Zendesk Shareholder Letter Q1 2019 - 1

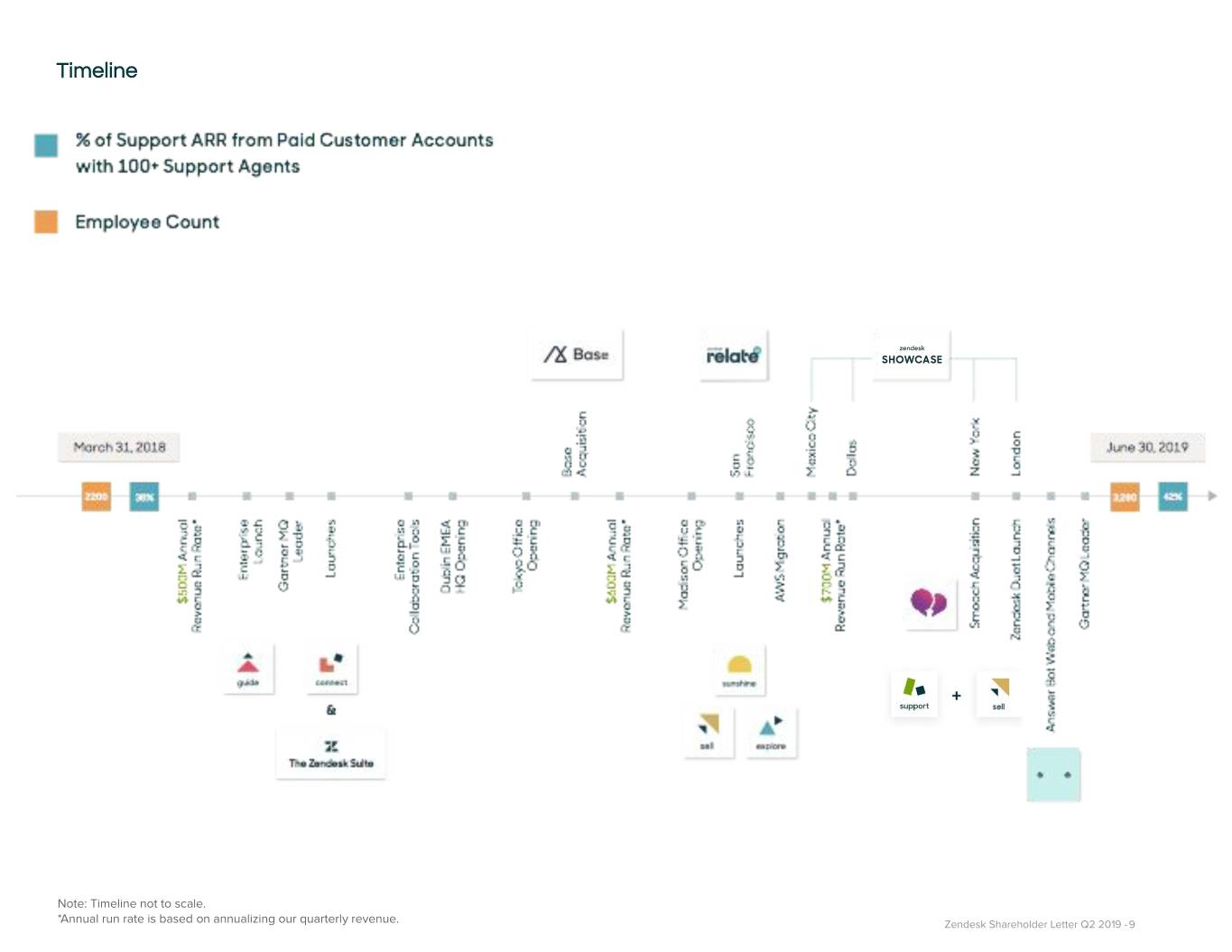

Introduction $194.6M We continued to see strong demand for our family of products in the second quarter of 2019, as Q2 2019 revenue companies around the world seek to transform their businesses by adopting modern software and applications to better serve their customers. Our 37% revenue in the second quarter of 2019 grew by 37% versus the prior year period, driven by the Q2 2019 Y/Y revenue growth growing appeal of our software that serves companies ranging from high-growth startups and small businesses to midsized and large analytics tool. We quickly followed those Mikkel Svane, CEO enterprises. More than 145,000 paid customer milestones in the second quarter with our accounts, across more than 160 countries, have acquisition of Smooch Technologies Holdings chosen Zendesk to help them provide the best ULC, the company behind Smooch and its conversations platform, to expand our customer experiences. conversational messaging efforts. We also In the second quarter, we delivered revenue of introduced our first combined offering for sales $194.6 million. We maintained the health of our and customer service called Zendesk Duet and SMB business and saw continued strong demand expanded Answer Bot to new channels. for The Zendesk Suite, while simultaneously advancing upmarket with enterprise customers. We are focused now on investing in advancing During the quarter, the percentage of our annual features and tightening integration of these new Elena Gomez, CFO recurring revenue from customers with 100 or products and our platform and further building our more Zendesk Support agents advanced to 42% go-to-market efforts around them. We will versus 38% a year ago. Our dollar-based net demonstrate how all of these investments in our expansion rate remained healthy at 117%. family of products and our Sunshine platform come together to enable organizations to deliver For the past year, we have been rapidly the most seamless, holistic customer experience introducing new product innovation and packages at our Relate conference. With our investments, that we believe set us up for future sustained we will be able to expand our capabilities and growth and entry into new markets. At our annual reach more broadly into the CRM space. We Zendesk Relate user conference last November, believe we are in a strong position to build our we introduced Zendesk Sunshine, our open and company and lead CRM innovation to become a flexible CRM platform; Zendesk Sell, our entry into multibillion-dollar revenue company that continues sales software; and Zendesk Explore, our data to deliver durable growth and scale. Marc Cabi, Strategy & IR Zendesk Shareholder Letter Q2 2019 - 2

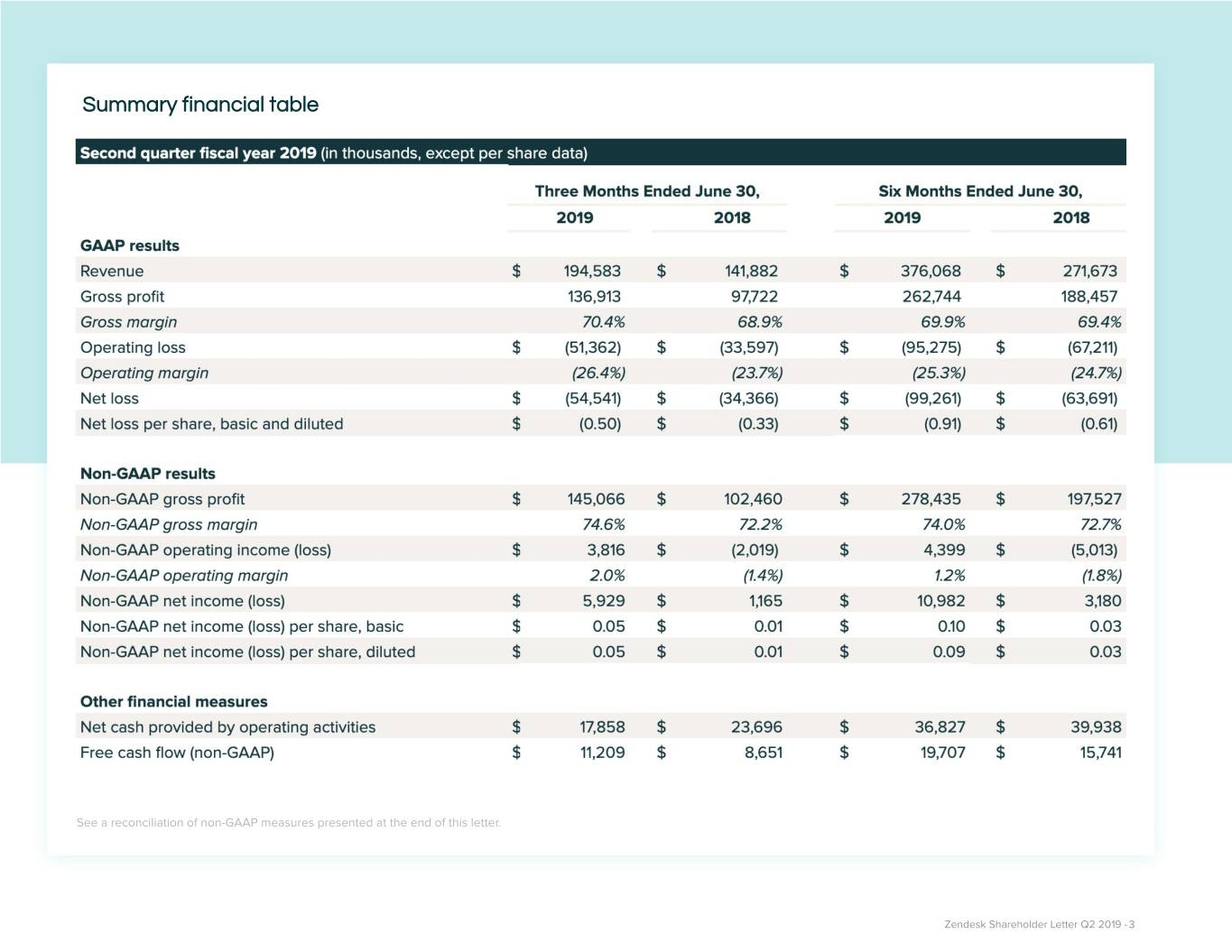

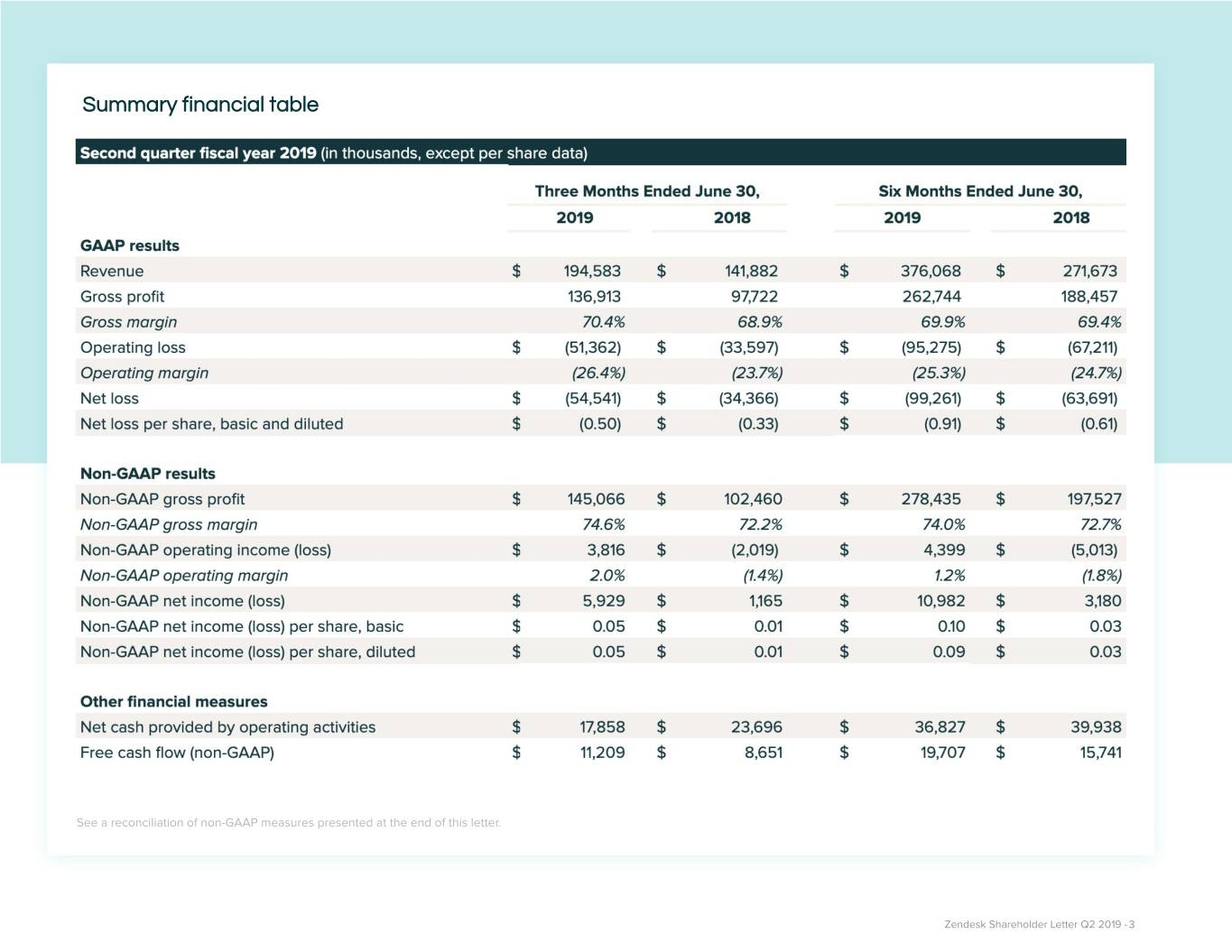

Summary financial table See a reconciliation of non-GAAP measures presented at the end of this letter. Zendesk Shareholder Letter Q2 2019 - 3

Investing for growth Our investments in the past year in introducing transformative products Our messaging investments are focused on two key areas: 1) seamlessly and a new CRM platform have extended our capabilities and reach integrating all the major social channels and web and mobile messaging beyond support to serve the broader customer journey. We will continue channels into our family of products and 2) enabling messaging to make big investments as we mature and more tightly integrate our new solutions more broadly for brands and partners through the products and platform, and as we develop new packaging, bundles, and conversations platform powered by Smooch. Our conversation solutions go-to-market initiatives to make purchasing and implementing our team is discovering and building for use cases to serve the unique ways solutions even easier for organizations. We are focused on product and that modern businesses—such as multi-sided marketplaces—serve all platform investments as follows. their stakeholders. Power every customer-facing conversation for our customers Our investments in messaging will enable organizations to connect with their customers through popular social messaging apps or web and The Zendesk Suite has demonstrated early success with a bundled mobile messaging solutions as a part of omnichannel conversations omnichannel solution. With The Suite, companies can quickly and easily integrated with Zendesk Support. For example, we have been implement an omnichannel experience in which all support agents can advancing our support of WhatsApp across channels since our Smooch interact with customers seamlessly across email, chat, voice, and acquisition. Additionally, we envision organizations using Zendesk to self-service help options. We believe the acquisition of Smooch centrally manage private messaging conversations with customers on represents our next step in delivering a more holistic omnichannel their websites and mobile apps. experience by connecting conversations between businesses and customers on any messaging channel—from websites and mobile apps to We also plan to invest in the conversations platform powered by leading messaging apps. Smooch. Our long-term vision for this platform is to enable conversations beyond only agents and customers. As an example, Mobile messaging has become a leading form of communication, with marketplace businesses might use our platform to power direct more than 2 billion consumers using mobile messaging apps. Customers conversations between buyers and sellers, and allow escalation to a expect the convenience and interactivity of messaging to be a part of their customer service representative from the marketplace. We believe there experience when communicating with businesses, just as it is in their are many opportunities and are investing in a conversation solutions personal interactions. The best customer experiences will be driven by team to support businesses seeking to leverage Smooch’s best-in-class the ability to create seamless, continuous conversations between conversations platform to craft personalized messaging experiences. customers and organizations across multiple communication channels, including messaging. Zendesk Shareholder Letter Q2 2019 - 4

