Filing under Rule 425 under the U.S. Securities Act of 1933

Filing by: NIPPONKOA Insurance Co., Ltd.

Subject Company: SOMPO JAPAN INSURANCE INC. (SEC File No. 132-02678)

Subject Company: NIPPONKOA Insurance Co., Ltd. (SEC File No. 132-02677)

October 30, 2009

| | | | |

| | Corporate Name: | | SOMPO JAPAN INSURANCE INC. |

| | Name of Representative: | | Masatoshi Sato, President and CEO |

| | (Code Number: 8755 | | TSE, OSE, NSE, SSE and FSE) |

| | |

| | Corporate Name: | | NIPPONKOA Insurance Co., Ltd. |

| | Name of Representative: | | Makoto Hyodo, President and CEO |

| | (Code Number: 8754 | | TSE, OSE and NSE) |

Announcement of Share Exchange Plan and of Business Plan

SOMPO JAPAN INSURANCE INC. (President and Chief Executive Officer: Masatoshi Sato) (“SOMPO JAPAN”) and NIPPONKOA Insurance Co., Ltd., (President and Chief Executive Officer: Makoto Hyodo) (“NIPPONKOA”) (collectively, the “Parties”) entered into the Memorandum of Understanding for business integration on March 13, 2009, and the Share Exchange Agreement on July 29, 2009. SOMPO JAPAN and NIPPONKOA hereby announce that the Parties resolved to authorize the Share Exchange Plan, the Business Integration Agreement and the Business Plan for the New Group at meetings of respective boards of directors today and the Parties have executed the Business Integration Agreement.

The business integration is subject to shareholder approval at a shareholders’ meeting of each Party and to regulatory approvals.

I. Summary of Share Exchange

| 1. | Share Exchange Schedule |

| | |

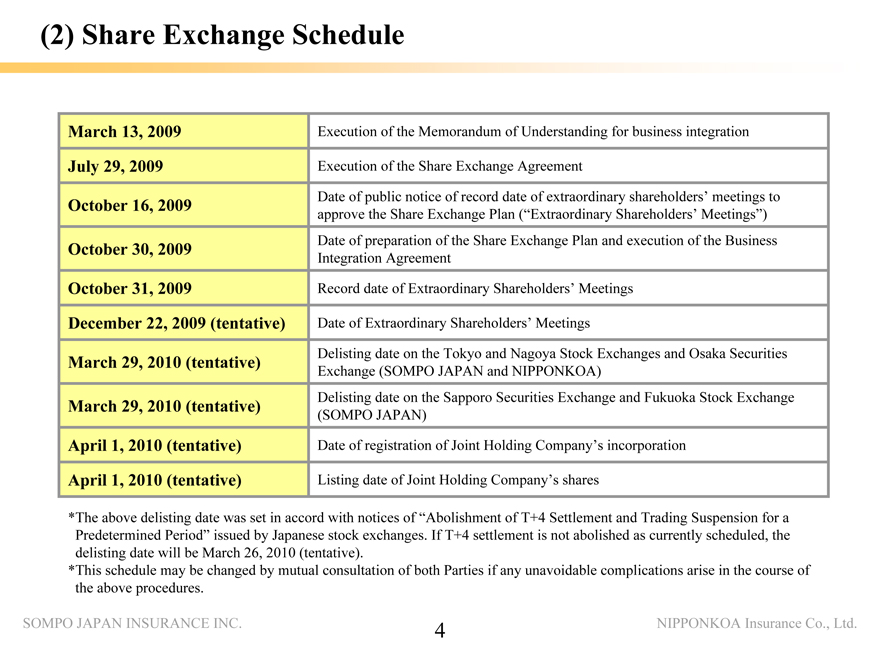

| Execution of the Memorandum of Understanding for business integration (date of board of directors resolution): | | March 13, 2009 |

| |

| Execution of the Share Exchange Agreement (date of board of directors resolution): | | July 29, 2009 |

| |

| Date of public notice of record date of extraordinary shareholders’ meetings to approve the share exchange plan (“Extraordinary Shareholders’ Meetings”): | | October 16, 2009 |

| |

| Date of preparation of the Share Exchange Plan and execution of the Business Integration Agreement (date of board of directors resolution): | | October 30, 2009 |

| |

| Record date of Extraordinary Shareholders’ Meetings: | | October 31, 2009 |

| |

| Date of Extraordinary Shareholders’ Meetings: | | December 22, 2009 (tentative) |

| |

| Delisting date: | | March 29, 2010 (tentative) |

| |

| Effective date of share exchange: | | April 1, 2010 (tentative) |

| |

| Date of registration of joint holding company’s incorporation: | | April 1, 2010 (tentative) |

| |

| Listing date of joint holding company’s shares: | | April 1, 2010 (tentative) |

The above delisting date was set in accord with notices of “Abolishment of T+4 Settlement and Trading Suspension for a Predetermined Period” issued by Japanese stock exchanges. If T+4 settlement is not abolished as currently scheduled, the delisting date will be March 26, 2010 (tentative).

This schedule may be changed by mutual consultation of both Parties if any unavoidable complications arise in the course of the above procedures.

1/11

| 2. | Allotment of Shares in Connection with Share Exchange (Share Exchange Ratio) |

| | | | |

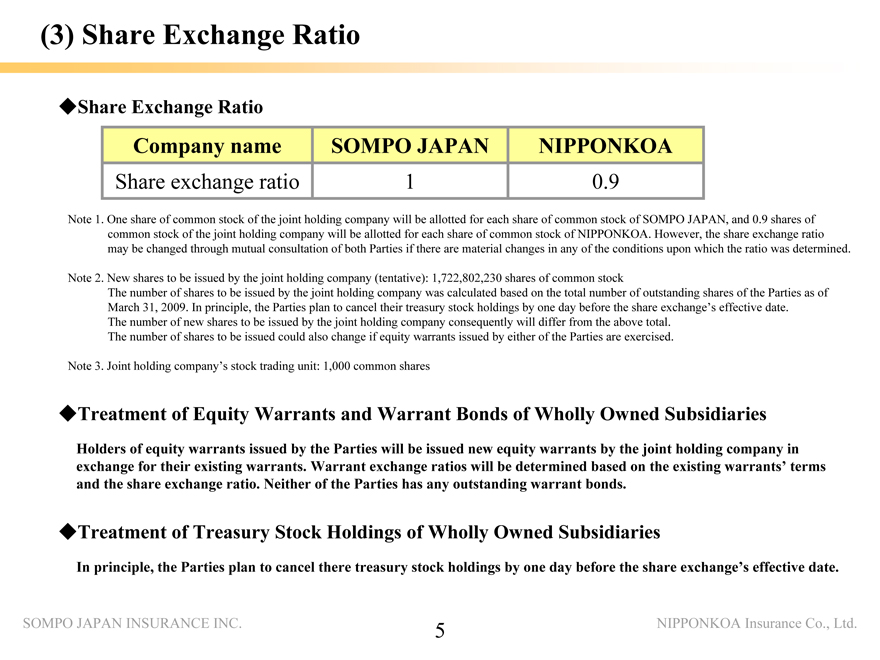

| | | SOMPO JAPAN | | NIPPONKOA |

Share Exchange Ratio | | 1 | | 0.9 |

| | 1. | One share of common stock of the joint holding company will be allotted for each share of common stock of SOMPO JAPAN, and 0.9 shares of common stock of the joint holding company will be allotted for each share of common stock of NIPPONKOA. However, the Share Exchange Ratio may be changed through mutual consultation of both Parties if there are material changes in any of the conditions upon which the ratio was determined. |

| | 2. | New shares to be issued by the joint holding company (tentative): 1,722,802,230 shares of common stock |

| | | The number of shares to be issued by the Joint Holding Company was calculated based on the total number of outstanding shares of the Parties as of March 31, 2009. In principle, the Parties plan to cancel their treasury stock holdings by one day before the share exchange’s effective date. The number of new shares to be issued by the joint holding company consequently may differ from the above total. The number of shares to be issued could also change if equity warrants issued by either of the Parties are exercised. |

| | 3. | Joint holding company’s stock trading unit: 1,000 common shares |

| | 4. | With respect to the basis of calculations related to the share exchange, the calculation process, and the Parties’ relationships with the parties that performed the calculations, there have been no changes from the content of the press release dated July 29, 2009. |

| 3. | Treatment of Equity Warrants and Warrant Bonds of Wholly Owned Subsidiaries |

| | Holders of equity warrants issued by the Parties will be issued new equity warrants by the joint holding company in exchange for their existing warrants. Warrant exchange ratios will be determined based on the existing warrants’ terms and the share exchange ratio. Neither of the Parties has issued any outstanding warrant bonds. |

| 4. | Treatment of Treasury Stock Holdings of Wholly Owned Subsidiaries |

| | In principle, the Parties plan to cancel there treasury stock holdings by one day before the share exchange’s effective date. |

| 5. | Matters Related to Joint Holding Company’s Listing Applications |

| | The Parties plan to apply to list the newly established joint holding company’s shares on the Tokyo Stock Exchange and Osaka Securities Exchange effective April 1, 2010. Because the Parties will become wholly owned subsidiaries of the joint holding company as a result of the share exchange, the Parties plan to delist their shares effective March 29, 2010. SOMPO JAPAN will delist from the Tokyo, Nagoya, and Fukuoka Stock Exchanges and Osaka and Sapporo Securities Exchanges and NIPPONKOA will delist from the Tokyo and Nagoya Stock Exchanges and Osaka Securities Exchange in accord with the exchanges’ respective regulations. |

