FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

Commission File Number:333-163336

For the month ofJuly 2010.

NKSJ Holdings, Inc.

(Translation of registrant’s name into English)

26-1, Nishi-Shinjuku 1-chome

Shinjuku-ku, Tokyo 160-8338

Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Information furnished on this form:

Table of Contents

Notice Concerning Issuance of Stock Acquisition Rights (Stock Compensation-type Stock Options)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | |

| | NKSJ Holdings, Inc. |

| Date: July 30, 2010 | | | | |

| | By: | | /S/ HIROHISA KURUMIDA |

| | | | Hirohisa Kurumida |

| | | | Manager of Corporate Legal Department |

[English Translation]

Notice Concerning Issuance of Stock Acquisition Rights (Stock Compensation-type Stock Options)

[English Translation]

July 30, 2010

| | | | |

| | Corporate Name: Representatives: | | NKSJ Holdings, Inc. Makoto Hyodo, Chairman and Co-CEO Masatoshi Sato, President and Co-CEO |

| | Securities Code: | | 8630, TSE, OSE |

Notice Concerning Issuance of Stock Acquisition Rights (Stock Compensation-type Stock Options)

The Company hereby announces that the Company resolved at the meeting of the Board of Directors held today to issue share options (Stock Compensation-type Stock Options) to directors and executive officers of the Company and principal subsidiaries (Sompo Japan Insurance Inc. and NIPPONKOA Insurance Co., Ltd.) of the Company, conditional upon receipt of an offer from the relevant director or executive officer of each company, as follows.

| 1. | Reasons for Allotment of Stock Acquisition Rights as Stock Options |

Stock Acquisition Rights will be allotted to directors and executive officers of the Company, Sompo Japan Insurance Inc. and NIPPONKOA Insurance Co., Ltd. for the purposes of NKSJ Group achieving even greater motivation and increased morale on the part of those directors and executive officers to increase stock prices and improve business performance, and to further promote management which places importance on shareholder benefit and corporate value.

| 2. | Terms and Conditions of Issuance of Stock Acquisition Rights |

| | <1> | Name of Stock Acquisition Rights |

Twenty-third Issue of Stock Acquisition Rights of NKSJ Holdings, Inc.

| | <2> | Total number of the Stock Acquisition Rights |

13,978 stock acquisition rights.

The above is expected number of the allotment. If the total number of the Stock Acquisition Rights to be allotted is less than expected, such as in the case where applications are not made as expected, total number of allotment of Stock Acquisition Rights will be reduced accordingly.

| | <3> | Class and Number of Shares Underlying Stock Acquisition Rights |

The shares underlying the Stock Acquisition Rights shall be 1,397,800 common shares of stock of the Company and the number of shares of stock underlying each Stock Acquisition Right (the “Number of Underlying Shares”) shall be one hundred (100).

The number of the shares of stock underlying the Stock Acquisition Rights shall be adjusted using the following formula in the event that the Company effects a share split or consolidation of shares with respect to the shares of common stock of the Company; provided, however, that said adjustments shall be made only for the Number of Underlying Shares of the Stock Acquisition Rights that have not been exercised at that time, and a fraction of less than one produced as a result of the adjustment shall be rounded down to the nearest lower integer:

| | | | | | | | | | | | |

| | Number of | | | | Number of | | | | Ratio of | | |

| | Underlying Shares | | = | | Underlying Shares | | x | | split | | |

| | after adjustment | | | | before adjustment | | | | (or consolidation) | | |

In addition to the above, adjustment shall be made within reasonable limits to the Number of Underlying Shares in the event that the Company issues new shares of stock or disposes treasury shares each at a price below the market value, the Company effects merger, corporate split, share exchange or share transfer, or the Company allots shares of common stock of the Company without consideration, or in the event of any other cause that otherwise makes adjustment thereto unavoidable.

| | <4> | Value of Property to be Contributed Upon Exercise of Stock Acquisition Rights |

