellium NV (Netherlands)* | | | 233,752 | | | | 881,245 | |

Horsehead Holding Corp. (United States)* | | | 480,000 | | | | 1,363,200 | |

| | | | | | | | |

| | |

| | | | | | | 2,244,445 | |

| | | | | | | | |

Multiline Retail — 0.77% | | | | | | | | |

PT Mitra Adiperkasa Tbk (Indonesia)* | | | 12,301,000 | | | | 3,094,732 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels — 0.23% | | | | | | | | |

Total Gabon (Gabon) | | | 4,670 | | | | 928,731 | |

| | | | | | | | |

Pharmaceuticals — 1.78% | | | | | | | | |

Dr. Reddy’s Laboratories Ltd. (India)(a) | | | 110,177 | | | | 7,138,368 | |

| | | | | | | | |

Real Estate Investment Trusts — 2.13% | | | | | | | | |

American Tower Corp. (United States) | | | 64,000 | | | | 6,542,720 | |

Gaming and Leisure Properties, Inc. (United States) | | | 68,217 | | | | 1,989,890 | |

| | | | | | | | |

| | |

| | | | | | | 8,532,610 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| Motley Fool Independence Fund | | | | 17 |

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | | | | | | | | |

| | |

Equity Securities (continued) | | | | | | | | |

Real Estate Management & Development — 1.43% | | | | | | | | |

Henderson Land Development Co., Ltd. (Hong Kong) | | | 899,127 | | | $ | 5,742,505 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment — 3.43% | | | | | | | | |

Intel Corp. (United States) | | | 219,000 | | | | 7,415,340 | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan)(a) | | | 290,000 | | | | 6,368,400 | |

| | | | | | | | |

| | |

| | | | | | | 13,783,740 | |

| | | | | | | | |

Software — 2.40% | | | | | | | | |

DuzonBizon Co., Ltd. (South Korea) | | | 513,180 | | | | 9,649,915 | |

| | | | | | | | |

Specialty Retail — 2.11% | | | | | | | | |

Williams-Sonoma, Inc. (United States) | | | 115,000 | | | | 8,481,250 | |

| | | | | | | | |

Technology Hardware, Storage & Peripherals — 1.70% | | | | | | | | |

Apple, Inc. (United States) | | | 57,000 | | | | 6,811,500 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods — 5.76% | | | | | | | | |

Swatch Group SA (The) (Switzerland) | | | 13,000 | | | | 5,077,014 | |

Tod’s SpA (Italy) | | | 42,000 | | | | 3,517,604 | |

Under Armour, Inc. Class A (United States)* | | | 152,820 | | | | 14,530,126 | |

| | | | | | | | |

| | |

| | | | | | | 23,124,744 | |

| | | | | | | | |

Transportation Infrastructure — 0.78% | | | | | | | | |

DP World Ltd. (United Arab Emirates) | | | 90,000 | | | | 1,818,792 | |

International Container Terminal Services, Inc. (Philippines) | | | 750,000 | | | | 1,320,972 | |

| | | | | | | | |

| | |

| | | | | | | 3,139,764 | |

| | | | | | | | |

Wireless Telecommunication Services — 1.78% | | | | | | | | |

SBA Communications Corp. Class A (United States)* | | | 60,000 | | | | 7,141,200 | |

| | | | | | | | |

| | |

Total Equity Securities (Cost $ 260,844,033) | | | | | | | 372,403,123 | |

| | | | | | | | |

| | |

Participatory Notes — 3.28% | | | | | | | | |

Air Freight & Logistics — 0.27% | | | | | | | | |

Aramex PJSC (United Arab Emirates)(b) | | | 1,299,000 | | | | 1,092,810 | |

| | | | | | | | |

Banks — 1.00% | | | | | | | | |

Al Rajhi Banking & Investment Co. (Saudi Arabia)(b) | | | 290,332 | | | | 3,992,120 | |

| | | | | | | | |

Food Products — 2.01% | | | | | | | | |

Almarai Co. (Saudi Arabia)(b) | | | 385,759 | | | | 8,075,174 | |

| | | | | | | | |

| | |

Total Participatory Notes (Cost $ 10,809,816) | | | | | | | 13,160,104 | |

| | | | | | | | |

See Notes to Financial Statements.