Extending our footprint in support and beyond Last November we introduced Zendesk Sell, extending our capabilities beyond support into salesforce automation software. Zendesk Sell expanded our reach into the broader CRM market and fits with our long-term product strategy to cover the customer experience from sales to support to proactive outreach and engagement. The combination of Zendesk Sell and Zendesk Support provides support agents with additional context gathered in the sales process and allows support agents to notify sales of opportunities that surface during a support conversation. The launch of Zendesk Duet in June brought Zendesk Sell’s sales automation and Zendesk Support’s ticketing capabilities together into a single package. Designed specially to provide a holistic view of customers for both support agents and sales representatives, each team can easily access the other team’s tools to tie customer conversations together and gain more complete Nubank insight into the entire customer journey—from pre-sales through post-sales. Duet is our first step in bundling products across CRM functions. We are Brazilian financial technology company Nubank continuing to mature Sell’s features and develop more robust capabilities. launched in 2013 with its mobile-first banking and credit card services that challenged traditional To extend our reach in support, we are developing tools to help foster financial institutions. Today, Nubank is one of the collaboration across organizations. For instance, we recently launched side fastest-growing companies in Latin America, conversations with Slack in Zendesk Support. It enables customer service expanding from two million customers to more than teams to collaborate and communicate with anyone in their company, such as ten million over the last two years. The company’s a sales representative, by messaging on Slack directly from Zendesk Support. growth is fueled by word of mouth—more than 80 percent of new customers are referrals from existing We also continue to invest in and advance Zendesk Explore, our data users. Nubank started using Zendesk Support in analytics tool, to help businesses build and scale personal, connected 2014 as an email ticketing system and subsequently experiences for their customers. Integrated with our products, Explore makes it easier for companies to see and analyze data across all support channels added more functionality as the company grew. The with a vision of a single view of customer analytics across teams and Zendesk API connects different systems to give channels, so companies can focus on measuring and improving the customer agents a better view of customers and what they experience they deliver. need, reducing response times and allowing Nubank to be truly customer-centric. Zendesk Shareholder Letter Q2 2019 - 5

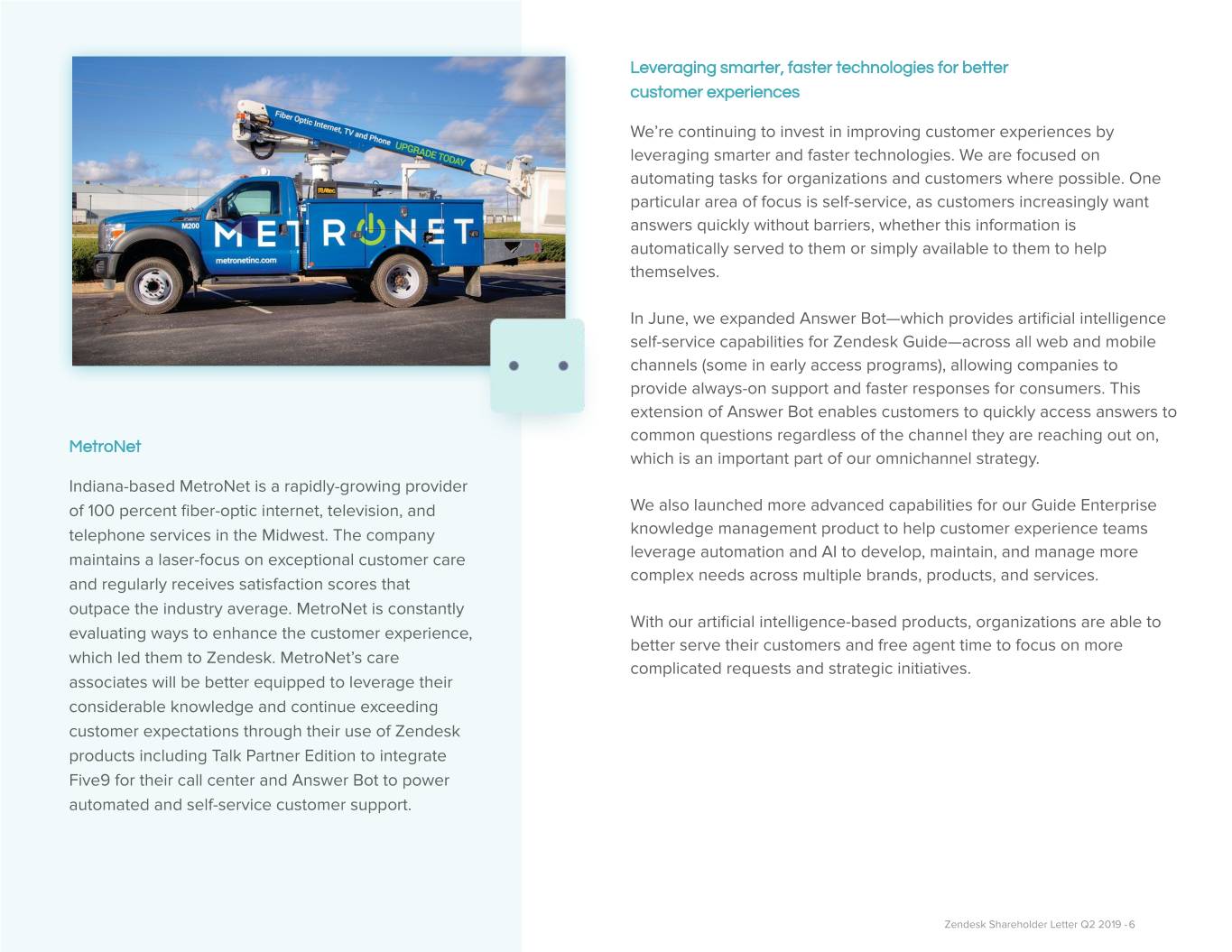

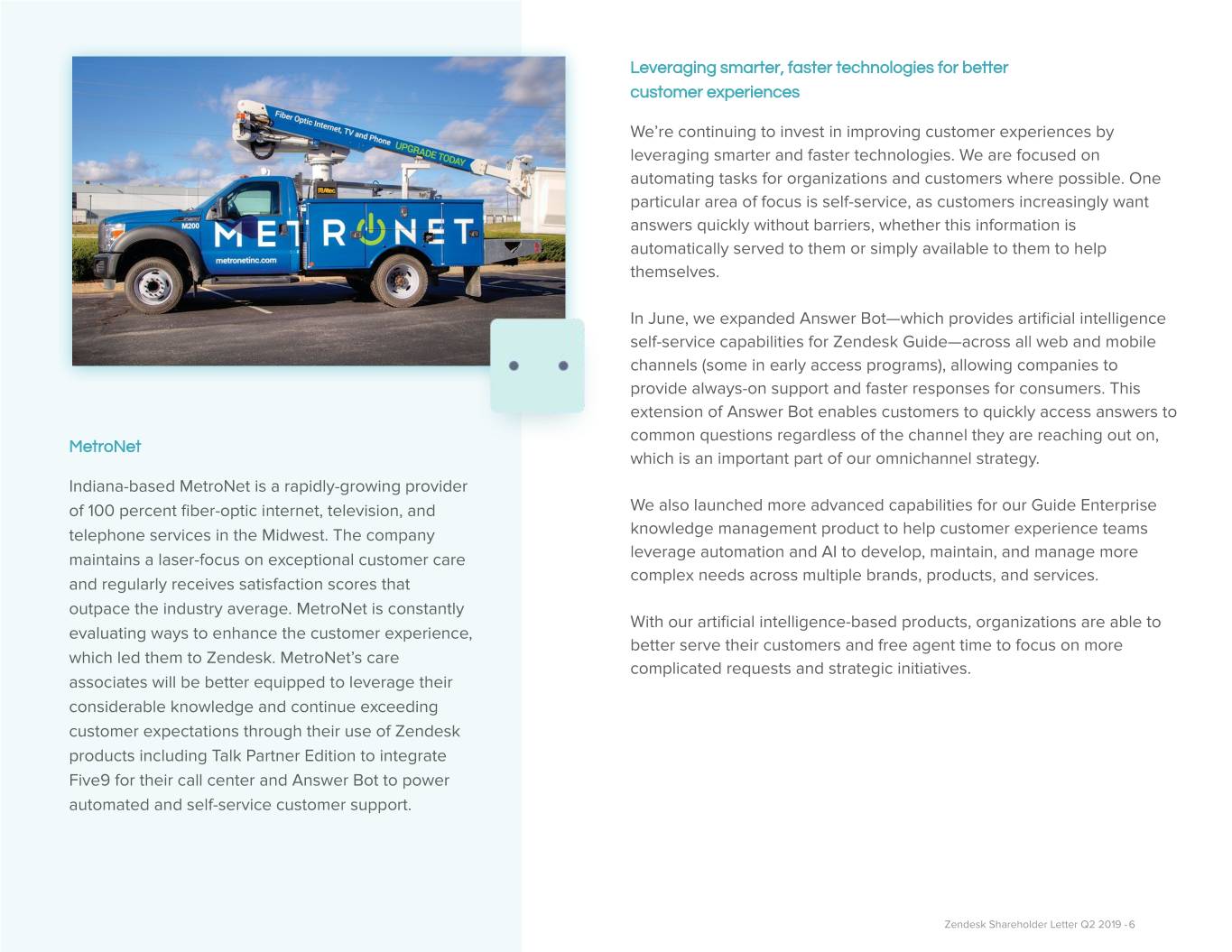

Leveraging smarter, faster technologies for better customer experiences We’re continuing to invest in improving customer experiences by leveraging smarter and faster technologies. We are focused on automating tasks for organizations and customers where possible. One particular area of focus is self-service, as customers increasingly want answers quickly without barriers, whether this information is automatically served to them or simply available to them to help themselves. In June, we expanded Answer Bot—which provides artificial intelligence self-service capabilities for Zendesk Guide—across all web and mobile channels (some in early access programs), allowing companies to provide always-on support and faster responses for consumers. This extension of Answer Bot enables customers to quickly access answers to common questions regardless of the channel they are reaching out on, MetroNet which is an important part of our omnichannel strategy. Indiana-based MetroNet is a rapidly-growing provider of 100 percent fiber-optic internet, television, and We also launched more advanced capabilities for our Guide Enterprise telephone services in the Midwest. The company knowledge management product to help customer experience teams maintains a laser-focus on exceptional customer care leverage automation and AI to develop, maintain, and manage more complex needs across multiple brands, products, and services. and regularly receives satisfaction scores that outpace the industry average. MetroNet is constantly With our artificial intelligence-based products, organizations are able to evaluating ways to enhance the customer experience, better serve their customers and free agent time to focus on more which led them to Zendesk. MetroNet’s care complicated requests and strategic initiatives. associates will be better equipped to leverage their considerable knowledge and continue exceeding customer expectations through their use of Zendesk products including Talk Partner Edition to integrate Five9 for their call center and Answer Bot to power automated and self-service customer support. Zendesk Shareholder Letter Q2 2019 - 6

