UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a- 6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Hines Global REIT, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | |

| o | | | | No fee required. |

| o | | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

|

| | | | | |

| x | | | | Fee paid previously with preliminary materials. |

| o | | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

Hines Global REIT, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

To the stockholders of Hines Global REIT, Inc.:

We are pleased to invite our stockholders to the annual meeting of stockholders of Hines Global REIT, Inc. (the “Company”). The annual meeting will be held in the 2nd Floor Conference Center of Williams Tower, 2800 Post Oak Boulevard, Houston, Texas 77056 at 9:00 a.m., local time, on July 17, 2018.

The board of directors of the Company (the “Board”) has called the annual meeting in order to seek your approval of, among other things, the Company’s Plan of Liquidation and Dissolution (the “Plan of Liquidation”). The principal purpose of the Plan of Liquidation is to provide liquidity to our stockholders by selling the Company’s assets, paying its debts and distributing the net proceeds from liquidation to our stockholders.

In connection with a review of potential strategic alternatives available to the Company, as well as management’s estimate of the range of liquidating distributions per share to be received by our stockholders in a planned liquidation pursuant to the Plan of Liquidation, the Board has determined that it is in the best interests of the Company and its stockholders to sell all or substantially all of the Company’s properties and assets and liquidate and dissolve the Company pursuant to the Plan of Liquidation. The Board also has determined that the terms and conditions of the Plan of Liquidation are fair to you, advisable and in your best interest and has unanimously approved the sale of all or substantially all of the Company’s assets and the dissolution of the Company pursuant to the Plan of Liquidation, pending your approval. Accordingly, the Board unanimously recommends that you vote “FOR” the approval of the Plan of Liquidation.

We presently estimate that if the Plan of Liquidation is approved by our stockholders and we are able to successfully implement the Plan of Liquidation, then after the sale of all or substantially all of the Company’s assets and the payment of all of the Company’s outstanding liabilities, we will have made total distributions to our stockholders of approximately $10.00 to $11.00 per share of the Company’s common stock, comprised of three components: (i) the $1.05 per share Special Distribution (defined below); (ii) the $0.12 per share Return of Invested Capital Distributions (defined below); and (iii) the range of liquidating distributions to be made pursuant to the Plan of Liquidation of $8.83 to $9.83 per share of the Company’s common stock, estimated by the Board as of April 23, 2018. Although we have provided an estimated range of liquidating distributions, we cannot determine at this time when, or potentially whether, we will be able to make any liquidating distributions to our stockholders or the amount of any such distributions. See “Risk Factors—Risks Related to the Liquidation of the Company” in the enclosed proxy statement.

We paid a special distribution of $1.05 per share to stockholders of record as of December 30, 2017, which was funded in part from the net proceeds received from six asset sales completed during 2017 (the “Special Distribution”). In addition, the Board authorized monthly distributions aggregating $0.325 per share for the six months ending June 30, 2018 and the Board designated an aggregate of $0.12 per share of these distributions as a return of stockholders’ invested capital (the “Return of Invested Capital Distributions”) (such designation is not indicative of the characterization of these distributions for income tax purposes). The Return of Invested Capital Distributions have been paid or will be paid to stockholders of record as of monthly record dates on the first business day of the month following the month to which the distributions relate.

At the meeting, you will be asked to:

| |

| • | Consider and vote upon a proposal to approve the Plan of Liquidation, pursuant to which the Company will sell all or substantially all of the Company’s assets and be dissolved (the “Plan of Liquidation Proposal”); |

| |

| • | Consider and vote upon a proposal to approve the adjournment of the annual meeting to a later date, if necessary, to solicit additional proxies in the event that there are insufficient shares represented in person or by proxy voting in favor of the approval of the Plan of Liquidation Proposal; |

| |

| • | Consider and vote upon a proposal to elect seven directors for one-year terms expiring at the 2019 annual meeting of stockholders and until the election and qualification of their successors or earlier if the Company is liquidated and dissolved prior to the expiration of their terms; |

| |

| • | Consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; and |

| |

| • | Conduct such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

The Board has unanimously approved each of the proposals and recommends that you vote “FOR” each of the proposals described in the accompanying proxy statement.

Your vote is very important. Approval of the Plan of Liquidation Proposal requires the affirmative vote of the holders of at least a majority of the shares of our common stock outstanding and entitled to vote thereon. We cannot complete the sale of all or substantially all of our assets pursuant to the terms of the Plan of Liquidation unless the Plan of Liquidation Proposal is approved by our stockholders. With the exception of the sale of the properties in the Logistics Portfolio, as described in more detail in the enclosed proxy statement, the completion of any asset sales pursuant to contracts entered into on or after April 23, 2018, will be subject to stockholder approval of the Plan of Liquidation Proposal; provided, that, in the event that the Plan of Liquidation Proposal is not approved by the stockholders, the Company will continue to operate its business in the ordinary course, including, without limitation, selling one or more properties from time to time to the extent deemed by the Board to be in the best interest of the Company and its stockholders. Whether or not you plan to attend the annual meeting, please complete, sign, date and return the enclosed proxy card, or submit your proxy by the Internet or telephone, as soon as possible. If you hold your shares in “street name,” you should instruct your broker how to vote in accordance with your voting instruction card. If you fail to vote by proxy or in person, or fail to instruct your broker on how to vote, it will have the same effect as a vote “AGAINST” the Plan of Liquidation Proposal, and “AGAINST” the proposal to elect our directors.

You are also encouraged to review carefully the enclosed proxy statement, as it explains the reasons for the proposals to be voted on at the annual meeting and contains other important information, including a copy of the Plan of Liquidation, which is attached as Appendix A to the proxy statement. In particular, please review the matters referred to under “Risk Factors” starting on page 17 for a discussion of the risks related to the Plan of Liquidation and the business of the Company.

Thank you in advance for your cooperation and continued support.

|

| |

| | By Order of the Board of Directors, |

| | |

| | Jeffrey C. Hines |

| | Chairman |

Houston, Texas

May 10, 2018

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED THE TRANSACTIONS DESCRIBED IN THIS PROXY STATEMENT, OR DETERMINED IF THIS PROXY STATEMENT IS ACCURATE OR ADEQUATE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This proxy statement is dated May 10, 2018 and

is first being delivered or made available to stockholders on or about May 16, 2018

Hines Global REIT, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held July 17, 2018

To the stockholders of Hines Global REIT, Inc.:

The annual meeting of stockholders of Hines Global REIT, Inc. a Maryland corporation (the “Company”), will be held in the 2nd Floor Conference Center of Williams Tower, 2800 Post Oak Boulevard, Houston, Texas 77056 at 9:00 a.m., local time, on July 17, 2018.

At the meeting, you will be asked to:

| |

| 1. | Consider and vote upon a proposal to approve the Company’s Plan of Liquidation and Dissolution (the “Plan of Liquidation”), pursuant to which the Company will sell all or substantially all of the Company’s assets and be dissolved (the “Plan of Liquidation Proposal”); |

| |

| 2. | Consider and vote upon a proposal to approve the adjournment of the annual meeting to a later date, if necessary, to solicit additional proxies in the event that there are insufficient shares represented in person or by proxy voting in favor of the approval of the Plan of Liquidation Proposal (the “Adjournment Proposal”); |

| |

| 3. | Consider and vote upon a proposal to elect seven directors for one-year terms expiring at the 2019 annual meeting of stockholders and until the election and qualification of their successors or earlier if the Company is liquidated and dissolved prior to the expiration of their terms (the “Election of Directors Proposal”); |

| |

| 4. | Consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 (the “Appointment of Independent Auditors Proposal”); and |

| |

| 5. | Conduct such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

The Board has unanimously approved each of the proposals and recommends that you vote “FOR” the Plan of Liquidation Proposal, “FOR” the Adjournment Proposal, “FOR” the Election of Directors Proposal and “FOR” the Appointment of Independent Auditors Proposal. Information about each of the proposals is included in the accompanying proxy statement. We urge you to read this material carefully. A copy of the Plan of Liquidation is attached as Appendix A to the proxy statement.

