FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number:333-163336

For the month ofAugust 2010.

NKSJ Holdings, Inc.

(Translation of registrant’s name into English)

26-1, Nishi-Shinjuku 1-chome

Shinjuku-ku, Tokyo 160-8338

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

Information furnished on this form:

Table of Contents

Summary of Consolidated Financial Results for the three months ended June 30, 2010

Summary of Consolidated Financial Results for the three months ended June 30, 2010

(Supplementary Information)

Quarterly Securities Report for the Three Months Ended June 30, 2010

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | | | | NKSJ Holdings, Inc. | | |

Date: August 27, 2010 | | | | | | | | |

| | | | By: | | /S/ HIROHISA KURUMIDA | | |

| | | | | | Hirohisa Kurumida | | |

| | | | | | Manager of Corporate Legal Department | | |

[English Translation]

Summary of Consolidated Financial Results for the three months ended June 30, 2010

UNOFFICIAL TRANSLATION

This document is an unofficial English translation of the Japanese original.

August 13, 2010

NKSJ Holdings, Inc.

Summary of Consolidated Financial Results for the three months ended June 30, 2010

| | |

Company Name: | | NKSJ Holdings, Inc. |

Listed on: | | Tokyo and Osaka Stock Exchange |

Stock Code Number: | | 8630 |

URL: | | http://www.nksj-hd.com/ |

Representative Director: | | Masatoshi Sato, President & CEO |

Contact: | | Kazuhisa Tamura, Manager, Accounting Department |

| | | | | | | | | | | | |

Scheduled date to file Quarterly Financial Report: | | August 13, 2010 | | | | | | | | | | |

Scheduled date to start payment of dividends: | | ——— | | | | | | | | | | |

Supplementary information for quarterly financial statements: | | Yes | | | | | | | | | | |

Schedule for quarterly investor meeting: | | None | | | | | | | | | | |

Note) Any amounts less than one million yen are rounded down, unless otherwise noted.

| 1. | Consolidated Financial Results for the three months ended June 30, 2010 (April 1 to June 30, 2010) |

| (1) | Consolidated Results of Operations |

| | | | | | | | | | | | |

| | | Ordinary income | | Ordinary profit | | Net income |

| | | millions of yen | | % | | millions of yen | | % | | millions of yen | | % |

Three months ended June 30, 2010 | | 663,446 | | — | | 23,365 | | — | | 13,422 | | — |

Three months ended June 30, 2009 | | — | | — | | — | | — | | — | | — |

| Note) | The percentages are changes from corresponding period of previous fiscal year. |

| | | | |

| | | Net income

per share | | Diluted net income

per share |

| | | yen | | yen |

Three months ended June 30, 2010 | | 8.08 | | 8.07 |

Three months ended June 30, 2009 | | — | | — |

| (2) | Consolidated Financial Conditions |

| | | | | | | | |

| | | Total assets | | Total net assets | | Equity ratio | | Total net assets

per share |

| | | millions of yen | | millions of yen | | % | | yen |

As of June 30, 2010 | | 9,061,946 | | 1,097,536 | | 12.1 | | 658.04 |

As of March 31, 2010 | | — | | — | | — | | — |

| | | | |

Reference) Equity capital: | | As of June 30, 2010 | | 1,092,658 million yen |

| | As of March 31, 2010 | | — million yen |

| | | | | | | | | | |

| | | Dividends per share |

| | | First

quarter-end | | Second

quarter-end | | Third

quarter-end | | Fiscal

year-end | | Annual |

| | | yen | | yen | | yen | | yen | | yen |

Year ended March 31, 2010 | | — | | — | | — | | — | | — |

Year ending March 31, 2011 | | — | | | | | | | | |

Year ending March 31, 2011 (Forecast) | | | | — | | — | | 20.00 | | 20.00 |

| Note) | Revision to the forecasts for dividends during the first quarter: None |

| 3. | Consolidated Forecasts for the fiscal year ending March 31, 2011 (April 1, 2010 to March 31, 2011) |

Note) The percentages are changes from corresponding period of previous fiscal year.

| | | | | | | | | | | | | | |

| | | Ordinary income | | Ordinary profit | | Net income | | Net income

per share |

| | | millions of yen | | % | | millions of yen | | % | | millions of yen | | % | | yen |

Interim forecast (April 1 to September 30, 2010) | | 1,323,000 | | — | | 17,000 | | — | | 9,000 | | — | | 5.41 |

Fiscal year ending March 31, 2011 (April 1, 2010 to March 31, 2011) | | 2,642,000 | | — | | 48,000 | | — | | 25,000 | | — | | 15.04 |

| Note) | Revision to the forecasts for the fiscal year during the first quarter: None |

| Note) | Please refer to “Other information” on page 2 for details. |

| (1) | Changes in significant subsidiaries during the first quarter: None |

Note) The above shows changes in specified subsidiaries resulting in the change in the scope of consolidation during the first quarter.

| (2) | Adoption of simplified accounting methods or special accounting methods: Yes |

Note) The above shows adoption of simplified accounting methods or accounting methods used specifically for the preparation of the quarterly consolidated financial statements.

| (3) | Changes in accounting policies, procedures and methods of presentation |

| | |

Changes due to revisions to accounting standards: | | None |

| |

‚ Changes due to other reasons: | | None |

Note) The above shows changes which are shown in “Changes in significant accounting policies for the preparation of the quarterly consolidated financial statements.”

| (4) | Number of shares outstanding (Common stock): |

| | |

Total shares outstanding including treasury stock: | | |

| |

As of June 30, 2010 | | 1,661,409,178 shares |

| |

As of March 31, 2010 | | — shares |

| |

‚ Treasury stock: | | |

| |

As of June 30, 2010 | | 958,551shares |

| |

As of March 31, 2010 | | — shares |

| |

ƒ Average number of shares outstanding: | | |

| |

For the three months ended June 30, 2010 | | 1,661,096,165shares |

| |

For the three months ended June 30, 2009 | | — shares |

(Disclosure regarding the execution of the quarterly review process)

This summary is outside the scope of the quarterly review procedure which is required by “Financial Instruments and Exchange Act”, but the review procedure of the quarterly financial statements was completed.

(Note for using forecasted information etc.)

The forecasts included in this document are based on the currently available information and certain assumptions that we believe reasonable. Accordingly, the actual results may differ materially from those projected herein depending on various factors.

NKSJ Holdings, Inc. was established on April 1, 2010 as a holding company of Sompo Japan Insurance Inc. and NIPPONKOA Insurance Co., Ltd. This consolidated fiscal year is the first period, so there are no results for the fiscal year ended March 31, 2010 and the three months ended June 30, 2009.

Contents

| 1. | Qualitative Information related to the Consolidated Financial Results for the three months ended June 30, 2010 |

| (1) | Qualitative information related to the consolidated results of operations |

The consolidated results of operations for the three months ended June 30, 2010 are as follows.

Underwriting income of 619.4 billion yen, investment income of 41.4 billion yen and other ordinary income of 2.5 billion yen resulted in ordinary income of 663.4 billion yen.

In contrast, underwriting expenses of 518.6 billion yen, investment expenses of 12.4 billion yen, operating, general and administrative expenses of 105.5 billion yen and other ordinary expenses of 3.3 billion yen resulted in ordinary expenses of 640.0 billion yen.

As a result, ordinary profit amounted to 23.3 billion yen and net income amounted to 13.4 billion yen.

| (2) | Qualitative information related to the consolidated financial conditions |

As of June 30, 2010, the total assets amounted to 9,061.9 billion yen and the total net assets amounted to 1,097.5 billion yen.

| (3) | Qualitative information related to the consolidated forecasts |

There is no change on the consolidated forecasts for the fiscal year ending March 31, 2011 (first half fiscal year and full fiscal year) as disclosed on May 20, 2010.

| (1) | Summary of changes in significant subsidiaries |

None.

| (2) | Summary of adoption of simplified accounting methods or special accounting methods |

Income taxes are calculated by applying a reasonably estimated effective tax rate to income before income taxes. The estimated effective tax rate is determined by estimating the effective tax rate after applying deferred tax accounting for the fiscal year, including the first quarter of this fiscal year. When it is remarkably unreasonable to adopt this accounting method, income taxes are calculated by the statutory effective tax rate.

| (3) | Summary of changes in accounting policies, procedures and methods of presentation |

NKSJ Holdings, Inc. is a sole parent company of Sompo Japan Insurance Inc. and NIPPONKOA Insurance Co., Ltd. established through share exchange on April 1, 2010. This consolidated fiscal year is the first period, so there is no change in accounting policies, procedures and methods of presentation.

Please refer to significant accounting policies for the preparation of the quarterly consolidated financial statements on page 5 for details.

| (4) | Summary of significant events related to going-concern assumption |

None.

2

| 3. | Quarterly Consolidated Financial Statements |

| (1) | Quarterly Consolidated Balance Sheets |

| | | |

| | | (Millions of yen) | |

| | | As of June 30, 2010 | |

Assets: | | | |

Cash and deposits | | 231,443 | |

Call loans | | 98,271 | |

Receivables under resale agreements | | 88,980 | |

Receivables under securities borrowing transactions | | 29,720 | |

Monetary receivables bought | | 67,334 | |

Money trusts | | 84,687 | |

Securities | | 6,493,858 | |

Loans | | 722,910 | |

Tangible fixed assets | | 364,691 | |

Intangible fixed assets | | 31,431 | |

Other assets | | 590,676 | |

Deferred tax assets | | 264,283 | |

Allowance for possible loan losses | | (6,343 | ) |

| | | |

Total assets | | 9,061,946 | |

| | | |

Liabilities: | | | |

Underwriting funds: | | 7,414,499 | |

Reserve for outstanding losses and claims | | 1,022,013 | |

Underwriting reserves | | 6,392,486 | |

Bonds | | 128,000 | |

Other liabilities | | 288,878 | |

Reserve for retirement benefits | | 104,674 | |

Reserve for retirement benefits to directors | | 103 | |

Reserve for bonus payments | | 6,587 | |

Reserves under the special laws: | | 20,856 | |

Reserve for price fluctuation | | 20,856 | |

Deferred tax liabilities | | 808 | |

| | | |

Total liabilities | | 7,964,409 | |

| | | |

Net assets: | | | |

Shareholders’ equity: | | | |

Common stock | | 100,045 | |

Capital surplus | | 438,552 | |

Retained earnings | | 324,515 | |

Treasury stock | | (559 | ) |

| | | |

Total shareholders’ equity | | 862,553 | |

| | | |

Valuation and translation adjustments: | | | |

Unrealized gains on securities available for sale, net of tax | | 247,933 | |

Deferred gains on hedges | | 4,117 | |

Foreign currency translation adjustments | | (21,946 | ) |

| | | |

Total valuation and translation adjustments | | 230,104 | |

| | | |

Stock acquisition rights | | 1,776 | |

Non-controlling interests | | 3,101 | |

| | | |

Total net assets | | 1,097,536 | |

| | | |

Total liabilities and net assets | | 9,061,946 | |

| | | |

3

| (2) | Quarterly Consolidated Statements of Income |

| | | |

| | | (Millions of yen) | |

| | | Three months ended

June 30, 2010

(April 1 to June 30, 2010) | |

Ordinary income: | | 663,446 | |

Underwriting income: | | 619,473 | |

Net premiums written | | 504,951 | |

Deposits of premiums by policyholders | | 39,147 | |

Interest and dividend income on deposits of premiums, etc. | | 15,175 | |

Life insurance premiums written | | 48,085 | |

Reversal of reserve for outstanding losses and claims | | 11,001 | |

Investment income: | | 41,471 | |

Interest and dividend income | | 43,965 | |

Investment gains on money trusts | | 368 | |

Investment gains on trading securities | | 31 | |

Gains on sales of securities | | 2,684 | |

Transfer of interest and dividend income on deposits of premiums, etc. | | (15,175 | ) |

