UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ☒ | Definitive Proxy Statement | |||

| ☐ | Definitive Additional Materials | |||

| ☐ | Soliciting Material Under Rule 14a-12 | |||

EXCHANGE LISTED FUNDS TRUST EXCHANGE TRADED CONCEPTS TRUST | ||||

| (Name of Registrant as Specified In Its Charter) | ||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1) | Title of each class of securities to which transaction applies: | |||

| 2) | Aggregate number of securities to which transaction applies: | |||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) | Proposed maximum aggregate value of transaction: | |||

| 5) | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1) | Amount Previously Paid: | |||

| 2) | Form, Schedule or Registration Statement No.: | |||

| 3) | Filing Party: | |||

| 4) | Date Filed: | |||

EXCHANGE TRADED CONCEPTS TRUST

EXCHANGE LISTED FUNDS TRUST

10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120

November 22, 2021

Dear Shareholder,

On behalf of the Board of Trustees of each of Exchange Traded Concepts Trust and Exchange Listed Funds Trust (each, a “Trust” and together, the “Trusts”), I am writing to inform you about a joint special meeting of shareholders for each series (collectively, the “Funds”) of each Trust that will be held on December 22, 2021, at 11:00 a.m., Eastern Time, at the offices of the Funds’ investment adviser, Exchange Traded Concepts, LLC, located at 295 Madison Avenue, New York, New York 10017 (together with any postponements or adjournments, the “Meeting”).

At the Meeting, shareholders will be asked to elect two Trustees to each Trust’s Board – Ms. Linda Petrone and Mr. Stuart Strauss. Ms. Petrone has served as a Trustee to each Trust since October 17, 2019. Mr. Strauss has served as a Trustee to Exchange Traded Concepts Trust since January 1, 2021. Ms. Petrone brings to each Board valuable experience she has gained serving in leadership roles in the equity derivatives group of a large financial institution, as well as her knowledge of the financial services industry. Mr. Strauss brings to the Board valuable experience he has gained as an attorney in the investment management industry, including as partner of a major law firm, representing exchange-traded funds and other investment companies as well as their sponsors and advisers and his knowledge of and experience in investment management law and the financial services industry. We now ask that you vote to elect Ms. Petrone and Mr. Strauss as Trustees for each Trust.

If you have received this mailing, you are a shareholder of record as of November 15, 2021 of one or more of the Funds. You are entitled to vote at the Meeting and any adjournments of the Meeting. Each Trust’s Board recommends that you vote “FOR” the proposal. For additional information about the proposal, please see the accompanying Joint Proxy Statement.

You can vote any one of these four ways:

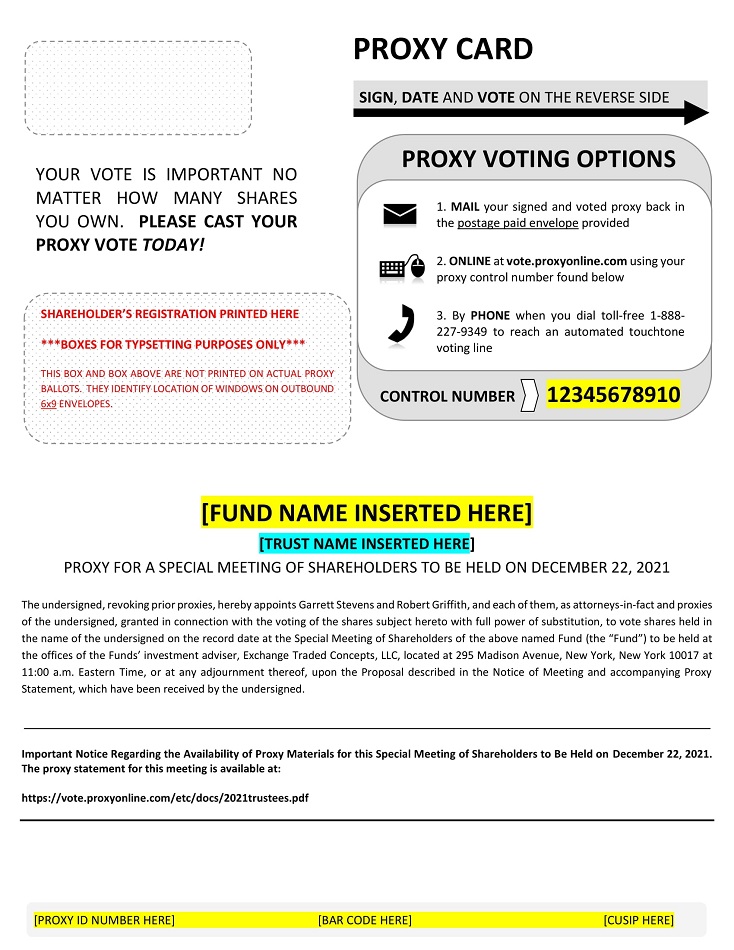

| ● | By mail with the enclosed proxy card - be sure to sign, date and return it in the enclosed postage-paid envelope; |

| ● | Through the website listed on the enclosed proxy voting instructions; |

| ● | By telephone using the toll-free number listed in the proxy voting instructions; or |

| ● | In person at the shareholder meeting on December 22, 2021 at 11:00 a.m., Eastern Time. |

We encourage you to please vote through the website or telephone numbers provided, using the voting control number that appears on your proxy card enclosed. Your vote is extremely important to us.

We appreciate your support and prompt response in this matter and look forward to continuing to serve these Funds.

Respectfully,

J. Garrett Stevens

Trustee and President, Exchange Traded Concepts, LLC

President, Exchange Listed Funds Trust

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

EXCHANGE TRADED CONCEPTS TRUST

EXCHANGE LISTED FUNDS TRUST

10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120

Notice of Joint Special Meeting of Shareholders

To Be Held on December 22, 2021

A joint special meeting of shareholders (the “Meeting”) of Exchange Traded Concepts Trust and Exchange Listed Funds Trust (each, a “Trust” and together, the “Trusts”) will be held at the offices of Exchange Traded Concepts, LLC, 295 Madison Avenue, New York, New York 10017, on December 22, 2021 at 11:00 a.m., Eastern Time.

At the Meeting, shareholders of each Trust will be asked to vote on the proposal to elect Trustees to the Board of Trustees. Shareholders also may be asked to transact such other business as may properly come before the Meeting.

Shareholders of record of the Funds at the close of business on November 15, 2021 are entitled to notice of, and to vote at, the Meeting or any adjournment(s) thereof. The proposal will be voted upon separately by each Trust; however, the vote for each Trustee will apply on a Trust-wide basis, and all applicable series of each Trust will vote together on the proposal.

After careful consideration, the Board of Trustees of each Trust unanimously recommends that shareholders vote “FOR” the proposal to elect Trustees to the Board of Trustees of each Trust.

We call your attention to the accompanying Joint Proxy Statement. Your vote is very important to us regardless of the number of shares you hold. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting via telephone or the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the applicable Trust(s) prior to the Meeting, or by voting in person at the Meeting.

By Order of the Boards of Trustees,

J. Garrett Stevens

President, Exchange Listed Funds Trust

Trustee and President, Exchange Traded Concepts, LLC

November 22, 2021

EXCHANGE TRADED CONCEPTS TRUST

EXCHANGE LISTED FUNDS TRUST

10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120

JOINT PROXY STATEMENT

Joint Special Meeting of Shareholders

To be Held on December 22, 2021

Important Notice Regarding the Availability of Proxy Materials for the Joint Special Meeting of Shareholders to be Held on December 22, 2021:

The Join Proxy Statement is available on the Internet at https://vote.proxyonline.com/etc/docs/2021trustees.pdf.

This Joint Proxy Statement and enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Boards of Trustees of Exchange Traded Concepts Trust and Exchange Listed Funds Trust (each, a “Trust” and together, the “Trusts”). The proxies are being solicited for use at a Joint Special Meeting of Shareholders of the Trusts to be held at the offices of Exchange Traded Concepts, LLC, 295 Madison Avenue, New York, New York 10017, on December 22, 2021 at 11:00 a.m., Eastern Time, and at any and all adjournments or postponements thereof (the “Meeting”). This Joint Proxy Statement and the accompanying notice and the proxy card are being first mailed to shareholders on or about November 22, 2021.