The Board has fixed the close of business on May 7, 2018 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment thereof. Only record holders of common stock at the close of business on the record date are entitled to notice of, and to vote, at the annual meeting.

Approval of the Plan of Liquidation Proposal requires the affirmative vote of the holders of at least a majority of the shares of our common stock outstanding and entitled to vote thereon. Approval of the Election of Directors Proposal requires the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the meeting.

Approval of the Adjournment Proposal and Appointment of Independent Auditors Proposal requires the affirmative vote of a majority of the votes cast at the meeting. If you fail to vote by proxy or in person, or fail to instruct your broker on how to vote, it will have the same effect as a vote “AGAINST” the Plan of Liquidation Proposal, and “AGAINST” the Election of Directors Proposal.

Whether you own few shares or many shares and whether you plan to attend in person or not, it is important that your shares be voted on matters that come before the meeting. If you do not attend the meeting and vote in person, you may authorize a proxy to vote your shares by using the Internet or a toll-free telephone number. Instructions for using these convenient services are provided on the enclosed proxy card and in the attached proxy statement. If you have any questions about these directions, please call our proxy solicitor, Broadridge Investor Communications Solutions, Inc., at (833) 814-9452. If you prefer, you may authorize a proxy to vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it in the envelope provided. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with the directors’ recommendations. Any proxy given by a stockholder may be revoked by the stockholder at any time prior to the voting of the proxy, by delivering a written notice of revocation to our Secretary, by executing and delivering a later-dated proxy or by attending the annual meeting and voting in person. Your prompt cooperation will be greatly appreciated.

We encourage you to read the accompanying proxy statement in its entirety and to submit a proxy or voting instructions so that your shares will be represented and voted even if you do not attend the annual meeting. If you have questions about these proposals or would like additional copies of the proxy statement, please contact: Hines Global REIT, Inc., Attention: Ryan T. Sims, Chief Financial Officer and Secretary, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118; telephone: (888) 220-6121.

You are cordially invited to attend the annual meeting. Your vote is very important.

|

| |

| | By Order of the Board of Directors, |

| | |

| | Ryan T. Sims |

| | Secretary |

Houston, Texas

May 10, 2018

PROXY STATEMENT

TABLE OF CONTENTS

Hines Global REIT, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

PROXY STATEMENT

INTRODUCTION

The accompanying proxy, delivered or made available to our stockholders together with this proxy statement, is solicited by and on behalf of the board of directors (the “Board”) of Hines Global REIT, Inc. (“Hines Global” or the “Company”) for use at the annual meeting of our stockholders and at any adjournment or postponement thereof. References in this proxy statement to “we,” “us,” “our” or like terms also refer to the Company. We expect to deliver or otherwise make this proxy statement and the accompanying proxy card available to our stockholders on or about May 16, 2018. Our 2017 Annual Report to Stockholders was delivered or made available to stockholders on or about April 30, 2018.

SUMMARY

This summary highlights information included elsewhere in this proxy statement. This summary does not contain all of the information you should consider before voting on the proposals presented in this proxy statement. You should read the entire proxy statement carefully, including the appendices attached hereto. For your convenience, we have included cross references to direct you to a more complete description of the topics described in this summary.

Hines Global REIT, Inc.

We were formed as a Maryland corporation by Hines Interests Limited Partnership (“Hines”) on December 10, 2008, primarily for the purpose of investing in a diversified portfolio of quality commercial real estate properties and other real estate investments located throughout the United States and internationally. We are structured as an umbrella partnership real estate investment trust, and substantially all of our business is conducted through Hines Global REIT Properties LP (the “Operating Partnership”). Since August 2009, we have raised approximately $3.1 billion through public offerings of shares of our common stock.

We have made investments directly including through entities wholly-owned by the Operating Partnership or indirectly through joint ventures. We have invested in a real estate portfolio that is diversified by asset type, geographic area, lease expirations and tenant industries throughout the United States and internationally. As of April 23, 2018, we owned interests in 33 real estate investments which contain, in the aggregate, 13.9 million square feet of leasable space. Our portfolio consisted 64% of office investments, 22% of retail investments, 12% of industrial investments and 2% of residential/living investments, of which approximately 61% is located throughout the United States and approximately 39% is located internationally (based on our pro rata share of the appraised value of each of the investments as of December 31, 2017).

The mailing address and phone number of our principal executive offices is 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 and (888) 220-6121.

Plan of Liquidation and Dissolution (See page 32)

On April 23, 2018, the Board adopted the Plan of Liquidation and Dissolution, which is attached to this proxy statement as Appendix A (the “Plan of Liquidation”), pursuant to which we expect to take the following actions:

| |

| • | We will undertake the orderly sale of all of our properties and other assets, with the exception that the previously approved sale of the properties in the Logistics Portfolio may be completed regardless of whether the Plan of Liquidation is approved by our stockholders, as described in this proxy statement. |

| |

| • | We will pay or provide for our outstanding liabilities and expenses, which may include establishing a reserve fund or transferring assets to a liquidating trust to pay contingent liabilities and ongoing expenses in an amount to be determined as information concerning such contingencies and expenses becomes available. |

| |

| • | We will make liquidating distributions to our stockholders in an aggregate amount, estimated as of April 23, 2018, of approximately $8.83 to $9.83 per share of the Company’s common stock. When the Special Distribution (defined below) and the Return of Invested Capital Distributions (defined below), which equal an aggregate of $1.17 per share of the Company’s common stock, are combined with the estimated range of liquidating distributions described above, the estimated aggregate amount of distributions to our stockholders is approximately $10.00 to $11.00 per share of the Company’s common stock. Although we have provided an estimated range of liquidating distributions, we cannot determine at this time when, or potentially whether, we will be able to make any liquidating distributions to our stockholders or the amount of any such distributions. See “Risk Factors—Risks Related to the Liquidation of the Company” beginning on page 17. |

| |

| • | We will wind up our operations and dissolve the Company in accordance with the Plan of Liquidation, which provides that: |

| |

| i. | the final liquidating distribution to our stockholders (or to a liquidating trust, established for their benefit) will be made no later than the second anniversary of the date on which our stockholders approve the Plan of Liquidation Proposal (the “Effective Date”); |

| |

| ii. | upon a determination made by the Board, we may transfer and assign to a liquidating trust the Company’s remaining cash and property to pay (or adequately provide for) all the remaining debts and liabilities and pay the remainder to our stockholders; and |

| |

| iii. | at any time prior to the filing of Articles of Dissolution with the State Department of Assessments and Taxation of Maryland (the “SDAT”), the Board may terminate the Plan of Liquidation if it determines that doing so is in accordance with the best interests of our stockholders. |

Estimated Range of Liquidating Distributions

The estimated range of liquidating distributions of $8.83 to $9.83 per share of the Company’s common stock, estimated as of April 23, 2018 is based upon (i) the Board’s estimate of the range of proceeds to be received by the Company from the sale of the Company’s properties pursuant to the Plan of Liquidation and from the sale of the properties in the Logistics Portfolio, (ii) the amount of indebtedness owed on each property, including any estimated penalties that we expect to incur at the time of the disposition of such properties for early payment thereof and other indebtedness of the Company, (iii) the amount of cash on hand, including net proceeds from sales of the Company’s properties completed prior to the Board’s approval of the Plan of Liquidation, (iv) estimated cash flows to be generated by the continued operations of the Company during the liquidation process, and (v) the estimated expenses to be incurred in connection with the sale of each property and the winding down and dissolution of the Company.