| | | | |

| 18 | | | | Motley Fool Independence Fund |

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | |

| | | | | | | | | |

| | |

Other Investments — 3.88% | | | | | | | | |

Temporary Cash Investment — 3.88% | | | | | | | | |

BNY Mellon Cash Reserve | | | 15,568,187 | | | $ | 15,568,187 | |

| | | | | | | | |

| | |

Total Other Investments (Cost $ 15,568,187) | | | | | | | 15,568,187 | |

| | | | | | | | |

| | |

Total Investments Portfolio (Cost $ 287,222,036) — 99.95% | | | | | | | 401,131,414 | |

Assets in Excess of Other Liabilities — 0.05% | | | | | | | 205,456 | |

| | | | | | | | |

| | |

NET ASSETS — 100.00% | | | | | | | | |

(Applicable to 19,752,068 shares outstanding) | | | | | | $ | 401,336,870 | |

| | | | | | | | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | ADR — American Depositary Receipts |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. Total market value of Rule 144A securities is $13,160,104 and represents 3.28% of net assets as of October 31, 2015. |

LP — Limited Partnership

PCL — Public Company Limited

PLC — Public Limited Company

See Notes to Financial Statements.

| | | | |

| Motley Fool Independence Fund | | | | 19 |

Statement of Assets and Liabilities

| | | | | | | |

| | | As of

October 31, 2015 | | |

| | |

| | | | | | | | |

Assets: | | | | | | | |

| | |

Investments in securities of unaffiliated issuers, at value (at cost, $287,222,036) | | | $ | 401,131,414 | | | |

| | |

Foreign currency, at value (at cost, $10,719) | | | | 10,791 | | | |

Receivables: | | | | | | | |

Dividends and tax reclaims | | | | 428,659 | | | |

Investment securities sold | | | | 2,075,284 | | | |

Shares of beneficial interest sold | | | | 285,765 | | | |

Prepaid expenses and other assets | | | | 24,600 | | | |

| | | | | | | |

Total Assets | | | | 403,956,513 | | | |

| | | | | | | |

| | |

Liabilities | | | | | | | |

Payables: | | | | | | | |

Investment securities purchased | | | | 1,591,214 | | | |

Shares of beneficial interest redeemed | | | | 213,180 | | | |

Dividend withholding tax | | | | 8,989 | | | |

Accrued expenses: | | | | | | | |

Audit fees | | | | 19,500 | | | |

Accounting and administration fees | | | | 74,420 | | | |

Advisory fees | | | | 587,059 | | | |

Custodian fees | | | | 29,599 | | | |

Legal fees | | | | 2,538 | | | |

Transfer agent fees | | | | 52,238 | | | |

Other expenses | | | | 40,906 | | | |

| | | | | | | |

Total Liabilities | | | | 2,619,643 | | | |

| | | | | | | |

Net Assets | | | $ | 401,336,870 | | | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 20 | | | | Motley Fool Independence Fund |

Statement of Assets and Liabilities

| | | | | | | |

| | | As of

October 31, 2015 | | |

| | |

| | | | | | | | |

| | |

Net Assets Consist of: | | | | | | | |

Paid-in-Capital | | | $ | 287,264,092 | | | |

Accumulated Net Investment Loss | | | | (11,005 | ) | | |

Accumulated Net Realized Gain on Investments and Foreign Currency Transactions | | | | 189,701 | | | |

Net Unrealized Appreciation/(Depreciation) on Investments, Foreign Currencies, and Assets and Liabilities Denominated in Foreign Currencies | | | | 113,894,082 | | | |

| | | | | | | |

Net Assets | | | $ | 401,336,870 | | | |

| | |

| | | | | | | |

| | |

Net Asset Value: | | | | | | | |

$0.001 par value, unlimited shares authorized | | | | | | | |

Investor Shares: | | | | | | | |

Net assets applicable to capital shares outstanding | | | $ | 393,611,286 | | | |

Shares outstanding | | | | 19,372,457 | | | |

| | | | | | | |

Net asset value, offering, and redemption price per share* | | | $ | 20.32 | | | |

| | |

| | | | | | | |

| | |

Institutional Shares: | | | | | | | |

Net assets applicable to capital shares outstanding | | | $ | 7,725,584 | | | |

Shares outstanding | | | | 379,611 | | | |

| | | | | | | |

Net asset value, offering, and redemption price per share* | | | $ | 20.35 | | | |

| | |

| | | | | | | |

| * | A charge of 2% is imposed on the redemption proceeds of shares redeemed or exchanged within 90 days of purchase. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Motley Fool Independence Fund | | | | 21 |

