Shareholder Letter Q4 2018 February 5, 2019 Zendesk Shareholder Letter Q4 2018 - 1

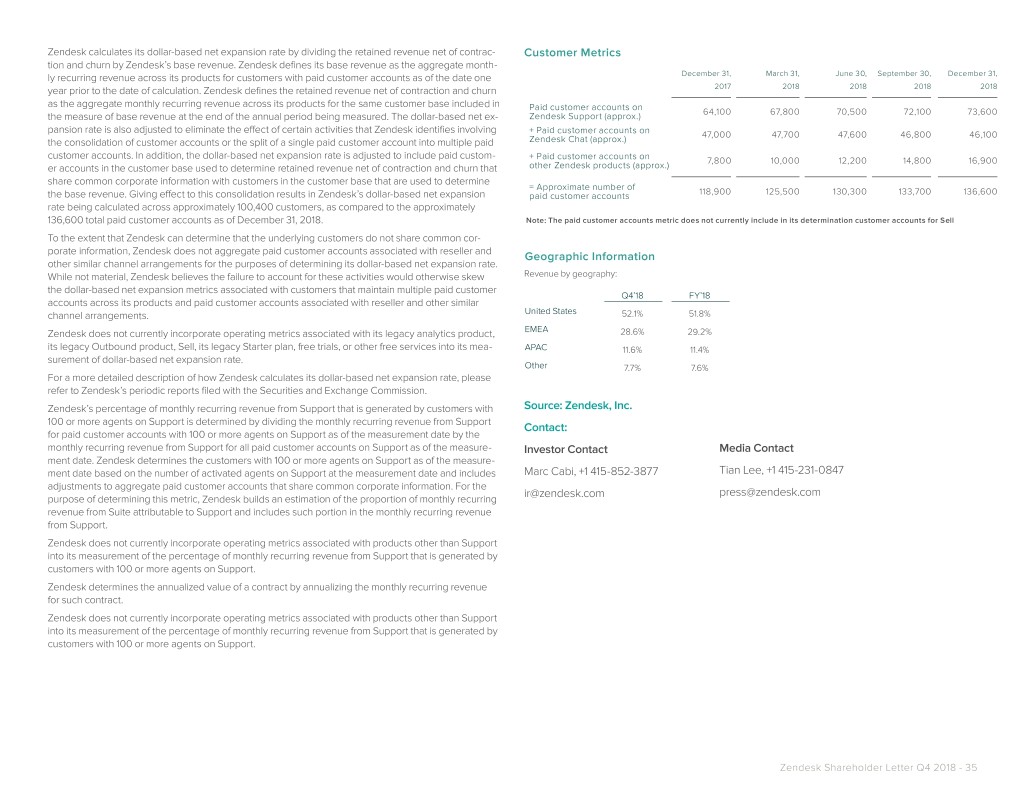

Introduction In 2018, we made significant advances in $172.2M expanding our addressable market, competitive Q4 2018 Revenue position, and growth opportunities. Through disciplined execution of our strategic plan, we matured our family of products to offer a truly 41% omnichannel experience with the launch of The Q4 2018 Y/Y Revenue Growth Mikkel Svane Zendesk Suite; scaled our enterprise business CEO with enhanced product features and go-to- market initiatives; and expanded our capabilities to serve the broader customer experience with $598.7M the launches of Zendesk Sell and Zendesk Full-Year 2018 Revenue Sunshine, our open and flexible CRM platform. For the full-year 2018, we delivered 39% revenue growth—an acceleration compared to 39% 38% growth for full-year 2017—and increased Full-Year 2018 Y/Y Revenue Growth our operating cash flow margin by approximately three percentage points and free cash flow Note: All results and guidance in this letter are based margin by approximately two percentage points on the new revenue recognition standard ASC 606 and Elena Gomez ASU 2016-18. compared to full-year 2017. CFO Around the world, companies large and small Our fourth quarter and full-year results are seeking to transform their businesses demonstrate our progress. We continue to through customer experience, and that trend deliver strong revenue growth from small and is driving strong demand for our products. midsized businesses and large enterprises. In 2019, we will continue to capitalize on this Our upmarket momentum continued as we trend. Specifically, we will focus on maturing our partner with enterprises to serve increasingly family of products; advancing our CRM platform; complex use cases. As a proxy of our success expanding our reach to larger enterprises; and in moving upmarket, the percentage of our continuing our strength in SMB. Additionally, we monthly recurring revenue from customers will further scale our operations to support our with 100 or more Zendesk Support agents Marc Cabi growth to become a multibillion-dollar revenue expanded to 40% at the end of the fourth Strategy & IR company in the long term. quarter compared to 38% a year ago. Zendesk Shareholder Letter Q4 2018 - 2

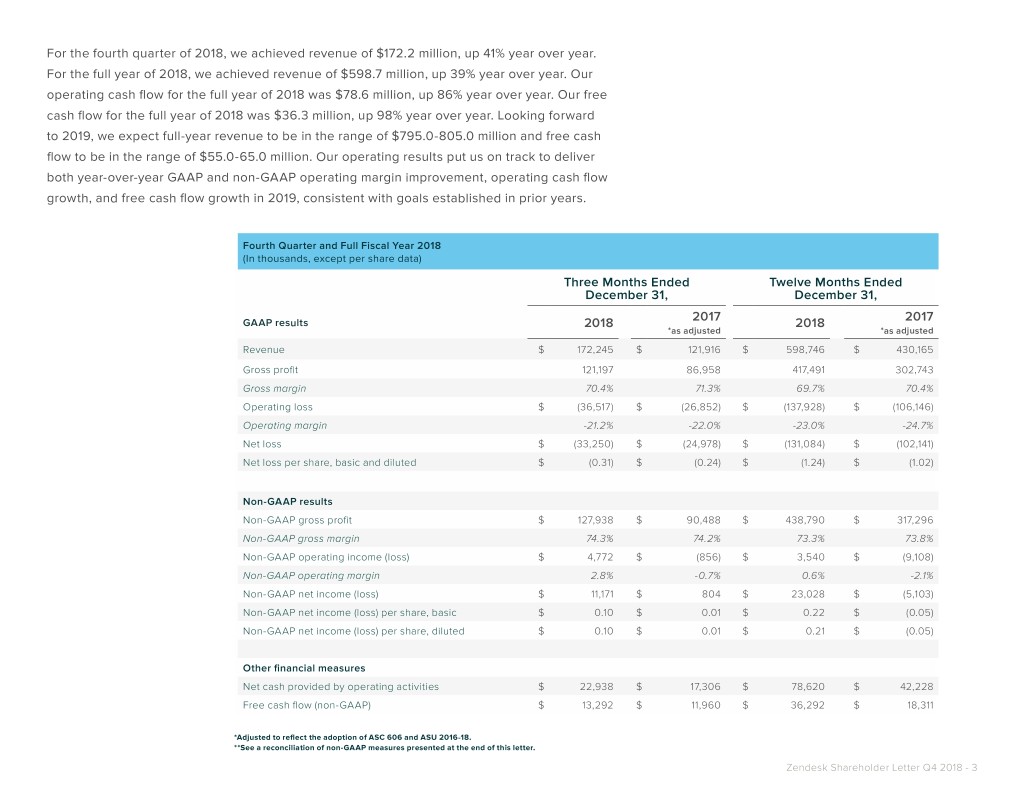

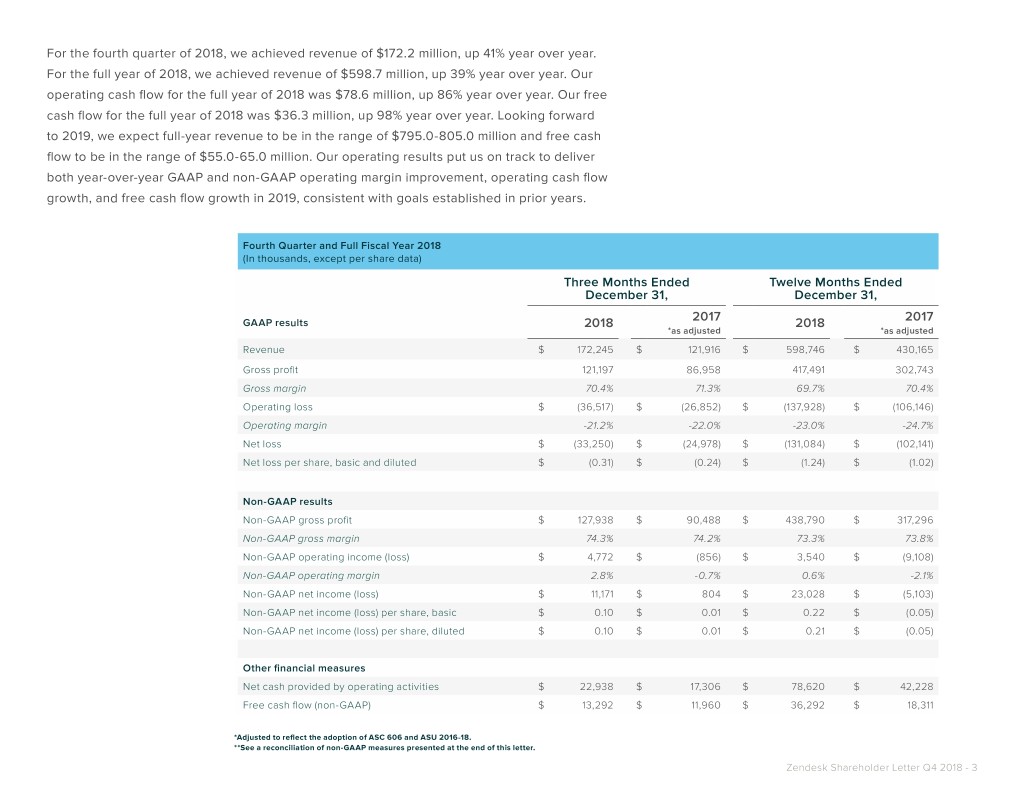

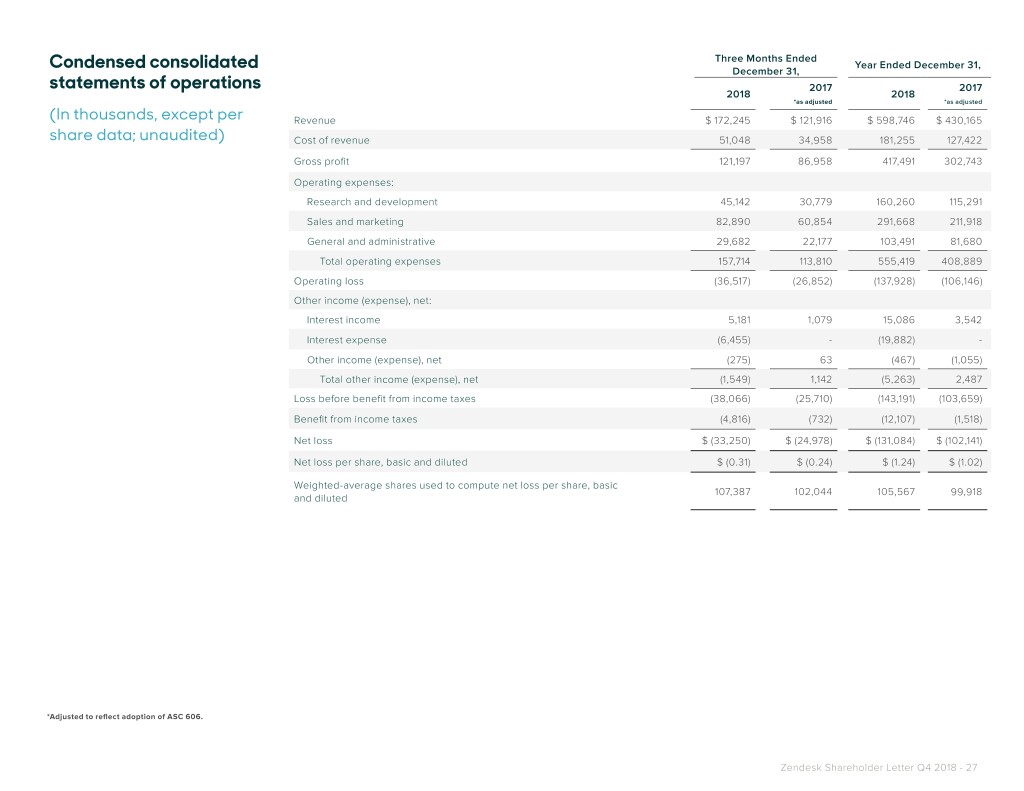

For the fourth quarter of 2018, we achieved revenue of $172.2 million, up 41% year over year. For the full year of 2018, we achieved revenue of $598.7 million, up 39% year over year. Our operating cash flow for the full year of 2018 was $78.6 million, up 86% year over year. Our free cash flow for the full year of 2018 was $36.3 million, up 98% year over year. Looking forward to 2019, we expect full-year revenue to be in the range of $795.0-805.0 million and free cash flow to be in the range of $55.0-65.0 million. Our operating results put us on track to deliver both year-over-year GAAP and non-GAAP operating margin improvement, operating cash flow growth, and free cash flow growth in 2019, consistent with goals established in prior years. Fourth Quarter and Full Fiscal Year 2018 (In thousands, except per share data) Three Months Ended Twelve Months Ended December 31, December 31, 2017 2017 GAAP results 2018 2018 *as adjusted *as adjusted Revenue $ 172,245 $ 121,916 $ 598,746 $ 430,165 Gross profit 121,197 86,958 417,491 302,743 Gross margin 70.4% 71.3% 69.7% 70.4% Operating loss $ (36,517) $ (26,852) $ (137,928) $ (106,146) Operating margin -21.2% -22.0% -23.0% -24.7% Net loss $ (33,250) $ (24,978) $ (131,084) $ (102,141) Net loss per share, basic and diluted $ (0.31) $ (0.24) $ (1.24) $ (1.02) Non-GAAP results Non-GAAP gross profit $ 127,938 $ 90,488 $ 438,790 $ 317,296 Non-GAAP gross margin 74.3% 74.2% 73.3% 73.8% Non-GAAP operating income (loss) $ 4,772 $ (856) $ 3,540 $ (9,108) Non-GAAP operating margin 2.8% -0.7% 0.6% -2.1% Non-GAAP net income (loss) $ 11,171 $ 804 $ 23,028 $ (5,103) Non-GAAP net income (loss) per share, basic $ 0.10 $ 0.01 $ 0.22 $ (0.05) Non-GAAP net income (loss) per share, diluted $ 0.10 $ 0.01 $ 0.21 $ (0.05) Other financial measures Net cash provided by operating activities $ 22,938 $ 17,306 $ 78,620 $ 42,228 Free cash flow (non-GAAP) $ 13,292 $ 11,960 $ 36,292 $ 18,311 *Adjusted to reflect the adoption of ASC 606 and ASU 2016-18. **See a reconciliation of non-GAAP measures presented at the end of this letter. Zendesk Shareholder Letter Q4 2018 - 3

2018 in Review Our growth in 2018 reflects the strength of our Our family of products and platform unify products, our ability to execute, and global customer communication and data across trends that are driving demand. disparate channels and departments, and simplify the process of providing omnichannel Organizations are under pressure to change customer service and engagement. Built to the way they do business and serve their leverage modern public cloud technologies and customers because of rapidly shifting consumer standards, our products are easy to implement, expectations. Customers are moving faster, are use, and scale, and are also easily configurable more informed, and are more empowered than and customizable to serve large, complex use ever before. The organizations they do business cases. The beautifully simple nature of our with need to adapt and transform to keep up products serves a wide range of customers with these changes. Companies around the ranging from businesses that are using customer world are seeking to transform their businesses service software for the first time to those that to better serve their customers. are undergoing massive digital transformation This global trend is driving strong demand projects to better serve their customers. for our products, which are purpose- Some of our more complex use cases include built to help companies deliver the best providing a unified customer view by overlaying customer experiences and adapt to changing our products and platform across many expectations. With customers in more than 160 disparate legacy systems; setting up consumer countries and territories and approximately product companies to sell directly to consumers; half of our revenue outside of the U.S., we are and empowering companies to differentiate their seeing strong global demand and revenue businesses through customer experience. growth in every region. For the full year of 2018, In 2018, we made advances across our product our revenue increased 35% in the U.S., 43% in family, our sales and marketing initiatives, and EMEA, 47% in APAC, and 45% in other countries our operations that drove significant revenue and territories. growth and positioned us well for future growth. Zendesk Shareholder Letter Q4 2018 - 4

Omnichannel The introduction of The Zendesk Suite in the second quarter raised our competitive offering by delivering a truly omnichannel, integrated solution, which today’s customers demand. The Suite enables fast and easy implementation of an omnichannel experience, in which all support agents are able to interact with customers across all channels seamlessly. Sales of The Suite have been robust and far exceeded our expectations. By providing an easier purchase option, we believe The Suite has delivered on our objective of achieving a higher average per customer sale price. Although The Suite is designed primarily for small and midsized businesses, we’re seeing it lead to more strategic omnichannel discussions with large enterprises, many of whom are developing their own customized omnichannel bundles of our products to best serve the needs of their agents and customers. In 2018, Zendesk was named a Gartner Peer Insights Customers’ Choice for CRM Customer Engagement Center (in August) and for IT Service Management Tools (in February and again in November). Both recognitions are based on reviews and ratings from customers using our software. Disclaimer: Gartner Peer Insights Customers’ Choice constitute the subjective opinions of individual end-user reviews, ratings, and data applied against a documented methodology; they neither represent the views of, nor constitute an endorsement by, Gartner or its affiliates. The Gartner References described herein, (the “Gartner References”) represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”), and are not representations of fact. Each Gartner Reference speaks as of its original publication date (and not as of the date of this Shareholder Letter) and the opinions expressed in the Gartner References are subject to change without notice. Zendesk Shareholder Letter Q4 2018 - 5