2/11

| 6. | Profile of Holding Company to Be Established through Share Exchange |

| | | | | | |

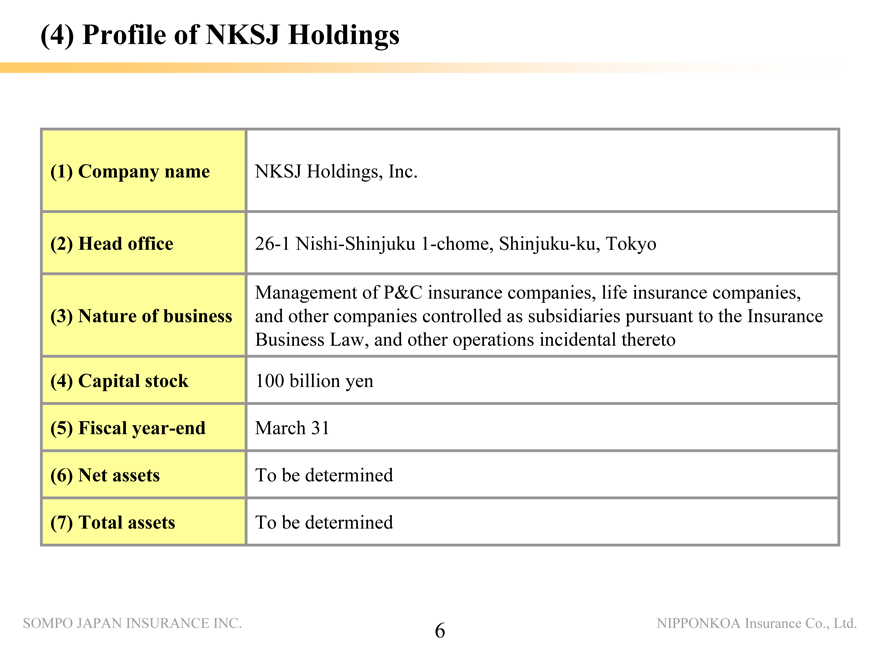

(1) Company name | | NKSJ Holdings, Inc. | | | | |

| | |

(2) Head office | | 26-1 Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo | | |

| | | |

(3) Planned corporate officer appointments | | Chairman and co-CEO | | Makoto Hyodo | | Currently NIPPONKOA, President & CEO |

| | | |

| | President and co-CEO | | Masatoshi Sato | | Currently SOMPO JAPAN, President and CEO |

| | | |

| | Director (outside director) | | Akira Genma | | Currently Shiseido Company, Limited, Senior Advisor |

| | | |

| | Director (outside director) | | Tsunehisa Katsumata | | Currently The Tokyo Electric Power Company, Incorporated, Chairman of the Board of Directors |

| | | |

| | Director (outside director) | | Seiichi Asaka | | Currently NSK Ltd., Chairman of the Board |

| | | |

| | Director (outside director) | | Sumitaka Fujita | | Currently ITOCHU Corporation, Special Advisor |

| | | |

| | Director (outside director) | | Yoshiharu Kawabata | | Lawyer |

| | | |

| | Director | | Yasuhide Fujii | | Currently NIPPONKOA, Director & Managing Executive Officer |

| | | |

| | Director | | Yuichi Yamaguchi | | Currently NIPPONKOA, Director & Managing Executive Officer |

| | | |

| | Director (outside director) | | George Olcott | | Currently CAMBRIDGE Judge Business School, Senior Fellow |

| | | |

| | Director | | Kengo Sakurada | | Currently SOMPO JAPAN, Director, Managing Executive Officer |

| | | |

| | Director | | Hiroyuki Yamaguchi | | Currently SOMPO JAPAN, Director, Managing Executive Officer |

| | | |

| | Auditor (outside auditor) | | Koichi Masuda | | Certified Public Accountant |

| | | |

| | Auditor (outside auditor) | | Makiko Yasuda | | Lawyer |

| | | |

| | Auditor (outside auditor) | | Motoyoshi Nishikawa | | Currently NIPPON STEEL CORPORATION, Advisor |

| | | |

| | Auditor | | Atau Kadokawa | | Currently NIPPONKOA, Auditor |

| | | |

| | Auditor | | Jiro Handa | | Currently SOMPO JAPAN, Auditor |

| |

(4) Nature of business | | Management of P&C insurance companies, life insurance companies, and other companies controlled as subsidiaries pursuant to the Insurance Business Law, and other operations incidental thereto |

| | | |

(5) Capital stock | | ¥100 billion | | | | |

| | | |

(6) Fiscal year-end | | March 31 | | | | |

| | | |

(7) Net assets | | To be determined | | | | |

| | | |

(8) Total assets | | To be determined | | | | |

| |

(9) Exchanges where shares to be listed | | Tokyo Stock Exchange, Osaka Securities Exchange |

| |

(10) Independent auditor | | ERNST & YOUNG SHINNIHON LLC |

| |

(11) Stock transfer agent | | Daiko Clearing Services Corporation |

| * | Directors and auditors excluding chairman and president are written in the above list according to the date of birth respectively. |

3/11

The share exchange is classified as an acquisition under applicable accounting standards for business combinations. The transaction will accordingly be accounted for by the purchase method. The amount of goodwill to be recognized from the share exchange has yet to be determined.

4/11

II. Business Plan for New Group

| 1. | Group Management Targets |

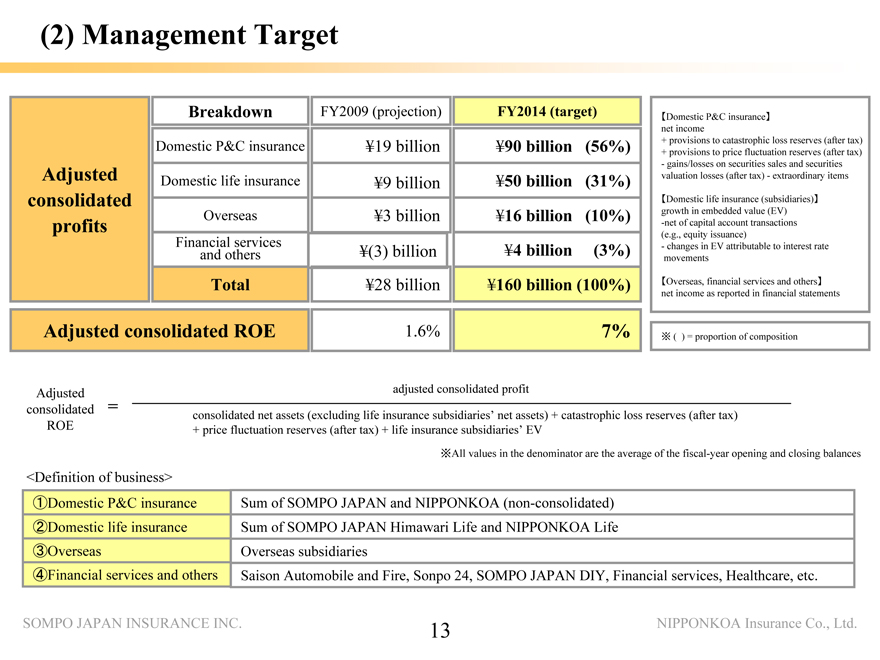

The Group’s 5-year (FY2014-end) management targets are as follows.

| | | | | | | | | |

| | | FY2009 (projected) | | FY2014 (targets) | |

| | | Adjusted profits | | Adjusted profits | | Share of total | |

Adjusted consolidated profits | | ¥ | 28.0 billion | | ¥ | 160.0 billion | | 100 | % |

Domestic P&C insurance business1 | | ¥ | 19.0 billion | | ¥ | 90.0 billion | | 56 | % |

Domestic life insurance business2 | | ¥ | 9.0 billion | | ¥ | 50.0 billion | | 31 | % |

Overseas insurance business3 | | ¥ | 3.0 billion | | ¥ | 16.0 billion | | 10 | % |

Financial services & other businesses3 | | ¥ | (3.0) billion | | ¥ | 4.0 billion | | 3 | % |

| | | | | | |

| | | FY2009 (projected) | | | FY2014 (target) | |

Adjusted consolidated ROE4 | | 1.6 | % | | 7 | % |

| 1. | The domestic P&C insurance business’s adjusted profits are sum totals of SOMPO JAPAN and NIPPONKOA’s respective non-consolidated profits, calculated as follows. |

| | Domestic P&C insurance business’s adjusted profits = net income + provisions to catastrophic loss reserves (after tax) + provisions to price fluctuation reserves (after tax) - gains/losses on securities sales and securities valuation losses (after tax) - extraordinary items |

| 2. | The domestic life insurance business’s adjusted profits are sum totals of SOMPO JAPAN Himawari Life Insurance Co., Ltd.’s and NIPPONKOA Life Insurance Co., Ltd.’s respective profits, calculated as growth in embedded value (EV) net of capital account transactions (e.g., equity issuance) and changes in EV attributable to interest rate movements. |

| 3. | Overseas insurance, financial services and other businesses’ adjusted profits are net income as reported in financial statements. |

| 4. | Adjusted consolidated ROE = adjusted consolidated profits ÷ (consolidated net assets (excluding life insurance subsidiaries’ net assets) + catastrophic loss reserves (after tax) + price fluctuation reserves (after tax) + life insurance subsidiaries’ EV) |

| | All values in the denominator are the average of the fiscal-year opening and closing balances. |

| 2. | Synergies and Plans for Major Businesses |

| | (1) | Domestic P&C Insurance Business |

In integrating their operations, the Parties will enhance their competitiveness in the P&C insurance business by boosting operating efficiency, offering high-quality products and services that meet customers’ needs, and steadily executing the following initiatives.

