Zendesk Shareholder Letter Q3 2017 - 1 Shareholder Letter November 01, 2017 Third Quarter 2017 Exhibit 99.2

Zendesk Shareholder Letter Q3 2017 - 2 Mikkel Svane CEO Elena Gomez CFO Marc Cabi Strategy & IR $112.8M 40% 114,000 Q3 2017 Revenue Y/Y Revenue Growth Paid Customer Accounts Introduction Zendesk is proud of our results for the third quarter. We experienced a reacceleration of revenue growth across our business and positioned ourselves to meet or exceed our strategic goals for the year. With the critical fourth quarter underway, we are in a strong position to land and expand within larger organizations while continuing the solid momentum of our transactional business. Our third quarter results highlight the inroads we are making with larger organizations. We closed a significantly larger number of enterprise-class deals this quarter—both new business and expansions. In addition, we are building optimism around our 2018 growth potential, given greater visibility into our pipeline of expansion opportunities with existing customers and new business opportunities with prospective customers across a variety of industries. ~

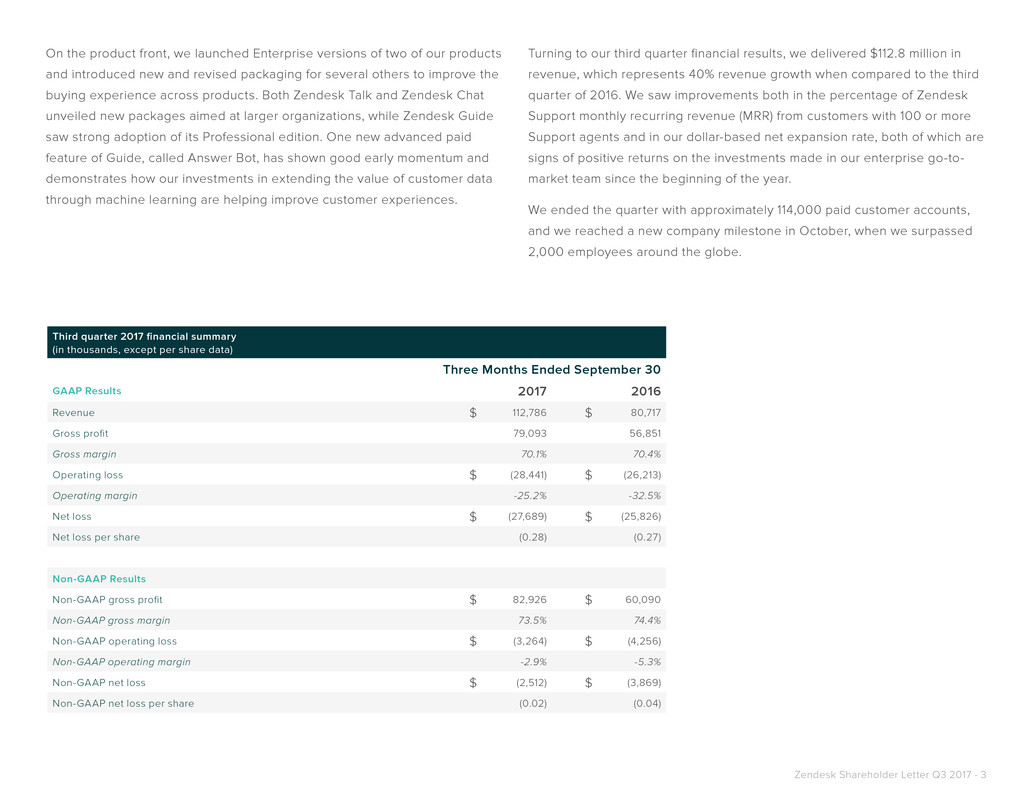

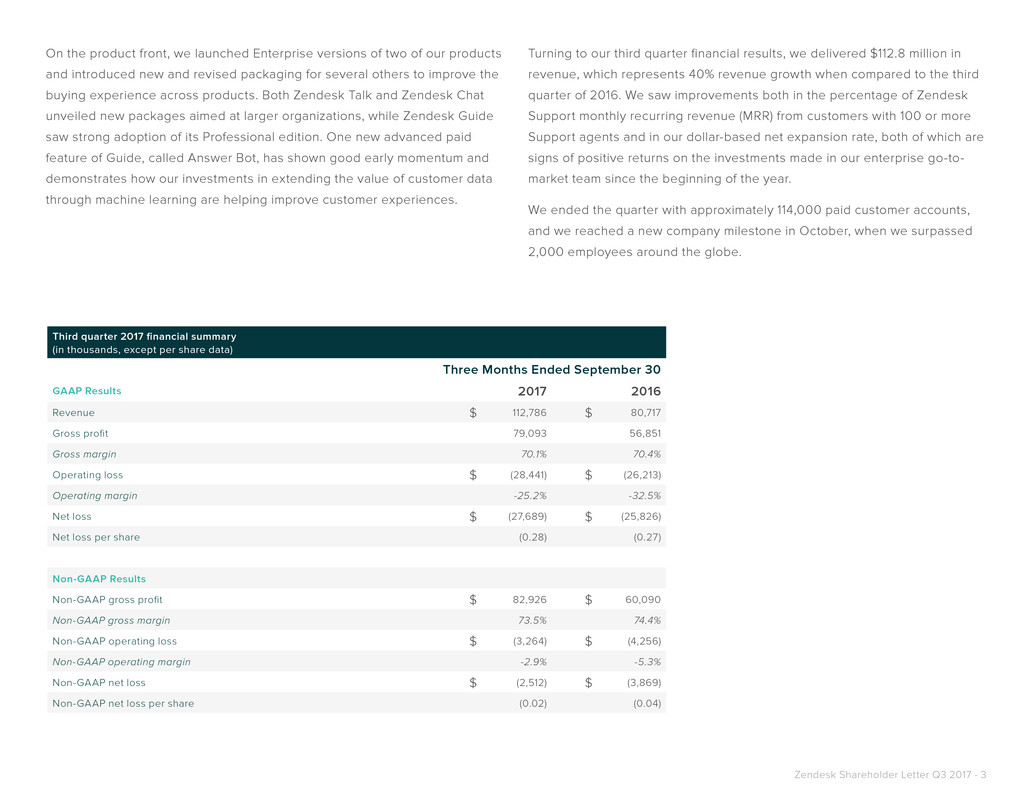

Zendesk Shareholder Letter Q3 2017 - 3 Third quarter 2017 financial summary (in thousands, except per share data) Three Months Ended September 30 GAAP Results 2017 2016 Revenue $ 112,786 $ 80,717 Gross profit 79,093 56,851 Gross margin 70.1% 70.4% Operating loss $ (28,441) $ (26,213) Operating margin -25.2% -32.5% Net loss $ (27,689) $ (25,826) Net loss per share (0.28) (0.27) Non-GAAP Results Non-GAAP gross profit $ 82,926 $ 60,090 Non-GAAP gross margin 73.5% 74.4% Non-GAAP operating loss $ (3,264) $ (4,256) Non-GAAP operating margin -2.9% -5.3% Non-GAAP net loss $ (2,512) $ (3,869) Non-GAAP net loss per share (0.02) (0.04) On the product front, we launched Enterprise versions of two of our products and introduced new and revised packaging for several others to improve the buying experience across products. Both Zendesk Talk and Zendesk Chat unveiled new packages aimed at larger organizations, while Zendesk Guide saw strong adoption of its Professional edition. One new advanced paid feature of Guide, called Answer Bot, has shown good early momentum and demonstrates how our investments in extending the value of customer data through machine learning are helping improve customer experiences. Turning to our third quarter financial results, we delivered $112.8 million in revenue, which represents 40% revenue growth when compared to the third quarter of 2016. We saw improvements both in the percentage of Zendesk Support monthly recurring revenue (MRR) from customers with 100 or more Support agents and in our dollar-based net expansion rate, both of which are signs of positive returns on the investments made in our enterprise go-to- market team since the beginning of the year. We ended the quarter with approximately 114,000 paid customer accounts, and we reached a new company milestone in October, when we surpassed 2,000 employees around the globe.

Zendesk Shareholder Letter Q3 2017 - 4 Key accomplishments Timeline not to scale 110K 1600 1800 Google Play Channel Framework 80K Satisfaction Prediction 70K Inaugural Analyst Day SMS Rebrand 1400 Office 365Pathfinder Gartner MQ Leader Forrester Wave Strong Performer Jan 2016 Jan 2017 India Office Opening TokyoSao Paulo Sydney Answer BotEnterprise 90K Manila Office Opening 100K AWS Connect Integration Base Integration SDK Fabric 2000 Enterprise Montpellier Office Opening Singapore Office Opening + + ZENDESK PRESENTS Lorem ipsum

