Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: NIPPONKOA Insurance Co., Ltd.

Subject Company: SOMPO JAPAN INSURANCE INC. (SEC File No. 132-02678)

Subject Company: NIPPONKOA Insurance Co., Ltd. (SEC File No. 132-02677)

[Note: The following are the corrected English versions of the press release and investor presentation material that were made public in Japan on July 29, 2009. They supersede the prior English versions that were filed on July 29, 2009 pursuant to Rule 425 under the Securities Act of 1933, as amended.]

July 29, 2009

| | | | |

| | Corporate Name: | | SOMPO JAPAN INSURANCE INC. |

| | Name of Representative: | | Masatoshi Sato, President and CEO |

| | (Code Number:8755 | | TSE, OSE, NSE, SSE and FSE) |

| | Contact: | | Hirofumi Shinjin, Manager of Public Relations Office of Corporate Communication Planning Department |

| | | | Telephone: +813-3349-3723 |

| | |

| | Corporate Name: | | NIPPONKOA Insurance Co., Ltd. |

| | Name of Representative: | | Makoto Hyodo, President and CEO |

| | (Code Number:8754 | | TSE, OSE and NSE) |

| | Contact: | | Manabu Ishikawa, Manager of Public Relations Department |

| | | | Telephone: +813-3593-5386 |

Execution of Agreement for Business Integration

SOMPO JAPAN INSURANCE INC. (President and Chief Executive Officer: Masatoshi Sato) (“SOMPO JAPAN”) and NIPPONKOA Insurance Co., Ltd. (President and Chief Executive Officer: Makoto Hyodo) (“NIPPONKOA”) (collectively, the “Parties”) entered into a “Memorandum of Understanding” for business integration on March 13, 2009. SOMPO JAPAN and NIPPONKOA hereby announce that the Parties resolved today at meetings of each company’s board of directors that SOMPO JAPAN and NIPPONKOA will enter into an agreement for business integration (the “Agreement”) that stipulates additional terms of the business integration and the share exchange ratio.(*)

The business integration is subject to shareholder approval at a shareholders’ meeting of each Party and to regulatory approvals.

I. Outline of the Agreement for Business Integration

| 1. | Name of the Joint Holding Company |

NKSJ Holdings, Inc.

| 2. | Location of the Head Office of the Joint Holding Company |

26-1, Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo

| 3. | Governance System of the Joint Holding Company |

(1) Company type

The Joint Holding Company will have a board of auditors. The governance system outlined below will be adopted to ensure fairness and transparency.

| (*) | In this press release, references to “share exchange” refer to the “kabushiki-iten” transaction under the laws of Japan, which was referred to as “joint stock transfer” or “joint stock exchange” in prior press release and other materials that have been made publicly available by the Parties in connection with the business integration contemplated herein. |

1/23

At the time of the incorporation of the Joint Holding Company, the two following representative directors will be appointed as co-CEOs.

Co-CEO and Representative Director and Chairman: Makoto Hyodo

Co-CEO and Representative Director and President: Masatoshi Sato

| | (3) | Directors and Corporate Auditors |

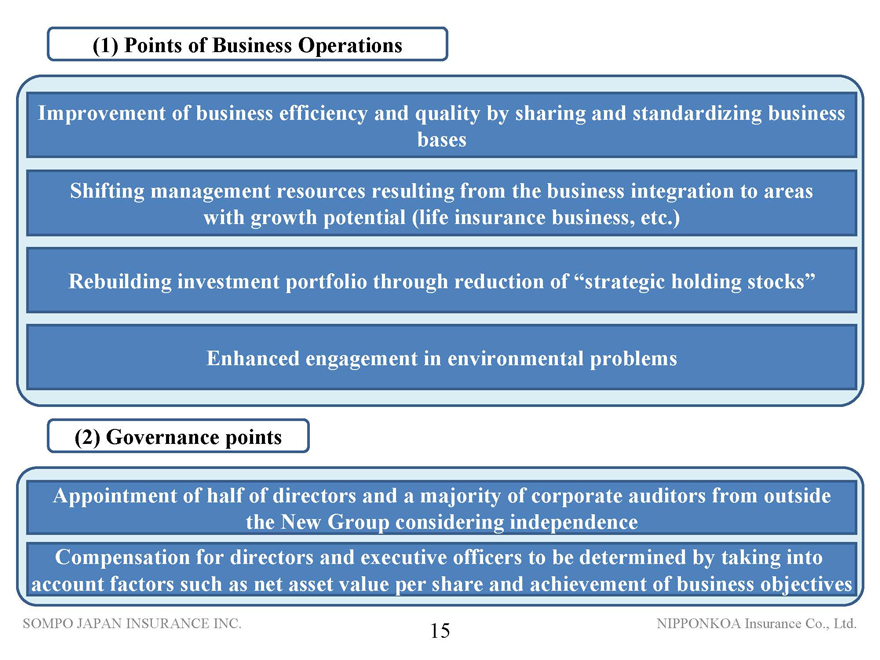

The number of directors and the number of corporate auditors of the Joint Holding Company will be as outlined below. The term of office of directors is one year. In addition, half of the directors will be appointed from outside companies to ensure fair and highly transparent group operations.

| | (i) | Number of directors of the Joint Holding Company: 12 (including six outside directors) |

| | (ii) | Number of corporate auditors of the Joint Holding Company: 5 (including three outside corporate auditors) |

| | (4) | Nomination and Compensation Committee |

The Joint Holding Company will establish the Nomination and Compensation Committee. The chairman and a majority of the members of this committee must be outside directors and/or outside corporate auditors. The Nomination and Compensation Committee will be responsible for appointing candidates for the Joint Holding Company’s directors and corporate auditors. The Nomination and Compensation Committee will also be involved in appointing candidates for the Parties’ directors, executive officers and corporate auditors after the Joint Holding Company has been established. The details will be determined by consultation between the Parties.

Compensation for directors and executive officers will be determined by taking into consideration factors such as net asset value per share and the status of achievement of business objectives from the medium to long term perspective of fostering corporate value and shareholder value.

| 4. | Summary of Share Exchange |

Details of allotment related to the share exchange (Share Exchange Ratio)

| | | | |

| | | SOMPO JAPAN | | NIPPONKOA |

Share Exchange Ratio | | 1 | | 0.9 |

(Note 1) One share of common stock of the Joint Holding Company will be allotted and delivered for each share of common stock of SOMPO JAPAN, and 0.9 shares of common stock of the Joint Holding Company will be allotted and delivered for each share of common stock of NIPPONKOA. However, the Share Exchange Ratio may be changed through mutual consultation of both Parties if there are material changes in any of the conditions upon which the ratio has been determined.

(Note 2) New shares to be issued by the Joint Holding Company (planned): 1,722,802,230 shares of common stock.

The number of shares provided above is calculated based on the total number of outstanding shares of the Parties as of March 31, 2009. The number of such new shares may be changed if treasury stock of the Parties is cancelled or if share options of the Parties are exercised prior to the incorporation of the Joint Holding Company.

2/23

| | (2) | Basis of calculation for the allotment in relation to the share exchange |

Please refer to Exhibit 1 entitled “Basis of Calculation for the Allotment in relation to the Share Exchange”.

| 5. | Schedule of Share Exchange |

| | |

| Execution of the Memorandum of Understanding for business integration | | March 13, 2009 |

| |

| Execution of the Agreement for business integration | | July 29, 2009 |

| |

| Preparation of a share exchange plan | | By the end of October 2009 (tentative) |

| |

| Extraordinary shareholders meeting to approve the share exchange plan | | Late December, 2009 (tentative) |

| |

| Date of incorporation and registration of the Joint Holding Company (effective date) | | April 1, 2010 (tentative) |

This schedule may be changed by mutual consultation of both Parties if any unavoidable complications arise in the course of the above procedures.

Decisions on matters that have not yet been finalized will be announced as soon as the relevant decisions are made.

II. Background, objectives and basic principles, and effects of business integration

1. Background and objectives and basic principles of business integration

The Parties’ background and objectives and basic principles of business integration were announced together with the Memorandum of Understanding for the business integration on March 13, 2009. (Summary of the announcement is attached as Exhibit 2).

2. Effects of business integration

SOMPO JAPAN and NIPPONKOA have chosen an arrangement for business integration in which the Parties will coexist under the umbrella of a Joint Holding Company to achieve business integration quickly. SOMPO JAPAN and NIPPONKOA will maintain and further expand and develop their respective customer bases by taking advantage of economies of scale, continuing to cooperate after integration and maintaining and reinforcing each Party’s own brand.

3/23

Moreover, SOMPO JAPAN and NIPPONKOA will enhance operational efficiency and quality by sharing and standardizing their business platforms, including products, back office operations and IT systems. The Parties will thus provide high quality services that meet needs of customers by taking the customers’ perspective into account.

In addition, SOMPO JAPAN and NIPPONKOA will aim to maximize integration synergy quickly through joint use of their business platforms.

| (1) | Perspective of customers |

SOMPO JAPAN and NIPPONKOA will review “from the perspective of customers” their entire service process, from the execution of an insurance contract to payment for an insurance claim. By using their know-how, infrastructures and management resources, while keeping in mind such keywords as “convenience” and “easy to understand,” SOMPO JAPAN and NIPPONKOA will seek to meet their customers’ expectations and provide the sense of security.

| | (i) | SOMPO JAPAN and NIPPONKOA plan to develop new products shared by the Parties in key product areas, including automobile insurance, fire insurance and personal accident insurance and will release them sequentially. SOMPO JAPAN and NIPPONKOA will keep in mind such keywords as “convenience” and “easy to understand” and provide new solutions to the various risks facing customers. |

| | (ii) | SOMPO JAPAN and NIPPONKOA will seek to improve services provided at the level of “agents,” where most client interactions occur. In order to accomplish this goal, the Parties will improve support for those agents in the areas of IT, products and consulting by sharing and jointly implementing education and IT systems including jointly developing a new retail business model to improve agent business efficiency (PT-R). |

| | (iii) | SOMPO JAPAN and NIPPONKOA will seek to provide high quality customer services by sharing claims handling services such as processing of accident reports and the initial handling of claims 24 hours a day, 365 days a year and by sharing various customer centers (call centers). |

| | (iv) | SOMPO JAPAN and NIPPONKOA seek to create a new integrated business system to serve as a joint basis for the Parties by bringing together the Parties’ IT system development capability, know-how and infrastructure. In this way, SOMPO JAPAN and NIPPONKOA will aim to improve convenience for customers, to provide safety and services of the highest quality, and to improve both the efficient system development and system functions. Moreover, SOMPO JAPAN and NIPPONKOA will further improve the quality of their business operations and build an efficient back office operation system. To that end, the Parties intend to share and standardize back office operations, such as sales-related back office operations, in coordination with the development of new products and integration into the new system. |

4/23

| (2) | Contribution to social welfare |

| | (i) | SOMPO JAPAN and NIPPONKOA will aim to contribute to social welfare in the areas of safety and security by using the know-how and business infrastructure developed by the Parties. Specifically, SOMPO JAPAN and NIPPONKOA will jointly promote an “eco-safety drive” in order to prevent both accidents and environmental problems. |

| | (ii) | SOMPO JAPAN and NIPPONKOA will proactively cope with the global environmental problems, and the Parties will jointly develop and provide products and services to address the problem of global warming. |

| (3) | Enhancement of corporate value |

| | (i) | Life insurance business |

SOMPO JAPAN and NIPPONKOA are contemplating the option of merging their subsidiary life insurance companies (Sompo Japan Himawari Life Insurance Co., Ltd. and NIPPONKOA Life Insurance Company, Limited, respectively). The Parties will strategically allocate management resources of the New Group to take advantage of growth potential in the life insurance business. SOMPO JAPAN and NIPPONKOA will aim to increase Embedded Value* by about ¥50 billion per year in three to five years after integration by providing attractive products to the market enlarged by our business integration.