| | (i) | Substantially reduce costs by unifying products, back-office processes, and IT systems. |

| | (ii) | Maximize quality from the customer’s perspective through the Retail Business Model Reform Project (PT-R) and the most advanced IT systems in the industry. |

| | (iii) | Reduce operating costs through such means as joint use of infrastructures and joint placement of orders. |

| | (iv) | Increase profits by sharing and improving the Parties’ know-how. |

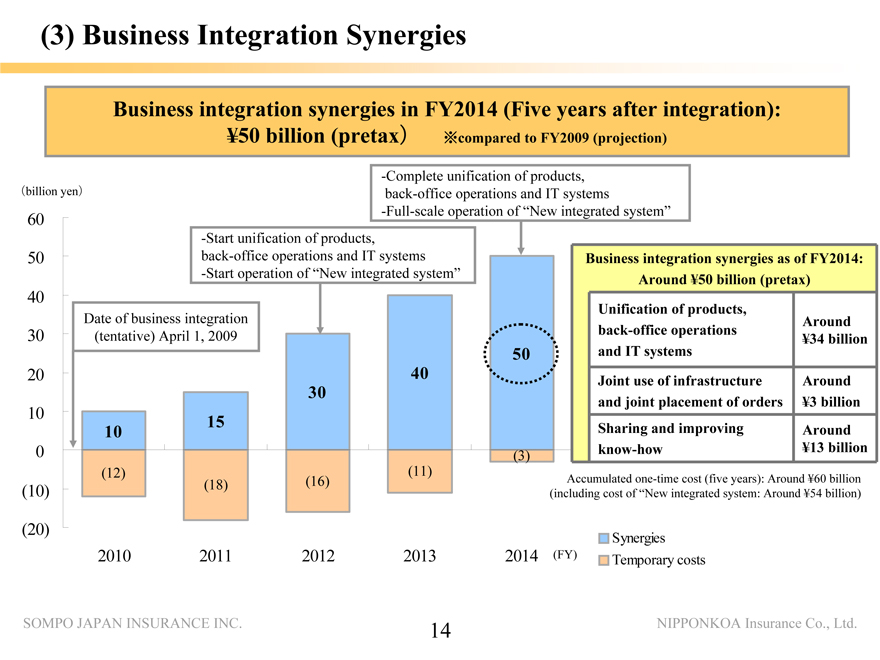

Through these initiatives, the Parties aim to realize synergies of around ¥30 billion by fiscal 2012 and around ¥50 billion by fiscal 2014, the fifth year following the business integration.

5/11

<Synergies as of FY2014>

| | | | |

| Domestic P&C insurance business |

| Effects of cost reduction by unification of products, back-office operations, and IT systems | | Effects of cost reduction through joint use of infrastructure and joint placement of orders, etc. | | Effects of increase of profits by sharing and improving know-how |

| | |

| Around ¥34 billion | | Around ¥3 billion | | Around ¥13 billion |

| | * | The above figures are pretax-basis synergies projected to be realized in fiscal 2014 (relative to fiscal 2009). The business integration is also projected to result in one-time costs totaling ¥60 billion over approximately the first five years after business integration. |

| | (2) | Domestic Life Insurance Business |

The Parties’ life insurance subsidiaries (SOMPO JAPAN Himawari Life Insurance Co., Ltd., and NIPPONKOA Life Insurance Co., Ltd.), which are both currently on growth trajectories by offering products that meet customers’ needs, aim to merge within two years after the business integration.

The Parties aim to increase their life insurance subsidiaries’ embedded value* by ¥50 billion per year in fiscal 2014 by strategically deploying their new group’s management resources and offering compelling products and services to a broader market by virtue of the business integration.

| | * | Embedded value is the sum total of a life insurer’s net asset value and the present value of future profits from in-force insurance policies. |

| | (3) | Overseas Insurance Business |

The Parties will pursue business expansion, mainly through M&As, in overseas insurance markets with promising growth prospects, capitalizing on their human resources and strengthened financial foundation following the business integration.

| | (4) | Asset Management Business |

To strengthen their new Group’s asset management operations, the Parties’ asset management subsidiaries (Sompo Japan Asset Management Co., Ltd., and Zest Asset Management Limited) will aim to merge by a target date of fiscal 2010.

The Parties also aim to further boost their investment returns, increase their asset management know-how, and strengthen their asset management capabilities by transferring to a new asset management subsidiary their respective front-office operations that manage SOMPO JAPAN and NIPPONKOA’s portfolios of securities held as pure investments.

Additionally, the Parties will endeavor to reduce strategic-holding stocks on an ongoing basis and improve management of strategic-holding stocks by using individual stock valuations provided by the new asset management subsidiary and other sources as one of the criteria for investment decisions.

| | (5) | Risk Consulting (Management) Business |

To improve their consulting and new service development capabilities in response to growing, increasingly diverse risks, the Parties’ risk consulting (management) subsidiaries (Sompo Japan Risk Management Inc. and NK Risk Consulting Co., Ltd.) aim to integrate by early in fiscal 2010.

As the largest risk consultancy affiliated with a P&C insurer, the new company will seek to offer the highest-quality services, peace of mind, and new solutions to customers.

The Parties will collaboratively utilize their business infrastructure and accumulated know-how in other businesses such as healthcare, defined contribution (DC) pension plans, and environmental businesses.

The Parties will also pursue an optimal group culture conducive to synergies among other subsidiaries.

6/11

Exhibit 1

Background and Objectives and Basic Principle of Business Integration

I. Background and objectives of business integration

In the face of the declining birthrate and aging society – the significant challenges Japan faces in the medium to long-term period – as well as of increased risks associated with depopulating society, deteriorating global climate changes, and in response to the diversified consumer demands amidst the individual’s lifestyle changes, companies are urged to take proper actions and contribute to social safety and to customers’ sense of security.

Based on this shared perspective, SOMPO JAPAN and NIPPONKOA decided to establish a “new solution service group which provides consumers with security and service of the highest quality and contribute to social welfare” (the “New Group”), while sharing as a unitary group the strengths nurtured through 120 years of their respective histories.

II. Management’s vision and the New Group’s aspirations

1. The group which seeks to provide the highest-quality security and service

SOMPO JAPAN and NIPPONKOA will further strengthen the product development, the claims handling capacity, and the IT capability while providing an increasing number of customers with the security and service of the highest quality through the combined distribution channels of the group.

2. The group with focus on its business in Japan

SOMPO JAPAN and NIPPONKOA will focus on their business in Japan and enhance the brand value of the Parties in Japan as well as by sharing the business platform, improve the group management efficiency and further bolster their competitiveness.

3. The group which provides a broad range of solutions friendly to the society and the environment

SOMPO JAPAN and NIPPONKOA will seek to provide a broad range of solutions to people’s lives and corporate activities in the areas of health, medical care and environment that transcend the conventional framework of insurance business. By maintaining proactive communications with various stakeholders, SOMPO JAPAN and NIPPONKOA will seek to fulfill their corporate social responsibility (CSR) and aim to achieve a sound balance between the environment and the business management through adoption of measures designed for global warming.

4. The group which seeks to maximize the shareholder value

SOMPO JAPAN and NIPPONKOA will seek to maximize their shareholder value by efficiently allocating the management resources to business areas with growth potential including the life insurance business, the overseas insurance business and the asset management business and improving business efficiency in the group, and will aim to realize fair and sustainable return to their shareholders. SOMPO JAPAN and NIPPONKOA will also further strive to achieve transparency in corporate governance and seek to establish brand recognition for the group underpinned by profitability, growth potential, trust and soundness.

5. The group with a free, vigorous, open and energetic corporate culture

SOMPO JAPAN and NIPPONKOA will use their know-how and revitalize the organization through the provision of opportunities for employee interactions at various levels and regions as well as joint learning opportunities. SOMPO JAPAN and NIPPONKOA aim to build up a group where agents and employees can feel satisfied with their work and grow together as the best partners.

6. The group independent from the influence of any corporate or financial group

As an independent group, SOMPO JAPAN and NIPPONKOA will establish equal and friendly relationships with any corporate or financial group.

7/11

III. Basic principle of business integration

1. Perspective of customers

SOMPO JAPAN and NIPPONKOA will make all the value judgments from the “customers’ perspective” and pursue the best business practices.

2. Emphasis on speed

SOMPO JAPAN and NIPPONKOA will place emphasis on speed with the aim to quickly realize the effects of the growth strategy, the business integration and the business alliance.

3. Independent group from any corporate or financial group

SOMPO JAPAN and NIPPONKOA will establish equal and friendly relationships with any corporate or financial group as an independent New Group, with an understanding that the Parties will continue to operate under the joint holding company.

4. Equal spirit

After the integration, the New Group will abide by the spirit of equality between the Parties.

5. Enhancement of corporate value

Subject to the above, SOMPO JAPAN and NIPPONKOA will expeditiously and aggressively implement measures to boost the corporate value of the entire New Group.