Zendesk Shareholder Letter Q3 2017 - 5 Go-to-market momentum We are reaping the benefits of a maturing go-to-market organization, following last year’s reorganization of our sales and marketing investments. We are pleased with the improvement we’ve seen in sales team productivity and the progress made by the overall go-to-market organization. Recent additions to our marketing leadership are helping us refine our strategies for both attracting new customers and expanding with our current ones. The overall health of the business is reflected in the results we’ve seen both with smaller customers and on the enterprise side. The growth in our transactional business—characterized by a low-touch sales model— continues on a strong, predictable trajectory. Hilarie Koplow-McAdams, Board Member Meanwhile, our expanded investment in territory-based sales teams, coupled with an increased number of pre-sales solutions consultants, is showing encouraging results, with acceleration in the up-market side of our business. Our sales model leverages the strong connections that our in-market sales leaders have with local customers and the agility those leaders have to quickly address customer needs. As a result, we are uncovering more opportunities for larger deals and more complex use cases requiring multiple Zendesk products. The metrics we use to measure our momentum up market improved substantially during the third quarter, including the average value of our deals over $50,000 in annual contract value (ACV) and the percentage of our Support recurring revenue from customers with 100 or more Support agents. In September, we appointed Hilarie Koplow-McAdams to our Board of Directors. Hilarie has held executive leadership positions at New Relic, Salesforce, Intuit, and Oracle. She brings extensive enterprise software sales expertise to our Board and will be a key resource as we seek to accelerate our up-market sales momentum.

Zendesk Shareholder Letter Q3 2017 - 6 In October, we held our largest U.S. conference ever in New York. Targeted at an audience of current and prospective customers, Relate Live hosted more than 1,000 attendees. Along with industry trends and best practices in customer experience and service, the event included an entire day focused solely on product workshops, training, and certification, and we saw strong interest in product and technology-focused sessions throughout the conference. In addition, each of the live-streamed keynote sessions were viewed an average of 30,000 times during the first two days of the conference.

Zendesk Shareholder Letter Q3 2017 - 7 Find the right channel for the job Help customers help themselves Product update New Chat and Talk products designed for the enterprise made their debuts in the third quarter. We now have four channels—email, live chat, messaging, and phone support—specifically packaged to align to the needs of our enterprise buyers. In August we launched Chat Enterprise—with features like skills-based routing and roles and permissions—designed to fulfill the requirements of some of our largest Chat customers. Live chat continues to be an important part of our product strategy, and our Chat widget today appears on websites that reach a total of almost 1.5 billion visitors per month. Additionally, Zendesk Message is now available on all paid Chat offerings, widening the scope of live chat agents, who can now respond to inbound messages from channels such as Facebook Messenger, Twitter Direct Message, and LINE. In September we launched Talk Enterprise with new features including a Launch Success Program, monthly diagnostics, usage SLAs, and failover on demand (to route calls to an alternate number). This new plan is designed to give our largest Talk customers hands-on support and the tools they need to deliver phone support at scale. Additionally, we launched Textback—a feature for Talk customers on the Professional and Enterprise plans—as an additional IVR option that allows callers to choose text support instead of waiting on the phone for an agent. Textback provides an opportunity for customers to seamlessly switch channels and get asynchronous support. Zendesk employees teamed up to develop this feature—which was made available to customers in September—during our annual internal hackathon in May. By repackaging Chat and Talk plans with a unified naming structure and with cross-product needs in mind, we made it easy for our customers to select the plan level that will best fit their requirements across all our products. Additionally, we now have the building blocks in place for future opportunities to bundle our products together into a unified omnichannel offering. Solve sensitive problems Respond in real time Come together in one place

