UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2009

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT of 1934 |

Commission file number 000-53587

INVITEL HOLDINGS A/S

(Exact name of Registrant as specified in its charter)

Denmark

(Jurisdiction of incorporation or organization)

Puskas Tivadar u. 8-10, H-2040 Budaors, Hungary

(Address of principal executive offices)

Robert Bowker

Chief Financial Officer, Invitel Holdings A/S

Puskas Tivadar u. 8-10

H-2040 Budaors, Hungary

Telephone: (011) 361-801-1374

Facsimile: (011) 361-801-1555

(Name, Telephone, Facsimile Number and Address of Company Contact Person)

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

| | | | |

Title of each class | | | | Name of each exchange on which registered |

Ordinary Shares of EUR 0.01 each American Depository Shares, each representing one Ordinary Share, EUR 0.01 per Ordinary Share | | | | None |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 16,725,733 Ordinary Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. x Yes ¨ No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. ¨ Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

¨ Large accelerated filer ¨ Accelerated filer x Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

| | | | |

¨ U.S. GAAP | | x International Financial Reporting Standards as issued by the International Accounting Standards Board | | ¨ Other |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

TABLE OF CONTENTS

2

INTRODUCTION

On February 8, 2010, Invitel Holdings A/S (“Invitel Holdings” or the “Company”) filed Form 25 with the Securities and Exchange Commission (the “SEC”) and the NYSE Amex Stock Exchange (the “NYSE Amex”) to delist Invitel Holdings’ American Depositary Shares (ADS) from the NYSE Amex. The NYSE Amex removed Invitel Holdings’ ADSs from the NYSE Amex as of close of trading on February 17, 2010.

Invitel Holdings is a “foreign private issuer” as defined in Rule 3b-4 of the General Rules and Regulations Under the Securities Exchange Act of 1934. As a foreign private issuer, Invitel Holdings is required to file with the SEC annual reports on Form 20-F.

On April 2, 2010, Invitel Holdings filed Form 15 with the SEC which will enable Invitel Holdings to deregister from the SEC and to cease reporting under the Securities Exchange Act of 1934, as amended. Upon the filing of the Form 15, the obligation of Invitel Holdings to file periodic reports with the SEC under the Exchange Act was suspended immediately. The deregistration will be effective 90 days after the filing (July 2, 2010), unless the Form 15 is earlier withdrawn by Invitel Holdings or denied by the SEC. Invitel Holdings reserves the right to withdraw the filing of the Form 15 for any reason prior to its effectiveness.

INTERNATIONAL FINANCIAL REPORTING STANDARDS

Our consolidated financial statements included in this Report are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). See “Item 18. Financial Statements” and “Item 5. Operating and Financial Review and Prospects” for further discussion.

FORWARD-LOOKING STATEMENTS

This Report on Form 20-F contains forward-looking statements. Statements that are not historical facts are forward-looking statements made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. These statements are based on our estimates and assumptions and are subject to risks and uncertainties, which could cause actual results to differ materially from those expressed or implied in the statements. Words such as “believes”, “anticipates”, “estimates”, “expects”, “intends” and similar expressions are intended to identify forward-looking statements. Forward-looking statements (including oral representations) are only predictions or statements of current plans, which we review continuously. For all forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

The following important factors, along with those factors discussed elsewhere in this Report on Form 20-F and in our other reports filed with the Securities and Exchange Commission, could affect future results and could cause those results to differ materially from those expressed in the forward-looking statements:

| | • | | Our inability to execute our business strategy; |

| | • | | The continuing effects of the global economic crisis and in particular the effects of the recent macroeconomic issues affecting the Hungarian economy; |

3

| | • | | Changes in the growth rate of the overall Hungarian, E.U. and Central and South Eastern European economies such that inflation, interest rates, currency exchange rates, business investment and consumer spending are impacted; |

| | • | | Our ability to effectively manage and otherwise monitor our operations, costs, regulatory compliance and service quality; |

| | • | | Changes in consumer preferences for different telecommunication technologies, including trends toward mobile and cable substitution; |

| | • | | Our ability to generate growth or profitable growth; |

| | • | | Material changes in available technology and the effects of such changes including product substitutions and deployment costs; |

| | • | | Our ability to retain key employees; |

| | • | | Political changes in Hungary; |

| | • | | Changes in exchange rates; |

| | • | | Changes in our accounting assumptions that regulatory agencies, including the SEC, may require or that result from changes in the accounting rules or their application, which could result in an impact on our financial results; |

| | • | | Our ability to successfully complete the integration of any businesses or companies that we may acquire into our operations; and |

| | • | | The factors referred to in the “Risk Factors” section of this Report. |

You should consider these important factors in evaluating any forward-looking statements in this Report on Form 20-F or otherwise made by us or on our behalf. We urge you to read this entire Report for a more complete discussion of the factors that could affect our future performance, the Hungarian and Central and South Eastern European telecommunications industry and Hungary in general. In light of these risks, uncertainties and assumptions, the events described or suggested by the forward-looking statements in this Report may not occur.

Except as required by law or applicable stock exchange rules or regulations, we undertake no obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above and contained elsewhere in this Report.

4

CERTAIN DEFINITIONS

In this Report, unless indicated otherwise in this report or the context requires otherwise, the following definitions shall apply:

American Depositary Shares (ADS). A security that allows shareholders in the United States to hold and trade interests in foreign-based companies more easily. ADSs are often evidenced by certificates known as American depositary receipts, or ADRs. Invitel Holdings is a Danish corporation that issues Ordinary Shares. Each Invitel Holdings ADS represents one Invitel Holdings Ordinary Share.

Common Stock. The common stock of Hungarian Telephone and Cable Corp., par value $0.001.

Company. (Invitel Holdings A/S, together with its consolidated subsidiaries (as successor to Hungarian Telephone and Cable Corp., and its consolidated subsidiaries).

DKK. The Danish kroner, which is the lawful currency of Denmark.

E.U. The European Union.

Euro, € or EUR.The euro, which is the lawful currency of the participating member states of the E.U.

Euroweb. Euroweb Hungary and Euroweb Romania, collectively.

Euroweb Hungary. Euroweb Internet Szolgáltató ZRt., a Hungarian company, which was an indirect subsidiary of HTCC until it merged into Invitel effective January 1, 2008.

Euroweb Romania. S.C. EuroWeb Romania S.A., a joint stock company incorporated in Romania and whose registered office is at 102 Lipscani Street (Nouveau Center), building A, 3rd floor, Bucharest, Romania, and an indirect subsidiary of Invitel Holdings.

forint or HUF.The Hungarian forint, which is the lawful currency of the Republic of Hungary.