8/11

Exhibit 2

General Information on Parties

| | | | |

| Corporate Name | | SOMPO JAPAN INSURANCE INC. | | NIPPONKOA Insurance Co., Ltd. |

| | |

| Line of Business | | Non-life insurance | | Non-life insurance |

| | |

| Date of Incorporation | | February 12, 1944 | | October 1, 1944 |

| | |

| Date of Establishment | | 1888 | | 1892 |

| | |

| Location of Head Office | | 26-1, Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo | | 7-3, Kasumigaseki 3-chome, Chiyoda-ku, Tokyo |

| | |

| Title and Name of Representative | | President and Chief Executive Officer Masatoshi Sato | | President and Chief Executive Officer Makoto Hyodo |

| | |

Capital (as of March 31, 2009) | | ¥70 billion | | ¥91.2 billion |

| | |

Total Number of Issued Shares (as of March 31, 2009) | | 987,733 thousand shares | | 816,743 thousand shares |

| | |

Net Assets (consolidated) (as of March 31, 2009) | | ¥594.9 billion | | ¥345.4 billion |

| | |

Total Assets (consolidated) (as of March 31, 2009) | | ¥5,913.3 billion | | ¥3,089.5 billion |

| | |

| End of Fiscal Year | | March | | March |

| | |

Number of Employees (consolidated) (as of March 31, 2009) | | 19,572 | | 9,501 |

| | |

Major Shareholders and Shareholding Ratios (as of March 31, 2009) | | Japan Trustee Services Bank, Ltd. (Trust account) (6.77%) Japan Trustee Services Bank, Ltd (Trust account 4G) (5.59%) The Master Trust Bank of Japan, Ltd. (Trust account) (5.42%) State Street Bank and Trust Company (4.69%) The Dai-Ichi Mutual Life Insurance Company (4.14%) Mizuho Corporate Bank, Ltd. (3.27%) | | State Street Bank and Trust Company (8.76%) Longleaf Partners Fund (7.80%) Nippon Express Co., Ltd. (4.35%) Japan Trustee Services Bank, Ltd. (Trust account 4G) (4.22%) Mellon Bank NA Treaty Client Omnibus (2.71%) The Bank of Tokyo-Mitsubishi UFJ, Ltd. (2.67%) |

| |

| Relationship between Parties | | No material capital, personal or business relationship exists among the Parties, nor is any of the Parties a related party (“kanren tojisha”) vis-à-vis one another. |

| | |

Number of Agents (as of March 31, 2009) | | 49,430 | | 29,857 |

| | |

Network in Japan (as of July 1, 2009) | | Branch offices (109), sub-branch offices of the sales section (537); claims handling and service offices (265) | | Branch offices (79), sub-branch offices of the sales section (415); claims handling offices (183) |

| | |

Number of Overseas Offices (as of July 1, 2009) | | 93 offices in 29 countries | | 26 offices in 17 countries |

| | |

| URL | | http://www.sompo-japan.co.jp | | http://www.nipponkoa.co.jp |

9/11

(Financial Results for the Previous Three Years)

(Data below listed in ¥100 millions, except per share data)

| | | | | | |

Consolidated basis | | | | | | |

| | | (1) SOMPO JAPAN INSURANCE INC. |

Fiscal year ended | | March 31, 2007 | | March 31, 2008 | | March 31, 2009 |

Ordinary income | | 19,015 | | 18,941 | | 17,679 |

Net premiums written | | 13,866 | | 13,687 | | 13,081 |

Ordinary profit | | 1,105 | | 940 | | (1,440) |

Net income | | 619 | | 596 | | (667) |

Net income per share (yen) | | 62.93 | | 60.57 | | (67.75) |

Dividends per share (yen)* | | 16.00 | | 20.00 | | 20.00 |

Net assets per share (yen) | | 1,476.81 | | 1,086.86 | | 602.30 |

* Dividends per share are on a non-consolidated basis. (Data below listed in ¥100 millions, except per share data) |

Consolidated basis | | | | | | |

| | | (2) NIPPONKOA Insurance Co., Ltd. |

Fiscal year ended | | March 31, 2007 | | March 31, 2008 | | March 31, 2009 |

Ordinary income | | 10,004 | | 9,754 | | 9,491 |

Net premiums written | | 7,128 | | 6,986 | | 6,638 |

Ordinary profit | | 281 | | 177 | | (30) |

Net income | | 158 | | 89 | | 99 |

Net income per share (yen) | | 19.81 | | 11.63 | | 13.15 |

Dividends per share (yen)* | | 7.50 | | 7.50 | | 8.00 |

Net assets per share (yen) | | 962.55 | | 711.58 | | 458.09 |

* Dividends per share are on a non-consolidated basis. (Data below listed in ¥100 millions) |

Consolidated basis | | | | | | |

| | | (Reference) Sum of the two companies ((1) + (2)) |

Fiscal year ended | | March 31, 2007 | | March 31, 2008 | | March 31, 2009 |

Ordinary income | | 29,020 | | 28,695 | | 27,170 |

Net premiums written | | 20,995 | | 20,674 | | 19,720 |

Ordinary profit | | 1,386 | | 1,118 | | (1,470) |

Net income | | 778 | | 686 | | (567) |

10/11

(Forecast)

(Data below listed in ¥100 millions, except per share data)

| | | | |

| | |

| | | SOMPO JAPAN INSURANCE INC. | | NIPPONKOA Insurance Co., Ltd. |

Fiscal year ending | | March 31, 2010

Forecast for the full fiscal year | | March 31, 2010

Forecast for the full fiscal year |

Ordinary income | | 17,980 | | 8,900 |

Ordinary profit | | 590 | | 220 |

Net income | | 320 | | 130 |

Net income per share (yen) | | 32.50 | | 17.27 |

Dividends per share (yen)* | | 20.00 | | 8.00 |

| * | Dividends per share are on a non-consolidated basis. |

11/11

Share Exchange Plan and Business Plan for Establishing Joint Holding Company

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

October 30, 2009

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

1. Summary of Share Exchange Plan

2. Business Plan of the New Group

[Note]

The Share Exchange is subject to the fulfillment of terms and conditions relating to the Share Exchange, including shareholder approval at extraordinary shareholders’ meeting of each Party, regulatory notices and approvals stipulated by applicable Japanese and foreign laws, and absence of any other event that could be materially detrimental to the Share Exchange.

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

1. Summary of Share Exchange Plan

2. Business Plan of the New Group

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

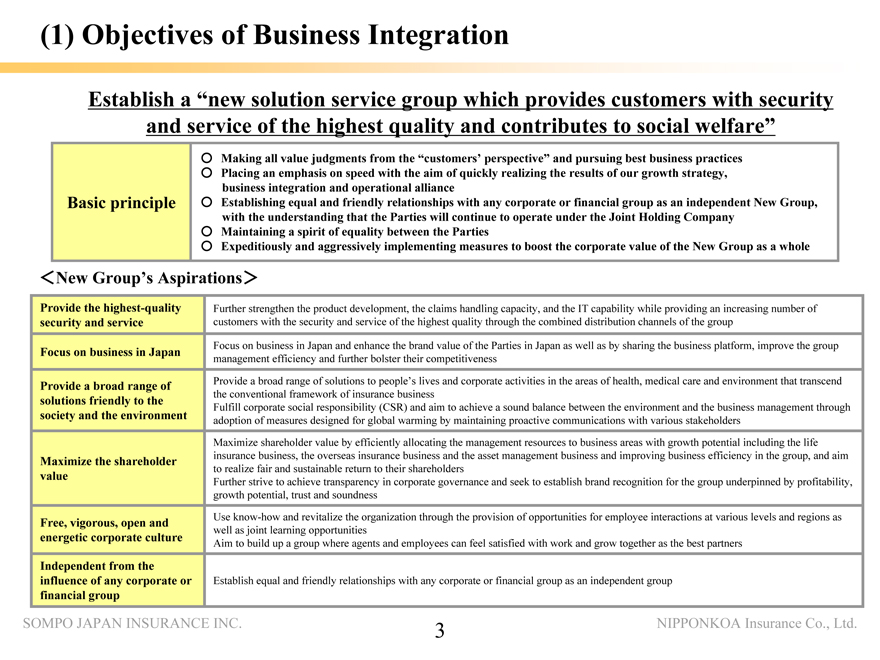

(1) | | Objectives of Business Integration |

Establish a “new solution service group which provides customers with security and service of the highest quality and contributes to social welfare”

Making all value judgments from the “customers’ perspective” and pursuing best business practices

Placing an emphasis on speed with the aim of quickly realizing the results of our growth strategy, business integration and operational alliance

Basic principle Establishing equal and friendly relationships with any corporate or financial group as an independent New Group, with the understanding that the Parties will continue to operate under the Joint Holding Company

Maintaining a spirit of equality between the Parties

Expeditiously and aggressively implementing measures to boost the corporate value of the New Group as a whole

<New Group’s Aspirations>

Provide the highest-quality security and service

Focus on business in Japan

Provide a broad range of solutions friendly to the society and the environment

Maximize the shareholder value

Free, vigorous, open and energetic corporate culture

Independent from the influence of any corporate or financial group

Further strengthen the product development, the claims handling capacity, and the IT capability while providing an increasing number of customers with the security and service of the highest quality through the combined distribution channels of the group

Focus on business in Japan and enhance the brand value of the Parties in Japan as well as by sharing the business platform, improve the group management efficiency and further bolster their competitiveness

Provide a broad range of solutions to people’s lives and corporate activities in the areas of health, medical care and environment that transcend the conventional framework of insurance business Fulfill corporate social responsibility (CSR) and aim to achieve a sound balance between the environment and the business management through adoption of measures designed for global warming by maintaining proactive communications with various stakeholders Maximize shareholder value by efficiently allocating the management resources to business areas with growth potential including the life insurance business, the overseas insurance business and the asset management business and improving business efficiency in the group, and aim to realize fair and sustainable return to their shareholders Further strive to achieve transparency in corporate governance and seek to establish brand recognition for the group underpinned by profitability, growth potential, trust and soundness Use know-how and revitalize the organization through the provision of opportunities for employee interactions at various levels and regions as well as joint learning opportunities Aim to build up a group where agents and employees can feel satisfied with work and grow together as the best partners

Establish equal and friendly relationships with any corporate or financial group as an independent group

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

(2) | | Share Exchange Schedule |

March 13, 2009 Execution of the Memorandum of Understanding for business integration

July 29, 2009 Execution of the Share Exchange Agreement

October 16, 2009 Date of public notice of record date of extraordinary shareholders’ meetings to

approve the Share Exchange Plan (“Extraordinary Shareholders’ Meetings”)

October 30, 2009 Date of preparation of the Share Exchange Plan and execution of the Business

Integration Agreement

October 31, 2009 Record date of Extraordinary Shareholders’ Meetings

December 22, 2009 (tentative) Date of Extraordinary Shareholders’ Meetings

March 29, 2010 (tentative) Delisting date on the Tokyo and Nagoya Stock Exchanges and Osaka Securities

Exchange (SOMPO JAPAN and NIPPONKOA)

March 29, 2010 (tentative) Delisting date on the Sapporo Securities Exchange and Fukuoka Stock Exchange

(SOMPO JAPAN)

April 1, 2010 (tentative) Date of registration of Joint Holding Company’s incorporation

April 1, 2010 (tentative) Listing date of Joint Holding Company’s shares

*The above delisting date was set in accord with notices of “Abolishment of T+4 Settlement and Trading Suspension for a Predetermined Period” issued by Japanese stock exchanges. If T+4 settlement is not abolished as currently scheduled, the delisting date will be March 26, 2010 (tentative).

