UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a- 6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Hines Global REIT, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | |

| þ | | | | No fee required. |

| o | | | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | (5) | | Total fee paid: |

|

| | | | | |

| o | | | | Fee paid previously with preliminary materials. |

| o | | | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | (3) | | Filing Party: |

| | | (4) | | Date Filed: |

Hines Global REIT, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held September 10, 2019

To the stockholders of Hines Global REIT, Inc.:

I am pleased to invite our stockholders to the annual meeting of stockholders of Hines Global REIT, Inc., (the “Company”). The annual meeting will be held in the 2nd Floor Conference Center of Williams Tower, 2800 Post Oak Boulevard, Houston, Texas 77056 at 9:00 a.m., local time, on September 10, 2019. At the meeting, you will be asked to:

| |

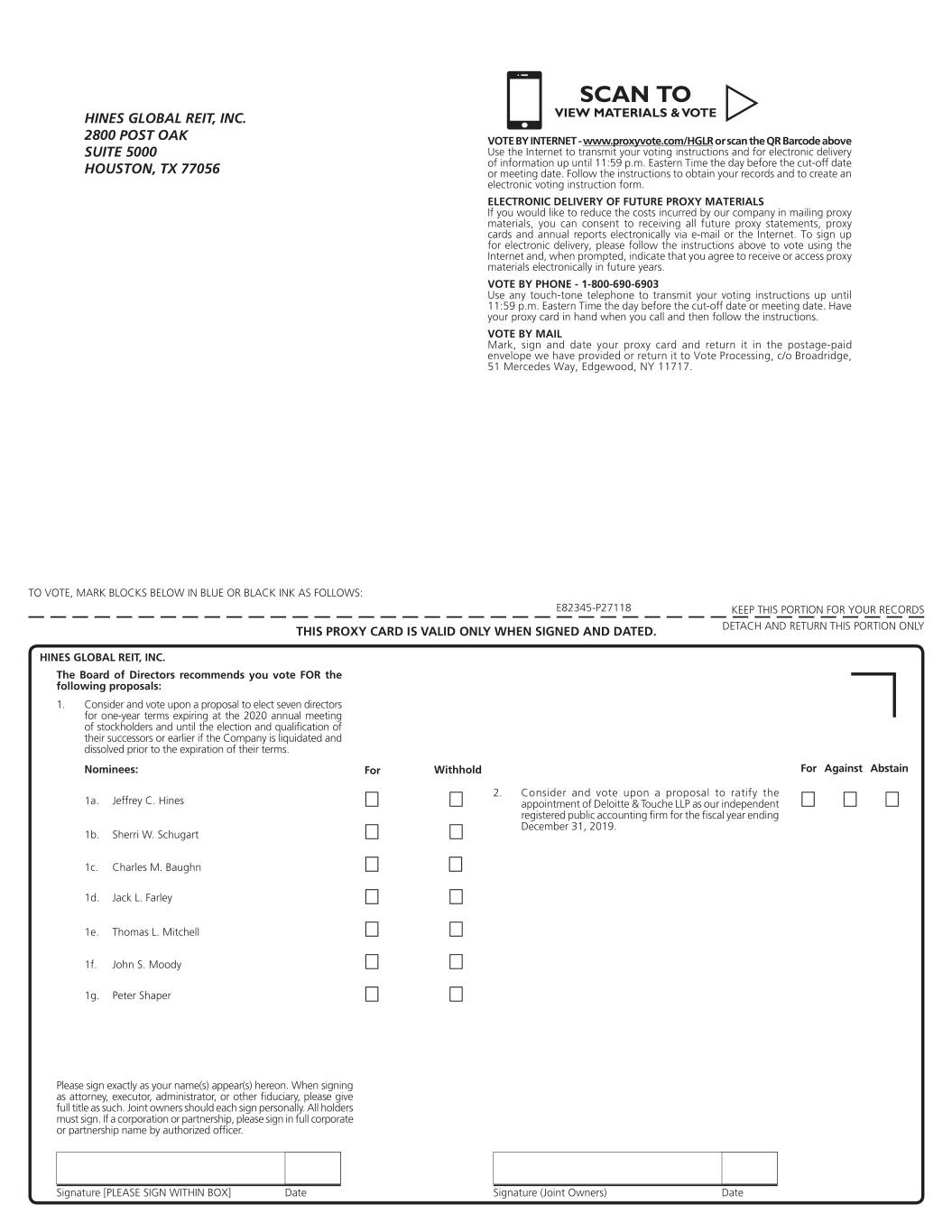

| • | Consider and vote upon a proposal to elect seven directors for one-year terms expiring at the 2020 annual meeting of stockholders and until the election and qualification of their successors or earlier if the Company is liquidated and dissolved prior to the expiration of their terms (the “Election of Directors Proposal”); |

| |

| • | Consider and vote upon a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019 (“the Appointment of Independent Auditors Proposal”); and |

| |

| • | Conduct such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

Our board of directors has fixed the close of business on June 14, 2019 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting or any adjournment thereof. Only record holders of common stock at the close of business on the record date are entitled to notice of, and to vote, at the annual meeting.

Regardless of whether you own few shares or many shares or whether you plan to attend in person or not, it is important that your shares be voted on matters that come before the meeting. If you do not attend the meeting and vote in person, you may authorize a proxy to vote your shares by using a toll-free telephone number or the Internet. Instructions for using these convenient services are provided on the enclosed proxy card and in the attached proxy statement. If you have any questions about these directions, please call our proxy solicitor, Broadridge Investor Communications Solutions, Inc., at (833) 814-9452. If you prefer, you may authorize a proxy to vote your shares by marking your votes on the proxy card, signing and dating it, and mailing it in the envelope provided. If you sign and return your proxy card without specifying your choices, it will be understood that you wish to have your shares voted in accordance with the directors’ recommendations. Any proxy given by a stockholder may be revoked by the stockholder at any time prior to the voting of the proxy, by delivering a written notice of revocation to our Secretary, by executing and delivering a later-dated proxy or by attending the annual meeting and voting in person. Your prompt cooperation will be greatly appreciated.

We encourage you to read the accompanying proxy statement in its entirety and to submit a proxy or voting instructions so that your shares will be represented and voted even if you do not attend the annual meeting. If you have questions about these proposals or would like additional copies of the proxy statement, please contact: Hines Global REIT, Inc., Attention: Hines Global REIT Investor Relations, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 (Telephone: (888) 220-6121).

You are cordially invited to attend the annual meeting. Your vote is important.

|

| |

| | By Order of the Board of Directors, |

| | |

| | Jeffrey C. Hines |

| | Chairman |

Houston, Texas

July 2, 2019

Proxy Statement

TABLE OF CONTENTS

|

| |

| INTRODUCTION | |

| QUESTIONS AND ANSWERS | |

| PROPOSAL ONE: ELECTION OF DIRECTORS | |

| General | |

| Nominees for the Board of Directors | |

| CORPORATE GOVERNANCE | |

| Audit Committee | |

| Nominating and Corporate Governance Committee | |

| Conflicts Committee | |

| Compensation Committee | |

| Code of Business Conduct and Ethics | |

| Compensation Committee Interlocks and Insider Participation | |

| Board Leadership Structure and Role in Risk Oversight | |

| DIRECTOR COMPENSATION | |

| EXECUTIVE OFFICERS | |

| EXECUTIVE COMPENSATION | |

| STOCK OWNERSHIP BY DIRECTORS, EXECUTIVE OFFICERS AND CERTAIN STOCKHOLDERS | |

| Ownership | |

| Section 16(a) Beneficial Ownership Reporting Compliance | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | |

| Our Advisor | |

| Hines | |

| Ownership Interests | |

| Policies and Procedures for Review of Related Party Transactions | |

| PROPOSAL TWO: RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| Fees | |

| Pre-approval Policies and Procedures | |

| AUDIT COMMITTEE REPORT | |

| RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| OTHER MATTERS PRESENTED FOR ACTION AT THE 2019 ANNUAL MEETING | |

| STOCKHOLDER PROPOSALS FOR THE 2020 ANNUAL MEETING | |

Hines Global REIT, Inc.

