Washington, D.C. 20549

Gifford R. Zimmerman

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports

right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

Table of Contents

| | |

| Chairman’s Letter to Shareholders | 4 |

| Portfolio Managers’ Comments | 5 |

| Fund Leverage | 10 |

| Share Information | 11 |

| Risk Considerations | 13 |

| Performance Overview and Holding Summaries | 14 |

| Shareholder Meeting Report | 22 |

| Report of Independent Registered Public Accounting Firm | 23 |

| Portfolios of Investments | 24 |

| Statement of Assets and Liabilities | 72 |

| Statement of Operations | 73 |

| Statement of Changes in Net Assets | 74 |

| Statement of Cash Flows | 76 |

| Financial Highlights | 78 |

| Notes to Financial Statements | 82 |

| Additional Fund Information | 94 |

| Glossary of Terms Used in this Report | 95 |

| Reinvest Automatically, Easily and Conveniently | 97 |

| Annual Investment Management Agreement Approval Process | 98 |

| Board Members & Officers | 105 |

3

Chairman’s Letter to Shareholders

Dear Shareholders,

I am honored to serve as the new independent chairman of the Nuveen Fund Board, effective July 1, 2018. I’d like to gratefully acknowledge the stewardship of my predecessor William J. Schneider and, on behalf of my fellow Board members, reinforce our commitment to the legacy of strong, independent oversight of your Funds.

If stock markets are forward-looking, then the recently elevated volatility suggests the consensus view is changing. Rising interest rates, moderating corporate earnings growth prospects and unpredictable geopolitical events including trade wars and Brexit have clouded the horizon. With economic growth in China and Europe already slowing this year, and U.S. growth possibly peaking, investors are watching for clues as to the global economy’s resilience amid these headwinds.

However, it’s important to remember that interim market swings may not reflect longer-term economic conditions. Global growth is indeed slowing, but it’s still positive. The U.S. economy remains strong, even in the face of late-cycle pressures. Low unemployment and firming wages should continue to support consumer spending, and the November mid-term elections resulted in no major surprises. In China, the government remains committed to using fiscal stimulus to offset softening exports. Europe also remains vulnerable to trade policy, but European corporate earnings have remained healthy and their central bank has reaffirmed its commitment to a gradual stimulus withdrawal. In a slower growth environment, there are opportunities for investors who seek them more selectively.

A more challenging landscape can distract you from your investment goals. But you can maintain long-term perspective by setting realistic expectations about short-term volatility and working with your financial advisor to evaluate your goals, timeline and risk tolerance. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Terence J. Toth

Chairman of the Board

December 21, 2018

4

Portfolio Managers’ Comments

Nuveen Municipal Value Fund, Inc. (NUV)

Nuveen AMT-Free Municipal Value Fund (NUW)

Nuveen Municipal Income Fund, Inc. (NMI)

Nuveen Enhanced Municipal Value Fund (NEV)

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen, LLC. Portfolio managers Daniel J. Close, CFA, Christopher L. Drahn, CFA, and Steven M. Hlavin discuss U.S. economic and municipal market conditions, key investment strategies and the twelve-month performance of these four national Funds. Dan has managed NUV and NUW since 2016. Chris assumed portfolio management responsibility for NMI in 2011. Steve has been involved in the management of NEV since its inception in 2009, taking on full portfolio management responsibility in 2010.

What factors affected the U.S. economy and the national municipal market during the twelve-month reporting period ended October 31, 2018?

The U.S. economy accelerated in this reporting period, with gross domestic product (GDP) growth reaching 4.2% (annualized) in the second quarter of 2018, the fastest pace since 2014, then receding to a still relatively robust 3.5% annualized rate in the third quarter of 2018, according to the Bureau of Economic Analysis “second” estimate. GDP is the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes. The boost in economic activity during the second quarter of 2018 was attributed to robust spending by consumers, businesses and the government, as well as a temporary increase in exports, as farmers rushed soybean shipments ahead of China’s retaliatory tariffs. While consumer and government spending continued to drive economic growth in the third quarter, the export contribution declined as expected and both business spending and housing investment weakened.

Consumer spending, the largest driver of the economy, remained well supported by low unemployment, wage gains and tax cuts. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 3.7% in October 2018 from 4.1% in October 2017 and job gains averaged around 210,000 per month for the past twelve months. The jobs market has continued to tighten, while average hourly earnings grew at an annualized rate of 3.1% in October 2018. The Consumer Price Index (CPI) increased 2.5% over the twelve-month reporting period ended October 31, 2018 on a seasonally adjusted basis, as reported by the Bureau of Labor Statistics.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy or sell securities, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments (continued)

Low mortgage rates and low inventory drove home prices higher during this recovery cycle. But the price momentum slowed in recent months as mortgage rates began to drift higher and homes have become less affordable. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, was up 5.5% in September 2018 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over-year increases of 4.8% and 5.1%, respectively.

With the U.S. economy delivering a sustainable growth rate and employment strengthening, the Federal Reserve’s (Fed’s) policy making committee continued to incrementally raise its main benchmark interest rate. The most recent increase, in September 2018, was the third rate hike in 2018 to date and the eighth rate hike since December 2015. Fed Chair Janet Yellen’s term expired in February 2018, and incoming Chairman Jerome Powell indicated he would likely maintain the Fed’s gradual pace of interest rate hikes. The September 2018 meeting confirmed the market’s expectations of another increase in December 2018, followed by additional increases in 2019. Notably, the Fed’s statement dropped “accommodative” from the description of its monetary policy, which Chairman Powell explained did not represent a change in the course of policy but rather an acknowledgement of the strengthening economy. Additionally, the Fed continued reducing its balance sheet by allowing a small amount of maturing Treasury and mortgage securities to roll off each month without reinvestment. The market expects the pace to remain moderate and predictable, with minimal market disruption.

Geopolitical news remained a prominent market driver. The U.S. moved forward with tariffs on imported goods from China, as well as on steel and aluminum from Canada, Mexico and Europe. These countries announced retaliatory measures in kind, intensifying concerns about a trade war, although there have been some positive developments. In July 2018, the U.S. and the Europe Union announced they would refrain from further tariffs while they negotiate trade terms, and in October 2018, the U.S., Mexico and Canada agreed to a new trade deal to replace the North American Free Trade Agreement. The U.S. and China resumed trade negotiations in August 2018, but the talks yielded little progress and President Trump subsequently mentioned imposing tariffs on the balance of Chinese goods. Brexit negotiations made modest progress, but the Irish border remained a sticking point and Prime Minister Theresa May was expected to face difficulty getting a plan approved in Parliament. Elsewhere in Europe, markets remained nervous about Italy’s new euroskeptic coalition government, immigration policy and political risk in Turkey. The U.S. Treasury issued additional sanctions on Russia in April 2018 and re-imposed sanctions on Iran following the U.S. withdrawal from the 2015 nuclear agreement. Bearish crude oil supply news, along with heightened tensions between the U.S. and Saudi Arabia after the disappearance of a Saudi journalist, drove oil price volatility. On the Korean peninsula, the leaders of South Korea and North Korea met during April 2018 and jointly announced a commitment toward peace, while the U.S.-North Korea summit yielded an agreement with few additional details.

The broad municipal bond market posted a modestly negative return for this reporting period. As the economy gained momentum and the Fed continued to nudge its policy rate higher, interest rates rose across the yield curve. However, short-term rates increased by a wider margin than longer-term rates, which were anchored by modest inflation expectations, resulting in a flattening yield curve.