In 2018, we will extend Answer Bot to additional channels and features— including the Web Form, Web Widget, and Chat—as well as adding support for other languages including Spanish, Portuguese, German, and French. We also expect to release an Enterprise version of Guide as we continue to see further growth opportunity around monetizing self-service. Our work in AI was recognized in September when Zendesk won the Alconics Award for Best Innovation in Natural Language Processing and was a finalist for Best Intelligent Assistant Innovation. The awards are organized by AI Business—a three-year-old, AI-focused news portal—which announced the awards at September’s AI Summit event. “We want our customers to write in and reach out whenever they need help. Answer Bot helps our support team help our customers self-serve and get their responses faster.” -Dollar Shave Club Answer Bot Also in the third quarter, Answer Bot graduated from its early access program to become a paid add-on to our Guide self-service product. It is our first machine learning product to directly monetize our data assets. Answer Bot is designed to respond quickly to common inquiries, while routing more complex questions that require more personalized and contextual responses to support agents. While still new, Answer Bot has gained traction within our customer base. One of the unique aspects of Answer Bot is its pricing model: Customers pay only for answers that resolved the inquiry without requiring agent intervention. One of our customers, Dollar Shave Club, is using Answer Bot to respond to repetitive tickets about subscription changes by giving customers a fast response with relevant content from the company’s knowledge base. Dollar Shave Club now resolves over 10% of all tickets without human intervention using Answer Bot, while sustaining high customer satisfaction rates. One of the largest benefits has been that Support agents are now free to focus on more complex questions and have additional bandwidth for Chat, allowing Dollar Shave Club to extend their live chat support hours without needing to hire additional agents.

Zendesk Shareholder Letter Q3 2017 - 9 Developer platform updates APPS MARKETPLACE 630+ public apps CHAT MOBILE SDK 4 MILLION chats completed in the third quarter SUPPORT MOBILE SDK 5 MILLION tickets created in the third quarter WEB WIDGET 21,000+ monthly active widgets Infrastructure Cloud infrastructure provides a broad set of products and services that companies like Zendesk can use as building blocks to run sophisticated and scalable applications. We are moving more of our infrastructure investments to cloud providers to help us move faster, operate more securely, and scale our costs over time. This also allows us to move our data center operations closer to our customers. We are actively exploring longer term cloud infrastructure arrangements, and are committed to moving away from our co-located data centers to cloud infrastructure. Partnerships We also expanded our relationship with Base, a sales force automation platform, during the third quarter. Base announced a deeper integration with Zendesk to allow joint customers to deliver a more seamless experience for their customers through greater visibility and collaboration between sales and support teams. Help?

Zendesk Shareholder Letter Q3 2017 - 10 Customers Among the customers to join us or expand with us recently include: 99designs - an online graphic design marketplace Betterment - an independent online financial advisor ClassDojo - a classroom communication platform for teachers, parents, and students Cotton On - a clothing retailer with seven brands and 1,500 stores worldwide GitHub - a development platform with almost 20 million users MediaOcean - an advertising services and software company Minor Hotels - an international owner, operator, and investor with 155 hotels NatureBox - an online snack food retailer SkipTheDishes - an online food delivery service StarRez - a provider of higher-ed student housing software

Zendesk Shareholder Letter Q3 2017 - 11 Spotlight on EMEA Our EMEA team has made strong advances in building new customer relationships with large companies. The regional, territory-focused approach has fostered an expanding pipeline that includes many household names across a variety of industries. In addition to direct sales, marketing, and success activities, the teams in Europe have also been keenly focused on building regional partner relationships that are successfully yielding new customers. Some of our new enterprise-class customers in Europe include: Adyen - an Amsterdam-based global payments company that reported processing transactions worth $90 billion in 2016 First Utility - a large independent energy and broadband provider in the U.K. Merlin Entertainments - a leading entertainment company with 123 attractions in 24 countries, including Legoland, Madame Tussauds, and The London Eye Park Indigo - a France-based global parking network operator managing over two million parking spaces in more than 750 cities

Zendesk Shareholder Letter Q3 2017 - 12 Operating metrics As a proxy of our success with up-market opportunities, we measure our number of contracts signed with an annual value of $50,000 or greater. In the third quarter, we closed over 50% more of these contracts versus the third quarter of 2016, with the average contract size up over 40% more than the average size in the third quarter of 2016. Another metric we use to gauge our penetration within larger organizations is represented by the percentage of Support MRR generated by customers with 100 or more Support agents, which grew to 37% at the end of the third quarter of 2017, compared to 35% at the end of the second quarter of 2017 and 33% at the end of the third quarter of 2016. While we expect this metric to grow gradually, we see this third quarter increase as evidence of improving up-market momentum, which correlates with recent investments in expanding our territory-based sales approach. Our dollar-based net expansion rate also increased by two percentage points to end the third quarter at 118%, compared to 116% at the end of the second quarter of 2017 and 114% at the end of the third quarter of 2016. Consistent with expectations in prior quarters, we expect our dollar-based net expansion rate to remain in the 110-120% range over the next several quarters. % of total quarter-ending Support MRR from paid customer accounts with 100+ Support agents 37%100+ Agents Q3 2017

Zendesk Shareholder Letter Q3 2017 - 13 Corporate social responsibility (CSR) In October we crossed a meaningful milestone as a company: 2,000 employees around the world. As we continue to grow our team globally, we are committing to more initiatives that specifically promote equality, diversity, and inclusion in the workplace. With 45% of our employees based outside of the U.S., embracing diverse perspectives is critical to our relevance as a global company. Already our recently hired senior manager of diversity and inclusion is having an impact on the creation of a more inclusive workplace. Our initial steps toward greater inclusion have focused on the establishment of employee resource groups (ERGs). So far, we have launched ERGs for employees of color (called Mosaic) and for LGBTQ employees (called Pride). As part of our efforts to foster dialogue and understanding around LGBTQ issues, Zendesk was a major sponsor of the San Francisco Gay Men’s Chorus inaugural Lavender Pen Tour in October. The eight-day series of concerts and seminars—across five southern U.S. states—served to bring support and awareness of the LGBTQ community to areas where its members are not always as readily welcomed, while our support provided an opportunity for our executives, employees, and customers to engage in the events. The CSR team has continued to align its work with Zendesk’s go-to- market efforts by working closely with our field marketing organization to encourage startups and early-stage companies to integrate CSR programs and initiatives into their business models. The benefits of CSR for startups include improvements in recruiting, retention, brand, and reputation. One such outreach effort was France Digitale Day in Paris in September, where our head of CSR led a session with more than 500 startups and influencers. The Zendesk Neighbor Foundation—set up to support the local communities where we have offices—extended its support to areas hit by recent natural disasters. The Foundation is donating $125,000 in grants to organizations providing relief to those impacted by Hurricane Harvey in Houston, Hurricane Maria in Puerto Rico, the Mexico City earthquake, and the wildfires in Northern California.

