Matthew J. Beck

August 31, 2017

For the fiscal year ended August 31, 2017, the return on the Institutional Class Shares was 18.28%. The return on the Class A Shares was 17.99% and the return on the Class C Shares was 17.13%.1 This compares to 13.47% for the Russell 2000 Value Index, 9.06% for the 60% Russell 2000 Value Index/40% Barclays Government Credit Index, and 16.23% for the S&P 500 over the same period. These returns were attained with an allocation of about 40% in cash, 57% in equities, and 3% in fixed income during the fiscal year.

Please see the table below for the Fund's historical performance information through the calendar quarter ended September 30, 2017.

Average Annual Total Returns (Unaudited) | | | Gross | Net |

Period Ended September 30, 2017 | Past 1 Year | Since Inception2 | Expense Ratio3 | Expense Ratio4 |

Roumell Opportunistic Value Fund –Institutional Class Shares | 20.00% | 1.90% | 1.63% | 1.23% |

Roumell Opportunistic Value Fund –Class A Shares | 19.61% | 1.71% | 1.88% | 1.48% |

With 4.50% maximum sales load | 14.22% | 1.02% | 1.88% | 1.48% |

Roumell Opportunistic Value Fund –Class C Shares | 18.77% | -0.93% | 2.63% | 2.23% |

60% Russell 2000 Value Index, and 40% Barclays Capital U.S. Government Credit Index | 13.67% | 8.29% | N/A | N/A |

| Russell 2000 Value Index | 20.55% | 10.93% | N/A | N/A |

| S&P 500 Total Return Index | 18.61% | 13.21% | N/A | N/A |

The quoted performance data represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance data regarding the Fund, including performance data current to the Fund's most recent month-end, please visit ncfunds.com or call the Fund at (800)773-3863. Fee waivers and expenses reimbursements have positively impacted Fund performance.

1A maximum sales charge imposed on purchases of 4.50% is charged to the Class A shares. A maximum deferred sales charge of 1.00% is applied to the Class C shares. For the fiscal year ended August 31, 2017, the one year return with sales load on the Class A shares was 13.67 %. The one year return with the deferred sales charge on the Class C shares was 16.13%.

2The Fund's inception date is December 31, 2010.

3Gross expense ratio includes acquired fund fees and expenses and other expenses.

4The Advisor has entered into an Expense Limitation Agreement with the Fund under which it has agreed to waive or reduce its fees in an amount that limits the Fund's annual operating expenses (exclusive of acquired fund fees and expenses, interest, taxes, brokerage fees and commissions, extraordinary expenses, and payments under the Rule 12b-1 distribution plan) to not more than 1.23% of the average daily net assets of the Fund through September 30, 2018. The Expense Limitation Agreement may not be terminated prior to that date. Further, net annual operating expenses for the Fund may exceed those contemplated by the waiver due to acquired fund fees and other expenses that are not waived under the Expense Limitation Agreement. During the past fiscal year, this expense ratio was limited by a similar Operating Plan between the Advisor and the Fund's Administrator.

RAM Deep Value Investing vs. "Great Company" Investing

In May, I attended Berkshire Hathaway's annual meeting in Omaha, NE. A few weeks later, I gave a presentation at a value investment conference in Zurich, Switzerland hosted by John Mihaljevic's Manual of Ideas (MOI). MOI is a thoughtful community of value investors from all over the world. At each venue, I spoke to a number of professional investors about their approaches to investing. Buffett's shareholder meeting, often referred to as "Capitalism's Woodstock," is a cult of sorts for investors in search of "great companies." In fact, most investors, even ones with an overall value orientation, are in search of great companies. I often feel like the odd man out at these events. It's worth reflecting on why RAM does not pursue great companies but rather focuses on finding significantly undervalued securities.

What is a "great company"? A great company is most often viewed as one with a high return on invested capital (ROIC) or return on equity (ROE), and with an opportunity to reinvest its cash flows with high returns as well, which is often referred to as a return on incremental invested capital. Moreover, the reinvestment opportunities should have a long runway. Such companies are often longingly referred to as "compounders." For example, Coca Cola, a long time Buffett favorite, has an average return on equity of roughly 35% over the past 25 years - clearly qualifying as a great company.

Do great companies make great investments? Yes and no. They certainly make wonderful investment candidates if held for long enough periods of time and if their ROIC/ROE rates remain intact. Over time, these common stocks' returns will likely track their internally generated investment returns. Thus, the reasoning goes, it's best to find companies that have strong underlying investment returns because these returns will ultimately be reflected in the investor's stock returns.

The great company investor faces one overarching challenge – will the company remain great? History has proven that our dynamic, ever-disrupting economy, can humble even the best of companies. Eastman Kodak, accounting for an estimated 90% of film sales and 85% of camera sales in the mid-1970s, filed for bankruptcy in 2012. A&P, with an estimated 75% market share of U.S. grocery sales in the 1950s, filed for bankruptcy in 2015. Today, IBM is struggling in ways not imagined 10 years ago, while Whole Foods is being acquired by Amazon at a price below where its stock traded five years ago. It's worth asking: How many companies have a true economic moat around their businesses? Remember, investors typically "pay up" for these companies based on the belief that their business models are highly sustainable and consequently there's often little margin of safety, given the price paid.

An additional challenge for the great company investor is the difficulty of adding value to buying such businesses. In other words, given the investment demand for company compounders (high return on invested capital and incremental capital investments) is so high, how does one add investment value? Deep value investor and friend Marty Whitman once noted, "No successful investor ever made money buying what is popular when it is popular." Recent history may challenge Marty on this front, but we believe the basic insight is eminently rational and spot on.

Indexing is the solution commonly put forth to address the difficulty of trying to pick which great companies will remain great and which ones are mispriced. The S&P 500 Index contains many great companies. Some will maintain and/or grow their internal return rates, while others will be disrupted or simply mismanaged. Many believe they should just buy the whole basket at a low fee and go fishing. It's not an unreasonable idea. Think about it…if a business has stable, reliable cash flows and reinvestment rates, everyone has the basic numbers to appropriately price the security.

To be clear, there are investors who seem particularly adept at determining the strength of a company's competitive edge and genuine growth prospects, and can thus capture mispricing if the overall market is not sufficiently pricing in the durability of future cash flows. However, it's not a skill set that RAM possesses. It's not what we do. That said, as we have often noted, we do episodically find great companies that are momentarily in the dog house and priced accordingly. We have no qualms when it comes to purchasing such securities. After all, Wall Street is mostly comprised of followers best described as individuals trafficking in the average opinion of the average opinion. Collectively, Wall Street tends to fall in love or out of love as a group. Savvy contrarians can periodically exploit this communal tendency to hide out in the safety of crowds.

Our investment mantra lies in pursuing value not by searching for great companies, even ones that might be reasonably priced, but rather in sourcing "Out of favor, overlooked and misunderstood" securities. The rationale is simple enough to us – the odds of discovering mispricing are far greater in such an arena. Admittedly, the inputs for RAM securities are not as neat and formulaic as the inputs for great companies. While the vast majority of investors are focused on near-term company cash flow or earnings, we are decidedly interested in areas where investor interest is low because of poor current outlooks or uncertainty - two things which frighten most investors who are comforted by identifiable positive characteristics. RAM is comforted by bargain prices. The fact remains that most investors chase the same investment characteristics and therefore reduce the probability of adding investment value.

In other words, our securities possess "hair," i.e., their current profit profiles often look terrible. They definitely don't screen well, which is precisely why mispricing is much more likely. The inputs are more complicated. To properly analyze such securities, one must possess a rich ecosystem of industry contacts. Walking trade show floors often proves to be invaluable. Assessing probabilities and suitably weighing odds are the tricks of the trade. Thus, while math is at the center of what we do, deep value is not the domain of accountants, economic forecasters, and those never wanting to leave their offices. Deep value investing, as practiced by RAM, more accurately relies on the skill sets of detectives, investigative journalists, and insurance underwriters. Insurance is a game of pricing probabilities and investing similarly boils down to probabilities, not certainties.

It is important to highlight that RAM's approach is anchored in viewing businesses not strictly as going-concern entities, but also as owning assets that are potentially desirable to larger companies operating in the same industry. In fact, building a business most often involves buying smaller ones. Generous premiums to market prices are often paid because the cost to recreate the asset(s) would be even greater, while also consuming the precious commodity of time. RAM's north star has always been driven by answering a simple question: Would we take this company private, in a heartbeat, at its current price? The answer to this question is deeply informed by whether we believe the business could be sold at a materially higher price.