Special Distribution and Return of Invested Capital Distributions

We paid a special distribution of $1.05 per share to stockholders of record as of December 30, 2017, which was funded in part from the net proceeds received from six asset sales completed during 2017 (the “Special Distribution”). In addition, the Board authorized monthly distributions aggregating $0.325 per share for the six months ending June 30, 2018 and the Board designated an aggregate of $0.12 per share of these distributions as a return of stockholders’ invested capital (the “Return of Invested Capital Distributions”) (such designation is not indicative of the characterization of these distributions for income tax purposes). The Return of Invested Capital Distributions have been paid or will be paid to stockholders of record as of monthly record dates on the first business day of the month following the month to which the distributions relate. As noted above, when the Special Distribution and the Return of Invested Capital Distributions, which equal an aggregate of $1.17 per share of the Company’s common stock, are combined with the estimated range of liquidating distributions described above, the estimated

aggregate amount of distributions to our stockholders is approximately $10.00 to $11.00 per share of the Company’s common stock. Although we have provided an estimated range of liquidating distributions, we cannot determine at this time when, or potentially whether, we will be able to make any liquidating distributions to our stockholders or the amount of any such distributions. See “Risk Factors—Risks Related to the Liquidation of the Company” beginning on page 17.

Implementation of the Plan of Liquidation and Other Asset Sales (See page 40)

Prior to the Board’s consideration and approval of the Plan of Liquidation, on February 26, 2018, the Board determined, consistent with prior discussions, that it was advisable and in the Company’s best interests to sell (i) the Poland Logistics Portfolio, a logistics portfolio comprised of five industrial parks located in Warsaw, Wroclaw and Upper Silesia, Poland (the “Poland Portfolio”), (ii) the Germany Logistics Portfolio, a logistics portfolio comprised of five logistic buildings located in Erfurt, Forchheim, Nuremberg, Karlsdorf and Duisburg, Germany (the “Germany Portfolio”) and (iii) FM Logistic, a property located in Moscow, Russia (“FM Logistic” and, together with the Poland Portfolio and the Germany Portfolio, the “Logistics Portfolio”). The sale of the properties in the Logistics Portfolio is not part of the Plan of Liquidation and is not contingent on whether the Plan of Liquidation Proposal is approved by our stockholders.

We intend to complete the sale of the properties in the Logistics Portfolio whether or not our stockholders approve the Plan of Liquidation Proposal. We cannot complete the sale of all or substantially all of our assets pursuant to the terms of the Plan of Liquidation unless the Plan of Liquidation Proposal is approved by our stockholders. With the exception of the sale of the properties in the Logistics Portfolio, the completion of any asset sales pursuant to contracts entered into on or after April 23, 2018 will be subject to stockholder approval of the Plan of Liquidation Proposal; provided, that, in the event that the Plan of Liquidation Proposal is not approved by the stockholders, the Company will continue to operate its business in the ordinary course, including, without limitation, selling one or more properties from time to time to the extent deemed by the Board to be in the best interest of the Company and its stockholders.

Annual Meeting (See page 29)

The annual meeting will be held on July 17, 2018, at 9:00 a.m., local time in the 2nd Floor Conference Center of Williams Tower, 2800 Post Oak Boulevard, Houston, Texas 77056.

At the meeting, you will be asked to:

| |

| 1. | Consider and vote upon a proposal to approve the Plan of Liquidation, pursuant to which the Company will sell all or substantially all of the Company’s assets and be dissolved (the “Plan of Liquidation Proposal”); |

| |

| 2. | Consider and vote upon a proposal to approve the adjournment of the annual meeting to a later date, if necessary, to solicit additional proxies in the event that there are insufficient shares represented in person or by proxy voting in favor of the approval of the Plan of Liquidation Proposal (the “Adjournment Proposal”); |

| |

| 3. | Consider and vote upon a proposal to elect seven directors for one-year terms expiring at the 2019 annual meeting of stockholders and until the election and qualification of their successors or earlier if the Company is liquidated and dissolved prior to the expiration of their terms (the “Election of Directors Proposal”); |

| |

| 4. | Consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 (the “Appointment of Independent Auditors Proposal”); and |

| |

| 5. | Conduct such other business as may properly come before the annual meeting or any adjournment thereof. |

Required Vote (See page 29)

Plan of Liquidation Proposal. This proposal requires the affirmative vote of the holders of at least a majority of the shares of our common stock outstanding and entitled to vote thereon. Any shares not voted (whether by abstention, withholding authority, or broker non-vote) will have the effect of votes against the Plan of Liquidation Proposal.

Adjournment Proposal. This proposal requires the affirmative vote of a majority of the votes cast at the meeting. Any shares not voted (whether by abstention, broker non-vote, or otherwise) have no impact on the vote.

Election of Directors Proposal. There is no cumulative voting in the election of our directors. Each director is elected by the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the meeting. Any shares present but not voted (whether by abstention, withholding authority or broker non-vote) will have the effect of votes against the election of nominees to the Board.

Appointment of Independent Auditors Proposal. This proposal requires the affirmative vote of a majority of the votes cast at the meeting. Any shares not voted (whether by abstention or otherwise) have no impact on the vote.

Brokers who hold shares in street name for customers have the authority to vote on “routine” proposals when they have not received instructions from beneficial owners. However, brokers are precluded from exercising their voting discretion with respect to approval of non-routine matters, such as the approval of the Plan of Liquidation Proposal and, as a result, absent specific instructions from the beneficial owner of such shares, brokers will not vote those shares. This is referred to as a “broker non-vote”. Broker non-votes will be considered as “present” for purposes of determining a quorum. Broker non-votes will have the effect of a vote “AGAINST” the Plan of Liquidation Proposal and Election of Directors Proposal but will have no effect on the Adjournment Proposal. Because brokers have discretionary authority to vote for the Appointment of Independent Auditors Proposal, in the event they do not receive voting instructions from the beneficial owner of the shares, there will not be any broker non-votes with respect to that proposal.

Record Date and Quorum (See page 29)

The record date for the determination of holders of our common stock entitled to notice of and to vote at the annual meeting, or any adjournment or postponement of the annual meeting, is the close of business on May 7, 2018. Each stockholder is entitled to cast one vote on each matter presented at the annual meeting for each share of common stock that such holder owned as of the record date. On the record date, 272.7 million shares of our common stock were issued and outstanding and entitled to vote at the annual meeting.

The presence at the meeting, in person or represented by proxy, of the holders entitled to cast at least fifty percent (50%) of all of the votes entitled to be cast at the meeting constitutes a quorum. A quorum is necessary to transact business at the annual meeting. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum; however, abstentions and broker non-votes will not be counted as votes cast. If a quorum is not present at the annual meeting, we expect that the annual meeting will be adjourned to a later date.