2800 Post Oak Boulevard, Suite 5000

Houston, Texas 77056-6118

PROXY STATEMENT

INTRODUCTION

The accompanying proxy, delivered or made available to our stockholders together with this proxy statement, is solicited by and on behalf of the board of directors (the “Board”) of Hines Global REIT, Inc. (“Hines Global” or the “Company”) for use at the annual meeting of our stockholders and at any adjournment or postponement thereof. References in this proxy statement to “we,” “us,” “our” or like terms also refer to the Company. We expect to deliver or otherwise make this proxy statement and the accompanying proxy card available to our stockholders on or about July 10, 2019. Our 2018 Annual Report to Stockholders was delivered or made available to our stockholders on or about April 30, 2019.

Important Notice Regarding Availability of Proxy Materials

This proxy statement, the form of proxy card, our 2018 Annual Report to Stockholders and our annual report on Form 10-K for the year ended December 31, 2018, are available in the SEC Filings section of our website at https://www.hinessecurities.com/past-offerings/hines-global-reit/sec-filings/.

Stockholders may also obtain a copy of these materials by writing to Hines Global REIT, Inc., Attention: Hines Global REIT Investor Relations. Upon payment of a reasonable fee, stockholders may also obtain a copy of the exhibits to our Annual Report on Form 10-K for the year ended December 31, 2018.

QUESTIONS AND ANSWERS

What is the date of the annual meeting and where will it be held?

Our 2019 annual meeting of stockholders will be held on September 10, 2019, at 9:00 a.m., local time. The meeting will be held in the 2nd Floor Conference Center of Williams Tower, 2800 Post Oak Boulevard, Houston, Texas 77056.

What is the purpose of the meeting and what will I be voting on at the annual meeting?

The purpose of the annual meeting is to consider and vote on the following proposals:

| |

| • | Election of Directors Proposal: Our Board has determined that it is in the best interests of our stockholders to elect seven directors for one-year terms expiring in 2020 annual meeting of stockholders and until the election and qualification of their successors or earlier if the Company is liquidated and dissolved prior to the expiration of their terms; |

| |

| • | Appointment of Independent Auditors Proposal: Our Board has determined that it is in the best interests of the Company and our stockholders to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019; and |

| |

| • | At the annual meeting, you may be asked to conduct such other business as may properly come before the annual meeting or any postponement or adjournment thereof. |

Our Board does not know of any matters that may be acted upon at the meeting other than the matters set forth in the proposals listed above.

Who can vote at the meeting?

The record date for the determination of holders of our common stock entitled to notice of and to vote at the meeting, or any adjournment or postponement of the meeting, is the close of business on June 14, 2019. Each holder of our shares of common stock issued and outstanding as of the record date is entitled to vote at the meeting. As of the record date, 264.1 million shares of our common stock were issued and outstanding, and therefore entitled to vote at the annual meeting.

How many votes do I have?

Each share of our common stock has one vote on each matter considered at the annual meeting or any postponement or adjournment thereof.

How can I vote?

You may vote in person at the meeting or by proxy. Stockholders have the following three options for submitting their votes by proxy:

| |

| • | via the Internet at http://www.proxyvote.com/HGLR; |

| |

| • | by telephone, by calling toll free (800) 690-6903; or |

| |

| • | by mail, by completing, signing, dating and returning your proxy card in the enclosed envelope. |

For those stockholders with Internet access, we encourage you to authorize a proxy to vote your shares via the Internet, a convenient means of authorizing a proxy that also provides cost savings to us. In addition, when you authorize a proxy to vote your shares via the Internet or by phone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and, therefore, not be counted. For further instructions on voting and the control number required to authorize a proxy to vote your shares via the Internet or by phone, see your proxy card enclosed with this proxy statement.

If your shares of common stock are held in an account by a bank, broker, or other nominee on your behalf, you may receive instructions from your bank, broker, or other nominee describing how to vote your shares. A number of banks and brokerage firms participate in a program that also permits stockholders to direct their vote by the Internet or telephone. This option is

separate from that offered by Broadridge Investor Communications Solutions, Inc., the firm we have retained to aid in the solicitation process, and should be reflected on the voting form from a bank or brokerage firm that accompanies this proxy statement. If your shares are held in an account at a bank or brokerage firm that participates in such a program, you may direct the vote of these shares by the Internet or telephone by following the instructions on the voting form enclosed with the proxy from the bank or brokerage firm. Directing the voting of your shares will not affect your right to vote in person if you decide to attend the annual meeting.

You also may vote your shares at the meeting. If you attend the annual meeting, you may submit your vote in person, and any previous votes that you submitted, whether by Internet, phone or mail, will be superseded by the vote that you cast at the annual meeting. To obtain directions to be able to attend the meeting and vote in person, contact Hines Global REIT Investor Relations at (888) 220-6121.

May I vote in person?

Yes. You may attend the annual meeting and vote your shares in person, rather than signing and mailing a proxy card, voting via the Internet or voting by telephone.

What are the recommendations of our Board?

Our Board recommends that you vote “for” Proposals 1 and 2.

What vote is required to approve each proposal?

Election of Directors Proposal. There is no cumulative voting in the election of our directors. Each director is elected by the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the meeting. Any shares present but not voted (whether by abstention, withholding authority or broker non-vote) will have the effect of votes against the election of nominees to our Board.

Appointment of Independent Auditors Proposal. This proposal requires the affirmative vote of a majority of the votes cast at the meeting. Any shares not voted (whether by abstention or otherwise) have no impact on the vote.

Approval by our stockholders of each of the proposals requires that a quorum be present at the meeting.

As of the record date, our directors and executive officers own or control less than 1% of our outstanding shares of common stock and intend to vote such shares “FOR” each of the proposals.

How will proxies be voted?

Shares represented by valid proxies will be voted at the meeting in accordance with the directions given. If the enclosed proxy card is signed and returned without any directions given, the shares will be voted:

| |

| • | “FOR” the Election of Directors proposal; and |

| |

| • | “FOR” the Ratification of the Appointment of Independent Auditors Proposal. |

Our Board does not intend to present, and has no information indicating that others will present, any business at the annual meeting other than as set forth in the attached Notice of Annual Meeting of Stockholders. However, if other matters requiring the vote of our stockholders properly come before the meeting, it is the intention of the persons named in the accompanying proxy card to vote the proxies held by them in accordance with their discretion on such matters.

How can I change my vote or revoke a proxy?

If you own common stock as a record holder on the record date, you may revoke your proxy at any time prior to the voting thereof by submitting a later-dated proxy (either in the mail, or by telephone or the Internet), by attending the meeting and voting in person (although attendance at the meeting alone will not cause your previously granted proxy to be revoked unless you specifically so request) or by written notice to us addressed to: Hines Global REIT, Inc., Attention: Jason P. Maxwell, General Counsel and Secretary, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. No written revocation shall be effective, however, unless and until it is received by us at or prior to the meeting.

What if I return my proxy but do not mark it to show how I am voting?

If your proxy card is signed and returned without specifying your choices, your shares will be voted as recommended by our Board.

What constitutes a “quorum”?

The presence at the meeting, in person or represented by proxy, of the holders entitled to cast at least 50 percent of all of the votes entitled to be cast at the meeting constitutes a quorum. Abstentions and broker non-votes will be counted as present for the purpose of establishing a quorum; however, abstentions and broker non-votes will not be counted as votes cast.

What do I need to do now?

Simply authorize a proxy to vote your shares by Internet or telephone as soon as possible or indicate on your proxy card how you want to vote and sign, date and return it by fax or mail it to us in the enclosed envelope, unless you plan to attend the annual meeting and vote in person. Instructions for submitting your vote are set forth on the proxy card. If you have any questions about these instructions, please call Broadridge Investor Communications Solutions, Inc. at (833) 814-9452.

Will you incur expenses in soliciting proxies?

