Exhibit 99.2

Results 2Q24 JBS 1

Aquaculture Plant - based and proteins business #3 European producer of plant - ba S ed protein #2 S almon producer in Australia Prepared Foods #1 Brazilian producer of plant - ba S ed #2 in prepared food S in Brazil #1 in prepared food S in the United Kingdom #1 in food in Australia MARKET LEADER NEW AVENUES OF GROWTH Beef #1 Global beef producer Canada | USA | Brazil | Australia Poultry #1 Global poultry producer USA | Mexico | Brazil | Europe Pork #2 Global pork producer USA | Brazil | Australia | Europe In 2024, we will complete a new cultivated protein facility in Spain 2

1. Enhance Scale in Existing Categories and Geographies 2. Increase and Diversify Value - Added and Brand Portfolio Long Term Growth Strategy Pur S uing additional value - enhancing growth opportunitie S with financial di S cipline Improve operational performance Capture S ignificant S ynergie S Enhance growth and margin profile Realize benefit S O f vertical integration 3 . New proteins Close to the Final Consumer - Multichannel 3

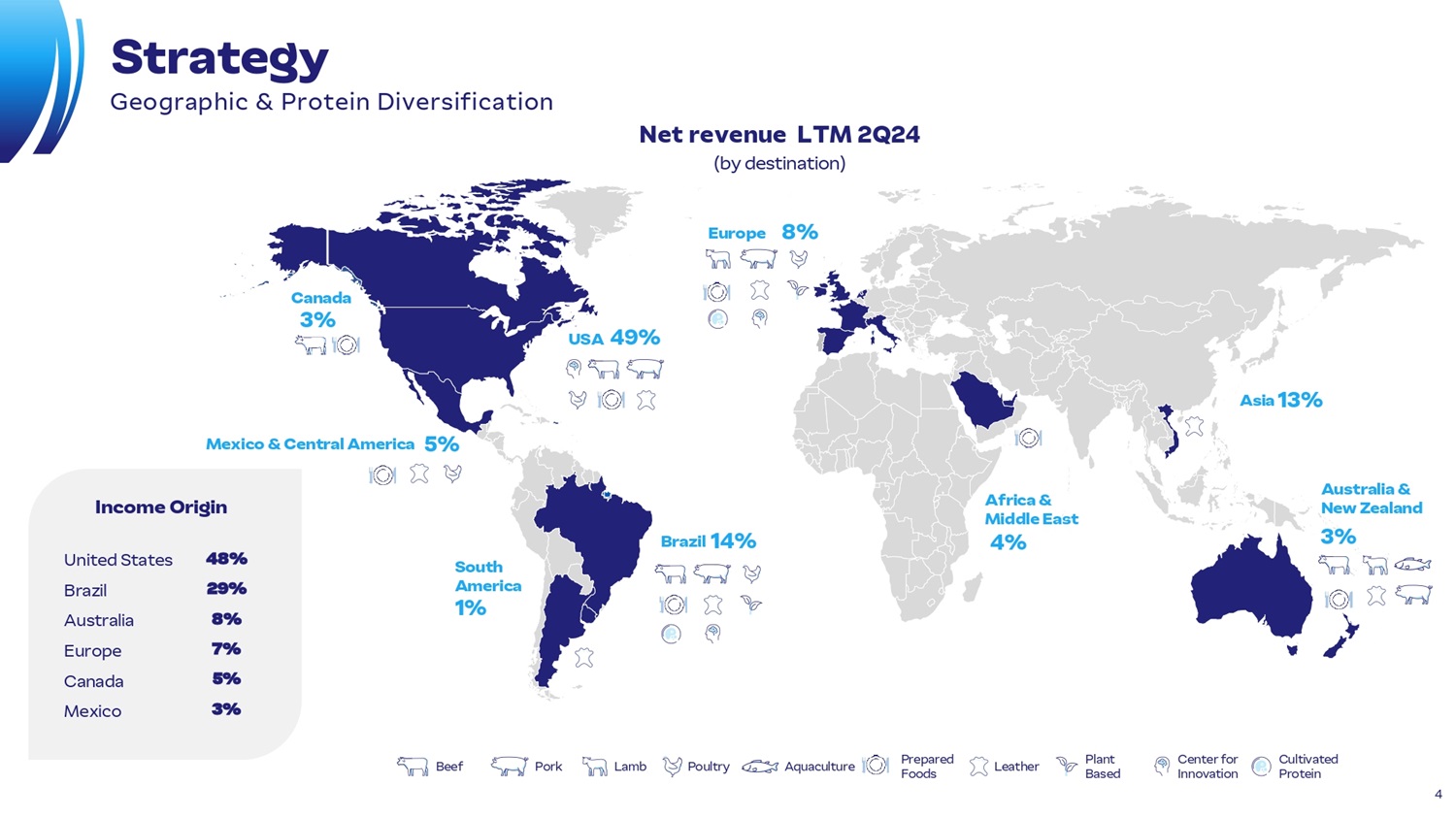

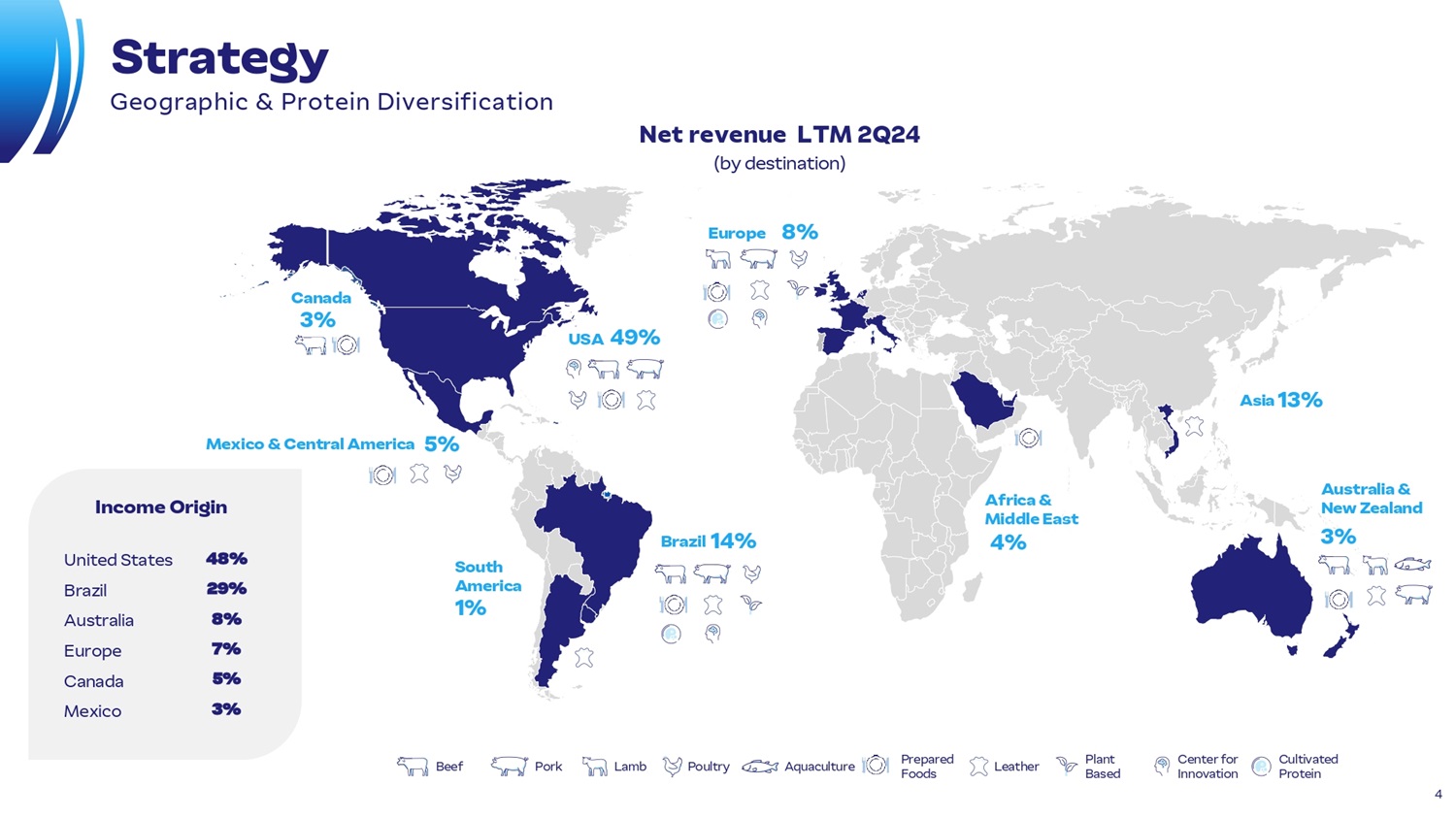

Income Origin United State S Brazil Au S tralia Europe Canada Mexico 48% 29% 8% 7% 5% 3% Beef Pork Lamb Poultry Aquaculture Leather Plant Ba S ed Center for Innovation Cultivated Protein Prepared Food S South America 1% Mexico & Central America 5% Brazil 14% Asia 13% Africa & Middle East 4% USA 49% 3% Canada Australia & New Zealand 3% Net revenue LTM 2Q24 (by de S tination) Europe 8% Strategy Geographic & Protein Diver S ification 4

