UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Under Rule 14a-12 |

| |

EXCHANGE TRADED CONCEPTS TRUST |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | | No fee required. |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | 1) | | Title of each class of securities to which transaction applies: |

| | | | | |

| | | 2) | | Aggregate number of securities to which transaction applies: |

| | | | | |

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | | |

| | | 4) | | Proposed maximum aggregate value of transaction: |

| | | | | |

| | | 5) | | Total fee paid: |

| | | | | |

| | | |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | | | |

| | | 1) | | Amount Previously Paid: |

| | | | | |

| | | 2) | | Form, Schedule or Registration Statement No.: |

| | | | | |

| | | 3) | | Filing Party: |

| | | | | |

| | | 4) | | Date Filed: |

| | | | | |

EXCHANGE TRADED CONCEPTS TRUST

ETC 6 Meridian Hedged Equity-Index Option Strategy ETF (SIXH)

ETC 6 Meridian Low Beta Equity Strategy ETF (SIXL)

ETC 6 Meridian Mega Cap Equity ETF (SIXA)

ETC 6 Meridian Small Cap Equity ETF (SIXS)

10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120

July 20, 2022

Dear Shareholder,

On behalf of the Board of Trustees of Exchange Traded Concepts Trust (the “Trust”), I am writing to inform you of a special meeting of shareholders of the ETC 6 Meridian Hedged Equity-Index Option Strategy ETF, ETC 6 Meridian Low Beta Equity Strategy ETF, ETC 6 Meridian Mega Cap Equity ETF, and ETC 6 Meridian Small Cap Equity ETF (the “Funds”) that will be held on August 24, 2022, at 11:00 a.m. Eastern Time at the offices of the Funds’ investment adviser, Exchange Traded Concepts, LLC (the “Adviser”), located at 295 Madison Avenue, New York, New York 10017 (together with any postponements or adjournments, the “Meeting”).

At the Meeting, you will be asked to (1) approve a new investment advisory agreement between the Trust, on behalf of each Fund, and the Adviser and (2) approve payment to the Adviser for its continued service to each Fund from May 7, 2022 until the new investment advisory agreement is approved by shareholders and effective. The original investment advisory agreement between the Trust and the Adviser with respect to the Funds inadvertently lapsed on May 6, 2022 because the Board of Trustees did not renew the agreement due to an administrative error. The material terms of the proposed new investment advisory agreement are identical to those of the original agreement including the advisory fee payable to the Adviser. Although the original advisory agreement was not renewed by the Board of Trustees, the Adviser has continued to provide the Funds with uninterrupted investment advisory services consistent with the terms and conditions of that agreement. Approval of the new advisory agreement by shareholders of one Fund is not contingent on approval of the new advisory agreement by shareholders of any other Fund.

If you have received this mailing, you are a shareholder of record as of July 11, 2022 of one or more of the Funds. You are entitled to vote at the Meeting and any adjournments of the Meeting. The Trust’s Board recommends that you vote “FOR” the proposals. For additional information about the proposals, please see the accompanying proxy statement.

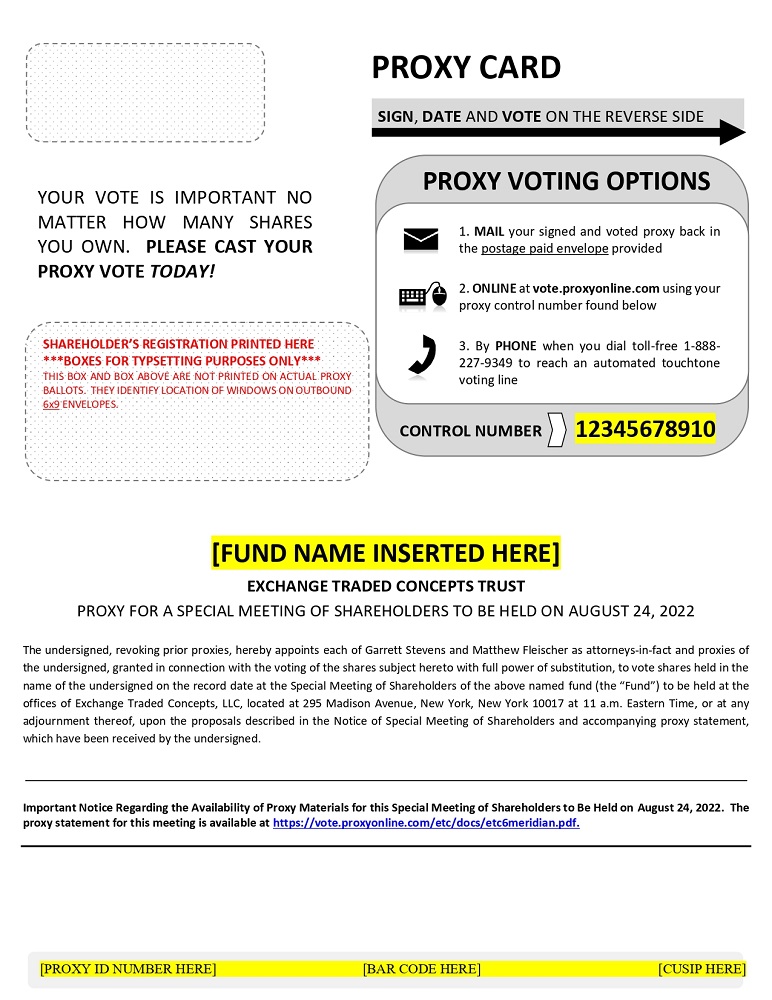

You can vote any one of these four ways:

| · | By mail with the enclosed proxy card - be sure to sign, date and return it in the enclosed postage-paid envelope; |

| · | Through the website listed on the enclosed proxy voting instructions; |

| · | By telephone using the toll-free number listed in the proxy voting instructions; or |

| · | In person at the shareholder meeting on August 24, 2022 at 11:00 a.m., Eastern Time. |

We encourage you to please vote through the website or telephone numbers provided, using the voting control number that appears on your proxy card enclosed. Your vote is extremely important to us. If you have questions, please call 1-866-796-1285 for additional information.

We appreciate your support and prompt response in this matter and look forward to continuing to serve the Funds.

Respectfully,

J. Garrett Stevens

Trustee and President, Exchange Traded Concepts Trust

PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY CARD IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

EXCHANGE TRADED CONCEPTS TRUST

10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120

Notice of Special Meeting of Shareholders

To Be Held on August 24, 2022

A special meeting of shareholders (the “Meeting”) of the ETC 6 Meridian Hedged Equity-Index Option Strategy ETF, ETC 6 Meridian Low Beta Equity Strategy ETF, ETC 6 Meridian Mega Cap Equity ETF, and ETC 6 Meridian Small Cap Equity ETF (the “Funds”), each a series of Exchange Traded Concepts Trust (the “Trust”), will be held at the offices of Exchange Traded Concepts, LLC, 295 Madison Avenue, New York, New York 10017, on August 24, 2022 at 11:00 a.m. Eastern Time.