For RAM, resource conversions have always been source of value creation. In the past eighteen months, for instance, we have had five of our holdings bought out by larger companies: WCI Communities (WCIC), Sizmek (SZMK), Fortress Investments (FIG), Atwood Oceanics (ATW) and Covisint (COVS).

RAM mitigates the risk of buying unloved securities in several ways:

| | Balance Sheet Strength – Provides time for investment optionality to play out and ability to average down |

| | Unique Assets – If the company cannot segue to profitability as a going-concern, the assets are desirable to competitors |

| | Multiple Shots on Goal – Like to have several ways to win, providing investment redundancy |

| | Alignment of Interests – Management and board incentives |

| | Price – Demand a sizable discount to our calculation of intrinsic value |

Additionally, we add to our investment differentiation by greater portfolio concentration (often 5% to 7% positions compared to typical portfolios with 2% company weightings). It is in our DNA to be highly opportunistic. As such, we are disciplined enough to hold cash in the absence of compelling investment candidates, and are willing to average down our cost basis. Finally, it is worth noting, as we have done previously, we are committed to maintaining a modest level of assets under management that allows us to optimally execute our strategy, focusing as it does in micro and small cap securities. Simply put, large pools of money seem to be highly correlated with diminishing returns.

There is another factor worth noting when viewing our returns against benchmarks. Indexes are comprised of leveraged companies since most capital structures combine equity and debt financing. RAM is typically holding a basket of unleveraged companies. For example, the current median debt to EBITDA ratio for non-financial companies in the S&P 500 is roughly 2.3x (it's the highest ratio since 2000). Our top ten equity holdings, on the other hand, collectively not only have no debt, but also hold significant amounts of cash. Our top ten holdings as of June 30th have an average cash balance equaling roughly 40% of their market capitalizations. Company leverage flows through to underlying company investment returns as a company's ROE is a function of its return on assets and the degree to which those assets are leveraged.

What is it that we might be doing right wherein unlevered ugly ducklings are beating the debt-enhanced beautiful swans? Notwithstanding our research process and risk mitigation strategies, we believe the answer lies in one word – price. Paying a bargain price has added value. The sizable mispricing that results from the institutional and psychological bias to own what's pretty, combined with the parallel fear of being seen hanging out with the unpopular kids, can be put to profitable use. While others long to belong with the in-crowd, we long to buy cheap.

Finally, a word on the current environment's pricing of corporate assets: plant and equipment, inventory, intellectual property, etc. The compound annual growth rate in book value for the S&P 500 is 4% over the past five years, but the index itself has compounded at nearly 15% during the same period. Notwithstanding the shortcomings of book value as an analytical tool, this fact strongly suggests that prices have outstripped the growth in corporate net worth by a considerable amount in the past five years.

Yes, in the current environment, deep value securities are difficult to find…but it's not impossible. With regularity, the degree to which some security and/or industry is being taken out to the woodshed is often too dramatic. Our job is to find these situations. We feel confident that patience and discipline will pay off and feel well-positioned to take advantage of possible market disruption. However, if valuations stay elevated - a clear possibility if interest rates remain super low - our ability to find pockets of value, and to own them in meaningful size, will provide ample return optionality, in our opinion.

Recent Updates of Top Five Equity Holdings

Rosetta Stone, RST. RST's year-over-year (Y/Y) second quarter revenue was flat despite the company's exiting of several Enterprise & Education (E&E) language markets and a dramatic pull-back in consumer advertising as a result of the company's laser-like focus on profitability over revenue growth. Revenue came in at $48 million compared to FactSet consensus of $45 million. Moreover, operating expenses decreased by 20% Y/Y, representing the company's 10th consecutive quarter of expense reductions.

The gem in RST's portfolio – Lexia Learning – grew revenue at 20% Y/Y and maintained 95% plus renewal rates. In fact, in the second quarter the subscription renewal rate was above 100%, i.e., customers are not only renewing but they're buying more licenses. Bookings were down slightly but John Hass, CEO, made clear that this was the result of schools wanting to sign deals in the 3rd quarter because of new budgeting norms. John also announced that July bookings were in fact up 30% Y/Y.

For the first time in several quarters, E&E Language grew Y/Y revenue, by 4%, after accounting for countries the company chose to exit last year. John continued to communicate a very positive message for the company's new Catalyst E&E offering and noted on the call that the company is being exposed to large corporate opportunities that were previously unavailable to it given the shortcomings of its legacy product which lacked the tracking and reporting software increasingly demanded by corporate and educational clients.

Consumer was a noteworthy bright spot despite a Y/Y revenue decline of 10%. SaaS unit mix is now 66%, up from 26% in the year-ago period. The company's decision to offer a three-month lower cost subscription versus a higher one or two-year subscription, looks – so far – like a winning strategy. While the new model reduces immediate cash flow, it appears to be opening up access to a new class of consumers – paying consumer subscribers grew from 272K in 2Q16 to 375K in 2Q17. Further, the company announced that its calculation of LTV to CAC (long-term expected lifetime value of all products to customer acquisition costs including working media and the people deploying it) went from 1.5x to 1.8x, i.e., the revenue estimated to come from a consumer subscription is estimated to be 80% above cost versus 50% one year ago. Management has worked hard to find the right go-to-market strategy for the consumer business and results so far appear promising.

RST announced the hiring of Matt Hulett to the newly created position of President of Language where he will oversee the Company's language learning business. Mr. Hulett has over 20 years of leadership experience, including President of the corporate travel division of Expedia and CEO of AdXpose. This hire will free up John Hass to further pursue licensing deals that the company has identified as a significant opportunity. Recall, earlier this year RST signed a deal with a Japanese partner in which the company received a $13 million upfront payment (with virtually no associated costs) and also a revenue sharing partnership with Univision. Note, just a year ago investors questioned whether the company's consumer vertical possessed any value at all. RAM's thesis has always been anchored in Lexia first and E&E language second, with a free shot on goal with the consumer business. There's little question now, in our opinion, that the consumer freebie will be icing on the cake of this investment.

As a result of the company's successful turnaround efforts, RST expects to generate cash this year, despite ramping up its growth spending on Lexia. The company reaffirmed its FY '17 guidance, including an estimated year-end cash balance of $44 million while maintaining a debt-free balance sheet.

As of the fiscal year ended August 31, 2017, the Fund held 6.49% in Rosetta Stone, RST.

Paratek Pharmaceuticals, PRTK. "The successful completion of our planned clinical program for omadacycline and our recent pre-NDA meetings with the FDA represent important strategic milestones on our pathway to approval," said Michael Bigham, Chairman and Chief Executive Officer, Paratek. "We believe that omadacycline represents a much-needed new antibiotic treatment option in an era of rising bacterial resistance. With the data generated to date in all three Phase 3 studies, we remain confident in the path to regulatory approval in both the U.S. and EU. Based on our recent pre-NDA meetings with FDA, we will initiate our rolling submission in December of this year."

Recent Highlights

| | Reported positive top-line efficacy, safety, and tolerability data in the OPTIC study, a Phase 3 registration study of IV to once-daily oral omadacycline in community-acquired bacterial pneumonia (CABP) |

| | Reported positive top-line efficacy, safety, and tolerability data in the OASIS-2 study, a Phase 3 registration study of once-daily oral-only omadacycline in acute bacterial skin and skin structure infections (ABSSSI) |

| | Completed two pre-NDA meetings, focused on clinical/non-clinical and CMC topics, with the U.S. Food and Drug Administration confirming plans for NDA submission |

| | Received endorsement of the Pediatric Investigation Plan from the European Medicines Agency |

| | Presented 10 posters and oral presentations at American Society of Microbiology's ASM Microbe 2017 conference in New Orleans |

| | Expanded commercial, medical and drug supply teams |

| | Strengthened balance sheet, extending runway through Q2 2019, including full cost of product launch |

PRTK's announcement of its third Phase 3 trial (an oral-only dosing skin trial) was initially met with investor enthusiasm but was soon replaced with concern about elevated instances of nausea and vomiting. We believe these concerns are misplaced. First, 75% of the nausea/vomiting instances were deemed to be "mild" and occurred in the first two days when dosing is larger than subsequent days. Second, nausea/vomiting did not lead to discontinuation. In fact, more patients completed the OMD arms of all 3 studies than they did the comparator, Linezolid. Third, the efficacy against all the key pathogens tested was better for PRTK's omadacycline compared to the comparator, Linezolid. On its earnings call, the company commented, "The overall response rate with omadacycline was 87.5%, which was five percentage points higher than Linezolid." Fourth, OMD is not a first-line antibiotic, it's a second and third line drug for higher at-risk populations where mild GI is not a big concern, according to doctors to whom we've spoken. To be clear, this issue is solely associated with the oral-only dosing, not the IV to oral dosing regimen.