The Board of Trustees of each Trust (each, a “Board” and together, the “Boards”) have called the Meeting and are soliciting proxies from shareholders of each series of the Trusts (each, a “Fund” and collectively, the “Funds”), as identified in these proxy materials, for the following purpose:

| Proposal | Funds Voting |

| To elect Trustees to each Trust’s Board of Trustees | All Funds of each Trust |

Shareholders of record of the Funds at the close of business on November 15, 2021 (the “Record Date”) are entitled to vote at the Meeting or any adjournment(s) thereof. The proposal will be voted upon separately by each Trust; however, the vote for each Trustee will apply on a Trust-wide basis, and all applicable series of each Trust will vote together on the proposal. The proposal will be implemented for a Trust if approved by shareholders and is not contingent on the approval of the proposal by the other Trust.

Shareholders can find important information about the Funds in their shareholder reports. Each Fund will furnish, without charge, a copy of the most recent annual report and the most recent semi-annual report succeeding such annual report, if any, to a Fund shareholder upon request. You may obtain copies of these reports by writing to the applicable Trust at the address set forth above or by calling the Fund or visiting a Fund’s website as set forth below:

Exchange Listed Funds Trust

Shareholders of the Armor US Equity Index ETF can request the Fund’s shareholder reports by calling 1-844-880-3837 or visiting www.armoretfs.com.

When available, shareholders of the Asian Growth Cubs ETF can request the Fund’s shareholder reports by calling 1-833-833-3177 or visiting www.dawnglobal.com.

Shareholders of the Cabana Target Drawdown 5 ETF, Cabana Target Drawdown 7 ETF, Cabana Target Drawdown 10 ETF, Cabana Target Drawdown 13 ETF, and Cabana Target Drawdown 16 ETF can request the Funds’ annual or semi-annual reports by calling 1-800-239-9536 or visiting www.cabanaetfs.com. When available, shareholders of the Cabana Target Leading Sector Aggressive ETF, Cabana Target Leading Sector Conservative ETF, and Cabana Target Leading Sector Moderate ETF can request the Funds’ annual or semi-annual reports by calling the phone number or visiting the website listed above.

Shareholders of the Corbett Road Tactical Opportunity ETF can request the Fund’s shareholder reports by calling 1-866-983-0885 or visiting www.corbettroadfunds.com.

Shareholders of the QRAFT AI-Enhanced US High Dividend ETF, QRAFT AI-Enhanced US Large Cap ETF, QRAFT AI-Enhanced US Large Cap Momentum ETF, and QRAFT AI-Enhanced US Next Value ETF can request the Funds’ shareholder reports by calling 1-855-973-7880 or visiting www.qraftaietfs.com.

Shareholders of the Gavekal Asia Pacific Government Bond ETF can request the Fund’s shareholder by calling 1-833-817-7116 or visiting www.agovetf.com.

Shareholders of the Saba Closed-End Funds ETF can request the Fund’s shareholder reports by calling 1-212-542-4644 or visiting www.sabaetf.com.

Shareholders of The High Yield ETF can request the Fund’s shareholder reports by calling 1-844-880-3837 or visiting www.hyldetf.com.

Exchange Traded Concepts Trust

Shareholders of the ETC 6 Meridian Hedged Equity-Index Option Strategy ETF, ETC 6 Meridian Low Beta Equity Strategy ETF, ETC 6 Meridian Mega Cap Equity ETF, and ETC 6 Meridian Small Cap Equity ETF can request the Funds’ shareholder reports by calling 1-866-749-6383 or visiting www.6meridianfunds.com. When available, shareholders of the ETC 6 Meridian Quality Growth ETF can request the Fund’s shareholder reports by calling the phone number or visiting the website listed above.

When available, shareholders of the Bitwise Crypto Industry Innovators ETF can request the Fund’s shareholder reports by calling 1-833-365-2487 or visiting www.bitqetf.com.

Shareholders of the Capital Link NextGen Protocol ETF and Capital Link NextGen Vehicles & Technology ETF can request the Funds’ shareholder reports by calling 1-833-466-6383 or visiting www.cli-etfs.com.

Shareholders of the EMQQ The Emerging Markets Internet & Ecommerce™ ETF can request the Fund’s shareholder reports by calling 1-855-888-9892 or visiting www.emqqetf.com.

When available, shareholders of the FMQQ The Next Frontier Internet & Ecommerce ETF can request the Fund’s shareholder reports by calling 1-855-888-9892 or visiting www.fmqqetf.com.

When available, shareholders of the Fount Metaverse ETF and Fount Subscription Economy ETF can request the Funds’ shareholder reports by calling 1-855-425-7426 or visiting www.fountetfs.com.

Shareholders of the Hull Tactical US ETF can request the Fund’s shareholder reports by calling 1-844-485-5383 or visiting www.hulltacticalfunds.com.

Shareholders of the Nifty India Financials ETF can request the Fund’s shareholder reports by calling 1-855-212-4633 or visiting www.indiafinancials.com.

Shareholders of the North Shore Global Uranium Mining ETF can request the Fund’s shareholder reports by calling the Fund at 1-877-876-6383 or visiting www.urnmetf.com.

Shareholders of the ROBO Global® Artificial Intelligence ETF, ROBO Global® Healthcare Technology and Innovation ETF and ROBO Global® Robotics and Automation Index ETF can request the Funds’ shareholder reports by calling 1-855-456-7626 or visiting www.roboglobaletfs.com.

Shareholders of the Vesper U.S. Large Cap Short-Term Reversal Strategy ETF can request the Fund’s shareholder reports by calling 1-833-835-6633 or visiting www.utrnetf.com.

ii

TABLE OF CONTENTS

iii

Election of Trustees to the Boards of Trustees of

Exchange Traded Concepts Trust and Exchange Listed Funds Trust

The purpose of the proposal is to ask shareholders to elect Linda Petrone and Stuart Strauss (each, a “Nominee” and together, the “Nominees”) to the Board of each Trust. Each Nominee is an independent or disinterested person within the meaning of the Investment Company Act of 1940 (the “1940 Act”). A Trustee is deemed to be independent to the extent he or she is not an “interested person” of the Trust as that term is defined in the 1940 Act (“Independent Trustee”). Exchange Listed Funds Trust currently consists of three Independent Trustees, including Ms. Petrone, and one Trustee who is an “interested person” of the Trust as that term is defined in the 1940 Act (the “Interested Trustee”). Exchange Traded Concepts Trust currently consists of four Independent Trustees, including each Nominee, and one Interested Trustee. For each Trust, each Trustee was elected to the Board by the initial shareholder of the Trust at the time of the Trust’s organization, except for the Nominees and Timothy J. Jacoby, who was elected by shareholders of each Trust at a special joint meeting of shareholders held on May 12, 2015. Ms. Petrone was appointed as a Trustee of each Trust effective October 17, 2019. Mr. Strauss was appointed as a Trustee of Exchange Traded Concepts Trust effective January 1, 2021. Each Trustee, including the Nominees, has been serving as a Trustee to one or both Boards continuously since his or her election or appointment.

Section 16(a) of the 1940 Act restricts the Board’s ability to appoint new Trustees to the Board unless immediately after such appointment at least two-thirds of the Trustees then holding office have been elected by shareholders of the Trust. Presently, three-quarters of the Trustees of Exchange Listed Funds Trust and three-fifths of the Trustees of Exchange Traded Concepts Trust have been elected by shareholders. In connection with each Nominee’s consideration by the Boards, as applicable, each Board’s Governing and Nominating Committee and Independent Trustees reviewed each Nominee’s biographical information, experiences, and other factors they deemed relevant. Each Board proposes that shareholders of the respective Trust elect the Nominees so each Board has the flexibility to fill vacancies and appoint new Trustees in the future without the expense of conducting additional shareholder meetings. If each Nominee is elected, all Trustees on each Board will have been elected by shareholders of their respective Trust.

If shareholders of either Trust do not elect Ms. Petrone, she would continue serving on that Trust’s Board but would not be considered to have been elected by shareholders. This could cause another proxy solicitation to be required to fill a Board vacancy in the future. Such additional proxy solicitation will not be needed if Ms. Petrone is elected at the Meeting.