Enterprise Momentum In 2018, we further scaled and grew our enterprise business with enhanced product features and go-to-market initiatives. Over the past two years, we have built enterprise-level capabilities into our products and designed Zendesk works with Australia’s Digital Transformation workflow and collaboration features for large, Agency (DTA) to implement its customer experience complex organizations. Thanks to our product strategy. The partnership began when DTA chose innovation, we can deliver solutions for a Zendesk to improve the day-to-day interactions growing number of larger and more intricate use internally between teams and externally with other cases across existing and new customers. agencies. Having now expanded to 110 agents using Zendesk Support, the DTA is leveraging Zendesk Guide In 2018, we also significantly matured our and Zendesk’s AI capabilities to build a powerful self- enterprise sales and marketing initiatives service platform with the goal of providing a seamless by hiring talent and building teams with the and efficient experience for its users. experience necessary to serve as strategic partners with our enterprise customers. We broadened our sales and customer success capabilities across named accounts, pre-sales consulting and professional services, and solutions and success partners, while increasing our executive engagement with strategic customer accounts. We also hired an executive- level leader of partner channels to develop a partner ecosystem and strategy to extend our reach with enterprise customers. Zendesk Shareholder Letter Q4 2018 - 6

Introducing Zendesk Sell We introduced Zendesk Sell in the fourth quarter, extending our capabilities in sales force automation. Zendesk Sell expands our reach into the broader CRM market and fits with our long-term product strategy to cover the customer experience from sales to support to proactive engagement. Zendesk Sell gives sales teams the ease of use that we’re known for in our customer service products, along with enhanced productivity, processes, and pipeline visibility. The integration of Zendesk Support and Zendesk Sell provides support agents more context from the sales process and allows support agents to notify sales of opportunities surfaced during a support conversation. With this integration, conversations with a customer can be visible across an organization. Zendesk Shareholder Letter Q4 2018 - 7

Staples Canada is transforming itself from an office supply company into the “working and learning” company. With this transformation, the teams needed new tools to better support their customers in the new mission. Key to this was a unified view of customers across sales and support, and increased agility to react to the changing needs of their consumer base. With plans to significantly increase the number of actively managed customers, Staples Canada wanted to present 300 reps and agents with clear customer context in a seamlessly integrated experience. Zendesk Sell provided a simplified user experience and provided the visibility sellers and agents needed to make each call successful, while offering visibility into “the other side of the business” for the first time. Zendesk products’ omnichannel capabilities will provide customer support agents a unified view of the customer while providing customers a superior, seamless customer experience across all channels. Zendesk Shareholder Letter Q4 2018 - 8

CRM Platform The fourth-quarter launch of Zendesk Sunshine, our open and flexible CRM platform, marked a significant milestone as we set out to become a platform company. Sunshine drives our longer-term strategy to move further upmarket and address more enterprise use cases, as well as to expand beyond customer support into the broad CRM market. Already, our new platform is opening new opportunities and more strategic conversations with enterprise customers. We took a different platform approach with Sunshine, which we believe sets us apart from competitors and makes our platform more appealing to companies as they adapt to fast-changing customer expectations. Sunshine is built in the public cloud on Amazon Web Services (AWS), giving developers the freedom to build in their own way with open standards. With Sunshine, businesses can connect and understand all their customer data, wherever they live, and build and deploy customer apps and services faster. It provides businesses the ability to unify and use data from any internal or external resource for a complete picture of their customers. . Zendesk Shareholder Letter Q4 2018 - 9

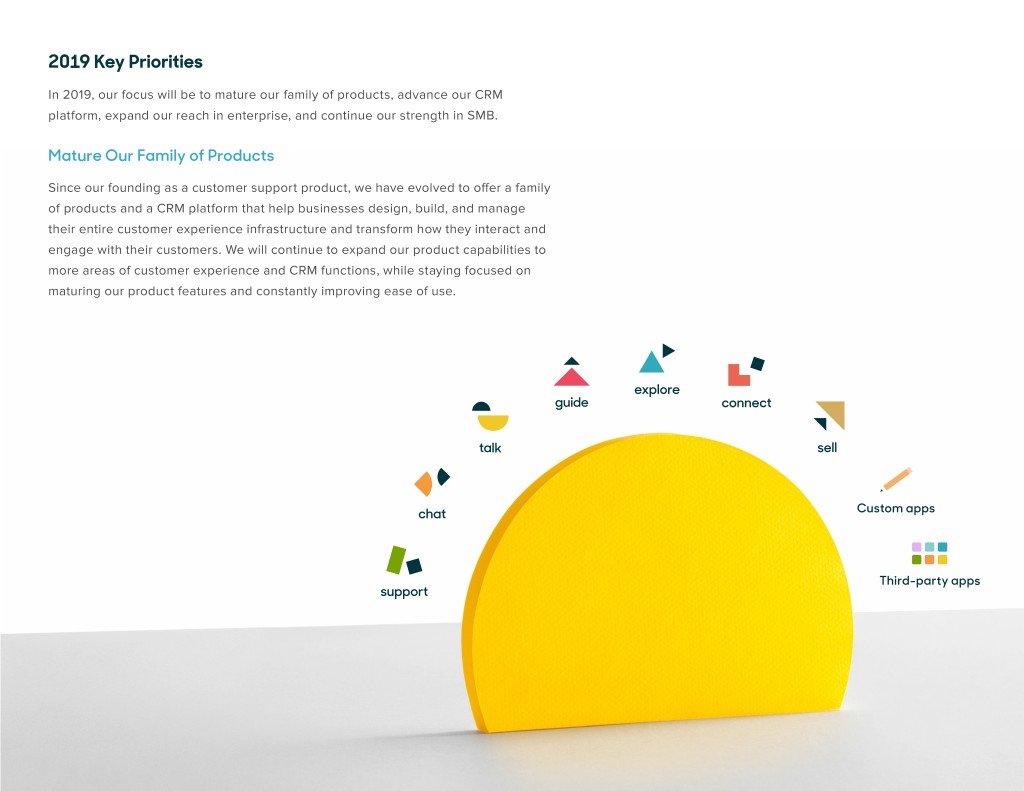

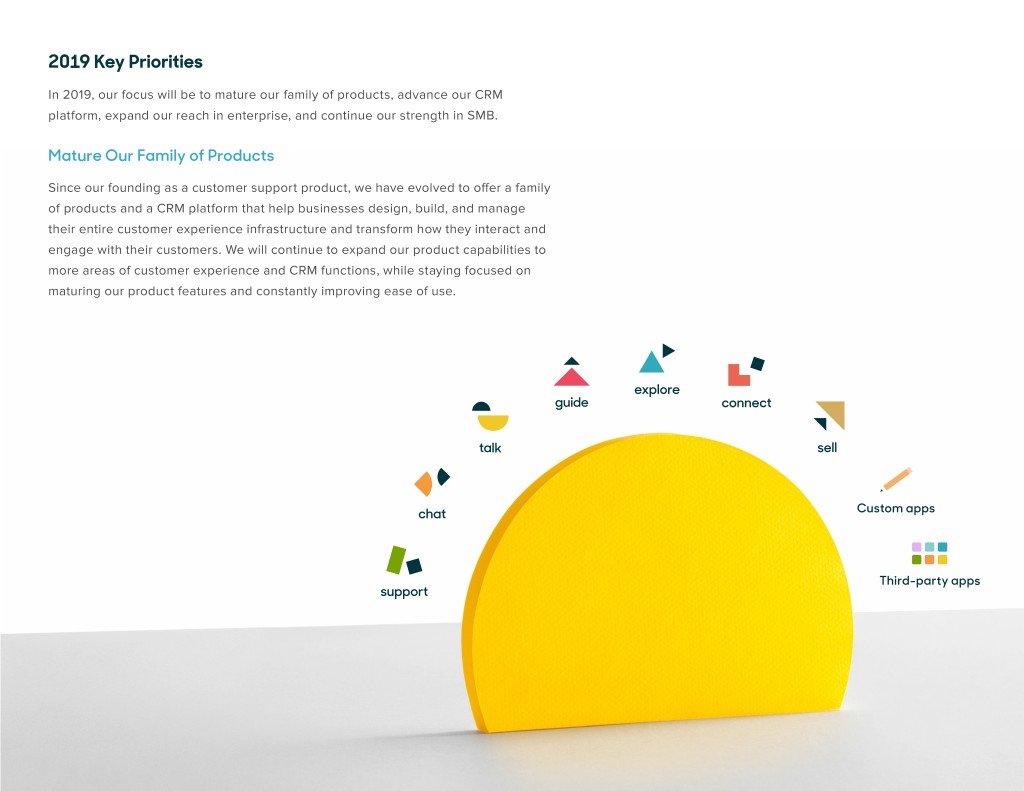

2019 Key Priorities In 2019, our focus will be to mature our family of products, advance our CRM platform, expand our reach in enterprise, and continue our strength in SMB. Mature Our Family of Products Since our founding as a customer support product, we have evolved to offer a family of products and a CRM platform that help businesses design, build, and manage their entire customer experience infrastructure and transform how they interact and engage with their customers. We will continue to expand our product capabilities to more areas of customer experience and CRM functions, while staying focused on maturing our product features and constantly improving ease of use. Custom apps Third-party apps

Technology solutions provider Black Box purchased The Zendesk Suite and is up and running with Zendesk Support and Zendesk Chat to provide customer service as 2019 Product Focus: well as pre- and post-sale technical support. In addition OMNICHANNEL to improved agent productivity, Zendesk gives Black Box better visibility and reporting, leading to new KPIs Building on the success of The Zendesk Suite and quicker feedback for agents. This improved access in 2018, we plan to offer omnichannel bundles to real-time data has resulted in improvements in the appropriate for enterprise-scale customers or customer experience. The company plans to implement different use cases. We also plan to enhance the Zendesk Guide to provide a self-service knowledge base omnichannel experience for agents that use our both for agents internally and for external customers. family of products and bring similar omnichannel features and experiences into Zendesk Sell. PRODUCT INTEGRATION As we’ve expanded beyond customer service into broader areas of the customer journey with Zendesk Sell and Zendesk Connect, we will mature and better integrate these products with Zendesk Support, providing customers and agents a more seamless experience across customer relationship management functions. Zendesk Shareholder Letter Q4 2018 - 11

ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING Answer Bot, which provides artificial intelligence self-service capabilities for Zendesk Guide, has helped many companies better serve their customers in a significantly more efficient and cost-effective manner. In 2019, we intend to make Answer Bot available and easier to use across more channels and further advance the sophistication of its artificial intelligence for more use cases. Zendesk Shareholder Letter Q4 2018 - 12

Advance Our CRM Platform In 2019, we will expand the availability of the Zendesk Sunshine CRM platform, expanding its capabilities and its integration across both our family of products and external data sources. We will focus on building a unified ASG Technologies is an enterprise software company providing customer profile to manage cross-system identities and solutions for information management and IT systems conversations, in addition to new developer resources and management. In early 2018, ASG Customer Care implemented tools to drive adoption and new use cases. Sunshine will Zendesk for 100 agents supporting its large, global customer help us serve more complex CRM use cases and build more base. The team has also rolled out Zendesk Chat and Zendesk strategic relationships with our customers. Guide and has since seen a rise in customers using self- service—from 4% to over 28% by the end of 2018. Expand Our Reach in Enterprise Looking ahead, ASG Customer Care plans to enable Zendesk In 2019, we will extend our reach in larger enterprises as Community and is looking forward to the implementation of we serve as trusted partners that strategically engage with Zendesk Sunshine, which will provide the team with reliable our customers around their visions and transformations. information about the company’s portfolio of over 150 products We are scaling these capabilities by hiring talent with and solutions at the organization level, helping ensure that only expertise in enterprise sales, success, relationships, licensed customers receive full support. systems architecture, and integrations. We are expanding our sales team and building further on pre-sales consulting and professional services. Additionally, we are developing a partner ecosystem strategy to help us reach and serve more enterprise customers and build a community of developer evangelists for our CRM platform. Zendesk Shareholder Letter Q4 2018 - 13

Continue Our Strength in SMB At our core, we believe that all customer experiences should be simple and effortless. That is why we build our products to be beautifully simple, democratizing their usability for all sizes and types of businesses. This belief has enabled us to build a compelling brand and leadership position serving both small-to- medium-sized organizations and larger enterprises. The SMB market is best served through a self-serve or low-touch model. We are investing in building a more efficient velocity sales model targeted at small and midsized businesses. We continue to improve our website, making it easy for customers to understand our products, begin a free trial, and become paying customers. We are fueling a healthy lead generation engine with digital marketing. And, we are ramping our startup program globally, which provides startups with Zendesk products and guidance from a Zendesk specialist on setting up their software and putting the customer experience at the center of their businesses. In summary, with our strong, accelerating momentum in 2018, and our plans for 2019 and beyond, we are confident in our ability to be a multibillion-dollar revenue company in the long term and help organizations build the best customer experiences with Zendesk. Zendesk Shareholder Letter Q4 2018 - 14

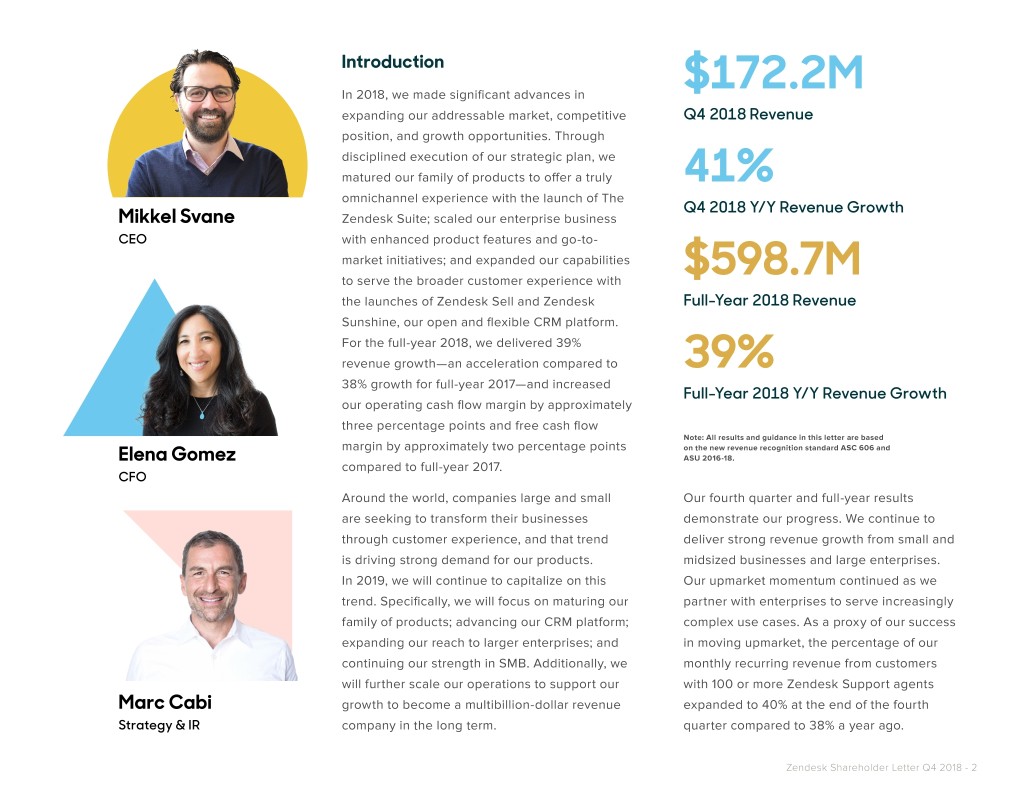

2018 Timeline % of Support MRR from Paid Customer Accounts with 100+ Support Agents Employee Count The Future of Customer Experience Dec 31, 2017 Dec 31, 2018 New York New Dallas London Chicago São Paulo Singapore Melbourne Base Acquisition Mexico City Mexico San Francisco 2000 38% 2700 40% Leader Launch Opening Opening Launches Launches Enterprise Enterprise Answer Bot Answer Gartner MQ Dublin EMEA HQ Opening Tokyo Office Tokyo �500M Annual ��00M Annual Madison Office Multi-language Revenue Run Rate* Revenue Run Rate* Revenue Collaboration Tools Collaboration � sell explore The Zendesk Suite Note: Timeline not to scale *Annual run rate is based on annualizing our quarterly revenue Zendesk Shareholder Letter Q4 2018 - 15