Statement of Operations

| | | | | | | |

| | | Year Ended

October 31, 2015 | | |

| | |

| | | | | | | | |

Investment Income | | | | | | | |

Dividends | | | $ | 5,993,306 | | | |

Interest | | | | 695 | | | |

Less foreign taxes withheld | | | | (232,185 | ) | | |

| | | | | | | |

Total Investment Income | | | | 5,761,816 | | | |

| | | | | | | |

Expenses | | | | | | | |

Accounting and administration fees | | | | 357,660 | | | |

Blue sky fees | | | | 50,285 | | | |

Shareholder account-related services - Investor Shares | | | | 208,513 | | | |

Shareholder account-related services - Institutional Shares | | | | 48 | | | |

Chief Compliance Officer fees | | | | 25,400 | | | |

Custodian fees | | | | 99,699 | | | |

Investment advisory fees | | | | 3,556,494 | | | |

Professional fees | | | | 43,353 | | | |

Shareholder reporting fees | | | | 53,510 | | | |

Transfer agent fees - Investor Shares | | | | 292,740 | | | |

Transfer agent fees - Institutional Shares | | | | 38,099 | | | |

Trustee fees | | | | 36,106 | | | |

Other expenses | | | | 29,587 | | | |

| | | | | | | |

Total expenses | | | | 4,791,494 | | | |

| | | | | | | |

Expenses waived/reimbursed net of amount recaptured - Investor Shares | | | | 87,009 | | | |

Expenses waived/reimbursed net of amount recaptured - Institutional Shares | | | | (80,208 | ) | | |

| | | | | | | |

Net expenses | | | | 4,798,295 | | | |

| | | | | | | |

Net Investment Income (Loss) | | | | 963,521 | | | |

| | | | | | | |

Realized and Unrealized Gain (Loss) | | | | | | | |

Net realized gain (loss) from: | | | | | | | |

Investment securities | | | | 424,531 | | | |

Foreign currency transactions | | | | (949,226 | ) | | |

| | | | | | | |

Net realized gain (loss) on investments and foreign currency transactions | | | | (524,695 | ) | | |

| | | | | | | |

Change in net unrealized appreciation/(depreciation) on: | | | | | | | |

Investment securities | | | | (5,800,674 | ) | | |

Foreign currency translations | | | | 463,876 | | | |

| | | | | | | |

Change in net unrealized appreciation/(depreciation) on investments, foreign currencies, and assets and liabilities denominated in foreign currencies | | | | (5,336,798 | ) | | |

| | | | | | | |

Net realized and unrealized gain (loss) | | | | (5,861,493 | ) | | |

| | | | | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | $ | (4,897,972 | ) | | |

| | | | | | | |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 22 | | | | Motley Fool Independence Fund |

Statements of Changes in Net Assets

| | | | | | | | | | | | | | | |

| | | Year Ended

October 31,

2015 | | Year Ended

October 31,

2014 | | |

| | | |

| | | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net Investment Income (Loss) | | | $ | 963,521 | | | | $ | 2,107,078 | | | |

Net Realized Gain (Loss) on Investments and Foreign Currency Transactions | | | | (524,695 | ) | | | | 6,863,887 | | | |

Change in Net Unrealized Appreciation/(Depreciation) on Investments and Foreign Currency Translation | | | | (5,336,798 | ) | | | | 29,060,345 | | | |

| | | | | | | | | | | | | |

Net increase (decrease) in net assets resulting from operations | | | | (4,897,972 | ) | | | | 38,031,310 | | | |

| | | | | | | | | | | | | |

Dividends to Shareholders: | | | | | | | | | | | | |

Dividends from net investment income | | | | | | | | | | | | |

Investor Shares | | | | (2,188,018 | ) | | | | (835,870 | ) | | |

Institutional Shares | | | | (26,738 | ) | | | | — | | | |

Distributions from net realized capital gains | | | | | | | | | | | | |

Investor Shares | | | | (6,627,841 | ) | | | | (3,348,906 | ) | | |

Institutional Shares | | | | (72,605 | ) | | | | — | | | |

| | | | | | | | | | | | | |

Total dividends and distributions | | | | (8,915,202 | ) | | | | (4,184,776 | ) | | |

| | | | | | | | | | | | | |

Capital Share Transactions: | | | | | | | | | | | | |

Proceeds from shares sold | | | | | | | | | | | | |

Investor Shares (2,584,826 and 4,432,705 shares, respectively) | | | | 53,616,724 | | | | | 87,255,195 | | | |