If shareholders of Exchange Traded Concepts Trust do not elect Mr. Strauss, he would continue serving on that Trust’s Board but would not be considered to have been elected by shareholders. If shareholders of Exchange Listed Funds Trust do not elect Mr. Strauss, he would not serve on that Trust’s Board and the Board may consider replacement candidates for nomination. This could cause another proxy solicitation to be required to fill a Board vacancy in the future. Such additional proxy solicitation will not be needed if Mr. Strauss is elected at the Meeting.

The persons named as proxies intend, in the absence of contrary instructions, to vote all proxies on behalf of shareholders for the election of the Nominees. The Nominees have consented to being named in this Joint Proxy Statement and to serving, or continuing to serve, on each Trust’s Board of Trustees. However, if the Nominees should become unavailable for election, due to events not known or anticipated, the persons named as proxies will vote for such other nominee(s) as the current Board may recommend.

1

Board Responsibilities. The management and affairs of each Trust and its respective series are overseen by each Trust’s Board. The Board elects the officers of the Trust who are responsible for administering the day-to-day operations of the Trust and the Funds. Each Board has approved contracts, as described below, under which certain companies provide essential services to each Trust and the Funds.

Like for most mutual funds, the day-to-day business of each Trust, including the management of risk, is performed by third-party service providers, such as the Funds’ investment adviser, Exchange Traded Concepts, LLC (the “Adviser”), the Funds’ sub-advisers, as applicable, each Trust’s distributor and each Trust’s administrator. The Trustees of each Trust are responsible for overseeing that Trust’s service providers and, thus, have oversight responsibility with respect to risk management performed by those service providers. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance or reputation of the Funds. Each Trust and its service providers employ a variety of processes, procedures and controls to identify many of those possible events or circumstances, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur. Each service provider is responsible for one or more discrete aspects of the Trust’s business (e.g., the sub-adviser may be responsible for the day-to-day management of a Fund’s portfolio investments) and, consequently, for managing the risks associated with that function. Each Board has emphasized to the Trust’s service providers the importance of maintaining vigorous risk management.

The Trustees’ role in risk oversight begins before the inception of a fund, at which time certain of the fund’s service providers present the Board with information concerning the investment objectives, strategies and risks of the fund as well as proposed investment limitations for the fund. Additionally, the fund’s investment adviser provides the Board with an overview of, among other things, its investment philosophy, brokerage practices and compliance infrastructure. Thereafter, the Board continues its oversight function as various personnel, including the Trust’s Chief Compliance Officer, as well as personnel of any sub-adviser and other service providers such as the fund’s independent accountants, make periodic reports to the Audit Committee or to the Board with respect to various aspects of risk management. The Board and the Audit Committee oversee efforts by management and service providers to manage risks to which each series of the Trust may be exposed.

Each Board is responsible for overseeing the nature, extent and quality of the services provided to the Funds by the Adviser and any sub-advisers and receives information about those services at its regular meetings. In addition, on an annual basis, in connection with its consideration of whether to renew the advisory agreements with the Adviser and any applicable sub-adviser, the Board meets with the Adviser and sub-adviser to review such services. Among other things, the Board regularly considers the Adviser’s and any sub-adviser’s adherence to each Fund’s investment restrictions and compliance with various Fund policies and procedures and with applicable securities regulations. The Board also reviews information about each Fund’s performance and the Fund’s investments, including, for example, portfolio holdings schedules.

Each Trust’s Chief Compliance Officer reports regularly to the Board to review and discuss compliance issues and Fund and Adviser risk assessments. At least annually, the Trust’s Chief Compliance Officer provides the Board with a report reviewing the adequacy and effectiveness of the Trust’s policies and procedures and those of its service providers, including the Adviser and any sub-advisers. The report addresses the operation of the policies and procedures of the Trust and each service provider since the date of the last report; any material changes to the policies and procedures since the date of the last report; any recommendations for material changes to the policies and procedures; and any material compliance matters since the date of the last report.

2

Each Board receives reports from the Trust’s service providers regarding operational risks and risks related to the valuation and liquidity of portfolio securities. Each Board also has established a valuation committee that is responsible for implementing each Trust’s Fair Value Procedures and Pricing Procedures and providing reports to the Board concerning investments for which market quotations are not readily available. Annually, the Board approved independent registered public accounting firm reviews with the Audit Committee its audit of the Funds’ financial statements, focusing on major areas of risk encountered by the Funds and noting any significant deficiencies or material weaknesses in the Funds’ internal controls. Additionally, in connection with its oversight function, each Board oversees Fund management’s implementation of disclosure controls and procedures, which are designed to ensure that information required to be disclosed by the Trust in its periodic reports with the U.S. Securities and Exchange Commission (the “SEC”) are recorded, processed, summarized, and reported within the required time periods. Each Board also oversees the Trust’s internal controls over financial reporting, which comprise policies and procedures designed to provide reasonable assurance regarding the reliability of the Trust’s financial reporting and the preparation of the Trust’s financial statements.

From their review of these reports and discussions with the Adviser, sub-advisers, the Chief Compliance Officer, the independent registered public accounting firm and other service providers, the Board and the Audit Committee learn in detail about the material risks of the Funds, thereby facilitating a dialogue about how management and service providers identify and mitigate those risks.

Each Board recognizes that not all risks that may affect the Funds can be identified and/or quantified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve the Funds’ goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Trustees as to risk management matters are typically summaries of the relevant information. Most of the Funds’ investment management and business affairs are carried out by or through the Adviser and other service providers each of which has an independent interest in risk management but whose policies and the methods by which one or more risk management functions are carried out may differ from the Funds’ and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. As a result of the foregoing and other factors, each Board’s ability to monitor and manage risk, as a practical matter, is subject to limitations.

Board Committees. The Board of each Trust has established the following standing committees of the Board:

Audit Committee. The Board has an Audit Committee that is composed of each of the Independent Trustees of the Trust. The Audit Committee operates under a written charter approved by the Board. The principal responsibilities of the Audit Committee include: recommending which firm to engage as the Funds’ independent registered public accounting firm and whether to terminate this relationship; reviewing the independent registered public accounting firm’s compensation, the proposed scope and terms of its engagement, and the firm’s independence; pre-approving audit and non-audit services provided by the Funds’ independent registered public accounting firm to the Trust and certain other affiliated entities; serving as a channel of communication between the independent registered public accounting firm and the Trustees; reviewing the results of each external audit, including any qualifications in the independent registered public accounting firm’s opinion, any related management letter, management’s responses to recommendations made by the independent registered public accounting firm in connection with the audit, reports submitted to the Committee by the internal auditing department of the Trust’s administrator that are material to the Trust as a whole, if any, and management’s responses to any such reports; reviewing each Fund’s audited financial statements and considering any significant disputes between the Trust’s management and the independent registered public accounting firm that arose in connection with the preparation of those financial statements; considering, in consultation with the independent registered public accounting firm and the Trust’s senior internal accounting executive, if any, the independent registered public accounting firms’ report on the adequacy of the Trust’s internal financial controls; reviewing, in consultation with the Funds’ independent registered public accounting firm, major changes regarding auditing and accounting principles and practices to be followed when preparing a Fund’s financial statements; and other audit related matters. The Audit Committee also serves as the Trust’s Qualified Legal Compliance Committee, which provides a mechanism for reporting legal violations. The Audit Committee meets periodically, as necessary. The Audit Committee for the Board of Exchange Listed Funds Trust met six (6) times during the fiscal year ended August 31, 2021. The Audit Committee for the Board of Exchange Traded Concepts Trust met five (5) times during the fiscal year ended August 31, 2021.

3

Governance and Nominating Committee. The Board has a Governance and Nominating Committee that is composed of each of the Independent Trustees of the Trust. The Governance and Nominating Committee operates under a written charter approved by the Board. The principal responsibility of the Governance and Nominating Committee is to consider, recommend and nominate candidates to fill vacancies on the Board, if any. The Governance and Nominating Committee generally will not consider nominees recommended by shareholders. Each Governance and Nominating Committee has adopted a formal charter, copies of which are attached as Exhibits A and B. The Governance and Nominating Committee meets periodically, as necessary. The Governance and Nominating Committee for the Board of Exchange Listed Funds Trust met one (1) time during the fiscal year ended August 31, 2021. The Governance and Nominating Committee for the Board of Exchange Traded Concepts Trust met one (1) time during the fiscal year ended August 31, 2021.