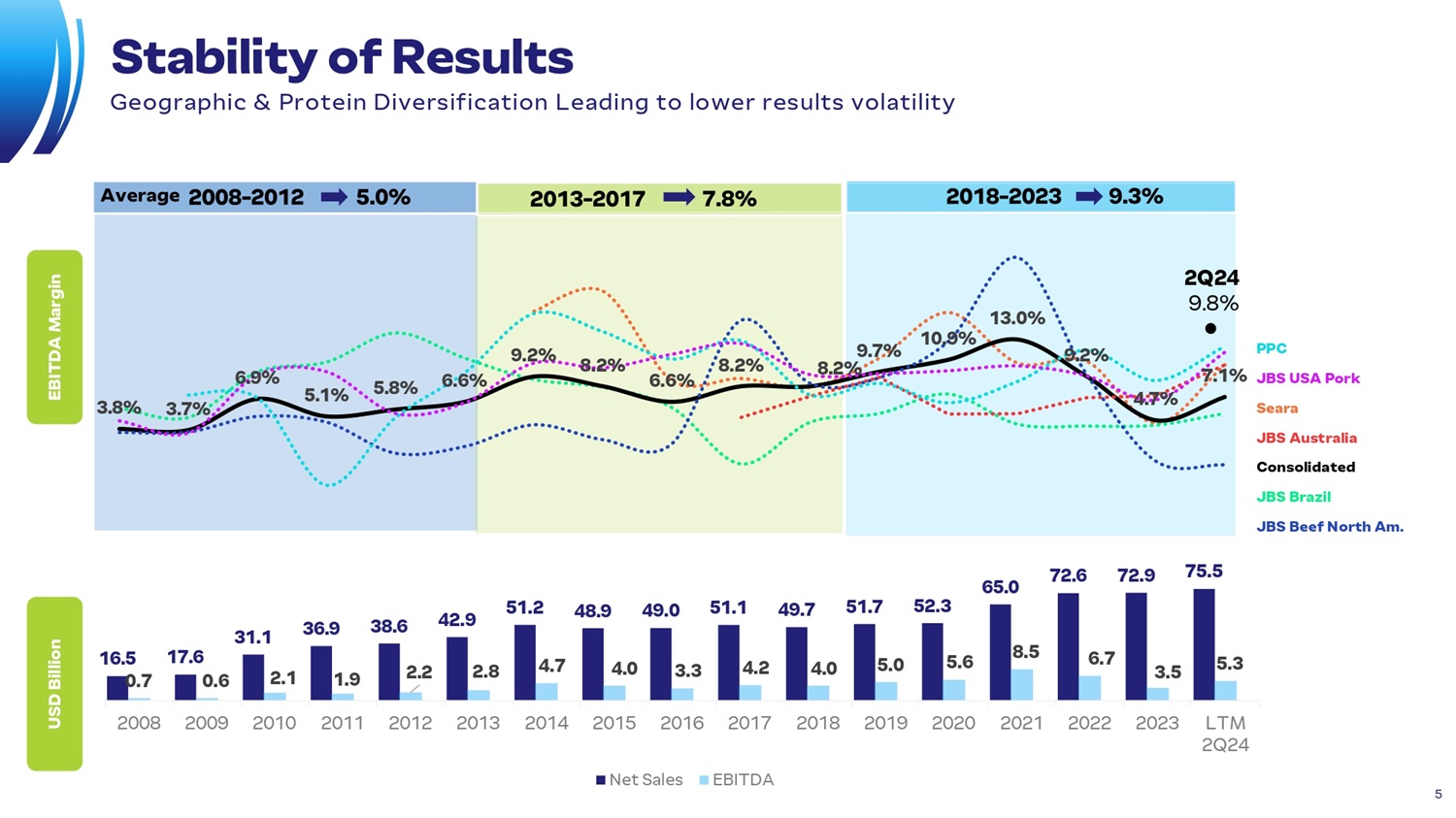

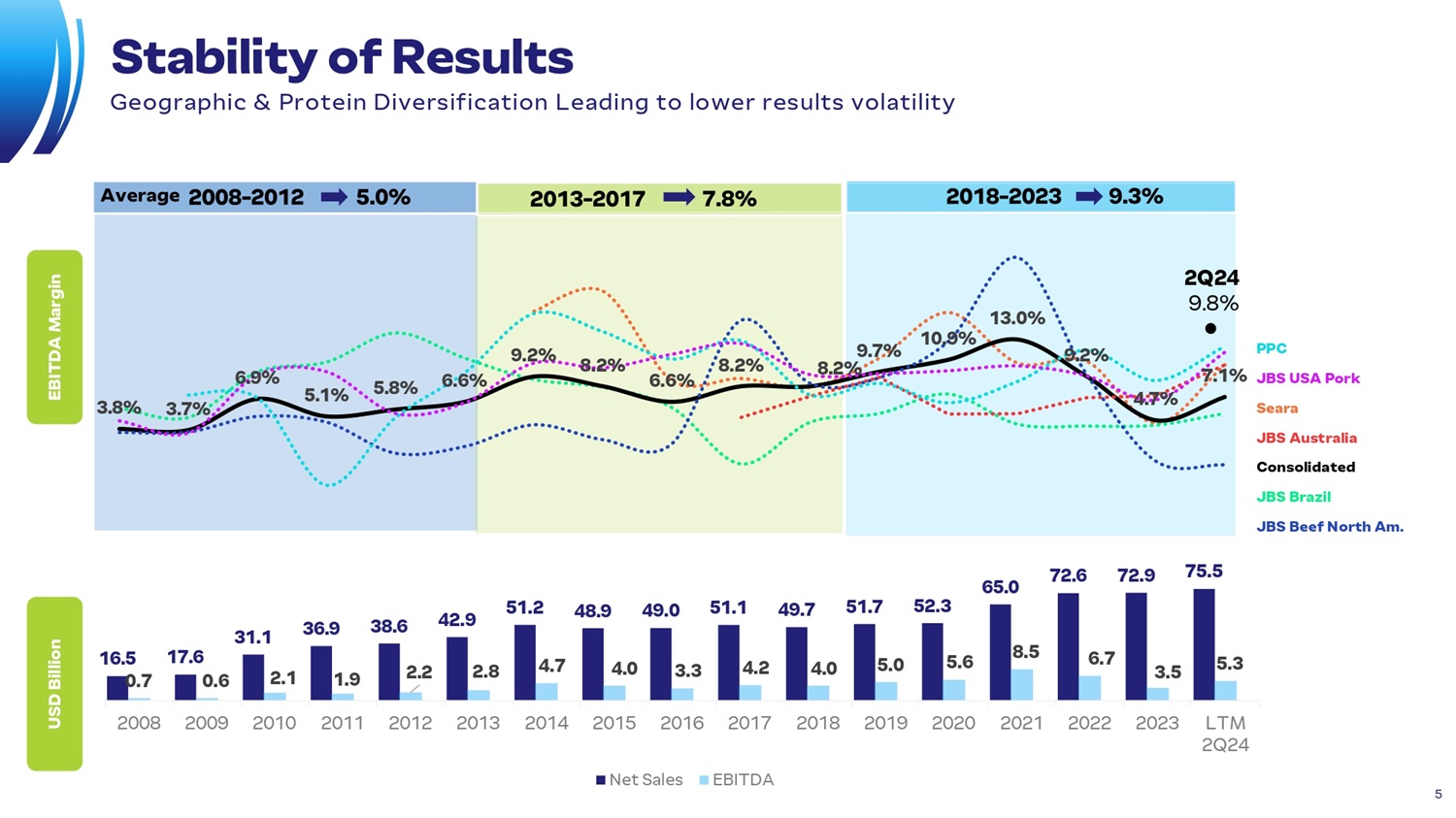

16.5 31.1 36.9 38.6 42.9 51.2 48.9 49.0 51.1 49.7 51.7 52.3 65.0 72.6 72.9 75.5 0. 7 17.6 0.6 2.1 1.9 2.2 2.8 4.7 4.0 3.3 4.2 4.0 5.0 5.6 8.5 6.7 3.5 5.3 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 LTM 2Q24 Net Sale S EBITDA 3.8% 3.7% 6.9% 5.1% 5.8% 6.6% 9.2% 8.2% 6.6% 8.2% 8.2% 9.7% 10.9% 13.0% 9.2% 4.7% EBITDA Margin USD Billion Stability of Results Geographic & Protein Diver S ification Leading to lower re S ult S volatility 2Q24 9.8% PPC 5 7.1% JBS USA Pork Seara JBS Australia Consolidated JBS Brazil JBS Beef North Am .

