Matthew J. Beck

Item 1. REPORTS TO STOCKHOLDERS.

Cavalier Funds

ANNUAL REPORT

May 31, 2017

Cavalier Adaptive Income Fund

Cavalier Dividend Income Fund

Cavalier Dynamic Growth Fund

Cavalier Fundamental Growth Fund

Cavalier Global Opportunities Fund

Cavalier Hedged High Income Fund

Cavalier Multi Strategist Fund

Cavalier Tactical Rotation Fund

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Cavalier Funds (the "Funds"). The Funds' shares are not deposits or obligations of, or guaranteed by, any depository institution. The Funds' shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Funds nor the Funds' distributor is a bank.

The Cavalier Funds are distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 100 E. Six Forks Road, Suite 200, Raleigh, NC, 27609. There is no affiliation between the Cavalier Funds, including their principals, and Capital Investment Group, Inc.

| Table of Contents | | |

| | | |

| Letter to Shareholders | | 1 |

| Cavalier Adaptive Income Fund | | 4 |

| Cavalier Dividend Income Fund | | 12 |

| Cavalier Dynamic Growth Fund | | 20 |

| Cavalier Fundamental Growth Fund | | 31 |

| Cavalier Global Opportunities Fund | | 42 |

| Cavalier Hedged High Income Fund | | 50 |

| Cavalier Multi Strategist Fund | | 58 |

| Cavalier Tactical Rotation Fund | | 67 |

| Notes to Financial Statements | | 77 |

| Auditor Opinion | | 91 |

| Additional Information | | 92 |

Statements in this Annual Report that reflect projections or expectations of future financial or economic performance of the Cavalier Funds ("Funds") and of the market in general and statements of the Funds' plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

An investment in the Funds is subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that the Funds will be successful in meeting their investment objectives. Investment in the Funds is also subject to the following risks: Fund of Funds Risk, Control of Portfolio Funds Risk, Market Risk, Management Style Risk, Common Stock Risk, Other Equity Securities Risk, Large-Cap Securities Risk, Small-Cap and Mid-Cap Securities Risk, Sector Risk, Foreign Securities and Emerging Markets Risk, Short Sales Risk, Leverage Risk, Portfolio Turnover Risk, Investment Advisor Risk, Fixed Income Risk, Interest Rate Risk, Inflation Risk, High-Yield Risk, Corporate Debt Securities Risk, Convertible Securities Risk, Risks from Treasury Inflation-Protected Securities, Derivatives Risk, Futures Risk, Swaps Risk, Risk from Purchasing Options, Risk from Writing Options, Fixed-Income Market Risk, Commodities Risk, Real Estate Risk, Mortgage and Asset-Backed Securities Risk, General Market Risk, Foreign Investment Risk, Currency Risk, Emerging Markets Risk, Depository Receipts Risk, and Micro-Cap Securities Risk. More information about these risks and other risks can be found in the Funds' prospectus.

The performance information quoted in this Annual Report represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting ncfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The prospectus contains this and other information about the Funds. A copy of the prospectus is available at ncfunds.com or by calling Shareholder Services at 800-773-3863. The prospectus should be read carefully before investing. |

This Annual Report was first distributed to shareholders on or about August 15, 2017.

For More Information on Your Cavalier Funds:

See Our Web site @ ncfunds.com

or

Call Our Shareholder Services Group at 800-773-3863.

Dear Investor,

We appreciate the opportunity to present to you the annual report for the period ending May 31st 2017. As we enter the mid-point of 2017 the markets continue a period of historically low volatility. The VIX (CBOE Volatility Index) which measures the equity markets expectations of 30-day volatility has remained at a historically very low level for 2017. Also, the standard deviation so far in 2017 has measured less than 5%, another extremely low measure of volatility for the markets. This bull market that began in 2009 now becomes the second longest bull market in history only surpassed by the 1987 to 2000 bull market. Since the financial crisis ended in 2009 stocks have moved consistently higher. Just observing all Morningstar size and style categories, the 5-year returns ending May 31st, 2017 every single category has appreciated at a double-digit annualized rate. This has brought a level of complacency in the markets where prices may become disconnected from fundamentals. This risk will be most prevalent in businesses that have not had the fundamental earnings growth to support their share price appreciation. With markets today trading at higher valuations, high level of complacency, and heightened geopolitical risks, in our view it will be prudent to avoid unnecessary risks and maintain a disciplined investment philosophy.

The portfolio construction of our Cavalier Equity and Fixed Income funds adhere to the theory of adaptive correlation and offer a flexible way to off-set short-term market events by gradually, but quickly, reallocating assets to where they will be most effective. Our goal is not to completely avoid downside in a severe bear market, but have portfolios that can mitigate downside volatility. The ability to adapt to a changing market will be critical. We believe we are entering an era where risk management and the effective use of tactical risk management will serve investors well, and help them meet their goals.

Macro Commentary

With the first half of 2017 nearly complete, the global equity markets have been very kind for the bulls. The S&P 500 has posted 24 all-time closing highs since the year started. Even with heighted geopolitical risks, tightening monetary policy stance by the Federal Reserve, and modest GDP growth from the US economy, the stock market has quietly climbed higher. The first half of 2017 has been so easy for the bulls, the largest drawdown for the S&P 500 was only -2.80% from March 1st to April 15th. Statistically this is the second smallest drawdown in history for the S&P 500 dating back to 1928. The only year with a smaller drawdown than 2017 was 1995, and that year the S&P 500 performed very well in the second half of the year with about a 13% return. History has shown that years with a lower than average drawdown, market performance has been strong in the second half on the year. As a recap for market performance as of May 31st, the S&P 500 is up 8.66% from the beginning of 2017, and on a total return basis, the Barclays U.S. Aggregate Bond index is up 2.38%. There has been large performance divergence among sectors within the S&P 500. The energy sector is down about 12% and on the contrary the technology sector is up about 20% from the beginning of 2017. Additionally, there is divergence among large cap and small cap US equites, as US large caps have outperformed US small caps with the Russell 2000 up only 1.48% from the beginning of 2017. The YTD% returns for international developed markets have rebounded in 2017 with the S&P Global BMI up 10.20% since the beginning of 2017 through the end of May. High Yield bonds continue to offer attractive income and yields with modest total return. The Markit iBoxx USD Liquid High Yield Index was up 4.3% for the year through the end of May.

In summary, it has been a strong start for U.S. equities as market volatility has remained low through the first half of 2017, and markets have benefited with low drawdowns and strong performance. History has shown that markets ending the first half of the year with a steady increase also tend to rise steady in the second half of the year. For the S&P 500 going back to 1961, the index has averaged a gain of 5.41% in the second half when the market has been up in the first half of the year.

Cavalier Adaptive Income Fund

For the fiscal year ended May 31, 2017 in the Cavalier Adaptive Income Fund, the return on the Institutional Class Shares was 8.54%, and the return on the Class C Shares was 7.46%. This compares to 1.58% for the Barclays Capital US Aggregate Bond Index over the same period.

Cavalier Dividend Income Fund

For the fiscal year ended May 31, 2017 in the Cavalier Dividend Income Fund, the return on the Institutional Class Shares was 4.09%, and the return on the Class C Shares was 3.03%. This compares to 14.80% for the MSCI ACWI High Dividend Yield NR Index and 14.62% for the Russell 1000 Value Index over the same period.

Cavalier Dynamic Growth Fund

For the fiscal year ended May 31, 2017 in the Cavalier Dynamic Growth Fund, the return on the Institutional Class Shares was 16.50%, and the return on the Class C Shares was 15.42%. This compares to 18.13% for the S&P Global Broad Market Index and 17.16% for the S&P 500 Total Return Index over the same period.

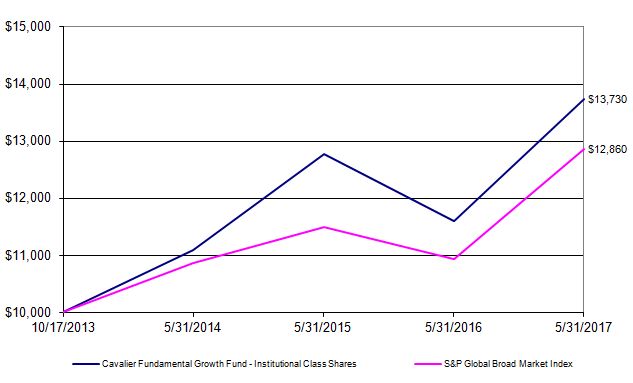

Cavalier Fundamental Growth Fund

For the fiscal year ended May 31, 2017 in the Cavalier Fundamental Growth Fund, the return on the Institutional Class Shares was 18.42%, and the return on the Class C Shares was 17.37%. This compares to 18.13% for the S&P Global Broad Market Index over the same period.