Board Meetings and Board Committees. At any meeting of the Board, a majority of the Trustees then in office must be in attendance to constitute a quorum. For each Trust, the Trust does not have policies with respect to the Trustees’ attendance at meetings, but as a matter of practice all of the Trustees attend the Trust’s Board and committee meetings (in person or by telephone) to the extent possible. The Board of each Trust held three regular meetings during the fiscal year ended August 31, 2021. In addition, the Board of Exchange Traded Concepts Trust held five (5) special meetings and the Board of Exchange Listed Funds Trust held four (4) special meetings during the fiscal year ended August 31, 2021. During this time period, all of the Trustees attended at least 75% of all of the meetings of the Board and Board committees for which they were eligible to attend.

Members of each Board. The Chair of each Board is an interested person of the Funds. Mr. Richard Hogan serves as Chair of the Board of Exchange Listed Funds Trust and Mr. J. Garrett Stevens serves as Chair of the Board of Exchange Traded Concepts Trust. In addition to the Chair, each Trust also has a lead Independent Trustee. Mr. David Mahle serves as the lead Independent Trustee for Exchange Listed Funds Trust and Mr. Timothy J. Jacoby serves as the lead Independent Trustee for Exchange Traded Concepts Trust. Each Board is comprised of a super-majority of Independent Trustees – 75% for Exchange Listed Funds Trust and 80% for Exchange Traded Concepts Trust. Each Trust has an Audit Committee and a Governance and Nominating Committee, each of which is chaired by an Independent Trustee and comprised solely of Independent Trustees. The committee chair for each committee is responsible for running the committee meeting, formulating agendas for those meetings, and coordinating with management to serve as a liaison between the Independent Trustees and management on matters within the scope of the responsibilities of the committee as set forth in its Board-approved charter. Each Board has determined that this leadership structure is appropriate given the specific characteristics and circumstances of the Funds. Each Board made this determination in consideration of, among other things, the fact that the Independent Trustees of the Funds constitute a super-majority of the Board, the number of Independent Trustees that constitute the Board, the amount of assets under management in the Trust, the number of Funds overseen by the Board, and the total number of Trustees on the Board. Each Board also believes that its leadership structure facilitates the orderly and efficient flow of information to the Independent Trustees from Fund management.

4

Trustees and Officers. Information regarding the Trustees, including each Nominee, and the executive officers of each Trust is set forth in the sections below. Each Trustee holds office during the continued lifetime of the Trust until he or she dies, resigns, is declared bankrupt or incompetent by a court of appropriate jurisdiction, or is removed, or, if sooner, until the next meeting of Trust shareholders called for the purpose of electing Trustees and until the election and qualification of his successor. Any Trustee may resign at any time and may be removed by a vote of two-thirds of the outstanding shares of the Trust or by action of a majority of the Trustees. Each officer serves until he resigns or is removed by the Board or by the President of the Trust or by such other officer upon whom such power of removal may be conferred by the Board.

Legal Proceedings. Neither Board is aware of any legal proceedings involving the Nominees that would be material to an evaluation of the ability or integrity of the Nominees and that would require disclosure under Item 401(f) of Regulation S-K under the Securities Exchange Act of 1934.

Information Specific to Exchange Traded Concepts Trust

Trustees and Officers. Currently, the Board consists of four Independent Trustees, Ms. Linda Petrone (Nominee) and Messrs. Timothy J. Jacoby, Stuart Strauss (Nominee), and Mark Zurack, and one Interested Trustee, Mr. J. Garrett Stevens. The address of each Trustee is c/o Exchange Traded Concepts Trust, 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120. Information regarding the Trustees, including the Nominees, is set forth below.

Name and |

Position(s) |

Term of Office |

Principal Occupation(s) | Number of Portfolios in Fund Complex2 Overseen By Trustee | Other Directorships Held by Trustee During the Past 5 Years |

| Interested Trustee | |||||

J. Garrett Stevens (1979)

| Trustee and President | Trustee (Since 2009); President (Since 2011) | Investment Adviser/Vice President, T.S. Phillips Investments, Inc. (since 2000); Chief Executive Officer, Exchange Traded Concepts, LLC (since 2009); President, Exchange Traded Concepts Trust (since 2011); President, Exchange Listed Funds Trust (since 2012). | 19 | Trustee, ETF Series Solutions (2012 to 2014). |

| Independent Trustees | |||||

Timothy J. Jacoby (1952) | Trustee | Since 2014 | Senior Partner, Deloitte & Touche LLP, Private Equity/Hedge Fund/Mutual Fund Services Practice (2000 to 2014). | 37 | Independent Trustee, Edward Jones Money Market Fund (since 2017); Audit Committee Chair, Perth Mint Physical Gold ETF (2018 to 2020); Independent Trustee, Source ETF Trust (2014 to 2015). |

Linda Petrone (1962) | Trustee | Since 2019 | Founding Partner, Sage Search Advisors (since 2012).

| 37 | None. |

Stuart Strauss (1953) | Trustee | Since 2021 | Partner, Dechert, LLP (2009 to 2020). | 19 | None. |

| Mark Zurack (1957) | Trustee | Since 2011 | Professor, Columbia Business School (since 2002). | 19 | Independent Trustee, AQR Funds (35 portfolios) (since 2014); Independent Trustee, Exchange Listed Funds Trust (2019); Independent Trustee, Source ETF Trust (2014 to 2015). |

| (1) | Each Trustee shall serve during the continued life of the Trust until he or she dies, resigns, is declared bankrupt or incompetent by a court of competent jurisdiction, or is removed. |

| (2) | The fund complex includes each series of the Trust and of Exchange Listed Funds Trust. |

5

Set forth below is information about each of the persons currently serving as officers of the Trust. The address of Messrs. J. Garrett Stevens, Richard Hogan, James J. Baker, Jr., and Matthew Fleischer is c/o Exchange Traded Concepts Trust, 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120; and the address of Mr. Eric Olsen is SEI Investments Company, One Freedom Valley Drive, Oaks, Pennsylvania 19456.

Name and | Position(s) | Term of Office and Length of Time Served1 |

Principal Occupation(s) |

| J. Garrett Stevens (1979) | Trustee and President | Trustee (Since 2009); President (Since 2011) | Investment Adviser/Vice President, T.S. Phillips Investments, Inc. (since 2000); Chief Executive Officer, Exchange Traded Concepts, LLC (since 2009); President, Exchange Listed Funds Trust (since 2012). |

| Richard Hogan (1961) | Secretary | Since 2011 | President, Exchange Traded Concepts, LLC (since 2011); Private Investor (since 2003); Trustee and Secretary, Exchange Listed Funds Trust (since 2012); Board Member, Peconic Land Trust (2012 to 2016); Managing Member, Yorkville ETF Advisors (2011 to 2016). |

| James J. Baker Jr. (1951) | Treasurer | Since 2015 | Managing Partner, Exchange Traded Concepts, LLC (since 2011); Managing Partner, Yorkville ETF Advisors (2012 to 2016); Vice President, Goldman Sachs (2000 to 2011). |

Eric Olsen (1970) | Assistant Treasurer | Since 2021 | Director, Fund Accounting, SEI Investments Global Funds Services (since 2021); Deputy Head of Fund Operations, Traditional Assets, Aberdeen Standard Investments (2013 to 2021). |

Matthew B. Fleischer (1983) | Chief Compliance Officer | Since 2021 | Associate Counsel, Ameriprise Financial, Columbia Threadneedle Funds (2015 to 2017); Vice President, Compliance, Goldman Sachs Group, Inc., Goldman Sachs Asset Management Funds (2017 to 2021); Chief Compliance Officer, Exchange Listed Funds Trust (since 2021); Chief Compliance Officer, Exchange Traded Concepts Trust (since 2021). |

| 1 | Each officer serves at the pleasure of the Board. |

Individual Trustee and Nominee Qualifications. The Trust has concluded that each of the Trustees, including the Nominees, should serve on the Board because of their ability to review and understand information about the Funds provided to them by management, to identify and request other information they may deem relevant to the performance of their duties, to question management and other service providers regarding material factors bearing on the management and administration of the Funds, and to exercise their business judgment in a manner that serves the best interests of the Funds’ shareholders. The Trust has concluded that each of the Trustees should serve as a Trustee based on their own experience, qualifications, attributes and skills as described below.

