Filed pursuant to

Rule 424(b)(3)

Registration No. 333-158478

MACQUARIE CNL GLOBAL INCOME TRUST, INC.

Supplement No. One dated March 22, 2011

to Prospectus dated April 23, 2010

TABLE OF CONTENTS

APPENDIX B – Prior Performance Tables – MIRA

APPENDIX C – Prior Performance Tables – CNL LLC and MIRA Inc.

APPENDIX D – Form of Subscription Agreement (post-escrow)

(i)

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement is part of, and should be read in conjunction with, our prospectus dated April 23, 2010 and the additional information incorporated by reference herein and described under the heading “Incorporation of Certain Information By Reference” in this supplement. This supplement replaces all prior supplements to the prospectus. Capitalized terms used in this supplement have the same meaning as in the prospectus unless otherwise stated herein. The terms “we,” “our,” “us” and “Macquarie CNL Global Income Trust, Inc.” means Macquarie CNL Global Income Trust, Inc. and its subsidiaries.

This supplement updates our prospectus pursuant to Section 10(a)(3) of the Securities Act of 1933. This supplement also includes updated information from prior supplements, updated information about certain prior public investment programs and background information of our sponsors or their affiliates, updated information about our distribution policy and our redemption plan, and updated information about fees payable to our advisor.

RECENT DEVELOPMENTS

Status of Our Offering

We commenced our initial public offering of shares of our common stock on April 23, 2010. Until our receipt and acceptance of subscriptions aggregating at least $2 million, all subscription proceeds were placed in escrow pursuant to the terms of an escrow agreement with UMB Bank, N.A. As of October 6, 2010, we satisfied the conditions of this escrow. As of October 8, 2010, we had accepted investors’ subscriptions to this offering received through October 6, 2010, at which time their funds were released from escrow and we commenced operations. Accordingly, all references in the prospectus to the prior escrow should be disregarded.

From April 23, 2010 through December 31, 2010, we had received total subscription proceeds in this offering for approximately $8.1 million and issued 818,145 shares of common stock to 187 investors. Further, during the period January 1, 2011 through March 2, 2011, we received an additional $2.5 million and issued an additional 248,260 shares of common stock. The total subscription proceeds received through March 2, 2011 include approximately $34,000 for 3,572 shares issued pursuant to our distribution reinvestment plan. The shares sold and the gross offering proceeds received from such sales do not include 22,222 shares purchased by our advisor for $200,000 preceding the commencement of our offering. As of March 2, 2011, there remained approximately 148.9 million shares of common stock available to be offered and sold in this offering.

Unless extended, this offering will terminate on April 23, 2012 (which is two years after the effective date of our registration statement on Form S-11 relating to this offering). In certain states, we will be required to renew our registration statement or file a new registration statement to extend the offering beyond this date. If we extend our offering beyond two years from the effective date of our registration statement, we will provide information in a prospectus supplement.

Attached to this supplement as Appendix D is an updated form of subscription agreement which replaces the form of subscription agreement contained in the prospectus dated April 23, 2010 and supplements thereto.

Termination of our Automatic Purchase Plan

Although we adopted an automatic purchase plan that allowed stockholders to make cash investments of $25 per month or $75 per quarter, our board of directors approved the termination of the automatic purchase plan. The termination date for the plan is March 31, 2011, after which shares in this offering may no longer be purchased under the automatic purchase plan. Accordingly, effective after March 31, 2011, all references in the prospectus to the automatic purchase plan should be disregarded.

1

Redemption Plan

As of December 31, 2010, we had not received any redemption requests under our share redemption plan. As of that date, shares had not become eligible for redemption because they had not yet been held for one year.

Fees Paid in Connection with Our Offering

The Managing Dealer receives selling commissions of up to 7% of gross offering proceeds, marketing support fees of 3% of gross offering proceeds and reimbursement of actual expenses incurred in connection with due diligence of the offering. All or any portion of these fees may be reallowed to participating brokers.

For the year ended December 31, 2010, we incurred the following fees (in thousands):

| | | | |

| | | Year Ended

December 31, 2010 | |

Selling commissions | | $ | 523 | |

Marketing support fee and due diligence expense reimbursements | | | 240 | |

| | | | |

Total | | $ | 763 | |

| | | | |

Fees Paid in Connection with Our Operations

For the year ended December 31, 2010, our advisor earned no fees but incurred reimbursable expenses as follows (in thousands):

| | | | |

| | | Year Ended

December 31, 2010 | |

Investment Services Fees(1) | | $ | — | |

| | | | |

Asset Management Fees(2) | | | — | |

| | | | |

Financing Coordination Fee(3) | | | — | |

| | | | |

Reimbursable expenses:(4) | | | | |

Offering costs | | | 405 | |

Acquisition costs | | | — | |

Operating expenses | | | 962 | |

| | | | |

Total | | | 1,367 | |

| | | | |

Total fees earned and reimbursable expenses | | $ | 1,367 | |

| | | | |

FOOTNOTES:

| (1) | Investment Services Fees are paid for services in connection with the selection, evaluation, structure and purchase of Assets, generally equal to 1.85% of the purchase price of properties, the funds advanced for loans or the amount invested in the case of other Assets (except securities). No Investment Services Fee will be paid to our advisor in connection with investments that are securities. |

| (2) | Asset Management Fees are equal to 0.08334% per month of our Real Estate Asset Value, including our proportionate shares of those properties owned in joint ventures, and the outstanding principal amount of any loans made, and 0.1042% of the book value of securities, as of the end of the preceding month. |

| (3) | We will pay our advisor a Financing Coordination Fee equal to 1% of the gross amount of refinancings of any debt obligations of the Company or any of its subsidiaries. |

| (4) | Our advisor and its affiliates are entitled to reimbursement of certain expenses incurred on our behalf in connection with our organization, offering, acquisitions, and operating activities. Pursuant to the Advisory Agreement, we will not reimburse our advisor any amount by which Total Operating Expenses paid or incurred by us exceed the greater of 2% of Average Invested Assets or 25% of Net Income in any expense year, commencing April 1, 2011, except if a majority of our independent directors determines that such excess expenses are justified based on unusual and nonrecurring factors. |

2

Amounts Due our Advisor and its Affiliates

Amounts due to our advisor and its affiliates as of December 31, 2010 for fees and expenses described above are as follows (in thousands):

| | | | |

| | | Year Ended

December 31, 2010 | |

Due to the advisor and its affiliates: | | | | |

Offering expenses | | $ | 33 | |

Operating expenses | | | 900 | |

| | | | |

Total | | $ | 933 | |

| | | | |

| |

Due to Managing Dealer: | | | | |

Selling commissions | | $ | 47 | |

Marketing support fees and due diligence expense reimbursements | | | 20 | |

| | | | |

Total | | $ | 67 | |

| | | | |

Total due to affiliates | | $ | 1,000 | |

| | | | |

For a more detailed discussion of the fees and compensation payable to our advisor, its affiliates and related parties, see “Management Compensation,” and “The Advisor and the Advisory Agreement.”

Changes in Certain Fees to be Paid to Our Advisor

On August 12, 2010, we amended the Advisory Agreement with our advisor and entered into a second amended and restated advisory agreement for the purpose of restructuring fees to be paid to our advisor for certain services. The Advisory Agreement, as now amended, reduced the Investment Services Fee to be paid to our advisor from (i) 3% to 1.85% of the purchase price or the amount invested in the case of real properties and (ii) 2% to 1.85% of the funds advanced for loans or the amount invested in the case of other Assets, except real properties or securities, for services in connection with the selection, evaluation, structure and purchase of Assets. As previously provided in the Advisory Agreement, no Investment Services Fee shall be paid to our advisor in connection with our purchase of investments that are securities.