Valued Added: Diversified Global Brands Portfolio 6

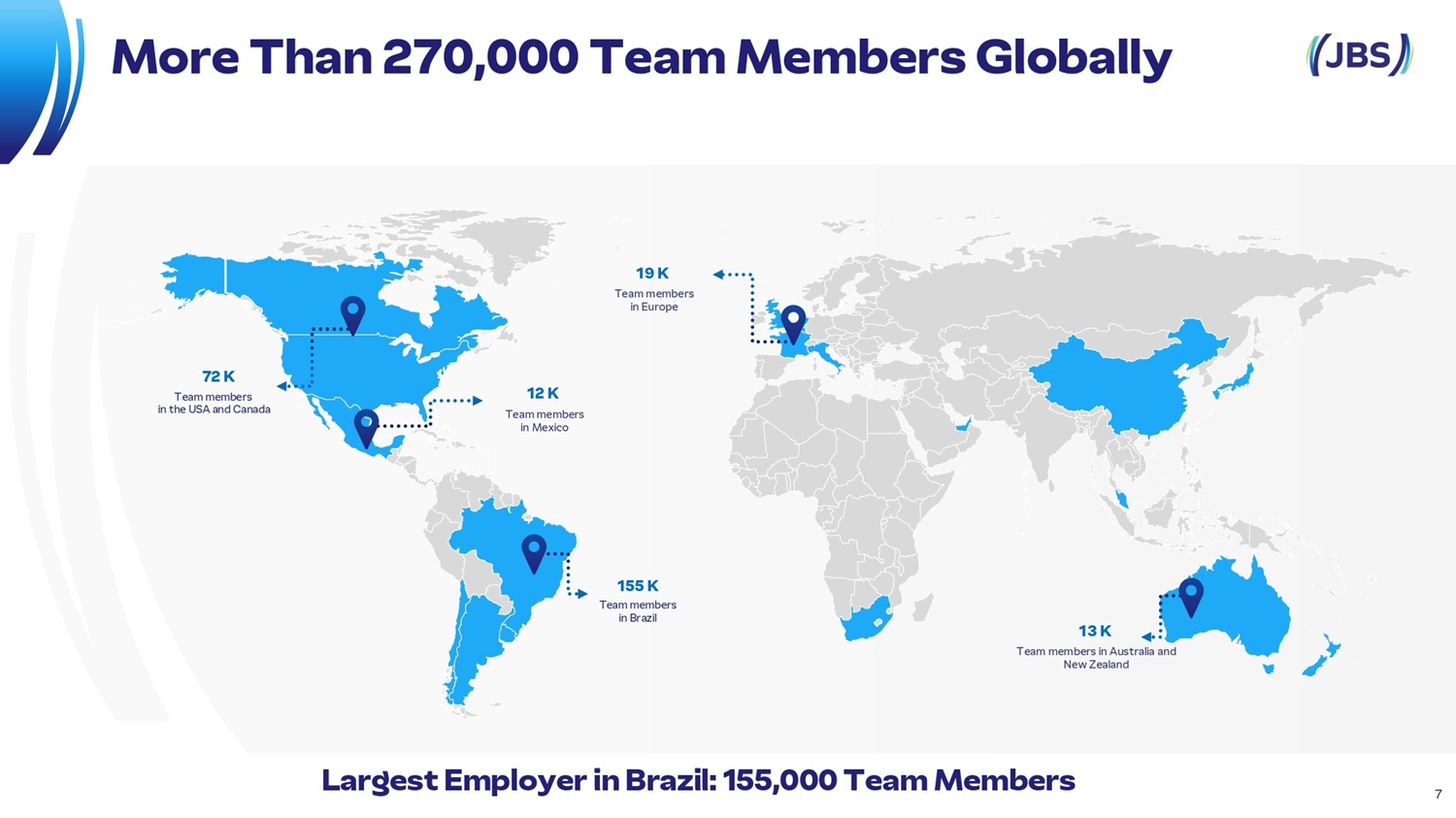

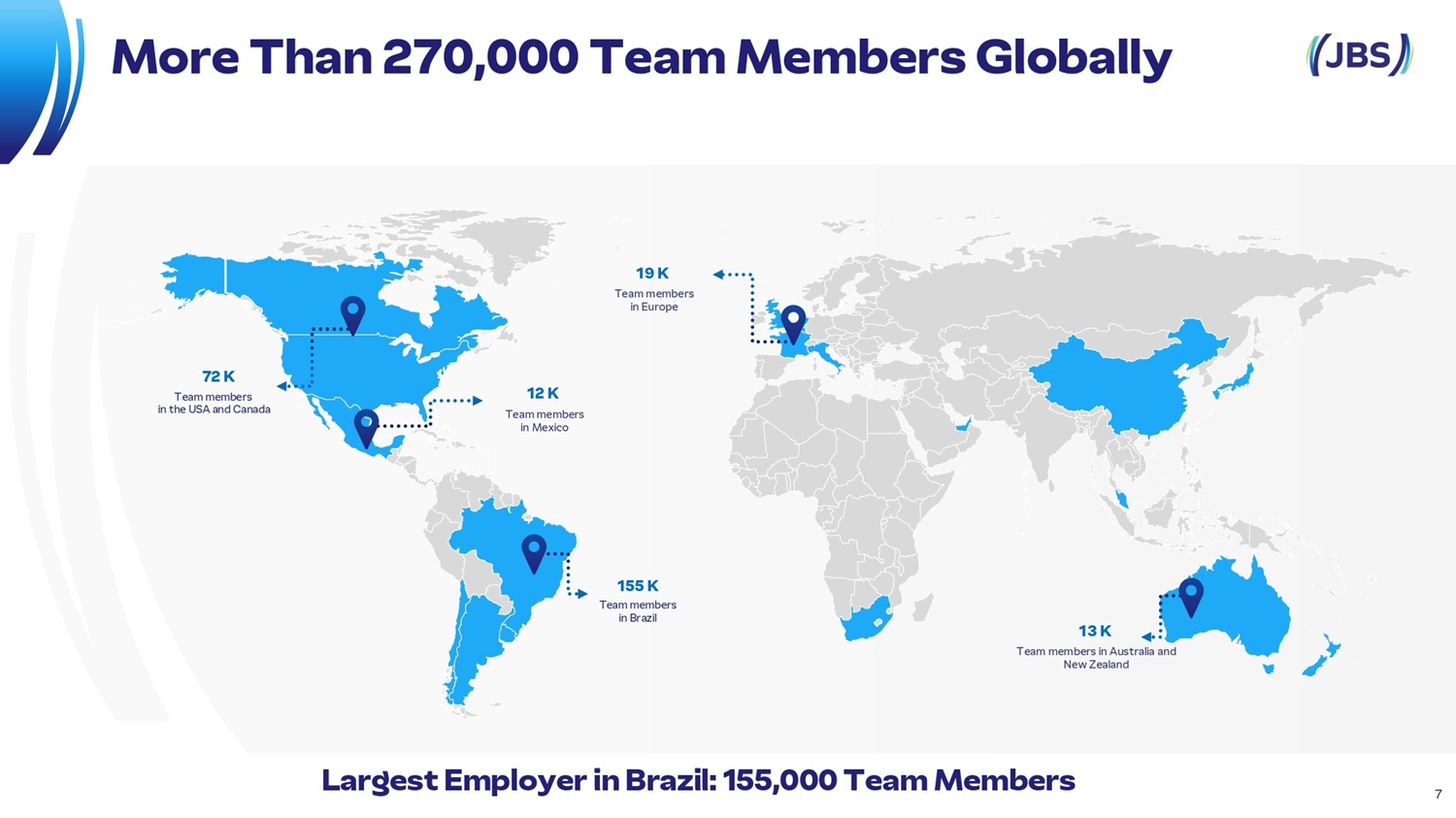

13 K Team member S in Au S tralia and New Zealand 155 K Team member S in Brazil 12 K Team member S in Mexico 19 K Team member S in Europe 72 K Team member S in the USA and Canada Largest Employer in Brazil: 155,000 Team Members More Than 270,000 Team Members Globally 7

Top - rated company by global financial institutions in the food and beverage sector. 2024 Latin America Executive Team – Food and Beverage Most Honored Company Be S t CEO – 1 S t place (3rd con S ecutive year) Be S t CFO - 1 S t place (3rd con S ecutive year) Be S t IR Profe SS ional – 1 S t place - SellSide Be S t IR Team - 1 S t place (4th con S ecutive year) Be S t IR Program - 1 S t place (3rd con S ecutive year) Be S t Board - 1 S t place (2nd con S ecutive year) 8 Trust that fuels recognition

Investments Brazil: Largest cattle facility in Latin America, Campo Grande - MS • R$ 150 million inve S tment • Production capacity doubled • Creation of 2,300 new jobs Australia: Expansion of the Whale Point facility in Tasmania • R$ 400 million inve S tment • Expan S ion of land - ba S ed S almon farming capacity • Reducing time and co S t S a SS ociated with developing fi S h in marine environment S • Con S truction of a hatchery capable of producing over 7 million fi S h Saudi Arabia: New breaded factory in Jeddah • US$ 50 million inve S tment • Production capacity quadrupled • Creation of more than 500 new jobs • Recent opening of the proce SS ing facility in the city of Damman, with 250 employee S , a production capacity of 10,000 ton S , and 8 di S tribution center S acro SS the country. 9

Sustainability Green Offices 2.0: Increase in small producer productivity - Service to 1,500 farms, with nearly 800,000 hectares under management - Service provided in three area S : Green Environmental Office Green Technical Assistance Office Green Managerial Assistance Office - Expectation to S erve an additional 1,300 properties by the end of the year Cowpower: Sustainable aviation fuel • Transformation of animal waste from operations in the US, Canada, and Australia into aviation fuel • In two years, 1.2 million tons of beef tallow and pork fat directed towards the production of Sustainable Aviation Fuel (SAF) 10