Nominees. The Trust has concluded that Ms. Petrone should serve as a Trustee because of the experience she has gained serving in leadership roles in the equity derivatives group of a large financial institution, as well as her knowledge of the financial services industry.

The Trust has concluded that Mr. Strauss should serve as a Trustee because of the experience he has gained as an attorney in the investment management industry, including as partner of a major law firm, representing exchange-traded funds and other investment companies as well as their sponsors and advisers and his knowledge of and experience in investment management law and the financial services industry.

Remaining Trustees. The Trust has concluded that Mr. Stevens should serve as Trustee because of the experience he gained in his roles with registered broker-dealer and investment management firms, as Chief Executive Officer of the Adviser, his experience in and knowledge of the financial services industry, and the experience he has gained as serving as Trustee of the Trust since 2009.

The Trust has concluded that Mr. Jacoby should serve as a Trustee because of the experience he has gained from over 25 years in or serving the investment management industry. Until his retirement in June 2014, Mr. Jacoby served as a partner at the audit and professional services firm Deloitte & Touche LLP, where he had worked since 2000, providing various services to asset management firms that manage mutual funds, hedge funds and private equity funds. Prior to that, Mr. Jacoby held various senior positions at financial services firms. Additionally, he served as a partner at Ernst & Young LLP. Mr. Jacoby is a Certified Public Accountant.

The Trust has concluded that Mr. Zurack should serve as a Trustee because of the experience he has gained serving in various leadership roles in the equity derivatives groups of a large financial institution, his experience in teaching equity derivatives at the graduate level, as well as his knowledge of the financial services industry.

6

In its periodic assessment of the effectiveness of the Board, the Board considers the complementary individual skills and experience of the individual Trustees primarily in the broader context of the Board’s overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Funds.

Ownership of Securities. As of the Record Date, no Trustee beneficially owned shares of any series of the Trust.

Board Compensation. The following table sets forth the compensation paid to the Trustees of the Trust for the fiscal year ended August 31, 2021. Independent Trustee fees are paid from the investment advisory fee paid to the Adviser by the Funds. Trustee compensation does not include reimbursed out-of-pocket expenses in connection with attendance at meetings.

| Name | Aggregate | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from the Trust and Fund Complex1 |

| Interested Trustee | ||||

| Stevens | $0 | N/A | N/A | $0 for service on 1 board |

| Independent Trustees | ||||

| Jacoby | $65,500 | N/A | N/A | $139,913 for service on 2 boards |

| Mahle2 | $29,500 | N/A | N/A | $90,000 for service on 2 boards |

| Petrone | $58,000 | N/A | N/A | $116,000 for service on 2 boards |

| Strauss3 | $31,000 | N/A | N/A | $31,000 for service on 1 board |

| Zurack | $58,000 | N/A | N/A | $58,000 for service on 1 board |

| 1 | The fund complex includes each series of the Trust and of Exchange Listed Funds Trust. |

| 2 | David Mahle served as an Independent Trustee of the Trust through December 31, 2020. For his service as lead Independent Trustee, Mr. Mahle was entitled to a $5,000 annual fee. |

| 3 | Stuart Strauss was appointed as an Independent Trustee of the Trust effective January 1, 2021. |

Communication with Trustees. Shareholders may send communications directly to the Trustees in writing at the address specified above under “Trustees and Officers.”

Information Related to the Independent Accountants and the Audit Committee. Cohen & Company, Ltd. (“Cohen”) is located at 151 North Franklin Street, Suite 575, Chicago, Illinois 60606 and serves as the independent registered public accounting firm for each Fund comprising the Trust. More information related to Cohen and the Audit Committee, including the Audit Committee’s pre-approval policies and procedures, can be found in Exhibit C.

Required Vote. If a quorum is present, the affirmative vote of a plurality of shares of the Trust voted in person or by proxy is required for the election of a Nominee. Shareholders of the Funds of the Trust will vote together as a single class and the voting power of the shares of the Funds will be counted together in determining the results of the voting for the proposal.

The Board of Trustees of Exchange Traded Concepts Trust unanimously recommends that

shareholders vote “FOR” the proposal.

7

Information Specific to Exchange Listed Funds Trust

Trustees and Officers. Currently, the Board consists of three Independent Trustees, Ms. Linda Petrone (Nominee) and Messrs. Timothy J. Jacoby and David M. Mahle, and one Interested Trustee, Mr. Richard Hogan. Mr. Strauss (Nominee) does not currently serve on the Board of the Trust. The address of each Trustee is c/o Exchange Listed Funds Trust, 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120. Information regarding the Trustees, including each Nominee, is set forth below.

Name and | Position(s) | Term of | Principal | Number of Portfolios in Fund Complex(2) Overseen By Trustee | Other |

| Interested Trustee | |||||

Richard Hogan (1961) | Trustee and Secretary | Since 2012 | Director, Exchange Traded Concepts, LLC (since 2011); Private Investor (since 2002); Secretary, Exchange Traded Concepts Trust (since 2011); Managing Member, Yorkville ETF Advisors (2011 to 2016). | 18 | Board Member, Peconic Land Trust of Suffolk County, NY. |

| Independent Trustees | |||||

Timothy J. Jacoby (1952) | Trustee | Since 2014 | Senior Partner, Deloitte & Touche LLP, Private Equity/Hedge Fund/Mutual Fund Services Practice (2000 to 2014). | 37 | Independent Trustee, Edward Jones Money Market Fund (since 2017); Audit Committee Chair, Perth Mint Physical Gold ETF (2018 to 2020); Independent Trustee, Source ETF Trust (2014 to 2015). |

David M. Mahle (1943) | Trustee | Since 2012 | Consultant, Jones Day (2012 to 2015); Of Counsel, Jones Day (2008 to 2011); Partner, Jones Day (1988 to 2008). | 18 | Independent Trustee, Exchange Traded Concepts Trust (2012 to 2020); Independent Trustee, Source ETF Trust (2014-2015). |

Linda Petrone (1962) | Trustee | Since 2019 | Founding Partner, Sage Search Advisors (since 2012). | 37 | None. |

| Independent Trustee Nominee | |||||

Stuart Strauss (1953) | Trustee Nominee | N/A | Partner, Dechert, LLP (2009 to 2020). | 19 | None. |

| 1 | Each Trustee shall serve during the continued life of the Trust until he or she dies, resigns, is declared bankrupt or incompetent by a court of competent jurisdiction, or is removed. |

| 2 | The Fund Complex includes each series of the Trust and of Exchange Traded Concepts Trust. |

8

Set forth below is information about each of the persons currently serving as officers of the Trust. The address of Messrs. J. Garrett Stevens, Richard Hogan, James J. Baker Jr., and Matthew Fleischer is c/o Exchange Listed Funds Trust, 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120; and the address of Mr. Christopher W. Roleke is Foreside Management Services, LLC, 10 High Street, Suite 302, Boston, Massachusetts 02110.