(Note) Embedded Value (“EV”) is the sum of the net asset value of the company and the present value of future profits from in-force contracts.

| | (ii) | Asset management business |

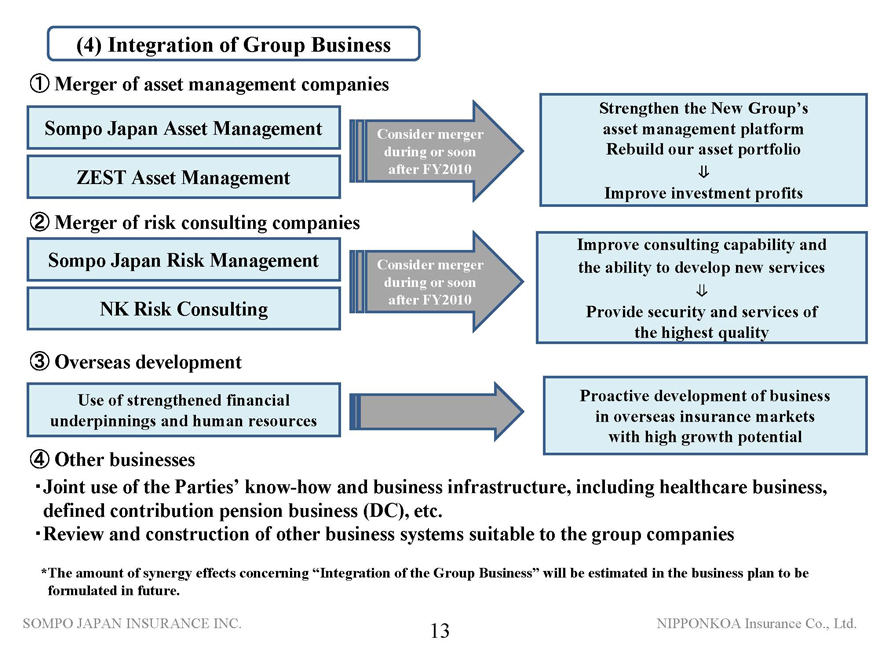

SOMPO JAPAN and NIPPONKOA are considering a possible merger of their subsidiary investment management companies (Sompo Japan Asset Management Co., Ltd. and ZEST Asset Management Limited, respectively) during or soon after fiscal 2010 in order to strengthen the New Group’s asset management platform.

The New Group will seek to improve investment profits by rebuilding its asset portfolio including through such measures as reduction of our ownership of strategic holding stocks.

| | (iii) | Risk consulting (management) business |

SOMPO JAPAN and NIPPONKOA are considering a merger of subsidiaries of both Parties that conduct risk consulting and management (Sompo Japan Risk Management Inc. and NK Risk Consulting Co., Ltd., respectively) during or soon after fiscal 2010 in order to improve the Party’s consulting capability and the ability to develop new services in response to increased and diversified risks. SOMPO JAPAN and NIPPONKOA will thus aim to provide new solution services by providing customers with security and services of the highest quality in the risk-consulting arena.

5/23

SOMPO JAPAN and NIPPONKOA will develop business in the overseas insurance market, which is an area of high growth potential, utilizing a stronger financial base and a better human resource pool made possible by the business integration.

SOMPO JAPAN and NIPPONKOA will jointly use the know-how and business infrastructure developed by the Parties in areas such as the healthcare business, and the defined contribution pension business (“DC”). Furthermore, the Parties will consider adopting measures through which integration benefits can be fully realized respecting other group companies.

| (4) | Synergy by business integration |

SOMPO JAPAN and NIPPONKOA will seek to maximize the synergy effects of integration as quickly as possible in order to enhance corporate value.

In addition, in order to improve group profits, SOMPO JAPAN and NIPPONKOA will shift management resources (personnel, capital, etc.) increased by integration to the promising areas including the life insurance market and overseas markets.

About ¥30 billion in synergy effect of integration is anticipated for fiscal 2012 including the amount provided below. SOMPO JAPAN and NIPPONKOA plan to make further announcements regarding anticipated synergy effects and the business plan of the New Group, reflecting such synergy effects, at the time of the announcement of the share exchange plan, scheduled around the end of October 2009.

6/23

| | | | |

| Domestic Non-Life Insurance Business |

| | |

| Effects of cost reductions by sharing products, IT systems and back office operations | | Effects of cost reductions through joint use of infrastructure and joint placement of orders | | Effects of increase of profits by sharing and improving know-how |

| | |

| About ¥12.5 billion | | About ¥5 billion | | About ¥10.5 billion |

| | |

| Group Business Operations |

| |

| Effects deriving from integration of life insurance companies, asset management companies and risk management companies | | Effects deriving from integration of overseas business, healthcare business and defined contribution pension business |

| * | The total synergy value provided above is our estimate of such synergy value (pretax) resulting from the business integration as of the end of fiscal 2012 (compared to the estimates for fiscal 2009); however, we also expect to incur temporary costs (an average of ¥5.5 billion per year) for about three years after the integration. |

7/23

Exhibit 1

Basis of Calculation for the Allotment in relation to the Share Exchange

1. Calculation basis

In order to ensure the fairness of the Parties’ respective calculation of the share exchange ratio to be used in the Share Exchange, SOMPO JAPAN requested Nomura Securities Co., Ltd. (“Nomura Securities”), Mizuho Securities Co., Ltd. (“Mizuho Securities”) and Goldman Sachs Japan Co., Ltd. (“Goldman Sachs”), and NIPPONKOA requested Merrill Lynch Japan Securities Co., Ltd. (“Merrill Lynch”) and Mitsubishi UFJ Securities Co., Ltd. (“Mitsubishi UFJ Securities”), to perform fairness analyses relating to the calculation of the share exchange ratio in connection with the business integration.

Because the common stock of each of the Parties has a market price, Nomura Securities has adopted the average market price method, as well as the comparable peer company method, the dividend discount model analysis method (the “DDM Method”) and contribution analysis, for calculating the share exchange ratio. The calculation results based on each method are as follows. The calculation range of the share exchange ratio shows the range of the number of shares of the Joint Holding Company’s common stock that are to be allotted for each share of common stock of NIPPONKOA, assuming that one share of common stock of the Joint Holding Company will be allotted for each share of SOMPO JAPAN’s common stock.

| | | | |

| | | Adopted Method | | Calculation Range of

Share Exchange Ratio |

| (1) | | Average Market Price Method | | 0.85 ~ 0.92 |

| (2) | | Comparable Peer Company Method | | 0.53 ~ 0.69 |

| (3) | | DDM Method | | 0.74 ~ 1.05 |

| (4) | | Contribution Analysis | | 0.54 ~ 1.26 |

In the average market price method, the calculation range of the share exchange ratio is based on (1) the closing stock price on July 28, 2009 (the “Record Date”); (2) the average closing stock price during the week before the Record Date; (3) the average closing stock price during the month before the Record Date; (4) the average closing stock price between May 21, 2009 (one business day after the date of the disclosure of the financial results for the fiscal year ended March 31, 2009) and the Record Date; (5) the average closing stock price during the three months before the Record Date and (6) the average closing stock price between March 16, 2009 (one business day after the Memorandum of Understanding was announced) and the Record Date.

8/23

Nomura Securities has used the information provided by the Parties, in addition to publicly available information, to conduct its analysis. Nomura Securities has not conducted any independent verification of the accuracy and completeness of this information, but rather has assumed that all such materials and information are accurate and complete. In addition, Nomura Securities has not made any independent evaluation, appraisal or assessment of the assets or liabilities (including contingent liabilities) of either party or their affiliates, nor has Nomura Securities independently analyzed or assessed each individual asset and liability. Nomura Securities has not appointed any third party for appraisal or assessment. Nomura Securities calculated the share exchange ratio based on information and economic conditions as of July 28, 2009, and Nomura Securities assumes that the financial projections (including the profit plan and other information) reported by the Parties have been rationally prepared on the basis of the best possible estimates and judgment currently available from the management of each Party.

Because the common stock of each of the Parties has a market price, Mizuho Securities has adopted the average market price method, as well as the comparable peer company method and the dividend discount model analysis method (the “DDM Method”), for calculating the share exchange ratio. The calculation results based on each method are as follows. The calculation range of the share exchange ratio shows the range of the number of shares of the Joint Holding Company’s common stock to be allotted for each share of common stock of NIPPONKOA, assuming that one share of common stock of the Joint Holding Company will be allotted for each share of SOMPO JAPAN’s common stock.

| | | | |

| | | Adopted Method | | Calculation Range of

Share Exchange Ratio |

(1) | | Average Market Price Method | | 0.851 ~ 0.942 |

(2) | | Comparable Peer Company Method | | 0.485 ~ 0.927 |

(3) | | Dividend Discount Model Analysis (DDM Method) | | 0.453 ~ 1.020 |

In the average market price method, the calculation range of the share exchange ratio is based on (1) the closing stock price on July 24, 2009 (one business day before July 25, 2009, when there were press reports about the share exchange ratio) (the “Record Date”); (2) the average closing stock price during the week before the Record Date; (3) the average closing stock price during the month before the Record Date; and (4) the average closing stock price during the three months before the Record Date.

Mizuho Securities has used the information provided by the Parties, in addition to publicly available information, to conduct its analysis. Mizuho Securities has not conducted any independent verification of the accuracy and completeness of this information, but rather has assumed that all such materials and information are accurate and complete. In addition, Mizuho Securities has not made any independent evaluation, appraisal or assessment of the assets or liabilities (including contingent liabilities) or reserves of either party, their subsidiaries or their affiliates, nor has Mizuho Securities independently analyzed or assessed each individual asset or liability or reserve. Mizuho Securities has not appointed any third party for appraisal or assessment. Mizuho Securities calculated the share exchange ratio based on information and economic conditions up to and as of July 28, 2009, and Mizuho Securities assumes that the financial projections (including the profit plan and other information) reported by the Parties have been rationally prepared on the basis of the best possible estimates and judgment currently available from the management of each Party.