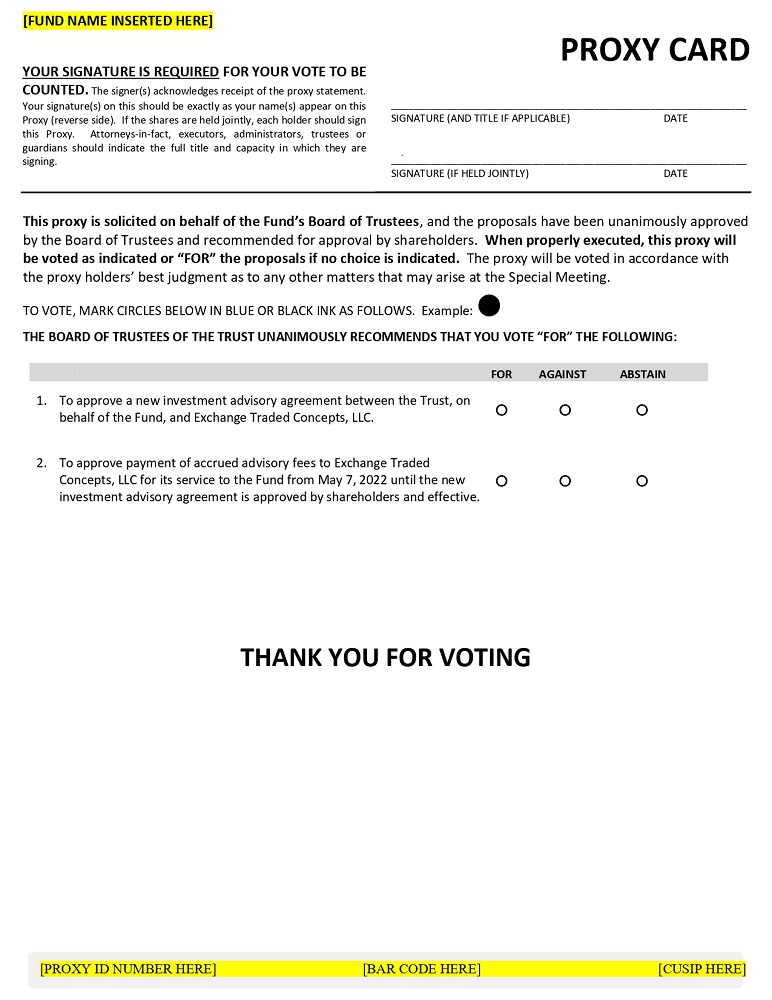

At the Meeting, shareholders of each Fund will be asked to vote on the following proposals:

| 1. | To approve a new investment advisory agreement between the Trust, on behalf of each Fund, and Exchange Traded Concepts, LLC, investment adviser to the Funds. |

| 2. | To approve payment of accrued advisory fees to Exchange Traded Concepts, LLC for its service to each Fund from May 7, 2022 until the new investment advisory agreement is approved by shareholders and effective. |

Shareholders also may be asked to transact such other business as may properly come before the Meeting. Shareholders of record of the Funds at the close of business on July 11, 2022 are entitled to notice of, and to vote at, the Meeting or any adjournment(s) thereof.

After careful consideration, the Board of Trustees of the Trust unanimously recommends that shareholders vote “FOR” the proposals.

We call your attention to the accompanying proxy statement. Your vote is very important to us regardless of the number of shares you hold. You are requested to complete, date, and sign the enclosed proxy card and return it promptly in the envelope provided for that purpose. Your proxy card also provides instructions for voting via telephone or the Internet if you wish to take advantage of these voting options. Proxies may be revoked prior to the Meeting by timely executing and submitting a revised proxy (following the methods noted above), by giving written notice of revocation to the Trust prior to the Meeting, or by voting in person at the Meeting.

By Order of the Board of Trustees,

J. Garrett Stevens

Trustee and President, Exchange Traded Concepts Trust

July 20, 2022

EXCHANGE TRADED CONCEPTS TRUST

ETC 6 Meridian Hedged Equity-Index Option Strategy ETF (SIXH)

ETC 6 Meridian Low Beta Equity Strategy ETF (SIXL)

ETC 6 Meridian Mega Cap Equity ETF (SIXA)

ETC 6 Meridian Small Cap Equity ETF(SIXS)

10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73120

PROXY STATEMENT

Special Meeting of Shareholders

To be Held on August 24, 2022

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to be Held on August 24, 2022:

The Proxy Statement is available online at https://vote.proxyonline.com/etc/docs/etc6meridian.pdf.

This Proxy Statement and enclosed notice and proxy card are being furnished in connection with the solicitation of proxies by the Board of Trustees of Exchange Traded Concepts Trust (the “Trust”). The proxy is being solicited for use at a special meeting of shareholders of the ETC 6 Meridian Hedged Equity-Index Option Strategy ETF, ETC 6 Meridian Low Beta Equity Strategy ETF, ETC 6 Meridian Mega Cap Equity ETF, and ETC 6 Meridian Small Cap Equity ETF (the “Funds”), each a series of the Trust, to be held at the offices of Exchange Traded Concepts, LLC (the “Adviser”), 295 Madison Avenue, New York, New York 10017, on August 24, 2022 at 11:00 a.m. Eastern Time and at any and all adjournments or postponements thereof (the “Meeting”). This Proxy Statement and the accompanying notice and proxy card are being first mailed to shareholders on or about July 25, 2022.

At the Meeting, shareholders of each Fund will be asked to vote on the following proposals:

| 1. | To approve a new investment advisory agreement between the Trust, on behalf of each Fund, and the Adviser. |

| 2. | To approve payment of accrued advisory fees to the Adviser for its service to each Fund from May 7, 2022 until the new investment advisory agreement is approved by shareholders and effective. |

Shareholders also may be asked to transact such other business as may properly come before the Meeting. Shareholders of record of the Funds at the close of business July 11, 2022 (the “Record Date”) are entitled to vote at the Meeting or any adjournment(s) thereof.

If you have any questions about the proposal or about voting, please call AST Fund Solutions, LLC, the Funds’ proxy solicitor, at 1-866-749-6383.

Shareholders can find important information about the Funds in their shareholder reports. The Funds will furnish, without charge, a copy of their most recent annual report and the most recent semi-annual report succeeding such annual report, if any, to a Fund shareholder upon request. You may obtain copies of these reports by writing to the Trust at the address set forth above or by calling 1-866-749-6383 or visiting the Funds’ website at www.6meridianfunds.com.

PROPOSAL 1

Approval of a New Investment Advisory Agreement for the Funds

Background. The Adviser has served as investment adviser to the Funds since their commencement of operations. Due to an administrative error, the Board did not approve the continuance of the investment advisory agreement between the Trust, on behalf of the Funds, and the Adviser (the “Original Agreement”) prior to the expiration of its initial term at the end of the day on May 6, 2022. As soon as the Trust’s officers and the Adviser became aware on June 14, 2022 of the unintended termination, steps immediately were taken address the situation.

Section 15 of the Investment Company Act of 1940 (the “1940 Act”) requires that if an investment advisory agreement is to continue for more than two years from its effective date, such continuance must be approved at least annually by a fund’s board. In the event that the board fails to approve the investment advisory agreement as required, the agreement will automatically lapse at the end of its initial term. As a result, the fund would no longer have a valid advisory agreement and must arrange for a new agreement to be approved by the fund’s board and shareholders.

The Board unanimously approved a new investment advisory agreement between the Trust and the Adviser with respect to the Funds (the “New Agreement”) at a meeting on June 22, 2022, subject to shareholder approval. Despite the termination of the Original Agreement, the Adviser is providing uninterrupted services to the Funds consistent with its terms and conditions and is ensuring that the Funds continue to operate and function normally. The Board is requesting that each Fund’s shareholders approve the New Agreement to ensure there is an appropriate agreement in place providing for the Adviser to continue serving as investment adviser to such Fund.

Approval of the New Agreement will not raise the fees paid by any Fund or such Fund’s shareholders. The New Agreement is identical in all material respects to the Original Agreement. The effective date of the New Agreement with respect to a Fund will be the date shareholders of the Fund approve the New Agreement. If the New Agreement with the Adviser is not approved with respect to a Fund, the Board will consider other options including a new request for shareholder approval of a new investment advisory agreement.

As a result of the termination of the Original Agreement, the investment sub-advisory agreement between the Adviser and the Funds’ investment sub-adviser, Hightower 6M Holding, LLC (“6 Meridian”), also may have automatically terminated. In that event, at its meeting on June 22, 2022, the Board unanimously approved (i) an interim sub-advisory agreement pursuant to which 6 Meridian is continuing to provide sub-advisory services to the Funds and (ii) a new sub-advisory agreement that will become effective immediately after the New Agreement becomes effective in reliance on the Trust’s manager of managers exemptive relief described in the Funds’ prospectus. The exemptive relief permits the Adviser to enter into a new sub-advisory agreement subject to the approval of the Board but without shareholder approval. Both the interim and new sub-advisory agreements are identical in all material respects to the original sub-advisory agreement including the annual rate of compensation of 0.49% payable to 6 Meridian. Like the Adviser, 6 Meridian continues to provide uninterrupted services to the Funds and ensure the day-to-day portfolio management of the Funds is not impacted by the termination of the Original Agreement. Shareholders are not being asked to approve the new sub-advisory agreement with 6 Meridian because the Trust and the Adviser will rely on the manager of managers exemptive relief to enter into that agreement as described above.