Institutional Shares (222,884 and 193,353 shares, respectively) | | | | 4,626,757 | | | | | 3,969,308 | | | |

Reinvestment of dividends | | | | | | | | | | | | |

Investor Shares (424,462 and 215,246 shares, respectively) | | | | 8,654,772 | | | | | 4,104,739 | | | |

Institutional Shares (4,766 and 0 shares, respectively) | | | | 97,176 | | | | | — | | | |

Value of shares redeemed | | | | | | | | | | | | |

Investor Shares (3,334,905 and 3,348,765 shares, respectively) | | | | (68,761,591 | ) | | | | (65,654,802 | ) | | |

Institutional Shares (40,220 and 1,172 shares, respectively) | | | | (818,282 | ) | | | | (24,625 | ) | | |

Redemption and small-balance account fees | | | | | | | | | | | | |

Investor Shares | | | | 72,419 | | | | | 84,895 | | | |

Institutional Shares | | | | 5 | | | | | — | | | |

| | | | | | | | | | | | | |

Net increase (decrease) from capital share transactions | | | | (2,512,020 | ) | | | | 29,734,710 | | | |

| | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | | (16,325,194 | ) | | | | 63,581,244 | | | |

| | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | |

Beginning of Period | | | | 417,662,064 | | | | | 354,080,820 | | | |

| | | | | | | | | | | | | |

End of Period* | | | $ | 401,336,870 | | | | $ | 417,662,064 | | | |

| | | |

| | | | | | | | | | | | | |

*Including undistributed net investment income (loss) | | | $ | (11,005 | ) | | | $ | 1,893,210 | | | |

| | | |

| | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Motley Fool Independence Fund | | | | 23 |

Financial Highlights

(for a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended October 31, | |

Investor Shares | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | | | |

Net Asset Value, Beginning of Year | | $ | 21.00 | | | $ | 19.24 | | | $ | 15.48 | | | $ | 14.15 | | | $ | 14.14 | |

| | | | | | | | | | | | | | | | | | | | |

Income (Loss) From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(1) | | | 0.05 | | | | 0.11 | | | | 0.07 | | | | 0.14 | | | | 0.11 | |

Net Gain (Loss) on Securities (Realized and Unrealized) | | | (0.29 | ) | | | 1.87 | | | | 3.79 | | | | 1.29 | | | | 0.15 | |

| | | | | | | | | | | | | | | | | | | | |

Total From Investment Operations | | | (0.24 | ) | | | 1.98 | | | | 3.86 | | | | 1.43 | | | | 0.26 | |

| | | | | | | | | | | | | | | | | | | | |

Less Distributions | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.11 | ) | | | (0.04 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.15 | ) |

Net Realized Capital Gains | | | (0.33 | ) | | | (0.18 | ) | | | — | | | | — | | | | (0.11 | ) |

| | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (0.44 | ) | | | (0.22 | ) | | | (0.11 | ) | | | (0.10 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | |

Redemption and Small-Balance Account Fees | | | —* | | | | —* | | | | 0.01 | | | | —* | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | |

Net Asset Value, End of Year | | $ | 20.32 | | | $ | 21.00 | | | $ | 19.24 | | | $ | 15.48 | | | $ | 14.15 | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Total Return(2)(3) | | | (1.13 | %) | | | 10.43 | % | | | 25.14 | % | | | 10.21 | % | | | 1.91 | % |

Net Assets, End of Year (thousands) | | $ | 393,611 | | | $ | 413,624 | | | $ | 354,081 | | | $ | 227,881 | | | $ | 198,232 | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Ratio of Expenses to Average Net Assets | | | 1.15 | % | | | 1.26 | % | | | 1.36 | % | | | 1.47 | % | | | 1.43 | % |