The Advisory Agreement, as now amended, also changed the Disposition Fee from 3% to 1% in the case of the sale of real properties and certain other Assets. If our advisor, its affiliates or related parties provide a substantial amount of services in connection with the sale of one or more Assets (including the sale of all of our Assets or the sale of our Company or a portion thereof), we will pay our advisor, its affiliates or related parties a Disposition Fee in an amount equal to (i) in the case of the sale of real property, the lesser of (A) one-half of a competitive real estate commission or (B) 1% of the sales price of such property or properties, (ii) in the case of the sale of any Asset other than real property, loans or securities investments, 1% of the sales price of such Asset. The Disposition Fee in the case of the sale of any loan remains at 1% of the contract price of such loan. As previously provided in the Advisory Agreement, no Disposition Fee shall be paid to our advisor in connection with our disposition of investments that are securities; however, we may pay usual and customary brokerage fees to an affiliate or related party of our advisor, if, at the time of such payment, such affiliate or related party is a properly registered and licensed broker-dealer (or equivalent) in the jurisdiction in which the securities are being sold.

Further, the Advisory Agreement, as now amended, reduced from 8% to 6% the Priority Return that must be paid to investors before we may pay our advisor as Incentive Fees the Subordinated Share of Net Sales Proceeds from a sale of all or a portion of our Assets, the Subordinated Incentive Fee payable upon a Liquidity Event and the Performance Fee payable upon the occurrence of a Liquidity Event or one or more sales of assets subsequent to the termination or non-renewal of the Advisory Agreement.

In addition, the Advisory Agreement, as now amended, provides that we will pay our advisor for services rendered in connection with the refinancing of any debt obligations of the Company or any of its subsidiaries a Financing Coordination Fee equal to 1% of the gross amount of any such refinancing. Such Financing Coordination

3

Fees are included in Total Operating Expenses for purposes of calculating conformance with the 2%/25% Guidelines.

In connection with our entering into the second amended and restated Advisory Agreement, our board of directors approved a second amendment and restatement of our articles of incorporation pursuant to Section 2-603 of the MGCL which was filed with the Maryland Department of Assessments and Taxation on August 13, 2010. The amendment also clarified that that we may distribute our own securities as stock distributions to our stockholders.

Distribution Policy

On May 25, 2010, our board of directors authorized a daily cash distribution of $0.0017808 per share of common stock which commenced on October 7, 2010, the day following the date on which we received and accepted subscriptions for the minimum offering of $2.0 million in shares of common stock. Distributions are calculated based on the number of days each stockholder has been a stockholder of record in that month. Distributions that accrued in October, the month the minimum offering was met, and November, the subsequent month, were aggregated and paid in December. Thereafter, at the end of each month, that month’s distributions will be aggregated and paid in the following month. The daily distribution rate is equal to an annualized distribution rate of 6.5%, using our offering price of $10.00 per share. Our board of directors intends to evaluate our distribution policy on a quarterly basis.

We may pay some or all of these distributions from sources other than cash flow from operations, such as cash flows from financing activities, which may include borrowings, cash resulting from a waiver or deferral of fees, and proceeds of our initial public offering. Distributions for stockholders participating in our distribution reinvestment plan will be reinvested into shares of our common stock promptly following the date such distributions are paid to the extent shares are available.

For the period October 7, 2010 through November 30, 2010, we distributed $42,647 to our stockholders. For the period December 1, 2010 through December 31, 2010, we had accrued $40,732 in distributions payable to our stockholders which we distributed on January 14, 2011. We did not have distributable earnings in 2010 and, therefore, distributions were made from financing activities including proceeds from this offering.

Macquarie — Charter Hall Group Transaction

On February 12, 2010, Macquarie Group Limited entered into an agreement to sell the majority of its Australian core real estate funds management platform to Charter Hall Group, a Sydney-based property funds management and development company (the “Charter Hall Group Transaction”). The Charter Hall Group Transaction, which was substantially completed in March 2010, included the sale of the management business of Macquarie Office Trust, Macquarie CountryWide Trust and Macquarie Direct Property Funds (which includes Macquarie Direct Property Fund, Macquarie Martin Place Trust and Macquarie Property Income Fund). Further, as part of the transaction, Charter Hall Group also acquired the asset service and property management businesses that support these funds. The Charter Hall Group Transaction did not affect Macquarie’s ownership of Macquarie CNL Global Income Advisors, LLC, our advisor. As a result of the Charter Hall Group Transaction, this supplement updates certain information about Macquarie and/or its affiliates in the sections of the prospectus titled “QUESTIONS AND ANSWERS ABOUT THIS OFFERING,” “BUSINESS,” and “PRIOR PERFORMANCE SUMMARY.”

Macquarie — EPN GP, LLC Transaction

On June 18, 2010, Macquarie sold its 50% interest in the Macquarie DDR Trust (“MDT”) responsible entity to EPN GP, LLC. As a part of this transaction, Macquarie will provide transitional services related to the management and administration of the trust until December 2010. Following the transaction, MDT has been renamed EDT Retail Trust. As a result of this transaction, this supplement updates certain information about Macquarie and/or its affiliates in the sections of the prospectus titled “QUESTIONS AND ANSWERS ABOUT THIS OFFERING,” “BUSINESS,” and “PRIOR PERFORMANCE SUMMARY.”

4

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The Commission allows us to “incorporate by reference” certain information that we file with it, which means that we can disclose important information to you by referring you to various documents that we have filed separately with the Commission. The information incorporated by reference is deemed to be a part of our prospectus and the information that we later file with the Commission may update and supersede the information in our prospectus, including information incorporated by reference. For information on how to access this information, see the following section of this supplement entitled “WHERE YOU CAN FIND MORE INFORMATION.”

We incorporate by reference the following documents that we have previously filed with the Commission:

| | • | | Annual Report on Form 10-K for the fiscal year ended December 31, 2010 filed on March 7, 2011. |

Upon request we will provide to each person, including a beneficial owner, to whom this supplement is delivered, a copy of any or all of the information that we have incorporated by reference into this supplement but have not delivered to investors. To receive a free copy of those documents, other than exhibits, unless they are specifically incorporated by reference in those documents, call or write to:

CNL Client Services

PO Box 4920

Orlando, FL 32802

866-650-0650, option 3

www.cnl.com

5

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith, file annual, quarterly and current reports with the Commission. Such reports can be inspected and copied at the Public Reference Room of the Commission located at 100 F Street, NE, Washington, D.C. 20549. Please call the Commission at 1-800-SEC-0330 for more information on the operation of the Public Reference Room. Copies of such materials, including the documents that are incorporated by reference into our filings, can be obtained from the Public Reference Section of the Commission at prescribed rates. Such materials may also be accessed via the “View SEC Filings” link on the web site maintained by us athttp://www.MacquarieCNLGlobalIncomeTrust.com. Unless specifically listed above in “INCORPORATION OF CERTAIN INFORMATION BY REFERENCE,” the contents of that web site are not intended to be incorporated by reference into our prospectus.

We have filed a registration statement on Form S-11, of which this supplement forms a part, and related exhibits with the Commission under the Securities Act. The registration statement contains additional information about us and this offering. You can inspect or access electronically the registration statement and exhibits by the means described in the paragraph above.

PROSPECTUS SUMMARY

The following supersedes and replaces in full the first paragraph under the heading “PROSPECTUS SUMMARY – Our Sponsors, Our Advisor and Other Related Entities” which appears on page 1 of the prospectus. In addition, all references to Macquarie Capital Funds throughout the prospectus are to be deemed replaced with Macquarie Infrastructure and Real Assets or MIRA.