Beyond Borders Through the Beyond Borders program, the Company offers its team members the opportunity to internationalize their professional careers by changing roles or extending their knowledge to another country, strengthening JBS's organizational culture worldwide. Instituto J&F Over 900 students enrolled in the education center, preparing young people for bu S ine SS . Better Futures Tuition - free community college tuition for JBS team member S and their dependent S . More than 6,000 people signed up. Instituto J&F MASTER Continuou S training program for team members on the front line of production. Hometown Strong Community inve S tment project S that support the communities where JBS is located through ca S h donation S , infra S tructure improvement S and affordable hou S ing. Social JBS projects around the world 11 Nouri S hing dream S , generating po SS ibilitie S

Financial & Operating 12

(53.2) 2Q23 328.8 2Q24 18,052 19,284 2Q23 2Q24 1,997 2,973 11.1% 15.4% 2Q23 2Q24 Gro SS Margin (%) Net Result (USD million) 2Q24 Consolidated Results (IFRS – USD) Adjusted EBITDA (USD million) 903 1,894 9.8% 5.0% 2Q23 2Q24 Gro SS Margin (%) Net Revenue (USD million) Gross Profit (USD million) 13

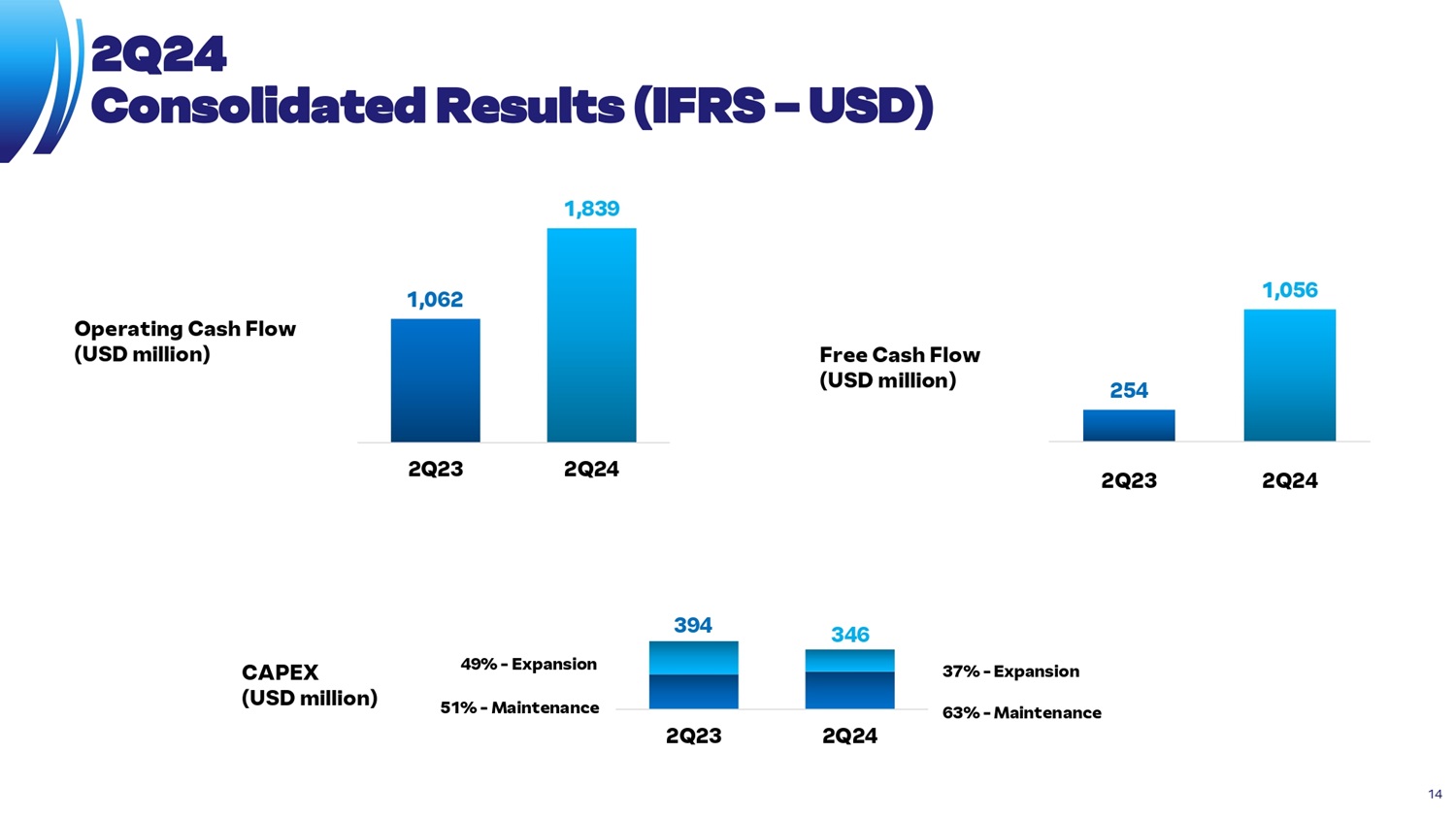

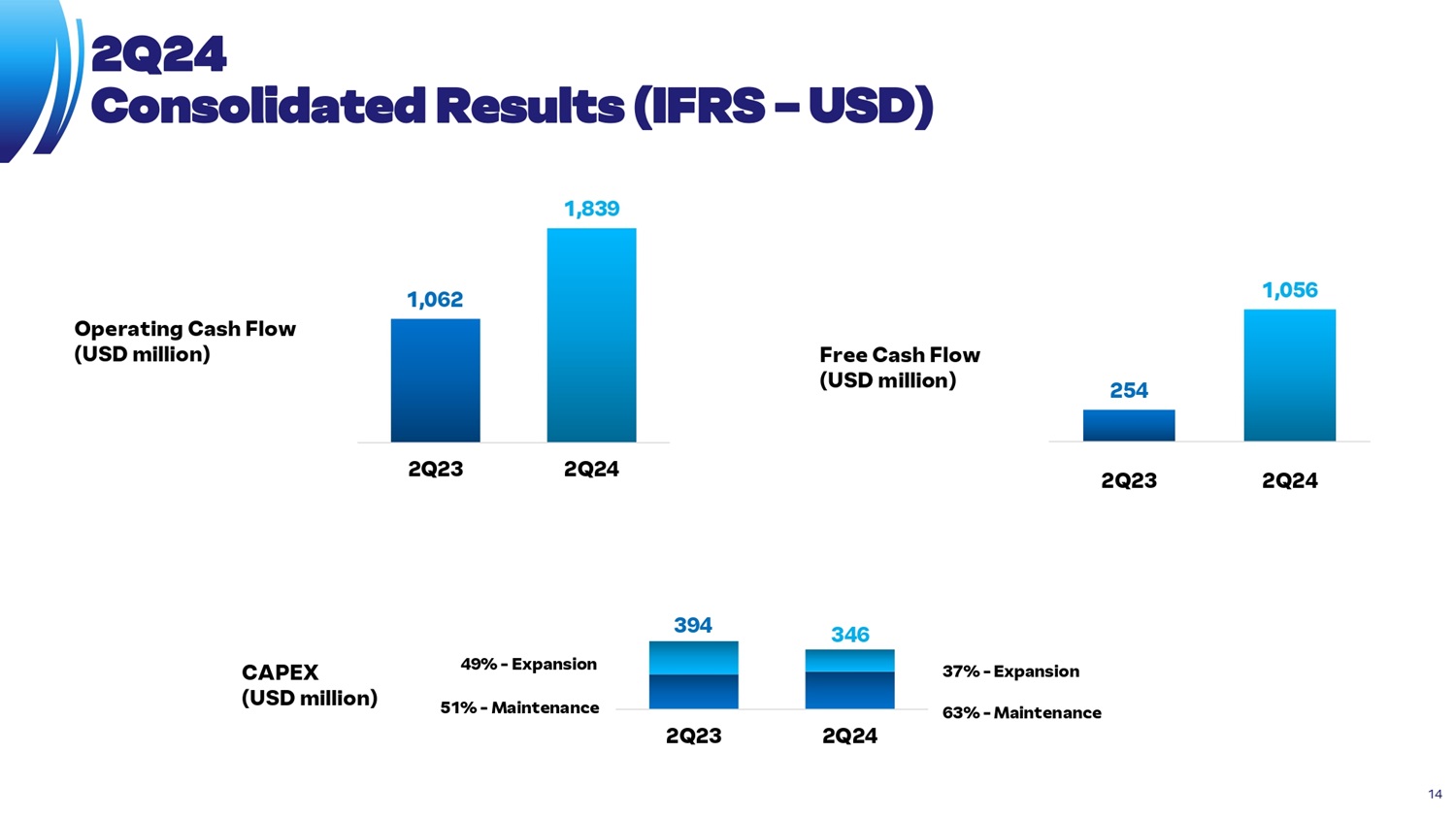