Along with the overall economic outlook, tax reform was a significant market driver for municipal bonds in this reporting period. Early drafts of the tax bill fostered significant uncertainty about the impact on the municipal bond market, leading municipal bonds to underperform taxable bonds in December 2017 and provoking issuers to rush bond offerings ahead of the pending tax law. Issuance in December 2017 reached an all-time high of $62.5 billion, exacerbating the market’s price decline during the month. However, all of the supply was absorbed and municipal bond valuations subsequently returned to more typical levels.

The final tax reform legislation signed on December 27, 2017 largely spared municipal bonds and was considered neutral to positive for the municipal market overall. Notably, a provision that would have eliminated the tax-preferred status of 20% to 30% of the municipal bond market was not included in the final bill. Moreover, investors were relieved that the adopted changes apply only to newly issued municipal bonds and also could be beneficial from a technical standpoint. Because new issue advance refunding bonds are no longer tax exempt, the total supply of municipal bonds will decrease going forward, boosting the scarcity value of

6

existing municipal bonds. The new tax law also caps the state and local tax (SALT) deduction for individuals, which will likely increase demand for tax-exempt municipal bonds, especially in states with high income and/or property taxes.

Following the issuance surge in late 2017, issuance remained sharply lower in early 2018. However, the overall balance of municipal bond supply and demand remained advantageous for prices. Municipal bond issuance nationwide totaled $388.6 billion in this reporting period, a 0.3% increase from the issuance for the twelve-month reporting period ended October 31, 2018. The overall low level of interest rates encouraged issuers to continue to actively refund their outstanding debt. In these transactions the issuers are issuing new bonds and taking the bond proceeds and redeeming (calling) old bonds. These refunding transactions have ranged from 40% to 60% of total issuance over the past few years. Thus, the net issuance (all bonds issued less bonds redeemed) is actually much lower than the gross issuance. So, while gross issuance volume has been strong, the net has not, and this was an overall positive technical factor on municipal bond investment performance in recent years. Although the pace of refundings is slowing, net negative issuance is expected to continue.

Despite the volatility surrounding the potential tax law changes, demand remained robust and continued to outstrip supply. Low global interest rates have continued to drive investors toward higher after-tax yielding assets, including U.S. municipal bonds. As a result, municipal bond fund inflows have remained steady through the end of the reporting period.

What key strategies were used to manage these Funds during the twelve-month reporting period ended October 31, 2018?

Interest rates rose in this reporting period but not uniformly. The yield curve flattened as the rate increase on the short end outpaced that on the long end. The rise in yields weighed on bond prices, but the gradual pace of the increase kept municipal bond fund flows fairly stable. Supply and demand conditions remained favorable, and credit fundamentals were relatively robust. During this time, we continued to take a bottom-up approach to discovering sectors that appeared undervalued as well as individual credits that we believed had the potential to perform well over the long term.

Our trading activity continued to focus on pursuing the Funds’ investment objectives. All four Funds engaged in elevated tax loss swap activity during this reporting period, as the rising interest rate environment provided attractive opportunities to do so. This strategy involves selling bonds that were bought when interest rates were lower and reinvesting the proceeds into bonds offering higher yield levels to capitalize on the tax loss (which can be used to offset future taxable gains) and boost the Funds’ income distribution capabilities. Additionally during this reporting period, all four Funds replaced some New Jersey Tobacco Settlement bonds that were refunded.

NUV and NUW bought intermediate to longer maturities with mid-investment grade credit ratings. NUV added bonds across a diverse range of sectors while NUW made purchases in the state and local general obligation (GO) and dedicated tax sectors. To fund our buying, NUV and NUW mainly used call and maturity proceeds.

In NMI, we maintained the overweight allocations to lower investment grade credits (and corresponding underweights to high grade bonds), modestly adding to the overweights in the single-A and BBB rated categories while trimming the Fund’s AAA and AA rated exposures. As a result of our preference for lower rated bonds, NMI continued to be overweighted in the health care (especially hospitals), transportation (airports and toll roads) and tobacco sectors, and underweighted in state and local GO bonds. NMI was also overweighted in the pre-refunded/escrowed sector, due to older existing holdings being advance refunded by new issues.

For NEV, we invested in tax loss swaps across a wide range of sectors including toll roads, airports, charter schools, higher education, health care and dedicated sales tax. In addition to the aforementioned tobacco bond calls, selected Chicago Board of Education and Marathon Oil bonds were called in this reporting period. Three of the Fund’s tender option bond (TOB) trusts matured and new TOB trusts were established to maintain consistent leverage levels.

As of October 31, 2018, NUV, NUW and NEV continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management, income enhancement and total return enhancement.

7

Portfolio Managers’ Comments (continued)

How did the Funds perform during the twelve-month reporting period ended October 31, 2018?

The tables in each Fund’s Performance Overview and Holding Summaries section of this report provide the Funds’ total returns for the one-year, five-year, ten-year and since inception periods ended October 31, 2018. Each Fund’s total returns at net asset value (NAV) are compared with the performance of a corresponding market index.

For the twelve months ended October 31, 2018, the total returns at NAV for NUV and NUW underperformed the return for the national S&P Municipal Bond Index and NMI’s and NEV’s returns outperformed the return for the national index.

The factors affecting performance in this reporting period included yield curve and duration positioning, credit ratings allocation and sector allocation. Given differences in the maturity structures of the four Funds’ portfolios, the performance impact of duration and yield curve positioning varied by Fund. For NUV, this positioning detracted from performance, driven by overweight allocations among the longest dated segments. NUW was hurt by an overweight to the 10- to 12-year category, but strong relative performance from an overweight at the very shortest (0- to 2-year) end of the yield curve compensated for the negative impact. NMI’s slight overweight allocations to select longer maturities was offset to a great extent by underweights in some of the weaker performing intermediate parts of the curve. NEV maintained a longer average duration than the benchmark, which was unfavorable during the rising interest rate environment, but it was offset by the positive contribution from the Fund’s underweight allocation to longer dated bonds.

For all four Funds, credit ratings allocations were strongly beneficial to performance. Credit spreads narrowed, helping lower rated bonds outperform high grade bonds in this reporting period. NMI, NUV and NUW were most aided by their overweights to BBB and single-B rated bonds. Single-B rated bonds are primarily tobacco securitization bonds, a sector that outperformed in this reporting period. NMI’s modest overweight to the BB category also benefited performance. NEV held overweights to BBB rated, below investment grade and non-rated bonds, which added to excess return versus the benchmark.

Sector positioning was a positive contributor to NUV, NUW and NMI’s performance. NUV and NUW were helped by their exposure to pre-refunded bonds, as well as by an overweight to health care in NUV and an underweight in higher education in NUW. Sector weightings were advantageous across NMI’s overweights in tobacco and health care and underweight in GO bonds. Security selection in the health care sector also boosted performance. Both an overweight and security selection in Illinois bonds was another positive contributor to NMI, while having no exposure to Puerto Rico bonds slightly detracted from relative results. For NEV, the overall impact of sector allocations was neutral. NEV benefited from its overweight allocations to the tobacco and industrial development revenue/pollution control revenue (IDR/PCR) sectors. Within the IDR/PCR sector, the Fund saw standout performance from FirstEnergy Solutions bonds (see the Update on FirstEnergy Solutions Corp. commentary in this report) and Lombard Public Facilities Corporation, Illinois, Conference Center and Hotel revenue bonds, which appreciated significantly due to a bond exchange to restructure the debt. However, an overweight to the hospital sector, which declined slightly during this reporting period, as well as a bias toward higher quality credits within the sector, were detrimental to performance. The Fund also saw disappointing results from its transportation sector holdings, as the Fund’s airport bonds tended to be of higher credit quality and lagged during the reporting period.