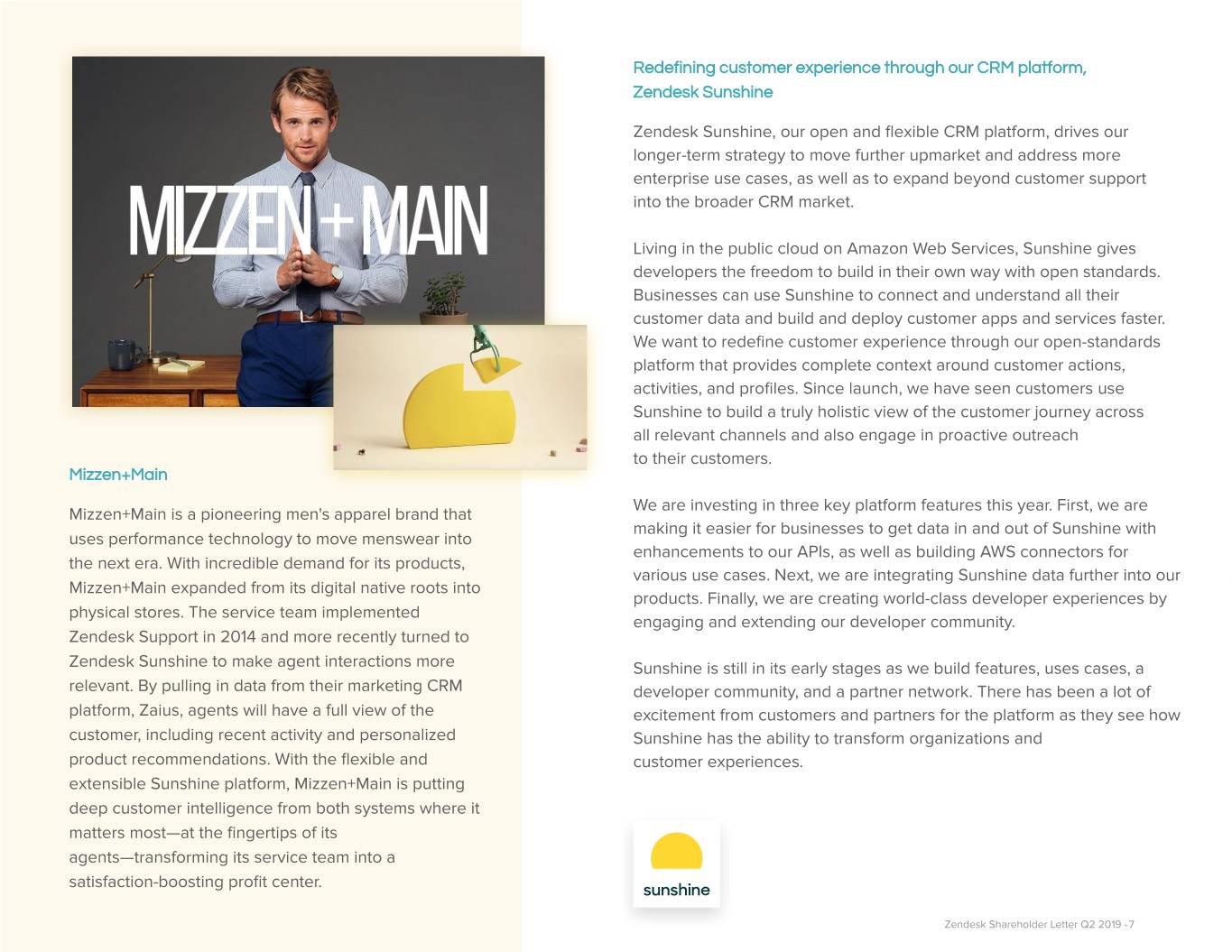

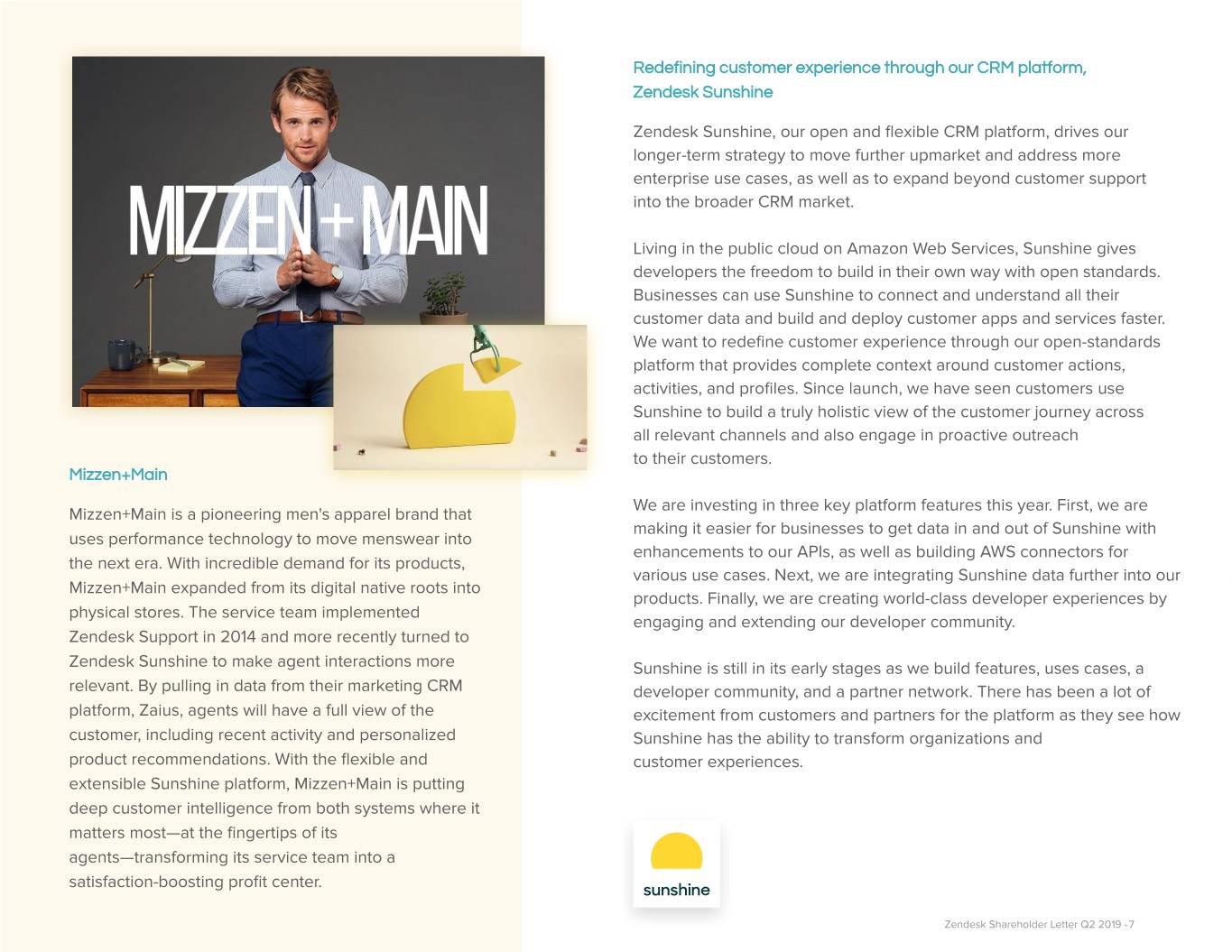

Redefining customer experience through our CRM platform, Zendesk Sunshine Zendesk Sunshine, our open and flexible CRM platform, drives our longer-term strategy to move further upmarket and address more enterprise use cases, as well as to expand beyond customer support into the broader CRM market. Living in the public cloud on Amazon Web Services, Sunshine gives developers the freedom to build in their own way with open standards. Businesses can use Sunshine to connect and understand all their customer data and build and deploy customer apps and services faster. We want to redefine customer experience through our open-standards platform that provides complete context around customer actions, activities, and profiles. Since launch, we have seen customers use Sunshine to build a truly holistic view of the customer journey across all relevant channels and also engage in proactive outreach to their customers. Mizzen+Main We are investing in three key platform features this year. First, we are Mizzen+Main is a pioneering men's apparel brand that making it easier for businesses to get data in and out of Sunshine with uses performance technology to move menswear into enhancements to our APIs, as well as building AWS connectors for the next era. With incredible demand for its products, various use cases. Next, we are integrating Sunshine data further into our Mizzen+Main expanded from its digital native roots into products. Finally, we are creating world-class developer experiences by physical stores. The service team implemented engaging and extending our developer community. Zendesk Support in 2014 and more recently turned to Zendesk Sunshine to make agent interactions more Sunshine is still in its early stages as we build features, uses cases, a relevant. By pulling in data from their marketing CRM developer community, and a partner network. There has been a lot of platform, Zaius, agents will have a full view of the excitement from customers and partners for the platform as they see how customer, including recent activity and personalized Sunshine has the ability to transform organizations and product recommendations. With the flexible and customer experiences. extensible Sunshine platform, Mizzen+Main is putting deep customer intelligence from both systems where it matters most—at the fingertips of its agents—transforming its service team into a satisfaction-boosting profit center. Zendesk Shareholder Letter Q2 2019 - 7

Zendesk Relate 2020 We will demonstrate—live and in person—how all of these investments in our family of products and our Sunshine platform come together to enable organizations to deliver seamless, holistic customer experiences at Zendesk Relate, our annual user conference. Relate is our flagship event, where we make big announcements and share with our customers how they can strategically use our products and platform to provide the best customer experiences. Relate will be held March 3-5, 2020, in Miami. At Relate, we will also host our annual investor event, where we will talk in more detail about our long-term vision and strategy to be a multibillion-dollar revenue company. Zendesk Shareholder Letter Q2 2019 - 8

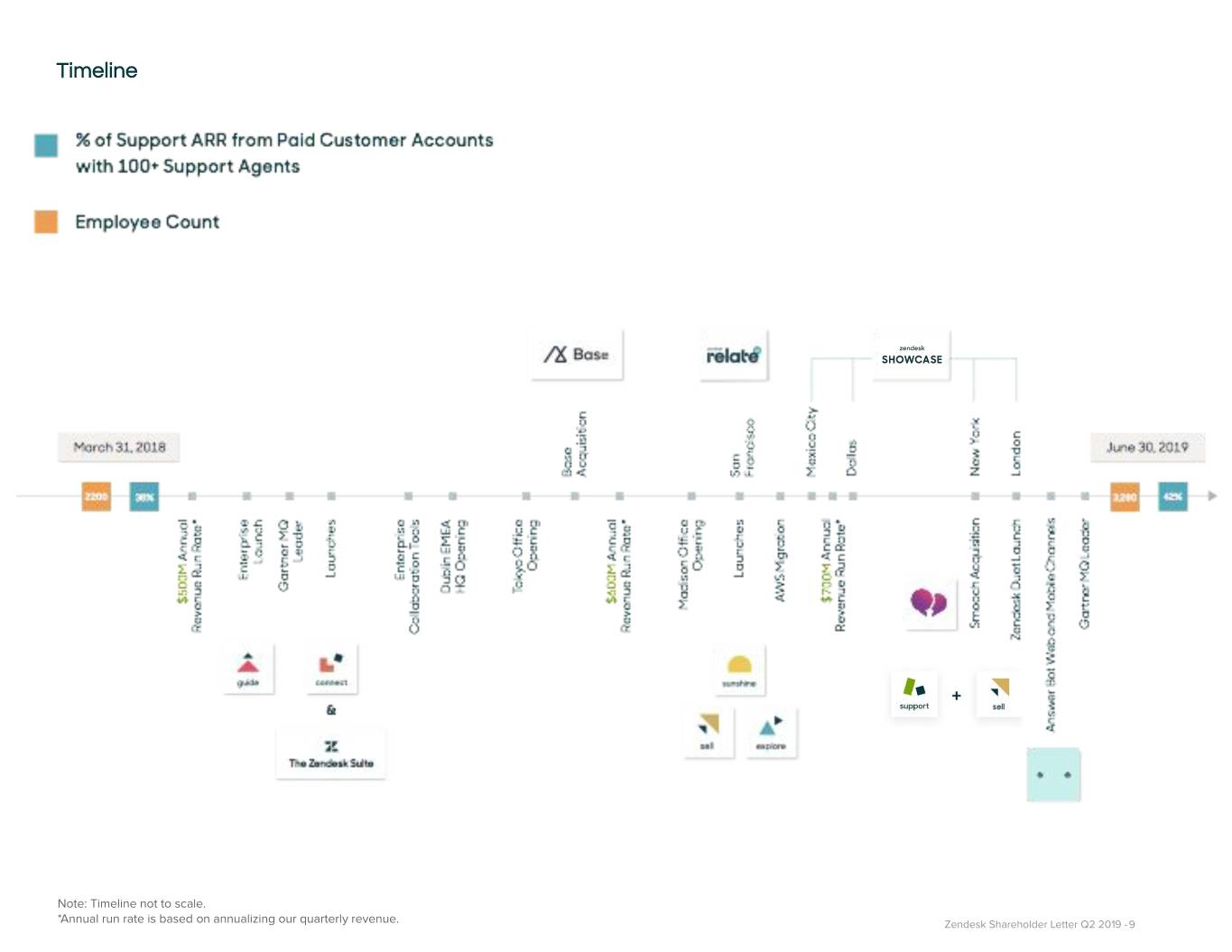

Timeline Note: Timeline not to scale. *Annual run rate is based on annualizing our quarterly revenue. Zendesk Shareholder Letter Q2 2019 - 9

Customers Among the customers to join or expand with us recently are: Alliance Laundry Systems FreshBooks A provider of commercial A Canada-based provider of laundry systems cloud accounting solutions Back Market Fullscript A France-based ecommerce A Canada-based platform for online platform for refurbished products supplement prescriptions Bonhams GMO Pepabo, Inc. A privately owned A Japan-based IT services provider international auction house Corsair Klipsch A provider of high-performance PC A global manufacturer of premium peripherals and components sound solutions Duolingo A science-based language education platform Zendesk Shareholder Letter Q2 2019 - 10

Customers Among the customers to join or expand with us recently are: Life Fitness Origami A global provider in commercial A Japanese mobile fitness equipment and game tables payment platform Ligentia PayJoy A global freight forwarder and A provider of pay-as-you-go supply chain management provider smartphone financing MetroNet The Motley Fool A U.S.-based communication A multimedia financial service provider services company Mizzen+Main Under Armour A U.S.-based clothing company that A U.S.-based athletic specializes in performance menswear wear company Nubank Weber-Stephen Products A Brazilian financial A manufacturer of charcoal, gas, and technology company electric outdoor grills and accessories Zendesk Shareholder Letter Q2 2019 - 11

We’re working our magic June 2019 Gartner Magic Quadrant for the CRM Customer Engagement Center Gartner does not endorse any vendor, product or service depicted in its research publications, and does not advise technology users to select only In June 2019, our efforts were those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and again recognized by Gartner. should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of For the fourth year in a row, merchantability or fitness for a particular purpose. Gartner Inc. named Zendesk a The Gartner Reports described herein, (the “Gartner Reports”) represent(s) research opinion or viewpoints published, as part of a syndicated subscription service, by Gartner, Inc. (“Gartner”) and are not representations of fact. Each Leader in the Magic Quadrant Gartner Report speaks as of its original publication date (and not as of the date of this Shareholder Letter), and the opinions expressed in the Gartner Reports for the CRM Customer are subject to change without notice. Engagement Center. Zendesk Shareholder Letter Q2 2019 -

Zendesk has been named a strong performer in Customer Service Solutions by Forrester Research. The Forrester Wave™: Customer Service Solutions, Q2 2019 recognizes Zendesk as being among the highest scores in the market presence category. The report also cites Zendesk’s reputation in “beautifully simple experiences,” noting that “it (Zendesk) has special appeal to digital-first companies or companies investing in their digital operations.” For the report, 12 vendors were evaluated across 33 criteria, which were grouped into three categories: current offering, strategy, and market presence. Zendesk received the highest possible score in the Market Presence category. Zendesk Shareholder Letter Q2 2019 - 13

Operating metrics A key metric we use to gauge our penetration within larger organizations is represented by the percentage of Support ARR generated by customers with 100 or more Support agents. That % of total percentage was approximately 42% at the end of quarter-ending the second quarter of 2019, compared to 40% at Support ARR the end of the first quarter of 2019 and 38% as from paid customer reported at the end of the second quarter of 2018. accounts with 100+ Support agents Our dollar-based net expansion rate, which we use to quantify our annual expansion within existing customers, was 117% at the end of the second quarter, compared to 118% at the end of the first quarter of 2019. Our dollar-based net expansion rate was 119% at the end of the second quarter of 2018. Consistent with expectations in prior quarters, we believe a healthy dollar-based net expansion rate for Zendesk is 110% - 120%. Dollar-based net expansion rate Zendesk Shareholder Letter Q2 2019 - 14