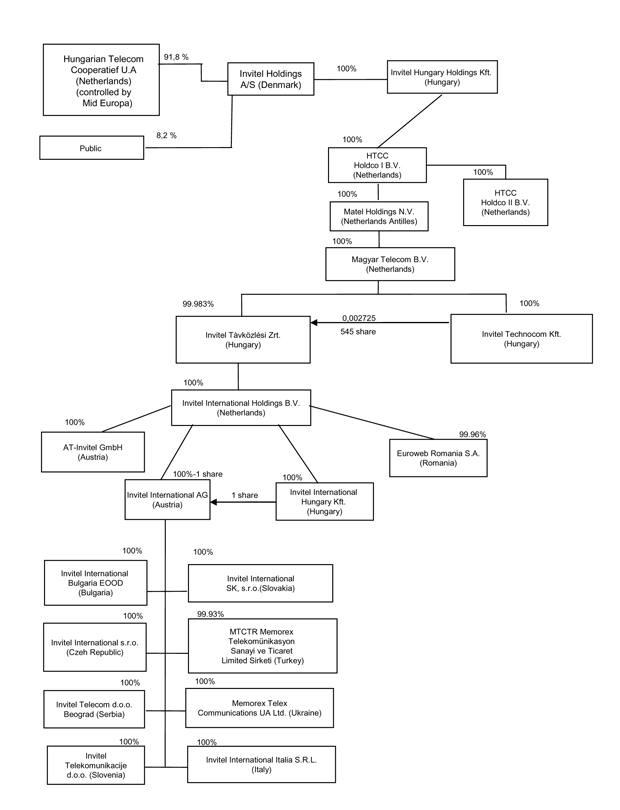

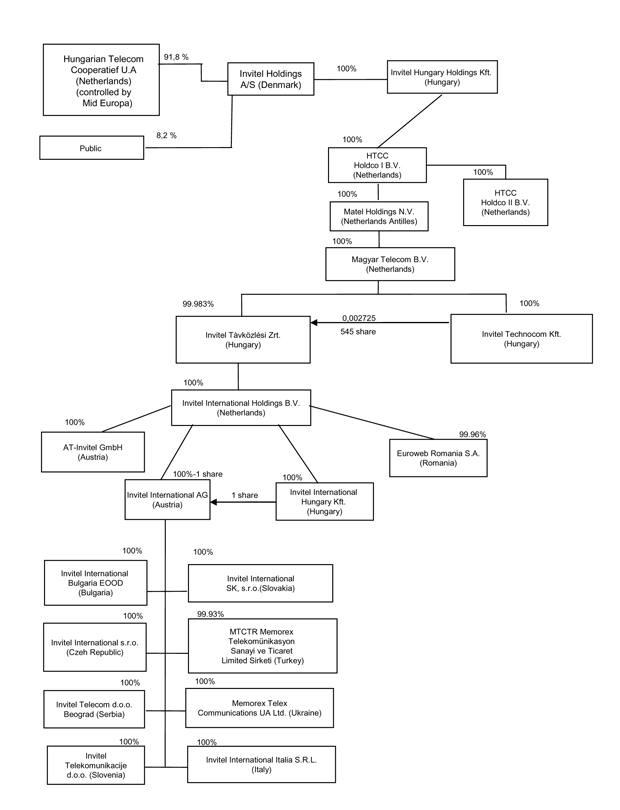

Group. All subsidiaries are majority owned and controlled subsidiaries of Invitel Holdings.

historical concession area. Each of the 54 geographically defined concessions areas for local public fixed line voice telephony service in Hungary which, prior to 2002, were served by local telephone operators with exclusive rights and responsibilities for providing local fixed line telecommunications services.

Holdco I. HTCC Holdco I B.V., a company incorporated in the Netherlands, and an indirect subsidiary of Invitel Holdings.

Holdco II. HTCC Holdco II B.V., a company incorporated in the Netherlands, and an indirect subsidiary of Invitel Holdings.

HTFI. Hungarian Telecom Finance International Limited, a company controlled by Mid Europa.

HTCC. Hungarian Telephone and Cable Corp., a Delaware company and the parent company prior to the Reorganization. HTCC was merged out of existence following the completion of the Reorganization merger and is succeeded by Invitel Holdings.

5

Hungarian Telecom refers to Hungarian Telecom (Netherlands) Cooperatief U.A., a cooperative association organized under the laws of The Netherlands and a company controlled by Mid Europa.

Hungarotel. Hungarotel Távközlési Zrt., a Hungarian company, which was an indirect subsidiary of HTCC until it merged into Invitel effective January 1, 2008.

Hungarotel historical concession areas. The areas in which Hungarotel operated five telecommunications concessions granted by the Hungarian government on an exclusive basis until 2002.

Indentures. The indenture governing the senior secured notes due 2016 issued by Matel. and the indenture governing the senior floating rate notes due 2013, issued by Holdco II.

International Business. Our international wholesale business which includes Invitel International AG (including the Invitel International AG Subsidiaries), Invitel International Hungary and Euroweb Romania.

Invitel. Invitel Távközlési Zrt., a Hungarian company, and an indirect subsidiary of Invitel Holdings.

Invitel Acquisition. The acquisition by HTCC of Matel Holdings and its direct and indirect subsidiaries, including its principal operating subsidiaries Invitel and Euroweb, which acquisition was completed on April 27, 2007.

INVITEL GmbH. AT-INVITEL GmbH, a limited liability company incorporated in Austria and whose registered office is at Ortsstrasse 24, 2331 Vösendorf, Austria, and an indirect subsidiary of Invitel Holdings.

Invitel historical concession areas. The areas in which Invitel operated nine telecommunications concessions granted by the Hungarian government on an exclusive basis until 2002.

Invitel Holdings.Invitel Holdings A/S, a Danish company, and the parent company (as successor to Hungarian Telephone and Cable Corp.) following the Reorganization.

Invitel Holdings ADSs. The American Depositary Shares or ADSs that represent Invitel Holdings’ ordinary shares. Each Invitel Holdings’ ADS represents one Invitel Holdings ordinary share.

Invitel International AG. Invitel International AG, a joint stock company incorporated in Austria and whose registered office is at Ortsstrasse 24, 2331 Vösendorf, Austria, and an indirect subsidiary of Invitel Holdings. Memorex Telex Communications AG was renamed Invitel International AG effective July 25, 2008. Invitel International AG directly owns (i) 100% of the issued share capital of Invitel International SK, s.r.o., a limited liability company incorporated in the Slovak Republic and whose registered office is at Haanova 12, 851 04 Bratislava, Slovak Republic (“Invitel Slovakia”); (ii) 99.93% of the issued share capital of MTCTR Memorex Telekomünikasyon Sanayi ve Ticaret Limited Sirketi, a limited liability company incorporated in Turkey and whose registered office is at Eski Büyükdere, Caddesi 29, Bilek is Merkezi Kat: 7, TR-34416 4. Levent, Istanbul, Turkey (“Memorex Turkey”); (iii) 100% of the issued share capital of Memorex Telex Communications UA Ltd., a limited liability company incorporated in the Ukraine and whose registered office is at Akademika Zabolotnogo str. 20-A, UA - 03187 Kiev, Ukraine (“Memorex Ukraine”); (iv) 100% of the issued share capital of Invitel International Italia S.R.L, a limited liability company incorporated in Italy and whose registered office is at Via F.lli Campi, 20135 Milano, Italy (“Invitel Italy”); (v) 100% of the issued share capital of Invitel International Bulgaria EOOD, a limited liability company incorporated in Bulgaria and whose

6

registered office is at 85-87, Todor Aleksandrov blvd., floor 2, office 2B, 1303 Sofia, Bulgaria (“Invitel Bulgaria”); (vi) 100% of the issued share capital of Invitel International CZ s.r.o., a limited liability company incorporated in the Czech Republic and whose registered office is at Seřadiště 65/7 101 00, Prague, 10 Czech Republic (“Invitel Czech Republic”); (vii) 100% of the issued share capital of Invitel Telecom d.o.o. Beograd, a limited liability company incorporated in Serbia and whose registered office is at 64a Bulevar AVNOJ-a, Belgrad, Serbia (“Invitel Serbia”); and (viii) 100% of the issued share capital of Invitel Telekomunikacije d.o.o., a limited liability company incorporated in Slovenia and whose registered office is at Zelezna Cesta 8a 1000 Ljubljana, Slovenia (“Invitel Slovenia” and together with Invitel Slovakia, Memorex Turkey, Memorex Ukraine, Invitel Italy, Invitel Bulgaria, Invitel Czech Republic and Invitel Serbia, the “Invitel International AG Subsidiaries”).

Invitel International Hungary.Invitel International Hungary Kft, a limited liability company incorporated in Hungary and whose registered office is at Budaörs, Puskás Tivadar utca 8-10, H-2040 Hungary, and an indirect subsidiary of Invitel Holdings.

Invitel Technocom. Invitel Technocom Kft, a Hungarian company, and an indirect subsidiary of Invitel Holdings. PanTel Technocom Kft. was renamed Invitel Technocom Kft. effective January 1, 2008.

Invitel Telecom. Invitel Telecom Kft., a Hungarian company, which was an indirect subsidiary of Invitel Holdings until it merged into Invitel effective June 30, 2009.

Magyar Telekom refers to Magyar Telekom Nyrt., the largest provider of fixed line telecommunications services in Hungary, which is listed on both the Budapest Stock Exchange and the New York Stock Exchange, and whose parent company is Deutsche Telekom AG (which owns 59.2% of Magyar Telekom).

