UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22264

The Motley Fool Funds Trust

(Exact name of registrant as specified in charter)

Motley Fool Asset Management, LLC

2000 Duke Street, Suite 175

Alexandria, VA 22314

(Address of principal executive offices) (Zip code)

Peter E. Jacobstein

Motley Fool Asset Management, LLC

2000 Duke Street, Suite 175

Alexandria, VA 22314

(Name and address of agent for service)

Registrant’s telephone number, including area code: (703) 302-1100

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

| | |

| MOTLEY FOOL INDEPENDENCE FUND (FOOLX) | |  |

| | |

| | During the year ended October 31, 2013, the Motley Fool Independence Fund returned 25.14% versus a return of 26.48% for its benchmark, the MSCI World Index. |

| | Consumer discretionary stocks continued to be the market leaders at home and abroad, the continuation of a four-year trend that started with the bottoming of global markets in 2009. |

| | |

| MOTLEY FOOL GREAT AMERICA FUND (TMFGX) | |  |

| | |

| | During the year ended October 31, 2013, the Motley Fool Great America Fund returned 37.44% versus a return of 33.79% for its benchmark, the Russell Midcap Index. |

| | Little-known or appreciated KapStone Paper returned more than 100%, and too many stocks to name returned greater than 50% over the last year. Smaller caps outperformed large caps by nearly 10% for the year – the type of dichotomy that is unlikely to repeat during the coming year. |

| | |

| MOTLEY FOOL EPIC VOYAGE FUND (TMFEX) | |  |

| | |

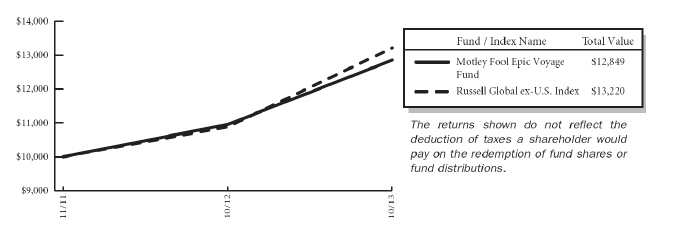

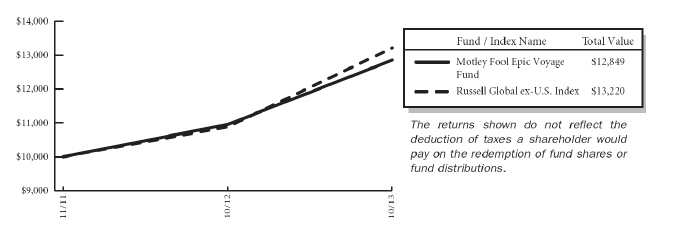

| | During the year ended October 31, 2013, the Motley Fool Epic Voyage Fund returned 17.32% versus a return of 21.58% for its benchmark, the Russell Global Ex-US Index. |

| | Developed markets around the world dramatically outperformed emerging markets for the year. |

This report has been prepared for shareholders of Motley Fool Independence Fund, Motley Fool Great America Fund and Motley Fool Epic Voyage Fund. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current prospectus, which contains more complete information about the Funds. Investors are reminded to read the prospectus carefully before investing. Returns quoted represent past performance, which is no guarantee of future results. Current returns may be lower or higher and can be found at foolfunds.com. Share prices will fluctuate and there may be a gain or loss when shares are redeemed. Fund shares are distributed by Foreside Funds Distributors LLC, Berwyn, Pennsylvania.

Letter from the President

| | |

President Peter Jacobstein | | Dear Fellow Shareholder: As I write this letter in early December, pundits are proclaiming 2013 the year of the Great Rotation. They’re referring to individual investors’ massive move back to stocks after years of selling. Data from the Investment Company Institute bears this out: from 2008 through 2012, investors pulled money out of equity mutual funds each year – a total of $535 billion during the period. But beginning in January of 2013, the trend reversed sharply. For the first nine months of the year, investors added $134 billion to equity mutual funds. |

To which I say: aaarrrrghhhh!

Here’s the problem: in 2009, as money was flowing out of equity funds, the Dow Jones Industrial Average bottomed out around 6,600. Individual investors fled the stock market. They continued to do so until January 2013, at which time the Dow stood at about 13,400. Then they piled back in.

Let me repeat: aaarrrrghhhh!

Individual investors were selling their shares when they should have been buying.

OK, so in hindsight that was a bad time to sell. A fair question is: what’s the outlook for stock purchases today?

I have no idea. Nor does anyone. Not the guy on CNBC. Not your friend with the hot tip. No one can consistently predict the short-term direction of the stock market. Period.

So what’s a prudent investor to do? My own solution is to do what Motley Fool Funds’ portfolio team does. Make investments I believe in and can understand.

| | |

| |

| |

| | |

| The Motley Fool Funds Trust | | 3 |

And hold them for as long as I can. When the market goes up, and when the market goes down.

In two words: Stay Invested.

At Motley Fool Funds, we believe there’s a right way to invest. In fact, we built our whole company around it.

We invest according to Foolish principles: We’re bottom-up investors – we research and buy companies we believe we can understand. And we seek to hold them for the long term – to hold down trading costs and tax bills. (Much more on this in Portfolio Manager Bill Mann’s excellent letter, which follows.)

We charge simple, fair fees: We don’t charge sales loads or 12b-1 fees, ever.

We embrace radical transparency: We believe you ought to know how we’re investing your money, so we write in plain English. We publish a fantastic monthly email dispatch – Declarations (you can sign up today at FoolFunds.com). We publish all of our funds’ holdings every month on our website, FoolFunds.com. We hold semiannual conference calls with the portfolio team, and we invite all our shareholders to visit us at our headquarters once a year for a party.

On behalf of all of us at Motley Fool Funds, thank you for your investment.

Sincerely,

Peter Jacobstein

President, Motley Fool Asset Management

| | |

|

| |

| | |

| 4 | | The Motley Fool Funds Trust |

Letter to Shareholders

| | |

Portfolio Manager Bill Mann | | Dear Fellow Fool Funds Shareholder: Last January I broke my shoulder skiing with my daredevil 11-year old daughter. We were in Beaver Creek, Colorado, and it was snowing to beat the band; lots of deep, beautiful powder but rather poor visibility. We had picked some pretty good lines through the trees and were tearing it up. Then I hit a jump that I didn’t see and landed square on my shoulder. BAM! Broken scapula – which is, I’m told, a pretty tough bone to break. All I know is that I’d prefer not to find out again. It is tempting to leave the story above alone, because if you’re injured, you should at least have the benefit of an awesome story to go with it. And tree skiing sounds pretty awesome. Except that I left out one piece of information – we were on a green slope. Those are the easier ones – the near total opposite of this: |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

We’d totally been skiing more aggressive stuff earlier, but we were on our last run down before the lifts closed. The key reason I fell was the fact that my guard was completely down, and I wasn’t really paying as close attention as I should have been.

Isn’t that the case with so many things? How many times have you been forced to concentrate to do something skillful, only to follow it up with something boneheaded when less concentration seems required?

To make an almost completely ham-handed comparison, in investing many times

| | |

| |

| |

| | |

| The Motley Fool Funds Trust | | 5 |

the risks are far higher when things feel more secure, but unlike skiing, this isn’t entirely a function of our letting our guards down. In investing, the times that seem the easiest are actually when risks are at their greatest, not only because people become less cautious (though they do), but also because cheery stock markets are very rarely cheap.

In 2009, when we started the Motley Fool Independence Fund, one well known market commentator acidly noted our “perfect timing” in getting into the mutual fund business. He wasn’t paying us a compliment. But our timing was good – we put our stake in the ground at a time when equities were more out of favor than they’d been in a generation. We felt good about doing this because we were willing to wait.

What a difference a year makes.

In last year’s annual report I wrote to you about investing in Korean Girl Bands. Seriously, go back and look. OK, it’s possible that we were talking about other things as well, such as the utter disinterest of investors in buying equities, incredible levels of market correlation, the impending mime apocalypse (that’s in there, too), and our need to be patient.

Why did we need to be patient at the end of 2012? Well, in short, 2012 was a pretty bad investing year, and I was advising folks to take the long view. Buy when others are selling. Face your fears. That sort of thing.

In short, 2012 seems like a million years ago, because 2013 was the polar opposite. It seems, in the short course of 12 months, that we have gone from the fear end of the spectrum to the greed end. The good news is that the advice I gave last year holds true for the current environment, but for precisely the opposite reason: to win in investing, patience is required.