Other ordinary income | | 2,501 | |

Ordinary expenses: | | 640,080 | |

Underwriting expenses: | | 518,649 | |

Net claims paid | | 291,713 | |

Loss adjustment expenses | | 33,027 | |

Net commissions and brokerage fees | | 90,321 | |

Maturity refunds to policyholders | | 69,500 | |

Life insurance claims paid | | 14,166 | |

Provision for underwriting reserves | | 16,475 | |

Investment expenses: | | 12,495 | |

Investment losses on money trusts | | 498 | |

Losses on sales of securities | | 1,348 | |

Impairment losses on securities | | 4,923 | |

Operating, general and administrative expenses | | 105,544 | |

Other ordinary expenses: | | 3,390 | |

Interest paid | | 1,793 | |

| | | |

Ordinary profit | | 23,365 | |

| | | |

Extraordinary gains: | | 1,989 | |

Gains on disposal of fixed assets | | 53 | |

Gains on negative goodwill | | 149 | |

Other extraordinary gains | | 1,785 | |

Extraordinary losses: | | 3,471 | |

Losses on disposal of fixed assets | | 131 | |

Impairment losses | | 36 | |

Provision for reserves under the special laws: | | 2,363 | |

Provision for price fluctuation reserve | | 2,363 | |

Other extraordinary losses | | 939 | |

| | | |

Income before income taxes and non-controlling interests | | 21,883 | |

| | | |

Income taxes and deferred income taxes | | 8,528 | |

| | | |

Income before non-controlling interests | | 13,355 | |

| | | |

Non-controlling interests | | (67 | ) |

| | | |

Net income | | 13,422 | |

| | | |

4

| (3) | Notes on Going-Concern Assumption |

None.

| (4) | Significant Accounting Policies for the Preparation of the Quarterly Consolidated Financial Statements |

| | (1) | Number of consolidated subsidiaries: 23 companies |

Sompo Japan Insurance Inc.

NIPPONKOA Insurance Co., Ltd.

Sonpo 24 Insurance Company Limited

Saison Automobile and Fire Insurance Company, Limited

Sompo Japan Himawari Life Insurance Co., Ltd.

NIPPONKOA Life Insurance Company, Limited

Sompo Japan DIY Life Insurance Co., Ltd.

Sompo Japan DC Securities Co., Ltd.

Healthcare Frontier Japan Inc.

Sompo Japan Asset Management Co., Ltd.

Sompo Japan Insurance Company of America

Sompo Japan Insurance Company of Europe Limited

NIPPONKOA Insurance Company (Europe) Limited

NIPPONKOA Management Services (Europe) Limited

Nippon Insurance Company of Europe Limited

Sompo Japan Asia Holdings Pte. Ltd.

Sompo Japan Insurance (Singapore) Pte. Ltd.

Tenet Insurance Company Limited

Sompo Japan Insurance (China) Co., Ltd.

NIPPONKOA Insurance Company (China) Limited

Sompo Japan Insurance (Hong Kong) Company Limited

NIPPONKOA Insurance Company (Asia) Limited

Yasuda Seguros S.A.

Tenet Insurance Company Limited is the company which was acquired 100% of its shares by Sompo Japan Insurance Inc. as of May 31, 2010.

| | (2) | Names of principal non-consolidated subsidiaries |

Names of principal non-consolidated subsidiaries

Ark Re Limited

Sompo Japan Reinsurance Company Limited

As the non-consolidated subsidiaries do not have a material impact on reasonable judgment about the Group’s financial conditions and results of operations in terms of total assets, ordinary income, net income or loss and retained earnings, they are excluded from the scope of consolidation.

| | 2. | Application of the equity method |

| | (1) | Number of affiliates accounted for under the equity method: 6 companies |

Hitachi Capital Insurance Corporation

Yasuda Enterprise Development Co., Ltd.

Berjaya Sompo Insurance Berhad

Universal Sompo General Insurance Company Limited

Maritima Seguros S.A.

Maritima Saude Seguros S.A.

5

| | (2) | The non-consolidated subsidiaries and affiliates (Ark Re Limited and Sompo Japan Reinsurance Company Limited, etc.) are not accounted for under the equity method as each company has a minor impact on net income or loss and retained earnings and they do not have a material impact as a whole. |

| | (3) | NKSJ Holdings, Inc. holds 20% or more of voting rights of Japan Earthquake Reinsurance Co., Ltd. (“Japan Earthquake”) through domestic insurance subsidiaries. As Japan Earthquake is engaged in public business and NKSJ Holdings, Inc. can not have a material impact on Japan Earthquake’s decision of finance, promotion and business strategy, Japan Earthquake is excluded from affiliate. |

| | 3. | The balance sheet dates of consolidated subsidiaries |

The balance sheet dates of the first quarter of the foreign consolidated subsidiaries are March 31. As the differences in the quarterly balance sheet dates do not exceed three months, the financial statements as of March 31 are used for the preparation of the quarterly consolidated financial statements.

Necessary adjustments are made for the significant transactions during the periods from the quarterly balance sheet dates of the subsidiaries to the quarterly consolidated balance sheet date.

| | (1) | Valuation policies and methods for securities |

| | (a) | Trading securities are carried at fair value. |

Cost of sale is calculated under the moving-average method.

| | (b) | Bonds held to maturity are carried at amortized cost based on the moving-average method. |

| | (c) | Policy reserve matching bonds are carried at amortized cost based on the moving-average method in accordance with “Temporary Treatment of Accounting and Auditing Concerning Policy Reserve Matching Bonds in the Insurance Industry” (Japanese Institute of Certified Public Accountants Industry Audit Practice Committee Report No.21). |

The outline of risk management policy in relation to policy reserve matching bonds is as follows.

Certain domestic consolidated life insurance subsidiary sets up “policy reserve for single-premium whole-life” as a sub-category, and follows the management policy to match the duration of the policy reserve in the sub-category with the duration of policy reserve matching bonds corresponding to this sub-category within a certain range, to better manage the changes in the interest rate risk associated with the assets and liabilities.

| | (d) | Stocks of non-consolidated subsidiaries and affiliates that are not accounted for under the equity method are carried at cost based on the moving-average method. |

| | (e) | Securities available for sale which have readily determinable fair value are carried at fair value based on the market price as of the quarterly balance sheet date. |

Changes in unrealized gains or losses, net of applicable income taxes, are directly included in net assets, and cost of sale is calculated based on the moving-average method.

| | (f) | Securities available for sale which are considered extremely difficult to figure out fair value are carried at cost based on the moving-average method. |

| | (g) | Securities managed as trust assets in money trust for trading purposes are carried at fair value. |

| | (h) | Securities managed as trust assets in money trusts classified as other than trading purposes or held to maturity are carried on the same basis as that of securities available for sale. |

| | (2) | Valuation policies and methods for derivative financial instruments |

Derivative financial instruments are carried at fair value.

6

| | (3) | Depreciation methods of significant assets |

| | (a) | Tangible fixed assets (excluding lease assets) |

Depreciation of tangible fixed assets (excluding lease assets) held by NKSJ Holdings, Inc. and its domestic consolidated subsidiaries is computed using the declining-balance method, except for buildings (excluding fixtures) acquired on or after April 1, 1998 on which depreciation is computed using the straight-line method.

Depreciation of tangible fixed assets (excluding lease assets) held by the foreign consolidated subsidiaries is mainly computed using the straight-line method.

| | (b) | Intangible fixed assets |

Capitalized software for internal use held by the consolidated subsidiaries is amortized using the straight-line method based on the estimated useful life.

| | (4) | Accounting policies for significant reserves |

| | (a) | Allowance for possible loan losses |

In order to provide for losses from defaults, the domestic consolidated insurance subsidiaries establish allowance for possible loan losses in accordance with the internal standards for self-assessment of assets and the policy of write-off and provision.

For claims on debtors that have legally, formally or substantially entered into bankruptcy, special liquidation or whose notes have been under suspension at clearing houses, allowances are provided based on the amount remaining after deduction of the estimated recoverable amounts from the disposal of collateral and from guarantees.

For claims on debtors that are highly probable that they would bankrupt in the future, allowances are provided based on the amount remaining after deduction of the estimated recoverable amounts from the disposal of collateral and from guarantees, considering the debtor’s overall solvency assessment.

For claims other than those described above, allowances are provided based on the amount of claims multiplied by the default rate, which is computed based on historical loan loss experience.

The departments responsible for respective assets assess relevant claim in accordance with the in-house self-assessment criteria. The asset auditing department independently reviews the results and allowances are provided based on the said results.

The other consolidated subsidiaries determine the collectability of the receivables respectively to provide allowances based on the said results to cover the estimated future losses.

| | (b) | Reserve for retirement benefits |

In order to provide for employees’ retirement benefits, the domestic consolidated subsidiaries record the amount, which was considered to occur at the end of the first quarter, based on the projected retirement benefit obligation and the estimated plan assets at the end of the fiscal year.

Prior service costs are amortized using the straight-line method over certain years within the average remaining service years of employees at the time of occurrence.

Actuarial gains and losses are amortized using the straight-line method over certain years within the average remaining service years of employees at the time of occurrence from the following fiscal year.

| | (c) | Reserve for retirement benefits to directors |

In order to provide for retirement benefits to directors, the domestic consolidated subsidiaries record the amount deemed accrued at the end of the first quarter based on internal regulations.

| | (d) | Reserve for bonus payments |

In order to provide for employees’ bonus payments, the estimated amounts to be paid at the end of the first quarter are recorded.

| | (e) | Reserve for price fluctuation |

In order to provide for possible losses arising from price fluctuation of stock etc, the domestic consolidated insurance subsidiaries set aside reserves under Article 115 of the Insurance Business Act.