We will bear all costs associated with soliciting proxies for the meeting. Solicitations may be made on behalf of our Board by mail, personal interview, telephone or other electronic means by our officers, who will receive no additional compensation with respect to the solicitation of proxies. We have retained Broadridge Investor Communications Solutions, Inc. to aid in the solicitation of proxies. We will pay Broadridge Investor Communications Solutions, Inc. a fee of approximately $5,000 in addition to variable costs related to the solicitation of proxies as well as reimbursement of its out-of-pocket expenses. We will request that certain banks, brokers, custodians, nominees, fiduciaries and other record holders forward copies of the proxy materials to people on whose behalf they hold shares of common stock and request authority for the exercise of proxies by the record holders on behalf of those people, if necessary. In compliance with the regulations of the Securities and Exchange Commission (the “SEC”), we will reimburse such persons for reasonable expenses incurred by them in forwarding proxy materials to the beneficial owners of our common stock.

What does it mean if I receive more than one proxy card?

Some of your shares may be registered differently or held in different accounts. You should authorize a proxy to vote the shares held in each of your accounts by telephone, the Internet or mail. If you mail proxy cards, please sign, date and return each proxy card to guarantee that all of your shares are voted. If you hold your shares in registered form and wish to combine your stockholder accounts in the future, you should contact Hines Global REIT Investor Relations at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 or call us at (888) 220-6121. Combining accounts reduces excess printing and mailing costs, resulting in cost savings to us that benefit you as a stockholder.

What if I receive only one set of proxy materials although there are multiple stockholders at my address?

The SEC has adopted a rule concerning the delivery of documents filed by us with the SEC, including proxy statements and annual reports to stockholders. The rule allows us to, with the consent of affected stockholders, send a single set of any annual report, proxy statement, proxy statement combined with a prospectus or information statement to any household at which two or more stockholders reside if they share the same last name or we reasonably believe they are members of the same family. This procedure is referred to as “Householding.” This rule benefits both you and us. It reduces the volume of duplicate information received at your household and helps us reduce expenses. Each stockholder subject to Householding will continue to receive a separate proxy card or voting instruction card.

We will promptly deliver, upon written or oral request, a separate copy of our annual report or proxy statement, as applicable, to a stockholder at a shared address to which a single copy was previously delivered. If you received a single set of disclosure documents for this year, but you would prefer to receive your own copy, you may direct requests for separate copies to Hines Global REIT Investor Relations at 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118 or call us at (888) 220-6121. Likewise, if your household currently receives multiple copies of disclosure documents and you would like to receive one set, please contact Hines Global REIT Investor Relations.

How do I submit a stockholder proposal for next year’s annual meeting or proxy materials, and what is the deadline for submitting a proposal?

In accordance with Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), if you wish to present a proposal for inclusion in the proxy materials for next year’s annual meeting, we must receive written notice of your proposal at our executive offices no later than March 12, 2020. Any such proposal must meet the requirements set forth in the rules and regulations of the SEC in order to be eligible for inclusion in the proxy materials for our 2020 annual meeting. For any proposal that is not submitted for inclusion in the proxy materials for the 2020 annual meeting but is instead sought to be presented directly at the meeting, Rule 14a-4(c) under the Exchange Act permits our management to exercise discretionary voting authority under proxies we solicit unless we receive timely notice of the proposal in accordance with the procedures set forth in our bylaws. Pursuant to our current bylaws, in order for a stockholder proposal to be properly submitted for presentation at our 2020 annual meeting, we must receive written notice of the proposal at our executive offices during the period beginning on March 12, 2020 and ending on April 11, 2020. All proposals must contain the information specified in, and otherwise comply with, our bylaws. Proposals should be sent via registered, certified or express mail to: Hines Global REIT, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118, Attention: Jason P. Maxwell, General Counsel and Secretary. For additional information, see the section in this proxy statement captioned “Stockholder Proposals for the 2020 Annual Meeting.”

Who can help answer my questions?

If you have questions about voting procedures, please call our proxy solicitor, Broadridge Investor Communications Solutions, Inc., at (833) 814-9452, or Hines Global REIT Investor Relations, at (888) 220-6121.

PROPOSAL ONE:

ELECTION OF DIRECTORS

General

Our Board ultimately is responsible for the management and control of our business and operations. We have no employees and have retained Hines Global Advisors, LP (the “Advisor”) to manage our day-to-day operations, including the acquisition of our properties. The Advisor is an affiliate of our sponsor, Hines Interests Limited Partnership (“Hines”). Our Board, especially our independent directors, is responsible for monitoring and supervising our Advisor’s conduct of our day-to-day operations.

Our Articles of Amendment and Restatement (our “Charter”) and bylaws provide for a board of directors with no fewer than three and no more than ten directors, a majority of whom must be independent. An “independent director” is defined under our Charter and means a person who is not, and within the last two years has not been, directly or indirectly associated with Hines or our Advisor by virtue of:

| |

| • | ownership of an interest in Hines, our Advisor or their affiliates, other than the Company or any affiliate with securities registered under the Exchange Act; |

| |

| • | employment by (or service as an officer, trust manager or director of) Hines, our Advisor or their affiliates, other than service as a director for us or any affiliate with securities registered under the Exchange Act; |

| |

| • | performance of services, other than as a director, for us or any affiliate with securities registered under the Exchange Act; |

| |

| • | service as a director, trust manager or trustee of more than three real estate investment trusts advised by our Advisor or organized by Hines; or |

| |

| • | maintenance of a material business or professional relationship with Hines, our Advisor or any of their affiliates. |

An independent director cannot be associated with us, Hines or our Advisor, either directly or indirectly, as set forth above. An indirect relationship includes circumstances in which a director’s spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law or brothers- or sisters-in-law, is or has been associated with us, Hines, our Advisor, or their affiliates.

A business or professional relationship is considered material if the gross revenue derived by the director from our Advisor or Hines and their affiliates exceeds five percent of either the director’s annual gross revenue during either of the last two years or the director’s net worth on a fair market value basis.

In addition, our independent directors must meet the independence requirements specified below under “Corporate Governance.”

We currently have seven directors, four of whom are independent. Generally, directors are elected annually by our stockholders, and there is no limit on the number of times a director may be elected to office. Each director serves until the next annual meeting of stockholders or until his or her successor has been duly elected and qualifies.

During 2018, our Board held 27 meetings, including Board committee meetings. No director attended fewer than 75 percent of the aggregate of all meetings held during 2018 by our Board and by Board committees. Our Board has adopted a policy that each director is expected to attend annual meetings of stockholders when possible. All of our directors attended the 2018 annual meeting of stockholders, and we anticipate that all of our directors will attend our 2019 annual meeting of stockholders.

Nominees for our Board

The proxy holders named on the proxy card intend to vote for the election of the seven nominees listed below. Our Board has selected these nominees on the recommendation of our Board’s Nominating and Corporate Governance Committee. If you do not wish your shares to be voted for particular nominees, please identify the exceptions in the designated space provided on the proxy card or, if you are authorizing a proxy by telephone or the Internet, follow the instructions provided when you vote. Directors will be elected by the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the meeting. Any shares not voted by abstention, withholding authority, or broker non-vote will have the effect of votes against the election of nominees to our Board.

If, by the time of the meeting, one or more of the nominees should become unable to serve for any reason, shares represented by proxies will be voted for the remaining nominees and for any substitute nominee or nominees designated by the Nominating and Corporate Governance Committee. No proxy will be voted for a greater number of persons than the number of nominees described in this proxy statement.