Description of the Investment Advisory Agreement. The Original Agreement was approved by the sole initial shareholder of each Fund on May 4, 2020 and was effective on May 7, 2020. The materials terms of the Original Agreement and the New Agreement are identical including the advisory fee payable to the Adviser. The following description of the material terms of the New Agreement is only a summary and is qualified in its entirety by reference to Exhibit A – Form of Investment Advisory Agreement.

Advisory Services. Under the New Agreement, like the Original Agreement, the Adviser provides investment advisory services to the Funds and is responsible for, among other things, overseeing the Sub-Adviser, including regular review of the Sub-Adviser’s performance, trading portfolio securities on behalf of the Funds, and selecting broker-dealers to execute purchase and sale transactions, subject to the supervision of the Board. The Adviser also arranges for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Funds to operate. The Adviser administers the Funds’ business affairs, provides office facilities and equipment and certain clerical, bookkeeping and administrative services, and provides its officers and employees to serve as officers or Trustees of the Trust.

Advisory Fee. Under the terms of the Original Agreement and New Agreement, each Fund pays the Adviser a fee calculated daily and paid monthly at an annual rate of 0.61% of the Fund’s average daily net assets.

Duration and Termination. The New Agreement will become effective with respect to a Fund upon approval by the shareholders of the Fund. After the initial two-year term, the continuance of the New Agreement must be approved at least annually: (i) by the vote of the Trustees or by a vote of the shareholders of the Funds; and (ii) by the vote of a majority of the Trustees who are not parties to the Advisory Agreement or “interested persons” or of any party thereto, in accordance with the 1940 Act. The New Agreement will terminate automatically in the event of its assignment and is terminable at any time without penalty by the Trustees of the Trust or, with respect to the Fund, by a majority of the outstanding voting securities of the Fund, or by the Adviser on not more than sixty (60) days’ nor less than thirty (30) days’ written notice to the Trust. As used in the New Agreement, the terms “majority of the outstanding voting securities,” “interested persons” and “assignment” have the same meaning as such terms in the 1940 Act.

Indemnification. The New Agreement, like the Original Agreement, provides that the Adviser shall indemnify and hold harmless the Trust, all affiliated persons thereof, and all controlling persons from and against any and all claims, losses, liabilities or damages (including reasonable attorneys’ fees and other related expenses) by reason of or arising out of the Adviser’s willful misfeasance, bad faith or gross negligence generally in the performance of its duties, or by reason of the reckless disregard of its obligations and duties under the New Agreement.

Additional Information About the Adviser. The principal address of the Adviser and its executive officers and directors is 10900 Hefner Pointe Drive, Suite 400, Oklahoma City, Oklahoma 73013. The Adviser was formed in 2009 and is majority owned by Cottonwood ETF Holdings LLC, which is located at One Shorewood Court, P.O. Box 2008, Shelter Island, New York 11964.

The following table lists the executive officers and directors of the Adviser:

| Name | Principal Occupation |

| J. Garrett Stevens | Chief Executive Officer |

| Richard Hogan | President |

| James J. Baker Jr. | Director of Capital Markets |

| Dennis Lowenfels | Chief Compliance Officer |

In addition, the following officers of the Adviser serve as officers of the Trust:

| Name | Position with Trust |

| J. Garrett Stevens | Trustee and President |

| James J. Baker Jr. | Vice President |

| Chris Roleke | Treasurer |

| Richard Hogan | Secretary |

| Matthew Fleischer | Chief Compliance Officer |

Pursuant to the Original Agreement, for the fiscal year ended November 30, 2021, the Funds paid advisory fees to the Adviser in the following amounts:

| ETC 6 Meridian Hedged Equity-Index Option Strategy ETF | $1,415,111 |

| ETC 6 Meridian Low Beta Equity Strategy ETF | $749,300 |

| ETC 6 Meridian Mega Cap Equity ETF | $887,118 |

| ETC 6 Meridian Small Cap Equity ETF | $319,308 |

Below is a list of other funds managed by the Adviser with similar investment objectives as the Funds, the size of each such fund, and the rate of the Adviser’s compensation with respect to each such fund. Unlike the Funds, the advisory fee for each fund listed below is a unitary fee, except for the ETC 6 Meridian Quality Growth ETF.

Fund | Advisory Fee Rate | Assets as of May 31, 2022 |

| ETC 6 Meridian Quality Growth ETF | 0.61%1 | $26,673,279 |

| Hull Tactical US ETF | 0.91% | $24,568,465 |

| QRAFT AI-Enhanced U.S. Large Cap ETF | 0.75% | $10,738,391 |

| QRAFT AI-Enhanced U.S. Large Cap Momentum ETF | 0.75% | $15,211,547 |

| QRAFT AI-Enhanced U.S. Next Value ETF | 0.75% | $5,783,528 |

| Cabana Target Drawdown 5 ETF | 0.80%2 | $37,780,112 |

| Cabana Target Drawdown 7 ETF | 0.80%2 | $214,699,562 |

| Cabana Target Drawdown 10 ETF | 0.80%2 | $691,980,966 |

| Cabana Target Drawdown 13 ETF | 0.80%2 | $228,291,662 |

| Cabana Target Drawdown 16 ETF | 0.80%2 | $159,077,604 |

| Cabana Target Leading Sector Aggressive ETF | 0.80%3 | $117,502,424 |

| Cabana Target Leading Sector Conservative ETF | 0.80%3 | $335,683,133 |

| Cabana Target Leading Sector Moderate ETF | 0.80%3 | $58,619,260 |

| Asian Growth Cubs ETF | 0.99%4 | $11,614,876 |

| Roundhill Cannabis ETF | 0.75%5 | $1,802,783 |

| Grizzle Growth ETF | 0.75% | $1,235,517 |

1 The Adviser has contractually agreed to waive its fees and reimburse expenses to the extent necessary to keep total annual operating expenses of the fund (excluding amounts payable pursuant to any plan adopted in accordance with Rule 12b-1, interest expense, taxes, brokerage commissions, acquired fund fees and expenses, other expenditures which are capitalized in accordance with generally accepted accounting principles, and extraordinary expenses) from exceeding 1.00% of the fund’s average daily net assets until at least March 31, 2023, unless earlier terminated by the Board of Trustees of Exchange Traded Concepts Trust for any reason at any time.

2 The Adviser has contractually agreed to waive its fees and reimburse expenses to the extent necessary to keep total annual operating expenses of the fund (excluding amounts payable pursuant to any plan adopted in accordance with Rule 12b-1, interest expense, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and extraordinary expenses) from exceeding 0.69% of the fund’s average daily net assets until at least August 31, 2022, unless earlier terminated by the Board of Trustees of Exchange Traded Concepts Trust for any reason at any time.

3 The Adviser has contractually agreed to waive a portion of its management fee in an amount equal to 0.21% of the fund’s average daily net assets until at least August 31, 2022, unless earlier terminated by the Board of Trustees of Exchange Listed Funds Trust for any reason at any time.

4 The Adviser has contractually agreed to waive its fees and reimburse expenses to the extent necessary to keep total annual operating expenses of the fund (excluding amounts payable pursuant to any plan adopted in accordance with Rule 12b-1, interest expense, taxes, brokerage commissions, other expenditures which are capitalized in accordance with generally accepted accounting principles, and extraordinary expenses) from exceeding 0.99% of the fund’s average daily net assets until at least August 31, 2022, unless earlier terminated by the Board of Trustees of Exchange Listed Funds Trust for any reason at any time.

5 The Adviser has agreed to waive 0.16% of its management fees for the fund until at least April 30, 2023. This agreement may be terminated only by, or with the consent of, the fund’s Board of Trustees.

Required Vote. Approval of Proposal 1 with respect to each Fund requires the affirmative vote of a “majority of the outstanding voting securities” of such Fund when a quorum is present. Under the 1940 Act, a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the shares of the Fund present or represented by proxy at the Meeting if the holders of more than 50% of the outstanding shares are present or represented by proxy at the Meeting, or (b) more than 50% of the outstanding shares. If Proposal 1 is approved by a Fund’s shareholders, the New Agreement with respect to such Fund is expected to become effective on the date of the Meeting.

If Proposal 1 is not approved by a Fund’s shareholders, the Adviser will continue to provide services to such Fund and the Board will consider alternatives for the Fund, including seeking subsequent approval of a new investment advisory agreement by shareholders. Approval of the New Agreement by shareholders of one Fund is not contingent on approval of the New Agreement by shareholders of any other Fund.

