Matthew J. Beck

Item 1. REPORTS TO STOCKHOLDERS.

October 2017

Dear Investor,

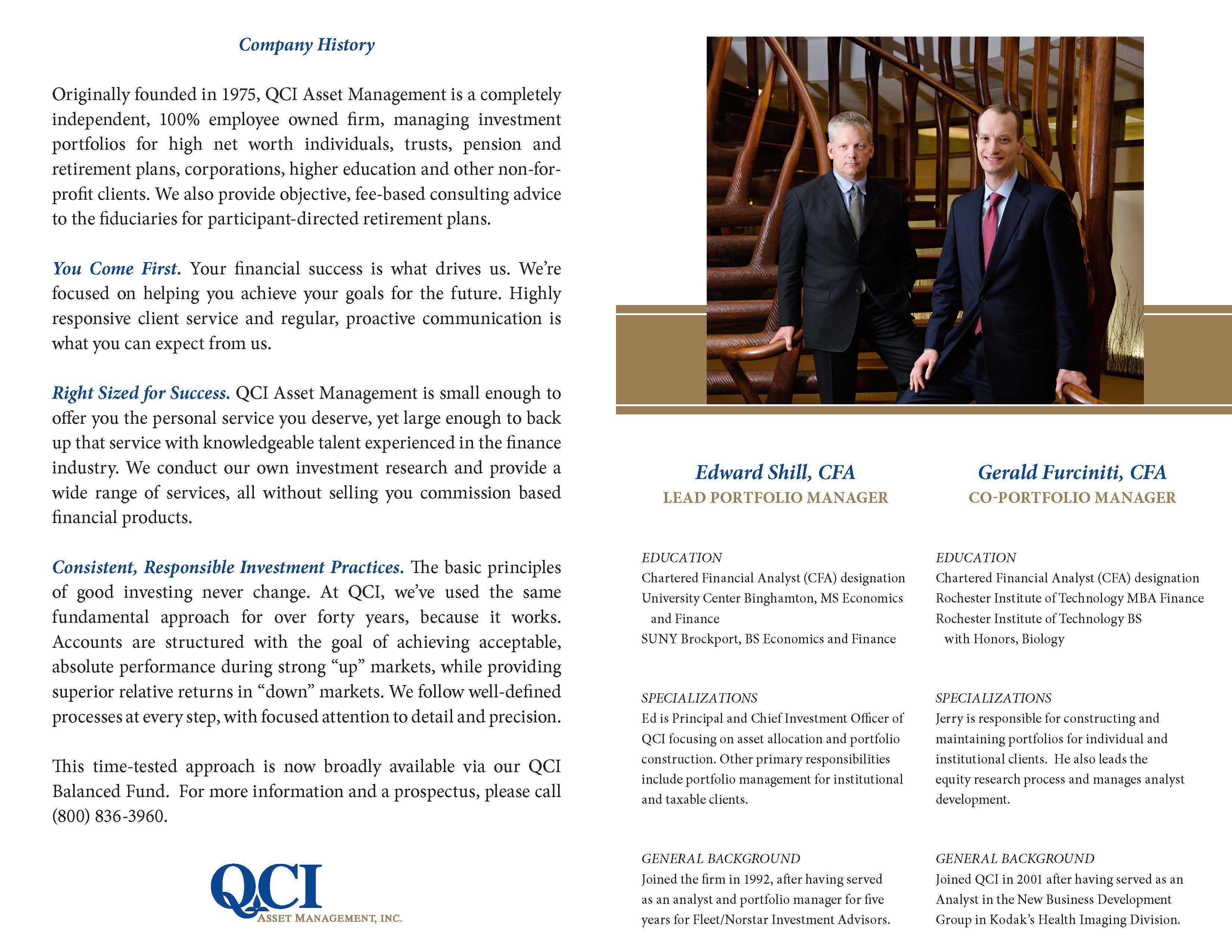

Two popular investment adages we hear every Spring are beware the "Summer doldrums," and "Sell in May and go away." Stock markets around the world debunked these old sayings and powered through the summer months to post all-time highs. The economic expansion which started the better part of a decade ago continued its steady, albeit lackluster, grind higher. We believe this sub-par growth is the new normal as many drivers of U.S. Economic growth face headwinds. Automobiles, housing, and ballooning consumer debt have us thinking that growth in 2018 will be subdued.

