UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT

PURSUANT TO SECTION 13

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2011

Commission file number 333-155319

PETROBRAS ARGENTINA S.A.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

REPUBLIC OF ARGENTINA

(Jurisdiction of incorporation of organization)

Maipú 1, 22 S.S. Floor

(C1084ABA) Buenos Aires

Argentina

(Address of principal executive offices)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | |

Title of each Class | | Name of Each Exchange On Which Registered |

| American Depositary Shares, each representing 10 Class B shares of Petrobras Argentina S.A. | | New York Stock Exchange |

| |

| Class B shares of Petrobras Argentina S.A. | | New York Stock Exchange* |

| * | Not for trading, but only in connection with the registration of American Depositary Shares pursuant to the requirements of the NYSE. |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

The number of outstanding shares of each of the issuer’s classes of capital or common stock as of December 31, 2011 was:

Petrobras Argentina S.A. Class B ordinary shares, nominal value Ps. 1.00 per share 1,009,618,410

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Petrobras Argentina S.A. Yes x No ¨

| † | Petrobras Argentina S.A. is a well-known seasoned issuer as a successor issuer to Petrobras Energía Participaciones S.A., pursuant to Rule 12g-3 of the Securities Exchange Act of 1934. |

If this report is an annual or transitional report, indicate by check mark if the registrant is not required to file reports pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934.

Petrobras Argentina S.A. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days:

Petrobras Argentina S.A. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.495 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Not applicable.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ IFRS ¨ Other x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Petrobras Argentina S.A. Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

| † | Petrobras Argentina S.A. is accelerated filer as a successor issuer to Petrobras Energía Participaciones S.A., pursuant to Rule 12g-3 of the Securities Exchange Act of 1934. |

Indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 ¨ Item 18 x

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Petrobras Argentina S.A. Yes ¨ No x

TABLE OF CONTENTS

NOTE ON MERGER

This Annual Report on Form 20-F has been filed by Petrobras Argentina S.A. (“PESA”) (formerly Petrobras Energía S.A.). On January 30, 2009, separate shareholders’ meetings of Petrobras Energía Participaciones S.A. (“PEPSA”) and PESA approved their merger, pursuant to which PEPSA was merged and absorbed into PESA, the surviving company.

Shareholders of PEPSA have received shares of PESA (in the United States, in the form of American Depositary Receipts) (“ADSs”), and the ADSs of PEPSA have been removed from listing on the New York Stock Exchange (the “NYSE”) and from registration with the U.S. Securities and Exchange Commission (the “SEC”). Following this exchange of shares, ADSs, each representing 10 Class B shares of PESA, have been listed and began trading on the NYSE. PESA is the successor issuer to PEPSA, as contemplated by Rule 12g-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

All references in this Annual Report to:

“Petrobras Argentina”, “Petrobras Energía,” “PESA”, “the Company”, “we,” “us,” “our,” and similar terms refer to Petrobras Argentina S.A. and its subsidiaries, but excludes affiliates and companies under joint control. Prior to July 2003, PESA’s corporate name was Pecom Energía S.A. On March 27, 2009, the shareholders of PESA approved the change of the company’s corporate name from Petrobras Energía S.A. to Petrobras Argentina, S.A. See “Item 4—History and Development.”

“Petrobras Energía Participaciones,” and “PEPSA” refer to Petrobras Energía Participaciones S.A. Prior to July 2003, the corporate name of PEPSA was Pérez Companc S.A.

“Petrobras” refers to Petróleo Brasileiro S.A. – PETROBRAS.

“Argentine pesos”, “pesos” or “Ps.” refer to the currency of the Republic of Argentina.

“U.S. dollars” or “U.S.$” refer to the currency of the United States of America.

“Argentina” refers to the Republic of Argentina, and “Argentine government” refer to the federal government of Argentina.

FORWARD LOOKING STATEMENTS

Some of the information included in this Annual Report contains information that is forward looking, including statements regarding capital expenditures, competition and sales, oil and gas reserves and prospects and trends in the oil and gas, Refining and Distribution, Petrochemicals and electricity industries.

Certain statements contained in this Annual Report are forward-looking statements and are not based on historical facts, such as statements containing the words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” and similar words. These forward-looking statements are subject to risks, uncertainties and assumptions, including those discussed in “Item 3. Key Information—Risk Factors” and elsewhere in this Annual Report. Factors that could cause actual results to differ materially and adversely include, but are not limited to:

| | • | | Changes in general economic, business, political or other conditions in Argentina or changes in general economic or business conditions in other Latin American countries; |

| | • | | The availability of financing at reasonable terms to Argentine companies, such as us; |

| | • | | The failure of governmental authorities to approve proposed measures or transactions described in this Annual Report; |

| | • | | Changes in the price of hydrocarbons and oil products; |

| | • | | Changes to our capital expenditure plans; |

| | • | | Changes in laws or regulations affecting our operations; |

1

| | • | | Other factors discussed under “Risk Factors” in Item 3 of this Annual Report. |

Forward-looking statements speak only as of the date they were made. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all of these factors. In light of these limitations, you should not place undue reliance on forward-looking statements contained in this Annual Report.

2

PART I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

Not applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

3

Item 3. KEY INFORMATION

SELECTED FINANCIAL DATA

The financial information set forth below may not contain all of the financial information that you should consider when making an investment decision. This information should be read in conjunction with, and is qualified in its entirety by reference to, the “Risk Factors” included in this Annual Report. See “Item 3—Risk Factors.” You should also carefully read our financial statements and “Item 5. Operating and Financial Review and Prospects” included in this Annual Report for additional financial information about us.

Our consolidated financial statements are prepared in accordance with regulations of theComisión Nacional de Valores(the Argentine Securities Commission, or “CNV”), and, except for the matters described in Note 3 to our consolidated financial statements, with generally accepted accounting principles in Argentina (as approved by the Professional Council of Economic Sciences of the City of Buenos Aires, or its Spanish acronym “CPCECABA”), or Argentine GAAP. Argentine GAAP differs in certain significant respects from generally accepted accounting principles in the United States, or U.S. GAAP. Note 21 to our financial statements as of and for the fiscal years ended December 31, 2011, 2010 and 2009 (the “audited consolidated financial statements”) provides a description of the principal differences between Argentine GAAP and U.S. GAAP, and Note 22 provides reconciliation to U.S. GAAP of net income, shareholders’ equity and certain other selected financial data.

Consideration of the effects of inflation. Accounting practices

We maintain our statutory financial records in pesos. In addition, we present our audited consolidated financial statements in constant currency following the restatement method established by Technical Resolution No. 6 of the Argentine Federation of Professional Councils in Economic Science (or its Spanish acronym “FACPCE”) and in accordance with CNV General Resolutions No. 415 and 441.

Under such method, the audited consolidated financial statements reflected the effects of the changes in the purchasing power of the Argentine peso through August 31, 1995. Starting September 1, 1995, under CNV General Resolution No. 272, we interrupted the use of this method and maintained the restatements made through such date.

On March 6, 2002, the CPCECABA approved Resolution MD No. 3/2002 providing, among other things, the reinstatement of the adjustment-for-inflation method for the interim periods or years ended after March 31, 2002, allowing for the accounting measurements restated based on the change in the purchasing power of the Argentine peso through the interruption of adjustments, such as those whose original date is within the stability period, to be stated in Argentine pesos as of December 2001. Through General Resolution No. 415 dated July 25, 2002, the CNV requires that the information related to the financial statements that are to be filed after the date on which the regulation became effective be disclosed adjusted for inflation.

On March 25, 2003, the PEN issued Decree No. 664 establishing that the financial statements for years ending as from such date be filed in nominal currency. Consequently, and under CNV Resolution No. 441, we no longer applied inflation accounting as from March 1, 2003.

According to inflation data published by theInstituto Nacional de Estadística y Censos (the national statistics and census institute, or “INDEC”), from 2007 to 2011, the Argentine consumer price index increased 8.5%, 7.2%, 7.7%, 10.9% and 9.5%, respectively; and the wholesale price index increased 14.4%, 8.8%, 10.3%, 14.5% and 12.7%, respectively. Notwithstanding the above mentioned, reports published by the International Monetary Fund (the “IMF”) state that their staff is also using alternative measures of inflation for macroeconomic surveillance, including data produced by private sources, which have shown inflation rates considerably higher than those issued by the INDEC since 2007. The IMF has called on Argentina to adopt remedial measures to address the quality of official data.

Inflation could also affect the comparability among the different periods presented herein.