Recommendation of the Company’s Board (See page 29)

The Board has unanimously approved each of the proposals and recommends that you vote “FOR” the Plan of Liquidation Proposal, “FOR” the Adjournment Proposal, “FOR” the Election of Directors Proposal and “FOR” the Appointment of Independent Auditors Proposal.

Opinion of Financial Advisor (See page 43)

In connection with the Board’s approval of the Plan of Liquidation, Robert A. Stanger & Co., Inc. (which we refer to in this proxy statement as “Stanger”), rendered an opinion, dated April 20, 2018, to the Board as to the reasonableness, from a financial point of view, of the Company’s estimated range of aggregate liquidating distributions per share of the Company’s common stock to be paid to the Company’s stockholders in connection with the successful implementation of the Plan of Liquidation. The full text of Stanger’s written opinion is attached as Appendix B to this proxy statement and is incorporated in this document by reference. The written opinion sets forth, among other things, the assumptions made, procedures followed, factors considered and limitations on the review undertaken by Stanger in rendering its opinion. Stanger’s opinion did not address the merits of the underlying decision by the Board to approve the Plan of Liquidation or related documents or the relative merits of any related transactions compared with other business strategies or transactions available or that have been or might be considered by the Company or the Board or in which the Company might engage. Stanger’s advisory services and opinion were provided for the information and assistance of the Board in connection with its consideration of the Plan of Liquidation and the opinion does not constitute a recommendation as to how any holder of the Company’s common stock should vote with respect to the Plan of Liquidation Proposal or any other matter.

Risk Factors (See page 17)

In evaluating the Plan of Liquidation, you should carefully read this proxy statement and especially consider the factors discussed in the section entitled “Risk Factors” beginning on page 16 of this proxy statement.

Interests of the Company’s Directors, Executive Officers and Affiliated Entities in the Liquidation (See page 49)

In considering the Board’s recommendation that you vote “FOR” the approval of the Plan of Liquidation Proposal, you should be aware that certain of our directors, executive officers and affiliated entities may have interests in the liquidation of the Company. The Board was aware of these interests and considered them in its decision to approve the Plan of Liquidation. See “Proposal One: Plan of Liquidation Proposal—Interests of the Company’s Directors, Executive Officers and Affiliated Entities in the Liquidation” below.

Appraisal or Dissenters’ Rights (See page 43)

Pursuant to Maryland law and our charter (our “Charter”), you are not entitled to appraisal or dissenters rights (or rights of an objecting stockholder) in connection with the Plan of Liquidation.

Litigation Relating to the Plan of Liquidation (See page 52)

There is currently no litigation arising from our actions in connection with the Plan of Liquidation.

Regulatory Matters (See page 42)

Other than in connection with the filing of this proxy statement with Securities and Exchange Commission (the “SEC”), the deregistration of the Company’s common stock under the Exchange Act, and any requirements under Maryland law, the Company is not aware of any regulatory or governmental requirements that must be complied with or regulatory or governmental approvals that must be obtained in connection with the Plan of Liquidation.

Material U.S. Federal Income Tax Consequences (See page 52)

You are urged to read the discussion in the section entitled “Proposal One: Plan of Liquidation Proposal—Material U.S. Federal Income Tax Consequences” beginning on page 52 of this proxy statement and to consult your tax advisor as to the United States federal income tax consequences of the Plan of Liquidation, as well as the effects of state, local and foreign tax laws.

Important Notice Regarding Availability of Proxy Materials

This proxy statement, the form of proxy card, our 2017 Annual Report to Stockholders and our annual report on Form 10-K for the year ended December 31, 2017, are available in the SEC Filings section of our website at http://www.hinessecurities.com/reits/hines-global-reit/sec-filings/. Stockholders may also obtain a copy of these materials by writing to Hines Global REIT, Inc., Attention: Ryan T. Sims, Chief Financial Officer and Secretary. Upon payment of a reasonable fee, stockholders may also obtain a copy of the exhibits to our Annual Report on Form 10-K for the year ended December 31, 2017.

QUESTIONS AND ANSWERS

Annual Meeting

What is the date of the annual meeting and where will it be held?

Our 2018 annual meeting of stockholders will be held on July 17, 2018, at 9:00 a.m., local time. The meeting will be held in the 2nd Floor Conference Center of Williams Tower, 2800 Post Oak Boulevard, Houston, Texas 77056.

What is the purpose of the meeting and what will I be voting on at the annual meeting?

The purpose of the annual meeting is to consider and vote on the following proposals:

Plan of Liquidation Proposal: The Board has determined that it is advisable and in the best interests of the Company and our stockholders to sell all or substantially all of our assets, pay off our outstanding liabilities, distribute the net proceeds to our stockholders and dissolve. To do so, the Board has adopted the Plan of Liquidation. Stockholder approval is required to complete the Plan of Liquidation.

Adjournment Proposal: The Board has determined that it is in the best interests of the Company and our stockholders to provide for the adjournment of the annual meeting to a later date, if necessary, to solicit additional proxies in the event that there are insufficient shares represented in person or by proxy voting in favor of the Plan of Liquidation Proposal.

Election of Directors Proposal: The Board has determined that it is in the best interests of the Company and our stockholders to elect seven directors for one-year terms expiring at the 2019 annual meeting of stockholders and until the election and qualification of their successors or earlier if the Company is liquidated and dissolved prior to the expiration of their terms.

Appointment of Independent Auditors Proposal: The Board has determined that it is in the best interests of the Company and our stockholders to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018.

At the annual meeting, you may be asked to conduct such other business as may properly come before the annual meeting or any postponement or adjournment thereof.

The Board does not know of any matters that may be acted upon at the meeting other than the matters set forth in the proposals listed above.

Plan of Liquidation

What is the Plan of Liquidation?

The Plan of Liquidation contemplates the orderly sale of our assets and the payment of or provision for our outstanding liabilities and expenses, which may include establishing a reserve fund or transferring assets to a liquidating trust to pay contingent liabilities and ongoing expenses in an amount to be determined as information concerning such contingencies and expenses becomes available. The principal purpose of the liquidation is to seek to provide liquidity to our stockholders by liquidating our assets and distributing the net proceeds of the liquidation to the holders of our common stock. On February 26, 2018, prior to the Board’s consideration and approval of the Plan of Liquidation, the Board, consistent with prior discussions, determined that it was advisable and in the Company’s best interests to sell the properties in the Logistics Portfolio. The disposition of the properties in the Logistics Portfolio is not part of the Plan of Liquidation and is not contingent on stockholder approval. See “Proposal One: Plan of Liquidation Proposal— Implementation of the Plan of Liquidation and Other Asset Sales.” We intend to continue to market our remaining properties and to sell such properties on the most favorable terms reasonably available to us. We also will continue to evaluate this marketing effort throughout the liquidation process in order to

seek to ensure that the sale of our remaining assets occurs in a manner designed to enhance the consideration received for such remaining assets.

At such time as the Company has sold its assets, satisfied its liabilities and distributed the net proceeds of asset sales to our stockholders, we will file Articles of Dissolution with the SDAT, and the Company will cease to exist and all outstanding shares of common stock will be cancelled. Even if our stockholders approve the liquidation of the Company pursuant to the Plan of Liquidation, at any time prior to the filing of Articles of Dissolution, the Board may amend or terminate the Plan of Liquidation without further stockholder approval if it determines that doing so would be in the best interest of the Company and our stockholders.