*This schedule may be changed by mutual consultation of both Parties if any unavoidable complications arise in the course of the above procedures.

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

Share Exchange Ratio

Company name SOMPO JAPAN NIPPONKOA

Share exchange ratio 1 0.9

Note 1. One share of common stock of the joint holding company will be allotted for each share of common stock of SOMPO JAPAN, and 0.9 shares of common stock of the joint holding company will be allotted for each share of common stock of NIPPONKOA. However, the share exchange ratio may be changed through mutual consultation of both Parties if there are material changes in any of the conditions upon which the ratio was determined.

Note 2. New shares to be issued by the joint holding company (tentative): 1,722,802,230 shares of common stock

The number of shares to be issued by the joint holding company was calculated based on the total number of outstanding shares of the Parties as of March 31, 2009. In principle, the Parties plan to cancel their treasury stock holdings by one day before the share exchange’s effective date. The number of new shares to be issued by the joint holding company consequently will differ from the above total.

The number of shares to be issued could also change if equity warrants issued by either of the Parties are exercised.

Note 3. Joint holding company’s stock trading unit: 1,000 common shares

Treatment of Equity Warrants and Warrant Bonds of Wholly Owned Subsidiaries

Holders of equity warrants issued by the Parties will be issued new equity warrants by the joint holding company in exchange for their existing warrants. Warrant exchange ratios will be determined based on the existing warrants’ terms and the share exchange ratio. Neither of the Parties has any outstanding warrant bonds.

Treatment of Treasury Stock Holdings of Wholly Owned Subsidiaries

In principle, the Parties plan to cancel there treasury stock holdings by one day before the share exchange’s effective date.

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

(4) | | Profile of NKSJ Holdings |

(1) Company name

(2) Head office

(3) Nature of business

(4) Capital stock

(5) Fiscal year-end

(6) Net assets

(7) Total assets

NKSJ Holdings, Inc.

26-1 Nishi-Shinjuku 1-chome, Shinjuku-ku, Tokyo

Management of P&C insurance companies, life insurance companies, and other companies controlled as subsidiaries pursuant to the Insurance Business Law, and other operations incidental thereto

100 billion yen

March 31

To be determined

To be determined

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

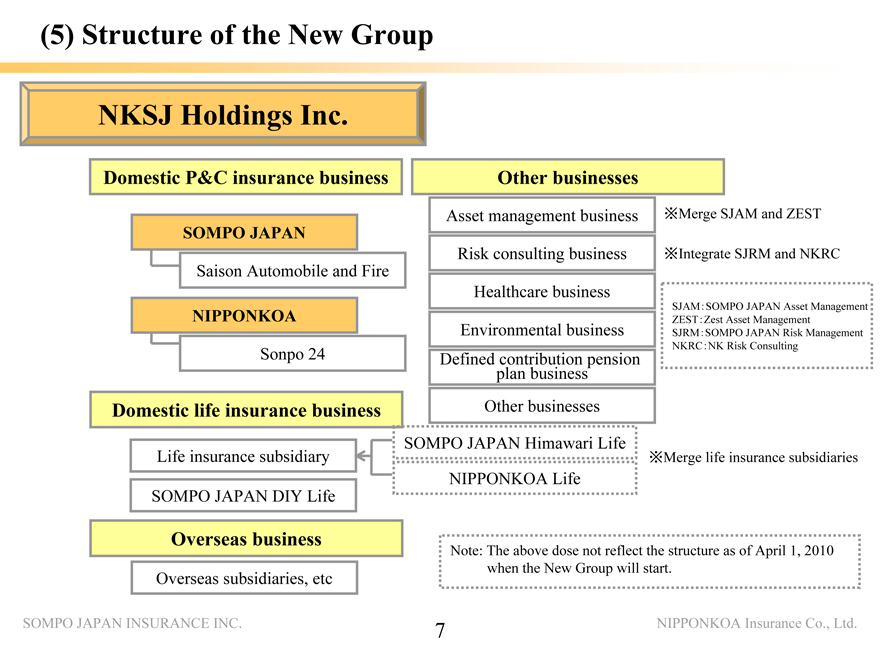

(5) | | Structure of the New Group |

NKSJ Holdings Inc.

Domestic P&C insurance business Other businesses

Asset management business Merge SJAM and ZEST

SOMPO JAPAN

Risk consulting business Integrate SJRM and NKRC Saison Automobile and Fire Healthcare business

SJAM: SOMPO JAPAN Asset Management

NIPPONKOA ZEST: Zest Asset Management Environmental

business SJRM: SOMPO JAPAN Risk Management

Sonpo 24 Defined contribution pension NKRC: NK Risk Consulting plan business

Domestic life insurance business Other businesses

SOMPO JAPAN Himawari Life

Life insurance subsidiary Merge life insurance subsidiaries NIPPONKOA Life

SOMPO JAPAN DIY Life

Overseas business

Note: The above dose not reflect the structure as of April 1, 2010 when the New Group will start.

Overseas subsidiaries, etc

SOMPO JAPAN INSURANCE INC. 7 NIPPONKOA Insurance Co., Ltd.

(6) Business Strategy

The Parties have chosen an arrangement for business integration in which the Parties will coexist under the umbrella of the Joint Holding Company to prevent negative effect by merger. The Parties will aim to maximize business integration synergy quickly.

The New Group will make use of its post-integration position and strengths.

Domestic P&C insurance business

Domestic life insurance business

Overseas business

Asset management business

Other businesses

-Top-level P&C insurance share in approximately half of the prefectures in Japan -Strong sales base supported by exclusive, specialized professional agents

-Competitive edge based on financial institutions-related agents, which are primary regional banks

The Parties will seek to enhance operational efficiency and quality by sharing and standardizing their business platforms, including products, back office operations and IT systems. The Parties

will seek to provide high quality service that meet needs of customers by taking the customers’ perspective into account.

The Parties’ life insurance subsidiaries (SOMPO JAPAN Himawari Life Insurance Co., Ltd., and NIPPONKOA Life Insurance Co., Ltd.) aim to merge within two years after the business integration.

The Parties will strategically deploy management resources in life insurance business which are both currently on growth trajectories by offering products that meet customer’ needs

The Parties will seek to offer compelling products and services to a broader market by virtue of the business integration.

The Parties will seek to reinforce sales promotion and improve service quality by shifting human resource and sharing know-how.

The Parties will pursue business expansion, mainly through M&As, in overseas insurance markets with promising growth prospects, capitalizing on their human resources and strengthened financial foundation following the business integration.

The Parties’ asset management subsidiaries (SOMPO JAPAN Asset Management Co., Ltd., and ZEST Asset Management Limited) will aim to merge by a target date of fiscal 2010.

The Parties aim to further boost their investment returns, increase their asset management know-how, and strengthen their asset management capabilities by transferring to a new asset management subsidiary their respective front-office operations that manage SOMPO JAPAN and NIPPONKOA’s portfolios of securities held as pure investments.

The Parties will endeavor to reduce strategic-holding stocks on an ongoing basis and improve management of strategic-holding stocks by using individual stock valuations provided by the new asset management subsidiary and other sources as one of the criteria for investment decisions.

The Parties’ risk consulting (management) subsidiaries (SOMPO JAPAN Risk Management Inc. and NK Risk Consulting Co., Ltd.) aim to integrate by early in fiscal 2010.

The Parties will collaboratively utilize their business infrastructure and accumulated know-how in other businesses such as healthcare, defined contribution (DC) pension plans, and environmental businesses.

SOMPO JAPAN INSURANCE INC.

NIPPONKOA Insurance Co., Ltd.

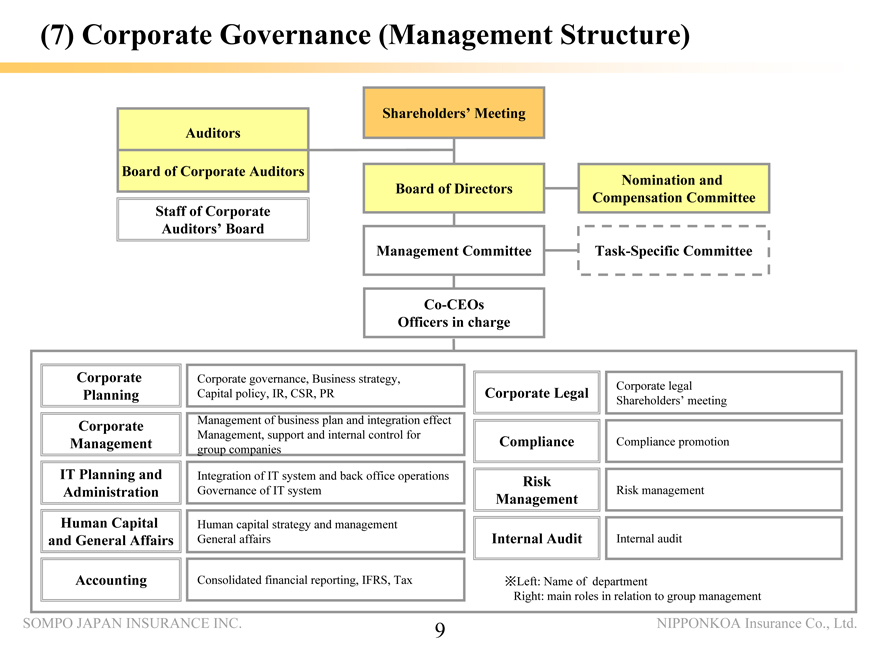

(7) | | Corporate Governance (Management Structure) |

Shareholders’ Meeting Auditors

Board of Corporate Auditors

Nomination and Board of Directors Staff of Corporate Compensation Committee Auditors’ Board

Management Committee Task-Specific Committee

Co-CEOs Officers in charge

Corporate Corporate governance, Business strategy,

Corporate

legal Planning Capital policy, IR, CSR, PR Corporate

Legal Shareholders’ meeting Corporate Management of

business plan and integration effect Management, support and internal control for

Management Compliance Compliance promotion group companies IT Planning and Integration of IT system and back office operations

Risk

Administration Governance of IT system Risk management

Management Human Capital Human capital strategy and management and General Affairs General affairs Internal Audit Internal audit

Accounting Consolidated financial reporting, IFRS, Tax Left: Name of department

Right: main

roles in relation to group management

SOMPO JAPAN INSURANCE INC. 9 NIPPONKOA Insurance Co., Ltd.