Evaluation by the Board of Trustees. At the meeting of the Board on June 22, 2022, the Board considered the approval of the New Agreement. The Board discussed the lapse of the Original Agreement and the steps taken to address the situation. The Board noted that the Adviser continues to provide uninterrupted services to the Funds. The Board further noted that the material terms of the New Agreement, including the compensation payable to the Adviser, are identical to the terms of the Original Agreement.

In considering whether to approve the New Agreement on behalf of each Fund and its shareholders, the Board took into consideration (i) the nature, extent, and quality of the services provided by the Adviser to the Funds; (ii) each Fund’s performance; (iii) the Adviser’s costs of and profits from providing such services, including any fall-out benefits enjoyed by the Adviser or its affiliates; (iv) comparative fee and expense data for each Fund; (v) the extent to which the advisory fee for each Fund reflects economies of scale shared with shareholders; and (vi) certain other factors the Board deemed to be relevant. The Independent Trustees were assisted in their review by independent legal counsel and met with counsel separately without management present.

Nature, Extent and Quality of Services. With respect to the nature, extent and quality of the services to be provided to the Funds, the Board considered the Adviser’s specific responsibilities in its allocated aspects of the day-to-day management of the Funds. The Board noted that such responsibilities include oversight of the Funds’ sub-adviser, monitoring compliance with various policies and procedures and applicable securities regulations, trading portfolio securities and other investment instruments on behalf of each Fund, selecting broker-dealers to execute purchase and sale transactions, determining the daily baskets of deposit securities and cash components, executing portfolio securities trades for purchases and redemptions of shares, overseeing general portfolio compliance with relevant law, quarterly reporting to the Board, and implementing Board directives as they relate to the Funds. The Board considered the qualifications, experience and responsibilities of the Adviser’s investment personnel, the quality of the Adviser’s compliance infrastructure, and the determination of the Trust’s Chief Compliance Officer that the Adviser has appropriate compliance policies and procedures in place. The Board noted that it had been provided with the Adviser’s registration form on Form ADV as well as its responses to a detailed series of questions, which included a description of the Adviser’s operations, service offerings, personnel, compliance program, risk management program, and financial condition, and whether there had been any material changes to such information since it was last presented to the Board. The Board considered the Adviser’s experience working with exchange-traded funds (“ETFs”), including the Funds and other series of the Trust and other ETFs outside of the Trust.

The Board also considered other services provided to the Funds by the Adviser, such as arranging for transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Funds to operate; administering the Funds’ business affairs; providing office facilities and equipment and certain clerical, bookkeeping and administrative services; liaising with and reporting to the Board on matters relating to Fund operations, portfolio management and other matters essential to the Funds’ business activities; supervising each Fund’s registration as an investment company and the offering of shares to the public, including oversight and preparation of regulatory filings; working with ETF market participants, including authorized participants, market makers, and exchanges, to help facilitate an orderly trading environment for each Fund’s shares; and providing its officers and employees to serve as officers or Trustees of the Trust.

Based on the factors discussed above, as well as those discussed below, the Board concluded that it was satisfied with the nature, extent, and quality of the services provided to the Funds by ETC.

Performance. The Board reviewed each Fund’s performance in light of its stated investment objective, noting that each Fund is actively managed. The Board was provided with reports regarding the past performance of each Fund, including a report prepared by an independent third party comparing each Fund’s performance with the performance of a group of peer funds for various time periods. In reviewing each Fund’s performance, the Board took into account that each Fund has had a relatively short operating history over which to consider the Adviser’s performance. The Board further noted that it received regular reports regarding each Fund’s performance at its quarterly meetings.

Cost of Advisory Services and Profitability. The Board reviewed the advisory fee to be paid by each Fund to the Adviser under the New Agreement, noting that the fee is the same as the fee that was payable under the Original Agreement. The Board reviewed a report prepared by an independent third party comparing each Fund’s advisory fee to those paid by a group of peer funds. The Board noted that the advisory fee for ETC 6 Meridian Hedged Equity-Index Option Strategy ETF was on the low end of its peer group range, the advisory fee for ETC 6 Meridian Low Beta Equity Strategy ETF was on the high end of its peer group range, and the advisory fee for each of ETC 6 Meridian Mega Cap Equity ETF and ETC 6 Meridian Small Cap Equity ETF was in the middle of the applicable peer group range. The Board took into consideration that, unlike other series of the Trust, the Funds’ advisory fee was not structured as a “unitary fee”. The Board considered information provided about the costs and expenses incurred by the Adviser in providing advisory services, evaluated the compensation and benefits to be received by the Adviser from its relationship with the Funds, and reviewed a profitability analysis from ETC with respect to the Funds. In light of this information, the Board concluded that the advisory fee appeared reasonable in light of the services rendered.

Economies of Scale. The Board considered whether economies of scale have been realized with respect to the Funds. The Board concluded that no significant economies of scale have been realized by the Funds and that the Board will have the opportunity to periodically reexamine whether such economies have been achieved.

Conclusion. No single factor was determinative of the Board’s decision to approve the New Agreement; rather, the Board based its determination on the total mix of information available to it. Based on a consideration of all the factors in their totality, the Board, including the Independent Trustees, determined that the New Agreement, including the compensation payable thereunder, was fair and reasonable to each Fund. The Board, including the Independent Trustees, therefore, determined that the approval of the New Agreement was in the best interests of each Fund and its shareholders.

The Board of Trustees unanimously recommends that

shareholders vote “FOR” Proposal 1.

PROPOSAL 2

Approval of Payment of Accrued Advisory Fees to the Adviser

Background. Despite the lapse of the Original Agreement due to an administrative error, the Adviser continues to provide uninterrupted services to the Funds and ensure that the Funds operate and function normally. Since the date the Original Agreement terminated, however, the Adviser has not been paid for its service to the Funds. The advisory fees the Adviser would have retained had the Original Agreement continued in effect are being accrued by the Funds but have not been paid. At the meeting of the Board on June 22, 2022, the Board determined to request that shareholders approve the payment to the Adviser of the applicable amount of the accrued investment advisory fees for the services the Adviser has provided since May 6, 2022 and will continue to provide until the New Agreement is approved by shareholders.

Though the Adviser will not be paid for its services during the lapsed period unless shareholders approve such payment and the New Agreement is effective, the Board determined at the June 22 meeting that 6 Meridian, the Funds’ sub-adviser, which also has continued to provide uninterrupted services to the Funds, should continue to be paid its sub-advisory fee during this period. The Board agreed, therefore, to permit the release by each Fund of an amount equal to that portion of the accrued advisory fee (i.e., 0.49% of the 0.61% aggregate annual advisory fee) that would have been paid by the Adviser to 6 Meridian had the Original Agreement continued in effect.

The Funds have been accruing the aggregate advisory fees beginning May 7, 2022 at the annual rate of 0.61% of each Fund’s average daily net assets, as reflected in the Original Agreement and the New Agreement, and subject to any required waivers and/or reimbursements pursuant to the Funds’ expense limitation agreement with the Adviser. Therefore, approval of payment to the Adviser for its services to the Funds beginning May 7, 2022 will not increase the fees paid by the Funds or impact the Funds’ net asset value as the fees have been accruing for the duration of the lapsed period in the event shareholders approve payment. As of July 11, 2022, the amount of accrued fees reflecting the portion of each Fund’s aggregate advisory fee that would have been retained by the Adviser after having paid 6 Meridian its sub-advisory fee is $59,667 for ETC 6 Meridian Hedged Equity-Index Option Strategy ETF, $31,226 for ETC 6 Meridian Low Beta Equity Strategy ETF, $34,778 for ETC 6 Meridian Mega Cap Equity ETF, and $13,358 for ETC 6 Meridian Small Cap Equity ETF.

Evaluation by the Board of Trustees. At the meeting on June 22, 2022, the Board discussed the appropriateness of paying the Adviser the fees it would have retained had the Original Agreement remained in effect. The Board considered the nature and quality of the Adviser’s services to the Funds since their inception including the continued uninterrupted services provided since the lapse of the Original Agreement. The Board noted that the Funds and their shareholders have experienced no economic harm during the period since the inadvertent termination of the Original Agreement and that the amount payable would be no more than the amount the Funds would have paid had the Original Agreement remained in effect. The Board further noted it would be unfair to the Adviser to have to forfeit the accrued advisory fees and that shareholders should not unjustly benefit from an administrative error that has caused no harm to any Fund or from the Adviser’s performance of investment advisory services for the Funds without paying for such services. The Independent Trustees were assisted in their review by independent legal counsel and met with counsel separately without management present.