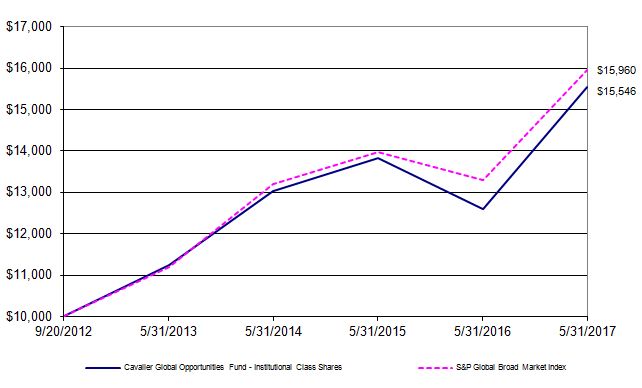

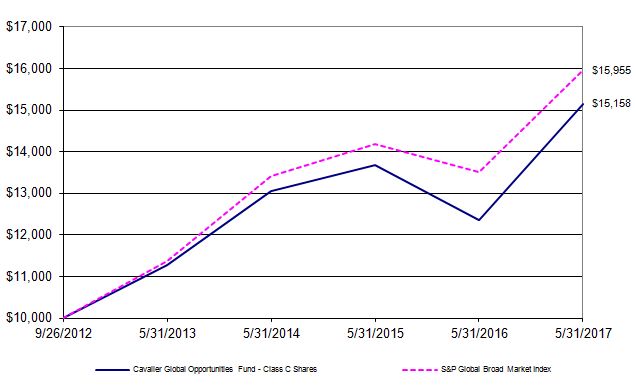

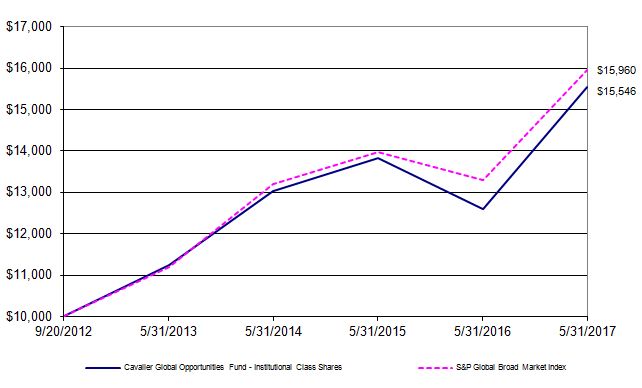

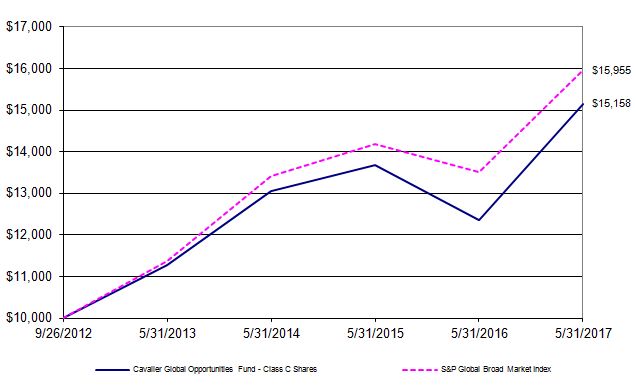

Cavalier Global Opportunities Fund

For the fiscal year ended May 31, 2017 in the Cavalier Global Opportunities Fund, the return on the Institutional Class Shares was 23.53%, and the return on the Class C Shares was 22.73%. This compares to 18.13% for the S&P Global Broad Market Index over the same period.

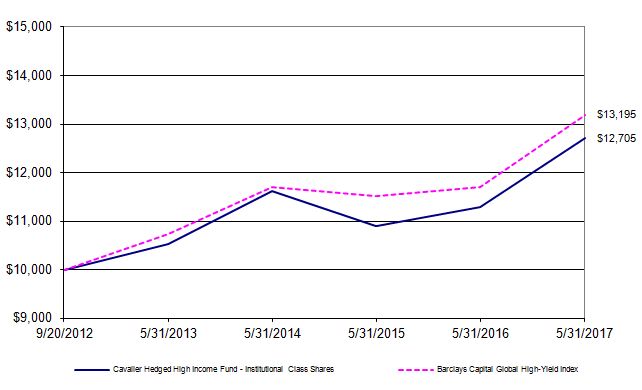

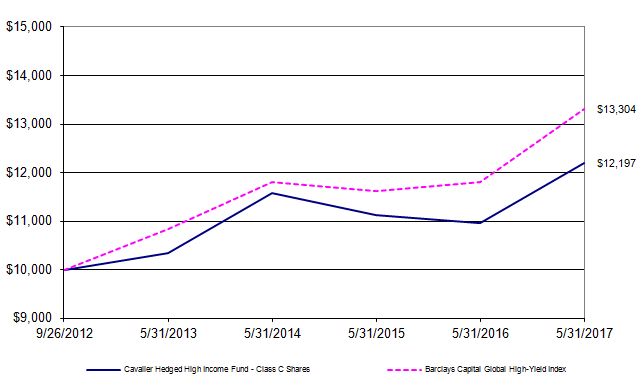

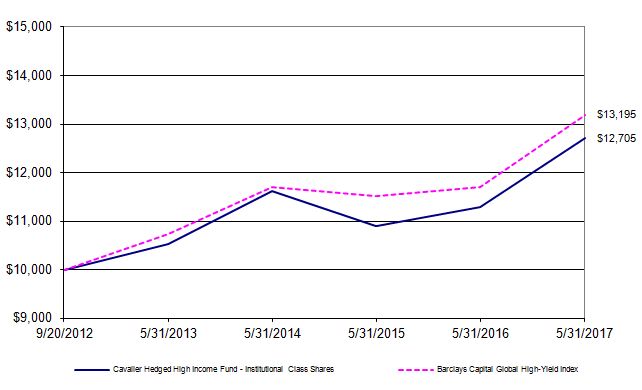

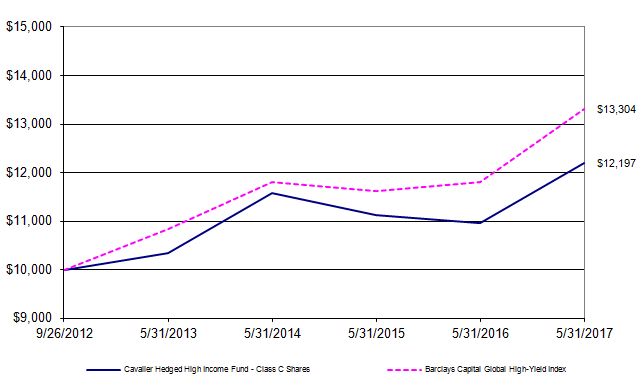

Cavalier Hedged High Income Fund

For the fiscal year ended May 31, 2017 in the Cavalier Hedged High Income Fund, the return on the Institutional Class Shares was 12.45%, and the return on the Class C Shares was 11.38%. This compares to 12.74% for the Barclays Capital Global High-Yield Index over the same period.

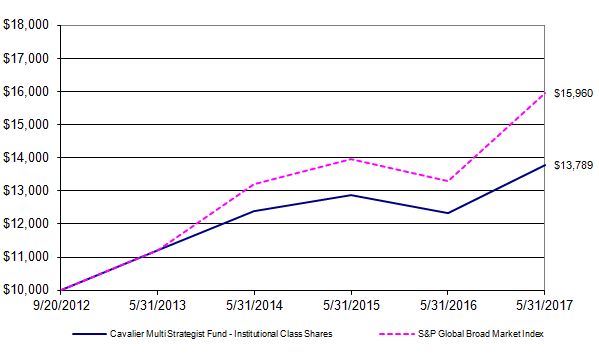

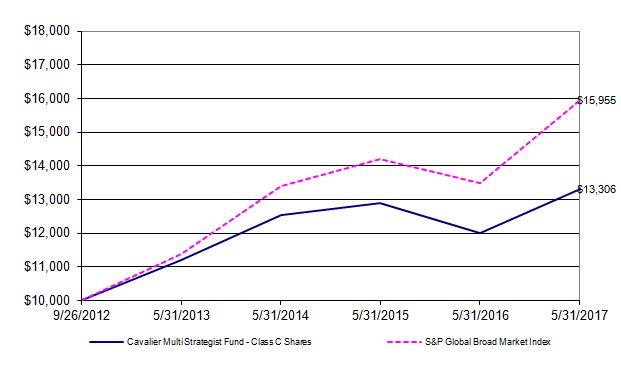

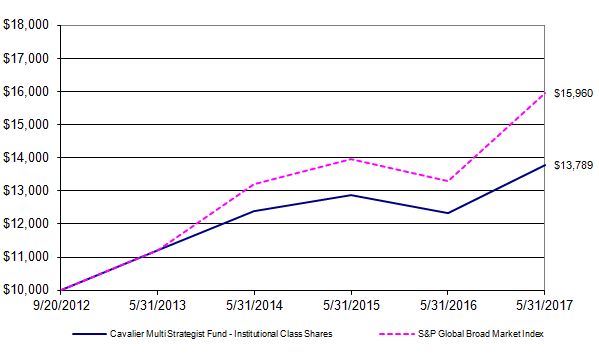

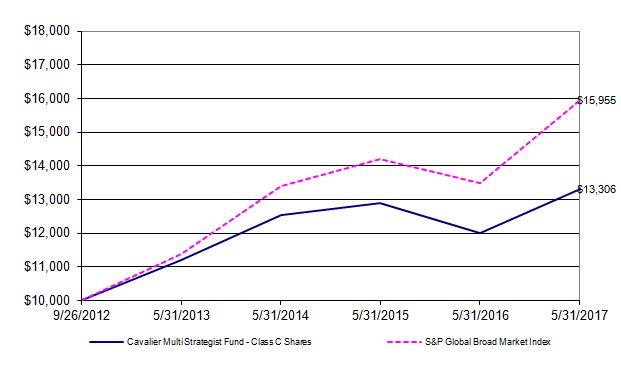

Cavalier Multi Strategist Fund

For the fiscal year ended May 31, 2017 in the Cavalier Multi Strategist Fund, the return on the Institutional Class Shares was 11.82%, and the return on the Class C Shares was 10.72%. This compares to 18.13% for the S&P Global Broad Market Index over the same period.