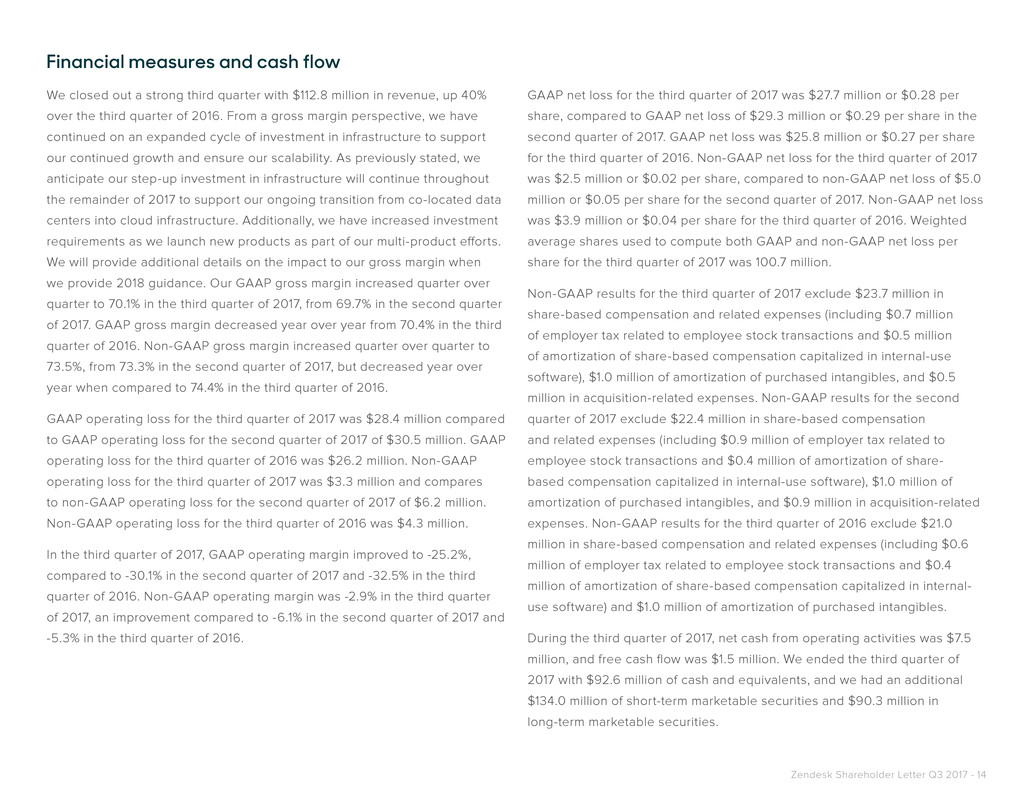

Zendesk Shareholder Letter Q3 2017 - 14 Financial measures and cash flow We closed out a strong third quarter with $112.8 million in revenue, up 40% over the third quarter of 2016. From a gross margin perspective, we have continued on an expanded cycle of investment in infrastructure to support our continued growth and ensure our scalability. As previously stated, we anticipate our step-up investment in infrastructure will continue throughout the remainder of 2017 to support our ongoing transition from co-located data centers into cloud infrastructure. Additionally, we have increased investment requirements as we launch new products as part of our multi-product efforts. We will provide additional details on the impact to our gross margin when we provide 2018 guidance. Our GAAP gross margin increased quarter over quarter to 70.1% in the third quarter of 2017, from 69.7% in the second quarter of 2017. GAAP gross margin decreased year over year from 70.4% in the third quarter of 2016. Non-GAAP gross margin increased quarter over quarter to 73.5%, from 73.3% in the second quarter of 2017, but decreased year over year when compared to 74.4% in the third quarter of 2016. GAAP operating loss for the third quarter of 2017 was $28.4 million compared to GAAP operating loss for the second quarter of 2017 of $30.5 million. GAAP operating loss for the third quarter of 2016 was $26.2 million. Non-GAAP operating loss for the third quarter of 2017 was $3.3 million and compares to non-GAAP operating loss for the second quarter of 2017 of $6.2 million. Non-GAAP operating loss for the third quarter of 2016 was $4.3 million. In the third quarter of 2017, GAAP operating margin improved to -25.2%, compared to -30.1% in the second quarter of 2017 and -32.5% in the third quarter of 2016. Non-GAAP operating margin was -2.9% in the third quarter of 2017, an improvement compared to -6.1% in the second quarter of 2017 and -5.3% in the third quarter of 2016. GAAP net loss for the third quarter of 2017 was $27.7 million or $0.28 per share, compared to GAAP net loss of $29.3 million or $0.29 per share in the second quarter of 2017. GAAP net loss was $25.8 million or $0.27 per share for the third quarter of 2016. Non-GAAP net loss for the third quarter of 2017 was $2.5 million or $0.02 per share, compared to non-GAAP net loss of $5.0 million or $0.05 per share for the second quarter of 2017. Non-GAAP net loss was $3.9 million or $0.04 per share for the third quarter of 2016. Weighted average shares used to compute both GAAP and non-GAAP net loss per share for the third quarter of 2017 was 100.7 million. Non-GAAP results for the third quarter of 2017 exclude $23.7 million in share-based compensation and related expenses (including $0.7 million of employer tax related to employee stock transactions and $0.5 million of amortization of share-based compensation capitalized in internal-use software), $1.0 million of amortization of purchased intangibles, and $0.5 million in acquisition-related expenses. Non-GAAP results for the second quarter of 2017 exclude $22.4 million in share-based compensation and related expenses (including $0.9 million of employer tax related to employee stock transactions and $0.4 million of amortization of share- based compensation capitalized in internal-use software), $1.0 million of amortization of purchased intangibles, and $0.9 million in acquisition-related expenses. Non-GAAP results for the third quarter of 2016 exclude $21.0 million in share-based compensation and related expenses (including $0.6 million of employer tax related to employee stock transactions and $0.4 million of amortization of share-based compensation capitalized in internal- use software) and $1.0 million of amortization of purchased intangibles. During the third quarter of 2017, net cash from operating activities was $7.5 million, and free cash flow was $1.5 million. We ended the third quarter of 2017 with $92.6 million of cash and equivalents, and we had an additional $134.0 million of short-term marketable securities and $90.3 million in long-term marketable securities.