What amount will stockholders receive from the liquidation?

Due to the uncertainties as to the ultimate sale prices of our assets, the time that may be required to liquidate and dissolve the Company, the expenses associated with the liquidation of the Company and the ultimate settlement amount of our liabilities, it is difficult to predict the amounts which will ultimately be distributed to our stockholders should the Plan of Liquidation be approved by our stockholders and implemented by the Board. While a number of factors may change this amount, we estimate, as of April 23, 2018, that if the Plan of Liquidation is approved by our stockholders and we are able to successfully implement the Plan of Liquidation, then after the sale of all or substantially all of the Company’s assets and the payment of all of the Company’s outstanding liabilities, we will have made total distributions to our stockholders of approximately $10.00 to $11.00 per share of the Company’s common stock, comprised of three components: (i) the $1.05 per share Special Distribution; (ii) the $0.12 per share Return of Invested Capital Distributions; and (iii) the range of liquidating distributions to be made pursuant to the Plan of Liquidation of $8.83 to $9.83 per share of the Company’s common stock, estimated by the Board as of April 23, 2018. Although we have provided an estimated range of liquidating distributions, we cannot determine at this time when, or potentially whether, we will be able to make any liquidating distributions to our stockholders or the amount of any such distributions. See “Risk Factors—Risks Related to the Liquidation of the Company” beginning on page 17.

How was the estimated range of total stockholder distributions of $10.00 to $11.00 per share of the Company’s common stock derived?

As noted above, the estimated range of total stockholder distributions of $10.00 to $11.00 per share of the Company’s common stock consists of three components: (i) the $1.05 per share Special Distribution, which was paid in January 2018 to our stockholders of record as of December 30, 2017; (ii) the $0.12 per share Return of Invested Capital Distributions authorized by the Board for the six months ending June 30, 2018, which have been paid or will be paid by July 2, 2018; and (iii) the range of liquidating distributions of $8.83 to $9.83 per share of the Company’s common stock, estimated by the Board as of April 23, 2018.

The estimated range of liquidating distributions of $8.83 to $9.83 per share of the Company’s common stock as of April 23, 2018 is based upon (i) the Board’s estimate of the range of proceeds to be received by the Company from the sale of the Company’s properties pursuant to the Plan of Liquidation and from the sale of the properties in the Logistics Portfolio, (ii) the amount of indebtedness owed on each property, including any estimated penalties that we expect to incur at the time of the disposition of such properties for early payment thereof and other indebtedness of the Company, (iii) the amount of cash on hand, including net proceeds from sales of the Company’s properties completed prior to the Board’s approval of the Plan of Liquidation, (iv) estimated cash flows to be generated by the continued operations of the Company during the liquidation process, and (v) the estimated expenses to be incurred in connection with the sale of each property and the winding down and dissolution of the Company. These estimates are based upon market, economic, financial and other circumstances and conditions existing as of the date of this proxy statement, and any changes in such circumstances and conditions during the period under which we implement the Plan of Liquidation could have a material effect on the ultimate amount of proceeds received by stockholders. Real estate market values are constantly changing and fluctuate with changes in interest rates, availability of financing, changes in general economic conditions and real estate tax rates, competition in the real estate market, the availability of suitable buyers, the perceived quality, consistency and dependability of income flows from tenancies and a number of other local, regional and national factors. In addition, environmental contamination, potential major repairs which

are not presently contemplated, increased operating costs or other unknown liabilities, including in connection with non-compliance with applicable laws, if any, at the Company’s properties may adversely impact the sales price of those assets. As a result, the actual prices at which we are able to sell our properties may be less than the amounts we have assumed for purposes of stating estimated liquidating distributions, which would result in the amount of such distributions being less than the amount stated in this proxy statement and the timing of the sales of our properties may not occur within the expected time frame. Although we have provided an estimated range of liquidating distributions, we cannot determine at this time when, or potentially whether, we will be able to make any liquidating distributions to our stockholders or the amount of any such distributions. See “Risk Factors—Risks Related to the Liquidation of the Company” and “Proposal One: Plan of Liquidation Proposal—Background of the Plan of Liquidation” beginning on pages 17 and 32, respectively.

If the Plan of Liquidation Proposal is approved by the stockholders and the Company is able to successfully implement the Plan of Liquidation, what is the aggregate amount of distributions that stockholders will have received, including regular operating distributions, since the time of their initial investment?

In addition to the estimated range of total stockholder distributions of $10.00 to $11.00 per share described in the immediately preceding question and answer, our stockholders have received regular operating distributions from the time of their initial investment. Accordingly, if the Plan of Liquidation Proposal is approved by our stockholders and we are able to successfully implement the Plan of Liquidation, the aggregate amount of distributions that our stockholders will have received, including regular operating distributions, since the time of their initial investment will vary depending on when they made their initial investment. For example, we currently expect that stockholders who were among our initial investors and made their initial investment on November 1, 2009, shortly after we commenced our initial public offering, will have received greater aggregate distributions than stockholders who made their initial investment after November 1, 2009, as they will have held their investment for a longer period of time and will have received more regular operating distributions than stockholders who made their initial investment after November 1, 2009. Accordingly, if the Plan of Liquidation is successfully implemented, we expect that stockholders who made their initial investment on November 1, 2009 and elected to receive cash distributions will have received aggregate distributions in the range of $15.62 to $16.62 per share of the Company’s common stock. The range of aggregate distributions of $15.62 to $16.62 per share includes: (i) regular operating distributions of $5.62 per share received or to be received from November 1, 2009 through June 2018, (ii) the Special Distribution, (iii) the Return of Invested Capital Distributions, and (iv) the range of liquidating distributions of $8.83 to $9.83 per share of the Company’s common stock, estimated by the Board as of April 23, 2018.

On the opposite end of the spectrum, assuming the Plan of Liquidation Proposal is approved by our stockholders and we are able to successfully implement the Plan of Liquidation, we expect that investors who became stockholders at the end of our second and final public offering will have received lower aggregate distributions than stockholders who invested earlier in our public offerings. For example, we expect that stockholders who made their initial investment on April 1, 2014, just prior to the completion of our second public offering, and elected to receive cash distributions, will have received aggregate distributions in the range of $12.64 to $13.64 per share of the Company’s common stock. The range of aggregate distributions of $12.64 to $13.64 per share includes: (i) regular operating distributions of $2.64 per share received or to be received from April 1, 2014 through June 2018, (ii) the Special Distribution, (iii) the Return of Invested Capital Distributions, and (iv) the range of liquidating distributions of $8.83 to $9.83 per share of the Company’s common stock, estimated by the Board as of April 23, 2018. Accordingly, assuming the successful implementation of the Plan of Liquidation, we expect that stockholders who made their initial investment in shares of the Company’s common stock between November 1, 2009 and April 1, 2014 will have received aggregate distributions in a range that is between the ranges presented above for our initial investors and investors who invested at the end of our second public offering. We expect to continue making regular operating distributions as we seek approval of the Plan of Liquidation Proposal from our stockholders. Although we have provided an estimated range of aggregate distributions, we cannot determine at this time when, or potentially whether, we will be able to make any liquidating distributions to our stockholders or the amount of any such liquidating distributions. See “Risk Factors-Risks Related to the Liquidation of the Company” beginning on page 17.

What will happen if the Plan of Liquidation Proposal is not approved?