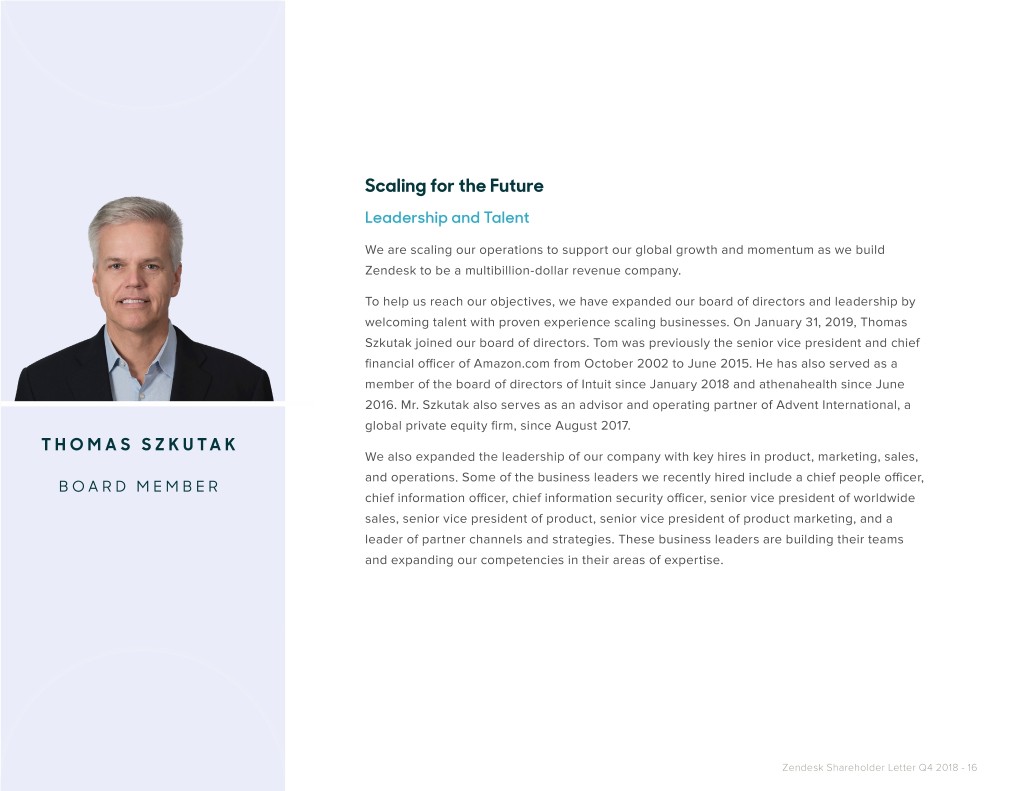

Scaling for the Future Leadership and Talent We are scaling our operations to support our global growth and momentum as we build Zendesk to be a multibillion-dollar revenue company. To help us reach our objectives, we have expanded our board of directors and leadership by welcoming talent with proven experience scaling businesses. On January 31, 2019, Thomas Szkutak joined our board of directors. Tom was previously the senior vice president and chief financial officer of Amazon.com from October 2002 to June 2015. He has also served as a member of the board of directors of Intuit since January 2018 and athenahealth since June 2016. Mr. Szkutak also serves as an advisor and operating partner of Advent International, a global private equity firm, since August 2017. THOMAS SZKUTAK We also expanded the leadership of our company with key hires in product, marketing, sales, and operations. Some of the business leaders we recently hired include a chief people officer, BOARD MEMBER chief information officer, chief information security officer, senior vice president of worldwide sales, senior vice president of product, senior vice president of product marketing, and a leader of partner channels and strategies. These business leaders are building their teams and expanding our competencies in their areas of expertise. Zendesk Shareholder Letter Q4 2018 - 16

Operations Our leadership team has taken many steps to improve and mature the operations of our company. We implemented company-wide goals that cascade from our top strategic priorities and also implemented weekly operational reviews to assess the status of our priorities and raise any issues to the leadership team immediately. Additionally, our customer events serve to tighten alignment among our product, sales, and marketing teams as key product launches are announced at some of these events. Looking ahead, we will continue to mature our operations and drive efficiency in a number of ways, such as workforce planning and location strategy, tighter processes throughout the company, and investment in shared services, scalable tools, and business partnering. Cloud Infrastructure Serving our customers with a modern, open platform is key to Zendesk’s success. To ensure we maintain flexibility and agility as we scale, we are continuing our investments in cloud services-based infrastructure. Over the past year, we have been migrating our customers’ accounts from co-located data centers to cloud infrastructure. We expect to complete the full migration by the end of the first half of 2019, with only a small number of our largest customers left to be transitioned. In 2019, we will begin to optimize our use of cloud infrastructure to boost productivity and advance our product and platform capabilities. Zendesk Shareholder Letter Q4 2018 - 17

Customers Among the customers to join or expand with us recently are: Great Wolf Resorts ASG Technologies A hospitality company that owns and An enterprise software company operates resorts in North America providing solutions for information management and IT systems management Groupon A mobile and online e-commerce marketplace Australian Government Digital Transformation Agency An agency that helps government HYPE improve digital service An Italy-based mobile-only banking company with a connected Mastercard Black Box A digital solutions provider that helps LimeRoad customers design, build, manage, and A fashion and lifestyle social shopping secure their IT infrastructure platform based in India Childrensalon Medline A U.K.-based online retailer of designer A manufacturer and distributor of children’s clothing medical supplies GitHub mytaxi A development platform provider for A map-based taxi ordering service in building software Europe Zendesk Shareholder Letter Q4 2018 - 18

Myntra An India-based e-commerce store for TransferWise fashion and lifestyle products A U.K.-based company that provides international money transfer services New Look A global fashion retailer based in the U.K. TriMet A provider of bus, light rail, and commuter rail service in the Portland, Recipe Unlimited Oregon region A Canada-based, full-service restaurant operator and franchisor Utiligroup A U.K.-based software company serving REV Group the utilities and energy industries A designer, manufacturer, and distributor of specialty vehicles, parts, and services Xinja An independent, digital neobank based Salud S.A. in Australia A provider of prepaid medical plans in Ecuador Youse An online insurance sales platform in Staples Canada Brazil An office supply retail chain based in Canada Zendesk Shareholder Letter Q4 2018 - 19

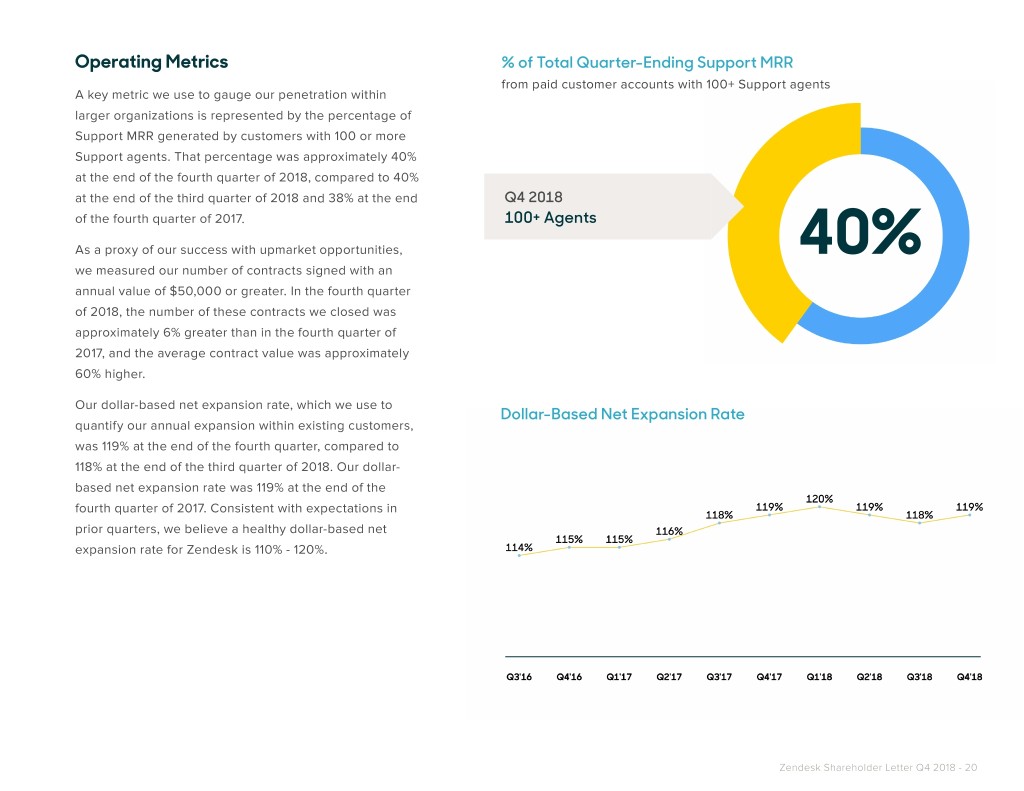

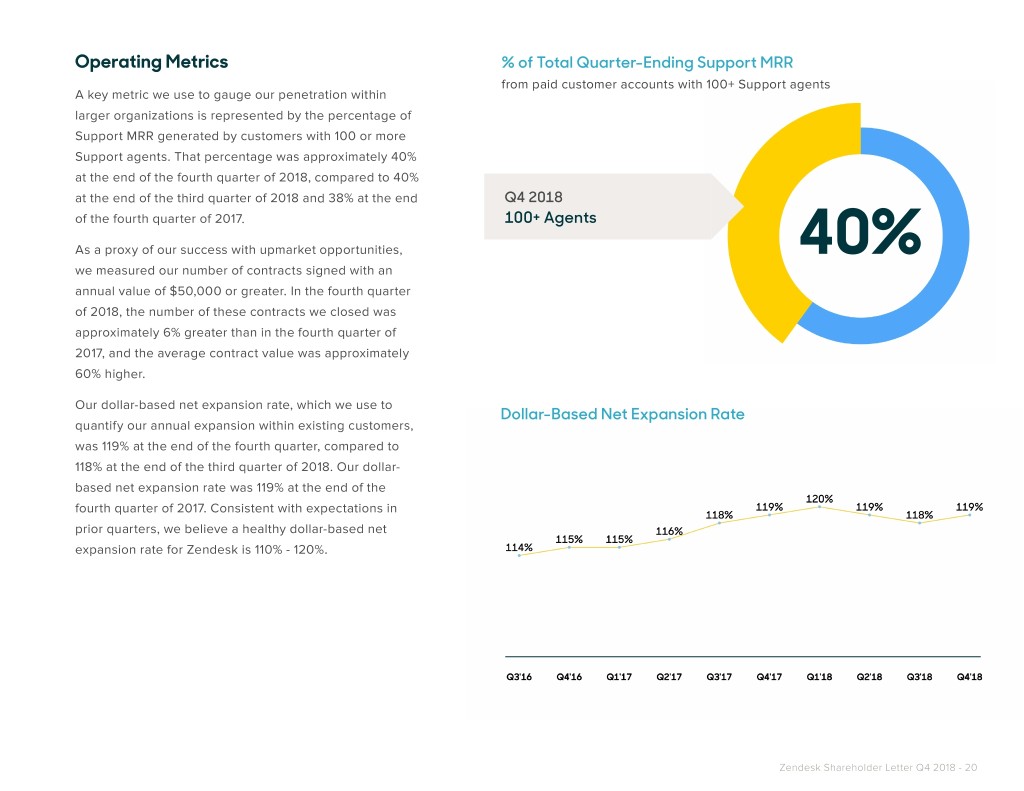

Operating Metrics % of Total Quarter-Ending Support MRR from paid customer accounts with 100+ Support agents A key metric we use to gauge our penetration within larger organizations is represented by the percentage of Support MRR generated by customers with 100 or more Support agents. That percentage was approximately 40% at the end of the fourth quarter of 2018, compared to 40% at the end of the third quarter of 2018 and 38% at the end Q4 2018 of the fourth quarter of 2017. 100+ Agents As a proxy of our success with upmarket opportunities, 40% we measured our number of contracts signed with an annual value of $50,000 or greater. In the fourth quarter of 2018, the number of these contracts we closed was approximately 6% greater than in the fourth quarter of 2017, and the average contract value was approximately 60% higher. Our dollar-based net expansion rate, which we use to Dollar-Based Net Expansion Rate quantify our annual expansion within existing customers, was 119% at the end of the fourth quarter, compared to 118% at the end of the third quarter of 2018. Our dollar- based net expansion rate was 119% at the end of the fourth quarter of 2017. Consistent with expectations in prior quarters, we believe a healthy dollar-based net expansion rate for Zendesk is 110% - 120%. Zendesk Shareholder Letter Q4 2018 - 20

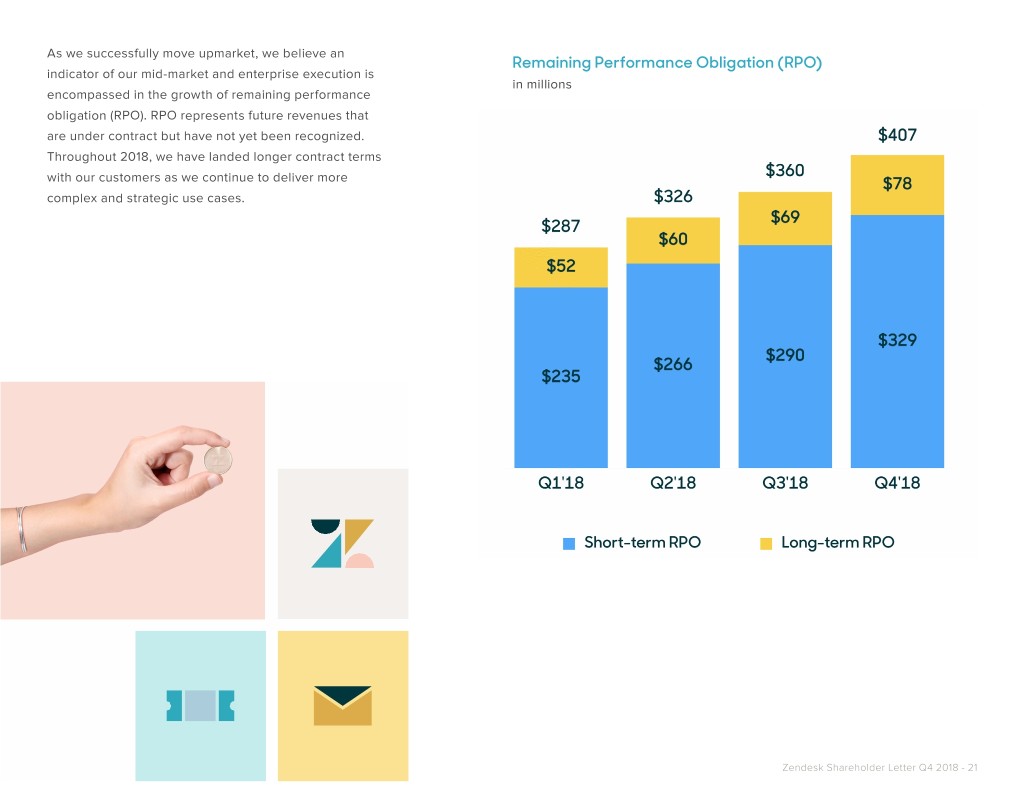

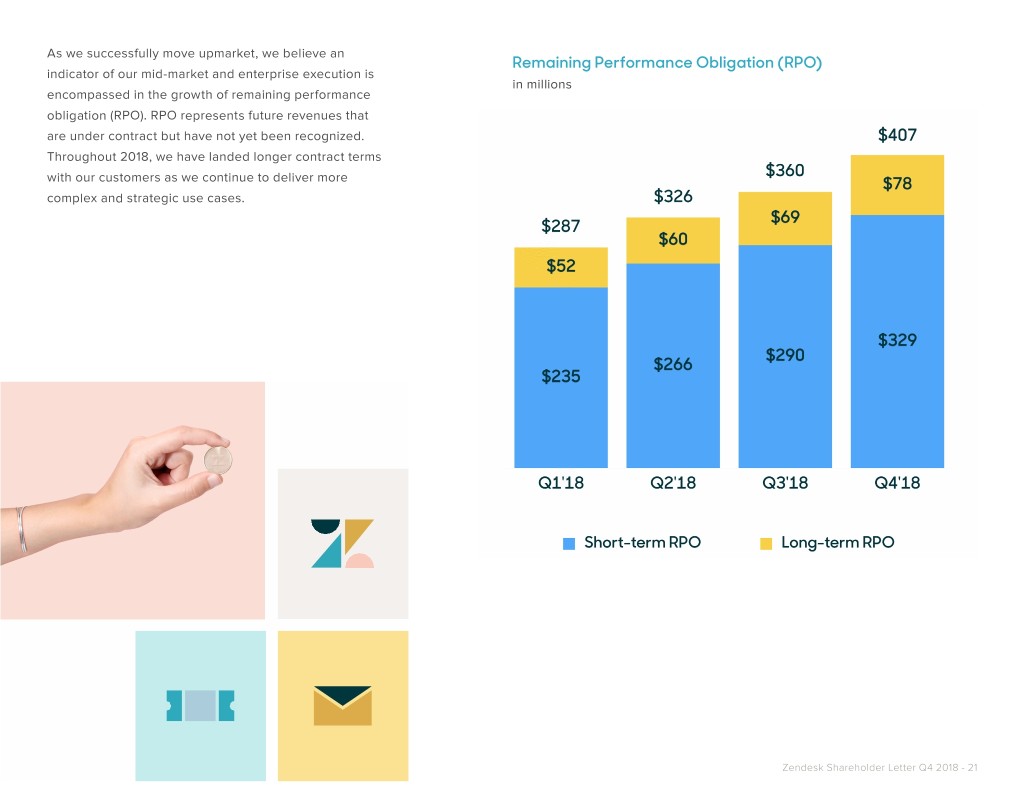

As we successfully move upmarket, we believe an Remaining Performance Obligation (RPO) indicator of our mid-market and enterprise execution is in millions encompassed in the growth of remaining performance obligation (RPO). RPO represents future revenues that are under contract but have not yet been recognized. Throughout 2018, we have landed longer contract terms with our customers as we continue to deliver more complex and strategic use cases. Zendesk Shareholder Letter Q4 2018 - 21