What, you thought I was going to shout at you to jump in with both feet? Many stock markets around the world sit at all-time highs. In direct opposition to the experience of the previous five years, investors are once again pouring money into equity mutual funds. This is a great environment for people who run investment firms. Whether it’s a great environment for investors is an entirely different question.

My message last year was an exhortation for you to get out there and invest. Obviously, given the spectacular performance of the stock market, my advice this year is the opposite, correct?

No, it isn’t. I fully believe that superinvestor Shelby Davis had it exactly right when he said that the best time to invest is when you have the money. Setting money aside to invest is a lifetime habit. While I do not see as many opportunities in stocks today as I did a year ago (or, my heavens, four years ago), it’s not like we are investing in the market. We are investing in companies – we are owners of businesses. Buying into a great business – like Under Armour, or Shimano, or Swatch, or Guinness Nigeria, or Bank of Greenland – at a fair price is the very

| | |

| |

| |

| | |

| 6 | | The Motley Fool Funds Trust |

basis of business-centric investing. We own these firms because they have moats and what we view as a plain capability to generate supernormal returns on capital. Even if we struggle to find places to invest, we still would much rather own great companies than not.

So, everything’s better, right?

The rapid rise in stock markets throughout the world suggests that the financial troubles of the past four years are behind us. While I agree that things are better, if the troubles were truly behind us, central banks around the globe would be ratcheting up interest rates from crisis levels. This isn’t happening, not much anyway.

In fact, the event that destabilized global markets the most in 2013 was a suggestion by Federal Reserve Chairman Benjamin Bernanke that things were in fact improving. Treasury yields soared (and emerging market stocks and currencies skittered) following Bernanke’s suggestion that the central bank would slow its pace of bond purchases. The Federal Reserve is considering a host of bad options when it does decide to slow its bond buying, but the reality is that, with a $4 trillion balance sheet, it cannot keep up the same pace.

The funny thing is that an interest rate increase would be a sign that the U.S. economy has become less fragile. We don’t know when interest rates will rise from their still-historically low levels. But rise they will, because they must. We don’t place any stock in trade on our ability to time the market, and we don’t really think anyone else is that competent at market timing, either. After all, those who have been positioning themselves for an explosion of inflation and/or interest rates have been waiting five years for the “inevitable” to happen.

The thing is, it is inevitable, and as such, at some point those who hold long-dated bonds are almost certainly going to suffer fairly significant loss. That’s more like a physics problem than it is a financial one – if something can’t persist in perpetuity, then at some point it will stop.

| | |

|

| |

| | |

| The Motley Fool Funds Trust | | 7 |

Such considerations don’t really come into bearing when we analyze businesses for investment. I’d say that we don’t really put them on our list, but the truth is we really don’t have such a list. Our goal is to find the best businesses in the world, and buy them at a price that we believe (to use my favorite Bushism) misunderestimates the pricing power and market opportunity these companies have before them. Our usage of macroeconomic trends is, thus, merely responsive. When we believe that the market has overreacted to some trend or event by creating value in a company we consider to be great, we will be at the ready to invest.

That’s the thing that’s so frustrating to me about 2013. There are lots of things that investors should freak out about – and yet by and large the massive flows of easy money have overwhelmed every other signal to which the market might respond. Investor David Einhorn described the liquidity as “jelly doughnuts.” The first one tastes awesome and gives you a shot of energy. The fifth? Not so much. At some point the massive injections of liquidity will manifest in their own problems. The question is when.

This may sound like bad news. For investors with a value bent, it’s quite the opposite. We spend all of our time focusing on finding companies that have pricing power that come at what we believe to be a discount, and have the right people running them. It’s a pretty simple model. In a nutshell: if you can buy companies that are cheap, important and jerk-free, you’re probably going to do OK.

The key – and I stress this – is that in order to benefit from the pricing power of these companies in spite of whatever macroeconomic influences buffer, batter or even bolster their share prices in the shorter term is that you have to stay invested in them. How many times have we as investors looked at companies that we didn’t own and say“man, I knew that was going to be big!”?You might feel a little smarter, but you sure as heck don’t feel any richer. In our practice, we resist selling shares of companies that have the highest rating on our“awesomeness continuum”even if we believe they are slightly overvalued. These kinds of companies are always desirable – and while we might not allocate new capital to them if we believe they’re priced dearly, we firmly believe that the greater mistake is in walking away from a great franchise over a few pennies.

I like to take time in these pages to remind you how we invest. You will note once again that the turnover for our three funds is well below the average of our peers. This is a manifestation of three virtuous philosophies.

First, we are business-centric investors. While we are willing to sell any company in our portfolio at any time, we hate doing so.

Second, we believe in low-cost investing, and among the greatest costs for investors are the frictional ones from trading that come in the form of bid/ask spreads, commissions and taxes. We are terrible clients for brokers, and we don’t mind that one bit.

| | |

|

| |

| | |

| 8 | | The Motley Fool Funds Trust |

And finally, we believe that overtrading is a manifestation of overconfidence, and we like to remain humble about what we know and what we do not know. We know that there are observable traits of great businesses, and we like to concentrate our assets in those businesses and hold on tight. We do not know what the future holds, which is why we would prefer to stay invested, patient and disciplined, in businesses that have proven track records of excellence rather than consistently seeking out the next new thing.

Annual Results

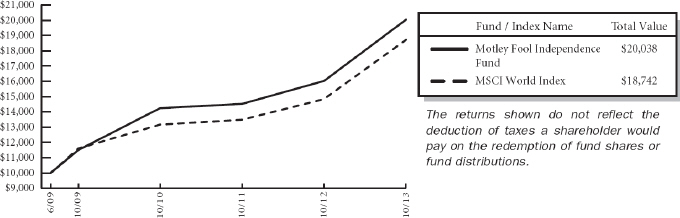

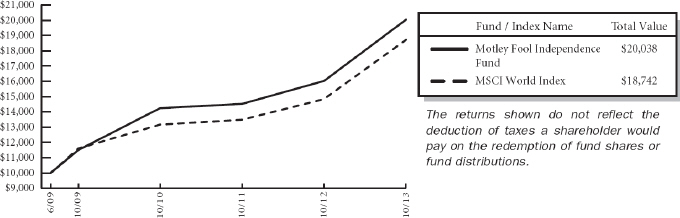

For the year ending October 31, 2013, the Motley Fool Independence Fund turned in gains of 25.1% versus 26.5% for its benchmark, the MSCI World Index. If you bought shares in the Independence Fund on the day it launched in June 2009, you would have doubled your money by the end of October.

For the year ending October 31, 2013, the Motley Fool Great America Fund turned in returns of 37.4% versus 33.8% for the Russell Midcap Index. From its inception in November 2010, Great America has generated returns of 73.1% versus 61.9% for its benchmark.

For the year ending October 31, 2013, the Motley Fool Epic Voyage Fund turned in returns of 17.3% versus 21.6% for the Russell Global ex-US Index. From its inception in November 2011, Epic Voyage has generated returns of 28.5% versus 32.2% for its benchmark.

As I have noted in the past, we do not spend much time thinking about one year returns, which we believe are a function of lots of randomness. Nor do we think much about our benchmarks – we make no effort to match our holdings to the indexes by company, geography or by industry. In 2013 both the Independence Fund and especially the Epic Voyage fund were harmed by our decision to allocate a much higher percentage of our invested assets to emerging markets stocks than our benchmarks (20.3% for Independence Fund versus 7.6% for the MSCI World, and 43.9% versus 13.9% for the Russell Global ex-US).

While much of the investment world makes macroeconomic bets, we focus on companies, and we like to buy them at times when they’re beaten down in price. Emerging market stocks have quickly gone from being in to very much out. A look at the worst performing stock markets for 2013 includes Brazil (-10%), Peru (-22%), and Mexico (-6%).

All three of our funds’ returns versus their benchmarks were negatively impacted by our large cash balances. I lament neither decision. We were able to find some wonderful companies in 2013, including Crown Seal in Thailand, Carter Bank & Trust in Virginia, Crimson Wine Group in California, and Industrias Bachoco in Mexico. But we are only willing to invest at prices we believe to be advantageous. We appreciate your patience with us, and believe that over the long term such an investment policy maximizes our chance of generating a satisfactory return for shareholders.

| | |

|

| |

| | |

| The Motley Fool Funds Trust | | 9 |

One more thing...

I am constantly reminded that the money we manage is not our own. It is yours. OK, some of it is our own – the investment team maintains significant stakes in the three Fool Funds. We are humbled and honored by your faith in us.

