|

Filing under Rule 425 under the U.S. Securities Act of 1933 Filing by: SOMPO JAPAN INSURANCE INC. Subject Company: SOMPO JAPAN INSURANCE INC. (SEC File No. 132-02678) Subject Company: NIPPONKOA Insurance Co., Ltd. (SEC File No. 132-02677) |

Thank you for giving up some of your valuable time today.

Now, I would like to start my presentation with this handout and we would like to move on to the Q&A session afterwards.

(Or would it be rather convenient for you to have only the Q&A session?)

In the Q&A session I will communicate through an interpreter.

Please open the cover sheet.

TSE 1st Section

Ticker : 8755

Corporate Presentation

September 2009

SOMPO JAPAN INSURANCE INC.

This is today’s agenda for discussion.

Firstly, I would like to talk about the growth potential and profitability of the Japanese P&C insurance industry.

Subsequently, I will talk about our business strategies including the business integration with Nipponkoa.

Please turn to page 2.

Agenda for Discussion

Japanese P&C insurance industry

—Growth potential

—Profitability

Sompo Japan

—How and where to grow

—Synergies by business integration with Nipponkoa

—Investment value

Financial soundness, ABS-CDO guarantee loss, Dividend, Valuation 1

I would like to emphasize that the Japanese P&C insurance industry is attractive.

Points are shown on this page.

For detail, please turn to page 3.

Japanese P&C Insurance Industry

Japanese P&C insurance market to grow

—Steady growth in line with economic growth

—Defensive in economic downturn

—Growth potential for liability insurance and medical insurance

Structurally stable profitability

—Underwriting balance ratio has been always positive

—Advisory rating system as a profit stabilizer 2

2

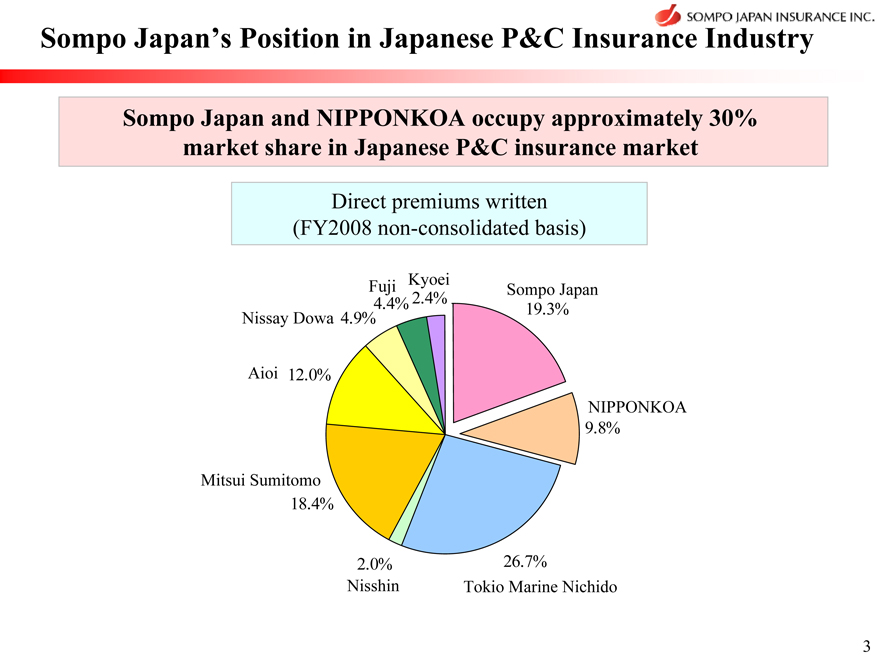

This slide shows a market share of the players in Japan.

We are the second biggest company in Japan with a market share of approximately 20%.

And around 30% would be occupied by the Joint Holding Company to be formed with Nipponkoa.

Please turn to page 4.

Sompo Japan’s Position in Japanese P&C Insurance Industry

Sompo Japan and NIPPONKOA occupy approximately 30%

market share in Japanese P&C insurance market

Direct premiums written

(FY2008 non-consolidated basis)

Fuji Kyoei

Sompo Japan 4.4% 2.4%

19.3% Nissay Dowa 4.9%

Aioi 12.0%

NIPPONKOA 9.8%

Mitsui Sumitomo

18.4%

2.0% 26.7%

Nisshin Tokio Marine Nichido

3

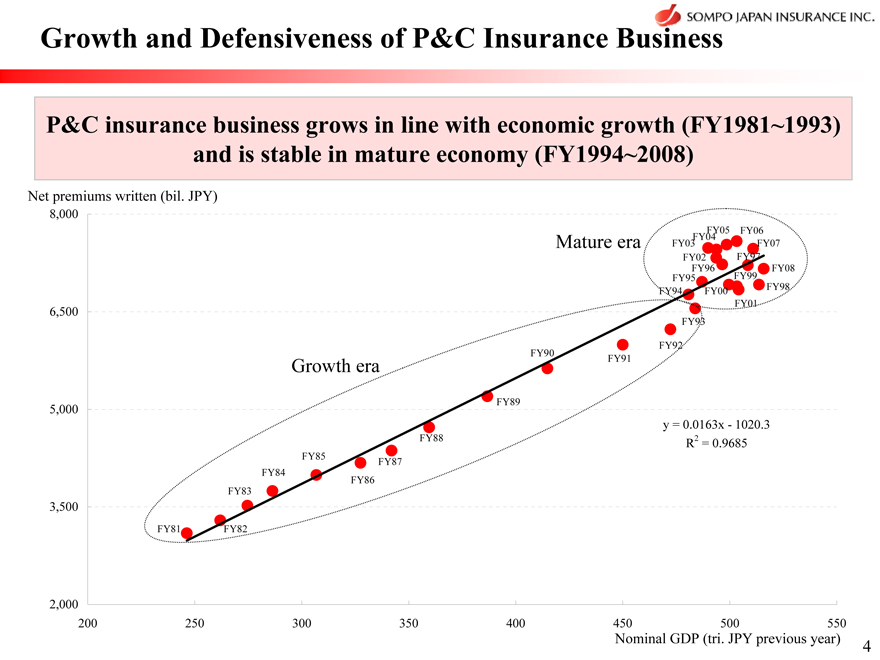

We would like to point to the growth and defensiveness of the P&C insurance business.

The P&C insurance business has the characteristics of growing in line with economic growth.

We can observe the characteristics of high correlation between GDP and net premiums written from 1981 to 1993.

Currently, Japan’s economy is mature, so it is difficult to expect high growth for the P&C insurance.

But the market will not necessarily shrink in a mature situation or recession.

The defensiveness is the strength of the P&C insurance business.

Please turn to page 5.

Growth and Defensiveness of P&C Insurance Business

P&C insurance business grows in line with economic growth (FY1981~1993) and is stable in mature economy (FY1994~2008)

Net premiums written (bil. JPY)