The Fed has been raising rates ever-so-slowly, and recently announced they will begin selling the bonds they had bought to stimulate the economy out of the great recession of 2008. Ten years ago, the Fed held less than $1 trillion in bonds, today's number is over $4 trillion- the "wind-down" will be watched closely. Interest rates have already lifted modestly in 2017. We expect some more upward pressure if the economy holds together and the Fed raises rates further while reducing bond holdings. We remain relatively short with our bond durations to guard against rising rates.

The stock market has hit many all-time highs in 2017, and has posted a double-digit total return through 9 months. Given the late-cycle nature of both the economy and market, we have structured accounts with a conservative bias. We use "airbags" in portfolios, such as floor stops, to participate if the market continues to rally, but protect principal if the market corrects. The ability of the market to handle the body blows of political turmoil, mother nature, a tightening Fed, and the wild card of North Korea has been nothing short of amazing. In our opinion, now is not the time for unbridled enthusiasm towards stocks nor is time to move totally to the sidelines and bunker down. We will stay vigilant as always.

As for QCI, we are moving forward on building for future growth. We have added several new folks in operations and we are broadening out our investment team. If you have not seen the new website – www.-e-qci.com – please log on and take a look. Profiles of the entire company are now listed there. The new QCI office reconstruction is in full swing; check out Facebook to follow along as we look to be in the new facility at 1050 Pittsford-Victor Road at this time next year.

We welcome your input and insight. Please feel free to contact us if we can be of any assistance.