7

| | (5) | Significant hedge accounting |

Generally the domestic consolidated subsidiaries apply the deferral hedge accounting method to interest rate swaps to hedge cash flow fluctuation risk of floating-rate loans and bonds and interest rate fluctuation risk related to long-term insurance contracts based on “The accounting and auditing treatment on the application of the financial products accounting standard to the insurance industry” (Japanese Institute of Certified Public Accountants Industry Audit Practice Committee Report No.26, hereafter “Industry Audit Practice Committee Report No.26”). The exceptional treatment is applied to certain interest rate swaps to the extent that such transactions meet certain conditions required for the application of the exceptional treatment.

The domestic consolidated subsidiaries apply fair value hedge accounting to equity swap transactions for hedging the future stock price fluctuation risks.

The fair value hedge accounting method is applied to foreign exchange forward contracts, currency option transactions and currency swap transactions in order to reduce foreign exchange rate fluctuation risk on foreign currency denominated assets. The exceptional treatment is applied to the transactions to the extent that such transactions meet certain conditions required for application of the exceptional treatment.

Hedge effectiveness is judged by periodically comparing the accumulated fluctuations of the market value or cash flows of the hedged item to those of the related hedging instrument for the period from the commencement of the hedge to the date of judgment. However, when the material conditions are shared among the hedging instrument and the hedged item and its effectiveness is considered high, when interest rate swaps meet requirements for applying the exceptional method or when certain transactions fulfill the required conditions to apply the exceptional treatment, the judgment of the hedge effectiveness is omitted.

The hedge effectiveness based on Industry Audit Practice Committee Report No.26 is judged by monitoring the interest rates which impact the calculation of theoretical prices of both insurance liabilities as hedged item and interest rate swaps as hedging instrument which are grouped by different remaining periods.

| | (6) | Amortization of goodwill |

Goodwill is amortized over 20 years using the straight-line method. Insignificant amounts of goodwill are amortized at one time.

| | (7) | Accounting for consumption taxes |

NKSJ Holdings, Inc. and its domestic consolidated subsidiaries account for national and local consumption taxes using the tax-excluded method, except for the domestic consolidated insurance subsidiaries’ expenses such as loss adjustment expenses and operating, general and administrative expenses for which the domestic consolidated insurance subsidiaries account using the tax-included method.

Non-deductible consumption taxes relating to assets are included in other assets and amortized in equal installments over five years.

| (5) | Notes for Material Changes in Shareholders’ Equity |

None.

8

As of June 30, 2010

| 1. | Bonds held to maturity (which have readily determinable fair value) |

| | | | | | |

| | | (Millions of yen) |

| | | Carrying amount

on balance sheet | | Fair value | | Unrealized gains (losses) |

Domestic bonds | | 1,064,939 | | 1,127,109 | | 62,169 |

Foreign securities | | 85,561 | | 85,736 | | 175 |

| | | | | | |

Total | | 1,150,501 | | 1,212,846 | | 62,344 |

| | | | | | |

| |

2. Policy reserve matching bonds (which have readily determinable fair value) | | |

| |

| | | (Millions of yen) |

| | | Carrying amount

on balance sheet | | Fair value | | Unrealized gains (losses) |

Domestic bonds | | 10,442 | | 10,972 | | 530 |

| | | | | | |

Total | | 10,442 | | 10,972 | | 530 |

| | | | | | |

| 3. | Securities available for sale (which have readily determinable fair value) |

| | | | | | | |

| | | (Millions of yen) | |

| | | Cost | | Carrying amount

on balance sheet | | Unrealized gains (losses) | |

Domestic bonds | | 2,456,168 | | 2,535,300 | | 79,132 | |

Domestic stocks | | 1,133,722 | | 1,486,446 | | 352,723 | |

Foreign securities | | 1,112,585 | | 1,056,449 | | (56,136 | ) |

Others | | 127,660 | | 129,891 | | 2,231 | |

| | | | | | | |

Total | | 4,830,137 | | 5,208,087 | | 377,950 | |

| | | | | | | |

Notes)

| 1. | Certificate of deposit, which are classified as cash and deposits and beneficial interests in the loan trusts, which are classified as monetary receivables bought in the quarterly consolidated balance sheet, are included in “Others” above. |

| 2. | Impairment losses on securities available for sale amount to 4,824 million yen. |

NKSJ Holdings, Inc. and its domestic consolidated subsidiaries recognize impairment losses on securities available for sale if fair value declines by 30% or more of their cost at the end of the first quarter, as a rule.

9

| (7) | Derivatives transactions |

As of June 30, 2010

| | | | | | | | | | | |

| | | (Millions of yen) | |

Type | | Transaction | | Notional

amount | | | Fair value | | | Unrealized

gains (losses) | |

Currency derivatives | | Forward foreign exchange: | | | | | | | | | |

| | Short | | 61,427 | | | 2,841 | | | 2,841 | |

| | Long | | 43,805 | | | (1,443 | ) | | (1,443 | ) |

| | Currency option: | | | | | | | | | |

| | Short | | 18,199 | | | | | | | |

| | | | 182 | * | | (0 | ) | | 182 | |

| | Long | | 16,810 | | | | | | | |

| | | | 182 | * | | 1,605 | | | 1,422 | |

| | | | | | | | | | | |

Interest rate derivatives | | Interest rate swap | | 15,000 | | | 63 | | | 63 | |

| | | | | | | | | | | |

Equity derivatives | | Equity index option: | | | | | | | | | |

| | Short | | 5,417 | | | | | | | |

| | | | 205 | * | | (16 | ) | | 188 | |

| | Long | | 4,400 | | | | | | | |

| | | | 205 | * | | 508 | | | 303 | |

| | | | | | | | | | | |

Bond derivatives | | Bond future: | | | | | | | | | |

| | Short | | 478 | | | (9 | ) | | (9 | ) |

| | | | | | | | | | | |

Others | | Credit derivatives: | | | | | | | | | |

| | Short | | 7,000 | | | (9 | ) | | (9 | ) |

| | Long | | 4,000 | | | 10 | | | 10 | |

| | Weather derivatives: | | | | | | | | | |

| | Short | | 463 | | | | | | | |

| | | | 17 | * | | (23 | ) | | (5 | ) |

| | Long | | 24 | | | | | | | |

| | | | — | * | | — | | | — | |

| | Earthquake derivatives: | | | | | | | | | |

| | Short | | 4,130 | | | | | | | |

| | | | 138 | * | | (21 | ) | | 116 | |

| | Long | | 3,447 | | | | | | | |

| | | | 358 | * | | 172 | | | (186 | ) |

| | Other forward: | | | | | | | | | |

| | Long | | 67 | | | 2 | | | 2 | |

| | | | | | | | | | | |

Total | | | | — | | | 3,682 | | | 3,479 | |

| | | | | | | | | | | |

Notes)

| | 1. | Derivatives transactions to which hedge accounting is applied are excluded. |

| | 2. | Amounts with an asterisk (*) represent the amount of the option premiums. |

10

Three months ended June 30, 2010 (April 1 to June 30, 2010)

| (1) | The name of acquiree and its type of business, reason for the business integration, date of integration, legal form of the integration, name of the controlling entity after the integration, percentage of voting rights acquired and the primary reason for defining the acquirer |

| | (a) | The name of acquiree and its type of business |

NIPPONKOA Insurance Co., Ltd. : Property and casualty insurance

| | (b) | Reason for the business integration |

In the face of the declining birthrate and aging society—the significant challenges Japan faces in the medium to long-term period—as well as of increased risks associated with depopulating society, deteriorating global climate change, and in response to the diversified consumer demands amidst the individuals’ lifestyle changes, companies are urged to take proper actions and contribute to social safety and to customers’ sense of security.

Based on this shared perspective, SOMPO JAPAN and NIPPONKOA decided to establish a—new solution service group which provides customers with security and service of the highest quality and contribute to social welfare, while sharing as a unitary group the strengths nurtured through 120 years of their respective history.

April, 1, 2010

| | (d) | Legal form of the integration |

Share exchange

| | (e) | Name of the controlling entity after the integration |

NKSJ Holdings, Inc.

| | (f) | Percentage of voting rights acquired |

100%

| | (g) | The primary reason for defining the acquiror |

Sompo Japan Insurance Inc. was defined as the acquiror based on relative ownership percentage of voting rights in general.

| (2) | The business term of the acquiree included in the quarterly consolidated statements of income for first quarter |

From April 1, 2010 to June 30, 2010

| (3) | Acquisition cost with details of the acquiree |

| | | | | | |

Purchase price | | 444,248 million yen | | | | |

Amount of stock acquisition rights | | 713 million yen | | | | |

| | | | | | |

Total | | 444,962 million yen | | | | |

11

| (4) | Share exchange ratio, basis of calculation for the share exchange and the number of shares to be allotted |

One share of common stock of NKSJ Holdings, Inc. was allotted and delivered for each share of common stock of SOMPO JAPAN, and 0.9 shares of common stock of NKSJ Holdings, Inc. were allotted and delivered for each share of common stock of NIPPONKOA.

| | (b) | Basis of calculation for the allotment in relation to the share exchange |

In order to ensure the fairness of the share exchange ratio to be used in the share exchange, SOMPO JAPAN appointed Nomura Securities Co., Ltd., Mizuho Securities Co., Ltd. and Goldman Sachs Japan Co., Ltd., and NIPPONKOA appointed Merrill Lynch Japan Securities Co., Ltd. and Mitsubishi UFJ Securities Co., Ltd. to calculate the share exchange ratio. Based on the calculation results and a comprehensive consideration of the financial conditions, asset conditions and future outlook of the Parties, SOMPO JAPAN and NIPPONKOA engaged in careful deliberation concerning the share exchange ratio. The Parties concluded and agreed that the share exchange ratio mentioned above is appropriate.

| | (c) | Number of shares to be allotted |

| | | | |

SOMPO JAPAN | | 984,055,299 shares | | |

NIPPONKOA | | 677,207,979 shares | | |

| | (a) | Amount of negative goodwill |

149 million yen

| | (b) | Reason for recognizing negative goodwill |

The net amounts of assets acquired and liabilities assumed on the day of business integration exceeded the amount of investment based on evaluation of entity.

| (6) | Amounts of assets acquired and liabilities assumed on the day of business integration |

| | | | |

Total assets: | | 3,064,910 million yen | | |

Securities | | 2,180,871 million yen | | |

Total liabilities: | | 2,619,450 million yen | | |

Underwriting funds | | 2,482,288 million yen | | |

| (7) | Estimated amounts of influence on the quarterly consolidated statements of income for the fiscal year ending March 31, 2011 assuming that the business integration had been completed on the commencement date of the fiscal year |

There is no influence because the business integration was held on the same date of the commence date of the quarterly consolidated period for the fiscal year ending March 31, 2011.