Matel. Magyar Telecom B.V., a company incorporated in The Netherlands, and an indirect subsidiary of Invitel Holdings.

Matel Holdings. Matel Holdings N.V., a company incorporated in The Netherlands Antilles, and an indirect subsidiary of Invitel Holdings.

Memorex. Memorex Telex Communications AG, an Austrian company, together with its consolidated subsidiaries. Memorex Telex Communications AG was renamed Invitel International AG effective July 25, 2008.

Memorex Acquisition. The acquisition by HTCC of 95.7% of the outstanding equity of Memorex, which acquisition was completed on March 5, 2008. We acquired the remaining minority interest on August 28, 2008.

Memorex Subsidiaries. The consolidated subsidiaries of Memorex (now Invitel International AG Subsidiaries).

Mid Europa orMEP.Refers to Mid Europa Partners Limited and any investment fund or vehicle advised, sponsored or managed directly or indirectly by Mid Europa Partners Limited, including Hungarian Telecom and HTFI.

Notes.The senior secured notes due 2016 issued by Matel and the senior floating rate notes due 2013, issued by Holdco II.

NHH. The Hungarian National Communications Authority.

7

our historical concession areas or the Company’s historical concession areas. The Hungarotel historical concession areas and the Invitel historical concession areas combined.

Ordinary Shares.The ordinary shares issued by Invitel Holdings with a nominal value of EUR 0.01 each.

PanTel. PanTel Távközlési Kft., a Hungarian company, which was an indirect subsidiary of HTCC until it merged into Invitel effective January 1, 2008.

PanTel Technocom. PanTel Technocom Kft, a Hungarian company, and an indirect subsidiary of Invitel Holdings. PanTel Technocom Kft. was renamed Invitel Technocom Kft. effective January 1, 2008.

Registrant. Refers to Invitel Holdings as successor to HTCC.

Reorganization.The Reorganization completed on February 26, 2009 pursuant to which HTCC effectively changed its place of incorporation from Delaware to Denmark by merging HTCC with and into a wholly owned subsidiary of Invitel Holdings, a newly formed company in Denmark that we created for the purpose of the Reorganization. Each share of HTCC was converted into the right to receive one American Depositary Share of Invitel Holdings. After completion of the Reorganization, Invitel Holdings and its subsidiaries continue to conduct the business formerly conducted by HTCC and its subsidiaries.

Report. This annual report on Form 20-F for the fiscal year ended December 31, 2009.

RIO. Reference Interconnect Offer.

RUO. Reference Unbundling Offer.

SEC. The United States Securities and Exchange Commission.

SMP. Significant Market Power. A telecommunications services provider, which has been designated with significant market power following a market analysis by the Hungarian regulatory authorities.

TDC. TDC A/S, a Danish company (formerly known as Tele Danmark A/S), together with its affiliates.

Tele2 Hungary. Tele2 Magyarország Kft., a Hungarian company, which was an indirect subsidiary of Invitel Holdings, subsequently renamed Invitel Telecom Kft. effective January 1, 2008 and merged into Invitel effective June 30, 2009.

Tele2 Hungary Acquisition. The acquisition by the Company of Tele2 Hungary, which acquisition was completed on October 18, 2007.

U.S. dollar, USD or $. The U.S. dollar, which is the lawful currency of the United States of America.

V-holding. V-holding Tanácsadó Zrt., a Hungarian company, which was an indirect subsidiary of HTCC until it merged into Invitel effective January 1, 2008.

we, us and our. Refers to the Invitel Holdings and its subsidiaries, as the case may be.

In addition, at the end of the document we have included a glossary of certain technical terms used in this Report under the heading “Glossary of Terms”.

8

PART I

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

Not applicable.

9

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable.

10

3A. Selected Financial Data

For the years ended December 31, 2009 and 2008, we have prepared our consolidated financial statements in accordance with IFRS as issued by the IASB.

Until December 31, 2008, Invitel Holdings’ (through its predecessor company, HTCC) consolidated financial statements were prepared in accordance with the accounting principles generally accepted in the United States of America (“U.S. GAAP”). We have therefore restated our consolidated financial information as of January 1, 2008 and December 31, 2008 for the year ended December 31, 2008, in accordance with IFRS 1, on “First Time Adoption of IFRS”, and financial information set forth in this Report for the year ended December 31, 2008, differs from information previously published. Transition from reporting under U.S. GAAP to IFRS is set forth in Note 32 to our consolidated financial statements. As a first-time adopter of IFRS at January 1, 2009, Invitel Holdings’ (through its predecessor company, HTCC) has followed the guidance described in IFRS 1. The options selected for the purpose of the transition to IFRS are described in the Notes to the consolidated financial statements. Impacts of the transition on the balance sheet at January 1, 2008, the income statement for the year ended December 31, 2008, and the balance sheet at December 31, 2008, are presented and commented upon in Note 32 to our consolidated financial statements.

The following tables provide a summary of the consolidated financial statements of Invitel Holdings as of and for the years ended December 31, 2009 and 2008. The audited consolidated financial statements at and for the years ended December 31, 2009 and 2008 appear at the end of this Report. On February 24, 2009 at a special meeting, the stockholders of HTCC approved the adoption of an agreement and plan of merger among HTCC and Invitel Holdings whereby HTCC effectively changed its place of incorporation from Delaware to Denmark by effectively merging HTCC with and into Invitel Holdings. As a result of these transactions, Invitel Holdings became the successor to HTCC. The accounting for the reorganization was accounted for as a transaction between entities under common control at predecessor value basis and as such, there were no changes in the historical consolidated carrying amounts of assets, liabilities and stockholders’ equity / (deficit) in the consolidated financial statements. The consolidated income statement and statement of comprehensive income / (loss), cash flow statement and changes in equity for the year ended December 31, 2009 include the combined results of HTCC from January 1, 2009 to February 26, 2009 and Invitel Holdings from February 27, 2009 to December 31, 2009.

The summary consolidated financial information presented here as of and for the years ended December 31, 2009 and 2008 should be read in conjunction with the audited consolidated financial statements of Invitel Holdings as of and for the years ended December 31, 2009 and 2008 and the accompanying notes thereto included elsewhere in this Report. The consolidated financial statements and the accompanying notes thereto have been prepared in accordance with IFRS.

We are in the process of selling our International Business which includes Invitel International AG and its subsidiaries, AT-Invitel GmbH, Invitel International Hungary Kft and Euroweb Romania. Accordingly, the International Business was classified as discontinued operations and our remaining business (hereinafter referred to as “Continuing Operations”) was shown as continuing operations in our consolidated income statement for the years ended December 31, 2009 and 2008.

11

Non-GAAP and Non-IFRS Financial Measures

EBITDA, adjusted EBITDA, segment gross margin and the related ratios presented in this Report are supplemental measures of performance and liquidity that are not required by, or presented in accordance with, U.S. GAAP or IFRS. We present non-U.S. GAAP and non-IFRS measures because we believe that they and similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance and liquidity. The non-U.S. GAAP and non-IFRS measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools and should not be considered in isolation or as a substitute for analysis of our operating results as reported under U.S. GAAP or IFRS. Furthermore, EBITDA, adjusted EBITDA, segment gross margin, net debt and leverage and coverage ratios are not measurements of our financial performance or liquidity under U.S. GAAP or IFRS and should not be considered as an alternative to net profit or any other performance measures derived in accordance with U.S. GAAP or IFRS or as an alternative to cash flow from operating, investing or financing activities as a measure of our liquidity as derived in accordance with U.S. GAAP or IFRS.