The Board of Trustees unanimously recommends that

shareholders vote “FOR” Proposal 2.

GENERAL INFORMATION

Record Date/Shareholders Entitled to Vote. Each Fund is a separate series, or portfolio, of the Trust, which is a Delaware statutory trust and registered investment company under the 1940 Act. The record holders of outstanding shares of a Fund are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Meeting with respect to the Funds.

Shareholders of each Fund at the close of business on the Record Date will be entitled to be present and vote at the Meeting. As of the Record Date, the total number of shares outstanding and entitled to vote for each Fund is set forth below:

| Fund | Shares Outstanding |

| ETC 6 Meridian Hedged Equity-Index Option Strategy ETF | 9,025,000 |

| ETC 6 Meridian Low Beta Equity Strategy ETF | 4,350,000 |

| ETC 6 Meridian Mega Cap Equity ETF | 4,800,000 |

| ETC 6 Meridian Small Cap Equity ETF | 1,425,000 |

Voting Proxies. You should read the entire Proxy Statement before voting. If you have any questions regarding the Proxy Statement, please call toll-free 1-866-796-1285. If you sign and return the accompanying proxy card, you may revoke it by giving written notice of such revocation to the Secretary of the Trust(s) prior to the Meeting or by delivering a subsequently dated proxy card or by attending and voting at the Meeting in person. Proxies voted by telephone or internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number listed in the enclosed proxy card. Properly executed proxies will be voted, as you instruct, by the persons named in the accompanying proxy card. In the absence of such direction, however, the persons named in the accompanying proxy card intend to vote “FOR” the proposals and may vote at their discretion with respect to other matters not now known to the Boards that may be presented at the Meeting. Attendance by a shareholder at the Meeting does not, on its own, revoke a proxy.

If sufficient votes are not received by the date of the Meeting, a person named as proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. The persons named as proxies will vote all proxies in favor of adjournment that voted in favor of the proposal (or abstained) and vote against adjournment all proxies that voted against the proposal.

Quorum Required. Each Fund must have a quorum of shares represented at the Meeting, in person or by proxy, to take action on any matter relating to that Fund. Under the Trust’s Agreement and Declaration of Trust, a quorum is constituted by the presence in person or by proxy of at least one-third of the outstanding shares of each Fund entitled to vote at the Meeting.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. Abstentions and broker non-votes will not be counted as voting on the proposal or any other matter at the Meeting when the voting requirement is based on achieving a plurality or percentage of the “voting securities present.”

If a quorum is not present at the Meeting, or a quorum is present at the Meeting but sufficient votes to approve a proposal are not received, the Secretary of the Meeting or the holders of a majority of the shares of the Funds or Trust (as applicable to each proposal) present at the Meeting in person or by proxy may adjourn the Meeting with respect to such proposal(s) to permit further solicitation of proxies.

Method and Cost of Proxy Solicitation. Proxies will be solicited by the Trust primarily by mail. The solicitation also may include telephone, facsimile, electronic or oral communications by certain officers or employees of the Trust or the Adviser or the sub-adviser to the Funds, none of whom will be paid for these services, or by a third-party proxy solicitation firm. The Adviser will pay the costs of the Meeting and the expenses incurred in connection with the solicitation of proxies. The Trust also may request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Funds held of record by such persons. The Adviser may reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of the Funds.

Other Service Providers. SEI Investments Distribution Co. and SEI Investments Global Funds Services, both located at One Freedom Valley Drive, Oaks, Pennsylvania 19456, serve as distributor and administrator, respectively, for each Fund. The Bank of New York Mellon, located at 240 Greenwich Street, New York, New York 10286, serves as the custodian and transfer agent for each Fund.

Share Ownership. To the knowledge of the Trust’s management, as of the close of business on the Record Date, the officers and Trustees of the Trust, as a group, beneficially owned less than one percent of each Fund’s outstanding shares and less than one percent of the Trust’s outstanding shares. To the knowledge of the Trust’s management, as of the close of business on the Record Date, persons owning of record more than 5% of the outstanding shares of a Fund, and their names and addresses, are listed in the table below. Any shareholder listed in the table below as owning 25% or more of the outstanding shares of a Fund may be presumed to “control” (as that term is defined in the 1940 Act) that Fund. Shareholders controlling a Fund could have the ability to vote a majority of the shares of that Fund on any matter requiring the approval of Fund shareholders, respectively. From time to time, the number of shares held in “street name” accounts of various securities brokers and dealers for the benefit of their clients may exceed 5% of the total shares outstanding of a Fund or a Trust.

| Fund | Participant Name and Address | Percentage Ownership |

| ETC 6 Meridian Hedged Equity-Index Option Strategy ETF | Pershing LLC One Pershing Plaza Jersey City, New Jersey 07399 | 97% |

| ETC 6 Meridian Low Beta Equity Strategy ETF | Pershing LLC One Pershing Plaza Jersey City, New Jersey 07399 | 98% |

| ETC 6 Meridian Mega Cap Equity ETF | Pershing LLC One Pershing Plaza Jersey City, New Jersey 07399 | 98% |

| ETC 6 Meridian Small Cap Equity ETF | Pershing LLC One Pershing Plaza Jersey City, New Jersey 07399 | 98% |

Affiliated Brokerage. For each Fund’s most recently completed fiscal year, no Fund paid commissions on portfolio brokerage transactions to brokers who may be deemed to be affiliated persons of a Fund or the Adviser or affiliated persons of such persons.

Other Matters to Come Before the Meeting. The Funds’ management does not know of any matters to be presented at the Meeting other than the proposal described above. If other business should properly come before the Meeting, the proxy holders will vote thereon in accordance with their best judgment.

Shareholder Proposals. The Agreement and Declaration of Trust, as amended, and By-Laws of the Trust does not provide for annual meetings of shareholders, and the Trust does not currently intend to hold such meetings in the future. Shareholder proposals for inclusion in a proxy statement for any subsequent meeting of the Trust’s shareholders must be received by the Trust a reasonable period of time prior to any such meeting.

Householding. If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate proxy cards. If you would like to receive a separate copy of this Proxy Statement, please contact the bank, trust company, broker, dealer, investment adviser or other financial intermediary through which you hold your shares directly. If you would like to receive a separate copy of future proxy statements, or you are now receiving multiple copies of proxy statements and would like to receive a single copy in the future, please contact your financial intermediary.

Reports and Other Information. Proxy materials, reports, and other information filed by the Funds can be inspected and copied at the Public Reference Facilities maintained by the SEC at 100 F Street, NE, Washington, DC 20549-0102. The SEC maintains a website (http://www.sec.gov) that contains other information about the Funds.

TO ENSURE THE PRESENCE OF A QUORUM AT THE SPECIAL MEETING, PROMPT EXECUTION AND RETURN OF THE ENCLOSED PROXY IS REQUESTED. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE, ALONG WITH INSTRUCTIONS ON HOW TO VOTE OVER THE INTERNET OR BY TELEPHONE SHOULD YOU PREFER TO VOTE BY ONE OF THOSE METHODS.

By Order of the Board of Trustees,

J. Garrett Stevens

Trustee and President, Exchange Traded Concepts Trust

July 20, 2022

EXHIBIT A

FORM OF INVESTMENT ADVISORY AGREEMENT

INVESTMENT ADVISORY AGREEMENT (the “Agreement”) made as of this ___ day of ___________ 2022 by and between EXCHANGE TRADED CONCEPTS TRUST (the “Trust”), a Delaware statutory trust registered as an investment company under the Investment Company Act of 1940 (the “1940 Act”), and EXCHANGE TRADED CONCEPTS, LLC, an Oklahoma limited liability company (the “Adviser”).