Ratio of Expenses to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | 1.13 | % | | | 1.23 | % | | | 1.37 | % | | | 1.54 | % | | | 1.58 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 0.23 | % | | | 0.55 | % | | | 0.44 | % | | | 0.93 | % | | | 0.76 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | 0.25 | % | | | 0.59 | % | | | 0.43 | % | | | 0.86 | % | | | 0.61 | % |

Portfolio Turnover | | | 21 | % | | | 24 | % | | | 22 | % | | | 37 | % | | | 37 | % |

| * | Amount represents less than $0.005 per share. |

| (1) | Per share data calculated using average shares outstanding method. |

| (2) | During the years ended October 31, 2013 and October 31, 2011, 0.06% and 0.07%, respectively, of the Fund’s total return was attributable to redemption and small-balance account fees received as referenced in Note 4. Excluding this item, the total return would have been 25.08% and 1.84%, respectively. For the years ended October 31, 2015, October 31, 2014 and October 31, 2012, redemption and small-balance account fees received had no effect on the Fund’s total return. |

| (3) | Total return reflects the rate an investor would have earned on an investment in the Fund during the period. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| 24 | | | | Motley Fool Independence Fund |

Financial Highlights

| | | | | | | | | | | | | | | | |

| | | Year Ended

October 31, | | Period

Ended

October 31, |

| Institutional Shares | | 2015 | | 2014(1)(2) |

Net Asset Value, Beginning of Period | | | | $ | 21.01 | | | | | | | $ | 20.36 | | | |

Income (Loss) From Investment Operations | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(3) | | | | | 0.10 | | | | | | | | 0.03 | | | |

Net Gain (Loss) on Securities (Realized and Unrealized) | | | | | (0.31 | ) | | | | | | | 0.62 | | | |

Total From Investment Operations | | | | | (0.21 | ) | | | | | | | 0.65 | | | |

Less Distributions | | | | | | | | | | | | | | | | |

Net Investment Income | | | | | (0.12 | ) | | | | | | | — | | | |

Net Realized Capital Gains | | | | | (0.33 | ) | | | | | | | — | | | |

Total Distributions | | | | | (0.45 | ) | | | | | | | — | | | |

Redemption and Small-Balance Account Fees | | | | | —* | | | | | | | | — | | | |

Net Asset Value, End of Period | | | | $ | 20.35 | | | | | | | $ | 21.01 | | | |

| | | | | | |

| | | | | | | | | | | | | | | |

Total Return(4) | | | | | (0.97 | %) | | | | | | | 3.19 | % | | |

Net Assets, End of Period (thousands) | | | | $ | 7,726 | | | | | | | $ | 4,038 | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | |

Ratio of Expenses to Average Net Assets | | | | | 0.95 | % | | | | | | | 0.95 | % | | |

Ratio of Expenses to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | | | 2.14 | % | | | | | | | 3.78 | % | | |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | | | 0.46 | % | | | | | | | 0.39 | % | | |

Ratio of Net Investment Income (Loss) to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | | | (0.73 | %) | | | | | | | (2.43 | %) | | |

Portfolio Turnover | | | | | 21 | % | | | | | | | 24 | % | | |

| * | Amount represents less than $0.005 per share. |

| (1) | Commenced operations on June 17, 2014. All ratios for the period have been annualized. Total return for the period has not been annualized. |

| (2) | Because of commencement of operations and related preliminary transaction costs, these ratios are not necessary indicative of future ratios. |

| (3) | Per share data calculated using average shares outstanding method. |

| (4) | Total return reflects the rate an investor would have earned on an investment in the Fund during the period. |

The accompanying notes are an integral part of these financial statements.