Social Impact Social impact has long been an important element of Zendesk’s culture and brand. Promoting empathy to solve complex social issues is core to our values, as we believe it is an important way for employees to engage with work, our customers, and our communities around the globe. Products Pricing Solutions Demos Customers Resources Get Started To support this belief, we have undertaken an effort to build an Empathy Movement. At our Relate global user conference in November, we held an Empathy in Action workshop where SOCIAL IMPACT we taught our customers how to bring volunteerism into their contact center cultures. The workshop scored the highest of all breakout sessions in attendee engagement. More than 100 customers have signed pledges to join us in efforts to Working for good promote empathy through diversity and inclusion initiatives and volunteering. Zendesk employees have committed to giving six hours of their time volunteering in their communities each year. Over the course of 2018, Zendesk employees volunteered approximately 16,500 hours in their communities. Our engagement was matched by an increasing financial investment coordinated through the Zendesk Neighbor Foundation, with more than $2 million in financial assistance and free software donated to our global community partners. In addition to employee engagement, we launched our first social impact web page dedicated to sharing our focus areas and the mission we set as a company to be a good neighbor and give back to the communities we call home. Zendesk Shareholder Letter Q4 2018 - 22

Select Financial Measures (In millions, except per share data) Three Months Ended Comments December 31, September 30, December 31, 2018 2018 2017 *as adjusted GAAP results Strong and balanced growth between small and midsized businesses and enterprise drove solid revenue growth of 41% Revenue $ 172.2 $ 154.8 $ 121.9 y/y. We made meaningful strides in moving upmarket, and performance of The Zendesk Suite has remained strong. Gross margin for 2018 continues to be negatively impacted as we transition services from our co-located data centers to Gross margin 70.4% 69.6% 71.3% cloud infrastructure. We anticipate completing the migration during the first half of 2019. On a sequential basis, we saw approximately 80 bps uplift q/q. Operating loss $ (36.5) $ (34.2) $ (26.9) Improved approximately 90 bps q/q and 80 bps y/y largely Operating margin -21.2% -22.1% -22.0% due to scale as revenue growth outpaced operating expense growth and more than offset gross margin pressures. Non-GAAP results Non-GAAP gross margin for 2018 continues to be negatively impacted as we transition services from our co-located data Non-GAAP gross margin 74.3% 73.2% 74.2% centers to cloud infrastructure. We anticipate completing the migration during the first half of 2019. On a sequential basis, we saw approximately 110 bps uplift q/q. Non-GAAP operating income (loss) $ 4.8 $ 3.8 $ (0.9) Improved approximately 40 bps q/q and 350 bps y/y largely Non-GAAP operating margin 2.8% 2.4% -0.7% due to scale as revenue growth outpaced operating expense growth and more than offset y/y declines in gross margin. *Adjusted to reflect the adoption of ASC 606. *Quarter-over-quarter comparisons (q/q) are for the three months ended December 31, 2018, compared to the three months ended September 30, 2018. *Year-over-year comparisons (y/y) are for the three months ended December 31, 2018, compared to the three months ended December 31, 2017. **See a reconciliation of non-GAAP measures presented at the end of this letter. Zendesk Shareholder Letter Q4 2018 - 23

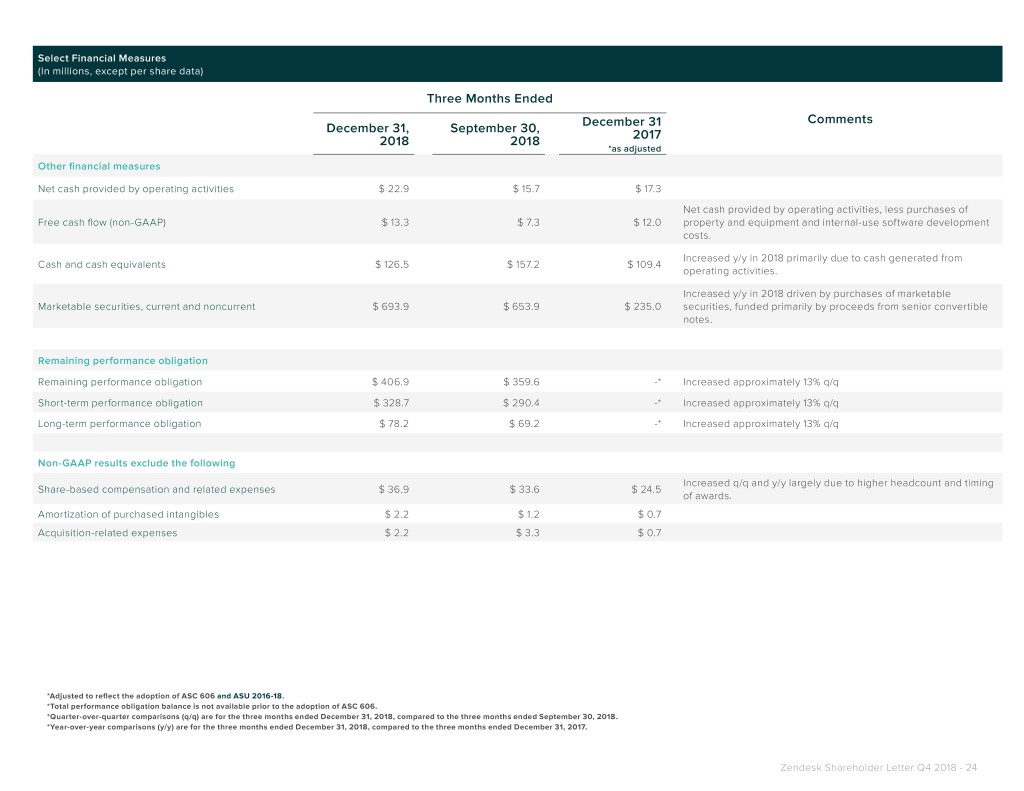

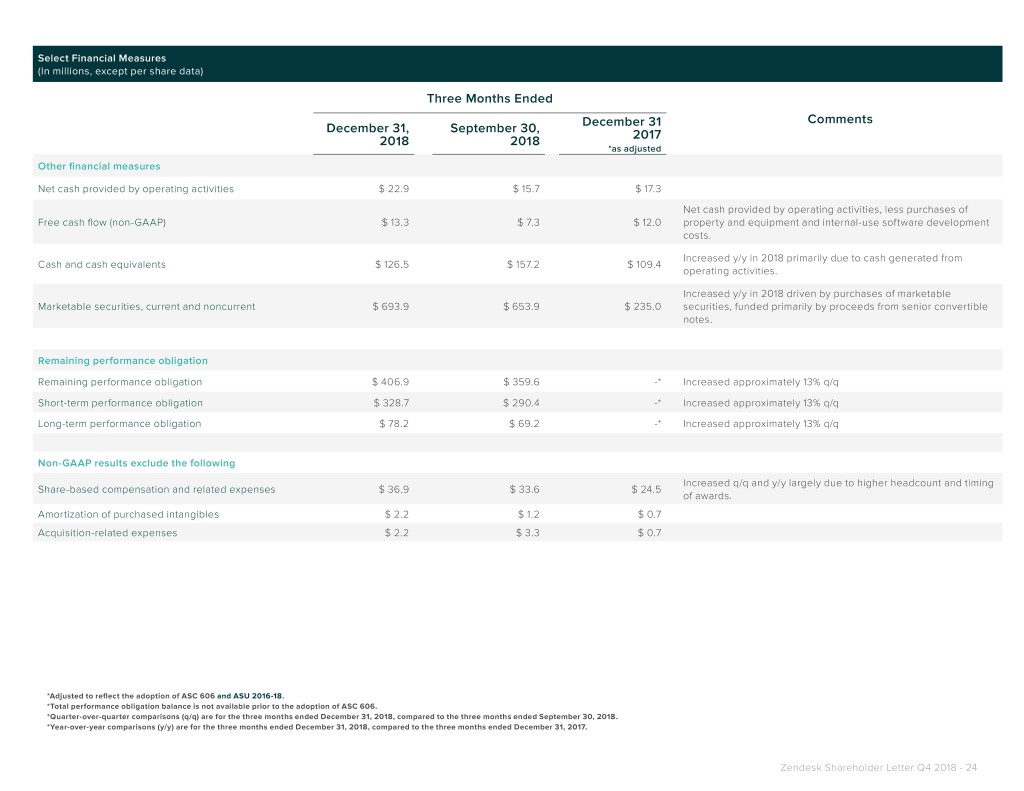

Select Financial Measures (In millions, except per share data) Three Months Ended Comments December 31, September 30, December 31 2018 2018 2017 *as adjusted Other financial measures Net cash provided by operating activities $ 22.9 $ 15.7 $ 17.3 Net cash provided by operating activities, less purchases of Free cash flow (non-GAAP) $ 13.3 $ 7.3 $ 12.0 property and equipment and internal-use software development costs. Increased y/y in 2018 primarily due to cash generated from Cash and cash equivalents $ 126.5 $ 157.2 $ 109.4 operating activities. Increased y/y in 2018 driven by purchases of marketable Marketable securities, current and noncurrent $ 693.9 $ 653.9 $ 235.0 securities, funded primarily by proceeds from senior convertible notes. Remaining performance obligation Remaining performance obligation $ 406.9 $ 359.6 -* Increased approximately 13% q/q Short-term performance obligation $ 328.7 $ 290.4 -* Increased approximately 13% q/q Long-term performance obligation $ 78.2 $ 69.2 -* Increased approximately 13% q/q Non-GAAP results exclude the following Increased q/q and y/y largely due to higher headcount and timing Share-based compensation and related expenses $ 36.9 $ 33.6 $ 24.5 of awards. Amortization of purchased intangibles $ 2.2 $ 1.2 $ 0.7 Acquisition-related expenses $ 2.2 $ 3.3 $ 0.7 *Adjusted to reflect the adoption of ASC 606 and ASU 2016-18. *Total performance obligation balance is not available prior to the adoption of ASC 606. *Quarter-over-quarter comparisons (q/q) are for the three months ended December 31, 2018, compared to the three months ended September 30, 2018. *Year-over-year comparisons (y/y) are for the three months ended December 31, 2018, compared to the three months ended December 31, 2017. Zendesk Shareholder Letter Q4 2018 - 24

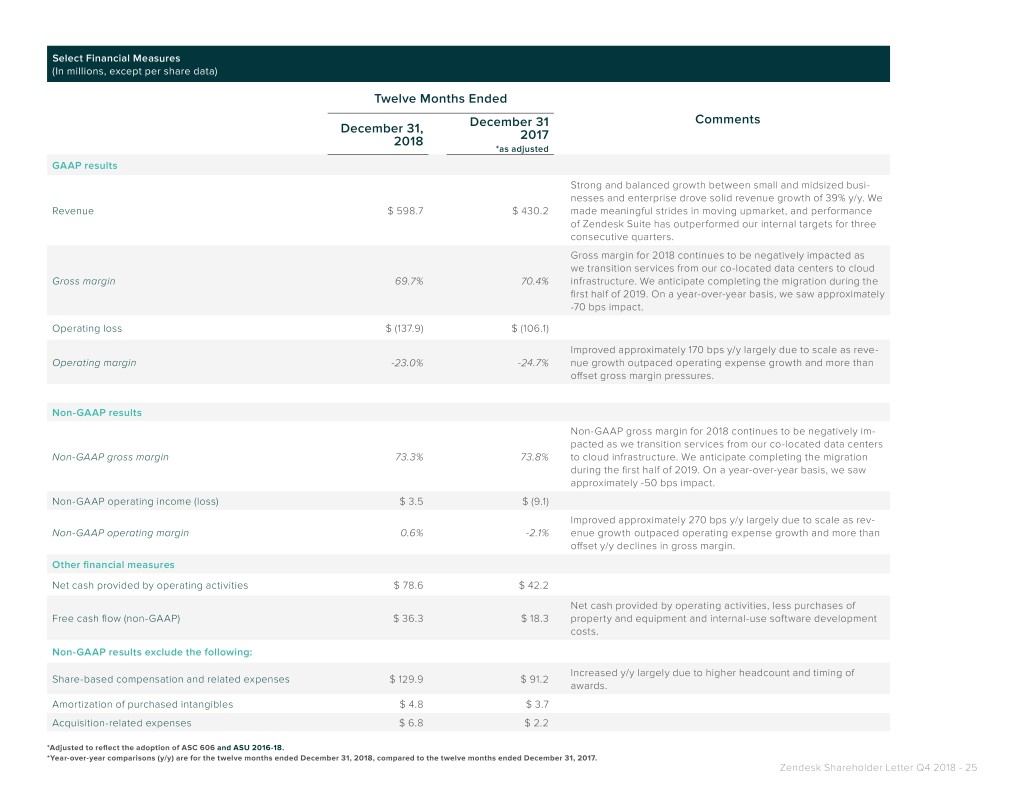

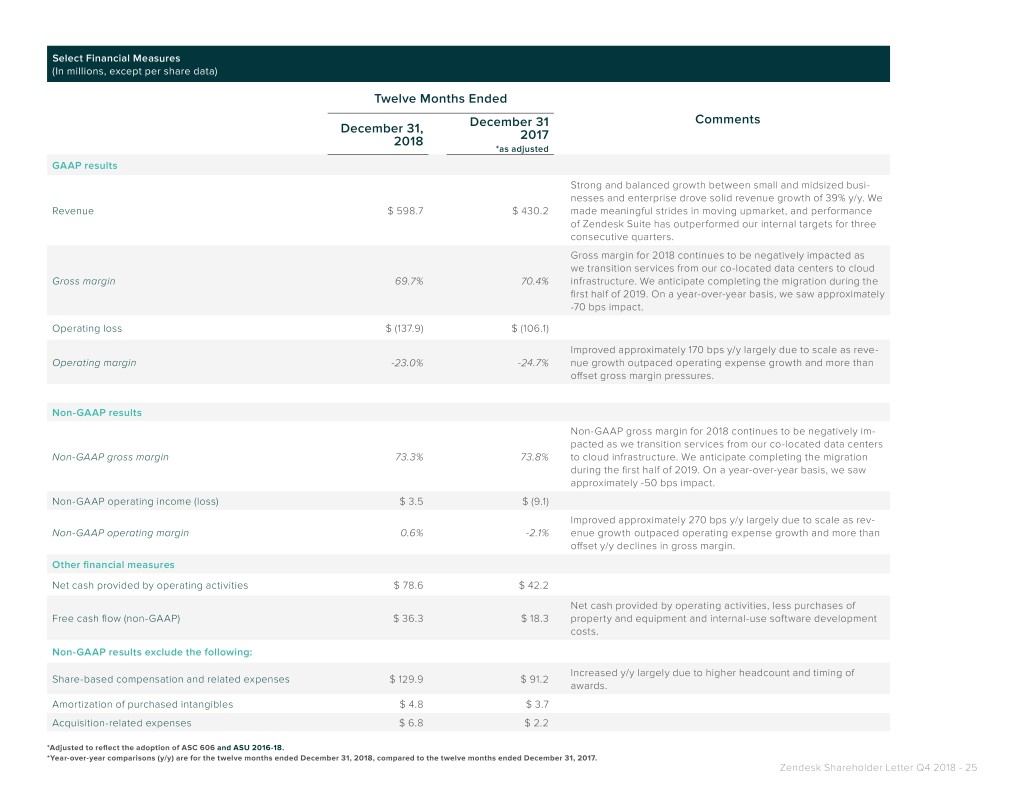

Select Financial Measures (In millions, except per share data) Twelve Months Ended December 31 Comments December 31, 2017 2018 *as adjusted GAAP results Strong and balanced growth between small and midsized busi- nesses and enterprise drove solid revenue growth of 39% y/y. We Revenue $ 598.7 $ 430.2 made meaningful strides in moving upmarket, and performance of Zendesk Suite has outperformed our internal targets for three consecutive quarters. Gross margin for 2018 continues to be negatively impacted as we transition services from our co-located data centers to cloud Gross margin 69.7% 70.4% infrastructure. We anticipate completing the migration during the first half of 2019. On a year-over-year basis, we saw approximately -70 bps impact. Operating loss $ (137.9) $ (106.1) Improved approximately 170 bps y/y largely due to scale as reve- Operating margin -23.0% -24.7% nue growth outpaced operating expense growth and more than offset gross margin pressures. Non-GAAP results Non-GAAP gross margin for 2018 continues to be negatively im- pacted as we transition services from our co-located data centers Non-GAAP gross margin 73.3% 73.8% to cloud infrastructure. We anticipate completing the migration during the first half of 2019. On a year-over-year basis, we saw approximately -50 bps impact. Non-GAAP operating income (loss) $ 3.5 $ (9.1) Improved approximately 270 bps y/y largely due to scale as rev- Non-GAAP operating margin 0.6% -2.1% enue growth outpaced operating expense growth and more than offset y/y declines in gross margin. Other financial measures Net cash provided by operating activities $ 78.6 $ 42.2 Net cash provided by operating activities, less purchases of Free cash flow (non-GAAP) $ 36.3 $ 18.3 property and equipment and internal-use software development costs. Non-GAAP results exclude the following: Increased y/y largely due to higher headcount and timing of Share-based compensation and related expenses $ 129.9 $ 91.2 awards. Amortization of purchased intangibles $ 4.8 $ 3.7 Acquisition-related expenses $ 6.8 $ 2.2 *Adjusted to reflect the adoption of ASC 606 and ASU 2016-18. *Year-over-year comparisons (y/y) are for the twelve months ended December 31, 2018, compared to the twelve months ended December 31, 2017. Zendesk Shareholder Letter Q4 2018 - 25