8,000 6,500 5,000 3,500 2,000

200 250 300 350 400 450 500 550

Growth era

Mature era

FY05 FY06 FY04 FY03 FY07 FY02 FY97 FY96 FY08 FY95 FY99 FY94 FY00 FY98 FY01

FY93

FY92 FY90 FY91

FY89

FY88 FY85 FY87 FY84 FY86 FY83

FY81 FY82

y = 0.0163x-1020.3 R2 = 0.9685

Nominal GDP (tri. JPY previous year) 4

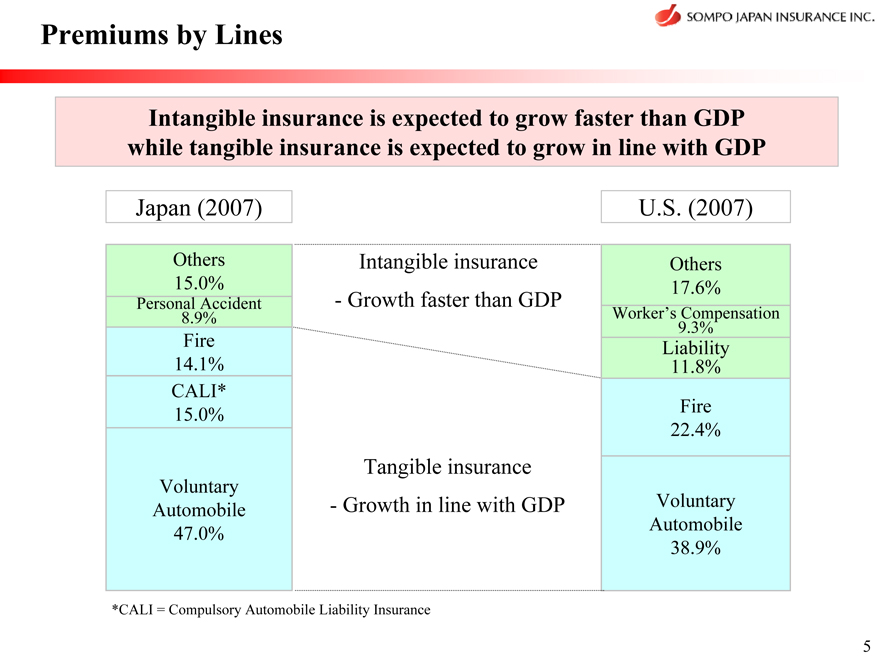

This is a comparison of the breakdown of insurance coverage in Japan and the US.

We have two growth drivers in our market.

One is tangible insurance like Fire or Auto, in which we expect an increase of premium income in proportion to GDP growth.

The other is intangible insurance like Personal Accident or Liability, in which we expect development of the market exceeding GDP growth.

Especially in the intangible area, more expansion can be expected because the market is relatively less penetrated than its counterpart in the US.

Please turn to page 6.

Premiums by Lines

Intangible insurance is expected to grow faster than GDP while tangible insurance is expected to grow in line with GDP

Japan (2007) U.S. (2007)

Others Intangible insurance Others 15.0% 17.6% Personal Accident - Growth faster than GDP

8.9% Worker’s Compensation 9.3%

Fire Liability 14.1% 11.8% CALI* 15.0% Fire 22.4% Tangible insurance Voluntary

- Growth in line with GDP Voluntary Automobile Automobile 47.0% 38.9%

*CALI = Compulsory Automobile Liability Insurance

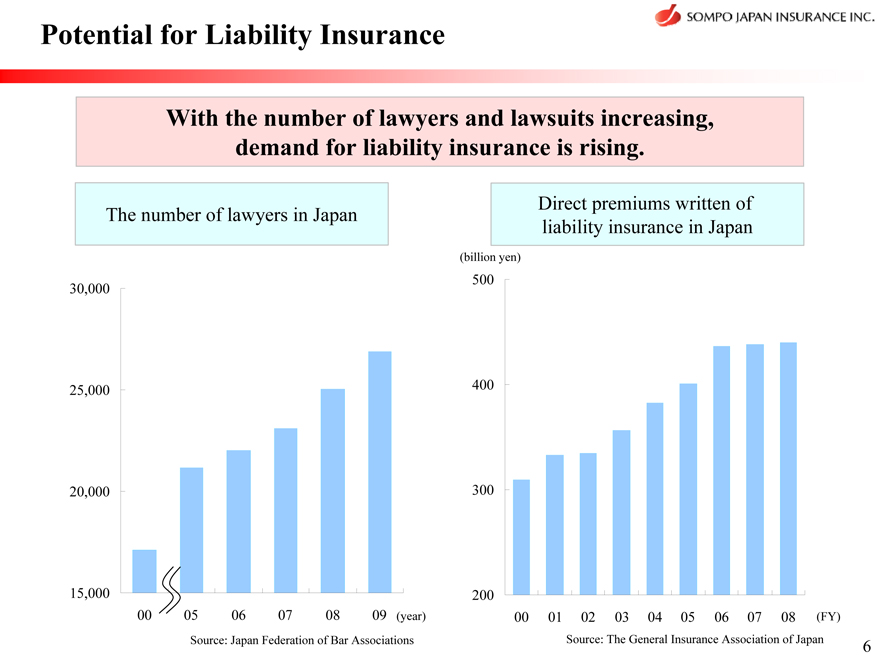

Among the intangible insurance, one example is liability insurance.

The left-hand chart shows the number of lawyers in Japan.

The increase in the number of lawyers shows a change in the social and legal environment.

It’s becoming more important to be prepared for legal claims in Japan.

Under these circumstances there is rising demand for liability insurance cover.

Liability insurance premiums have already shown significant increase, and we expect such trend to continue.

Please turn to page 7.

Potential for Liability Insurance

With the number of lawyers and lawsuits increasing, demand for liability insurance is rising.

Direct premiums written of The number of lawyers in Japan liability insurance in Japan

30,000 25,000 20,000

15,000

00 05 06 07 08 09 (year) Source: Japan Federation of Bar Associations

(billion yen) 500

400

300

200

00 01 02 03 04 05 06 07 08 (FY) Source: The General Insurance Association of Japan 6

.

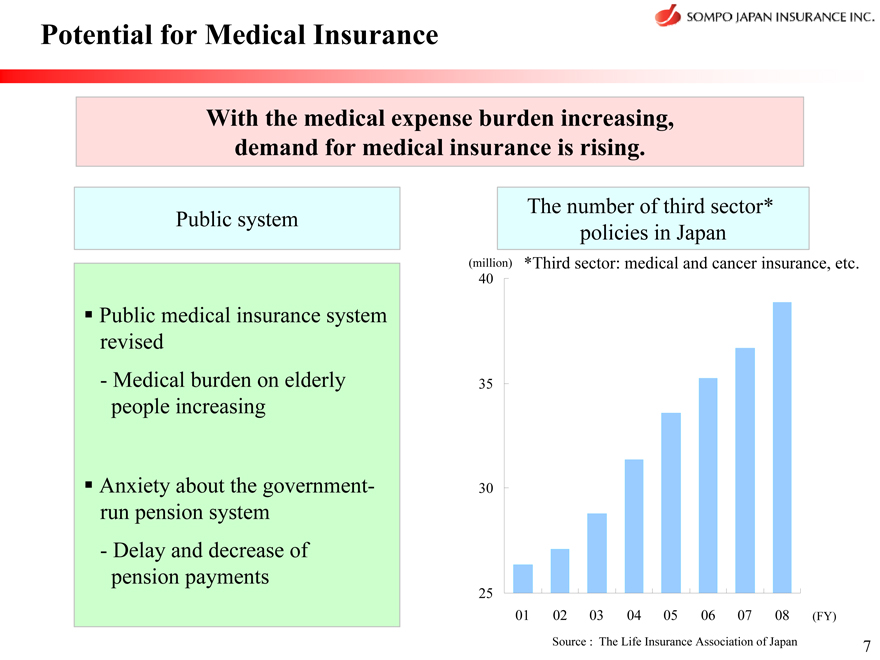

Another field is Medical insurance

A large proportion of medical costs have been covered through the public insurance system.

But this is gradually changing.

A certain portion of medical costs has to be paid by the individuals, and the portion is getting larger and larger due to the deterioration of the public medical insurance system.

People are losing confidence in the public medical insurance system, and this is an opportunity for us as a private medical insurance provider.

Medical insurance has shown fast growth and we expect the trend to continue, as the demand will continue to increase as the public system weakens.

Please turn to page 8.

Potential for Medical Insurance

With the medical expense burden increasing, demand for medical insurance is rising.

The number of third sector* Public system policies in Japan

Public medical insurance system revised

- Medical burden on elderly people increasing

Anxiety about the government-run pension system

- Delay and decrease of pension payments

(million) *Third sector: medical and cancer insurance, etc.