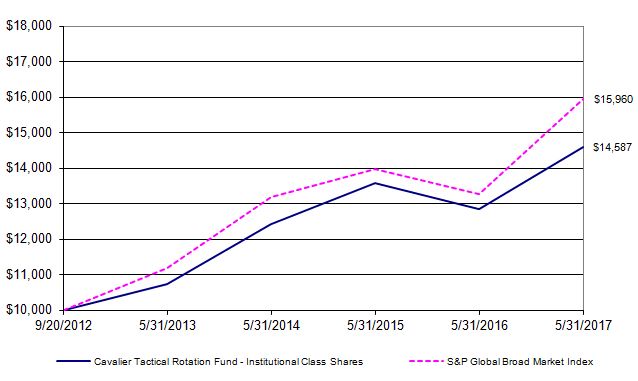

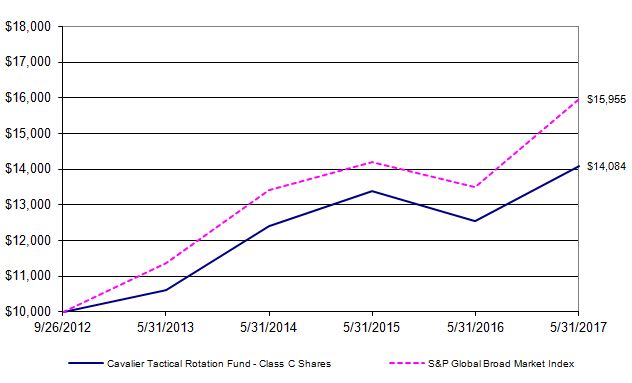

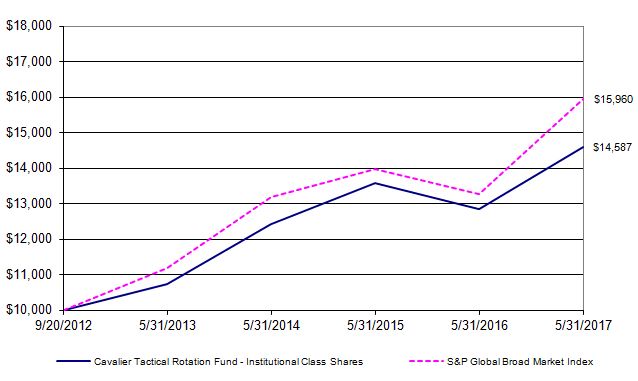

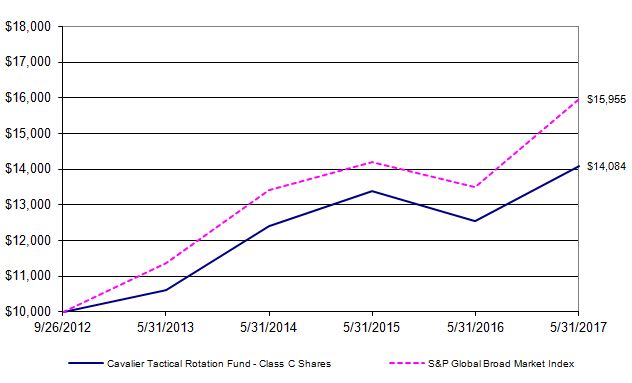

Cavalier Tactical Rotation Fund

For the fiscal year ended May 31, 2017 in the Cavalier Tactical Rotation Fund, the return on the Institutional Class Shares was 13.50%, and the return on the Class C Shares was 12.47%. This compares to 18.13% for the S&P Global Broad Market Index over the same period. The return on the Class P Shares was 12.00% for the period from July 1, 2016 (Date of Initial Public Investment) through May 31, 2017, which compares to a return of 21.60% for the S&P Global Broad Market Index for the same time period.

Summary

Cavalier has designed our suite of products to be suitable for investors seeking the capture of benchmark-like performance in up markets along with the comfort of having a safety net of downside protection built into each Fund offering to reduce asset loss in bear markets. Cavalier Funds are built around the concept that investors can experience benchmark results over a full market cycle, when compared to a static asset allocation, or buy-and- hold investing, with less fear and panic during times of market duress. As markets climb higher and reach new highs in 2017, our goal at Cavalier is to deliver investment products that can achieve market returns in bull markets and tactically seek to manage risk and downside volatility when markets eventually move into bear market territory.

Thank you for the continued opportunity to serve you.

Disclosures:

The performance information quoted above represents past performance and past performance does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance data, current to the most recent month end, may be obtained by calling the Funds at 800-773-3863. Fee waivers and expense reimbursements have positively impacted the Funds' performance.

The inception date of the Institutional Class Shares for the Cavalier Adaptive Income Fund and Cavalier Dynamic Growth Fund is October 2, 2009. The inception date of the Institutional Class Shares for the Cavalier Dividend Income Fund, Cavalier Global Opportunities Fund, Cavalier Hedged High Income Fund, Cavalier Multi Strategist Fund, and Cavalier Tactical Rotation Fund is September 20, 2012. The inception date of the Institutional Class Shares of the Cavalier Fundamental Growth Fund is October 17, 2013.

The inception dates of the Class C Shares for the Cavalier Adaptive Income Fund and Cavalier Dynamic Growth Fund are February 25, 2011 and February 18, 2011, respectively. The inception date of the Institutional Class Shares for the Cavalier Dividend Income Fund, Cavalier Global Opportunities Fund, Cavalier Hedged High Income Fund, Cavalier Multi Strategist Fund, and Cavalier Tactical Rotation Fund is September 26, 2012. The inception date of the Institutional Class Shares of the Cavalier Fundamental Growth Fund is November 4, 2013.

(RCCAV0617001)

| Cavalier Adaptive Income Fund - Institutional Class Shares | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

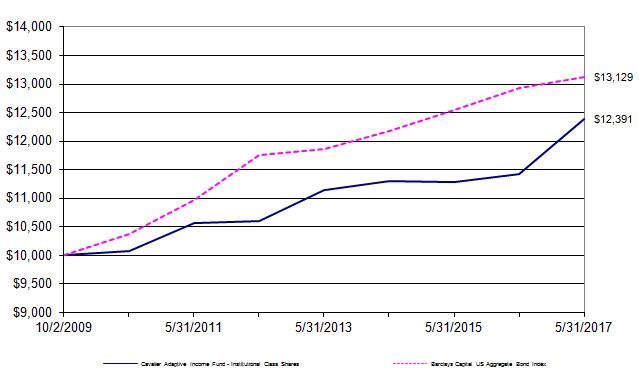

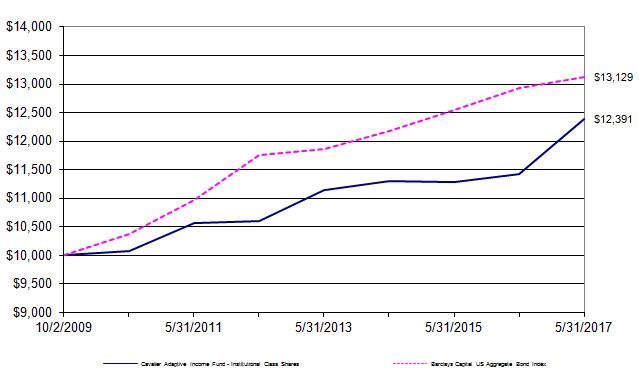

| For the period from October 2, 2009 (Date of Initial Public Investment) through May 31, 2017 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| The graph above assumes an initial $10,000 investment and represents the reinvestment of dividends and capital gains. This graph depicts the performance of Cavalier Adaptive Income Fund - Institutional Class Shares versus the Barclays Capital US Aggregate Bond Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | | One | | Five | | Since | | Inception | | Expense | | |

| | | May 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | | |

| | | Institutional Class Shares | | | 8.54% | | 3.17% | | 2.84% | | 10/02/09 | | 2.45% | | |

| | | Barclays Capital US Aggregate Bond Index | | 1.58% | | 2.24% | | 3.62% | | N/A | | N/A | | |

| | | | | | | | | | | | | | | | | | | | |

| * The gross expense ratio shown is from the Funds' prospectus dated September 28, 2016. | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| Cavalier Adaptive Income Fund - Class C Shares | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

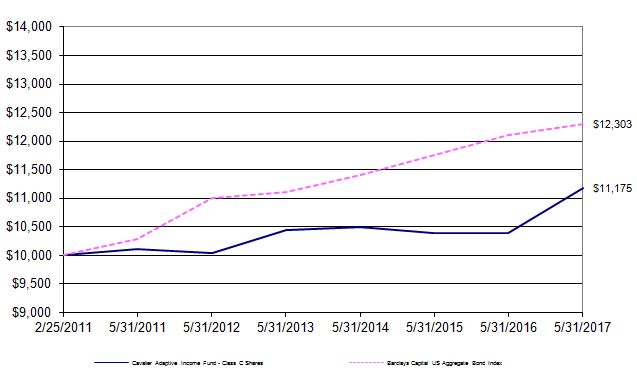

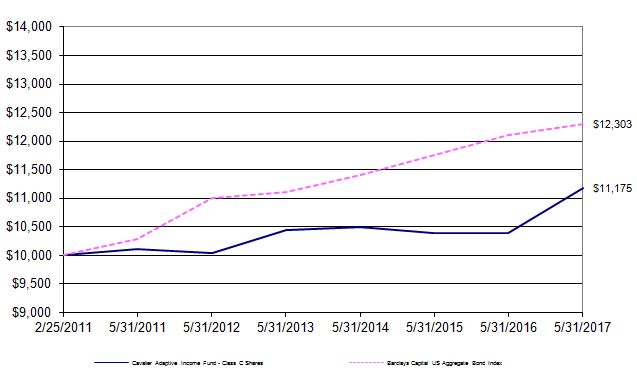

| For the period from February 25, 2011 (Date of Initial Public Investment) through May 31, 2017 | | |

| | | | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| The graph above assumes an initial $10,000 investment and represents the reinvestment of dividends and capital gains. This graph depicts the performance of Cavalier Adaptive Income Fund - Class C Shares versus the Barclays Capital US Aggregate Bond Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | | One | | Five | | Since | | Inception | | Expense | | |

| | | May 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | | |

| | | Class C Shares** | | | | 7.46% | | 2.15% | | 1.79% | | 02/25/11 | | 3.45% | | |

| | | Barclays Capital US Aggregate Bond Index | | 1.58% | | 2.24% | | 3.36% | | N/A | | N/A | | |

| * The gross expense ratio shown is from the Funds' prospectus dated September 28, 2016. | | | | |

| ** | As of February 24, 2017, the "Advisor Class" Shares were renamed to the "Class C" Shares. There were no other changes to this class of shares. Class C Shares held longer than 7 years will automatically convert to Institutional Class Shares. Institutional Class Shares are not subject to the distribution and service plan (Rule 12b-1) fees of 1.00%. |

| | |

|

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| Cavalier Adaptive Income Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | |

| As of May 31, 2017 | | | | | | | |

| | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | |

| CLOSED-END FUNDS - 39.44% | | | | | | |

| | Advent Claymore Convertible Securities and Income Fund | | 30,784 | $ | 499,932 |

| | Avenue Income Credit Strategies Fund | | | | 36,667 | | 529,105 |

| | First Trust/Aberdeen Global Opportunity Income Fund | | | 84,037 | | 1,010,965 |