In addition, the use of leverage was an important factor affecting performance of the Funds. Leverage is discussed in more detail later in the Fund Leverage section of this report.

8

An Update on FirstEnergy Solutions Corp.

FirstEnergy Solutions Corp. and all of its subsidiaries filed for protection under Chapter 11 of the U.S. Bankruptcy Code on March 18, 2018. FirstEnergy Solutions and its subsidiaries specialize in coal and nuclear energy production. It is one of the main energy producers in the state of Ohio and a major energy provider in Pennsylvania. Because of the challenging market environment for nuclear and coal power in the face of inexpensive natural gas, FirstEnergy Corp., FirstEnergy Solution’s parent announced in late 2016 that it would begin a strategic review of its generation assets. FirstEnergy Solutions is a unique corporate issuer in that the majority of its debt was issued in the municipal market to finance pollution control and waste disposal for its coal and nuclear plants. A substantial amount of bondholders, of which Nuveen Funds are included, entered into an “Agreement in Principal” with FirstEnergy Corp., to resolve potential claims that bondholders may have against FirstEnergy Corp. The agreement is subject to the approval of the FirstEnergy Corp. board of directors, FirstEnergy Solutions and the bankruptcy court.

In terms of FirstEnergy Solutions holdings, shareholders should note that NUW and NMI had no exposure to FirstEnergy, while NUV had 0.62% and NEV had 1.74%. It should be noted that exposure for NUV was in the secured structure, which continues to track close to par.

9

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the NEV relative to its comparative benchmark was the Fund’s use of leverage through investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. This was also a factor, although less significantly, for NUV, NUW and NMI because their use of leverage is more modest. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments in recent years have been much lower than the interest the Fund has been earning on its portfolio of long-term bonds that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund common shares will experience a greater increase in their net asset value if the municipal bonds acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the bonds acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Over the last few quarters, short-term interest rates have indeed increased from their extended lows after the 2007-09 financial crisis. This increase has reduced common share net income, and also reduced potential for long-term total returns. Nevertheless, the ability to effectively borrow at current short-term rates is still resulting in enhanced common share income, and management believes that the advantages of continuation of leverage outweigh the associated increase in risk and volatility described above.

The use of leverage through inverse floating rate securities had a negative impact on the performance of NUW and a negligible impact on the performance of NUV, NMI and NEV over the reporting period.

As of October 31, 2018, the Funds’ percentages of leverage are as shown in the accompanying table.

| | | | | | | | | | | | | |

| | | NUV | | | NUW | | | NMI | | | NEV | |

| Effective Leverage* | | | 2.37 | % | | | 7.31 | % | | | 0.00 | % | | | 39.49 | % |

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. |

10

Share Information

DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of October 31, 2018. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to shareholders were as shown in the accompanying table.

| | | | | | | | | | | | | |

| | | Per Share Amounts | |

| Monthly Distributions (Ex-Dividend Date) | | NUV | | | NUW | | | NMI | | | NEV | |

| November 2017 | | $ | 0.0325 | | | $ | 0.0600 | | | $ | 0.0405 | | | $ | 0.0680 | |

| December | | | 0.0310 | | | | 0.0600 | | | | 0.0390 | | | | 0.0650 | |

| January | | | 0.0310 | | | | 0.0600 | | | | 0.0390 | | | | 0.0650 | |

| February | | | 0.0310 | | | | 0.0600 | | | | 0.0390 | | | | 0.0650 | |

| March | | | 0.0310 | | | | 0.0600 | | | | 0.0390 | | | | 0.0650 | |

| April | | | 0.0310 | | | | 0.0600 | | | | 0.0390 | | | | 0.0650 | |

| May | | | 0.0310 | | | | 0.0600 | | | | 0.0390 | | | | 0.0650 | |

| June | | | 0.0310 | | | | 0.0560 | | | | 0.0360 | | | | 0.0620 | |

| July | | | 0.0310 | | | | 0.0560 | | | | 0.0360 | | | | 0.0620 | |

| August | | | 0.0310 | | | | 0.0560 | | | | 0.0360 | | | | 0.0620 | |

| September | | | 0.0310 | | | | 0.0560 | | | | 0.0360 | | | | 0.0565 | |

| October 2018 | | | 0.0310 | | | | 0.0560 | | | | 0.0360 | | | | 0.0565 | |

| Total Monthly Per Share Distributions | | $ | 0.3735 | | | $ | 0.7000 | | | $ | 0.4545 | | | $ | 0.7570 | |

| Ordinary Income Distribution* | | $ | 0.0160 | | | $ | 0.0191 | | | $ | 0.0026 | | | $ | 0.0114 | |

| Total Distributions from Net Investment Income | | $ | 0.3895 | | | $ | 0.7191 | | | $ | 0.4571 | | | $ | 0.7684 | |

| Total Distributions from Long-Term Capital Gains | | $ | — | | | $ | 0.1816 | | | $ | — | | | $ | — | |

| Total Distributions | | $ | 0.3895 | | | $ | 0.9007 | | | $ | 0.4571 | | | $ | 0.7684 | |

| | |

| Yields | | | | | | | | | | | | | | | | |

| Market Yield** | | | 4.05 | % | | | 4.68 | % | | | 4.28 | % | | | 5.34 | % |

| Taxable-Equivalent Yield** | | | 5.33 | % | | | 6.16 | % | | | 5.63 | % | | | 7.03 | % |

| * | Distribution paid in December 2017. |

| ** | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 24.0%. When comparing a Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

11

Share Information (continued)

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

EQUITY SHELF PROGRAMS

During the current reporting period, NUW and NMI were authorized by the Securities and Exchange Commission to issue additional shares through an equity shelf program (Shelf Offering). Under these programs, NUW and NMI, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per share. The total amount of shares authorized under these Shelf Offerings are as shown in the accompanying table.

| | | | | | | |

| | | NUW | | | NMI | |

| Additional authorized shares | | | 1,400,000 | | | | 800,000 | |

During the current reporting period, the following Funds sold shares through their Shelf Offerings at a weighted average premium to their NAV per share as shown in the accompanying table.

| | | | | | | |

| | | NUW | | | NMI | |

| Shares sold through shelf offering | | | 299,412 | | | | 187,400 | |

| Weighted average premium to NAV per share sold | | | 2.92 | % | | | 4.54 | % |

Refer to Notes to Financial Statements, Note 4 – Fund Shares, Equity Shelf Programs and Offering Costs for further details of Shelf Offerings and each Fund’s respective transactions.