The value of the property to be contributed when each Stock Acquisition Right is exercised shall be the amount of money obtained by multiplying one (1) yen, which is the amount to be paid in for each share that can be received by exercising the Stock Acquisition Rights, by the Number of Underlying Shares.

| | <5> | Period During Which the Stock Acquisition Rights Can Be Exercised |

From August 17, 2010 through August 16, 2035

| | <6> | Matters Regarding the Stated Capital and Capital Reserves That Will Be Increased Due to Issuance of Shares upon Exercise of Stock Acquisition Rights |

| | (1) | The amount of stated capital that shall be increased in the event of issuing shares as a result of the exercise of the Stock Acquisition Rights shall be one-half of the maximum increase in capital, etc., as calculated pursuant to Article 17, Paragraph 1 of the Ordinance on Company Accounting. A fraction of less than one yen produced as a result of this calculation shall be rounded up to the nearest yen. |

| | (2) | The amount of capital reserves that shall be increased in the event of issuing shares as a result of the exercise of the Stock Acquisition Rights shall be the maximum increase in capital, etc., as set forth in (1) above, minus the amount of increase in the amount of stated capital as set forth in (1) above. |

| | <7> | Restriction on Acquisition of Stock Acquisition Rights by way of Assignment |

Acquisition of the Stock Acquisition Rights by way of assignment shall require the approval of the board of directors of the Company.

| | <8> | Causes for Which the Company Can Acquire the Stock Acquisition Rights and Conditions of Acquisition |

If a shareholders meeting of the Company approves a proposal set forth in (1) through (5) below (or in the event that the board of directors of the Company has resolved that the resolution of a shareholders meeting is not necessary), the Company may acquire the Stock Acquisition Rights for no consideration, on the date as shall be separately prescribed by the board of directors:

| | (1) | A proposal to approve a merger agreement in which the Company will be extinguished; |

| | (2) | A proposal to approve a company split agreement or a company split plan in which the Company will be the splitting company; |

| | (3) | A proposal to approve an agreement of a share exchange or share transfer plan in which the Company will become a wholly owned subsidiary; |

| | (4) | A proposal to approve the amending of the articles of incorporation, in order to create a provision to the effect that the approval of the Company is required for the acquisition of shares by assignment, as a condition of all shares issued by the Company,; or |

| | (5) | A proposal to approve the amendment of the articles of incorporation, in order to create a provision to the effect that as a condition of the shares underlying the Stock Acquisition Rights the approval of the Company is required for the acquisition of these shares by way of assignment, or that the Company may acquire all of the shares of such class by a resolution of a shareholders meeting. |

| | <9> | Conditions of Exercise of the Stock Acquisition Rights |

| | (1) | Each of the directors and executives officers of the Company, directors and executive officers of Sompo Japan Insurance Inc. and directors and executive officers of NIPPONKOA Insurance Co., Ltd. who are the holders of the Stock Acquisition Rights may exercise the Stock Acquisition Rights held by him/her only within a period of 10 days from the day immediately following the day on which he/she forfeits the position as either a director or executive officer of the relevant company. |

| | (2) | A holder of the Stock Acquisition Rights (Stock Compensation-type Stock Options) which have been allotted based on his/her capacity as a director or executive officer of the Company, Sompo Japan Insurance Inc. or NIPPONKOA Insurance Co., Ltd., must exercise all of the Stock Acquisition Rights held by him/her together and shall not be permitted to exercise only a part of such Stock Acquisition Rights. |

| | <10> | Policy concerning Decisions in Connection With the Content of Extinguishing Stock Acquisition Rights in a Restructuring of Corporate Organization, as Well as the Delivery of Stock Acquisition Rights in the Company to Be Restructured |