40 35 30

25

01 02 03 04 05 06 07 08 (FY) Source : The Life Insurance Association of Japan 7

.

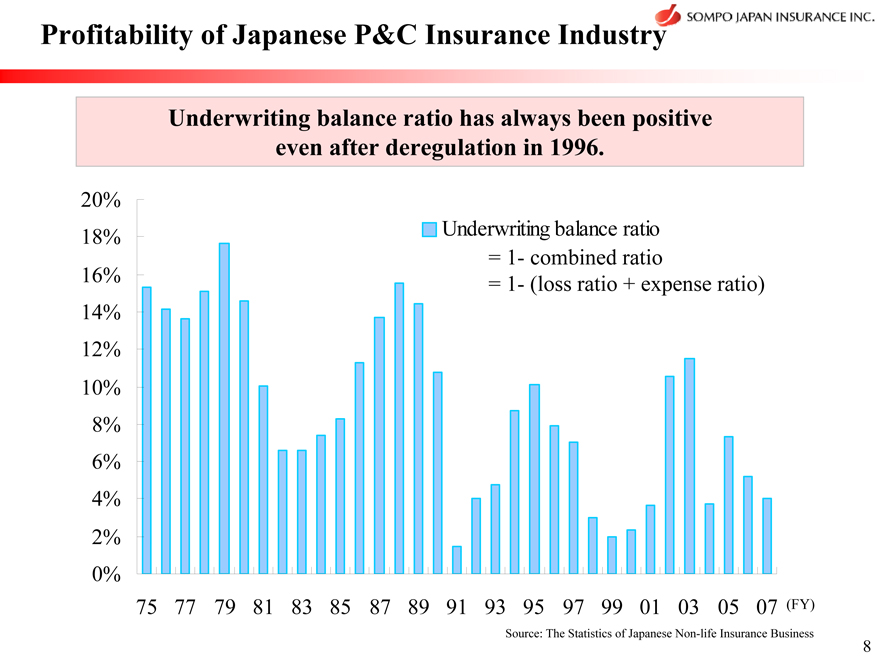

We have to think about profitability as well as the top line growth.

This chart shows the underwriting balance ratio in our market.

It has always been positive even after deregulation in 1996.

Please turn to page 9.

Profitability of Japanese P&C Insurance Industry

Underwriting balance ratio has always been positive even after deregulation in 1996.

Underwriting balance ratio

= 1- combined ratio

= 1- (loss ratio + expense ratio)

20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0%

75 77 79 81 83 85 87 89 91 93 95 97 99 01 03 05 07 (FY)

Source: The Statistics of Japanese Non-life Insurance Business

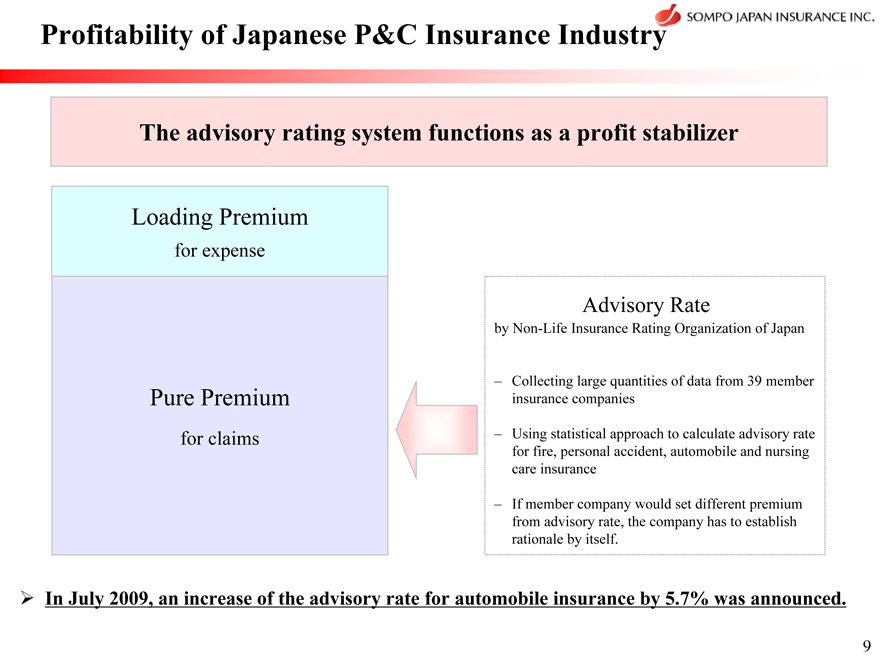

The Advisory Rating System contributes to the stable profitability.

Pure premium is decided in accordance with the trend of the loss ratio based on the data collected from P&C insurance companies in Japan.

If the loss ratio is getting worse, premium rates can be raised.

In July 2009, an increase of the advisory rate for automobile insurance by 5.7% was announced.

Following the raise of the advisory rate, we are considering raising our rate.

Please turn to page 10.

Profitability of Japanese P&C Insurance Industry

The advisory rating system functions as a profit stabilizer

Loading Premium

for expense

Pure Premium

for claims

Advisory Rate

by Non-Life Insurance Rating Organization of Japan

– Collecting large quantities of data from 39 member insurance companies

– Using statistical approach to calculate advisory rate for fire, personal accident, automobile and nursing care insurance

– If member company would set different premium from advisory rate, the company has to establish rationale by itself.

In July 2009, an increase of the advisory rate for automobile insurance by 5.7% was announced.

9

Now, I would like to talk about our strategy.

We are focusing on “Growth on a profit basis” and “Group management.”

Points are shown on this page.

For detail, please turn to page 11.

Sompo Japan’s Strategy

Growth on a profit basis

Pursue “Retail business model reform project (PT-R)”

Enhance quality and profitability in domestic P&C insurance business

Group management

Streamline domestic P&C insurance business operation and reallocate corporate resources to growth areas

Establish highly stable and well-balanced business portfolio

10

This is an overview of “retail business model reform project” or “PT-R.”

We are trying to improve our business quality for better customer service.

At the same time, we are pursuing profitability and top-line growth by enhancing efficiency.

Please turn to page 12.

Growth on a Profit Basis

Optimal balance among Quality enhancement, Profitability and Top-line growth through “PT-R”

Quality Enhancement

- Better customer service

Retail business model reform project “PT-R”

Enhance efficiency

Profitability

Top-line Growth

11

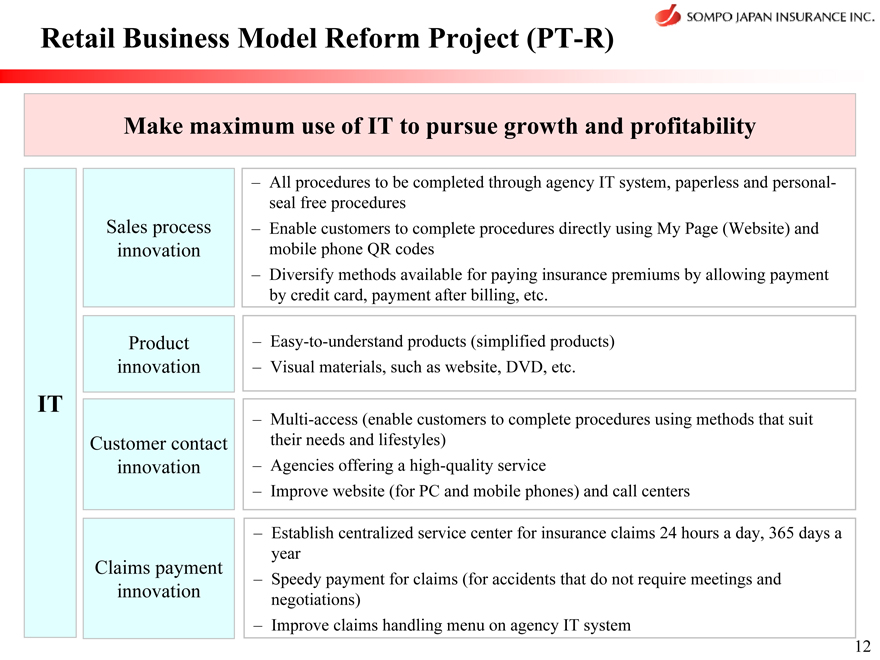

Maximum use of IT is a major focus of “PT-R.”