Zendesk Shareholder Letter Q3 2017 - 15 Guidance Our financial guidance for the remainder of 2017 reflects our expectations that we will continue to expand our go-to-market team’s productivity, further invest in and expand our up-market efforts, and broaden our sales across a growing family of products. For the fourth quarter of 2017, we expect revenue to range between $118.0 and $120.0 million. We expect our GAAP operating loss for the fourth quarter of 2017 to range between $29.0 and $31.0 million. We expect our non-GAAP operating loss for the fourth quarter of 2017 to range between $3.0 and $5.0 million, which we estimate to exclude share-based compensation and related expenses of approximately $24.7 million, amortization of purchased intangibles of approximately $0.7 million, and acquisition-related expenses of $0.6 million. For the full year of 2017, we expect revenue to range between $425.0 and $427.0 million, compared to our previous full-year guidance range of $420.0 and $425.0 million. This range represents revenue growth between 36% and 37% year over year. We expect our GAAP operating loss to range between $116.0 and $118.0 million. We expect our non-GAAP operating loss to range between $18.0 and $20.0 million, which we estimate to exclude share- based compensation and related expenses of approximately $92.3 million, amortization of purchased intangibles of approximately $3.7 million, and acquisition-related expenses of $2.0 million. Our updated full-year guidance reflects our confidence in being able to maintain a high growth rate through the end of 2017. We continue to expect net cash from operating activities and free cash flow to be positive for the full year 2017. This target regarding free cash flow includes cash used for purchases of property and equipment and internal- use software development costs. We have not reconciled free cash flow guidance to net cash from operating activities for this future period because we do not provide guidance on the reconciling items between net cash from operating activities and free cash flow, as a result of the uncertainty regarding, and the potential variability of, these items. The actual amount of such reconciling items will have a significant impact on our free cash flow and, accordingly, a reconciliation of net cash from operating activities to free cash flow for the period is not available without unreasonable effort. Finally, we estimate we will have approximately 102.1 million weighted average shares outstanding for the fourth quarter of 2017 and 100.0 million weighted average shares outstanding for the full year of 2017, each based only on current shares outstanding and anticipated activity associated with equity incentive plans.

Zendesk Shareholder Letter Q3 2017 - 16 Condensed consolidated statements of operations (In thousands, except per share data; unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2017 2016 2017 2016 Revenue $112,786 $80,717 $307,066 $223,376 Cost of revenue 33,693 23,866 92,464 68,318 Gross profit 79,093 56,851 214,602 155,058 Operating expenses: Research and development 29,358 22,953 84,512 66,683 Sales and marketing 56,778 43,899 156,707 119,421 General and administrative 21,398 16,212 59,502 48,149 Total operating expenses 107,534 83,064 300,721 234,253 Operating loss (28,441) (26,213) (86,119) (79,195) Other income, net 619 681 1,345 745 Loss before provision for (benefit from) income taxes (27,822) (25,532) (84,774) (78,450) Provision for (benefit from) income taxes (133) 294 (786) 800 Net loss $(27,689) $(25,826) $(83,988) $(79,250) Net loss per share, basic and diluted $(0.28) $(0.27) $(0.85) $(0.86) Weighted-average shares used to compute net loss per share, basic and diluted 100,659 94,085 99,203 92,274

Zendesk Shareholder Letter Q3 2017 - 17 Condensed consolidated balance sheets (In thousands, except par value; unaudited) September 30 2017 December 31, 2016 Assets Current assets: Cash and cash equivalents $92,603 $93,677 Marketable securities 133,959 131,190 Accounts receivable, net of allowance for doubtful accounts of $751 and $1,269 as of September 30, 2017 and December 31, 2016, respectively 51,465 37,343 Prepaid expenses and other current assets 24,318 17,608 Total current assets 302,345 279,818 Marketable securities, noncurrent 90,263 75,168 Property and equipment, net 59,600 62,731 Goodwill and intangible assets, net 67,779 53,296 Other assets 9,350 4,272 Total assets $529,337 $475,285 Liabilities and stockholders’ equity Current liabilities: Accounts payable $11,212 $4,555 Accrued liabilities 21,588 19,106 Accrued compensation and related benefits 26,325 20,281 Deferred revenue 154,163 123,276 Total current liabilities 213,288 167,218 Deferred revenue, noncurrent 1,727 1,257 Other liabilities 8,152 7,382 Total liabilities 223,167 175,857 Stockholders’ equity: Preferred stock, par value $0.01 per share - - Common stock, par value $0.01 per share 1,010 971 Additional paid-in capital 711,301 624,026 Accumulated other comprehensive loss (2,205) (5,197) Accumulated deficit (403,936) (319,720) Treasury stock, at cost - (652) Total stockholders’ equity 306,170 299,428 Total liabilities and stockholders’ equity $529,337 $475,285