Operating Cash Flow (USD million) Free Cash Flow (USD million) 1,062 1,839 2Q23 2Q24 394 346 2Q23 2Q24 254 1,056 2Q23 2Q24 63% - Maintenance 37% - Expansion 51% - Maintenance 49% - Expansion 2Q24 Consolidated Results (IFRS – USD) CAPEX (USD million) 14

876 13 14 1,073 988 686 1,715 1,677 2,907 2,598 2,120 649 2,413 884 450 2,895 3,853 Cash and Short Term Equivalents 2025 2028 2031 2034 2035 to 2051 2052 2053 2026 2027 Ca S h and Equivalent S ¹ Include S available ca S h re S ource S and revolving and guaranteed credit line S from JBS USA and JBS SA. 2029 2030 Revolving credit facilitie S USD 2.9 Bn in the US 2032 2033 Revolving credit facilitie S USD 450 mn in Brazil Debt Amortization Schedule (USD Million)¹ Average Principal Term: 11.1 yrs Average Cost: 5.66% p.a. 15

Net Debt/ Leverage / Interest Coverage Source Breakdown Currency and Cost Breakdown Short Term and Long Term LT 95.3% ST 4.7% ¹ Inclui dívida S em outra S moeda S , como Euro S e dólare S canaden S e S . Bonds 86% Banks 3% CRA 11% Entity Breakdown JBS USA 87.1% JBS SA 11.7% Seara 1.2% USD¹ 87.4% 5.08% p.a. BRL 12.6% 9.69% p.a. 16,652 16,053 15,297 15,866 14,759 3.21x 3.20x 4.00x 4.95x 4.21x 4.15x 4.87x 4.42x 3.66x 2.77x 2Q23 4Q23 1Q24 3Q23 Net Debt (USD Million S ) Intere S t Cover. 2Q24 Leverage (USD) 16

85 387 4.1% 17.4% 2Q23 2Q24 2,082 2,223 2Q23 2Q24 Seara Products Seara Net Revenue (IFRS - USD million) Adjusted EBITDA (IFRS - USD million and %) 2Q24 17