Continuing Operations

We encourage you to read the information contained in this section in conjunction with “Item 5. Operating and Financial Review and Prospects”.

| | | | | | |

| | | Continuing Operations(1)

For the year ended December 31, | |

| | | 2009 | | | 2008 | |

| | | (€ in millions) | | | (€ in millions) | |

| | |

Statement of Operations Data: | | | | | | |

Total operating revenue | | 210.0 | | | 265.9 | |

Segment gross margin (unaudited)(2) | | 171.4 | | | 207.4 | |

Segment gross margin (%) (unaudited) | | 82 | % | | 78 | % |

Operating expenses | | (73.3 | ) | | (94.9 | ) |

Depreciation, amortization and impairment | | (100.1 | ) | | (76.1 | ) |

| | | | | | |

Income / (loss) from operations | | (2.0 | ) | | 36.4 | |

Net financial expenses(3) | | (122.8 | ) | | (85.6 | ) |

| | | | | | |

Income / (loss) before tax | | (124.8 | ) | | (49.2 | ) |

Income taxes expense | | 10.5 | | | (3.7 | ) |

| | | | | | |

Income / (loss) after tax | | (114.3 | ) | | (52.9 | ) |

| | |

Number of weighted average shares: | | | | | | |

Basic | | 16,681,349 | | | 16,422,390 | |

Diluted | | 16,687,146 | | | 16,910,462 | |

| | |

Earnings per share of continuing operations: | | | | | | |

Basic | | (6.85 | ) | | (3.22 | ) |

Diluted | | (6.85 | ) | | (3.22 | ) |

| | |

Balance Sheet Data (2008 is unaudited): | | | | | | |

Cash and cash equivalents | | 50.1 | | | 28.6 | |

Net working capital(4) | | (25.7 | ) | | (73.2 | ) |

Total assets | | 590.1 | | | 875.7 | |

12

| | | | | | |

| | | Continuing Operations(1)

For the year ended December 31, | |

| | | 2009 | | | 2008 | |

| | | (€ in millions) | | | (€ in millions) | |

| | |

Cash-pay third party debt(5) | | 466.4 | | | 544.8 | |

Related party subordinated loan(6) | | 288.5 | | | — | |

Share capital | | 0.2 | | | — | |

Total equity(7) | | (130.5 | ) | | (38.7 | ) |

| | |

Other Data (unaudited): | | | | | | |

EBITDA(8) | | 98.1 | | | 112.5 | |

Adjusted EBITDA(9) | | 104.8 | | | 129.8 | |

Capital expenditures(10) | | 38.9 | | | 44.8 | |

Net cash-pay interest expense(11) | | (53.3 | ) | | (66.4 | ) |

Net cash-pay third party debt(12) | | 416.3 | | | 516.2 | |

| (1) | The Continuing Operations represents our remaining business following the decision of our Board of Directors on December 18, 2009 to sell our International Business which was classified as discontinued operations in our consolidated income statement for the years ended December 31, 2009 and 2008. For further discussion on discontinued operations see note 4 “Assets Classified as Held-for-Sale and Discontinued Operations” in the notes to the consolidated financial statements. |

| (2) | We define segment gross margin as segment revenue minus segment cost of sales for each of our operating segments. Segment gross margin is not a measurement of financial performance under IFRS and should not be considered as an alternative to net income or to cash flow from operating, investing or financing activities, as a measure of liquidity or an indicator of our operating performance or any other measures of performance derived in accordance with IFRS. Management uses segment gross margin as a tool for various purposes including measuring and evaluating our financial and operational performance, making compensation decisions, planning and budgeting decisions and financial planning purposes. We believe that the presentation of segment gross margin is useful for investors because it reflects management’s view of core operations and cash flow generation upon which management bases financial, operational and planning decisions and presents measurements that investors and their lending banks have indicated to management are important in assessing us and our liquidity. For a description of the reconciliation of segment gross margin to income from operations, see “Item 5. Operating and Financial Review and Prospects”. |

| (3) | Net financial expenses include interest income, interest expense (including amortization of bond discount and deferred borrowing costs), net foreign exchange gains / losses, gains / losses from fair value changes of derivative financial instruments, other financial expense and loss on extinguishment of debt. |

| (4) | We define net working capital as total current assets (excluding cash and cash equivalents and current assets relating to derivative financial instruments) less current liabilities (excluding current liabilities relating to derivative financial instruments, current obligations under capital leases and the current installments of long term debt). |

| (5) | Cash-pay third party debt in 2008 includes debt under the Amended Senior Facilities Agreement, the 2004 Notes and related bond discount, the 2007 Notes, the Bridge Loan, the Yapi Loan and the Preps Loans and excludes liabilities related to capital leases and deferred borrowing costs. Cash-pay third party debt in 2009 includes the 2007 Notes and the 2009 Notes. |

| (6) | Related party subordinated loan includes the loan payable to Mid Europa, see note 19“Borrowings” in the notes to the consolidated financial statements. |

| (7) | Total equity includes minority interest. |

13

| (8) | We define EBITDA as net income (loss) plus income taxes, net financial expenses and depreciation and amortization. Other companies in our industry may calculate EBITDA in a different manner. EBITDA is not a measurement of financial performance under IFRS and should not be considered as an alternative to net gain or to cash flow from operating, investing or financing activities, as a measure of liquidity or an indicator of our operating performance or any other measures of performance derived in accordance with IFRS. Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements. In addition, EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments. Management uses EBITDA as a tool for various purposes including measuring and evaluating our financial and operational performance, making compensation decisions, planning and budgeting decisions and financial planning purposes. We believe that the presentation of EBITDA is useful for investors because it reflects management’s view of core operations and cash flow generation upon which management bases financial, operational and planning decisions and presents measurements that investors and their lending banks have indicated to management are important in assessing us and our liquidity. EBITDA is reconciled to net income / (loss) as follows: |

| | | | | | |

| | | Continuing Operations

For the years ended

December 31, | |

| | | 2009 | | | 2008 | |

| | | (€ millions) | | | (€ millions) | |

Net income (loss) | | (114.3 | ) | | (52.9 | ) |

Income taxes | | (10.5 | ) | | 3.7 | |

Gain (loss) on derivatives | | 17.4 | | | (1.2 | ) |

Foreign exchange gain (loss), net | | 15.2 | | | 14.2 | |

Financing expenses, net | | 90.2 | | | 72.6 | |

Depreciation and amortization | | 100.1 | | | 76.1 | |

EBITDA | | 98.1 | | | 112.5 | |

| (9) | We define Adjusted EBITDA as EBITDA plus the cost of restructuring, due diligence expenses and share-based compensation, special projects related consulting expenses, Sarbanes-Oxley and compliance expenses and other special projects related items. The same considerations set forth in footnote 8 above with respect to the uses and limitations of EBITDA apply to Adjusted EBITDA. Adjusted EBITDA is reconciled as follows: |

| | | | | |

| | | Continuing Operations

For the years ended

December 31, | |

| | | 2009 | | 2008 | |

| | | (€ millions) | | (€ millions) | |

EBITDA | | 98.1 | | 112.5 | |

Cost of restructuring(a) | | 2.5 | | 8.2 | |

Due diligence expenses(b) | | — | | 3.8 | |

Share-based compensation(c) | | — | | (2.7 | ) |

Special projects related consulting expenses(d) | | 2.7 | | 1.8 | |

Sarbanes-Oxley and compliance expenses(e) | | 0.9 | | 1.8 | |

Other special projects related items(f) | | 0.6 | | 4.4 | |

Adjusted EBITDA | | 104.8 | | 129.8 | |

14

| | (a) | Cost of restructuring includes severance expenses, termination expenses and early termination of lease contract expenses relating to reorganizations in the Group. |

| | (b) | Due diligence expenses represent legal, financial and other consulting expenses relating to vendor due diligences. |

| | (c) | Share based compensation includes non-cash expense relating to options/ warrants granted and non-cash expense/ (income) on the mark-to-market revaluation of outstanding options / warrants. |

| | (d) | Special projects related consulting expenses mainly include the cost related to the following projects undertaken by the group: the mobile project in 2008 in which we investigated the potential purchase of a mobile license, re-domiciliation in 2008 and 2009 and mergers of subsidiaries in the group in 2008 and 2009. |

| | (e) | Sarbanes-Oxley and compliance expenses represents costs associated with being an SEC registrant and include expenses such as Sarbanes-Oxley project and related audit fees, SEC filing fees, proxy fees, SEC listing and other annual fees and Delaware and other US taxes prior to our re-domiciliation in February 2009. |

| | (f) | Other special projects related items include IPTV service development expenses and other consulting expenses related to strategic projects. |

| (10) | Capital expenditures represent the “acquisition of telecommunications network equipment and other intangibles” line item in our consolidated statement of cash flows. |

| (11) | Net cash-pay interest expense equals interest expense excluding interest on the Subordinated shareholder loan less interest income and excludes the amortization of deferred borrowing costs and loan discounts and other interest expense. |

| (12) | Net cash-pay third party debt equals cash-pay third party debt less cash and cash equivalents. |