Sincerely,

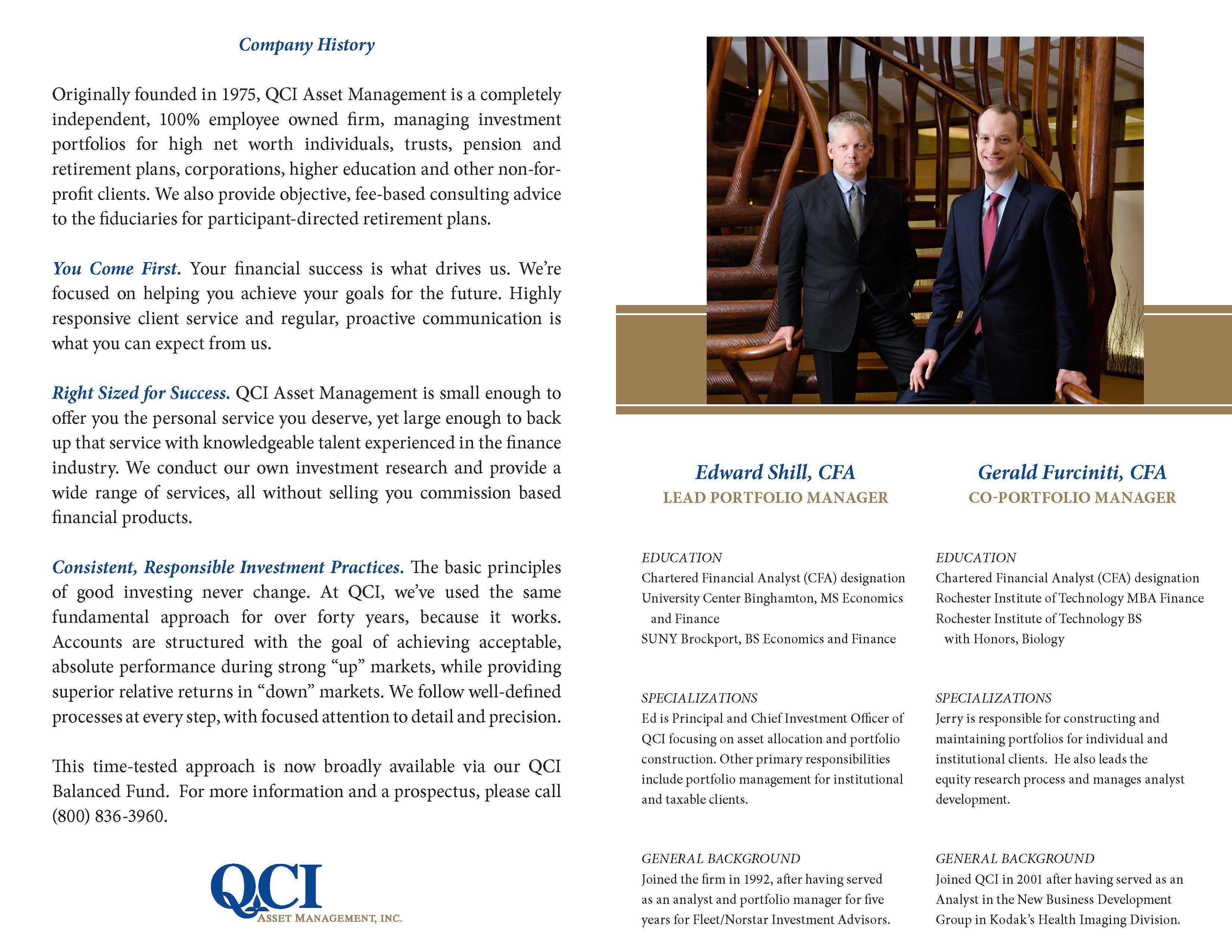

Edward Shill, CFA Gerald Furciniti, CFA

Portfolio Manager Portfolio Manager

Required SEC Communication:

A current copy of the Securities and Exchange Commission (SEC) Advisors Registration for ADV Parts 1 & 2 (brochure) for QCI Asset Management, Inc. is available upon written request, as well as available on our web site.

A current copy of the Client Privacy Notice is mailed with on June 30 reports, as well as is available upon written request and also available on our web site.

A current copy of the Proxy Voting Policy for QCI Asset Management, Inc. is available upon written request, as well as available on our web site.

Please contact us if there have been any changes in your financial situation or investment objectives, or if you wish to impose or modify any restrictions on the management of your assets.

We recommend that you compare your QCI reports with your custodian statement.

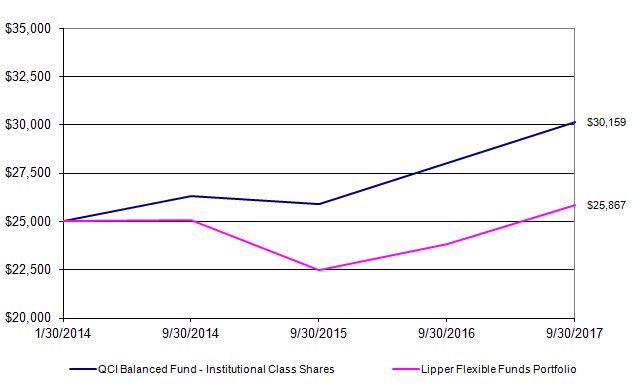

Please see the table below for the Fund's historical performance information through the calendar quarter ended September 30, 2017: |

Average Annual Total Returns (Unaudited) | | | | |

Period Ended September 30, 2017 | One Year | Three Year | Since Inception | Gross Expense Ratio** |

QCI Balanced Fund | 7.59% | 4.64% | 5.26% | 1.20% |

Lipper Flexible Funds Portfolio*** | 8.62% | 1.01% | 0.93% | N/A |

The performance data quoted above represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain more current performance data regarding the Fund, including performance data current to the Fund's most recent month-end, please visit ncfunds.com or call the Fund at 1-800-773-3863. Fee waivers and expenses reimbursements have positively impacted Fund performance.

*The Fund's inception date is January 31, 2014.

**Gross ratio is from the Fund's prospectus dated January 30, 2017. More recent expense ratios are found in the Financial Highlights. The Fund's expense limit reflects a contractual expense limitation that continues through January 31, 2018. Thereafter, the expense limitation may be changed or terminated at any time. Performance would have been lower without this expense limitation.

***You cannot invest directly in this index. The index does not have an investment advisor and does not pay any commissions, expenses, or taxes. If the index did pay commissions, expenses, or taxes, the returns would be lower.

(QCI1017001)

QCI Balanced Fund

Notes to Financial Statements

1. Organization and Significant Accounting Policies

The QCI Balanced Fund (the "Fund") is a series of the Starboard Investment Trust (the "Trust"). The Trust is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end management investment company.

The Fund is a separate diversified series of the Trust and commenced operations on January 30, 2014. The investment objective of the Fund is to balance current income and principal conservation with the opportunity for long-term growth. The Fund seeks to achieve its investment objective by investing in a diverse portfolio of corporate, agency, and U.S. Government fixed income securities, preferred stock, common stock of primarily large and mid-capitalization issuers, and derivative securities. Allocation to equity and fixed income securities will range from 25%-75% of assets.