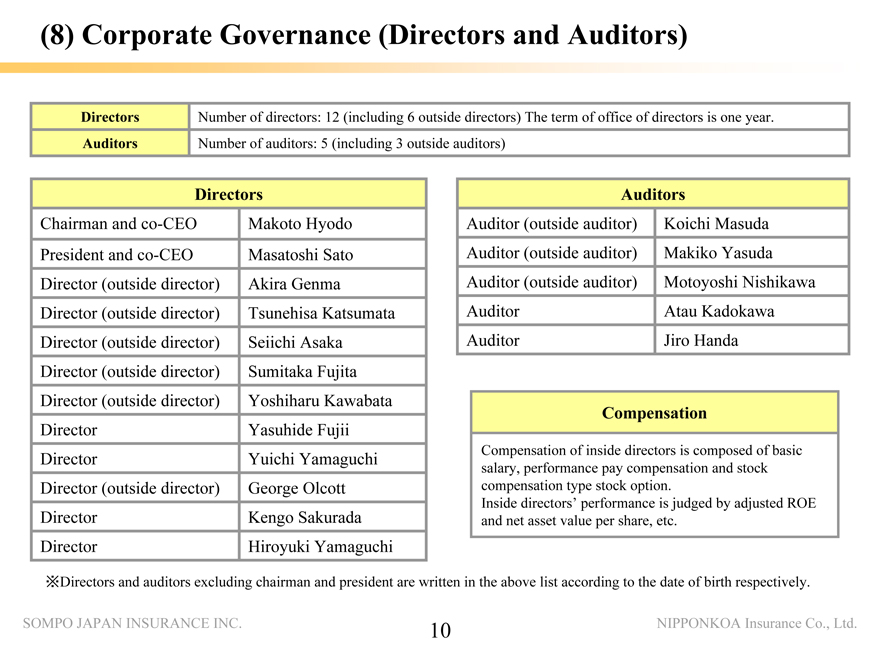

(8) | | Corporate Governance (Directors and Auditors) |

Directors Number of directors: 12 (including 6 outside directors) The term of office of directors is one year.

Auditors Number of auditors: 5 (including 3 outside auditors)

Directors

Chairman and co-CEO Makoto Hyodo

President and co-CEO Masatoshi Sato

Director (outside director) Akira Genma

Director (outside director) Tsunehisa Katsumata

Director (outside director) Seiichi Asaka

Director (outside director) Sumitaka Fujita

Director (outside director) Yoshiharu Kawabata

Director Yasuhide Fujii

Director Yuichi Yamaguchi

Director (outside director) George Olcott

Director Kengo Sakurada

Director Hiroyuki Yamaguchi

Auditors

Auditor Koichi Masuda

Auditor Makiko Yasuda

Auditor (outside auditor) Motoyoshi Nishikawa

Auditor (outside auditor) Atau Kadokawa

Auditor (outside auditor) Jiro Handa

Compensation

Compensation of inside directors is composed of basic salary, performance pay compensation and stock compensation type stock option.

Inside directors’ performance is judged by adjusted ROE and net asset value per share, etc.

Directors and auditors excluding chairman and president are written in the above list according to the date of birth respectively.

SOMPO JAPAN INSURANCE INC.

10

NIPPONKOA Insurance Co., Ltd.

1. Summary of Share Exchange Plan

2. Business Plan of the New Group

SOMPO JAPAN INSURANCE INC.

11

NIPPONKOA Insurance Co., Ltd.

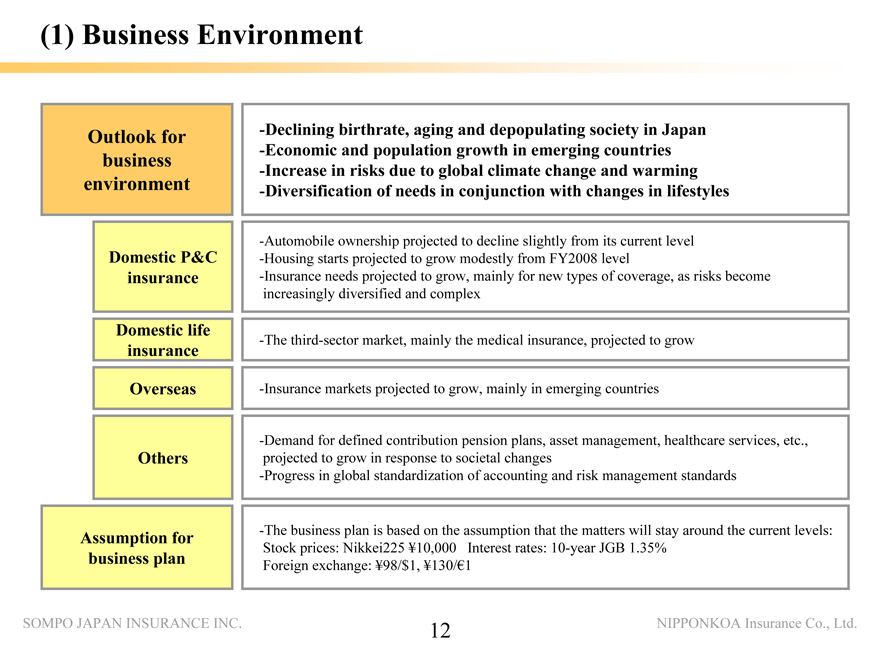

Outlook for

business

environment

Domestic P&C

insurance

Domestic life

insurance

Overseas

Others

Assumption for business plan

SOMPO JAPAN INSURANCE INC.

-Declining birthrate, aging and depopulating society in Japan -Economic and population growth in emerging countries -Increase in risks due to global climate change and warming -Diversification of needs in conjunction with changes in lifestyles

-Automobile ownership projected to decline slightly from its current level -Housing starts projected to grow modestly from FY2008 level

-Insurance needs projected to grow, mainly for new types of coverage, as risks become increasingly diversified and complex

-The third-sector market, mainly the medical insurance, projected to grow

-Insurance markets projected to grow, mainly in emerging countries

-Demand for defined contribution pension plans, asset management, healthcare services, etc., projected to grow in response to societal changes -Progress in global standardization of accounting and risk management standards

-The business plan is based on the assumption that the matters will stay around the current levels: Stock prices: Nikkei225 ¥10,000 Interest rates: 10-year JGB 1.35% Foreign exchange: ¥98/$1, ¥130/€1

12 NIPPONKOA Insurance Co., Ltd.

Breakdown FY2009 (projection) FY2014 (target) [Domestic P&C insurance]

net income

Domestic P&C insurance ¥19 billion ¥90 billion (56%) + + provisions provisions to to catastrophic price fluctuation loss reserves reserves (after (after tax) tax)

-gains/losses on securities sales and securities

Adjusted Domestic life insurance ¥9 billion ¥50 billion (31%) valuation losses (after tax) - extraordinary items

consolidated [Domestic life insurance (subsidiaries)]

Overseas ¥3 billion ¥16 billion (10%) growth in embedded value (EV)

profits -net of capital account transactions

(e.g., equity issuance)

Financial services ¥(3) billion ¥4 billion (3%) - changes in EV attributable to interest rate

and others movements

Total ¥28 billion ¥160 billion (100%) [Overseas, financial services and others]

net income as reported in financial statements

Adjusted consolidated ROE 1.6% 7% ( ) = proportion of composition

Adjusted adjusted consolidated profit consolidated = consolidated net assets (excluding life insurance subsidiaries’ net assets) + catastrophic loss reserves (after tax) ROE + price fluctuation reserves (after tax) + life insurance subsidiaries’ EV

All values in the denominator are the average of the fiscal-year opening and closing balances

<Definition of business>

1Domestic P&C insurance Sum of SOMPO JAPAN and NIPPONKOA (non-consolidated)

2Domestic life insurance Sum of SOMPO JAPAN Himawari Life and NIPPONKOA Life

3Overseas Overseas subsidiaries

4Financial services and others Saison Automobile and Fire, Sonpo 24, SOMPO JAPAN DIY, Financial services, Healthcare, etc.

SOMPO JAPAN INSURANCE INC. 13 NIPPONKOA Insurance Co., Ltd.