Wait, wait, wait. You didn’t think we were done, did you? For the last two years we have run a contest, and we’re doing it again this year. I’m pretty sure no other mutual fund company does anything similar. If you send an email to stayinvested@foolfunds.com, you will be eligible to have me and other members of the FoolFunds investment team come to your town to join you for lunch. Everyone who mails us will receive a Fool Funds ski hat, so please include your name and postal address in your email. We’ll register you for Declarations, our free, monthly email newsletter. (Existing Declarations subscribers, you can win, too!)

In 2012 we went to Saratoga Springs, NewYork, and in 2013 we were in Morristown, New Jersey. Both times we met Motley Fool Funds shareholders who absolutely delighted us with their tales, their hopes and their dreams, and on both cases our hosts showed deep pride in showing us their communities.

This year we’re doing it again. Would love to come and see where you are from and share a meal with some fellow Fools. (People who live in Hawaii encouraged to enter multiple times.)

Foolish Best,

William H. Mann, III

P.S. Thanks for reading all the way to end. Enjoy the rest of the report and send us a quick hello at stayinvested@foolfunds.com to enter the contest.

The Letter to Shareholders seeks to describe some of the Adviser’s current opinions and views of the financial markets. Although the Adviser believes it has a

| | |

|

| |

| | |

| 10 | | The Motley Fool Funds Trust |

reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Fund that are discussed in the Letter to Shareholders were held during the period covered by the annual report. They do not comprise the entire investment portfolio of the Fund, may be sold at any time, and may no longer be held by the Fund. The opinions of the Adviser with respect to those securities may change at any time.

New to investing? Reading your first mutual fund annual report?

New to investing? Reading your first mutual fund annual report?

Welcome! Here are some important things you need to know.

Mutual fund investing offers many potential benefits. But there also are risks. Financial gain is not guaranteed when it comes to investing in equity securities. It’s possible to lose money, including your principal — especially during the short term.

We focus on stocks we have good reason to believe are undervalued by the market. We expect the price of these stocks eventually to rise as the market recognizes the true worth of the companies issuing them. But keep in mind that value stocks can remain undervalued by the market for a long time. And it’s possible that the intrinsic worth of any particular company may not match our valuation.

Our funds may invest in foreign companies and in companies with small market capitalization. There are certain risks associated with these types of investments. The risks are described on pages 13, 28, and 41 of this report. Additional risk information is provided in section 3 of the Notes to Financial Statements, pp. 58-62.

| | |

|

| |

| | |

| The Motley Fool Funds Trust | | 11 |

Motley Fool Independence Fund Portfolio Characteristics

At October 31, 2013, the Motley Fool Independence Fund (the “Fund”) had an audited net asset value of $19.24 per share attributed to 18,398,888 shares outstanding. This compares with an unaudited net asset value as of June 16, 2009 of $10.00 per share attributed to 100,000 shares outstanding. From the Fund’s launch on June 16, 2009 to October 31, 2013, the Fund had an average annual total return of 17.22% versus a return of 15.44% over the same period for its benchmark, MSCI World Index. The graph below shows the performance of $10,000 invested in the Fund at inception. The results shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| | | | |

Average Annual Total Returns as of 10/31/2013 |

| | | Fund* | | Benchmark** |

| | | | | |

One Year | | 25.14% | | 26.48% |

Since Inception | | 17.22% | | 15.44% |

Inception Date | | 06/16/2009 | | |

Total Annual Fund Operating Expenses Before Expense Limitation (February 28, 2013 Prospectus) | | 1.54% | | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.FoolFunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

*These returns reflect expense waivers by the Fund’s investment adviser. Without these waivers, returns would have been lower.

**The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World Index consists of the following 23 developed market country indices: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and the United States. The MSCI World Index is not available for direct investment. The Fund may invest in countries that are not included within the MSCI World Index (such as emerging market countries) and its investment portfolio is not weighted in terms of countries or issuers the same as the MSCI World Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the MSCI World Index. Since Inception returns for the Benchmark reflect the performance based on the Inception Date of the Fund.

| | |

|

| |

| | |

| 12 | | Motley Fool Independence Fund |

The investment objective of the Independence Fund is to achieve long-term capital appreciation. The Fund pursues this objective by investing primarily in common stocks of companies located anywhere in the world. The Fund invests in areas of the market that, in the view of Motley Fool Asset Management, LLC (the “Adviser”), offer the greatest potential for long-term capital appreciation. The Fund may invest in other types of securities and in other asset classes when, in the judgment of the Adviser, such investments offer attractive potential returns. As such, the Fund’s performance will deviate significantly from its benchmark from time to time. It is the view of the Adviser that this deviation is less meaningful over shorter time frames and is more relevant over multi-year periods.

Because the Independence Fund is free to invest in companies of any size around the world, at times, the Fund may be heavily invested in small-cap stocks and foreign securities, each of which presents extra risk. Small-cap stocks tend to be more volatile and less liquid than their large-cap counterparts. Fluctuations in currency exchange rates can cause losses when investing in foreign securities, with emerging markets presenting additional risks of illiquidity, political instability, and lax regulation. You are strongly encouraged to read more about the Fund’s strategies and risks in the prospectus.

The Independence Fund invests in securities of companies the Adviser believes are undervalued. Unlike mutual funds that are constrained by a style-box, the Fund may invest in any company, country, market, industry or sector where the Adviser’s analysis suggests that there is opportunity for gains that outweigh risks. In identifying investments for the Fund, the Adviser looks for companies it believes the market has irrationally undervalued and looks for companies that have high-quality businesses with strong market positions, manageable leverage, and robust streams of free cash flow. The following tables show the top 11 holdings, sector allocation and top 11 countries in which the Fund was invested as of October 31, 2013. Portfolio holdings are subject to change without notice.

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times –to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times –to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

| | |

| Top Eleven Holdings* | | % of Net

Assets |

| | | |

Baidu, Inc. | | 2.80% |

Google, Inc. | | 2.62 |

HDFC Bank Ltd. | | 2.61 |

Berkshire Hathaway, Inc. | | 2.59 |

Banco Latinoamericano de Comercio Exterior SA | | 2.49 |

Markel Corp. | | 2.42 |

Loews Corp. | | 2.41 |

Compartamos SAB de CV | | 2.39 |

WellPoint, Inc. | | 2.24 |

Chipotle Mexican Grill, Inc. | | 2.14 |

Tod’s S.p.A. | | 1.97 |

| | |

| | 26.68% |

| | |

| * | As of the date of the report, the fund had a holding of 6.56% in the BNY Mellon Cash Reserve. |

| | |

|

| |

| | |

| Motley Fool Independence Fund | | 13 |

The Motley Fool Independence Fund uses the Global Industry Classification StandardSM (“GICS SM”) as the basis for the classification of securities on the Schedule of Investments (“SOI”). We believe that this makes the SOI classifications more standard with the rest of the industry.

| | |

Sector Allocation | | % of Net

Assets |

| |

Financials | | 29.65% |

Consumer Discretionary | | 17.65 |

Information Technology | | 13.37 |

Health Care | | 8.59 |

Consumer Staples | | 7.60 |

Energy | | 6.61 |

Industrials | | 3.51 |

Telecommunication Services | | 2.50 |

Materials | | 2.36 |

Utilities | | 1.02 |

| | |

| | 92.86% |

| | |

| | |

Top Eleven Countries | | % of Net

Assets |

| |

United States* | | 43.38% |

South Korea | | 3.94 |

India | | 3.84 |

Switzerland | | 3.78 |

China | | 3.70 |

Japan | | 3.36 |

Hong Kong | | 3.30 |

Saudi Arabia | | 3.12 |

Bermuda | | 2.84 |

Panama | | 2.49 |

Mexico | | 2.39 |

| | |

| | 76.14% |

| | |

| * | As of the date of the report, the fund had a holding of 6.56% in the BNY Mellon Cash Reserve. |

| | |

|

| |

| | |

| 14 | | Motley Fool Independence Fund |

About Your Expenses

As a shareholder of the Independence Fund, you incur ongoing costs, including advisory fees and other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2013 to October 31, 2013.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Independence Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund as compared to the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