Omadacycline will have to compete in a competitive antibiotic marketplace with price sensitivities. However, OMD has four attributes in its favor: multiple indications at launch, IV/Oral formulation enabling early hospital discharge, no effective IV/Oral similarly classed drug to displace, and the ability to be price flexible between the IV and oral doses. Finally, PRTK will begin its Phase 2 UTI (urinary tract infection) trial in the fourth quarter of this year. If successful, PRTK will be the first antibiotic in twenty years to have three separate indications along with the other attributes highlighted above.

As of the fiscal year ended August 31, 2017, the Fund held 5.63% in Paratek Pharmaceuticals, PRTK.

Liquidity Services, LQDT. The company reported results in line with our thesis – a strong and growing GovDeals vertical with challenging operations in other segments. GMV (gross market value) of goods liquidated on the company's platforms totaled $161 million, down from $179 million in the prior year. Revenue followed the decline in GMV and came in at $66 million, down from $85 million in the prior year.

LQDT's GovDeals segment, however, continued to shine. It reported record GMV of $76 million, up 18% from last year's comparable quarter. Moreover, the take-rate (commission), is now steady at 10%, up from 8% two years ago.

Another bright spot was the company's retail supply chain marketplace (RSCG), which reported GMV up 5.1% year over year. Recall, roughly 5% of store purchased goods are returned, while roughly 15% of online purchases are returned. The increase in retail returns creates the need for reverse supply chain management and LQDT appears to be participating in this secular trend.

The company's two other verticals – Capital Assets Group (CAG) and DoD Surplus and Scrap contracts – underperformed. Bill Angrick, CEO, commented, "Our capital assets business experienced unexpected headwinds in Q3 due to lower than anticipated client sales activity and delays in large asset sales, as well as lower volumes of goods received and lower service fee revenue in our DoD Surplus contract."

The company maintains an exceptionally strong balance sheet with cash at quarter end of $114 million, down from $116 million. We continue to believe LQDT provides a highly compelling investment narrative anchored in owning the leading municipal online liquidation marketplace platform, optionality on other marketplace verticals and cost savings from the introduction of its Liquidity One initiative.

As of the fiscal year ended August 31, 2017, the Fund held 5.39% in Liquidity Services, LQDT.

Marchex, MCHX. MCHX is making meaningful strides in segueing from being a phone call generating third-party marketplace to one offering distinct phone call software analytic tools. RAM's investment thesis is anchored in the belief that MCHX's call analytics technology is robust and sits in front of positive secular growth trends, it possesses the balance sheet to weather the transition, and was purchased at a price that effectively provides us a free option on the company's successful transition to being a leading call analytics company.

First, the company is managing its transition without putting its balance sheet at risk. In its initial analysis, RAM projected a 2017 cash-burn of $10 million; year to date the company's cash has gone from $104 million to $102.4 million, a drop of only $1.6 million. Cash represents roughly 85% of the company's current market capitalization.

Second, the company's Speech Analytics capabilities are being recognized by the industry as possessing strong technology. Companies are looking for software solutions to help them better understand the raw data across millions of customer phone conversations. MCHX's technology provides real time, actionable intelligence that can be used to increase sales and improve call center operations. Analyzing customer phone conversations for keywords and phrases has reached an inflection point given the sophistication of speech recognition technology. Some industry observers have noted that speech recognition technology is today where online clicking behavior was ten years ago.

MCHX continues to develop key partnering relationships. Last year, the company announced a partnership with Facebook, allowing customers to track the efficacy of their FB ads in generating phone calls. The FB relationship is still nascent but the company reports that more beta-tests producing positive results. In the last quarter, the company announced new integrations with Adobe Cloud, enabling marketers to both increase sales and retain customers by better understanding how customers interact with their brands.

Our own channel checks have provided positive feedback on MCHX's capabilities and value-add to their business.

Finally, the company recently announced the results of an independent product review in automatic speech recognition for call analytics. Enterprise Technology Analyst Frank Ohlhorst put Marchex Speech Analytics head-to-head with recognized leader in automatic speech recognition (ASR) systems, IBM's Watson. Ohlhorst concluded, "We know this is only a sub-set of Watson's full capabilities, but for companies looking to evaluate call data and analyze consumer business phone calls, Marchex Speech Analytics proved superior. That said, there are still elements that can be compared between Marchex and Watson, which include accuracy of how voice is processed and ultimately transcribed, and Marchex outperformed Watson from that perspective."

As of the fiscal year ended August 31, 2017, the Fund held 5.03% in Marchex, MCHX.

Sandstorm Gold, SAND. Nolan Watson, President and CEO, noted, "The record production numbers and strong operating cash flow helped grow our cash balance to more than $32 million by quarter-end, enabling us to add a number of new stream and royalties to the portfolio… The quarterly results are a great example of the power of the stream and royalty business model at work." The company expects attributable gold equivalent production for 2017 to be 45,000 to 55,000 ounces. The company forecasts production to rise to over 65,000 ounces per annum by 2020.

On April 26th, the company made a major announcement of its intention to acquire all the issued shares of Mariana Resources, Ltd. that it did not already own. Mariana shareholders approved the deal. SAND will own 30% of the Hot Maden mine and local operator Lidya Mining will own 70%. Lidya is a subsidiary of Calik Holding, a large Turkish holding company run by Prime Minister Erdogen's brother-in-law with roughly $3 billion in revenue. Turkey has long been a favorite operating environment for major international mining companies. However, one cannot ignore what appears to be heightened political risk in Turkey.

Economically speaking, the Hot Maden asset is exceptionally compelling given a mine level break-even point of roughly $400/ounce as a result of its grade quality. Hot Maden's mine attributes are stunning with a Preliminary Economic Assessment estimate of 11 grams of gold per rock ton compared to the typical range of 3 to 5 grams per ton. SAND's engineers believe the HM asset could in fact yield 13 g/t to 15 g/t of gold. SAND management is quite excited about the investment, which it anticipates converting into a future stream. The effective cost of the transaction is roughly $179 million for an asset expected to begin cash flowing at $50 million beginning in 2021/2022 for what will likely be over ten years based on today's spot prices.

A Preliminary Economic Assessment report was completed by RungePincockMinarco, effective date March 1, 2017. RungePincockMinarco is the world's largest publicly listed independent group of mining technical experts, with history stretching back to 1968. In the report, in which it assumed $1,250/oz gold and $2.75/lb copper, and an 8% discount rate, Runge placed a present value (PV) on the Hot Maden Project at $1.366 billion. This translates into a PV of $410 million for SAND's 30% interest.

Perhaps most importantly, we believe investors do not appreciate the counterparty strength now embedded in SAND's portfolio (79% mid-tier and major miners rising to an estimated 97% in 2022 estimated in the company's current presentation) and the likely eventual take-out of the company in whole. In a take-out, we believe SAND's valuation would be in the 5% cap rate range.

The investment beauty of SAND (at current price levels), is an embedded value of "what is" (greater than 10% FCF generation), and embedded future income from streams simply coming on line wherein SAND has no capital outlays. Moreover, SAND possesses an unlevered capital structure.

As of the fiscal year ended August 31, 2017, the Fund held 4.97% in Sandstorm Gold, SAND.

We will continue to methodically and diligently search for out-of-favor, overlooked and misunderstood investments and stay true to being balance sheet focused, opportunistic, and thoughtful while gathering enough information to make well-informed investment decisions.