(3) | | Business Integration Synergies |

Business integration synergies in FY2014 (Five years after integration):

¥50 billion (pretax) compared to FY2009 (projection)

-Complete unification of products, (billion yen) back-office operations and IT systems

-Full-scale operation of “New integrated system”

60

-Start unification of products,

50 back-office operations and IT systems Business integration synergies as of FY2014:

-Start operation of “New integrated system” Around ¥50 billion (pretax)

40

Unification of products,

Date of business integration Around

30 (tentative) April 1, 2009 back-office operations

¥34 billion 50 and IT systems

20 40

Joint use of infrastructure Around

30

and joint placement of orders ¥3 billion

10

15 Sharing and improving

10 Around 0 know-how ¥13 billion

(18) (16) Accumulated one-time cost (five years): Around ¥60 billion (10) (including cost of “New integrated system: Around ¥54 billion)

Synergies

2010 2011 2012 2013 2014 (FY) Temporary costs

SOMPO JAPAN INSURANCE INC. 14 NIPPONKOA Insurance Co., Ltd.

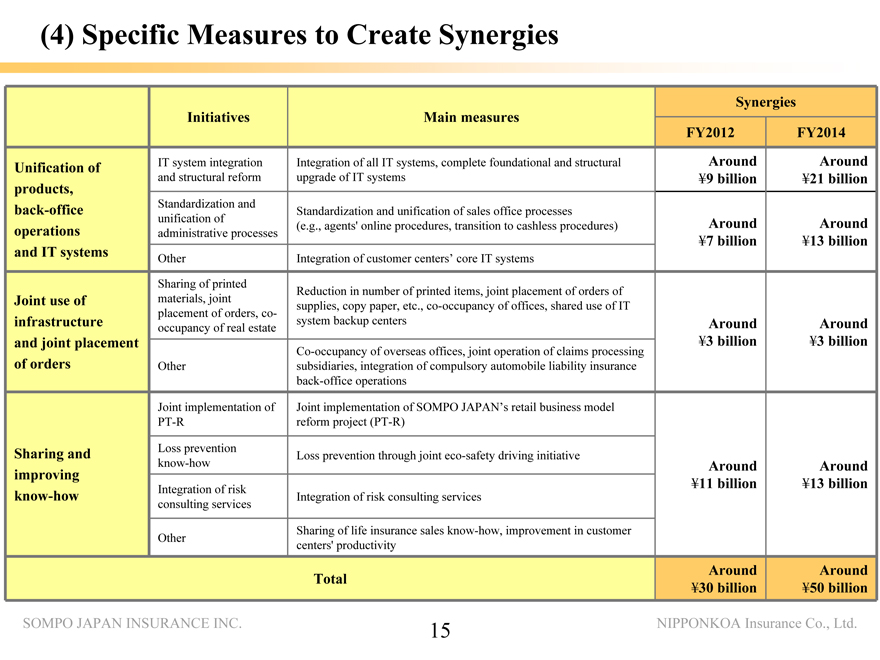

(4) | | Specific Measures to Create Synergies |

Unification of products, back-office operations and IT systems

Joint use of infrastructure and joint placement of orders

Sharing and improving know-how

Initiatives

IT system integration and structural reform

Standardization and unification of administrative processes

Other

Sharing of printed materials, joint placement of orders, co-occupancy of real estate

Other

Joint implementation of PT-R

Loss prevention know-how

Integration of risk consulting services

Other

Main measures

Integration of all IT systems, complete foundational and structural upgrade of IT systems

Standardization and unification of sales office processes

(e.g., agents’ online procedures, transition to cashless procedures) Integration of customer centers’ core IT systems

Reduction in number of printed items, joint placement of orders of supplies, copy paper, etc., co-occupancy of offices, shared use of IT system backup centers

Co-occupancy of overseas offices, joint operation of claims processing subsidiaries, integration of compulsory automobile liability insurance back-office operations

Joint implementation of SOMPO JAPAN’s retail business model reform project (PT-R)

Loss prevention through joint eco-safety driving initiative

Integration of risk consulting services

Sharing of life insurance sales know-how, improvement in customer centers’ productivity

Total

Synergies

FY2012 FY2014

Around Around

¥9 billion ¥21 billion

Around Around

¥7 billion ¥13 billion

Around Around

¥3 billion ¥3 billion

Around Around

¥11 billion ¥13 billion

Around Around

¥30 billion ¥50 billion

NIPPONKOA Insurance Co., Ltd.

15

SOMPO JAPAN INSURANCE INC.

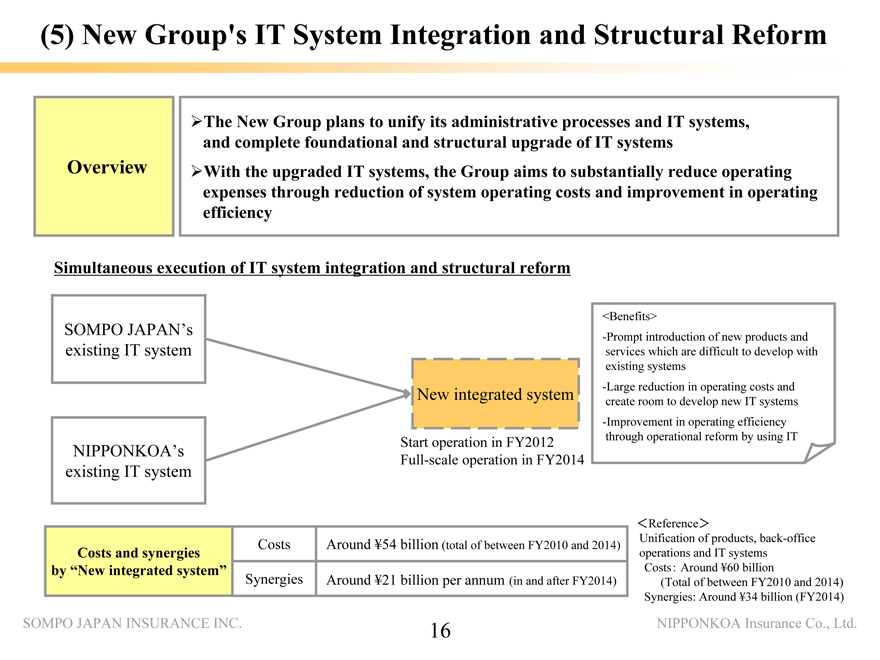

(5) | | New Group’s IT System Integration and Structural Reform |

The New Group plans to unify its administrative processes and IT systems, and complete foundational and structural upgrade of IT systems Overview With the upgraded IT systems, the Group aims to substantially reduce operating expenses through reduction of system operating costs and improvement in operating efficiency

Simultaneous execution of IT system integration and structural reform

SOMPO JAPAN’s <Benefits>

-Prompt introduction of new products and existing IT system

services which are difficult to develop with existing systems

New integrated system -Large reduction in

operating costs and create room to develop new IT systems

-Improvement in operating efficiency Start operation

in FY2012 through operational reform by using IT

NIPPONKOA’s

Full-scale operation in FY2014 existing IT

system

<Reference>

Costs Unification of products, back-office Around ¥54 billion (total of between FY2010 and 2014) Costs and synergies operations and IT systems by “New integrated system” Costs: Around ¥60 billion Synergies Around ¥21 billion per annum (in and after FY2014) (Total of between FY2010 and 2014) Synergies: Around ¥34 billion (FY2014)

SOMPO JAPAN INSURANCE INC. 16 NIPPONKOA Insurance Co., Ltd.

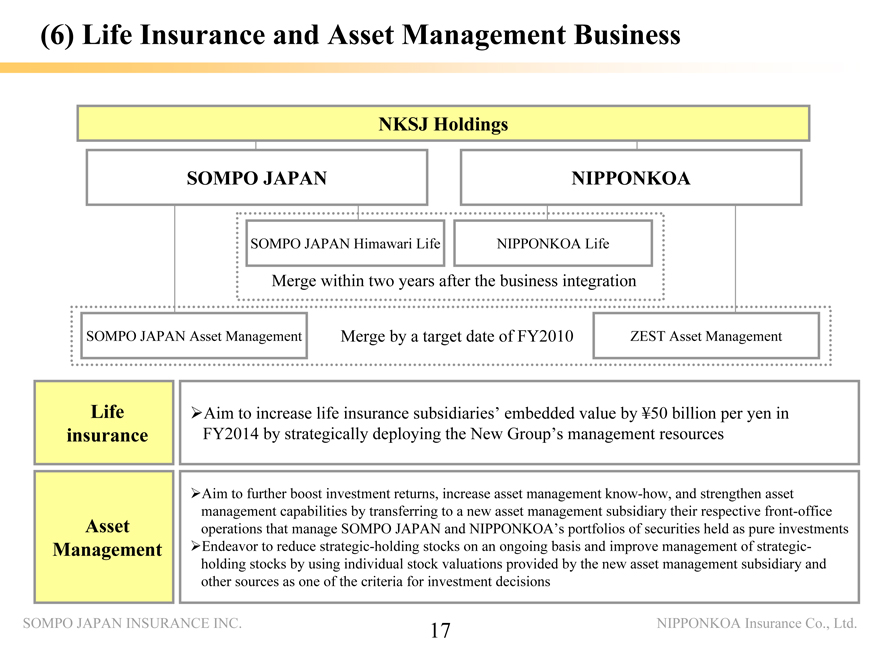

(6) | | Life Insurance and Asset Management Business |

NKSJ Holdings

SOMPO JAPAN

NIPPONKOA

SOMPO JAPAN Himawari Life

NIPPONKOA Life

Merge within two years after the business integration

SOMPO JAPAN Asset Management

Merge by a target date of FY2010

ZEST Asset Management

Life Aim to increase life insurance subsidiaries’ embedded value by ¥50 billion per yen in

insurance FY2014 by strategically deploying the New Group’s management resources

Aim to further boost investment returns, increase asset management know-how, and strengthen asset

management capabilities by transferring to a new asset management subsidiary their respective front-office

Asset operations that manage SOMPO JAPAN and NIPPONKOA’s portfolios of securities held as pure investments

Management Endeavor to reduce strategic-holding stocks on an ongoing basis and improve management of strategic-

holding stocks by using individual stock valuations provided by the new asset management subsidiary and

other sources as one of the criteria for investment decisions

SOMPO JAPAN INSURANCE INC. 17 NIPPONKOA Insurance Co., Ltd.