The Fund currently has an unlimited number of authorized shares, which are divided into two classes - Institutional Class Shares and Retail Class Shares. Each class of shares has equal rights as to assets of the Fund, and the classes are identical, except for differences in ongoing distribution and service fees. The Retail Class Shares are subject to distribution plan fees as described in Note 3. Income, expenses (other than distribution and service fees), and realized and unrealized gains or losses on investments are allocated to each class of shares based upon its relative net assets. All classes have equal voting privileges, except where otherwise required by law or when the Trustees determine that the matter to be voted on affects only the interests of the shareholders of a particular class. As of September 30, 2017, no Retail Class Shares have been issued.

The following is a summary of significant accounting policies consistently followed by the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America ("GAAP").

Investment Valuation

The Fund's investments in securities are carried at fair value. Securities listed on an exchange or quoted on a national market system are valued at the last sales price as of 4:00 p.m. Eastern Time. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. Other securities traded in the over-the-counter market and listed securities for which no sale was reported on that date are valued at the most recent bid price. Securities and assets for which representative market quotations are not readily available (e.g., if the exchange on which the portfolio security is principally traded closes early or if trading of the particular portfolio security is halted during the day and does not resume prior to the Fund's net asset value calculation) or which cannot be accurately valued using the Fund's normal pricing procedures are valued at fair value as determined in good faith under policies approved by the Trustees. A portfolio security's "fair value" price may differ from the price next available for that portfolio security using the Fund's normal pricing procedures. Instruments with maturities of 60 days or less are valued at amortized cost, which approximates market value.

The Fund may invest in portfolios of open-end investment companies (the "Underlying Funds"). The Underlying Funds value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the Underlying Funds. Open-ended funds are valued at their respective net asset values as reported by such investment companies.

Fair Value Measurement

Various inputs are used in determining the value of the Fund's investments. These inputs are summarized in the three broad levels listed below:

Level 1: quoted prices in active markets for identical securities

Level 2: other significant observable inputs (including quoted prices for similar securities and identical securities in inactive markets, interest rates, credit risk, etc.)

Level 3: significant unobservable inputs (including the Fund's own assumptions in determining fair value of investments)

(Continued)

QCI Balanced Fund

Notes to Financial Statements

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following table summarizes the inputs as of September 30, 2017 for the Fund's assets measured at fair value:

| QCI Balanced Fund | | |

| Investments in Securities (a) | | Total | | Level 1 | | Level 2 | | Level 3 |

| Assets | | | | | | | | |

| Corporate Bonds | $ | 11,536,929 | $ | - | $ | 11,536,929 | $ | - |

| Federal Agency Obligations | | 4,259,161 | | - | | 4,259,161 | | - |

| United States Treasury Notes | | 11,737,977 | | - | | 11,737,977 | | - |

| Common Stocks* | | 29,703,661 | | 29,703,661 | | - | | - |

| Open-End Fund | | 714,268 | | 714,268 | | - | | - |

| Exchange-Traded Products | | 1,237,540 | | 1,237,540 | | - | | - |

| Short-Term Investment | | 975,940 | | 975,940 | | - | | - |

| Total Assets | $ | 60,165,476 | $ | 32,631,409 | $ | 27,534,067 | $ | - |

| | | | | | | | | |

* Refer to the Schedule of Investments for industry classification.

| (a) | The Fund had no transfers into or out of Level 1, 2, or 3 during the fiscal year ended September 30, 2017. It is the Fund's policy to record transfers at the end of the year. |

Investment Transactions and Investment Income

Investment transactions are accounted for as of the date purchased or sold (trade date). Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis and includes accretion/amortization of discounts and premiums using the effective interest method. Gains and losses are determined on the identified cost basis, which is the same basis used for Federal income tax purposes.

Expenses

The Fund bears expenses incurred specifically on its behalf as well as a portion of Trust level expenses, which are allocated according to methods reviewed annually by the Trustees.

Distributions

The Fund may declare and distribute dividends from net investment income (if any), monthly. Distributions from capital gains (if any) are generally declared and distributed annually. Dividends and distributions to shareholders are recorded on ex-date.

Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in the net assets from operations during the reporting period. Actual results could differ from those estimates.