Best Regards,

Jim Roumell

Portfolio Manager

Roumell Opportunistic Value Fund

RCRAM1017002

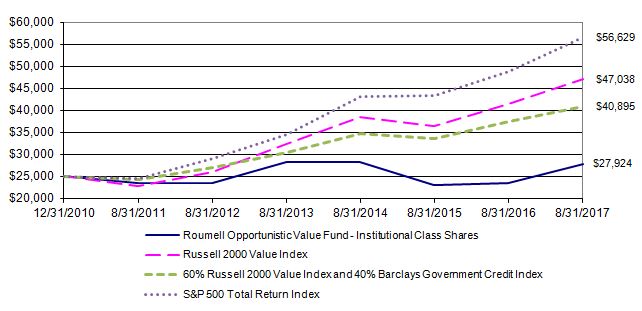

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | |

| Institutional Class Shares | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

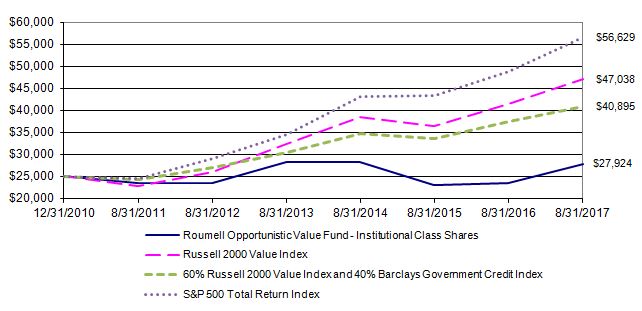

| For the period from December 31, 2010 (Date of Initial Public Investment) to August 31, 2017 |

| | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $25,000 Investment | | | | | | | | |

| This graph assumes the minimum initial investment of $25,000 at December 31, 2010 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Roumell Opportunistic Value Fund Institutional Class Shares (the "Fund") versus the Russell 2000 Value Index, a blend of 60% of the Russell 2000 Value Index and 40% of the Barclays Government Credit Index, and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | |

| | | As of | | | | One | | Five | | Since | | Inception | | Expense | |

| | | August 31, 2017 | | | Year | | Year | | Inception | Date | | Ratio* | |

| | | Institutional Class Shares | | 18.28% | | 3.55% | | 1.74% | | 12/31/10 | | 1.63% | |

| | | Russell 2000 Value Index | | 13.47% | | 12.50% | | 9.94% | | N/A | | N/A | |

| | | 60% Russell 2000 Value Index and | | | | | | | | | | |

| | | 40% Barclays Government Credit Index | 9.06% | | 8.65% | | 7.66% | | N/A | | N/A | |

| | | S&P 500 Total Return Index | | 16.23% | | 14.33% | | 13.04% | | N/A | | N/A | |

| | | | | | | | | | | | | | | | | | | |

| * The gross expense ratio shown is from the Fund's prospectus dated December 29, 2016. | | |

| | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

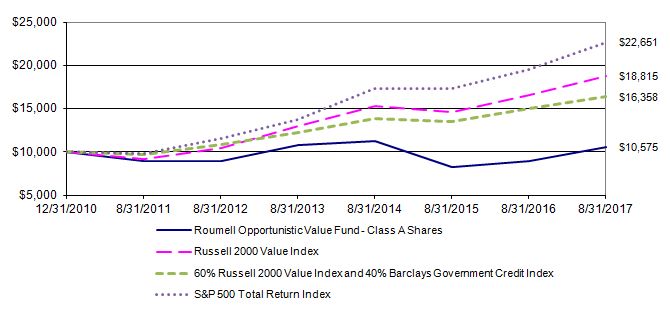

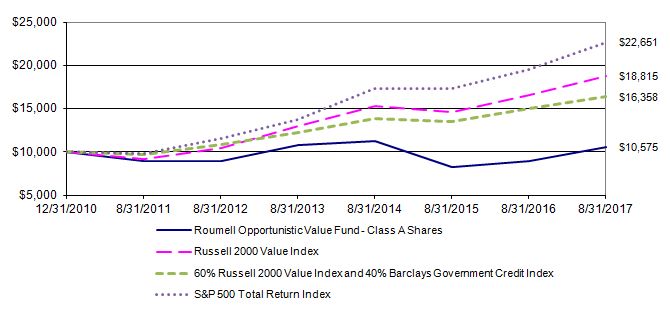

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | |

| Class A Shares | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| For the period from December 31, 2010 (Date of Initial Public Investment) to August 31, 2017 | | |

| | | | | | | | | | | | | | | | | | | |

| Comparison of the Change in Value of a $10,000 Investment | | | | | | | |

| This graph assumes an initial investment of $10,000 ($9,550 after maximum sales load of 4.50%) at December 31, 2010 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Roumell Opportunistic Value Fund Class A Shares (the "Fund") versus the Russell 2000 Value Index, a blend of 60% of the Russell 2000 Value Index and 40% of the Barclays Government Credit Index, and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | | Gross | |

| | | As of | | | | | | One | | Five | Since | | Inception | | Expense | |

| | | August 31, 2017 | | | | | Year | | Year | Inception | Date | | Ratio* | |

| | | Class A Shares - No Sales Load | | | 17.99% | | 3.28% | 1.41% | | 12/31/10 | | 1.88% | |

| | | Class A Shares - 4.50% Maximum Sales Load | | 13.67% | | 2.51% | 0.84% | | 12/31/10 | | 1.88% | |

| | | Russell 2000 Value Index | | | | 13.47% | | 12.50% | 9.94% | | N/A | | N/A | |

| | | 60% Russell 2000 Value Index and | | | | | | | | | | | |

| | | | 40% Barclays Government Credit Index | | 9.06% | | 8.65% | 7.66% | | N/A | | N/A | |

| | | S&P 500 Total Return Index | | | | 16.23% | | 14.33% | 13.04% | | N/A | | N/A | |

| * The gross expense ratio shown is from the Fund's prospectus dated December 29, 2016. | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

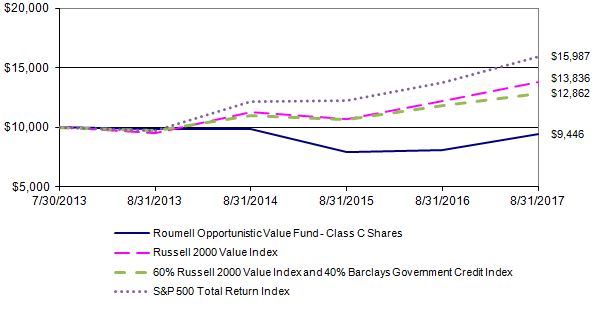

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Performance Update (Unaudited) | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

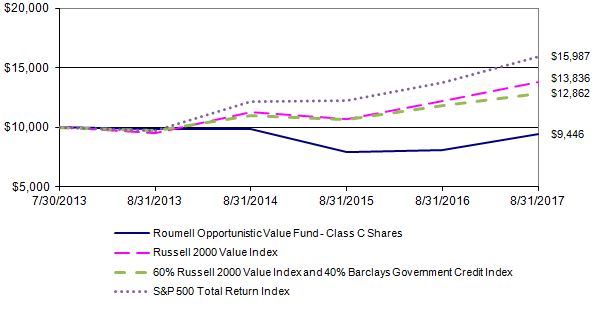

| For the period from July 30, 2013 (Date of Initial Public Investment) to August 31, 2017 | | | | | | |

| This graph assumes an initial investment of $10,000 at July 30, 2013 (Date of Initial Public Investment). All dividends and distributions are reinvested. This graph depicts the performance of the Roumell Opportunistic Value Fund Class C Shares (the "Fund") versus the Russell 2000 Value Index, a blend of 60% of the Russell 2000 Value Index and 40% of the Barclays Government Credit Index, and the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the indices are not available for investment and are unmanaged. The comparison is shown for illustrative purposes only. |

| | | | | | | | | | | | | | | | | | | |

| | Average Annual Total Returns | |

| | | | | | | | | | | | | | | | | | Gross | |

| | | As of | | | | One | | Three | | Since | | Inception | | Expense | |

| | | August 31, 2017 | | | | Year | | Year | | Inception | | Date | | Ratio* | |

| | | Class C Shares | | | | 17.13% | | -1.38% | | -1.39% | | 07/30/13 | | 2.63% | |

| | | Russell 2000 Value Index | | | 13.47% | | 7.06% | | 8.26% | | N/A | | N/A | |

| | | 60% Russell 2000 Value Index and | | | | | | | | | | |

| | | | 40% Barclays Government Credit Index | 9.06% | | 5.44% | | 6.35% | | N/A | | N/A | |

| | | S&P 500 Total Return Index | | 16.23% | | 9.53% | | 12.15% | | N/A | | N/A | |

| | | | | | | | | | | | | | | | | | | |

| * The gross expense ratio shown is from the Fund's prospectus dated December 29, 2016. | | | |

| | | | | | | | | | | | | | | | | | | |

| Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting ncfunds.com. |

| | | | | | | | | | | | | | | | | | | |

| The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of distributions. |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | |

| | | | | | | | | | | |

| Schedule of Investments | | | | | | | |

| | | | | | | | | | | |

| As of August 31, 2017 | | | | | | | |

| | | | | | | Shares | | Cost | | Value (Note 1) |

| | | | | | | | | | | |

| COMMON STOCKS - 47.99% | | | | | | |

| | | | | | | | | | | |

| | Business Services - 6.49% | | | | | | |

| | * | Rosetta Stone, Inc. | | | 462,554 | $ | 3,477,583 | $ | 4,255,497 |

| | | | | | | | | | | |

| | Consumer Discretionary - 3.07% | | | | | | |

| | | Aimia, Inc. | | | 1,150,000 | | 1,449,857 | | 2,012,500 |

| | | | | | | | | | | |

| | Energy - 0.43% | | | | | | | |

| | * | Goodrich Petroleum Corp. | | 33,030 | | 1,528,466 | | 284,058 |

| | | | | | | | | | | |

| | Financials - 3.66% | | | | | | | |

| | * | Great Elm Capital Group, Inc. | | 363,799 | | 1,234,739 | | 1,200,537 |

| | * | Hallmark Financial Services, Inc. | | 117,000 | | 1,211,983 | | 1,199,250 |

| | | | | | | | | | | 2,399,787 |

| | Health Care - 5.63% | | | | | | | |

| | * | Paratek Pharmaceuticals, Inc. | | 130,941 | | 1,935,534 | | 3,692,536 |

| | | | | | | | | | | |

| | Information Technology - 21.37% | | | | | | |

| | * | Edgewater Technology, Inc. | | 265,900 | | 1,860,256 | | 1,701,760 |

| | * | GSI Technology, Inc. | | | 210,670 | | 1,091,414 | | 1,398,849 |

| | * | Liquidity Services, Inc. | | 619,303 | | 4,173,173 | | 3,530,027 |

| | * | Marchex, Inc. | | | 1,067,000 | | 3,020,807 | | 3,297,030 |

| | * | Seachange International, Inc. | | 867,720 | | 2,212,033 | | 2,264,749 |

| | * | The Rubicon Project, Inc. | | 482,470 | | 2,901,247 | | 1,814,087 |

| | | | | | | | | | | 14,006,502 |

| | Materials - 4.97% | | | | | | | |

| | * | Colossus Minerals, Inc. | | 1,247,121 | | 1,670,952 | | 1,247 |

| | * | Sandstorm Gold Ltd. | | | 686,980 | | 2,467,941 | | 3,256,285 |

| | | | | | | | | | | 3,257,532 |

| | Real Estate - 2.37% | | | | | | | |

| | * | Five Point Holdings LLC | | 107,000 | | 1,575,389 | | 1,514,050 |

| | | Lai Fung Holdings Ltd. | | 24,000 | | 26,410 | | 37,109 |

| | | | | | | | | | | 1,551,159 |

| | | | | | | | | | | |

| | | Total Common Stocks (Cost $31,837,784) | | | | | 31,459,571 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Continued | | | | | | |

| | | | | | | | | | | |

| As of August 31, 2017 | | | | | | | |

| | | | | | | Shares | | Cost | | Value (Note 1) |

| | | | | | | | | | | |

| CLOSED-END FUND - 1.87% | | | | | | |

| | | Medley Capital Corp. | | | 204,000 | $ | 1,316,742 | $ | 1,226,040 |

| | | | | | | | | | | |

| | | Total Closed-End Fund (Cost $1,316,742) | | | | | 1,226,040 |

| PREFERRED STOCKS - 7.63% | | | | | | |

| | | | | Maturity | | | | | | |

| | | Eagle Point Credit | Date | Interest Rate | | | | | |

| | | | Co., Inc. | 9/30/2027 | 6.750% | 52,000 | | 1,300,000 | | 1,330,992 |

| | | Oxford Lane Capital | | | | | | | |

| | | | Corp. | 6/30/2024 | 6.750% | 62,630 | | 1,565,750 | | 1,581,408 |

| | | TICC Capital Corp. | 3/30/2024 | 6.500% | 80,010 | | 2,001,507 | | 2,089,861 |

| | | | | | | | | | | |

| | | Total Preferred Stocks (Cost $4,867,257) | | | | | 5,002,261 |

| | | | | | | Interest | | Maturity | | |

| CONVERTIBLE BOND - 0.00% | Par | Rate | | Date | | |

| | μ | BPZ Resources, Inc. | $ | 1,657,000 | 8.500% | | 10/1/2017 | | 2,071 |

| | | | | | | | | | | |

| | | Total Convertible Bond (Cost $1,550) | | | | | 2,071 |

| | | | | | | Interest | | Maturity | | |

| CORPORATE BOND - 2.56% | Par | Rate | | Date | | |

| | | CSI Compressco LP | $ | 1,856,000 | 7.250% | | 8/15/2022 | | 1,677,360 |

| | | | | | | | | | | |

| | | Total Corporate Bond (Cost $1,390,566) | | | | | 1,677,360 |

| U.S. TREASURY SECURITIES - 29.71% | | Interest | | Maturity | | |

| | | | | | Par | Rate | | Date | | |

| | † | U.S. Treasury Bill | | $ | 1,500,000 | 0.000% | | 9/14/2017 | | 1,499,528 |

| | † | U.S. Treasury Bill | | 4,000,000 | 0.000% | | 9/21/2017 | | 3,998,028 |

| | | U.S. Treasury Bill | | 6,000,000 | 0.000% | | 9/28/2017 | | 5,995,777 |

| | | U.S. Treasury Note | | 5,500,000 | 1.000% | | 3/15/2019 | | 5,475,078 |

| | † | U.S. Treasury Note | | 2,500,000 | 1.750% | | 3/31/2022 | | 2,507,226 |

| | | | | | | | | | | |

| | | Total U.S. Treasury Securities (Cost $19,464,373) | | | | | 19,475,637 |

| | | | | | | Strike | | Exercise | | |

| WARRANTS - 0.01% | | Shares | Price | | Date | | |

| | E*ə | Colossus Minerals, Inc. | 624,807 | $ | 1.00 | | 3/17/2020 | | 6,248 |

| | | | | | | | | | | |

| | | Total Warrants (Cost $438) | | | | | | 6,248 |

| | | | | | | | | | | |

| | | | | | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Continued | | | | | | |

| | | | | | | | | | | |

| As of August 31, 2017 | | | | | | | |

| | | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | | |

| SHORT-TERM INVESTMENT - 10.36% | | | | | | |

| | | Federated Treasury Obligations Fund - Institutional | | | | |

| | | | Class Shares, 0.87% § | | | | 6,790,566 | $ | 6,790,566 |

| | | | | | | | | | | |

| | | Total Short-Term Investment (Cost $6,790,566) | | | | | 6,790,566 |

| | | | | | | | | | | |

| Total Value of Investments (Cost $65,669,276) - 100.13% | | | | $ | 65,639,754 |

| | | | | | | | | | | |

| Total Value of Options Written (Premiums Received $211,281) - (0.14)% | | | | (89,950) |

| | | | | | | | | | | |

| Other Assets Less Liabilities - 0.01% | | | | | | 2,203 |

| | | | | | | | | | | |

| | Net Assets - 100.00% | | | | | | $ | 65,552,007 |

| | | | | | | | | | | |

| | | * | Non-income producing investment | | | | | |

| | | § | Represents 7 day effective yield | | | | | | |

| | | † | All or a portion of security is segregated as collateral for options written. | | |

| | | | | | | | | | | |

| | | μ | The Fund was issued the escrow security, cusip 055ESC206, as a result of a confirmed Plan of Liquidation for BPZ Resources, Inc., interest rate of 8.500% and maturity date of October 1, 2017. On January 4, 2016, the Fund received a distribution totaling $61,934 and the escrow security. On April 5, 2016, an additional distribution was made to holders totaling $159,539. On October 18, 2016, an additional distribution was made to holders totaling $28,050. The escrow security was established for possible future distributions. As of August 31, 2017, no additional distributions had been made. The security is valued at its closing market price via the primary pricing source established by the Fund's Administrator and approved by the Fund's Board of Trustees. The maturity date of the security is a placeholder and is subject to change until all distributions have been made to the holders of the escrow security as determined by BPZ Resources, Inc. |

| | | | | | | | | | | |

| | | ə | Security is fair valued using the pricing policies approved by the Fund's Board of Trustees. In determining the price of the security, the Board of Trustees considered the issuer, terms, and the size of the Fund's investment in the security. As of August 31, 2017, the security represents 0.01% of net assets and is not considered a material portion of the Fund. |

| | | | |

| See Notes to Financial Statements | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Schedule of Options Written | | | | | |

| | | | | | | | | | | |

| As of August 31, 2017 | | | | | | | |

| | | | | Contracts (a) | Notional Value | Exercise Price | | Expiration Date | | Value (Note 1) |

| | | | | | | | | | | |

| OPTIONS WRITTEN - 0.14% | | | | | | |

| | | | | | | | | | | |

| | PUT OPTIONS WRITTEN - 0.14% | | | | | | |

| | | * | DSW, Inc. | 1,250 | $ | 1,875,000 | $ | 15.00 | | 10/20/2017 | $ | 18,750 |