12

2. Business integration

| (1) | The name of acquiree and its type of business, reason for the business integration, date of integration, legal form of the integration, name of the controlling entity after the integration, percentage of voting rights acquired and the primary reason for defining the acquiror |

| | (a) | The name of acquiree and its type of business |

Tenet Insurance Company Limited (“Tenet”) :Property and casualty insurance

| | (b) | Reason for the business integration |

Through the acquisition of Tenet, Sompo Japan Group plans to further strengthen its solid platform and expand its operations in Singapore and Southeast Asia.

May, 31, 2010

| | (d) | Legal form of the integration |

Acquisition of shares by cash

| | (e) | Name of the controlling entity after the integration |

Tenet Insurance Company Limited

| | (f) | Percentage of voting rights acquired |

100%

| | (g) | The primary reason for defining the acquiror |

Sompo Japan was defined as the acquiror because Sompo Japan acquired shares of Tenet by cash.

| (2) | The business term of the acquiree included in the quarterly consolidated statements of income for first quarter |

None. The acquisition date is regarded as June 30, 2010.

| (3) | Acquisition cost with details of the acquiree |

| | | | |

| Purchase price | | 97 million Singapore dollar | | |

| Direct cost for the acquisition | | 1 million Singapore dollar | | |

| | | | |

| Total | | 98 million Singapore dollar | | |

38 million Singapore dollar

| | (b) | Reason for recognizing goodwill |

The acquisition cost exceeded the net amounts of assets acquired and liabilities assumed on the day of business integration.

| | (c) | Method and term of amortization |

Straight-line amortization in 20 years

13

| (5) | Amounts of assets acquired and liabilities assumed on the day of business integration |

| | | | |

Total assets: | | 122 million Singapore dollar | | |

Deposits | | 72 million Singapore dollar | | |

Total liabilities: | | 62 million Singapore dollar | | |

Underwriting funds | | 55 million Singapore dollar | | |

14

| 4. | Supplementary Information |

| (1) | Summary of Results of Operations |

| | | |

| | | (Millions of yen) | |

| | | Three months ended

June 30, 2010

(April 1 to June 30, 2010) | |

Ordinary income and expenses: | | | |

Underwriting income: | | 619,473 | |

Net premiums written | | 504,951 | |

Deposits of premiums by policyholders | | 39,147 | |

Life insurance premiums written | | 48,085 | |

Underwriting expenses: | | 518,649 | |

Net claims paid | | 291,713 | |

Loss adjustment expenses | | 33,027 | |

Net commissions and brokerage fees | | 90,321 | |

Maturity refunds to policyholders | | 69,500 | |

Life insurance claims paid | | 14,166 | |

| | | |

Investment income: | | 41,471 | |

Interest and dividend income | | 43,965 | |

Gains on sales of securities | | 2,684 | |

Investment expenses: | | 12,495 | |

Losses on sales of securities | | 1,348 | |

Impairment losses on securities | | 4,923 | |

| | | |

Operating, general and administrative expenses | | 105,544 | |

| | | |

Other ordinary income and expenses | | (889 | ) |

| | | |

Ordinary profit | | 23,365 | |

| | | |

Extraordinary gains and losses: | | | |

Extraordinary gains | | 1,989 | |

Extraordinary losses | | 3,471 | |

| | | |

Net extraordinary losses | | (1,482 | ) |

| | | |

Income before income taxes and non-controlling interests | | 21,883 | |

Income taxes and deferred income taxes | | 8,528 | |

Income before non-controlling interests | | 13,355 | |

Non-controlling interests | | (67 | ) |

| | | |

Net income | | 13,422 | |

| | | |

15

| (2) | Premiums Written and Claims Paid by Lines of Business (Consolidated) |

Direct premiums written (including deposits of premiums by policyholders)

| | | | | | |

| | | (Millions of yen) |

| | | Three months ended June 30, 2010

(April 1 to June 30, 2010) |

Business line | | Amount | | % of total

amount | | Rate of

change |

| | | | % | | % |

Fire and allied insurance | | 89,069 | | 15.2 | | — |

Marine insurance | | 14,890 | | 2.5 | | — |

Personal accident insurance | | 77,847 | | 13.3 | | — |

Voluntary automobile insurance | | 252,769 | | 43.1 | | — |

Compulsory automobile liability insurance | | 66,838 | | 11.4 | | — |

Others | | 85,564 | | 14.6 | | — |

| | | | | | |

Total | | 586,981 | | 100.0 | | — |

Deposits of premiums by policyholders | | 39,147 | | 6.7 | | — |

| | | | | | |

Net premiums written

| | | | | | |

| | | (Millions of yen) |

| | | Three months ended June 30, 2010

(April 1 to June 30, 2010) |

Business line | | Amount | | % of total

amount | | Rate of

change |

| | | | % | | % |

Fire and allied insurance | | 56,708 | | 11.2 | | — |

Marine insurance | | 11,471 | | 2.3 | | — |

Personal accident insurance | | 50,897 | | 10.1 | | — |

Voluntary automobile insurance | | 251,954 | | 49.9 | | — |

Compulsory automobile liability insurance | | 56,675 | | 11.2 | | — |

Others | | 77,244 | | 15.3 | | — |

| | | | | | |

Total | | 504,951 | | 100.0 | | — |

| | | | | | |

Net claims paid

| | | | | | |

| | | (Millions of yen) |

| | | Three months ended June 30, 2010

(April 1 to June 30, 2010) |

Business line | | Amount | | % of total

amount | | Rate of

change |

| | | | % | | % |

Fire and allied insurance | | 24,212 | | 8.3 | | — |

Marine insurance | | 6,305 | | 2.2 | | — |

Personal accident insurance | | 24,721 | | 8.5 | | — |

Voluntary automobile insurance | | 147,739 | | 50.6 | | — |

Compulsory automobile liability insurance | | 56,715 | | 19.4 | | — |

Others | | 32,020 | | 11.0 | | — |

| | | | | | |

Total | | 291,713 | | 100.0 | | — |

| | | | | | |

Note to the above three tables:

The above figures represent amounts before offsetting internal transactions among consolidated segments.

16

| (3) | Life Insurance Business (Consolidated) |

Life insurance premiums

| | | | |

| | | (Millions of yen) |

| | | Three months ended June 30, 2010

(April 1 to June 30, 2010) |

| | | Amount | | Rate of change |

| | | | | % |

Life insurance premiums | | 48,085 | | — |

Note) The above figures represent amounts before offsetting internal transactions among consolidated segments.

Total amount of policies in force

| | | | |

| | | (Millions of yen) |

| | | As of June 30, 2010 |

| | | Amount | | Rate of change |

| | | | | % |

Individual insurance | | 15,492,154 | | — |

Individual annuities | | 277,140 | | — |

Group insurance | | 3,019,192 | | — |

Group annuities | | — | | — |

Notes)

| 1. | The above figures represent amounts before offsetting internal transactions among consolidated segments. |

| 2. | Amount of “Individual annuities” represents the sum of annuity fund at the beginning of annuity payment of contracts before the beginning of annuity payment and policy reserves for the contracts after the beginning of annuity payment. |

Total amount of new policies

| | | | | | |

| | | (Millions of yen) |

| | | Three months ended June 30, 2010

(April 1 to June 30, 2010) |

| | | Net increase by

new policies

and conversion | | New policies | | Net increase

by conversion |

Individual insurance | | 693,607 | | 693,607 | | — |

Individual annuities | | 3,138 | | 3,138 | | — |

Group insurance | | 11,344 | | 11,344 | | — |

Group annuities | | — | | — | | — |

Notes)

| 1. | The above figures represent amounts before offsetting internal transactions among consolidated segments. |

| 2. | Amount of “Net increase by new policies and conversion” for “Individual annuities” represents the amount of annuity fund at the beginning of annuity payment. |

Annualized premiums of new policies (individual insurance and individual annuities)

| | | | |

| | | (Millions of yen) |

| | | Three months ended June 30, 2010

(April 1 to June 30, 2010) |

| | | Amount | | Rate of change |

| | | | | % |

Annualized premiums of new policies | | 7,815 | | — |

Note) The above figures represent amounts before offsetting internal transactions among consolidated segments.

17

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the information in relation to the NKSJ Holdings, Inc. (“NKSJ”). To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of NKSJ in light of the information currently available to NKSJ, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of NKSJ, as the case may be, to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. NKSJ does not undertake or will not undertake any obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by NKSJ in their subsequent domestic filings in Japan and filings with, or submissions to, the U.S. Securities Exchange Commission pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and other factors referred to above include, but are not limited to, those below.

| (1) | Effects of deterioration of economic and business conditions in Japan |

| (2) | Risks associated with non-life insurance business, life insurance business, and other businesses in which NKSJ group participates |

| (3) | Changes to laws, regulations, and systems |

| (4) | Risk of natural disasters |

| (5) | Occurrence of unpredictable damages |

| (7) | Overseas business risk |

| (8) | Effects of declining stock price |

| (9) | Effects of fluctuation in exchange rate |

| (10) | Effects of fluctuation in interest rate |

| (12) | Effects of decline in creditworthiness of investment and/or loan counterparties |

| (13) | Credit rating downgrade |

| (15) | Risk concerning retirement benefit liabilities |

| (16) | Occurrence of personal information leak |

| (17) | Damage on business operations by major disasters |

| (18) | Effects resulting from business integration |

18

[English Translation]

Summary of Consolidated Financial Results for the three months ended June 30, 2010

(Supplementary Information)

UNOFFICIAL TRANSLATION

This document is an unofficial English translaion of Japanese original.

Summary of Consolidated Financial Results

for the three months ended June 30, 2010

Supplementary Information

August 13, 2010

NKSJ Holdings, Inc.