| | Tortoise Pipeline & Energy Fund, Inc. | | | | 30,174 | | 602,574 |

| | | | | | | | | | |

| | Total Closed-End Funds (Cost $2,534,177) | | | | | | 2,642,576 |

| | | | | | | | | | |

| EXCHANGE-TRADED PRODUCTS - 22.84% | | | | | | |

| | Deutsche X-trackers High Yield Corporate Bond ETF | | | 31,402 | | 734,807 |

| | PowerShares Senior Loan Portfolio | | | | 34,151 | | 796,060 |

| | | | | | | | | | |

| | Total Exchange-Trade Products (Cost $1,531,848) | | | | | | 1,530,867 |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 37.25% | | | | | | |

| § | Fidelity Investments Money Market Government Portfolio - | | | | |

| | Institutional Class, 0.69% | | | | 2,496,129 | | 2,496,129 |

| | | | | | | | | | |

| | Total Short-Term Investment (Cost $2,496,129) | | | | | | 2,496,129 |

| | | | | | | | | | |

| Total Value of Investments (Cost $6,562,154) - 99.53% | | | | | $ | 6,669,572 |

| | | | | | | | | | |

| Other Assets Less Liabilities - 0.47% | | | | | | 31,592 |

| | | | | | | | | | |

| | Net Assets - 100.00% | | | | | | $ | 6,701,164 |

| | | | | | | | | | |

| § | Represents 7 day effective yield | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Summary of Investments | | | | | | |

| | | | | | | | | | |

| | | | | | % of Net Assets | | Value | | |

| | | | Closed-End Funds | | 39.44% | $ | 2,642,576 | | |

| | | | Exchange-Traded Products | | 22.84% | | 1,530,867 | | |

| | | | Short-Term Investment | | 37.25% | | 2,496,129 | | |

| | | | Other Assets Less Liabilities | 0.47% | | 31,592 | | |

| | | | Total Net Assets | | 100.00% | $ | 6,701,164 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| Cavalier Adaptive Income Fund | | |

| | | | | | | | |

| Statement of Assets and Liabilities | | |

| | | | | | | | |

| As of May 31, 2017 | | | |

| | | | | | | | |

| Assets: | | | | | |

| | Investments, at value (cost $6,562,154) | $ | 6,669,572 |

| | Receivables: | | | |

| | | Fund shares sold | | | 281 |

| | | Dividends | | | 572 |

| | | Due from Advisor | | | 31,873 |

| | Prepaid expenses: | | | |

| | | Registration and filing expenses | | 17,607 |

| | | Fund accounting fees | | | 2,783 |

| | | Compliance fees | | | 16 |

| | | | | | | | |

| | Total assets | | | 6,722,704 |

| | | | | | | | |

| Liabilities: | | | | | |

| | Accrued expenses: | | | |

| | | Professional fees | | | 15,000 |

| | | Distribution and service fees - Class C Shares | | 1,760 |

| | | Shareholder fulfillment fees | | 1,751 |

| | | Trustee fees and meeting expenses | | 1,337 |

| | | Custody and banking fees | | 913 |

| | | Insurance fees | | | 646 |

| | | Security pricing fees | | | 92 |

| | | Administration fees | | | 41 |

| | | | | | | | |

| | Total liabilities | | | 21,540 |

| | | | | | | | |

| Total Net Assets | | $ | 6,701,164 |

| | | | | | | | |

| Net Assets Consist of: | | | |

| | Paid in capital | | $ | 6,785,560 |

| | Accumulated net realized loss on investments | | (191,814) |

| | Net unrealized appreciation on investments | | 107,418 |

| | | | | | | | |

| Total Net Assets | | $ | 6,701,164 |

| | | | | | | | |

| Institutional Class Shares of beneficial interest outstanding, no par value (unlimited authorized shares) | 431,604 |

| | Net Assets | | | $ | 4,497,634 |

| | Net Asset Value, Offering Price and Redemption Price Per Share | $ | 10.42 |

| | | | | | | | |

| Class C Shares of beneficial interest outstanding, no par value (unlimited authorized shares) | | 218,848 |

| | Net Assets | | | $ | 2,203,530 |

| | Net Asset Value, Offering Price and Redemption Price Per Share (a) | $ | 10.07 |

| | | | | | | | |

| (a) | Contingent deferred sales charge for Class C Shares is imposed on proceeds redeemed within one year of the purchase date (note 1). |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| Cavalier Adaptive Income Fund | | |

| | | | | | | | |

| Statement of Operations | | |

| | | | | | | | |

| For the year ended May 31, 2017 | | |

| | | | | | | | |

| Investment Income: | | |

| | Dividends | | | $ | 340,684 |

| | | | | | | | |

| | Total Investment Income | | 340,684 |

| | | | | | | | |

| Expenses: | | | | | |

| | Advisory fees (note 2) | | 45,351 |

| | Professional fees | | 41,193 |

| | Fund accounting fees (note 2) | | 38,896 |

| | Registration and filing expenses | | 38,055 |

| | Transfer agent fees (note 2) | | 31,973 |

| | Administration fees (note 2) | | 24,026 |

| | Distribution and service fees - Class C Shares (note 3) | | 16,701 |

| | Shareholder fulfillment fees | | 16,432 |

| | Compliance fees | | 13,056 |

| | Trustee fees and meeting expenses | | 10,367 |

| | Custody and banking fees (note 2) | | 5,115 |

| | Insurance fees | | | 2,241 |

| | Other operating expenses | | 1,907 |

| | Security pricing fees | | 1,674 |

| | | | | | | | |

| | Total Expenses | | | 286,987 |

| | | | | | | | |

| | Fees waived and reimbursed by Advisor (note 2) | | (183,169) |

| | | | | | | | |

| | Net Expenses | | | 103,818 |

| | | | | | | | |

| Net Investment Income | | 236,866 |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | |

| | | | | | | | |

| | Net realized gain from investment transactions | | 393,578 |

| | Capital gain distributions from underlying funds | | 1,157 |

| | Net change in unrealized appreciation on investments | | (66,415) |

| | | | | | | | |

| Net Realized and Unrealized Gain on Investments | | 328,320 |

| | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | $ | 565,186 |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| Cavalier Adaptive Income Fund | | | | | | | |

| | | | | | | | | | | | |

| Statements of Changes in Net Assets | | | | | | | |

| | | | | | | | | | | | |

| For the years ended May 31, | | | | | 2017 | | 2016 |

| | | | | | | | | | | | |

| Operations: | | | | | | | | |

| | Net investment income | | | | $ | 236,866 | $ | 131,548 |

| | Net realized gain (loss) from investment transactions | | | | 393,578 | | (372,540) |

| | Net realized gain from underlying funds | | | | | 1,157 | | 3,021 |

| | Net change in unrealized appreciation (depreciation) on investments | | (66,415) | | 230,506 |

| | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | 565,186 | | (7,465) |

| | | | | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | |

| | Net investment income | | | | | | | |

| | | Institutional Class Shares | | | | | (183,339) | | (145,755) |

| | | Class C Shares | | | | | (55,795) | | (3,706) |

| | | | | | | | | | | | |

| Decrease in Net Assets Resulting from Distributions | | | | (239,134) | | (149,461) |

| | | | | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | |

| | Shares sold | | | | | | 1,578,382 | | 30,206,617 |

| | Reinvested dividends and distributions | | | | | 236,830 | | 100,209 |

| | Shares repurchased | | | | | (3,925,408) | | (42,233,840) |

| Decrease from Beneficial Interest Transactions | | | | (2,110,196) | | (11,927,014) |

| | | | | | | | | | | | |

| Net Decrease in Net Assets | | | | | (1,784,144) | | (12,083,940) |

| | | | | | | | | | | | |

| Net Assets: | | | | | | | | |

| | Beginning of Year | | | | | 8,485,308 | | 20,569,248 |

| | End of Year | | | | | $ | 6,701,164 | $ | 8,485,308 |

| | | | | | | | | | | | |

| Accumulated Net Investment Loss | | | | $ | - | $ | (4,764) |

| | | | | | Year Ended | | Year Ended |

| Share Information: | May 31, 2017 | | May 31, 2016 |

| | Institutional Class Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 59,686 | $ | 609,864 | | 2,899,776 | $ | 28,753,137 |

| | | Reinvested dividends and distributions | 17,834 | | 182,579 | | 9,849 | | 96,642 |

| | | Shares repurchased | (353,628) | | (3,617,139) | | (4,186,536) | | (41,431,319) |

| | Net Decrease in Shares of | | | | | | | |

| | Beneficial Interest | (276,108) | $ | (2,824,696) | | (1,276,911) | $ | (12,581,540) |

| | | | | | | | | | | | |

| | Class C Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 97,493 | $ | 968,518 | | 152,538 | $ | 1,453,480 |

| | | Reinvested dividends and distributions | 5,458 | | 54,251 | | 378 | | 3,567 |

| | | Shares repurchased | (31,198) | | (308,269) | | (83,726) | | (802,521) |

| | Net Increase in Shares of | | | | | | | |

| | Beneficial Interest | 71,753 | $ | 714,500 | | 69,190 | $ | 654,526 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | |

| Cavalier Adaptive Income Fund | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding during each | | Institutional Class Shares |

| of the fiscal years ended May 31, | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 9.98 | $ | 9.98 | $ | 10.15 | $ | 10.19 | $ | 10.16 | |

| | | | | | | | | | | | | | | | |

| Income (Loss) from Investment Operations | | | | | | | | | | | |

| | Net investment income | | 0.38 | (c) | 0.10 | (c) | 0.17 | (c) | 0.17 | (c) | 0.39 | |

| | Net realized and unrealized gain (loss) on | | | | | | | | | |

| | | investments | | 0.46 | | (0.00) | (g)(h) | (0.17) | | (0.05) | | 0.14 | |

| | | | | | | | | | | | | | | | |

| Total from Investment Operations | | 0.84 | | 0.10 | | - | | 0.12 | | 0.53 | |

| | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | |

| | From net investment income | | (0.40) | | (0.10) | | (0.16) | | (0.16) | | (0.48) | |