Zendesk Shareholder Letter Q3 2017 - 18 Condensed consolidated statements of cash flows (In thousands; unaudited) Three Months Ended September 30, 2017 2016 Cash flows from operating activities Net loss $(27,689) $(25,826) Adjustments to reconcile net loss to net cash provided by (used in) operating activities: Depreciation and amortization 8,131 6,853 Share-based compensation 22,518 19,995 Excess tax benefit from share-based award acvitity - (133) Other 22 622 Changes in operating assets and liabilities: Accounts receivable (10,420) (9,355) Prepaid expenses and other current assets (2,094) 459 Other assets and liabilities (1,919) (1,449) Accounts payable 3,428 (1,641) Accrued liabilities 2,655 842 Accrued compensation and related benefits 109 (286) Deferred revenue 12,773 9,353 Net cash provided by (used in) operating activities 7,514 (566) Cash flows from investing activities Purchases of property and equipment (4,058) (4,084) Internal-use software development costs (1,922) (1,540) Purchases of marketable securities (52,954) (80,469) Proceeds from maturities of marketable securities 27,274 7,495 Proceeds from sale of marketable securities 7,401 25,613 Net cash used in investing activities (24,259) (52,985) Cash flows from financing activities Proceeds from exercise of employee stock options 3,375 10,499 Proceeds from employee stock purchase plan 3,841 3,032 Taxes paid related to net share settlement of equity awards (652) (281) Excess tax benefit from share-based award acvitity - 133 Net cash provided by financing activities 6,564 13,383 Effect of exchange rate changes on cash and cash equivalents 9 (279) Net decrease in cash and cash equivalents (10,172) (40,447) Cash and cash equivalents at beginning of period 102,775 118,036 Cash and cash equivalents at end of period $92,603 $77,589

Zendesk Shareholder Letter Q3 2017 - 19 Non-GAAP results (In thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Three Months Ended September 30, Nine Months Ended September 30, 2017 2016 2017 2016 Reconciliation of gross profit and gross margin GAAP gross profit $79,093 $56,851 $214,602 $155,058 Plus: Share-based compensation 2,408 1,919 6,668 5,355 Plus: Employer tax related to employee stock transactions 98 85 401 277 Plus: Amortization of purchased intangibles 848 848 2,597 2,525 Plus: Amortization of share-based compensation capitalized in internal-use software 479 387 1,357 1,223 Non-GAAP gross profit $82,926 $60,090 $225,625 $164,438 GAAP gross margin 70% 70% 70% 69% Non-GAAP adjustments 4% 4% 3% 5% Non-GAAP gross margin 74% 74% 73% 74% Reconciliation of operating expenses GAAP research and development $29,358 $22,953 $84,512 $66,683 Less: Share-based compensation (7,776) (7,172) (22,273) (20,548) Less: Employer tax related to employee stock transactions (252) (232) (1,155) (802) Less: Acquisition-related expenses (261) _ (436) _ Non-GAAP research and development $21,069 $15,549 $60,648 $45,333 GAAP research and development as percentage of revenue 26% 28% 28% 30% Non-GAAP research and development as percentage of revenue 19% 19% 20% 20% GAAP sales and marketing $56,778 $43,899 $156,707 $119,421 Less: Share-based compensation (6,716) (6,657) (18,362) (17,780) Less: Employer tax related to employee stock transactions (195) (184) (809) (574) Less: Amortization of purchased intangibles (135) (106) (360) (314) Less: Acquisition-related expenses (281) - (469) - Non-GAAP sales and marketing $49,451 $36,952 $136,707 $100,753 GAAP sales and marketing as percentage of revenue 50% 54% 51% 53% Non-GAAP sales and marketing as percentage of revenue 44% 46% 45% 45%

Zendesk Shareholder Letter Q3 2017 - 20 (continued...) Non-GAAP results (In thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter. Three Months Ended September 30, Nine Months Ended September 30, 2017 2016 2017 2016 GAAP general and administrative $21,398 $16,212 $59,502 $48,149 Less: Share-based compensation (5,619) (4,247) (15,502) (12,654) Less: Employer tax related to employee stock transactions (109) (120) (512) (462) Less: Acquisition-related expenses - - (521) - Non-GAAP general and administrative $15,670 $11,845 $42,967 $35,033 GAAP general and administrative as percentage of revenue 19% 20% 19% 22% Non-GAAP general and administrative as percentage of revenue 14% 15% 14% 16% Reconciliation of operating loss and operating margin GAAP operating loss $(28,441) $(26,213) $(86,119) $(79,195) Plus: Share-based compensation 22,519 19,995 62,805 56,337 Plus: Employer tax related to employee stock transactions 654 621 2,877 2,115 Plus: Amortization of purchased intangibles 983 954 2,957 2,839 Plus: Acquistion-related expenses 542 - 1,426 - Plus: Amortization of share-based compensation capitalized in internal-use software 479 387 1,357 1,223 Non-GAAP operating loss $(3,264) $(4,256) $(14,697) $(16,681) GAAP operating margin (25)% (32)% (28)% (35)% Non-GAAP adjustment 22% 27% 23% 28% Non-GAAP operating margin (3)% (5)% (5)% (7)% Reconciliation of net loss GAAP net loss $(27,689) $(25,826) $(83,988) $(79,250) Plus: Share-based compensation 22,519 19,995 62,805 56,337 Plus: Employer tax related to employee stock transactions 654 621 2,877 2,115 Plus: Amortization of purchased intangibles 983 954 2,957 2,839 Plus: Acquistion-related expenses 542 - 1,426 - Plus: Amortization of share-based compensation capitalized in internal-use software 479 387 1,357 1,223 Non-GAAP net loss $(2,512) $(3,869) $(12,566) $(16,736)

Zendesk Shareholder Letter Q3 2017 - 21 Three Months Ended September 30, Nine Months Ended September 30, 2017 2016 2017 2016 Reconciliation of net loss per share, basic and diluted GAAP net loss per share, basic and diluted $(0.28) $(0.27) $(0.85) $(0.86) Non-GAAP adjustments to net loss 0.26 0.23 0.72 0.68 Non-GAAP net loss per share, basic and diluted $(0.02) $(0.04) $(0.13) $(0.18) Weighted-average shares used to compute net loss per share, basic and diluted 100,659 94,085 99,203 92,274 Computation of free cash flow Net cash provided by (used in) operating activities $7,514 $(566) $24,739 $3,994 Less: purchases of property and equipment (4,058) (4,084) (13,334) (12,494) Less: internal-use software development costs (1,922) (1,540) (5,237) (4,313) Free cash flow $1,534 $(6,190) $6,168 $(12,813) (continued...) Non-GAAP results (In thousands, except per share data) The following table shows Zendesk’s GAAP results reconciled to non-GAAP results included in this letter.