WHEREAS, the Board of Trustees of the Trust (the “Board”) agrees to engage the Adviser to act as the investment adviser to the Trust on behalf of the series set forth on Schedule A to this Agreement (each a “Fund” and, collectively, the “Funds”), as such schedule may be amended from time to time upon mutual agreement of the parties, and to provide certain related services, as more fully set forth below, and to perform such services under the terms and conditions hereinafter set forth;

NOW, THEREFORE, in consideration of the mutual covenants and benefits set forth herein, the Trust and the Adviser do hereby agree as follows:

| 1. | The Adviser’s Services. |

(a) Discretionary Investment Management Services. The Adviser shall act as investment adviser with respect to the Funds. In such capacity, the Adviser shall, subject to the supervision of the Board, regularly provide the Funds with investment research, advice and supervision and shall furnish continuously an investment program for the Funds, consistent with the respective investment objectives and policies of each Fund. The Adviser shall determine, from time to time, what securities shall be purchased for the Funds, what securities shall be held or sold by the Funds and what portion of the Funds’ assets shall be held uninvested in cash, subject always to the provisions of the Trust’s Agreement and Declaration of Trust, By-Laws and its registration statement on Form N- 1A (the “Registration Statement”) under the 1940 Act, and under the Securities Act of 1933 (the “1933 Act”), covering Fund shares, as filed with the U.S. Securities and Exchange Commission (the “Commission”), and to the investment objectives, policies and restrictions of the Funds, as each of the same shall be from time to time in effect. To carry out such obligations, the Adviser shall exercise full discretion and act for the Funds in the same manner and with the same force and effect as the Funds themselves might or could do with respect to purchases, sales or other transactions, as well as with respect to all other such things necessary or incidental to the furtherance or conduct of such purchases, sales or other transactions. No reference in this Agreement to the Adviser having full discretionary authority over each Fund’s investments shall in any way limit the right of the Board, in its sole discretion, to establish or revise policies in connection with the management of a Fund’s assets or to otherwise exercise its right to control the overall management of a Fund.

(b) Selection of Sub-Adviser(s). The Adviser shall have the authority hereunder to select and retain sub-advisers, including an affiliated person (as defined under the 1940 Act) of the Adviser (each a “Sub-Adviser”), for each of the Funds referenced in Schedule A to perform some or all of the services for which the Adviser is responsible pursuant to this Agreement. The Adviser shall supervise the activities of the Sub-Adviser(s), and the retention of a Sub-Adviser by the Adviser shall not relieve the Adviser of its responsibilities under this Agreement. Any such Sub-Adviser shall be registered and in good standing with the Commission and capable of performing its sub- advisory duties pursuant to a sub-advisory agreement approved by the Trust’s Board of Trustees and, except as otherwise permitted by the 1940 Act or by rule or regulation, a vote of a majority of the outstanding voting securities of the applicable Fund. The Adviser will compensate the Sub-Adviser for its services to the Funds.

(c) Compliance. The Adviser agrees to comply with the requirements of the 1940 Act, the Investment Advisers Act of 1940 (the “Advisers Act”), the 1933 Act, the Securities Exchange Act of 1934 (the “1934 Act”), the Commodity Exchange Act and the respective rules and regulations thereunder, as applicable, as well as with all other applicable federal and state laws, rules, regulations and case law that relate to the services and relationships described hereunder and to the conduct of its business as a registered investment adviser. The Adviser also agrees to comply with the objectives, policies and restrictions set forth in the Registration Statement, as amended or supplemented, of the Funds, and with any policies, guidelines, instructions and procedures approved by the Board and provided to the Adviser. In selecting each Fund’s portfolio securities and performing the Adviser’s obligations hereunder, the Adviser shall cause each Fund to comply with the diversification and source of income requirements of Subchapter M of the Internal Revenue Code of 1986 (the “Code”), for qualification as a regulated investment company if the Fund has elected to be treated as a regulated investment company under the Code. The Adviser shall maintain compliance procedures that it reasonably believes are adequate to ensure its compliance with the foregoing. No supervisory activity undertaken by the Board shall limit the Adviser’s full responsibility for any of the foregoing.

(d) Proxy Voting. The Board has the authority to determine how proxies with respect to securities that are held by the Funds shall be voted, and the Board has initially determined to delegate the authority and responsibility to vote proxies for each Fund’s securities to the Adviser. So long as proxy voting authority for a Fund has been delegated to the Adviser, the Adviser shall exercise its proxy voting responsibilities. The Adviser shall carry out such responsibility in accordance with any instructions that the Board shall provide from time to time, and at all times in a manner consistent with Rule 206(4)-6 under the Advisers Act and its fiduciary responsibilities to the Trust. The Adviser shall provide periodic reports and keep records relating to proxy voting as the Board may reasonably request or as may be necessary for the Funds to comply with the 1940 Act and other applicable law. Any such delegation of proxy voting responsibility to the Adviser may be revoked or modified by the Board at any time. The Trust acknowledges and agrees that the Adviser may delegate its responsibility to vote proxies for a Fund to the Fund’s Sub-Adviser(s).

(e) Recordkeeping. The Adviser shall not be responsible for the provision of administrative, bookkeeping or accounting services to the Funds, except as otherwise provided herein or as may be necessary for the Adviser to supply to the Trust or its Board the information required to be supplied under this Agreement.

The Adviser shall maintain separate books and detailed records of all matters pertaining to Fund assets advised by the Adviser required by Rule 31a-1 under the 1940 Act (other than those records being maintained by any administrator, custodian or transfer agent appointed by the Funds) relating to its responsibilities provided hereunder with respect to the Funds, and shall preserve such records for the periods and in a manner prescribed therefore by Rule 31a-2 under the 1940 Act (the “Funds’ Books and Records”). The Funds’ Books and Records shall be available to the Board at any time upon request, shall be delivered to the Trust upon the termination of this Agreement and shall be available without delay during any day the Trust is open for business.

(f) Holdings Information and Pricing. The Adviser shall provide regular reports regarding Fund holdings, and shall, on its own initiative, furnish the Trust and the Board from time to time with whatever information the Adviser believes is appropriate for this purpose. The Adviser agrees to immediately notify the Trust if the Adviser reasonably believes that the value of any security held by a Fund may not reflect its fair value. The Adviser agrees to provide any pricing information of which the Adviser is aware to the Trust, the Board and/or any Fund pricing agent to assist in the determination of the fair value of any Fund holdings for which market quotations are not readily available or as otherwise required in accordance with the 1940 Act or the Trust’s valuation procedures for the purpose of calculating each Fund’s net asset value in accordance with procedures and methods established by the Board.

(g) Cooperation with Agents of the Trust. The Adviser agrees to cooperate with and provide reasonable assistance to the Trust, any Trust custodian or foreign sub- custodians, any Trust pricing agents and all other agents and representatives of the Trust, such information with respect to the Funds as they may reasonably request from time to time in the performance of their obligations, provide prompt responses to reasonable requests made by such persons and establish appropriate interfaces with each so as to promote the efficient exchange of information and compliance with applicable laws and regulations.

2. Code of Ethics. The Adviser has adopted a written code of ethics that it reasonably believes complies with the requirements of Rule 17j-1 under the 1940 Act, which it will provide to the Trust. The Adviser shall ensure that its Access Persons (as defined in the Adviser’s Code of Ethics) comply in all material respects with the Adviser’s Code of Ethics, as in effect from time to time. Upon request, the Adviser shall provide the Trust with a (i) a copy of the Adviser’s current Code of Ethics, as in effect from time to time, and (ii) certification that it has adopted procedures reasonably necessary to prevent Access Persons from engaging in any conduct prohibited by the Adviser’s Code of Ethics. Annually, the Adviser shall furnish a written report, which complies with the requirements of Rule 17j-1, concerning the Adviser’s Code of Ethics to the Trust. The Adviser shall respond to requests for information from the Trust as to violations of the Code of Ethics by Access Persons and the sanctions imposed by the Adviser. The Adviser shall immediately notify the Trust of any material violation of the Code of Ethics, whether or not such violation relates to a security held by any Fund.

3. Information and Reporting. The Adviser shall provide the Trust and its respective officers with such periodic reports concerning the obligations the Adviser has assumed under this Agreement as the Trust may from time to time reasonably request.