Information presented in US GAAP does not include any adjustment to eliminate the effects of inflation required under Argentina GAAP, as they are also permitted by Regulation S-X of the SEC.

Proportional consolidation of companies under which we exercise joint control

In accordance with the procedure set forth in Technical Resolution No. 21 of the FACPCE , we have consolidated our financial statements line by line on a proportional basis with the companies in which we exercise joint control (other than Compañía Inversora en Transmisión Eléctrica Citelec S.A., or “Citelec”, which we sold on July 19, 2007). See “Item 5—Proportional Consolidation and Presentation of Discussion.” In the consolidation of companies over which we exercise joint control, the amount of the investment in the companies under joint control and the interest in their income (loss) and cash flows are replaced by our proportional interest in the subsidiaries assets, liabilities and income (loss) and cash flows. In addition, related party receivables, payables and transactions within the consolidated group and companies under joint control are eliminated on a pro rata basis pursuant to our ownership share in that company.

4

New accounting standards – Adoption of IFRS for Fiscal year ending December 31, 2012

On December 30, 2009, the CNV issued General Resolution No. 562/09 providing for the application of Technical Resolution No.26 of the FACPCE which adopts, for certain entities admitted to the public offering regime under Law No. 17,811, whether by reason of the public offering of their shares or corporate bonds, or of their having requested authorization to be admitted to the above referenced regime, the international financial reporting standards (“IFRS”) issued by the International Accounting Standards Board (IASB). The Company will be required to adopt such standards as from fiscal year beginning January 1, 2012.

On April 13, 2010, the Company´s board of directors (the “Board of Directors”) approved an implementation plan for adoption of such accounting standards.

In compliance with the requirements of General Resolution No. 562/09, as amended, and after reviewing the Company’s implementation plan in connection with the adoption of IFRS, as of December 31, 2011 the Board has not become aware of circumstances requiring changes to the before mentioned plan or indicating deviation from the established goals and dates.

Pursuant to CNV General Resolution No. 562/09, as supplemented, the Company’s financial statements for fiscal years starting as from January 1, 2012 shall be prepared in accordance with Technical Resolution No. 26 of the FACPCE providing for the adoption of IFRS.

Accordingly, the first annual and interim financial statements to be prepared by the Company in accordance with IFRS will be those for fiscal year ending December 31, 2012 and the three-month period ended March 31, 2012, respectively.

As of the date of this Annual Report, the Company has complied with the specific implementation plan. The effects of adopting IFRS and reconciliation between Argentine GAAP and IFRS are set forth in Note 20 to our audited consolidated financial statements.

Notwithstanding the above mentioned, information presented under IFRS in Note 20 is for illustrative purposes only and subject to change. The amounts under IFRS will only be final when Petrobras Argentina issues its consolidated financial statements for 2012, the year in which it adopts IFRS for the first time in accordance with CNV resolutions.

U.S. GAAP Information

The effects of inflation accounting and the proportional consolidation of Distrilec Inversora S.A. (“Distrilec”) (for all years presented) or Petrobras de Valores Internacional de España S.L. (“PVIE”) (for the years ended December 31, 2007 and 2008 and for the three months ended March 31, 2009), jointly controlled companies under Argentine GAAP, have not been reversed in the reconciliations to U.S. GAAP.

The proportional consolidation of Compañía de Inversiones de Energía S.A. (“CIESA”), for the years ended December 31, 2011, 2010, 2009, 2008 and 2007 under Argentine GAAP, has been reversed in the U.S. GAAP information. This reversal was due to (1) CIESA having negative shareholders’ equity for each of those five years for purposes of U.S. GAAP, and (2) our not having assumed commitments to make capital contributions or to provide financial assistance to CIESA, which caused our interests in CIESA to be valued at zero.

5

The following tables set forth selected financial data (including data for joint control companies consolidated under the proportional consolidation method), as of and for the years ended December 31, 2011, 2010, 2009, 2008, and 2007.

Petrobras Argentina S.A.—Income Statement Data

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | (in millions of pesos, except for per share amounts and number of shares or as otherwise indicated) | |

Argentine GAAP: | | | | | | | | | | | | | | | | | | | | |

Net sales | | | 14,278 | | | | 14,442 | | | | 11,972 | | | | 15,175 | | | | 13,458 | |

Cost of sales | | | (11,025 | ) | | | (10,806 | ) | | | (8,858 | ) | | | (11,000 | ) | | | (10,111 | ) |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 3,253 | | | | 3,636 | | | | 3,114 | | | | 4,175 | | | | 3,347 | |

Administrative and selling expenses | | | (1,708 | ) | | | (1,746 | ) | | | (1,668 | ) | | | (1,758 | ) | | | (1,465 | ) |

Exploration expenses | | | (391 | ) | | | (190 | ) | | | (336 | ) | | | (238 | ) | | | (172 | ) |

Other operating expenses, net | | | (560 | ) | | | (258 | ) | | | (192 | ) | | | (231 | ) | | | (177 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 594 | | | | 1,442 | | | | 918 | | | | 1,948 | | | | 1,533 | |

Equity in earnings of affiliates | | | 223 | | | | 156 | | | | 210 | | | | 305 | | | | 176 | |

Financial expenses and holding losses, net | | | (317 | ) | | | (401 | ) | | | (701 | ) | | | (782 | ) | | | (495 | ) |

Other (expenses) income, net | | | 189 | | | | (357 | ) | | | 1,288 | | | | (117 | ) | | | 139 | |

| | | | | | | | | | | | | | | | | | | | |

Income before income tax and minority interest in subsidiaries | | | 689 | | | | 840 | | | | 1,715 | | | | 1,354 | | | | 1,353 | |

Income tax | | | 7 | | | | (201 | ) | | | (726 | ) | | | (508 | ) | | | (503 | ) |

Minority interest in subsidiaries | | | 8 | | | | (29 | ) | | | (64 | ) | | | (70 | ) | | | (88 | ) |

| | | | | | | | | | | | | | | | | | | | |

Net income | | | 704 | | | | 610 | | | | 925 | | | | 776 | | | | 762 | |

| | | | | | | | | | | | | | | | | | | | |

Basic/diluted earnings per share | | | 0.697 | | | | 0.604 | | | | 0.916 | | | | 0.769 | | | | 0.755 | |

Number of shares outstanding (in millions): | | | | | | | | | | | | | | | | | | | | |

Class B | | | 1,010 | | | | 1,010 | | | | 1,010 | | | | 1,010 | | | | 1,010 | |

| | | | | |

U.S. GAAP: | | | | | | | | | | | | | | | | | | | | |

Net sales | | | 12,178 | | | | 11,036 | | | | 8,558 | | | | 10,994 | | | | 9,469 | |

Operating income (loss) | | | (196 | ) | | | 420 | | | | 287 | | | | 704 | | | | 64 | |

Income (loss) from continuing operations | | | (121 | ) | | | 265 | | | | (6 | ) | | | 187 | | | | (458 | ) |

Income (loss) from discontinued operations | | | 71 | | | | 268 | | | | 102 | | | | 247 | | | | 434 | |

Net income (loss) | | | (50 | ) | | | 533 | | | | 96 | | | | 434 | | | | (24 | ) |

Basic/diluted net income (loss) per share | | | | | | | | | | | | | | | | | | | | |

Income (loss) from continuing operations | | | (0.120 | ) | | | 0.262 | | | | (0.006 | ) | | | 0.185 | | | | (0.453 | ) |

Income (loss) from discontinued operations | | | 0.070 | | | | 0.265 | | | | (0.101 | ) | | | 0.245 | | | | 0.430 | |

6

Petrobras Argentina S.A.—Balance Sheet Data

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| | | (in millions of pesos, except for per share amounts and number of shares or as otherwise indicated) | |

Argentine GAAP: | | | | | | | | | | | | | | | | | | | | |

Consolidated Balance Sheet | | | | | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | | | | | |

Current assets | | | | | | | | | | | | | | | | | | | | |

Cash | | | 247 | | | | 581 | | | | 327 | | | | 492 | | | | 98 | |

Investments | | | 1,563 | | | | 2,325 | | | | 1,243 | | | | 989 | | | | 1,094 | |

Trade receivables | | | 2,224 | | | | 1,824 | | | | 1,792 | | | | 1,635 | | | | 1,605 | |

Other receivables | | | 1,089 | | | | 1,802 | | | | 2,467 | | | | 1,595 | | | | 2,659 | |

Inventories | | | 1,001 | | | | 1,099 | | | | 1,011 | | | | 1,536 | | | | 996 | |