Discontinued Operations

The following table sets out selected historical financial information for our International Business. We are in the process of selling our International Business which includes Invitel International AG and its subsidiaries, AT-Invitel GmbH, Invitel International Hungary Kft and Euroweb Romania. Accordingly, the International Business was classified as discontinued operations in our consolidated income statement for the years ended December 31, 2009 and 2008.

| | | | | | |

| | | Discontinued Operations(1)

For the year ended December 31, | |

| | | 2009 | | | 2008 | |

| | | (€ in millions) | | | (€ in millions) | |

| | |

Statement of Operations Data: | | | | | | |

Total operating revenue | | 117.5 | | | 113.6 | |

Segment gross margin (unaudited)(2) | | 74.4 | | | 61.7 | |

Segment gross margin (%) (unaudited) | | 63 | % | | 54 | % |

Operating expenses | | (32.6 | ) | | (35.4 | ) |

Depreciation, amortization and impairment | | (13.1 | ) | | (11.8 | ) |

| | | | | | |

Income / (loss) from operations | | 28.7 | | | 14.5 | |

Net financial expenses(3) | | (2.4 | ) | | (4.6 | ) |

| | | | | | |

Income / (loss) before tax | | 26.3 | | | 9.9 | |

Income taxes expense | | (2.4 | ) | | (4.3 | ) |

| | | | | | |

Income / (loss) after tax | | 23.9 | | | 5.6 | |

| | |

Number of weighted average shares: | | | | | | |

Basic | | 16,681,349 | | | 16,422,390 | |

Diluted | | 16,687,146 | | | 16,910,462 | |

15

| | | | | | |

| | | Discontinued Operations(1)

For the year ended December 31, | |

| | | 2009 | | | 2008 | |

| | | (€ in millions) | | | (€ in millions) | |

| | |

Earnings per share of discontinued operations: | | | | | | |

Basic | | 1.43 | | | 0.34 | |

Diluted | | 1.43 | | | 0.33 | |

| | |

Balance Sheet Data: | | | | | | |

Cash and cash equivalents | | 15.4 | | | | |

Net working capital(4) | | (10.6 | ) | | | |

Total assets | | 241.9 | | | | |

Cash-pay third party debt(5) | | 18.7 | | | | |

Related party loan(6) | | — | | | | |

Total equity | | 50.9 | | | | |

| | |

Other Data (unaudited): | | | | | | |

EBITDA(7) | | 41.8 | | | 26.3 | |

Adjusted EBITDA(8) | | 46.3 | | | 36.8 | |

Capital expenditures(9) | | 24.4 | | | 33.8 | |

Net cash-pay interest expense(10) | | (1.0 | ) | | (1.2 | ) |

Net cash-pay third party debt(11) | | 3.3 | | | 14.4 | |

| (1) | We are in the process of selling our International Business which includes Invitel International AG and its subsidiaries, AT-Invitel GmbH, Invitel International Hungary Kft and Euroweb Romania. Accordingly, the International Business was classified as discontinued operations in our consolidated income statement for the years ended December 31, 2009 and 2008. Also, we have issued carve-out financial statements for our International Business for the years ended December 31, 2009 and 2008. |

| (2) | We define segment gross margin as segment revenue minus segment cost of sales for each of our operating segments. Segment gross margin is not a measurement of financial performance under IFRS and should not be considered as an alternative to net income or to cash flow from operating, investing or financing activities, as a measure of liquidity or an indicator of our operating performance or any other measures of performance derived in accordance with IFRS. Management uses segment gross margin as a tool for various purposes including measuring and evaluating our financial and operational performance, making compensation decisions, planning and budgeting decisions and financial planning purposes. We believe that the presentation of segment gross margin is useful for investors because it reflects management’s view of core operations and cash flow generation upon which management bases financial, operational and planning decisions and presents measurements that investors and their lending banks have indicated to management are important in assessing us and our liquidity. |

| (3) | Net financial expenses include interest income, interest expense, net foreign exchange gains / losses, and other financial expenses. |

| (4) | We define net working capital as total current assets excluding cash and cash equivalents less current liabilities (excluding current obligations under capital leases and the current installments of long term debt). |

| (5) | Cash-pay third party debt includes debt under the Yapi Bank Loan and the Preps Loans and excludes liabilities related to capital leases and deferred borrowing costs. |

| (6) | Related party loan includes loans granted by Matel and Invitel Zrt to the International Business. |

16

| (7) | We define EBITDA as net income / (loss) plus income taxes, net financial expenses and depreciation and amortization. Other companies in our industry may calculate EBITDA in a different manner. EBITDA is not a measurement of financial performance under IFRS and should not be considered as an alternative to net gain or to cash flow from operating, investing or financing activities, as a measure of liquidity or an indicator of our operating performance or any other measures of performance derived in accordance with IFRS. Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA does not reflect any cash requirements for such replacements. In addition, EBITDA does not reflect our cash expenditures or future requirements for capital expenditures or contractual commitments. Management uses EBITDA as a tool for various purposes including measuring and evaluating our financial and operational performance, making compensation decisions, planning and budgeting decisions and financial planning purposes. We believe that the presentation of EBITDA is useful for investors because it reflects management’s view of core operations and cash flow generation upon which management bases financial, operational and planning decisions and presents measurements that investors and their lending banks have indicated to management are important in assessing us and our liquidity. EBITDA is reconciled to net income / (loss) as follows: |

| | | | |

| | | Discontinued Operations

For the years ended

December 31, |

| | | 2009 | | 2008 |

| | | (€ millions) | | (€ millions) |

Net income (loss) | | 23.9 | | 5.6 |

Income taxes | | 2.4 | | 4.3 |

Foreign exchange gain (loss), net | | 0.7 | | 1.6 |

Financing expenses, net | | 1.7 | | 3.0 |

Depreciation and amortization | | 13.1 | | 11.8 |

EBITDA | | 41.8 | | 26.3 |

| (8) | We define Adjusted EBITDA as EBITDA plus the cost of restructuring, due diligence expenses, special projects related consulting expenses, Sarbanes-Oxley and compliance expenses and other special projects related items. The same considerations set forth in footnote 7 above with respect to the uses and limitations of EBITDA apply to Adjusted EBITDA. Adjusted EBITDA is reconciled as follows: |

| | | | |

| | | Discontinued Operations

For the years ended

December 31, |

| | | 2009 | | 2008 |

| | | (€ millions) | | (€ millions) |

EBITDA | | 41.8 | | 26.3 |

Cost of restructuring(a) | | 0.9 | | 6.4 |

Due diligence expenses(b) | | 0.5 | | — |

Special projects related consulting expenses(c) | | 1.0 | | 0.2 |

Sarbanes-Oxley and compliance(d) | | 0.2 | | 0.2 |

Other special projects related items(e) | | 1.9 | | 3.7 |

Adjusted EBITDA | | 46.3 | | 36.8 |

| | (a) | Cost of restructuring includes severance expenses, termination expenses of duplicate telecom infrastructure contracts and lease contract termination expenses relating to reorganization of the International Business. |

17

| | (b) | Due diligence expenses represent legal, financial and other consulting expenses relating to due diligences relating to the potential sale of the International Business. |

| | (c) | Special projects related consulting expenses mainly include the cost of legal fees related to the pre-acquisition legal claims of Memorex. |

| | (d) | Sarbanes-Oxley and compliance represents costs associated with being an SEC registrant and include expenses such as Sarbanes-Oxley project and related audit fees, SEC filing fees, proxy fees, SEC listing and other annual fees prior to our re-domiciliation in February 2009. |

| | (e) | Other special projects related items mainly include Memorex Turkey start-up expenses in 2008 and 2009 and expenses relating to the pre-acquisition legal claims of Memorex as well as due diligence expenses relating to the sale of the International Business. |

| (9) | Capital expenditures represent the “acquisition of telecommunications network equipment and other intangibles” line item in our consolidated carve-out statement of cash flows. |

| (10) | Net cash-pay interest expense equals net interest expense excluding interest on related party loans less interest income and excludes the amortization of deferred borrowing costs. |

| (11) | Net cash-pay third party debt equals cash-pay third party debt less cash and cash equivalents. |

18

Exchange Rate Information

Forint per Euro

The following table sets out, for the periods and dates indicated, the period-end, average, high and low official rates set by the National Bank of Hungary for forint per EUR 1.00. We make no representation that the forint amounts referred to in this Report could have been or could be converted into any currency at any particular rate or at all.