9/23

Goldman Sachs performed a stock price analysis and a comparable companies analysis based on publicly available information, and a DDM analysis based on financial projections prepared by managements of the Parties, as approved for Goldman Sachs’ use by SOMPO JAPAN. The results of respective analyses are shown below. The below ranges of the share exchange ratio are for a number of shares of the Joint Holding Company to be issued in exchange for one share of NIPPONKOA common stock assuming that one share of the Joint Holding Company stock will be issued in exchange for one share of SOMPO JAPAN common stock. In performing the stock price analysis, Goldman Sachs used July 24, 2009 as the base date, and reviewed the closing market prices of the Parties on the base date and the closing market prices of the Parties during the one-month, three-month and six-month period ending on the base date as a basis for the analysis. In addition, no company used in this analysis as a comparison is directly comparable to SOMPO JAPAN and NIPPONKOA. Goldman Sachs delivered to SOMPO JAPAN a written opinion, approved by the fairness committee of Goldman Sachs & Co., that, as of July 29, 2009, and based upon and subject to certain conditions, including the below assumptions, the share exchange ratio of one share of common stock of the Joint Holding Company to be issued in exchange for one share of common stock of SOMPO JAPAN agreed to pursuant to the Agreement was fair to the shareholders of SOMPO JAPAN from a financial point of view. Goldman Sachs provided its advisory services and the opinion for the information and assistance of the Board of Directors of SOMPO JAPAN in connection with its consideration of the share exchange and such opinion does not constitute a recommendation as to how any shareholder of SOMPO JAPAN should vote with respect to such share exchange or any other matter. Goldman Sachs did not recommend any specific share exchange ratio to SOMPO JAPAN or its Board of Directors or that any specific share exchange ratio constituted the only appropriate share exchange ratio. Please refer to Note 1 on the bottom of Exhibit 1 hereto for a more detailed description about the assumptions and disclaimers for the analyses and opinion of Goldman Sachs.

| | | | |

| | | Analysis Method | | Range of Share Exchange Ratio |

| | Stock Price Analysis | | 0.77 ~ 1.57 |

‚ | | Comparable Companies Analysis | | 0.53 ~ 2.74 |

ƒ | | DDM Analysis | | 0.51 ~ 1.24 |

Goldman Sachs’ analyses and opinion are necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to Goldman Sachs as of, July 29, 2009, and Goldman Sachs assumes no responsibility for updating, revising or reaffirming this opinion based on circumstances, developments or events occurring after the date thereof. Goldman Sachs assumed with SOMPO JAPAN’s consent that the financial forecasts for the Parties, including synergies, have been reasonably prepared on a basis reflecting the best currently available estimates and judgment of management of SOMPO JAPAN.

10/23

Merrill Lynch, considering the trends of the market share prices, forecasts and other aspects of the performance of NIPPONKOA and Sompo Japan, conducted its valuation using a market price analysis, a comparable companies analysis and a discounted cash flow (“DCF”) analysis, and the Board of Directors of NIPPONKOA received a valuation report from Merrill Lynch on July 29, 2009. (Furthermore, the Board of Directors of NIPPONKOA received a written opinion on July 29, 2009, to the effect that, based on the assumptions set forth below and other conditions set forth in such written opinion, the Share Exchange Ratio to be used in the Share Exchange is fair, from a financial point of view, to the holders of common stock of NIPPONKOA, other than Sompo Japan and its affiliates. The written opinion will be attached to the convocation notice for the meeting of NIPPONKOA’s stockholders to vote on the proposed Share Exchange. Moreover, the Board of Directors of NIPPONKOA has received supplementary explanation from Merrill Lynch concerning the assumptions and disclaimers related to its analyses and opinions in evaluating the stockholder value of each company. Please see Note 2 to Attachment 1 for details.) The market price analysis was based (1) on the closing price of each company on July 24, 2009 (the “Record Date (i)”) and the average closing prices of each company for the one-month, three-month and six-month periods up to and including the Record Date (i) and (2) on the closing prices of each company on March 11, 2009 (the “Record Date (ii)”), the business day immediately prior to the day on which the Share Exchange of NIPPONKOA and Sompo Japan was reported by newspapers, and the average closing prices for the one-month, three-month and six-month periods up to and including the Record Date (ii). The table below sets forth the primary methodologies that Merrill Lynch used in its valuations of NIPPONKOA and Sompo Japan, along with the ranges of share exchange ratios obtained as a result of such valuations are set forth below. (The following ranges represent the number of shares of NIPPONKOA to be transferred for one share of the Joint Holding Company, assuming that each share of Sompo Japan is to be transferred for one share of the Joint Holding Company.)

| | | | |

Methodology | | Range of Share Exchange Ratios |

1-1 | | Market Price Analysis (Record Date (i)) | | 0.85 ~ 1.01 |

1-2 | | Market Price Analysis (Record Date (ii)) | | 1.01 ~ 1.44 |

2 | | Comparable Companies Analysis | | 0.62 ~ 0.96 |

3 | | DCF Analysis | | 0.72 ~ 1.29 |

11/23

Merrill Lynch, in preparing its written opinion and the valuations set forth in its valuation report, which were the basis for the written opinion, has assumed and relied on the accuracy and completeness of all information supplied to it by NIPPONKOA and Sompo Japan or otherwise made available to Merrill Lynch, discussed with or reviewed by Merrill Lynch, or publicly available, and has not assumed any responsibility for independently verifying such information or undertaken an independent evaluation or appraisal of any of the assets, liabilities or facilities of NIPPONKOA or Sompo Japan. Moreover, with respect to the prospects for business, profits, cash flow, assets, liabilities, new business plans, and other matters furnished to or discussed with Merrill Lynch, in addition to any information concerning cost savings expected to arise from the Share Exchange or the expenses related to the execution of the Share Exchange including the amount and timing of such cost savings and related expenses and synergies, Merrill Lynch assumed that they were reasonably prepared and reflected the best currently available estimates and judgment of NIPPONKOA’s or Sompo Japan’s management as to the expected future financial performance of NIPPONKOA or Sompo Japan. The written opinion and valuation report provided by Merrill Lynch are necessarily based on the information available to it and economic conditions as they existed on July 29, 2009, and Merrill Lynch assumes no responsibility to update, revise, or reconfirm either its opinion or analyses based on any circumstances, changes, or for any other cause arising after such date.

Merrill Lynch is acting as financial advisor to NIPPONKOA and will receive a fee from NIPPONKOA for its services, a significant portion of which is contingent on the consummation of the Share Exchange.

Because the common stock of each of the Parties has a market price, Mitsubishi UFJ Securities has adopted the average market price method, as well as the comparable peer company method based on the revised net assets and the dividend discount model analysis method (the “DDM Method”), for calculating the share exchange ratio. The calculation results based on each method are as follows. The calculation range of the share exchange ratio shows the range of the number of shares of the Joint Holding Company’s common stock to be allotted for each share of common stock of NIPPONKOA, assuming that one share of common stock of the Joint Holding Company will be allotted for each share of SOMPO JAPAN’s common stock.

| | | | |

| | | Adopted Method | | Calculation Range of

Share Exchange Ratio |

(1) | | Average Market Price Method (Record Date (i)) | | 0.773 ~ 1.121 |

(2) | | Average Market Price Method (Record Date (ii)) | | 0.613 ~ 1.571 |

(3) | | Comparable Peer Company Method | | 0.710 ~ 0.862 |

(4) | | DDM Method | | 0.773 ~ 1.114 |

In the average market price method, the closing stock price has been applied for the periods of one month and three months on and until the record date of July 27, 2009 (the “Record Date” (i)) and for any day after March 16, 2009 (one business day after the announcement on the Memorandum of Understanding), as well as for the period of one month, three months and six months on and until the record date of March 11, 2009 (the “Record Date” (ii)) (one business day before March 12, 2009, when there were press reports speculating about the business integration).

12/23

Mitsubishi UFJ Securities has used the information provided by the Parties, in addition to publicly available information, to conduct its analysis. Mitsubishi UFJ Securities has not conducted any independent verification of the accuracy and completeness of this information, but rather has assumed that all such materials and information are accurate and complete. In addition, Mitsubishi UFJ Securities has not made any independent evaluation, appraisal or assessment of the assets or liabilities (including contingent liabilities) of either party or their affiliates, nor has Mitsubishi UFJ Securities independently analyzed or assessed each individual asset and liability. Mitsubishi UFJ Securities has not appointed any third party for appraisal or assessment. Mitsubishi UFJ Securities calculated the share exchange ratio based on information and economic conditions up to and as of July 27, 2009, and Mitsubishi UFJ Securities assumes that the financial projections (including the profit plan and other information) reported by the Parties have been rationally prepared on the basis of the best possible estimates and judgment currently available from the management of each Party.

2. Determination of the Share Exchange Ratio

SOMPO JAPAN and NIPPONKOA considered various factors, including the financial conditions, asset conditions and future outlook of the Parties, and engaged in careful deliberation concerning the share exchange ratio, and in the process, SOMPO JAPAN referred to the results of analyses of Nomura Securities, Mizuho Securities and Goldman Sachs, and NIPPONKOA referred to the results of analyses of Merrill Lynch and Mitsubishi UFJ Securities. Today, the Parties concluded that the share exchange ratio mentioned above is appropriate, and agreed on the ratio.

Furthermore, SOMPO JAPAN obtained opinions from Nomura Securities and Mizuho Securities, dated July 29, 2009, stating that from a financial point of view, the agreed share exchange ratio is fair to the shareholders of SOMPO JAPAN, subject to the conditions set forth hereunder and certain other conditions. SOMPO JAPAN has also received an opinion from Goldman Sachs, dated July 29, 2009, stating that from a financial point of view, the agreed share exchange ratio of one share of common stock of the Joint Holding Company to be issued in exchange for each share of common stock of SOMPO JAPAN is fair to the shareholders of SOMPO JAPAN, subject to the conditions set forth hereunder and certain other conditions. Also, NIPPONKOA obtained an opinion from Merrill Lynch and Mitsubishi UFJ Securities dated July 29, 2009, stating that from a financial point of view, the agreed share exchange ratio is fair to the shareholders of NIPPONKOA, subject to the conditions set forth hereunder and certain other conditions

3. Relationship with entities that performed fairness analyses

None of Nomura Securities, Goldman Sachs nor Mizuho Securities, the institutions that performed fairness analyses relating to the calculation of the share exchange ratio for SOMPO JAPAN, is a related party of SOMPO JAPAN, and none of them has a material interest in the reorganization contemplated in this document.

Furthermore, neither Merrill Lynch nor Mitsubishi UFJ Securities, the institutions that performed fairness analyses relating to the calculation of the share exchange ratio for NIPPONKOA, constitutes a related party with respect to NIPPONKOA, and none of them has a material interest in the reorganization.