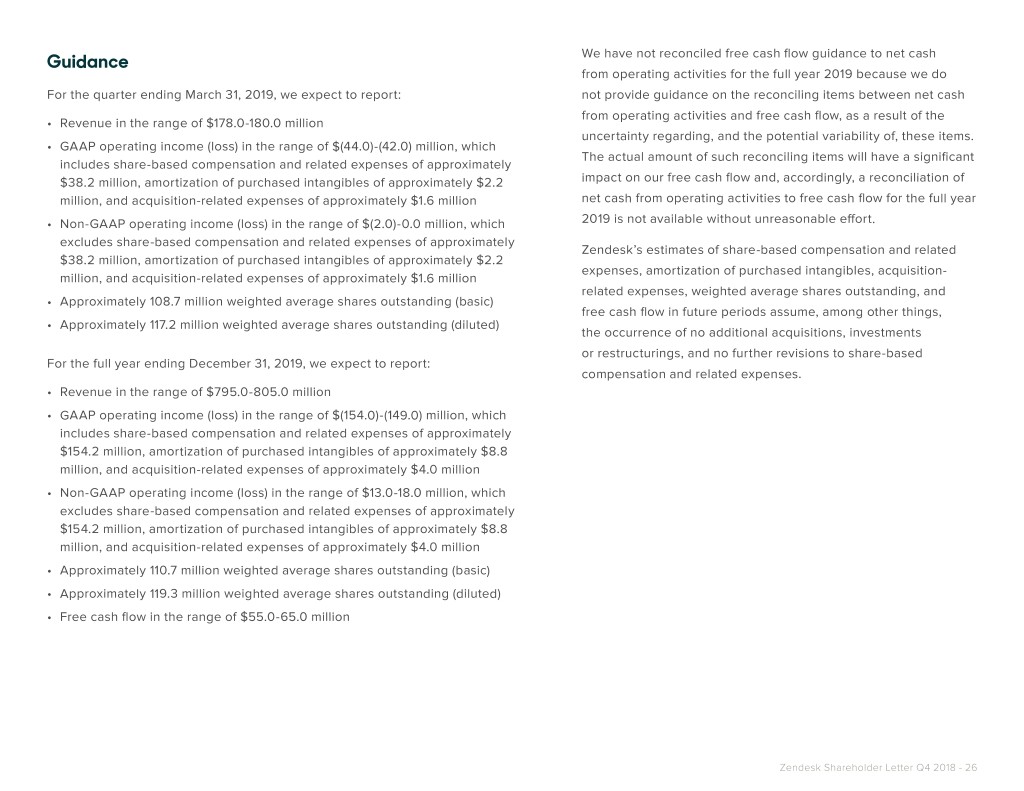

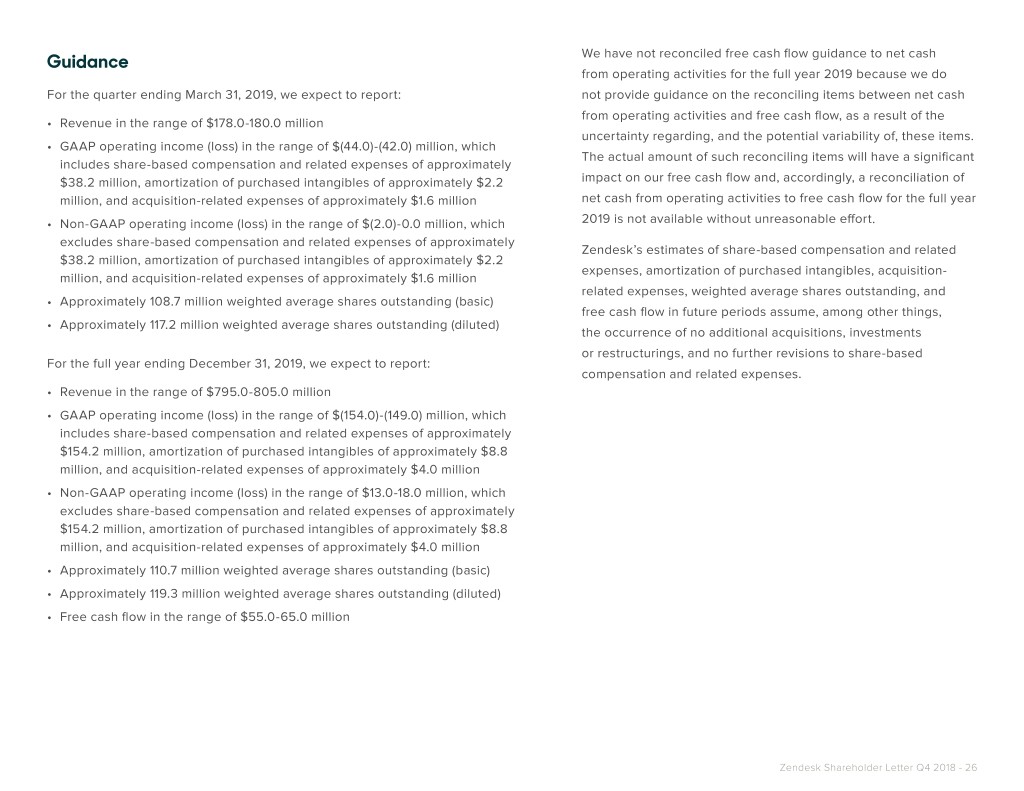

We have not reconciled free cash flow guidance to net cash Guidance from operating activities for the full year 2019 because we do For the quarter ending March 31, 2019, we expect to report: not provide guidance on the reconciling items between net cash from operating activities and free cash flow, as a result of the • Revenue in the range of $178.0-180.0 million uncertainty regarding, and the potential variability of, these items. • GAAP operating income (loss) in the range of $(44.0)-(42.0) million, which The actual amount of such reconciling items will have a significant includes share-based compensation and related expenses of approximately $38.2 million, amortization of purchased intangibles of approximately $2.2 impact on our free cash flow and, accordingly, a reconciliation of million, and acquisition-related expenses of approximately $1.6 million net cash from operating activities to free cash flow for the full year • Non-GAAP operating income (loss) in the range of $(2.0)-0.0 million, which 2019 is not available without unreasonable effort. excludes share-based compensation and related expenses of approximately Zendesk’s estimates of share-based compensation and related $38.2 million, amortization of purchased intangibles of approximately $2.2 expenses, amortization of purchased intangibles, acquisition- million, and acquisition-related expenses of approximately $1.6 million related expenses, weighted average shares outstanding, and • Approximately 108.7 million weighted average shares outstanding (basic) free cash flow in future periods assume, among other things, • Approximately 117.2 million weighted average shares outstanding (diluted) the occurrence of no additional acquisitions, investments or restructurings, and no further revisions to share-based For the full year ending December 31, 2019, we expect to report: compensation and related expenses. • Revenue in the range of $795.0-805.0 million • GAAP operating income (loss) in the range of $(154.0)-(149.0) million, which includes share-based compensation and related expenses of approximately $154.2 million, amortization of purchased intangibles of approximately $8.8 million, and acquisition-related expenses of approximately $4.0 million • Non-GAAP operating income (loss) in the range of $13.0-18.0 million, which excludes share-based compensation and related expenses of approximately $154.2 million, amortization of purchased intangibles of approximately $8.8 million, and acquisition-related expenses of approximately $4.0 million • Approximately 110.7 million weighted average shares outstanding (basic) • Approximately 119.3 million weighted average shares outstanding (diluted) • Free cash flow in the range of $55.0-65.0 million Zendesk Shareholder Letter Q4 2018 - 26

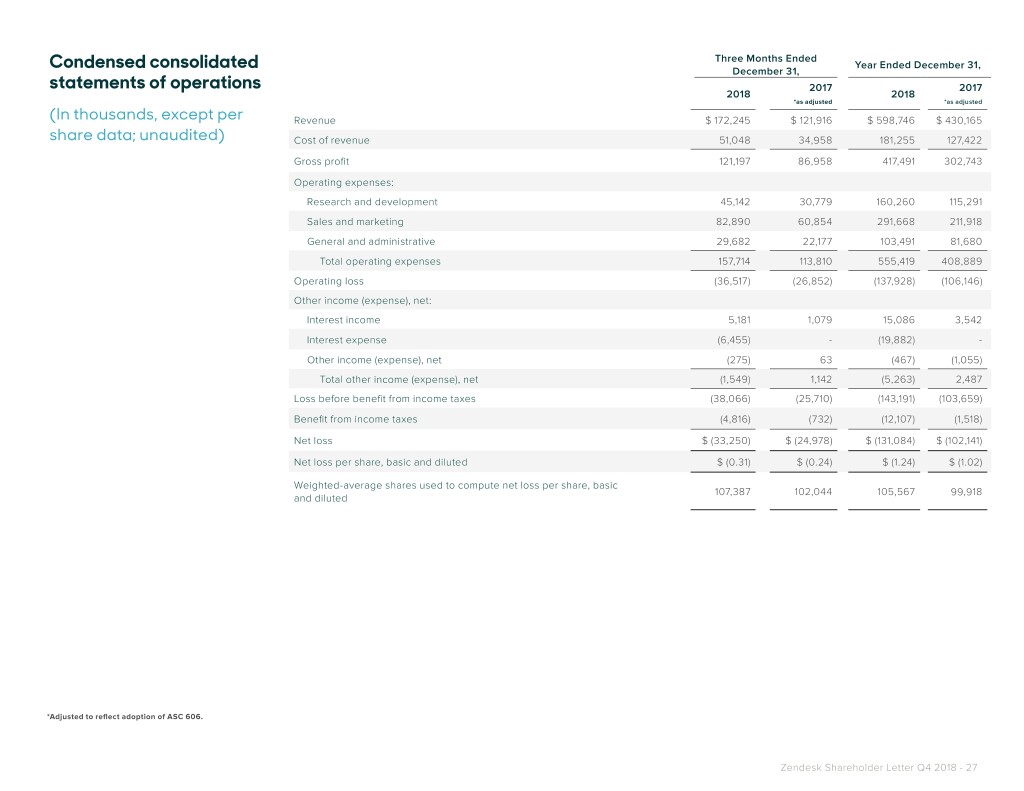

Three Months Ended Year Ended December 31, Condensed consolidated December 31, statements of operations 2017 2017 2018 2018 *as adjusted *as adjusted (In thousands, except per Revenue $ 172,245 $ 121,916 $ 598,746 $ 430,165 share data; unaudited) Cost of revenue 51,048 34,958 181,255 127,422 Gross profit 121,197 86,958 417,491 302,743 Operating expenses: Research and development 45,142 30,779 160,260 115,291 Sales and marketing 82,890 60,854 291,668 211,918 General and administrative 29,682 22,177 103,491 81,680 Total operating expenses 157,714 113,810 555,419 408,889 Operating loss (36,517) (26,852) (137,928) (106,146) Other income (expense), net: Interest income 5,181 1,079 15,086 3,542 Interest expense (6,455) - (19,882) - Other income (expense), net (275) 63 (467) (1,055) Total other income (expense), net (1,549) 1,142 (5,263) 2,487 Loss before benefit from income taxes (38,066) (25,710) (143,191) (103,659) Benefit from income taxes (4,816) (732) (12,107) (1,518) Net loss $ (33,250) $ (24,978) $ (131,084) $ (102,141) Net loss per share, basic and diluted $ (0.31) $ (0.24) $ (1.24) $ (1.02) Weighted-average shares used to compute net loss per share, basic 107,387 102,044 105,567 99,918 and diluted *Adjusted to reflect adoption of ASC 606. Zendesk Shareholder Letter Q4 2018 - 27

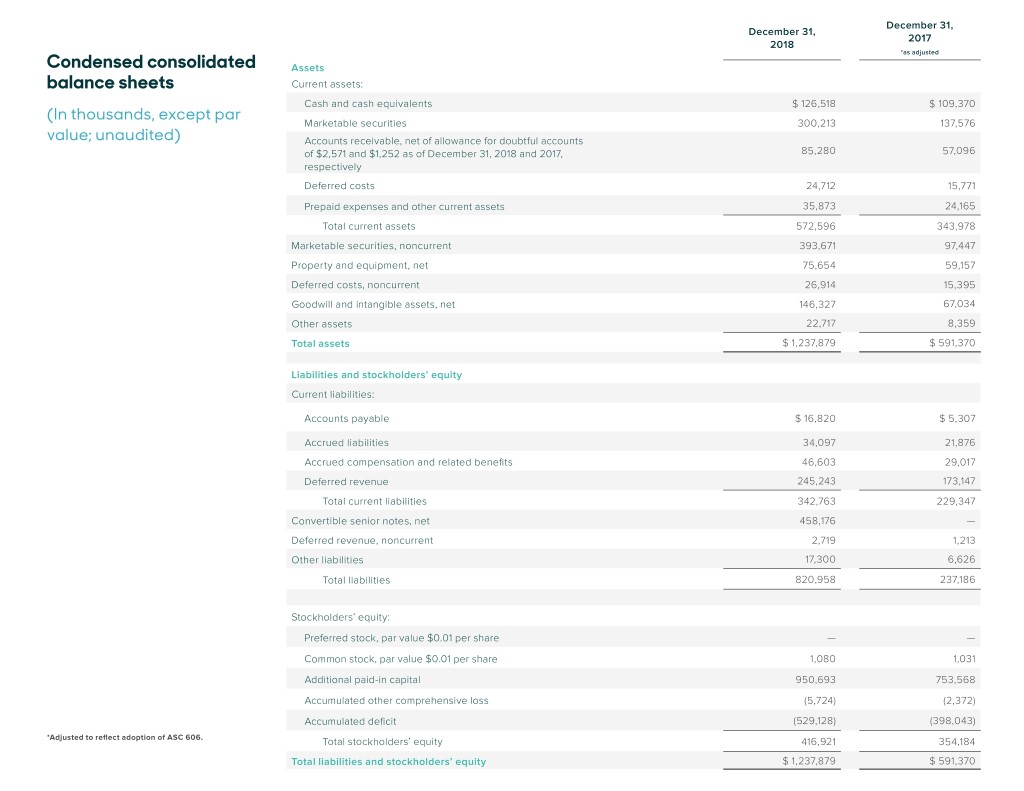

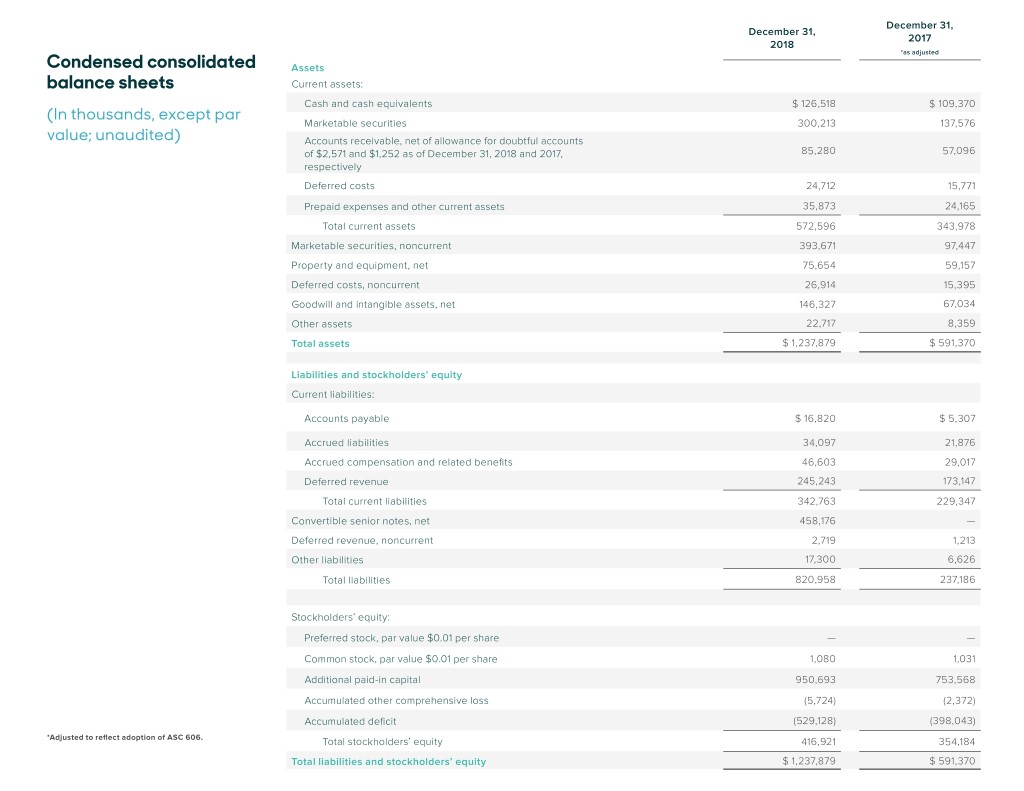

December 31, December 31, 2017 2018 *as adjusted Condensed consolidated Assets balance sheets Current assets: Cash and cash equivalents $ 126,518 $ 109,370 (In thousands, except par Marketable securities 300,213 137,576 value; unaudited) Accounts receivable, net of allowance for doubtful accounts of $2,571 and $1,252 as of December 31, 2018 and 2017, 85,280 57,096 respectively Deferred costs 24,712 15,771 Prepaid expenses and other current assets 35,873 24,165 Total current assets 572,596 343,978 Marketable securities, noncurrent 393,671 97,447 Property and equipment, net 75,654 59,157 Deferred costs, noncurrent 26,914 15,395 Goodwill and intangible assets, net 146,327 67,034 Other assets 22,717 8,359 Total assets $ 1,237,879 $ 591,370 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 16,820 $ 5,307 Accrued liabilities 34,097 21,876 Accrued compensation and related benefits 46,603 29,017 Deferred revenue 245,243 173,147 Total current liabilities 342,763 229,347 Convertible senior notes, net 458,176 — Deferred revenue, noncurrent 2,719 1,213 Other liabilities 17,300 6,626 Total liabilities 820,958 237,186 Stockholders’ equity: Preferred stock, par value $0.01 per share — — Common stock, par value $0.01 per share 1,080 1,031 Additional paid-in capital 950,693 753,568 Accumulated other comprehensive loss (5,724) (2,372) Accumulated deficit (529,128) (398,043) *Adjusted to reflect adoption of ASC 606. Total stockholders’ equity 416,921 354,184 Total liabilities and stockholders’ equity $ 1,237,879 $ 591,370