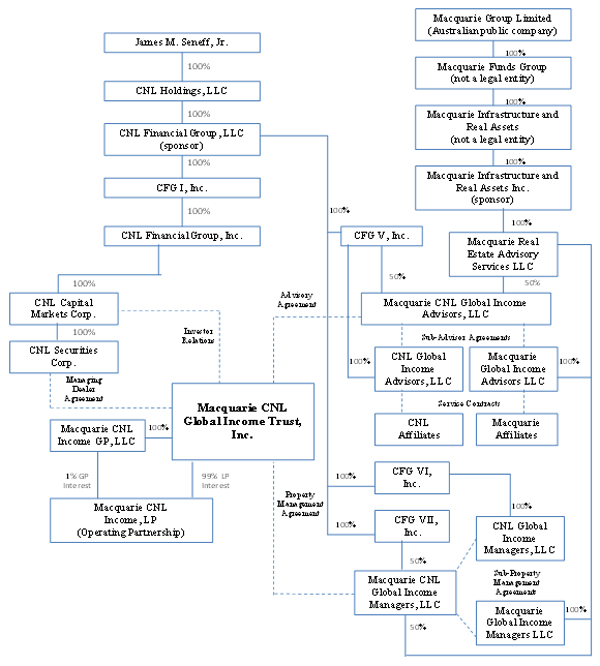

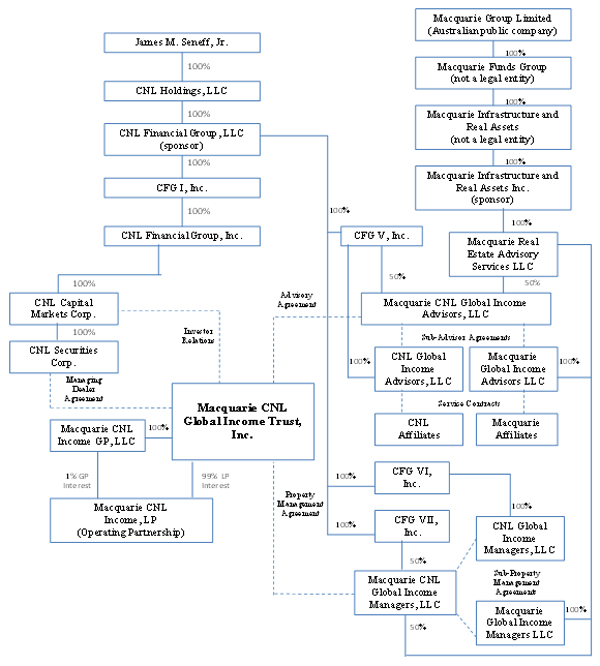

Our Sponsors, Our Advisor and Other Related Entities

CNL Financial Group, LLC (“CNL LLC”) and Macquarie Infrastructure and Real Assets Inc. (“MIRA Inc.”) are our sponsors and who we consider to be our promoters. CNL LLC is an affiliate of CNL Financial Group, Inc. (“CNL”), which is one of the nation’s largest, privately held real estate investment and development companies, and is controlled by James M. Seneff, Jr. MIRA Inc. is a subsidiary under the Macquarie Infrastructure and Real Assets division (“MIRA”) (formerly known as “Macquarie Capital Funds”) of Macquarie Funds Group. Macquarie Funds Group is a business platform focused on the creation and management of specific asset class investor funds within Macquarie Group Limited, or “Macquarie.” Among other services, MIRA offers a range of real estate service capabilities including portfolio and asset management, development related services, property management services, due diligence, investment advisory services, financing and capital management and investor relations. Macquarie, a public company and global provider of banking, financial, advisory, investment and funds management services, is listed on the Australian Securities Exchange under the symbol MQG.

The following supersedes and replaces in full the discussion and table under the heading “PROSPECTUS SUMMARY – Compensation of our Advisor and Affiliates” beginning on page 10 of the prospectus.

Compensation of Our Advisor and Affiliates

Our advisor, its affiliates and related parties will perform services relating to the investment, management and sale of our assets. In addition, CNL Securities Corp., the managing dealer for this offering, will perform services in connection with the offer and sale of shares. The following table describes in summary form the compensation and reimbursement of expenses that we contemplate paying to our advisor, its affiliates and the managing dealer. The estimated maximum dollar amounts presented in the table are based on the assumption that we sell all of the shares of the offering at the following prices:

| | • | | 97.5% of the 150,000,000 shares are sold through our primary offering at $10.00 per share; and |

| | • | | 2.5% of such shares are sold pursuant to the distribution reinvestment plan at $9.50 per share. |

6

Offering-stage compensation relates only to this primary offering, as opposed to any subsequent offerings. All or a portion of the selling commissions or marketing support fees will not be charged with regard to shares sold to certain categories of purchasers and for sales eligible for volume discounts and, in limited circumstances, the managing dealer fee may be reduced with respect to certain purchases.

| | | | |

Type of Compensation and

Recipient | | Method of Computation | | Estimated Maximum Dollar Amount |

|

| Fees Paid in Connection with Our Offering |

| | | | | |

| Selling commissions to managing dealer and participating brokers | | Up to 7% of gross proceeds of shares sold in our primary offering. No selling commissions will be paid in connection with shares sold pursuant to our distribution reinvestment plan. | | $102.375 million |

| | | | | |

| Marketing support fees to managing dealer and participating brokers | | Up to 3% of gross proceeds of shares sold in our primary offering. No marketing support fees will be paid in connection with shares sold pursuant to our distribution reinvestment plan. | | $43.875 million |

| | | | | |

| Reimbursement of other organizational and offering expenses to our advisor, its affiliates and related parties | | Actual expenses incurred in connection with our formation and this offering, including bona fide, itemized and detailed due diligence expenses incurred by our managing dealer and participating brokers. Under FINRA rules, the total amount of organizational and offering expenses (including selling commissions and marketing support fees) we incur for this offering may not exceed 15% of gross proceeds of our primary offering. | | Amount is not determinable at this time but is estimated to be 1.5% of gross offering proceeds ($22.472 million) |

| | | | | |

|

Fees Paid in Connection with the Acquisition of Properties, and Making Loans or Other Real Estate-Related Investments |

| | | | | |

| Investment services fee to our advisor on the purchase price of assets | | 1.85% of the purchase price of properties, the funds advanced for loans or the amount invested in the case of other assets (except securities) for services in connection with the selection, evaluation, structure and purchase of assets. No investment services fee will be paid to our advisor in connection with our purchase of securities. | | Amount is not determinable at this time but is estimated to be $20.480 million (assuming no debt financing to purchase assets) and approximately $77.218 million (assuming debt financing equals 75% of our total assets) |

| | | | | |

| Other acquisition fees to our advisor, its affiliates and related parties | | Fees that are usual and customary for comparable services in connection with the financing of a property or the acquisition of securities. Such fees are in addition to the investment services fees (described above). We may pay a brokerage fee that is usual and customary to an affiliate or related party of our advisor in connection with our purchase of securities if, at the time of such payment, such affiliate or related party is a properly registered and licensed broker-dealer (or equivalent) in the jurisdiction in which the securities are being acquired. Payment of such fees will be subject to approval of our board of directors, including a majority of our independent directors. | | Amount is not determinable at this time |

7

| | | | |

Type of Compensation and

Recipient | | Method of Computation | | Estimated Maximum Dollar Amount |

| | | | | |

| Reimbursement of acquisition expenses to our advisor, its affiliates and related parties | | Actual expenses incurred in connection with the selection and purchase of properties and making loans or other real estate-related investments. | | Amount is not determinable at this time but is estimated to be 0.50% of the purchase price of the assets, or $6.512 million (assuming no debt financing) and approximately $24.553 million (assuming debt financing equal to 75% of our total assets) |

|

| Fees Paid in Connection with Our Operations |

| | | | | |

| Asset management fee to our advisor | | We will pay our advisor a monthly asset management fee in an amount equal to 0.08334% of the real estate asset value (the greater of the amount actually paid for the purchase of real property, or the most recently obtained appraised value of the real property that may have been obtained by us to provide valuations to certain ERISA plan stockholders, exclusive of acquisition fees and acquisition expenses) of our properties, including our proportionate share of those properties owned in joint ventures, and of the outstanding principal amount of any loans made, and an amount equal to 0.1042% of the book value of securities, as of the end of the preceding month. | | Amount is not determinable at this time |

| | | | | |

| Fees to our property manager | | We, or our subsidiary property owners, will pay our property manager property management fees in an amount up to 4.5% of the gross revenues for management of our properties. This fee may be increased, subject to the approval of a majority of our independent directors, for certain properties, such as in connection with higher market fees payable with respect to properties located outside of the United States. In the event our property manager (through one of our sub-property managers) contracts with a third-party property manager in respect of a property, the management fees for such third-party property manager will be paid by our property manager. In addition, if our property manager provides leasing services with respect to a property, we, or our subsidiary property owners, will pay the property manager leasing fees equal to the leasing fees charged by unaffiliated persons rendering comparable services in the same geographic location of the applicable property. Our property manager also will be paid a project management fee equal to 5% of the total hard and soft costs for managing tenant and capital improvements. We, or our subsidiary property owners, will reimburse our property manager for the costs and expenses incurred on our behalf to the extent included in the annual business plan for a property, or as we may otherwise agree. Such costs and expenses may include the wages and salaries and other employee-related expenses of all on-site employees of our property manager or | | Amount is not determinable at this time |