Name | Position(s) Held | Term of | Principal Occupation(s) |

J. Garrett Stevens (1979) | President | Since 2012 | Investment Adviser/Vice President, T.S. Phillips Investments, Inc. (since 2000); Chief Executive Officer, Exchange Traded Concepts, LLC (since 2009); and President, Exchange Traded Concepts Trust (since 2011). |

Richard Hogan (1961) | Trustee and Secretary | Since 2012 | Director, Exchange Traded Concepts, LLC (since 2011); Private Investor (since 2003); Secretary, Exchange Traded Concepts Trust (since 2011); Board Member, Peconic Land Trust (2012 to 2016); Managing Member, Yorkville ETF Advisors (2011 to 2016). |

Christopher W. Roleke (1972) | Treasurer | Since 2012 | Managing Director/Fund Principal Financial Officer, Foreside Management Services, LLC (since 2011). |

James J. Baker Jr. (1951) | Assistant Treasurer | Since 2015 | Managing Partner, Exchange Traded Concepts, LLC (since 2011); Managing Partner, Yorkville ETF Advisors (2012 to 2016); Vice President, Goldman Sachs (2000 to 2011). |

Matthew B. Fleischer (1983) | Chief Compliance Officer | Since 2021 | Associate Counsel, Ameriprise Financial, Columbia Threadneedle Funds (2015 to 2017); Vice President, Compliance, Goldman Sachs Group, Inc., Goldman Sachs Asset Management Funds (2017 to 2021); Exchange Listed Funds Trust, Chief Compliance Officer (since 2021); Exchange Traded Concepts Trust, Chief Compliance Officer (since 2021). |

| 1 | Each officer serves at the pleasure of the Board. |

Individual Trustee and Nominee Qualifications. The Trust has concluded that each of the Trustees and Mr. Strauss, a Nominee, should serve on the Board because of their ability to review and understand information about the Funds provided to them by management, to identify and request other information they may deem relevant to the performance of their duties, to question management and other service providers regarding material factors bearing on the management and administration of the Funds, and to exercise their business judgment in a manner that serves the best interests of the Funds’ shareholders. The Trust has concluded that each of the Trustees should serve as a Trustee based on their own experience, qualifications, attributes and skills as described below.

9

Nominees. The Trust has concluded that Ms. Petrone should serve as a Trustee because of the experience she has gained serving in leadership roles in the equity derivatives group of a large financial institution, as well as her knowledge of the financial services industry.

The Trust has concluded that Mr. Strauss should serve as a Trustee because of the experience he has gained as an attorney in the investment management industry, including as partner of a major law firm, representing exchange-traded funds and other investment companies as well as their sponsors and advisers and his knowledge of and experience in investment management law and the financial services industry.

Remaining Trustees. The Trust has concluded that Mr. Hogan should serve as a Trustee because of his 26+ years of experience in senior level ETF management which began at Spear, Leeds & Kellogg (“SLK”) in 1987, becoming a Limited Partner in 1990 and a Managing Director in 1992. As Managing Director of the Index Derivatives Group, he established trading operations in Chicago, Singapore and London as well as other satellite operations and nurtured Exchange Traded Funds (“ETFs”) as a Specialist in SPDRs, WEBS, Sector SPDRs, iShares and other ETFs. Mr. Hogan became a Managing Director of Goldman Sachs when SLK was merged and played a critical role in combining the ETF operations of SLK, Goldman and Hull Trading (a prior Goldman acquisition). He has worked closely with Exchange staff, issuers, index providers and others in conceiving, designing, developing, launching, marketing and trading new ETFs, and championed the idea of a fixed income ETF. Mr. Hogan is a Founder and Director of the Adviser.

The Trust has concluded that Mr. Jacoby should serve as a Trustee because of the experience he has gained from over 25 years in or serving the investment management industry. Until his retirement in June 2014, Mr. Jacoby served as a partner at the audit and professional services firm Deloitte & Touche LLP, where he had worked since 2000, providing various services to asset management firms that manage mutual funds, hedge funds and private equity funds. Prior to that, Mr. Jacoby held various senior positions at financial services firms. Additionally, he served as a partner at Ernst & Young LLP. Mr. Jacoby is a Certified Public Accountant.

The Trust has concluded that Mr. Mahle should serve as a Trustee because of the experience he has gained as an attorney in the investment management industry of a major law firm, representing exchange-traded funds and other investment companies as well as their sponsors and advisers and his knowledge and experience in investment management law and the financial services industry. Mr. Mahle is also a professor of law at Fordham Law School, where he lectures on investment companies and investment adviser regulations.

In its periodic assessment of the effectiveness of the Board, the Board considers the complementary individual skills and experience of the individual Trustees primarily in the broader context of the Board’s overall composition so that the Board, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the business of the Funds.

Ownership of Securities. As of the Record Date, no Trustee beneficially owned shares of any series of the Trust.

10

Board Compensation. The following table sets forth the compensation paid to the Trustees of the Trust for the fiscal year ended August 31, 2021. Independent Trustee fees are paid from the unitary fee paid to the Adviser by the Funds. Trustee compensation does not include reimbursed out-of-pocket expenses in connection with attendance at meetings.

| Name | Aggregate Compensation | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from the Trust and Fund Complex1 |

| Interested Trustee | ||||

| Hogan | $0 | N/A | N/A | $0 for service on 1 board |

| Independent Trustees | ||||

| Jacoby | $74,413 | N/A | N/A | $139,913 for service on 2 boards |

| Mahle | $60,500 | N/A | N/A | $90,000 for service on 2 boards |

| Petrone | $58,000 | N/A | N/A | $116,000 for service on 2 boards |

| 1 | The Fund Complex includes each series of the Trust and Exchange Traded Concepts Trust. |

Communication with Trustees. Shareholders may send communications directly to the Trustees in writing at the address specified above under “Trustees and Officers.”

Information Related to the Independent Accountants and the Audit Committee. Cohen & Company, Ltd. is located at 151 North Franklin Street, Suite 575, Chicago, Illinois 60606 and serves as the independent registered public accounting firm for each Fund comprising the Trust. More information related to the Cohen and the Audit Committee, including the Audit Committee’s pre-approval policies and procedures, can be found in Exhibit C.

Required Vote. If a quorum is present, the affirmative vote of a plurality of shares of the Trust voted in person or by proxy is required for the election of a Nominee. Shareholders of the Funds of the Trust will vote together as a single class and the voting power of the shares of the Funds will be counted together in determining the results of the voting for the proposal.

The Board of Trustees of Exchange Listed Funds Trust unanimously recommends that

shareholders vote “FOR” the proposal.

11

Record Date/Shareholders Entitled to Vote. Each Fund is a separate series, or portfolio, of its respective Trust, each of which is a Delaware statutory trust and registered investment company under the 1940 Act. The record holders of outstanding shares of a Fund are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Meeting with respect to that Fund. The record holders of outstanding shares of each Fund of each Trust also are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Meeting with respect to the Trust.

Shareholders of each Trust at the close of business on November 15, 2021, the Record Date, will be entitled to be present and vote at the Meeting. A table indicating the number of shares outstanding and entitled to vote on behalf of each Fund can be found in Exhibit D.

Voting Proxies. You should read the entire Proxy Statement before voting. If you sign and return the accompanying proxy card, you may revoke it by giving written notice of such revocation to the Secretary of the Trust(s) prior to the Meeting or by delivering a subsequently dated proxy card or by attending and voting at the Meeting in person. Proxies voted by telephone or internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number listed in the enclosed proxy card. Properly executed proxies will be voted, as you instruct, by the persons named in the accompanying proxy card. In the absence of such direction, however, the persons named in the accompanying proxy card intend to vote “FOR” the election of each Nominee and may vote at their discretion with respect to other matters not now known to the Boards that may be presented at the Meeting. Attendance by a shareholder at the Meeting does not, in itself, revoke a proxy.

If sufficient votes are not received by the date of the Meeting, a person named as proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. The persons named as proxies will vote all proxies in favor of adjournment that voted in favor of the proposal (or abstained) and vote against adjournment all proxies that voted against the proposal.

Quorum Required. Each Fund must have a quorum of shares represented at the Meeting, in person or by proxy, to take action on any matter relating to that Fund. Under each Trust’s Agreement and Declaration of Trust, a quorum is constituted by the presence in person or by proxy of at least one-third of the outstanding shares of each Fund or Trust (as applicable to each proposal) entitled to vote at the Meeting.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. Abstentions and broker non-votes will not be counted as voting on the proposal or any other matter at the Meeting when the voting requirement is based on achieving a plurality or percentage of the “voting securities present.”

If a quorum is not present at the Meeting, or a quorum is present at the Meeting but sufficient votes to approve a proposal are not received, the Secretary of the Meeting or the holders of a majority of the shares of the Funds or Trust (as applicable to each proposal) present at the Meeting in person or by proxy may adjourn the Meeting with respect to such proposal(s) to permit further solicitation of proxies.