SHARE REPURCHASES

During August 2018, the Funds’ Board of Directors/Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of October 31, 2018, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding shares as shown in the accompanying table.

| | | | | | | | | | | | | |

| | | NUV | | | NUW | | | NMI | | | NEV | |

| Shares cumulatively repurchased and retired | | | — | | | | — | | | | — | | | | — | |

| Shares authorized for repurchase | | | 20,690,000 | | | | 1,540,000 | | | | 875,000 | | | | 2,495,000 | |

OTHER SHARE INFORMATION

As of October 31, 2018, and during the current reporting period, the Funds’ share prices were trading at a premium/(discount) to their NAVs as shown in the accompanying table.

| | | | | | | | | | | | | |

| | | NUV | | | NUW | | | NMI | | | NEV | |

| NAV | | $ | 9.84 | | | $ | 15.88 | | | $ | 10.92 | | | $ | 14.24 | |

| Share price | | $ | 9.18 | | | $ | 14.36 | | | $ | 10.09 | | | $ | 12.70 | |

| Premium/(Discount) to NAV | | | (6.71 | )% | | | (9.57 | )% | | | (7.60 | )% | | | (10.81 | )% |

| 12-month average premium/(discount) to NAV | | | (4.85 | )% | | | (3.19 | )% | | | (0.65 | )% | | | (6.68 | )% |

12

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Municipal Value Fund, Inc. (NUV)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. These and other risk considerations such as tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NUV.

Nuveen AMT-Free Municipal Value Fund (NUW)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. These and other risk considerations such as tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NUW.

Nuveen Municipal Income Fund, Inc. (NMI)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. These and other risk considerations such as tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NMI.

Nuveen Enhanced Municipal Value Fund (NEV)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. The Fund uses only inverse floaters for its leverage, increasing its exposure to interest rate risk and credit risk, including counter-party credit risk. These and other risk considerations such as tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NEV.

13

| | |

NUV | Nuveen Municipal Value Fund, Inc. |

| | Performance Overview and Holding Summaries as of October 31, 2018 |

| |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

Average Annual Total Returns as of October 31, 2018 |

| |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

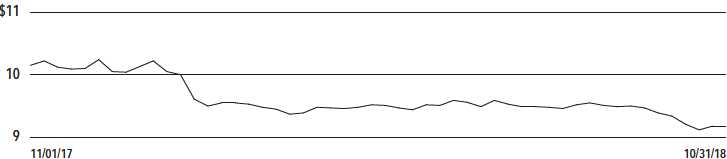

| NUV at NAV | | | (0.71 | )% | | | 4.54 | % | | | 6.01 | % |

| NUV at Share Price | | | (5.55 | )% | | | 4.48 | % | | | 5.30 | % |

| S&P Municipal Bond Index | | | (0.31 | )% | | | 3.33 | % | | | 4.97 | % |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

14

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 101.7% |

| Corporate Bonds | 0.0% |

| Other Assets Less Liabilities | 0.7% |

Net Assets Plus Floating Rate | |

Obligations | 102.4% |

| Floating Rate Obligations | (2.4)% |

Net Assets | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 10.7% |

| AAA | 5.4% |

| AA | 34.6% |

| A | 22.9% |

| BBB | 16.5% |

| BB or Lower | 6.4% |

| N/R (not rated) | 3.5% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Transportation | 21.2% |

| Tax Obligation/Limited | 20.4% |

| Tax Obligation/General | 13.4% |

| Health Care | 13.1% |

| U.S. Guaranteed | 10.4% |

| Utilities | 7.1% |

| Other | 14.4% |

Total | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| Texas | 15.8% |

| Illinois | 13.4% |

| California | 9.0% |

| Colorado | 6.6% |

| New York | 5.6% |

| Florida | 4.9% |

| New Jersey | 3.7% |

| Ohio | 3.5% |

| Wisconsin | 3.4% |

| Michigan | 2.9% |

| Nevada | 2.8% |

| Washington | 2.7% |

| Indiana | 2.0% |

| South Carolina | 1.6% |

| Massachusetts | 1.6% |

| Maryland | 1.4% |

| Other | 19.1% |

Total | 100% |

15

| | |

NUW | Nuveen AMT-Free Municipal Value Fund |

| | Performance Overview and Holding Summaries as of October 31, 2018 |

| |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

Average Annual Total Returns as of October 31, 2018 |

| |

| | | Average Annual | |

| | | | | | | | | Since | |

| | | 1-Year | | | 5-Year | | | Inception | |

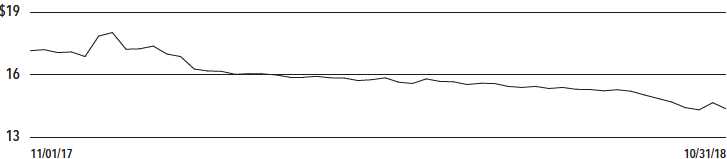

| NUW at NAV | | | (1.31 | )% | | | 4.35 | % | | | 6.25 | % |

| NUW at Share Price | | | (11.54 | )% | | | 3.82 | % | | | 4.73 | % |

| S&P Municipal Bond Index | | | (0.31 | )% | | | 3.33 | % | | | 4.54 | % |

Since inception returns are from 2/25/09. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

16

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 102.2% |

| Other Assets Less Liabilities | 1.5% |

Net Assets Plus Floating Rate | |

Obligations | 103.7% |

| Floating Rate Obligations | (3.7)% |

Net Assets | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 23.7% |

| AAA | 8.1% |

| AA | 23.6% |

| A | 26.7% |

| BBB | 11.5% |

| BB or Lower | 5.1% |

| N/R (not rated) | 1.3% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| U.S. Guaranteed | 20.0% |

| Tax Obligation/Limited | 14.7% |

| Tax Obligation/General | 14.2% |

| Transportation | 13.5% |

| Utilities | 12.7% |

| Water and Sewer | 6.8% |

| Health Care | 6.1% |

| Consumer Staples | 5.0% |

| Other | 7.0% |

Total | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| California | 12.0% |

| Texas | 10.4% |

| Illinois | 10.0% |

| Florida | 7.9% |

| Nevada | 6.1% |

| Colorado | 5.4% |

| Ohio | 5.1% |

| New Jersey | 4.8% |

| Wisconsin | 4.7% |

| New York | 3.9% |

| Maryland | 3.6% |

| Indiana | 3.3% |

| Arizona | 3.0% |

| Other | 19.8% |

Total | 100% |

17

| | |

NMI | Nuveen Municipal Income Fund, Inc. |

| | Performance Overview and Holding Summaries as of October 31, 2018 |

| |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

Average Annual Total Returns as of October 31, 2018 |

| |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

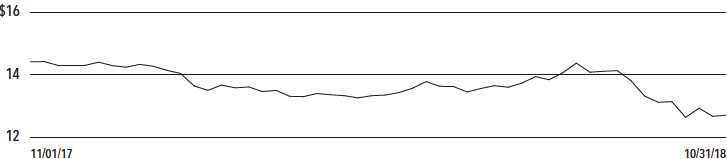

| NMI at NAV | | | (0.05 | )% | | | 4.75 | % | | | 6.67 | % |

| NMI at Share Price | | | (8.14 | )% | | | 4.51 | % | | | 5.19 | % |

| S&P Municipal Bond Index | | | (0.31 | )% | | | 3.33 | % | | | 4.97 | % |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