8

| | | | |

Type of Compensation and

Recipient | | Method of Computation | | Estimated Maximum Dollar Amount |

| | |

| | its subcontractors who are engaged in the operation, management or maintenance of our properties, including taxes, insurance and benefits relating to such employees, and legal, travel and other out-of-pocket expenses that are directly related to the management of specific properties. | | |

| | | | | |

| Financing coordination fee to our advisor | | If our advisor provides services in connection with the refinancing of any debt obligations of the company or any of our subsidiaries, we will pay our advisor a financing coordination fee equal to 1% of the gross amount of such refinancing, subject to certain limitations. | | Amount is not determinable at this time because this fee is based on a fixed percentage of any debt refinancing. |

| | | | | |

| Service Fee to CNL Capital Markets Corp. | | We will pay CNL Capital Markets Corp., an affiliate of CNL, an initial setup fee and an annual maintenance fee of $4.57 and $19.20, respectively, per investor for providing certain administrative services to us. | | Amount is not determinable at this time as actual amounts are dependent on the number of investors |

| | | | | |

| Reimbursement to our advisor, its affiliates and related parties for total operating expenses | | We will reimburse our advisor, its affiliates and related parties for actual total operating expenses incurred (which, in general, are those expenses relating to our administration on an on-going basis). To the extent that total operating expenses payable or reimbursable by us in any four consecutive fiscal quarters (an “expense year”), commencing with the fourth full quarter following the effective date of this offering exceeds the greater of 2% of average invested assets or 25% of net income (as defined in our articles of incorporation), our advisor is required to reimburse us within 60 days after the end of the expense year the amount by which the total operating expenses paid or incurred by us exceed the 2%/25% guidelines, unless a majority of our independent directors determine that such excess expenses are justified based on unusual and non-recurring factors. | | Amount is not determinable at this time |

| | | | | |

|

Fees Paid in Connection with Sales, Liquidation or Other Significant Events |

| | | | | |

| Disposition fee to our advisor, its affiliates and related parties | | We will pay a disposition fee in an amount equal to (i) in the case of the sale of real property, the lesser of (A) one-half of a competitive real estate commission, or (B) 1% of the sales price of such property, (ii) in the case of the sale of any asset other than real property, loans or securities investments, 1% of the sales price of such asset, and (iii) in the case of the sale of loans, 1% of the contract price of any loan, if our advisor, its affiliates or related parties provide a substantial amount of services, as determined by our independent directors, in connection with the sale of one or more assets (including a sale of all of our assets or the sale of our company or a portion thereof). We will not pay a disposition fee upon the maturity, prepayment, workout, modification or extension of a loan unless there is a corresponding fee paid by the borrower to us, in which case the disposition fee will be the lesser of (i) 1% of | | Amount is not determinable at this time as they are dependent upon the price at which assets are sold |

9

| | | | |

Type of Compensation and

Recipient | | Method of Computation | | Estimated Maximum Dollar Amount |

| | |

| | the principal amount of the loan or (ii) the amount of the fee paid by the borrower in connection with such transaction. If we take ownership of a property as a result of a workout or foreclosure of a loan, we will pay a disposition fee of 1% of the contract price of such real property when sold. Even if our advisor receives a disposition fee, we may still be obligated to pay fees or commissions to another third party. However, the amount of real estate commissions or brokerage fees paid to our advisor or its affiliates, when added to the sums paid to unaffiliated parties in such a capacity, may not exceed the lesser of (i) a competitive real estate or brokerage commission or (ii) an amount equal to 6% of the sales price. We will not pay our advisor a disposition fee in connection with the sales of investments that are securities, however, we may pay a disposition fee in the form of a usual and customary brokerage fee to an affiliate or related party of our advisor, if, at the time of such payment, such affiliate or related party is a properly registered and licensed broker-dealer (or equivalent) in the jurisdiction in which the securities are being sold. | | |

| | | | | |

| Subordinated share of net sales proceeds payable to our advisor from the sales of assets | | Upon the sale of our assets, we will pay our advisor a subordinated share of net sales proceeds equal to (i) 15% of the amount by which (A) the sum of net sales proceeds from the sale of our assets, and distributions paid to our stockholders from our inception through the measurement date, and total incentive fees, if any, previously paid to our advisor exceeds (B) the sum of the amount paid for our common stock in this offering which is outstanding (without deduction for organizational and offering expenses and less amounts paid to redeem shares under our share redemption plan) (“invested capital”) and amounts required to pay our stockholders a 6% cumulative, noncompounded annual return (the “priority return”) on invested capital, less (ii) total incentive fees, if any, previously paid to our advisor. “Incentive fees” means the subordinated share of net sales proceeds, the subordinated incentive fee and the performance fee. No subordinated share of net sales proceeds will be paid to our advisor following a listing of our shares. | | Amount is not determinable at this time |

| | | | | |

| Subordinated incentive fee payable to our advisor at such time, if any, as a liquidity event with respect to our shares occurs | | Upon a listing, if any, of our common stock on a national securities exchange, or the receipt by our stockholders of cash or combination of cash and securities that are listed on a national securities exchange as a result of a merger, share acquisition or similar transaction, we will pay our advisor a subordinated incentive fee equal to (i) 15% of the amount by which (A) the sum of our market value or the market value of the listed securities received in exchange for our common stock, including any cash consideration received by our stockholders, and the total distributions paid or declared and payable to our stockholders since inception until the date of listing, and the total incentive fees, if any, previously paid to our advisor from inception to date of listing of our common stock or the effective date of our stockholders’ receipt of | | Amount is not determinable at this time |

10

| | | | |

Type of Compensation and

Recipient | | Method of Computation | | Estimated Maximum Dollar Amount |

| | |

| | listed securities or cash exceeds (B) the sum of our invested capital and the total distributions required to be made to the stockholders in order to pay them the priority return from our inception through the date of listing, less (ii) total incentive fees, if any, previously paid to our advisor. We may pay such fee in cash or listed equity securities or a combination of both. | | |

| | | | | |

| Performance fee payable to our advisor | | Upon termination or non-renewal of the advisory agreement by our advisor for good reason (as defined in the advisory agreement) or by us or our operating partnership other than for cause (as defined in the advisory agreement), if a listing of our shares of common stock, or other liquidity event with respect to our shares of common stock, has not occurred, our advisor will be entitled to be paid a performance fee. The performance fee will be calculated upon a listing of our common stock on a national securities exchange or in connection with the receipt by our stockholders of cash or securities that are listed on a national securities exchange in exchange for our common stock, as a result of a merger, share acquisition or similar transaction, or a sale of any of our assets following such termination event and (i) in the event of a listing, or applicable merger, share acquisition or similar transaction, shall be calculated and paid in the same manner as the subordinated incentive fee and (ii) in the case of a sale of an asset, shall be calculated and paid in the same manner as the subordinated share of net sales proceeds, except that the amount of the performance fee payable to our advisor will be equal to the amount as calculated above multiplied by the quotient of (A) the number of days elapsed from the initial effective date of the advisory agreement through the effective date of the termination event, divided by (B) the number of days elapsed from the initial effective date of the advisory agreement through the date of listing or relevant merger, share acquisition or similar transaction, or the sales, as applicable. The performance fee will be payable in cash or listed equity securities within 30 days following the final determination of the performance fee. | | Amount is not determinable at this time |

| | | | | |

There are many conditions and restrictions on the amount of compensation our advisor, its affiliates and related parties may receive. The foregoing summarizes the anticipated terms of compensation arrangements during this offering; however, the terms of these arrangements may be changed in the future, subject to the approval of our independent directors. For a more detailed explanation of the fees and expenses payable to our advisor, its affiliates and related parties, see “Estimated Use of Proceeds” and “Management Compensation.”