(Stock code number : 8630)

Summary of Consolidated Financial Results for the three months ended June 30, 2010

Supplementary Information Contents

Overview of Business Results of Principal Consolidated Subsidiaries

| | |

Sompo Japan Insurance Inc. (Non-consolidated) | | 2 |

Quarterly Balance Sheets | | 2 |

Quarterly Statements of Income | | 3 |

Premiums Written and Claims Paid by Lines of Business | | 4 |

Solvency Margin Ratio | | 5 |

Exposure to Structured Finance (As of June 30, 2010) | | 6 |

| |

NIPPONKOA Insurance Co., Ltd. (Non-consolidated) | | 9 |

Quarterly Balance Sheets | | 9 |

Quarterly Statements of Income | | 10 |

Premiums Written and Claims Paid by Lines of Business | | 11 |

Solvency Margin Ratio | | 12 |

Investments in the securitized paper and subprime loans (As of June 30, 2010) | | 13 |

| |

SONPO 24 Insurance Co., Ltd. (Non-Consolidated) | | 14 |

Quarterly Balance Sheets | | 14 |

Quarterly Statements of Income | | 15 |

Premiums Written and Claims Paid by Lines of Business | | 16 |

Solvency Margin Ratio | | 17 |

| |

Saison Automobile and Fire Insurance Company, Limited (Non-consolidated) | | 18 |

Quarterly Balance Sheets | | 18 |

Quarterly Statements of Income | | 19 |

Premiums Written and Claims Paid by Lines of Business | | 20 |

Solvency Margin Ratio | | 21 |

| |

Sompo Japan Himawari Life Insurance Co., Ltd. (Non-consolidated) | | 22 |

Quarterly Balance Sheets | | 22 |

Quarterly Statements of Income | | 23 |

Major Business Results | | |

(Total amount of policies in force and total amount of new policies, Annualized premiums) | | 24 |

Solvency Margin Ratio | | 25 |

| |

NIPPONKOA Life Insurance Co., Ltd. (Non-consolidated) | | 26 |

Quarterly Balance Sheets | | 26 |

Quarterly Statements of Income | | 27 |

Major Business Results | | |

(Total amount of policies in force and total amount of new policies, Annualized premiums) | | 28 |

Solvency Margin Ratio | | 29 |

| |

Sompo Japan DIY Life Insurance Co., Ltd. (Non-consolidated) | | 30 |

Quarterly Balance Sheets | | 30 |

Quarterly Statements of Income | | 31 |

Major Business Results | | |

(Total amount of policies in force and total amount of new policies, Annualized premiums) | | 32 |

Solvency Margin Ratio | | 33 |

| |

Supplementary Explanation | | 34 |

Calculation of ratios | | 34 |

Solvency margin ratio | | 34 |

1

Overview of Business Results of Principal Consolidated Subsidiaries

(Reference) Sompo Japan Insurance Inc. (Non-consolidated)

Quarterly Balance Sheets

| | | | | | | | | |

| | | (Millions of yen) | |

| | | As of June 30, 2010 | | | As of March 31, 2010 | | | Increase

(Decrease) | |

| | | Amount | | | Amount | | | | |

Assets: | | | | | | | | | |

Cash and deposits | | 70,768 | | | 118,455 | | | (47,686 | ) |

Call loans | | 72,600 | | | 46,800 | | | 25,800 | |

Receivables under resale agreements | | 88,980 | | | 61,489 | | | 27,490 | |

Monetary receivables bought | | 33,842 | | | 34,585 | | | (742 | ) |

Money trusts | | 6,288 | | | 6,773 | | | (485 | ) |

Securities | | 3,405,319 | | | 3,525,735 | | | (120,415 | ) |

Loans | | 470,213 | | | 476,173 | | | (5,960 | ) |

Tangible fixed assets | | 212,095 | | | 212,244 | | | (148 | ) |

Intangible fixed assets | | 96 | | | 758 | | | (662 | ) |

Other assets | | 370,223 | | | 437,671 | | | (67,448 | ) |

Deferred tax assets | | 180,072 | | | 121,347 | | | 58,724 | |

Allowance for possible loan losses | | (4,088 | ) | | (5,068 | ) | | 980 | |

Allowance for possible investment losses | | (7,734 | ) | | (7,734 | ) | | — | |

| | | | | | | | | |

Total assets | | 4,898,677 | | | 5,029,232 | | | (130,554 | ) |

| | | | | | | | | |

Liabilities: | | | | | | | | | |

Underwriting funds: | | 3,796,435 | | | 3,797,586 | | | (1,150 | ) |

Reserve for outstanding losses and claims | | 677,750 | | | 687,801 | | | (10,050 | ) |

Underwriting reserves | | 3,118,684 | | | 3,109,784 | | | 8,900 | |

Bonds | | 128,000 | | | 128,000 | | | — | |

Other liabilities | | 177,390 | | | 181,855 | | | (4,464 | ) |

Reserve for retirement benefits | | 77,596 | | | 76,741 | | | 854 | |

Reserve for bonus payments | | 4,466 | | | 13,405 | | | (8,938 | ) |

Reserves under the special laws: | | 12,935 | | | 11,462 | | | 1,472 | |

Reserve for price fluctuation | | 12,935 | | | 11,462 | | | 1,472 | |

| | | | | | | | | |

Total liabilities | | 4,196,824 | | | 4,209,051 | | | (12,226 | ) |

| | | | | | | | | |

Net assets: | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | |

Common stock | | 70,000 | | | 70,000 | | | — | |

Capital surplus | | 24,229 | | | 24,229 | | | — | |

Retained earnings | | 328,869 | | | 338,304 | | | (9,434 | ) |

Total shareholders’ equity | | 423,099 | | | 432,534 | | | (9,434 | ) |

Valuation and translation adjustments: | | | | | | | | | |

Unrealized gains on securities available for sale, net of tax | | 278,753 | | | 386,343 | | | (107,589 | ) |

Total valuation and translation adjustments | | 278,753 | | | 386,343 | | | (107,589 | ) |

Stock acquisition rights | | — | | | 1,302 | | | (1,302 | ) |

| | | | | | | | | |

Total net assets | | 701,853 | | | 820,181 | | | (118,327 | ) |

| | | | | | | | | |

Total liabilities and net assets | | 4,898,677 | | | 5,029,232 | | | (130,554 | ) |

| | | | | | | | | |

2

(Reference) Sompo Japan Insurance Inc. (Non-consolidated)

Quarterly Statements of Income

| | | | | | | | | | | | | | | |

| | | | | | (Millions of yen) | |

| | | | | | Three months ended

June 30, 2009

(April 1 to

June 30, 2009) | | | Three months ended

June 30, 2010

(April 1 to

June 30, 2010) | | | Increase

(Decrease) | | | Rate of

change | |

| | | | | | Amount | | | Amount | | | | | | | |

Ordinary income: | | | | | 395,567 | | | 407,570 | | | 12,002 | | | 3.0 | % |

Underwriting income: | | | | | 374,436 | | | 381,432 | | | 6,996 | | | 1.9 | |

Net premiums written | | | | | 330,758 | | | 331,126 | | | 368 | | | 0.1 | |

Deposits of premiums by policyholders | | | | | 24,989 | | | 29,466 | | | 4,476 | | | 17.9 | |

Interest and dividend income on deposits of premiums, etc. | | | | | 10,747 | | | 9,955 | | | (792 | ) | | (7.4 | ) |

Reversal of reserve for outstanding losses and claims | | | | | 7,717 | | | 10,050 | | | 2,333 | | | 30.2 | |

Investment income: | | | | | 19,999 | | | 24,632 | | | 4,632 | | | 23.2 | |

Interest and dividend income | | | | | 27,496 | | | 23,991 | | | (3,505 | ) | | (12.7 | ) |

Investment gains on money trusts | | | | | 109 | | | 0 | | | (109 | ) | | (99.9 | ) |

Investment gains on trading securities | | | | | — | | | 28 | | | 28 | | | — | |

Gains on sales of securities | | | | | 2,968 | | | 1,657 | | | (1,310 | ) | | (44.2 | ) |

Transfer of interest and dividend income on deposits of premiums, etc. | | | | | (10,747 | ) | | (9,955 | ) | | 792 | | | — | |

Other ordinary income | | | | | 1,131 | | | 1,504 | | | 372 | | | 33.0 | |

| | | | | | | | | | | | | | | |

Ordinary expenses: | | | | | 398,706 | | | 392,212 | | | (6,494 | ) | | (1.6 | ) |

Underwriting expenses: | | | | | 329,542 | | | 324,499 | | | (5,043 | ) | | (1.5 | ) |

Net claims paid | | | | | 204,602 | | | 189,198 | | | (15,403 | ) | | (7.5 | ) |

Loss adjustment expenses | | | | | 19,036 | | | 23,595 | | | 4,558 | | | 23.9 | |

Net commissions and brokerage fees | | | | | 55,986 | | | 55,575 | | | (410 | ) | | (0.7 | ) |

Maturity refunds to policyholders | | | | | 33,231 | | | 44,770 | | | 11,538 | | | 34.7 | |

Provision for underwriting reserves | | | | | 13,329 | | | 8,900 | | | (4,428 | ) | | (33.2 | ) |

Investment expenses: | | | | | 6,981 | | | 9,020 | | | 2,038 | | | 29.2 | |

Investment losses on money trusts | | | | | — | | | 226 | | | 226 | | | — | |

Investment losses on trading securities | | | | | 136 | | | — | | | (136 | ) | | (100.0 | ) |

Losses on sales of securities | | | | | 1,969 | | | 900 | | | (1,069 | ) | | (54.3 | ) |

Impairment losses on securities | | | | | 856 | | | 4,146 | | | 3,290 | | | 384.2 | |

Operating, general and administrative expenses | | | | | 59,828 | | | 56,784 | | | (3,043 | ) | | (5.1 | ) |

Other ordinary expenses: | | | | | 2,353 | | | 1,908 | | | (445 | ) | | (18.9 | ) |

Interest paid | | | | | 684 | | | 1,757 | | | 1,072 | | | 156.7 | |

| | | | | | | | | | | | | | | |

Ordinary profit (loss) | | | | | (3,139 | ) | | 15,358 | | | 18,497 | | | — | |

| | | | | | | | | | | | | | | |

Extraordinary gains: | | | | | 97 | | | 3,105 | | | 3,007 | | | 3,069.2 | |

Gains on disposal of fixed assets | | | | | 97 | | | 16 | | | (81 | ) | | (83.3 | ) |

Other extraordinary gains | | | | | — | | | 3,088 | | | 3,088 | | | — | |

Extraordinary losses: | | | | | 771 | | | 2,317 | | | 1,546 | | | 200.5 | |

Losses on disposal of fixed assets | | | | | 87 | | | 78 | | | (8 | ) | | (10.3 | ) |

Provision for reserves under the special laws: | | | | | 683 | | | 1,472 | | | 788 | | | 115.3 | |

Provision for price fluctuation reserve | | | | | 683 | | | 1,472 | | | 788 | | | 115.3 | |