If the Company will effect a merger (limited to the case in which the Company will be the company that is extinguished as a result of the merger), absorption-type company split, an incorporation-type company split, a share exchange or share transfer (hereinafter referred to collectively as a “Corporate Restructuring”), then Stock Acquisition Rights in the relevant company as prescribed in Article 236, Paragraph 1, Item (viii)(a) through (e) of the Companies Act (the “Restructured Company”) shall be delivered to existing holders of the Stock Acquisition Rights as of the time the Corporate Restructuring comes into effect (the “Existing Stock Acquisition Rights”), in accordance with the following conditions, and in this event the Existing Stock Acquisition Rights shall be extinguished and the Restructured Company shall issue new Stock Acquisition Rights; provided, however, that this shall be limited to cases in which delivery of Stock Acquisition Rights in the Restructured Company in accordance with the following conditions is stipulated in the absorption-type merger agreement, the consolidation-type merger agreement, the absorption-type corporate split agreement, the incorporation-type company split plan, the share exchange agreement or the share transfer plan:

| | (1) | Number of Stock Acquisition Rights that are to be delivered of the Restructured Company |

These Stock Acquisition Rights are to be delivered in the same number as the number of Stock Acquisition Rights that are respectively held by the holders of the Existing Stock Acquisition Rights

| | (2) | Class of Shares of the Restructured Company Underlying the Stock Acquisition Rights. |

Shares of common stock of the Restructured Company

| | (3) | Number of Shares of the Restructured Company Underlying the Stock Acquisition Rights |

This shall be determined in accordance with <3> above in consideration of the conditions, etc., of the Corporate Restructuring.

| | (4) | Value of Property to Be Contributed at the Time of Exercise of the Stock Acquisition Rights |

The value of the property to be contributed at the time of exercise of each of the Stock Acquisition Rights to be delivered shall be the value of the property as prescribed in <4> above, obtained by adjustment in consideration of the conditions, etc., of the Corporate Restructuring.

| | (5) | Period during Which the Stock Acquisition Rights Can Be Exercised |

This shall be the period from whichever is later of the commencement date of the period during which the Stock Acquisition Rights can be exercised as set forth in <5> above, or the effective date of the Corporate Restructuring, through the final date of the period during which the Stock Acquisition Rights can be exercised as set forth in <5> above.

| | (6) | Matters in Connection With the Stated Capital and Capital Reserves to Be Increased in the Event of Issue of the Shares as a Result of Exercise of Stock Acquisition Rights |

To be determined in accordance with <6> above.

| | (7) | Restriction on Acquisition of Stock Acquisition Rights by Way of Assignment |

Assignment of Stock Acquisition Rights shall require the approval of the board of directors of the Restructured Company.

| | (8) | Causes for Which the Company Can Acquire the Stock Acquisition Rights and Conditions of Acquisition |

These shall be determined in accordance with <8> above.

| | (9) | Other Conditions of Exercise of Stock Acquisition Rights |

These shall be determined in accordance with <9> above.

| | <11> | Treatment of Fractional Less Than One Share That Occur at the Time of Exercise of the Stock Acquisition Rights |

In cases where the number of the shares to be issued to the holder of Stock Acquisition Rights who has exercised his/her Stock Acquisition Rights includes a fraction of less than one share, such fraction shall be rounded down to the nearest lower integer.

| | <12> | Amount to be paid in for each Stock Acquisition Right |

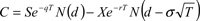

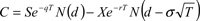

The amount to be paid in for each Stock Acquisition Right shall be the amount obtained by multiplying the option price per share calculated by the Black–Scholes Model using the basic numerical value set forth below by the Number of Underlying Shares.

Where

| | i | Option price per share(C) |

| | ii | Stock price (S): Closing price of the regular trading of the shares of common stocks of the Company at the Tokyo Stock Exchange on August 16, 2010 (if there is no closing price on such date, the base price of the next transaction date) |

| | iii | Exercise Price (X): One (1) yen |

| | iv | Expected time to maturity (T): Three (3) years |

| | v | Volatility (s): Stock price fluctuation rate calculated based on the closing price of the regular trading of the shares of common stock of the Company (for the period from August 17, 2007 through March 31, 2010, Sompo Japan Insurance, Inc.) on each trading date over 3 years (from August 17, 2007 through August 16, 2010) |

| | vi | Risk-free interest rate (r): Interest rate of Japanese government bonds with a maturity that corresponds to the expected time to maturity |

| | vii | Yield (q): Dividend per share (expected dividend for the business year ended in March 2011) divided by stock price set forth in ii above |

| | viii | Cumulative distribution function of the standard normal distribution (N(·)) |