Other assets | | | 52 | | | | 142 | | | | 269 | | | | 5 | | | | — | |

| | | | | | | | | | | | | | | | | | | | |

Total current assets | | | 6,176 | | | | 7,773 | | | | 7,109 | | | | 6,252 | | | | 6,452 | |

Non-current assets | | | | | | | | | | | | | | | | | | | | |

Trade receivables | | | 244 | | | | 230 | | | | 202 | | | | 154 | | | | 228 | |

Other receivables | | | 1,475 | | | | 446 | | | | 790 | | | | 522 | | | | 657 | |

Inventories | | | 98 | | | | 81 | | | | 82 | | | | 95 | | | | 100 | |

Investments | | | 3,400 | | | | 3,351 | | | | 3,709 | | | | 3,477 | | | | 3,270 | |

Property, plant and equipment | | | 10,726 | | | | 10,789 | | | | 11,128 | | | | 12,556 | | | | 10,609 | |

Other assets | | | 51 | | | | 89 | | | | 63 | | | | 35 | | | | 41 | |

| | | | | | | | | | | | | | | | | | | | |

Total non-current assets | | | 15,994 | | | | 14,986 | | | | 15,974 | | | | 16,839 | | | | 14,905 | |

| | | | | | | | | | | | | | | | | | | | |

Total assets | | | 22,170 | | | | 22,759 | | | | 23,083 | | | | 23,091 | | | | 21,357 | |

| | | | | | | | | | | | | | | | | | | | |

Liabilities | | | | | | | | | | | | | | | | | | | | |

Current liabilities | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | | 1,976 | | | | 1,926 | | | | 1,607 | | | | 1,873 | | | | 1,728 | |

Short-term debt | | | 856 | | | | 1,285 | | | | 2,508 | | | | 2,445 | | | | 1,922 | |

Payroll and social security taxes | | | 312 | | | | 270 | | | | 260 | | | | 351 | | | | 261 | |

Taxes payable | | | 359 | | | | 503 | | | | 415 | | | | 463 | | | | 280 | |

Reserves | | | 160 | | | | 162 | | | | 124 | | | | 125 | | | | 124 | |

Other liabilities | | | 1,202 | | | | 960 | | | | 575 | | | | 530 | | | | 305 | |

| | | | | | | | | | | | | | | | | | | | |

Total current liabilities | | | 4,865 | | | | 5,106 | | | | 5,489 | | | | 5,787 | | | | 4,620 | |

Non-current liabilities | | | | | | | | | | | | | | | | | | | | |

Accounts payable | | | 190 | | | | 171 | | | | 161 | | | | 136 | | | | 179 | |

Long-term debt | | | 3,137 | | | | 4,257 | | | | 4,590 | | | | 5,152 | | | | 5,430 | |

Payroll and social security taxes | | | 166 | | | | 125 | | | | 111 | | | | 73 | | | | 60 | |

Taxes payable | | | 1,066 | | | | 1,102 | | | | 1,451 | | | | 1,501 | | | | 1,428 | |

Reserves | | | 290 | | | | 167 | | | | 136 | | | | 119 | | | | 86 | |

Other Liabilities | | | 1,325 | | | | 868 | | | | 587 | | | | 494 | | | | 307 | |

| | | | | | | | | | | | | | | | | | | | |

Total non-current liabilities | | | 6,174 | | | | 6,690 | | | | 7,036 | | | | 7,475 | | | | 7,490 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities | | | 11,039 | | | | 11,796 | | | | 12,525 | | | | 13,262 | | | | 12,110 | |

| | | | | | | | | | | | | | | | | | | | |

Minority interest in subsidiaries | | | 760 | | | | 989 | | | | 969 | | | | 882 | | | | 817 | |

Total Shareholders’ Equity | | | 10,371 | | | | 9,974 | | | | 9,589 | | | | 8,947 | | | | 8,430 | |

| | | | | | | | | | | | | | | | | | | | |

Total liabilities and shareholders’ equity | | | 22,170 | | | | 22,759 | | | | 23,083 | | | | 23,091 | | | | 21,357 | |

| | | | | | | | | | | | | | | | | | | | |

Capital Stock | | | 1,010 | | | | 1,010 | | | | 1,010 | | | | 1,010 | | | | 1,010 | |

| | | | | | | | | | | | | | | | | | | | |

U.S. GAAP: | | | | | | | | | | | | | | | | | | | | |

Total assets | | | 18,687 | | | | 19,772 | | | | 20,161 | | | | 20,502 | | | | 19,343 | |

Shareholders’ equity | | | 10,033 | | | | 9,864 | | | | 9,537 | | | | 8,886 | | | | 8,689 | |

7

EXCHANGE RATES

From April 1, 1991 until the end of 2001, Law No. 23,928 and Decree No. 529/91 (together, the “Convertibility Law”) established a fixed exchange rate under which theBanco Central de la República Argentina(the central bank of Argentina, the “Central Bank”) was obliged to sell U.S. dollars at a fixed rate of one peso per U.S. dollar. On January 6, 2002, the Argentine Congress enacted the Public Emergency and Foreign Exchange System Reform Law No. 25,562 (the “Public Emergency Law”), which suspended certain provisions of the Convertibility Law, including the fixed exchange rate of Ps. 1 to U.S.$1, and granted the Argentine government the power to set the exchange rate between the peso and foreign currencies and to issue regulations related to the foreign exchange market. Following a brief period during which the Argentine government established a temporary dual exchange rate system, pursuant to the Public Emergency Law, the peso was allowed to float freely against other currencies since February 2002.

The following table sets forth the annual high, low, average and period-end exchange rates for the periods indicated, expressed in Argentine pesos per U.S. dollar and not adjusted for inflation. There can be no assurance that the Argentine peso will not depreciate or appreciate again in the future. The Federal Reserve Bank of New York does not report a noon buying rate for pesos.

| | | | | | | | | | | | | | | | |

| | | Argentine peso per U.S. dollar | |

| | | High | | | Low | | | Average (1) | | | Period-end | |

Year ended December 31, | | | | | | | | | | | | | | | | |

| | | | |

2011 | | | 4.30 | | | | 3.97 | | | | 4.13 | | | | 4.30 | |

2010 | | | 3.99 | | | | 3.79 | | | | 3.91 | | | | 3.98 | |

2009 | | | 3.85 | | | | 3.45 | | | | 3.73 | | | | 3.80 | |

2008 | | | 3.47 | | | | 2.98 | | | | 3.16 | | | | 3.45 | |

2007 | | | 3.18 | | | | 3.06 | | | | 3.12 | | | | 3.15 | |

| | | | |

Month: | | | | | | | | | | | | | | | | |

| | | | |

April 2012 | | | 4.42 | | | | 4.32 | | | | 4.36 | | | | 4.42 | |

March 2012 | | | 4.38 | | | | 4.34 | | | | 4.36 | | | | 4.38 | |

February 2012 | | | 4.36 | | | | 4.33 | | | | 4.35 | | | | 4.36 | |

January 2012 | | | 4.34 | | | | 4.30 | | | | 4.32 | | | | 4.34 | |

| (1) | The figures provided represent the average of the exchange rates at the close of trading on each business day during the relevant period. |

8

EXCHANGE CONTROLS

Prior to December 1989, the Argentine foreign exchange market was subject to exchange controls. From December 1989 until April 1991, Argentina had a freely floating exchange rate for all foreign currency transactions, and the transfer of dividend payments in foreign currency abroad and the repatriation of capital were permitted without prior approval of the Central Bank. From April 1, 1991, when the Convertibility Law became effective, until December 21, 2001, when the Central Bank decided to close the foreign exchange market, the Argentine currency was freely convertible into U.S. dollars.

On December 3, 2001, the Argentine government imposed a number of monetary and currency exchange control measures through Decree No. 1,570/01, which included restrictions on the free disposition of funds deposited with banks and tight restrictions on transferring funds abroad without the Central Bank’s prior authorization subject to specific exceptions for transfers related to foreign trade. The Central Bank has gradually eased these restrictions with a view to gradually normalizing the domestic exchange market, and as a result, most restrictions relating to the repayment of foreign creditors and the payment of dividends to foreign shareholders have been lifted. In June 2003 the Argentine government set restrictions on capital flows into Argentina, which mainly consisted of a prohibition against the transfer abroad of any funds until 180 days after their entry into the country.

Furthermore, in June 2005, through Decree No. 616/05, the Argentine government established further restrictions on capital flows into Argentina, including increasing the period that certain incoming funds must remain in Argentina to 365 calendar days and requiring that 30% of such incoming funds be deposited with a bank in Argentina in a non-transferable, non-interest bearing account for 365 calendar days. Export and import financing operations, as well as primary public offerings of corporate bonds listed on self-regulated markets, among others, are exempt from the foregoing provision.