13/23

(Note 1)

Goldman Sachs and its affiliates are engaged in investment banking and financial advisory services, commercial banking, securities trading, investment management, principal investment, financial planning, benefits counseling, risk management, hedging, financing, brokerage activities and other financial and non-financial activities and services for various persons and entities. In the ordinary course of these activities and services, Goldman Sachs and its affiliates may at any time make or hold long or short positions and investments, as well as actively trade or effect transactions, in the equity, debt and other securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of third parties, SOMPO JAPAN, NIPPONKOA and any of their respective affiliates or any currency or commodity that may be involved in the transaction contemplated by the Agreement (the “Transaction”) for their own account and for the accounts of their customers. Goldman Sachs has acted as financial advisor to SOMPO JAPAN in connection with, and has participated in certain of the negotiations leading to, the Transaction. Goldman Sachs expects to receive fees for its services in connection with the Transaction, a portion of which is contingent upon consummation of the Transaction, and SOMPO JAPAN has agreed to reimburse certain of Goldman Sachs’ expenses arising, and indemnify Goldman Sachs against certain liabilities that may arise, out of its engagement. In addition, Goldman Sachs has provided and is currently providing certain investment banking and other financial services to SOMPO JAPAN and its affiliates. Goldman Sachs also may provide investment banking and other financial services to SOMPO JAPAN, NIPPONKOA and their respective affiliates in the future. In connection with the above-described services, Goldman Sachs has received, and may receive, compensation.

In connection with its analyses and opinion, Goldman Sachs has reviewed, among other things, the Agreement; the Annual Securities Reports (Yuka Shoken Houkoku-Sho) of SOMPO JAPAN and NIPPONKOA for the five fiscal years ended March 31, 2009; certain other communications from SOMPO JAPAN and NIPPONKOA to their respective stockholders; certain internal financial analyses and forecasts for SOMPO JAPAN prepared by its management and certain internal analyses and forecasts for NIPPONKOA prepared by its management and reviewed by the management of SOMPO JAPAN, in each case as approved for Goldman Sachs’ use by SOMPO JAPAN (the “Forecasts”), including certain cost savings projected by the managements of SOMPO JAPAN and NIPPONKOA to result from the Transaction, as prepared by the managements of SOMPO JAPAN and NIPPONKOA and approved for Goldman Sachs’ use by SOMPO JAPAN (the “Synergies”). Goldman Sachs also has held discussions with members of the senior managements of SOMPO JAPAN and NIPPONKOA regarding their assessment of the past and current business operations, financial condition and future prospects of NIPPONKOA and with the members of senior management of SOMPO JAPAN and NIPPONKOA regarding their assessment of the past and current business operations, financial condition and future prospects of SOMPO JAPAN and the strategic rationale for, and the potential benefits of, the Transaction. In addition, Goldman Sachs has reviewed the reported price and trading activity for the common shares of SOMPO JAPAN and NIPPONKOA, compared certain financial and stock market information for SOMPO JAPAN and NIPPONKOA with similar information for certain other companies the securities of which are publicly traded, considered the relative exposure of SOMPO JAPAN and NIPPONKOA to losses from financial guarantee insurance on CDO securities, and performed such other studies and analyses, and considered such other factors, as Goldman Sachs considered appropriate.

14/23

For purposes of rendering its opinion, Goldman Sachs has relied upon and assumed, without assuming any responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, discussed with or reviewed by Goldman Sachs and Goldman Sachs does not assume any liability for any such information. In that regard, Goldman Sachs has assumed with the consent of SOMPO JAPAN that the Forecasts, including the Synergies, have been reasonably prepared on a basis reflecting the best currently available estimates and judgments of the management of SOMPO JAPAN. In addition, Goldman Sachs has not made an independent evaluation or appraisal of the assets and liabilities (including any contingent, derivative or off-balance-sheet assets and liabilities) of SOMPO JAPAN or NIPPONKOA, or any of their respective subsidiaries, and Goldman Sachs has not been furnished with any such evaluation or appraisal. Goldman Sachs also has assumed that all governmental, regulatory or other consents and approvals necessary for the consummation of the Transaction will be obtained without any adverse effect on the Joint Holding Company, SOMPO JAPAN or NIPPONKOA or on the expected benefits of the Transaction in any way meaningful to its analysis. Goldman Sachs also assumed that the Transaction will be consummated on the terms set forth in the Agreement, without the waiver or modification of any term or condition the effect of which would be in any way meaningful to its analysis. Goldman Sachs is not an actuary and its services did not include any actuarial determination or evaluation by Goldman Sachs or any attempt to evaluate actuarial assumptions. In that regard, Goldman Sachs has made no analysis of, and expresses no opinion as to, the adequacy of the reserves of SOMPO JAPAN, or NIPPONKOA. In addition, Goldman Sachs is not expressing any opinion as to the impact of the Transaction on the solvency or viability of SOMPO JAPAN, NIPPONKOA or the Joint Holding Company or the ability of SOMPO JAPAN, NIPPONKOA or the Joint Holding Company to pay its obligations when they come due, and its opinion does not address any legal, regulatory, tax or accounting matters. Goldman Sachs’ opinion does not address the underlying business decision of SOMPO JAPAN to engage in the Transaction, or the relative merits of the Transaction as compared to any strategic alternatives that may be available to SOMPO JAPAN. The opinion addresses only the fairness from a financial point of view to the common shareholders of SOMPO JAPAN, as of July 29, 2009, of the share exchange ratio of one share of common stock of the Joint Holding Company to be issued in exchange for each share of common stock of SOMPO JAPAN pursuant to the Agreement. Goldman Sachs does not express any view on, and its opinion does not address, any other term or aspect of the Agreement or Transaction, including, without limitation, the fairness of the Transaction to, or any consideration received in connection therewith by, NIPPONKOA or the common shareholders of NIPPONKOA or any other class of securities, creditors, or other constituencies of SOMPO JAPAN or NIPPONKOA; nor as to the fairness of the amount or nature of any compensation to be paid or payable to any of the officers, directors or employees of SOMPO JAPAN or NIPPONKOA, or class of such persons in connection with the Transaction, whether relative to the share exchange ratio pursuant to the Agreement or otherwise. Goldman Sachs is not expressing any opinion as to the prices at which shares of SOMPO JAPAN, the Joint Holding Company, or NIPPONKOA will trade at any time.

The preparation of a fairness opinion is a complex process and is not necessarily susceptible to partial analysis or summary description. Selecting portions of the analyses or of the summary set forth above, without considering the analyses as a whole, could create an incomplete view of the processes underlying Goldman Sachs’ opinion. In arriving at its fairness determination, Goldman Sachs considered the results of all of its analyses and did not attribute any particular weight to any factor or analysis considered by it. Rather, Goldman Sachs made its determination as to fairness on the basis of its experience and professional judgment after considering the results of all of its analyses.

15/23

(Note 2)

Both the valuation report and the written opinion delivered by Merrill Lynch were prepared solely for the use of the Board of Directors of NIPPONKOA in connection with its evaluation of the share exchange ratio for the Share Exchange, and may not be used or relied upon for any other purpose.

Merrill Lynch has made qualitative judgments as to the significance and relevance of each analysis and each factor considered in the course of preparing these documents. Accordingly, Merrill Lynch believes that its analysis must be considered as a whole and that selecting portions of its analysis and factors, without considering all analyses and factors, could create an incomplete view of the processes underlying such analysis and opinion. In its analysis, Merrill Lynch made numerous assumptions with respect to NIPPONKOA, Sompo Japan, industry performance and regulatory environment, general business, economic, market and financial conditions, as well as other matters, many of which are beyond the control of NIPPONKOA and involve the application of complex methodologies and educated judgment. No company, business or transaction used in any analysis as a comparison is identical to NIPPONKOA, Sompo Japan, or the Share Exchange. Analyses relating to the value of businesses or securities are not appraisals and may not reflect the present or future prices at which businesses, companies or securities may actually be sold, which may be significantly different from those suggested by those analysis. Accordingly, these analyses and estimates are inherently subject to substantial uncertainty.

Merrill Lynch has not undertaken an independent evaluation of the solvency or fair value of NIPPONKOA or of Sompo Japan, and has assumed, with the consent of NIPPONKOA, that certain accounting and tax-related procedures will be followed in connection with this transaction. Merrill Lynch has assumed that in the course of obtaining the necessary regulatory consents or approvals for this transaction, no restrictions, including any divestiture requirements or amendments or modifications, will be imposed by the relevant authorities that will have a material adverse affect on the contemplated benefits of this transaction.

In connection with the preparation of the written opinion, Merrill Lynch has not been authorized by NIPPONKOA or its Board of Directors to solicit, nor has it solicited, third-party indications of interest for the acquisition of all or any part of NIPPONKOA.

16/23

NIPPONKOA has agreed to indemnify Merrill Lynch for certain liabilities arising out of its engagement. Merrill Lynch has, in the past, provided financial advisory and financial services to NIPPONKOA and Sompo Japan and has received, and may receive, fees for the rendering of such services. Further, in the ordinary course of business, Merrill Lynch or its affiliates may actively trade the common stock or other securities of NIPPONKOA, as well as the common stock or other securities of Sompo Japan for its own account and for the accounts of its customers and, accordingly, may at any time hold a long or short position in such securities.

Neither the valuation report nor the written opinion delivered by Merrill Lynch address the merits of the underlying decision by NIPPONKOA to engage in this transaction or constitutes a recommendation to any stockholder of NIPPONKOA as to how such stockholder should vote on (or whether any opposing stockholder should exercise its statutory opposition rights of appraisal in respect of) this transaction or any matter related thereto. In addition, Merrill Lynch has not been asked to address, nor do the valuation report or the written opinion address, the fairness to, or any other consideration of, the holders of any class of securities, creditors or other constituencies of NIPPONKOA other than the holders of the common stock of NIPPONKOA. Merrill Lynch does not express any opinion herein as to the prices at which shares of NIPPONKOA, Sompo Japan or the Joint Holding Company will trade following the announcement or consummation of this transaction, or as to the appropriateness of the trade of any such shares.

17/23

Exhibit 2

Background and Objectives and Basic Principle of Business Integration

I. Background and objectives of business integration

In the face of the declining birthrate and aging society – the significant challenges Japan faces in the medium to long-term period – as well as of increased risks associated with depopulating society, deteriorating global climate changes, and in response to the diversified consumer demands amidst the individual’s lifestyle changes, companies are urged to take proper actions and contribute to social safety and to customers’ sense of security.

Based on this shared perspective, SOMPO JAPAN and NIPPONKOA decided to establish a “new solution service group which provides consumers with security and service of the highest quality and contribute to social welfare” (the “New Group”), while sharing as a unitary group the strengths nurtured through 120 years of their respective histories.

II. Management’s vision and the New Group’s aspirations

1. The group which seeks to provide the highest-quality security and service

SOMPO JAPAN and NIPPONKOA will further strengthen the product development, the claims handling capacity, and the IT capability while providing an increasing number of customers with the security and service of the highest quality through the combined distribution channels of the group.