As we successfully move upmarket, we believe an indicator of our mid-market and enterprise execution is encompassed in the growth of remaining performance obligation (RPO). RPO represents future revenues that are under contract but have not yet been recognized. As we continue to move upmarket to serve enterprise customers Remaining performance and deliver more complex and strategic use cases, we obligation (RPO) have landed longer contract terms with our customers. in millions UPMARKET Zendesk Shareholder Letter Q2 2019 - 15

Social impact first half of 2019, Zendesk employees volunteered more than 10,000 hours in their local communities. We also brought on board a new Tech Social impact has long been a foundational element of Zendesk’s culture For Good manager to expand our efforts to identify and scale the way and brand. Promoting empathy to solve complex social issues is core to we use Zendesk technology to support homelessness in our our values, as we believe it is an important way for employees to communities; asylum seekers and immigrants who need access to engage with work, our customers, and our communities around the information and support; and disaster relief organizations that support globe. Our goals for social impact fall into three core areas: being a the rebuilding of people’s lives after a natural disaster. good neighbor, which focuses on the employee experience of investing in their communities by volunteering; standing up for equality, where we At Zendesk, we celebrate diversity and inclusion. As part of this, we will make key investments and strive to support and nurture diverse celebrated Pride month. We continued our tradition of participating in workplaces and communities; and democratizing technology, where we Pride festivities with nearly all of our global offices taking part in local aim to bring technology to organizations committed to social change. events. This year, we hosted 24 in-office educational and community building events, and we have already or will participate in Pride parades As part of these goals, Zendesk employees have committed to giving six or city-sponsored celebrations in San Francisco, Madison, London, hours of their time volunteering in their communities each year. In the Dublin, Montpellier, Copenhagen, São Paulo, and Melbourne. Zendesk Shareholder Letter Q2 2019 - 16

Select financial measures Quarter-over-quarter comparisons (q/q) are for the three months ended June 30, 2019, compared to the three months ended March 31, 2019. Year-over-year comparisons (y/y) are for the three months ended June 30, 2019, compared to the three months ended June 30, 2018. See a reconciliation of non-GAAP measures presented at the end of this letter. Zendesk Shareholder Letter Q2 2019 - 17

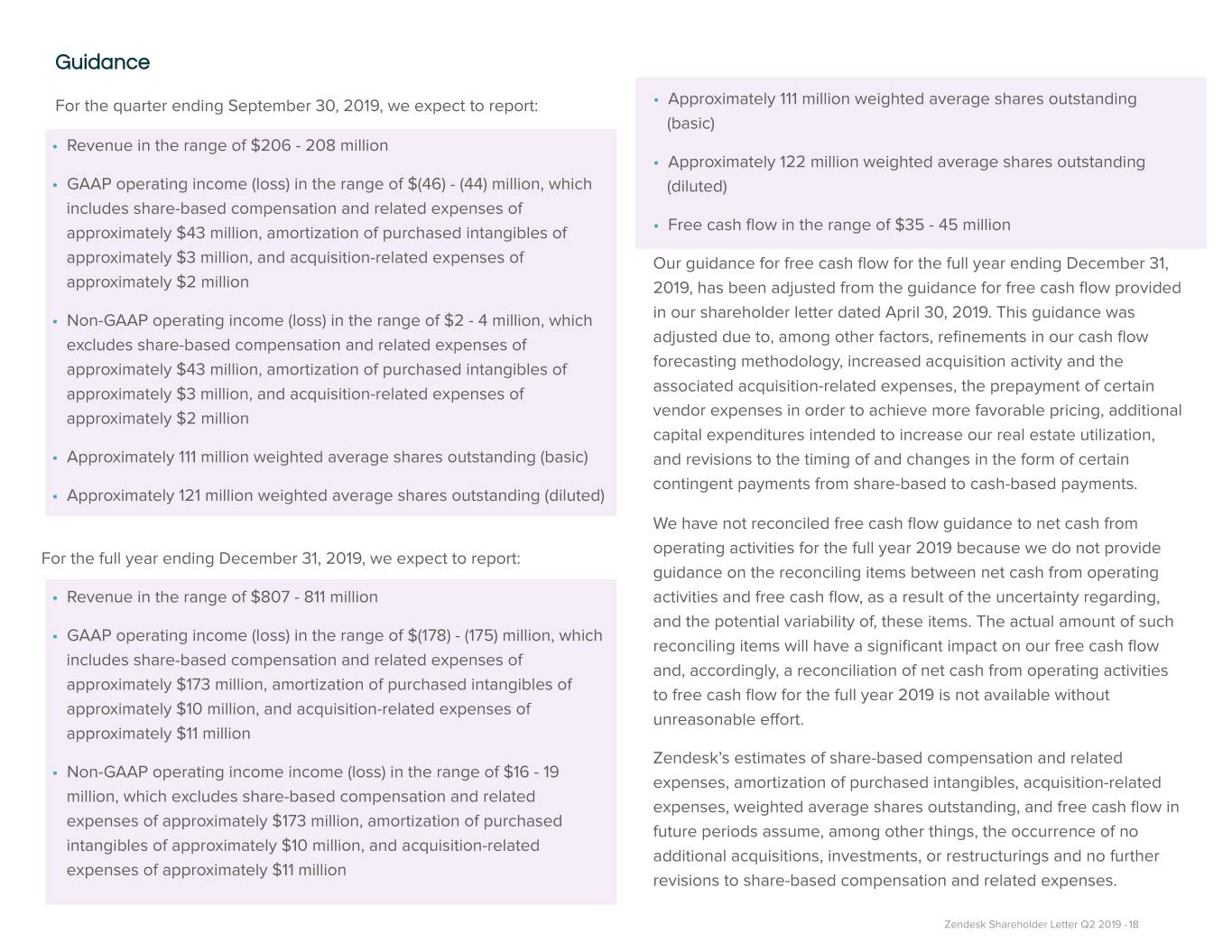

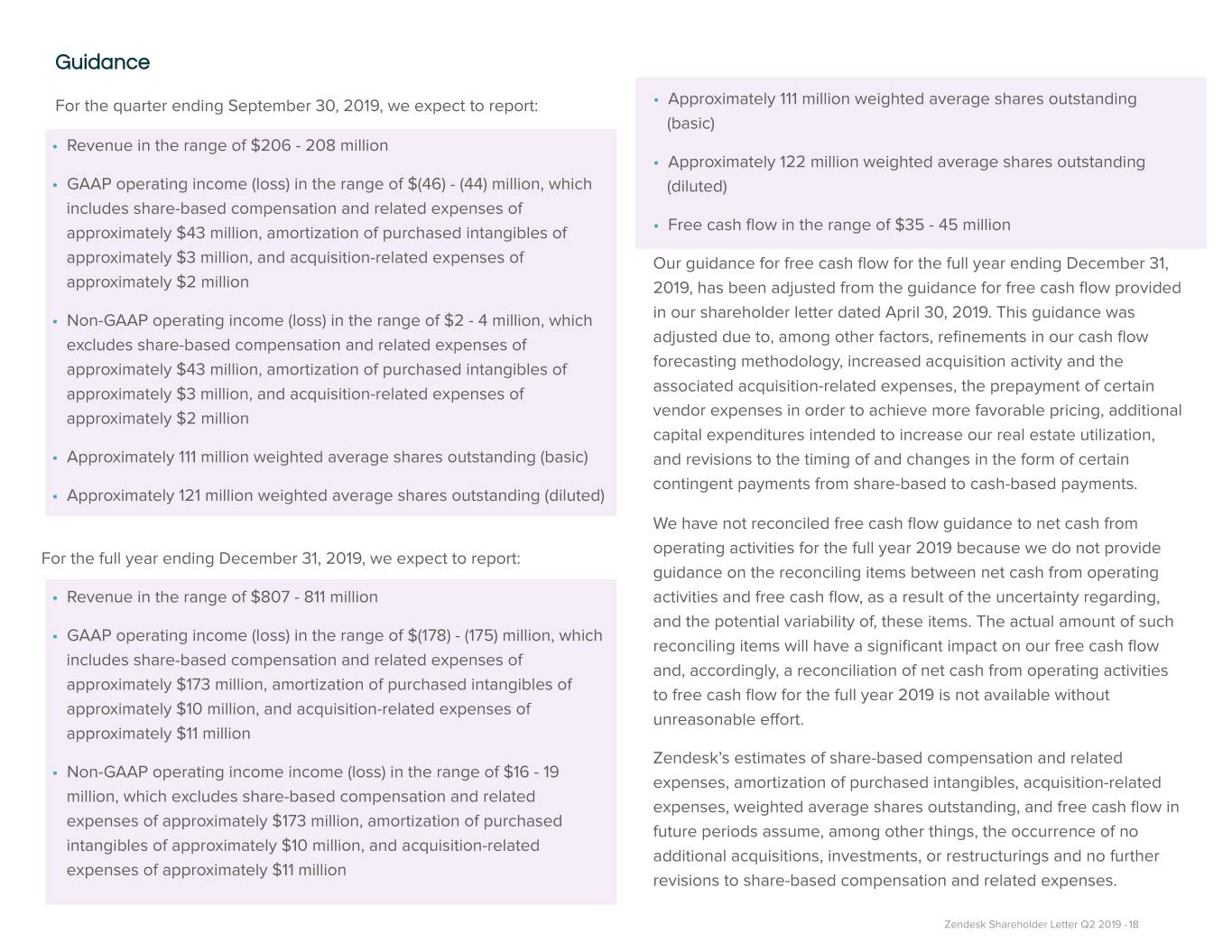

Guidance For the quarter ending September 30, 2019, we expect to report: • Approximately 111 million weighted average shares outstanding (basic) • Revenue in the range of $206 - 208 million • Approximately 122 million weighted average shares outstanding • GAAP operating income (loss) in the range of $(46) - (44) million, which (diluted) includes share-based compensation and related expenses of approximately $43 million, amortization of purchased intangibles of • Free cash flow in the range of $35 - 45 million approximately $3 million, and acquisition-related expenses of Our guidance for free cash flow for the full year ending December 31, approximately $2 million 2019, has been adjusted from the guidance for free cash flow provided in our shareholder letter dated April 30, 2019. This guidance was • Non-GAAP operating income (loss) in the range of $2 - 4 million, which excludes share-based compensation and related expenses of adjusted due to, among other factors, refinements in our cash flow approximately $43 million, amortization of purchased intangibles of forecasting methodology, increased acquisition activity and the approximately $3 million, and acquisition-related expenses of associated acquisition-related expenses, the prepayment of certain approximately $2 million vendor expenses in order to achieve more favorable pricing, additional capital expenditures intended to increase our real estate utilization, • Approximately 111 million weighted average shares outstanding (basic) and revisions to the timing of and changes in the form of certain contingent payments from share-based to cash-based payments. • Approximately 121 million weighted average shares outstanding (diluted) We have not reconciled free cash flow guidance to net cash from operating activities for the full year 2019 because we do not provide For the full year ending December 31, 2019, we expect to report: guidance on the reconciling items between net cash from operating • Revenue in the range of $807 - 811 million activities and free cash flow, as a result of the uncertainty regarding, and the potential variability of, these items. The actual amount of such • GAAP operating income (loss) in the range of $(178) - (175) million, which reconciling items will have a significant impact on our free cash flow includes share-based compensation and related expenses of and, accordingly, a reconciliation of net cash from operating activities approximately $173 million, amortization of purchased intangibles of to free cash flow for the full year 2019 is not available without approximately $10 million, and acquisition-related expenses of unreasonable effort. approximately $11 million Zendesk’s estimates of share-based compensation and related • Non-GAAP operating income income (loss) in the range of $16 - 19 expenses, amortization of purchased intangibles, acquisition-related million, which excludes share-based compensation and related expenses, weighted average shares outstanding, and free cash flow in expenses of approximately $173 million, amortization of purchased future periods assume, among other things, the occurrence of no intangibles of approximately $10 million, and acquisition-related additional acquisitions, investments, or restructurings and no further expenses of approximately $11 million revisions to share-based compensation and related expenses. Zendesk Shareholder Letter Q2 2019 - 18