On October 26, 2011, the Argentine government issued Decree No. 1,722/11 providing that all foreign currency revenues obtained from exports made by mining and oil and gas companies must be repatriated and sold within the local foreign exchange market, which is the general regime applicable to revenues generated by Argentine exports. Prior to the issuance of Decree No. 1,722/11, companies engaged in the hydrocarbon exploration and development benefited from a special regime that allowed them to retain overseas up to 70% of the proceeds of certain exports. See “item 3 – Risk Factors—Exchange controls in Argentina may impair our ability to service our foreign currency-denominated debt obligations and pay dividends.”

9

RISK FACTORS

Factors Relating to Argentina

Political and economic instability in Argentina has affected and may continue to adversely affect our financial condition and results of operations.

We are an Argentine corporation (sociedad anónima). As of December 31, 2011, approximately 84% of our total assets, 94% of our net sales, 87% of our combined crude oil and gas production and 84% of our proved oil and gas reserves were located in Argentina. Fluctuations in the Argentine economy and actions adopted by the Argentine government have had and may continue to have a significant impact on Argentine companies, including us. Specifically, we have been affected and may continue to be affected by inflation, interest rates, the value of the peso against foreign currencies, increasingly burdensome foreign exchange and price controls, regulatory policies, business and tax regulations and in general by the political, social and economic scenario in Argentina and in other countries that may affect Argentina.

The Argentine economy has experienced significant volatility in recent decades, characterized by periods of low or negative growth, high and variable levels of inflation and currency devaluation.

During 2001 and 2002, Argentina went through a period of severe political, economic and social crisis. See “Item 4—Business Overview—Our Principal Market.” The crisis had significant and adverse consequences on our company, including (i) losses derived from the effects of the peso devaluation on our affiliates and our affiliates’ net borrowing position, which primarily was denominated in U.S. dollars, (ii) the impairment of the book value of certain gas areas and tax assets due to material changes in the prospects of our operations, (iii) a decrease in U.S. dollar cash flows due to the imposition of export taxes, (iv) limits on the availability in the financial market to renew our short-term lines of credit and the current portion of our medium and long-term financings at maturity and (v) restrictions on our ability to pass through the effects of inflation to the prices of products sold by us in the domestic market. In 2002, we reported a significant net loss and our liquidity was adversely affected. Within this context and in order to secure compliance with our financial commitments, we reduced our investment plan and reached an agreement with our financial creditors and holders of notes to extend the maturity profile of a substantial portion of our debt, at face value. As a result, capital expenditures in 2002, net of divestments, totaled only Ps. 139 million, a relatively low amount compared to our historical average investment.

Following the 2001 crisis, the Argentine economy experienced a strong recovery. During 2008 and 2009, however, the Argentine economy suffered a new deceleration of activity caused by local and external factors, including an extended drought and effects from a global economic crisis. Real Gross Domestic Product (“GDP”) growth recovered in 2010 and 2011, at annual rates of 9% according to the Ministry of Economy and Production (the “Ministry of Economy”). Nevertheless, uncertainty remains as to whether Argentina´s long-term growth will not be adversely affected by continued inflationary pressures, the loss of competitiveness and the lack of a legal framework that is suitable to attract foreign investments.

We cannot provide any assurance that future economic, social and political developments in Argentina, over which we have no control, will not adversely affect our financial condition or results of operations, including our ability to pay our debts at maturity or dividends.

The Argentine economy has been adversely affected by economic developments in other markets.

Financial and securities markets in Argentina are influenced by economic and market conditions in other markets worldwide. Although economic conditions vary from country to country, investors’ perceptions of events occurring in one country may substantially affect capital flows into and investments in securities from issuers in other countries, including Argentina. Furthermore, the Argentine economy has been affected by events in developed economies which are trading partners or that impact the global economy. Consequently, there can be no assurance that the Argentine financial system and securities markets will not continue to be adversely affected by events in developed countries’ economies or events in other emerging markets. This could adversely affect our results of operations and financial condition.

A lack of financing for Argentine companies, whether due to government regulation or market forces, may negatively impact the execution of our strategic business plan.

The prospects for Argentine companies of accessing financial markets might be limited in terms of the amount of financing available, and the conditions and cost of such financing. The default on the Argentine sovereign debt at the end of 2001, the global economic crisis that started in the fourth quarter of 2008 and the resulting international stock market crash and the insolvency of major financial institutions toward the end of 2008, have limited the ability of Argentine companies to access international financial markets as they have in the past. Since June 2009, a greater number of Argentine companies have gained access to the international capital markets, albeit at conditions more onerous than competitors based in other countries in the region.

10

Our ability to execute and carry out our strategic business plan depends upon our ability to obtain financing at a reasonable cost and on reasonable terms. In recent years, we have regularly obtained financing from the private pension fund system in Argentina, which has been a significant purchaser of our debt and shares. However, in November 2008 the Argentine National Congress passed a law eliminating the private pension system, mandating that funds administered by the private Retirement and Pension Funds Administrators (the “AFJP”), be transferred to a new administrator, the National Social Security Administration (Administración Nacional de la Seguridad Social, the “ANSES”). Because the private pension funds until that moment had been major institutional investors in the Argentine capital markets, the transfer of their assets to a state-run administrator has led to a decline in liquidity in the local capital markets, and may limit the sources of financing for Argentine companies, including us. If we are unable to gain access to international or local financial markets to refinance our indebtedness at reasonable cost and on reasonable terms, we may have to reduce our projected capital expenditures, which, in turn, may negatively affect the implementation of our business plan.

Fluctuations in the value of the peso may adversely affect the Argentine economy, our financial condition and the results of operations.

The value of the peso has fluctuated significantly in the past and may do so in the future. Since the end of the Ps.1.00 to U.S.$1.00 parity in January 2002, the peso has fluctuated significantly in value. As a result, the Central Bank has taken several measures to stabilize the exchange rate. The marked devaluation of the peso in 2002 had a negative impact on the ability of the Argentine government and companies to honor their foreign currency-denominated debt, led to very high inflation initially and had a negative impact on businesses whose success depends on domestic market demand, including public utilities.

The significant peso devaluation during 2002 adversely affected our results of operations and financial condition. Substantially all of our financial debt and a significant portion of our affiliates’ debt were denominated in U.S. dollars. Before the enactment of the Public Emergency Law in January 2002, our cash flow, generally denominated in U.S. dollars or dollar-adjusted, provided a natural hedge against exchange rate risks. The Argentine regulatory framework after the enactment of the Public Emergency Law (which included the pesification of utility rates, regulatory issues related to the renegotiation of pesified utility rates, new taxes on hydrocarbon exports, and the implementation of regulations to prevent an increase in prices to final users in the domestic market and restrictions on exports), however, limited our ability to hedge the impact of the peso devaluation.

If the peso devalues significantly, all of the negative effects on the Argentine economy related to such devaluation could recur, with adverse consequences to our business. Furthermore, a substantial increase in the value of the peso against the U.S. dollar also presents risks for the Argentine economy since it may lead to a deterioration of the country’s current account balance and the balance of payments.

We are unable to predict the future value of the peso against the U.S. dollar and how any fluctuations may affect the demand of our products and services. Moreover, the Argentine government may introduce regulatory changes that prevent or limit us from offsetting the risk derived from our exposure to the U.S. dollar and, if so, we cannot predict the impact of these changes on our financial condition and results of operations. See “Item 3 – Exchange Rates”

Inflation may escalate and undermine economic growth in Argentina and adversely affect our financial condition and results of operations.

In the past, inflation has undermined the Argentine economy and the government’s ability to stimulate economic growth. During 2002, the Argentine consumers price index increased by 41%, and the wholesale price index increased by 118.2%. This inflation reflected both the effect of the peso devaluation on production costs and a significant change in relative prices, which was partially offset by the elimination of rate adjustments and a strong drop in demand as a result of the recession. According to inflation data published by the National Statistics Institute, in 2003, the rate of inflation decreased significantly, a 3.7% increase in the consumer price index and a 2.0% increase in the wholesale price index.