2. The group with focus on its business in Japan

SOMPO JAPAN and NIPPONKOA will focus on their business in Japan and enhance the brand value of the Parties in Japan as well as by sharing the business platform, improve the group management efficiency and further bolster their competitiveness.

3. The group which provides a broad range of solutions friendly to the society and the environment

SOMPO JAPAN and NIPPONKOA will seek to provide a broad range of solutions to people’s lives and corporate activities in the areas of health, medical care and environment that transcend the conventional framework of insurance business. By maintaining proactive communications with various stakeholders, SOMPO JAPAN and NIPPONKOA will seek to fulfill their corporate social responsibility (CSR) and aim to achieve a sound balance between the environment and the business management through adoption of measures designed for global warming.

4. The group which seeks to maximize the shareholder value

SOMPO JAPAN and NIPPONKOA will seek to maximize their shareholder value by efficiently allocating the management resources to business areas with growth potential including the life insurance business, the overseas insurance business and the asset management business and improving business efficiency in the group, and will aim to realize fair and sustainable return to their shareholders. SOMPO JAPAN and NIPPONKOA will also further strive to achieve transparency in corporate governance and seek to establish brand recognition for the group underpinned by profitability, growth potential, trust and soundness.

18/23

5. The group with a free, vigorous, open and energetic corporate culture

SOMPO JAPAN and NIPPONKOA will use their know-how and revitalize the organization through the provision of opportunities for employee interactions at various levels and regions as well as joint learning opportunities. SOMPO JAPAN and NIPPONKOA aim to build up a group where agents and employees can feel satisfied with their work and grow together as the best partners.

6. The group independent from the influence of any corporate or financial group

As an independent group, SOMPO JAPAN and NIPPONKOA will establish equal and friendly relationships with any corporate or financial group.

III. Basic principle of business integration

1. Perspective of customers

SOMPO JAPAN and NIPPONKOA will make all the value judgments from the “customers’ perspective” and pursue the best business practices.

2. Emphasis on speed

SOMPO JAPAN and NIPPONKOA will place emphasis on speed with the aim to quickly realize the effects of the growth strategy, the business integration and the business alliance.

3. Independent group from any corporate or financial group

SOMPO JAPAN and NIPPONKOA will establish equal and friendly relationships with any corporate or financial group as an independent New Group, with an understanding that the Parties will continue to operate under the Joint Holding Company.

4. Equal spirit

After the integration, the New Group will abide by the spirit of equality between the Parties.

5. Enhancement of corporate value

Subject to the above, SOMPO JAPAN and NIPPONKOA will expeditiously and aggressively implement measures to boost the corporate value of the entire New Group.

19/23

Exhibit 3

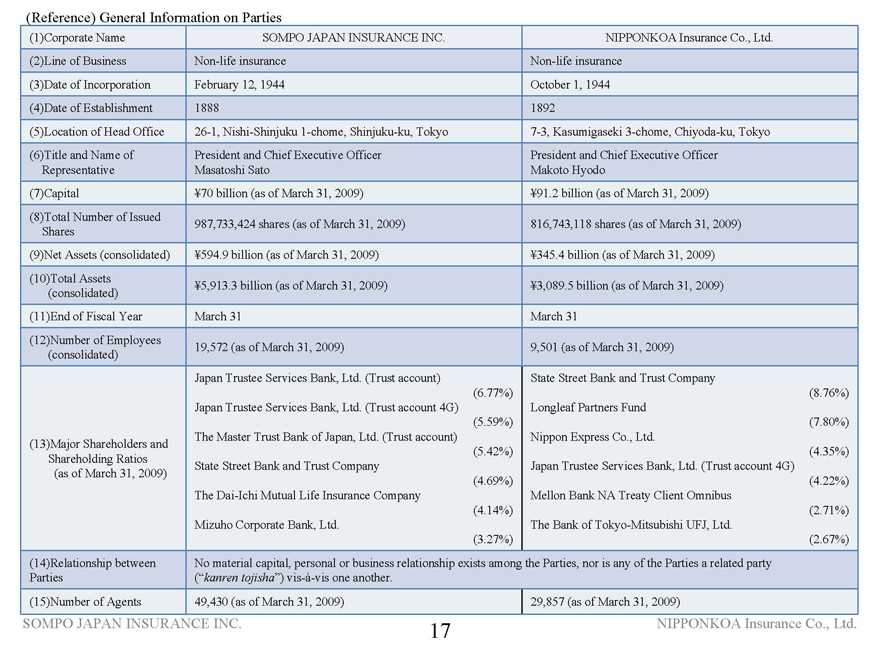

General Information on Parties

| | | | |

| Corporate Name | | SOMPO JAPAN INSURANCE INC. | | NIPPONKOA Insurance Co., Ltd. |

| | |

| Line of Business | | Non-life insurance | | Non-life insurance |

| | |

| Date of Incorporation | | February 12, 1944 | | October 1, 1944 |

| | |

| Date of Establishment | | 1888 | | 1892 |

| | |

| Location of Head Office | | 26-1, Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo | | 7-3, Kasumigaseki 3-chome, Chiyoda-ku, Tokyo |

| | |

| Title and Name of Representative | | President and Chief Executive Officer Masatoshi Sato | | President and Chief Executive Officer Makoto Hyodo |

| | |

Capital (as of March 31, 2009) | | ¥70 billion | | ¥91.2 billion |

| | |

Total Number of Issued Shares (as of March 31, 2009) | | 987,733 thousand shares | | 816,743 thousand shares |

| | |

Net Assets (consolidated) (as of March 31, 2009) | | ¥594.9 billion | | ¥345.4 billion |

| | |

Total Assets (consolidated) (as of March 31, 2009) | | ¥5,913.3 billion | | ¥3,089.5 billion |

| | |

| End of Fiscal Year | | March | | March |

| | |

Number of Employees (consolidated) (as of March 31, 2009) | | 19,572 | | 9,501 |

| | |

Major Shareholders and Shareholding Ratios (as of March 31, 2009) | | Japan Trustee Services Bank, Ltd. (Trust account) (6.77%) Japan Trustee Services Bank, Ltd (Trust account 4G) (5.59%) The Master Trust Bank of Japan, Ltd. (Trust account) (5.42%) State Street Bank and Trust Company (4.69%) The Dai-Ichi Mutual Life Insurance Company (4.14%) Mizuho Corporate Bank, Ltd. (3.27%) | | State Street Bank and Trust Company (8.76%) Longleaf Partners Fund (7.80%) Nippon Express Co., Ltd. (4.35%) Japan Trustee Services Bank, Ltd. (Trust account 4G) (4.22%) Mellon Bank NA Treaty Client Omnibus (2.71%) The Bank of Tokyo-Mitsubishi UFJ, Ltd. (2.67%) |

| |

| Relationship between Parties | | No material capital, personal or business relationship exists among the Parties, nor is any of the Parties a related party (“kanren tojisha”) vis-à-vis one another. |

| | |

Number of Agents (as of March 31, 2009) | | 49,430 | | 29,857 |

| | |

Network in Japan (as of July 1, 2009) | | Branch offices (109), sub-branch offices of the sales section (537); claims handling and service offices (265) | | Branch offices (79), sub-branch offices of the sales section (415); claims handling offices (183) |

| | | | |

Number of Overseas Offices (as of July 1, 2009) | | 93 offices in 29 countries | | 26 offices in 17 countries |

| | |

| URL | | http://www.sompo-japan.co.jp | | http://www.nipponkoa.co.jp |

20/23

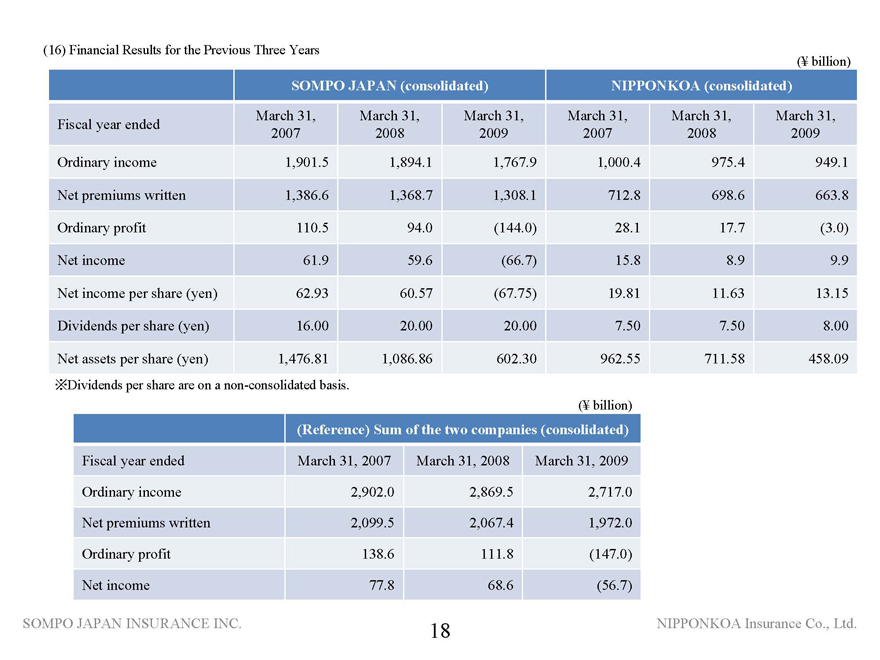

(Financial Results for the Previous Three Years)

(Data below listed in ¥100 millions, except per share data)

| | | | | | |

Consolidated basis | | | | | | |

| | | (1) SOMPO JAPAN INSURANCE INC. |

Fiscal year ended | | March 31, 2007 | | March 31, 2008 | | March 31, 2009 |

Ordinary income | | 19,015 | | 18,941 | | 17,679 |

Net premiums written | | 13,866 | | 13,687 | | 13,081 |

Ordinary profit | | 1,105 | | 940 | | (1,440) |

Net income | | 619 | | 596 | | (667) |

Net income per share (yen) | | 62.93 | | 60.57 | | (67.75) |

Dividends per share (yen)* | | 16.00 | | 20.00 | | 20.00 |

Net assets per share (yen) | | 1,476.81 | | 1,086.86 | | 602.30 |

* Dividends per share are on a non-consolidated basis. (Data below listed in ¥100 millions, except per share data) |

Consolidated basis | | | | | | |

| | | (2) NIPPONKOA Insurance Co., Ltd. |

Fiscal year ended | | March 31, 2007 | | March 31, 2008 | | March 31, 2009 |

Ordinary income | | 10,004 | | 9,754 | | 9,491 |

Net premiums written | | 7,128 | | 6,986 | | 6,638 |

Ordinary profit | | 281 | | 177 | | (30) |

Net income | | 158 | | 89 | | 99 |

Net income per share (yen) | | 19.81 | | 11.63 | | 13.15 |

Dividends per share (yen)* | | 7.50 | | 7.50 | | 8.00 |

Net assets per share (yen) | | 962.55 | | 711.58 | | 458.09 |

* Dividends per share are on a non-consolidated basis. (Data below listed in ¥100 millions) |

Consolidated basis | | | | | | |

| | | (Reference) Sum of the two companies ((1) + (2)) |

Fiscal year ended | | March 31, 2007 | | March 31, 2008 | | March 31, 2009 |

Ordinary income | | 29,020 | | 28,695 | | 27,170 |

Net premiums written | | 20,995 | | 20,674 | | 19,720 |

Ordinary profit | | 1,386 | | 1,118 | | (1,470) |

Net income | | 778 | | 686 | | (567) |

(Forecast)

(Data below listed in ¥100 millions, except per share data)

| | | | |

Consolidated basis | | | | |

| | | SOMPO JAPAN INSURANCE INC. | | NIPPONKOA Insurance Co., Ltd. |

Fiscal year ending | | March 31, 2010

Forecast for the full fiscal year | | March 31, 2010

Forecast for the full fiscal year |

Ordinary income | | 17,980 | | 8,900 |

Ordinary profit | | 590 | | 220 |

Net income | | 320 | | 130 |

Net income per share (yen) | | 32.50 | | 17.27 |

Dividends per share (yen)* | | 20.00 | | 8.00 |

| * | Dividends per share are on a non-consolidated basis. |

(Outlook)

The agreement will not materially affect the financial results of either SOMPO JAPAN or NIPPONKOA for the fiscal year ended March 31, 2010.