| | From net realized gains | | - | | - | | (0.01) | | - | | (0.02) | |

| | | | | | | | | | | | | | | | |

| Total Distributions | | | (0.40) | | (0.10) | | (0.17) | | (0.16) | | (0.50) | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | $ | 10.42 | $ | 9.98 | $ | 9.98 | $ | 10.15 | $ | 10.19 | |

| | | | | | | | | | | | | | | | |

| Total Return (a) | | | 8.54% | | 1.02% | | (0.04)% | | 1.25% | | 5.33% | |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Year (in thousands) | $ | 4,498 | $ | 7,063 | $ | 19,813 | $ | 9,280 | $ | 7,679 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | | | |

| Gross Expenses to Average Net Assets (b) | | 3.90% | | 2.04% | | 1.72% | | 0.70% | | 0.86% | |

| Net Expenses to Average Net Assets (b) | | 1.29% | | 0.94% | (f) | 0.88% | (e) | 0.70% | | 0.84% | |

| Net Investment Income to Average | | | | | | | | | | | |

| | Net Assets (d) | | | 3.68% | | 0.98% | (f) | 1.72% | (e) | 1.73% | | 3.14% | |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 110.84% | | 246.74% | | 106.26% | | 127.64% | | 82.95% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| (a) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (b) | Does not include expenses of the investment companies in which the Fund invests. | | | | | |

| (c) | Calculated using the average shares method. | | | | | | | | | |

| (d) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Includes reimbursement of acquired fund fees. | | | | | | | | | |

| (f) | Includes reimbursement of acquired fund fees and expenses for the period from June 1, 2015 through December 17, 2015. Expense limitation agreement was updated to exclude acquired fund fees and expenses from the waiver effective December 18, 2015 (see note 2). |

| (g) | Less than $0.01 per share. | | | | | | | | | | | |

| (h) | The amount of net realized and unrealized gain (loss) on investments per share for the year ended May 31, 2016 does not accord with the amount in the Statement of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| | | | | |

| | | | | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | (Continued) |

| Cavalier Adaptive Income Fund | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding during each | | Class C Shares (h) |

| of the fiscal years ended May 31, | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 9.67 | $ | 9.70 | $ | 9.87 | $ | 9.91 | $ | 9.94 | |

| | | | | | | | | | | | | | | | |

| Income (Loss) from Investment Operations | | | | | | | | | | | |

| | Net investment income (loss) | | 0.29 | (c) | (0.01) | (c) | 0.08 | (c) | 0.07 | (c) | 0.27 | |

| | Net realized and unrealized gain (loss) on | | | | | | | | | | |

| | | investments | | 0.42 | | 0.01 | (g) | (0.17) | | (0.04) | | 0.14 | |

| | | | | | | | | | | | | | | | |

| Total from Investment Operations | | 0.71 | | (0.00) | | (0.09) | | 0.03 | | 0.41 | |

| | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | |

| | From net investment income | | (0.31) | | (0.03) | | (0.07) | | (0.07) | | (0.42) | |

| | From net realized gains | - | | - | | (0.01) | | - | | (0.02) | |

| | | | | | | | | | | | | | | | |

| Total Distributions | | | (0.31) | | (0.03) | | (0.08) | | (0.07) | | (0.44) | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | $ | 10.07 | $ | 9.67 | $ | 9.70 | $ | 9.87 | $ | 9.91 | |

| | | | | | | | | | | | | | | | |

| Total Return (a) | | | 7.46% | | 0.05% | | (0.97)% | | 0.29% | | 4.16% | |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Year (in thousands) | $ | 2,204 | $ | 1,422 | $ | 756 | $ | 818 | $ | 760 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | | | |

| Gross Expenses to Average Net Assets (b) | | 5.27% | | 3.17% | | 2.72% | | 1.70% | | 1.86% | |

| Net Expenses to Average Net Assets (b) | | 2.28% | | 2.12% | (f) | 1.88% | (e) | 1.70% | | 1.84% | |

| Net Investment Income (Loss) to Average | | | | | | | | | | | |

| | Net Assets (d) | | | 2.96% | | (0.14)% | (f) | 0.79% | (e) | 0.73% | | 2.14% | |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 110.84% | | 246.74% | | 106.26% | | 127.64% | | 82.95% | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| (a) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (b) | Does not include expenses of the investment companies in which the Fund invests. | | | | | | | |

| (c) | Calculated using the average shares method. | | | | | | | | | | | |

| (d) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (e) | Includes reimbursement of acquired fund fees. | | | | | | | | | | | |

| (f) | Includes reimbursement of acquired fund fees and expenses for the period from June 1, 2015 through December 17, 2015. Expense limitation agreement was updated to exclude acquired fund fees and expenses from the waiver effective December 18, 2015 (see note 2). |

| (g) | The amount of net realized and unrealized gain (loss) on investments per share for the year ended May 31, 2016 does not accord with the amount in the Statement of Operations due to the timing of purchases and sales of Fund shares in relation to fluctuating market values. |

| (h) | As of February 24, 2017, the "Advisor Class" Shares were renamed to the "Class C" Shares. There were no other changes to this class of shares. |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | | |

| Cavalier Dividend Income Fund - Institutional Class Shares | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

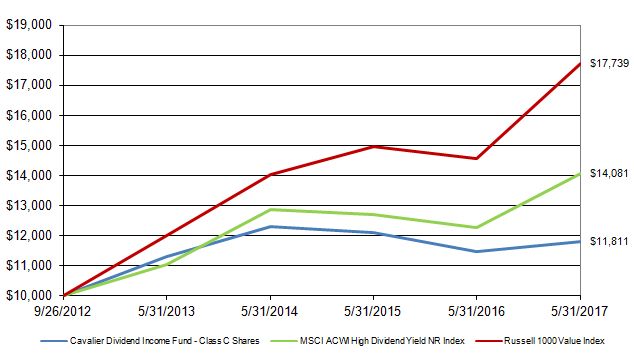

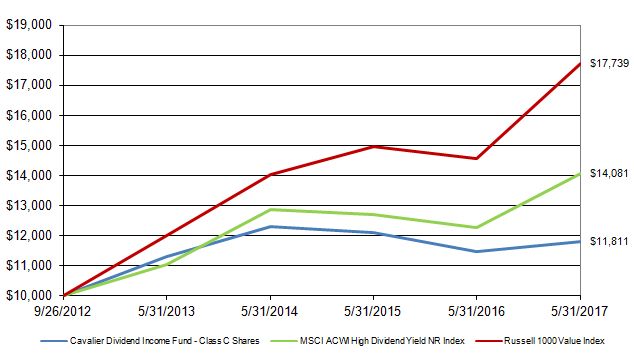

| For the period from September 20, 2012 (Date of Initial Public Investment) through May 31, 2017 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| The graph above assumes an initial $10,000 investment and represents the reinvestment of dividends and capital gains. This graph depicts the performance of Cavalier Dividend Income Fund - Institutional Class Shares versus the MSCI ACWI High Dividend Yield NR Index and the Russell 1000 Value Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | | One | | Three | | Since | | Inception | | Expense | | |

| | | May 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | | |

| | | Institutional Class Shares | | | 4.09% | | -0.69% | | 4.14% | | 09/20/12 | | 8.58% | | |

| | | MSCI ACWI High Dividend Yield NR Index | | 14.80% | | 3.05% | | 7.30% | | N/A | | N/A | | |

| | | Russell 1000 Value Index** | | | 14.62% | | 7.67% | | 13.03% | | N/A | | N/A | | |

| * The gross expense ratio shown is from the Funds' prospectus dated September 28, 2016. | | | | |

| **The Fund compared its performance against the MSCI ACWI High Dividend Yield NR Index previously, but the Advisor believes the Russell 1000 Index is a more appropriate and accurate index against which to compare the Fund's investment strategies and, therefore, the Russell 1000 Index will replace the MSCI ACWI High Dividend Yield NR Index in future comparisons. The Russell 1000 Index is a market capitalization-weighted index, meaning that the largest companies constitute the largest percentages in the index and will affect performance more than the smallest index members. |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestment of distributions. |

| Cavalier Dividend Income Fund - Class C Shares | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| For the period from September 26, 2012 (Date of Initial Public Investment) through May 31, 2017 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| The graph above assumes an initial $10,000 investment and represents the reinvestment of dividends and capital gains. This graph depicts the performance of Cavalier Dividend Income Fund - Class C Shares versus the MSCI AWI High Dividend Yield NR Index and the Russell 1000 Value Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | | One | | Three | | Since | | Inception | | Expense | | |

| | | May 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | | |

| | | Class C Shares** | | | | 3.03% | | -1.68% | | 3.62% | | 09/26/12 | | 9.58% | | |

| | | MSCI ACWI High Dividend Yield NR Index | | 14.80% | | 3.05% | | 7.59% | | N/A | | N/A | | |

| | | Russell 1000 Value Index*** | | | 14.62% | | 7.67% | | 13.00% | | N/A | | N/A | | |

| * The gross expense ratio shown is from the Funds' prospectus dated September 28, 2016. | | | | |

| ** | As of February 24, 2017, the "Advisor Class" Shares were renamed to the "Class C" Shares. There were no other changes to this class of shares. Class C Shares held longer than 7 years will automatically convert to Institutional Class Shares. Institutional Class Shares are not subject to the distribution and service plan (Rule 12b-1) fees of 1.00%. |

|

| ***The Fund compared its performance against the MSCI ACWI High Dividend Yield NR Index previously, but the Advisor believes the Russell 1000 Index is a more appropriate and accurate index against which to compare the Fund's investment strategies and, therefore, the Russell 1000 Index will replace the MSCI ACWI High Dividend Yield NR Index in future comparisons. The Russell 1000 Index is a market capitalization-weighted index, meaning that the largest companies constitute the largest percentages in the index and will affect performance more than the smallest index members. |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestment of distributions. |

| Cavalier Dividend Income Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | |

| As of May 31, 2017 | | | | | | | |

| | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | |

| COMMON STOCKS - 44.48% | | | | | | |

| | | | | | | | | | |

| | Consumer Discretionary - 6.67% | | | | | | |

| | | | | | | | | | |

| | * | Cabela's, Inc. | | | | | 996 | $ | 52,619 |

| | | | | | | | | | |

| | Financials - 20.31% | | | | | | | |

| | | | | | | | | | |

| | * | Berkshire Hathaway, Inc. - Class B | | | | 618 | | 102,143 |

| | | TD Ameritrade Holding Corp. | | | | 1,553 | | 58,020 |

| | | | | | | | | | 160,163 |

| | Industrials - 17.50% | | | | | | | |

| | | | | | | | | | |

| | | Union Pacific Corp. | | | | 845 | | 93,204 |

| | | Valmont Industries, Inc. | | | | 306 | | 44,798 |

| | | | | | | | | | 138,002 |

| | | | | | | | | | |

| | | Total Common Stocks (Cost $361,287) | | | | | 350,784 |

| | | | | | | | | | |

| EXCHANGE-TRADED PRODUCTS - 44.50% | | | | | | |

| | | iShares Trust Russell 1000 Value ETF | | | 1,541 | $ | 176,491 |

| | | iShares Trust Russell 2000 Value ETF | | | 1,518 | | 174,524 |

| | | | | | | | | | |

| | | Total Exchange-Traded Products (Cost $356,967) | | | | | 351,015 |

| | | | | | | | | | |

| SHORT-TERM INVESTMENT - 5.50% | | | | | | |

| | § | Fidelity Investments Money Market Government Portfolio - | | | | |

| | | Institutional Class, 0.69% | | | | 43,344 | | 43,344 |

| | | | | | | | | | |

| | | Total Short-Term Investment (Cost $43,344) | | | | | 43,344 |

| | | | | | | | | | |

| Total Value of Investments (Cost $761,598) - 94.48% | | | | $ | 745,143 |

| | | | | | | | | | |

| Other Assets Less Liabilities - 5.52% | | | | | | 43,559 |

| | | | | | | | | | |

| | Net Assets - 100.00% | | | | | $ | 788,702 |

| | | | | | | | | | |

| § | Represents 7 day effective yield | | | | | | |

| * | Non income-producing investment | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Summary of Investments | | | | | |

| | | | | | | | | | |

| | | | by Sector | | % of Net Assets | | Value | | |

| | | | Consumer Discretionary | 6.67% | $ | 52,619 | | |

| | | | Financials | | 20.31% | | 160,163 | | |

| | | | Industrials | | 17.50% | | 138,002 | | |

| | | | Exchange-Traded Products | 44.50% | | 351,015 | | |

| | | | Short-Term Investment | 5.50% | | 43,344 | | |

| | | | Other Assets Less Liabilities | 5.52% | | 43,559 | | |

| | | | Total Net Assets | | 100.00% | $ | 788,702 | | |

| | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| Cavalier Dividend Income Fund | | |

| | | | | | | | |

| Statement of Assets and Liabilities | | |

| | | | | | | | |

| As of May 31, 2017 | | | |

| | | | | | | | |

| Assets: | | | | | |

| | Investments, at value (cost $761,598) | $ | 745,143 |

| | Receivables: | | | |

| | | Fund shares sold | | | 694 |

| | | Dividends and interest | | 537 |

| | | Due from Advisor | | | 53,956 |

| | Prepaid expenses: | | | |

| | | Registration and filing expenses | | 15,534 |

| | | Fund accounting fees | | | 2,750 |

| | | | | | | | |

| | Total assets | | | | 818,614 |

| | | | | | | | |

| Liabilities: | | | | | |

| | Accrued expenses: | | | |

| | | Professional fees | | | 25,411 |

| | | Shareholder fulfillment fees | | 1,751 |

| | | Trustee fees and meeting expenses | | 1,337 |

| | | Custody and banking fees | | 968 |

| | | Insurance fees | | | 299 |

| | | Security pricing fees | | | 74 |

| | | Distribution and service fees - Class C Shares | | 62 |

| | | Administration fees | | | 10 |

| | | | | | | | |

| | Total liabilities | | | 29,912 |

| | | | | | | | |

| Total Net Assets | | | $ | 788,702 |

| | | | | | | | |

| Net Assets Consist of: | | | |

| | Paid in capital | | $ | 1,047,337 |

| | Accumulated net realized loss on investments | | (242,180) |

| | Net unrealized depreciation on investments | | (16,455) |

| | | | | | | | |

| Total Net Assets | | | $ | 788,702 |

| | | | | | | | |

| Institutional Class Shares of beneficial interest outstanding, no par value (unlimited authorized shares) | 67,276 |

| | Net Assets | | | $ | 707,268 |

| | Net Asset Value, Offering Price and Redemption Price Per Share | $ | 10.51 |

| | | | | | | | |

| Class C Shares of beneficial interest outstanding, no par value (unlimited authorized shares) | | 7,679 |

| | Net Assets | | | $ | 81,434 |

| | Net Asset Value, Offering Price and Redemption Price Per Share (a)(b) | $ | 10.61 |

| | | | | | | | |

| (a) | Contingent deferred sales charge for Class C Shares is imposed on shares redeemed within one year of the purchase date (note 1). |

| | | | | | | | |

| (b) | Net Asset Value presented does not recalculate due to rounding on the Class C Shares for Financial Statement purposes. |

| | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| Cavalier Dividend Income Fund | | |

| | | | | | | | |

| Statement of Operations | | |

| | | | | | | | |

| For the year ended May 31, 2017 | | |

| | | | | | | | |

| Investment Income: | | |

| | Dividends | | | $ | 30,652 |

| | | | | | | | |

| | Total Investment Income | | 30,652 |

| | | | | | | | |

| Expenses: | | | | | |

| | Professional fees | | 54,667 |

| | Fund accounting fees (note 2) | | 38,334 |

| | Registration and filing expenses | | 34,299 |

| | Transfer agent fees (note 2) | | 31,973 |

| | Administration fees (note 2) | | 24,026 |

| | Shareholder fulfillment fees | | 13,644 |

| | Trustee fees and meeting expenses | | 10,367 |

| | Advisory fees (note 2) | | 10,261 |

| | Custody and banking fees (note 2) | | 4,907 |

| | Compliance fees (note 2) | | 4,434 |

| | Other operating expenses | | 3,973 |

| | Insurance fees | | | 1,595 |

| | Security pricing fees | | 1,520 |

| | Distribution and service fees - Class C Shares (note 3) | | 886 |

| | | | | | | | |

| | Total Expenses | | | 234,886 |

| | | | | | | | |

| | Fees waived and reimbursed by Advisor (note 2) | | (215,913) |

| | | | | | | | |

| | Net Expenses | | | 18,973 |

| | | | | | | | |

| Net Investment Income | | 11,679 |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investments: | | |

| | | | | | | | |

| | Net realized gain from: | | |

| | | Investment transactions | | 128,988 |

| | | Capital gain distributions from underlying funds | | 1,301 |

| | | | | | | | |

| | Net change in unrealized depreciation on investments | | (92,219) |

| | | | | | | | |

| Net Realized and Unrealized Gain on Investments | | 38,070 |

| | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | $ | 49,749 |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| Cavalier Dividend Income Fund | | | | | | | |

| | | | | | | | | | | | |

| Statements of Changes in Net Assets | | | | | | | |

| | | | | | | | | | | | |

| For the years ended May 31, | | | | | 2017 | | 2016 |

| | | | | | | | | | | | |

| Operations: | | | | | | | | |

| | Net investment income | | | | $ | 11,679 | $ | 19,541 |

| | Net realized gain (loss) from: | | | | | | | |

| | | Investment transactions | | | | | 128,988 | | (367,643) |

| | | Capital gain distributions from underlying funds | | | | 1,301 | | 9,600 |

| | Net change in unrealized appreciation (depreciation) on investments | | (92,219) | | 56,161 |

| | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | 49,749 | | (282,341) |

| | | | | | | | | | | | |

| Distributions to Shareholders From: | | | | | | | |

| | Net investment income | | | | | | | |

| | | Institutional Class Shares | | | | | (4,000) | | (26,727) |

| | | Class C Shares | | | | | (20) | | (472) |

| | | | | | | | | | | | |

| | Return of Capital | | | | | | | |

| | | Institutional Class Shares | | | | | (6,232) | | - |

| | | Class C Shares | | | | | (515) | | - |

| | | | | | | | | | | | |

| Decrease in Net Assets Resulting from Distributions | | | | (10,767) | | (27,199) |

| | | | | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | |

| | Shares sold | | | | | | 66,574 | | 2,618,175 |

| | Reinvested dividends and distributions | | | | | 10,767 | | 17,044 |

| | Shares repurchased | | | | | (1,134,064) | | (5,888,112) |

| | | | | | | | | | | | |

| Decrease from Beneficial Interest Transactions | | | | | (1,056,723) | | (3,252,893) |

| | | | | | | | | | | | |

| Decrease in Net Assets | | | | | (1,017,741) | | (3,562,433) |

| | | | | | | | | | | | |

| Net Assets: | | | | | | | | |

| | Beginning of Year | | | | | 1,806,443 | | 5,368,876 |

| | End of Year | | | | | $ | 788,702 | $ | 1,806,443 |

| | | | | | | | | | | | |

| Accumulated net investment loss | | | | $ | - | $ | (7,659) |

| | | | | | Year Ended | | Year Ended |

| Share Information: | May 31, 2017 | | May 31, 2016 |

| | Institutional Class Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 6,267 | $ | 66,015 | | 253,821 | $ | 2,533,046 |

| | | Reinvested dividends and distributions | 978 | | 10,232 | | 1,610 | | 16,606 |

| | | Shares repurchased | (108,624) | | (1,124,142) | | (568,931) | | (5,769,408) |

| | Net Decrease in Shares of | | | | | | | |

| | | Beneficial Interest | (101,379) | $ | (1,047,895) | | (313,500) | $ | (3,219,756) |

| | | | | | | | | | | | |

| | Class C Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 52 | $ | 559 | | 8,068 | $ | 85,129 |

| | | Reinvested dividends and distributions | 50 | | 535 | | 42 | | 438 |

| | | Shares repurchased | (932) | | (9,922) | | (11,107) | | (118,704) |

| | Net Decrease in Shares of | | | | | | | |

| | | Beneficial Interest | (830) | $ | (8,828) | | (2,997) | $ | (33,137) |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | |

| Cavalier Dividend Income Fund | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding during each of the | | Institutional Class Shares |

| fiscal years or period ended May 31, | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | (f) |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 10.19 | $ | 10.87 | $ | 11.41 | $ | 11.02 | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

| Income (Loss) from Investment Operations | | | | | | | | | | | |

| | Net investment income | | 0.12 | (g) | 0.08 | (g) | 0.46 | (g) | 0.55 | (g) | 0.29 | |

| | Net realized and unrealized gain (loss) on | | | | | | | | | | | |

| | | investments | | 0.30 | | (0.68) | | (0.51) | | 0.41 | | 1.02 | |

| | | | | | | | | | | | | | | | |

| Total from Investment Operations | | 0.42 | | (0.60) | | (0.05) | | 0.96 | | 1.31 | |

| | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | |

| | From net investment income | | (0.04) | | (0.08) | | (0.46) | | (0.49) | | (0.29) | |

| | From net realized gains | | - | | - | | (0.03) | | (0.08) | | - | |

| | From return of capital | | (0.06) | | - | | - | | - | | - | |

| | | | | | | | | | | | | | | | |

| Total Distributions | | | (0.10) | | (0.08) | | (0.49) | | (0.57) | | (0.29) | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | $ | 10.51 | $ | 10.19 | $ | 10.87 | $ | 11.41 | $ | 11.02 | |

| | | | | | | | | | | | | | | | |

| Total Return (c) | | | 4.09% | | (5.51)% | | (0.43)% | | 9.03% | | 13.32% | (b) |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Period (in thousands) | $ | 707 | $ | 1,718 | $ | 5,241 | $ | 5,090 | $ | 1,090 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | | | |

| Gross Expenses to Average Net Assets (d) | | 20.25% | | 8.23% | | 3.56% | | 1.15% | | 0.70% | (a) |

| Net Expenses to Average Net Assets (d) | | 1.58% | | 1.58% | (i) | 1.23% | (h) | 1.15% | | 0.70% | (a) |

| Net Investment Income to Average | | | | | | | | | | | |

| | Net Assets (e) | | 1.11% | | 0.75% | (i) | 4.19% | (h) | 4.97% | | 4.74% | (a) |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 83.66% | | 118.07% | | 23.77% | | 2.70% | | 83.50% | (b) |

| | | | | | | | | | | | | | | | |

| (a) | Annualized. | | | | | | | | | | | | |

| (b) | Not annualized. | | | | | | | | | | | |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | Does not include expenses of the investment companies in which the Fund invests. | | | | | |

| (e) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (f) | For the period from September 20, 2012 (Date of Initial Public Investment) to May 31, 2013. | | | | | |

| (g) | Calculated using the average shares method. | | | | | | | | | | | |

| (h) | Includes reimbursement of acquired fund fees. | | | | | | | | | | | |

| (i) | Includes reimbursement of acquired fund fees and expenses for the period from June 1, 2015 through December 17, 2015. Expense limitation agreement was updated to exclude acquired fund fees and expenses from the waiver effective December 18, 2015 (see note 2). |

| | | | |

| | | | | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | (Continued) |

| Cavalier Dividend Income Fund | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding during each of the | | Class C Shares (k) |

| fiscal years or period ended May 31, | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | (f) |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Period | $ | 10.36 | $ | 11.12 | $ | 11.68 | $ | 11.18 | $ | 10.00 | |

| | | | | | | | | | | | | | | | |

| Income (Loss) from Investment Operations | | | | | | | | | | | |

| | Net investment income (loss) | | (0.01) | (g) | (0.06) | (g) | 0.43 | (g) | 0.43 | (g) | 0.24 | |

| | Net realized and unrealized gain (loss) on | | | | | | | | | | | |

| | | investments | | 0.32 | | (0.65) | | (0.60) | | 0.53 | | 1.17 | |

| | | | | | | | | | | | | | | | |

| Total from Investment Operations | | 0.31 | | (0.71) | | (0.17) | | 0.96 | | 1.41 | |

| | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | |

| | From net investment income | | - | (j) | (0.05) | | (0.36) | | (0.38) | | (0.23) | |

| | From net realized gains | | - | | - | | (0.03) | | (0.08) | | - | |

| | From return of capital | | (0.06) | | - | | - | | - | | - | |

| | | | | | | | | | | | | | | | |

| Total Distributions | | | (0.06) | | (0.05) | | (0.39) | | (0.46) | | (0.23) | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | $ | 10.61 | $ | 10.36 | $ | 11.12 | $ | 11.68 | $ | 11.18 | |

| | | | | | | | | | | | | | | | |

| Total Return (c) | | | 3.03% | | (6.41)% | | (1.45)% | | 8.79% | | 14.25% | (b) |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Period (in thousands) | $ | 81 | $ | 88 | $ | 128 | $ | 79 | $ | 5 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | | | |

| Gross Expenses to Average Net Assets (d) | | 23.68% | | 8.47% | | 4.56% | | 2.15% | | 1.70% | (a) |

| Net Expenses to Average Net Assets (d) | | 2.58% | | 2.66% | (i) | 2.23% | (h) | 2.15% | | 1.70% | (a) |

| Net Investment Income (Loss) to Average | | | | | | | | | | | |

| | Net Assets (e) | | (0.06)% | | (0.61)% | (i) | 3.79% | (h) | 3.84% | | 4.68% | (a) |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 83.66% | | 118.07% | | 23.77% | | 2.70% | | 83.50% | (b) |

| | | | | | | | | | | | | | | | |

| (a) | Annualized. | | | | | | | | | | | | |

| (b) | Not annualized. | | | | | | | | | | | | |

| (c) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (d) | Does not include expenses of the investment companies in which the Fund invests. | | | | | | | |

| (e) | Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies in which the Fund invests. |

| (f) | For the period from September 26, 2012 (Date of Initial Public Investment) to May 31, 2013. | | | | | | | |

| (g) | Calculated using the average shares method. | | | | | | | | | | | |

| (h) | Includes reimbursement of acquired fund fees. | | | | | | | | | | | |

| (i) | Includes reimbursement of acquired fund fees and expenses for the period from June 1, 2015 through December 17, 2015. Expense limitation agreement was updated to exclude acquired fund fees and expenses from the waiver effective December 18, 2015 (see note 2). |

| (j) | Less than $0.01 per share. | | | | | | | | | | | |

| (k) | As of February 24, 2017, the "Advisor Class" Shares were renamed to the "Class C" Shares. There were no other changes to this class of shares. |

| | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | | |

| Cavalier Dynamic Growth Fund - Institutional Class Shares | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| For the period from October 2, 2009 (Date of Initial Public Investment) through May 31, 2017 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| The graph above assumes an initial $10,000 investment and represents the reinvestment of dividends and capital gains. This graph depicts the performance of Cavalier Dynamic Growth Fund - Institutional Class Shares versus the S&P Global Broad Market Index and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | One | | Five | | Since | | Inception | | Expense | | |

| | | May 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | | |

| | | Institutional Class Shares | | | 16.50% | | 11.09% | | 8.35% | | 10/02/09 | | 1.92% | | |

| | | S&P Global Broad Market Index | | | 18.13% | | 12.27% | | 6.84% | | N/A | | N/A | | |

| | | S&P 500 Total Return Index | | | 17.16% | | 15.41% | | 3.26% | | N/A | | N/A | | |

| | | | | | | | | | | | | | | | | | | | |

| * The gross expense ratio shown is from the Funds' prospectus dated September 28, 2016. |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cavalier Dynamic Growth Fund - Class C Shares | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| For the period from February 18, 2011 (Date of Initial Public Investment) through May 31, 2017 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| The graph above assumes an initial $10,000 investment and represents the reinvestment of dividends and capital gains. This graph depicts the performance of Cavalier Dynamic Growth Fund - Class C Shares versus the S&P Global Broad Market Index and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | | |

| | | As of | | | One | | Five | | Since | | Inception | | Expense | | |

| | | May 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | | |

| | | Class C Shares** | | | | 15.42% | | 9.97% | | 6.50% | | 02/18/11 | | 2.92% | | |

| | | S&P Global Broad Market Index | | | 18.13% | | 12.27% | | 7.78% | | N/A | | N/A | | |

| | | S&P 500 Total Return Index | | | 17.16% | | 15.41% | | -0.83% | | N/A | | N/A | | |

| * The gross expense ratio shown is from the Funds' prospectus dated September 28, 2016. | | | | |

| ** | As of February 24, 2017, the "Advisor Class" Shares were renamed to the "Class C" Shares. There were no other changes to this class of shares. Class C Shares held longer than 7 years will automatically convert to Institutional Class Shares. Institutional Class Shares are not subject to the distribution and service plan (Rule 12b-1) fees of 1.00%. |

| | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Cavalier Dynamic Growth Fund | | | | | | |

| | | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | | |

| As of May 31, 2017 | | | | | | | | |

| | | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | | |

| COMMON STOCKS - 84.54% | | | | | | | |

| | | | | | | | | | | |

| | Consumer Discretionary - 19.17% | | | | | | | |

| | | adidas AG | | | | | | 1,346 | $ | 129,149 |

| | | Carnival Corp. | | | | | | 1,801 | | 115,390 |

| | | Fast Retailing Co. Ltd. | | | | | 3,301 | | 110,914 |

| | * | IMAX Corp. | | | | | | 4,504 | | 112,825 |

| | μ | Luxottica Group SpA | | | | | 2,782 | | 167,894 |

| | | PulteGroup, Inc. | | | | | | 10,429 | | 236,425 |

| | | The Children's Place, Inc. | | | | | 1,144 | | 123,781 |

| | | Toll Brothers, Inc. | | | | | 6,419 | | 236,925 |

| | * | Ulta Beauty, Inc. | | | | | | 557 | | 169,796 |

| | | | | | | | | | | 1,403,099 |

| | Consumer Staples - 2.76% | | | | | | | |

| | | Sysco Corp. | | | | | | 3,703 | | 202,036 |

| | | | | | | | | | | |

| | Energy - 1.32% | | | | | | | | |

| | | Noble Energy, Inc. | | | | | 3,381 | | 97,001 |

| | | | | | | | | | | |

| | Financials - 8.78% | | | | | | | | |

| | | Chubb Ltd. | | | | | | 1,254 | | 179,560 |

| | | MSCI, Inc. | | | | | | 1,618 | | 164,599 |

| | | The Bank of New York Mellon Corp. | | | | | 2,784 | | 131,182 |

| | | The Goldman Sachs Group, Inc. | | | | | 791 | | 167,107 |

| | | | | | | | | | | 642,448 |

| | Health Care - 14.57% | | | | | | | |

| | | Allergan PLC | | | | | | 840 | | 187,950 |

| | | AmerisourceBergen Corp. | | | | | 1,931 | | 177,208 |

| | * | Celgene Corp. | | | | | | 1,749 | | 200,103 |

| | * | ICON PLC | | | | | | 2,060 | | 193,846 |

| | * | Quintiles IMS Holdings, Inc. | | | | | 1,483 | | 128,191 |

| | | Shire PLC | | | | | | 1,037 | | 179,111 |

| | | | | | | | | | | 1,066,409 |

| | Industrials - 5.24% | | | | | | | | |

| | * | AerCap Holdings NV | | | | | 3,843 | | 169,169 |

| | * | Axon Enterprise, Inc. | | | | | 8,924 | | 214,265 |

| | | | | | | | | | | 383,434 |

| | Information Technology - 25.99% | | | | | | | |

| | * | Alibaba Group Holding Ltd. | | | | | 1,575 | | 192,874 |

| | * | Alphabet, Inc. | | | | | | 212 | | 209,263 |

| | | Applied Materials, Inc. | | | | | 5,233 | | 240,090 |

| | | Broadcom Ltd. | | | | | | 717 | | 171,707 |

| | * | Check Point Software Technologies Ltd. | | | | 2,340 | | 262,197 |

| | * | Facebook, Inc. | | | | | | 1,695 | | 256,725 |

| | | NetEase, Inc. | | | | | | 482 | | 137,264 |

| | * | Qorvo, Inc. | | | | | | 2,430 | | 189,418 |

| | | Visa, Inc. | | | | | | 2,545 | | 242,360 |

| | | | | | | | | | | 1,901,898 |

| | | | | | | | | | | |

| | | | | | | | | | | (Continued) |

| Cavalier Dynamic Growth Fund | | | | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Continued | | | | | | | |

| | | | | | | | | | | |

| As of May 31, 2017 | | | | | | | | |

| | | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | | |

| COMMON STOCKS - Continued | | | | | | | |

| | | | | | | | | | | |

| | Real Estate - 2.41% | | | | | | | |

| | | Realogy Holdings Corp. | | | | | 5,797 | $ | 176,577 |

| | | | | | | | | | | |

| | Telecommunication Services - 4.30% | | | | | | | |

| | | KDDI Corp. | | | | | | 14,370 | | 199,312 |

| | | SoftBank Group Corp. | | | | | 2,841 | | 115,259 |

| | | | | | | | | | | 314,571 |

| | | | | | | | | | | |

| | | Total Common Stocks (Cost $5,766,492) | | | | | | 6,187,473 |

| | | | | | | | | | | |

| | | | | Number of | | | | Expiration | | |

| CALL OPTIONS PURCHASED - 0.18% | Contracts (b) | | Exercise Price | | Date | | |

| | * | CBOE Volatility Index | 427 | | $ | 23.00 | | 6/21/2017 | | 5,338 |

| | * | CBOE Volatility Index | 450 | | 22.00 | | 6/21/2017 | | 5,625 |

| | * | SPDR S&P 500 ETF Trust | 468 | | 249.00 | | 6/16/2017 | | 2,574 |

| | | | | | | | | | | |

| | | Total Call Options Purchased (Cost $25,336) | | | | | | 13,537 |

| | | | | | | | | | | |

| | | | | Number of | | | | Expiration | | |

| PUT OPTIONS PURCHASED - 0.49% | Contracts (b) | | Exercise Price | | Date | | |

| | * | SPDR S&P 500 ETF Trust | 18 | | 241.50 | | 6/16/2017 | | 3,483 |

| | * | SPDR S&P 500 ETF Trust | 45 | | 226.00 | | 9/15/2017 | | 9,742 |

| | * | SPDR S&P 500 ETF Trust | 105 | | 236.00 | | 6/16/2017 | | 5,985 |

| | * | SPDR S&P 500 ETF Trust | 132 | | 216.00 | | 9/15/2017 | | 16,302 |

| | | | | | | | | | | |

| | | Total Put Options Purchased (Cost $118,244) | | | | | | 35,512 |

| | | | | | | | | | | |

| EXCHANGE-TRADED PRODUCT - 6.93% | | | | | Shares | | |

| | | SPDR S&P 500 ETF Trust (a) | | | | | 2,100 | | 507,024 |

| | | | | | | | | | | |

| | | Total Exchange-Traded Product (Cost $496,520) | | | | | | 507,024 |

| | | | | | | | | | | |

| LIMITED PARTNERSHIP - 3.26% | | | | | Shares | | |

| | | The Blackstone Group LP | | | | | 7,255 | | 238,544 |

| | | | | | | | | | | |

| | | Total Limited Partnership (Cost $239,200) | | | | | | 238,544 |

| | | | | | | | | | | |

| U.S. TREASURY BILL - 6.12% | Principal | | Yield | | Maturity Date | | |

| | | United States Treasury Bill (a) | $ | 450,000 | | 0.000% | | 11/9/2017 | | 447,925 |

| | | | | | | | | | | |

| | | Total U.S. Treasury Bill (Cost $448,063) | | | | | | 447,925 |

| | | | | | | | | | | |

| Total Value of Investments (Cost $7,093,855) - 101.52% | | | | | | 7,430,015 |

| | | | | | | | | | | |

| Options Written (Premiums Received $89,859) - (1.23)% | | | | | | (89,905) |

| | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.29)% | | | | | | (21,457) |

| | | | | | | | | | | |

| | Net Assets - 100.00% | | | | | | $ | 7,318,653 |

| | | | | | | | | | | |

| | * | Non-income producing investment | | | | | | | |

| | μ | American Depositary Receipt | | | | | | | |

| | | | | | | | | | | |

| | (a) | All or a portion of this security is held as collateral for options written. | | | | |

| | (b) | Each contract is equivalent to 100 shares of underlying common stock. | | | | |

| | | | | | | | | | | (Continued) |

| Cavalier Dynamic Growth Fund | | | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Continued | | | | | | | |

| | | | | | | | | | | |

| As of May 31, 2017 | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | The following acronyms and abbreviations are used in this portfolio: | | | | |

| | NV - Netherlands security | | | | | | | |

| | PLC - Public Limited Company | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | Summary of Investments by Sector | | | | | | |

| | | | | | | | | | | |

| | | | Sector | | | % of Net Assets | | Value | | |

| | | | Consumer Discretionary | | 19.17% | $ | 1,403,099 | | |

| | | | Consumer Staples | | | 2.76% | | 202,036 | | |

| | | | Energy | | | 1.32% | | 97,001 | | |

| | | | Financials | | | 8.78% | | 642,448 | | |

| | | | Health Care | | | 14.57% | | 1,066,409 | | |

| | | | Industrials | | | 5.24% | | 383,434 | | |

| | | | Information Technology | | 25.99% | | 1,901,898 | | |

| | | | Real Estate | | | 2.41% | | 176,577 | | |

| | | | Telecommunication Services | | 4.30% | | 314,571 | | |

| | | | Call Options Purchased | | 0.18% | | 13,537 | | |

| | | | Put Options Purchased | | 0.49% | | 35,512 | | |

| | | | Exchange-Traded Product | | 6.93% | | 507,024 | | |

| | | | Limited Partnership | | | 3.26% | | 238,544 | | |

| | | | U.S. Treasury Bill | | | 6.12% | | 447,925 | | |

| | | | Call Options Written | | | -1.23% | | (89,905) | | |

| | | | Liabilities in Excess of Other Assets | | -0.29% | | (21,457) | | |

| | | | Total Net Assets | | | 100.00% | $ | 7,318,653 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | (Continued) |

| Cavalier Dynamic Growth Fund | | | | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Continued | | | | | | | |

| | | | | | | | | | | |

| As of May 31, 2017 | | | | | | | | |

| | | | | Number of Contracts (b) | | Exercise Price | | Expiration Date | | Value (Note 1) |

| | | | | | | | | | | |

| CALL OPTIONS WRITTEN - 1.23% | | | | | | | |

| | * | CBOE Volatility Index | 450 | | $ | 16.00 | | 6/21/2017 | $ | 14,625 |

| | * | CBOE Volatility Index | 134 | | 14.00 | | 6/21/2017 | | 6,700 |

| | * | SPDR S&P500 ETF Trust | 105 | | 236.00 | | 6/16/2017 | | 65,520 |

| | * | SPDR S&P500 ETF Trust | 18 | | 241.50 | | 6/16/2017 | | 3,060 |

| | | | | | | | | | | |

| | | Total Call Options Written (Premiums Received $89,859) | | | | 89,905 |

| | | | | | | | | | | |

| | Total Options Written (Premiums Received $89,859) | | | | | | 89,905 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | |

| Cavalier Dynamic Growth Fund | | | |

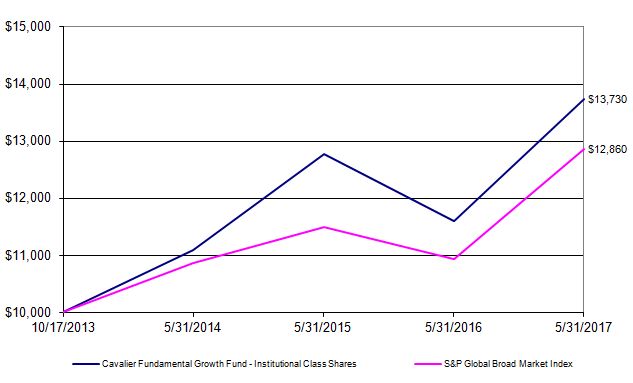

| | | | | | | | |