In addition, according to inflation data published by the INDEC, from 2007 to 2011, the Argentine consumer price index increased 8.5%, 7.2%, 7.7%, 10.9% and 9.5%, respectively; and the wholesale price index increased 14.4%, 8.8%, 10.3%, 14.5% and 12.7%, respectively. Notwithstanding the above mentioned, reports published by the IMF state that their staff is also using alternative measures of inflation for macroeconomic surveillance, including data produced by private sources, which have shown inflation rates considerably higher than those issued by the INDEC since 2007. The IMF has called on Argentina to adopt remedial measures to address the quality of official data.

11

Uncertainty surrounding future inflation may result in slowed economic activity and reduced growth. A high inflation environment could also undermine Argentina’s foreign competitiveness by diluting the effects of the peso devaluation, with negative effects on the level of economic activity and employment. Sustained inflation in Argentina, without a corresponding increase in the price paid by consumers for our products in the local market would have a negative effect on our results of operations and financial condition. We cannot estimate how our activities and results of operations will be affected by inflation in the future.

Exchange controls in Argentina may impair our ability to service our foreign currency-denominated debt obligations and pay dividends.

After December 2001, the Argentine authorities implemented a number of monetary and currency exchange control measures that included restrictions on the withdrawal of funds deposited with banks, the obligation to deposit foreign currency from exports with the Central Bank, restrictions on the transfers of funds abroad as well as restrictions relating to the servicing of foreign debt. The Central Bank has since issued a number of regulations aimed at gradually normalizing the domestic exchange market and, as a result, most restrictions in connection with the repayment of foreign creditors and the payment of dividends to foreign shareholders have been lifted. Nevertheless, certain exchange controls, including those imposed on foreign loans to the Argentine private sector, remain in place, with related requirements concerning the term of such loans, their denomination and transferability. See “Item 3— Exchange Rates—Exchange controls,” and “Item 5—Description of Indebtedness.”

On October 26, 2011, the Argentine government issued Decree No. 1,722/11 providing that all foreign currency revenues obtained from exports made by mining and oil and gas companies must be repatriated and sold within the local foreign exchange market, which is the general regime applicable to export revenues generated by Argentine exports. Prior to the issuance of Decree No. 1,722/11, companies engaged in the hydrocarbon exploration and development benefited from a special regime that allowed them to retain overseas up to 70% of the proceeds of certain exports.

In a further attempt to ease the pressure on the dollar and decrease the outflow of the Central Bank’s foreign currency reserves, through Resolution No. 36,162/11 of theSuperintendencia de Seguros de la Nación, dated October 26, 2011, the Argentine government ordered insurance companies to repatriate their foreign investments.

The Argentine government may impose additional exchange controls, which may adversely affect the Company´s ability to pay principal or interest payments on its debt when it becomes due or to pay dividends. See “item 3 – Risk Factors—Exchange controls in Argentina may impair our ability to service our foreign currency-denominated debt obligations and pay dividends,” “Item 3—Exchange Rates—Exchange controls” and “Item 5—Description of Indebtedness.”

Factors Relating to Our Business

Substantial or extended declines and volatility in the prices of crude oil, oil products and natural gas may have an adverse effect on our results of operations and financial condition.

A significant amount of our revenue is derived from sales of crude oil, oil products and natural gas. Factors affecting international prices for crude oil and related oil products include: political developments in crude oil producing regions, particularly in the Middle East; the ability of the Organization of Petroleum Exporting Countries (“OPEC”) and other crude oil producing nations to set and maintain crude oil production levels and prices; global and regional supply and demand for crude oil; competition from other energy sources; domestic and foreign government regulations; weather conditions and global conflicts or acts of terrorism. We have no control over these factors. Changes in crude oil prices generally result in changes in prices for related products. International oil prices have fluctuated widely over the last ten years.

Substantial or extended declines in international prices of crude oil and related oil products may have a material adverse effect on our business, results of operations and financial condition, and the value of our proved reserves. In addition, significant decreases in the prices of crude oil and related oil products may cause us to reduce or alter the timing of our capital expenditures, and this could adversely affect our production forecasts in the medium term and our reserve estimates in the future.

12

Argentine oil and gas production concessions and exploration permits are subject to certain conditions and may not be renewed or could be revoked.

The Hydrocarbons Law provides for oil and gas concessions to remain in effect for 25 years as from the date of their award, and further provides for the concession term to be extended for up to 10 additional years, subject to terms and conditions approved by the grantor at the time of the extension. The authority to extend the terms of current and new permits, concessions and contracts has been vested with the government of the province in which the relevant area is located (and the Argentine government in respect of offshore areas beyond 12 nautical miles). In order to be eligible for the extension, any concessionaire and permit holder must have complied with its obligations under the Hydrocarbons Law and the terms of the particular concession or permit, including evidence of payment of taxes and royalties, the supply of the necessary technology, equipment and labor force and compliance with various environmental, investment and development obligations. Under the Hydrocarbons Law, non-compliance with these obligations and standards may also result in the imposition of fines and in the case of material breaches, following the expiration of applicable cure periods, the revocation of the concession or permit. We cannot provide assurances that concessions that have not yet been renewed will be extended or that additional investment, royalty payment or other requirements will not be imposed on us in order to obtain extensions. See “item 4—Business Overview – Oil and Gas Exploration and Production—Statistical Information Relating to Oil and Gas Production.”

On April 4, 2012, the Company received notice of the decision by the government of the Province of Neuquén to terminate the concession for the Veta Escondida area. Within this context, the Company will enforce its rights regarding this reversal by the Province of Neuquén. A number of provincial governments have also recently revoked certain of YPF S.A.´s (“YPF”) concessions for lack of investment.

The termination or revocation of, or failure to obtain the extension of, additional concessions or permits could have a material adverse effect on our business and results of operations. See “Item 4—Regulation of Our Business.”

Our crude oil and natural gas reserves estimates involve some degree of uncertainty which could adversely affect our ability to generate income.

The proved crude oil and natural gas reserves set forth in this Annual Report account for our estimated quantities of crude oil, natural gas and natural gas liquids that geological and engineering data demonstrate with reasonable certainty to be recoverable from known reservoirs under existing economic and operating conditions according to applicable regulations. Our proved developed crude oil and natural gas reserves are those that can be expected to be recovered through existing wells with existing equipment and operating methods. See “Item 4—Oil and Gas Exploration and Production—Reserves.”

Proved reserve estimates could be materially different from the quantities of crude oil and natural gas that are ultimately recovered, and downward revisions of our estimates could impact our future results of operations and business plan, including our level of capital expenditures.

We may not be able to replace our oil and gas reserves and this may have an adverse impact on our future results of operations and financial condition.

In recent years, we have experienced a decline in reserves and production, including as a result of the sale of our interest in PVIE, new regulations in Bolivia which prevent us from accounting for reserves (see “Item 4— Business Overview—Reserves—Internal Control over Proved Reserves”) as well as our decision of not to migrate to service contracts for Block 18 and Palo Azul Unified Field in Ecuador. The possibility of replacing our crude oil and gas reserves in the future is dependent on our ability to access new reserves, both through successful exploration and reserve acquisitions. We consider exploration, which carries inherent risks and uncertainties, our main vehicle for future growth and reserves replacement.

Without successful exploration activities or reserve acquisitions, our proved reserves will decline as our oil and gas production will be forced to rely on our current portfolio of assets.

We cannot guarantee that our exploration, development and acquisition activities will allow us to offset the decline of our reserves. If we are not able to successfully find, develop or acquire additional reserves, our reserves and therefore our production may continue to decline and, consequently, this may adversely affect our future results of operations and financial condition.

13

The Argentine government has intervened in the oil and gas industry in the past, and is likely to continue to intervene.

To address the Argentine crisis of 2001 and 2002, the Argentine Congress enacted the Public Emergency Law and other emergency regulations, some of which continue in effect to date. Some of these regulations introduced a number of material changes to the regulatory framework applicable to the oil and gas industry in Argentina, and to other industries on which the Company´s affiliates are active, like the electricity industry.

As of the date of this Annual Report, the Public Emergency Law is still in effect. In addition, the Argentine government continues to introduce material changes to the regulatory regime applicable to the oil and gas industry, such as the recent revocation of thePetróleo Plus(“Oil Plus”) andRefinación Plus(“Refining Plus”) programs, or the obligation to repatriate and sell in the local market 100% of the foreign currency revenues obtained from oil and gas exports.

On April 16, 2012, the Argentine government, through Decree No. 530/12, removed YPF´s senior officers and empowered a government interventor of YPF for a period of 30 days with immediate effect. On May 3, 2012 the Argentine Congress enacted Law No. 26,741 for the expropriation of 51% of YPF´s Class D shares, out of the shares currently held by Repsol YPF S.A. (Spain), and 51% of Repsol YPF GAS S.A., represented by 60% of its Class A shares then held by Repsol Butano S.A. (Spain). Additionally, Law No. 26,741 declares that hydrocarbons self-sufficiency, as well as their production, industrialization, transport and marketing, are activities of public interest and primary goals of Argentina, empowering the Argentine government to take the necessary measures to achieve such goals.