We will realize innovation in four areas, sales process, product, customer contact and claims payment.

Please turn to page 13.

Retail Business Model Reform Project (PT-R)

Make maximum use of IT to pursue growth and profitability

– All procedures to be completed through agency IT system, paperless and personal- seal free procedures Sales process – Enable customers to complete procedures directly using My Page (Website) and innovation mobile phone QR codes

– Diversify methods available for paying insurance premiums by allowing payment by credit card, payment after billing, etc.

Product – Easy-to-understand products (simplified products) innovation – Visual materials, such as website, DVD, etc.

IT

– Multi-access (enable customers to complete procedures using methods that suit Customer contact their needs and lifestyles) innovation – Agencies offering a high-quality service

– Improve website (for PC and mobile phones) and call centers

– Establish centralized service center for insurance claims 24 hours a day, 365 days a year

Claims payment

– Speedy payment for claims (for accidents that do not require meetings and innovation negotiations)

– Improve claims handling menu on agency IT system

12

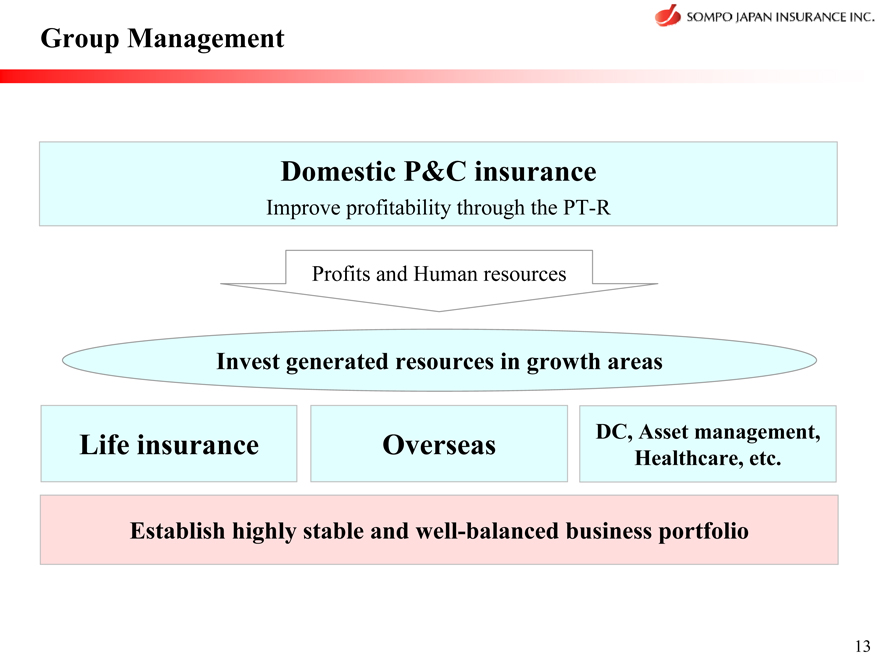

This is a big picture of allocation of management resources.

We are trying to improve profitability by executing “PT-R” in the domestic P&C insurance business.

We will shift profits and human resources generated towards our growth areas such as life insurance and overseas.

By accelerating the shift, we can establish highly stable and well-balanced business portfolio.

Please turn to page 14.

Group Management

Domestic P&C insurance

Improve profitability through the PT-R

Profits and Human resources

Invest generated resources in growth areas

Life insurance Overseas DC, Asset management,

Healthcare, etc.

Establish highly stable and well-balanced business portfolio

13

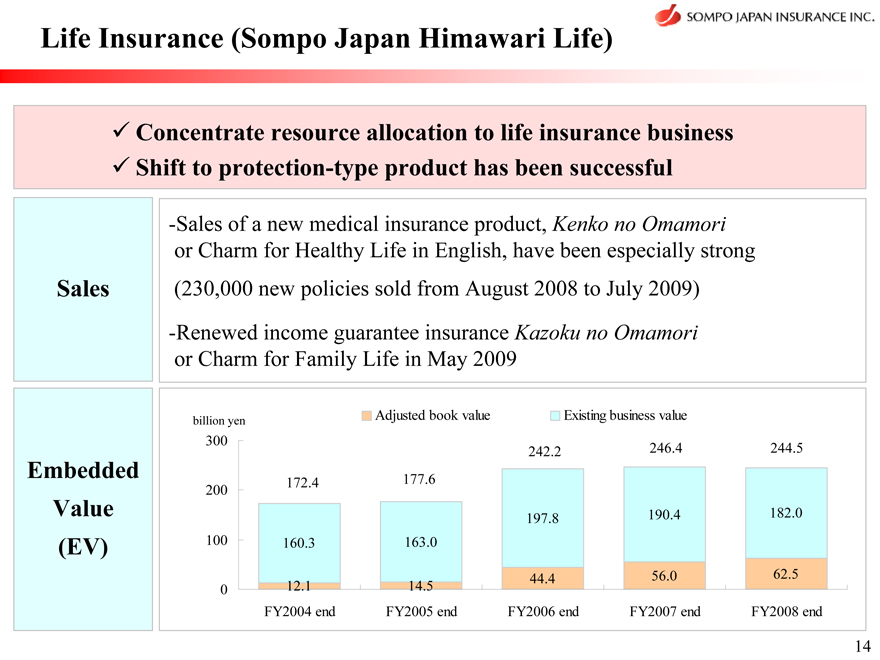

Next, I will discuss the life insurance business, to which we are concentrating resource allocation.

Sompo Japan Himawari Life has been shifting to a stronger focus on sales of protection-type products.

Especially, a new medical insurance product, Kenko no Omamori or Charm for Healthy Life in English, has been sold well, recording 230 thousand policy sales from last August to this July.

We expect embedded value to gradually increase going forward.

Please turn to page 15.

Life Insurance (Sompo Japan Himawari Life)

Concentrate resource allocation to life insurance business

Shift to protection-type product has been successful

-Sales of a new medical insurance product, Kenko no Omamori or Charm for Healthy Life in English, have been especially strong Sales (230,000 new policies sold from August 2008 to July 2009) -Renewed income guarantee insurance Kazoku no Omamori or Charm for Family Life in May 2009

Embedded Value (EV)

billion yen Adjusted book value Existing business value 300

242.2 246.4 244.5 172.4 177.6 200 197.8 190.4 182.0 100 160.3 163.0

44.4 56.0 62.5

0 12.1 14.5

FY2004 end FY2005 end FY2006 end FY2007 end FY2008 end

14

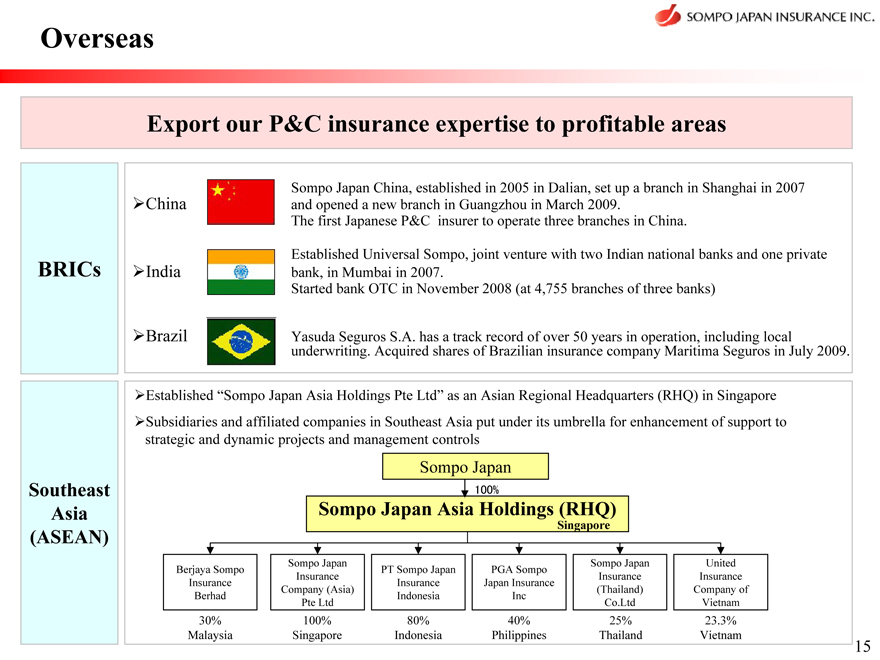

We are now actively developing our overseas business.