The following individuals are the seven nominees for our Board:

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| Jeffrey C. Hines | | 64 | | 2008 | | Mr. Hines joined Hines in 1982. He has served as the Chairman of our Board and as Chairman of the managers of the general partner of our Advisor since December 2008. Mr. Hines has served as the Chairman of the board of directors of Hines Global Income Trust, Inc. (f/k/a/ Hines Global REIT II) (“Hines Global Income Trust”) and Chairman of the managers of the general partner of Hines Global REIT II Advisors LP (“HGRIIALP”), the advisor to Hines Global Income Trust, since July 2013. Mr. Hines also served as the Chairman of the board of directors of Hines Real Estate Investment Trust, Inc. (“Hines REIT”) and the Chairman of the managers of the general partner of Hines Advisors Limited Partnership (“HALP”), the advisor to Hines REIT, from August 2003 through the liquidation and dissolution of Hines REIT in August 2018. He also served as a member of the management board of the Hines US Core Office Fund LP (the “Core Fund”) since August 2003 through the liquidation and dissolution of the Core Fund in December 2018. He is also the co-owner and President and Chief Executive Officer (“CEO”) of the general partner of Hines and is a member of Hines’ Executive Committee. Mr. Hines is responsible for overseeing all firm policies and procedures as well as day-to-day operations of Hines. He became President of the general partner of Hines in 1990 and CEO of the general partner of Hines in January 2008 and has overseen a major expansion of the firm’s personnel, financial resources, domestic and foreign market penetration, products and services. He has been a major participant in the development of the Hines domestic and international acquisition program and currently oversees a portfolio of $120.6 billion in assets under management. Mr. Hines graduated from Williams College with a B.A. in Economics and received his M.B.A. from Harvard Business School.

We believe that Mr. Hines’ career, spanning more than 35 years in the commercial real estate industry, including his leadership of Hines, and the depth of his knowledge of Hines and its affiliates, qualifies him to serve on our board of directors. |

| | | | | | | |

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| Sherri W. Schugart | | 53 | | 2018 | | Ms. Schugart joined Hines in 1995. In February 2016, Ms. Schugart was appointed as a member of Hines’ Executive Committee. Ms. Schugart has served as President and CEO for us and for the general partner of our Advisor since March 2013 and has served as a member of our Board since December 2018. Ms. Schugart has also served as President and CEO for Hines Global Income Trust and the general partner of HGRIIALP since August 2013. Also, since March 2013, Ms. Schugart has served as the President and CEO of HMS Income Fund, Inc. (“HMS”) and HMS Adviser GP LLC (the “HMS GP”), the general partner of the adviser to HMS. Additionally, in February 2014, Ms. Schugart was appointed as the Chairperson of the board of directors of HMS. Ms. Schugart also served as President of HMS and the general partner of its advisor from March 2013 until June 2019. Ms. Schugart has also served as President and CEO for Hines REIT, the general partner of HALP and the Core Fund from March 2013 through the liquidation and dissolution of Hines REIT in August 2018 and the Core Fund in December 2018. Prior to March 2013, Ms. Schugart had served as the Chief Operating Officer (“COO”) for us and the general partner of our Advisor and as the COO of Hines REIT, the general partner of HALP and the Core Fund since November 2011 through the liquidation and dissolution of Hines REIT in August 2018 and the Core Fund in December 2018. In these roles, Ms. Schugart was responsible for the execution of each entity’s business plan and oversight of day-to-day business operations, including issues related to portfolio strategy, asset management and all other operational and financial matters of each entity. Ms. Schugart also served as Chief Financial Officer (“CFO”) for us and the general partner of our Advisor from inception in December 2008 through October 2011. Ms. Schugart also served as the CFO for Hines REIT and the general partner of HALP from August 2003 through October 2011 and as the CFO of the Core Fund from July 2004 through October 2011. In these roles, her responsibilities included oversight of financial and portfolio management, equity and debt financing activities, investor relations, accounting, financial reporting, compliance and administrative functions in the U.S. and internationally. She has also been a Senior Managing Director of the general partner of Hines since October 2007 and has served as a director of the Dealer Manager since August 2003. Prior to holding these positions, she was a Vice President in Hines Capital Markets Group raising equity and debt financing for various Hines investment vehicles in the U.S. and internationally. Ms. Schugart has been responsible for arranging and managing more than $10 billion in equity and debt for Hines’ public and private investment funds. Prior to joining Hines, Ms. Schugart spent eight years with Arthur Andersen LLP, where she served both public and private clients in the real estate, construction, finance and banking industries. She holds a Bachelor of Business Administration degree in Accounting from Southwest Texas State University. We believe that Ms. Schugart’s significant experience as an executive at the Company and its affiliates qualifies her to serve as one of our directors. Ms. Schugart is able to draw on her extensive institutional knowledge, as well as her tenure serving public and private companies at Arthur Andersen LLP to provide valuable insight. |

| | | | | | | |

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| Charles M. Baughn | | 64 | | 2008 | | Mr. Baughn joined Hines in 1984. Mr. Baughn has served as a member of our board of directors and as a manager of the general partner of our Advisor since December 2008. Additionally, since July 2013, Mr. Baughn has served as a member of the board of directors of Hines Global Income Trust and as a member of the general partner of HGRIIALP. In connection with Mr. Baughn’s upcoming retirement from Hines, he will not stand for re-election to the board of directors of Hines Global Income Trust in September 2019, and will stop serving as a member of the general partner of HGRIIALP upon retirement from Hines. In addition, Mr. Baughn was a member of the board of directors of Hines REIT from April 2008 and was a manager of the general partner of HALP from August 2003 until the liquidation and dissolution of Hines REIT in August 2018. He also served as CEO of Hines REIT and the general partner of HALP from August 2003 through April 1, 2008. He has served as the Senior Managing Director of the general partner of Hines since 2012. Additionally, Mr. Baughn served as the CFO of the general partner of Hines from 2012 to 2018. As CFO, Mr. Baughn was responsible for overseeing Hines’ business operations, such as balance sheet related activities and bank and other debt financing. Previously, he also has served as an Executive Vice President and CEO-Capital Markets Group of the general partner of Hines from April 2001 through 2012 and, as such, was responsible for overseeing Hines’ capital markets group, which raises, places and manages equity and debt for Hines projects in the U.S. and internationally. Mr. Baughn is also a director of Hines Securities, Inc. and was a member of the Hines’ Executive Committee until June 2019. Until May 2015, Mr. Baughn also served as the CEO of Hines Securities, Inc. Mr. Baughn also served as a member of the management board of the Core Fund from 2003 until the liquidation and dissolution of the Core Fund in December 2018. During his tenure at Hines, he has contributed to the development or redevelopment of over 9 million square feet of office and special use facilities in the southwestern United States. He graduated from the New York State College of Ceramics at Alfred University with a B.A. and received his M.B.A. from the University of Colorado. Mr. Baughn holds Series 7, 24 and 63 securities licenses.

We believe that Mr. Baughn’s experience in the commercial real estate industry during his more than 34 year career with Hines, including his familiarity with Hines’ financial and investment policies, qualifies him to serve on our board of directors. |

| | | | | | | |

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| Jack L. Farley | | 55 | | 2009 | | Mr. Farley has served as an independent director since June 2009. Mr. Farley has served as the President and CEO of Apex Compressed Air Energy Storage LLC, since January 2011, the year the company was launched in order to develop, build, operate, and commercialize utility-scale compressed air energy storage assets. Additionally, since January 2016, he has served as a board member for Live Power Intelligence Company, LLC, which provides real-time power grid information to electric power markets. Prior to that he co-founded Liberty Green Renewables, LLC in June 2008 to pursue development, construction and operation of biomass-to-electricity generation projects in the Midwest and Southeast US. From 2003 to February 2008, Mr. Farley was Senior Vice President of Cinergy Corp., where he was responsible for the Power Trading and Marketing group. During his tenure, the group had approximately $30 billion of annual physical power sales and ranked in the top 15 in the US. Cinergy Corp. merged with Duke Energy (NYSE: DUK) in 2006. In October 2007, Fortis NV acquired Duke’s trading operations as a strategic enhancement to its nascent US banking activities. Prior to joining Cinergy/Duke, Mr. Farley was President of the West Region at Reliant Resources, Inc., where he managed a $1.1 billion portfolio of power generation assets, and was responsible for the development and construction of two combined-cycle gas turbine projects with a total investment of approximately $750 million.