We cannot complete the sale of all or substantially all of our assets pursuant to the terms of the Plan of Liquidation unless the Plan of Liquidation Proposal is approved by our stockholders. With the exception of the sale of the properties in the Logistics Portfolio, the completion of any asset sales pursuant to contracts entered into on or after April 23, 2018, will be subject to stockholder approval of the Plan of Liquidation Proposal; provided, that, in the event that the Plan of Liquidation Proposal is not approved by the stockholders, the Company will continue to operate its business in the ordinary course, including potentially selling properties from time to time to the extent deemed by the Board to be in the best interest of the Company and its stockholders, and the Board may reconsider other strategic alternatives available to the Company. If the Plan of Liquidation Proposal is not approved, the Company’s operating distributions will likely be lower as a result of asset sales that have been or are expected to be consummated, including the sale of the properties in the Logistics Portfolio, and because certain costs of operating as a public company will not be reduced as the portfolio is reduced, thus resulting in lower cash flow. In addition, the failure to approve the Plan of Liquidation Proposal could result in adverse tax consequences to the Company (for example, if the IRS successfully asserts that property sales previously made or agreed to be made by the Company prior to the Board’s consideration and approval of the Plan of Liquidation were dealer sales (i.e., inventory-like sales of property held primarily for sale to customers in the ordinary course of the Company’s business), the Company could be subject to penalty taxes on such property sales). See “Proposal One: Plan of Liquidation Proposal—Material U.S. Federal Income Tax Consequences” beginning on page 51. If the Plan of Liquidation Proposal is not approved, the Company intends to evaluate all of its options with respect to any sales proceeds received from the sale of those properties, including the sale of the properties in the Logistics Portfolio. Such options may include, without limitation, the distribution of such proceeds to stockholders, the reinvestment of such proceeds in real estate investments or the use of such proceeds for other corporate purposes.

Are any pending transactions as of the date of this proxy statement subject to stockholder approval?

As disclosed above, prior to April 23, 2018, the Board approved the disposition of the properties in the Logistics Portfolio, separate from its consideration and approval of the Plan of Liquidation. The disposition of the properties in the Logistics Portfolio is not conditioned upon approval by our stockholders of the Plan of Liquidation Proposal, but the proceeds from such sales will be included in the liquidating distributions to be paid to our stockholders. Other than the sale of the properties in the Logistics Portfolio, the sale of properties or other assets pursuant to contracts entered into on or after April 23, 2018, will be subject to stockholder approval of the Plan of Liquidation Proposal.

Do the Company’s directors, executive officers or affiliated entities have any interests in the liquidation of the Company?

Yes. In considering the Board’s recommendation that you vote “FOR” the approval of the Plan of Liquidation Proposal, you should be aware that certain of our directors, executive officers and affiliated entities may have interests in the liquidation. See “Proposal One: Plan of Liquidation Proposal—Interests of the Company’s Directors, Executive Officers and Affiliated Entities in the Liquidation” below beginning on page 49.

What are the federal income tax consequences of the liquidation to me?

If the Company makes distributions as a result of its implementation of the liquidation, a U.S. holder of common stock will realize, for federal income tax purposes, gain or loss equal to the difference between (i) the sum of the cash distributed to such stockholder directly plus the net value of any property transferred to any liquidating trust that may be established on the stockholder’s behalf; and (ii) the stockholder’s adjusted tax basis in his, her or its shares of common stock. Non-U.S. holders will be subject to U.S. federal income tax on any distributions received to the extent attributable to gains recognized by the Company on sales of real property located in the United States. See “Proposal One: Plan of Liquidation—Material U.S. Federal Income Tax Consequences” beginning on page 52. We urge each stockholder to consult with his or her own tax advisors regarding tax consequences of distributions made pursuant to the Plan of Liquidation.

Do I have appraisal or dissenters rights in connection with the liquidation?

Pursuant to Maryland law and our Charter, you are not entitled to appraisal or dissenters rights (or rights of an objecting stockholder) in connection with the Plan of Liquidation.

When do you believe the Plan of Liquidation will be completed?

If our stockholders approve the Plan of Liquidation Proposal, we expect to make one or more liquidating distributions to our stockholders during the period of the liquidation process and to make the final liquidating distribution on or before a date that is within 24 months after stockholder approval of the Plan of Liquidation Proposal. If we have not sold all of our assets and paid all of our liabilities within 24 months after stockholder approval of the Plan of Liquidation Proposal, or if the Board otherwise determines that it is advantageous to do so, we may transfer our remaining assets and liabilities to a liquidating trust and distribute interests in the liquidating trust to our stockholders. We cannot predict the exact amount to be distributed or the timing of the completion of the Plan of Liquidation. See “Proposal One: Plan of Liquidation Proposal—Overview of Liquidation” beginning on page 39.

What is a liquidating trust?

A liquidating trust is a trust organized for the primary purpose of liquidating and distributing the assets transferred to it after paying any of the remaining liabilities. If we form a liquidating trust, we will transfer to our stockholders beneficial interests in the liquidating trust. These interests will generally not be transferable by you.

Voting at the Annual Meeting

Who can vote at the meeting?

The record date for the determination of holders of our common stock entitled to notice of and to vote at the meeting, or any adjournment or postponement of the meeting, is the close of business on May 7, 2018. Each holder of our shares of common stock issued and outstanding as of the record date is entitled to vote at the meeting. On the record date, 272.7 million shares of our common stock were issued and outstanding and entitled to vote at the annual meeting.

How many votes do I have?

Each share of our common stock has one vote on each matter considered at the annual meeting or any postponement or adjournment thereof.

How can I vote?

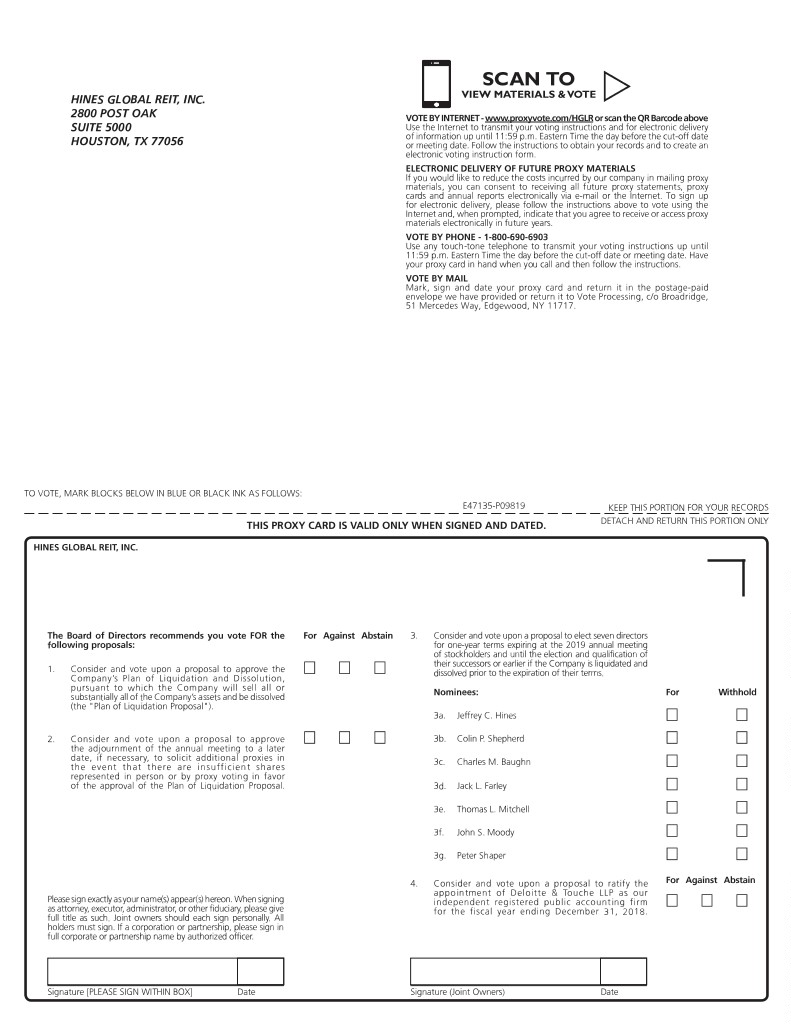

You may vote in person at the meeting or by proxy. Stockholders have the following three options for submitting their votes by proxy:

| |

| • | via the Internet at www.proxyvote.com/HGLR; |

| |

| • | by telephone, by calling toll free (800) 690-6903; or |

| |

| • | by mail, by completing, signing, dating and returning your proxy card in the enclosed envelope. |