We are confident that in countries with accelerating economic growth, we can use our P&C insurance expertise.

The key factor is profitability.

We plan to expand our business in these countries only where we can expect profit manageable by short tail business.

We are regarding two points as important.

First, tying up with the best partner with knowledge about the market and a well-known brand.

Second, using our P&C insurance expertise in the market.

Please turn to page 16.

Overseas

Export our P&C insurance expertise to profitable areas

BRICs

Sompo Japan China, established in 2005 in Dalian, set up a branch in Shanghai in 2007

China and opened a new branch in Guangzhou in March 2009.

The first Japanese P&C insurer to operate three branches in China.

Established Universal Sompo, joint venture with two Indian national banks and one private

India bank, in Mumbai in 2007.

Started bank OTC in November 2008 (at 4,755 branches of three banks)

Brazil Yasuda Seguros S.A. has a track record of over 50 years in operation, including local underwriting. Acquired shares of Brazilian insurance company Maritima Seguros in July 2009.

Established “Sompo Japan Asia Holdings Pte Ltd” as an Asian Regional Headquarters (RHQ) in Singapore

Subsidiaries and affiliated companies in Southeast Asia put under its umbrella for enhancement of support to strategic and dynamic projects and management controls

Southeast Asia (ASEAN)

Sompo Japan

100%

Sompo Japan Asia Holdings (RHQ)

Singapore

Sompo Japan Sompo Japan United Berjaya Sompo PT Sompo Japan PGA Sompo Insurance Insurance Insurance Insurance Insurance Japan Insurance Company (Asia) (Thailand) Company of Berhad Indonesia Inc Pte Ltd Co.Ltd Vietnam 30% 100% 80% 40% 25% 23.3% Malaysia Singapore Indonesia Philippines Thailand Vietnam

15

In our domestic business, DC, asset management and healthcare are our next profit source following the P&C and life insurance business.

These are the retail market businesses where we have advantages, such as cross-selling products in these areas to our P&C insurance customers.

Please turn to page 17.

DC, Asset Management and Healthcare

Diversify business lines for future profits

Expand cross-selling, leveraging our strength in the retail market

Defined Contribution Pension Plan (DC)

- Sompo Japan DC Securities

Asset management

- Sompo Japan Asset Management

(mainly managing third party’s assets)

Healthcare

- Healthcare Frontier Japan

(providing disease prevention service)

- Sompo Japan Healthcare Service

(providing mental healthcare service)16

We have decided to pursue business integration with Nipponkoa.

I would like to talk about the details from the next page.

Please turn to page 18.

Business Integration with NIPPONKOA

Purpose of business integration

- Maintain our solid position in the industry

- Accelerate current strategies to enhance profitability

Two companies will coexist under the umbrella of a Joint Holding Company

Anticipated synergies by the Business Integration (pretax) About 30 billion yen

Additional synergies in life insurance and asset management businesses

17

This is the purpose of the business integration.

To maintain our solid position in the industry and to accelerate our current strategies to enhance profitability, we have concluded that business integration with Nipponkoa is the best choice.

Please turn to page 19.

Purpose of Business Integration

Maintain our solid position in the industry

Accelerate current strategies to enhance profitability

Depopulating society, with birthrate declining and aging Perspective Increased risks associated with deteriorating global climate change Diversified consumer demands amidst the individuals’ lifestyle changes

Integration

18

This slide shows the New Group’s position and strength.

The New Group will make use of its post-integration position and strengths and seek to quickly maximize integration synergy.

Please turn to page 20.

The New Group’s Position and Strengths

Top-level P&C insurance market share in approximately half of the prefectures in Japan

Strong sales supported by exclusive, specialized professional agents

Competitive edge based on agents related to financial institutions, primarily regional banks

19

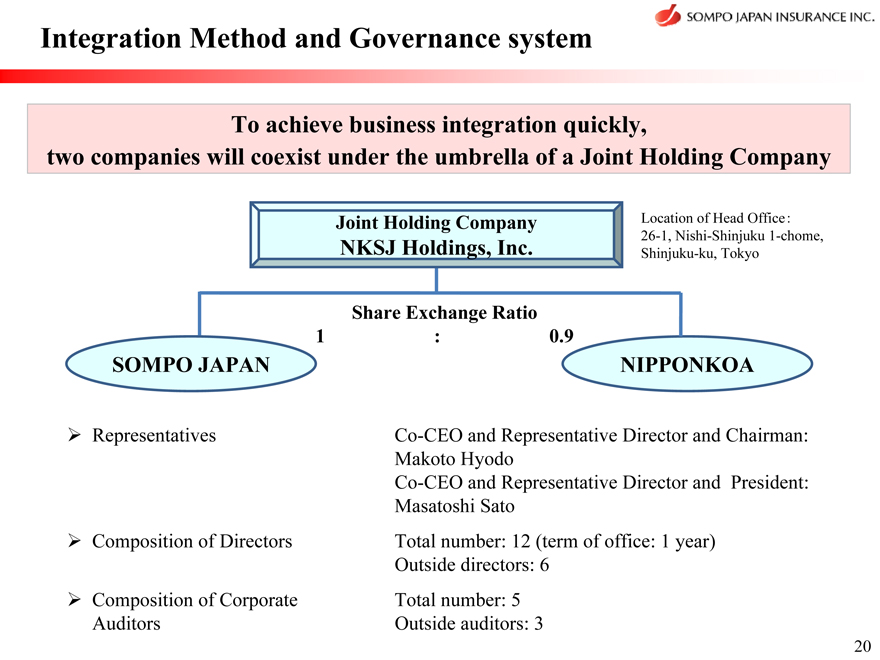

Under the business integration, we have chosen an arrangement for business integration in which the parties will coexist under the umbrella of a Joint Holding Company.

At the time of the incorporation of the Joint Holding Company, Mr. Hyodo, the current President of Nipponkoa, will be the co-CEO and Chairman, and I will be the co-CEO and President.

The total number of directors will be 12, half of which will be outside directors.

The total number of corporate auditors will be 5, including 3 outside auditors.

Please turn to page 21.

Integration Method and Governance system

To achieve business integration quickly, two companies will coexist under the umbrella of a Joint Holding Company

Joint Holding Company NKSJ Holdings, Inc.