(a) Notification of Breach / Compliance Reports. The Adviser shall notify the Trust immediately upon detection of (i) any material failure to manage any Fund in accordance with its investment objectives and policies or any applicable law; or (ii) any material breach of any of the Funds’ or the Adviser’s policies, guidelines or procedures. In addition, the Adviser shall provide a quarterly report regarding each Fund’s compliance with its investment objectives and policies, applicable law, including, but not limited to the 1940 Act and Subchapter M of the Code, as applicable, and the Fund’s policies, guidelines or procedures as applicable to the Adviser’s obligations under this Agreement. The Adviser agrees to correct any such failure promptly and to take any action that the Board may reasonably request in connection with any such breach. Upon request, the Adviser shall also provide the officers of the Trust with supporting certifications in connection with such certifications of Fund financial statements and disclosure controls pursuant to the Sarbanes-Oxley Act. The Adviser will promptly notify the Trust in the event (i) the Adviser is served or otherwise receives notice of any action, suit, proceeding, inquiry or investigation, at law or in equity, before or by any court, public board, or body, involving the affairs of the Trust (excluding class action suits in which a Fund is a member of the plaintiff class by reason of the Fund’s ownership of shares in the defendant) or the compliance by the Adviser with the federal or state securities laws or (ii) an actual change in control of the Adviser resulting in an “assignment” (as defined in the 1940 Act) has occurred or is otherwise proposed to occur.

(b) Board and Filings Information. The Adviser will also provide the Trust with any information reasonably requested regarding its management of the Funds required for any meeting of the Board, or for any shareholder report, amended registration statement, proxy statement, or prospectus supplement to be filed by the Trust with the Commission. The Adviser will make its officers and employees available to meet with the Board from time to time on due notice to review its investment management services to the Funds in light of current and prospective economic and market conditions and shall furnish to the Board such information as may reasonably be necessary in order for the Board to evaluate this Agreement or any proposed amendments thereto.

(c) Transaction Information. The Adviser shall furnish to the Trust such information concerning portfolio transactions as may be necessary to enable the Trust or its designated agent to perform such compliance testing on the Funds and the Adviser’s services as the Trust may, in its sole discretion, determine to be appropriate. The provision of such information by the Adviser to the Trust or its designated agent in no way relieves the Adviser of its own responsibilities under this Agreement.

(a) Principal Transactions. In connection with purchases or sales of securities for the account of a Fund, neither the Adviser nor any of its directors, officers or employees will act as a principal or agent or receive any commission except as permitted by the 1940 Act.

(b) Placement of Orders. The Adviser shall arrange for the placing of all orders for the purchase and sale of securities for a Fund’s account with brokers or dealers selected by the Adviser. In the selection of such brokers or dealers and the placing of such orders, the Adviser is directed at all times to seek for each Fund the most favorable execution and net price available under the circumstances. It is also understood that it is desirable for the Funds that the Adviser have access to brokerage and research services provided by brokers who may execute brokerage transactions at a higher cost to the Funds than may result when allocating brokerage to other brokers, consistent with section 28(e) of the 1934 Act and any Commission staff interpretations thereof. Therefore, the Adviser is authorized to place orders for the purchase and sale of securities for a Fund with such brokers, subject to review by the Board from time to time with respect to the extent and continuation of this practice. It is understood that the services provided by such brokers may be useful to the Adviser in connection with its or its affiliates’ services to other clients.

(c) Aggregated Transactions. On occasions when the Adviser deems the purchase or sale of a security to be in the best interest of a Fund as well as other clients of the Adviser, the Adviser may, to the extent permitted by applicable law and regulations, aggregate the order for securities to be sold or purchased. In such event, the Adviser will allocate securities or futures contracts so purchased or sold, as well as the expenses incurred in the transaction, in the manner the Adviser reasonably considers to be equitable and consistent with its fiduciary obligations to the Fund and to such other clients under the circumstances.

(d) Affiliated Brokers. The Adviser or any of its affiliates may act as broker in connection with the purchase or sale of securities or other investments for a Fund, subject to: (i) the requirement that the Adviser seek to obtain best execution and price within the policy guidelines determined by the Board and set forth in the Fund’s current prospectus and statement of additional information; (ii) the provisions of the 1940 Act; (iii) the provisions of the Advisers Act; (iv) the provisions of the 1934 Act; and (v) other provisions of applicable law. These brokerage services are not within the scope of the duties of the Adviser under this Agreement. Subject to the requirements of applicable law and any procedures adopted by the Board, the Adviser or its affiliates may receive brokerage commissions, fees or other remuneration from a Fund for these services in addition to the Adviser’s fees for services under this Agreement.

5. Custody. Nothing in this Agreement shall permit the Adviser to take or receive physical possession of cash, securities or other investments of a Fund.

| 6. | Allocation of Charges and Expenses. |

(a) Adviser’s Expenses. The Adviser will bear its own costs of providing services hereunder.

(b) Non-Unitary Fee Structure. With respect to the Funds listed in Schedule A to this Agreement, other than as herein specifically indicated or as set forth in other agreements to which the Adviser is a party, the Adviser shall not be responsible for a Fund’s expenses including, but not limited to, brokerage and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, fund administration, fund accounting, tax, audit, blue sky, shareholder services, legal, custody, printing, insurance, trustee fees, and other ongoing expenses of the Fund.

| 7. | Representations, Warranties and Covenants. |

(a) Properly Registered. The Adviser is registered as an investment adviser under the Advisers Act, and will remain so registered for the duration of this Agreement. The Adviser is not prohibited by the Advisers Act or the 1940 Act from performing the services contemplated by this Agreement, and to the best knowledge of the Adviser, there is no proceeding or investigation that is reasonably likely to result in the Adviser being prohibited from performing the services contemplated by this Agreement. The Adviser agrees to promptly notify the Trust of the occurrence of any event that would disqualify the Adviser from serving as an investment adviser to an investment company. The Adviser is in compliance in all material respects with all applicable federal and state law in connection with its investment management operations.

(b) ADV Disclosure. The Adviser has provided the Trust with a copy of its Form ADV as most recently filed with the Commission and will, promptly after filing any amendment to its Form ADV with the Commission, furnish a copy of such amendments to the Trust. The information contained in the Adviser’s Form ADV is accurate and complete in all material respects and does not omit to state any material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.

(c) Fund Disclosure Documents. The Adviser has reviewed and will in the future review, the Registration Statement, and any amendments or supplements thereto, the annual or semi-annual reports to shareholders, other reports filed with the Commission and any marketing material of a Fund (collectively the “Disclosure Documents”) and represents and warrants that with respect to disclosure about the Adviser, the manner in which the Adviser manages the Fund or information relating directly or indirectly to the Adviser, such Disclosure Documents contain or will contain, as of the date thereof, no untrue statement of any material fact and does not omit any statement of material fact which was required to be stated therein or necessary to make the statements contained therein not misleading.

(d) Use Of The Name “Exchange Traded Concepts.” The Adviser has the right to use the name “Exchange Traded Concepts” (the “Name”) in connection with its services to the Trust and that, subject to the terms set forth in Section 8 of this Agreement, the Trust shall have the right to use the Name in connection with the management and operation of the Funds. The Adviser is not aware of any threatened or existing actions, claims, litigation or proceedings that would adversely effect or prejudice the rights of the Adviser or the Trust to use the Name.

(e) Insurance. The Adviser maintains errors and omissions insurance coverage in an appropriate amount and shall provide prior written notice to the Trust (i) of any material changes in its insurance policies or insurance coverage; or (ii) if any material claims will be made on its insurance policies. Furthermore, the Adviser shall upon reasonable request provide the Trust with any information it may reasonably require concerning the amount of or scope of such insurance.

(f) No Detrimental Agreement. The Adviser represents and warrants that it has no arrangement or understanding with any party, other than the Trust, that would influence the decision of the Adviser with respect to its selection of securities for a Fund, and that all selections shall be done in accordance with what is in the best interest of the Fund.

(g) Conflicts. The Adviser shall act honestly, in good faith and in the best interests of the Trust including requiring any of its personnel with knowledge of Fund activities to place the interest of the Funds first, ahead of their own interests, in all personal trading scenarios that may involve a conflict of interest with the Funds, consistent with its fiduciary duties under applicable law.

(h) Representations. The representations and warranties in this Section 7 shall be deemed to be made on the date this Agreement is executed and at the time of delivery of the quarterly compliance report required by Section 3(a), whether or not specifically referenced in such report.