As of June 21, 2010, the rate was 278.32.

| | | | | | | | |

| | | Forint/Euro Exchange Rates |

| | | Period-End | | Average | | High | | Low |

| | | (amounts in HUF/EUR 1.00) |

Year | | | | | | | | |

2005 | | 252.73 | | 248.05 | | 255.93 | | 241.42 |

2006 | | 252.30 | | 264.27 | | 282.69 | | 249.55 |

2007 | | 253.35 | | 251.31 | | 261.17 | | 244.96 |

2008 | | 264.78 | | 251.25 | | 275.79 | | 229.11 |

2009 | | 270.84 | | 280.58 | | 316.00 | | 264.14 |

| | | | |

Month | | | | | | | | |

January 2010 | | 270.90 | | 269.33 | | 273.43 | | 266.51 |

February 2010 | | 270.19 | | 271.19 | | 274.13 | | 269.24 |

March 2010 | | 266.39 | | 265.50 | | 269.33 | | 261.60 |

April 2010 | | 266.28 | | 265.44 | | 272.32 | | 262.91 |

May 2010 | | 275.34 | | 276.31 | | 281.99 | | 267.88 |

Forint per U.S. Dollar

The following table sets out, for the periods and dates indicated, the period-end, average, high and low official rates set by the National Bank of Hungary for forint per $1.00. We make no representation that the forint amounts referred to in this Report could have been or could be converted into any currency at any particular rate or at all.

As of June 21, 2010, the rate was 224.36.

| | | | | | | | |

| | | Forint/$ Exchange Rates |

| | | Period-End | | Average | | High | | Low |

| | | (amounts in HUF/$1.00) |

Year | | | | | | | | |

2005 | | 213.58 | | 199.66 | | 217.54 | | 180.58 |

2006 | | 191.62 | | 210.51 | | 225.01 | | 191.02 |

2007 | | 172.61 | | 183.83 | | 199.52 | | 171.13 |

2008 | | 187.91 | | 171.80 | | 218.76 | | 144.11 |

2009 | | 188.07 | | 202.26 | | 249.29 | | 176.67 |

U.S. Dollar per Euro

The following table sets out, for the periods and dates indicated, the period-end, average, high and low official rates set by the National Bank of Hungary for U.S. dollar per EUR 1.00. We make no representation that the euro amounts referred to in this Report could have been or could be converted into any currency at any particular rate or at all.

19

As of June 21, 2010, the rate was 1.23.

| | | | | | | | |

| | | $/Euro Exchange Rates |

| | | Period-End | | Average | | High | | Low |

| | | (amounts in HUF/$1.00) |

Year | | | | | | | | |

2005 | | 1.18 | | 1.24 | | 1.35 | | 1.17 |

2006 | | 1.32 | | 1.26 | | 1.33 | | 1.18 |

2007 | | 1.47 | | 1.37 | | 1.49 | | 1.29 |

2008 | | 1.41 | | 1.46 | | 1.60 | | 1.24 |

2009 | | 1.44 | | 1.39 | | 1.27 | | 1.50 |

In this Report certain amounts stated in euro or forint have also been stated in U.S. dollars solely for the informational purposes of the reader, and should not be construed as a representation that such euro or forint amounts actually represent such U.S. dollar amounts or could be, or could have been, converted into U.S. dollars at the rate indicated or at any other rate. Unless otherwise stated or the context otherwise requires, such amounts have been stated at December 31, 2009 exchange rates.

3B. Capitalization and Indebtedness

Not applicable.

3C. Reasons for the Offer and Use of Proceeds

Not applicable.

3D. Risk Factors

You should carefully consider the risks described below and the other information in this Report. The risks and uncertainties that are described herein are not the only ones that we face. Additional risks and uncertainties of which we are not aware or that we currently believe are immaterial may also adversely affect our business, financial condition or results of operations. If any of the possible events described below occur, our business, financial condition or results of operations could be materially and adversely affected.

This Report also contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including the risks described below and elsewhere in this Report.

Risks Relating to Our Business

We have experienced substantial net losses and may need additional liquidity in the future.

During the year ended December 31, 2009, we incurred net losses of 90.1 million, and used a substantial amount of cash for capital investments. We also may require additional financing in the future. However, we cannot assure you that we will be able to improve our results of operations or obtain additional financing.

20

The global capital and credit markets have been experiencing extreme volatility and disruption during the past two years, which could limit the availability and increase the cost of financing. The availability of financing will depend on a variety of factors, such as economic and market conditions, the availability of credit, as well as the possibility that lenders could develop a negative perception of our prospects, the industry generally or the geographic markets where we operate. It may be difficult or impossible to obtain financing in the event that we need additional liquidity in the near future.

Our revenue and cash flow will be adversely affected if the Hungarian fixed line market further declines and our Mass Market Voice business declines at a higher rate than we expect.

Our business strategy depends, in part, on our ability to manage our Mass Market Voice operations, in terms of both our revenue and our market share. The Mass Market Voice market in Hungary has continued to decline, in terms of both the number of lines and total voice traffic (i.e. average usage per line). We experienced a decline in the number of Mass Market Voice lines in our historical concession areas from approximately 382,000 lines as at December 31, 2008, to 356,000 lines as at December 31, 2009. During 2009, we recorded an impairment loss of €39.4 million in our Mass Market Voice in concession cash generating unit.

We believe that the declines in the number of our fixed lines and in the Hungarian fixed line market in general have been caused primarily by competition from mobile operators and, to a lesser extent, cable television operators. Although we believe that the rate of churn from fixed service to mobile service has stabilized since the end of 2007 due to the very high mobile penetration in Hungary reaching approximately 118.7% as of December 31, 2009, fixed-to-mobile substitution for data services is likely to continue to have a negative impact on the fixed line market. We are also facing, and will likely continue to face, additional competition in our historical concession areas from Magyar Telekom, the largest incumbent fixed line operator, and from cable television operators (most significantly UPC Hungary and the cable business of Magyar Telekom through the T-Home brand) offering voice services in “triple play” (combined television, Internet and voice) service packages, which could further have a negative impact on our market share. We generally do not provide mobile services to the residential market, although we provide mobile voice services through a reseller arrangement with Vodafone and mobile Internet services through a reseller arrangement with Pannon.

A decline in our Mass Market Voice business at a rate greater than we anticipate, through a decrease in the number of lines and/or traffic could have a material adverse effect on our business, operating results and financial condition.

Our failure to increase revenue in the Mass Market Internet market may adversely affect our results of operations and reduce our market share.

Our strategy includes increasing our revenue in the Mass Market Internet by increasing our market penetration in a growing Mass Market Internet market. We are planning on increasing our revenue from Internet services to offset our decreased revenue from our Mass Market Voice services. However, our Mass Market Internet services are subject to strong competition from cable television operators in “triple play” (combined television, Internet and voice service). In addition, we have seen the growth in our Mass Market Internet business slow reflecting the slowdown in the whole residential fixed broadband market, as the recent economic crisis has taken a toll on consumer spending. We expect our Mass Market Internet business to grow again in the future as we expect the broadband penetration rate in Hungary to converge to that of Western Europe. If Hungary’s Internet usage does not grow as expected, or if our competitors are more successful at obtaining new customers or place downward pressure on prices to a greater degree than expected, we may not be able to increase our revenue in the Mass Market Internet market as planned, which could have a material adverse effect on our results of operations and reduce our market share.