| | | * | Ford Motor Co. | 1,900 | 1,900,000 | 10.00 | | 12/15/2017 | | 38,950 |

| | | * | Palo Alto Networks, | | | | | | |

| | | | Inc. | 150 | 1,350,000 | 90.00 | | 9/15/2017 | | 32,250 |

| | | | | | | | | | | |

| | | Total Put Options Written (Premiums Received $211,281) | | | $ | 89,950 |

| | | | | | | | | | | |

| | Total Options Written (Premiums Received $211,281) | | | $ | 89,950 |

| | | | | | | | | | | |

| | | (a) | Each contract is equivalent to 100 shares of the underlying common stock. | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | |

| | | | | | | | | | | |

| Schedule of Investments - Summary of Investments (Unaudited) | | | | | |

| | | | | | | | | | | |

| As of August 31, 2017 | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | Summary of Investments | | | | | | |

| | | | by Sector | | | % of Net | | | | |

| | | | | | | Assets | | Value | | |

| | | | Business Services | | | 6.49% | $ | 4,255,497 | | |

| | | | Consumer Discretionary | | 3.07% | | 2,012,500 | | |

| | | | Energy | | | 0.43% | | 284,058 | | |

| | | | Financials | | | 3.66% | | 2,399,787 | | |

| | | | Health Care | | | 5.63% | | 3,692,536 | | |

| | | | Information Technology | | 21.37% | | 14,006,502 | | |

| | | | Materials | | | 4.97% | | 3,257,532 | | |

| | | | Real Estate | | | 2.37% | | 1,551,159 | | |

| | | | Closed-End Fund | | | 1.87% | | 1,226,040 | | |

| | | | Preferred Stocks | | | 7.63% | | 5,002,261 | | |

| | | | Convertible Bond | | | 0.00% | | 2,071 | | |

| | | | Corporate Bond | | | 2.56% | | 1,677,360 | | |

| | | | U.S. Treasury Securities | | 29.71% | | 19,475,637 | | |

| | | | Warrants | | | 0.01% | | 6,248 | | |

| | | | Short-Term Investment | | 10.36% | | 6,790,566 | | |

| | | | Put Options Written | | (0.14%) | | (89,950) | | |

| | | | Other Assets Less Liabilities | | 0.01% | | 2,203 | | |

| | | | Total Net Assets | | | 100.00% | $ | 65,552,007 | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | |

| | | | | | | | |

| Statement of Assets and Liabilities | | |

| | | | | | | | |

| As of August 31, 2017 | | | |

| | | | | | | | |

| Assets: | | | | | |

| | Investments, at value (Cost $65,669,276) | $ | 65,639,754 |

| | Receivables: | | | |

| | | Deposits at Broker | | | 247,165 |

| | | Fund shares sold | | | 1,070 |

| | | Dividends and interest | | 87,318 |

| | Prepaid expenses: | | | |

| | | Fund accounting fees | | 3,250 |

| | | | | | | | |

| | Total assets | | | 65,978,557 |

| | | | | | | | |

| Liabilities: | | | | | |

| | Options written, at value (Premiums received $211,281) | | 89,950 |

| | Payables: | | | | |

| | | Fund shares repurchased | | 266,282 |

| | Accrued expenses: | | | |

| | | Advisory fees | | | 49,029 |

| | | Professional fees | | | 14,800 |

| | | Trustee fees and meeting expenses | | 1,333 |

| | | Interest expense | | | 1,309 |

| | | Custody fees | | | 1,287 |

| | | Registration and filing fees | | 993 |

| | | Shareholder fulfillment fees | | 470 |

| | | Distribution and service fees - Class A Shares and Class C Shares | | 417 |

| | | Miscellaneous expenses | | 350 |

| | | Compliance fees | | | 182 |

| | | Administration fees | | | 148 |

| | | | | | | | |

| | Total liabilities | | | 426,550 |

| | | | | | | | |

| Net Assets | | | | $ | 65,552,007 |

| | | | | | | | |

| Net Assets Consist of: | | | |

| | Paid in Beneficial Interest | $ | 67,525,895 |

| | Accumulated net investment loss | | (37,202) |

| | Accumulated net realized loss on investments | | (2,028,495) |

| | Net unrealized appreciation on investments and options written | | 91,809 |

| | Total Net Assets | | $ | 65,552,007 |

| | | | | | | | |

| | | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | |

| | | | | | | | |

| Statement of Assets and Liabilities - Continued | | |

| | | | | | | | |

| As of August 31, 2017 | | | |

| | | | | | | | |

| Institutional Class Shares of beneficial interest outstanding, no par value (a) | | 7,123,993 |

| | Net Assets | | | $ | 64,623,787 |

| | Net Asset Value, Offering Price and Redemption Price Per Share (b) | $ | 9.07 |

| | | | | | | | |

| Class A Shares of beneficial interest outstanding, no par value (a) | | 72,002 |

| | Net Assets | | | $ | 643,664 |

| | Net Asset Value and Redemption Price Per Share (b) | $ | 8.94 |

| | Offering Price Per Share ($8.94÷ 95.50%) | $ | 9.36 |

| | | | | | | | |

| Class C Shares of beneficial interest outstanding, no par value (a) | | 38,098 |

| | Net Assets | | | $ | 284,556 |

| | Net Asset Value, Offering Price and Redemption Price Per Share (b)(c) | $ | 7.47 |

| | | | | | | | |

| (a) | Unlimited Authorized Shares | | |

| (b) | The fund charges a 1% redemption fee on redemptions made within 60 days of initial purchase. |

| (c) | Contingent deferred sales charge for Class C Shares is imposed on proceeds redeemed within one year of purchase date (Note 1). |

| | | | |

| | | | | | | | |

| | | | | | | | |

| See Notes to Financial Statements | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | |

| | | | | | | | |

| Statement of Operations | | |

| | | | | | | | |

| For the Year Ended August 31, 2017 | | |

| | | | | | | | |

| Investment Income: | | |

| | Interest | | | $ | 522,390 |

| | Dividends | | | | 217,877 |

| | Total Investment Income | | 740,267 |

| | | | | | | | |

| Expenses: | | | | | |

| | Advisory fees (Note 2) | | 512,742 |

| | Administration fees (Note 2) | | 55,733 |

| | Registration and filing fees | | 34,058 |

| | Fund accounting fees (Note 2) | | 31,580 |

| | Professional fees | | 22,599 |

| | Transfer agent fees (Note 2) | | 21,000 |

| | Shareholder fulfillment fees | | 17,622 |

| | Custody fees (Note 2) | | 14,193 |

| | Compliance fees (Note 2) | | 12,001 |

| | Trustee fees and meeting expenses | | 8,058 |

| | Interest expense | | 5,814 |

| | Miscellaneous expenses (Note 2) | | 4,200 |

| | Insurance fees | | 3,756 |

| | Security pricing fees | | 3,710 |

| | Distribution and service fees - Class C Shares (Note 3) | | 3,186 |

| | Distribution and service fees - Class A Shares (Note 3) | | 1,687 |

| | | | | | | | |

| | Total Expenses | | 751,939 |

| | | | | | | | |

| | Advisory fees waived (Note 2) | | (63,173) |

| | | | | | | | |

| | Net Expenses | | | 688,766 |

| | | | | | | | |

| Net Investment Income | | 51,501 |

| | | | | | | | |

| Realized and Unrealized Gain on Investments: | | |

| | | | | | | | |

| | Net realized gain from: | | |

| | | Investments and foreign currency transactions | | 7,182,973 |

| | | Options written | | 40,388 |

| | | | | | | | 7,223,361 |

| | Net change in unrealized appreciation on: | | |

| | | Investments and translation of assets and liabilities of foreign currency | | 1,806,496 |

| | | Options written | | 121,331 |

| | | | | | | | 1,927,827 |

| | | | | | | | |

| Net Realized and Unrealized Gain on Investments | | 9,151,188 |

| | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | $ | 9,202,689 |

| | | | | | | | |

| See Notes to Financial Statements | | |

| | | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | |

| | | | | | | | | | | | |

| Statements of Changes in Net Assets | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| For the Year Ended August 31, | | | | | 2017 | | 2016 |

| | | | | | | | | | | | |

| Operations: | | | | | | | | |

| | Net investment income | | | | $ | 51,501 | $ | 362,393 |

| | Net realized gain (loss) from investments, foreign | | | | | | |

| | | currency transactions, and options written | | | | 7,223,361 | | (9,022,502) |