Three Months Ended Year Ended December 31, December 31, 2018 2017 2018 2017 Condensed consolidated *as adjusted *as adjusted statements of cash flows Cash flows from operating activities Net loss $ (33,250) $ (24,978) $ (131,084) $ (102,141) (In thousands; unaudited) Adjustments to reconcile net loss to net cash provided by operating activities: Depreciation and amortization 9,327 7,668 36,520 31,931 Share-based compensation 32,902 22,128 119,483 84,553 Amortization of deferred costs 6,180 4,102 21,304 14,434 Amortization of debt discount and issuance costs 6,101 - 18,766 - Income tax benefit related to convertible senior notes (5,731) - (13,784) - Other (16) 222 2,848 603 Changes in operating assets and liabilities: Accounts receivable (3,286) (6,162) (30,007) (21,201) Prepaid expenses and other current assets (453) 4 (10,620) (5,112) Deferred costs (14,182) (7,167) (40,898) (22,762) Other assets and liabilities 6,608 (442) 6,635 (5,765) Accounts payable (13,073) (5,398) 7,534 1,839 Accrued liabilities (3,229) 76 3,844 6,919 Accrued compensation and related benefits 12,539 5,896 15,026 7,399 Deferred revenue 22,501 21,357 73,053 51,531 Net cash provided by operating activities 22,938 17,306 78,620 42,228 Cash flows from investing activities Purchases of property and equipment (8,191) (3,062) (35,323) (16,396) Internal-use software development costs (1,455) (2,284) (7,005) (7,521) Purchases of marketable securities (108,800) (42,030) (700,226) (177,309) Proceeds from maturities of marketable securities 39,063 27,775 170,882 116,735 Proceeds from sales of marketable securities 30,584 2,946 71,359 31,090 Cash paid for acquisitions, net of cash acquired - - (79,363) (16,470) Purchase of strategic investment (10,000) - (10,000) - Net cash used in investing activities (58,799) (16,655) (589,676) (69,871) Cash flows from financing activities Proceeds from issuance of convertible senior notes, net of issuance costs paid - - 561,439 - of $13,561 Purchase of capped call related to convertible senior notes - - (63,940) - Proceeds from exercise of employee stock options 2,896 13,332 16,150 31,882 Proceeds from employee stock purchase plan 5,441 3,268 21,440 14,248 Taxes paid related to net share settlement of share-based awards (1,447) (574) (5,213) (2,989) Other (772) - (813) - Net cash provided by financing activities 6,118 16,026 529,063 43,141 Effect of exchange rate changes on cash, cash equivalents and restricted cash 36 40 (19) 328 Net increase (decrease) in cash, cash equivalents and restricted cash (29,707) 16,717 17,988 15,826 Cash, cash equivalents and restricted cash at beginning of period 158,583 94,171 110,888 95,062 Cash, cash equivalents and restricted cash at end of period $ 128,876 $ 110,888 $ 128,876 $ 110,888 *Adjusted to reflect adoption of ASC 606 and ASU 2016-18. Zendesk Shareholder Letter Q4 2018 - 29

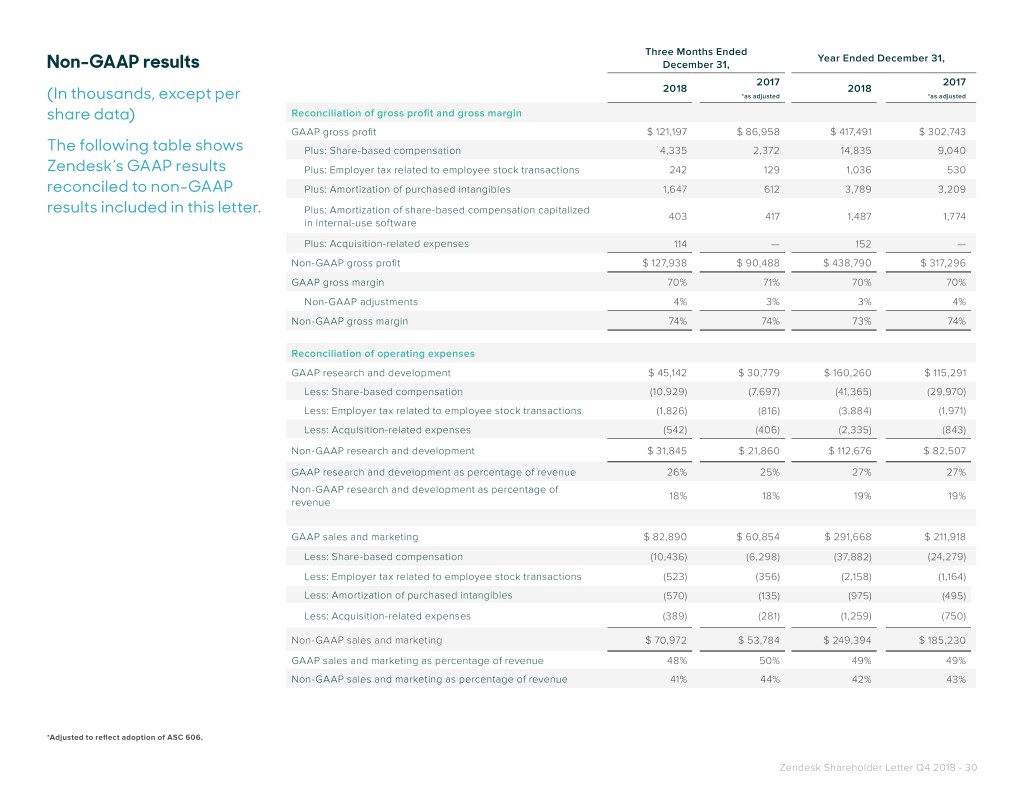

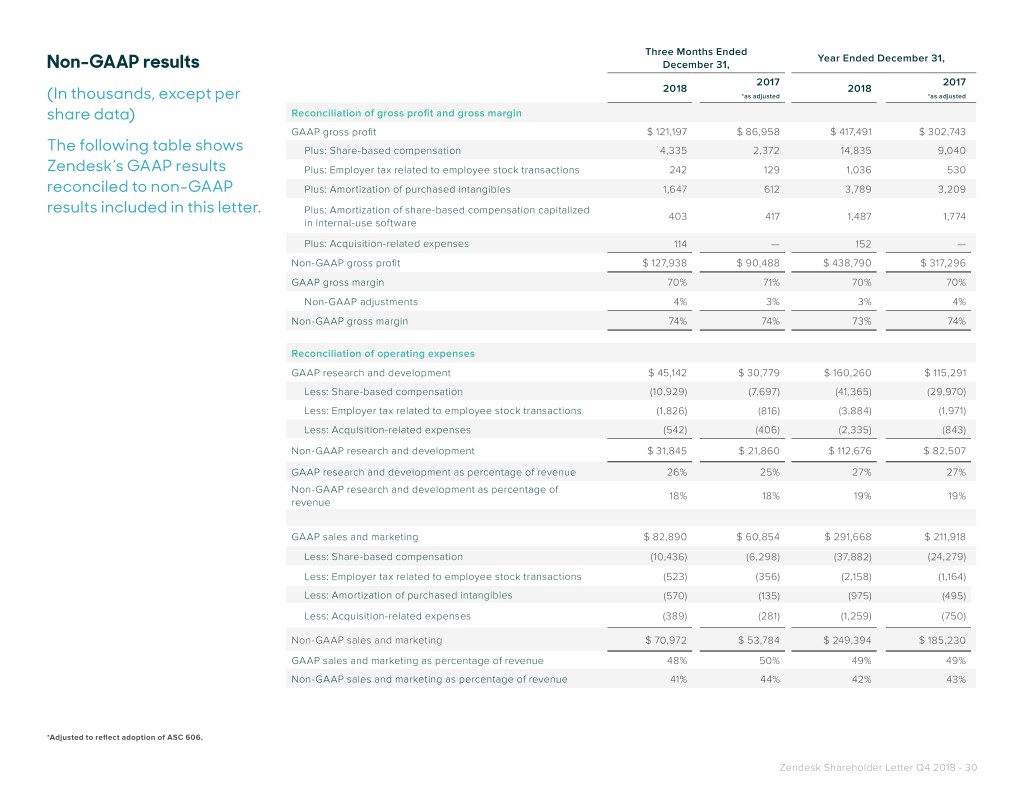

Three Months Ended Year Ended December 31, Non-GAAP results December 31, 2017 2017 2018 2018 (In thousands, except per *as adjusted *as adjusted share data) Reconciliation of gross profit and gross margin GAAP gross profit $ 121,197 $ 86,958 $ 417,491 $ 302,743 The following table shows Plus: Share-based compensation 4,335 2,372 14,835 9,040 Zendesk’s GAAP results Plus: Employer tax related to employee stock transactions 242 129 1,036 530 reconciled to non-GAAP Plus: Amortization of purchased intangibles 1,647 612 3,789 3,209 results included in this letter. Plus: Amortization of share-based compensation capitalized 403 417 1,487 1,774 in internal-use software Plus: Acquisition-related expenses 114 — 152 — Non-GAAP gross profit $ 127,938 $ 90,488 $ 438,790 $ 317,296 GAAP gross margin 70% 71% 70% 70% Non-GAAP adjustments 4% 3% 3% 4% Non-GAAP gross margin 74% 74% 73% 74% Reconciliation of operating expenses GAAP research and development $ 45,142 $ 30,779 $ 160,260 $ 115,291 Less: Share-based compensation (10,929) (7,697) (41,365) (29,970) Less: Employer tax related to employee stock transactions (1,826) (816) (3,884) (1,971) Less: Acquisition-related expenses (542) (406) (2,335) (843) Non-GAAP research and development $ 31,845 $ 21,860 $ 112,676 $ 82,507 GAAP research and development as percentage of revenue 26% 25% 27% 27% Non-GAAP research and development as percentage of 18% 18% 19% 19% revenue GAAP sales and marketing $ 82,890 $ 60,854 $ 291,668 $ 211,918 Less: Share-based compensation (10,436) (6,298) (37,882) (24,279) Less: Employer tax related to employee stock transactions (523) (356) (2,158) (1,164) Less: Amortization of purchased intangibles (570) (135) (975) (495) Less: Acquisition-related expenses (389) (281) (1,259) (750) Non-GAAP sales and marketing $ 70,972 $ 53,784 $ 249,394 $ 185,230 GAAP sales and marketing as percentage of revenue 48% 50% 49% 49% Non-GAAP sales and marketing as percentage of revenue 41% 44% 42% 43% *Adjusted to reflect adoption of ASC 606. Zendesk Shareholder Letter Q4 2018 - 30