We believe that Mr. Farley’s extensive leadership experience and understanding of the requirements of managing a public company, acquired during his tenure at Cinergy Corp. and Duke Energy qualify him to serve on our board of directors. This experience along with Mr. Farley’s M.B.A. from The Wharton School and his involvement in the preparation of earnings statements and the compliance process for Sarbanes-Oxley requirements of public companies enable him to provide valuable insight to our board of directors and our Audit Committee, for which he serves as Chairman. |

| | | | | | | |

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| Thomas L. Mitchell | | 59 | | 2009 | | Mr. Mitchell has served as an independent director since June 2009. Mr. Mitchell served as the Executive Vice President and CFO of Devon Energy Corporation (NYSE:DVN) from February 2014 to April 2017. Prior to February 2014, he served as the Executive Vice President and CFO of Midstates Petroleum Company, Inc. (NYSE: MPO), formerly Midstates Petroleum Company LLC, an exploration and production company, since 2011, and member of the Midstates board of directors from 2012 until January 2014. From 2006 to 2011, he was the Senior Vice President, CFO, Treasurer and Controller of Noble Corporation (NYSE: NE), a publicly-held offshore drilling contractor for the oil and gas industry. From 1997 to November 2006, Mr. Mitchell served as Vice President and Controller of Apache Corporation (NYSE, NASDAQ: APA), a publicly-held oil and gas exploration, development and production company. From 1996 to 1997, he served as Chief Accounting Officer (“CAO”) and Controller of Apache, and from 1989 to 1996, he served Apache in various positions. Prior to joining Apache, Mr. Mitchell spent seven years at Arthur Andersen & Co., an independent public accounting firm, where he practiced as a Certified Public Accountant (currently inactive), managing clients in the oil and gas, banking, manufacturing and government contracting industries. Mr. Mitchell graduated with honors from Bob Jones University with a B.S. in Accounting.

We believe Mr. Mitchell’s significant leadership experience at four public companies qualifies him to serve on our board of directors. In addition, through his previous experience in public accounting, Mr. Mitchell is able to provide valuable insight with respect to financial reporting processes and our system of internal controls. |

| | | | | | | |

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| John S. Moody | | 70 | | 2009 | | Mr. Moody has served as an independent director since June 2009. Mr. Moody has been President of Parkside Capital, LLC in Houston since January 2006. Parkside Capital, LLC is the general partner and manager of Parkside Capital Land Fund, LTD., a Texas real estate private equity firm which invests in raw land in high growth markets in Texas. From January 2004 to December 2005, Mr. Moody was the President and CEO of HRO Asset Management, LLC, a real estate advisory business headquartered in New York City, where he oversaw the acquisition of $850 million of real estate assets. From September 2001 to December 2003, he was the President of Marsh & McLennan Real Estate Advisors, Inc., where he developed the real estate strategy for the Marsh & McLennan Companies, including directing the execution of all real estate leases, projects and transactions. Mr. Moody was also the President and CEO of Cornerstone Properties, Inc., a publicly-held equity REIT which acquired, developed and operated large scale Class A office buildings in major metropolitan markets throughout the U.S. During his tenure at Cornerstone, assets grew from $500 million to $4.8 billion. From 1991 to 1995, Mr. Moody was the President and CEO of Deutsche Bank Realty Advisors, Inc., where he oversaw a $2 billion equity and debt portfolio. Mr. Moody has been a member of the board of directors of Huron Consulting Group (NASDAQ: HURN), a publicly-held integrated strategic services provider since October 2005. Since September 2006, he has been a member of the board of directors of Potlatch Corporation (NYSE: PCH), a publicly-held REIT with approximately 1.6 million acres of forestland. He became the Vice Chairman of the board of directors of Potlatch in January 2009. Mr. Moody also has served as the Chairman of the board of directors of Four Corners Property Trust Inc. (NYSE: FCPT) since November 2015. Mr. Moody was a member of the board of directors and Chairman of the Compensation Committee of CRIIMI MAE, Inc., a publicly-held REIT, from January 2004 to January 2006. He was also a member of the board of directors and Chairman of the Compensation Committee of Keystone Property Trust, a publicly-held REIT, from 2001 to 2004. Mr. Moody graduated from Stanford University with a B.S. and received his J.D. with honors from the University of Texas. |

| | | | | | | |

| | | | | | | We believe that Mr. Moody’s significant experience in the commercial real estate industry qualifies him to serve as one of our directors. Drawing on this experience, Mr. Moody is able to provide valuable insight regarding our investment strategies, internal controls and financial risk exposures. In addition, through his experience serving on the boards of several public companies, Mr. Moody is well-versed in the requirements of serving on a public company board. |

|

| | | | | | |

| Name | | Age | | Year First Elected | | Business Experience and Principal Occupation; Directorships in Public Corporations and Investment Companies |

| Peter Shaper | | 53 | | 2009 | | Mr. Shaper has served as an independent director since June 2009. He has served as a director and member of the audit committee of HMS since May 2012. Since 2012, Mr. Shaper also has served as the Chairman and CEO of Greenwell Energy Solutions, an independent specialty chemical supplier to the upstream oil and gas industry. Additionally, he is a founding partner of Genesis Park LP, a Houston-based private equity firm which was founded in 2000 and primarily focuses on buyouts, partnering strategies with public corporations and growth financing bringing each company capital, commercial execution capabilities and a depth of experience in mergers and acquisitions. Mr. Shaper also was the CEO of Harris CapRock Communications, Inc., a global provider of broadband communications to remote locations via satellite with revenues of over $300 million from 2002 through June 2011, when he resigned. From 1998 to 2000, Mr. Shaper was the president of Donnelley Marketing, a Division of First Data Corporation, where he was directly responsible for the turnaround and eventual sale of the $100 million revenue database marketing company to a strategic buyer. In 1996, Mr. Shaper helped found the Information Management Group, (“IMG”), as its Executive Vice President of Operations and CFO. IMG grew to over $600 million in revenue during Mr. Shaper’s tenure. Prior to joining IMG, Mr. Shaper was with a Dallas-based private equity firm, where he was responsible for investments in numerous technology-oriented companies, as well as assisting those companies with developing long-term strategies and financial structures. Mr. Shaper also has several years’ experience with the international consulting firm McKinsey & Company. Mr. Shaper graduated from Stanford University with a B.S. in industrial engineering and received his M.B.A. from Harvard Business School.

We believe Mr. Shaper’s significant experience as a senior executive officer of sophisticated companies such as Greenwell Energy Solutions, Harris CapRock Communications, Genesis Park and Donnelley Marketing/First Data, as well as his experience founding and leading IMG, qualify him to serve on our board of directors. |

Our Board unanimously recommends a vote “FOR” each of the nominees set forth above.

CORPORATE GOVERNANCE

The four standing committees of our Board are: the Audit Committee, the Conflicts Committee, the Nominating and Corporate Governance Committee and the Compensation Committee. You may obtain copies of the charters for all of our Board committees from our website at www.hinessecurities.com/past-offerings/hines-global-reit/corporate-governance/. Each committee has four members and is composed entirely of our four independent directors. Currently, Mr. Moody serves as chairman of the Conflicts Committee, Mr. Farley serves as chairman of the Audit Committee, Mr. Shaper serves as chairman of the Compensation Committee and Mr. Mitchell serves as chairman of the Nominating and Corporate Governance Committee.