The following supersedes and replaces in full the discussion under the heading “PROSPECTUS SUMMARY – Our Offering” beginning on page 16 of the prospectus.

Our Offering

On October 6, 2010, we received aggregate subscription proceeds in excess of the minimum offering amount of $2.0 million in shares of common stock, and on October 8, 2010, the funds were released from escrow and we commenced operations. As of March 2, 2011, we had received aggregate offering proceeds of approximately $10.6 million from the sale of 1,066,405 of our common shares in our public offering, including approximately

11

$34,000 for 3,572 shares issued pursuant to our distribution reinvestment plan. The shares sold and the gross offering proceeds received from such sales do not include 22,222 shares purchased by our advisor for $200,000 preceding the commencement of our offering. As of March 2, 2011, approximately 148.9 million shares remained available for offer and sale pursuant to our public offering.

We are offering a maximum of $1,500,000,000 (150,000,000 shares) of our common stock to the public through our managing dealer, CNL Securities Corp., a registered broker-dealer affiliated with CNL. The shares will be offered at $10.00 per share, unless our board of directors changes this price, in its sole discretion. We have initially designated 2.5% of the shares in this offering as issuable pursuant to our distribution reinvestment plan, whereby the shares will be sold at up to a 5% discount to the prices for the primary offering as described above. We reserve the right to reallocate the shares of common stock registered in this offering between the primary offering and our distribution reinvestment plan. The offering of our shares will terminate on or before April 23, 2012, which is two years from the April 23, 2010 initial effective date of the registration statement for this offering. In addition, if we extend the offering for another year and file another registration statement during the one-year extension in order to sell additional shares, we could continue to sell shares in this offering until the earlier of 180 days after the third anniversary of the commencement of this offering or the effective date of the subsequent registration statement. If we decide to extend the primary offering beyond April 23, 2012, we will provide that information in a prospectus supplement. If we file a subsequent registration statement, we could continue offering shares with the same or different terms and conditions. Nothing in our organizational documents prohibits us from engaging in additional subsequent public offerings of our stock. Our board of directors may terminate this offering at any time. This offering must be registered in every state in which we offer or sell shares. Generally, such registrations are for a period of one year. Thus, we may have to stop offering and selling shares in any state in which the registration is not renewed annually.

This is a “best efforts” offering, which means our managing dealer and the participating brokers selling shares in our offering are required only to use their best efforts to sell our shares and have no firm commitment or obligation to purchase any of our shares.

The following supersedes and replaces in full the discussion under the heading “PROSPECTUS SUMMARY – Our Distribution Policy” beginning on page 17 of the prospectus.

Our Distribution Policy

In order to qualify as a REIT, we are required to distribute 90% of our annual REIT taxable income to our stockholders. We expect to generate little, if any, cash flow or funds from operations available for distribution until we make substantial investments. Therefore, until such time as we have sufficient cash flow or funds from operations, we may decide to not pay distributions or to fund all or a portion of the payment of distributions from sources other than cash flow from operations or funds from operations, such as from cash flows generated by financing activities, a component of which includes our secured and unsecured borrowings and the proceeds of this offering. Our advisor, its affiliates or related parties may also advance cash to us or waive asset management fees or other fees in order for us to have cash to pay distributions in excess of available cash flow or funds from operations. We have not established any limit on the extent to which we may use borrowings or proceeds of this offering to pay distributions, and there will be no assurance that we will be able to sustain distributions at any level.

We declare distributions daily and pay them on a monthly basis to our stockholders. Our board of directors determines the amount of each distribution and whether the distribution will be in cash or other property, which may include our own securities. The amount of each distribution generally will be based upon such factors as the amount of cash available for distribution, current and projected cash requirements, tax considerations and other factors. Because of the effect of other items, including depreciation and amortization associated with real estate investments, distributions, in whole or in part, in any period may constitute a return of capital for federal tax purposes.

Some or all of these distributions may be paid by the Company from sources other than cash flow from operations, such as cash flows from financing activities, which may include borrowings, cash resulting from a waiver or deferral of fees, and proceeds of our initial public offering. Distributions for stockholders participating in our distribution reinvestment plan will be reinvested into shares of the Company promptly following the date such distributions are paid to the extent shares are available.

12

On May 25, 2010, our board of directors authorized a daily distribution of $0.0017808 per share of common stock which commenced on October 7, 2010, the day following the date on which we received and accepted subscriptions for the minimum offering of $2.0 million in shares of common stock. Distributions are calculated based on the number of days each stockholder has been a stockholder of record in that month. Distributions that accrued in October, the month the minimum offering was met, and November, the subsequent month, were aggregated and paid in December. Thereafter, at the end of each month, that month’s distributions will be aggregated and paid in the following month. The daily distribution rate is equal to an annualized distribution rate of 6.5%, using the Company’s offering price of $10.00 per share. Our board of directors intends to evaluate our distribution policy on a quarterly basis.

For the period October 7, 2010 through November 30, 2010, we distributed $42,647 to our stockholders. For the period December 1, 2010 through December 31, 2010, we had accrued $40,732 in distributions payable to our stockholders which we distributed on January 14, 2011. We did not have distributable earnings in 2010 and, therefore, distributions were made from financing activities including proceeds from this offering.

The following supersedes and replaces in full the discussion under the heading “PROSPECTUS SUMMARY – Our Distribution Reinvestment Plan and Automatic Purchase Plan” which appears on page 18 of the prospectus.

Our Distribution Reinvestment Plan

We have adopted a distribution reinvestment plan that will allow our stockholders to have the full amount of their distributions reinvested in additional shares that may be available. We have designated 2.5% of the shares in this offering as shares issuable pursuant to our distribution reinvestment plan for this purpose.

The following information supersedes and replaces the first bullet under the heading “PROSPECTUS SUMMARY – Our Redemption Plan” which appears on page 18 of the prospectus.

Our Redemption Plan

| | • | | if we elect to redeem shares, some or all of the proceeds from the sale of shares under our distribution reinvestment plan attributable to any month may be used to redeem shares presented for redemption during such month. In addition, we may use up to $100,000 per calendar quarter of the proceeds from any public offering for redemptions (with the unused amount of any offering proceeds available for use in future quarters to the extent not used to invest in assets or for other purposes); |

The following supersedes and replaces in full the discussion under the heading “PROSPECTUS SUMMARY – Estimated Use of Proceeds” which appears on page 18 of the prospectus.

Estimated Use of Proceeds

We estimate that approximately 86.45% to 86.94% of the net offering proceeds after paying the investment services fees and other acquisition expenses, assuming the sale of one-half of the shares being offered or the sale of the maximum offering, respectively, will be used for investment in real estate, loans and other real estate-related assets and other corporate purposes. A portion of the gross offering proceeds will be used to pay selling commissions, the marketing support fee and other organizational and offering expenses.

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

The following supersedes and replaces in full the noted questions and answers under the heading “QUESTIONS AND ANSWERS ABOUT THIS OFFERING,” which appear on pages 20 and 21 of the prospectus.

| Q: | Who is Macquarie Group Limited? |

| | A: | Macquarie Group Limited, or “Macquarie,” is a global provider of banking, financial, advisory, investment and funds management services. Macquarie’s main business focus is making returns by providing a |

13

| | diversified range of services to clients. Macquarie acts on behalf of institutional, corporate and retail clients and counterparties around the world. |

Macquarie is listed in Australia on the Australian Securities Exchange (ASX: MQG) and is regulated by the Australian Prudential Regulation Authority, the Australian banking regulator, as the owner of Macquarie Bank Limited, an authorized deposit taker. Macquarie also owns a bank in the United Kingdom, Macquarie Bank International, which is regulated by the Financial Services Authority. Macquarie’s activities are also subject to scrutiny by other regulatory agencies around the world.