(Outline of accounting procedures)

The accounting procedures in relation to the Share Exchange will be announced when determined.

21/23

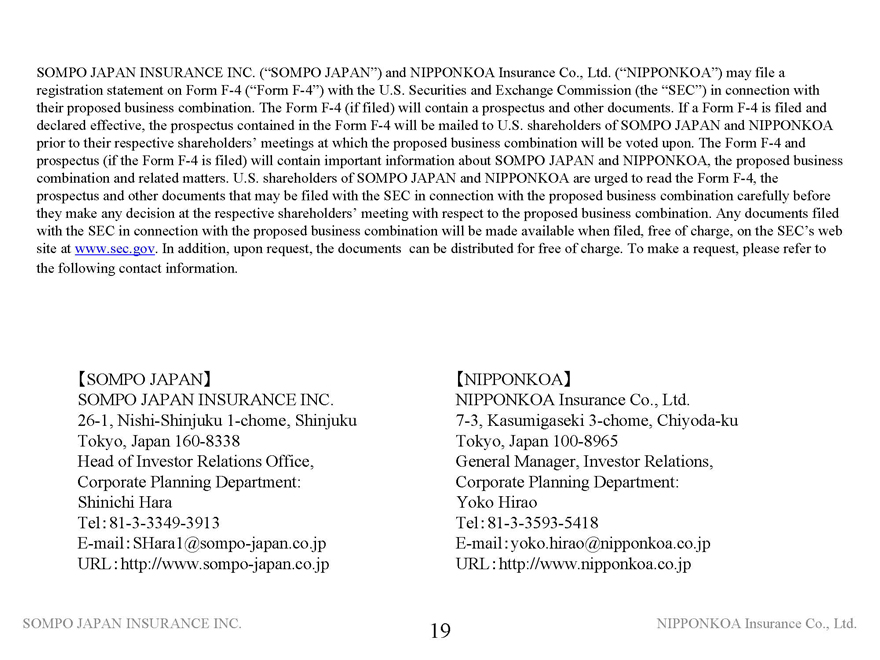

SOMPO JAPAN INSURANCE INC. (“SOMPO JAPAN”) and NIPPONKOA Insurance Co., Ltd. (“NIPPONKOA”) may file a registration statement on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with their proposed business combination. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of SOMPO JAPAN and NIPPONKOA prior to their respective shareholders’ meetings at which the proposed business combination will be voted upon. The Form F-4 and prospectus (if the Form F-4 is filed) will contain important information about SOMPO JAPAN and NIPPONKOA, the proposed business combination and related matters. U.S. shareholders of SOMPO JAPAN and NIPPONKOA are urged to read the Form F-4, the prospectus and other documents that have been or may be filed with the SEC in connection with the proposed business combination carefully before they make any decision at the respective shareholders’ meeting with respect to the proposed business combination. Any documents filed with the SEC in connection with the proposed business combination will be made available when filed, free of charge, on the SEC’s web site atwww.sec.gov. In addition, upon request, the documents can be distributed for free of charge. To make a request, please refer to the following contact information.

| | |

| SOMPO JAPAN INSURANCE INC. | | NIPPONKOA Insurance Co., Ltd. |

26-1, Nishi-Shinjuku 1-chome, Shinjuku Tokyo, Japan 160-8338 | | 7-3, Kasumigaseki 3-chome, Chiyoda-ku Tokyo, Japan 100-8965 |

Investor Relations Office Corporate Planning Department | | Investor Relations, Corporate Planning Department |

| Shinichi Hara | | Yoko Hirao |

| Tel: 81-3-3349-3913 | | Tel: 81-3-3593-5418 |

| E-mail:SHara1@sompo-japan.co.jp | | E-mail:yoko.hirao@nipponkoa.co.jp |

| URL:http:///www.sompo-japan.co.jp | | URL: http//www:nipponkoa.co.jp |

22/23

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the plans and expectations of SOMPO JAPAN and NIPPONKOA in relation to, and the benefits resulting from, their proposed business combination and business alliance described above. To the extent that statements in this press release do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of SOMPO JAPAN and NIPPONKOA in light of the information currently available to them, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of SOMPO JAPAN and NIPPONKOA (or the post-business combination group) to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. SOMPO JAPAN and NIPPONKOA undertake no obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by SOMPO JAPAN and NIPPONKOA (or the post-business combination group) in their subsequent domestic filings in Japan and filings with the SEC.

The risks, uncertainties and other factors referred to above include, but are not limited to:

| | (1) | economic and business conditions in and outside Japan; |

| | (2) | the regulatory outlook of the Japanese insurance industry; |

| | (3) | occurrence of losses the type or magnitude of which could not be foreseen at the time of writing the insurance policies covering such losses; |

| | (4) | the price and availability of reinsurance; |

| | (5) | the performance of the two companies’ (or the post-business combination group’s) investments; |

| | (6) | the two companies’ being unable to reach a mutually satisfactory agreement on the detailed terms of the proposed business combination or otherwise unable to complete it; and |

| | (7) | difficulties in realizing the synergies and benefits of the post-business combination group. |

23/23

DRAFT

S&C Draft July 28, 2009

Privileged and Confidential

Establishment of a Joint Holding Company for Business Integration (Share Exchange)

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

July 29, 2009

1

| | • | | Today, as scheduled, SOMPO JAPAN and NIPPONKOA executed an Agreement for Business Integration, which includes the share exchange ratio and other details, in connection with the business integration for which the Memorandum of Understanding was executed in March. |

| | • | | Today, we are here to explain the matters upon which we have agreed at this stage, in addition to the effects of the business integration. |

| | • | | First, I would like to talk about the outline of the business integration. |

1. Outline of the Business Integration

2. Effects of the Business Integration

3. Summary

4. (Reference) General Information on the Parties

[Note]

The Share Exchange is subject to the fulfillment of terms and conditions relating to the Share Exchange including shareholder approval at an extraordinary shareholders’ meeting of each Party and regulatory notices and approvals stipulated by Japanese and foreign laws. In addition, the Share Exchange is based on the assumption that any other event that could be materially detrimental to the Share Exchange will not occur.

1. Outline of the Business Integration

2. Effects of the Business Integration

3. Summary

4. (Reference) General Information on the Parties

| | • | | I would like to once again briefly explain the outline of the Memorandum of Understanding announced in March |

| | • | | SOMPO JAPAN and NIPPONKOA decided to establish “a new solution service group with the aim of providing customers with the highest-quality security and service and contributing to social welfare” while sharing as a unitary group the strengths nurtured over the 120 years of our respective histories. |

| | • | | The five basic principles of the Business Integration consist of the pursuit of best business practices from the customers’ perspective, an emphasis on speed, the independence of the New Group, a spirit of equality and the enhancement of corporate value. |

| | • | | Please see the bottom portion of the slide for the New Group’s aspirations. |

Memorandum of Understanding for the Business Integration Announced on March 13, 2009

Establishing “a new solution service group with the aim of providing customers with the highest-quality security and service and contributing to social welfare”

Basic Principles of the Business Integration

Making all value judgments from the “customers’ perspective” and pursuing best business practices

Placing an emphasis on speed with the aim of quickly realizing the results of our growth strategy, business integration and operational alliance

Establishing equal and friendly relationships with any corporate or financial group as an independent New Group, with the understanding that the Parties will continue to operate under the Joint Holding Company

The New Group is to maintain a spirit of equality between the Parties

Expeditiously and aggressively implementing measures to boost the corporate value of the New Group as a whole

The New Group’s Aspirations (Management’s Vision)

Providing the highest-quality security and service

Focusing on the domestic business

Providing a broad range of solutions that are friendly to society and the environment

Maximizing shareholder value

A free, vigorous, open and energetic corporate culture

Independence from the influence of any corporate or financial group

4

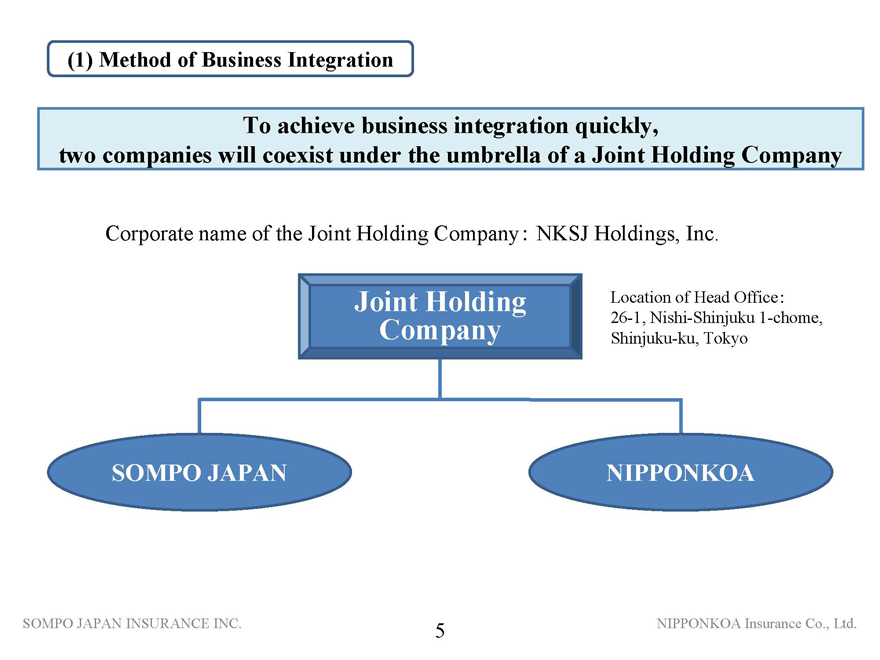

| | • | | I will now explain the form of the business integration. |

| | • | | Under the business integration, we have chosen an arrangement for business integration in which the Parties will coexist under the umbrella of a Joint Holding Company. |

| | • | | Even if we choose not to adopt a merger as the form of integration, we think that we will be able to realize sufficient synergies through standardizing and sharing our business base. |

| | • | | In addition, the corporate name of the Joint Holding Company will be NKSJ Holdings, Inc., and the location of the head office will be the current head office of SOMPO JAPAN. |

(1) Method of Business Integration

To achieve business integration quickly, two companies will coexist under the umbrella of a Joint Holding Company

Corporate name of the Joint Holding Company: NKSJ Holdings, Inc.