18

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 98.4% |

| Other Assets Less Liabilities | 1.6% |

Net Assets | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 12.9% |

| AAA | 0.6% |

| AA | 18.5% |

| A | 32.0% |

| BBB | 23.1% |

| BB or Lower | 7.0% |

| N/R (not rated) | 5.9% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Health Care | 21.8% |

| Tax Obligation/General | 14.1% |

| U.S. Guaranteed | 12.7% |

| Transportation | 12.0% |

| Tax Obligation/Limited | 10.0% |

| Education and Civic Organizations | 9.3% |

| Utilities | 6.8% |

| Other | 13.3% |

Total | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| California | 17.6% |

| Colorado | 10.2% |

| Illinois | 9.6% |

| Texas | 8.2% |

| Wisconsin | 7.8% |

| Florida | 5.9% |

| Ohio | 4.6% |

| Pennsylvania | 3.4% |

| Missouri | 3.1% |

| Arizona | 2.4% |

| Tennessee | 2.4% |

| Minnesota | 2.1% |

| New York | 2.1% |

| Georgia | 2.0% |

| Other | 18.6% |

Total | 100% |

19

| | |

NEV | Nuveen Enhanced Municipal Value Fund |

| | Performance Overview and Holding Summaries as of October 31, 2018 |

| |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

Average Annual Total Returns as of October 31, 2018 |

| |

| | | Average Annual | |

| | | | | | | | | Since | |

| | | 1-Year | | | 5-Year | | | Inception | |

| NEV at NAV | | | (0.17 | )% | | | 6.25 | % | | | 6.20 | % |

| NEV at Share Price | | | (5.93 | )% | | | 4.33 | % | | | 4.50 | % |

| S&P Municipal Bond Index | | | (0.31 | )% | | | 3.33 | % | | | 3.73 | % |

Since inception returns are from 9/25/09. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Share Price Performance — Weekly Closing Price

20

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 125.8% |

| Other Assets Less Liabilities | 1.2% |

Net Assets Plus Floating Rate | |

Obligations | 127.0% |

| Floating Rate Obligations | (27.0)% |

Net Assets | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 14.9% |

| AAA | 3.0% |

| AA | 26.3% |

| A | 20.8% |

| BBB | 18.9% |

| BB or Lower | 7.9% |

| N/R (not rated) | 8.2% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Tax Obligation/Limited | 24.2% |

| Health Care | 16.0% |

| Transportation | 12.8% |

| U.S. Guaranteed | 11.7% |

| Tax Obligation/General | 9.6% |

| Education and Civic Organizations | 6.7% |

| Utilities | 5.9% |

| Other | 13.1% |

Total | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| Illinois | 14.4% |

| California | 9.5% |

| New Jersey | 8.3% |

| Wisconsin | 8.3% |

| Ohio | 7.7% |

| Pennsylvania | 6.8% |

| Louisiana | 4.7% |

| Guam | 4.7% |

| Florida | 4.6% |

| New York | 3.6% |

| Georgia | 3.5% |

| Washington | 3.5% |

| Arizona | 2.5% |

| Other | 17.9% |

Total | 100% |

21

Shareholder Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen on August 8, 2018 for NUV, NUW, NMI and NEV; at this meeting the shareholders were asked to elect Board Members.

| | | | | |

| | NUV | NUW | NMI | NEV |

| | Common | Common | Common | Common |

| | Shares | Shares | Shares | Shares |

Approval of the Board Members was reached as follows: | | | | |

| Margo L. Cook | | | | |

| For | 181,432,160 | 14,100,057 | 7,648,213 | 22,659,542 |

| Withhold | 4,462,101 | 343,422 | 422,275 | 836,107 |

| Total | 185,894,261 | 14,443,479 | 8,070,488 | 23,495,649 |

| Jack B. Evans | | | | |

| For | 180,613,263 | 14,038,891 | 7,620,179 | 22,546,985 |

| Withhold | 5,280,998 | 404,588 | 450,309 | 948,664 |

| Total | 185,894,261 | 14,443,479 | 8,070,488 | 23,495,649 |

| Albin F. Moschner | | | | |

| For | 180,883,234 | 14,084,523 | 7,636,410 | 22,630,447 |

| Withhold | 5,011,027 | 358,956 | 434,078 | 865,202 |

| Total | 185,894,261 | 14,443,479 | 8,070,488 | 23,495,649 |

| William J. Schneider | | | | |

| For | 180,339,085 | 14,058,520 | 7,557,738 | 22,557,883 |

| Withhold | 5,555,176 | 384,959 | 512,750 | 937,766 |

| Total | 185,894,261 | 14,443,479 | 8,070,488 | 23,495,649 |

22

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors/Trustees of

Nuveen Municipal Value Fund, Inc.

Nuveen AMT-Free Municipal Value Fund

Nuveen Municipal Income Fund, Inc.

Nuveen Enhanced Municipal Value Fund:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the portfolios of investments, of Nuveen Municipal Value Fund, Inc., Nuveen AMT-Free Municipal Value Fund, Nuveen Municipal Income Fund, Inc., and Nuveen Enhanced Municipal Value Fund (the “Funds”) as of October 31, 2018, the related statements of operations and cash flows (Nuveen Enhanced Municipal Value Fund ) for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of October 31, 2018, the results of their operations and the cash flows of Nuveen Enhanced Municipal Value Fund for the year then ended, the changes in their net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of October 31, 2018, by correspondence with the custodian and brokers or other appropriate auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen investment companies since 2014.

Chicago, Illinois

December 27, 2018

23

| | |

| NUV | Nuveen Municipal Value Fund, Inc. Portfolio of Investments October 31, 2018 |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | LONG-TERM INVESTMENTS – 101.7% | | | |

| | | MUNICIPAL BONDS – 101.7% | | | |

| | | Alaska – 0.1% | | | |

| $ 2,710 | | Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed Bonds, | 12/18 at 100.00 | B3 | $ 2,704,607 |

| | | Series 2006A, 5.000%, 6/01/32 | | | |

| | | Arizona – 1.2% | | | |

| | | Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Senior Lien | | | |

| | | Series 2017A: | | | |

| 2,935 | | 5.000%, 7/01/35 | 7/27 at 100.00 | AA– | 3,294,097 |

| 4,750 | | 5.000%, 7/01/36 | 7/27 at 100.00 | AA– | 5,312,210 |

| 5,600 | | Salt Verde Financial Corporation, Arizona, Senior Gas Revenue Bonds, Citigroup Energy Inc. | No Opt. Call | BBB+ | 6,366,472 |

| | | Prepay Contract Obligations, Series 2007, 5.000%, 12/01/37 | | | |

| 4,240 | | Scottsdale Industrial Development Authority, Arizona, Hospital Revenue Bonds, Scottsdale | 9/20 at 100.00 | AA | 4,422,956 |

| | | Healthcare, Series 2006C. Re-offering, 5.000%, 9/01/35 – AGC Insured | | | |

| | | Tucson, Arizona, Water System Revenue Bonds, Refunding Series 2017: | | | |

| 1,000 | | 5.000%, 7/01/32 | 7/27 at 100.00 | AA | 1,140,900 |

| 1,410 | | 5.000%, 7/01/33 | 7/27 at 100.00 | AA | 1,602,944 |

| 1,000 | | 5.000%, 7/01/34 | 7/27 at 100.00 | AA | 1,133,600 |

| 750 | | 5.000%, 7/01/35 | 7/27 at 100.00 | AA | 847,178 |

| 21,685 | | Total Arizona | | | 24,120,357 |

| | | Arkansas – 0.3% | | | |

| 5,650 | | Fayetteville, Arkansas, Sales and Use Tax Revenue Bonds, Series 2006A, 4.750%, 11/01/18 – | 5/18 at 100.00 | AA | 5,650,000 |

| | | AGM Insured | | | |

| | | California – 9.1% | | | |

| 4,615 | | Anaheim Public Financing Authority, California, Lease Revenue Bonds, Public Improvement | No Opt. Call | AA | 4,052,293 |

| | | Project, Series 1997C, 0.000%, 9/01/23 – AGM Insured | | | |

| 5,000 | | Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, Series | 4/23 at 100.00 | AA– (4) | 5,626,100 |