Founded in 1969, Macquarie operates in more than 70 office locations in 28 countries. Macquarie employed over 15,500 people and had assets under management of approximately US$307 billion as of September 30, 2010.

The figures noted in this “Questions and Answers about This Offering” section for each of Macquarie Group Limited, Macquarie Funds Group and the global real estate platform of Macquarie Funds Group and its affiliates are as of September 30, 2010 and include Macquarie DDR Trust (“MDT”) unless stated otherwise. On June 18, 2010, Macquarie sold its 50% interest in MDT’s responsible entity to EPN GP, LLC. As a part of this transaction, Macquarie provided transitional services related to the management and administration of the trust until December 18, 2010. Following the transaction, MDT was renamed EDT Retail Trust.

| Q: | Who is Macquarie Infrastructure and Real Assets? |

| | A: | Macquarie Infrastructure and Real Assets (“MIRA”) is a business platform within Macquarie Funds Group, one of Macquarie’s six main operating groups. MIRA is a leading global alternative asset manager specializing in infrastructure, real estate and private equity funds and customized accounts. Through specialist management companies, as of September 30, 2010, it manages 6 listed and 37 unlisted funds or vehicles that invest in infrastructure (including airports, toll roads, communications infrastructure, utilities and related sectors), real estate (including investments in retail, office, industrial, and commercial sectors as well as real estate development), and other sectors. MIRA manages listed funds in Australia, Canada, the United States, Korea and Singapore. It manages unlisted funds in Australia, Korea, Hong Kong, India, Canada, the United States, Europe, Russia, South Africa, Mexico1 and the United Arab Emirates. As of September 30, 2010, assets under management in these funds totaled approximately $93 billion. |

Included within MIRA is a global real estate business platform made up of Macquarie subsidiaries (some of which are regulated in jurisdictions where they provide services) and professionals primarily focused on the creation and management of listed and unlisted real estate funds and real estate joint ventures in Australia, Asia, North America and Europe. The real estate service capabilities of MIRA and its affiliates include portfolio and asset management, development related services, due diligence, investment advisory services, financing and capital management, and investor relations. As of September 30, 2010, MIRA and its affiliates managed a global real estate portfolio with assets valued over $11 billion.

On July 2, 2010, Macquarie Group announced changes to some of its operating groups. As part of these changes, MIRA (formerly known as Macquarie Capital Funds) separated from Macquarie Capital and became a division of Macquarie Funds Group on October 1, 2010. MIRA Inc. is a corporation within the MIRA business platform and was formerly known as Macquarie Capital Funds Inc.

| Q: | Why are MIRA Inc. and CNL LLC jointly sponsoring this offering? |

| | A: | MIRA Inc. and CNL LLC believe they bring strong complementary skills to the sponsorship of our company. CNL has a 35-year track record of forming and acquiring real estate businesses in the United States. Macquarie Real Estate Advisory Services LLC is an affiliate of MIRA. As of September 30, 2010, MIRA and its affiliates managed a global real estate portfolio with assets under management valued over $11 billion. |

| 1 | Macquarie Mexican Infrastructure Fund is comprised of parallel listed and unlisted vehicles. |

14

The following supersedes and replaces in full the noted question and answer under the heading “QUESTIONS AND ANSWERS ABOUT THIS OFFERING,” which appears on page 24 of the prospectus.

| Q: | What will we do with the money raised in this offering? |

| | A: | Depending primarily on the number of shares sold in this offering, we estimate that approximately 86.45% to 86.94% of the net offering proceeds after paying investment services fees and other acquisition fees, assuming the sale of one-half of the shares being offered or the sale of the maximum offering, respectively, will be used to invest in real estate, loans and other real estate-related assets, and other corporate purposes, including the repurchase of shares of our common stock under our redemption plan. The remainder of the offering proceeds will be used to pay selling commissions, the marketing support fee and other organizational and offering expenses. Pending the acquisition of properties or other real estate-related assets, we intend to invest the funds in short-term certificates of deposit issued by a bank, short-term securities directly or indirectly issued or guaranteed by the U.S. government or other short-term, highly liquid investments with appropriate safety of principal. These investments are expected to provide a lower internal rate of return than we seek to achieve from our intended investments. |

RISK FACTORS

The following risk factor supersedes and replaces the corresponding risk factor under the heading “RISK FACTORS — Offering Related Risks” beginning on page 27 of the prospectus.

Offering Related Risks

This is a “best efforts” offering and the number and type of investments we make will depend on the total proceeds raised in the offering. In the event we raise substantially less than the maximum offering amount, we will make fewer investments, resulting in a less diversified portfolio of investments in terms of number, amount and location.

This offering is being made on a “best efforts” basis, which means our managing dealer and participating brokers are only required to use their best efforts to sell shares of our common stock and have no firm commitment or obligation to purchase any of our shares. We are not required to sell the full amount offered in our prospectus. If the total proceeds from the offering are substantially less than the maximum offering amount, we will make fewer investments, resulting in less diversification in terms of the number of investments owned, the geographic regions in which our real property investments are located and the types of investments that we make. A lack of diversification would increase the likelihood that any single investment’s performance would materially affect our overall investment performance. Your investment in our shares will be subject to greater risk to the extent that we have limited diversification in our portfolio of investments. Additionally, our inability to raise substantial funds would increase our fixed operating expenses as a percentage of gross income.

The following risk factors supersede and replace the corresponding risk factors under the heading “RISK FACTORS — Company Related Risks” beginning on page 29 of the prospectus.

Company Related Risks

We and our advisor have limited operating histories and the prior performance of real estate investment programs sponsored by CNL, MIRA, or their affiliates, may not be indicative of our future results.

We and our advisor have limited operating histories. Prior to October 8, 2010, the date our operations commenced, we had no previous performance history. You should not rely upon the past performance of other real estate investment programs sponsored by CNL or MIRA to predict our future results. You should consider our prospects in light of the risks, uncertainties and difficulties frequently encountered by companies that are, like us, in their early stage of development. To be successful, our advisor must, among other things:

| | • | | identify and acquire investments that meet our investment objectives; |

15

| | • | | attract, integrate, motivate and retain qualified personnel to manage our day-to-day operations; |

| | • | | respond to competition for our targeted real estate properties and other investments; and |

| | • | | continue to build and expand its operational structure to support our business. |

There can be no assurance that our advisor will succeed in achieving these goals.

Because we rely on affiliates of CNL or MIRA for advisory, property management and managing dealer services, if these affiliates or their executive officers and other key personnel are unable to meet their obligations to us, we may be required to find alternative providers of these services, which could disrupt our business.

CNL and MIRA, through one or more of their respective affiliates or subsidiaries, jointly own and control our advisor and our property manager. CNL and MIRA each also separately own and control, directly or through affiliates or subsidiaries, our advisor’s sub-advisors and entities that are expected to provide property management services to us. In addition, CNL, through a subsidiary, owns and controls CNL Securities Corp., the managing dealer of this offering. In the event that any of these affiliates or related parties are unable to meet their obligations to us, we might be required to find alternative service providers, which could disrupt our business by causing delays and/or increasing our costs.

Further, our success depends to a significant degree upon the continued contributions of certain executive officers and other key personnel of our advisor, its affiliates and related parties, each of whom would be difficult to replace. We do not have employment agreements with our executive officers, and we cannot guarantee that they will remain affiliated with us or our advisor. Although several of our executive officers and other key employees of affiliates of our advisor, including Andrew A. Hyltin and Steven D. Shackelford, have entered into employment agreements with affiliates of our advisor, these agreements are terminable at will, and we cannot guarantee that such persons will remain employed by our advisor or its affiliates. We do not maintain key person life insurance on any of our executive officers.

In addition, the joint venture operating agreement for our advisor and property manager provides for the purchase by one member of the membership interests of the other member under the terms, and subject to the conditions, set forth in the agreement. We may lose the services of either of CNL or MIRA and their respective affiliates and related parties if one party exercises its purchase right.