Location of Head Office :

26-1, Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo

Share Exchange Ratio

SOMPO JAPAN

NIPPONKOA

Representatives

Composition of Directors

Composition of Corporate Auditors

Co-CEO and Representative Director and Chairman: Makoto Hyodo Co-CEO and Representative Director and President: Masatoshi Sato Total number: 12 (term of office: 1 year) Outside directors: 6 Total number: 5 Outside auditors: 3

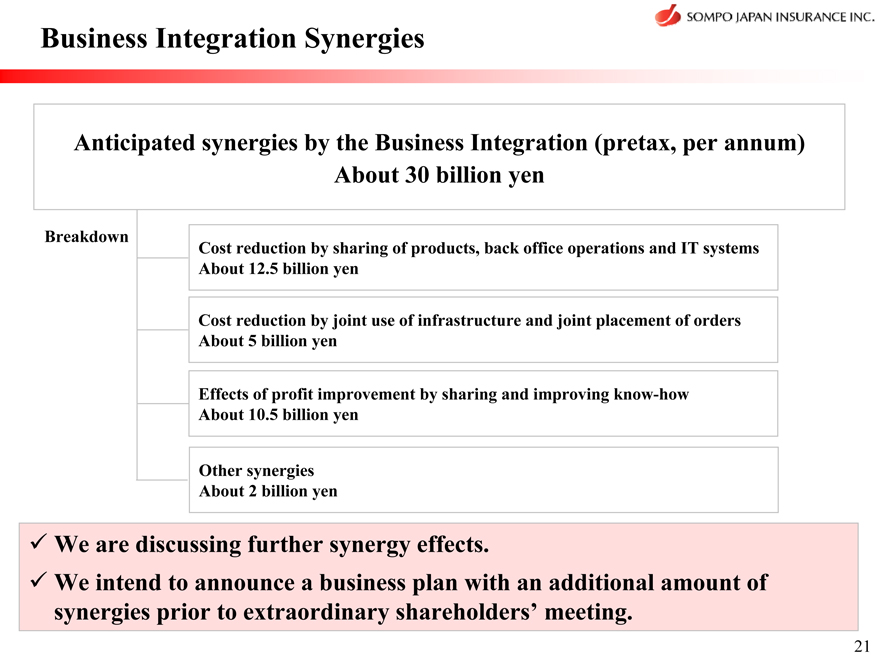

We anticipate synergy effects resulting from the business integration to be about 30 billion yen.

The specific breakdown is cost reduction of about 12.5 billion yen by streamlining the business process and lowering business expenses through sharing products, back office operations and IT systems.

We anticipate about 5 billion yen of cost reduction through the joint use of the parties’ infrastructure and joint placement of orders.

A profit improvement effect of about 10.5 billion yen is expected by sharing and improving our know-how.

Now we are discussing further synergy effects and plan to make another announcement on a business plan which may make possible additional amount of synergies prior to the extraordinary shareholders’ meeting.

Please turn to page 22.

Business Integration Synergies

Anticipated synergies by the Business Integration (pretax, per annum) About 30 billion yen

Breakdown

Cost reduction by sharing of products, back office operations and IT systems About 12.5 billion yen

Cost reduction by joint use of infrastructure and joint placement of orders About 5 billion yen

Effects of profit improvement by sharing and improving know-how About 10.5 billion yen

Other synergies About 2 billion yen

We are discussing further synergy effects.

We intend to announce a business plan with an additional amount of synergies prior to extraordinary shareholders’ meeting.

21

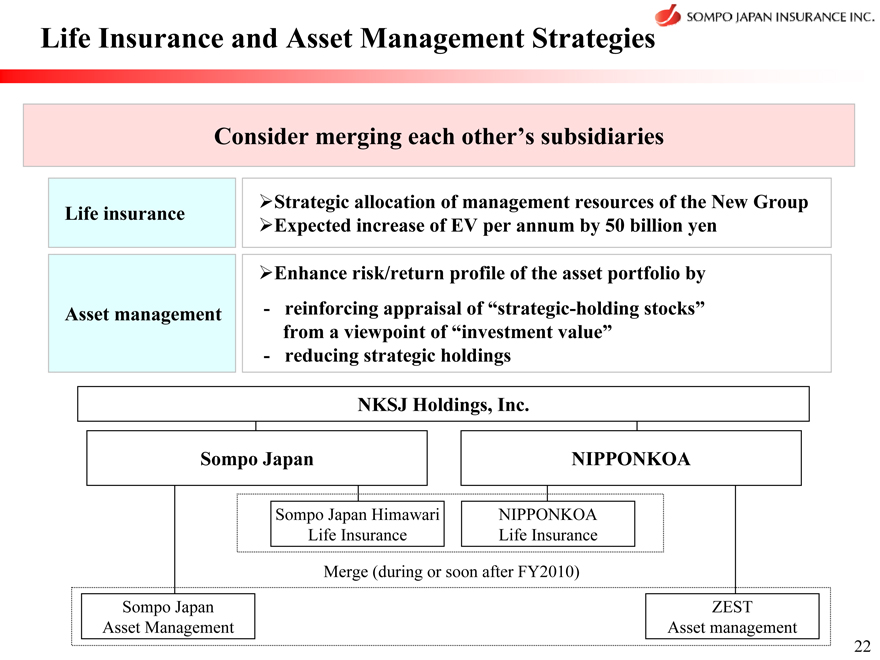

This slide shows our life insurance and asset management strategies.

In the life insurance business, we are considering a merger of each other’s subsidiaries and strategically allocate the New Group’s management resources and aim to increase EV by 50 billion yen.

With respect to the asset management business, we are considering merging each other’s subsidiaries.

Furthermore, the New Group will seek to improve investment profits by rebuilding its asset portfolio through such measures as reduction of “strategic-holding stocks.”

Please turn to page 23.

Life Insurance and Asset Management Strategies

Consider merging each other’s subsidiaries

?Strategic allocation of management resources of the New Group Life insurance

?Expected increase of EV per annum by 50 billion yen

?Enhance risk/return profile of the asset portfolio by Asset management—reinforcing appraisal of “strategic-holding stocks” from a viewpoint of “investment value”—reducing strategic holdings

NKSJ Holdings, Inc.

Sompo Japan NIPPONKOA

Sompo Japan Himawari NIPPONKOA Life Insurance Life Insurance

Merge (during or soon after FY2010)

Sompo Japan ZEST Asset Management Asset management

22

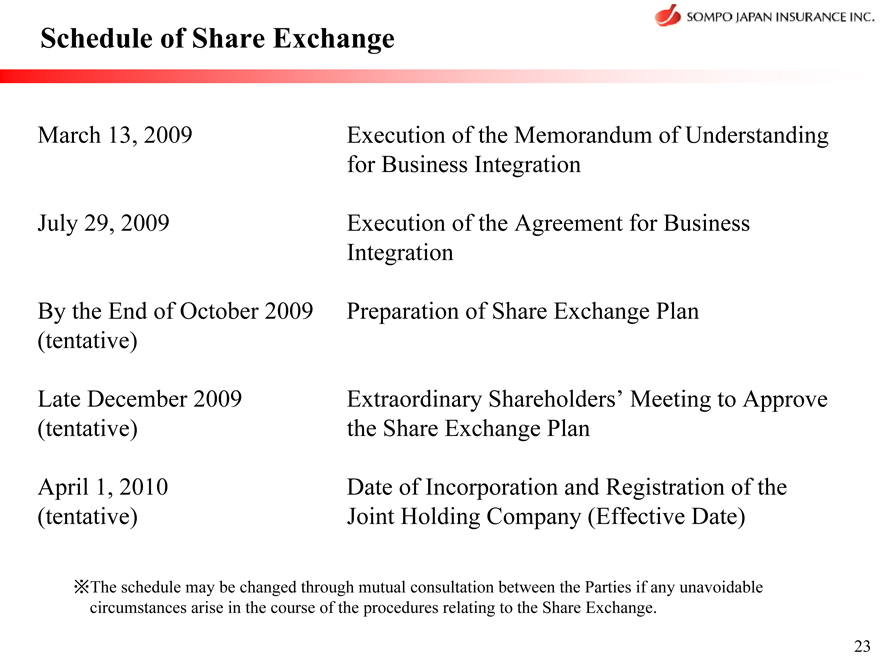

This is the tentative schedule going forward.

By the end of October, we seek to prepare a share exchange plan and make an announcement regarding such plan.