Joint Holding Company

SOMPO JAPAN

NIPPONKOA

Location of Head Office:26-1, Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo

5

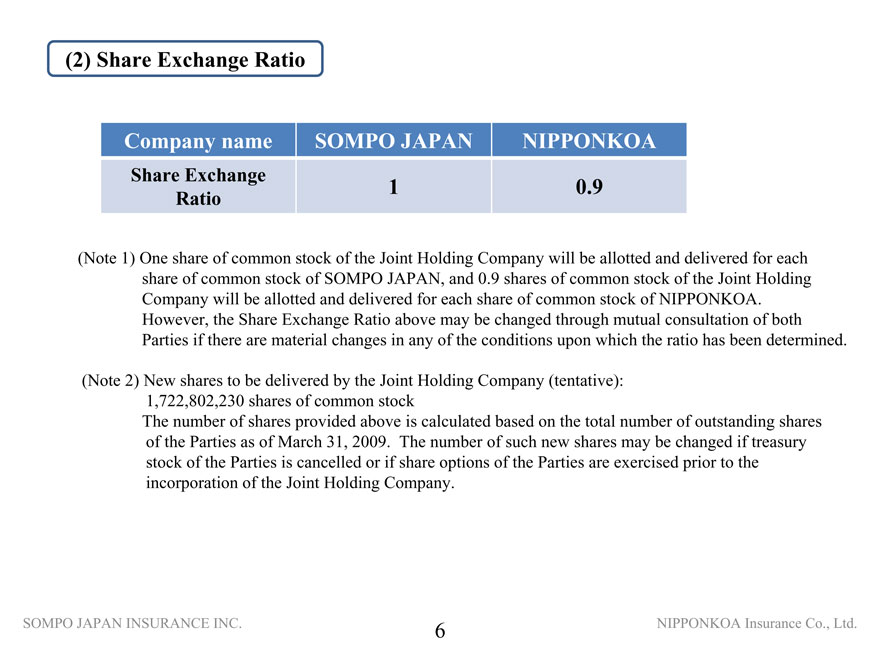

| | • | | Now I will explain about the share exchange ratio. |

| | • | | The share exchange ratio will be one share of common stock of SOMPO JAPAN and 0.9 shares of common stock of NIPPONKOA. Based on this ratio, common stock of the Joint Holding Company will be allotted to the shareholders of both companies. |

| | • | | We agreed on and determined the share exchange ratio, upon repeated, careful negotiation and consultation, with reference to the results of fairness analyses conducted by financial advisors of the Parties and comprehensively taking into account factors including the financial conditions, assets conditions and future outlook of the Parties. |

(2) Share Exchange Ratio

Company name SOMPO JAPAN NIPPONKOA Share Exchange Ratio 1 0.9

(Note 1) One share of common stock of the Joint Holding Company will be allotted and delivered for each share of common stock of SOMPO JAPAN, and 0.9 shares of common stock of the Joint Holding Company will be allotted and delivered for each share of common stock of NIPPONKOA. However, the Share Exchange Ratio above may be changed through mutual consultation of both Parties if there are material changes in any of the conditions upon which the ratio has been determined.

(Note 2) New shares to be delivered by the Joint Holding Company (tentative):

1,722,802,230 shares of common stock

The number of shares provided above is calculated based on the total number of outstanding shares of the Parties as of March 31, 2009. The number of such new shares may be changed if treasury stock of the Parties is cancelled or if share options of the Parties are exercised prior to the incorporation of the Joint Holding Company.

6

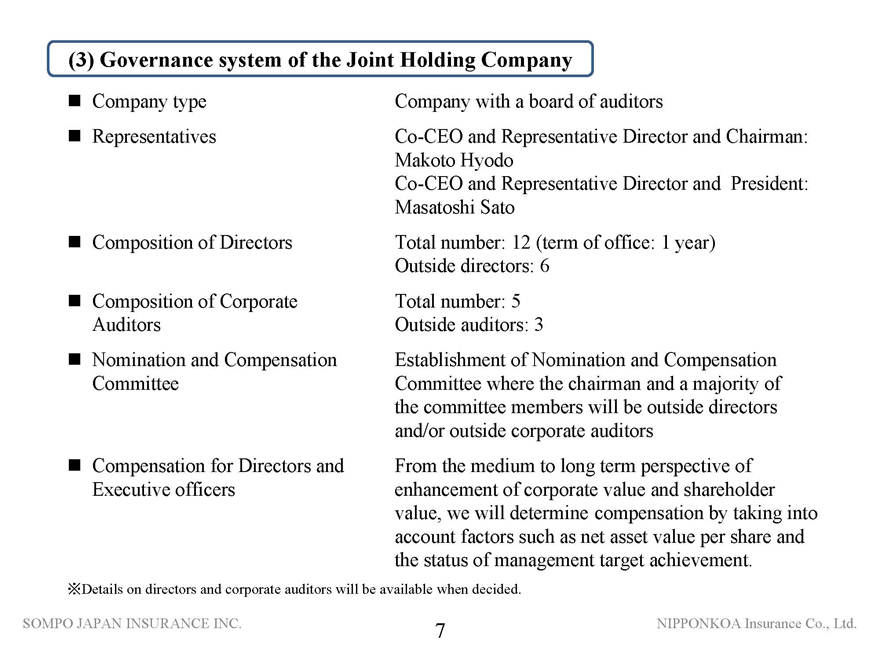

| | • | | Now we will explain the governance of the Joint Holding Company. |

| | • | | The Joint Holding Company will have a board of auditors. |

| | • | | At the time of the incorporation of the joint holding company, Mr. Hyodo, the current President of NIPPONKOA, will be the Representative Director and Chairman, and Mr. Sato, the current President of SOMPO JAPAN, will be the Representative Director and President. Both will manage the company as co-CEOs. |

| | • | | The total number of directors will be 12, half of which will be from outside companies. |

| | • | | Total number of corporate auditors will be 5, including 3 which is a majority from outside companies. |

| | • | | Further, we will establish nomination and compensation committee, where the chairman and a majority of members are outside directors and/or outside corporate auditors. |

| | • | | With respect to compensation for directors and executive officers, from the medium to long term perspective of enhancement of corporate value and shareholder value, we will determine compensation by taking into account factors such as net asset value per share and the status of achievement of management targets. |

(3) Governance system of the Joint Holding Company

Company type Company with a board of auditors

Representatives Joint CEO and Representative Director and Chairman: Makoto Hyodo Joint CEO and Representative Director and President: Masatoshi Sato

Composition of Directors Total number: 12 (term of office: 1 year) Outside directors: 6

Composition of Corporate Total number: 5 Auditors Outside auditors: 3

Nomination/Compensation Establishment of nomination and compensation Committees committees where the chairman and a majority of the committee members will be outside officers.

Compensation for Directors From the medium to long term perspective of enhancement of corporate value and shareholder value, we will determine compensation by taking into account factors such as net assets per share and the status of management target achievement.

Details on directors and corporate auditors will be available when decided.

7

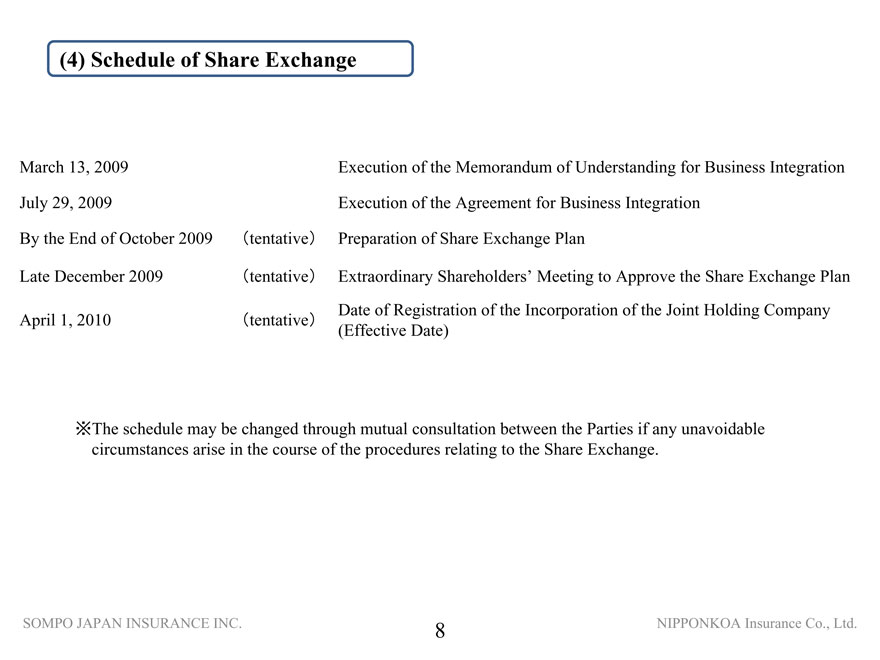

| | • | | This shows the schedule going forward. |

| | • | | Today, we executed an Agreement for Business Integration. Going forward, by the end of October, we will prepare a share exchange plan and make an announcement regarding the plan. |

| | • | | Subsequently, SOMPO JAPAN and NIPPONKOA each plans to hold an extraordinary shareholders’ meeting in late December, where the shareholders of each company will vote on whether or not to approve the share exchange plan. |

| | • | | After obtaining shareholder approvals and subject to regulatory approvals, the New Group will be established on April 1, 2010. |

| | • | | Next, I will explain about effects of the business integration. Please turn to page 9. |

(4) Schedule of Share Exchange

March 13, 2009 Execution of the Memorandum of Understanding for Business Integration

July 29, 2009 Execution of the Agreement for Business Integration

By the End of October 2009 tentative Preparation of Share Exchange Plan

Late December 2009 tentative Extraordinary Shareholders Meeting to Approve the Share Exchange Plan

April 1, 2010 tentative Date of Registration of the Incorporation of the Joint Holding Company (Effective Date)

The schedule may be changed through mutual consultation between the Parties if any unavoidable circumstances arise in the course of the procedures relating to the Share Exchange.