The following risk factors supersede and replace the corresponding risk factors under the heading “RISK FACTORS — Risks Related to Conflicts of Interest and Our Relationships with Our Advisor, Its Affiliates and Related Parties” beginning on page 33 of the prospectus.

Risks Related to Conflicts of Interest and Our Relationships with Our Advisor, Its Affiliates and Related Parties

Our advisor, property manager and other entities affiliated with CNL or MIRA that conduct our day-to-day operations will face competing demands on their time.

We rely upon our advisor, including its investment committee, our property manager and the executive officers and employees of entities affiliated with CNL or MIRA, to conduct our day-to-day operations. Certain of these persons also conduct the day-to-day operations of other real estate investment programs sponsored, jointly or individually, by CNL, MIRA, or their respective affiliates, including CNL Macquarie Global Growth Trust, Inc., and may have other business interests as well. Our directors, James M. Seneff, Jr. and Matthew S. Banks, also are managers of our advisor and officers and/or directors of other entities affiliated with our advisor, including the advisors to other real estate investment programs sponsored, jointly or individually, by CNL, MIRA, or their respective affiliates, including CNL Macquarie Global Growth Trust, Inc. We have in common with CNL Macquarie Global Growth Trust, Inc. the same initial executive officers. Additionally, our advisor and the advisor to CNL Macquarie Global Growth Trust, Inc. have in common the same initial managers, executive officers and investment committee members. We currently anticipate that our executive officers and the executive officers of our advisor that are common to both our advisor, and the advisor of CNL Macquarie Global Growth Trust, Inc., will, on average, devote approximately one-third of their time to our business and operations, approximately one-third of their time to the business and operations of CNL Macquarie Global Growth Trust, Inc., and the balance of their time

16

will be devoted to other individual or joint real estate programs of CNL, MIRA, or their affiliates, as applicable. It is also intended that the managers of our advisor (who are not also executive officers of our advisor) and the investment committee members of our advisor will devote the time necessary to fulfill their respective duties to us and our advisor. However, because these persons have competing interests on their time and resources, they may find it difficult to allocate their time between our business and these other activities. During times of intense activity in other programs and ventures, they may devote less time and resources to our business than is necessary or appropriate.

Other real estate investment programs sponsored by CNL, MIRA, or their respective affiliates, use investment strategies that are similar to ours, our advisor and its affiliates, and their and our executive officers will face conflicts of interest relating to the purchase and leasing of properties and other investments, and such conflicts may not be resolved in our favor.

One or more real estate investment programs sponsored by CNL, MIRA, or their respective affiliates, including CNL Macquarie Global Growth Trust, Inc., may be seeking to invest in properties and other real estate-related investments similar to the assets we are seeking to acquire. CNL has one public and MIRA and its affiliates have nine unlisted, active real estate investment programs with investment strategies similar to ours. In addition, affiliates of CNL and MIRA are jointly sponsoring CNL Macquarie Global Growth Trust, Inc., an active real estate investment program. All of these programs invest in commercial properties. As a result, we may be buying properties and other real estate-related investments at the same time as other programs sponsored by CNL, MIRA, or their affiliates, and managed by the executive officers and employees of our advisor or its affiliates, that are also buying properties and other real estate-related investments. We cannot assure you that properties we want to acquire will be allocated to us in this situation. Neither CNL, MIRA, nor their respective affiliates, are required to allocate any prospective investment to our advisor for review. Our advisor may choose a property that provides lower returns to us than a property allocated to another program sponsored by CNL, MIRA, or their affiliates. We also may be precluded from certain investment opportunities. In addition, we may acquire properties in geographic areas where other programs sponsored by CNL, MIRA, or their respective affiliates, own properties. If one of such other programs sponsored by CNL, MIRA, or their respective affiliates, attracts a tenant that we are competing for, we could suffer a loss of revenue due to delays in locating another suitable tenant. You will not have the opportunity to evaluate the manner in which these conflicts of interest are resolved before or after making your investment.

The following risk factors supersede and replace the corresponding risk factors under the heading “RISK FACTORS — Federal Income Tax Risks” beginning on page 50 of the prospectus.

Federal Income Tax Risks

Our investment strategy may cause us to incur penalty taxes, lose our REIT status, or own and sell properties through taxable REIT subsidiaries (“TRSs”), each of which would diminish the return to our stockholders.

The sale of one or more of our properties may be considered prohibited transactions under the Code. Any “inventory-like” sales, such as the sale of condominiums, would almost certainly be considered such a prohibited transaction. See “Federal Income Tax Considerations — Requirements for Qualification as a REIT — Operational Requirements — Prohibited Transactions.” If we are deemed to have engaged in a “prohibited transaction” (i.e., we sell a property held by us primarily for sale in the ordinary course of our trade or business), all taxable gain we derive from such sale would be subject to a 100% penalty tax. The Code sets forth a safe harbor for REITs that wish to sell property without risking the imposition of the 100% penalty tax. The principal requirements of the safe harbor are that: (i) the REIT must hold the applicable property for not less than two years for the production of rental income prior to its sale; (ii) the aggregate expenditures made by the REIT, or any partner of the REIT, during the two-year period preceding the date of sale which are includible in the basis of the property do not exceed 30% of the net selling price of the property; and (iii) the REIT does not make more than seven sales of property during the taxable year, the aggregate adjusted bases of property sold during the taxable year does not exceed 10% of the aggregate bases of all of the REIT’s assets as of the beginning of the taxable year or the fair market value of property sold during the taxable year does not exceed 10% of the fair market value of all of the REIT’s assets as of the beginning of the taxable year. Given our investment strategy, the sale of one or more of our properties may not fall within the prohibited transaction safe harbor.

17

If we desire to sell a property pursuant to a transaction that does not fall within the safe harbor, we may be able to avoid the 100% penalty tax if we acquired the property through a TRS or acquired the property and transferred it to a TRS for a non-tax business purpose prior to the sale (i.e., for a reason other than the avoidance of taxes). However, there may be circumstances that prevent us from using a TRS in a transaction that does not qualify for the safe harbor. Additionally, even if it is possible to effect a property disposition through a TRS, we may decide to forego the use of a TRS in a transaction that does not meet the safe harbor based on our own internal analysis, the opinion of counsel or the opinion of other tax advisors that the disposition will not be subject to the 100% penalty tax. In cases where a property disposition is not effected through a TRS, the Internal Revenue Service could successfully assert that the disposition constitutes a prohibited transaction, in which event all of the net taxable gain from the sale of such property will be payable as a tax and thereby reducing the amount of cash available for investment by us or distribution to stockholders.

If we acquire a property that we anticipate will not fall within the safe harbor from the 100% penalty tax upon disposition, then we may acquire such property through a TRS in order to avoid the possibility that the sale of such property will be a prohibited transaction and subject to the 100% penalty tax. If we already own such a property directly or indirectly through an entity other than a TRS, we may contribute the property to a TRS if there is another, non-tax related business purpose for the contribution of such property to the TRS. Following the transfer of the property to a TRS, the TRS will operate the property and may sell such property and distribute the net proceeds from such sale to us, and we may distribute the net proceeds distributed to us by the TRS to our stockholders. Though a sale of the property by a TRS likely would eliminate the danger of the application of the 100% penalty tax, the TRS itself would be subject to a tax at the federal level, and potentially at the state and local levels, on the gain realized by it from the sale of the property as well as on the income earned while the property is operated by the TRS. This tax obligation would diminish the amount of the proceeds from the sale of such property that would be distributable to our stockholders. As a result, the amount available for distribution to our stockholders would be substantially less than if the REIT had not operated and sold such property through the TRS and such transaction was not successfully characterized as a prohibited transaction. The maximum federal corporate income tax rate currently is 35%. Federal, state and local corporate income tax rates may be increased in the future, and any such increase would reduce the amount of the net proceeds available for distribution by us to our stockholders from the sale of property through a TRS after the effective date of any increase in such tax rates.