21

Additionally, outside of our historical concession areas, we rely on the wholesale products of other operators, most importantly Magyar Telekom, in providing our Mass Market Internet services. Currently, these operators are subject to regulatory remedies imposed by the National Communications Authority (the “NHH”), pursuant to which we are granted access to such wholesale products on regulated prices and terms. However, subject to the findings of future market analysis procedures conducted by the NHH, such remedies may be relaxed or lifted, which may affect the profitability of our Mass Market Internet services.

Our Revenue from the Business segment may be adversely affected due to competition and the economic environment.

We believe that we are well positional to increase our market share in the Business segment. However, our Business segment operations have been negatively impacted by the economy as businesses seek to cut their expenditures and contract renewals become more competitive. If the economy continues to negatively impact the expenditures of businesses and competition continues to negatively affect the pricing of our contract renewals and the pricing of our new contracts, this could have a material adverse affect on our business, operating results and financial condition.

If we are not able to manage costs while effectively responding to competition and changing market conditions, our cash flow may be reduced and our ability to service our debt or implement our business strategies may be adversely affected.

Our business plan is dependent on our ability to effectively manage the costs associated with running our business. If we need to respond to actions by our competitors or unanticipated changes in our markets, we may be required to make capital investments in our business and other expenditures which would reduce our cash flow available for other purposes. This could have a negative impact on our ability to service existing debt and our business, results of operations and financial condition could be adversely affected.

We are subject to increased competition due to the business strategies of our competitors, prevailing market conditions and the effect of E.U. regulation on the Hungarian telecommunications market, which may result in the loss of customers and market share.

Competition in the Hungarian telecommunications sector has increased since 2001 as a result of market liberalization measures introduced by Act XL of 2001 on Communications (the “2001 Communications Act”) and more recently Act C of 2003 on Electronic Communications, effective from January 1, 2004 (the “2004 Communications Act”). The 2004 Communications Act promotes competition in fixed line and mobile telecommunications services through, among other things, the transposition of relevant E.U. directives and regulations and the imposition of universal service obligations (“USO”), cost accounting, price controls, Carrier Pre-Selection, Carrier Selection, Local Loop Unbundling and number portability. The 2004 Communications Act also grants powers to the NHH to impose obligations on market participants to remedy competitive deficiencies. As a result, we have faced, and could continue to face, increased competition.

Our competitors include mobile and fixed line telecommunications services providers in both the Mass Market and Business markets and cable television operators (offering “triple play” television, Internet and voice service packages) specifically in the Mass Market. The scope of competition and its effect on our business, operating results and financial condition will depend on a variety of factors that we currently cannot assess with precision and that are for the most part outside of our control. Such factors include, in addition to the regulatory measures described above, the business strategies and capabilities of

22

current and potential competitors, prevailing market conditions and the effect of E.U. regulation on the Hungarian telecommunications market, as well as the effectiveness of our efforts to address increased competition.

Competition in any or all of our services has led to, and may continue to lead to:

| | • | | loss of existing customers and greater difficulty in obtaining new customers; |

| | • | | the need for more rapid deployment of new technologies and related capital expenditure as existing technologies are becoming obsolescent at a more rapid pace; and |

| | • | | other developments that could have a material adverse effect on our financial condition and results of operations. |

Increased competition has led to, and may continue to lead to, increased customer churn. Customer churn is a measure of customers who stop purchasing our services, as manifested by the loss of either voice traffic (as measured in minutes) or lines, leading to reduced revenue. Fixed-to-mobile substitution has increased customer churn in both the Mass Market and Business markets in the past, although we believe that the rate of fixed-to-mobile churn has decreased since the beginning of 2005 as a result of Hungary’s very high mobile penetration rate. Further, we continue to face increasing competition from cable television operators. Although we attempt to control customer churn by improving our customer service, introducing new customized service offerings, utilizing effective advertising and through other means, if we are unsuccessful in any of these initiatives, our customer churn could further increase and our business could be materially adversely affected.

The current global financial crisis may result in the deterioration of economic conditions in our operating areas, which may impact demand for our services and affect our ability to obtain additional financing. Austerity measures introduced by the Hungarian government may similarly impact demand for our services.

Continued concerns about the systemic impact of potential long-term and wide-spread recession, energy costs, the availability and cost of credit, diminished business and consumer confidence and increased unemployment have contributed to increased market volatility and diminished expectations for European and emerging economies, including the jurisdictions in which we operate.

Our business is affected by general economic conditions in Hungary and the Central and Eastern European region. There are many factors that influence global and regional economies which are outside of our control. A cautious or negative business outlook may cause our Business customers to delay or cancel investment in information technology and telecommunications systems and services, which may adversely and directly affect our revenue and, in turn, slow the development of new services that could become future revenue sources for us. Although our revenue, in local currency terms, was adversely affected during 2009, a further deterioration of the global and regional economies could have a material adverse effect on our business, operating results and financial condition. The current global financial crisis may result in the deterioration of economic conditions in our operating areas. The impact of the credit crisis on our customers may adversely impact the overall demand for our products and services. This in turn may result in decreased revenue. In addition, a continued credit crisis may affect our ability to obtain additional financing.

In addition, as the global financial system experiences unprecedented credit and liquidity conditions and disruptions, leading to a reduction in liquidity, greater volatility, general widening of credit spreads and, in some cases, lack of transparency in money and capital markets, many lenders have reduced or ceased to provide funding to borrowers. If these conditions continue, or worsen, it could negatively affect our ability to raise funding in the debt capital markets and/or access secured lending markets on financial terms acceptable to us.

23

Budget deficits as a percentage of GDP have remained relatively high for Hungary over the last several years. The Updated Convergence Program, a government plan consisting of austerity measures to redress the Hungarian economy and which was endorsed by the European Commission in September 2006, contemplates a reduction in the general government budget deficit.

While the telecommunications sector is one of the industrial segments that has been less affected by the global financial crisis and economic slowdown, the recessionary conditions and uncertainty in the macroeconomic environment may adversely impact consumer spending on telecommunications products and services. Customers may decide that they can no longer afford certain of our services that are instrumental in supporting our revenues. For example, there has been a trend among Hungarian customers to disconnect their fixed voice lines, as consumers rely primarily on mobile telecommunications and view fixed-line voice services as an expendable discretionary expense.

In addition to a significant budget deficit, in recent years the Hungarian economy has been marked by a large current account deficit, rapid credit growth and a reliance of Hungarian businesses and consumers on foreign currency loans. These factors have left Hungary especially vulnerable to a financial crisis.

At the end of October 2008, the Hungarian government adopted a set of policies agreed upon with the E.U., the European Central Bank and the International Monetary Fund to bolster the Hungarian economy’s near-term stability and improve its long-term growth potential by ensuring fiscal sustainability and strengthening the financial sector. In addition, the International Monetary Fund extended Hungary significant financial assistance. These challenging economic conditions, the continuing turmoil in the financial sector and macroeconomic policies made in response to these conditions could have a material adverse effect on our business, financing, operating results and financial condition. On October 22, 2008, the National Bank of Hungary increased the base rate to 11.5%. Beginning on November 25, 2008, the National Bank of Hungary began lowering the base rate gradually, and since November 23, 2009, the base interest rate of the National Bank of Hungary has been 6.5%.

Economic and political developments in other European countries may also impact our business. For example, Bulgaria and Romania joined the E.U. on January 1, 2007. With respect to Turkey, the Turkish economy has experienced severe macroeconomic imbalances, including substantial budget deficits, significant balance of payment deficits, high rates of inflation and high real rates of interest (which are nominal interest rates less inflation). Risks concerning Greece, Portugal and Spain could impact the economy in general which may have an impact on our business.

The continued impact of the global economic and market conditions, including, among others, the events described above could have a material adverse effect on our business, financial condition, results of operations or liquidity.

The loss of our Registered Managers and other key senior management could negatively affect our ability to implement our business strategy and generate revenue.