Our Board has determined that each of our independent directors is independent within the meaning of the applicable (i) provisions set forth in our Charter, and (ii) requirements set forth in the Exchange Act and the applicable SEC rules, and (iii) although our shares are not listed on the New York Stock Exchange (the “NYSE”), under the independence rules set forth in the NYSE Listed Company Manual. Our Board follows the NYSE rules governing independence as part of its policy of maintaining strong corporate governance practices. To be considered independent under the NYSE rules, our Board must determine that a director does not have a material relationship with us and/or our consolidated subsidiaries (either directly or as a partner, stockholder or officer of an organization that has a relationship with any of those entities, including Hines and its affiliates). Under the NYSE rules, a director will not be independent if:

| |

| • | the director was employed by us within the last three years; |

| |

| • | an immediate family member of the director was employed by us as an executive officer within the last three years; |

| |

| • | the director, or an immediate family member of the director, received more than $120,000 during any 12-month period within the last three years in direct compensation from us, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| |

| • | the director is a current partner or employee of a firm that is our internal or external auditor, the director has an immediate family member who is a current partner of such a firm, the director has an immediate family member who is a current employee of such a firm and personally works on our audit, or the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on our audit within that time; |

| |

| • | the director or an immediate family member is, or has been with the last three years, employed as an executive officer of another company where any of our present executive officers at the same time serves or served on that company’s compensation committee; or |

| |

| • | the director was an executive officer or an employee (or an immediate family member of the director was an executive officer) of a company that makes payments to, or receives payments from, us for property or services in an amount which, in any of the last three fiscal years, exceeded the greater of $1,000,000 or 2% of such other company’s consolidated gross revenues. |

Interested parties may communicate matters they wish to raise with the directors by writing to Hines Global REIT, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118, Attention: Jason P. Maxwell, General Counsel and Secretary. Mr. Maxwell will deliver all appropriate communications to the Nominating and Corporate Governance Committee of our Board, which will, in its discretion, deliver such communications (together with any recommendations) to our Board no later than the next regularly scheduled meeting of our Board.

Audit Committee

The Audit Committee, in performing its duties:

| |

| • | oversees the integrity of our financial statements and other financial information to be provided to our stockholders; |

| |

| • | directly appoints, retains, compensates, evaluates and terminates the independent auditors; |

| |

| • | reviews with the independent auditors the plans and results of the audit engagement; |

| |

| • | approves professional services provided by our principal independent registered public accounting firm; |

| |

| • | reviews the independence, performance and qualifications of our principal independent registered public accounting firm; |

| |

| • | considers and approves the range of audit and non-audit fees; |

| |

| • | reviews the adequacy of our systems of disclosure controls and internal controls over financial reporting; and |

| |

| • | oversees our compliance with legal and regulatory requirements. |

Our Board has determined that each member of our Audit Committee is independent within the meaning of the applicable requirements set forth in or promulgated under the Exchange Act, as well as in the NYSE rules. In addition, our Board has determined that Jack L. Farley is an “audit committee financial expert” within the meaning of the applicable rules promulgated by the SEC. Unless otherwise determined by our Board, no member of the committee may serve as a member of the Audit Committee of more than two other public companies. During 2018, the Audit Committee held seven meetings.

The Audit Committee’s report on our financial statements for the fiscal year ended December 31, 2018 is presented below under the heading “Audit Committee Report.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, in performing its duties:

| |

| • | assists our Board in identifying individuals qualified to become members of our Board; |

| |

| • | recommends candidates to our Board to fill vacancies on our Board and to stand for election by the stockholders at the annual meeting; |

| |

| • | recommends committee assignments for directors to our full Board; |

| |

| • | periodically assesses the performance of our Board; |

| |

| • | reviews and recommends appropriate corporate governance policies and procedures to our Board; and |

| |

| • | reviews and reassesses the adequacy of and compliance with our Code of Business Conduct and Ethics for Senior Officers and Directors and recommends any proposed modifications to our Board for approval. |

Our Board has determined that each member of our Nominating and Corporate Governance Committee is independent within the meaning of the applicable requirements set forth in or promulgated under the Exchange Act, as well as in the NYSE rules.

Among the criteria the committee uses in evaluating the suitability of individual nominees for our Board (whether such nominations are made by management, a stockholder or otherwise), the committee considers each nominee’s:

| |

| • | personal and professional integrity, experience and skills; |

| |

| • | ability and willingness to devote the time and effort necessary to be an effective Board member; and |

| |

| • | commitment to acting in our best interests and the best interests of our stockholders. |

The committee also gives consideration to the diversity of our Board in terms of having an appropriate mix of experience, education and skills, to the requirements contained in our Charter and to each nominee’s ability to exercise independence of thought, objective perspective and mature judgment and to understand our business operations and objectives. Moreover, as required by our Charter, a director other than an independent director must have at least three years of relevant experience demonstrating the knowledge and experience required to successfully acquire and manage the type of assets we acquire, and at least one of our independent directors must have at least three years of relevant real estate experience.

If our Board determines to seek additional directors for nomination, the Nominating and Corporate Governance Committee considers whether it is advisable to retain a third-party search firm to identify candidates. During 2018, the committee paid no fees to third parties to assist in identifying or evaluating potential nominees. The Nominating and Corporate Governance

Committee also considers nominees timely submitted by stockholders under and in accordance with the provisions of our bylaws (see “Stockholder Proposals for the 2020 Annual Meeting” below). A stockholder’s notice must set forth specified information as to each person whom the stockholder proposes to nominate for election to our Board, including all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, by Regulation 14A under the Exchange Act (including such person’s written consent to being named in the proxy statement as a nominee and to serve as a director if elected). The Nominating and Corporate Governance Committee will consider all such nominees and will take into account all factors the committee determines are relevant, including the factors summarized above.

During 2018, the Nominating and Corporate Governance Committee held three meetings.

Conflicts Committee

The Conflicts Committee reviews and approves specific matters that our Board believes may involve conflicts of interest to determine whether the resolution of the conflict of interest is fair and reasonable to us and our stockholders. The Conflicts Committee is responsible for reviewing and approving the terms of all transactions between us and Hines or its affiliates or any member of our Board, including (when applicable) the economic, structural and other terms of all acquisitions and dispositions and the annual renewal of the advisory agreement (the “Advisory Agreement”) between us and our Advisor. The Conflicts Committee is also responsible for reviewing and approving each purchase or lease by us of property from an affiliate or purchase or lease by an affiliate from us. The Conflicts Committee is responsible for reviewing our Advisor’s performance and the fees and expenses paid by us to our Advisor and any of its affiliates. The review of such fees and expenses is required to be performed with sufficient frequency, but at least annually, to determine that the expenses incurred are in the best interest of our stockholders. The Conflicts Committee is also responsible for reviewing Hines’ performance as property manager of our directly owned properties.

During 2018, the Conflicts Committee held five meetings. The Conflicts Committee has reviewed our policies and reports that they are being followed by us and are in the best interests of our stockholders. Please read “Certain Relationships and Related Transactions — Policies and Procedures for Review of Related Party Transactions.” The Conflicts Committee reviewed each of the material transactions between Hines and its affiliates and the Company, which occurred during 2018. These transactions are described in “Certain Relationships and Related Transactions” below. The Conflicts Committee has determined that all our transactions and relationships with Hines and its affiliates during 2018 were fair and were approved in accordance with the policies referenced in “Certain Relationship and Related Transactions” below.

Compensation Committee

The Compensation Committee’s primary purpose is to oversee our compensation programs. The committee generally reviews and approves or recommends to our Board the compensation and benefits for our independent directors. We do not pay our non-independent directors for their service as directors. In the event we hire employees, our Compensation Committee will review and approve the compensation for our executive officers, as well as any employment, severance and termination agreements or arrangements made with any executive officer.

The Compensation Committee may form and delegate authority to subcommittees consisting of one or more members when appropriate, provided that the decision of such subcommittee shall be presented to the full Compensation Committee at its next meeting. During 2018, the Compensation Committee held two meetings.

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics, which is applicable to our directors and officers, including our principal executive officer, principal financial officer, principal accounting officer or controller and other persons performing similar functions, whether acting in their capacities as our officers or in their capacities as officers of our Advisor or its general partner. The Code of Business Conduct and Ethics covers topics including conflicts of interest, confidentiality of information, full and fair disclosure, reporting of violations and compliance with laws and regulations. Our Code of Business Conduct and Ethics is available, free of charge, on the Corporate Governance section of our website, www.hinessecurities.com/past-offerings/hines-global-reit/corporate-governance/. You may also obtain a copy of this code by writing to: Hines Global REIT Investor Relations, 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118. Waivers from our Code of Business Conduct and Ethics are discouraged, but any waivers from the Code of Business Conduct and Ethics that relate to any executive officer or director must be approved by our Nominating and Corporate Governance Committee and will be posted on our website at www.hinessecurities.com/past-offerings/hines-global-reit/corporate-governance/ within four business days of any such waiver.