For those stockholders with Internet access, we encourage you to authorize a proxy to vote your shares via the Internet, a convenient means of authorizing a proxy that also provides cost savings to us. In addition, when you authorize a proxy to vote your shares via the Internet or by phone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting and the control number required to authorize a proxy to vote your shares via the Internet or by phone, see your proxy card enclosed with this proxy statement.

If your shares of common stock are held in an account by a bank, broker, or other nominee on your behalf, you may receive instructions from your bank, broker, or other nominee describing how to vote your shares. A number of banks and brokerage firms participate in a program that also permits stockholders to direct their vote by the Internet or telephone. This option is separate from that offered by Broadridge Investor Communications Solutions, Inc., the firm we have retained to aid in the solicitation process, and should be reflected on the voting form from a bank or brokerage firm that accompanies this proxy statement. If your shares are held in an account at a bank or brokerage firm that participates in such a program, you may direct the vote of these shares by the Internet or telephone by following the instructions on the voting form enclosed with the proxy from the bank or brokerage firm. Directing the voting of your shares will not affect your right to vote in person if you decide to attend the annual meeting.

You also may vote your shares at the meeting. If you attend the annual meeting, you may submit your vote in person, and any previous votes that you submitted, whether by Internet, phone or mail, will be superseded by the vote that you cast at the annual meeting. To obtain directions to be able to attend the meeting and vote in person, contact Hines Global REIT Investor Relations at (888) 220-6121.

May I vote in person?

Yes. You may attend the annual meeting and vote your shares in person, rather than signing and mailing a proxy card, voting via the Internet or voting by telephone.

What are the recommendations of the Board?

The Board has unanimously approved each of the proposals and recommends that you vote “FOR” the Plan of Liquidation Proposal, “FOR” the Adjournment Proposal, “FOR” the Election of Directors Proposal and “FOR” the Appointment of Independent Auditors Proposal. Information about each of the proposals is included in the accompanying proxy statement.

What vote is required to approve each proposal?

Plan of Liquidation Proposal. This proposal requires the affirmative vote of the holders of at least a majority of the shares of our common stock outstanding and entitled to vote thereon. Any shares not voted (whether by abstention, withholding authority, or broker non-vote) will have the effect of votes against the Plan of Liquidation Proposal.

Adjournment Proposal. This proposal requires the affirmative vote of a majority of the votes cast at the meeting. Any shares not voted (whether by abstention, broker non-vote, or otherwise) have no impact on the vote.

Election of Directors Proposal. There is no cumulative voting in the election of our directors. Each director is elected by the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the meeting. Any shares present but not voted (whether by abstention, withholding authority or broker non-vote) will have the effect of votes against the election of nominees to the Board.

Appointment of Independent Auditors Proposal. This proposal requires the affirmative vote of a majority of the votes cast at the meeting. Any shares not voted (whether by abstention or otherwise) have no impact on the vote.

Approval by our stockholders of each of the proposals requires that a quorum be present at the meeting.

As of the record date, our directors and executive officers own or control less than 1% of our outstanding shares of common stock and intend to vote such shares “FOR” each of the proposals.

How will proxies be voted?

Shares represented by valid proxies will be voted at the meeting in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares will be voted:

| |

| • | “FOR” the Plan of Liquidation Proposal; |

| |

| • | “FOR” the Adjournment Proposal; |

| |

| • | “FOR” the Election of Directors Proposal; and |

| |

| • | “FOR” the Ratification of the Appointment of Independent Auditors Proposal. |

The Board does not intend to present, and has no information indicating that others will present, any business at the annual meeting other than as set forth in the attached Notice of Annual Meeting of Stockholders. However, if other matters requiring the vote of our stockholders properly come before the meeting, it is the intention of the persons named in the accompanying proxy card to vote the proxies held by them in accordance with their discretion on such matters.

How can I change my vote or revoke a proxy?

If you own common stock as a record holder on the record date, you may revoke your proxy at any time prior to the voting thereof by submitting a later-dated proxy (either in the mail, or by telephone or the Internet), by attending the meeting and voting in person (although attendance at the meeting alone will not cause your previously granted proxy to be revoked unless you specifically so request) or by written notice to us addressed to: Hines Global REIT, Inc., Attention: Ryan T. Sims, Chief Financial Officer and Secretary, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. No written revocation shall be effective, however, unless and until it is received by us at or prior to the meeting.

If you hold your shares in “street name” through a bank, broker or other nominee and have instructed such bank, broker or other nominee to vote your shares, you must instead follow the instructions received from your bank, broker or other nominee to change your vote.

What constitutes a “quorum”?

The presence at the meeting, in person or represented by proxy, of the holders entitled to cast at least 50 percent of all of the votes entitled to be cast at the meeting constitutes a quorum. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum; however, abstentions and broker non-votes will not be counted as votes cast.

What do I need to do now?

Simply authorize a proxy to vote your shares by Internet or telephone as soon as possible or indicate on your proxy card how you want to vote and sign, date and return it by fax or mail it to us in the enclosed envelope, unless you plan to attend the annual meeting and vote in person. Instructions for submitting your vote are set forth on the proxy card and under the caption “The Annual Meeting—Proxies”. If you have any questions about these instructions, please call Broadridge Investor Communications Solutions, Inc. at (833) 814-9452.

Will you incur expenses in soliciting proxies?

We will bear all costs associated with soliciting proxies for the meeting. Solicitations may be made on behalf of the Board by mail, personal interview, telephone or other electronic means by our officers, who will receive no additional compensation with respect to the solicitation of proxies. We have retained Broadridge Investor Communications Solutions, Inc. to aid in the solicitation of proxies. We will pay Broadridge Investor Communications Solutions, Inc. a fee of approximately $5,000 in addition to variable costs related to the solicitation of proxies as well as reimbursement of its out-of-pocket expenses. We will request that certain banks, brokers, custodians, nominees, fiduciaries and other record holders forward copies of the proxy materials to people on whose behalf they hold shares of common stock and request authority for the exercise of proxies by the record holders on behalf of those people, if necessary. In compliance with the regulations of the SEC, we will reimburse such persons for reasonable expenses incurred by them in forwarding proxy materials to the beneficial owners of our common stock.

What does it mean if I receive more than one proxy card?