Other extraordinary losses | | | | | — | | | 766 | | | 766 | | | — | |

| | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | | | (3,812 | ) | | 16,145 | | | 19,958 | | | — | |

Income taxes and deferred income taxes | | | | | (2,403 | ) | | 5,899 | | | 8,303 | | | — | |

Net income (loss) | | | | | (1,408 | ) | | 10,246 | | | 11,654 | | | — | |

| | | | | | | | | | | | | | | |

Underwriting result: | | | | | | | | | | | | | | | |

Net premiums written | | (+ | ) | | 330,758 | | | 331,126 | | | 368 | | | 0.1 | |

Net claims paid | | (– | ) | | 204,602 | | | 189,198 | | | (15,403 | ) | | (7.5 | ) |

Loss adjustment expenses | | (– | ) | | 19,036 | | | 23,595 | | | 4,558 | | | 23.9 | |

Operating expenses: | | (– | ) | | 111,792 | | | 108,983 | | | (2,809 | ) | | (2.5 | ) |

Net commissions and brokerage fees | | | | | 55,986 | | | 55,575 | | | (410 | ) | | (0.7 | ) |

Operating, general and administrative expenses related to underwriting | | | | | 55,805 | | | 53,407 | | | (2,398 | ) | | (4.3 | ) |

Underwriting result | | | | | (4,673 | ) | | 9,350 | | | 14,023 | | | — | |

| | | | | | | | | | | | | | | |

Underwriting profit (loss) | | | | | (12,378 | ) | | 1,426 | | | 13,804 | | | — | |

| | | | | | | | | | | | | | | |

Ratios: | | | | | | | | | | | | | | | |

Net loss ratio | | (% | ) | | 67.6 | | | 64.3 | | | (3.4 | ) | | | |

Net expense ratio | | (% | ) | | 33.8 | | | 32.9 | | | (0.9 | ) | | | |

Underwriting result ratio | | (% | ) | | (1.4 | ) | | 2.8 | | | 4.2 | | | | |

3

(Reference) Sompo Japan Insurance Inc. (Non-consolidated)

Premiums Written and Claims Paid by Lines of Business

Direct premiums written (excluding deposits of premiums by policyholders)

| | | | | | | | | | | | | | | | |

| | | (Millions of yen) | |

| | | Three months ended June 30, 2009

(April 1 to June 30, 2009) | | | Three months ended June 30, 2010

(April 1 to June 30, 2010) | |

Business line | | Amount | | % of total

amount | | | Rate of

change | | | Amount | | % of total

amount | | | Rate of

change | |

Fire and allied insurance | | 43,084 | | 12.3 | % | | (1.1 | )% | | 42,158 | | 11.9 | % | | (2.1 | )% |

Marine insurance | | 7,119 | | 2.0 | | | (23.3 | ) | | 7,919 | | 2.2 | | | 11.2 | |

Personal accident insurance | | 35,396 | | 10.1 | | | (1.1 | ) | | 35,722 | | 10.1 | | | 0.9 | |

Voluntary automobile insurance | | 166,185 | | 47.3 | | | (2.9 | ) | | 164,428 | | 46.5 | | | (1.1 | ) |

Compulsory automobile liability insurance | | 45,231 | | 12.9 | | | (28.0 | ) | | 46,412 | | 13.1 | | | 2.6 | |

Others | | 54,377 | | 15.5 | | | 0.3 | | | 56,876 | | 16.1 | | | 4.6 | |

| | | | | | | | | | | | | | | | |

Total | | 351,394 | | 100.0 | | | (6.7 | ) | | 353,517 | | 100.0 | | | 0.6 | |

Deposits of premiums by policyholders | | 24,989 | | — | | | (10.0 | ) | | 29,466 | | — | | | 17.9 | |

| | | | | | | | | | | | | | | | |

| | | | | | |

Net premiums written | | | | | | | | | | | | | | | | |

| |

| | | (Millions of yen) | |

| | | Three months ended June 30, 2009

(April 1 to June 30, 2009) | | | Three months ended June 30, 2010

(April 1 to June 30, 2010) | |

Business line | | Amount | | % of total

amount | | | Rate of

change | | | Amount | | % of total

amount | | | Rate of

change | |

Fire and allied insurance | | 33,438 | | 10.1 | % | | (2.3 | )% | | 34,500 | | 10.4 | % | | 3.2 | % |

Marine insurance | | 5,893 | | 1.8 | | | (22.7 | ) | | 6,203 | | 1.9 | | | 5.3 | |

Personal accident insurance | | 35,111 | | 10.6 | | | (1.2 | ) | | 35,572 | | 10.7 | | | 1.3 | |

Voluntary automobile insurance | | 167,204 | | 50.6 | | | (1.9 | ) | | 164,173 | | 49.6 | | | (1.8 | ) |

Compulsory automobile liability insurance | | 37,420 | | 11.3 | | | (25.1 | ) | | 38,980 | | 11.8 | | | 4.2 | |

Others | | 51,689 | | 15.6 | | | 2.5 | | | 51,694 | | 15.6 | | | 0.0 | |

| | | | | | | | | | | | | | | | |

Total | | 330,758 | | 100.0 | | | (5.0 | ) | | 331,126 | | 100.0 | | | 0.1 | |

| | | | | | | | | | | | | | | | |

| | | | | | |

Net claims paid | | | | | | | | | | | | | | | | |

| |

| | | (Millions of yen) | |

| | | Three months ended June 30, 2009

(April 1 to June 30, 2009) | | | Three months ended June 30, 2010

(April 1 to June 30, 2010) | |

Business line | | Amount | | Rate of

change | | | Net loss

ratio | | | Amount | | Rate of

change | | | Net loss

ratio | |

Fire and allied insurance | | 13,771 | | 4.0 | % | | 42.8 | % | | 14,504 | | 5.3 | % | | 43.7 | % |

Marine insurance | | 3,241 | | (3.2 | ) | | 60.0 | | | 4,020 | | 24.0 | | | 69.1 | |

Personal accident insurance | | 16,524 | | 3.5 | | | 51.3 | | | 16,834 | | 1.9 | | | 52.0 | |

Voluntary automobile insurance | | 95,834 | | (4.3 | ) | | 64.5 | | | 93,834 | | (2.1 | ) | | 67.1 | |

Compulsory automobile liability insurance | | 38,798 | | (2.6 | ) | | 112.0 | | | 38,750 | | (0.1 | ) | | 107.4 | |

Others | | 36,431 | | 72.7 | | | 73.4 | | | 21,254 | | (41.7 | ) | | 44.4 | |

| | | | | | | | | | | | | | | | |

Total | | 204,602 | | 5.6 | | | 67.6 | | | 189,198 | | (7.5 | ) | | 64.3 | |

| | | | | | | | | | | | | | | | |

4

(Reference) Sompo Japan Insurance Inc. (Non-consolidated)

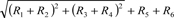

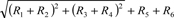

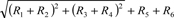

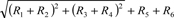

Solvency Margin Ratio

| | | | | | |

| | | (Millions of yen) | |

| | | As of June 30, 2010 | | | As of March 31, 2010 | |

(A) Total Solvency Margin | | 1,496,886 | | | 1,671,429 | |

Capital and funds, etc. | | 423,099 | | | 414,156 | |

Reserve for price fluctuation | | 12,935 | | | 11,462 | |

Contingency reserve | | 611 | | | 611 | |

Catastrophic loss reserve | | 474,909 | | | 466,702 | |

General allowance for possible loan losses | | 897 | | | 992 | |

Unrealized gains on securities (before tax effect deductions) | | 393,561 | | | 536,605 | |

Net unrealized gains and losses on real estate | | 52,252 | | | 52,252 | |

Excess amount of reserve for maturity refunds | | — | | | — | |

Subordinated debt, etc. | | 128,000 | | | 128,000 | |

Deductions | | 157,616 | | | 101,616 | |

Others | | 168,235 | | | 162,261 | |

(B) Total Risks | | | | | | |

| | 398,766 | | | 417,827 | |

Underwriting risk (R1) | | 83,963 | | | 83,975 | |

Underwriting risk for third-sector insurance products including accident, sickness and nursing-care insurance (R2) | | — | | | — | |

Guaranteed interest rate risk (R3) | | 5,368 | | | 5,368 | |

Investment risk (R4) | | 168,492 | | | 185,633 | |

Business management risk (R5) | | 9,088 | | | 9,493 | |

Major catastrophe risk | | 196,604 | | | 199,686 | |

(C) Solvency Margin Ratio (R6) [(A) / {(B) × 1/2}] × 100 | | 750.7 | % | | 800.0 | % |

| Note) | The above figures are calculated based on Articles 86 and 87 of the Ordinance for Enforcement of the Insurance Business Law and the provisions of Notification No. 50 of the Ministry of Finance (1996). The figures as of June 30, 2010 are partly calculated on the simplified method, for example, some bases for the major catastrophe risk calculation are deemed same as the figures as of March 31, 2010. |

5

Exposure to Structured Finance

As of June 30, 2010

August 13, 2010

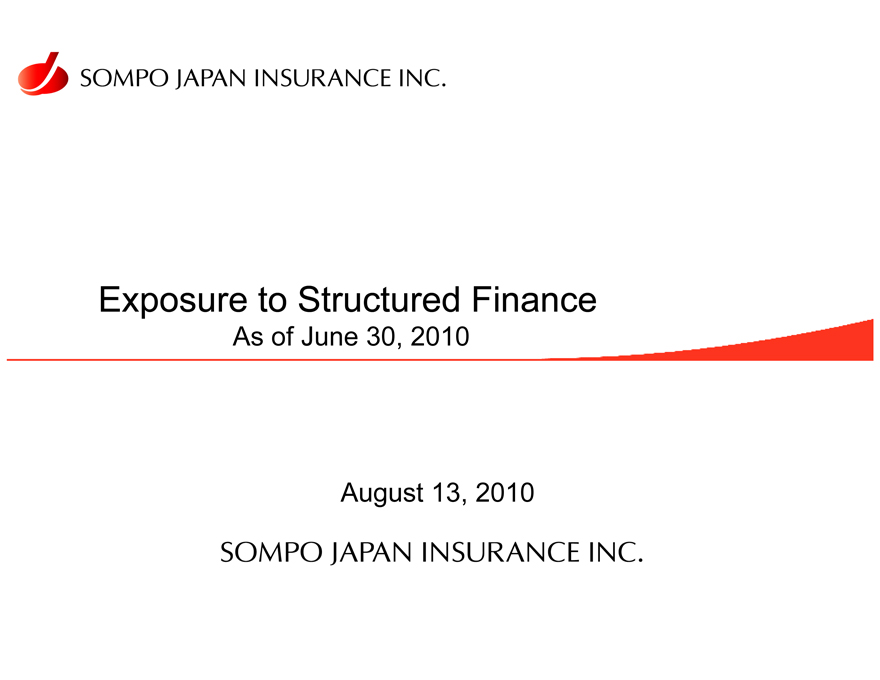

Summary of Financial Guarantee Insurance

Gains/Losses for

FY2010 1Q

(Overall financial guarantee)

6.4 billion yen gain (Gains from ABS-CDO guarantee)

Primarily due to some expected recovery from the past fiscal year’s loss payment.