| | | | | | | | | | | | | | |

| | | Beginning Account

Value 05/01/13 | | | | Ending Account

Value 10/31/13 | | | | Annualized

Expense Ratio(1) | | | | Expenses Paid

During Period(2) |

| | | | | | | | | | | | | | | |

Actual | | $1,000 | | | | $1,114.07 | | | | 1.35% | | | | $7.19 |

Hypothetical | | $1,000 | | | | $1,018.40 | | | | 1.35% | | | | $6.87 |

| (1) | These ratios reflect expenses waived by the Fund’s investment adviser. Without these Waivers, the Fund’s expenses would have been higher and the ending account values would have been lower. |

| (2) | Expenses are equal to the Fund’s annualized expense ratio for the period May 1, 2013 to October 31,2013, multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent fiscal half-year, then divided by 365. |

| | |

|

| |

| | |

| Motley Fool Independence Fund (Unaudited) | | 15 |

The Motley Fool Funds Trust

Motley Fool Independence Fund

Schedule of Investments

at October 31, 2013

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | | | | | | | | |

Equity Securities — 89.74% | | | | | | | | |

Beverages — 1.30% | | | | | | | | |

Coca-Cola HBC AG (Switzerland)* | | | 159,606 | | | $ | 4,590,393 | |

| | | | | | | | |

Capital Markets — 1.76% | | | | | | | | |

INTL FCStone, Inc. (United States)* | | | 85,513 | | | | 1,749,596 | |

TD Ameritrade Holding Corp. (United States) | | | 165,000 | | | | 4,497,900 | |

| | | | | | | | |

| | | | | | | 6,247,496 | |

| | | | | | | | |

Chemicals — 2.06% | | | | | | | | |

China BlueChemical Ltd. (China) | | | 5,000,000 | | | | 3,213,958 | |

Innophos Holdings, Inc. (United States) | | | 81,164 | | | | 4,067,940 | |

| | | | | | | | |

| | | | | | | 7,281,898 | |

| | | | | | | | |

Commercial Banks — 8.56% | | | | | | | | |

Banco Latinoamericano de Comercio Exterior SA (Panama) | | | 336,265 | | | | 8,820,231 | |

Credicorp Ltd. (Bermuda) | | | 47,000 | | | | 6,420,200 | |

HDFC Bank Ltd. (India)(a) | | | 255,000 | | | | 9,243,750 | |

Monarch Financial Holdings, Inc. (United States) | | | 167,309 | | | | 1,985,958 | |

Siam Commercial Bank PCL (Thailand)(b) | | | 725,000 | | | | 3,844,056 | |

| | | | | | | | |

| | | | | | | 30,314,195 | |

| | | | | | | | |

Commercial Services & Supplies — 3.51% | | | | | | | | |

Covanta Holding Corp. (United States) | | | 100,000 | | | | 1,717,000 | |

De La Rue PLC (United Kingdom) | | | 275,900 | | | | 3,781,418 | |

Depa Ltd. (United Arab Emirates)* | | | 5,815,390 | | | | 3,431,080 | |

KAR Auction Services, Inc. (United States) | | | 117,708 | | | | 3,498,282 | |

| | | | | | | | |

| | | | | | | 12,427,780 | |

| | | | | | | | |

Communications Equipment — 2.57% | | | | | | | | |

Cisco Systems, Inc. (United States) | | | 105,000 | | | | 2,362,500 | |

Infinera Corp. (United States)* | | | 661,100 | | | | 6,749,831 | |

| | | | | | | | |

| | | | | | | 9,112,331 | |

| | | | | | | | |

Computers & Peripherals — 1.62% | | | | | | | | |

Apple, Inc. (United States) | | | 11,000 | | | | 5,745,850 | |

| | | | | | | | |

Consumer Finance — 2.39% | | | | | | | | |

Compartamos SAB de CV (Mexico) | | | 4,350,000 | | | | 8,445,113 | |

| | | | | | | | |

| | |

| See Notes to Financial Statements. |

| |

| | |

| 16 | | Motley Fool Independence Fund |

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | | | | | | | | |

Equity Securities (continued) | | | | | | | | |

Diversified Financial Services — 2.59% | | | | | | | | |

Berkshire Hathaway, Inc. (United States)* | | | 53 | | | $ | 9,168,724 | |

| | | | | | | | |

Diversified Telecommunication Services — 1.01% | | | | | | | | |

Level 3 Communications, Inc. (United States)* | | | 117,500 | | | | 3,589,625 | |

| | | | | | | | |

Electric Utilities — 1.02% | | | | | | | | |

Brookfield Infrastructure Partners LP (Bermuda) | | | 92,127 | | | | 3,627,040 | |

| | | | | | | | |

Electronic Equipment, Instruments & Components — 1.29% | | | | | | | | |

CrucialTec Co., Ltd. (South Korea)* | | | 252,000 | | | | 3,145,452 | |

Samsung SDI Co., Ltd. (South Korea) | | | 8,500 | | | | 1,416,876 | |

| | | | | | | | |

| | | | | | | 4,562,328 | |

| | | | | | | | |

Energy Equipment & Services — 2.06% | | | | | | | | |

CGG (France)*(a) | | | 99,000 | | | | 2,173,050 | |

Geospace Technologies Corp. (United States)* | | | 52,400 | | | | 5,104,808 | |

| | | | | | | | |

| | | | | | | 7,277,858 | |

| | | | | | | | |

Food & Staples Retailing — 1.32% | | | | | | | | |

Costco Wholesale Corp. (United States) | | | 39,558 | | | | 4,667,844 | |

| | | | | | | | |

Food Products — 3.35% | | | | | | | | |

BRF - Brasil Foods SA (Brazil)(a) | | | 108,704 | | | | 2,546,935 | |

Nestle SA (Switzerland) | | | 68,694 | | | | 4,958,605 | |

PT Nippon Indosari Corpindo Tbk (Indonesia) | | | 7,906,960 | | | | 4,345,847 | |

| | | | | | | | |

| | | | | | | 11,851,387 | |

| | | | | | | | |

Health Care Equipment & Supplies — 5.04% | | | | | | | | |

Covidien PLC (Ireland) | | | 62,000 | | | | 3,974,820 | |

Natus Medical, Inc. (United States)* | | | 268,900 | | | | 5,305,397 | |

Nihon Kohden Corp. (Japan) | | | 133,481 | | | | 5,497,631 | |

Zimmer Holdings, Inc. (United States) | | | 35,000 | | | | 3,061,450 | |

| | | | | | | | |

| | | | | | | 17,839,298 | |

| | | | | | | | |

Health Care Providers & Services — 2.24% | | | | | | | | |

WellPoint, Inc. (United States) | | | 93,697 | | | | 7,945,506 | |

| | | | | | | | |

Hotels, Restaurants & Leisure — 5.98% | | | | | | | | |

Ajisen China Holdings Ltd. (Hong Kong) | | | 3,550,000 | | | | 3,724,971 | |

Chipotle Mexican Grill, Inc. (United States)* | | | 14,400 | | | | 7,588,368 | |

Penn National Gaming, Inc. (United States)* | | | 52,083 | | | | 3,047,376 | |

Wynn Macau Ltd. (Macau) | | | 1,000,000 | | | | 3,838,766 | |

| | |

| See Notes to Financial Statements. |

| |

| | |

| Motley Fool Independence Fund | | 17 |

| | | | | | | | |

Issues | | Shares | | | Value (Note 2) | |

| | | | | | | | | |

Equity Securities (continued) | | | | | | | | |

Hotels, Restaurants & Leisure (continued) | | | | | | | | |

Yum! Brands, Inc. (United States) | | | 44,132 | | | $ | 2,984,206 | |

| | | | | | | | |

| | | | | | | 21,183,687 | |

| | | | | | | | |

Insurance — 6.64% | | | | | | | | |

HCC Insurance Holdings, Inc. (United States) | | | 140,200 | | | | 6,400,130 | |

Loews Corp. (United States) | | | 176,690 | | | | 8,535,894 | |

Markel Corp. (United States)* | | | 16,200 | | | | 8,580,654 | |

| | | | | | | | |

| | | | | | | 23,516,678 | |

| | | | | | | | |

Internet & Catalog Retail — 1.79% | | | | | | | | |

CJ O Shopping Co., Ltd. (South Korea) | | | 18,949 | | | | 6,323,606 | |

| | | | | | | | |

Internet Software & Services — 5.41% | | | | | | | | |

Baidu, Inc. (China)*(a) | | | 61,500 | | | | 9,895,350 | |

Google, Inc. (United States)* | | | 9,000 | | | | 9,275,220 | |

| | | | | | | | |

| | | | | | | 19,170,570 | |

| | | | | | | | |

Leisure Equipment & Products — 1.81% | | | | | | | | |

Shimano, Inc. (Japan) | | | 73,000 | | | | 6,389,260 | |

| | | | | | | | |

Media — 1.45% | | | | | | | | |

DreamWorks Animation SKG, Inc. (United States)* | | | 85,000 | | | | 2,910,400 | |