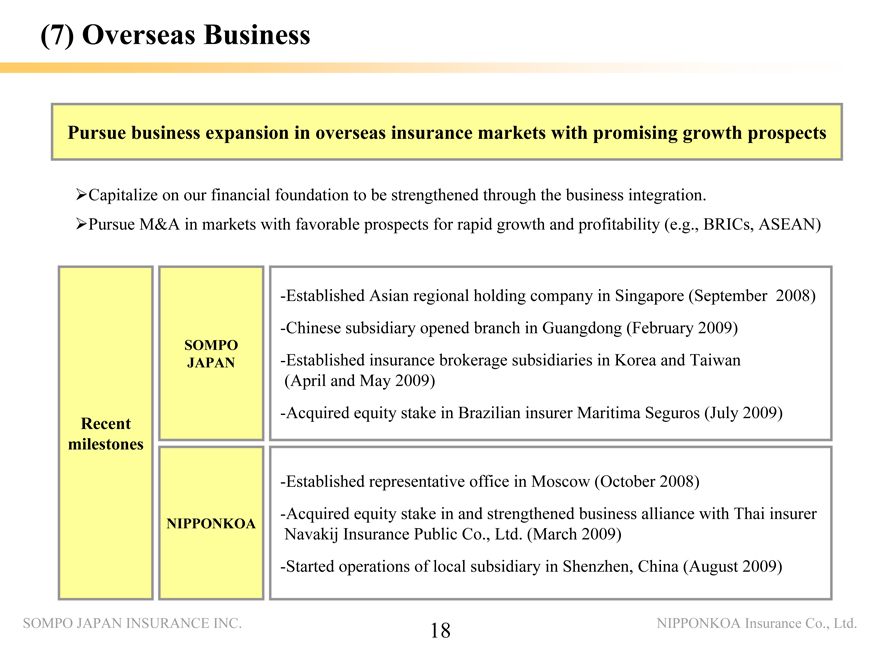

Pursue business expansion in overseas insurance markets with promising growth prospects

Capitalize on our financial foundation to be strengthened through the business integration.

Pursue M&A in markets with favorable prospects for rapid growth and profitability (e.g., BRICs, ASEAN)

-Established Asian regional holding company in Singapore (September 2008)

-Chinese subsidiary opened branch in Guangdong (February 2009)

SOMPO

JAPAN -Established insurance brokerage subsidiaries in Korea and Taiwan

(April and May 2009)

Recent -Acquired equity stake in Brazilian insurer Maritima Seguros (July 2009)

milestones

-Established representative office in Moscow (October 2008)

-Acquired equity stake in and strengthened business alliance with Thai insurer

NIPPONKOA Navakij Insurance Public Co., Ltd. (March 2009)

-Started operations of local subsidiary in Shenzhen, China (August 2009)

SOMPO JAPAN INSURANCE INC. 18 NIPPONKOA Insurance Co., Ltd.

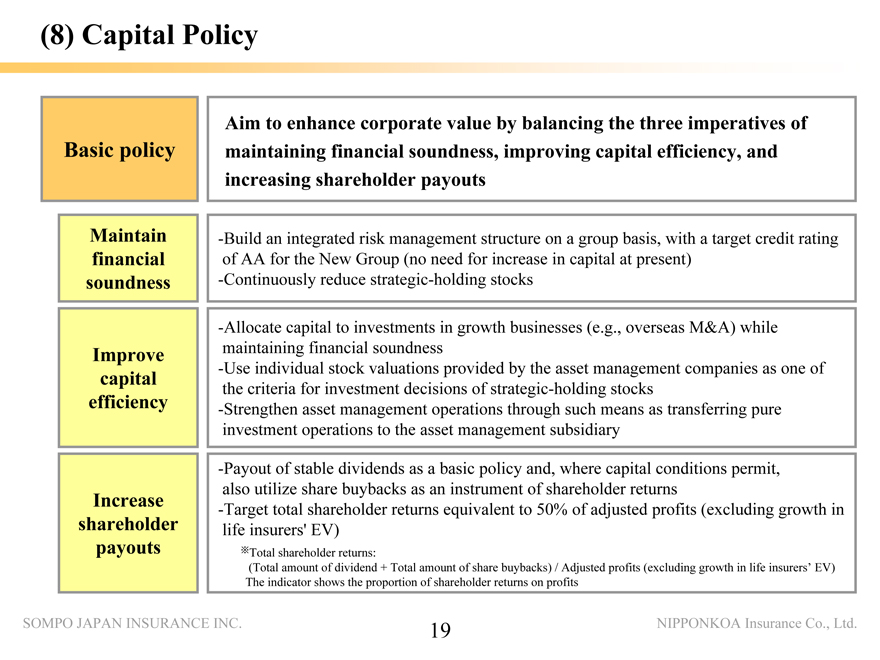

Aim to enhance corporate value by balancing the three imperatives of

Basic policy maintaining financial soundness, improving capital efficiency, and

increasing shareholder payouts

Maintain -Build an integrated risk management structure on a group basis, with a target credit rating

financial of AA for the New Group (no need for increase in capital at present)

soundness -Continuously reduce strategic-holding stocks

-Allocate capital to investments in growth businesses (e.g., overseas M&A) while

Improve maintaining financial soundness

capital -Use individual stock valuations provided by the asset management companies as one of

the criteria for investment decisions of strategic-holding stocks

efficiency -Strengthen asset management operations through such means as transferring pure

investment operations to the asset management subsidiary

-Payout of stable dividends as a basic policy and, where capital conditions permit,

also utilize share buybacks as an instrument of shareholder returns

Increase -Target total shareholder returns equivalent to 50% of adjusted profits (excluding growth in

shareholder life insurers’ EV)

payouts Total shareholder returns:

(Total amount of dividend + Total amount of share buybacks) / Adjusted profits (excluding growth in life insurers’ EV)

The indicator shows the proportion of shareholder returns on profits

SOMPO JAPAN INSURANCE INC. 19 NIPPONKOA Insurance Co., Ltd.

|

|

SOMPO JAPAN INSURANCE INC. (“SOMPO JAPAN”) and NIPPONKOA Insurance Co., Ltd. (“NIPPONKOA”) may file a registration statement on Form F-4 (“Form F-4”) with the U.S. Securities and Exchange Commission (the “SEC”) in connection with their proposed business combination. The Form F-4 (if filed) will contain a prospectus and other documents. If a Form F-4 is filed and declared effective, the prospectus contained in the Form F-4 will be mailed to U.S. shareholders of SOMPO JAPAN and NIPPONKOA prior to their respective shareholders’ meetings at which the proposed business combination will be voted upon. The Form F-4 and prospectus (if the Form F-4 is filed) will contain important information about SOMPO JAPAN and NIPPONKOA, the proposed business combination and related matters. U.S. shareholders of SOMPO JAPAN and NIPPONKOA are urged to read the Form F-4, the prospectus and other documents that may be filed with the SEC in connection with the proposed business combination carefully before they make any decision at the respective shareholders’ meeting with respect to the proposed business combination. Any documents filed with the SEC in connection with the proposed business combination will be made available when filed, free of charge, on the SEC’s web site at www.sec.gov. In addition, upon request, the documents can be distributed for free of charge. To make a request, please refer to

the following contact information.

[SOMPO JAPAN]

SOMPO JAPAN INSURANCE INC.

26-1, Nishi-Shinjuku 1-chome, Shinjuku

Tokyo, Japan 160-8338

Head of Investor Relations Office,

Corporate Planning Department:

Shinichi Hara

Tel: 81-3-3349-3913

E-mail: SHara1@sompo-japan.co.jp

URL: http://www.sompo-japan.co.jp

SOMPO JAPAN INSURANCE INC.

[NIPPONKOA]

NIPPONKOA Insurance Co., Ltd. 7-3, Kasumigaseki 3-chome, Chiyoda-ku Tokyo, Japan 100-8965 General Manager, Investor Relations, Corporate Planning Department: Yoko Hirao Tel: 81-3-3593-5418 E-mail: yoko.hirao@nipponkoa.co.jp URL: http://www.nipponkoa.co.jp

20 NIPPONKOA Insurance Co., Ltd.

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the plans and expectations of SOMPO JAPAN and NIPPONKOA in relation to, and the benefits resulting from, their proposed business combination and business alliance described above. To the extent that statements in this press release do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of SOMPO JAPAN and NIPPONKOA in light of the information currently available to them, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of SOMPO JAPAN and NIPPONKOA (or the post-business combination group) to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. SOMPO JAPAN and NIPPONKOA undertake no obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by SOMPO JAPAN and NIPPONKOA (or the post-business combination group) in their subsequent domestic filings in Japan and filings with the SEC. The risks, uncertainties and other factors referred to above include, but are not limited to:

(1) | | economic and business conditions in and outside Japan; |

(2) | | the regulatory outlook of the Japanese insurance industry; |

(3) occurrence of losses the type or magnitude of which could not be foreseen at the time of writing the insurance policies covering

such losses;

(4) the price and availability of reinsurance;

(5) the performance of the two companies’ (or the post-business combination group’s) investments;

(6) the two companies’ being unable to reach a mutually satisfactory agreement on the detailed terms of the proposed business combination or otherwise unable to complete it; and

(7) difficulties in realizing the synergies and benefits of the post-business combination group.

SOMPO JAPAN INSURANCE INC.

21

NIPPONKOA Insurance Co., Ltd.