Compensation Committee Interlocks and Insider Participation

During 2018, our Compensation Committee consisted of Messrs. Farley, Mitchell, Moody and Shaper, our four independent directors. None of our executive officers served as a director or member of the compensation committee of an entity whose executive officers included a member of our Board or Compensation Committee.

Board Leadership Structure and Role in Risk Oversight

We separate the roles of CEO and Chairman of our Board in recognition of the differences between the two roles. Sherri W. Schugart, as our CEO, is responsible for overall management of our business strategy and day-to-day operations, while Mr. Hines, as our Chairman, presides over meetings of our Board and provides guidance to Ms. Schugart regarding policies and procedures approved by our Board.

Our Board has determined that four of the seven members of our Board are “independent” within the standards of the NYSE, and each of our committees is comprised entirely of our independent directors. Each committee is given significant responsibility to oversee our governance policies and procedures and remains actively involved in the oversight of risk management and assessment. Our Board receives periodic presentations from our executive officers regarding our compliance with our corporate governance practices. While our Board maintains oversight responsibility, management is responsible for our day-to-day risk management processes. Our Board believes this division of responsibility is the most effective approach for addressing the risks we face.

DIRECTOR COMPENSATION

Our Board’s Compensation Committee designs our director compensation with the goals of attracting and retaining highly qualified individuals to serve as independent directors and to fairly compensate them for their time and efforts. Because of our unique attributes as an externally-managed REIT, service as an independent director on our Board requires a substantial time commitment. The Compensation Committee balances these considerations with the principles that our independent director compensation program should be transparent and, in part, should align directors’ interests with those of our stockholders.

The following table sets forth information regarding compensation paid to or earned by our directors during 2018.

2018 Director Compensation

|

| | | | | | | |

| Name | Fees Paid in Cash | Aggregate Stock Awards (1)(2) | Option Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Non-Qualified Deferred Compensation Earnings | All Other Compensation | Total Compensation |

| Jack L. Farley | $87,000 | $30,000 | $— | $— | $— | $— | $117,000 |

| Thomas L. Mitchell | $82,000 | $30,000 | $— | $— | $— | $— | $112,000 |

| John S. Moody | $78,500 | $30,000 | $— | $— | $— | $— | $108,500 |

| Peter Shaper | $82,000 | $30,000 | $— | $— | $— | $— | $112,000 |

Jeffery C. Hines, Colin P. Shepherd, Charles M. Baughn, and Sherri W. Schugart (3) | $— | $— | $— | $— | $— | $— | $— |

| |

| (1) | Each of Messrs. Farley, Mitchell, Moody and Shaper received 3,318.584 restricted common shares upon his re-election to our Board following our 2018 annual meeting. The shares were issued without registration under the Securities Act of 1933, as amended (the “Securities Act”), in reliance upon the exemption from registration contained in Section 4(a)(2) of the Securities Act for transactions not involving any public offering. |

| |

| (2) | The value of common stock awards was calculated based on the estimated net asset value, or NAV of $9.04 per share as of December 31, 2017 which was the estimated NAV per share most recently determined by our Board prior to the July 17, 2018 grant date of the awards. |

| |

| (3) | Messrs. Hines, Shepherd and Baughn, and Ms. Schugart, who are employees of Hines, receive no compensation for serving as members of our Board. Effective December 31, 2018, Mr. Shepherd resigned as a director and our Board elected Ms. Schugart to replace Mr. Shepherd. |

During 2018, we paid our independent directors an annual fee of $50,000, and a fee of $2,000 for each board meeting (or any committee thereof) attended in person. In the event that a committee meeting was held on the same day as a board meeting, each independent director received $1,500 for each committee meeting attended in person on such day. During 2018, we also paid each of our independent directors a fee of $750 for each board or committee meeting attended via teleconference. We continued to pay fees at these rates in 2019, with the exception that, effective May 23, 2019, our independent directors will be paid an annual fee of $60,000, which will be prorated for the remainder of 2019 and each of our independent directors will be paid a fee of $1,000 for each board or committee meeting attended via teleconference for the remainder of 2019.

We paid the following annual retainers to the Chairpersons of our Board’s committees for 2018:

| |

| • | $7,500 to the Chairperson of the Conflicts Committee; |

| |

| • | $10,000 to the Chairperson of the Audit Committee; |

| |

| • | $5,000 to the Chairperson of the Compensation Committee; and |

| |

| • | $5,000 to the Chairperson of the Nominating and Corporate Governance Committee. |

All directors are reimbursed by us for reasonable out-of-pocket expenses incurred in connection with attendance at Board or committee meetings.

Each independent director elected or reelected to our Board (whether through a stockholder meeting or by directors to fill a vacancy on our Board) will be granted $30,000 in restricted shares on or about the date of election or reelection. These restricted shares will fully vest on the earlier to occur of: (i) the first anniversary of the applicable grant date, subject to the independent director serving continuously as an independent director through and until the first anniversary of the applicable grant date; (ii) the termination of service as an independent director due to the independent director’s death or disability; or (iii) a change in control of the Company, subject to the independent director serving continuously through and until the date of the change in control of the Company.

EXECUTIVE OFFICERS

On May 23, 2019, our Board unanimously approved an executive succession plan (the “Succession Plan”) in connection with strategic changes within the global investment management platform of Hines. Hines informed our Board that it believes that such changes will best position Hines for long-term growth as one of the premier real estate firms in the world, and will enable Hines to continue providing best-in-class investment advisory and management services to us and its investors. Pursuant to the Succession Plan, the following leadership transitions were approved by our Board and took effect on June 30, 2019:

| |

| • | CFO. Ryan T. Sims transitioned his role and responsibilities as CFO of Hines Global to J. Shea Morgenroth, who has served as our CAO and Treasurer since November 2011 and prior to that, served as our Senior Controller since our inception. Mr. Sims is expected to remain as an executive advisor to our management and Board through December 2019 in order to ensure an orderly transition. He also currently intends to serve in certain management positions at other Hines-affiliated entities and funds through December 2019. |

| |

| • | CAO and Treasurer. Mr. Morgenroth transitioned his role and responsibilities as our CAO and Treasurer to A. Gordon Findlay, who is a Vice President - Controller at Hines and has been involved with managing the accounting, financial reporting and SEC reporting functions since our inception. |

| |

| • | General Counsel and Secretary. Jason P. Maxwell has been appointed to serve in the newly-created role of General Counsel of the Company, and has also succeeded Mr. Sims as our Secretary. Mr. Maxwell has served as Assistant Secretary and internal legal counsel for the Company since our inception. |

The changes and transitions described above are not the result of any disagreement with Hines Global regarding its operations, policies or practices.