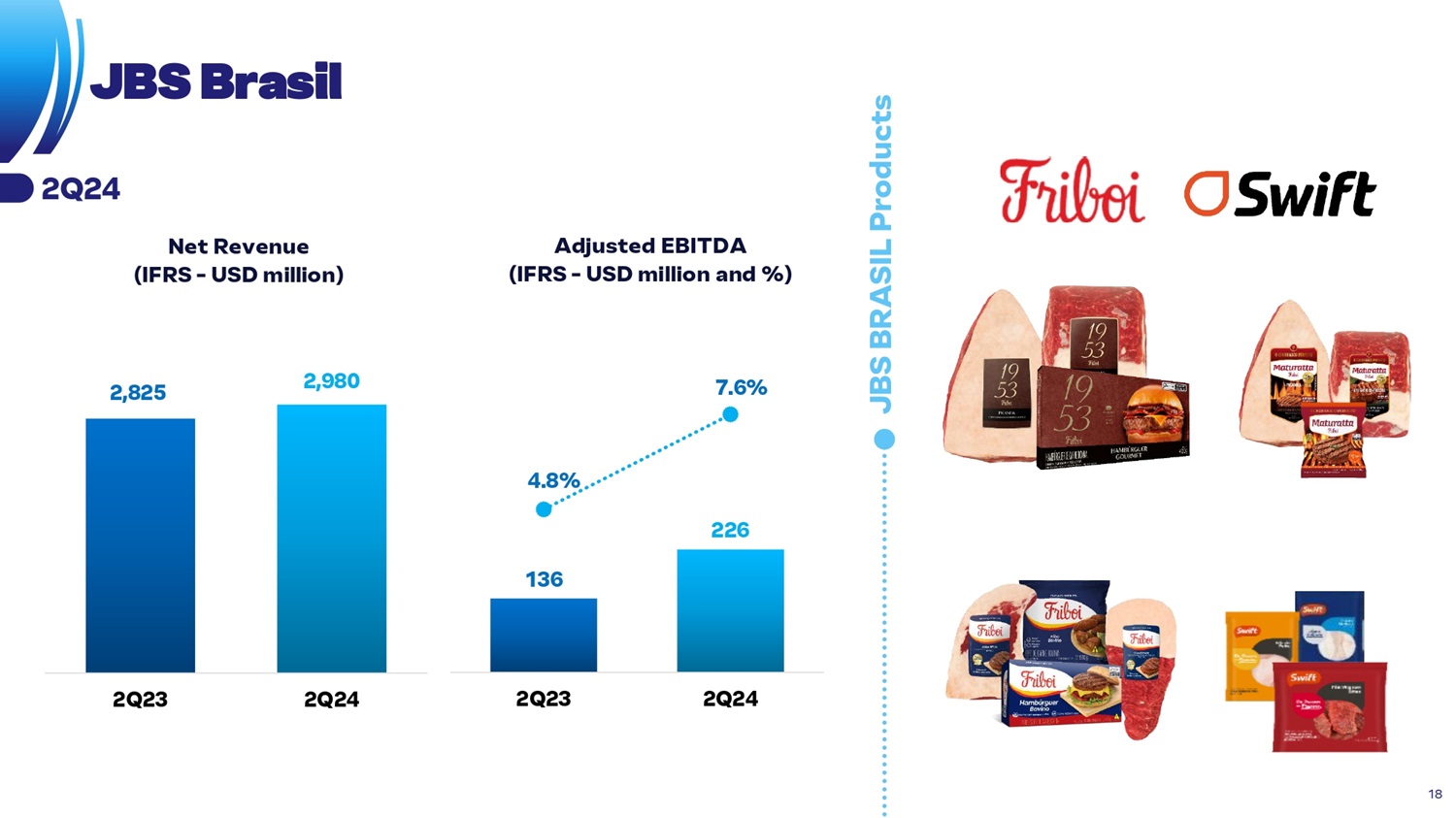

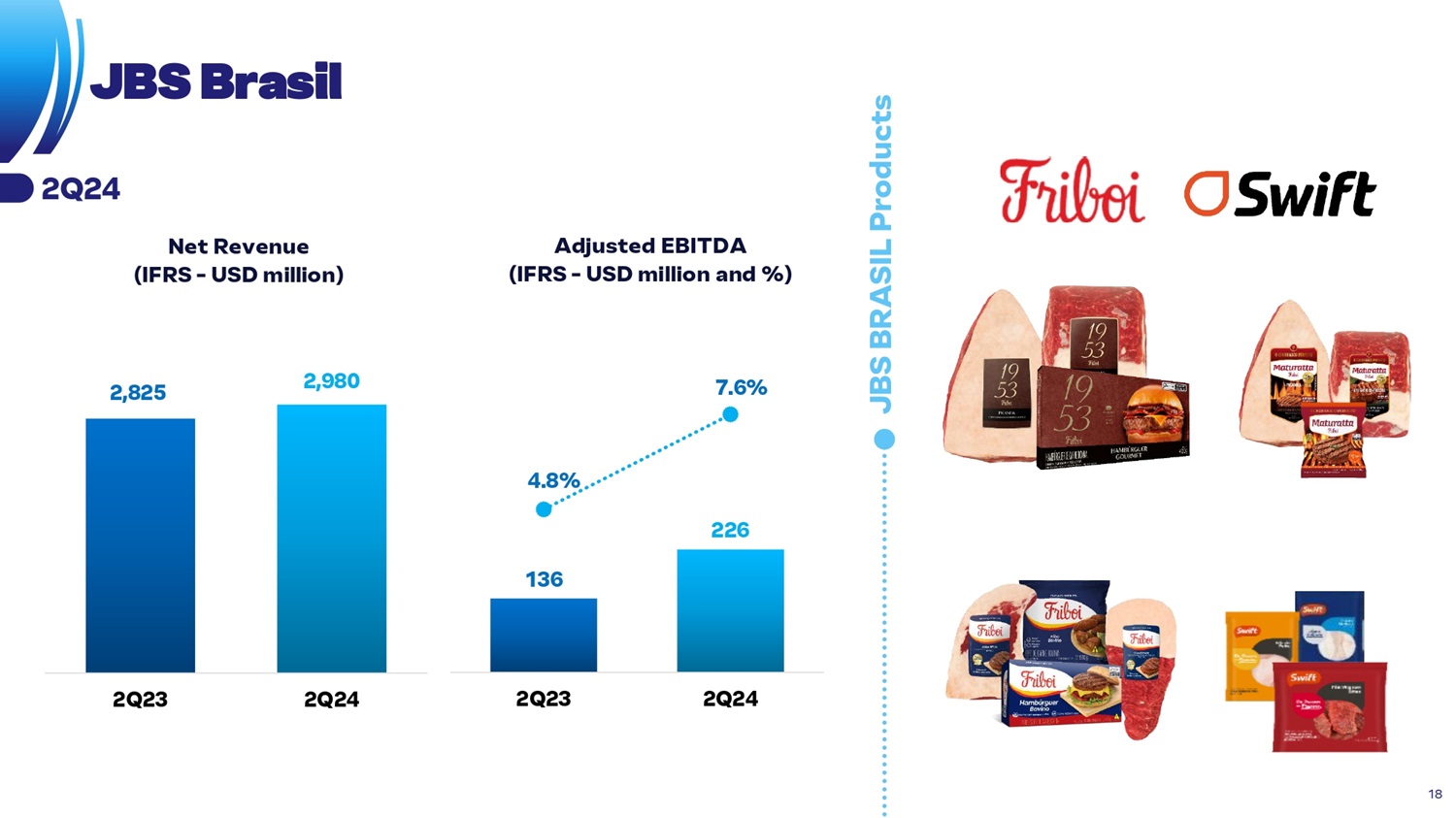

JBS BRASIL Products 136 226 4.8% 7.6% 2Q23 2Q24 2,825 2,980 2Q23 2Q24 JBS Brasil Net Revenue (IFRS - USD million) Adjusted EBITDA (IFRS - USD million and %) 2Q24 18