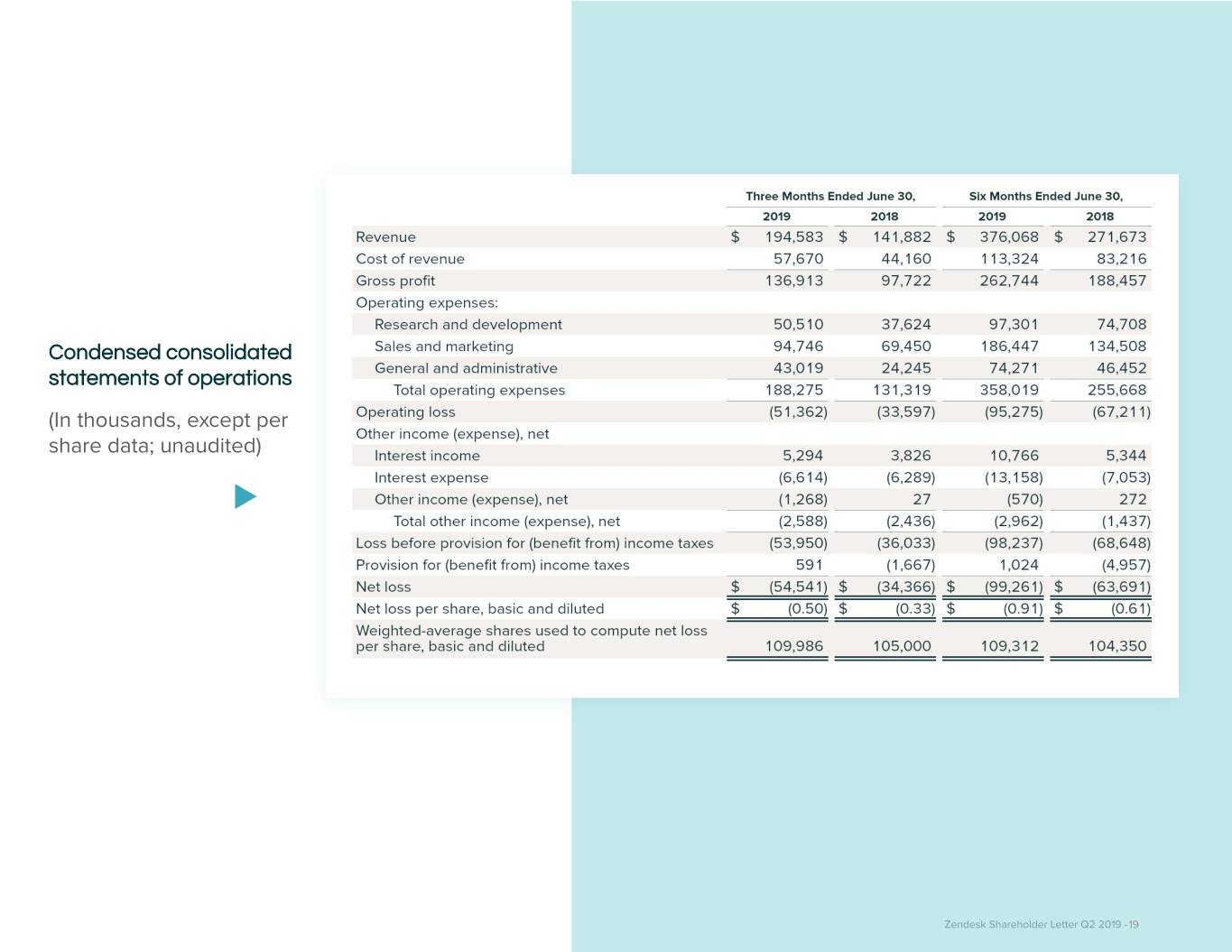

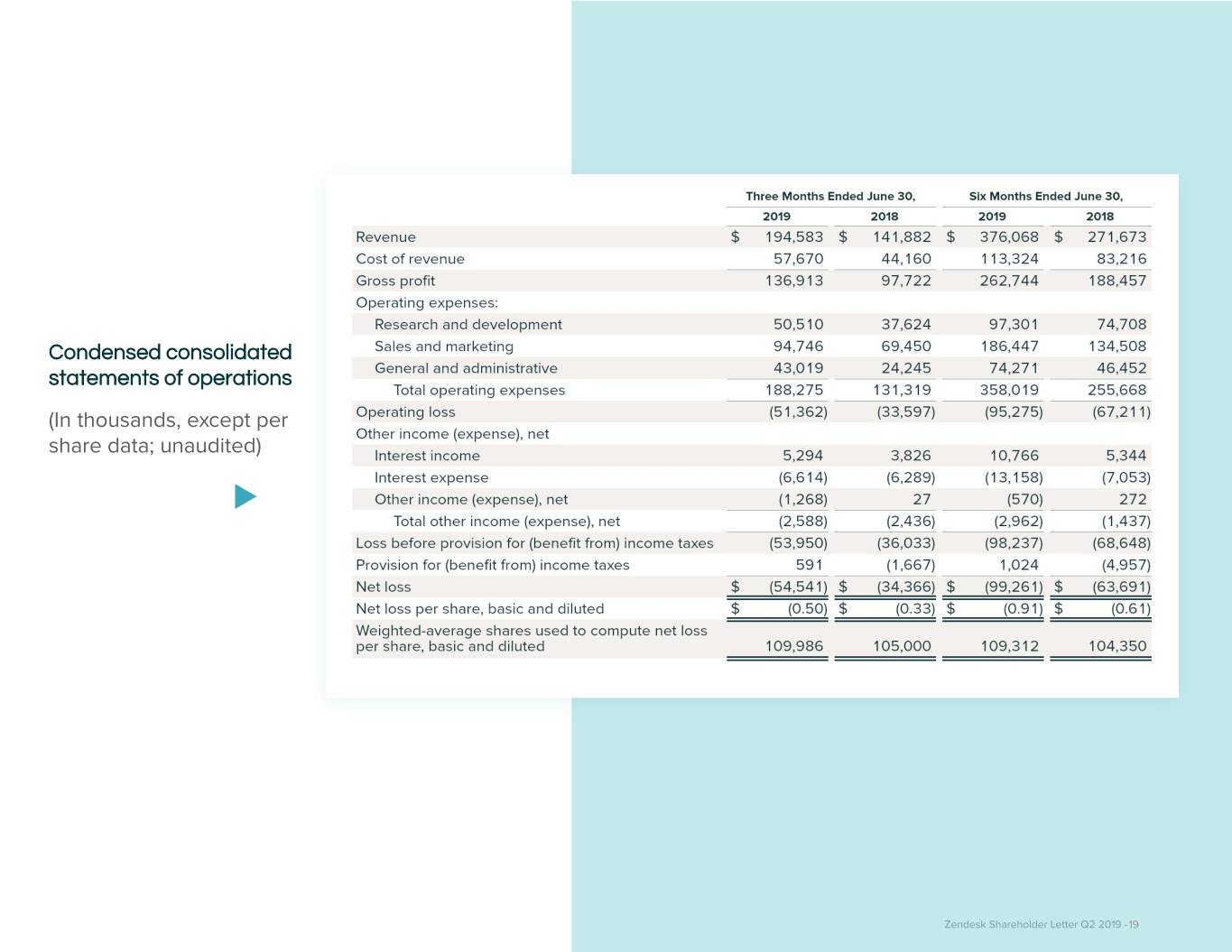

Condensed consolidated statements of operations (In thousands, except per share data; unaudited) Zendesk Shareholder Letter Q2 2019 - 19

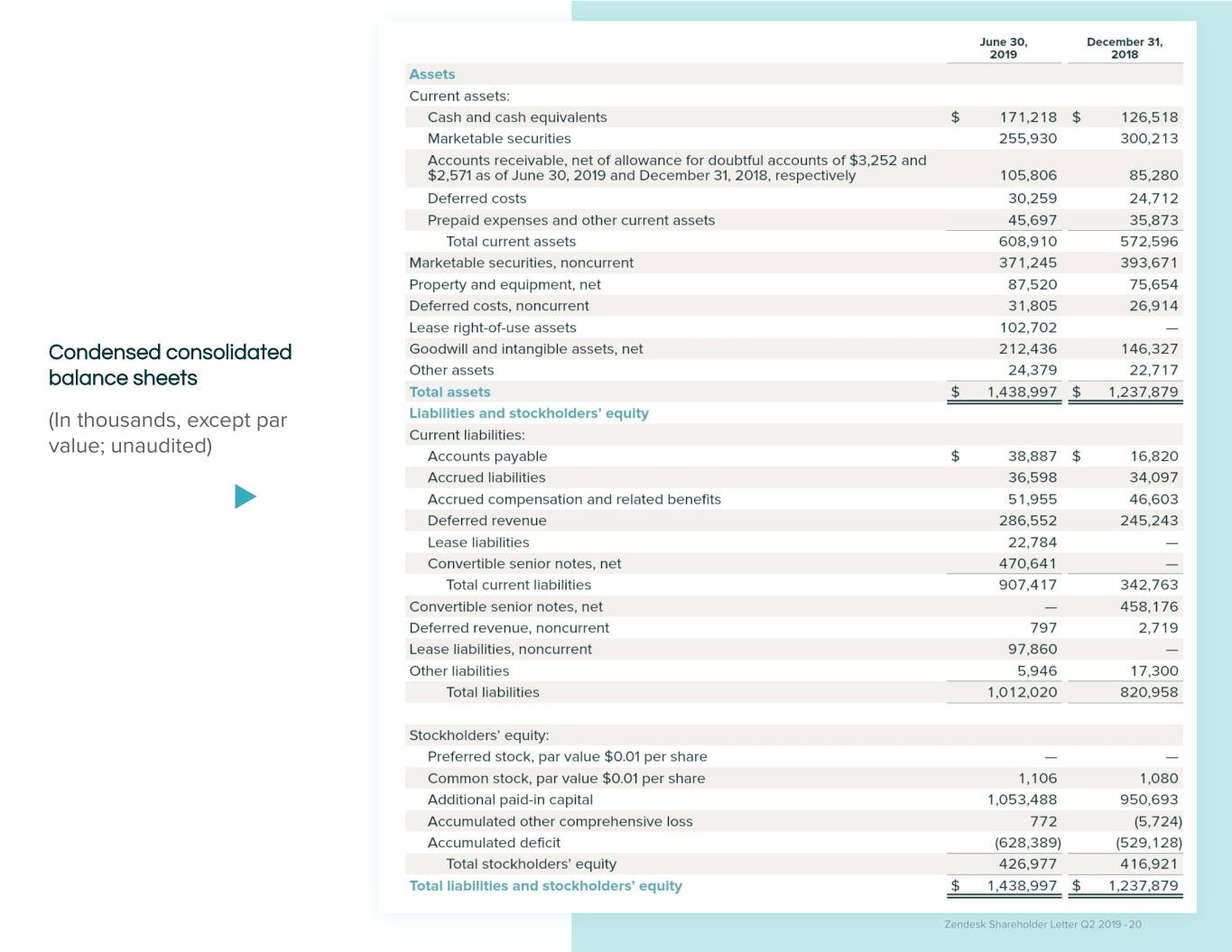

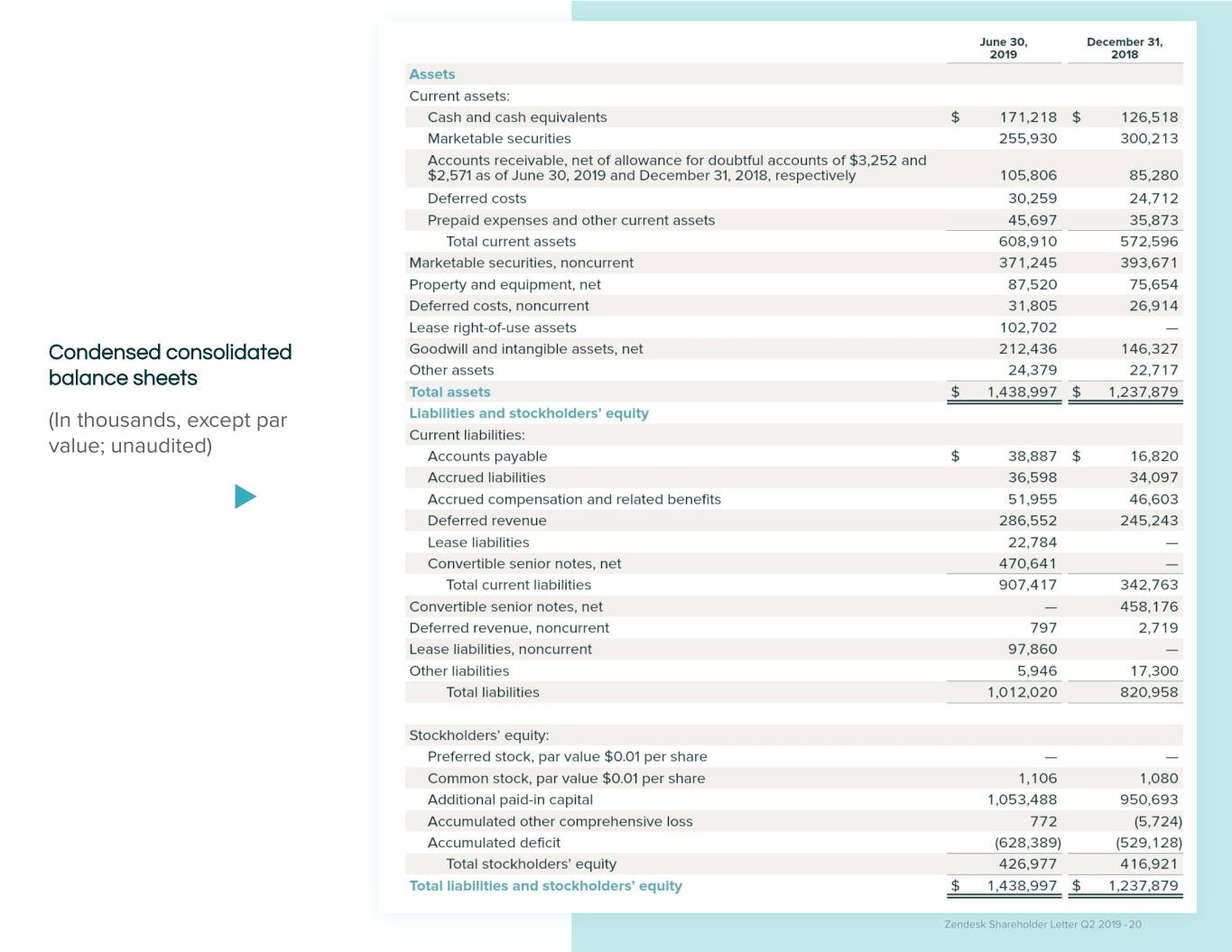

Condensed consolidated balance sheets (In thousands, except par value; unaudited) Zendesk Shareholder Letter Q2 2019 - 20