(Continued)

QCI Balanced Fund

Notes to Financial Statements

Federal Income Taxes

No provision for income taxes is included in the accompanying financial statements, as the Fund intends to distribute to shareholders all taxable investment income and realized gains and otherwise comply with Subchapter M of the Internal Revenue Code applicable to regulated investment companies.

2. Transactions with Related Parties and Service Providers

Advisor

The Fund pays a monthly fee to QCI Asset Management, Inc. (the "Advisor") calculated at the annual rate of 0.75% of the Fund's average daily net assets.

The Advisor has entered into a contractual agreement (the "Expense Limitation Agreement") with the Trust, on behalf of the Fund, under which it has agreed to waive or reduce its fees and to assume other expenses of the Fund, if necessary, in amounts that limit the Fund's total operating expenses (exclusive of interest, taxes, brokerage commissions, borrowing costs, fees and expenses of other investment companies in which the Fund invests, and other expenditures which are capitalized in accordance with GAAP, other extraordinary expenses not incurred in the ordinary course of the Fund's business, and amounts, if any, payable under a Rule 12b-1 distribution plan) to not more than 1.00% of the average daily net assets of the Fund for the current fiscal year. The current term of the Expense Limitation Agreement remains in effect until January 31, 2018. While there can be no assurance that the Expense Limitation Agreement will continue after that date, it is expected to continue from year-to-year thereafter. For the fiscal year ended September 30, 2017, $440,596 in advisory fees were incurred, of which $109,919 in advisory fees were waived by the Advisor.

Administrator

The Fund pays a monthly fee to The Nottingham Company (the "Administrator") based upon the average daily net assets of the Fund and calculated at the annual rates as shown in the schedule below subject to a minimum of $2,000 per month. The Administrator also receives a fee as to procure and pay the Fund's custodian, as additional compensation for fund accounting and recordkeeping services, and additional compensation for certain costs involved with the daily valuation of securities and as reimbursement for out-of-pocket expenses. The Administrator also receives a miscellaneous compensation fee for peer group, comparative analysis, and compliance support totaling $350 per month. As of September 30, 2017, the Administrator received $4,200 in miscellaneous compensation expenses.

A breakdown of the fees is provided in the following table:

| Administration Fees* | Custody Fees* | Fund Accounting Fees (minimum monthly) | Fund Accounting Fees (asset- based fee) | Blue Sky Administration Fees (annual) |

Average Net Assets | Annual Rate | Average Net Assets | Annual Rate |

| First $100 million | 0.100% | First $100 million | 0.020% | $2,250 | 0.01% | $150 per state |

| Next $150 million | 0.080% | Over $100 million | 0.009% | | | |

| Next $250 million | 0.060% | | | | | |

| Next $500 million | 0.050% | *Minimum monthly fees of $2,000 and $417 for Administration and Custody, respectively. |

| Next $1 billion | 0.040% |

| Over $2 billion | 0.030% |

The Fund incurred $65,226 in administration fees, $13,292 in custody fees, and $38,874 in fund accounting fees for the fiscal year ended September 30, 2017.

Compliance Services

Cipperman Compliance Services, LLC provides services as the Trust's Chief Compliance Officer. Cipperman Compliance Services, LLC is entitled to receive customary fees from the Fund for their services pursuant to the Compliance Services agreement with the Fund.

(Continued)

QCI Balanced Fund

Notes to Financial Statements

Transfer Agent

Nottingham Shareholder Services, LLC ("Transfer Agent") serves as transfer, dividend paying, and shareholder servicing agent for the Fund. For its services, the Transfer Agent is entitled to receive compensation from the Fund pursuant to the Transfer Agent's fee arrangements with the Fund. The Fund incurred $27,000 in transfer agent fees during the fiscal year ended September 30, 2017.

Distributor

Capital Investment Group, Inc. (the "Distributor") serves as the Fund's principal underwriter and distributor. The Distributor receives $5,000 per year paid in monthly installments for services provided and expenses assumed.

Certain officers of the Trust are also officers of the Administrator.