Method and Cost of Proxy Solicitation. Proxies will be solicited by the Trusts primarily by mail. The solicitation also may include telephone, facsimile, electronic or oral communications by certain officers or employees of the Trusts or the Adviser or any sub-adviser to the Trusts, none of whom will be paid for these services, or by a third-party proxy solicitation firm. The Adviser will pay the costs of the Meeting and the expenses incurred in connection with the solicitation of proxies, and a sub-adviser or other entity may reimburse the Adviser for a portion of the expenses related to the solicitation of proxies for the Funds. The Trusts also may request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Funds held of record by such persons. The Adviser may reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of the Funds.

12

Investment Adviser, Sub-Advisers, Principal Underwriters, and Administrators

Exchange Traded Concepts Trust. Exchange Traded Concepts, LLC, located at 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120, serves as the investment adviser to each Fund of the Trust.

Vident Investment Advisory, LLC, located at 1125 Sanctuary Parkway, Suite 515, Alpharetta, Georgia 30009, serves as the sub-adviser to the Trust’s ROBO Global® Robotics and Automation Index ETF. Penserra Capital Management LLC, located at 4 Orinda Way, 100-A, Orinda, California 94563, serves as the sub-adviser to the Trust’s EMQQ The Emerging Markets Internet & Ecommerce ETF. HTAA, LLC located at 141 West Jackson Boulevard, Suite 1650, Chicago, Illinois 60604, serves as the sub-adviser to the Trust’s Hull Tactical US ETF. 6 Meridian LLC, located at 8301 E 21st St. North, Suite 150, Wichita, Kansas 67206, serves as the sub-adviser to the Trust’s ETC 6 Meridian Hedged Equity-Index Option Strategy ETF, ETC 6 Meridian Low Beta Equity Strategy ETF, ETC 6 Meridian Mega Cap Equity ETF, ETC 6 Meridian Small Cap Equity ETF, and ETC 6 Meridian Quality Growth ETF.

SEI Investments Distribution Co. and SEI Investments Global Funds Services, both located at One Freedom Valley Drive, Oaks, Pennsylvania 19456, serve as distributor and administrator, respectively, for each Fund of the Trust.

Exchange Listed Funds Trust. Exchange Traded Concepts, LLC, located at 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120, serves as the investment adviser to each Fund of the Trust.

Cabana LLC, located at 220 S. School Avenue, Fayetteville, Arkansas 72701, serves as the sub-adviser to the Trust’s Cabana Target Drawdown 5 ETF, Cabana Target Drawdown 7 ETF, Cabana Target Drawdown 10 ETF, Cabana Target Drawdown 13 ETF, Cabana Target Drawdown 16 ETF, Cabana Target Leading Sector Aggressive ETF, Cabana Target Leading Sector Conservative ETF, and Cabana Target Leading Sector Moderate ETF. MacKay Shields LLC, located at 1345 Avenue of the Americas, New York, New York 10105, and WhiteStar Asset Management LLC, located at 300 Crescent Court, Suite 200 Dallas, Texas 75201, each serve as a sub-adviser to the Trust’s High Yield ETF. Saba Capital Management, L.P., located at 405 Lexington Avenue, 58th Floor, New York, New York 10174, serves as the sub-adviser to the Trust’s Saba Closed-End Funds ETF. Corbett Road Capital Management, LLC, located at 7901 Jones Branch Drive, Suite 800, McLean, Virginia 22102, serves as the sub-adviser to the Trust’s Corbett Road Tactical Opportunity ETF. Gavekal Capital Limited, located at Suite 3101, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong, serves as the sub-adviser to the Trust’s Gavekal Asia Pacific Government Bond ETF. Kingsway Capital Partners Limited, located at Eight Floor, 6 New Street Square, New Fetter Lane, London, England, EC4A 3A, serves as the sub-adviser to the Trust’s Asian Growth Cubs ETF.

Foreside Fund Services, LLC, located at Three Canal Plaza, Suite 100, Portland, Maine 04101, serves as the distributor for each Fund of the Trust. The Bank of New York Mellon (“BNYM”), located at 240 Greenwich Street, New York, New York, 10286, serves as administrator for each Fund of the Trust.

13

Share Ownership. To the knowledge of each Trust’s management, as of the close of business on the Record Date, the officers and Trustees of each Trust, as a group, beneficially owned less than one percent of each Fund’s outstanding shares and less than one percent of each Trust’s outstanding shares. To the knowledge of each Trust’s management, as of the close of business on the Record Date, persons owning of record more than 5% of the outstanding shares of a Fund or the Trust, and their names and addresses, were as listed in Exhibit E. Any shareholder listed in Exhibit E as owning 25% or more of the outstanding shares of a Fund or Trust may be presumed to “control” (as that term is defined in the 1940 Act) that Fund or Trust, respectively. Shareholders controlling a Fund or Trust could have the ability to vote a majority of the shares of that Fund or Trust on any matter requiring the approval of Fund or Trust shareholders, respectively. From time to time, the number of shares held in “street name” accounts of various securities brokers and dealers for the benefit of their clients may exceed 5% of the total shares outstanding of a Fund or a Trust.

Other Matters to Come Before the Meeting. The Trusts’ management does not know of any matters to be presented at the Meeting other than the proposal described above. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Shareholder Proposals. The Agreement and Declaration of Trust, as amended, and By-Laws of each Trust do not provide for annual meetings of shareholders, and the Trusts do not currently intend to hold such meetings in the future. Shareholder proposals for inclusion in a proxy statement for any subsequent meeting of a Trust’s shareholders must be received by the Trust a reasonable period of time prior to any such meeting.

Householding. If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Joint Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of this Joint Proxy Statement, please contact the bank, trust company, broker, dealer, investment adviser or other financial intermediary through which you hold your shares (each, an “Authorized Institution”) directly. If you would like to receive a separate copy of future proxy statements, or you are now receiving multiple copies of proxy statements and would like to receive a single copy in the future, please contact your Authorized Institution.

Reports and Other Information. Proxy materials, reports, and other information filed by the Funds can be inspected and copied at the Public Reference Facilities maintained by the SEC at 100 F Street, NE, Washington, DC 20549-0102. The SEC maintains a website (at http://www.sec.gov) that contains other information about the Funds.

TO ENSURE THE PRESENCE OF A QUORUM AT THE SPECIAL MEETING, PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

By Order of the Boards of Trustees,

J. Garrett Stevens

President, Exchange Listed Funds Trust

Trustee and President, Exchange Traded Concepts, LLC

November 22, 2021

14

EXCHANGE TRADED CONCEPTS TRUST

(the “Trust”)

Governance and Nominating Committee Charter

(the “Charter”)

| I. | Governance and Nominating Committee: Membership |

The Governance and Nominating Committee (the “Committee”) shall be composed entirely of “Independent Trustees” (members of the Board of Trustees (the “Board”) who are not interested persons of the Trust as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended), and consist of all the Independent Trustees with one Independent Trustee elected as chair of the Committee (the “Chair”). Matters to be addressed “periodically” under the terms of this Charter shall be addressed at least annually, normally in conjunction with the annual self-assessment required by Section V.C. hereof.

| II. | Board: Selection and Tenure |

| A. | The Committee shall periodically review the composition of the Board, including its size and the balance of its members’ skills, experience and background, and shall make recommendations to the Board concerning the need to increase or decrease the size of the Board or to add individuals with different backgrounds or skill sets in order to provide an appropriate mix of backgrounds, knowledge and experience on the Board. |

| B. | The Committee shall periodically review and make recommendations with regard to the tenure of the Independent Trustees, including term limits and/or age limits. |

| C. | The Committee shall periodically review and make recommendations with respect to adoption of and administration of any policy for retirement from Board membership. |

| III. | Board: Nominations and Functions |

| A. | The Committee shall select and nominate all persons to serve as Independent Trustees. The Committee shall evaluate candidates’ qualifications for Board membership and the independence of such candidates from the investment advisers and other principal service providers for the funds of the Trust. Persons selected must be independent in terms of both the letter and the spirit of the 1940 Act. The Committee shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, e.g., business, financial or family relationships with investment advisers or service providers. |

| B. | The Committee also shall consider proposals of and make recommendations for “interested” Trustee candidates to the Board. |