In addition to Ms. Schugart, the individuals listed below are our current executive officers, each of whom has been elected to serve until our 2019 annual meeting of stockholders, or (if longer) until a qualified successor has been duly elected and qualifies or the Company is liquidated and dissolved. The business address of each of our executive officers is: c/o Hines Global REIT, Inc., 2800 Post Oak Boulevard, Suite 5000, Houston, Texas 77056-6118.

|

| | | | |

| Name and Title | | Age | | Experience |

J. Shea Morgenroth, CFO

| | 44 | | Mr. Morgenroth has served as CFO for us and the general partner of our Advisor since June 2019. Mr. Morgenroth joined Hines in October 2003, and is a Senior Vice President - Controller and the CFO of Investment Management at Hines, a position he has held since April 2019. Prior to that, he was a Vice President - Controller for Hines since July 2012. Mr. Morgenroth also has served as the CFO of Hines Global Income Trust and the general partner of HGRIIALP since June 2019. Since November 2011, Mr. Morgenroth served as the CAO and Treasurer for Hines Global and the general partner of the Advisor. Mr. Morgenroth has served as CAO and Treasurer for Hines Global Income Trust and the general partner of HGRIIALP from July 2013 until June 2019. Mr. Morgenroth also served as CAO and Treasurer of Hines REIT and the general partner of HALP from November 2011 through the liquidation and dissolution of Hines REIT in August 2018. In these roles, Mr. Morgenroth has been responsible for the oversight of the treasury, accounting, financial reporting and SEC reporting functions, as well as the Sarbanes-Oxley compliance program in the U.S. and internationally. Prior to his appointment as CAO and Treasurer for Hines Global, Mr. Morgenroth served as a Senior Controller for Hines Global and the general partner of the Advisor from December 2008 until November 2011 and for Hines REIT and the general partner of HALP from January 2008 until November 2011 and as a Controller for Hines REIT and the general partner of HALP from October 2003 to January 2008. In these roles, he was responsible for the management of the accounting, financial reporting and SEC reporting functions. Prior to joining Hines, Mr. Morgenroth was a manager in the audit practices of Arthur Andersen LLP and Deloitte & Touche LLP, serving clients primarily in the real estate industry. He holds a B.B.A. in Accounting from Texas A&M University and is a Certified Public Accountant.

|

| | | | | |

David L. Steinbach, Chief Investment Officer (“CIO”)

| | 42 | | Mr. Steinbach joined Hines in 1999 and is a Senior Managing Director - Investment Management, Co-Head of Investment Management and the Global CIO for Hines. Mr. Steinbach has served as the CIO for us and the general partner of our Advisor since July 2014. Mr. Steinbach has also served as the CIO for Hines Global Income Trust and the general partner of HGRIIALP since July 2014. In these roles, he is responsible for management of the real estate acquisition program in the U.S. and internationally. He is a member of Hines’ Executive and Investment Committees. He previously served as a Managing Director - Investment Management of the general partner of Hines since February 2011 to February 2017 and was responsible for the acquisition of over $4 billion in assets for various Hines affiliates in the U.S. and internationally. Prior to this role he served in various roles in which he was responsible for acquisitions, asset management and property dispositions on behalf of the Company, Hines REIT, Hines Global Income Trust and the Core Fund, both in the U.S. and internationally. He graduated from Texas A&M University with a Bachelors and Masters in Business Administration. |

| | | | | |

|

| | | | |

| Name and Title | | Age | | Experience |

Kevin L. McMeans, Asset Management Officer

| | 54 | | Mr. McMeans joined Hines in 1992. Since December 2008, Mr. McMeans has served as the Asset Management Officer for us and the general partner of our Advisor. Mr. McMeans also served as Asset Management Officer for Hines Global Income Trust and the general partner of HGRIIALP from August 2013 to June 2019. Since February 2015, he has served as a Senior Managing Director of Investment Management of the general partner of Hines. Prior to February 2015, he also served as a Managing Director of Investment Management of the general partner of Hines. In these roles, he is responsible for overseeing the management of the various investment properties owned by each of the funds in the U.S. and internationally. Additionally, Mr. McMeans served as the Asset Management Officer of Hines REIT and the general partner of HALP from April 2008 until the liquidation and dissolution of Hines REIT in August 2018. He also has served as the Asset Management Officer of the Core Fund from January 2005 through the liquidation and dissolution of the Core Fund in December 2018. He previously served as the CFO of Hines Corporate Properties, an investment venture established by Hines with a major U.S. pension fund, from 2001 through June 2004. In this role, Mr. McMeans was responsible for negotiating and closing debt financings, underwriting and evaluating new investments, negotiating and closing sale transactions and overseeing the administrative and financial reporting requirements of the venture and its investors. Before joining Hines, Mr. McMeans spent four and a half years at Deloitte & Touche LLP in the audit department. He graduated from Texas A&M University with a B.S. in Computer Science. |

| | | | | |

A. Gordon Findlay, CAO and Treasurer

| | 44 | | Mr. Findlay has served as CAO and Treasurer for us and the general partner of our Advisor since June 2019. Mr. Findlay joined Hines in November 2006. Mr. Findlay has served as a Vice President - Controller for Hines since October 2016 and as a Senior Controller for Hines from 2012 until October 2016. In these roles, he has been involved with managing the accounting, financial reporting and SEC reporting functions related to Hines Global , Hines Global Income Trust, and Hines REIT. Mr. Findlay has served as CAO and Treasurer of Hines Global Income Trust, and the general partner of HGRIIALP since June 2019. Prior to joining Hines, Mr. Findlay spent six years in the audit practice of Ernst & Young LLP, serving public and private clients in various industries. He holds a B.B.A. in Accounting from University of Houston - Downtown and is a Certified Public Accountant.

|

| | | | | |

|

| | | | |

| Name and Title | | Age | | Experience |

Jason P. Maxwell, General Counsel and Secretary

| | 46 | | Mr. Maxwell has served as General Counsel and Secretary of us and the general partner of our Advisor since June 2019. Mr. Maxwell joined Hines in June 2006 and has served as Senior Vice President - Legal and Co-Head of Legal at Hines since May 2019. Prior to that, he was a Vice President - Legal for Hines since September 2016 and is also the General Counsel of HALP, a position he has held since January 2014 (prior to that, he held the title of Corporate Counsel of Hines and HALP from May 2006 through December 2013). In his role at Hines, Mr. Maxwell created and leads the internal legal function for HALP and provides legal services to us, Hines Global Income Trust, HMS Income Fund and many of their affiliated entities, as well as serving as Assistant or Corporate Secretary to several of such entities. Mr. Maxwell has served as the General Counsel and Secretary of Hines Global Income Trust, the general partner of HGRIIALP and HMS Income Fund since June 2019. Since August 2015, he has also served as the Chief Compliance Officer of HMS Income Fund and its registered investment adviser, HMS Adviser LP. Among his other responsibilities, he provides corporate governance and general compliance guidance for the previously mentioned funds’ boards of directors. Prior to joining Hines, Mr. Maxwell was a partner in the law firm of Locke Liddell & Sapp LLP (n/k/a Locke Lord) where he practiced corporate and securities law. He graduated from the University of Miami with a B.B.A. in Finance and holds a J.D. from Georgetown University Law Center. He is a member of the State Bar of Texas.

|

EXECUTIVE COMPENSATION

We have no employees. Our day-to-day management functions are performed by our Advisor and its affiliates. All of our executive officers are employed by and receive compensation from our Advisor or its affiliates, for all of their services to the Hines organization, including their service as our executive officers. The compensation received by our executive officers is not paid or determined by us, but rather by our Advisor or affiliates of our Advisor based on all the services provided by these individuals to the Hines organization, including us. As a result, we do not have and our compensation committee has not considered, a compensation policy or program for our executive officers and have not included a “Compensation Discussion and Analysis,” or “Compensation Committee Report” in this proxy statement. See “Certain Relationships and Related Transactions” below for a discussion of fees and expenses payable to our Advisor and its affiliates.

STOCK OWNERSHIP BY DIRECTORS,

EXECUTIVE OFFICERS AND CERTAIN STOCKHOLDERS

Ownership

The following table shows, as of June 30, 2019, the amount of our common stock beneficially owned (unless otherwise indicated) by (1) any person who is known by us to be the beneficial owner of more than 5% of our outstanding common stock, (2) our directors, (3) our executive officers, and (4) all of our directors and executive officers as a group. Except as otherwise indicated, all shares are owned directly, and the owner of such shares has the sole voting and investment power with respect thereto.

|

| | | | | | | | |

| | | | | Common Shares Beneficially Owned | (2) |

Name of Beneficial Owner (1) | | Position | | Number of Common Shares | | Percentage of Class | |

| Jeffrey C. Hines | | Chairman of Our Board | | 1,111 |

| | * (3) (4) | |

| Charles M. Baughn | | Director | | 9,031 |