Subsequently, each company plans to hold an extraordinary shareholders’ meeting in late December.

After obtaining shareholder approvals and subject to regulatory approvals, the Joint Holding Company is scheduled to be established on April 1, 2010.

Please turn to page 24.

Schedule of Share Exchange

March 13, 2009 Execution of the Memorandum of Understanding for Business Integration

July 29, 2009 Execution of the Agreement for Business Integration

By the End of October 2009 Preparation of Share Exchange Plan (tentative)

Late December 2009 Extraordinary Shareholders’ Meeting to Approve (tentative) the Share Exchange Plan

April 1, 2010 Date of Incorporation and Registration of the (tentative) Joint Holding Company (Effective Date)

?The schedule may be changed through mutual consultation between the Parties if any unavoidable circumstances arise in the course of the procedures relating to the Share Exchange.

23

Lastly, I will talk about the investment value of Sompo Japan.

Points are shown on this page.

For detail, please turn to page 25.

Investment Value

Financial soundness

- Sufficient net asset with AA credit ratings

Minimized risk of further loss on ABS-CDO guarantee

Upturn of underwriting profit

Enhancing shareholder returns

Undervalued vs. NAV

24

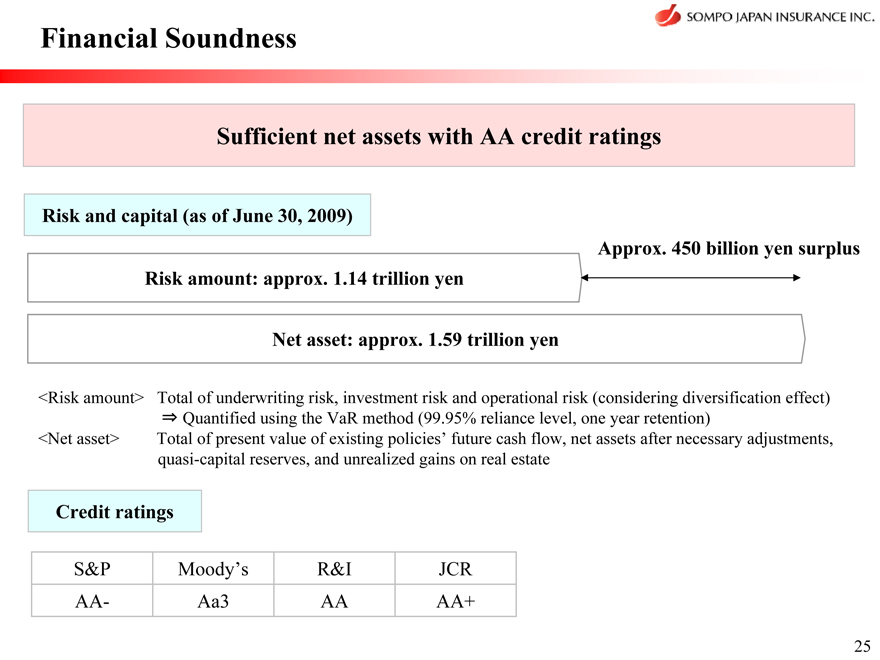

Currently, we have sufficient net assets compared to the risk amount.

Our capital policy aims to achieve an increase in corporate value while keeping a balance between financial soundness and capital efficiency.

Credit ratings are also maintained at the AA range by major rating agencies.

Please turn to page 26.

Financial Soundness

Sufficient net assets with AA credit ratings

Risk and capital (as of June 30, 2009)

Risk amount: approx. 1.14 trillion yen

Approx. 450 billion yen surplus

Net asset: approx. 1.59 trillion yen

<Risk amount> Total of underwriting risk, investment risk and operational risk (considering diversification effect)

Quantified using the VaR method (99.95% reliance level, one year retention)

<Net asset> Total of present value of existing policies’ future cash flow, net assets after necessary adjustments, quasi-capital reserves, and unrealized gains on real estate

Credit ratings

S&P Moody’s R&I JCR AA- Aa3 AA AA+

25

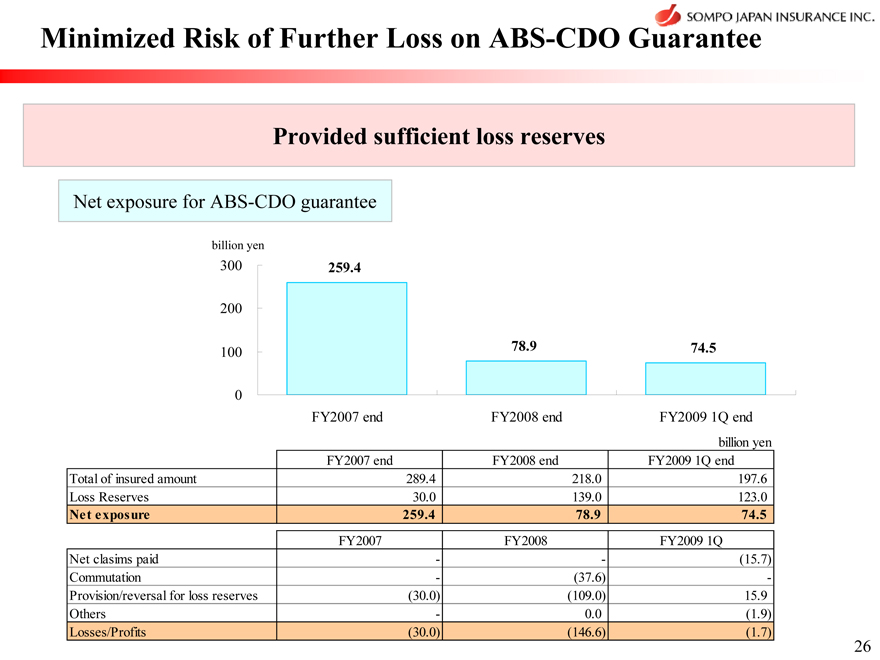

Regarding ABS-CDO guarantee, we can say that the risk of further loss is minimized.

In FY2008, we provided sufficient loss reserves for the entire duration of the guarantee based on the assessment of the severe conditions of the credit market.

We have been also striving to terminate guarantee contracts with guarantee counterparties.

In FY2008, such terminations, also called commutations, have been performed for two contracts.

As a result, our net exposure has decreased to 74.5 billion yen.

Please turn to page 27.

Minimized Risk of Further Loss on ABS-CDO Guarantee

Provided sufficient loss reserves

Net exposure for ABS-CDO guarantee

billion yen

300 259.4

200

100 78.9 74.5

0

FY2007 end FY2008 end FY2009 1Q end

FY2007 end FY2008 end FY2009 1Q end Total of insured amount 289.4 218.0 197.6 Loss Reserves 30.0 139.0 123.0

Net exposure 259.4 78.9 74.5

FY2007 FY2008 FY2009 1Q Net clasims paid- - (15.7) Commutation - (37.6) - Provision/reversal for loss reserves (30.0) (109.0) 15.9 Others - 0.0 (1.9) Losses/Profits (30.0) (146.6) (1.7)

billion yen

26

As for P&C insurance underwriting, FY2007 was a tough year due to the deterioration of top-line and loss ratio.

However, underwriting profit excluding financial guarantee insurance bottomed out in FY2008 and has recently shown a positive trend.

Please turn to page 28.