8

1. Outline of the Business Integration

2. Effects of the Business Integration

3. Summary

4. (Reference) General Information on the Parties

9

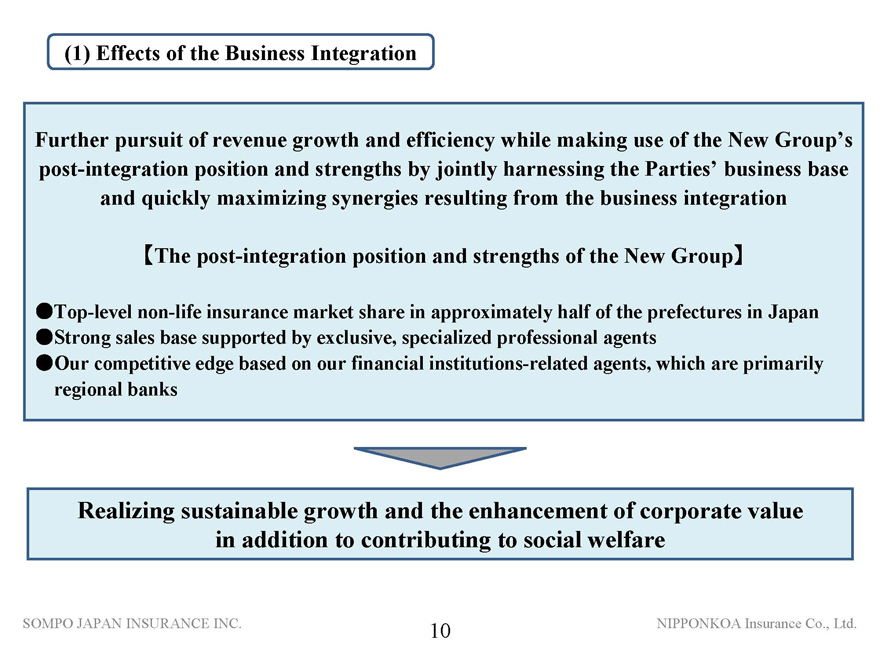

| | • | | The New Group will make use of its post-integration position and strengths and seek to quickly maximize integration synergy by jointly harnessing the business base of the Parties. |

| | • | | We will maintain and further expand and develop our respective customer bases by maintaining and reinforcing each Party’s own brand. |

| | • | | We will enhance business efficiency and quality by sharing and standardizing the business bases for our products, back office operations and IT systems, among other areas. |

| | • | | The New Group will improve group profits by shifting management resources created as a result of the business integration to areas with growth potential and enhance corporate value through integration synergy. |

| | • | | Please turn to page 11. |

(1) Effects of the Business Integration

Further pursuit of revenue growth and efficiency while making use of the New Group’s post-integration position and strengths by jointly harnessing the Parties’ business base and quickly maximizing synergies resulting from the business integration

[The post-integration position and strengths of the New Group]

•Top-level non-life insurance market share in approximately half of the prefectures in Japan

•Strong sales base supported by exclusive, specialized professional agents

•Our competitive edge based on our financial institutions-related agents, which are primarily regional banks

Realizing sustainable growth and the enhancement of corporate value in addition to contributing to social welfare

10

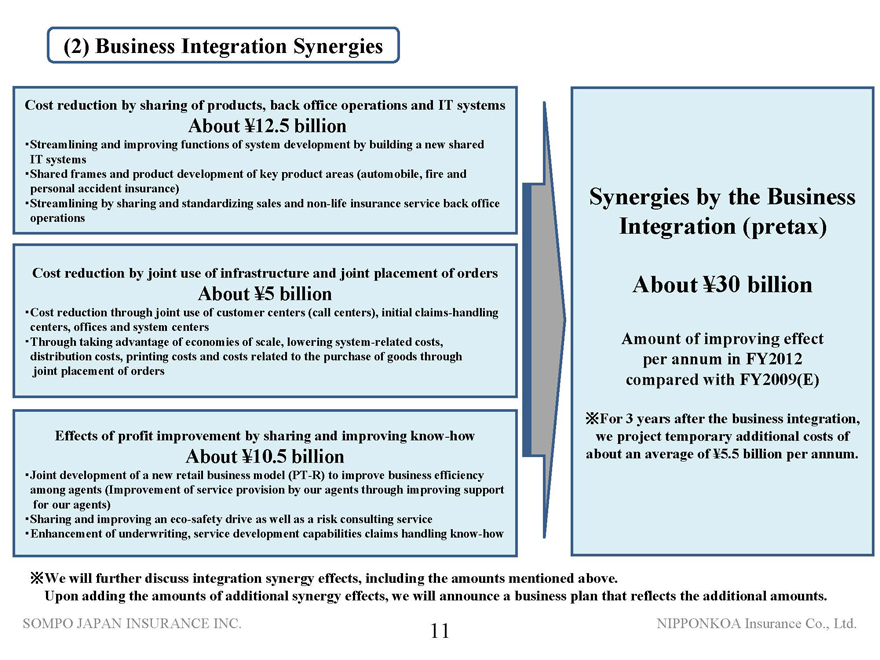

| | • | | We anticipate synergy effects resulting from the business integration of about ¥30 billion per year in FY2012. |

| | • | | The specific breakdown is: we anticipate cost reduction of about ¥12.5 billion by significantly streamlining the business process and lowering business expenses through sharing products, back office operations and IT systems. |

| | • | | We anticipate a synergy effect of about ¥5 billion through joint use of the Parties’ infrastructure including stores and call centers as well as through reduction of system related costs, distribution costs and printing costs by the Parties’ joint placement of orders. |

| | • | | We anticipate a profit improvement effect of about ¥10.5 billion by improving service provision by our agents and sharing and improving know-how such as loss prevention and risk consulting. |

| | • | | However, we also expect temporary additional costs for three years after the integration. |

| | • | | Going forward, we will further continue our discussion and plan to make another announcement on a business plan which will reflect the synergy values when we make an announcement on the share exchange plan scheduled at the end of October. |

| | • | | Please turn to page 12. |

(2) Business Integration Synergies

Cost reduction by sharing of products, back office operations and IT systems

¥12.5 billion

Streamlining and improving functions of system development by building a new shared IT systems base

Shared frames and product development of key product areas (automobile, fire and non-life insurance)

Streamlining by sharing and standardizing sales and non-life insurance service back office operations

Cost reduction by joint use of infrastructure and joint placement of orders

¥5 billion

Cost reduction through joint use of customer centers (call centers), claims services and initial claims-handling, stores and system centers

Through taking advantage of economies of scale, lowering system-related costs, distribution costs, printing costs and costs related to the purchase of goods through joint placement of orders

Effects of profit improvement by sharing and improving know-how

¥10.5 billion

Improvement of service provision by our agents through improving support for our agents and joint development of a new retail business model (PT-R) to improve business efficiency among agents

Sharing and improving an eco-safety drive as well as a risk consulting service

Enhancement of underwriting, service development capabilities and non-life insurance investigation know-how

Synergies by the Business Integration (pretax)

¥30 billion

(Effect amount per annum in FY 2012)

(Estimated in FY2009)

For 3 years after the business integration, we project temporary accumulated additional costs of about an average of ¥5.5 billion per annum.

We will further discuss the FY 2012 integration synergy effects, including the amounts mentioned above. Upon adding the amounts of additional synergy effects, we will announce a business plan that reflects the additional amounts.

11

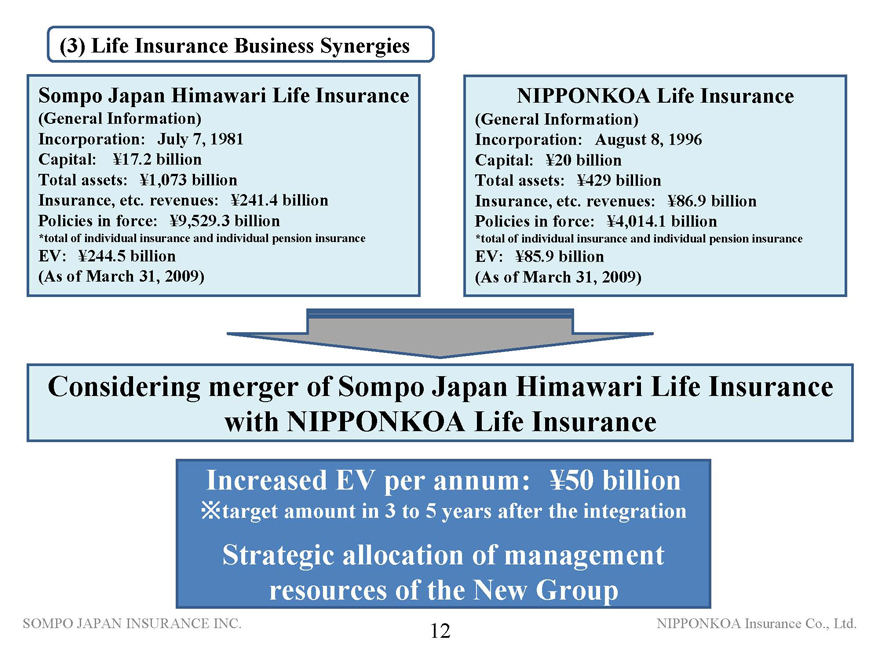

| | • | | This shows our life insurance business synergies. |

| | • | | In the life insurance business, an area with growth potential, we will consider a merger between Sompo Japan Himawari Life Insurance and NIPPONKOA Life Insurance and strategically allocate the New Group’s management resources. |

| | • | | We aim to increase EV by ¥50 billion per year in three to five years after the integration by introducing attractive products into the expanded market resulting from the business integration. |

| | • | | Please turn to page 13. |

(3) Life Insurance Business Synergies

Sompo Japan Himawari Life Insurance

(General Information)

Incorporation:July 7, 1981

Capital: ¥17.2 billion

Total assets:¥1,073 billion

Insurance, etc. revenues:¥241.4 billion

Policies in force:¥9,529.3 billion

*total of individual insurance and individual pension insurance

EV:¥244.5 billion

(As of March 31, 2009)

NIPPONKOA Life Insurance

(General Information)

Incorporation:August 8, 1996

Capital:¥20 billion

Total assets:¥429 billion

Insurance, etc. revenues:¥86.9 billion

Policies in force:¥4,014.1 billion

*total of individual insurance and individual pension insurance

EV:¥85.9 billion

(As of March 31, 2009)

Considering merger of Sompo Japan Himawari Life Insurance with NIPPONKOA Life Insurance

Increased EV per annum: ¥50 billion

targe tamount in 3 to 5-years after the integration

Strategic allocation of management resources of the New Group

12

| | • | | We will explain the integration of the group business. |

| | • | | With respect to the asset management business, we will consider having the Parties’ investment management companies merge during or soon after FY 2010 in order to strengthen the asset management structure of the New Group. Furthermore, the New Group will seek to improve investment profits by rebuilding its asset portfolio through such measures as reduction of our ownership of “strategic holding stocks” intended to solidify our business relationships with corporate customers. |