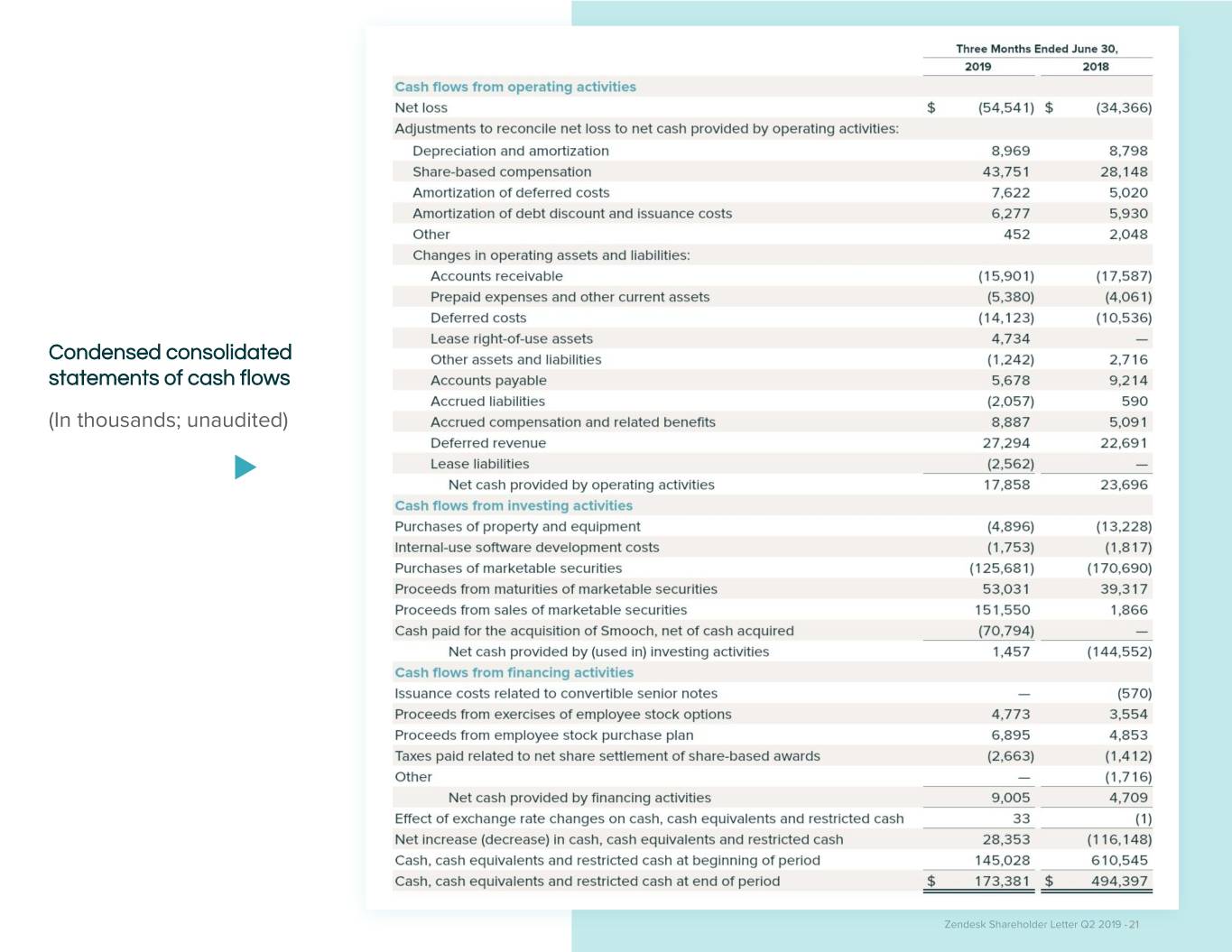

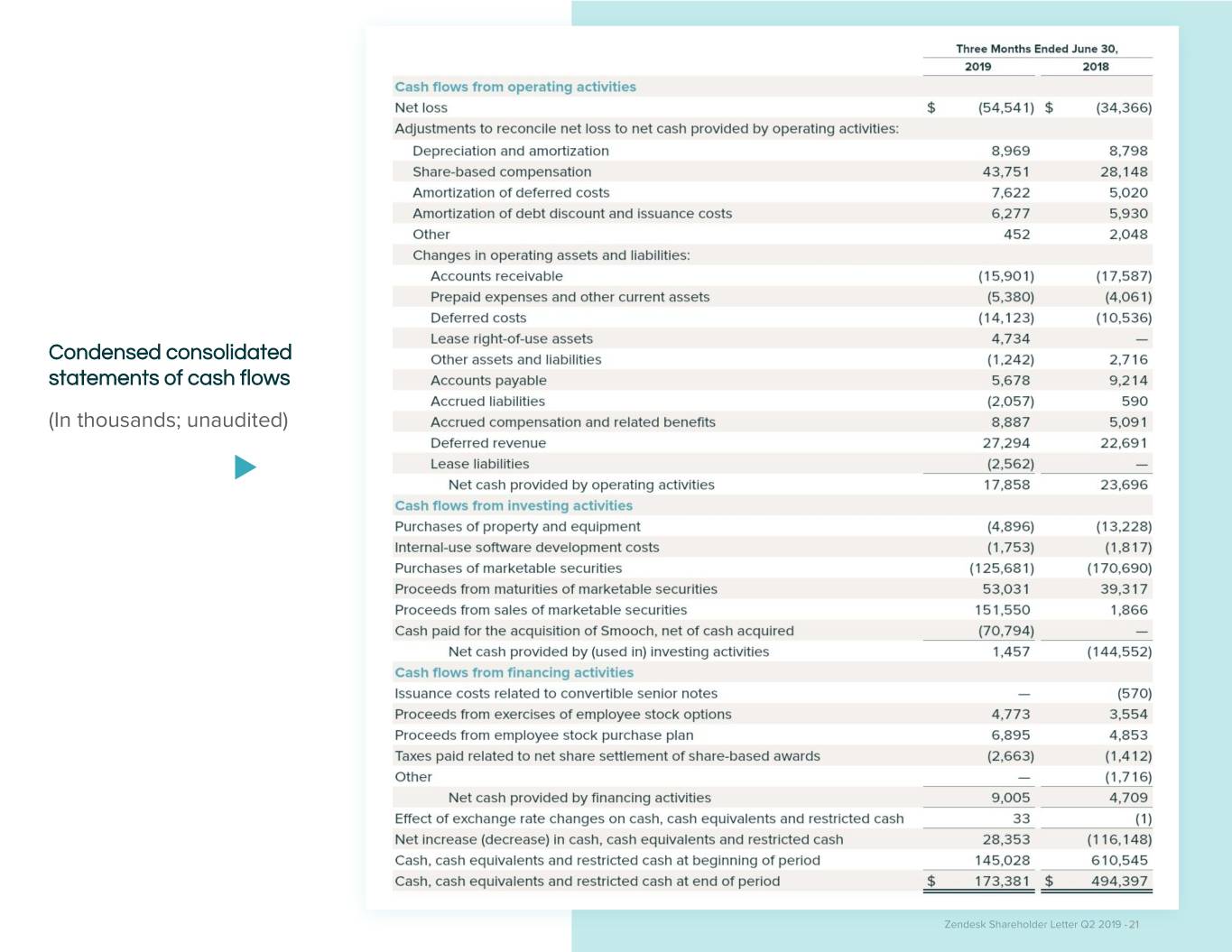

Condensed consolidated statements of cash flows (In thousands; unaudited) Zendesk Shareholder Letter Q2 2019 - 21

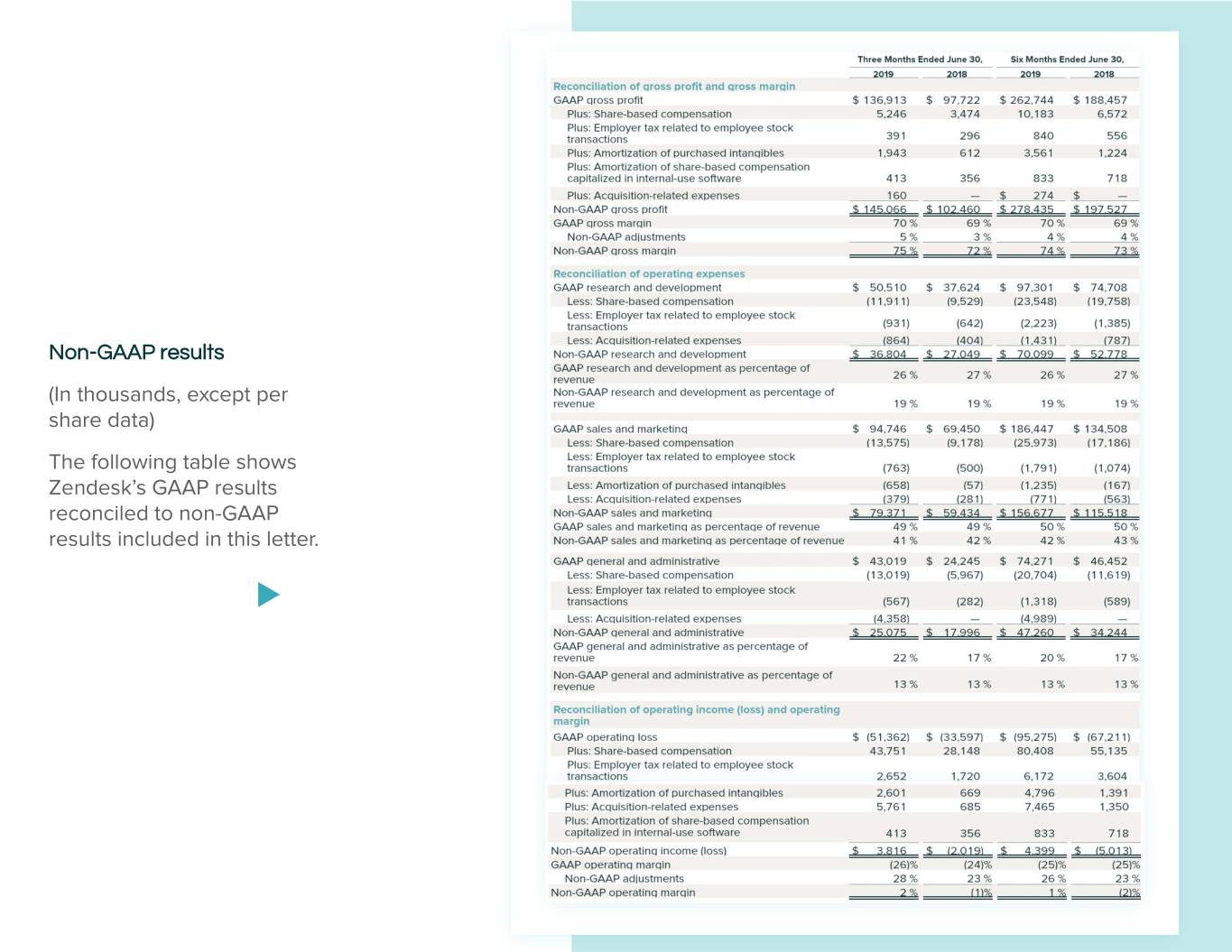

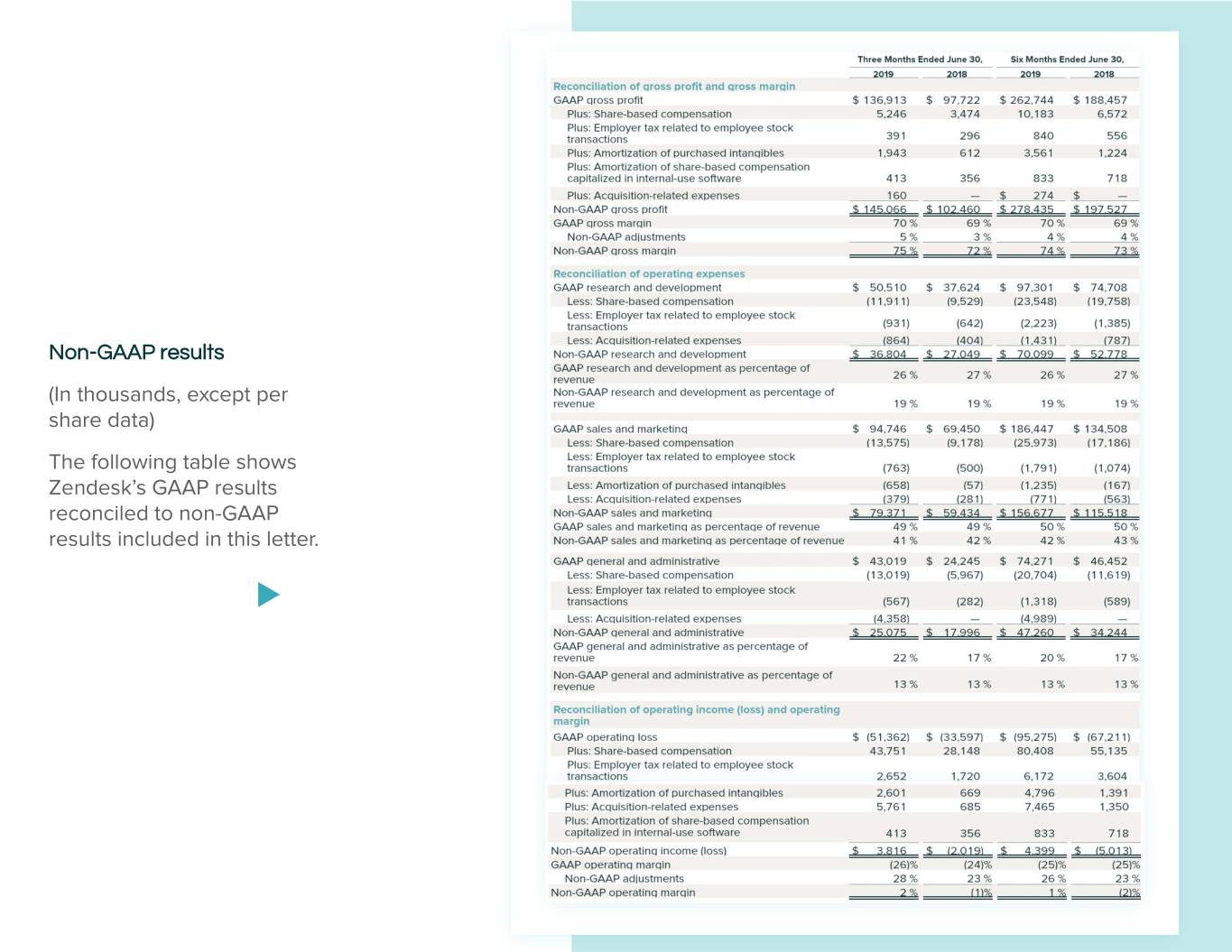

Non-GAAP results (In thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Zendesk Shareholder Letter Q2 2019 -