Zendesk Shareholder Letter Q3 2017 - 22 About Zendesk Zendesk builds software for better customer relationships. It empowers organizations to im- prove customer engagement and better understand their customers. Approximately 114,000 paid customer accounts in over 160 countries and territories use Zendesk products. Based in San Francisco, Zendesk has operations in the United States, Europe, Asia, Australia, and South America. Learn more at www.zendesk.com. Forward-Looking Statements This press release contains forward-looking statements, including, among other things, statements regarding Zendesk’s future financial performance, its continued investment to grow its business, and progress towards its long-term financial objectives. The words such as “may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases that denote future expectation or intent regarding Zendesk’s financial results, operations, and other matters are intended to identify forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual results, performance, or achievements to differ materially, including (i) adverse changes in general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang- ing market dynamics and customer preferences or achieve increased market acceptance of its products; (iii) Zendesk’s expectation that the future growth rate of its revenues will decline, and that, as its costs increase, Zendesk may not be able to generate sufficient revenues to achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes it difficult to evaluate its prospects and future operating results; (v) the market in which Zendesk oper- ates is intensely competitive, and Zendesk may not compete effectively; (vi) the development of the market for software as a service business software applications; (vii) Zendesk’s ability to introduce and market new products and to support its products on a shared services platform; (viii) Zendesk’s ability to integrate acquired businesses and technologies success- fully or achieve the expected benefits of such acquisitions; (ix) Zendesk’s ability to effectively manage its growth and organizational change; (x) breaches in Zendesk’s security measures or unauthorized access to its customers’ data; (xi) service interruptions or performance prob- lems associated with Zendesk’s technology and infrastructure; (xii) real or perceived errors, failures, or bugs in its products; (xiii) Zendesk’s substantial reliance on its customers renewing their subscriptions and purchasing additional subscriptions; and (xiv) Zendesk’s ability to effectively expand its sales capabilities. The forward-looking statements contained in this press release are also subject to additional risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter ended June 30, 2017. Further information on potential risks that could affect actu- al results will be included in the subsequent periodic and current reports and other filings that Zendesk makes with the Securities and Exchange Commission from time to time, including its Quarterly Report on Form 10-Q for the quarter ended September 30, 2017. Forward-looking statements represent Zendesk’s management’s beliefs and assumptions only as of the date such statements are made. Zendesk undertakes no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unantici- pated events, except as required by law. About Non-GAAP Financial Measures To provide investors and others with additional information regarding Zendesk’s results, the following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross margin, non-GAAP operating expenses, non-GAAP operating loss and operating margin, non-GAAP net loss, non-GAAP net loss per share, basic and diluted, and free cash flow. Specifically, Zendesk excludes the following from its historical and prospective non-GAAP financial measures, as applicable: Share-based Compensation and Amortization of Share-based Compensation Capitalized in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain employees. It is principally aimed at aligning their interests with those of its stockholders and at long-term retention, rather than to address operational performance for any particular period. As a result, share-based compensation expenses vary for reasons that are generally unrelated to financial and operational performance in any particular period. Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of employer taxes related to its employee stock transactions as an expense that is dependent on its stock price, employee exercise and other award disposition activity, and other factors that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock transactions vary for reasons that are generally unrelated to financial and operational perfor- mance in any particular period. Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible assets, including the amortization of the cost associated with an acquired entity’s developed technology, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are evaluated for impairment regularly, amortization of the cost of purchased intangibles is an expense that is not typically affected by operations during any particular period. Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as transac- tion costs, integration costs, restructuring costs, and acquisition-related retention payments, including amortization of acquisition-related retention payments capitalized in internal-use software, as events that are not necessarily reflective of operational performance during a period. In particular, Zendesk believes the consideration of measures that exclude such expenses can assist in the comparison of operational performance in different periods which may or may not include such expenses. Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from operating activities, less purchases of property and equipment and internal-use software development costs. Zendesk uses free cash flow, among other measures, to evaluate the ability of its operations to generate cash that is available for purposes other than capital expenditures and capitalized software development costs. Zendesk believes that informa- tion regarding free cash flow provides investors with an important perspective on the cash available to fund ongoing operations. Zendesk’s disclosures regarding its expectations for its non-GAAP operating margin include adjustments to its expectations for its GAAP operating margin that exclude the expected share-based compensation and related expenses, amortization of purchased intangibles, and acquisition-related expenses excluded from its expectations for non-GAAP operating loss as compared to its expectation for GAAP operating loss for the same period. Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to GAAP operating margin for future periods beyond the current fiscal year because Zendesk does not provide guidance on the reconciling items between GAAP operating margin and non-GAAP operating margin for such periods, as a result of the uncertainty regarding, and the potential variability of, these items. The actual amount of such reconciling items will have a significant impact on Zendesk’s non-GAAP operating margin and, accordingly, a reconciliation of GAAP operating margin to non-GAAP operating margin guidance for such periods is not available without unreasonable effort.