A-1

| C. | The Committee may adopt from time to time specific, minimum qualifications that the Committee believes a candidate must meet before being considered as a candidate for Board membership and shall comply with any rules adopted from time to time by the U.S. Securities and Exchange Commission regarding investment company nominating committees and the nomination of persons to be considered as candidates for Board membership. |

| D. | The Committee shall review shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to the Committee at the applicable Trust’s offices. The Committee shall adopt, by resolution, a policy regarding its procedures for considering candidates for the Board, including any recommended by shareholders. |

| E. | The Committee, with the assistance of counsel, shall review the independence of incumbent Independent Trustees and shall make recommendations to the Board in the event it determines that an incumbent Trustee no longer satisfies applicable standards of independence. |

| IV. | Committees: Selection and Review |

| A. | The Committee shall periodically review committee assignments and make nominations for Independent Trustee membership on all committees. |

| B. | The Committee shall periodically review and make recommendations to the full Board regarding the responsibilities and charters of any committees (other than the Audit Committee) of the Board, whether there is a continuing need for each committee, whether there is a need for additional committees, and whether committees should be combined or reorganized. |

| V. | Board: Education and Operations |

| A. | The Committee shall periodically review and make recommendations about ongoing education for incumbent Independent Trustees and about appropriate orientation for new Trustees. |

| B. | The Committee shall periodically review and make recommendations about the organization of board meetings, including the frequency, timing and agendas of the meetings. |

| C. | The Committee shall conduct a self-assessment and coordinate evaluation of the performance of the Board (and, in particular, the Independent Trustees) as a whole, at least annually, with a view towards enhancing its effectiveness. |

| D. | The Committee shall periodically, with the assistance of its counsel, define and clarify the duties and responsibilities of Board members. Included among these shall be legal and fiduciary duties, expectations regarding preparation, attendance, participation at meetings, fund ownership and limitations on investments. |

A-2

| VI. | Committee Procedures |

| A. | The Committee shall meet at the direction of its Chair as often as appropriate to accomplish its purpose. In any event, the Committee shall meet at least once each year and shall conduct at least one meeting in person. |

| B. | A majority of the members of the Committee shall constitute a quorum for the transaction of business at any meeting of the Committee. The action of a majority of the members of the Committee present at a meeting at which a quorum is present shall be the action of the Committee. The Committee may meet in person or by telephone, and the Committee may act by written consent, to the extent permitted by law and by the applicable Trust’s by-laws. In the event of any inconsistency between this Charter and a Trust’s organizational documents, the provisions of the Trust’s organizational documents shall govern. |

| C. | The Committee shall submit minutes of its meeting on a regular basis and shall regularly report to the full Board no later than the next regularly scheduled Board meeting. |

| D. | The Committee shall review the Committee charter at least annually and recommend appropriate changes. |

| E. | The Committee shall have the resources and authority to discharge its responsibilities, including authority to retain special counsel and other experts or consultants at the expense of the appropriate Fund(s) or Trust. |

| F. | The Committee may invite members of management, counsel, and others to attend its meetings as it deems appropriate. |

| VII. | Other Powers and Responsibilities |

| A. | The Committee shall monitor the performance of legal counsel for the Independent Trustees, and any other service providers (other than the independent auditors, which are monitored by the Audit Committee) that are chosen by the Independent Trustees, and shall supervise counsel for the Independent Trustees. |

| B. | The Committee shall periodically review and make recommendations about any appropriate changes to director compensation to the full Board. |

| C. | The Committee has the authority to review and make recommendations to the Board concerning all other matters not listed above pertaining to the functioning of the Board and committees of the Board and pertaining generally to the governance of the Trust, including the performance of individual Independent Trustees; the procedures applicable to meetings of the Board and the setting of agendas for Board meetings; the need to assign inside or outside staff or consultants to support the Independent Trustees; the adequacy and appropriateness of insurance coverage; and the review and evaluation of possible conflicts of interest. |

| Adopted: | October 20, 2009 |

| Amended: | February 23, 2012 |

| Amended: | March 1, 2016 |

A-3

EXCHANGE TRADED CONCEPTS TRUST

Board of Trustees Retirement Policy

Statement of General Policy

Each Trustee shall resign at the end of the calendar year in which such person first attains the age of seventy-five years.

Exemption from General Policy

A Trustee may continue to serve for one or more additional one-year terms after attaining the age of seventy-five under the following circumstances:

Prior to the end of the calendar year in which a Trustee first attains the age of seventy-five (and prior to the end of each calendar year thereafter), the Board of Trustees of the Trust shall (i) meet to review the performance such Board member; (ii) find that the continued service of such Board member is in the best interests of the Trust; and (iii) unanimously approve the exemption from the Trust’s retirement policy.

| Adopted: | October 20, 2009 |

| Amended: | February 23, 2012 |

| Amended: | March 1, 2016 |

A-4

EXCHANGE LISTED FUNDS TRUST

(the “Trust”)

Governance and Nominating Committee Charter

(the “Charter”)

| I. | Governance and Nominating Committee: Membership |

The Governance and Nominating Committee (the “Committee”) shall be composed entirely of “Independent Trustees” (members of the Board of Trustees (the “Board”) who are not interested persons of the Trust as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended), and consist of all the Independent Trustees with one Independent Trustee elected as chair of the Committee (the “Chair”). Matters to be addressed “periodically” under the terms of this Charter shall be addressed at least annually, normally in conjunction with the annual self-assessment required by Section V.C. hereof.

| II. | Board: Selection and Tenure |

| A. | The Committee shall periodically review the composition of the Board, including its size and the balance of its members’ skills, experience and background, and shall make recommendations to the Board concerning the need to increase or decrease the size of the Board or to add individuals with different backgrounds or skill sets in order to provide an appropriate mix of backgrounds, knowledge and experience on the Board. |

| B. | The Committee shall periodically review and make recommendations with regard to the tenure of the Independent Trustees, including term limits and/or age limits. |

| C. | The Committee shall periodically review and make recommendations with respect to adoption of and administration of any policy for retirement from Board membership. |

| III. | Board: Nominations and Functions |

| A. | The Committee shall select and nominate all persons to serve as Independent Trustees. The Committee shall evaluate candidates’ qualifications for Board membership and the independence of such candidates from the investment advisers and other principal service providers for the funds of the Trust. Persons selected must be independent in terms of both the letter and the spirit of the 1940 Act. The Committee shall also consider the effect of any relationships beyond those delineated in the 1940 Act that might impair independence, e.g., business, financial or family relationships with investment advisers or service providers. |

| B. | The Committee also shall consider proposals of and make recommendations for “interested” Trustee candidates to the Board. |

B-1

| C. | The Committee may adopt from time to time specific, minimum qualifications that the Committee believes a candidate must meet before being considered as a candidate for Board membership and shall comply with any rules adopted from time to time by the U.S. Securities and Exchange Commission regarding investment company nominating committees and the nomination of persons to be considered as candidates for Board membership. |

| D. | The Committee shall review shareholder recommendations for nominations to fill vacancies on the Board if such recommendations are submitted in writing and addressed to the Committee at the applicable Trust’s offices. The Committee shall adopt, by resolution, a policy regarding its procedures for considering candidates for the Board, including any recommended by shareholders. |

| E. | The Committee, with the assistance of counsel, shall review the independence of incumbent Independent Trustees and shall make recommendations to the Board in the event it determines that an incumbent Trustee no longer satisfies applicable standards of independence. |

| IV. | Committees: Selection and Review |

| A. | The Committee shall periodically review committee assignments and make nominations for Independent Trustee membership on all committees. |

| B. | The Committee shall periodically review and make recommendations to the full Board regarding the responsibilities and charters of any committees (other than the Audit Committee) of the Board, whether there is a continuing need for each committee, whether there is a need for additional committees, and whether committees should be combined or reorganized. |

| V. | Board: Education and Operations |

| A. | The Committee shall periodically review and make recommendations about ongoing education for incumbent Independent Trustees and about appropriate orientation for new Trustees. |