3. Distribution and Service Fees

The Trustees, including a majority of the Trustees who are not "interested persons" of the Trust as defined in the 1940 Act and who have no direct or indirect financial interest in such plan or in any agreement related to such plan, adopted a distribution plan pursuant to Rule 12b-1 of the 1940 Act (the "Plan"). The 1940 Act regulates the manner in which a regulated investment company may assume expenses of distributing and promoting the sales of its shares and servicing of its shareholder accounts. The Plan provides that the Fund may incur certain expenses, which may not exceed 0.25% per annum of the average daily net assets of the Retail Class Shares for each year elapsed subsequent to adoption of the Plan, for payment to the Distributor and others for items such as advertising expenses, selling expenses, commissions, travel or other expenses reasonably intended to result in sales of shares of the Fund or support servicing of shareholder accounts. For the fiscal year ended September 30, 2017, no fees were incurred by the Fund.

4. Purchases and Sales of Investment Securities

For the fiscal year ended September 30, 2017, the aggregate cost of purchases and proceeds from sales of investment securities (excluding short-term securities) were as follows:

| Purchases of Securities | | Proceeds from Sales of Securities |

| $13,714,832 | | $14,826,201 |

Purchases of Government Securities | | Proceeds from Sales of Government Securities |

| $2,955,323 | | $2,818,294 |

5. Federal Income Tax

Distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

Management reviewed the Fund's tax positions taken on federal income tax returns for the open tax years/period ended from September 30, 2014 through September 30, 2017, and the Fund does not have a liability for uncertain tax positions. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the open tax years/period, the Fund did not incur any interest or penalties.

QCI Balanced Fund

Notes to Financial Statements

For the fiscal year ended September 30, 2017, the following reclassifications were made:

| Undistributed Net Investment Income | $ 9 |

| Paid In Capital | | (9) |

Distributions during the fiscal years ended were characterized for tax purposes as follows:

| | | Distributions from |

For the Fiscal Year Ended | | Ordinary Income | Long-Term- Capital Gains |

| 09/30/2017 | | $ 510,649 | $ - |

| 09/30/2016 | | $ 538,090 | $ - |

At September 30, 2017, the tax-basis cost of investments and components of distributable earnings were as follows:

| Cost of Investments | $ | 53,956,144 |

| | | |

| Unrealized Appreciation | $ | 6,791,787 |

| Unrealized Depreciation | | (582,455) |

| Net Unrealized Appreciation | | 6,209,332 |

| | | |

| Accumulated Net Capital Losses | | (268,085) |

| | | |

| Distributable Earnings | $ | 5,941,247 |

| | | | | | |

The difference between book-basis and tax-basis net unrealized appreciation is attributable to the tax deferral of losses from wash sales. The Fund has a capital loss carryforward of $268,085, which is short-term in nature and has no expiration.

6. Beneficial Ownership

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the Investment Company Act of 1940. As of September 30, 2017, SEI Private Trust Company held 47.97% of the Fund.

7. Commitments and Contingencies

Under the Trust's organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Trust entered into contracts with its service providers, on behalf of the Fund, and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. The Fund expects risk of loss to be remote.

8. Subsequent Events

In accordance with GAAP, the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date of issuance of these financial statements. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Trustees of the Starboard Investment Trust

and the Shareholders of the QCI Balanced Fund

We have audited the accompanying statement of assets and liabilities of the QCI Balanced Fund, a series of shares of beneficial interest in the Starboard Investment Trust, (the "Fund") including the schedule of investments, as of September 30, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended and the financial highlights for each of the years in the three-year period then ended and for the period January 30, 2014 (commencement of operations) through September 30, 2014. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2017 by correspondence with the custodian. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of the QCI Balanced Fund as of September 30, 2017, and the results of its operations for the year then ended, the changes in its net assets for each of the years in the two-year period then ended and its financial highlights for each of the years in the three-year period then ended and for the period January 30, 2014 through September 30, 2014, in conformity with accounting principles generally accepted in the United States of America.

BBD, LLP

Philadelphia, Pennsylvania

November 29, 2017

QCI Balanced Fund

Additional Information

(Unaudited)

1. Proxy Voting Policies and Voting Record

A copy of the Trust's Proxy Voting and Disclosure Policy and the Advisor's Disclosure Policy are included as Appendix B to the Fund's Statement of Additional Information and are available, without charge, upon request, by calling 800-773-3863, and on the website of the Securities and Exchange Commission ("SEC") at sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent period ended June 30 is available (1) without charge, upon request, by calling the Fund at the number above and (2) on the SEC's website at sec.gov.