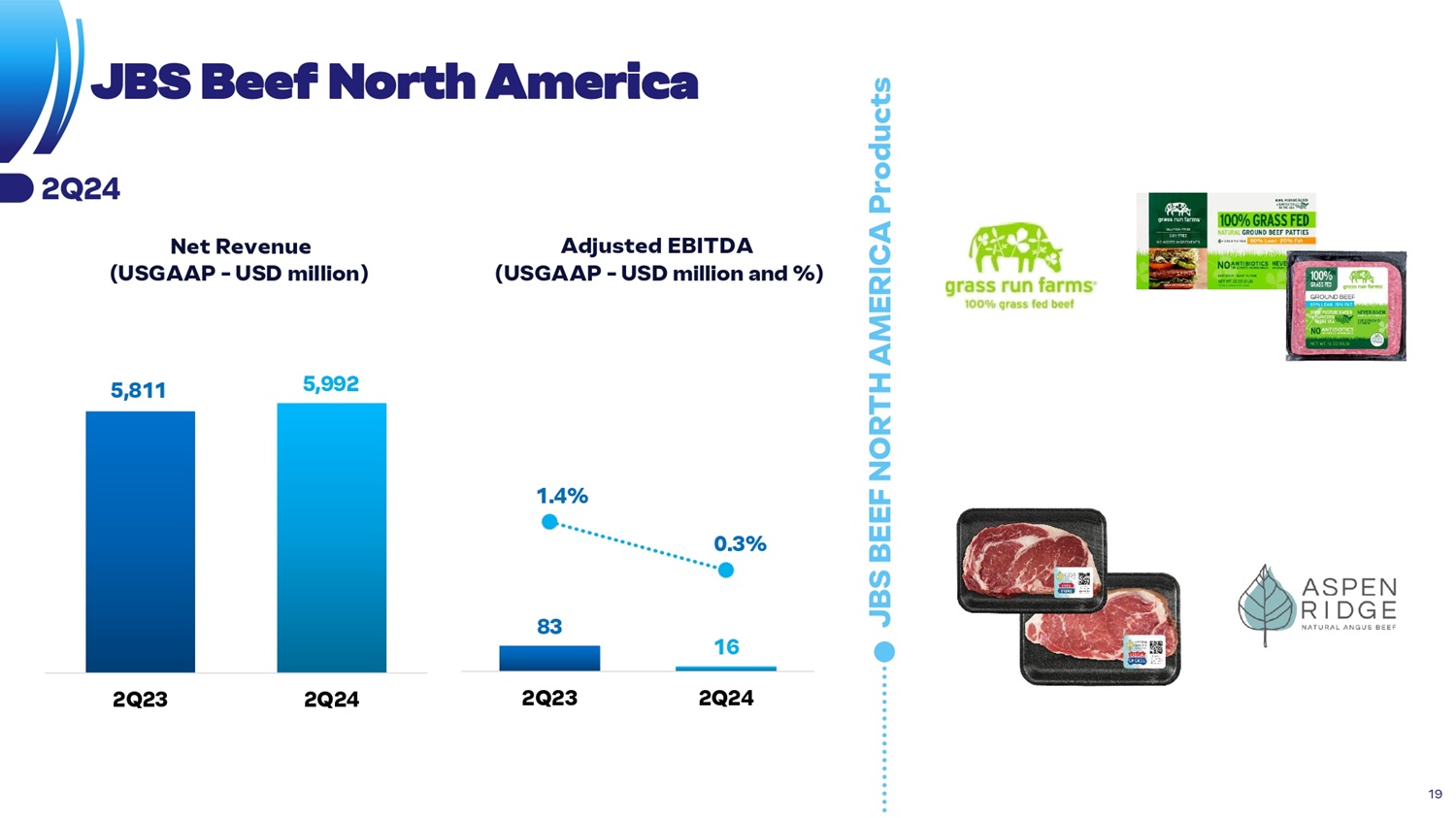

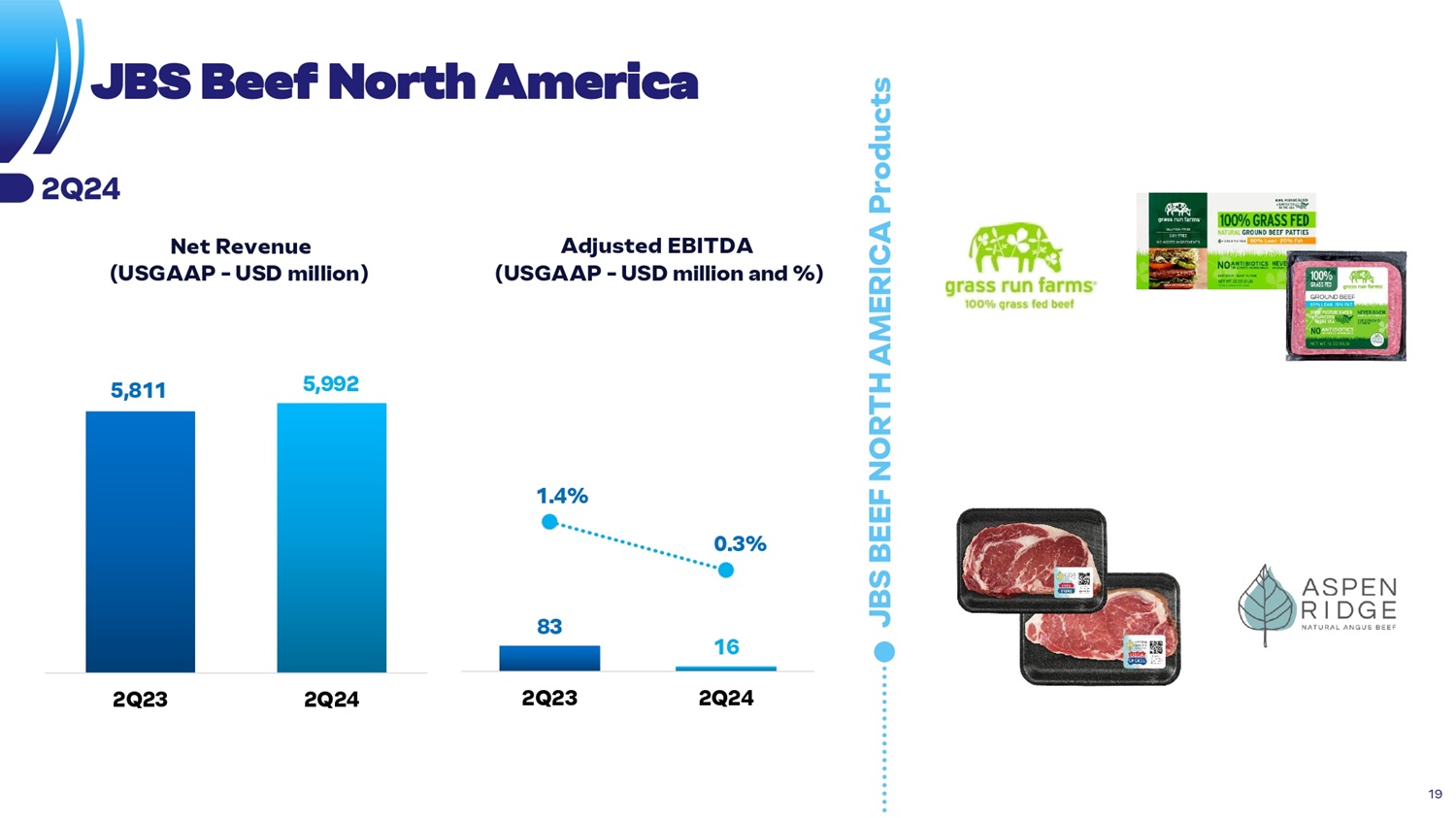

5,811 5,992 2Q23 2Q24 83 16 1.4% 0.3% 2Q23 2Q24 JBS BEEF NORTH AMERICA Products JBS Beef North America Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 2Q24 19

JBS AUSTRALIA Products 130 202 8.6% 12.2% 2Q23 2Q24 JBS Australia 1,509 1,652 2Q23 2Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 2Q24 20

27 273 1.5% 12.6% 2Q23 2Q24 JBS USA PORK Products JBS USA Pork 1,777 2,162 2Q23 2Q24 Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 2Q24 21

4,308 4,559 2Q23 2Q24 249 656 5.8% 14.4% 2Q23 2Q24 PPC Products Pilgrim’s Pride Net Revenue (USGAAP - USD million) Adjusted EBITDA (USGAAP - USD million and %) 2Q24 22

Nota 1: Con S idera China e Hong Kong Export de S tination S O f JBS during 2Q24 20.5% Greater China¹ 16.1% USA 15.7% Africa & Middle Ea S t 9.3% Japan 8.2% South Korea 6.8% E.U. 6.7% Mexico 4.1% South America 3.5% Philippine S 2.9% Canada 6.0% Other S Consolidated exports Exports Revenue in 2Q24: US$4.9Bi +2.4% v S . 2Q23 A S ia corre S ponded to ~ 48% of total exports 23

JBS Bringing more to the table