The Company has a number of areas under concession held jointly with YPF, as well as joint ownership of some affiliates. The Argentine government´s expropriation of a majority of shares in YPF and intervention in YPF´s business could adversely affect our business, financial condition and results of operations.

We cannot assure that these or other measures that may be adopted by the Argentine government will not have a material adverse effect on our business, financial condition or results of operations.

Limits on exports of hydrocarbons and related oil products have affected and may continue to affect our results of operations.

In recent periods, the Argentine government has introduced a series of measures limiting exports of hydrocarbons and related oil products, which have prevented us from profiting from higher prices of these commodities in the international markets, and materially affected our competitiveness and results of operations.

In April 2004, to facilitate the recovery of natural gas prices, the Argentine Secretary of Energy (the “SE”) entered into an agreement with natural gas producers requiring them to sell a specified amount of gas in the local regulated market. During 2006, the SE required producers to redirect gas earmarked for export to supply local thermal power plants and gas distribution companies. In January 2007, the SE confirmed that the ability to export hydrocarbons would be subject to the satisfaction of domestic demand and that export would have to be authorized on a case-by-case basis by the SE. These measures prevent us from benefiting from higher margins in the international markets. In 2007, upon the expiration of the aforementioned agreement, the Argentine government and producers signed a new agreement effective until 2011 aimed at securing the domestic supply of gas.

Under these agreements, temporary limits on certain natural gas exports have been imposed to avoid a crisis in the local supply of natural gas, depriving us of higher margins in the international markets.

Pursuant to SE Resolution No. 1679/04, since December 2004, producers must obtain the approval of the Argentine government prior to exporting crude oil or diesel oil. To obtain this approval, exporters must demonstrate that they have either satisfied local demand requirements or have granted the domestic market the opportunity to acquire oil or diesel oil under terms similar to current domestic market prices and, in the case of diesel oil, they must also demonstrate, if applicable, that commercial terms offered to the domestic market are at least equal to those offered to their own gas station network. Furthermore, in December 2006, pursuant to SE Resolution No. 1338/06, the SE extended these regulations to the export of gasoline, fuel oil and fuel oil mixtures, diesel oil, aero kerosene, jet fuel, lubricants, asphalts, coke and by-products for use in the petrochemical industry. In January 2008 the Argentine government temporarily prohibited the exports of gasoline and diesel oil until the domestic market was fully supplied at the prices in force on October 31, 2007.

14

These restrictions may significantly and adversely affect the profitability of our operations, preventing us from capturing the upside of export prices, and negatively impacting the total volume of refined products sold in the domestic market, due to our need to manage crude oil volumes processed in accordance with our storage capacity.

We cannot assure you that the Argentine government will not increase export restrictions on hydrocarbons and related oil products. If it were to do so, our financial condition and results of operations could be adversely affected.

Export taxes on our products have negatively affected, and may continue to negatively affect, the profitability of our operations.

On March 1, 2002, the Argentine government imposed a withholding tax on exports of hydrocarbons, initially lasting five years. This tax framework has prevented us from benefiting from significant increases in international prices for oil, oil related products and natural gas, hindered us from offsetting sustained increases in costs endemic to the energy industry, and materially affected our competitiveness and results of operations. Effective November 2007, the Ministry of Economy adopted a more onerous method for calculating withholding taxes on exports of crude oil and certain oil by-products. See “Item 5—Factors affecting our consolidated results of operations—Regulations of the Energy Industry in Argentina—Withholding Taxes on Exports.”

We cannot assure you that the Argentine government will reduce current export tax rates or will not increase them further. We cannot predict the impact that any changes may have on our results of operations and financial condition.

Limitations on local pricing in Argentina may adversely affect our results of operations.

In recent years, due to regulatory, economic and government policy factors, our domestic crude oil, gasoline, diesel and other fuel prices have frequently lagged substantially behind prevailing international and regional market prices for such products, and our ability to increase prices has been limited. Likewise, the prices at which we sell natural gas in Argentina (particularly to the residential sector) are subject to government regulations and currently are substantially below regional market prices for natural gas. For additional information on domestic pricing for our products, see “Item 5—Factors Affecting our Consolidated Results of Operations—Regulation of the Energy Industry in Argentina” and “Item 4—Regulation of our Business—Argentine Regulatory Framework.”

We cannot assure you that we will be able to increase the domestic prices of our products, and limitations on our ability to do so will continue to adversely affect our financial condition and results of operations. Similarly, we cannot assure you that hydrocarbon prices in Argentina will track increases or decreases in hydrocarbon prices in the international or regional markets.

Oil and gas prices could affect our level of capital expenditures.

The prices that we are able to obtain for our hydrocarbon products affect the viability of investments in new exploration, development and refining, and as a result the timing and amount of our projected capital expenditures for such purposes. We budget capital expenditures by taking into account, among other things, market prices for our hydrocarbon products. In the event that current domestic prices decrease, our ability to improve our hydrocarbon recovery rates, identify new reserves and carry out certain of our other capital expenditure plans is likely to be affected, which, in turn, could have an adverse effect on our results of operations.

The Argentine government and our affiliated utility companies are in the process of renegotiating utility contracts, and the recoverability of our investments in these affiliates depends on the successful completion of these negotiations.

The macroeconomic situation of the country after the enactment of the Public Emergency Law impacted the economic and financial condition of utility companies in Argentina. The combined effect of (i) the devaluation of the peso in 2002, (ii) the government decision to freeze rates in pesos without reflecting the impact of the devaluation and (iii) financial debts primarily denominated in foreign currency, adversely affected the financial condition, results of operations and ability to satisfy financial obligations and pay dividends of utility companies. Although some of these utility companies have been successful in restructuring their indebtedness, their return to financial stability and profitability on a long-term basis depends on a successful negotiation of tariff increases with the Argentine government. Our affiliates Edesur S.A. (“EDESUR”) and Transportadora de Gas del Sur S.A. (“TGS”) have engaged in negotiations with the Utilities Contract Renegotiation and Analysis Committee (Unidad de Renegociación y Análisis de Contratos de Servicios Públicos) (“UNIREN”). However, to date, these discussions have not resulted in tariff increases sufficient for our affiliated utility companies to return to financial stability and profitability. See “Item 4—Gas and Energy—Gas Transportation-TGS—Tariff Renegotiation Process” and “Item 4—Gas and Energy— Electricity—Electricity Distribution: EDESUR” and “Item 4—Regulation of Our Business—Argentine Regulatory Framework—Natural Gas and Electricity.”

15

Our operations could be adversely affected by events beyond our control.

Our operations may be curtailed, delayed, interrupted or canceled as a result of weather conditions, mechanical difficulties, shortages or delays in the delivery of equipment, coercive actions and compliance with governmental requirements, or other events that could adversely impact our costs of production, results of operation and financial condition. For example, from March 9, 2007 to April 10, 2007, operations in Block 18, in Ecuador, were curtailed as a result of coercive actions taken by local communities. During this period, cumulative oil production decreased by approximately 305,000 barrels of oil equivalent in our participation. Future events beyond our control may affect our results of operations and financial condition.

Our activities may be adversely affected by events in countries in which we do business.

Our operations are concentrated in Latin America, a region that has experienced significant economic, social, political and regulatory volatility. In recent periods, many governments in Latin America have taken steps to assert greater control or increase their share of revenues from the energy sector, spurred by soaring oil and gas prices and nationalist politics. See “Item 4—Regulation of our Businesses—Venezuelan Regulatory Framework—Bolivian Regulatory Framework.”

These risks are evidenced by changes in business conditions that we have experienced in Venezuela, Bolivia and Ecuador. See “Item 5—Factors affecting our Consolidated Results of Operations” See “Item 4—Oil and Gas Exploration and Production—Production—Production Outside Argentina.”

We could be subject to organized labor action.

Many of our operations are highly labor-intensive and require a significant number of workers. The sectors in which we operate are largely unionized. We have experienced organized work disruptions and stoppages in the past, frequently due to strikes by employees of contractors we employ. We cannot assure you that we will not experience such disruptions or work stoppages in the future, and any such action could adversely affect our business and revenues.