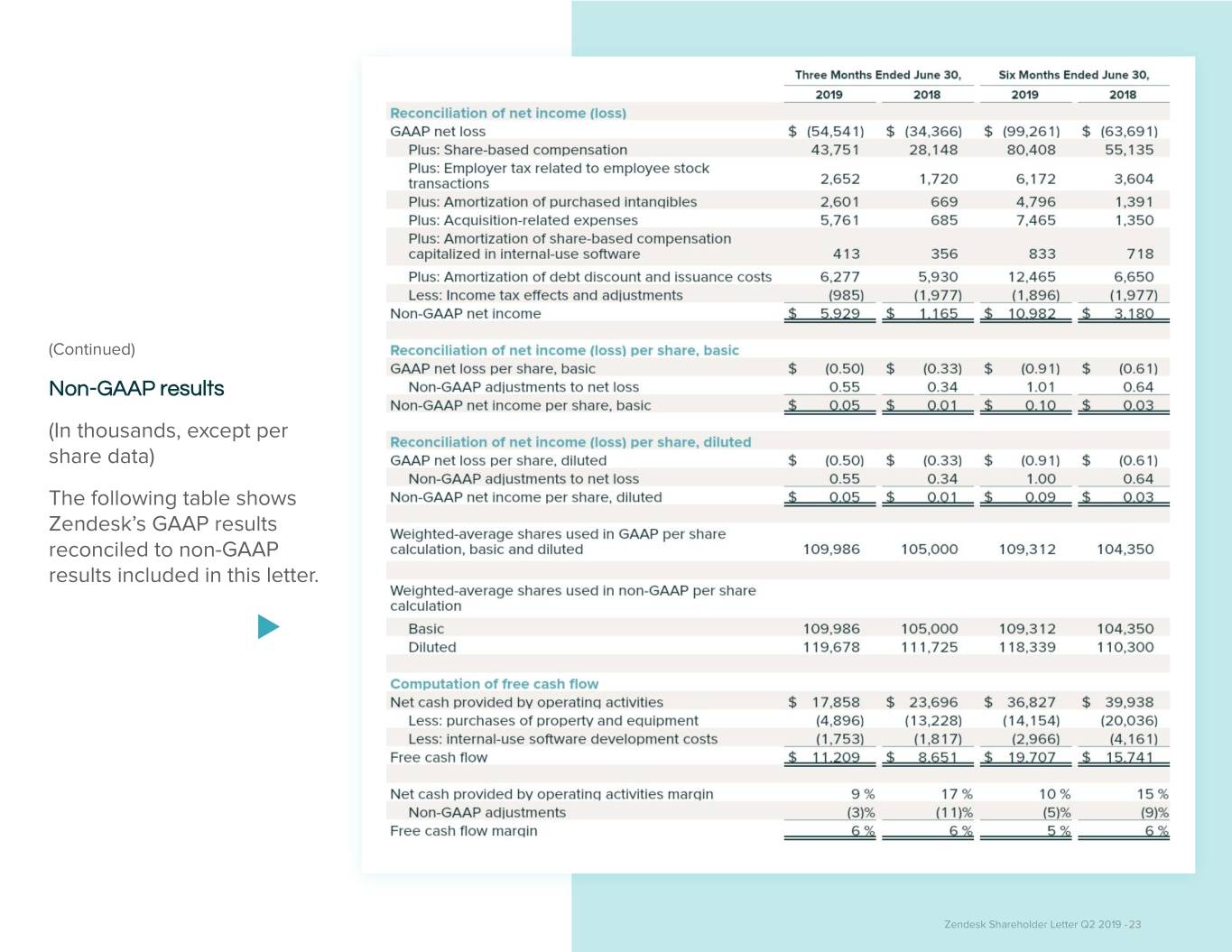

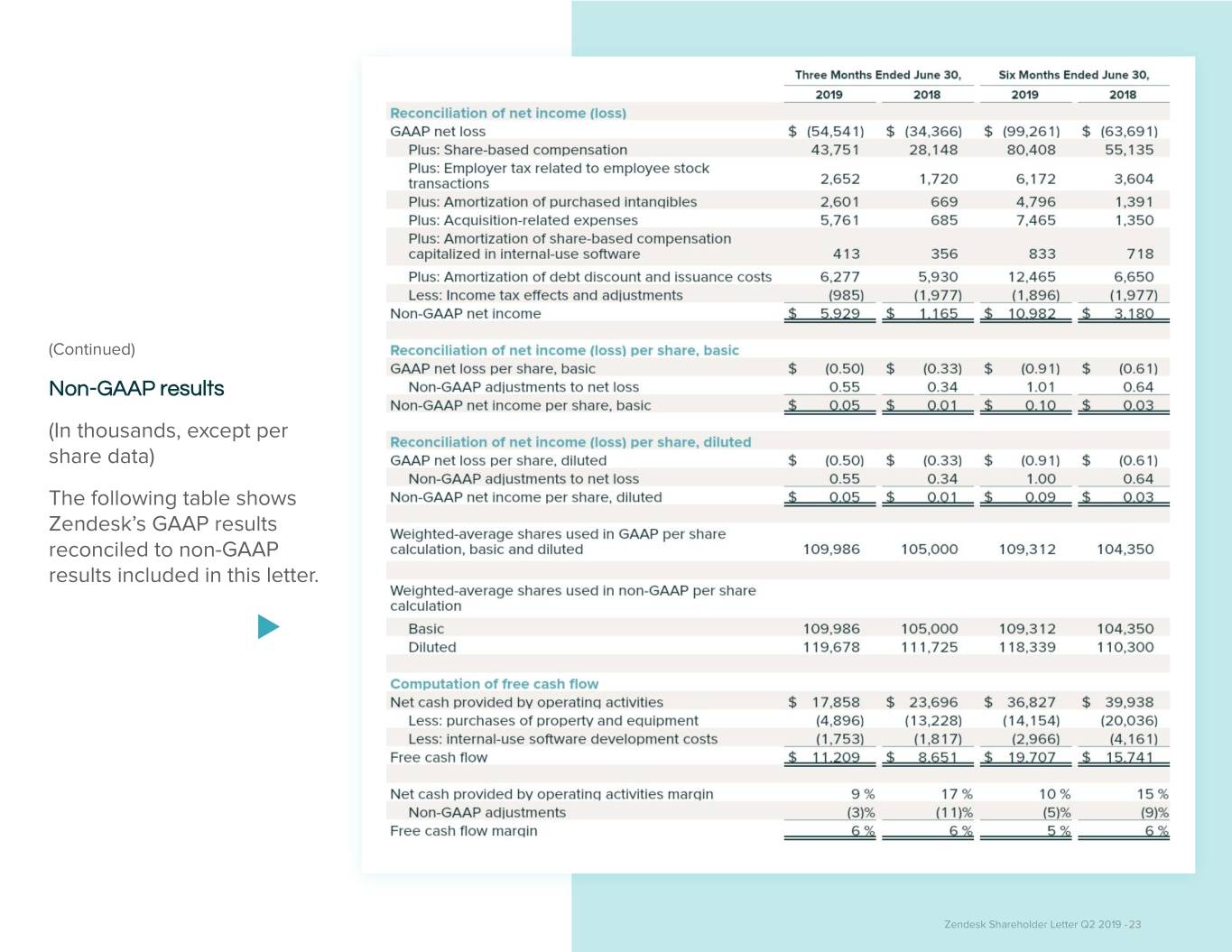

(Continued) Non-GAAP results (In thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Zendesk Shareholder Letter Q2 2019 - 23

About Zendesk Forward-looking statements represent Zendesk’s management’s beliefs and assumptions only as of the date such statements are made. Zendesk undertakes no obligation to update any The best customer experiences are built with Zendesk. Our customer service and engagement forward-looking statements made in this shareholder letter to reflect events or circumstances after products are powerful and flexible, and scale to meet the needs of any business. Zendesk serves the date of this shareholder letter or to reflect new information or the occurrence of unanticipated businesses across a multitude of industries, with more than 145,000 paid customer accounts events, except as required by law. offering service and support in over 30 languages. Zendesk is headquartered in San Francisco, and operates worldwide with 17 offices in North America, Europe, Asia, Australia, and South America. About non-GAAP financial measures Learn more at www.zendesk.com. To provide investors and others with additional information regarding Zendesk’s results, the Forward-looking statements following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross margin, non-GAAP operating expenses, non-GAAP operating income (loss) and operating margin, This shareholder letter contains forward-looking statements, including, among other things, non-GAAP net income (loss), non-GAAP net income (loss) per share, basic and diluted, free cash statements regarding Zendesk’s future financial performance, its continued investment to grow its flow, and free cash flow margin. business, and progress toward its long-term financial objectives. Words such as “may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases that denote future Specifically, Zendesk excludes the following from its historical and prospective non-GAAP financial expectation or intent regarding Zendesk’s financial results, operations, and other matters are measures, as applicable: intended to identify forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Share-Based Compensation and Amortization of Share-based Compensation Capitalized in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain employees. The outcome of the events described in these forward-looking statements is subject to known and It is principally aimed at aligning their interests with those of its stockholders and at long-term unknown risks, uncertainties, and other factors that may cause Zendesk’s actual results, retention, rather than to address operational performance for any particular period. As a result, performance, or achievements to differ materially, including (i) adverse changes in general share-based compensation expenses vary for reasons that are generally unrelated to financial and economic or market conditions; (ii) Zendesk’s ability to adapt its products to changing market operational performance in any particular period. dynamics and customer preferences or achieve increased market acceptance of its products; (iii) Zendesk’s ability to effectively expand its sales capabilities; (iv) Zendesk’s ability to effectively Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of employer market and sell its products to larger enterprises; (v) Zendesk’s expectation that the future growth taxes related to its employee stock transactions as an expense that is dependent on its stock price, rate of its revenues will decline, and that, as its costs increase, Zendesk may not be able to employee exercise and other award disposition activity, and other factors that are beyond generate sufficient revenues to achieve or sustain profitability; (vi) the intensely competitive market Zendesk’s control. As a result, employer taxes related to its employee stock transactions vary for in which Zendesk operates and the difficulty that Zendesk may have in competing effectively; (vii) reasons that are generally unrelated to financial and operational performance in any Zendesk’s ability to introduce and market new products and to support its products on a shared particular period. services platform; (viii) Zendesk’s ability to maintain and develop its strategic relationships with third parties; (ix) Zendesk’s ability to integrate acquired businesses and technologies successfully or Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible assets, achieve the expected benefits of such acquisitions; (x) Zendesk’s ability to effectively manage its including the amortization of the cost associated with an acquired entity’s developed technology, as growth and organizational change, including its international expansion strategy; (xi) potential items arising from pre-acquisition activities determined at the time of an acquisition. While these breaches in Zendesk’s security measures or unauthorized access to its customers’ data; (xii) intangible assets are evaluated for impairment regularly, amortization of the cost of purchased Zendesk's ability to comply with privacy and data security regulations; (xiii) the development of the intangibles is an expense that is not typically affected by operations during any particular period. market for software as a service business software applications; (xiv) potential service interruptions or performance problems associated with Zendesk’s technology and infrastructure; (xv) real or Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transaction perceived errors, failures, or bugs in its products; (xvi) Zendesk’s substantial reliance on its costs, integration costs, restructuring costs, and acquisition-related retention payments, including customers renewing their subscriptions and purchasing additional subscriptions; and (xvii) amortization of acquisition-related retention payments capitalized in internal-use software, as events Zendesk’s ability to accurately forecast expenditures on third-party managed hosting services. that are not necessarily reflective of operational performance during a period. In particular, Zendesk believes the consideration of measures that exclude such expenses can assist in the comparison of The forward-looking statements contained in this shareholder letter are also subject to additional operational performance in different periods which may or may not include such expenses. risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter Amortization of Debt Discount and Issuance Costs: In March 2018, Zendesk issued $575 million of ended March 31, 2019. Further information on potential risks that could affect actual results will be convertible senior notes due in 2023, which bear interest at an annual fixed rate of 0.25%. The included in the subsequent periodic and current reports and other filings that Zendesk makes with imputed interest rate of the convertible senior notes was approximately 5.26%. This is a result of the the Securities and Exchange Commission from time to time, including its Quarterly Report on Form debt discount recorded for the conversion feature that is required to be separately accounted for as 10-Q for the quarter ended June 30, 2019. Zendesk Shareholder Letter Q2 2019 - 24

equity, and debt issuance costs, which reduce the carrying value of the convertible debt instrument. Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP gross The debt discount is amortized as interest expense together with the issuance costs of the debt. margin for future periods because Zendesk does not provide guidance on the reconciling items The expense for the amortization of debt discount and debt issuance costs is a non-cash item, and between GAAP gross margin and non-GAAP gross margin, as a result of the uncertainty regarding, we believe the exclusion of this interest expense will provide for a more useful comparison of our and the potential variability of, these items. The actual amount of such reconciling items will have a operational performance in different periods. significant impact on Zendesk’s non-GAAP gross margin and, accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for the period is not available without Income Tax Effects: Zendesk utilizes a fixed long-term projected tax rate in its computation of unreasonable effort. non-GAAP income tax effects to provide better consistency across interim reporting periods. In projecting this long-term non-GAAP tax rate, Zendesk utilizes a financial projection that excludes Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for internal the direct impact of other non-GAAP adjustments. The projected rate considers other factors such planning and forecasting purposes. Zendesk’s management does not itself, nor does it suggest that as Zendesk’s current operating structure, existing tax positions in various jurisdictions, and key investors should, consider such non-GAAP financial measures in isolation from, or as a substitute legislation in major jurisdictions where Zendesk operates. For the year ending December 31, 2019, for, financial information prepared in accordance with GAAP. Zendesk presents such non-GAAP Zendesk has determined the projected non-GAAP tax rate to be 21%. Zendesk will periodically financial measures in reporting its financial results to provide investors with an additional tool to re-evaluate this tax rate, as necessary, for significant events, based on relevant tax law changes, evaluate Zendesk’s operating results. Zendesk believes these non-GAAP financial measures are material changes in the forecasted geographic earnings mix, and any significant acquisitions. useful because they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making. This allows investors and others to Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from better understand and evaluate Zendesk’s operating results and future prospects in the same operating activities, less purchases of property and equipment and internal-use software manner as management. development costs. Free cash flow margin is calculated as free cash flow as a percentage of total revenue. Zendesk uses free cash flow, free cash flow margin, and other measures, to evaluate the Zendesk’s management believes it is useful for itself and investors to review, as applicable, both ability of its operations to generate cash that is available for purposes other than capital GAAP information that may include items such as share-based compensation and related expenses, expenditures and capitalized software development costs. Zendesk believes that information amortization of debt discount and issuance costs, amortization of purchased intangibles, and regarding free cash flow and free cash flow margin provides investors with an important perspective acquisition-related expenses, and the non-GAAP measures that exclude such information in order to on the cash available to fund ongoing operations. assess the performance of Zendesk’s business and for planning and forecasting in subsequent periods. When Zendesk uses such a non-GAAP financial measure with respect to historical periods, Zendesk has not reconciled free cash flow guidance to net cash from operating activities for the it provides a reconciliation of the non-GAAP financial measure to the most closely comparable year ending December 31, 2019 because Zendesk does not provide guidance on the reconciling GAAP financial measure. When Zendesk uses such a non-GAAP financial measure in a items between net cash from operating activities and free cash flow, as a result of the uncertainty forward-looking manner for future periods, and a reconciliation is not determinable without regarding, and the potential variability of, these items. The actual amount of such reconciling items unreasonable effort, Zendesk provides the reconciling information that is determinable without will have a significant impact on Zendesk’s free cash flow and, accordingly, a reconciliation of net unreasonable effort and identifies the information that would need to be added or subtracted from cash from operating activities to free cash flow for the year ending December 31, 2019 is not the non-GAAP measure to arrive at the most directly comparable GAAP measure. Investors are available without unreasonable effort. encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure as Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to GAAP detailed above. operating margin for future periods beyond the current fiscal year because Zendesk does not provide guidance on the reconciling items between GAAP operating margin and non-GAAP Non-GAAP gross margin for the first quarter of 2019 excludes $5.8 million in share-based operating margin for such periods, as a result of the uncertainty regarding, and the potential compensation and related expenses (including $0.4 million of amortization of share-based variability of, these items. The actual amount of such reconciling items will have a significant impact compensation capitalized in internal-use software and $0.5 million of employer tax related to on Zendesk’s non-GAAP operating margin and, accordingly, a reconciliation of GAAP operating employee stock transactions), $1.6 million of amortization of purchased intangibles, and $0.1 million margin to non-GAAP operating margin guidance for such periods is not available without of acquisition-related expenses. Non-GAAP operating loss and non-GAAP operating margin for the unreasonable effort. first quarter of 2019 exclude $40.6 million in share-based compensation and related expenses (including $3.5 million of employer tax related to employee stock transactions and $0.4 million of Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include amortization of share-based compensation capitalized in internal-use software), $1.7 million of adjustments to its expectations for its GAAP gross margin that exclude share-based compensation acquisition-related expenses, and $2.2 million of amortization of purchased intangibles. Free cash and related expenses in Zendesk’s cost of revenue, amortization of purchased intangibles primarily flow for the first quarter of 2019 includes cash used for purchases of property and equipment of related to developed technology, and acquisition-related expenses. The share-based compensation $9.3 million and internal-use software development costs of $1.2 million. and related expenses excluded due to such adjustments are primarily comprised of the share-based compensation and related expenses for employees associated with Zendesk’s infrastructure and customer experience organization. Zendesk Shareholder Letter Q2 2019 - 25