| | Net change in unrealized appreciation (depreciation) on | | | | |

| | | investments, translation of assets and liabilities | | | | | | |

| | | in foreign currency, and options written | | | | 1,927,827 | | 10,556,791 |

| | | | | | | | | | | | |

| Net Increase in Net Assets Resulting from Operations | | | 9,202,689 | | 1,896,682 |

| | | | | | | | | | | | |

| Distributions to Shareholders: | | | | | | | |

| | Net investment income | | | | | | | |

| | | Institutional Class Shares | | | | | - | | (54,086) |

| | | Class A Shares | | | | | - | | (1,751) |

| | | Class C Shares | | | | | - | | (5,455) |

| | | | | | | | | | | | |

| | Return of capital | | | | | | | |

| | | Institutional Class Shares | | | | | (75,979) | | - |

| | | Class A Shares | | | | | (1,215) | | - |

| | | Class C Shares | | | | | (1,079) | | - |

| | | | | | | | | | | | |

| Decrease in Net Assets Resulting from Distributions | | | (78,273) | | (61,292) |

| | | | | | | | | | | | |

| Beneficial Interest Transactions: | | | | | | | |

| | Shares sold | | | | | | 11,537,821 | | 19,863,818 |

| | Redemption fees | | | | | 454 | | (261) |

| | Reinvested dividends and distributions | | | | 67,389 | | 54,875 |

| | Shares repurchased | | | | | (3,598,868) | | (15,787,586) |

| | | | | | | | | | | | |

| Increase in Net Assets from Beneficial Interest Transactions | | 8,006,796 | | 4,130,846 |

| | | | | | | | | | | | |

| Net Increase in Net Assets | | | | | 17,131,212 | | 5,966,236 |

| | | | | | | | | | | | |

| Net Assets: | | | | | | | | |

| | Beginning of Year | | | | | 48,420,795 | | 42,454,559 |

| | End of Year | | | | | $ | 65,552,007 | $ | 48,420,795 |

| | | | | | | | | | | | |

| Accumulated Net Investment Loss | | | | $ | (37,202) | $ | (128,030) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | (Continued) |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | |

| | | | | | | | | | | | |

| Statements of Changes in Net Assets - Continued | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| For the Year ended August 31, | 2017 | | 2016 |

| | | | | | | | | | | | |

| Share Information: | | | | | | | |

| | Institutional Class Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 1,352,954 | $ | 11,529,651 | | 2,858,824 | $ | 19,832,043 |

| | | Redemption fees | - | | 454 | | - | | (261) |

| | | Reinvested dividends | | | | | | | |

| | | | and distributions | 8,147 | | 65,095 | | 7,041 | | 47,735 |

| | | Shares repurchased | (412,541) | | (3,352,868) | | (2,150,142) | | (15,151,192) |

| Net Increase in Beneficial | | | | | | | |

| Interest and Shares | 948,560 | $ | 8,242,332 | | 715,723 | $ | 4,728,325 |

| | | | | | | | | | | | |

| | Class A Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | 910 | $ | 8,170 | | 2,358 | $ | 16,133 |

| | | Reinvested dividends | | | | | | | |

| | | | and distributions | 154 | | 1,215 | | 251 | | 1,685 |

| | | Shares repurchased | (18,007) | | (154,447) | | (46,860) | | (323,445) |

| Net Decrease in Beneficial | | | | | | | |

| Interest and Shares | (16,943) | $ | (145,062) | | (44,251) | $ | (305,627) |

| | | | | | | | | | | | |

| | Class C Shares | Shares | | Amount | | Shares | | Amount |

| | | Shares sold | - | $ | - | | 2,584 | $ | 15,642 |

| | | Reinvested dividends | | | | | | | |

| | | | and distributions | 163 | | 1,079 | | 959 | | 5,455 |

| | | Shares repurchased | (12,857) | | (91,553) | | (51,540) | | (312,949) |

| Net Decrease in Beneficial | | | | | | | |

| Interest and Shares | (12,694) | $ | (90,474) | | (47,997) | $ | (291,852) |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights - Institutional Class Shares | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding | | August 31, |

| during the fiscal years ended | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, | | | | | | | | | | | |

| Beginning of Year | $ | 7.68 | $ | 7.48 | $ | 10.50 | $ | 11.15 | $ | 9.31 | |

| | | | | | | | | | | | | | | | |

| Income (Loss) from Investment | | | | | | | | | | | |

| Operations: | | | | | | | | | | | |

| | Net investment income | | 0.01 | (c) | 0.06 | (c) | 0.08 | (c) | 0.13 | | 0.03 | |

| | Net realized and unrealized | | | | | | | | | | | |

| | | gain (loss) on investments | | 1.39 | | 0.15 | | (1.90) | | (0.16) | | 1.89 | |

| Total from Investment Operations | 1.40 | | 0.21 | | (1.82) | | (0.03) | | 1.92 | |

| | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | |

| | From net investment income | | - | | (0.01) | | (0.22) | | (0.03) | | (0.08) | |

| | From realized gains | | - | | - | | (0.98) | | (0.59) | | - | |

| | From return of capital | | (0.01) | | - | | - | | - | | - | |

| Total Distributions | | (0.01) | | (0.01) | | (1.20) | | (0.62) | | (0.08) | |

| Paid in Beneficial Interest: | | | | | | | | | | | |

| | From redemption fees | | 0.00 | (b) | (0.00) | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) |

| Total Paid in Beneficial Interest | | 0.00 | (b) | (0.00) | (b) | 0.00 | (b) | 0.00 | (b) | 0.00 | (b) |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | $ | 9.07 | $ | 7.68 | $ | 7.48 | $ | 10.50 | $ | 11.15 | |

| | | | | | | | | | | | | | | | |

| Total Return | | 18.28% | | 2.81% | | (18.82)% | | (0.12)% | (a) | 20.71% | (a) |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Year | | | | | | | | | | | |

| | (in thousands) | $ | 64,624 | $ | 47,421 | $ | 40,835 | $ | 39,842 | $ | 33,617 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | |

| Interest Expense to Average | | | | | | | | | | | |

| | Net Assets | | 0.01% | | - | | - | | - | | - | |

| Gross Expenses to Average | | | | | | | | | | | |

| | Net Assets (d) | | 1.34% | | 1.23% | | 1.23% | | 1.23% | | 1.23% | |

| Net Expenses to Average | | | | | | | | | | | |

| | Net Assets (d) | | 1.23% | (e) | 1.23% | | 1.23% | | 1.23% | | 1.23% | |

| Net Investment Income to Average | | | | | | | | | |

| | Net Assets | | 0.10% | | 0.86% | | 0.94% | | 1.27% | | 0.31% | |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 111.52% | | 71.27% | | 66.14% | | 92.74% | | 77.73% | |

| | | | | | | | | | | | | | | | |

| (a) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (b) | Actual amount is less than $0.01 per share. | | | | | | | | | |

| (c) | Calculated using the average shares method. | | | | | | | | | |

| (d) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) and after any waivers and reimbursements (net expense ratio). |

| (e) | Excludes interest expense of 0.01% of net assets. | | | | | | | | |

| | | | | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights - Class A Shares | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding | | August 31, |

| during the fiscal years ended | | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, | | | | | | | | | | | |

| Beginning of Year | $ | 7.59 | $ | 7.42 | $ | 10.44 | $ | 11.10 | $ | 9.28 | |

| | | | | | | | | | | | | | | | |

| Income (Loss) from Investment | | | | | | | | | | |

| Operations: | | | | | | | | | | | |

| | Net investment income (loss) | (0.01) | (d) | 0.04 | (d) | 0.07 | (d) | 0.12 | | 0.01 | |

| | Net realized and unrealized | | | | | | | | | | |

| | | gain (loss) on investments | 1.37 | | 0.15 | | (1.89) | | (0.17) | | 1.88 | |

| Total from Investment Operations | 1.36 | | 0.19 | | (1.82) | | (0.05) | | 1.89 | |

| | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | |

| | From net investment income | - | | (0.02) | | (0.22) | | (0.02) | | (0.07) | |

| | From realized gains | | - | | - | | (0.98) | | (0.59) | | - | |

| | From return of capital | | (0.01) | | - | | - | | - | | - | |

| Total Distributions | | (0.01) | | (0.02) | | (1.20) | | (0.61) | | (0.07) | |

| Paid in Beneficial Interest: | | | | | | | | | | | |

| | From redemption fees | | - | | - | | - | | 0.00 | (c) | - | |

| Total Paid in Beneficial Interest | - | | - | | - | | 0.00 | (c) | - | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Year | $ | 8.94 | $ | 7.59 | $ | 7.42 | $ | 10.44 | $ | 11.10 | |