2. Quarterly Portfolio Holdings

The Fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Fund's Forms N-Q are available on the SEC's website at sec.gov. You may review and make copies at the SEC's Public Reference Room in Washington, D.C. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 800-SEC-0330. You may also obtain copies without charge, upon request, by calling the Fund at 800-773-3863.

3. Tax Information

We are required to advise you within 60 days of the Fund's fiscal year-end regarding federal tax status of certain distributions received by shareholders during each fiscal year. The following information is provided for the Fund's fiscal year ended September 30, 2017.

During the fiscal year ended September 30, 2017, the Fund paid $510,649 in income distributions but no long-term capital gain distributions.

Dividend and distributions received by retirement plans such as IRAs, Keogh-type plans, and 403(b) plans need not be reported as taxable income. However, many retirement plans may need this information for their annual information meeting.

4. Schedule of Shareholder Expenses

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution [and/or service] (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2017 through September 30, 2017.

Actual Expenses – The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (e.g., an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

(Continued)

QCI Balanced Fund

Additional Information

(Unaudited)

| Institutional Class Shares | Beginning Account Value April 1, 2017 | Ending Account Value September 30, 2017 | Expenses Paid During Period* |

Actual Hypothetical (5% annual return before expenses) | | | |

| $1,000.00 | $1,039.00 | $5.11 |

| $1,000.00 | $1,020.05 | $5.06 |

*Expenses are equal to the average account value over the period multiplied by the Fund's annualized expense ratio of 1.00%, multiplied by 183/365 (to reflect the one-half year period).

5. Approval of the Investment Advisory Agreement

A Special Meeting of Shareholders of the QCI Balanced Fund, a series of the Starboard Investment Trust, was called for April 11, 2017 at 3:00 p.m. Eastern Time at the offices of The Nottingham Company, 116 South Franklin Street, Rocky Mount, North Carolina 27804. There being no quorum present, upon motion duly made and seconded, the meeting was adjourned until 3:00 p.m. on May 3, 2017.

The Chairman reviewed the Notice of Special Meeting of Shareholders mailed on or about March 1, 2017 to all shareholders of the Fund of record as of the close of business on February 10, 2017 (the "Record Date"). The Chairman also reviewed the Proxy Statement accompanying the Notice, the Proxy Card, and the Ballot Counts from Broadridge Financial Solutions, Inc. He ordered that copies of these documents be maintained with the records of the Trust. The Chairman noted that as of the Record Date, there were 5,236,173.506 shares of the QCI Balanced Fund that were outstanding and entitled to vote at the meeting.

The Chairman first stated that 2,641,643.496 shares of the QCI Balanced Fund were present by proxy at the meeting. The Chairman noted that the shares present by proxy at the meeting exceeded a majority of the outstanding shares of the Fund as of the Record Date and, accordingly, a quorum was present for the Fund for purposes of transaction of business at the meeting.

The Chairman stated that approval of the proposals submitted to the Fund's shareholders required the approval of a "majority of the outstanding voting shares" entitled to vote thereon, which meant the affirmative vote of the lesser of: (i) more than 50% of the outstanding shares of the Fund; or (ii) 67% or more of the shares of the Fund present at the meeting, provided more than 50% of the Fund's outstanding shares are present in person or by proxy at the meeting. Thereafter, upon motion duly made and seconded, the item was submitted to the shareholders of the Fund for consideration.

The Chairman stated that the first item of business was to consider a proposal to shareholders of the QCI Balanced Fund to approve an Investment Advisory Agreement with QCI Asset Management, Inc., the Fund's proposed investment advisor. The Chairman announced that 2,624,185.333 shares had been voted in favor of the item, no shares had been voted against the item, and 17,458.163 shares had abstained from voting on the item. Since both a majority of the shares of the Fund and more than 67% of the shares of the Fund present voted in favor of the item, the proposal to approve the Investment Advisory Agreement for the QCI Balanced Fund was approved.

There being no further business to come before the meeting, the same, upon motion duly made and seconded, was adjourned.

6. Shareholder Votes

At a meeting of the Shareholders on May 3, 2017, the Advisor received the necessary shareholder votes for approval of the Interim Investment Advisory Agreement for the Fund.