| | | | |

| Motley Fool Independence Fund | | | | 25 |

Motley Fool Great America Fund Portfolio Characteristics

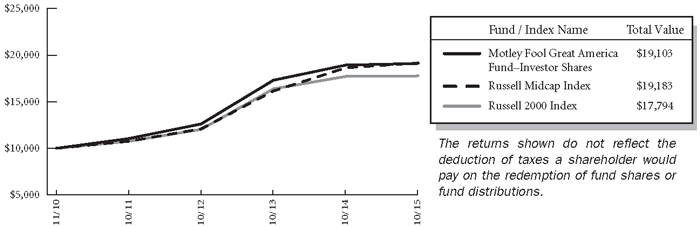

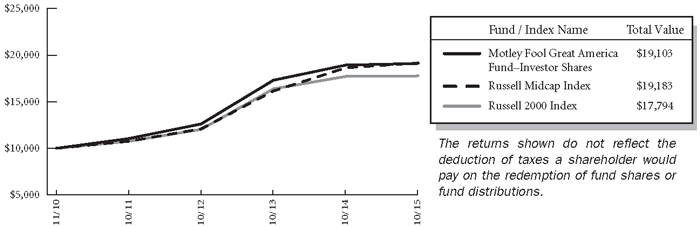

At October 31, 2015, the Motley Fool Great America Fund Investor Shares had an audited net asset value of $18.72 per share attributed to 12,741,968 shares outstanding and the Institutional Shares had an audited net asset value of $18.75 per share attributed to 373,787 shares outstanding. This compares with an unaudited net asset value as of November 1, 2010 for the Investor Shares of $10.00 per share attributed to 102,000 shares outstanding and as of June 17, 2014 for the Institutional Shares of $17.94 per share attributed to 1 share outstanding. From the Investor Shares launch on November 1, 2010 to October 31, 2015, the Shares had an average annual total return of 13.83% versus a return of 13.92% over the same period for its benchmark, Russell Midcap Index. Over the same period, the Russell 2000 Index returned 12.22%. From June 17, 2014 to October 31, 2015 the Institutional Shares returned 3.48%, versus a return of 4.03% over the same period for the Russell Midcap Index. Over the same period, the Russell 2000 Index returned 0.39%.

Please note that we have added a secondary index for the Fund, the Russell 2000 Index. The Fund’s primary benchmark, the Russell Midcap Index, remains unchanged. The Principal Investment Strategies of the Fund emphasize investments in both small- and mid-market capitalization companies. As the name implies, the Russell Midcap Index tracks mid-cap companies and is the single best broad-based benchmark for the Fund. However, the Fund also invests in small-cap companies, many of which are constituents of the small-cap Russell 2000 Index. By providing the performance history of the Russell 2000 Index alongside the Russell Midcap Index, we believe we are providing additional information which is relevant to the Fund’s current and prospective investors.

The graph below shows the performance of $10,000 invested in the Investor Shares at inception. The results shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | | | | | |

Average Annual Total Returns as of 10/31/2015 | | | | | | | | |

| | | | | | | | | |

| | | One Year | | Since

Inception | | Inception

Date | | |

Investor Shares* | | 0.91% | | 13.83% | | 11/1/2010 | | |

Institutional Shares* | | 1.04% | | 3.48% | | 6/17/2014 | | |

Russell Midcap Index** | | 2.77% | | — (1) | | — | | |

Russell 2000 Index*** | | 0.34% | | — (2) | | — | | |

Fund Expense Ratios(3): Investor Shares: Gross 1.20% and Net 1.15%; Institutional Shares: Gross 3.08% and Net 0.95% | | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.FoolFunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

| | | | |

| 26 | | | | Motley Fool Great America Fund |

(1)The index returned 13.92% from the inception date of the Investor Shares and 4.03% from the inception date of the Institutional Shares.

(2)The index returned 12.22% from the inception date of the Investor Shares and 0.39% from the inception date of the Institutional Shares.

(3)The expense ratios of the Fund are set forth according to the 2/28/15 Prospectus for the Fund and may differ from the expense ratios disclosed in the Financial Highlights tables in this report. See the Financial Highlights for more current expense ratios.

*These returns reflect expense waivers by the Fund’s investment adviser. Without these waivers, returns would have been lower.

**The Russell Midcap Index is an unmanaged, free float-adjusted, market capitalization weighted index that is designed to measure the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The Fund may invest in companies that are not included within the Russell Midcap Index and its investment portfolio is not weighted in terms of issuers the same as the Russell Midcap Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the Russell Midcap Index.

***The Russell 2000 Index is an unmanaged, free float-adjusted, market capitalization weighted index that is designed to measure the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000 Index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Fund may invest in companies that are not included within the Russell 2000 Index and its investment portfolio is not weighted in terms of issuers the same as the Russell 2000 Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the Russell 2000 Index.