Our performance and continued success depends, in part, on our Registered Managers and other key members of senior management. In particular, we depend in large part on the knowledge, expertise, reputation and services of our President and Chief Executive Officer, Martin Lea, and our Chief Financial Officer, Robert Bowker (the “Registered Managers”). The familiarity of these individuals with our company and our business, their experience in management and with financial matters, and their combined experience in the telecommunications market generally make them important to our continued success. The loss of our Chief Executive Officer, Chief Financial Officer or any other members of our senior management could negatively affect our ability to implement our business strategy and generate revenue.

24

Technological changes and the shortening life cycles of our services and infrastructure may affect our operating results and financial condition and may require us to make unanticipated capital expenditures.

The telecommunications industry is characterized by rapidly changing technology, related changes in customer demands and the need for new services at competitive prices. Technological developments are also shortening life cycles of both services and the business infrastructure on which those services are based, and are facilitating convergence of different segments of the increasingly global information industry. In addition, competition based on alternative technologies, such as cable television networks or voice-over IP, wireless based technologies or radio-based alternative networks in our voice markets, could provide a lower cost solution or render our services obsolete or cost-inefficient in our markets.

Our future success will be impacted by our ability to anticipate, invest in and implement new technologies in order to provide services at competitive prices. In addition, we may not receive the necessary licenses to provide services based on these new technologies or may be negatively impacted by unfavorable regulation regarding the usage of these technologies. Technological advances may also affect our operating results and financial condition by shortening the useful life of some of our assets or by requiring us to make additional unanticipated capital expenditures, particularly in connection with our network. If we need to respond to actions by our competitors or unanticipated changes in our markets or market conditions, we may be required to make investments in our business and other expenditures which would reduce our cash flow available for other purposes, including servicing our debt.

Network or system failures could result in reduced user traffic and revenue, or require unanticipated capital expenditures, and could harm our reputation.

Our technical infrastructure (including our network infrastructure for fixed-network services) is vulnerable to damage or interruption from information technology failures, power loss, floods, windstorms, fires, intentional wrongdoing and similar events. Unanticipated problems at our facilities, network or system failures, hardware or software failures or computer viruses could affect the quality of our services and cause service interruptions. Any of these occurrences could result in reduced user traffic and revenue, or require unanticipated capital expenditures, and could harm our reputation.

We depend on our ability to store, retrieve, process and manage a significant amount of information. If our IT systems fail to perform as expected, or if we suffer an interruption, malfunction or loss of information processing capabilities, it could negatively affect our ability to service our customers.

Our business depends on continuously upgrading our existing networks.

We must continue to upgrade our existing fixed-line networks in a timely manner in order to retain and expand our customer base in each of our markets and to successfully implement our strategy. Among other things, the needs of our business could require us to:

| | • | | upgrade the functionality of our networks to allow for the increased customization of services; |

| | • | | increase our coverage in some of our markets; |

| | • | | expand and maintain customer service, network management and administrative systems; and |

| | • | | upgrade older systems and networks to adapt them to new technologies. |

Many of these tasks, which could create additional financial strain on our business and financial condition, are not entirely under our control and may be affected by applicable regulation. If we fail to

25

execute them successfully, our services and products may be less attractive to new customers and we may lose existing customers to our competitors, which would adversely affect our business, financial condition and results of operations.

We are dependent on third party vendors for our information, billing and network systems as well as IPTV service. Any significant disruption in our relationship with these vendors could increase our costs and affect our operating efficiencies.

Sophisticated information and billing systems are vital to our ability to monitor and control costs, bill customers, process customer orders, provide customer service and achieve operating efficiencies. We currently rely on internal systems and third party vendors to provide some of our information and processing systems as well as applications that support our IP services, including IPTV. Some of our billing, customer service and management information systems have been developed by third parties for us and may not perform as anticipated. In addition, our plans for developing and implementing our information systems, billing systems, network systems and IPTV service rely on the delivery of products and services by third party vendors. Our right to use these systems is dependent upon license agreements with third party vendors. Some of these agreements are cancelable by the vendor and the cancellation of these agreements could impair our ability to process orders or bill our customers. Since we rely on third party vendors to provide some of these services, any switch in vendors could be costly and affect operating efficiencies. We do not have direct operational or financial control over our key suppliers and have limited influence with respect to the manner in which these key suppliers conduct their businesses. Our reliance on these suppliers exposes us to risks related to delays in the delivery of their services.

We depend on third party telecommunications providers over which we have no direct control for the provision of certain of our services.

Our ability to provide high quality fixed-line telecommunications services depends on our ability to interconnect with the telecommunications networks and services of other fixed-line operators and mobile operators, particularly those of our competitors. While we have interconnection agreements in place with other operators, we do not have direct control over the quality of their networks and the interconnections services they provide. Any difficulties or delays in interconnecting with other networks and services, or the failure of any operator to provide reliable interconnections or roaming services to us on a consistent basis, could result in our loss of subscribers or a decrease in voice traffic, which would reduce our revenues and adversely affect our business, financial condition and results of operations.

Our operations require substantial capital expenditures, which we may not be able to fund from cash generated from operations or financing facilities.

We require substantial capital to maintain, upgrade and enhance our network facilities and operations. While we have historically been able to fund capital expenditures from cash generated from operations and financing facilities, this may not be possible in the future and the other risks described in this section could materially reduce cash available from operations or significantly increase our capital expenditure requirements, and these outcomes could cause capital not to be available when needed. In addition, costs associated with the licenses that we need to operate our existing networks and technologies and those that we may develop in the future, and costs and rental expenses related to their deployment, could be significant. The amount and timing of our future capital requirements may differ materially from our current estimates due to various factors, many of which are beyond our control. We may also be required to raise additional debt or equity financing in amounts that could be substantial. The type, timing and terms of any future financing will depend on our cash needs and the prevailing conditions in the financial markets. We cannot assure you that we would be able to accomplish any of these measures on a timely basis or on commercially reasonable terms, if at all. Further, we cannot assure you that we will generate sufficient cash flows in the future to meet our capital expenditure needs, sustain our operations

26

or meet our other capital requirements, which may have a material adverse effect on our business, financial condition and results of operations. See “Item 5. Operating and Financial Review and Prospects — Liquidity and Capital Resources” for further discussion. This could adversely affect our ability to implement our business strategy and result in a reduction of revenue.

Legal contingencies and liabilities could have a substantial negative impact on our financial condition, cash flows and profitability.

We are subject, in the ordinary course of business, to litigation and other legal, civil, tax, stamp duty, regulatory and competition claims. We cannot be certain that we will have a successful outcome in any proceedings or that our cash flow will be sufficient to cover all future claims against us. Any increase in the frequency and size of these claims, may adversely impact our profitability and cash flow and have a material adverse effect on our results of operations and financial condition. In addition, if these claims rise to a level of frequency or size that is significantly higher than similar claims made against our competitors, our reputation and business will likely be harmed. See “Item 8. Financial Information — Legal and Administrative Proceedings” for further discussion.

Risks Relating to Regulatory Matters

The changing regulatory environment, the difficulty to predict the result of certain market analyses by the regulator, price regulations, and other regulatory initiatives and investigations could affect the results of our operations, our financial condition and the success and profitability of our business.

The 2004 Communications Act has resulted in significant changes to the Hungarian telecommunications sector and the regulatory environment is constantly changing. The NHH was established in 2004 and is now the sole agency responsible for oversight and monitoring of the Hungarian telecommunications industry, with the power to impose regulatory remedies. In 2006 the Ministry of Information Technology and Communications (the government department formerly responsible for legislation relating to the Hungarian telecommunication industry) was incorporated into the Ministry of Economics and Transport. In mid-2008, the industrial parts were carved out into a new Ministry of Transport, Telecommunications and Energy. As of January 1, 2009, all relevant legislative and supervisory competences concerning telecommunications were taken over by the Prime Minister’s Office, while the Ministry of Transport, Telecommunications and Energy remained the official department responsible for the postal sector only. For a more detailed discussion of Hungary’s telecommunications industry regulation, please see “Item 4. Information on the Company — Hungarian Regulatory Environment”.