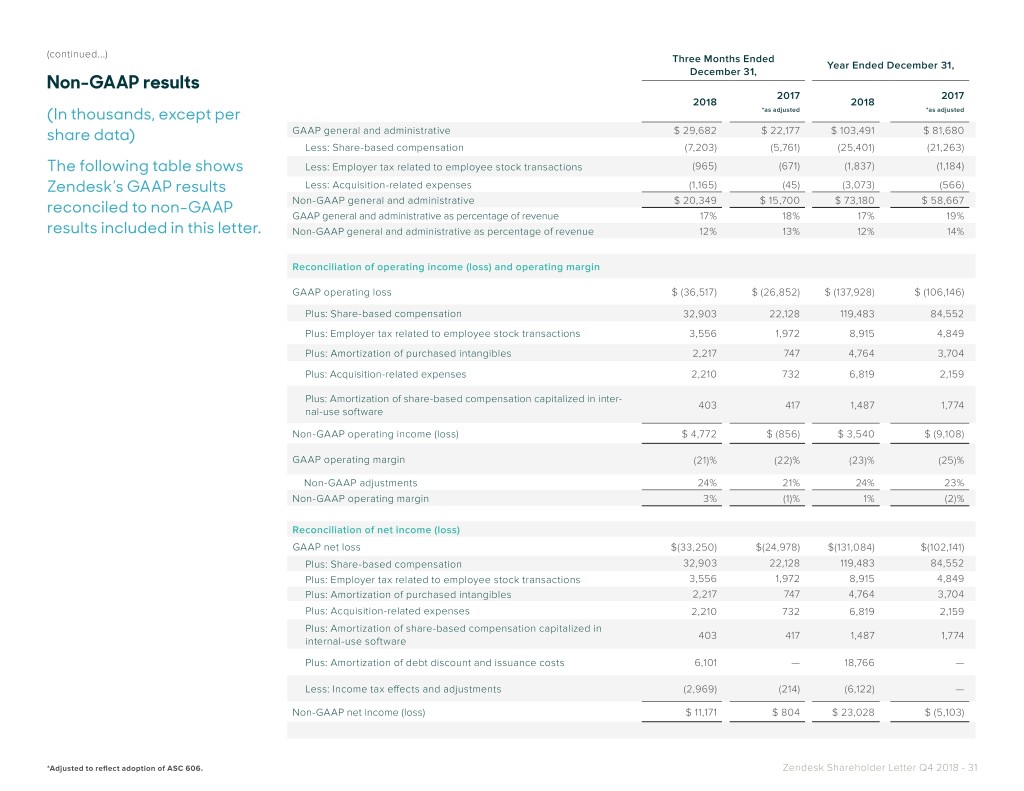

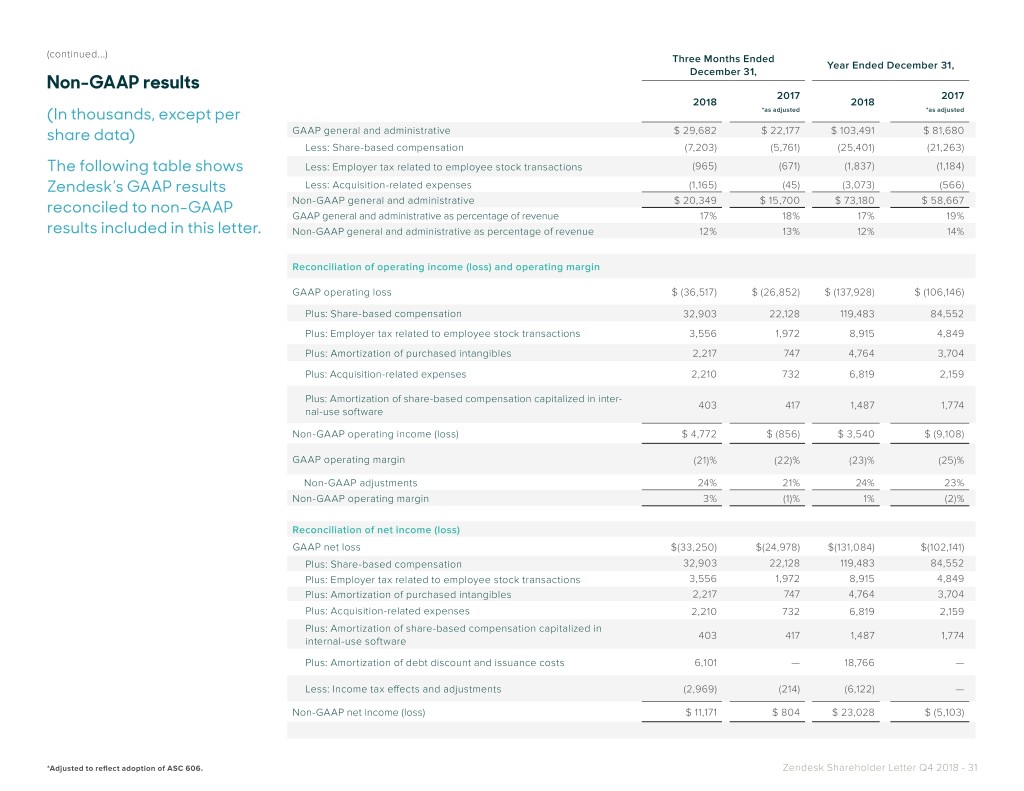

(continued...) Three Months Ended Year Ended December 31, December 31, Non-GAAP results 2017 2017 2018 2018 (In thousands, except per *as adjusted *as adjusted share data) GAAP general and administrative $ 29,682 $ 22,177 $ 103,491 $ 81,680 Less: Share-based compensation (7,203) (5,761) (25,401) (21,263) The following table shows Less: Employer tax related to employee stock transactions (965) (671) (1,837) (1,184) Zendesk’s GAAP results Less: Acquisition-related expenses (1,165) (45) (3,073) (566) reconciled to non-GAAP Non-GAAP general and administrative $ 20,349 $ 15,700 $ 73,180 $ 58,667 GAAP general and administrative as percentage of revenue 17% 18% 17% 19% results included in this letter. Non-GAAP general and administrative as percentage of revenue 12% 13% 12% 14% Reconciliation of operating income (loss) and operating margin GAAP operating loss $ (36,517) $ (26,852) $ (137,928) $ (106,146) Plus: Share-based compensation 32,903 22,128 119,483 84,552 Plus: Employer tax related to employee stock transactions 3,556 1,972 8,915 4,849 Plus: Amortization of purchased intangibles 2,217 747 4,764 3,704 Plus: Acquisition-related expenses 2,210 732 6,819 2,159 Plus: Amortization of share-based compensation capitalized in inter- 403 417 1,487 1,774 nal-use software Non-GAAP operating income (loss) $ 4,772 $ (856) $ 3,540 $ (9,108) GAAP operating margin (21)% (22)% (23)% (25)% Non-GAAP adjustments 24% 21% 24% 23% Non-GAAP operating margin 3% (1)% 1% (2)% Reconciliation of net income (loss) GAAP net loss $(33,250) $(24,978) $(131,084) $(102,141) Plus: Share-based compensation 32,903 22,128 119,483 84,552 Plus: Employer tax related to employee stock transactions 3,556 1,972 8,915 4,849 Plus: Amortization of purchased intangibles 2,217 747 4,764 3,704 Plus: Acquisition-related expenses 2,210 732 6,819 2,159 Plus: Amortization of share-based compensation capitalized in 403 417 1,487 1,774 internal-use software Plus: Amortization of debt discount and issuance costs 6,101 — 18,766 — Less: Income tax effects and adjustments (2,969) (214) (6,122) — Non-GAAP net income (loss) $ 11,171 $ 804 $ 23,028 $ (5,103) *Adjusted to reflect adoption of ASC 606. Zendesk Shareholder Letter Q4 2018 - 31

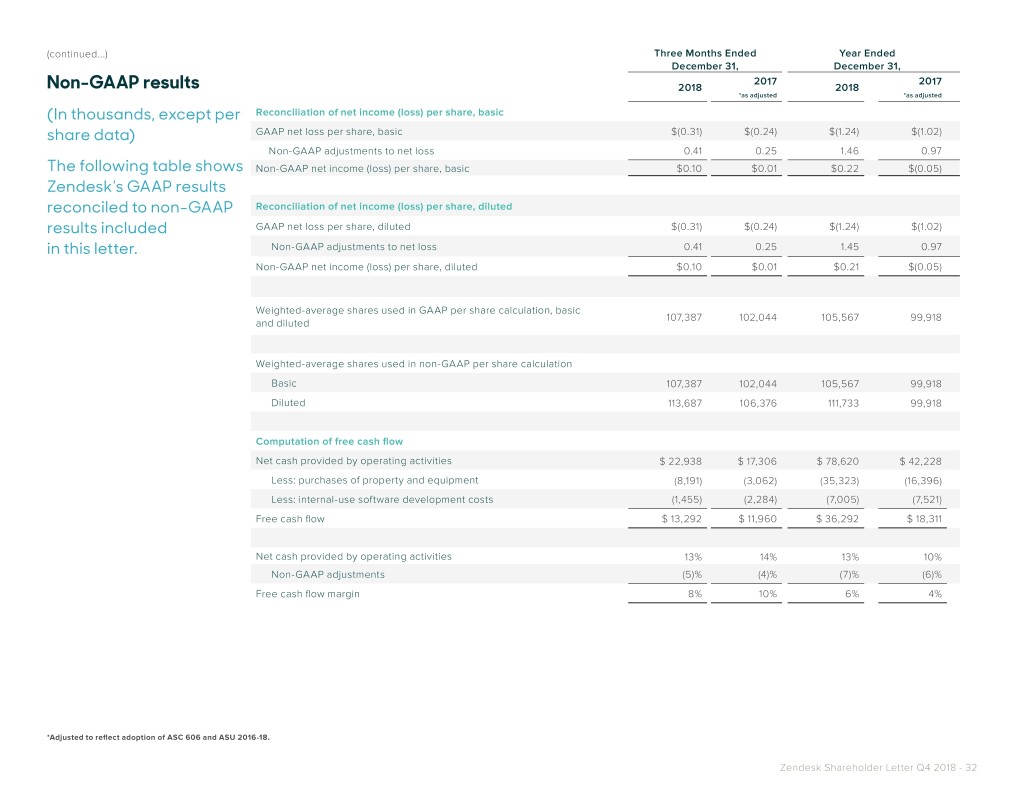

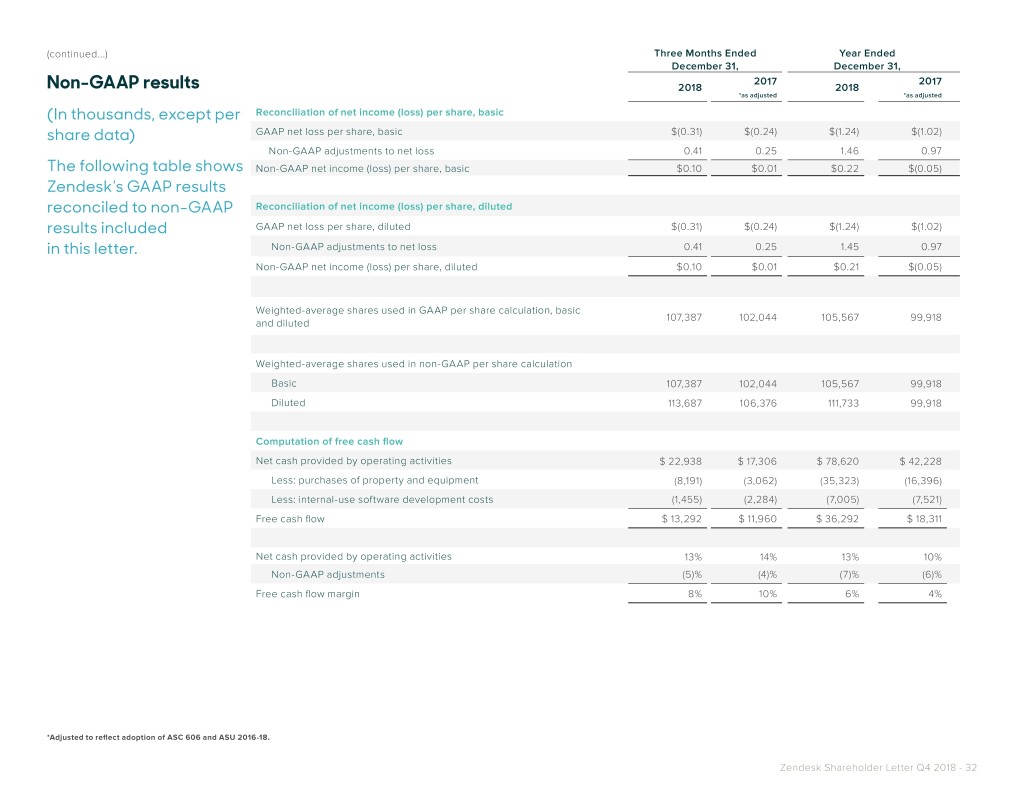

(continued...) Three Months Ended Year Ended December 31, December 31, 2017 2017 Non-GAAP results 2018 2018 *as adjusted *as adjusted (In thousands, except per Reconciliation of net income (loss) per share, basic share data) GAAP net loss per share, basic $(0.31) $(0.24) $(1.24) $(1.02) Non-GAAP adjustments to net loss 0.41 0.25 1.46 0.97 The following table shows Non-GAAP net income (loss) per share, basic $0.10 $0.01 $0.22 $(0.05) Zendesk’s GAAP results reconciled to non-GAAP Reconciliation of net income (loss) per share, diluted results included GAAP net loss per share, diluted $(0.31) $(0.24) $(1.24) $(1.02) in this letter. Non-GAAP adjustments to net loss 0.41 0.25 1.45 0.97 Non-GAAP net income (loss) per share, diluted $0.10 $0.01 $0.21 $(0.05) Weighted-average shares used in GAAP per share calculation, basic 107,387 102,044 105,567 99,918 and diluted Weighted-average shares used in non-GAAP per share calculation Basic 107,387 102,044 105,567 99,918 Diluted 113,687 106,376 111,733 99,918 Computation of free cash flow Net cash provided by operating activities $ 22,938 $ 17,306 $ 78,620 $ 42,228 Less: purchases of property and equipment (8,191) (3,062) (35,323) (16,396) Less: internal-use software development costs (1,455) (2,284) (7,005) (7,521) Free cash flow $ 13,292 $ 11,960 $ 36,292 $ 18,311 Net cash provided by operating activities 13% 14% 13% 10% Non-GAAP adjustments (5)% (4)% (7)% (6)% Free cash flow margin 8% 10% 6% 4% *Adjusted to reflect adoption of ASC 606 and ASU 2016-18. Zendesk Shareholder Letter Q4 2018 - 32

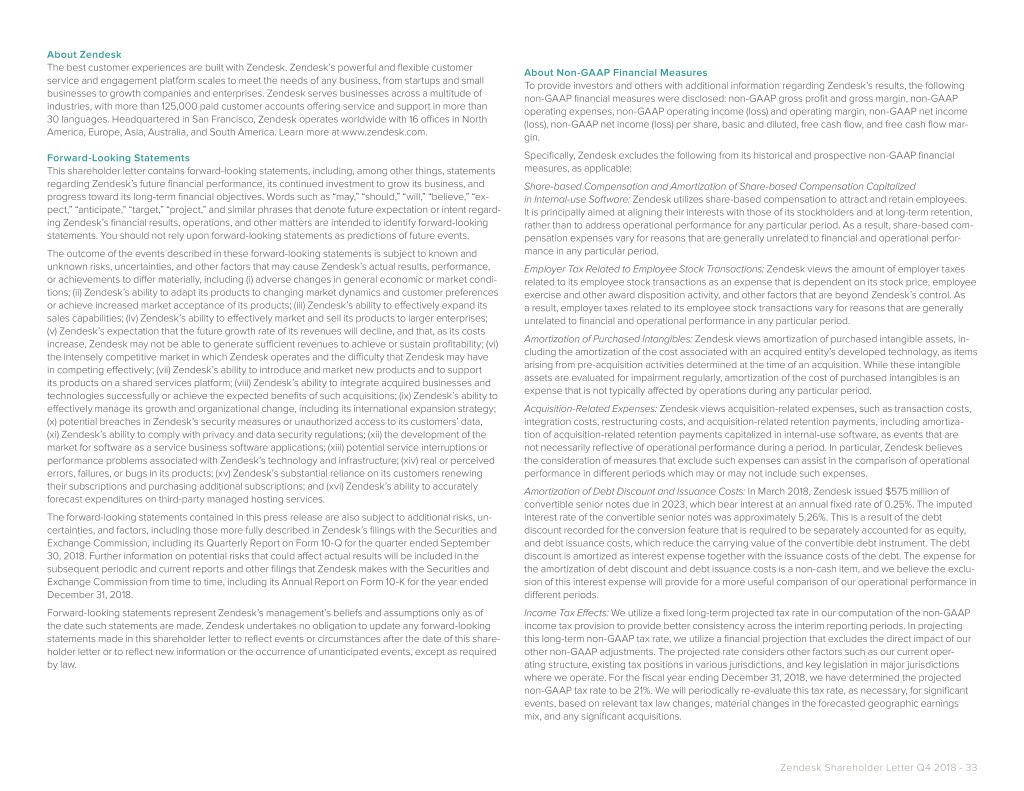

About Zendesk The best customer experiences are built with Zendesk. Zendesk’s powerful and flexible customer About Non-GAAP Financial Measures service and engagement platform scales to meet the needs of any business, from startups and small To provide investors and others with additional information regarding Zendesk’s results, the following businesses to growth companies and enterprises. Zendesk serves businesses across a multitude of non-GAAP financial measures were disclosed: non-GAAP gross profit and gross margin, non-GAAP industries, with more than 125,000 paid customer accounts offering service and support in more than operating expenses, non-GAAP operating income (loss) and operating margin, non-GAAP net income 30 languages. Headquartered in San Francisco, Zendesk operates worldwide with 16 offices in North (loss), non-GAAP net income (loss) per share, basic and diluted, free cash flow, and free cash flow mar- America, Europe, Asia, Australia, and South America. Learn more at www.zendesk.com. gin. Forward-Looking Statements Specifically, Zendesk excludes the following from its historical and prospective non-GAAP financial This shareholder letter contains forward-looking statements, including, among other things, statements measures, as applicable: regarding Zendesk’s future financial performance, its continued investment to grow its business, and Share-based Compensation and Amortization of Share-based Compensation Capitalized progress toward its long-term financial objectives. Words such as “may,” “should,” “will,” “believe,” “ex- in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain employees. pect,” “anticipate,” “target,” “project,” and similar phrases that denote future expectation or intent regard- It is principally aimed at aligning their interests with those of its stockholders and at long-term retention, ing Zendesk’s financial results, operations, and other matters are intended to identify forward-looking rather than to address operational performance for any particular period. As a result, share-based com- statements. You should not rely upon forward-looking statements as predictions of future events. pensation expenses vary for reasons that are generally unrelated to financial and operational perfor- The outcome of the events described in these forward-looking statements is subject to known and mance in any particular period. unknown risks, uncertainties, and other factors that may cause Zendesk’s actual results, performance, Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of employer taxes or achievements to differ materially, including (i) adverse changes in general economic or market condi- related to its employee stock transactions as an expense that is dependent on its stock price, employee tions; (ii) Zendesk’s ability to adapt its products to changing market dynamics and customer preferences exercise and other award disposition activity, and other factors that are beyond Zendesk’s control. As or achieve increased market acceptance of its products; (iii) Zendesk’s ability to effectively expand its a result, employer taxes related to its employee stock transactions vary for reasons that are generally sales capabilities; (iv) Zendesk’s ability to effectively market and sell its products to larger enterprises; unrelated to financial and operational performance in any particular period. (v) Zendesk’s expectation that the future growth rate of its revenues will decline, and that, as its costs Amortization of Purchased Intangibles: increase, Zendesk may not be able to generate sufficient revenues to achieve or sustain profitability; (vi) Zendesk views amortization of purchased intangible assets, in- the intensely competitive market in which Zendesk operates and the difficulty that Zendesk may have cluding the amortization of the cost associated with an acquired entity’s developed technology, as items in competing effectively; (vii) Zendesk’s ability to introduce and market new products and to support arising from pre-acquisition activities determined at the time of an acquisition. While these intangible its products on a shared services platform; (viii) Zendesk’s ability to integrate acquired businesses and assets are evaluated for impairment regularly, amortization of the cost of purchased intangibles is an technologies successfully or achieve the expected benefits of such acquisitions; (ix) Zendesk’s ability to expense that is not typically affected by operations during any particular period. effectively manage its growth and organizational change, including its international expansion strategy; Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transaction costs, (x) potential breaches in Zendesk’s security measures or unauthorized access to its customers’ data, integration costs, restructuring costs, and acquisition-related retention payments, including amortiza- (xi) Zendesk’s ability to comply with privacy and data security regulations; (xii) the development of the tion of acquisition-related retention payments capitalized in internal-use software, as events that are market for software as a service business software applications; (xiii) potential service interruptions or not necessarily reflective of operational performance during a period. In particular, Zendesk believes performance problems associated with Zendesk’s technology and infrastructure; (xiv) real or perceived the consideration of measures that exclude such expenses can assist in the comparison of operational errors, failures, or bugs in its products; (xv) Zendesk’s substantial reliance on its customers renewing performance in different periods which may or may not include such expenses. their subscriptions and purchasing additional subscriptions; and (xvi) Zendesk’s ability to accurately Amortization of Debt Discount and Issuance Costs: In March 2018, Zendesk issued $575 million of forecast expenditures on third-party managed hosting services. convertible senior notes due in 2023, which bear interest at an annual fixed rate of 0.25%. The imputed The forward-looking statements contained in this press release are also subject to additional risks, un- interest rate of the convertible senior notes was approximately 5.26%. This is a result of the debt certainties, and factors, including those more fully described in Zendesk’s filings with the Securities and discount recorded for the conversion feature that is required to be separately accounted for as equity, Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter ended September and debt issuance costs, which reduce the carrying value of the convertible debt instrument. The debt 30, 2018. Further information on potential risks that could affect actual results will be included in the discount is amortized as interest expense together with the issuance costs of the debt. The expense for subsequent periodic and current reports and other filings that Zendesk makes with the Securities and the amortization of debt discount and debt issuance costs is a non-cash item, and we believe the exclu- Exchange Commission from time to time, including its Annual Report on Form 10-K for the year ended sion of this interest expense will provide for a more useful comparison of our operational performance in December 31, 2018. different periods. Forward-looking statements represent Zendesk’s management’s beliefs and assumptions only as of Income Tax Effects: We utilize a fixed long-term projected tax rate in our computation of the non-GAAP the date such statements are made. Zendesk undertakes no obligation to update any forward-looking income tax provision to provide better consistency across the interim reporting periods. In projecting statements made in this shareholder letter to reflect events or circumstances after the date of this share- this long-term non-GAAP tax rate, we utilize a financial projection that excludes the direct impact of our holder letter or to reflect new information or the occurrence of unanticipated events, except as required other non-GAAP adjustments. The projected rate considers other factors such as our current oper- by law. ating structure, existing tax positions in various jurisdictions, and key legislation in major jurisdictions where we operate. For the fiscal year ending December 31, 2018, we have determined the projected non-GAAP tax rate to be 21%. We will periodically re-evaluate this tax rate, as necessary, for significant events, based on relevant tax law changes, material changes in the forecasted geographic earnings mix, and any significant acquisitions. Zendesk Shareholder Letter Q4 2018 - 33