In 2008 unionized employees went on strike over salary increases, adversely affecting our operations. In 2008, in the Austral basin in Argentina, the pace of production slowed as a result of the labor strike held by our contractor’s employees throughout May 2008, with an adverse impact on production levels in subsequent months. During 2009, 2010 and 2011, to a lesser extent, gas production in the Austral basin was affected by labor strikes by contractors’ personnel. See “Item 6– Employees.”

We do not maintain insurance coverage for business interruptions, including business interruptions caused by labor actions. Strikes, picketing or other types of conflict with the unionized personnel may adversely affect our results of operations and financial condition.

Our operations could cause environmental damage, and any changes in environmental laws may increase our operational costs.

Some of our operations are subject to environmental risks that may arise unexpectedly and result in material adverse effects on our results of operations and financial condition. In addition, the occurrence of any of these risks could result in personal injuries, loss of life, environmental damage, clean-up and repair expenses, equipment damage and liability in civil and administrative proceedings. We cannot assure you that we will not incur in additional costs related to the environment in the future, which could negatively impact our results of operations and financial condition. In addition, we cannot assure that the insurance coverage that we maintain is adequate to cover the losses that may potentially arise from these environmental risks.

Furthermore, we are subject to extensive environmental regulation both in Argentina and in the other countries in which we operate. Local, provincial and national authorities in Argentina and other countries where we operate are moving towards more stringent enforcement of environmental laws, which may require us to incur in higher compliance costs. We cannot predict what effects this may have on our financial condition and results of operations.

16

Risks Relating to Our Shares and ADSs

Our principal shareholders can exercise control over the Company.

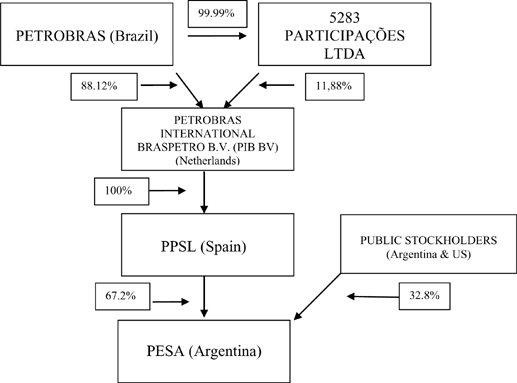

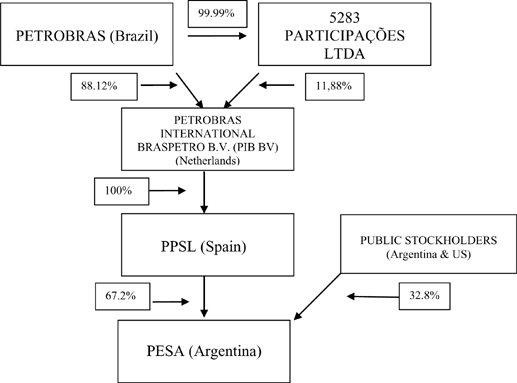

As of the date of this Annual Report, Petrobras holds 67.2% of our capital stock and voting rights and ANSES holds approximately 9.8% of our shares and voting rights. Petrobras will be able to determine or influence substantially on all matters requiring approval by a majority of our shareholders, including the election of a majority of our directors. Petrobras will also direct our operations and may be able to cause or prevent a change in our control. See “Item 7—Major Shareholders and Related Party Transactions.”

Restrictions on capital outflows imposed by Argentina may impair your ability to receive dividends and distributions on, and the proceeds of any sale of, the shares underlying the ADSs.

Argentine law currently permits the government to impose temporary restrictions on capital movements in circumstances where a serious imbalance develops in Argentina’s balance of payments or where there are reasons to foresee such an imbalance. Restrictions on capital outflows imposed by Argentina such as those that existed following the 2001 Argentine crisis could, if reinstated, impair or prevent the conversion of dividends, distributions, or the proceeds from any sale of shares, as the case may be, from pesos into U.S. dollars and the remittance of the U.S. dollars abroad. We cannot assure that the Argentine government will not take such measures in the future.

Under the terms of our deposit agreement with the depositary for the ADSs, the depositary will convert any cash dividend or other cash distribution we pay on the shares underlying the ADSs into U.S. dollars if, in the judgment of the depositary, that can be made on a practicable basis, and shall distribute such U.S. dollars in accordance with the Deposit Agreement subject, in each case, to any restrictions under Argentine laws or regulations or applicable permits issued by an Argentine governmental body. If the exchange rate fluctuates significantly during a time when the depositary cannot convert the foreign currency, you may lose some or all of the value of the dividend distribution.

Under Argentine law, shareholder rights may be different from other jurisdictions.

Our corporate affairs are governed by our by-laws and by Argentine Companies Law, which differ from the legal principles that would apply if we were incorporated in a jurisdiction in the United States or in other jurisdictions outside Argentina. In addition, rules governing the Argentine securities markets are different and may be subject to different enforcement in Argentina than in other jurisdictions.

Sales of a substantial number of shares could decrease the market prices of our shares and the ADSs.

Petrobras owns shares representing a significant majority of our capital stock. Sales of a substantial number of shares or ADSs by Petrobras, ANSES, or any other future significant shareholder, or the anticipation of such sales, could decrease the trading price of our shares and ADSs.

You may be unable to exercise preemptive, accretion or other rights with respect to the shares underlying your ADSs.

You may not be able to exercise the preemptive or accretion rights relating to the shares underlying your ADSs (see “Item 10. Additional Information—Preemptive Rights”) unless a registration statement under the U.S. Securities Act of 1933 (the “Securities Act”) is effective with respect to those rights or an exemption from the registration requirements of the Securities Act is available. We are not obligated to file a registration statement with respect to the shares relating to these preemptive rights, and we cannot assure you that we will file any such registration statement. Unless we file a registration statement or an exemption from registration is available, you may receive only the net proceeds from the sale of your preemptive rights by the depositary or, if the preemptive rights cannot be sold, they will be allowed to lapse. As a result, U.S. holders of shares or ADSs may suffer dilution of their interest in our company upon future capital increases.

In addition, under the Argentine Companies Law, foreign companies that own shares in an Argentine corporation are required to register with theInspección General de Justicia (Superintendency of Legal Entities, the “IGJ”) in order to exercise certain shareholder rights, including voting rights. If you own our shares directly (rather than in the form of ADSs) and you are a non-Argentine company and you fail to register with IGJ, your ability to exercise your rights as a holder of our shares may be limited.

You may be unable to exercise voting rights with respect to the shares underlying your ADSs at our shareholders’ meetings.

The depositary will be treated by us for all purposes as the shareholder with respect to the shares underlying your ADSs. As a holder of ADRs representing the ADSs being held by the depositary in your name, you will not have direct shareholder rights and may exercise voting rights with respect to the shares represented by the ADSs only in accordance with the deposit agreement relating to the ADSs. There are no provisions under Argentine law or under our by-laws that limit the exercise by ADS holders of their voting rights through the depositary with respect to the underlying shares. However, there are practical limitations on the ability of ADS holders to exercise their voting rights due to the additional procedural steps involved in communicating with these holders. ADS holders may be unable to exercise voting rights with respect to the shares underlying the ADSs as a result of these practical limitations.

17

Shareholders outside Argentina may face additional investment risk from currency exchange rate fluctuations in connection with their holding of our shares or ADSs.

We are an Argentine company and any future payments of dividends on our shares will be denominated in pesos. The peso has historically fluctuated significantly against many major world currencies, including the U.S. dollar. A depreciation of the peso would likely adversely affect the U.S. dollar or other currency equivalent of any dividends paid on our shares and could result in a decline in the value of our shares and ADSs as measured in U.S. dollars.

18

Item 4. INFORMATION ON THE COMPANY

HISTORY AND DEVELOPMENT

History

Petrobras Argentina S.A.

PESA is a corporation (sociedad anónima) organized and existing under the laws of the Republic of Argentina and registered on November 17, 1947 with the Public Registry of Commerce, under No.759, page 569, Book 47, Volume A, with a term of duration expiring June 18, 2046. Our principal place of business is located at Maipú 1, (C1084ABA), Buenos Aires, Argentina. Telephone: 54-11-4344-6000, fax 54-11-4344-6315 and web site atwww.petrobras.com.ar. Our process agent in the U.S. for certain contracts is CT Corporation System, located at 111 Eighth Avenue, New York, New York 10011. Our authorized representative in United States for our registration statement with SEC is Puglisi Associates, located at 850 Library Avenue, Suite 204, Newark, Delaware 19711.