Upturn of Underwriting Profit

Underwriting profit bottomed out

Underwriting profit excluding financial guarantee insurance

billion yen 70 60 50 40 30 20 10 0 (10) (20)

FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 FY2008

27

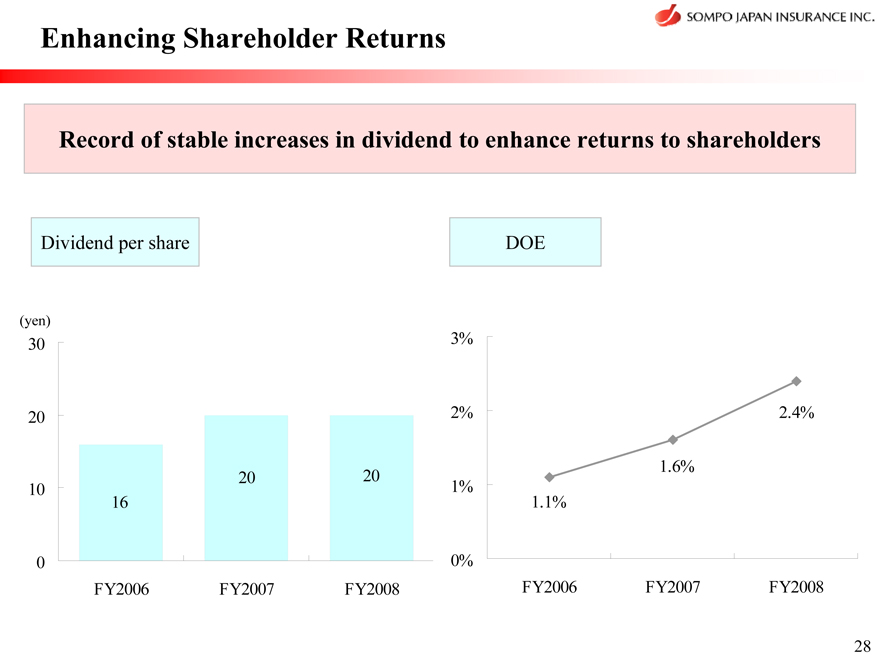

I will now discuss shareholder returns.

Sompo Japan’s basic policy has been to stably increase dividends and DOE.

Up until now, we have stably raised both our dividends and DOE.

Although our financial results for FY2008 declined, we kept the dividend at 20 yen per share, resulting in a DOE of 2.4%.

Please turn to page 29.

Enhancing Shareholder Returns

Record of stable increases in dividend to enhance returns to shareholders

Dividend per share DOE

(yen)

30

20

20 20 10 16

0

FY2006 FY2007 FY2008

3%

2% 2.4%

1.6%

1% 1.1%

0%

FY2006 FY2007 FY2008

28

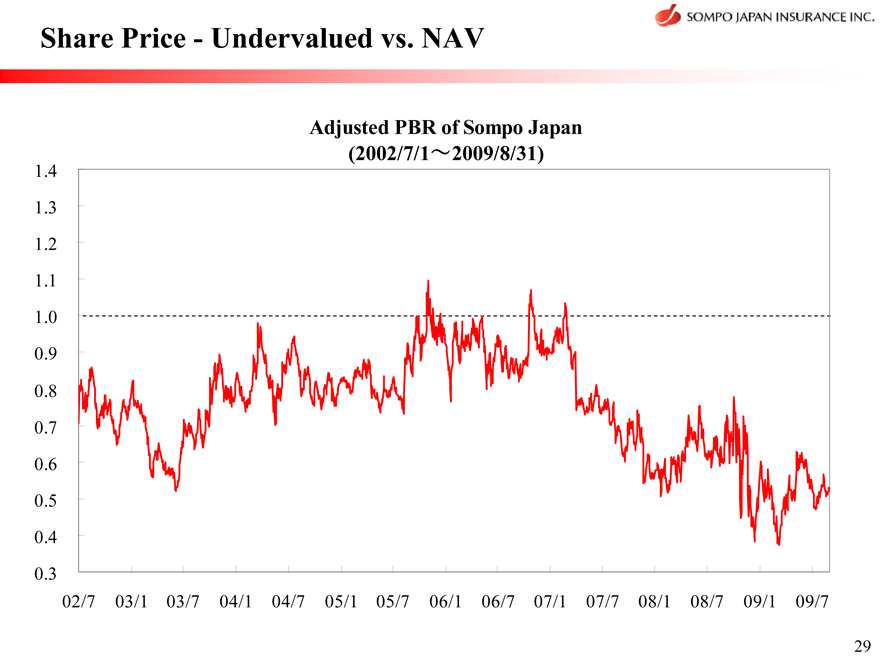

At the end of my presentation, I would like to show you our share price.

Currently, our share price has been undervalued versus NAV for over two years.

I would expect that the gap can be filled by implementing the business strategies I mentioned today.

Thank you for your attention and we will move on to the Q&A session.

Share Price - Undervalued vs. NAV

Adjusted PBR of Sompo Japan (2002/7/1~2009/8/31)

1.4 1.3 1.2 1.1 1.0 0.9

0.8 0.7 0.6 0.5 0.4 0.3

02/7 03/1 03/7 04/1 04/7 05/1 05/7 06/1 06/7 07/1 07/7 08/1 08/7 09/1 09/7

29

|

|

SOMPO JAPAN INSURANCE INC. (“SOMPO JAPAN”) and NIPPONKOA Insurance Co., Ltd. (“NIPPONKOA”) may file a registration statement on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with their proposed business combination. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of SOMPO JAPAN and NIPPONKOA prior to their respective shareholders’ meetings at which the proposed business combination will be voted upon. The Form F-4 and prospectus (if the Form F-4 is filed) will contain important information about SOMPO JAPAN and NIPPONKOA, the proposed business combination and related matters. U.S. shareholders of SOMPO JAPAN and NIPPONKOA are urged to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the proposed business combination carefully before they make any decision at the respective shareholders’ meeting with respect to the proposed business combination. Any documents filed with the SEC in connection with the proposed business combination will be made available when filed, free of charge, on the SEC’s web site at www.sec.gov. In addition, upon request, the documents can be distributed for free of charge. To make a request, please refer to the following contact information.

SOMPO JAPAN INSURANCE INC.

26-1, Nishi-Shinjuku 1-chome, Shinjuku Tokyo, Japan 160-8338 Head of Investor Relations Office, Corporate Planning Department: Shinichi Hara Tel : 81-3-3349-3913 E-mail : SHara1@sompo-japan.co.jp URL : http://www.sompo-japan.co.jp

30

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the plans and expectations of SOMPO JAPAN and NIPPONKOA in relation to, and the benefits resulting from, their proposed business combination and business alliance described above. To the extent that statements in this press release do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of SOMPO JAPAN and NIPPONKOA in light of the information currently available to them, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of SOMPO JAPAN and NIPPONKOA (or the post-business combination group) to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. SOMPO JAPAN and NIPPONKOA undertake no obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by SOMPO JAPAN and NIPPONKOA (or the post-business combination group) in their subsequent domestic filings in Japan and filings with the SEC. The risks, uncertainties and other factors referred to above include, but are not limited to: (1) economic and business conditions in and outside Japan; (2) the regulatory outlook of the Japanese insurance industry; (3) occurrence of losses the type or magnitude of which could not be foreseen at the time of writing the insurance policies covering such losses; (4) the price and availability of reinsurance; (5) the performance of the two companies’ (or the post-business combination group’s) investments; (6) the two companies’ being unable to reach a mutually satisfactory agreement on the detailed terms of the proposed business combination or otherwise unable to complete it; and (7) difficulties in realizing the synergies and benefits of the post-business combination group.

31

Contacts

Sompo Japan Insurance Inc.

Investor Relations Office, Corporate Planning Department

Telephone: +81-3-3349-3913 Fax: +81-3-3348-7322

E-Mail: SHara1@sompo-japan.co.jp HWatanabe11@sompo-japan.co.jp URL: http://www.sompo-japan.co.jp

-This presentation is prepared for information only and is not a solicitation, or offer, to buy or sell the securities of Sompo Japan. -Information contained in this presentation other than past facts are opinions or estimates at the time preparing the issue.

-These opinions or estimates of future performance are not guaranteed by Sompo Japan, and a large differentiation from described opinions or estimates may occur due to various uncertain factors.