About operating metrics Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue as the Zendesk reviews a number of operating metrics to evaluate its business, measure performance, aggregate annual recurring revenue across its products for customers with paid customer accounts identify trends, formulate business plans, and make strategic decisions. These include the number as of the date one year prior to the date of calculation. Zendesk defines the retained revenue net of of paid customer accounts on Zendesk Support, Zendesk Chat, and its other products, dollar-based contraction and churn as the aggregate annual recurring revenue across its products for the same net expansion rate, annual recurring revenue represented by its churned customers, and the customer base included in the measure of base revenue at the end of the annual period being percentage of its annual recurring revenue from Support originating from customers with 100 or measured. The dollar-based net expansion rate is also adjusted to eliminate the effect of certain more agents on Support. activities that Zendesk identifies involving the consolidation of customer accounts or the split of a single paid customer account into multiple paid customer accounts. In addition, the dollar-based net Zendesk defines the number of paid customer accounts at the end of any particular period as the expansion rate is adjusted to include paid customer accounts in the customer base used to sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free trials, or other determine retained revenue net of contraction and churn that share common corporate information free services, (ii) the number of accounts using Chat, exclusive of free trials or other free services, with customers in the customer base that are used to determine the base revenue. Giving effect to and (iii) the number of accounts on all of its other products, exclusive of free trials and other free this consolidation results in Zendesk’s dollar-based net expansion rate being calculated across services, each as of the end of the period and as identified by a unique account identifier. In the approximately 103,400 customers, as compared to the approximately 149,000 total paid customer quarter ended June 30, 2018, Zendesk began to offer an omnichannel subscription which provides accounts as of June 30, 2019. access to multiple products through a single paid customer account, Zendesk Suite and in the quarter ended June 30, 2019, Zendesk began to offer a subscription which provides access to Sell To the extent that Zendesk can determine that the underlying customers do not share common and Support through a single paid customer account, Zendesk Duet. All of the Suite paid customer corporate information, Zendesk does not aggregate paid customer accounts associated with accounts are included in the number of accounts on all of Zendesk’s other products and are not reseller and other similar channel arrangements for the purposes of determining its dollar-based net included in the number of paid customer accounts using Support or Chat. All of the Duet paid expansion rate. While not material, Zendesk believes the failure to account for these activities customer accounts are included in the number of paid customer accounts using Support. Existing would otherwise skew the dollar-based net expansion metrics associated with customers that customers may also expand their utilization of Zendesk’s products by adding new accounts and a maintain multiple paid customer accounts across its products and paid customer accounts single consolidated organization or customer may have multiple accounts across each of Zendesk’s associated with reseller and other similar channel arrangements. products to service separate subsidiaries, divisions, or work processes. Other than usage of Zendesk’s products through its omnichannel subscription offering, each of these accounts is also Zendesk does not currently incorporate operating metrics associated with its legacy analytics treated as a separate paid customer account. product, its legacy Outbound product, Sell, its legacy Starter plan, free trials, or other free services into its measurement of dollar-based net expansion rate. Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase revenue across its existing customer base through expansion of authorized agents associated with For a more detailed description of how Zendesk calculates its dollar-based net expansion rate, a paid customer account, upgrades in subscription plans, and the purchase of additional products please refer to Zendesk’s periodic reports filed with the Securities and Exchange Commission. as offset by churn, contraction in authorized agents associated with a paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net expansion rate is based upon annual Zendesk’s percentage of annual recurring revenue from Support that is generated by customers recurring revenue for a set of paid customer accounts on its products. Zendesk determines the with 100 or more agents on Support is determined by dividing the annual recurring revenue from annual recurring revenue value of a contract by multiplying the monthly recurring revenue for such Support for paid customer accounts with 100 or more agents on Support as of the measurement contract by twelve. Monthly recurring revenue for a paid customer account is a legal and contractual date by the annual recurring revenue from Support for all paid customer accounts on Support as of determination made by assessing the contractual terms of each paid customer account, as of the the measurement date. Zendesk determines the customers with 100 or more agents on Support as date of determination, as to the revenue Zendesk expects to generate in the next monthly period of the measurement date based on the number of activated agents on Support at the measurement for that paid customer account, assuming no changes to the subscription and without taking into date and includes adjustments to aggregate paid customer accounts that share common corporate account any platform usage above the subscription base, if any, that may be applicable to such information. For the purpose of determining this metric, Zendesk builds an estimation of the subscription. Beginning with the quarter ended June 30, 2019, we excluded the impact of revenue proportion of annual recurring revenue from Suite attributable to Support and includes such portion that we expect to generate from fixed-term contracts that are each associated with an existing in the annual recurring revenue from Support. account, are solely for additional temporary agents, and are not contemplated to last for the duration of the primary contract for the existing account from our determination of monthly recurring Zendesk does not currently incorporate operating metrics associated with products other than revenue. Monthly recurring revenue is not determined by reference to historical revenue, deferred Support into its measurement of the percentage of annual recurring revenue from Support that is revenue, or any other GAAP financial measure over any period. It is forward-looking and generated by customers with 100 or more agents on Support. contractually derived as of the date of determination. Zendesk determines its annual revenue run rate by multiplying the revenue generated over its most recently completed quarter by four. Zendesk Shareholder Letter Q2 2019 - 26

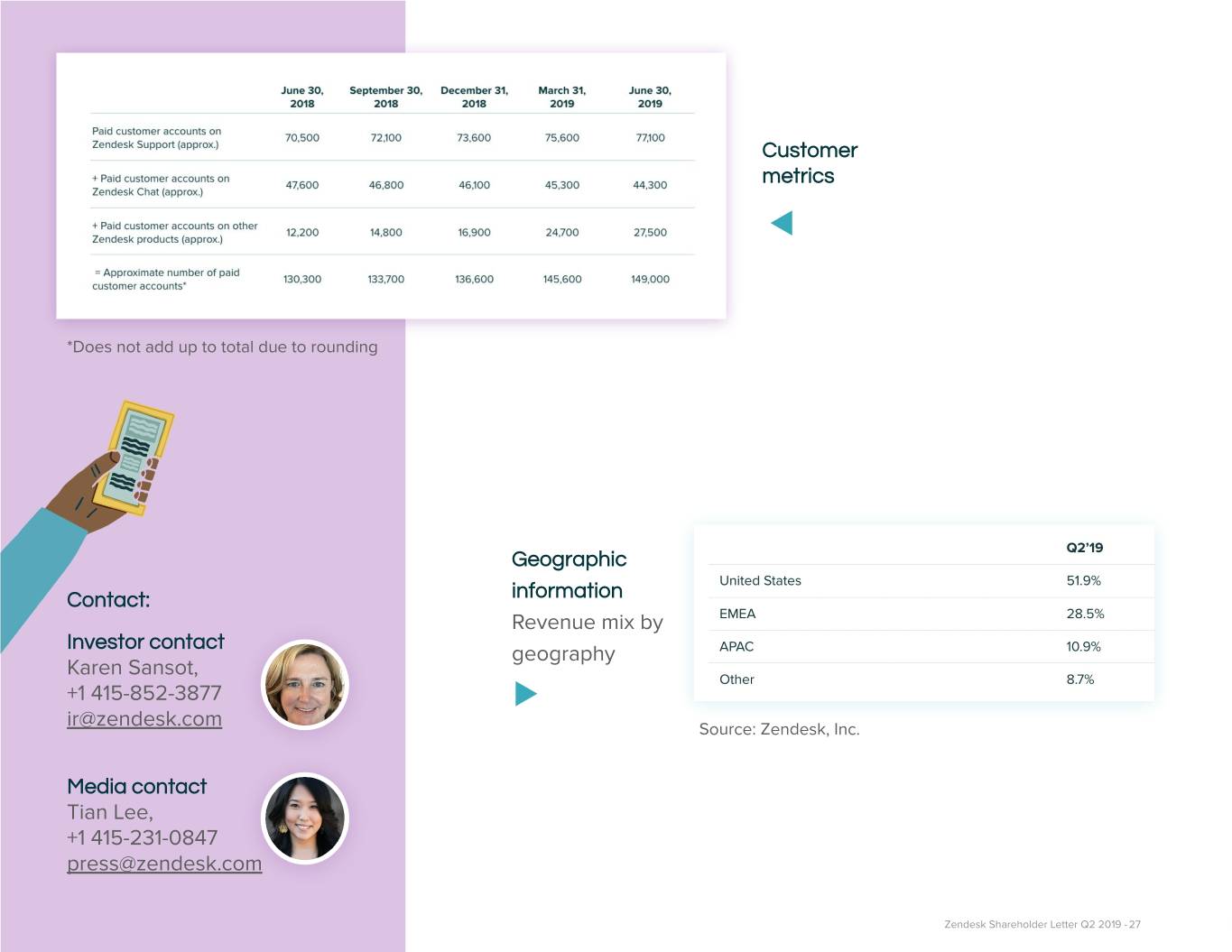

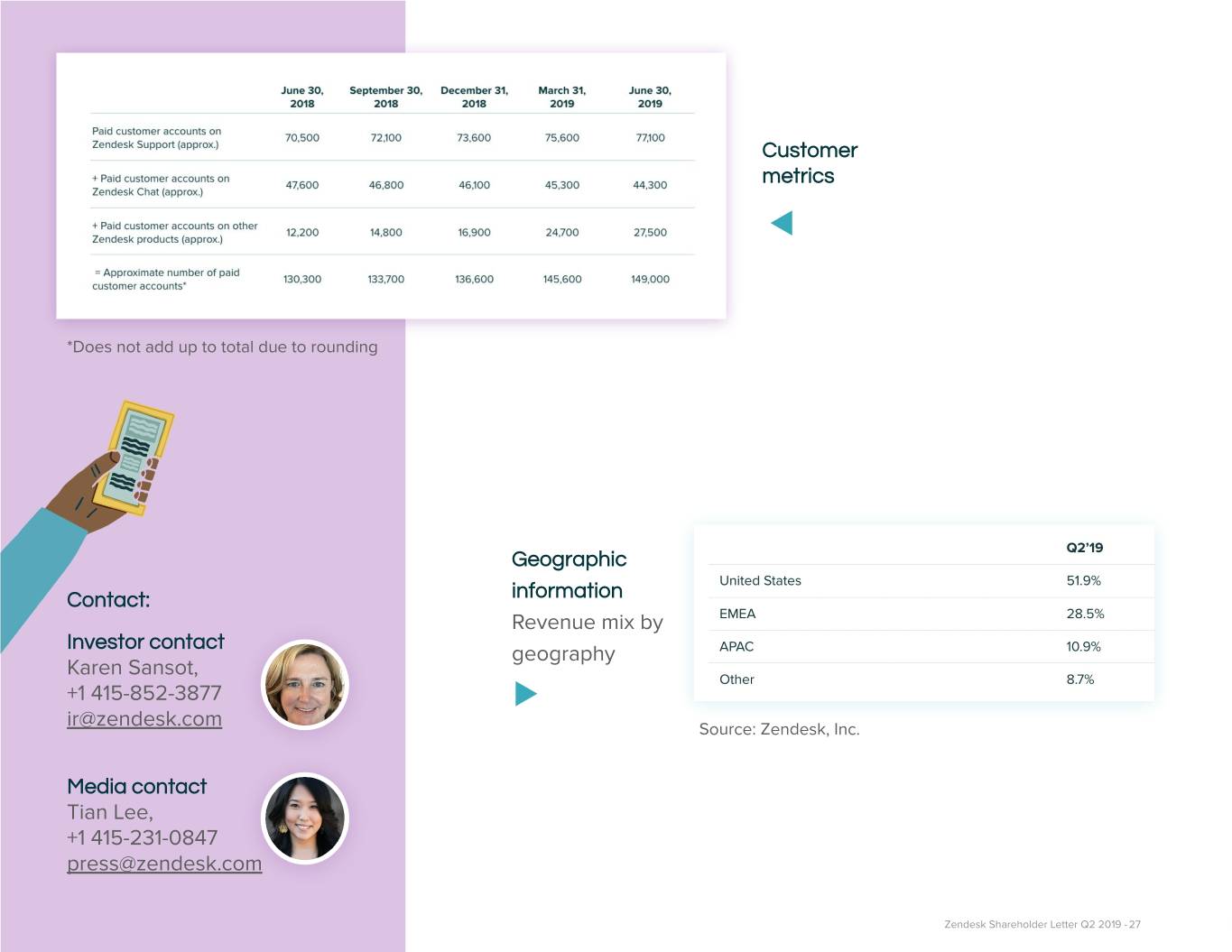

Customer metrics *Does not add up to total due to rounding Geographic Contact: information Revenue mix by Investor contact geography Karen Sansot, +1 415-852-3877 ir@zendesk.com Source: Zendesk, Inc. Media contact Tian Lee, +1 415-231-0847 press@zendesk.com Zendesk Shareholder Letter Q2 2019 - 27