8. The Name “Exchange Traded Concepts.” The Adviser grants to the Trust a sublicense to use the Name as part of the name of any Fund. The foregoing authorization by the Adviser to the Trust to use the Name as part of the name of any Fund is not exclusive of the right of the Adviser itself to use, or to authorize others to use, the Name; the Trust acknowledges and agrees that, as between the Trust and the Adviser, the Adviser has the right to use, or authorize others to use, the Name. The Trust shall (1) only use the Name in a manner consistent with uses approved by the Adviser; (2) use its best efforts to maintain the quality of the services offered using the Name; and (3) adhere to such other specific quality control standards as the Adviser may from time to time promulgate. At the request of the Adviser, the Trust will (a) submit to Adviser representative samples of any promotional materials using the Name; and (b) change the name of any Fund within three months of its receipt of the Adviser’s request, or such other shorter time period as may be required under the terms of a settlement agreement or court order, so as to eliminate all reference to the Name and will not thereafter transact any business using the Name in the name of any Fund; provided, however, that the Trust may continue to use beyond such date any supplies of prospectuses, marketing materials and similar documents that the Trust had on the date of such name change in quantities not exceeding those historically produced and used in connection with such Fund.

9. Adviser’s Compensation. The Funds shall pay to the Adviser, as compensation for the Adviser’s services hereunder, a fee, determined as described in Schedule A that is attached hereto and made a part hereof. Such fee shall be computed daily and paid not less than monthly in arrears by the Funds.

The method for determining net assets of a Fund for purposes hereof shall be the same as the method for determining net assets for purposes of establishing the offering and redemption prices of Fund shares as described in the Fund’s prospectus. In the event of termination of this Agreement, the fee provided in this Section shall be computed on the basis of the period ending on the last business day on which this Agreement is in effect subject to a pro rata adjustment based on the number of days elapsed in the current month as a percentage of the total number of days in such month.

10. Independent Contractor. In the performance of its duties hereunder, the Adviser is and shall be an independent contractor and, unless otherwise expressly provided herein or otherwise authorized in writing, shall have no authority to act for or represent the Trust or any Fund in any way or otherwise be deemed to be an agent of the Trust or any Fund. If any occasion should arise in which the Adviser gives any advice to its clients concerning the shares of a Fund, the Adviser will act solely as investment counsel for such clients and not in any way on behalf of the Fund.

11. Assignment. This Agreement shall automatically terminate, without the payment of any penalty, in the event of its assignment (as defined in section 2(a)(4) of the 1940 Act); provided that such termination shall not relieve the Adviser of any liability incurred hereunder.

12. Entire Agreement and Amendments. This Agreement represents the entire agreement among the parties with regard to the investment management matters described herein and may not be added to or changed orally and may not be modified or rescinded except by a writing signed by the parties hereto except as otherwise noted herein.

13. Duration and Termination.

(a) This Agreement shall become effective as of the date set forth above and shall remain in full force and effect continually thereafter, subject to renewal as provided in subparagraph (d) of this section and unless terminated automatically as set forth in Section 11 hereof or until terminated as follows:

(b) The Trust may cause this Agreement to terminate either (i) by vote of its Board or (ii) with respect to any Fund, upon the affirmative vote of a majority of the outstanding voting securities of the Fund; or

(c) The Adviser may at any time terminate this Agreement by not more than sixty (60) days’ nor less than thirty (30) days’ written notice delivered or mailed by registered mail, postage prepaid, to the Trust; or

(d) This Agreement shall automatically terminate two years from the date of its execution unless its renewal is specifically approved at least annually thereafter by (i) a majority vote of the Trustees, including a majority vote of such Trustees who are not interested persons of the Trust or the Adviser, at a meeting called for the purpose of voting on such approval; or (ii) the vote of a majority of the outstanding voting securities of each Fund; provided, however, that if the continuance of this Agreement is submitted to the shareholders of the Funds for their approval and such shareholders fail to approve such continuance of this Agreement as provided herein, the Adviser may continue to serve hereunder as to the Funds in a manner consistent with the 1940 Act and the rules and regulations thereunder; and

Termination of this Agreement pursuant to this Section shall be without payment of any penalty.

In the event of termination of this Agreement for any reason, the Adviser shall, immediately upon notice of termination or on such later date as may be specified in such notice, cease all activity on behalf of the Funds and with respect to any of the assets, except as otherwise required by any fiduciary duties of the Adviser under applicable law. In addition, the Adviser shall deliver the Fund Books and Records to the Trust by such means and in accordance with such schedule as the Trust shall direct and shall otherwise cooperate, as reasonably directed by the Trust, in the transition of portfolio asset management to any successor of the Adviser.

| 14. | Certain Definitions. For the purposes of this Agreement: |

(a) “Affirmative vote of a majority of the outstanding voting securities of the Fund” shall have the meaning as set forth in the 1940 Act, subject, however, to such exemptions as may be granted by the Commission under the 1940 Act or any interpretations of the Commission staff.

(b) “Interested persons” and “Assignment” shall have their respective meanings as set forth in the 1940 Act, subject, however, to such exemptions as may be granted by the Commission under the 1940 Act or any interpretations of the Commission staff.

15. Liability of the Adviser. The Adviser shall indemnify and hold harmless the Trust and all affiliated persons thereof (within the meaning of Section 2(a)(3) of the 1940 Act) and all controlling persons (as described in Section 15 of the 1933 Act) (collectively, the “Adviser Indemnitees”) against any and all losses, claims, damages, liabilities or litigation (including reasonable legal and other expenses) by reason of or arising out of the Adviser’s willful misfeasance, bad faith or gross negligence generally in the performance of its duties hereunder or its reckless disregard of its obligations and duties under this Agreement.

16. Enforceability. Any term or provision of this Agreement which is invalid or unenforceable in any jurisdiction shall, as to such jurisdiction be ineffective to the extent of such invalidity or unenforceability without rendering invalid or unenforceable the remaining terms or provisions of this Agreement or affecting the validity or enforceability of any of the terms or provisions of this Agreement in any other jurisdiction.

17. Limitation of Liability. The parties to this Agreement acknowledge and agree that all litigation arising hereunder, whether direct or indirect, and of any and every nature whatsoever shall be satisfied solely out of the assets of the affected Fund and that no Trustee, officer or holder of shares of beneficial interest of the Fund shall be personally liable for any of the foregoing liabilities. The Trust’s Certificate of Trust, as amended from time to time, is on file in the Office of the Secretary of State of the State of Delaware. Such Certificate of Trust and the Trust’s Agreement and Declaration of Trust describe in detail the respective responsibilities and limitations on liability of the Trustees, officers, and holders of shares of beneficial interest.

18. Jurisdiction. This Agreement shall be governed by and construed in accordance with the substantive laws of the state of Delaware and the Adviser consents to the jurisdiction of courts, both state or federal, in Delaware, with respect to any dispute under this Agreement.

19. Paragraph Headings. The headings of paragraphs contained in this Agreement are provided for convenience only, form no part of this Agreement and shall not affect its construction.

20. Counterparts. This Agreement may be executed simultaneously in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed as of the date first above written.

| | EXCHANGE TRADED CONCEPTS TRUST,

on behalf of each Fund listed on Schedule A |

| | |

| | By: | |

| | | Name: J. Garrett Stevens |

| | | Title: President |

| | |

| | EXCHANGE TRADED CONCEPTS, LLC |

| | |

| | By: | |

| | | Name: J. Garrett Stevens |

| | | Title: Chief Executive Officer |

SCHEDULE A

to the

INVESTMENT ADVISORY AGREEMENT

dated June 22, 022

between

EXCHANGE TRADED CONCEPTS TRUST

and

EXCHANGE TRADED CONCEPTS, LLC

The Trust will pay to the Adviser as compensation for the Adviser’s services rendered, a fee, computed daily at an annual rate based on the average daily net assets of the respective Fund in accordance the following fee schedule:

| Fund | Rate | Effective Date |

| 6 Meridian Low Beta Equity Strategy ETF | 61 bps | |

| 6 Meridian Mega Cap Equity ETF | 61 bps | |

| 6 Meridian Small Cap Equity ETF | 61 bps | |

| 6 Meridian Hedged Equity-Index Option Strategy ETF | 61 bps | |

| ADVISER: | | TRUST: |

| | | |

| Exchange Traded Concepts, LLC | | Exchange Traded Concepts Trust |

| | | |

| By: | | | By: | |

| J. Garrett Stevens | | J. Garrett Stevens |

| Chief Executive Officer | | President |