Multiplus SA (Brazil) | | | 178,600 | | | | 2,212,369 | |

| | | | | | | | |

| | | | | | | 5,122,769 | |

| | | | | | | | |

Metals & Mining — 0.31% | | | | | | | | |

Antofagasta PLC (United Kingdom) | | | 80,000 | | | | 1,093,366 | |

| | | | | | | | |

Multiline Retail — 0.74% | | | | | | | | |

Dollar Tree, Inc. (United States)* | | | 45,000 | | | | 2,628,000 | |

| | | | | | | | |

Oil, Gas & Consumable Fuels — 4.56% | | | | | | | | |

Denbury Resources, Inc. (United States)* | | | 262,200 | | | | 4,979,178 | |

Lukoil OAO (Russia)(a) | | | 62,350 | | | | 4,082,054 | |

Occidental Petroleum Corp. (United States) | | | 49,145 | | | | 4,721,852 | |

Total Gabon SA (Gabon) | | | 3,670 | | | | 2,356,940 | |

| | | | | | | | |

| | | | | | | 16,140,024 | |

| | | | | | | | |

Pharmaceuticals — 1.31% | | | | | | | | |

Dr. Reddy’s Laboratories Ltd. (India)(a) | | | 110,177 | | | | 4,368,518 | |

Mallinckrodt PLC (Ireland)* | | | 6,125 | | | | 257,311 | |

| | | | | | | | |

| | | | | | | 4,625,829 | |

| | | | | | | | |

| | |

| See Notes to Financial Statements. |

| |

| | |

| 18 | | Motley Fool Independence Fund |

| | | | | | | | |

| | |

| Issues | | Shares | | | Value

(Note 2) | |

| | | | | | | | | |

| | |

Equity Securities (continued) | | | | | | | | |

Real Estate Investment Trusts — 2.11% | | | | | | | | |

American Tower Corp. (United States) | | | 55,500 | | | $ | 4,403,925 | |

Lippo Malls Indonesia Retail Trust (Singapore) | | | 8,500,000 | | | | 3,074,924 | |

| | | | | | | | |

| | |

| | | | | | | 7,478,849 | |

| | | | | | | | |

Real Estate Management & Development — 4.11% | | | | | | | | |

Brookfield Asset Management, Inc. (Canada) | | | 166,374 | | | | 6,585,083 | |

Cheung Kong Holdings Ltd. (Hong Kong) | | | 235,337 | | | | 3,675,269 | |

Henderson Land Development Co., Ltd. (Hong Kong) | | | 726,671 | | | | 4,299,919 | |

| | | | | | | | |

| | |

| | | | | | | 14,560,271 | |

| | | | | | | | |

Semiconductors & Semiconductor Equipment — 1.60% | | | | | | | | |

Intel Corp. (United States) | | | 44,000 | | | | 1,074,920 | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan)(a) | | | 250,000 | | | | 4,602,500 | |

| | | | | | | | |

| | |

| | | | | | | 5,677,420 | |

| | | | | | | | |

Software — 0.87% | | | | | | | | |

DuzonBizon Co., Ltd. (South Korea) | | | 328,180 | | | | 3,078,790 | |

| | | | | | | | |

Specialty Retail — 0.96% | | | | | | | | |

Williams-Sonoma, Inc. (United States) | | | 65,000 | | | | 3,408,600 | |

| | | | | | | | |

Textiles, Apparel & Luxury Goods — 4.92% | | | | | | | | |

Swatch Group SA (Switzerland) | | | 6,000 | | | | 3,832,148 | |

Tod’s S.p.A. (Italy) | | | 42,000 | | | | 6,989,298 | |

Under Armour, Inc. (United States)* | | | 81,410 | | | | 6,606,422 | |

| | | | | | | | |

| | |

| | | | | | | 17,427,868 | |

| | | | | | | | |

Wireless Telecommunication Services — 1.48% | | | | | | | | |

SBA Communications Corp. (United States)* | | | 60,000 | | | | 5,248,200 | |

| | | | | | | | |

| | |

Total Equity Securities (Cost $ 228,973,726) | | | | | | | 317,768,453 | |

| | | | | | | | |

| | |

Participatory Notes — 3.12% | | | | | | | | |

Commercial Banks — 1.48% | | | | | | | | |

Al Rajhi Banking & Investment Co. (Saudi Arabia)(c) | | | 268,000 | | | | 5,243,353 | |

| | | | | | | | |

Food Products — 1.64% | | | | | | | | |

Almarai Co. (Saudi Arabia)(c) | | | 385,759 | | | | 5,789,695 | |

| | | | | | | | |

| | |

Total Participatory Notes (Cost $ 9,675,985) | | | | | | | 11,033,048 | |

| | | | | | | | |

| | |

| See Notes to Financial Statements. |

| |

| | |

| Motley Fool Independence Fund | | 19 |

| | | | | | | | |

| | |

| Issues | | Shares | | | Value

(Note 2) | |

| | | | | | | | | |

| | |

Other Investments — 6.56% | | | | | | | | |

Temporary Cash Investment — 6.56% | | | | | | | | |

BNY Mellon Cash Reserve | | | 23,217,509 | | | | $23,217,509 | |

| | | | | | | | |

| | |

Total Other Investments (Cost $23,217,509) | | | | | | | 23,217,509 | |

| | | | | | | | |

| | |

Total Investment Portfolio (Cost 261,867,220) — 99.42% | | | | | | | 352,019,010 | |

Liabilities in Excess of Other Assets — 0.58% | | | | | | | 2,061,810 | |

| | | | | | | | |

| | |

NET ASSETS — 100.00% | | | | | | | | |

(Applicable to 18,398,888 shares outstanding) | | | | | | | $354,080,820 | |

| | | | | | | | |

| | | | | | | | |

| * | Non-income producing security. |

| (a) | ADR — American Depositary Receipts |

| (b) | NVDR — Non-Voting Depository Receipts |

| (c) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. Total market value of Rule 144A securities is $11,033,048 and represents 3.12% of net assets as of October 31, 2013. |

LP — Limited Partnership

PCL — Public Company Limited

PLC — Public Limited Company

| | |

| See Notes to Financial Statements. |

| |

| | |

| 20 | | Motley Fool Independence Fund |

Statement of Assets and Liabilities

| | | | |

| | | As of October 31, 2013 | |

| | |

Assets: | | | | |

Investments in securities of unaffiliated issuers, at value

(at cost, $261,867,220) | | | $352,019,010 | |

| |

Foreign currency, at value

(at cost, $1,243,770) | | | 1,261,388 | |

Receivables: | | | | |

Dividends and tax reclaims | | | 432,221 | |

Interest | | | 224 | |

Shares of beneficial interest sold | | | 930,908 | |

Prepaid expenses and other assets | | | 27,681 | |

| | | | |

Total Assets | | | 354,671,432 | |

| | | | |

| |

Liabilities | | | | |

Payables: | | | | |

Investment securities purchased | | | 111,054 | |

Shares of beneficial interest redeemed | | | 58,555 | |

Accrued expenses: | | | | |

Audit fees | | | 19,000 | |

Accounting and administration fees | | | 42,371 | |

Advisory fees | | | 272,034 | |

Custodian fees | | | 10,105 | |

Legal fees | | | 3,803 | |

Transfer agent fees | | | 42,162 | |

Trustee fees | | | 475 | |

Other expenses | | | 31,053 | |

| | | | |

Total Liabilities | | | 590,612 | |

| | | | |

Net Assets | | $ | 354,080,820 | |

| | | | |

| | |

| The accompanying notes are an integral part of these financial statements. |

| |

| | |

| Motley Fool Independence Fund | | 21 |

Statement of Assets and Liabilities

| | | | | | | |

| | | As of October 31, 2013 | | |

| |

Net Assets Consist of: | | | | | | | |

Paid-in-Capital | | | $ | 260,041,662 | | | |

Undistributed Net Investment Income | | | | 590,254 | | | |

Accumulated Net Realized Gain on Investments and Foreign Currency Transactions | | | | 3,278,369 | | | |