Some of your shares may be registered differently or held in different accounts. You should authorize a proxy to vote the shares held in each of your accounts by telephone, the Internet or mail. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted. If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should contact Hines Global REIT Investor Relations at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 or call us at (888) 220-6121. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports to stockholders. The rule allows us to, with the consent of affected stockholders, send a single set of any annual report, proxy statement, proxy statement combined with a prospectus or information statement to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is referred to as “Householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to receive a separate proxy card or voting instruction card.

We will promptly deliver, upon written or oral request, a separate copy of our annual report or proxy statement, as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies to Hines Global REIT Investor Relations at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 or call us at (888) 220-6121. Likewise, if your household currently receives multiple copies of disclosure documents and you would like to receive one set, please contact Hines Global REIT Investor Relations.

How do I submit a stockholder proposal for next year’s annual meeting or proxy materials, and what is the deadline for submitting a proposal?

In accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), if you wish to present a proposal for inclusion in the proxy materials for next year’s annual meeting, we must receive written notice of your proposal at our executive offices no later than January 16, 2019. Any such proposal must meet the requirements set forth in the rules and regulations of the SEC in order to be eligible for inclusion in the proxy materials for our 2019 annual meeting. For any proposal that is not submitted for inclusion in the proxy materials for the 2019 annual meeting but is instead sought to be presented directly at the meeting, Rule 14a-4(c) under the Exchange Act permits our management to exercise discretionary voting authority under proxies we solicit unless we receive timely notice of the proposal in accordance with the procedures set forth in our bylaws. Pursuant to our current bylaws, in order for a stockholder proposal to be properly submitted for presentation at our 2019 annual meeting, we must receive written notice of the proposal at our executive offices during the period beginning on January 16, 2019 and ending at 5:00 p.m., Central time on February 15, 2019. All proposals must contain the information specified in, and otherwise comply with, our bylaws. Proposals should be sent via registered, certified or express mail to: Hines Global REIT, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118, Attention: Ryan T. Sims, Chief Financial Officer and Secretary. For additional information, see the section in this proxy statement captioned “Stockholder Proposals for the 2019 Annual Meeting.”

Who can help answer my questions?

If you have questions about voting procedures, please call our proxy solicitor, Broadridge Investor Communications Solutions, Inc., at (833) 814-9452, or Hines Global REIT Investor Relations, at (888) 220-6121.

Where can I find more information?

Additional information about us can be obtained from the various sources described under “Available Information” in this proxy statement.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 based on current expectations, forecasts and assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. Forward-looking statements generally can be identified by the use of words or phrases such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “foresee,” “looking ahead,” “is confident,” “should be,” “will,” “predicted,” “likely,” or similar words or phrases intended to identify information that is not historical in nature. These forward-looking statements include, among others, statements about the expected benefits of the Plan of Liquidation, the estimated range of distributions, the expected timing and completion of the Plan of Liquidation and the future business, performance and opportunities of the Company. These risks and uncertainties include, without limitation, the ability of the Company to obtain stockholder approvals required to consummate the Plan of Liquidation, the ability of the Company to find purchasers for its properties on reasonable terms; unanticipated difficulties or expenditures relating to the Plan of Liquidation; the response of tenants, business partners and competitors to the announcement of the Plan of Liquidation; legal proceedings that may be instituted against the Company and others related to the Plan of Liquidation; general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases, dependence on tenants’ financial condition, and competition from other developers, owners and operators of real estate); adverse economic or real estate developments in the Company’s existing markets; risks associated with the availability and terms of financing and the ability to refinance indebtedness as it comes due; reductions in asset valuations and related impairment charges; risks associated with downturns in domestic and local economies, changes in interest rates and volatility in the securities markets; potential liability for uninsured losses and environmental contamination; risks associated with the Company’s potential failure to qualify as a REIT under the Internal Revenue Code of 1986, as amended (the “Tax Code”), and possible adverse changes in tax and environmental laws; and risks associated with the Company’s dependence on key personnel of Hines or its affiliates whose continued service is not guaranteed. For a further list and description of such risks and uncertainties, see the reports filed by the Company with the SEC, including the Company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q. Any forward-looking statement speaks only as of the date of this proxy statement. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information or developments, future events or otherwise.

Our stockholders are cautioned not to place undue reliance on any forward-looking statement in this proxy statement. All forward-looking statements are made as of the date of this proxy statement, and the risk that actual results will differ materially from the expectations expressed in this proxy statement may increase with the passage of time. In light of the significant uncertainties inherent in the forward-looking statements in this proxy statement, the inclusion of such forward-looking statements should not be regarded as a representation by us or any other person that the objectives and plans set forth in this proxy statement will be achieved. Please see “Risk Factors” for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those presented in certain forward-looking statements.

RISK FACTORS

In deciding how to vote with respect to the approval of the Plan of Liquidation Proposal, you should carefully consider the following risk factors and all the other information contained in this proxy statement. Each of the risks described could result in a decrease in the proceeds ultimately distributed to you in connection with the Plan of Liquidation or otherwise with respect to your shares, or could adversely affect the timing of distributions.

Risks Related to the Liquidation of the Company

There can be no assurances concerning the prices at which our properties will be sold or the timing of such sales.

We cannot give any assurances as to the prices at which any of our properties ultimately will be sold, or the timing of such sales, including the disposition of the properties in the Logistics Portfolio. Real estate market values are constantly changing and fluctuate with changes in interest rates, availability of financing, changes in general economic conditions and real estate tax rates, competition in the real estate market, the availability of suitable buyers, the perceived quality, consistency and dependability of income flows from tenancies and a number of other local, regional and national factors. In addition, environmental contamination, potential major repairs which are not presently contemplated, increased operating costs or other unknown liabilities, including in connection with non-compliance with applicable laws, if any, at the Company’s properties may adversely impact the sales price of those assets. As a result, the actual prices at which we are able to sell our properties may be less than the amounts we have assumed for purposes of stating estimated liquidating distributions, which would result in the amount of such distributions being less than the amount stated in this proxy statement and the timing of the sales of our properties may not occur within the expected time frame. The amount available for distributions may also be reduced if the expenses we incur in selling our properties are greater than anticipated. In calculating our estimated range of liquidating distributions, we assumed that we will be able to find buyers for all of our assets at amounts based on our estimated range of market values for each property. However, for a variety of reasons, some of which are outside of our control, we may have overestimated the sales prices that we will ultimately be able to obtain for these assets. For example, in order to find buyers in a timely manner, we may be required to lower our asking price below the low end of our current estimate of the property’s market value. If we are not able to find buyers for these assets in a timely manner or if we have overestimated the sales prices we will receive, our liquidating distributions to our stockholders would be delayed or reduced. Furthermore, the estimated range of liquidating distributions as of April 23, 2018 is based upon: (i) the Board’s estimate of the range of proceeds to be received by the Company from the sale of the Company’s properties pursuant to the Plan of Liquidation and from the sale of the properties in the Logistics Portfolio, (ii) the amount of indebtedness owed on each property, including any estimated penalties that we expect to incur at the time of the disposition of such properties for early payment thereof and other indebtedness of the Company, (iii) the amount of cash on hand, including net proceeds from sales of the Company’s properties completed prior to the Board’s approval of the Plan of Liquidation, (iv) estimated cash flows to be generated by the continued operations of the Company during the liquidation process, and (v) the estimated expenses to be incurred in connection with the sale of each property and the winding down and dissolution of the Company.

If any of the parties to our sale agreements breach such agreements or default thereunder, or if the sales do not otherwise close, our liquidating distributions may be delayed or reduced.