The investment objective of the Great America Fund is to achieve long-term capital appreciation. The Fund pursues this objective by investing primarily in common stocks of companies organized in the United States. The Fund employs a value-based investment strategy and seeks long-term growth of capital by acquiring securities of companies at prices the investment adviser, Motley Fool Asset Management, LLC (the “Adviser”), believes to be significantly below their intrinsic value. The Fund may invest in other types of securities and in other asset classes when, in the judgment of the Adviser, such investments offer attractive potential returns. As such, the Fund’s performance will deviate significantly from its benchmark from time to time. It is the view of the Adviser that this deviation is less meaningful over shorter time frames and is more relevant over multi-year periods.

Although the Great America Fund may invest in companies with any market capitalization, the Adviser expects that investments in the securities of companies having smaller- and mid-market capitalizations will be important components of the Fund’s investment program. Investments in securities of these companies may involve greater risk than do investments in larger, more established companies. Small-and mid-cap stocks tend to be more volatile and less liquid than their large-cap counterparts. You are strongly encouraged to read more about the Fund’s strategies and risks in the prospectus.

The Great America Fund invests in securities of companies the Adviser believes are undervalued. Unlike mutual funds that hew to their benchmark, the Fund may invest in any company, industry or sector where the Adviser’s analysis suggests that there is opportunity for gains that outweigh risks. In identifying investments for the Fund, the Adviser looks for companies it believes the market has irrationally undervalued and looks for companies that have high-quality businesses with strong market positions, manageable leverage, and robust streams of free cash flow. The following tables show the top eleven holdings and sectors in which the Fund was invested as of October 31, 2015. Portfolio holdings are subject to change without notice.

| | | | |

| Motley Fool Great America Fund | | | | 27 |

| | |

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box. Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times – to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

| | |

| | | | | |

Top Eleven Holdings* | | % of Net

Assets |

| |

| | | | | | |

American Woodlark Corp. | | | | 3.42 | % |

Natus Medical, Inc. | | | | 3.34 | |

Tractor Supply Co. | | | | 3.24 | |

Infinera Corp. | | | | 3.06 | |

Markel Corp. | | | | 3.01 | |

Texas Roadhouse, Inc. | | | | 2.99 | |

Drew Industries, Inc. | | | | 2.96 | |

Carter Bank & Trust | | | | 2.56 | |

Under Armour, Inc. | | | | 2.48 | |

Thor Industries, Inc. | | | | 2.45 | |

Aceto Corp. | | | | 2.40 | |

| | | | | |

| | | | 31.91 | % |

| | | | | |

| | | | | |

* As of the date of the report, the fund had a holding of 3.28% in the BNY Mellon Cash Reserve.

The Motley Fool Great America Fund uses the Global Industry Classification StandardSM (“GICSSM”) as the basis for the classification of securities on the Schedule of Investments (“SOI”). We believe that this makes the SOI classifications more standard with the rest of the industry.

| | | | | |

Sector Allocation | | % of Net

Assets |

| |

| | | | | | |

Consumer Discretionary | | | | 29.84 | % |

Financials | | | | 20.79 | |

Health Care | | | | 16.47 | |

Industrials | | | | 10.67 | |

Information Technology | | | | 8.28 | |

Consumer Staples | | | | 4.02 | |

Telecommunication Services | | | | 3.41 | |

Materials | | | | 3.10 | |

Energy | | | | 1.84 | |

| | | | | |

| | | | 98.42 | % |

| | | | | |

| | | | | |

| | | | |

| 28 | | | | Motley Fool Great America Fund |

About Your Expenses

As a shareholder of the Great America Fund, you incur ongoing costs, including advisory fees and other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2015 to October 31, 2015.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund as compared to the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

| | |

Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average. Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

| | |

| | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

05/01/15 | | Ending

Account

Value

10/31/15 | | Annualized

Expense

Ratio(1) | | Expenses

Paid

During

Period(2) |

| | | | |

| | | | | | | | | | | | | | | | | | | | | |

Investor Shares | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000 | | | | $ | 955.09 | | | | | 1.15 | % | | | $ | 5.67 | |

Hypothetical | | | $ | 1,000 | | | | $ | 1,019.41 | | | | | 1.15 | % | | | $ | 5.85 | |

Institutional Shares | | | | | | | | | | | | | | | | | | | | |

Actual | | | $ | 1,000 | | | | $ | 955.65 | | | | | 0.95 | % | | | $ | 4.68 | |

Hypothetical | | | $ | 1,000 | | | | $ | 1,020.42 | | | | | 0.95 | % | | | $ | 4.84 | |