The Company will pay to the respective directors and executive officers of the Company monetary remuneration in an amount equal to the total amount to be paid in for the Stock Acquisition Rights allotted to him/her (the amount obtained by multiplying the amount to be paid in for each Stock Acquisition Right by the number of the Stock Acquisition Rights to be allotted) and the Company’s obligation to pay to him/her such monetary remuneration shall be offset by his/her obligation to pay the amount to be paid in for the Stock Acquisition Rights.

With respect to the directors and executive officers of each of Sompo Japan Insurance Inc. and NIPPONKOA Insurance Co., Ltd., each of those companies will pay to their directors and executive officers monetary remuneration in an amount equal to the total amount to be paid in for the Stock Acquisition Rights allotted to him/her and the Company will assume the obligations of those companies to pay such monetary remuneration and the Company’s obligation to pay monetary remuneration to each of such directors and executive officers shall be offset by his/her obligation to pay the amount to be paid in for the Stock Acquisition Rights.

The amount to be paid in for each Stock Acquisition Right obtained as a result of the above calculation is the fair value and shall not constitute an issue that is made on particularly favorable terms.

| | <13> | Date of Allotment of Each Stock Acquisition Right |

August 16, 2010

| | <14> | Date for the payment of monies in exchange for the Stock Acquisition Rights |

August 16, 2010

| | <15> | Persons to whom Stock Acquisition Rights Are Allotted and Number of Such Persons and Number of Stock Acquisition Rights to Be Allotted |

| | | | |

Persons to whom Stock Acquisition Rights Are Allotted and Number of Such Persons and Number of Stock Acquisition Right to

Be Allotted | | Number of

persons | | Number of

the Stock

Acquisition

Rights to be

allotted |

Directors* and Executive Officers of the Company | | 7 | | 904 |

Directors* and Executive Officers of Sompo Japan Insurance Inc. | | 40 | | 8,458 |

Directors* and Executive Officers of NIPPONKOA Insurance Co., Ltd. | | 26 | | 4,616 |

Total | | 73 | | 13,978 |

| * | Exclusive of outside directors and non-full time directors. |

Since some directors and corporate auditors of the Company and its principal subsidiaries hold concurrent offices in more than one of these companies, the actual number of the persons to be allotted with the Stock Acquisition Rights is 69.

- End -

Note Regarding Forward-looking Statements

This document includes “forward-looking statements” that reflect the information in relation to NKSJ Holdings, Inc. (“NKSJ”). To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of NKSJ in light of the information currently available to NKSJ, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of NKSJ, as the case may be, to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements. NKSJ does not undertake or will not undertake any obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by NKSJ in their subsequent domestic filings in Japan and filings with, or submissions to, the U.S. Securities Exchange Commission pursuant to the U.S. Securities Exchange Act of 1934.

The risks, uncertainties and other factors referred to above include, but are not limited to, those below.

| (1) | Effects of deterioration of economic and business conditions in Japan |

| (2) | Risks associated with non-life insurance business, life insurance business, and other businesses in which the NKSJ Group participates |

| (3) | Changes to laws, regulations, and systems |

| (4) | Risk of natural disasters |

| (5) | Occurrence of unpredictable damages |

| (7) | Overseas business risk |

| (8) | Effects of declining stock price |

| (9) | Effects of fluctuation in exchange rate |

| (10) | Effects of fluctuation in interest rate |

| (12) | Effects of decline in creditworthiness of investment and/or loan counterparties |

| (13) | Credit rating downgrade |

| (15) | Risk concerning retirement benefit liabilities |

| (16) | Occurrence of personal information leak |

| (17) | Damage on business operations by major disasters |

| (18) | Effects resulting from business integration |