| | | | | | | | | | | | | | | | |

| Total Return (a) | | 17.99% | | 2.54% | | (18.92)% | | (0.38)% | (b) | 20.46% | (b) |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Year | | | | | | | | | | | |

| | (in thousands) | $ | 644 | $ | 675 | $ | 988 | $ | 2,022 | $ | 2,553 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | |

| Interest Expense to Average | | | | | | | | | | | |

| | Net Assets | | 0.01% | | - | | - | | - | | - | |

| Gross Expenses to Average | | | | | | | | | | | |

| | Net Assets (e) | | 1.59% | | 1.48% | | 1.48% | | 1.48% | | 1.48% | |

| Net Expenses to Average | | | | | | | | | | | |

| | Net Assets (e) | | 1.48% | (f) | 1.48% | | 1.48% | | 1.48% | | 1.48% | |

| Net Investment Income (Loss) to | | | | | | | | | | |

| | Average Net Assets | | (0.13)% | | 0.61% | | 0.80% | | 1.02% | | 3.00% | |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 111.52% | | 71.27% | | 66.14% | | 92.74% | | 77.73% | |

| | | | | | | | | | | | | | | | |

| (a) | Total return does not reflect sales charge, if any. | | | | | | | | | |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (c) | Actual amount is less than $0.01 per share. | | | | | | | | | | |

| (d) | Calculated using the average shares method. | | | | | | | | | | |

| (e) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) and after any waivers and reimbursements (net expense ratio). |

| (f) | Excludes interest expense of 0.01% of net assets. | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | | |

| ROUMELL OPPORTUNISTIC VALUE FUND | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights - Class C Shares | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| For a share outstanding during | | August 31, |

| the fiscal year or period ended | 2017 | | 2016 | | 2015 | | 2014 | | 2013 | (e) |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning | | | | | | | | | | | |

| | of Period | $ | 6.40 | $ | 6.39 | $ | 9.22 | $ | 9.95 | $ | 10.00 | |

| Income (Loss) from Investment | | | | | | | | | | |

| | Operations: | | | | | | | | | | | |

| | Net investment income (loss) | (0.06) | (f) | (0.01) | (f) | 0.02 | (f) | 0.03 | | (0.01) | |

| | Net realized and unrealized gain | | | | | | | | | |

| | | (loss) on investments | | 1.15 | | 0.11 | | (1.66) | | (0.15) | | (0.04) | |

| Total from Investment Operations | 1.09 | | 0.10 | | (1.64) | | (0.12) | | (0.05) | |

| Less Distributions: | | | | | | | | | | | |

| | From net investment income | - | | (0.09) | | (0.21) | | (0.02) | | - | |

| | From realized gains | | - | | - | | (0.98) | | (0.59) | | - | |

| | From return of capital | | (0.02) | | - | | - | | - | | - | |

| Total Distributions | | (0.02) | | (0.09) | | (1.19) | | (0.61) | | - | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, End of Period | $ | 7.47 | $ | 6.40 | $ | 6.39 | $ | 9.22 | $ | 9.95 | |

| | | | | | | | | | | | | | | | |

| Total Return (c) | | 17.13% | | 1.78% | | (19.55)% | | (1.09)% | (d) | (0.50)% | (b)(d) |

| | | | | | | | | | | | | | | | |

| Net Assets, End of Period | | | | | | | | | | | |

| | (in thousands) | $ | 285 | $ | 325 | $ | 631 | $ | 2,434 | $ | 615 | |

| | | | | | | | | | | | | | | | |

| Ratios of: | | | | | | | | | | | | |

| Interest Expense to Average | | | | | | | | | | | |

| | Net Assets | | 0.01% | | - | | - | | - | | - | |

| Gross Expenses to Average | | | | | | | | | | | |

| | Net Assets (g) | | 2.34% | | 2.23% | | 2.23% | | 2.23% | | 2.23% | (a) |

| Net Expenses to Average | | | | | | | | | | | |

| | Net Assets (g) | | 2.23% | (h) | 2.23% | | 2.23% | | 2.23% | | 2.23% | (a) |

| Net Investment Income to Average | | | | | | | | | |

| | Net Assets | | (0.88)% | | (0.14)% | | 0.22% | | 0.27% | | (1.20)% | (a) |

| | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | 111.52% | | 71.27% | | 66.14% | | 92.74% | | 77.73% | (b) |

| | | | | | | | | | | | | | | | |

| (a) | Annualized. | | | | | | | | | | | |

| (b) | Not annualized. | | | | | | | | | | | |

| (c) | Total return does not reflect sales charge, if any. | | | | | | | |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and, consequently, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | For a share outstanding for the initial period from July 30, 2013 (Date of Initial Public Investment) to August 31, 2013. |

| (f) | Calculated using the average shares method. | | | | | | | | |

| (g) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) and after any waivers and reimbursements (net expense ratio). |

| (h) | Excludes interest expense of 0.01% of net assets. | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | |

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

1. Organization and Significant Accounting Policies

The Roumell Opportunistic Value Fund ("Fund") is a series of the Starboard Investment Trust ("Trust"). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company. The Fund is a separate non-diversified series of the Trust.

The Fund commenced operations on December 31, 2010. The investment objective of the Fund is to seek capital appreciation and income. Roumell Asset Management, LLC ("Roumell Asset Management" or the "Advisor") seeks to achieve the Fund's investment objective by using an opportunistic investment strategy. The Advisor is an opportunistic capital allocator (OCA) with a deep value bias in selecting individual securities. The Advisor will wait until an investment situation is presented where, in its opinion, the odds of success are favorable relative to the risks. In the absence of such situations, the Fund will stay liquid and on the sidelines invested in Cash and Cash Equivalents. The Advisor's approach to opportunistic investing emphasizes purchasing securities at a meaningful, quantifiable discount to its calculation of intrinsic value taking into consideration the understandability of the business model, the safety of the capital structure, and the competency of the company's management. Using this opportunistic strategy, however, may result in the Advisor finding many suitable investment opportunities for the Fund during certain periods, but finding very few during other periods.

The Fund currently has an unlimited number of authorized shares, which are available to three classes - Institutional Class Shares, Class A Shares, and Class C Shares. Each class of shares has equal rights as to assets of the Fund, and the classes are identical except for differences in sales charges and ongoing distribution and service fees. Class A Shares are subject to an initial sales charge of 4.50%. Class C Shares are subject to a contingent deferred sales charge of 1% of the proceeds redeemed within one year of the purchase date. Class A Shares and Class C Shares are subject to distribution plan fees, which are further discussed in Note 3. All share classes are subject to redemption fees within 60 days of the issuance of such shares of 1.00%. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. All classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class.

(Continued)

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

The following accounting policies have been consistently followed by the Fund and are in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Investment Valuation

The Fund's investments in securities are carried at value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the security is principally traded closes early or if trading of the particular security is halted during the day and does not resume prior to the Fund's net asset value calculation) or which cannot be accurately valued using the Fund's normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A security's "fair value" price may differ from the price next available for that security using the Fund's normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: Quoted prices in active markets for identical securities

Level 2: Other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc.)

Level 3: Significant unobservable inputs (including the Fund's own assumptions in determining fair value of investments)

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

(Continued)

ROUMELL OPPORTUNISTIC VALUE FUND

Notes to Financial Statements

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of August 31, 2017 for the Fund's assets measured at fair value:

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3(b) |

| Assets | | | | | | | | |

| Common Stocks* | $ | 31,459,571 | $ | 31,458,324 | $ | 1,247 | $ | - |

| Closed-End Fund | | 1,226,040 | | 1,226,040 | | - | | - |

| Preferred Stocks | | 5,002,261 | | 5,002,261 | | - | | - |

| Convertible Bond | | 2,071 | | - | | 2,071 | | - |

| Corporate Bond | | 1,677,360 | | - | | 1,677,360 | | - |

| U.S. Treasury Securities | | 19,475,637 | | - | | 19,475,637 | | - |

| Warrants | | 6,248 | | - | | - | | 6,248 |

| Short-Term Investment | | 6,790,566 | | 6,790,566 | | - | | - |

| Total Assets | $ | 65,639,754 | $ | 44,477,191 | $ | 21,156,315 | $ | 6,248 |

| | | | | | | | | |

| Liabilities | | | | | | | | |

| Put Options Written | $ | 89,950 | $ | - | $ | 89,950 | $ | - |

| Total Liabilities | $ | 89,950 | $ | - | $ | 89,950 | $ | - |

| | | | | | | | | |

*Refer to Schedule of Investments for breakdown by Sector.