Overall financial guarantee (Gains/Losses)

Loss payment (*1)

Provision/Reversal of Loss Reserves (*2)

Gains/Losses

FY2007

0.1

(30.0)

(29.9)

FY2008

(37.9)

(109.9)

(147.9)

FY2009

(63.8)

55.7

(8.0)

(Unit: billions of yen)

FY2009 1Q

(15.8)

14.1

(1.7)

FY2010 1Q

(0.2)

6.6

6.4

*1 Including commutation. *2 Including gains/losses of exchange hedge transaction.

Net exposure to ABS-CDOs

Net exposure to ABS-CDOs (after deduction of loss reserves) reduced to 40.8 billion yen. (Decreased by 2.7 billion yen since March 31, 2010)

(unit: billions of yen)

300.0 200.0 100.0 0.0

259.4

78.9

43.5

40.8

(Unit: billions of yen)

ABS-CDOs (Insured Amount)

Total of Insured Amount

Outstanding Loss Reserves

Insured Amount Net of Loss Reserves

3/31/2008

289.4

(30.0)

259.4

3/31/2009

218.0

(139.0)

78.9

3/31/2010

123.1

(79.5)

43.5

6/30/2010

117.4

(76.6)

40.8

6

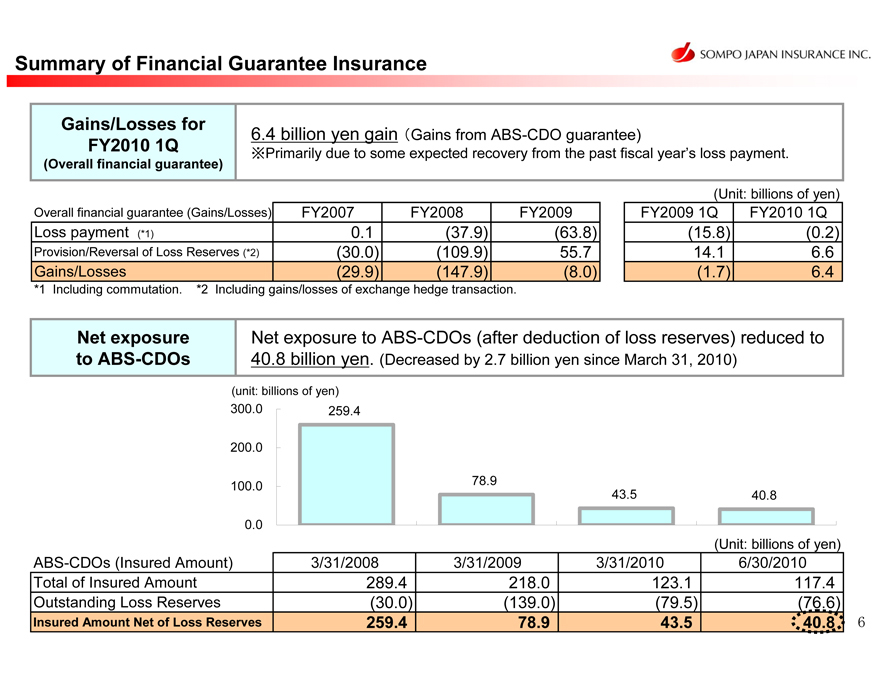

<Appendix 1> Financial Guarantee Insurance

(As of June 30, 2010, Unit: billions of yen, USD/JPY=88.51)

Categories

CDOs

ABS

ABS CDOs (backed by pools of asset backed securities) (*1)

Corporate CDOs (backed by pools of single corporate credits) (*2)

CDOs Total

RMBS (*3)

Global RMBS Domestic RMBS RMBS Total CMBS (*4) Other ABS

Global ABS (*5) Domestic ABS Other ABS Total

ABS Total

Public Finance Total

Insured Amount

Direct Insurance

(*6)

116.9 146.0 262.9

- 3

6.6 36.6-

3.3 8.6 12.0 48.6 -

311.5

Treaty Reinsurance

(*7)

0.5 1.6 2.2

10.8-10.8-

2 6.0 - 26.0 36.8 179.5

218.6

Total

117.4 147.7 265.2

10.8 36.6 47.4-

29.3 8.6 38.0 85.5 179.5

530.2

Outstanding Loss Reserve

(*8)

7 6.6 - 7 6.6

0.3 - 0.3 -

0.5 - 0.5 0.9 0.0

77.5

Insured Amount Net of Loss Reserves

40.8 147.7 188.5

10.4 36.6 47.0 -

28.8 8.6

37.5 84.5 179.4

452.6

Gains/Losses for FY2010 1Q

(*9)

6.4 -

6.4

-

-

6.4

*1 ABS CDOs (backed by pools of asset backed securities): The securities backed by securitized assets such as the RMBS, CDOs and CLOs.

*2 Corporate CDOs (backed by pools of single corporate credits): The securities backed by assets such as corporate bonds, loans and CDS.

*3 RMBS: Asset Backed Securities where underlying assets are residential mortgages. 93% of RMBS are rated investment grade (BBB or above) including AAA ratings for 79%.

*4 CMBS: Asset-backed securities where underlying assets are commercial mortgage loans.

*5 8% of global ABS are U.S. consumer loan-related ABS, while others are mainly related to corporate credit (e.g., leasing receivables).

*6 “Direct Insurance” includes facultative reinsurance policies and 9.0 billion yen of Direct Insurance to cover U.S. monoline guaranteed notes.

*7 “Treaty Reinsurance” is a portfolio-based reinsurance where certain parts of policies underwritten by an original insurer are ceded automatically to the reinsurer, Sompo Japan, in

accordance with the conditions agreed by the original insurer and the reinsurer.

*8 Recoverable reserve for the transaction which was terminated by claim payment is not included in “Outstanding Loss Reserve”.

*9 Total amount of 6.4 billion yen gain is comprised of 0.2 billion yen of loss payment offset by 8.1 billion yen of reversal of loss reserve and 1.5 billion yen losses of foreign

exchange hedge transaction for loss reserve. Financial Guarantee Insurance is not supposed to book mark-to-market unrealized gains/losses through income statement as it is

an insurance policy.

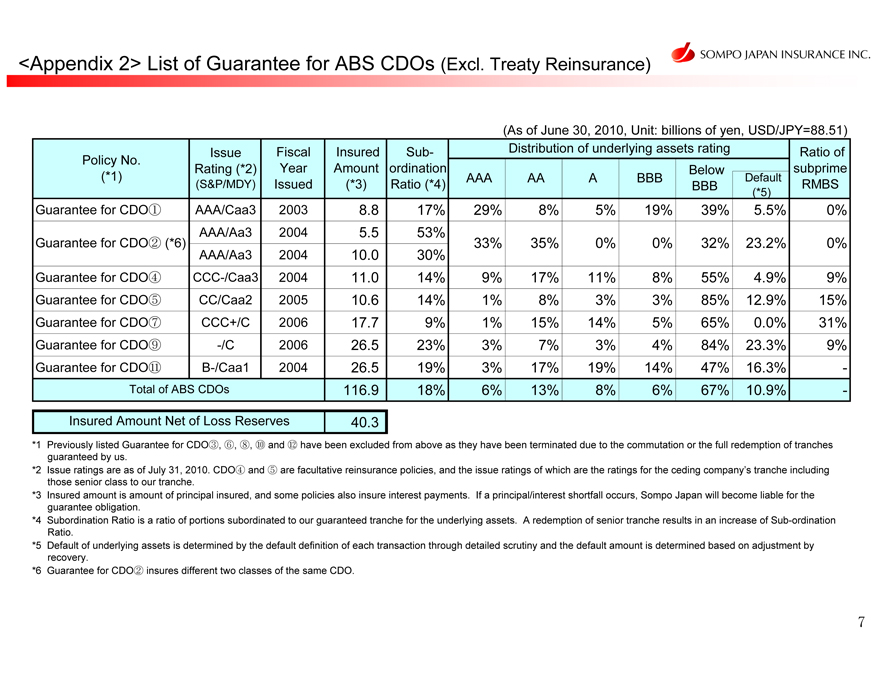

<Appendix 2> List of Guarantee for ABS CDOs (Excl. Treaty Reinsurance)

(As of June 30, 2010, Unit: billions of yen, USD/JPY=88.51)

Policy No. (*1)

Guarantee for CDO

Guarantee for CDO (*6)

Guarantee for CDO Guarantee for CDO Guarantee for CDO Guarantee for CDO Guarantee for CDO

Total of ABS CDOs

Issue Rating (*2) (S&P/MDY)

AAA/Caa3 AAA/Aa3 AAA/Aa3 CCC-/Caa3 CC/Caa2 CCC+/C

-/C B-/Caa1

Fiscal Year

Issued 2003 2004 2004 2004 2005 2006 2006 2004

Insured Amount (*3)

8.8

5.5

10.0

11.0

10.6

17.7

26.5

26.5 116.9

Subordination Ratio (*4) 17% 53% 30% 14% 14% 9% 23% 19% 18%

Distribution of underlying assets rating

AAA 29% 33%

9% 1% 1% 3%

3% 6%

AA 8% 35%

17% 8% 15% 7% 17% 13%

A 5% 0%

11% 3% 14% 3% 19% 8%

BBB 19% 0%

8% 3% 5

% 4% 14% 6%

Below BBB

39%

32%

55% 85% 65% 84% 47% 67%

Default (*5)

5.5%

23.2%

4.9% 12.9% 0.0% 23.3% 16.3

% 10.9%

Ratio of subprime RMBS

0%

0%

9% 15% 31% 9% -

Insured Amount Net of Loss Reserves 40.3

*1 Previously listed Guarantee for CDO, and have been excluded from above as they have been terminated due to the commutation or the full redemption of tranches

guaranteed by us.

*2 Issue ratings are as of July 31, 2010. CDO and are facultative reinsurance policies, and the issue ratings of which are the ratings for the ceding company’s tranche including

those senior class to our tranche.

*3 Insured amount is amount of principal insured, and some policies also insure interest payments. If a principal/interest shortfall occurs, Sompo Japan will become liable for the

guarantee obligation.