| | | 2013S-4, 5.000%, 4/01/38 (Pre-refunded 4/01/23) | | | |

| 4,245 | | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Gold | 1/19 at 100.00 | CCC | 1,852,560 |

| | | Country Settlement Funding Corporation, Refunding Series 2006, 0.000%, 6/01/33 | | | |

| | | California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Los | | | |

| | | Angeles County Securitization Corporation, Series 2006A: | | | |

| 3,275 | | 5.450%, 6/01/28 | 12/18 at 100.00 | B2 | 3,284,760 |

| 4,200 | | 5.600%, 6/01/36 | 12/18 at 100.00 | B2 | 4,205,670 |

| 1,175 | | California Department of Water Resources, Central Valley Project Water System Revenue Bonds, | 12/26 at 100.00 | AAA | 1,352,496 |

| | | Refunding Series 2016AW, 5.000%, 12/01/33 | | | |

| 10,000 | | California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health, | 11/26 at 100.00 | AA– | 10,903,700 |

| | | Refunding Series 2016B, 5.000%, 11/15/46 | | | |

| 1,200 | | California Health Facilities Financing Authority, Revenue Bonds, Children’s Hospital Los | 8/27 at 100.00 | BBB+ | 1,323,612 |

| | | Angeles, Series 2017A, 5.000%, 8/15/37 | | | |

| 13,000 | | California Health Facilities Financing Authority, Revenue Bonds, Kaiser Permanente System, | No Opt. Call | AA– | 15,701,140 |

| | | Series 2017A-2, 5.000%, 11/01/47 | | | |

| 3,850 | | California Health Facilities Financing Authority, Revenue Bonds, Saint Joseph Health System, | 7/23 at 100.00 | AA– | 4,205,432 |

| | | Series 2013A, 5.000%, 7/01/33 | | | |

| 2,335 | | California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center, Series | 7/20 at 100.00 | Baa2 (4) | 2,478,322 |

| | | 2010A, 5.750%, 7/01/40 (Pre-refunded 7/01/20) | | | |

24

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California (continued) | | | |

| | | California Municipal Finance Authority, Revenue Bonds, Linxs APM Project, Senior Lien | | | |

| | | Series 2018A: | | | |

| $ 2,830 | | 5.000%, 12/31/34 (Alternative Minimum Tax) | 6/28 at 100.00 | N/R | $ 3,090,360 |

| 3,300 | | 5.000%, 12/31/43 (Alternative Minimum Tax) | 6/28 at 100.00 | N/R | 3,532,056 |

| 1,625 | | California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series | 11/23 at 100.00 | A+ | 1,773,200 |

| | | 2013I, 5.000%, 11/01/38 | | | |

| 5,000 | | California State, General Obligation Bonds, Various Purpose Series 2011, 5.000%, 10/01/41 | 10/21 at 100.00 | AA– | 5,370,950 |

| 3,500 | | California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda | 6/26 at 100.00 | BB– | 3,566,185 |

| | | University Medical Center, Series 2016A, 5.000%, 12/01/46, 144A | | | |

| 3,125 | | California Statewide Community Development Authority, Revenue Bonds, Methodist Hospital | 8/19 at 100.00 | N/R (4) | 3,241,563 |

| | | Project, Series 2009, 6.750%, 2/01/38 (Pre-refunded 8/01/19) | | | |

| 4,505 | | Covina-Valley Unified School District, Los Angeles County, California, General Obligation | No Opt. Call | A+ | 3,255,358 |

| | | Bonds, Series 2003B, 0.000%, 6/01/28 – FGIC Insured | | | |

| 5,700 | | East Bay Municipal Utility District, Alameda and Contra Costa Counties, California, Water | 6/27 at 100.00 | AAA | 6,414,324 |

| | | System Revenue Bonds, Green Series 2017A, 5.000%, 6/01/45 | | | |

| 2,180 | | Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, | 1/31 at 100.00 | A– | 1,948,048 |

| | | Refunding Series 2013A, 0.000%, 1/15/42 (5) | | | |

| 30,000 | | Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, Series | No Opt. Call | AA+ (4) | 28,037,397 |

| | | 1995A, 0.000%, 1/01/22 (ETM) | | | |

| | | Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed | | | |

| | | Bonds, Series 2018A-1: | | | |

| 10,000 | | 5.250%, 6/01/47 | 6/22 at 100.00 | N/R | 10,064,300 |

| 4,100 | | 5.000%, 6/01/47 | 6/22 at 100.00 | N/R | 4,010,128 |

| | | Merced Union High School District, Merced County, California, General Obligation Bonds, | | | |

| | | Series 1999A: | | | |

| 2,500 | | 0.000%, 8/01/23 – FGIC Insured | No Opt. Call | AA– | 2,201,125 |

| 2,555 | | 0.000%, 8/01/24 – FGIC Insured | No Opt. Call | AA– | 2,173,947 |

| 2,365 | | Montebello Unified School District, Los Angeles County, California, General Obligation Bonds, | No Opt. Call | A– | 1,714,696 |

| | | Election 1998 Series 2004, 0.000%, 8/01/27 – FGIC Insured | | | |

| | | Mount San Antonio Community College District, Los Angeles County, California, General | | | |

| | | Obligation Bonds, Election of 2008, Series 2013A: | | | |

| 3,060 | | 0.000%, 8/01/28 (5) | 2/28 at 100.00 | Aa1 | 2,912,661 |

| 2,315 | | 0.000%, 8/01/43 (5) | 8/35 at 100.00 | Aa1 | 1,840,726 |

| 3,550 | | M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, Series | No Opt. Call | A | 4,753,912 |

| | | 2009C, 6.500%, 11/01/39 | | | |

| 2,350 | | Palomar Pomerado Health Care District, California, Certificates of Participation, Series 2009, | 11/19 at 100.00 | N/R (4) | 2,465,644 |

| | | 6.750%, 11/01/39 (Pre-refunded 11/01/19) | | | |

| 10,150 | | Placer Union High School District, Placer County, California, General Obligation Bonds, Series | No Opt. Call | AA | 5,851,374 |

| | | 2004C, 0.000%, 8/01/33 – AGM Insured | | | |

| | | San Bruno Park School District, San Mateo County, California, General Obligation Bonds, | | | |

| | | Series 2000B: | | | |

| 2,575 | | 0.000%, 8/01/24 – FGIC Insured | No Opt. Call | A+ | 2,182,287 |

| 2,660 | | 0.000%, 8/01/25 – FGIC Insured | No Opt. Call | A+ | 2,175,827 |

| 490 | | San Diego Tobacco Settlement Revenue Funding Corporation, California, Tobacco Settlement | 6/28 at 100.00 | BBB | 497,384 |

| | | Bonds, Subordinate Series 2018C, 4.000%, 6/01/32 | | | |

| 250 | | San Francisco Redevelopment Financing Authority, California, Tax Allocation Revenue Bonds, | 2/21 at 100.00 | BBB+ (4) | 277,910 |

| | | Mission Bay South Redevelopment Project, Series 2011D, 7.000%, 8/01/41 (Pre-refunded 2/01/21) | | | |

| 12,095 | | San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue | No Opt. Call | Baa2 | 9,842,548 |

| | | Bonds, Refunding Series 1997A, 0.000%, 1/15/25 – NPFG Insured | | | |

| 13,220 | | San Mateo County Community College District, California, General Obligation Bonds, Series | No Opt. Call | AAA | 9,789,013 |