Zendesk uses such a non-GAAP financial measure in a forward-looking manner for future periods, and Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from operating a reconciliation is not determinable without unreasonable effort, Zendesk provides the reconciling infor- activities, less purchases of property and equipment and internal-use software development costs. mation that is determinable without unreasonable effort and identifies the information that would need Free cash flow margin is calculated as free cash flow as a percentage of total revenue. Zendesk uses to be added or subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP free cash flow, free cash flow margin, and other measures, to evaluate the ability of its operations to measure. Investors are encouraged to review the related GAAP financial measures and the reconcilia- generate cash that is available for purposes other than capital expenditures and capitalized software tion of these non-GAAP financial measures to their most directly comparable GAAP financial measure as development costs. Zendesk believes that information regarding free cash flow and free cash flow mar- detailed above. gin provides investors with an important perspective on the cash available to fund ongoing operations. Non-GAAP gross margin for the third quarter of 2018 excludes $4.5 million in share-based compensa- Zendesk has not reconciled free cash flow guidance to net cash from operating activities for the year tion and related expenses (including $0.4 million of amortization of share-based compensation capital- ending December 31, 2019 because Zendesk does not provide guidance on the reconciling items ized in internal-use software and $0.2 million of employer tax related to employee stock transactions), between net cash from operating activities and free cash flow, as a result of the uncertainty regarding, and $0.9 million of amortization of purchased intangibles. Non-GAAP operating loss and non-GAAP and the potential variability of, these items. The actual amount of such reconciling items will have a sig- operating margin for the third quarter of 2018 exclude $33.6 million in share-based compensation and nificant impact on Zendesk’s free cash flow and, accordingly, a reconciliation of net cash from operating related expenses (including $1.8 million of employer tax related to employee stock transactions and $0.4 activities to free cash flow for the year ending December 31, 2019 is not available without unreasonable million of amortization of share-based compensation capitalized in internal-use software), $3.3 million of effort. acquisition-related expenses, and $1.2 million of amortization of purchased intangibles. Free cash flow for the third quarter of 2018 includes cash used for purchases of property and equipment of $7.1 million Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to GAAP and internal-use software development costs of $1.4 million. operating margin for future periods beyond the current fiscal year because Zendesk does not provide guidance on the reconciling items between GAAP operating margin and non-GAAP operating margin About Operating Metrics for such periods, as a result of the uncertainty regarding, and the potential variability of, these items. The Zendesk reviews a number of operating metrics to evaluate its business, measure performance, identify actual amount of such reconciling items will have a significant impact on Zendesk’s non-GAAP operat- trends, formulate business plans, and make strategic decisions. These include the number of paid cus- ing margin and, accordingly, a reconciliation of GAAP operating margin to non-GAAP operating margin tomer accounts on Zendesk Support, Zendesk Chat, and its other products, dollar-based net expansion guidance for such periods is not available without unreasonable effort. rate, monthly recurring revenue represented by its churned customers, and the percentage of its month- ly recurring revenue from Support originating from customers with 100 or more agents on Support. Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include adjustments to its expectations for its GAAP gross margin that exclude share-based compensation and related Zendesk defines the number of paid customer accounts at the end of any particular period as the sum expenses in Zendesk’s cost of revenue, amortization of purchased intangibles primarily related to of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free trials, or other free developed technology, and acquisition-related expenses. The share-based compensation and related services, (ii) the number of accounts using Chat, exclusive of free trials or other free services, and (iii) the expenses excluded due to such adjustments are primarily comprised of the share-based compensation number of accounts on all of its other products, exclusive of free trials and other free services, each as and related expenses for employees associated with Zendesk’s infrastructure and customer experience of the end of the period and as identified by a unique account identifier. In the quarter ended June 30, organization. 2018, Zendesk began to offer an omnichannel subscription which provides access to multiple products through a single paid customer account, Zendesk Suite. All of the Suite paid customer accounts are in- Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP gross mar- cluded in the number of accounts on all of Zendesk’s other products and are not included in the number gin for future periods because Zendesk does not provide guidance on the reconciling items between of paid customer accounts using Support or Chat. Existing customers may also expand their utilization GAAP gross margin and non-GAAP gross margin, as a result of the uncertainty regarding, and the of Zendesk’s products by adding new accounts and a single consolidated organization or customer may potential variability of, these items. The actual amount of such reconciling items will have a significant have multiple accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or impact on Zendesk’s non-GAAP gross margin and, accordingly, a reconciliation of GAAP gross margin work processes. Other than usage of Zendesk’s products through its omnichannel subscription offering, to non-GAAP gross margin guidance for the period is not available without unreasonable effort. each of these accounts is also treated as a separate paid customer account. Zendesk does not currently Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for internal plan- include accounts on its sales force automation product, Sell, in its determination of the number of paid ning and forecasting purposes. Zendesk’s management does not itself, nor does it suggest that inves- customer accounts. tors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase revenue information prepared in accordance with GAAP. Zendesk presents such non-GAAP financial measures across its existing customer base through expansion of authorized agents associated with a paid in reporting its financial results to provide investors with an additional tool to evaluate Zendesk’s oper- customer account, upgrades in subscription plans, and the purchase of additional products as offset by ating results. Zendesk believes these non-GAAP financial measures are useful because they allow for churn, contraction in authorized agents associated with a paid customer account, and downgrades in greater transparency with respect to key metrics used by management in its financial and operational subscription plans. Zendesk’s dollar-based net expansion rate is based upon monthly recurring revenue decision-making. This allows investors and others to better understand and evaluate Zendesk’s operat- for a set of paid customer accounts on its products. Monthly recurring revenue for a paid customer ing results and future prospects in the same manner as management. account is a legal and contractual determination made by assessing the contractual terms of each paid Zendesk’s management believes it is useful for itself and investors to review, as applicable, both GAAP customer account, as of the date of determination, as to the revenue Zendesk expects to generate information that may include items such as share-based compensation and related expenses, amortiza- in the next monthly period for that paid customer account, assuming no changes to the subscription tion of debt discount and issuance costs, amortization of purchased intangibles, and acquisition-related and without taking into account any platform usage above the subscription base, if any, that may be expenses, and the non-GAAP measures that exclude such information in order to assess the perfor- applicable to such subscription. Monthly recurring revenue is not determined by reference to historical mance of Zendesk’s business and for planning and forecasting in subsequent periods. When Zendesk revenue, deferred revenue, or any other GAAP financial measure over any period. It is forward-looking uses such a non-GAAP financial measure with respect to historical periods, it provides a reconciliation and contractually derived as of the date of determination. of the non-GAAP financial measure to the most closely comparable GAAP financial measure. When Zendesk Shareholder Letter Q4 2018 - 34

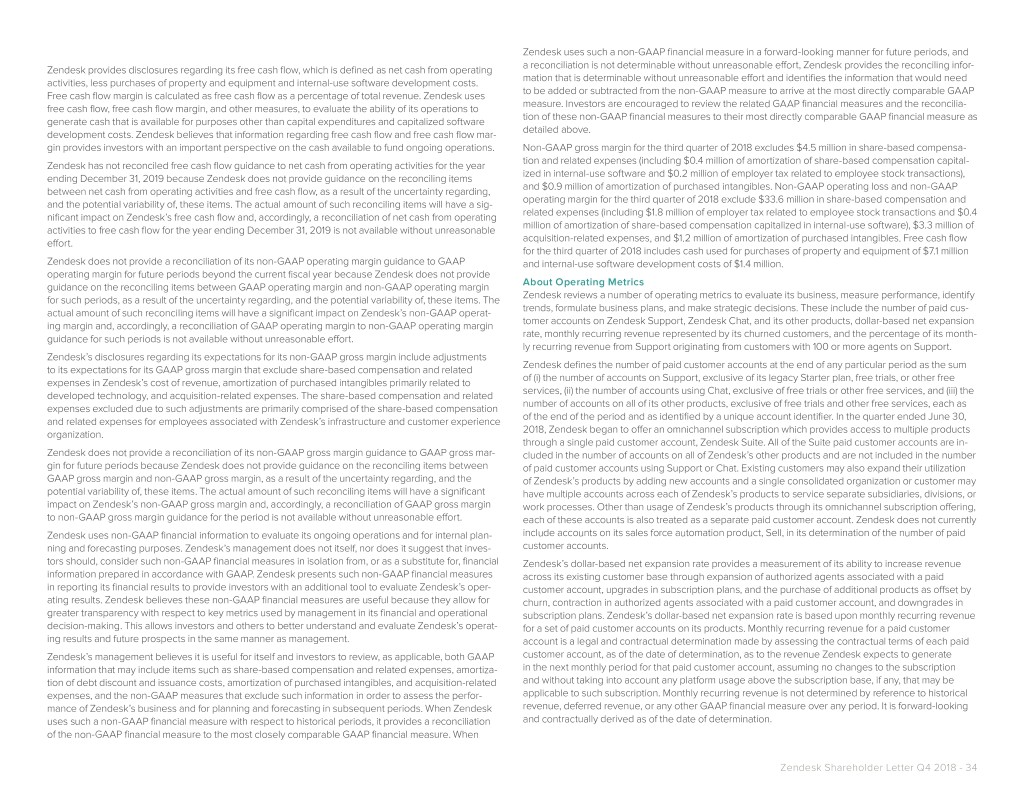

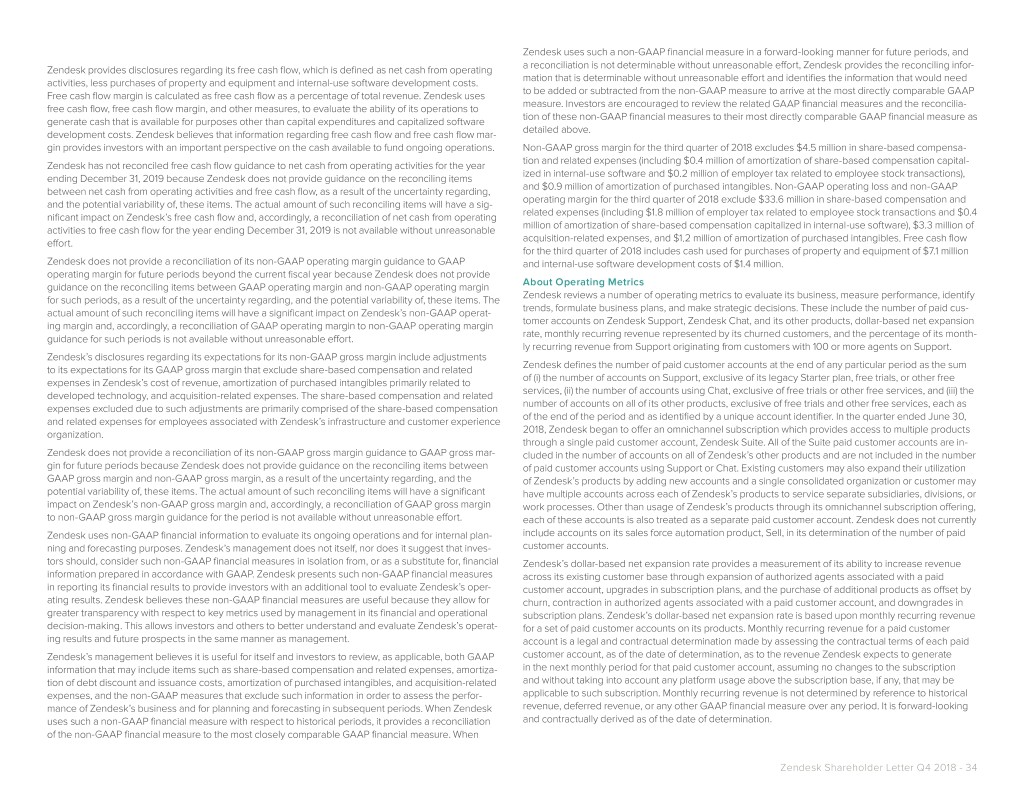

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net of contrac- Customer Metrics tion and churn by Zendesk’s base revenue. Zendesk defines its base revenue as the aggregate month- ly recurring revenue across its products for customers with paid customer accounts as of the date one December 31, March 31, June 30, September 30, December 31, year prior to the date of calculation. Zendesk defines the retained revenue net of contraction and churn 2017 2018 2018 2018 2018 as the aggregate monthly recurring revenue across its products for the same customer base included in Paid customer accounts on the measure of base revenue at the end of the annual period being measured. The dollar-based net ex- Zendesk Support (approx.) 64,100 67,800 70,500 72,100 73,600 pansion rate is also adjusted to eliminate the effect of certain activities that Zendesk identifies involving + Paid customer accounts on 47,000 47,700 47,600 46,800 46,100 the consolidation of customer accounts or the split of a single paid customer account into multiple paid Zendesk Chat (approx.) customer accounts. In addition, the dollar-based net expansion rate is adjusted to include paid custom- + Paid customer accounts on 7,800 10,000 12,200 14,800 16,900 er accounts in the customer base used to determine retained revenue net of contraction and churn that other Zendesk products (approx.) share common corporate information with customers in the customer base that are used to determine = Approximate number of the base revenue. Giving effect to this consolidation results in Zendesk’s dollar-based net expansion paid customer accounts 118,900 125,500 130,300 133,700 136,600 rate being calculated across approximately 100,400 customers, as compared to the approximately 136,600 total paid customer accounts as of December 31, 2018. Note: The paid customer accounts metric does not currently include in its determination customer accounts for Sell To the extent that Zendesk can determine that the underlying customers do not share common cor- porate information, Zendesk does not aggregate paid customer accounts associated with reseller and Geographic Information other similar channel arrangements for the purposes of determining its dollar-based net expansion rate. While not material, Zendesk believes the failure to account for these activities would otherwise skew Revenue by geography: the dollar-based net expansion metrics associated with customers that maintain multiple paid customer Q4’18 FY’18 accounts across its products and paid customer accounts associated with reseller and other similar channel arrangements. United States 52.1% 51.8% Zendesk does not currently incorporate operating metrics associated with its legacy analytics product, EMEA 28.6% 29.2% its legacy Outbound product, Sell, its legacy Starter plan, free trials, or other free services into its mea- APAC 11.6% 11.4% surement of dollar-based net expansion rate. Other 7.7% 7.6% For a more detailed description of how Zendesk calculates its dollar-based net expansion rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange Commission. Zendesk’s percentage of monthly recurring revenue from Support that is generated by customers with Source: Zendesk, Inc. 100 or more agents on Support is determined by dividing the monthly recurring revenue from Support Contact: for paid customer accounts with 100 or more agents on Support as of the measurement date by the monthly recurring revenue from Support for all paid customer accounts on Support as of the measure- Investor Contact Media Contact ment date. Zendesk determines the customers with 100 or more agents on Support as of the measure- ment date based on the number of activated agents on Support at the measurement date and includes Marc Cabi, +1 415-852-3877 Tian Lee, +1 415-231-0847 adjustments to aggregate paid customer accounts that share common corporate information. For the press@zendesk.com purpose of determining this metric, Zendesk builds an estimation of the proportion of monthly recurring ir@zendesk.com revenue from Suite attributable to Support and includes such portion in the monthly recurring revenue from Support. Zendesk does not currently incorporate operating metrics associated with products other than Support into its measurement of the percentage of monthly recurring revenue from Support that is generated by customers with 100 or more agents on Support. Zendesk determines the annualized value of a contract by annualizing the monthly recurring revenue for such contract. Zendesk does not currently incorporate operating metrics associated with products other than Support into its measurement of the percentage of monthly recurring revenue from Support that is generated by customers with 100 or more agents on Support. Zendesk Shareholder Letter Q4 2018 - 35