Net Unrealized Appreciation/(Depreciation) on Investments, Foreign Currencies, and Assets and Liabilities Denominated in Foreign Currencies | | | | 90,170,535 | | | |

| | | | | | | |

Net Assets | | | $ | 354,080,820 | | | |

| | | | | | | |

Net Asset Value: | | | | | | | |

$0.001 par value, unlimited shares authorized | | | | | | | |

Net assets applicable to capital shares outstanding | | | $ | 354,080,820 | | | |

Shares outstanding | | | | 18,398,888 | | | |

| | | | | | | |

Net asset value, offering, and redemption price per share* | | | $ | 19.24 | | | |

| | | | | | | |

| * | A charge of 2% is imposed on the redemption proceeds of shares redeemed or exchanged within 90 days of purchase. |

| | |

| The accompanying notes are an integral part of these financial statements. |

| |

| | |

| 22 | | Motley Fool Independence Fund |

Statement of Operations

| | | | | | | | | | |

| | | Year Ended

October 31, 2013 | | |

| | | | | | | | | |

Investment Income | | | | | | | |

Dividends | | | $ | 5,160,436 | | | |

Interest | | | | 19,141 | | | |

Less foreign taxes withheld | | | | (246,647 | ) | | |

| | | | | | | | |

Total Investment Income | | | | 4,932,930 | | | |

| | | | | | | | |

| | |

Expenses | | | | | | | |

Accounting and administration fees | | | | 249,847 | | | |

Blue sky fees | | | | 35,842 | | | |

Shareholder account-related services | | | | 198,091 | | | |

Chief Compliance Officer fees | | | | 15,621 | | | |

Custodian fees | | | | 118,970 | | | |

Investment advisory fees | | | | 2,641,349 | | | |

Professional fees | | | | 51,228 | | | |

Shareholder reporting fees | | | | 20,457 | | | |

Transfer agent fees | | | | 362,557 | | | |

Trustee fees | | | | 32,702 | | | |

Other expenses | | | | 38,056 | | | |

| | | | | | | | |

Total expenses | | | | 3,764,720 | | | |

| | | | | | | | |

Expenses waived/reimbursed net of amount recaptured | | | | (27,093 | ) | | |

| | | | | | | | |

Net expenses | | | | 3,737,627 | | | |

| | | | | | | | |

Net Investment Income | | | | 1,195,303 | | | |

| | | | | | | | |

| | |

Realized and Unrealized Gain (Loss) | | | | | | | |

| | |

Net realized gain (loss) from: | | | | | | | |

Investment securities | | | | 3,339,773 | | | |

Foreign currency transactions | | | | (78,371 | ) | | |

| | | | | | | | |

| | |

Net realized gain on investments and foreign currency transactions | | | | 3,261,402 | | | |

| | | | | | | | |

| | |

Change in net unrealized appreciation/(depreciation) on: | | | | | | | |

Investment securities | | | | 57,985,581 | | | |

Foreign currency translations | | | | 14,461 | | | |

| | | | | | | | |

| | |

Change in net unrealized appreciation/(depreciation) on investments, foreign currencies, and assets and liabilities denominated in foreign currencies | | | | 58,000,042 | | | |

| | | | | | | | |

| | |

Net realized and unrealized gain | | | | 61,261,444 | | | |

| | | | | | | | |

| | |

Net Increase in Net Assets Resulting from Operations | | | $ | 62,456,747 | | | |

| | | | | | | �� | | | |

| | |

| The accompanying notes are an integral part of these financial statements. |

| |

| | |

| Motley Fool Independence Fund | | 23 |

Statements of Changes in Net Assets

| | | | | | | | | | |

| | | Year

Ended

October 31,

2013 | | | Year

Ended

October 31,

2012 | | | |

| | | | | | | | | | | |

Operations: | | | | | | | | | | |

Net Investment Income | | $ | 1,195,303 | | | $ | 1,936,850 | | | |

Net Realized Gain/(Loss) on Investments and Foreign Currency Transactions | | | 3,261,402 | | | | (122,699 | ) | | |

Change in Net Unrealized Appreciation/(Depreciation) on Investments, Foreign Currencies, and Assets and Liabilities Denominated in Foreign Currencies | | | 58,000,042 | | | | 18,502,460 | | | |

| | | | | | | | | | |

| | | |

Net increase in net assets resulting from operations | | | 62,456,747 | | | | 20,316,611 | | | |

| | | | | | | | | | |

| | | |

Dividends to Shareholders: | | | | | | | | | | |

Dividends from net investment income | | | (1,588,159 | ) | | | (1,409,218 | ) | | |

| | | | | | | | | | |

| | | |

Capital Share Transactions: | | | | | | | | | | |

Proceeds from shares sold (6,299,592 and 3,537,966 shares, respectively) | | | 109,943,562 | | | | 52,796,542 | | | |

Reinvestment of dividends (100,131 and 99,973 shares, respectively) | | | 1,561,039 | | | | 1,385,628 | | | |

Value of shares redeemed (2,718,295 and 2,931,011 shares, respectively) | | | (46,269,770 | ) | | | (43,489,388 | ) | | |

| | | | | | | | | | |

Redemption and small-balance account fees | | | 96,740 | | | | 48,140 | | | |

| | | | | | | | | | |

Net increase from capital share transactions | | | 65,331,571 | | | | 10,740,922 | | | |

| | | | | | | | | | |

Total increase in net assets | | | 126,200,159 | | | | 29,648,315 | | | |

| | | | | | | | | | |

| | | |

Net Assets: | | | | | | | | | | |

Beginning of Period | | | 227,880,661 | | | | 198,232,346 | | | |

| | | | | | | | | | |

End of Period* | | $ | 354,080,820 | | | $ | 227,880,661 | | | |

| | | | | | | | | | |

* Including undistributed net investment income | | $ | 609,266 | | | $ | 1,002,122 | | | |

| | | | | | | | | | |

| | |

| The accompanying notes are an integral part of these financial statements. |

| |

| | |

| 24 | | Motley Fool Independence Fund |

Financial Highlights

(for a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | |

| | | Years Ended October 31, | |

| | | | | | | | | | | | | | | | | | | | | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010(1) | | | 2009(2)(3) | |

| | | | | |

Net Asset Value, Beginning of Period | | $ | 15.48 | | | $ | 14.15 | | | $ | 14.14 | | | $ | 11.48 | | | $ | 10.00 | |

Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income(4) | | | 0.07 | | | | 0.14 | | | | 0.11 | | | | 0.16 | | | | 0.02 | |

Net Gains on Securities (Realized and Unrealized) | | | 3.79 | | | | 1.29 | | | | 0.15 | | | | 2.59 | | | | 1.46 | |

Total From Investment Operations | | | 3.86 | | | | 1.43 | | | | 0.26 | | | | 2.75 | | | | 1.48 | |

Less Distributions | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.11 | ) | | | (0.10 | ) | | | (0.15 | ) | | | (0.02 | ) | | | — | |

Net Realized Capital Gains | | | — | | | | — | | | | (0.11 | ) | | | (0.08 | ) | | | — | |

Total Distributions | | | (0.11 | ) | | | (0.10 | ) | | | (0.26 | ) | | | (0.10 | ) | | | — | |

Redemption and Small-Balance Account Fees | | | 0.01 | | | | — | * | | | 0.01 | | | | 0.01 | | | | — | * |

Net Asset Value, End of Period | | $ | 19.24 | | | $ | 15.48 | | | $ | 14.15 | | | $ | 14.14 | | | $ | 11.48 | |

| | | | | | | | | | | | | | | | | | | | |

Total Return(5)(6) | | | 25.14 | % | | | 10.21 | % | | | 1.91 | % | | | 24.18 | % | | | 14.80 | % |

Net Assets, End of Period (thousands) | | $ | 354,081 | | | $ | 227,881 | | | $ | 198,232 | | | $ | 128,406 | | | $ | 30,427 | |

| | | | | |

Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | |

Ratio of Expenses to Average Net Assets | | | 1.36 | % | | | 1.47 | % | | | 1.43 | % | | | 1.38 | % | | | 1.35 | % |

Ratio of Expenses to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | 1.37 | % | | | 1.54 | % | | | 1.58 | % | | | 2.20 | % | | | 7.01 | % |

Ratio of Net Investment Income to Average Net Assets | | | 0.44 | % | | | 0.93 | % | | | 0.76 | % | | | 1.29 | % | | | 0.41 | % |

Ratio of Net Investment Income to Average Net Assets (Before Waivers and Reimbursement of Expenses and/or Recapture of Previously Waived Fees) | | | 0.43 | % | | | 0.86 | % | | | 0.61 | % | | | 0.47 | % | | | (5.25 | )% |