As a REIT, the value of our investment in all of our TRSs may not exceed 25% of the value of all of our assets at the end of any calendar quarter. If the Internal Revenue Service were to determine that the value of our interests in all of our TRSs exceeded 25% of the value of our total assets at the end of any calendar quarter, then we would fail to qualify as a REIT. If we determine it to be in our best interest to own a substantial number of our properties through one or more TRSs, then it is possible that the Internal Revenue Service may conclude that the value of our interests in our TRSs exceeds 25% of the value of our total assets at the end of any calendar quarter and therefore cause us to fail to qualify as a REIT. Additionally, as a REIT, no more than 25% of our gross income with respect to any year may be from sources other than real estate. Distributions paid to us from a TRS are considered to be non-real estate income. Therefore, we may fail to qualify as a REIT if distributions from all of our TRSs, when aggregated with all other non-real estate income with respect to any one year, are more than 25% of our gross income with respect to such year.

Legislative or regulatory action could adversely affect us.

In recent years, numerous legislative, judicial and administrative changes have been made in the provisions of the federal income tax laws applicable to investments similar to an investment in shares of our common stock. Additional changes to the tax laws are likely to continue to occur, and we cannot assure you that any such changes will not adversely affect the taxation of our stockholders. We are under no obligation to update the prospectus for any such changes. Any such changes could have an adverse effect on an investment in our shares or on the market value or the resale potential of our assets. You are urged to consult with your own tax advisor with respect to the impact of recent legislation on your investment in our shares and the status of legislative, regulatory or administrative developments and proposals and their potential effect on an investment in our shares. You also should note that our counsel’s tax opinion is based upon our representations and existing law and Treasury Regulations, applicable as of the date of its opinion, all of which are subject to change, either prospectively or retroactively.

18

Congress passed major federal tax legislation in 2003, with modifications to that legislation in 2005. One of the changes effected by that legislation generally reduced the tax rate on dividends paid by corporations prior to 2011 to individuals, trusts and estates to a maximum of 15%. In late 2010, legislation was enacted to extend this reduced rate for two years. REIT distributions generally do not qualify for this reduced rate. The tax changes did not, however, reduce the corporate tax rates. Therefore, the maximum corporate tax rate of 35% has not been affected. However, as a REIT, we generally would not be subject to federal or state corporate income taxes on that portion of our ordinary income or capital gain that we distribute currently to our stockholders, and we thus expect to avoid the “double taxation” typically imposed on other corporations.

Although REITs continue to receive substantially better tax treatment than entities taxed as corporations, it is possible that future legislation would result in a REIT having fewer tax advantages, and it could become more advantageous for a company that invests in real estate to elect to be taxed for U.S. federal income tax purposes as a corporation. As a result, our articles of incorporation provide our board of directors with the power, under certain circumstances, to revoke or otherwise terminate our REIT election and cause us to be taxed as a corporation, without the vote of our stockholders. Our board of directors has fiduciary duties to us and our stockholders in accordance with the Maryland General Corporation Law and could only cause such changes in our tax treatment if it determines in good faith that such changes are in the best interest of our stockholders.

The following supersedes and replaces in full the section of the prospectus entitled “ESTIMATED USE OF PROCEEDS” on pages 58 through 61 of the prospectus.

ESTIMATED USE OF PROCEEDS

The following table sets forth information about how we intend to use the proceeds raised in this offering, assuming that we sell:

| | • | | approximately one-half of the maximum offering, of which 2.5% are sold through our Distribution Reinvestment Plan which is the plan pursuant to which our stockholders may elect to have the full amount of their cash distributions reinvested in additional shares of our common stock; |

| | • | | the maximum offering, of which 2.5% are sold through our Distribution Reinvestment Plan; |

| | • | | the maximum offering, of which no shares are sold through our Distribution Reinvestment Plan; and |

| | • | | the actual sales as of December 31, 2010, including shares sold through our Distribution Reinvestment Plan. |

The estimates and the amounts set forth below represent our best estimate of our intended sales proceeds; however, this is a best efforts offering so there is no guarantee as to the amount of shares that we will sell. In addition, we reserve the right to reallocate shares we are offering between the primary offering and our Distribution Reinvestment Plan. Depending primarily on the number of shares sold in this offering, we estimate that approximately 88.24% to 88.74% of the Gross Proceeds will be used for investment, the payment of Investment Services Fees and Acquisition Expenses or other corporate purposes. “Gross Proceeds” means the purchase price of all Equity Shares sold for our account through all offerings, without deduction for Organizational and Offering Expenses or volume or other discounts. For the purpose of computing Gross Proceeds, the purchase price of any Equity Share for which reduced or no selling commissions or marketing support fees are paid to our Managing Dealer or a participating broker shall be deemed to be the full amount of the offering price per Equity Share pursuant to the prospectus for such offering, with the exception of Equity Shares purchased pursuant to our Distribution Reinvestment Plan, which will be factored into the calculation using their actual purchase price. The remainder of offering proceeds is expected to be used to pay selling commissions, the marketing support fee and other Organizational and Offering Expenses. The amount available for investment will be less to the extent that we use offering proceeds, including proceeds from our Distribution Reinvestment Plan, to fund redemptions under our Redemption Plan (which is our redemption plan designed to provide our eligible stockholders with limited, interim liquidity by enabling them to sell shares back to us prior to the Listing of our shares, if any) pay distributions, repay debt, pay operating expenses or establish reserves. While we believe the estimated use of proceeds set forth below is reasonable, you should view this table only as an estimate of the use of proceeds that may be achieved.

19

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Assuming Sale of 75 Million Shares | | | Assuming Sale of Maximum Offering | | | Assuming Sale of Maximum Offering | | | Actual Sales as of

December 31, 2010 | |

Percentage of shares sold pursuant to our Distribution Reinvestment Plan(1) | | | 2.5% | | | | 2.5% | | | | 0% | | | | 0.3% | |

| | | | | | | | |

| | | Amount | | | Percent | | | Amount | | | Percent | | | Amount | | | Percent | | | Amount | | | Percent | |

GROSS PROCEEDS(2) | | $ | 749,062,500 | | | | 100.00 | % | | $ | 1,498,125,000 | | | | 100.00 | % | | $ | 1,500,000,000 | | | | 100.00 | % | | $ | 8,127,853 | | | | 100.00 | % |

| | | | | | | | |

Less: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Selling Commissions and Marketing Support Fee(2)(3) | | | 73,125,000 | | | | 9.76 | % | | | 146,250,000 | | | | 9.76 | % | | | 150,000,000 | | | | 10.00 | % | | | 763,121 | | | | 9.39 | % |

Other Organizational and Offering Expenses(3) | | | 14,981,250 | | | | 2.00 | % | | | 22,471,875 | | | | 1.50 | % | | | 22,500,000 | | | | 1.50 | % | | | 405,282 | | | | 4.99 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

NET OFFERING PROCEEDS | | | 660,956,250 | | | | 88.24 | % | | | 1,329,403,125 | | | | 88.74 | % | | | 1,327,500,000 | | | | 88.50 | % | | | 6,959,450 | | | | 85.62 | % |

Less: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investment Services Fees(4)(6) | | | 10,183,000 | | | | 1.36 | % | | | 20,480,000 | | | | 1.37 | % | | | 20,451,000 | | | | 1.37 | % | | | — | | | | — | |

Acquisition Expenses(5)(6) | | | 3,238,000 | | | | 0.43 | % | | | 6,512,000 | | | | 0.43 | % | | | 6,503,000 | | | | 0.43 | % | | | — | | | | — | |

Initial Working Capital Reserve(7) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

AMOUNT AVAILABLE FOR INVESTMENT(8)(9) | | $ | 647,535,250 | | | | 86.45 | % | | $ | 1,302,411,125 | | | | 86.94 | % | | $ | 1,300,546,000 | | | | 86.70 | % | | $ | 6,959,450 | | | | 85.62 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Although we expect to sell 2.5% of the shares in this offering pursuant to our Distribution Reinvestment Plan, this table also illustrates the proceeds that would result should no shares be sold through our Distribution Reinvestment Plan in the case of a maximum offering. |