(Continued)

QCI Balanced Fund

Additional Information

(Unaudited)

A total of 5,236,173.506 shares of the Fund were entitled to vote at the shareholder meeting. It was noted that 2,624,185.333 shares voted in favor of the item, 0 shares voted against the item, and 17,458.163 shares abstained from voting on the item. Since both a majority of the shares of the Fund and more than 50% of the shares of the Fund present voted in favor of the item, the proposal to approve the Interim Advisory Agreement for the QCI Balanced Fund Fund was approved.

7. Information about Trustees and Officers

The business and affairs of the Fund and the Trust are managed under the direction of the Board of Trustees of the Trust. Information concerning the Trustees and officers of the Trust and Fund is set forth below. Generally, each Trustee and officer serves an indefinite term or until certain circumstances such as their resignation, death, or otherwise as specified in the Trust's organizational documents. Any Trustee may be removed at a meeting of shareholders by a vote meeting the requirements of the Trust's organizational documents. The Statement of Additional Information of the Fund includes additional information about the Trustees and officers and is available, without charge, upon request by calling the Fund toll-free at 800-773-3863. The address of each Trustee and officer, unless otherwise indicated below, is 116 South Franklin Street, Rocky Mount, North Carolina 27804. The Independent Trustees each received aggregate compensation of $3,125 during the fiscal year ended September 30, 2017 from the Fund for their services to the Fund and Trust.

Name, Age

and Address | Position

held with

Fund or Trust | Length of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

| Independent Trustees |

James H. Speed, Jr.

Date of Birth: 06/1953 | Independent Trustee, Chairman | Trustee since 7/09, Chair since 5/12 | Previously President and CEO of NC Mutual Insurance Company (insurance company) from 2003 to 2015. | 16 | Independent Trustee of the Brown Capital Management Mutual Funds for its four series, Hillman Capital Management Investment Trust for its one series, Centaur Mutual Funds Trust for its one series, Chesapeake Investment Trust, previously known as Gardner Lewis Trust, for its one series and WST Investment Trust for its two series (all registered investment companies). Member of Board of Directors of M&F Bancorp. Member of Board of Directors of Investors Title Company. Previously, Board of Directors of NC Mutual Life Insurance Company. |

(Continued)

QCI Balanced Fund

Additional Information

(Unaudited)

Name, Age

and Address | Position

held with

Fund or Trust | Length of Time Served | Principal Occupation

During Past 5 Years | Number of Portfolios in Fund Complex Overseen by Trustee | Other Directorships

Held by Trustee

During Past 5 Years |

Theo H. Pitt, Jr.

Date of Birth: 04/1936 | Independent Trustee | Since 9/10 | Senior Partner, Community Financial Institutions Consulting (financial consulting) since 1999; Partner, Pikar Properties (real estate) since 2001. | 16 | Independent Trustee of World Funds Trust for its forty nine series, Chesapeake Investment Trust, previously known as Gardner Lewis Investment Trust, for its one series, Leeward Investment Trust for its two series and Hillman Capital Management Investment Trust for its one series (all registered investment companies). |

Michael G. Mosley

Date of Birth: 01/1953 | Independent Trustee | Since 7/10 | Owner of Commercial Realty Services (real estate) since 2004. | 16 | None. |

J. Buckley Strandberg

Date of Birth: 03/1960 | Independent Trustee | Since 7/09 | President of Standard Insurance and Realty (insurance and property management) since 1982. | 16 | None. |

| Other Officers |

Katherine M. Honey

Date of Birth: 09/1973 | President and Principal Executive Officer | Since 05/15 | EVP of The Nottingham Company since 2008. | n/a | n/a |

Matthew J. Beck

Date of Birth: 06/1988 | Secretary | Since 05/15 | General Counsel of The Nottingham Company since 2014. | n/a | n/a |

Ashley E. Harris Date of Birth: 03/1984 | Treasurer, Assistant Secretary and Principal Financial Officer | Since 05/15 | Fund Accounting Manager and Financial Reporting, The Nottingham Company since 2008. | n/a | n/a |

Stacey Gillespie Date of Birth: 05/1974 | Chief Compliance Officer | Since 03/16 | Compliance Director, Cipperman Compliance Services, LLC (09/15-present). Formerly, Chief Compliance Officer of Boenning & Scattergood, Inc. (2013-2015) and Director of Investment Compliance at Boenning & Scattergood, Inc. (2007-2013). | n/a | n/a |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.