Portfolio Turnover | | | 22 | % | | | 37 | % | | | 37 | % | | | 37 | % | | | 50 | % |

* Amount represents less than $0.005 per share.

| (1) | Due to a clerical error, Net Gains on Securities (Realized and Unrealized) and Total From Investment Operations for the year ended October 31, 2010 were reported in the 2010 Annual Report as $2.39 and $2.55, respectively. Such amounts have been revised as shown above. |

| (2) | Because of commencement of operations and related preliminary transaction costs, these ratios are not necessarily indicative of future ratios. |

| (3) | Commenced operations on June 16, 2009. All ratios for the period have been annualized. Total return and portfolio turnover for the period have not been annualized. |

| | |

| The accompanying notes are an integral part of these financial statements. |

| |

| | |

| Motley Fool Independence Fund | | 25 |

Financial Highlights

| (4) | Per share data calculated using average shares outstanding method. |

| (5) | During the years ended October 31, 2013, October 31, 2011 and October 31, 2010, 0.06%, 0.07% and 0.08%, respectively, of the Fund’s total return was attributable to redemption and small-balance account fees received as referenced in Note 4. Excluding this item, the total return would have been 25.08%, 1.84% and 24.10%, respectively. For the year ended October 31, 2012 and the period ended October 31, 2009, redemption and small-balance account fees received had no effect on the Fund’s total return. |

| (6) | Total return reflects the rate an investor would have earned on an investment in the Fund during each period, assuming reinvestment of all distributions. |

| | |

| The accompanying notes are an integral part of these financial statements. |

| |

| | |

| 26 | | Motley Fool Independence Fund |

Motley Fool Great America Fund Portfolio Characteristics

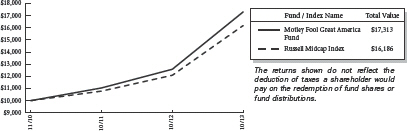

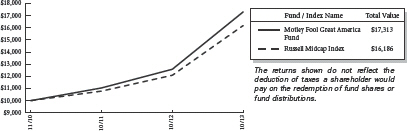

At October 31, 2013, the Motley Fool Great America Fund (the “Fund”) had an audited net asset value of $17.25 per share attributed to 9,412,353 shares outstanding. This compares with an unaudited net asset value as of November 1, 2010 of $10.00 per share attributed to 102,000 shares outstanding. From the Fund’s launch on November 1, 2010 to October 31, 2013, the Fund had an average annual total return of 20.10% versus a return of 17.43% over the same period for its benchmark, Russell Midcap Index. The graph below shows the performance of $10,000 invested in the Fund at inception. The results shown below do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

Let’s be serious though. A graph of the performance of any investment over less than three years tells you virtually nothing. In about five years, they’ll actually tell you quite a bit about how well we’re managing your money. Let’s be serious though. A graph of the performance of any investment over less than three years tells you virtually nothing. In about five years, they’ll actually tell you quite a bit about how well we’re managing your money.

|

| | | | |

| Average Annual Total Returns as of 10/31/2013 |

| | Fund* | | Benchmark** |

| |

| | |

One Year | | 37.44% | | 33.79% |

| |

Since Inception | | 20.10% | | 17.43% |

| |

Inception Date | | 11/01/2010 | | |

| |

Total Annual Fund Operating Expenses Before Expense Limitation (February 28, 2013 Prospectus) | | 1.74% | | |

| |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.FoolFunds.com. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

*These returns reflect expense waivers by the Fund’s investment adviser. Without these waivers, returns would have been lower.

**The Russell Midcap Index is an unmanaged, free float-adjusted, market capitalization weighted index that is designed to measure the performance of the mid-cap segment of the U.S. equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap Index represents approximately 31% of the total market capitalization of the Russell 1000 companies. The Fund may invest in companies that are not included within the Russell Midcap Index and its investment portfolio is not weighted in terms of issuers the same as the Russell Midcap Index. For this reason, the Fund’s investment performance should not be expected to track, and may exceed or trail, the Russell Midcap Index. Since Inception returns for the Benchmark reflect the performance based on the Inception Date of the Fund.

| | |

|

| |

| | |

| Motley Fool Great America Fund | | 27 |

The investment objective of the Great America Fund is to achieve long-term capital appreciation. The Fund pursues this objective by investing primarily in common stocks of companies organized in the United States. The Fund employs a value-based investment strategy and seeks long-term growth of capital by acquiring securities of companies at prices the investment adviser, Motley Fool Asset Management, LLC (the “Adviser”), believes to be significantly below their intrinsic value. The Fund may invest in other types of securities and in other asset classes when, in the judgment of the Adviser, such investments offer attractive potential returns. As such, the Fund’s performance will deviate significantly from its benchmark from time to time. It is the view of the Adviser that this deviation is less meaningful over shorter time frames and is more relevant over multi-year periods.

Although the Great America Fund may invest in companies with any market capitalization, the Adviser expects that investments in the securities of companies having smaller- and mid-market capitalizations will be important components of the Fund’s investment program. Investments in securities of these companies may involve greater risk than do investments in larger, more established companies. Small-and mid-cap stocks tend to be more volatile and less liquid than their large-cap counterparts. You are strongly encouraged to read more about the Fund’s strategies and risks in the prospectus.

The Great America Fund invests in securities of companies the Adviser believes are undervalued. Unlike mutual funds that hew to their benchmark, the Fund may invest in any company, industry or sector where the Adviser’s analysis suggests that there is opportunity for gains that outweigh risks. In identifying investments for the Fund, the Adviser looks for companies it believes the market has irrationally undervalued and looks for companies that have high-quality businesses with strong market positions, manageable leverage, and robust streams of free cash flow. The following tables show the top 11 holdings and sectors in which the Fund was invested as of October 31, 2013. Portfolio holdings are subject to change without notice.

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times –to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

Certain mutual fund ratings and review services have created style boxes, which look more or less like a tic-tac-toe board; arranging funds by the size of the companies they typically invest in (large-, mid-, and small-cap) along one axis, and along a “value” to “growth” basis on the other axis. This may be a helpful way – at times –to think about certain investment opportunities, but we don’t believe we’ll improve your returns by limiting ourselves to any one portion of that style box.

| | | | |

Top Eleven Holdings* | | % of Net

Assets | |

| | |

Geospace Technologies Corp. | | | 2.85 | % |

Berkshire Hathaway, Inc. | | | 2.66 | |

Markel Corp. | | | 2.59 | |

Texas Roadhouse, Inc. | | | 2.52 | |

CARBO Ceramics, Inc. | | | 2.41 | |

Trimas Corp. | | | 2.29 | |

American Woodmark Corp. | | | 2.20 | |

Thor Industries, Inc. | | | 2.14 | |

Tractor Supply Co. | | | 2.11 | |

Natus Medical, Inc. | | | 2.04 | |

SBA Communications Corp. | | | 2.01 | |

| | | | |

| | | 25.82 | % |

| | | | |

| * | As of the date of the report, the fund had a holding of 7.94% in the BNY Mellon Cash Reserve. |

| | |

|

| |

| | |

| 28 | | Motley Fool Great America Fund |

The Motley Fool Great America Fund uses the Global Industry Classification StandardSM (“GICS SM”) as the basis for the classification of securities on the Schedule of Investments (“SOI”). We believe that this makes the SOI classifications more standard with the rest of the industry.

| | |

Sector Allocation | | % of Net

Assets |

| |

Consumer Discretionary | | 24.91% |

Financials | | 22.70 |

Industrials | | 12.15 |

Information Technology | | 7.68 |

Energy | | 6.96 |

Health Care | | 6.55 |

Materials | | 6.21 |

Consumer Staples | | 3.38 |

Telecommunication Services | | 2.99 |

| | |

| | 93.53% |

| | |

| | |

|

| |

| | |

| Motley Fool Great America Fund | | 29 |

About Your Expenses

As a shareholder of the Great America Fund, you incur ongoing costs, including advisory fees and other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2013 to October 31, 2013.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund as compared to the costs of investing in other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds.

Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

Do you know how many times a fund, or the market, has returned a smooth 5% over a long period of time? Never. But we have to pick some example. In reality, the market’s returns are always far bumpier, with the market returning 20% one year, followed by a loss of 10% the next year, followed by a 3% gain, etc. These variations affect actual expenses as well. Happily, over almost all time periods of 20 years or longer, according to the research of University of Pennsylvania’s Jeremy Siegel and others, the domestic market’s returns have been at least 5% per year on average.

| | | | | | | | |

| | Beginning

Account

Value

05/01/13 | | Ending

Account

Value

10/31/13 | | Annualized

Expense

Ratio(1) | | Expenses

Paid

During

Period(2) |

| |

Actual | | $1,000 | | $1,191.60 | | 1.39% | | $7.68 |

Hypothetical | | $1,000 | | $1,018.20 | | 1.39% | | $7.07 |

| (1) | These ratios reflect expenses waived by the Fund’s investment adviser. Without these Waivers, the Fund’s expenses would have been higher and the ending account values would have been lower. |

| (2) | Expenses are equal to the Fund’s annualized expense ratio for the period May 1,2013 to October 31, 2013, multiplied by the average account value over the period, multiplied by the number of days (184) in the most recent fiscal half-year, then divided by 365. |

| | |

|

| |

| | |

| 30 | | Motley Fool Great America Fund (Unaudited) |

The Motley Fool Funds Trust

Motley Fool Great America Fund

Schedule of Investments

at October 31, 2013

| | | | | | | | |

| Issues | | Shares | | | Value (Note 2) | |

| | | | | | | | | |

Equity Securities — 93.53% | | | | | | | | |

Air Freight & Logistics — 3.33% | | | | | | | | |

CH Robinson Worldwide, Inc. (United States) | | | 46,000 | | | $ | 2,748,040 | |

XPO Logistics, Inc. (United States)* | | | 132,000 | | | | 2,663,760 | |

| | | | | | | | |

| | | | | | | 5,411,800 | |

| | | | | | | | |

| | |

Auto Components — 1.71% | | | | | | | | |

Drew Industries, Inc. (United States) | | | 55,311 | | | | 2,779,931 | |

| | | | | | | | |

Automobiles — 2.14% | | | | | | | | |

Thor Industries, Inc. (United States) | | | 59,988 | | | | 3,479,904 | |

| | | | | | | | |

Beverages — 1.45% | | | | | | | | |

Crimson Wine Group Ltd. (United States)* | | | 269,847 | | | | 2,361,161 | |

| | | | | | | | |

Building Products — 2.20% | | | | | | | | |

American Woodmark Corp. (United States)* | | | 105,200 | | | | 3,568,384 | |

| | | | | | | | |

Capital Markets — 4.70% | | | | | | | | |

Diamond Hill Investment Group, Inc. (United States) | | | 29,023 | | | | 3,200,366 | |

INTL FCStone, Inc. (United States)* | | | 79,300 | | | | 1,622,478 | |

TD Ameritrade Holding Corp. (United States) | | | 58,000 | | | | 1,581,080 | |

Virtus Investment Partners, Inc. (United States)* | | | 6,000 | | | | 1,221,120 | |

| | | | | | | | |

| | | | | | | 7,625,044 | |

| | | | | | | | |

| | |

Chemicals — 1.08% | | | | | | | | |

Innophos Holdings, Inc. (United States) | | | 35,000 | | | | 1,754,200 | |

| | | | | | | | |

Commercial Banks — 4.39% | | | | | | | | |

Access National Corp. (United States) | | | 65,529 | | | | 952,137 | |

Carter Bank & Trust (United States) | | | 156,643 | | | | 1,749,702 | |

Monarch Financial Holdings, Inc. (United States) | | | 217,900 | | | | 2,586,473 | |

Suffolk Bancorp. (United States)* | | | 93,646 | | | | 1,830,779 | |

| | | | | | | | |

| | | | | | | 7,119,091 | |

| | | | | | | | |

| | |

Commercial Services & Supplies — 2.08% | | | | | | | | |

Covanta Holding Corp. (United States) | | | 50,000 | | | | 858,500 | |

KAR Auction Services, Inc. (United States) | | | 85,000 | | | | 2,526,200 | |

| | | | | | | | |

| | | | | | | 3,384,700 | |

| | | | | | | | |

| | |

Communications Equipment — 3.75% | | | | | | | | |

Cisco Systems, Inc. (United States) | | | 130,000 | | | | 2,925,000 | |

Infinera Corp. (United States)* | | | 309,500 | | | | 3,159,995 | |

| | | | | | | | |

| | | | | | | 6,084,995 | |

| | | | | | | | |

| | |

| See Notes to Financial Statements. |

| |

| | |

| Motley Fool Great America Fund | | 31 |

| | | | | | | | |

| Issues | | Shares | | | Value (Note 2) | |

| | | | | | | | | |

Equity Securities (continued) | | | | | | | | |

Computers & Peripherals — 1.82% | | | | | | | | |

Apple, Inc. (United States) | | | 5,650 | | | $ | 2,951,277 | |

| | | | | | | | |

Diversified Financial Services — 2.66% | | | | | | | | |

Berkshire Hathaway, Inc. (United States)* | | | 25 | | | | 4,324,870 | |

| | | | | | | | |

Diversified Telecommunication Services — 0.99% | | | | | | | | |

Level 3 Communications, Inc. (United States)* | | | 52,418 | | | | 1,601,370 | |

| | | | | | | | |

Energy Equipment & Services — 5.26% | | | | | | | | |

CARBO Ceramics, Inc. (United States) | | | 31,200 | | | | 3,910,608 | |

Geospace Technologies Corp. (United States)* | | | 47,500 | | | | 4,627,450 | |

| | | | | | | | |

| | | | | | | 8,538,058 | |

| | | | | | | | |

Food & Staples Retailing — 1.93% | | | | | | | | |

Costco Wholesale Corp. (United States) | | | 26,500 | | | | 3,127,000 | |

| | | | | | | | |

Health Care Equipment & Supplies — 3.80% | | | | | | | | |

Natus Medical, Inc. (United States)* | | | 167,700 | | | | 3,308,721 | |

Varian Medical Systems, Inc. (United States)* | | | 39,500 | | | | 2,866,910 | |

| | | | | | | | |

| | | | | | | 6,175,631 | |

| | | | | | | | |

Health Care Providers & Services — 2.75% | | | | | | | | |

Quest Diagnostics, Inc. (United States) | | | 24,000 | | | | 1,437,840 | |

WellPoint, Inc. (United States) | | | 35,700 | | | | 3,027,360 | |

| | | | | | | | |

| | | | | | | 4,465,200 | |

| | | | | | | | |

Hotels, Restaurants & Leisure — 8.83% | | | | | | | | |

Chipotle Mexican Grill, Inc. (United States)* | | | 4,800 | | | | 2,529,456 | |

Panera Bread Co. (United States)* | | | 5,000 | | | | 789,600 | |

Penn National Gaming, Inc. (United States)* | | | 41,117 | | | | 2,405,756 | |

Red Robin Gourmet Burgers, Inc. (United States)* | | | 20,000 | | | | 1,523,600 | |

Texas Roadhouse, Inc. (United States) | | | 149,000 | | | | 4,085,580 | |

Wynn Resorts Ltd. (United States) | | | 18,000 | | | | 2,992,500 | |

| | | | | | | | |

| | | | | | | 14,326,492 | |

| | | | | | | | |

Household Durables — 1.72% | | | | | | | | |

TRI Pointe Homes, Inc. (United States)* | | | 175,000 | | | | 2,786,000 | |

| | | | | | | | |

Insurance — 5.32% | | | | | | | | |

HCC Insurance Holdings, Inc. (United States) | | | 35,000 | | | | 1,597,750 | |

Loews Corp. (United States) | | | 58,500 | | | | 2,826,135 | |

Markel Corp. (United States)* | | | 7,950 | | | | 4,210,876 | |

| | | | | | | | |

| | | | | | | 8,634,761 | |

| | | | | | | | |

Internet & Catalog Retail — 0.97% | | | | | | | | |

Liberty Interactive Corp. (United States)* | | | 58,150 | | | | 1,567,724 | |

| | | | | | | | |

| | |

| See Notes to Financial Statements. |

| |

| | |

| 32 | | Motley Fool Great America Fund |

| | | | | | | | |

| Issues | | Shares | | | Value (Note 2) | |

| | | | | | | | | |

Equity Securities (continued) | | | | | | | | |

Internet Software & Services — 1.33% | | | | | | | | |

Google, Inc. (United States)* | | | 2,100 | | | $ | 2,164,218 | |

| | | | | | | | |

Machinery — 4.53% | | | | | | | | |

Actuant Corp. (United States) | | | 56,500 | | | | 2,122,140 | |

Flow International Corp. (United States)* | | | 378,400 | | | | 1,509,816 | |