Zendesk Shareholder Letter Q3 2017 - 23 Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include adjustments to its expectations for its GAAP gross margin that exclude share-based com- pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased intangibles related to developed technology. The share-based compensation and related expenses excluded due to such adjustments are primarily comprised of the share-based compensation and related expenses for employees associated with Zendesk’s platform infrastructure and customer experience organization. Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP gross margin for future periods because Zendesk does not provide guidance on the rec- onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the uncertainty regarding, and the potential variability of, these items. The actual amount of such reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and, accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for the period is not available without unreasonable effort. Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for internal planning and forecasting purposes. Zendesk’s management does not itself, nor does it suggest that investors should, consider such non-GAAP financial measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk presents such non-GAAP financial measures in reporting its financial results to provide inves- tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these non-GAAP financial measures are useful because they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making. This allows investors and others to better understand and evaluate Zendesk’s operating results and future prospects in the same manner as management. Zendesk’s management believes it is useful for itself and investors to review, as applicable, both GAAP information that may include items such as share-based compensation and related expenses, amortization of purchased intangibles, and acquisition-related expenses, and the non-GAAP measures that exclude such information in order to assess the per- formance of Zendesk’s business and for planning and forecasting in subsequent periods. When Zendesk uses such a non-GAAP financial measure with respect to historical periods, it provides a reconciliation of the non-GAAP financial measure to the most closely compara- ble GAAP financial measure. When Zendesk uses such a non-GAAP financial measure in a forward-looking manner for future periods, and a reconciliation is not determinable without unreasonable effort, Zendesk provides the reconciling information that is determinable without unreasonable effort and identifies the information that would need to be added or subtracted from the non-GAAP measure to arrive at the most directly comparable GAAP measure. Investors are encouraged to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measure as detailed above. About Operating Metrics Zendesk reviews a number of operating metrics to evaluate its business, measure per- formance, identify trends, formulate business plans, and make strategic decisions. These include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its other products, dollar-based net expansion rate, monthly recurring revenue represented by its churned customers, and the percentage of its monthly recurring revenue from Support originating from customers with 100 or more agents on Support. Zendesk defines the number of paid customer accounts at the end of any particular period as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free trials, or other free services, (ii) the number of accounts using Chat, exclusive of free trials or other free services, and (iii) the number of accounts on all of its other products, exclusive of free trials and other free services, each as of the end of the period and as identified by a unique account identifier. Use of Support, Chat, and Zendesk’s other products requires separate subscriptions and each of these accounts are treated as a separate paid customer account. Existing customers may also expand their utilization of Zendesk’s products by adding new accounts and a single consolidated organization or customer may have multiple accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or work processes. Each of these accounts is also treated as a separate paid customer account. Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase revenue across its existing customer base through expansion of authorized agents associated with a paid customer account, upgrades in subscription plans, and the purchase of additional products as offset by churn, contraction in authorized agents associated with a paid customer account, and downgrades in subscription plans. Zendesk’s dollar-based net expansion rate is based upon monthly recurring revenue for a set of paid customer accounts on its products. Monthly recurring revenue for a paid customer account is a legal and contractual determination made by assessing the contractual terms of each paid customer account, as of the date of determination, as to the revenue Zendesk expects to generate in the next monthly period for that paid customer account, assuming no changes to the subscription and without taking into account any one-time discounts or any platform usage above the subscription base, if any, that may be applicable to such subscription. Monthly recurring revenue is not determined by reference to historical revenue, deferred revenue, or any other GAAP financial measure over any period. It is forward-looking and contractually derived as of the date of determination. Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue as the aggregate monthly recurring revenue across its products for customers with paid customer accounts on Support or Chat as of the date one year prior to the date of calculation. Zendesk defines the retained revenue net of contraction and churn as the aggregate monthly recurring revenue across its products for the same customer base included in the measure of base revenue at the end of the annual period being measured. The dollar-based net expansion rate is also adjusted to eliminate the effect of certain activities that Zendesk identifies involving the transfer of agents between paid customer accounts, consolidation of customer accounts, or the split of a single paid customer account into multiple paid customer accounts. In addition, the dollar-based net expansion rate is adjusted to include paid customer accounts in the customer base used to determine retained revenue net of contraction and churn that share common corporate information with customers in the customer base that are used to determine the base revenue. Giving effect to this consolidation results in Zendesk’s dollar-based net expansion rate being calculated across approximately 90,800 customers, as compared to the approximately 113,900 total paid customer accounts as of September 30, 2017. To the extent that Zendesk can determine that the underlying customers do not share common corporate information, Zendesk does not aggregate paid customer accounts associated with reseller and other similar channel arrangements for the purposes of determining its dollar-based net expansion rate. While not material, Zendesk believes the failure to account for these activities would otherwise skew the dollar-based net expansion metrics associated with customers that maintain multiple paid customer accounts across its products and paid customer accounts associated with reseller and other similar channel arrangements. Zendesk does not currently incorporate operating metrics associated with its analytics product or its Outbound product into its measurement of dollar-based net expansion rate.

Zendesk Shareholder Letter Q3 2017 - 24 For a more detailed description of how Zendesk calculates its dollar-based net expansion rate, please refer to Zendesk’s periodic reports filed with the Securities and Exchange Commission. Zendesk calculates its monthly recurring revenue represented by its churned customers on an annualized basis by dividing base revenue associated with paid customer accounts on Support that churn, either by termination of the subscription or failure to renew, during the annual period being measured, by Zendesk’s base revenue. Zendesk’s monthly recurring revenue represented by its churned customers excludes expansion or contraction associated with paid customer accounts on Support and the effect of upgrades or downgrades in subscription plan. The monthly recurring revenue represented by its churned customers is adjusted to exclude paid customer accounts that churned from the customer base used that share common corporate information with customer accounts that did not churn from the customer base during the annual period being measured. While not material, Zendesk believes the failure to make this adjustment could otherwise skew the monthly recurring revenue represented by its churned customers as a result of customers that maintain multiple paid customer accounts on Support. Zendesk’s percentage of monthly recurring revenue from Support that is generated by customers with 100 or more agents on Support is determined by dividing the monthly recurring revenue from Support for paid customer accounts with 100 or more agents on Support as of the measurement date by the monthly recurring revenue from Support for all paid customer accounts on Support as of the measurement date. Zendesk determines the customers with 100 or more agents on Support as of the measurement date based on the number of activated agents on Support at the measurement date and includes adjustments to aggregate paid customer accounts that share common corporate information. Zendesk determines the annualized value of a contract by annualizing the monthly recurring revenue for such contract. Zendesk does not currently incorporate operating metrics associated with products other than Support into its measurement of monthly recurring revenue represented by its churned customers or the percentage of monthly recurring revenue from Support that is generated by customers with 100 or more agents on Support. About Customer Metrics September 30, 2016 December 31, 2016 March 31, 2017 June 30, 2017 September 30, 2017 Paid customer accounts on Zendesk Support (approx.) 47,400 50,800 54,900 57,800 61,200 + Paid customer accounts on Zendesk Chat (approx.) 40,000 41,300 44,000 45,300 46,600 + Paid customer accounts on other Zendesk products (approx.) 1,700 2,200 2,900 4,300 6,100 = Approximate number of paid customer accounts 89,100 94,300 101,800 107,400 113,900 Source: Zendesk, Inc. Contact: Investor Contact Marc Cabi, +1 415-852-3877 ir@zendesk.com Media Contact Tian Lee, +1 415-231-0847 press@zendesk.com