| | | 2006A, 0.000%, 9/01/28 – NPFG Insured | | | |

| 5,000 | | San Mateo Union High School District, San Mateo County, California, General Obligation Bonds, | No Opt. Call | Aaa | 4,313,300 |

| | | Election of 2000, Series 2002B, 0.000%, 9/01/24 – FGIC Insured | | | |

25

| | |

| NUV | Nuveen Municipal Value Fund, Inc. Portfolio of Investments (continued) October 31, 2018 |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | California (continued) | | | |

| $ 5,815 | | San Ysidro School District, San Diego County, California, General Obligation Bonds, Refunding | No Opt. Call | AA | $ 1,282,847 |

| | | Series 2015, 0.000%, 8/01/48 | | | |

| 2,000 | | Tobacco Securitization Authority of Northern California, Tobacco Settlement Asset-Backed | 12/18 at 100.00 | BB– | 2,010,520 |

| | | Bonds, Refunding Series 2005A-2, 5.400%, 6/01/27 | | | |

| | | University of California, General Revenue Bonds, Series 2009O: | | | |

| 370 | | 5.250%, 5/15/39 (Pre-refunded 5/15/19) | 5/19 at 100.00 | N/R (4) | 377,119 |

| 720 | | 5.250%, 5/15/39 (Pre-refunded 5/15/19) | 5/19 at 100.00 | AA (4) | 733,853 |

| 210 | | 5.250%, 5/15/39 (Pre-refunded 5/15/19) | 5/19 at 100.00 | N/R (4) | 214,040 |

| 203,010 | | Total California | | | 186,900,687 |

| | | Colorado – 6.7% | | | |

| 5,200 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health Initiatives, | 1/19 at 100.00 | BBB+ | 5,204,732 |

| | | Series 2006A, 4.500%, 9/01/38 | | | |

| 7,105 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health Initiatives, | 1/23 at 100.00 | BBB+ | 7,478,368 |

| | | Series 2013A, 5.250%, 1/01/45 | | | |

| 2,845 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sisters of Charity of | 1/20 at 100.00 | AA– | 2,938,629 |

| | | Leavenworth Health Services Corporation, Refunding Composite Deal Series 2010B, | | | |

| | | 5.000%, 1/01/21 | | | |

| 15,925 | | Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sisters of Charity of | 1/20 at 100.00 | AA– | 16,348,764 |

| | | Leavenworth Health Services Corporation, Series 2010A, 5.000%, 1/01/40 | | | |

| 960 | | Colorado High Performance Transportation Enterprise, C-470 Express Lanes Revenue Bonds, | 12/24 at 100.00 | N/R | 1,015,699 |

| | | Senior Lien Series 2017, 5.000%, 12/31/47 | | | |

| 4,575 | | Colorado Springs, Colorado, Utilities System Revenue Bonds, Improvement Series 2018A-4, | 11/28 at 100.00 | AA | 5,130,908 |

| | | 5.000%, 11/15/43 | | | |

| 2,000 | | Colorado State Board of Governors, Colorado State University Auxiliary Enterprise System | 3/22 at 100.00 | AA (4) | 2,180,860 |

| | | Revenue Bonds, Series 2012A, 5.000%, 3/01/41 (Pre-refunded 3/01/22) | | | |

| | | Colorado State, Certificates of Participation, Lease Purchase Financing Program, National | | | |

| | | Western Center, Series 2018A: | | | |

| 1,250 | | 5.000%, 9/01/30 | 3/28 at 100.00 | Aa2 | 1,432,375 |

| 2,000 | | 5.000%, 9/01/31 | 3/28 at 100.00 | Aa2 | 2,274,500 |

| 1,260 | | 5.000%, 9/01/32 | 3/28 at 100.00 | Aa2 | 1,427,517 |

| 620 | | 5.000%, 9/01/33 | 3/28 at 100.00 | Aa2 | 697,134 |

| 3,790 | | Colorado State, Certificates of Participation, Rural Series 2018A, 5.000%, 12/15/37 | 12/28 at 100.00 | Aa2 | 4,236,538 |

| | | Denver City and County, Colorado, Airport System Revenue Bonds, Series 2012B: | | | |

| 2,750 | | 5.000%, 11/15/25 | 11/22 at 100.00 | AA– | 2,992,495 |

| 2,200 | | 5.000%, 11/15/29 | 11/22 at 100.00 | AA– | 2,385,218 |

| 5,160 | | Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien Series 2013B, | 11/23 at 100.00 | A+ | 5,611,294 |

| | | 5.000%, 11/15/43 | | | |

| 2,000 | | Denver Convention Center Hotel Authority, Colorado, Revenue Bonds, Convention Center Hotel, | 12/26 at 100.00 | Baa2 | 2,142,880 |

| | | Refunding Senior Lien Series 2016, 5.000%, 12/01/35 | | | |

| | | E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B: | | | |

| 9,660 | | 0.000%, 9/01/29 – NPFG Insured | No Opt. Call | A | 6,418,780 |

| 24,200 | | 0.000%, 9/01/31 – NPFG Insured | No Opt. Call | A | 14,632,288 |

| 17,000 | | 0.000%, 9/01/32 – NPFG Insured | No Opt. Call | A | 9,830,080 |

| 7,600 | | E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Refunding Series 2006B, 0.000%, | 9/26 at 52.09 | A | 2,887,772 |

| | | 9/01/39 – NPFG Insured | | | |

| | | E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Series 2004B: | | | |

| 7,700 | | 0.000%, 9/01/27 – NPFG Insured | 9/20 at 67.94 | A | 4,950,869 |

| 10,075 | | 0.000%, 3/01/36 – NPFG Insured | 9/20 at 41.72 | A | 3,946,881 |

| 8,000 | | Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs | No Opt. Call | A+ | 10,527,680 |

| | | Utilities, Series 2008, 6.500%, 11/15/38 | | | |

| 5,000 | | Rangely Hospital District, Rio Blanco County, Colorado, General Obligation Bonds, Refunding | 11/21 at 100.00 | Baa3 | 5,392,650 |

| | | Series 2011, 6.000%, 11/01/26 | | | |

26

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Colorado (continued) | | | |

| $ 3,750 | | Regional Transportation District, Colorado, Denver Transit Partners Eagle P3 Project Private | 7/20 at 100.00 | BBB+ | $ 3,877,013 |

| | | Activity Bonds, Series 2010, 6.000%, 1/15/41 | | | |

| 4,945 | | Regional Transportation District, Colorado, Sales Tax Revenue Bonds, Fastracks Project, Series | 11/26 at 100.00 | AA+ | 5,487,664 |

| | | 2017A, 5.000%, 11/01/40 | | | |

| 4,250 | | University of Colorado, Enterprise System Revenue Bonds, Series 2018B, 5.000%, 6/01/43 | 6/28 at 100.00 | Aa1 | 4,765,015 |

| 161,820 | | Total Colorado | | | 136,214,603 |

| | | Connecticut – 0.8% | | | |

| 1,500 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Hartford HealthCare, | 7/21 at 100.00 | A | 1,565,235 |

| | | Series 2011A, 5.000%, 7/01/41 | | | |

| 8,440 | | Connecticut State, General Obligation Bonds, Series 2015E, 5.000%, 8/01/29 | 8/25 at 100.00 | A1 | 9,178,669 |