*4 Subordination Ratio is a ratio of portions subordinated to our guaranteed tranche for the underlying assets. A redemption of senior tranche results in an increase of Sub-ordination

Ratio.

*5 Default of underlying assets is determined by the default definition of each transaction through detailed scrutiny and the default amount is determined based on adjustment by

recovery.

*6 Guarantee for CDO insures different two classes of the same CDO.

7

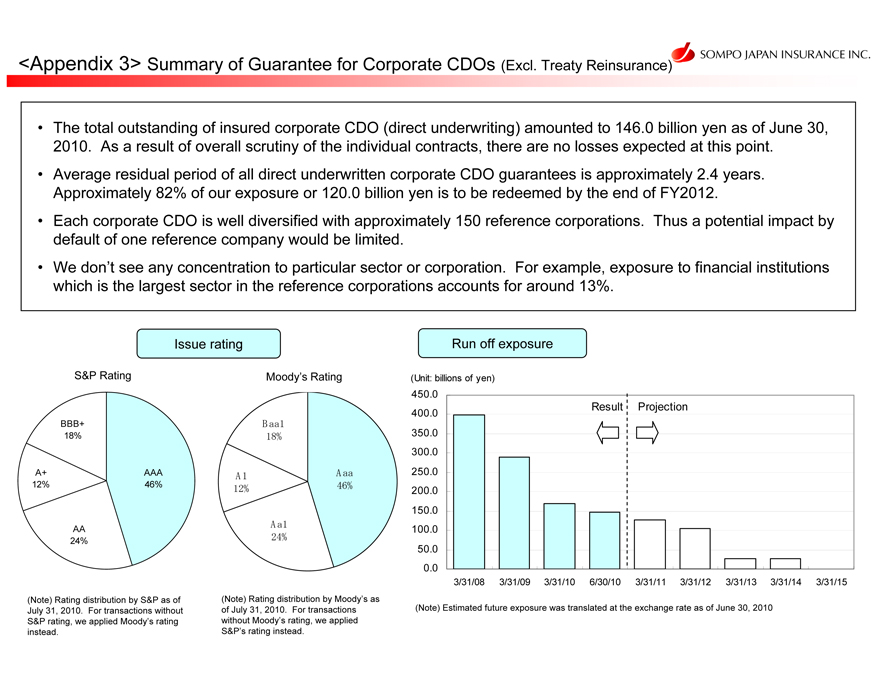

<Appendix 3> Summary of Guarantee for Corporate CDOs (Excl. Treaty Reinsurance)

The total outstanding of insured corporate CDO (direct underwriting) amounted to 146.0 billion yen as of June 30, 2010. As a result of overall scrutiny of the individual contracts, there are no losses expected at this point.

Average residual period of all direct underwritten corporate CDO guarantees is approximately 2.4 years. Approximately 82% of our exposure or 120.0 billion yen is to be redeemed by the end of FY2012.

Each corporate CDO is well diversified with approximately 150 reference corporations. Thus a potential impact by default of one reference company would be limited.

We don’t see any concentration to particular sector or corporation. For example, exposure to financial institutions which is the largest sector in the reference corporations accounts for around 13%.

Issue rating

S&P Rating

BBB+ 18%

A+ AAA 12% 46%

AA

24%

Moody’s Rating

Baa1 18%

A1 Aaa 12% 46%

Aa1 24%

(Note) Rating distribution by S&P as of July 31, 2010. For transactions without S&P rating, we applied Moody’s rating instead.

(Note) Rating distribution by Moody’s as of July 31, 2010. For transactions without Moody’s rating, we applied S&P’s rating instead.

Run off exposure

(Unit: billions of yen)

450.0 400.0 350.0 300.0 250.0 200.0 150.0 100.0 50.0 0.0

Result Projection

3/31/08 3/31/09 3/31/10 6/30/10 3/31/11 3/31/12 3/31/13 3/31/14 3/31/15

(Note) Estimated future exposure was translated at the exchange rate as of June 30, 2010

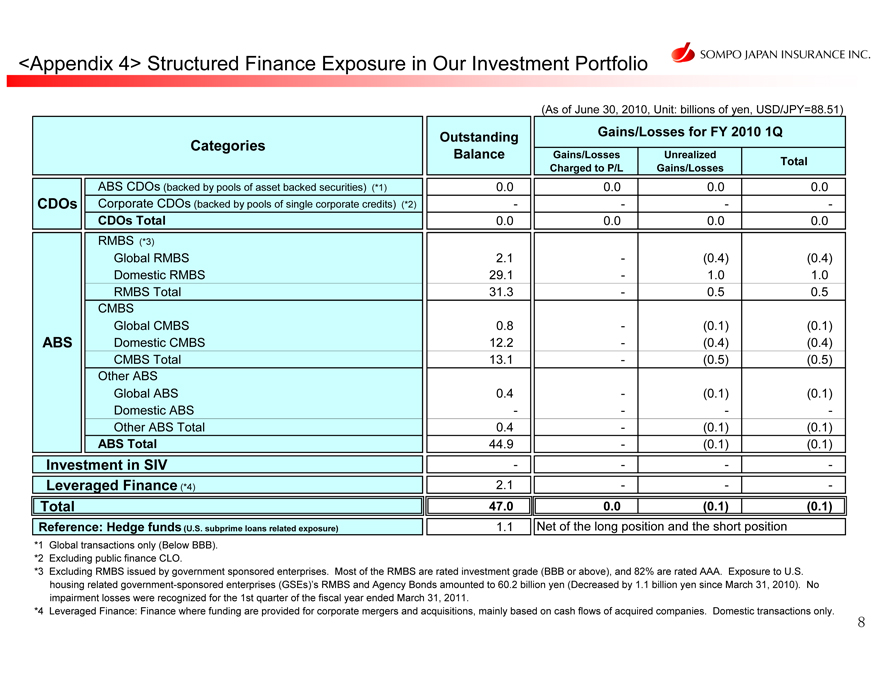

<Appendix 4> Structured Finance Exposure in Our Investment Portfolio

(As of June 30, 2010, Unit: billions of yen, USD/JPY=88.51)

Categories

ABS CDOs (backed by pools of asset backed securities) (*1)

CDOs

Corporate CDOs (backed by pools of single corporate credits) (*2)

CDOs Total

RMBS (*3)

Global RMBS Domestic RMBS RMBS Total CMBS

Global CMBS ABS Domestic CMBS

CMBS Total Other ABS

Global ABS Domestic ABS Other ABS Total

ABS Total Investment in SIV Leveraged Finance (*4) Total

Reference: Hedge funds (U.S. subprime loans related exposure)

Gains/Losses for FY 2010 1Q

Gains/Losses Charged to P/L

0.0 -

0.0

-

-

-

-

0.0

Unrealized Gains/Losses

0.0

-

0.0

(0.4)

1.0

0.5

(0.1)

(0.4)

(0.5)

(0.1)

-

(0.1)

(0.1)

-

(0.1)

Total

0.0

-

0.0

(0.4)

1.0

0.5

(0.1)

(0.4)

(0.5)

(0.1)

–

(0.1)

(0.1)

-

(0.1)

Outstanding Balance

0.0 - 0.0 2.1 29.1 31.3 0.8 12.2 13.1 0.4 - 0.4 44.9 - 2.1 47.0 1.1

Net of the long position and the short position

*1 Global transactions only (Below BBB).

*2 Excluding public finance CLO.

*3 Excluding RMBS issued by government sponsored enterprises. Most of the RMBS are rated investment grade (BBB or above), and 82% are rated AAA. Exposure to U.S. housing related government-sponsored enterprises (GSEs)’s RMBS and Agency Bonds amounted to 60.2 billion yen (Decreased by 1.1 billion yen since March 31, 2010). No impairment losses were recognized for the 1st quarter of the fiscal year ended March 31, 2011.

*4 Leveraged Finance: Finance where funding are provided for corporate mergers and acquisitions, mainly based on cash flows of acquired companies. Domestic transactions only.

8

(Reference) NIPPONKOA Insurance Co., Ltd. (Non-consolidated)

Quarterly Balance Sheets

| | | | | | | | | |

| | | (Millions of yen) | |

| | | As of June 30, 2010 | | | As of March 31, 2010 | | | Increase

(Decrease) | |

| | | Amount | | | Amount | | | | |

Assets: | | | | | | | | | |

Cash and deposits | | 70,242 | | | 80,793 | | | (10,551 | ) |

Call loans | | 25,000 | | | 50,000 | | | (25,000 | ) |

Monetary receivables bought | | 33,491 | | | 6,129 | | | 27,361 | |

Money trusts | | 56,789 | | | 56,752 | | | 37 | |

Securities | | 1,756,202 | | | 1,822,848 | | | (66,645 | ) |

Loans | | 221,087 | | | 227,417 | | | (6,329 | ) |

Tangible fixed assets | | 129,322 | | | 130,437 | | | (1,115 | ) |

Intangible fixed assets | | 531 | | | 534 | | | (3 | ) |

Other assets | | 162,744 | | | 159,263 | | | 3,480 | |

Deferred tax assets | | 78,684 | | | 60,392 | | | 18,291 | |

Allowance for possible loan losses | | (2,073 | ) | | (2,106 | ) | | 33 | |

| | | | | | | | | |

Total assets | | 2,532,023 | | | 2,592,464 | | | (60,441 | ) |

| | | | | | | | | |

Liabilities: | | | | | | | | | |

Underwriting funds: | | 2,044,167 | | | 2,059,290 | | | (15,123 | ) |

Reserve for outstanding losses and claims | | 266,522 | | | 267,872 | | | (1,349 | ) |

Underwriting reserves | | 1,777,644 | | | 1,791,418 | | | (13,773 | ) |

Other liabilities | | 57,910 | | | 65,184 | | | (7,274 | ) |

Reserve for retirement benefits | | 23,090 | | | 22,583 | | | 506 | |

Reserve for bonus payments | | 1,455 | | | 6,078 | | | (4,622 | ) |

Reserve for bonus payments to directors | | — | | | 41 | | | (41 | ) |

Reserves under the special laws: | | 6,421 | | | 5,643 | | | 778 | |

Reserve for price fluctuation | | 6,421 | | | 5,643 | | | 778 | |

| | | | | | | | | |

Total liabilities | | 2,133,044 | | | 2,158,821 | | | (25,777 | ) |

| | | | | | | | | |

Net assets: | | | | | | | | | |

Shareholders’ equity: | | | | | | | | | |

Common stock | | 91,249 | | | 91,249 | | | — | |

Capital surplus | | 46,702 | | | 46,702 | | | — | |