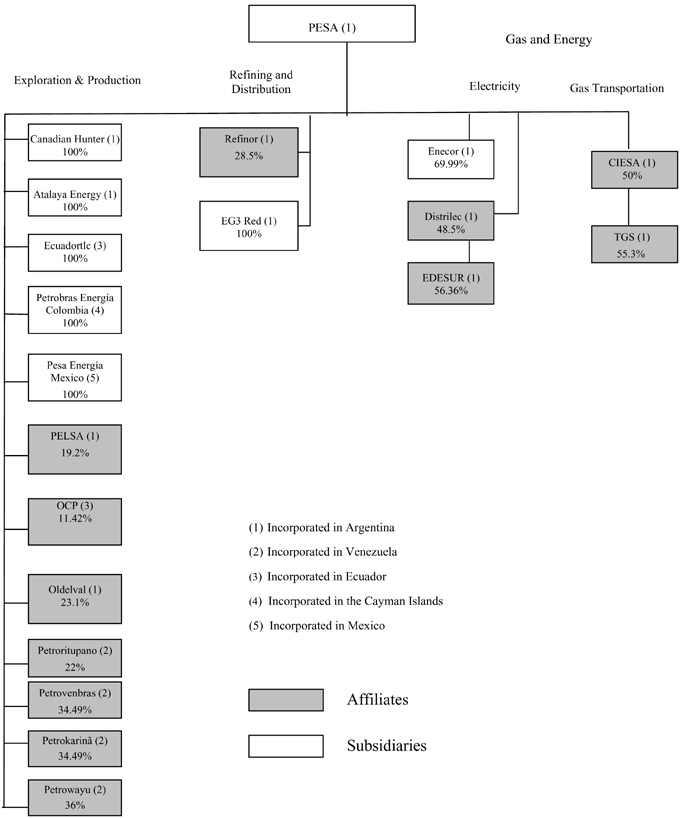

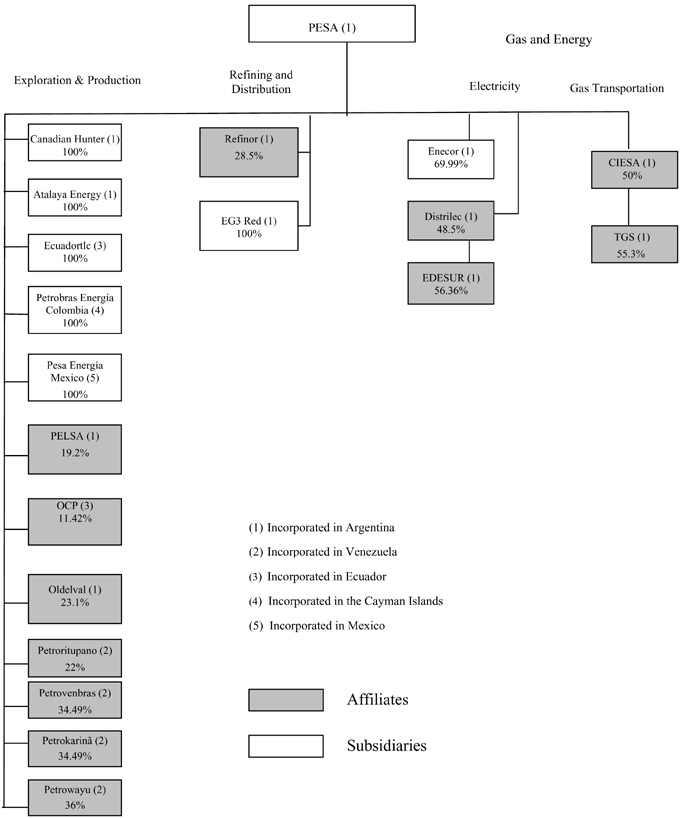

We are an integrated energy company,engaged in oil and gas exploration and production, refining, petrochemicals, electricity generation, transmission and distribution and hydrocarbon marketing and transportation. As of December 31, 2011, we maintain operations primarily in Argentina, and to a lesser extent in Bolivia, Ecuador, Mexico and Venezuela. Our operations are currently divided into four business segments that are in turn supported by corporate functions. The four business units are: (1) Oil and Gas Exploration and Production, (2) Gas and Energy, (3) Refining and Distribution, and (4) Petrochemicals.

PESA was founded in 1946 under the name “Compañía Naviera Pérez Companc” as a shipping company by the Pérez Companc family. In the mid-1950’s, the Company began its forestry operations when it acquired an important forestry area in northeastern Argentina. In the 1960s, it began servicing oil wells; over time, its maritime operations were gradually discontinued and replaced by oil-related activities.

The development of our oil and gas business is marked by two significant events. The first occurred in 1991 when we were awarded concessions to operate Puesto Hernández, one of the most important oilfields in Argentina in terms of reserves and production, located in the provinces of Neuquén and Mendoza, and the Faro Vírgenes and Santa Cruz areas in the Austral basin, located in the province of Santa Cruz. As a result of these concessions, we have become one of the largest oil and gas producers in Argentina.

The second event that was a key factor in our oil and gas operations growth abroad occurred in March 1994 when PESA was awarded the Oritupano-Leona area in Venezuela. This was the first step towards a significant regional expansion of our businesses.

Between 1990 and 1994, many state-owned enterprises were privatized in Argentina. As a result, PESA acquired interests in companies operating in the natural gas transportation and distribution, electricity generation, transmission and distribution, oil transportation, storage and shipment and refining sectors. These activities have formed our core business.

PESA has in the past conducted operations in other industries, including construction, real estate, telecommunications, mining and agriculture. Beginning in 1997, and through successive divestments, PESA restructured its business strategy with a focus on the energy sector in Argentina. As a result of these divestitures and the development of our energy businesses, PESA has become a vertically-integrated energy company whose operations are mainly located in Argentina.

Corporate reorganization of PESA and PEPSA

On September 2, 2008, the board of directors of each of PESA and PEPSA approved a preliminary agreement for the merger of both companies through the absorption of PEPSA by PESA. The effective merger date was set at January 1, 2009. As of that date all assets, liabilities, rights and obligations of the absorbed company were incorporated into Petrobras Energía. Immediately following the merger, Petrobras continued holding 67.2% of the outstanding shares of Petrobras Energía.

On January 30, 2009, the special shareholders’ meetings of PESA and PEPSA approved the merger of both companies, pursuant to which PEPSA was merged and absorbed into PESA, as surviving company. The board of directors of each of PESA and PEPSA approved the merger agreement between the two companies on April 14, 2009. This reorganization was authorized by Resolution No. 16,131 and subsequently registered with the IGJ.

19

As a result of this corporate reorganization, shareholders of PEPSA received shares of PESA (in the United States, in the form of ADSs), and the ADSs of PEPSA were removed from listing on the NYSE and from registration with the SEC. Immediately subsequent to this exchange of shares, ADSs, each representing 10 Class B shares of PESA, were listed and began trading on the NYSE.

Change of corporate name

On March 27, 2009, the general regular and special shareholders’ meeting of PESA approved the change of the Company’s corporate name to Petrobras Argentina S.A., which became effective on July 19, 2010, CNV notified PESA of the registration of the change of its corporate name with the IGJ.

Capital Expenditures and Divestitures

For a description of our capital expenditures see “Item 5—Liquidity and Capital Resources.”

For a description of our most significant divestitures see “Item 5—Factors Affecting Our Consolidated Results of Operations—Operations in Ecuador—Sale of Petrobras Argentina’s Interest in PVIE—Sale of the fertilizers business—Divestment of Innova—Divestment of the San Lorenzo refinery and other assets associated with the Refining and Distribution business segment.”

20

BUSINESS OVERVIEW

Our Strategy

Our long-term strategy is to grow as an integrated energy company in Argentina, while being a leader in profitability as well as social and environmental responsibility.

The main points of this strategy are:

| | • | | Setting our focus on our Argentine operations. |

| | • | | Increasing oil and gas reserves and maintaining production levels through profitable operations with a commitment to social and environmental responsibility. |

| | • | | Seeking profitability in the downstream business in Argentina, through a balanced crude production – refining – logistics – distribution chain. |

| | • | | Generating energy solutions through the development of businesses in the Gas and Energy segment. |

| | • | | Maintaining our position in styrenics markets. |

| | • | | Maintaining financial solvency, while pursuing operating and management efficiency and the development of human resources. |

In order to fulfill this strategy, we consider the following to be essential:

| | • | | A commitment to protecting the quality of our goods and services, the environment and the health and safety of our employees, contractors and neighboring communities. |

| | • | | Adoption of, and compliance with, corporate governance practices in line with recognized best practices. |