| 5,000 | | Connecticut State, General Obligation Bonds, Series 2015F, 5.000%, 11/15/33 | 11/25 at 100.00 | A1 | 5,367,350 |

| 9,797 | | Mashantucket Western Pequot Tribe, Connecticut, Special Revenue Bonds, Subordinate Series | No Opt. Call | N/R | 344,860 |

| | | 2013A, 0.240%, 7/01/31 (cash 4.000%, PIK 2.050%) (6) | | | |

| 24,737 | | Total Connecticut | | | 16,456,114 |

| | | District of Columbia – 1.4% | | | |

| 15,000 | | District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds, | 12/18 at 100.00 | N/R | 2,309,700 |

| | | Series 2006A, 0.000%, 6/15/46 | | | |

| 14,110 | | Metropolitan Washington Airports Authority, District of Columbia, Dulles Toll Road Revenue Bonds, | 4/22 at 100.00 | BBB+ | 14,729,570 |

| | | Dulles Metrorail & Capital Improvement Projects, Refunding Second Senior Lien Series 2014A, | | | |

| | | 5.000%, 10/01/53 | | | |

| 10,000 | | Metropolitan Washington Airports Authority, District of Columbia, Dulles Toll Road Revenue Bonds, | 10/28 at 100.00 | BBB+ | 12,390,200 |

| | | Dulles Metrorail Capital Appreciation, Second Senior Lien Series 2010B, 6.500%, 10/01/44 | | | |

| 39,110 | | Total District of Columbia | | | 29,429,470 |

| | | Florida – 5.0% | | | |

| 3,000 | | Cape Coral, Florida, Water and Sewer Revenue Bonds, Refunding Series 2011, 5.000%, 10/01/41 | 10/21 at 100.00 | AA (4) | 3,239,310 |

| | | (Pre-refunded 10/01/21) – AGM Insured | | | |

| 565 | | Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Renaissance | 6/25 at 100.00 | N/R | 583,634 |

| | | Charter School Income Projects, Series 2015A, 6.000%, 6/15/35, 144A | | | |

| 8,285 | | Florida, Development Finance Corporation, Surface Transportation Facility Revenue Bonds, | 1/19 at 105.00 | N/R | 8,573,981 |

| | | Brightline Passenger Rail Project – South Segment, Series 2017, 0.000%, 1/01/47, 144A | | | |

| | | (Alternative Minimum Tax) | | | |

| 4,000 | | Gainesville, Florida, Utilities System Revenue Bonds, Series 2017A, 5.000%, 10/01/37 | 10/27 at 100.00 | AA– | 4,495,040 |

| 2,845 | | Greater Orlando Aviation Authority, Florida, Airport Facilities Revenue Bonds, Refunding | 10/19 at 100.00 | AA– (4) | 2,923,437 |

| | | Series 2009C, 5.000%, 10/01/34 (Pre-refunded 10/01/19) | | | |

| 2,290 | | Hillsborough County Aviation Authority, Florida, Revenue Bonds, Tampa International Airport, | 10/24 at 100.00 | A+ | 2,461,865 |

| | | Subordinate Lien Series 2015B, 5.000%, 10/01/40 | | | |

| 5,090 | | Miami-Dade County Expressway Authority, Florida, Toll System Revenue Bonds, Series 2010A, | 7/20 at 100.00 | A+ | 5,286,627 |

| | | 5.000%, 7/01/40 | | | |

| 9,500 | | Miami-Dade County Health Facility Authority, Florida, Hospital Revenue Bonds, Miami Children’s | 8/21 at 100.00 | A+ (4) | 10,446,200 |

| | | Hospital, Series 2010A, 6.000%, 8/01/46 (Pre-refunded 8/01/21) | | | |

| 2,000 | | Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Refunding | 10/24 at 100.00 | A | 2,175,660 |

| | | Series 2014B, 5.000%, 10/01/37 | | | |

| 6,000 | | Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Series 2009B, | 10/19 at 100.00 | A (4) | 6,192,420 |

| | | 5.500%, 10/01/36 (Pre-refunded 10/01/19) | | | |

| 4,000 | | Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Series 2010B, | 10/20 at 100.00 | A | 4,187,960 |

| | | 5.000%, 10/01/29 | | | |

| 4,000 | | Miami-Dade County, Florida, Transit System Sales Surtax Revenue Bonds, Refunding Series 2012, | 7/22 at 100.00 | AA | 4,272,600 |

| | | 5.000%, 7/01/42 | | | |

| 9,590 | | Miami-Dade County, Florida, Water and Sewer System Revenue Bonds, Series 2010, 5.000%, | 10/20 at 100.00 | AA (4) | 10,110,737 |

| | | 10/01/39 (Pre-refunded 10/01/20) – AGM Insured | | | |

27

| | |

NUV | Nuveen Municipal Value Fund, Inc. |

| | Portfolio of Investments (continued) |

| | October 31, 2018 |

| |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Florida (continued) | | | |

| | | Orlando Utilities Commission, Florida, Utility System Revenue Bonds, Series 2018A: | | | |

| $ 3,500 | | 5.000%, 10/01/36 | 10/27 at 100.00 | AA | $ 3,938,900 |

| 3,780 | | 5.000%, 10/01/37 | 10/27 at 100.00 | AA | 4,244,713 |

| 1,120 | | 5.000%, 10/01/38 | 10/27 at 100.00 | AA | 1,254,030 |

| 10,725 | | Orlando, Florida, Contract Tourist Development Tax Payments Revenue Bonds, Series 2014A, | 5/24 at 100.00 | AA+ (4) | 12,141,236 |

| | | 5.000%, 11/01/44 (Pre-refunded 5/01/24) | | | |

| 3,250 | | Palm Beach County Health Facilities Authority, Florida, Revenue Bonds, Jupiter Medical Center, | 11/22 at 100.00 | BBB+ | 3,339,928 |

| | | Series 2013A, 5.000%, 11/01/43 | | | |

| 1,020 | | Putnam County Development Authority, Florida, Pollution Control Revenue Bonds, Seminole | 5/28 at 100.00 | A– | 1,106,659 |

| | | Electric Cooperatives, Inc., Project, Refunding Series 2018B, 5.000%, 3/15/42 | | | |

| 6,865 | | South Broward Hospital District, Florida, Hospital Revenue Bonds, Refunding Series 2015, | 5/25 at 100.00 | AA | 6,955,206 |

| | | 4.000%, 5/01/34 | | | |

| 3,300 | | Tampa, Florida, Health System Revenue Bonds, Baycare Health System, Series 2012A, | 5/22 at 100.00 | Aa2 | 3,548,523 |

| | | 5.000%, 11/15/33 | | | |

| 94,725 | | Total Florida | | | 101,478,666 |

| | | Georgia – 0.9% | | | |

| 3,325 | | Atlanta, Georgia, Water and Wastewater Revenue Bonds, Refunding Series 2015, 5.000%, 11/01/40 | 5/25 at 100.00 | Aa2 | 3,651,083 |

| 2,290 | | Fulton County Development Authority, Georgia, Hospital Revenue Bonds, Wellstar Health System, | 4/27 at 100.00 | A | 2,425,293 |

| | | Inc. Project, Series 2017A, 5.000%, 4/01/47 | | | |

| 6,000 | | Gainesville and Hall County Hospital Authority, Georgia, Revenue Anticipation Certificates, | 2/27 at 100.00 | AA– | 6,861,000 |

| | | Northeast Georgia Health Services Inc., Series 2017B, 5.500%, 2/15/42 | | | |